But the Fed has now backed off its ridiculous claims and is taking inflation more seriously.

By Wolf Richter for WOLF STREET.

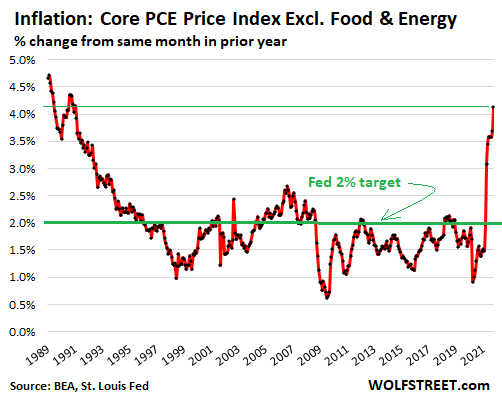

The lowest lowball inflation measure that the US government produces, “core PCE,” which excludes the now soaring food and energy prices and understates inflation by the most, is used by the Fed for its inflation target: a symmetrical 2% “core PCE.” And this core PCE in October, released today by the Bureau of Economic Analysis, spiked by 4.1%, more than twice the Fed’s inflation target, and the worst-hottest inflation reading since January 1991:

It’s not temporary, Fed Chair Jerome Powell groaned and muttered this morning upon seeing this inflation monster blow out, following his $4.5 trillion in money-printing in 21 months. Here he is, freshly re-nominated for another four years, viewing the problem of his own making that he will now have to deal with, by cartoonist Marco Ricolli for WOLF STREET:

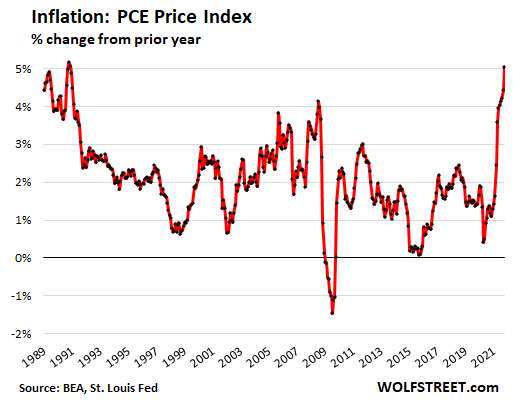

The overall PCE inflation index that includes food and energy, the second-lowest lowball inflation measure the US government produces, spiked by 5.0% in October, the worst-hottest since November 1990:

There is hardly anyone left on Wall Street with professional experience in this kind of inflation.

And the Fed still has the foot on the gas, but just slightly less so, planning to print $105 billion from mid-November through mid-December to repress long-term rates, and it’s still repressing short-term rates to near-zero – blowing at nearly full speed through every red light at every intersection.

On a month-to-month basis, the overall PCE increased by 0.43% in October from September, the worst-hottest increase since May. This amounts to an annualized pace of 5.2% (12 x 0.43%).

If you think that a car will slow down on its own somehow when you floor the accelerator, you’re tragically mistaken, as the history of automotive accidents shows.

Despite my assurances since early this year that inflation was heating up and that it wouldn’t be temporary for a variety of reasons, including that the entire inflation mindset of consumers and businesses had changed, the Fed at first claimed that it was due to the “base effect” and would go away on its own this year, then when inflation outran the base effect, it claimed until that this was just “temporary” or “transitory,” and then, when inflation outran temporary and transitory, and continued to spike, the Fed changed the definition of temporary and transitory.

But even the Fed has now backed off these ridiculous claims, and is taking inflation more seriously.

Following the re-nomination of Powell and the promotion of Brainard, they both elevated inflation to their Number 1 Priority in their thank-you statements.

Even ultra-dove San Francisco Fed president Mary Daly has now conceded that she’d be open to speeding up the tapering of asset purchases in December. Another dove, Jim Bullard has turned into a hawk, calling for faster taper, sooner balance sheet runoff, and sooner rate hikes. Even the doves see where this is going, with inflation spiking and the Fed’s foot still fully on the money-printing and interest-rate repression accelerator – and they don’t really want to go there.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This sickening behavior by the Fed , and their protection of the ultra-wealthy and the banks , is so nauseating that I find myself having to wait

a day or two to read Wolf’s excellent articles on Fed conduct at times.

Just remember, “little people” – counterfeiting for the average person is illegal – a federal offense with major jail time.

Really Federal – not fake “Federal” like these private , non-government ruthless “Fed” bankers.

Fed is evil

Fed is cancer

Fed is robber

More people realize that now than ever before.

End the Fed

“End the Fed”

And the CIA, NSA, and the FBI while we’re at it.

Wake up, you’re dreaming again.

A Quote:

“Whoever controls the volume of money in our Country is absolute master of all industry and commerce….and when you realize that the entire system is easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.

James A. Garfield

Is that why he was killed?

Some kid wanted his basketball shoes.

As Dr. Hudson observes:

The rise in inflation has been reflected in the rise in debt. That is where it is all masked.

And that includes Corporate, Banking Debt, along with average citizenry debt.

The FED has not learnt from juicing the Markets in 2000, 2007 and now 2021. It never gets punished for its incompetence and is more interested in Woke issues than it’s key mandate. How many lives must it ruin before it gets abolished?

“It never gets punished for its incompetence”

Well said. Action without consequences leads to unaccountability. Arsonists and Firefighter rolled into one. That is what the Fed really is.

It is only incompetence if it is not done on purpose. Otherwise it is wilful fraud and theft.

Woke issues!?!?

You mean like further enriching the plutocrats while screwing everyone else.

You clearly need to wake up.

The two are not mutually exclusive.

“Woke” is getting the blame now? That is rich (pardon the pun)!

For some, it seems that if you have no clue, just blame woke.

The fed getting involved in “diveristy” and climate change is “woke,” and it is far beyond the mandate of the Federal Reserve.

Ohai Mark!

I hear you and feel sad that People can’t see where the “con” is happening. The 4 trillion pushed through banks went via the speculators (hedge, spac whatever). They don’t trickle down, they reap paper gains. None of that helps the majority. But the majority of people can’t grasp this understanding and the con goes on. I have to stop reading the news or find a good psych person.

“People can’t see where the “con” is happening.”

That’s because they’re never taught exactly how the system works… probably by design. That’s how TAX COPORATIONS MORE can be so popular since the majority clueless don’t realize that THEY are the ones who end up paying some part of the tax with the other parts paid for by decreased product quality or quantity, lower pay and/or benefits for employees, or loss of jobs.

I understand they don’t even teach CIVICS in schools these days, so they haven’t a clue about their rights under the Bill of Rights either.

This is how we got here…

We got here with dishonest money…

Maybe W, but IMHO after teaching at a couple of high schools on a ROP ( Regional Occupational Program ) in the mid 1980s and being required to attend ”faculty meetings”,,, it is a very deliberate and carefully thought out and implemented plan to ”dumb down” the vast majority.

By whom I cannot say, but it seemed very clear when most of my students from those high schools, others were older and wanting to change careers, etc. ) could not do basic arithmetic, and don’t even ask about write a work order, etc…

Most of them were absolutely NOT stupid, just clearly NOT educated as I was in the late ’40s/early ’50s; in those days, there was no social promotion, and several good buds dropped out of school at legal age, 16, while in 8th grade.

So, my suggestion is to empower actual teachers, and especially the actually good teachers; base would be local small classrooms, walking distance for small kids, with all the guards needed at first,, and then insist one of their parents attend full time when any such young kid miss behaved, until the kid got the message,,,

I could go on, but will refrain for now…

Education at every level is the key; education in USA has been a joke for the vast majority for the last several/many decades.

Get rid of the corporations too. After, they are just a collective.

If you consider the shape this country and world are in you may understand why the fed and the other governments are doing it. Can you imagine the anarchy that will ensue when the stock market craters? Keeping the financial industry happy is the only bright spot we have to Keeping law and order, and we can certainly see the cracks getting bigger. The whole supply chain discussion isn’t cause of covid, it’s because the human race has finally reached the saturation point.

No it hasn’t.. we have plenty of alternatives to our late stage financialized oligarchy. There is a small problem though.. the people who have control of the levers don’t want it to change

Stic Zadinya said: “Can you imagine the anarchy that will ensue when the stock market craters?”

___________________________________

No. Why assume there would be anarchy? Perhaps it would be a positive change. Very possibly so.

If you know otherwise, please describe with cause and effect all the way through.

Orwellian Monetary Theory (OMT)

Debt is good.

Lender is slave to the borrower.

Saving is Punished.

“Stable” now means increasing (prices) at a stable rate of increase. (2nd Fed mandate)

Extremely low interest rates are moderate, even though at immoderate record lows. (3rd mandate)

The future funds the present. (It is no longer incumbent on each generation to pay their debts.)

Free market economy is arranged by unbridled unelected power. (central bankers)

Democracy is ruled by these monetary dictators.

Ignorance is strength.

Inflation is good.

Freedom is slavery.

We can not raise rates because there is too much debt, so we must allow the current condition of zero cost debt creation to continue.

Tax unrealized gains.

Rates must stay low to solve the employment situation, even though there are record job openings

The Federal Reserve, once the buyer of last resort for banks, is now buyer of last resort for Wall Street.

Central banks, once bound to only deal in federally backed securities will now set up dummy operations, Special Purchase Vehicles to circumvent this restriction.

Central Banks that are in place to prevent inflation, promote inflation and let it run hot.

Central banking now includes addressing climate change, racial and gender equity and “financial inclusion”

When will the real apartment rent increases flow down to CPI? I just heard on Bloomberg that rents in S FL were up 36% YOY.

i have friends living there. i can tell you they’re furious. to have $2,200 2 brs go to nearly $3,600 in one year is something they could never have imagined.

even bloomberg is calling it “strong rent growth,” as though it’s a good thing.

The entire gulf coast is experiencing big insurance increases due to FEMA raising the flood insurance rates. It’s bad across the entire coast line down south.

so you think landlords are passing that on? i wonder how much of that explains the increase.

If you build flood areas, why not?

FEMA suppresses the risk of building in flood areas by underwriting those insurances and then passing on the losses to the taxpayers.

Not very different from how GSEs and the Fed suppress the risk in mortgage lending.

End those cancerous programs and institutions.

Don’t ask how I know this but parts of Biloxi and Gulfport are some of the few areas right near Gulf of Mexico that have some elevation. Otherwise one should try to own property in Louisiana and Mississippi only north of I-10.

FEMA can also increase flood zone elevations. This adds more property to flood insurance coverage that was previously outside a flood zone. I know from experience.

It is a good thing, if you’re a member of the socioeconomic classes that include Bloomberg, most journalists, most op-ed authors, and most economists.

and most congressmen. which is why most of them, democrat and republican alike, are fawning over powell, saying he acted “courageously.” as though printing money requires courage.

But most jobs in Florida are between $7.25 to $10/hr? Unless one lives in the wealthier areas?

that’s not the case anymore. a lot of people have moved there from the north expecting to work from home permanently. we’ll see.

I wonder if there is such a thing as Outsource Insurance. 🤣

Yeah. I heard from a friend who is always ahead of everyone else and bought a house years ago and snowbirds, that houses that sold last year for $220K sold this year immediately for $320K.

It’s people cashing out of their overvalued and over-taxed properties up north, and down there everything under $500K looks on sale to them.

OK for them as long as they don’t bring their politics with them. But I think it’s time to look for the next sleeper spot.

The wealthier areas in S FL have the worst wages. The rich are really cheap there, that’s why they are rich.

And they are absolutely compelled to let you know it…

Especially the nouveau riche…

Would one find it depressing to live around such people and making low wages, even if the weather is sunny and recreational opportunities abound?

CPI will find a hundred reasns to prevent reporting on rent inflation. They’ll have some survey or a “hedonic adjustment” to discount all the inflation and day it’s, somehow, magically no more than 2%.

Biden is reacting to pressure from voters to do something about inflation. Both the politicians and the Fed are now stuffed because none of their inflation measures, by design, actually measure what voters are experiencing.

It doesn’t matter if the Fed ‘fixes’ any of the current measures, because real inflation for the average voter will still be above that.

If they change the measures, it will be admitting they were wrong. If they don’t, they can’t fix the actual problem. They’ve painted themselves into a corner.

The same goes for every other statistic, since there isn’t an honest one left. Same goes for every other government.

The game is up. The only question is how long it takes before Joe Average decides to act.

I am suspicious of the “survey”

Why, with hard Case Schiller data available, would they conduct a “survey”?

Who compiles the results of the unnecessary survey, and who would know if any behind the scenes “adjustments” take place?

Figures don’t lie. Liars figure.

That’s a great cartoon, inflated head and all. I’m guessing if there’s a lower portion of the cartoon it’s a wheelbarrow full of Reichmarks.

With or without 1970s experience, the steep WTF numbers suggests we are on new ground. Will extend-and-pretend at long last lose traction? It may be sharp calls must be made, and losers openly lose. It would be nice as a saver to see some positive real interest rates.

I see a knife edge between swinging into runaway inflation or deflation, maybe shown in the angst in the Powell cartoon. Maybe the coin lands on its edge, it all averages and we come out in goldilocks? Ha!

The Fed as de facto global central bank has wider global stuff to address too (swap lines, printing for the planet), on top of domestic fun. So many systems may be stress-tested at once. I must order more popcorn!

phleep

“swinging into runaway inflation or deflation,”

Let’s be clear…..with 6% inflation, a drop of 1% to 5% isnt “deflation”.

No one alive has seen deflation, and we likely will not.

A drop of 3% after 6% is still NET inflation…

Dear Wolf,

It is quite something to see the small and large markets of the world heave the same inflationary flames. Down in South Africa the country’s largest food producer (Tiger Brands) recently warned that they are picking up more serious inflation winds in the upstream production chains – meaning, more of the same self-inflationary inflation numbers will be hitting homes and dinner tables in the next few months… leading me to the thought:

Perhaps Douglas Adams could do something with the math that goes into all this money printing and inflation as concept for a space ship propulsion system like the one he had in his book – Hitchikers Guide to the Galaxy – based on an Italian bistro, and the near impossibility of calculating who actually owes what on a bill after a looong night of spaghetti-boozing.

just a thought.

Wolfstreet is your Hitchikers Guide to hyper-Galactic Inflationomics.

Haha,

In the meantime, all we hear from the Fed, Bank of England, and the ECB is Vogon poetry….

I’m afraid I’ve got some bad news for you about Douglas Adams.

Thumbs up to your comment. This inflationary environment reminds me of the end of Adams’s book “The Restaurant at the End of the Universe”, where the early inhabitants of earth are using leaves as currency. Because of hyperinflation, the leaders suggest burning down all the forests to reduce the monetary supply, and everyone cheers. I feel like everything the current administration is saying that will “fix” inflation is missing the mark. Instead of fixing the backlog at the ports, or releasing oil reserves, encourage the Fed to raise rates sooner and more aggressively. This will fix a myriad of problems beyond inflation, including the growing wealth gap.

When one puts a mediocre mind to a very complex jigsaw puzzle, what to you get?? One messed up looking landscape. Take a bow, Boys and Girls, at the Eccles Building. And who said that the Fed is not a political animal to its core? Now we need to keep eyes out as to how they will try to fool us with backdoor re-liquification. Country is bankrupt, and we are not talking about ethics or morals.

I keep hearing the country is “rich”, as if an asset mania represents real wealth.

“When one puts a mediocre mind to a very complex jigsaw puzzle, what to you get??”

It doesn’t take mediocre minds. It takes very smart people who are fooled into believing that their grossly simplistic theories and models with grossly inadequate data inputs and unknown unknowns are sufficient despite being proved defective over and over again. It’s called “Theory Induced Blindness,” in the central banks’ cases heavily reinforced by those who actually benefit from their flawed theory and models.

I’ve begun thinking of economists as modern-day witch doctors who totally believe in their unprovable theories. I’m pretty certain that traditional witch doctors think their incantations actually heal the sick, too.

YEP I WORKED ON WALL STREET STARTING IN 1970 AT DREXEL BURNHAM. NOT QUIT DEJA VU BUT THIS WILL PLAY INTO WAGES—THE DIFFERENCE FEW POWERFUL UNIONS COMPARED TO THE ’70’S AND NO COLA’S EXCEPT FOR THE RECENT DEERE CONTRACT. VERY FEW ON THE STREET HAVE SEEN THIS KIND OF INFLATION OR HAVE TRADE IN A PERIOD OF HIGHER INTEREST RATES. WE SHALL SEE.

I would say Wall St is betting they won’t need to pay those wages. (Deere will offshore those jobs.) As you say Unions are no longer a force, and they are stuck in the middle on vaccine mandates so they will lose more members. In the 70s the Fed chiefs were not yet rock stars. If the Fed had a zero balance sheet right now their ambivalence on rates would not make too much difference but this double pumping the monetary system, is just crazy. Well if they get a crash and the economy goes zero bound, they will have been vindicated.

John Deere make all of their 7R, 8R, and 9R tractors in Waterloo. They will not be offshoring these jobs.

According to the CEO of ZipRecruiter, people want to WFH. They are turning down jobs that require physical presence.

The irony is that if you can WFH, why not WFH in Thailand? Do these people think electrons need covid passports?

I’m an environmental engineer and I work work with engineers form all different traditional engineering disciplines.

The majority of traditional engineering work (civil, structural, geotech etc.) can be done WFH. Even so, none of these jobs can be offshored as engineering licenses are required in your jurisdiction of work. You could possibly offshore some preliminary design work, long before shop drawings, but the designers would need to be intimate with local codes. I doubt this would be efficient and I don’t see any traditional engineering firms doing this.

What about medical workers Michael? I have used virtual healthcare appointments recently. Should I expect future virtual healthcare to be provided to me by a doctor from the other side of the world?

K ag: Just wanted to say something about virtual medical that you reminded me of: unless it is purely to take info for the actual physical apt, it’s malpractice and fraud, albeit even if ‘legal’

This is ex: psychiatry for those who believe in it. But mainstream medicine for a physical problem requires a physical examination. It would make as much sense for a mechanic to diagnose a car via video link.

The speed with which ‘virtual medical’ has been welcomed by the industry raises doubts about its professionalism.

This for K-agri:

1. Suggest you do some review before posting.

2. Last small project, SF, on which I was the estimator, I was working with engineers in SF (electrical), Australia, Europe, and the architect was in NY, while the developer personnel were in SF, NY, and Asia…

While it is true that the final drawings and specifications must be ”stamped” by a local design professional, these days that is just a formality, and possibly/probably why many buildings in SF are continuing to sink into the fill and detritus of the last couple hundred years!

VVNvet

1) what kind of review?

2) Within engineering I am currently seeing alot of WFH national collaboration and some international collaboration in highly specialized areas. The countries you listed above are all signatories of the Washington accord. The point I was trying to make in my initial comment is that there are a lot of WFH jobs that are not being exported to India and won’t be. I am not seeing a complete collapse of NA engineering firms that all of these off-shoring comments imply should be happening.

Unions are a huge force but only in “public service” jobs.

ANDREW MELNICK,

Please use lower-case keys. Thanks.

My first degree was a draftsman back in the days of big drafting tables. One of the first things you had to learn to do was learn to letter, which meant learning how to form and write in an exact way and space letters and numbers in a visually appealing way.

In engineering drawings there was no room for style and lower case letters were not used, even when writing long text. Your eye quickly adjusts to reading all caps and then the other stuff starts looking funny. It was a little snobby but if someone wrote in lower case, you knew that person didn’t have formal training.

Architectural lettering was a less formal affair and you could display a little flair.

Another thing I ran across in my job is there are ANSI standards for warning labels and you see a lot of these around. There are three levels Danger, Warning and Caution, color coded red, orange and yellow respectively. Basically danger can kill you and caution is not likely to and warning is somewhere in between.

Anyway. The ANSI standard tells you what must be capitalized and how big letters must be. I think this is has to do with the mental connection that upper case big and bold is to get someone’s attention and then the details are to be written in a smaller less offensive font.

Technology changes and the reason why we do stuff changes. I was trained to leave two spaces after a period, something to do with typesetting I think. I believe the on-line standard is one space. Not sure really.

I used to periodically review 1890s to 1950s fire insurance plans as part of my work. The objective of my work was to identify areas of potential environmental concern which could have resulted from historical potentially contaminating activities (industrial processes, landfills, coal gasification plants etc.). I always awestruck by the skills of the draftsmen back in the day, those old plans were truly works of art. These are skillsets that no longer exist.

HTML for web page design removes extra spaces between words, thus you might hit the space bar twice after a period, but it will display one space in a browser.

But then we won’t be able to hear him.

I would point out the REAL difference between the 70s inflation and today’s inflation..

In the 70s the Fed FOUGHT inflation

Today, the Fed PROMOTES inflation

I reject the premise, the self authored mandate of the Fed, to promote ANY inflation. The seemingly harmless 2% rips 22 % off the dollar in ten years…that can not be squared with their “stable prices” mandate.

The Fed did not fight inflation until Paul Volcker took over. Like today, the Fed feared crashing the economy and markets by tightening. It has a strong inflationist bias.

Unions have been shrinking in the private sector for decades. There’s not much left to them now. It’s in the public sector where unions are flowering. I think this is why Scott Walker got into so much trouble. Now Wisconsin is a right to work state. And even the public sector unions in Wisconsin are on their way out. Not many people understand that when State of Wisconsin stopped withholding union dues from paychecks 2/3 of state workers stopped paying union dues. That means union influence within state government fell by a factor 3. Even if the unions by some miracle regained those state workers it wouldn’t be the same. The unions would have to be concerned with giving state workers what they wanted instead of what the unions wanted.

I think Wisconsin might have been a little ahead of the curve. It’s currently sweeping the country and we might see the results nationwide in a decade or two.

Inflation has hit homes, that twenty to fifty international students have to live in a bungalow. This is inflation in Canada.

@ Gen Z –

sounds more like a housing shortage

“There is hardly anyone left on Wall Street with professional experience in this kind of inflation.”

Sums it all up, plus adding in “There is hardly anyone on Wall Street with professional experience in this kind of monetary manipulation”.

Map coordinates: Here be dragons.

My investment house is advertising “Professional investment advice available. Minimum balance required: $10.” They’re stealing lunch money now.

You can find lunch for only $10?!

(I get it for 5$ with coupon

Only the Fed’s official talking points will change, while higher inflation goes about it’s intended dirty work. Sadly we have seen this movie before.

Fedrengi rules of aquisition: Once you’ve taken the value out of their money, never give it back.

😂

They won’t be happy until half the population is on food stamps and numerous other welfare programs in order to be able to just survive. I worked my entire life so I wouldn’t have to worry about the economy and finances. Who would have dreamed the happy horse shit going on in the world today? If I didn’t have kids it wouldn’t bother me near as much. I sure hope the people running this shitshow are proud of their self. Life is too short, they can’t be happy with the reflection in their mirror. At some point, they are gonna get to answer for all the good deeds they’ve done while above ground here on earth. I can’t help but get a big smile on my face when I think about that. Good luck everyone, Lord knows we are gonna need it.

To your penultimate – cheers! Cartoon is beautiful and polite.

I wish the supporters of current policies long life, so that they can experience the consequences of this cluster they have supported or created.

The supporters of current policies ALL HAVE INFLATION PROTECTED PENSIONS AND FUTURES……courtesy of us…

But what of us?

Yellen has at least 3 Pensions…(U of C, Fed, Treasury) not to mention the payback “speaking fees”

Sorry! I’m still puzzled by all this certainty about inflation–

The Fed had its foot on the gas starting in 2010, going pedal to the metal for 10 years with virtually NO inflation.

During those years I was continually amazed and surprised that virtually no scary inflation happened for all that time!

Then Covid comes along, with its obvious cause of goods and product shortages–and BOOM!!

—we get inflation. Which by the way is just what anyone who has taken an Economics 101 would expect to be caused by a supply shortage.

So why are we SO SURE that now we are sure that ALL this inflation is Powell’s fault– when Economics 101 has always warned that goods/services shortages would be EXPECTED to cause rise in prices. That should have been no surprise at all.

I’m not saying I know. I’m just saying I’m puzzled. Just asking why so many seem SO SURE they know now who or what to blame.

There was plenty of inflation, but it was mostly confined to housing, which for some reason nobody regards as inflation because I guess having a place to live isn’t a core need.

PeaSea

Of course you’re right about housing going up. But I’d call that asset inflation, rather than general price inflation, which I believe has a slightly different cause. My theory: people with high financial wealth were putting some of their money into physical assets as a hedge against feared possible future inflation.

I was one of those who expected inflation. Puzzled why that didn’t seem to be happening.

You can call it what you like, but most people will aver that they need a place to live almost as much as they need food, and even more than they need electricity. It’s something that people have to spend money on, and unless they are fabulously well-to-do they have to spend a significant portion of their income on it.

Of course, because China had been the great global disinflator for the past 3 decades. Emphasis on “had been”.

500M Chinese are middle class now, and they no longer want to do 996s and eat Ramen every day. I mean, we wouldn’t be having a semiconductor or oil shortage if the majority of Chinese were still riding bicycles in Shanghai as in the 1980s.

There has been inflation in the goods and services that the wealthy and wealthy pretenders bought, a lot of it. Haven’t seen it in a long time but the Wall Street Journal used to have an index for it years ago.

No inflation since 2010 ?

1. Stock market gone insane

2. Bitcoin up to the stratosphere.

3. Autos up

Yet Government, who don’t want to be responsible, jigs the numbers and says “no inflation.”

Stocks and crypto are not included in inflation. I do agree though that the so-called inflation was actually asset inflation until recently.

which is more pernicious in many ways than cpi price inflation, as it leads to society being unstable.

Ralph

“So why are we SO SURE that now we are sure that ALL this inflation is Powell’s fault”

Powell jumped M2 by 30% in just over a year…..

30%!!! What economics discussion would not suggest that brings rampant inflation?

historicus:

Agree that it would seem an increase of M1 or M2 would increase inflation. But my big question: Why didn’t that happen from 2010-2020 when it also went up rapidly? I thought it would, for exactly the reason you cited.

But what puzzles me is that what we saw is that ACTUAL inflation only happened IMMEDIATELY and RAPIDLY after Covid shortages–which points to Covid as the possible, if not likely, cause.

I’m not saying I know. I’m saying I’m puzzled.

Can you explain why it didn’t happen between 2010-2020?

Ralph, EXTREMELY simplified picture:

Imagine two balloons, 1st assets inflation balloon, 2nd CPI inflation.

In order to avoid blowing out of US economy, FED was blowing up assets and deflating CPI, or better said blowing up CPI slightly under 2% of balloon volume and rest pushing into assets. Simply said, by repressing long term rates.

What happened recently is that FED printed too much, too fast.

First there has been MONETARY stimulus and second there was FISCAL stimulus. So both balloons has started to blow up on faster pace and there was no time to let some air go from CPI into assets. Both types of STIMULUS was created by the FED! Thus, FED is main culprit for the inflation. FED pushed too much air into all the balloons, and no reverse repos and/or talking down on markets helped so far. That is the REASON, too much STIMULUS AIR into all the BALLOONS by the FED.

historicus: Two other data points from FRED:

From 2010-2016: M1 doubled (100% increase)

Over same period: inflation averaged about 1.5%/year. ??

@ Ralph Hiesy –

Increased dollars (Inflation 1) and rising prices (Inflation 2) has been continuous for decades. To make statements about inflation based on the CPI is a complete joke.

The Billion Prices Project (BPP) is an academic initiative at MIT Sloan and Harvard Business School that uses prices collected from hundreds of online retailers around the world on a daily basis to conduct research in macro and international economics and compute real-time inflation metrics.

I perceive a teeny tiny little patch feeding the blackrock behemoth. My mistake, its the same thing.

more like the BS Project ……………

Soooo, long term higher inflation.

Still making the comment that assets will have to either be a safe resource, or throw off money to retain value.

Now that we are looking at real interest rates, everything valued off of rates in the formula will now lose value in terms of money.

What do you really want? Buy it now.

And as for the rest sell it to those who want it!

And curing this is going to hurt, because we have no modern experience in dealing with inflation and systemic higher prices.

And high interest rates will be a huge shock to the system.

Someday this war’s gonna end…

yes. i can see resources and land holding value in an inflationary environment. stonks already priced for perfection, not so much.

RE won’t sustain current bubble pricing if mortgage rates rise, and it won’t take much of a rise to prick the bubble. During the previous bout of inflation we didn’t have wacko RE prices, so past performance doesn’t mean anything. We are in uncharted water…

My opinion: The most uncharted aspect is the low nominal interest rates. Beware of zeros whether in PE ratios and/or interest rates.

It’s not just the mortgage rates affecting houses anymore, it’s insurance, taxes, wages, healthcare, gas, and food. There is such a thing as a limit.

SoCal

As long as the Fed lends money to the mortgage industry (buys MBSs) at 3% below inflation, and businesses and people can get their hands on that money, they will spend it into the RE market.

I am not saying this is sustainable, but it is a skewed and ridiculous arrangement the Fed has fomented. It can not last, but until it ends…….?

Housing in USA reacts to mortgage rates.

If the rates go up to reflect inflation it has to come down.

Also because the prices are set by the margin sellers and buyers.

Just think the mortgage rates goes upto 8 percent then what happen to people buying homes with mortgages.

Real estate taxes are also set on the margin in most places. When you inflate house prices, everybody lands up paying more RE taxes. Then insurance coverage needs to be increased to cover the inflated valuations, etc.

The fed heads running WW2………..at this point in the war Germany has taken New York and the Japanese are in LA, the front is in Ohio and Colorado but its transitory…….

So……they wonder if we should consider the draft.

I have a new design for FOMC Charmin……..and its not for paper towels.

Americans will be getting a well deserved rest from some inflation as the dollar will continue to surge. While I think that Powell’s barking about tapering is about 25% of the story, the real factor pushing the dollar up is that China will likely embark on a massive devaluation of the Yuan.

Everyone buckle their seats as China gets ready to print.

The USD is crushing everything in its path like Godzilla. Precious metals are being decimated. Inflation? What inflation.

i can’t really understand why the dollar is surging.

Foreign actors want to have cash ready to buy bonds if yields shoot up? High oil prices? I have no idea.

Jake……when US Treasury interest rates either go up or there is speculation of higher US yields……….which might create a wider gap between what is available overseas and what the treasury offers……international folks buy the dollar to be prepared to invest in higher yield treasuries/or domestic debt instruments……..of course this is simplistic……but…..generally it is how it works.

Right now everybody……just about……thinks the fed to about to accelerate the taper which should drive US long rates higher.

Short term traders in gold are anticipating higher rates, so they are selling gold. If you believe US inflation is becoming embedded due to salary adjustments and/or our government will continue to print excessively to overcome any fed induced slowdown, in the long run this is a buying opportunity.

High productivity economies beat lower productivity economies. US produces innovation, those that don’t feel the pain.

I’d hardly call it a surge. On any longer term chart, it’s not even noticeable.

The CHF blew out in the summer-fall of 2011 before the SNB put in a form of reverse QE to suppress the value. Hit about 1.40 where now it’s around 1.10.

I wish the USD would actually surge since it’s my currency of reference. Then I would move most of my money into another one.

Jake W,

Interest rate parity arbitrage is driving the dollar higher.

August,

The Turkish Lira just went down 30% against the dollar.

People still seeing USD as cleanest shirt in the dirty laundry?

I convert another moderate tranche of USD to Thai baht every time the USD/THB increases 2% or so.

The dollar is surging due to the oft forgotten “EuroDollar” market. It’s complicated and I won’t go deep into it here, but basically. . .in times like these, other countries desperately need dollars. As such we are seeing rampant inflation nationality, and massive deflation internationally. One thing that people forget is that the FED has an obligation from foreign governments to offshore dollars, but they have no conduit other than the American consumer, to do so with. This creates the massive distortion that we’re currently seeing. It will probably get much worse before it subsides, as the whole stimulus bill and this endless QE have been a massive overshoot into the upper tiers of financial markets. These markets don’t “trickle down” so this inflation will continue to pump assets locally in our economy. It is possible to have the dollar collapse here and go higher internationally, and I think this is what we are seeing. The rest of the the world doesn’t have access to free FED money like our markets do.

John Galt

“… but they have no conduit other than the American consumer, to do so with.”

The Fed has swap lines with other central banks, including the ECB, through which it engages in currency swaps, where it takes, for example, euros in exchange for dollars. These swap lines were heavily used during the crisis (the balance reached $450 billion at one point) but have now fallen out of use.

In addition, many foreign companies and governments, especially in developing markets, borrow heavily in dollars from US investors (bond funds, etc.), which channels lots of dollars to those countries.

The problem there is that when this dollar-denominated debt matures, it has to be paid off in dollars, and when those dollars are more expensive at that time in terms of the exchange rate, and when new borrowing has a higher rate of interest, it often triggers a common and very predictable crisis in those countries. But it’s their own fault. They should never borrow in dollars. They should harden their own currency and borrow in it.

There are many other ways in which dollars circulate around the world, such as US-based companies paying for imports (HUGE), US companies paying for materials and components in other countries for goods to be assembled in other countries and to be sold in other countries, etc. Then there are remittances by US workers of foreign descent back to their families. Then there are $2 trillion in paper dollars, the majority of which is in foreign countries, etc. etc.

The dollar is the tallest “midget” in the fiat currency room

Maybe because contagions begin at the periphery and work their way inwards. When the periphery currencies degrade first it will boost the dollar. Don’t worry the dollar will be catching up with the other currencies. 😏

Investors are getting out of Yuan and into USD.

Also the dollar surges as people exit stocks (and go to cash) if you want to go the ‘markets crashing route’.

When people “exit stocks” they generally do so by selling stocks they own. When many people do this at once it puts downward pressure on stock prices. Wouldn’t this be reflected in stock indexes?

If you go to Gold Price.org and look at 20 year gold price in Dollar, Yen, GBP and Euro you can see true story of what has gone on. They vary some, but gold up from 4X – 6X depending on the currency. Dollar in the middle of the pack over 20 years.

@ Escierto –

What inflation? The inflation in most everything in the US.

Why should China devaluate?

That make every import more expensive to them. Also note, the Chinese monetary system is not organized the same way as the US monetary system.

Powells own ignorance has boxed himself in. His vanity may cause in-decision if he is worried about his legacy. Volker said F…it and hammered inflation with his reward being a double dip recession. Reagan was overwhelmed by his veracity and purpose and had to tip his hat to him.Powell is a timid creature whom has prospered under the Empires protective shawdow and special access to its wealth. He does not cast the shawdow of a confident man.

yes. just look at the way he stammers and stutters when he speaks. he’s the worst public speaker i’ve ever seen.

It’s hard for a person to be confident when spinning a web of fallacies. He has to worry about new fallacies contradicting old fallacies.

As we say in south omaha if his lips are moving he’s lying now he believes the lies

The foolishness of a financial system that hinges on every word of one banker. It is really a leveraged con game. I think it’s all going to be recognized that Bernanke led us all down the wrong path with the wealth affect.

It started with scumbag Greenspan.

DR DOOM

“Powell is a timid creature ”

Usually, the power is one click down, in the shadows.

I think Powell has some string pullers

Who is in the Fed’s tent? Who hijacked the Fed into ignoring 2 of its 3 mandates?

Why are 30yr mortgages half of what they were when we had similar (much lower in fact) inflation in 1999 and 2006?

Why do we have the greatest gap between Fed Funds and Inflation ….. EVER!!

1) The PCE y/y, next year, will breach 2009 low. The culprit : Manheim.

2) WTI is less than half price from a decade ago, in real terms.

3) CA taxes at the pumps are deflationary. Politicians will never let go. They choke oil. They jumped to the neutral zone, – the wind and the sun – to bit the pumps.

4) Bitten cars will lose their prices and revert to mean.

5) The deflation cycle have started, it’s built in. An insane debt and covid.

6) AI deflate brains.

7) Happy Thanksgiving to all.

8) Amazon is great. AAPL, the greatest. The whole world love AAPL & AMZN.

9) Central banks make money with them. Foreign entities invested in them. They are clean & safe.

10) A European recession will force foreign entities to liquidate.

11) With no fault of their own AAPl will fall.

12) US net worth will deflate. So will debt.

aapl and amzn are just as reliant on fake money and credit as anyone else.

Michael Engel

The Swiss National Bank has a HUGE APPL position…..

13) Black Wed is deflationary !

No way out of this pickle. It’s the 100year demographic cycle. The current govt debt bubble, household debt bubble, corp debt bubble, financial debt bubble all mean that nothing in collateral can go down too long otherwise it’s all over. There can be no default otherwise a total wipeout of household, corp, govt, net worth.

To be fair, what they did starting in Mar 2020 was the rational choice. Everything would’ve been gone otherwise – jobs, wealth destruction. But they also crossed the rubicon and bought corporate bonds. We’ve moved from a system of supply/demand to one driven by centralbank policy.

The Hobson’s choice is default and deflate, or continue on this path to crackup boom and upheaval.

They can’t let the pension system fail and break their promise to 76 million boomers. The Fed basically delivered this to boomers and screwed younger generations.

We don’t have currency, bond, or credit markets that function.

You can’t change demographics and the long term effects of technology/automation. For more evidence, look abroad. China’s trend rate of GDP will collapse and they’ll be left with a hugely indebted society and smaller population. Same with Japan.

Emperor’s got no clothes.

Nice synopsis Del!

So what’s the fed gonna do if/when the real estate, stocks, and bonds bubbles start to tank? Are they going to fire up the printers and buy everything in sight, or will they sit idly by and twiddle their thumbs?

I think they’re gonna print.

And what are they going to do when it doesn’t work anyway?

Which it won’t when market psychology turns against them.

I agree, it will stop working for them and psychology will turn against them. I don’t think it’s the right thing to do either, but I think it’s the most likely scenario to occur.

One or more of these everything bubbles will pop at some point and I cannot foresee any CB reaction that will not be inflationary. The CBs will not tolerate any deflation, so either they nail future QEs perfectly and we get our 2% inflation, or they over egg it just as they did in 2020 and we get significantly higher inflation. I just can’t foresee any alternatives. The 2020s seem to be lining up to be a decade of financial repression, a decent amount of inflation and negative real rates.

Go to digital dollar manipulate that or let system reset everyone goes broke except ultra rich

That’s called a depression as a child had grandma and aunts uncles talk about it ,aunt wore flour bag dresses to school ate lard sandwiches holes in shoes grandma got first farm 80 acres for 800$ bank traded it for there deposit 3-4 generations later history is forgotten sad really

good one Ron!

Dad talked about ”JAM” sandwiches in spite of his ”partying on dude” atta dude for the duration of what is, or should be known as ”the depression formerly known as the greatest.”

His instructions/recipe were to take two pieces of bread and JAM them together…

Just hoping WE the PEONs do not get hammered similarly once again,,, though all indications are that WE will be done that way again, SOONER AND LATER!!!

Gunlach said Fed has the ability to add a zero to asset prices, so you can’t put all your eggs into the basket that we are going to have an asset bust even though I think that might happen

There is little collateral supporting debt, other than mortgages and margin type lending with the latter frequently a bag of hot air. (Another example is ABS where the “collateral” is just more debt.) But yes, I agree with the point of your comment.

Del Fino

The Central Bankers have conducted a “magic show” for a few years….but the drape is being pulled back.

Central bankers know how to enter and implement “policy”, but not a clue how to exit.

What good is policy that, when removed, takes things back to where things were previous to the implementation?

Central bankers missed the physics lesson…

For every action, there is an equal and opposite reaction…..in Physics and Economics

Del_fino said:

A. “To be fair, what they did starting in Mar 2020 was the rational choice.”

B. ” The Fed basically delivered this to boomers and screwed younger generations.”

—————————————

A. Rational from the perspective of the elite …………..

B. They delivered to the elite at the expense of the non-elite ……….

I think the persistent inflation is resulting from a wealth effect, as opposed to stimulus. The stimulus is gone, but people are still spending freely. That’s because their houses and retirement accounts are fat. Even jokers buying junk stocks have made a killing.

unless they’re realizing those gains, they’re spending money they don’t have.

Worse. They are using inflated valuations of current assets to take out loans to buy more assets. Look at Bitcoin. The only problem is that asset valuations are virtual, and loan valuations are real. Once the price setting marginal trade for assets collapses (due to more sellers than buyers), it is all downhill from there.

PS If the Fed really wanted to cool things down, they would start by tightening margin requirements.

exactly. if you’re smart and made a bundle on bitcoin or appl, you sell it and use those profits to buy your home free and clear. now you owe no one anything. if you borrow based on inflated assets, you deserve everything that happens to you when this implodes.

“if you borrow based on inflated assets, you deserve everything that happens to you when this implodes.”

Yet I guarantee you rich and poor alike will claim no one could have seen it coming and it wasn’t their fault.

That’s definitionally what the “wealth effect” is.

yes, but people misunderstand it. people describe wealth effect as “spending some of those crypto or stock gains.” but as you said, that’s not what’s happening.

Yes, but my understanding is those things don’t end well. When you spike the punch bowl you spike company earnings and the price people pay for those earnings.

Once you reach a high enough level (for Japan I think it was a PE of about 70) the whole thing just gets to be a financial nightmare once people figure out it’s going to collapse and then government starts stepping in to try to manage the decline.

Why is the government buying mortgages as homes surge 20%? How can that be good for the taxpayer?

Why is the government keeping bonds at -5% compared to inflation? How does that help retirees who need safe income to live?

None of this is “capitalism” it’s just socialism for the billionaires.

It’s capitalism. A dictatorship of those who own the means of production.

Capitalism? Perhaps Fascism (AKA corporatism) would be a more accurate description.

“Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power.” – Benito Mussolini

As noted by Wolf…..and on Mises.org…

Savers have lost $4 Trillion in ten years…

https://wolfstreet.com/wp-content/uploads/2021/11/2021-11-17-Alex-Pollock.png

and it is not difficult to see where and to whom that money went.

Arranged THEFT, IMO. And what can people do when they are monetarily governed WITHOUT REPRESENTATION…..Taxed (promoted inflation) without representation?

We all know now that savers should have saved in gold and stock holders should have taken out home equity and dumped into stock market. It all works til music stops.

If they keep interest rates low energy (over) supplies are restored and prices drop. Chespeake can save more borrowing money than they lose selling oil. The Fed crashed energy prices in 2015 by holding rates too low too long. They can do it again.

Jet Fuel up 70 percent in a year. Where’s the solar plane I was promised? The administration says to bicycle to family for Thanksgiving. So be it.

Bets are on for number of patents in US patent office related to alternative fuel flight vehicles that have redacted text and a top security clearance stamp. For your safety you understand. And laziness to adapt to bird friendly flight paths. Nope. I overstand and see right through!

Love my scooter. Honda has new mini motor cycle out called the Navi I believe. 110 cc / 50 mph / 110 mpg for $2007 made in Mexico… Looks fun, but scooters have better storage.

Does anyone have any thoughts on how the whole “crypto” phenomenon fits into the inflation picture? I have no concept of how much “money” has been created, relative to what’s generated by the Fed and other central banks. I saw an article on bidding for an original copy of the US Constitution and there was a crypto group of some kind bidding. They lost, but sounds like they drove the final price by a lot. Is crypto fake money also driving prices? No clue – thoughts? Happy T-Day to everyone, BTW!

Crypto is soaking up some of the excess money printing into a new asset class. It is soaking up inflation which would normally be elsewhere, in another asset class.

i don’t totally understand this. wouldn’t the sellers of the crypto take that money and use it somewhere else, causing inflation in that other place?

Exactly. Same with the whole “cash on the sidelines” thingy. It’s a zero sum game.

Yes. Thus everything bubble to infinity

which is why milton friedman was right when he said that inflation is always a monetary phenomenon.

“wouldn’t the sellers of the crypto … causing inflation in that other place?”

Due to HODLers, the resulting flow is into crypto, so I agree with the soaking argument. It appears the same dynamics is true for housing.

The crypto universe is expanding geometrically.

Meaning, money poured into the crypto universe is divided over an infinite number of “coins”, and the eventual average value of all that “investment” will be Zero!

Everyone are hoping for “The Naughties” end game, that by holding thousands of thrash stocks they will also end up holding Amazon and eBay.

But, that’s only going to be possible if the investment universe is contracting.

Jake,

You are assuming incorrectly that buying crypto in US means dollars stay in US, they don’t. Most crypto is mined outside of the US and kept there. So, the dollars going into crypto stay outside of US, and the coins are mostly kept trapped in the blockchain.

This is how excess liquidity(inflation) is exported out of US economy.

Keep in mind that the money is always on the sidelines. When someone sells their crypto no money flows to the sidelines. The owner of the sidelined money changes. The owner of the crypto changes. From the perspective of inflation/deflation it doesn’t matter if person A or B owns that sidelined money. What matters is the volume of sidelined money.

When the volume of sidelined money expands you have inflation, at least in the financial assets world. I guess it’s possible to expand the volume of sidelined money and not use it. In which case – no inflation. But how likely is that?

You can protect yourself when the volume of sidelined money expands by buying an investment asset. Most people think of the result as their investment going up in value. In reality, they have just avoided their money going down in value.

When the volume of sidelined money switches from expansion to contraction the process reverses. Now investment assets become the hot potato instead of money.

Crytpo is an off balance sheet ponzi scheme which generates more money creation. In 2008 the mortgage industry and private money creation were out of the Feds control. Now the mortgage bubble is a bit larger, but the Feds monetary base is much larger, able to fend off the leveraged effect. Crypto likewise is only a few trillion, but growing. If you were to add a precious metal bubble the combined money growth relative to stable Fed dollars would reach critical mass. Then destablize Fed dollars, forex buyers running up the value while the real purchasing power continues to drop (due to inflation) and other forms of money in competition, crypto, gold, turkish lira, all creating a hyperinflationary distortion. When money goes into crypto isn’t soaking up anything, its putting new money in the system. Hussman makes the point that QE only circulates money through the stock market, for every buyer there is a seller. This leviates prices without adding value. The stock market is the Feds private sandbox, but there are others.

Crypto is a significant driver of inflation. It causes inflation by both reducing the available supply of goods and by increasing demand for goods.

Crypto mining uses a large amount of energy, but even worse, it requires a vast supply of silicon chips. Chips are going to crypto mining, because it is more profitable than anything else. Try buying a graphics card for a reasonable prices. The graphics card market is totally broken and prices are set by crypto mining profitability. If you are a gamer and have no interest in crypto mining, no luck to you.

As the chips go to crypto mining, everybody else ends up with chip shortage. Cars can’t be built, because manufacturing crypto mining chips is far more profitable than chips for car systems. So there is now a bad shortage of cars and prices go through the roof.

Now all these people, who made lots of money “investing” in crypto want to use their new wealth to buy cars and everything else. So, in addition to low supply there is also very high demand. Crypto is creating money out of thin air. It is already near $3 trillion and is growing fast. Unless the governments wake up, and ban this abomination very soon, this is going to end badly.

crypto is not creating money. all it’s doing is transferring money to those who got in early from those who got in late.

No, while it only transferring dollars or euro between people, crypto is money by itself and its value is created out of thin air. That would have also been the case even if wasn’t money, but just an asset. Think of someone who mined 1000 bitcoin on his laptop when it was cheap and easy to mine. Now it is worth $57 million. This is new money created. Now imagine it continues going up, and is worth $57 billion, or even $57 trillion. There is nothing really to stop it unless it is banned. Talk about inflation.

that’s not money. that’s marginal valuation. you could argue it’s creating wealth, but it’s not money.

It’s just digits on a computer screen until you get someone to pay you for it.

“Unless the governments wake up, and ban this abomination very soon…”

From today’s BBC …

“Indian government set to ban cryptocurrencies – India is set to go ahead with its plan to ban most cryptocurrencies in the country under a long-awaited bill.”

India will ban all crypto, except IndiaCrypto. This will be legal and controlled by the government.

So it will really be money.

Crypto mining is an example of how wasting resources (energy) creates “growth” in GDP. Wasted resources mean the economy is poorer for it yet it shows up as someone’s income and wealth.

It isn’t the only example either, not by a long shot.

The US healthcare industry fits the bill.

Here is a history lesson for crypto holders. Ethyl alcohol has useful purposes as a solvent and a fuel. But you can drink it and government likes to tax drinking heavily.

Government regulated solvents/fuels so that they had to add methanol which is termed denatured alcohol. After a lot of people died they had to add a secondary ingredient to make taste extremely awful.

Now if you want a solvent or a fuel you can go to the liquor store and pay 5X as much for Everclear or you can do what everyone else does and go to the hardware store and pay a reasonable price for the government’s denatured alcohol formula you can’t drink and will kill you if you try.

Government can do what they want with crypto by taxes and regulations. Next generations just wonders why it’s called denatured alcohol and Everclear.

Put interest rates equal to inflation, which is the financial historical norm of this country prior to 2009….and we will see what CRYPTOs are worth.

Note the beginning of CRYPTOs coincided with the nuevo central banking policies of promoting inflation while depressing interest rates.

Here’s a thought, what if Powell has just been set up to be a lame duck Fed president?

With Kaplan et al’s positions to be filled, could it be that Powell will face MMT nominees plus a vice chairman waiting for him to be forced out the door by a desperate treasury secretary and Whitehouse?

What do you guys think?

TimTim,

First, let’s distinguish between two types of jobs.

There will be 3 openings on the Federal Reserve Board of Governors, of 7 slots that include Powell and Brainard. Those 7 members are government employees, nominated by the Prez and confirmed by the Senate, and they always get to vote on the FOMC.

Then there are the 12 regional Federal Reserve Banks (FRBs). They’re owned by the banks in their district, and their employees are private sector employees.

Kaplan (Dallas Fed) and Rosengren (Boston Fed), who resigned to spend more time with their trades, will be replaced by folks chosen by the boards of their FRBs. These are private sector jobs and are not nominated by Biden or confirmed by the Senate. These two positions are on the FOMC where they rotate into and out of voting slots.

So we will have 3 openings of 7 slots on the powerful Fed Board of Governors; and we have 2 openings (that I know of) of the 12 FRBS. All of them sit on the policy setting FOMC. So this new Fed is going to look quite different.

There is no appetite at the Fed for MMT. Only MMT-lovers think that there’s going to be MMT in the US. No one needs MMT. And especially now, with the inflation going on, the Fed has bigger problems on its hands than debating a 120-year-old and heavily debunked economic theory. Just not going to happen. And the Fed can print money just fine without it.

Hmm, ok. Thank you.

A fair answer to some hyperbole I’ve seen elsewhere.

Tim,

Here’s a simpler way to think of it. What are the chances of bankers who own the fed, allowing the fed, to give their money(deposits & income) to you and me? Zero to none is the correct answer.

Plus what Wolf alluded to, but didn’t say, is the bankers can and will replace any board members that don’t tow the line.

Congress has almost no authority over the fed. Congress can only eliminate the entire system or live with it. Even if they eliminated the fed, the private banking system would reconstitute under a similar system, with the same guys running the show.

Have a good Thanksgiving everyone, in spite of the fed.

Correction 12 reg feds are owned by octagon in switzerland. Tfify.

I think he, the poweller, is, exactly as you suggest TT, the fall guy, etc…

That, or the ”bag man”… both of which are easy targets to shift the blame from the clearly corrupt political puppets on both sides,,, no matter how one ”wants” to assign blame…

”CLEAN HOUSE,,,, SENATE TOO…”’

I’m hoping for a Great Recession II.

Maybe it’ll help us get some equilibrium.

Am I wrong?

I think you’ll get your wish but it won’t be any less painful. Just a different pain affecting various groups differently.

Equilibrium? Not a chance. Whatever hits the fan will not be distributed equally.

MiTurn;

A modicum of patience is advised…

Also re-reading “Macbeth”, even in the form of Cliffs Notes, would be immensely helpful…

3 Witches kept their promises to the letter.

Macbeth got it all.

But not in the way he expected it.

And that’s the story of my life too,although I would not make a pimple on Macbeth’s royal butt.

I don’t believe these figures. Inflation is running more like 15% to 20% depending on your location and lifestyle. I’m glad Powell was reappointed. He will have to raise interest rates now whether he likes it or not. I’m looking forward to it. All my investments are in short term Treasuries and one year CD’s.

i hope so. and as bad as the current occupant of the white house has been, i’m confident he won’t post stupid tweets demanding that powell lower rates.

Swamp Creature,

Didn’t you say the other day that you weren’t impacted by inflation at all because of various reasons you cited? You see, there are plenty of people like you. And that’s why inflation is hard to average out over the whole population. Every item in the inflation basket is weighed by how often on average consumers spend money on it. So a lot of consumers don’t spend any money on cars or rent or plane tickets, while others get crushed by higher prices in things they spend a lot of money on.

So this PCE index here is the lowest lowball inflation index that the government produces and that the Fed uses at is measure. By contrast, CPI-W came in at 6.9%. So you can see the difference.

I thought about it when our friend Swamp Creature said that. He like many others becsme more prudent in order to deal with inflation. To some degree this the definition of inflation as Swamp Creature is experiencing a lower standard of living than if inflation hadn’t spiked up.

Inflation forces all economic actors to determine how they are going to act on it.

Swamp Creature might delay spending and I tried to adjust my portfolio to be more inflation resistant. These things probably are negative for short term economy.

I would peg my inflation at about 2% to 3% because of the measures I have taken. Since I’m a federal retiree I get a COLA which offsets the inflation that I experience. So I’m doing OK. But I realize others may not be so lucky.

From what I can see all the entitlement numbers are just going off the charts as we close in on 2030. I don’t see a positive real rate coming.

Correct about 15 / 20% inflation +or- Most likely you should have made those CD’s for 5 Years going back 2 years ago with 3 Years left . Remember you can always close them out Early and so what if you lose 90 days interest no big deal. Obviously No one in Power / Government / The Fed gives a S*** except about enhancing their own Portfolio / Income . This is a great Blog but so what most certainly has no direct effect on the Situation unfournelently . Lots of Smart people here to no avail however. Yes I understand Grass roots and am Hopeful

Now if the Blog grows to perhaps 500,000 readers and Comments

well then perhaps someone ( better make that several ) might get locked up promoting change . Words in the wind are just that Wind and I can’t buy Food with Wind now can I Talk is Cheap but in the news everyday with no changes.Just what I wanted to go back to work rather than enjoy retirement .

Thanks for your keen Insight Wolf, keep up the Good work it is appreciated Just think If I was Rich like the Fed members I could Donate 5 or 10 Million and have no doubt you could put it to good use . Yes Money is the Type of Power that seems to be running the World Now. Thank you Swamp for your great posts

Wolf, as I understand it (for the record my wife thinks I understand “very little,” She should know I married her…):

Inflation is up 3+(ish)% however the Dynamic US $ is up 5+(ish)%

Id so – shouldn’t that dampen the pain quite a bit?

The other day I looked at my bank balance, looked at food, energy and housing prices, and noticed that despite putting half my paycheck into savings each pay period, the purchasing power of those savings is actually going down every day. I felt bad about this for a moment, until I noticed that the dollar is up. I can’t afford to eat and I’ll never own a house, but that hardly matters because I’ll soon achieve my lifelong dream of acquiring a bunch of Chinese Yuan at a slight discount!

A lot of the BEA’s statistical data is derived from the BLS. Several members of the BEA are from the BLS. The BEA’s charts are influenced by the BLS.

I think we know inflation numbers are going to be really high as housing costs feed into their statistics this year. Plus real economy lags to Fed policy used to be about a year, but if Fed pops stock bubble it’s going to feedback within a week.

Powell repeatedly avers that if inflation gets out of hand, the Fed has “the tools” to rein it in and it it “won’t hesitate” to use them.

Hilarious. It’s already out of hand and it’s already hesitated to act.

it only has two tools. it can print money and it can remove printed money from circulation. that’s it. everything else is jawboning.

Jawboning is a tool.

Jake W

First, they have to take their effing foot off the gas. They still pump over 100,000 MILLION a month into the markets/economy/government (100 Billion)

Create inflation, slow walk and slow talk against that which they actually promoted (perhaps not to this degree)…..feed the federal government leviathan that spews socialistic measures and doles money out to the proletariat.

A very dangerous game played by those insulated from the ill effects.

1) Something is wrong with the inflated Dow. For 5TD the DOW is

hugging Aug 16 high.

2) The weekly DOW : There was a certain high, the Nov 8. The setup

week was Nov 15. In Nov 15 the DOW closed below the lowest point of Nov 8. This week breached the low of the setup week. We got a weekly trigger. The DOW is giving us a warning signs

3) Crypto : BTC/USD weekly : the same bs.

4) SPX weekly do nothing for whole month in Nov, tilting slightly up.

5) A Woke to Dallas Fed to contaminate TX.

6) We don’t know how JP will do in inflation. All we know is that he

saved us from plunging to 10K DOW and put money in our pockets.

7) The more he gave the more we hate…

2) The weekly DOW : There was a certain high, the Nov 8. The setup

week was Nov 15. In Nov 15 the DOW closed below the lowest point of Nov 8. This week breached the low of the setup week. We got a weekly trigger. The DOW is giving us a warning signs

Hi Michael,

Warning signs of?? Can you explain this further?

tell me, why exactly would dow going to $10k been so bad?

The problem is that it would have decreased the gap between rich and poor and increased social mobility.

Affects pensions insurance brokerage accounts deflationary as hell keep learning

Sounds good to me Ron. I could use some “deflationary as hell” right now.

Because the Fed has got a house of cards that the slightest wind is going to topple.

Leverage and long duration means Fed is going to try to slowly dial stimulus back without blowing up the zombies they are responsible for

The globalized supply chain is the major driver of this inflation. And, the President is worried because his name is all over globalization. If the FED raises rates, we will have an inflationary recession. There is not much the FED can do here.

Furthermore, inflation is a global problem … it is not just a US problem. The global supply chain is breaking down world wide.

Not breaking. Just adjusting. Accommodating all the debt. If people will pay and wait then why then as a supplier why not jack up prices? Supply and Demand is what I assume

The rates won’t fix the supply issue. Might help with inflation but I think the global economy is in un-charted territory

this is nonsense. you are confusing cause and effect. the supply chain is a mess because of overstimulation and money printing, not in spite of it.

suppose tomorrow, the president declares it national hot dog day, and orders everyone to eat hot dogs instead of turkey. let’s assume he has the legal power to do this. everyone would run out to the store and buy hot dogs, leading to a shortage.

there is nothing wrong with the hot dog supply chain, it just wasn’t set up to handle that much demand so quickly.

that’s what’s happening with everything. overstimulation caused excess demand. period.

I’d eat a burger, just because….

The supply chain is a mess because of climate change (and in Europe, income tax) restrictions on truckers plus Covid labour problems. The increased amount of goods due to inflation could have been handled otherwise. The capacity in terms of cargo units is there, but they’re all in the wrong places and not moving fast enough.

These problems are not going away. The number of ships off LA has officially dropped, but one look at marinetraffic shows the problem is actually worse. They’ve told the newly arrived ships to hold out of sight of land. There’s a whole stack of them doing 0.8 kts steerage (because it’s too deep to anchor) between 50-150 miles off the coast. The fact that they are busy constructing new lies shows they’ve run out of ideas to fix the problem.

Mostly from countries shutting down COVID related

The global supply chain is very complicated. Many things broke it and in hindsight, it ha been proven to be unstable. It will be very difficult to fix and raising rates is not the answer. This is a medium to longer term inflation problem.

Furthermore, whatever inflation happens from this breakdown is here to stay. This inflation will not be unwound.

I would disagree with your ‘in hindsight’, hordes of people knew disaster was coming and said so at the time. I worked a warehouse night shift 10 years ago, and everyone in the dispatch office knew it then. The JIT supply philosophy was always going to fail because it eliminated all the flexibility from the system to make a little more profit for the next quarter.

This is not “I told you so”, this is “I explained to you why it was inevitable”.

Jake

Indeed.

Powell and Yellen would suggest the supply chain is the cause of inflation. It contributes, no doubt.

But every purchasing agent in America called their suppliers, noting the inflation environment, and said

“Get me all you can at that price.” and then the bottlenecks

For to have inventory in an inflation is EVERYTHING in business….

maybe Powell and Yellen have never been in the real world.

Why do you think the stock market continues to shrug off everything? Is it mainly because of seasonal factors (investors holding through year end to avoid tax bills), or they have insider knowledge the Federal Reserve will not raise rates? Or speculative mania has become so intense (like in 1996-99) that nothing can dent the market?

The Fed syndicate has conspired with the US government to secretly purchase equities and manage prices under the pretense of it being a national security issue.

¯\_(ツ)_/¯

It’s entirely psychological. People may have many reasons for selling, but higher prices aren’t one of them.

The current mania is worse than late 90’s because it is more widespread.

In the US, it was only stocks. Now it is the entire bond market, the stock market, real estate and alternative “investments” like Crypto and NFT.

Outside the US, there was more speculation in stocks then than now, as most markets have flatlined or declined since 1999/2007. But the debt mania is global and there is a real estate bubble in many markets.

As ridiculous as the US stock market is right now and has been for years, the worst is debt. Until recently $10-$15T in negative yielding sovereign debt. Credit quality in the aggregate has never been worse and it’s substantially financed at the lowest rates ever.

The stock market shrugs off everything because it believes(naively) that the FED has it’s back. 120 billion every month in liquidity just means higher highs, and higher lows. It’s a cocaine operation, and it’s working. . .but anyone who remembers the 1980’s will know how an overdose of cocaine will end.

The US Dollar is coincidentally at its highest since 14 months ago (July 2020) as when the 10yr rate was at its lowest.

Ok, 16 months ago. 😁

from cnn, “Fifty-two percent of Americans disapprove of Biden’s handling of the economy and 42 percent approve. In April, he had a 54 percent approval rating for the economy.”

so basically, people approved of the stimmies when they hit their account. now they disapprove when its effects are manifest.

this is why universal franchise was a bad idea, and one that will ultimately prove fatal to america.

CNN, cough cough….

Universal franchise is a modern religion. It’s based upon the premise that the sum of individual ignorance and stupidity equals some form of enlightenment. Somehow, it’s a great idea when people who can barely manage their own life have a say in someone else’s.

No, I’m not interested in telling anyone else what they should be doing with their life.

I’m interested in telling people what to do. I think you all should take a bath.

It’s none of my business what you think. Or anyone else either.

AF –

“Somehow, it’s a great idea when people who can barely manage their own life have a say in someone else’s.”

Quote of the day, AF…

You’ve just described the very definition of a modern democracy, I’d say. We’re all in a bit of trouble from what I can see…

yes. people get viscerally angry when i challenge it, saying “everyone deserves a voice.” but no one has a response when i say that throughout history, universal franchise was the rare exception, not the rule. our founders realized exactly what you said, that most people don’t have the intellect, emotional maturity, or reasoning ability to dictate how others live.

What’s your alternative Jake? It’s easy to point out flaws, it’s a lot more difficult to posit a better alternative.

Jake,

America started with land owning men voting because until then citizenship in America was a fluid concept. Some of the founding fathers weren’t born in America. What most had in common was land ownership and race.

Voting itself was almost non existent in the world. Universal franchise was an unimaginable fantasy at the time.

Let’s be clear that ‘inflation excluding food and energy’ is a nonsense. It was first introduced in the Nixon years, entirely for political reasons.

Unless we can envisage ‘an economy without food and energy’, this measure is meaningless.

Even all-consumer measures are misleading, because they exclude inflation in asset prices.