After 13 years with on average negative real returns to savings, it is time to require the Fed to address its impact on savers.

By Alex J. Pollock, Senior Fellow at the Mises Institute.

With inflation running at over 6 percent and interest rates on savings near zero, the Federal Reserve is delivering a negative 6 percent real (inflation-adjusted) return on trillions of dollars in savings. This is effectively expropriating American savers’ nest eggs at the rate of 6 percent a year.

It is not only a problem in 2021, however, but an ongoing monetary policy problem of long standing. The Fed has been delivering negative real returns on savings for more than a decade. It should be discussing with the legislature what it thinks about this outcome and its impacts on savers.

The effects of central bank monetary actions pervade society and transfer wealth among various groups of people — a political action. Monetary policies can cause consumer price inflations, like we now have, and asset price inflations, like those we have in equities, bonds, houses, and cryptocurrencies. They can feed bubbles, which turn into busts. They can by negative real yields push savers into equities, junk bonds, houses, and cryptocurrencies, temporarily inflating prices further while substantially increasing risk. They can take money away from conservative savers to subsidize leveraged speculators, thus encouraging speculation. They can transfer wealth from the people to the government by the inflation tax. They can punish thrift, prudence, and self-reliance.

Savings are essential to long-term economic progress and to personal and family financial well-being and responsibility. However, the Federal Reserve’s policies, and those of the government in general, have subsidized and emphasized the expansion of debt, and unfortunately appear to have forgotten savings. The original theorists of the savings and loan movement, to their credit, were clear that first you had “savings,” to make possible the “loans.” Our current unbalanced policy could be described, instead of “savings and loans,” as “loans and loans.”

As one immediate step, Congress should require the Federal Reserve to provide a formal savers impact analysis as a regular part of its Humphrey-Hawkins reports on monetary policy and targets. This savers impact analysis should quantify, discuss, and project for the future the effects of the Fed’s policies on savings and savers, so that these effects can be explicitly and fairly considered along with the other relevant factors.

The critical questions include: What impact is Fed monetary policy having on savers? Who is affected? How will the Fed’s plans for monetary policy affect savings and savers going forward?

Consumer price inflation year over year as of October 2021 is running, as we are painfully aware, at 6.2 percent. For the ten months of 2021 year-to-date, the pace is even worse than that—an annualized inflation rate of 7.5 percent.

Facing that inflation, what yields are savers of all kinds, but notably including retired people and savers of modest means, getting on their savings? Basically nothing.

According to the Federal Deposit Insurance Corporation’s October 18, 2021, national interest rate report, the national average interest rate on savings account was a trivial 0.06 percent. On money market deposit accounts, it was 0.08 percent; on three-month certificates of deposit, 0.06 percent; on six-month CDs, 0.09 percent; on six-month Treasury bills, 0.05 percent; and if you committed your money out to five years, a majestic CD rate of 0.27 percent.

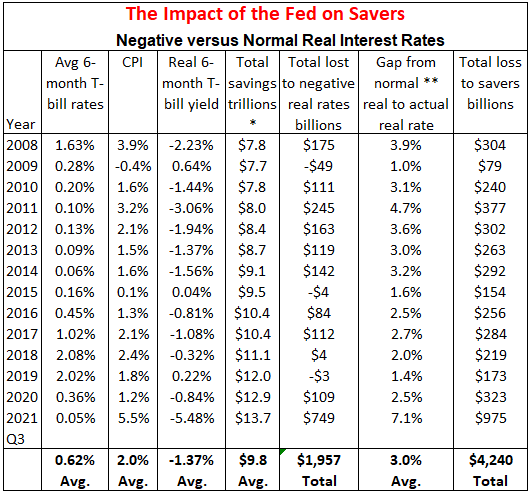

I estimate, as shown in the table below, that monetary policy since 2008 has cost American savers about $4 trillion.

The table assumes savers can invest in six-month Treasury bills, then subtracts from their average interest rate the matching inflation rate, giving the real interest rate to the savers. This is on average quite negative for these years. I calculate the amount of savings effectively expropriated by negative real rates. Then I compare the actual real interest rates to an estimate of the normal real interest rate for each year, based on the fifty-year average of real rates from 1958 to 2007. This gives us the gap the Federal Reserve has created between the actual real rates over the years since 2008 and what would have been historically normal rates. This gap is multiplied by household savings, which shows us by arithmetic the total gap in dollars.

*Total household savings consists of time and savings deposits, money market fund shares, and Treasury bills

** Normal real rate is the average of 6-month Treasury bill yields minus CPI inflation, 1958-2007, =1.66%

Sources: Federal Reserve Statistical Release, Financial Accounts of the United States – Z.1, U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, & Board of Governors of the Federal Reserve System (US), 6-Month Treasury Bill Secondary Market Rate

To repeat the answer: a $4 trillion hit to savers.

The Federal Reserve through a regular savers impact analysis should be having substantive discussions with Congress about how its monetary policy is affecting savings, what the resulting real returns to savers are, who the resulting winners and losers are, what the alternatives are, and how its plans will impact savers going forward.

After thirteen years with on average negative real returns to conservative savings, it is time to require the Federal Reserve to address its impact on savers. By Alex J. Pollock, Senior Fellow at the Mises Institute.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I agree with the general thrust of your article, but favoring leveraged speculators to keep economic growth and activity going seems to be everything going to plan.

Only in crisis and collapse can I see a paradigm shift happening like we need, long after the “winners” have insulated their gains.

I agree – fed’s STEAL DAILY and sheeple don’t get it

NIRP and 10% annual devaluation(before 2021 and since 2000) in our fiat $dollar

is causing DOUBLE THE TROUBLE

IS THERE ANY WONDER WHY over 50% of retirees live under poverty line

and now those retirees are in for round 2 which will devastate over 2/3rds quickly

The trouble is it doesn’t actually keep economic growth going. Inflation is a surrogate for growth, crowding out the real thing.

It’s more appearance than reality when you crank out inflation figures that understate inflation. Calculate real growth by measuring nominal growth and backing out inflation. Back out an artificially low inflation figure and presto you calculate artificially high real growth.

What we have mostly is a big increase in nominal spending. But the actual value that spending buys is questionable … if you can even buy the products and services you want in the first place.

This is the worst economy I can remember, including the stagflationary seventies and the aftermath of the great financial crisis in the teens.

Paradigm shift has happened. You live in lowless siciety.

Pls excuse an off- topic interruption:

CNBC headline on cryptos today AM:

‘Bitcoin briefly drops below $60,000 as major cryptocurrencies fall

It’s below fifty eight. It dropped over 4% overnite and now some poor kid in charge of the headline had better scramble.

To think some people still imagine this being a currency, as in currently or routinely acceptable in exchange for goods or services.

I think that is BULLSHIT 4 Trillion is a joke / It is really about $15 Trillion so far since 2008 / Since 911 in 2001 between the 20-year war the 2008 bailout the Covid 19 and tax cuts for the 1% the real numbers are probably around $75 Trillion Bucks we have printed.

$75 trillion??? You live in fantasy land. But OK, enjoy it.

Reality is bad enough. You don’t need to make up stuff to make it worse just because it juices your creative energies.

That’s why I stopped saving three years ago, no real incentive. Heck, I even cashed out my 401(K). Every penny I earn these days, I invest it in real estate to get cash flow.

silly – should have converted 401k to roth and then buy your real estate

TAX FREE

If interest rates were to rise, would the 1% start calling it a plan to “soak the rich”.

Or even worse, (shudder). They might call it “socialism”.

I think you may have that backwards. The 1% collect most of the interest that’s paid. It’s the lower 50% (plus US Govt, plus various over leveraged corporations) that owe most of the debt.

An interest rate increase will effectively tax the poor to increase cash flows to the wealthy. Bankruptcies would rise too though.

But it would also bring down asset prices, reducing the net worth of the 1% and making it easier for hard workers to build wealth.

Inflation directly “taxes” the poor.

PLEASE – d e v a l u a t i o n

Tax brackets are nominal, therefore inflation pushes incomes into higher tax brackets, reducing take-home pay.

And rising prices, smaller (cheating) sizes of packages, all reduce what you can buy with your smaller paycheck.

Nice comment, wisdom seeker. The 1% hoover up all the savings for themselves. And the Feds produce Treasuries that don’t fund any Congressional spending, but do insure the wealth of the 1%. Nice scam going on there. My view is that we screwed up by giving serial tax cuts on the incomes of the wealthy (dividends, interest, rents and cap gains). The system is constructed precisely to funnel all profits up to the top rung of the income ladder. Raise the tax rates on incomes of the wealthy, and cut the tax rates on wages. This will open up fiscal space that the government can invest into as it wishes. Any spending can create price increases. But you cannot have one demographic get all the gains.

No, an example of a socialist policy is the earned income tax credit as a refundable, a negative income tax. This money had to come from somewhere, as it isn’t actually “free”.

Socialism is giving someone’s property to another who did not earn it. The definition doesn’t have anything to do with who they are, whether a member of the ghastly 1% or the pauper. It’s just that many have convinced themselves that the latter has imaginary “rights” which someone else has to pay for.

Nice comment but one must add that too many among the 1% also have an overdeveloped sense of entitlement.

Too many have convinced themselves that they have an imaginary “right” to paychecks (and other wealth-increases) which are obscenely disproportionate to their actual personal contributions.

Too many have convinced themselves that their descendants have an imaginary “right” to inherit great wealth without contributing anything to society.

Sanity, it seems, is only found among the middle class who have more-or-less legitimately earned what they’ve got.

An imaginary right to pass things on to one’s survivors?

I feel that this right is far more rooted in natural rights than any other “right” to take it away from me or my surviving wishes.

It seems that the mere existence of a pile of wealth is justification for a “do gooder” to take it away for “the public good.”

And Thatcher said..

“Socialism fails, because you eventually run out of other people’s money.”

She never dreamed central bankers would be the never ending supply of money…

and that reality of today wasnt even dreamed of back then….when it was incumbent on every generation to pays its debts. That is how far adrift we have gone….in central banking.

Maggie Thatcher was a shill for the globalists. You know, the 1%.

As such her words carry no weight.

Do notice that rentiers also may run out of other peoples money.

A newer ending supply of money usually end with the money not being worth anything. But that have till now been the end of all and every fiat monetary system.

Perhaps private property should NOT be defended at all costs.

“It is not true that individuals possess a prescriptive ‘natural liberty’ in their economic activities. There is no ‘compact’ conferring perpetual rights on those who Have or on those who Acquire. The world is not so governed from above that private and social interest always coincide. It is not so managed here below that in practice they coincide. It is not a correct deduction from the principles of economics that enlightened self-interest always operates in the public interest.” JM Keynes, in his essay on Laissez faire economics. 1926

You mean like during the 2016 presidential debate when “the Syrian boy” was of more concern to the candidate instead of the hundreds of kids in equally or more perilous conditions in Bronx, Detroit, Oakland and every place in between.

I don’t see how the fed can address impact on savers, when their core policy is to manipulate people into getting indebted and having their purchasing power eroded.

It’s like asking an arsonist how he plans on putting out house fire.

Exactly. Their main goal IS to discourage saving and “liberate” funds to fuel “growth”.

Docile slave worker, a comfortable saver does not make.

The conditions for this THEFT was decided by a cabal, people in the Fed, unelected an unbridled.

This chart shows the damage….

Question for Mr. Powell…

“Did you or you parents ever save money …. to buy a large item or perhaps to get on your financial feet? And if so, why do you deny the Americans of today that avenue?

This chart shows the intentional change in the HISTORICAL policy and the shirking of duty by the Fed since 2008.

I mean no offense, and I mostly think you’re right, but do you ever grow tired of writing basically the same anti-fed comment (in different words) five times on every article?

That is how an obsession is acted out.

I enjoy seeing his comments on every single article, and hope he continues. It is important that new readers, not you, learn about the evil that is the FED, and historicus highlights it excellently.

Savers could have purchased Ibonds in increments of 10K a year, and they would have at least stayed even with inflation. However if you consider stock market returns vs Ibond returns, no comparison. The stock market is much better at tracking inflation than government inflation securities.

The Fed is purchasing I series bonds to supress their rates too.

The government is purchasing TIPS, but I was not aware of Ibond purchases. Since Ibonds are directly tied to CPI, I don’t see a mechanism where Ibond purchases could supress rates.

That was a joke, I think. That’s how I read it.

I-Bonds don’t keep up with inflation when you have to pay income taxes on the “inflation adjustment” as well as the interest. Ditto for TIPS.

Unless your income is low enough to avoid significant income taxes, all taxable bonds fail to keep up with inflation due to tax impacts.

Stocks may not keep up with inflation either… it depends on where the inflationary pressure goes in the system.

In the 1970s inflation waves, both stock- and bondholders lost badly to inflation from 1969-1982.

Ambrose Bierce,

That is precisely what the Fed has done. Through its policies and market manipulations, the Fed has shifted income and wealth from savers to stock market investors. So your point just confirms that the Fed decided who gets wealthy and who gets shafted — a handful of people made that decision.

The point of the article is that the Fed needs to be held to account for its decisions to take wealth and income from one group of Americans and hand it to the other group of Americans.

It’s not just savers. It’s bondholders, pension funds and their beneficiaries, and other groups. They Fed has pushed them into high-risk assets if they want to maintain any kind of income. This has distorted the entire financial system.

It also hurt the overall economy because retirees lost much of their income after 2008, and therefor cut back on their spending, which cut back on consumption. But the people that got rich in the stock market were the top 10%, which are the ones that own nearly all of the stocks, and they already make more than they spend, and they didn’t increase their spending. This whole policy was and is a giant economic clusterf**k.

“the Fed has shifted income and wealth from savers to….”

Gold and Economic Freedom by Alan Greenspan 1966

the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes.

since establishment of FED:

$1 in 1913 has the same purchasing power as $27.94 today. Over the 108 years this is a change of $26.94.

The average inflation rate of the dollar between 1913 and 2021 was 3.23% per year. The cumulative price increase of the dollar over this time was 2,693.83%.

As badly as the US$ has performed since 1913, it has outperformed the UK pound, the German Reichsmark, the French franc, the Italian lire, the Soviet (Russian) ruble and the C$.

It’ll take you 105 fresh US $20 bills to purchase one US $20 gold coin. The math is easy…

max,

That is just the ”official” relative rate and result as promulgated on the Bureau of Labor Inflation Calculator; IMHO, it is usually a lot more than either, as is reflected in shrinkage as well as rises in prices. For instance, the house I bought for exactly $40K in 1980 is now worth north of $800K!

Wolf says he has never seen actual deflation for more than short period(s) in his lifetime, and that is generally true in the ”macro” world.

Many of us on here have either seen some, or have lived with parents and grandparents who lost everything in the greatest depression so far since 1913.

That depression was not altered much for most people until World War 2,,, so I am just hoping that we can avoid another similar war solution and work through the current situation toward a more stable economy.

Even as a persistent optimist, that does not look very likely these days,,, but keep in mind that sooner or later the pendulum of life swings both ways.

i think the point of the welfare state was to provide a basic survival income to the low paid workers to stop them rioting whilst the wealthy shifted their jobs abroad to make more profits. Turbo Capitalism by Edward Litwak.

Have you seen the PBS special documentary “The Power of the Federal Reserve”? It can be seen from their web site.

In it, former Fed gov Fisher admits, though he doesnt seem to know the gravity of his statement… that…

The Fed dropped rates out the yield curve in order to FORCE…FORCE investors to take more risk. Then he said it was surprising how it impacted markets. Another bothersome comment.

So we can deduce that…

The Fed, who allegedly only had control over the front end…intentionally took a hammer to the long end, pushing rates to historical lows, 4000 yr lows. This is a DIRECT and INTENTIONAL violation of the 3rd mandate, “promote moderate (not extreme) long term interest rates”. This began the process of burdening future generations with massive debt, an pulling welath forward. And the “dual mandate” game omits this very important mandate.

FORCE, is the word he used. When did the Fed become the “forcer” of investment and market decisions? Force is a powerful word, and I dont find it in the Fed’ mission statement or directives.

The Fed has been hijacked, and it occurred, IMO about March 25, 2020.

I suspect Larry Fink will name the next Fed Chairman

As I’ve mentioned before, Fisher could say you took his comment out of context. The statement the the Fed “forced investors to take more risk” does not necessarily imply that this was an explicit goal of reducing rates.

Fisher could say that increasing employment by stimulating the economy was the main goal of reducing rates. And that it worked – very low unemployment. So they were right!

And the extent that people were forced into more risk-taking was totally unexpected.😮 Also the windfall increase in net worth of the top 1% filthy wealthy folks was so surprising and unexpected! 😁

According to CNBC, the average consumer debt is at record high levels ($94,000 which includes all types of consumer debt). Politicians might be evaluating whether increasing interest rates would make a lot of people unhappy. Maybe there is some calculation that compares [loss of votes from angry people in debt] vs. [loss of votes from angry savers not earning interest]. Another factor is angry too-big-to-fail financial institutions who start losing billions if a lot of people start defaulting on their debts (feds to the rescue!).

Looks like Gen X is going to be most pissed of if they start having to pay more interest on their debt (note that it’s natural that people in their age group have more debt). This is average debt of people in each category (CNBC):

Gen Z (ages 18 to 23): $9,593

Millennials (ages 24 to 39): $78,396

Gen X (ages 40 to 55): $135,841

Baby boomers (ages 56 to 74): $96,984

Silent generation (ages 75 and above): $40,925

“Between July and September, US household debt climbed to a new record of $15.24 trillion (Fed Bank of NY). It was an increase of 1.9%, or $286 billion, from the second quarter of the year.” So even with the stims-o-rama, flooding the economy with money galore, people are still going into more debt. 🤔

So for those that don’t have that debt locked in to current low interest rates for a couple decades, a significant increase in rates is gonna put them in the hot seat.

Although my opinion is that interest rates should be quickly, steadily and significantly increased, the result could very well be complex and chaotic.

“Have you seen the PBS special documentary ‘The Power of the Federal Reserve’ ”

AS I EXPECTED, they let them get away with the -BS- excuse that the entire banking system would have collapsed if the taxpayers hadn’t bailed out the results of the blatant, widespread fraud which caused the problem which was then followed by no repercussions for those involved.

Back when Bill Moyers was doing his outstanding, objective, balanced interviews where he typically asked all of the right questions, during the GFC he interviewed Reagan’s Director of the Office of Management and Budget, David A. Stockman and he contradicted that claim, later doing so in much greater detail in his NYT best selling book, “The Great Deformation: The Corruption of Capitalism in America.” Interview on YouTube:

David Stockman on Crony Capitalism – Bill Moyers & Company

He also twice interviewed William K. Black, a white collar crime lawyer and former bank regulator who was involved in the prosecution of around 1000 individuals after the S&L crisis. YouTube title of one of them:

BILL MOYERS JOURNAL | William K. Black | PBS

You’re correct, and you have to wonder why Calpers needed 8% returns while inflation was dogging along at 2%. There are pensioners and savers who have benefited from the Fed’s policies. If you were in the private sector mostly you have been left behind.

True Mr. Richter. The tax system is designed to specifically funnel all profits up to the 10%. This group already owns 80% of all US assets, including commodities. For those who acquire, there is never enough.

Hear, hear, Wolf. I am nominating you for Fed Chairman or even President in 2024. Being retired, normally, for previous generations of retirees, they could put enough cash into conservative, very safe liquid accounts every year so that they do not have to time asset sales in order to meet their Required Minimum Distributions from IRA’s, pensions, and SEP IRA’s.

I just sold an asset yesterday to generate my 2020 cash distribution, but I have to say I had some pale knuckles holding on to the edge of the seat until I did. Why couldn’t I just have 2 years worth of distributions in Treasury bills or notes to accomplish this??? I will and haven’t bought these so-called risk-free debt instruments since 2006 due to the ridiculous yields being offered. Rather bury cash in the backyard, wired with C-4 of course.

After one has been under some modicum of stress during his or her working years, WHY THE HECK DO WE HAVE TO PLAY ON THE RISKY RAILROAD TRACKS IN RETIREMENT THANKS TO THE MONETARY POLICIES OF THE U.S. FEDERAL RESERVE??!! Personally, I am sending them a big fat Lost Income bill or an arrest warrant for stealing from me for the last 13 years.

2021 Distribution, me bad and aged.

The Fed has destroyed the middle class, working poor, savers and retired.

In favor the wealthy and those connected to the ruling class.

Yep. And the lack of outrage is mind numbing

Because the masses are too ignorant to understand or do not care to inderstand.

Or the masses don’t protest fearing being gunned downed in cold blood by our militarized police.

The “masses”, for the most part, have a roof over their heads and food on the table. Needs are met, wants are always there but not necessary.

Some of those wants were obtained with the stimulus money.

J

I’m surprised you didn’t add….let them eat cake !

There is outrage, but it is censored. 😉

A frog in boiling water… and we have social media to keep the frog occupied.

Just eliminate capital gains tax on silver and gold coins minted by the US. Put them on the same tax footing as Federal Reserve Notes, and let people decide on their own in what medium they want to save.

I never liked that wages are taxed more than investment capital. They should be taxed the same, allowing the tax rate to fall for workers and rise for capital. The tax support for investors is unnecessary, they already have excess savings in the form of invested capital. Workers shouldn’t be paying more than passive investors, ever.

You got that right Petunia.

A modified flat tax with all income treated the same, no matter how much or how not so much a citizen takes in each year should be taxed at 20%.

But the amount of a “Living Wage,” which will differ based on where one lives, should be $30,000. Take a $15 an hour minimum wage job at full-time to get to the number of a Living Wage

If you have income of $30 grand or less, there should be no IRS tax liability. Every dollar thereafter should be taxed at the same fixed rate. Hedge fund billionaires will pay the same as everyone else. Now with the progressive tax code in the USA, high-end salaried workers pay a lot more than passive investors.

Think about it; we have the system the TPD (Two-Party-Duopoly) wants. Many people like the idea of “tax the rich,” so they think the progressive system is great. They are wrong on the ethics of the idea IMO, and as you point out Petunia, they are wrong on how the system is implemented.

You have to remember if you own stock in a company and it’s earnings before taxes is $1.00 per share, then the after tax earnings are $0.75 at 25% rate. If cap gains rate is 20% then you are left with $0.60. If your state taxes corporation’s income and has an income tax you can below at $0.50.

Capital gains taxes are rightly lower because it is largely a tax on inflation gains. My assets like my house or most stocks are not any different than 10 years ago but simply cost much more due to bad monetary policy. And if we had a competent functioning government taxes could be significantly lower. Exhibit A-Defense Exhibit B-Healthcare. Exhibit C-Banking. All funded by the taxpayer to a large degree without meaningful control.

To balance it out corporate tax would have to be removed, Petunia, which would be fine. That would also do much to level the playing field between big and small companies.

The goal should be to separate corporate and personal entities more, and tax people and not corporations. And then also remove many freedoms and opportunities currently enjoyed by corporations, such as e.g. the ability to donate money or to litigate as a separate entity from its owners.

Any money taken out of a company should then be taxed just like a salary.

Corporations ARE people.

SCOTUS says so.

Petunia:

+1000!

Wages should not be taxed at all. Taxing labor is a special kind of evil.

=I estimate, as shown in the table below, that monetary policy since 2008 has cost American savers about $4 trillion.=

“Crime Once Exposed Has no Refuge but in Audacity.”

Tacitus

Well,this scathing expose will produce even more Audacity in DC.Which will be backed by yet another multi-$$$TTT “Social Justice and Hyperstructure Bill”.

Barring the external shock nothing will ever f… change…

Does anyone remember “Arnheiter Affair” ?

Crew of USS Vance was completely demotivated by Lt Cmdr Arnheiter stupidity and chicken shit (CS is so petty and mean that it is 2 steps below of BS).Sailors assumed foetal position,ceased to move and refused to carry on.

Luckily for them Lt Cmdr Arnheiter was relieved of duty after 99 days as a ship captain.

Oh,and the favorite word of Lt Cmdr Arnheiter was “Audacious”

I fear that a bigger loss is coming because savers have been pushed into stocks and bonds and some I durance products they don’t understand.

Insurance products they don’t understand.oops.

Long time ago when I was young and eager to learn and undistracted by non-existent Internet I plowed thru the “Security Analysis” by Dodd & Graham.

None of the stuff contained therein applies anymore.I never bought a lottery tickets and never played at the casino (but always cashed in $5 encouragement chips, thank you very much).

Because odds are not in my favor.Thats all I need to know.

And if you look up “Gambler’s Ruin” at Wiki you’ll see that Capital matters more than Skill.No matter what I’ll do in the stock market – Big Operators will eventually take my savings via “pump-and-dump” or it will be death by 1000 cuts (I mean transaction fees).

Therefore-No.I will not be pulled or pushed into Stocks & RE & Crypto gambling.

If my savings go up in flames so be it.Worse things happened to better people if the History is any guide 😁

SO AGREE with Brent on this one:

Stopped already with the various gambling, stocks, commodities, casino, etc., mid ’80s, and have been very happy with that decision since.

Now with no debts other than monthly expenses, easily able to live the same life style (very modest ”wants” to be sure) on less than SS alone, etc.

Could be better off if I didn’t love to drive across USA to see family and friends and this beautiful country, and hope to do so at least once more in the current lifetime.

It is much easier to create a system that results in negative interest rates for large segments of society than to cut government spending or raise taxes sufficiently to balance the budget. If we are lucky, we will avoid the type of inflation that Germany experienced in the early 1920’s. If not, …

As the old saying goes, those who do not remember the past are condemned to relive it.

“The Federal Reserve through a regular savers impact analysis should be having substantive discussions with Congress about how its monetary policy is affecting savings, what the resulting real returns to savers are, who the resulting winners and losers are, what the alternatives are, and how its plans will impact savers going forward.”

Instead of the FED having discussions with Congress on these matters, why not have a panel of affected citizens ask the questions directly to Congress representatives on National television?

I don’t think any of them give a rat’s a$s about savers losing money to inflation. They only care about the donor class. If the savers get wiped out, so be it. They are just collateral damage.

I just hope 80 million of us who make crap wages, have no savings, assets, etc remember who it is who screwed us over when the financial levies fail. No more bailouts. No more austerity. No more sacrifices.

PLY,

The number is probably greater than 80m. I’m retired, fixed income, disabled, etc., and got tired of watching my “savings” lose against inflation regardless of what I did. So I converted much of it into silver. Wise? I don’t know. But I think longer-term it is. I didn’t know what else to do, but I do know that what I had been doing was costing me money — anti-investments.

I think converting savings to silver was very wise. It’s volatile, but it is one of the few things that is 50% off it’s all time high.

There is some risk of having money in the bank, even if that risk is extremely small. Getting 0.1% in an inflationary environment doesn’t compensate you for risk.

Banks know retail money is sticky and they can screw you on the interest rate.

true OS, but keep in mind that all time high was a result of those TX bros trying to corner the world silver market, apparently not realizing RU was sitting on billions of oz of that metal at that time…

Having a small bit of various metals, gold, silver, lead, etc., always on hand is good idea IMO, but my thinking is that it will not be very attractive for very long if the real poop hits the paddle, as opposed to the social crap always happening…

Real stuff, especially food, will be the long term commodity of value, though I can see the possibility of .22 shells, etc., as very tradable.

The next ”Carrington Event” should tell us a lot about what will be coming, eh?

I hope you did not get ETFs holding metals, which may not even hold the silver in reality and will declare bankruptcy when prices rise. READ your ETF terms and you will see.

FYI: oil prices and transportation delays due to oil and shipping industries’ manipulations may be causing part of inflation. The reported creation of about one THIRD of all US dollars ever created from 2019 to early 2021 by the banksters’ “Fed” (privately owned cartel) must also have hiked inflation by increasing the supply of dollars, while fewer goods were available due to the pandemic.

How long will this last? If our economy truly gained 312000 jobs during a recent month, maybe not for that long?

Keep buying those guns… and ammo, don’t forget ammo, brass case, boxer primer for longevity. And probably some spares like firing pins, recoil springs etc. From the looks of it either this or the next generation will need it.

The author was not clear on what he considered “monetary policy”.

Another aspect of interest rate suppression has been the “Greenspan put” (now Powell).

The same applies to other government loan guarantees, all of it.

Thank you Alex. Well written and informative.

As a student of physics, I always understood certain laws, such as Newtonian Dynamics, to be irrefutable and unchangeable. Economics has “laws” which the Federal Reserve, and other central banks, have chosen to break since 2008.

Two laws that should always be adhered to:

1) Capital must have value. i.e., it must cost to borrow money. Cash should not be given out freely.

2) Future capital must have more value than present (time) capital. i.e., it must be profitable to lend. When one lends money (bank savings account) the return on interest needs to be greater than the loss to inflation.

On 25 February 1927, the central bank of the USA was given a gift by Congress. It is to continue operating in perpetuity — or until Congress, and congress alone, sees fit to terminate it. Yes, the original 20 year charter Congress gave the Fed in 1913 has been torn up & the Fed lives forever!

And there is the binary monster that Nick Kelly referred to recently, “Only in digital logic is there a zero and a one, on or off, black or white.” Nick was wrong, the reality is that the Fed exists unchecked (it is “on” & will not be turned “off” as long as Congress is controlled by the TPD). The Fed’s mission is to break the Laws of Economics, and there is only bad in this — not a degree between good or bad.

The Fed began before my birth on Planet Earth, and the McFadden Act was passed by Congress before I was born as well. I have never missed a vote in my life. I have never voted for a candidate of the Two-Party-Duopoly for U.S. Congress. But, I can adjust my actions based on the cards I (and all other U.S. citizens) have been dealt. To that end, the Fed’s actions have helped make me a lot of money in the last decade, but I don’t dance with the devil, I watch it and try to stay a step ahead.

P.S. Nothin’ personal Nick. I enjoy reading your comments …

And speaking of devils, since the wind is howling from the WNW, I rode my bicycle past the Minneapolis Fed Bank a couple hours ago and barked up at Neal with a, “Raise rates fuc#head”. I don’t think Mr. Kashkari listens to me, eh?

I do not think there are any absolute laws in economics.

But some math do set constrains on monetary systems:

A monetary system with a fixed amount of money, for example gold as hard money, can not have interest on money. That make the amount of money on the books expand beyond the physical amount of money.

A monetary with fiat money, positive interest rates make the amount of money expand to infinite. The speed is decided by the interest rate. Only defaults can stop or slow this down.

No, there are no laws in economics because of human agency.

The only laws that hold up in economics are the laws of supply and demand.

Classical economics assumed personal responsibility and agency – in the self interest of the individual (led by the invisible hand of The Divine.)

The lack of agency in economic decisions would seem more of a problem and necessitate an economic theory that relied on flawed knowledge, not the perfect information assumed by classical economics, which is mostly dogma anyway.

Truth being all economics, aside from supply and demand is wishful thinking totalitarian BS.

This is the wrong debate. The problem is that monetary policy is now dictated by politics, not economics. The financial system is dying.

August Frost (an others)

The “science” of economics is really a, “behavioral science” supported in part by mathematics.

Everything you want to know and use except the “X” factor of human behavior.

“A monetary system with a fixed amount of money, for example gold as hard money, can not have interest on money.”

Maybe on an island with three people. But there was a time when banks competed for savers because money was actually backed by gold and wasn’t printed at will. Banks didn’t get free cash from the Fed back then.

You can’t print gold or silver. People are now finding this out because gold and silver coins that were available less than two years ago are off the market and what people are willing to sell is double the price. Don’t watch the market bullion price, watch the premiums on bullion coins.

Positive interest rates inflate the amount of money. If a monetary system with a fixed amount of money do operate with interest, the system do either crash or grind to a halt.

The reason is that after a while the amount of money “existing” on the books as deposits and loans exceeds the amount of money that exist physical.

The system crashes if all want to withdraw their money at the same time, because there is less physical money than bookkeeping say.

The system grind to a halt when rentiers save and take money out of circulation.

I heard a good law within the last week. Gold was valuable before it was money.

It’s still valuable even though it’s not money anymore.

Heard Larry Lindsey, a former central banker say that central bankers don’t really like to talk about gold because it’s a competitor.

Look at history, central bankers have a bad reputation for screwing citizens over on behalf of government.

I don’t think Newtonian Dynamics are irrefutable. They don’t hold in situations where either quantum mechanics or general relativity take priority.

Economics has nothing that would be considered a law by the physical sciences.

c_heale,

Yes, as moving objects approach the speed of light, time and mass change.

If I’m riding my bike or motorbike; if I’m driving my car, Newtonian Dynamics are indeed irrefutable. I enjoy, on occasion & in the proper place and time, pushing towards the boundaries between control and losing control — that’s where the Law of Physics do apply and need to be obeyed.

The Fed could conduct business with the idea that future money should be worth more that it is today. They don’t.

The Fed could conduct business with the idea that lenders should be rewarded and borrowers should bear a cost for access to money. They don’t.

Whoa there Dan. The lenders are the oligarchs whose income consists of dividends, property rents, cap gains, interest and extraction (commodities) income. So no matter the condition of the economy, the oligarchs win.

Economics is an exact science.

– “Economics has “laws”

The macroeconomics has laws.

The wealth is generated by the economics.

Then the wealth is channelled to your pockets by the wealth sharing mechanism: politics.

The things may get unfair for a time.

Good news – the reversion to the mean will sort the things out

Bad news – it could take decades.

Serves them right, One does what the brightest people do and follow them. Spent, spent because you never have to pay it back. The Politian’s and their Parasites will ,with the stroke on the keyboard wipe out all your debts. After that you WILL get a new leader. Does the name Mussolini, Stalin and Hitler sound familiar.???

I bought a book in 2015 called America 2020, The Survival Blueprint. I bought it because it scared me how reckless our government had become. I had a successful business that was hit hard during the GFC. Although I survived, it scared me. The book goes over in great detail how things would unfold if the government remained reckless. Looking back today, the book was pretty much spot on. I won’t say I knew this would happen but I will say that I had a strong feeling that it would. I began shifting my wealth away from cash and into hard assets like gold, silver, farmland, mining companies, dividend paying stocks, real estate, cars, etc. My goal wasn’t to make money, it was to protect my wealth that I had been so diligent to build. It was a good move.

Inflation is insidious and my new enemy. I am focusing all my efforts on beating it. I drive older cars, I wait to buy things when they’re on sale, I clip coupons, I shop at the thrift store, I eat out only on special occasions, I only buy things that I need. I’m on a buyers strike for the things that aren’t truly necessary. In my mind, it’s just a game. A game that I don’t want to lose. Keep in mind that I came from nothing. My parents were dirt poor. We had to raise rabbits in the barn because that was the only affordable way we could eat meat at the time.

The thing that bothers me the most though are the people that are reckless. I’m surrounded by people that live beyond their means (including the government which has lost money in 48 of the last 52 years). They drive new cars, they eat out all the time, they buy fancy things, they take lavish vacations, they’re in debt up to their eyeballs. If the government ends up bailing these reckless people out, at the expense of everyone else, I’m going to come unglued.

People living beyond their means doesn’t bother most people in this country, just read some of the comments and inferences here.

Proportionately, almost no one believes in accountability any more. The politicians, voters, government program recipients, and bureaucrats who administer government programs aren’t accountable. Only the taxpayer and there are fewer of them over time.

In modern culture, the taxpayer is supposed to function as a general all-purpose insurance policy to pay for someone else’s imaginary “rights” and for the irresponsible to “self-actualize” at someone else’s expense. Then to make good on any bad decisions when things do not “work out”.

No society with this behavior can survive longer term.

DS

So you’re wealthy ? Or think you are ?

And the biggest fear for you is losing some wealth ?

THAT’s what your wealth bought you ?

Fear ?

So sad, so sad

It’s incredibly sad. This is why the wealthy/elites are winning and will continue to win. Does this man mention the real culprits of the whole situation? Does he single out the MIC or the .1% standing right next to the money spigot? No, this small man will become unglued because he’s surrounded by proles who have the temerity to enjoy life a little. New cars and vacations are nothing in the grand scheme of things and certainly nothing when compared to the level of wealth continuously siphoned away by the actual rich. He’s been placed in a mental box

No, he fears having to bail out others who spend beyond their means, like in 2009, and like now via repressed interest rates.

No. We all are small economic actors in a public policy out of our control. He is making economic choices that he believes are best for him just like you do.

Small man?

Came from nothing.

Built a successful business.

Got hammered in 08

Lives debt free, and hands on with his investments.

And you call him a “small man”.

I would imagine that is what those at the “spigot”

would call him.

Dollar Stretcher –

Congrats on your success. Sounds like it was achieved by hard work, smart planning, and personal responsibility. And by rational, efficient, fair-play accumulation of wealth.

Early on in my life, in my teen and young adult philosophical phases, I decided that I didn’t really need that much money to live well. Other than physical health and security, and a healthy environment, it seemed like the main goal of wealth was to get people (or buy machines) to do things for you. But I put my nose to the grindstone to try to secure those things I valued, for fear that opportunity to live well might get worse.

Now being over the hill, cruising relatively comfortably, there’s another major factor that I didn’t anticipate. How to unlearn the attitudes I developed in order to get here. Now, the Chinese proverb “a rich man holds most tightly to his wallet” has more personal meaning for me. That saying is often true not only in the money sense. I seem to also hold most tightly to the deep attitudes and behavior that I thought were necessary for achieving my goals. It’s not easy to let those habits go.

Living in a foreign country, where there aren’t the negative stimuli that activate old attitudes, is a big help. Here, there is no way the government is going to bail out reckless people (unless they have good political connections). For example, a female who gets pregnant, without any decent job or personal support is going to have a very tough row to hoe. In a way, not indulging reckless people seems to contribute to a culture where people more realistic and polite on a personal basis. So the main thing to come unglued about is the entitled rich people, which is true almost everywhere.

– “I only buy things that I need.”

One of the biggest blessings in life is knowing what you need. The others are the freedom & health to pursue your goals.

I wish you to keep the three as long as you can.

Thanks Alex, outstanding article. And thanks Wolf for hosting him.

Alex has been a commenter and reader and donor here for a long time. He has been writing excellent stuff, published elsewhere. We finally got some of the logistics worked out.

You have a fairly sophisticated set of commentors. I enjoy your articles, in the future, I will take the time and visit the comment section as well.

Good stuff!

I’m on the mailing list for the Mises report. Lot’s of good information on there. If you want to know more about Austrian economics that’s a place to go. What’s good about the site is it doesn’t duplicate what’s on the Wolf Street Report.

I’ve been reading this site for some time and this is my first comment. In reading the comments I had to page all the way back to see who your comment was to or about. My short term memory isn’t what is once was so constantly refer back to check my thoughts.

Like the Vietnam Vet I’m vintage, 63 & 65, so bear with me. I have enjoyed most comments till I hit this article and found those complaining about an individual who had founded a successful business and needed to conserve his gains. How can someone complain about an individual simply trying to keep what they had saved over the years.

I simply can not understand that logic. I grew up as a sharecropper’s son and have abided by his morality ever since. That morality meant I must never look down upon any member of our society no matter their circumstances.

Maybe someone can help me understand? I’ve worked all my life and never taken a dime from our government for any reason. I know I’ve been lucky and successful but have trouble understanding.

Off topic I know and I also have a problem with the current Federal Reserve. But for over a hundred years it has lessoned the booms and busts of the economy.

SF

You know what I can’t understand ?

A man who served in the Armed Forces and then goes on to state that he never took a dime of government money.

OB

I guess you don’t consider military service a paying job.

Really???

OB,

And chances were that he was drafted as well. That was some great “handout” he got from our Government.

Here’s another I don’t understand.

” Keep your government hands off my Medicare ”

– another deluded one

Its simple. Think back to when you were a kid.

That 1st hand me down bike.

Now look at the present.

No safety net for a lot us growing up.

We learned that with the bike, and later in life with our

businesses and investments.

Enjoy each day. You could save kittens from a burning building

and there will still be critics.

Thank you!!!!

I agree with you 100%

I was shocked by how some of the commenters responded to his post. I was thinking how to reply, but you did it for me.

After Lail Brainard is appointed Fed Chief to replace J Powell, look for savers to get screwed even more than they are now. I see negative interest rates like those in Europe. Bank runs are not out of the question. People will be rushing to the bank to take their money out.

The Mises Institute explains inflation for beginners:

“Once societies began using paper, it was easy for governments to print new money, even if they had not collected any gold to redeem with the paper banknotes.

Throughout history, this has been a popular way for governments to generate new money, because it was easier than other options, such as collecting taxes. Although this was good for politicians, it was bad for the rest of us, as our money lost its value—this is called inflation.

During the twentieth century, we saw governments completely take over money. In America, you used to be able to exchange dollars for gold—a system called the gold standard.

In 1913, America created a central bank, the Federal Reserve, which began creating new dollars without new gold. In 1933, President Franklin Roosevelt made it illegal to own gold. In 1971, President Richard Nixon stopped exchanging dollars for gold with other countries.

And after that, there was nothing of value left backing the American dollar.

The result?

One hundred years before the founding of the Fed, the price of gold was $19.39.

One hundred years after the Fed, the price of gold was $1,204.50.

Why did this happen? With the full ability to create money, the government has been able to finance massive wars and government programs. All of this has come at the expense of the value of our currency and your savings.”

HH

Here’s a part that never gets mentioned.

What was U.S. population in 1913 ? What is it now in 2021 ?

What was world population in 1913 ? What is it now ?

As population increases, the money supply must also grow.

As far as a gold standard, there isn’t enough gold on Earth to accomodate all countries combined GDP.

What is this “savers” category we’re supposed to be concerned about? People who have large amounts of money sitting in savings accounts? Doesn’t seem like a real group. Most Americans don’t have significant savings, and those that do have them invested. Obviously those without savings aren’t concerned with their value being eroded, and those with investments are seeing great returns lately.

Savers = Hoarders

No sympathy for hoarders.

May you lose it all.

Unless you are going to work til the day they put you in the ground, you better learn to save. My mother is 94. That’s about 30 years of not getting a paycheck.

Saving is basically using an intermediary because you don’t have the time or the knowledge to invest wisely so a bank is supposed to do that for you and pay you a cut.

Savings mean excess income over and above living expenses.

Under capitalism that means you are overpaid.

Competition lowers income to mere subsistence.

Therfore, if you have savings, you were OVERPAID!

Rejoice in your good fortune !

Corporate work is hard especially the bigger the organization gets. One mid sized corporation I worked for was really good. When business was booming evey full time employee got a bonus. Evey month we broke a sales record we got a free catered dinner.

I have seen it the other way as well when the company stops the free coffee and treats you badly. Mainly it comes down to top management and the competitiveness of the business.

I’m guessing the “savers” are the 0.1% that have as much wealth as the entire middle class.

You completely misunderstand everything. You use the word invest when virtually everything today is a ponzi just waiting to implode. The smart money knows all these ponzi’s will implode so a lot of the smart money is 100 percent in cash waiting for the inevitable. Meanwhile Powell is killing these people with deep negative interest rates who are in “all cash”.

Doesn’t sound like smart money to me

It is interesting seeing Stark I mean Musk selling a significant portion of his shares. Almost like he knows a date or event in mind that will signal the rush to the exit. Understand he does have to exercise before August 2022 with large portions of his options. That is 9 months away. Why the big fake poll on the internet about “should I sell???” Pure PR

Investing or speculating?

If there is no or an abysmal dividend paid on the “investment”, but all gain is based on asset inflation, are not that speculating, not investing?

Add to this the $Trillions burned in unending lost wars, the proceeds of which went to the same ones who have benefitted from the savings deficit, and to paraphrase the great late Senator Dirksen, “A trillion here and a trillion there, and pretty soon your talking real money. BTW there is no one who can grasp the size of a Billion, much less a Trillion. Yet we glibly bandy these imponderables around as if we know what we are talking about.

The way that central bankers see it, debt deflation harms everyone, so printer will go brrrrrrr indefinitely.

Deflation is infinitely preferable to hyperinflation. Hyperinflation is the worst of all worlds.

Who has ever seen deflation?

Look at the dollar value chart provided by Wolf.

Does the demise of a fiat monetary system where the money become worthless count as deflation?

If so, a lot of fiat monetary systems have seen deflation as they were abandoned.

Historicus:

“Who has ever seen deflation?”

Those who are still alive (like myself) during a period of time there were/was “goods” but no money.

“After 13 years with on average negative real returns to savings, it is time to require the Fed to address its impact on savers.”

Do ya think? 13 effing years of water running up hill.

The Taylor Rule leaps to mind. WOLF, that would be an interesting article.

For to have the Fed be swayed by, what I think, are outside forces….to have the Fed embrace MMT, to have the threat they become hijacked without realization from a blind Congress is to risk the entire system, IMO.

At 6% annual inflation everything will cost twice as much by 2033 according to rule of 72. That seems a little light but who’s really counting inflation with any emphasis towards accuracy.

The Fed is an abstract concept to almost everyone. No amount of complaining about them will change a thing. Eyes glaze over, points fly above heads, pundits call conspiracies, Fax Checka calls rascism. Nothing ever happens except a social media kvetch.

Fed is going to have to make a choice. They can’t keep running -6% real rates or money is going to speed up going to hard assets.

Indeed, but I’ll posit that the fed doesn’t have to make any choices for any constituency. They can and do choose to do anything they want and gaslight their choices into your consent while taking care of themselves first.

Maybe, but I think they will have to decide to fight inflation or not. It will not take much to kill inflation I don’t think. Raising rates to around 1.5% will take the economy down.

I saw corporate bond market is at the longest duration ever and stocks with yield of 1.2% have estimated duration of about 80 years. Means stocks and bonds are super sensitive to tiny rate increase.

@Old School, Because they have waited WAY to long to raise rates, I suspect it will require a lot more than 1.5% to get inflation back under control now.

And suppose inflation is 7% and they raise to 5% (which is still 2% negative in real terms), stocks, bonds and real estate will be in a world of pain. Especially because of the long duration that is now prevalent, as you correctly point out.

Everybody seems to assume that a small interest rate rise would kill CPI inflation, but I am not convinced of that. Haven’t we seen the opposite in the past decade, where low rates didn’t cause high CPI inflation but did spark massive asset inflation?

So what if we get the reverse: asset deflation while CPI inflation remains stubbornly high? Yes, a crash in asset prices will lead to bankruptcies, which means some people lose their jobs. While this reduces demand in luxury items, this is not so much the case for essentials. We now have to face the fact that the currency has been thrashed. On top of that, these bankruptcies will also take out some of the supply.

Just another thought: one of things that became clear during the pandemic is that many of the essential jobs are the (relatively) low paid ones. Exactly the people who are hit hardest by inflation. And they are in a powerful position now.

Yushan,

You know your stuff and could be correct.

The one rate the Fed isn’t holding down is U.S. Savings Bonds, Series I. Currently the best game in town. Nothing else even comes close.

7.12% for next six months…can cash out in a year with the last 3-month interest penalty or 5 years with no penalty.

Pretty much resets every six months at CPI-U + 0%.. No one makes money selling these, so unless an advisor takes their fiduciary duty seriously, no one will ever know.

The Treasury had tepid demand, but not terrible demand in the 20 year auction today, but…that is before the debt ceiling is raised and the Treasury starts to really ramp up the sales of bonds.

The Treasury will run out of money by the 2nd week of December, so that debt ceiling will need to be raised. And once it is, the Treasury will come out blazing in December or January with lots of issuance. And with a high inflation rate, the Fed cant buy more of the Treasury crap than it is already doing, so investors need to step in, but all the governments have stopped buying US Treasuries, so the market will demand higher yields.

We might see some short term pressure downward on yields due to technical patterns, but once technicals levels are breached and the debt ceiling is raised, watch out for much higher interest rates, falling bond prices and the start of a market collapse.

I can’t help but think interest rates stay low

due to the huge supply of currency.Demand and supply

right.

The average joe or Jane has no idea what the time value of money or sound money and saving is about. Fiat is an Italian auto. De-basement is where they store the important stuff such as a 100 years supply of butt wipe. Congress and its political bitch the Fed knows its prey, the American Electorate, very well. MSM has already started trying to convince the Electorate that inflation is the sign of a great economy and reflects a high standard of living. They will proabaly be successful. The only thing that will focus their mush filled grey matter is massive,massive and more massive pain. $6 a gallon gasoline $15 a gallon milk, $8 box of goo-goo pops breakfast cereal and the mother of all pain giver ,expensive booze, might focus their attention. Then as always , MSM will conceive them Vlad the Mad is responsible.

Spot on. Only forgot to mention the FOMO and frothy markets that are hot because everything is selling out including stocks (wink wink) and crypto.

Some of you are probably too young to have parents who lived during the depression. So you haven’t heard what life was like. Let me tell you a story of my mother. She was a teen ager during the depression. They lived on a 17 acre farm in NW Wisconsin. They literally did not have any money. If my grandfather needed a new farm tool he would have the family stop eating eggs. He would sell eggs in town until he had enough money to buy that tool. Then the family could start eating eggs again. These are the tough decisions we are all going to have to learn, I think. Once, my mother got an orange in her Christmas stocking and didn’t know what it was. My grandmother was an artful seamstress. She would make her two daughters dresses out of gunny sacks. The one rule everyone abided by was extract maximum utility from everything or you don’t survive. My mother had me right after WWII. When I was a teenager I watched as she turned a plastic bag inside out and washed it. She had gotten the bag at the grocery store and the contents had been eaten. “Mom, what are you doing?” I naively asked. “Washing the bag so I can use it again” was her answer. None of us know how to do these things. And even if we learn we’ll remember how things used to be and be miserable for having those memories.

Maybe I’m wrong and we don’t end in a depression. I sure hope not. But the way we’re all fighting over resources and trying to beggar our neighbors sure makes it feel we’re already there. And the corruption in the political class is saying to me that group wants its guarantee and doesn’t care who else gets hurt.

Mostly right on RR; couple exceptions:

1. It was flour and other grain type cloth bags that were (and still are in places, ) made into clothing; ”gunny” sacks are very coarse burlap that would rub skin off soon if worn, they are appropriate only for coarse goods that require a lot of ”breathing” during shipment and storage.

2. Some folks, including even some boomers, still know very well how to squeeze every dime,,, harvest everything from a pig except the squeal, etc., etc… Saw that a ton when in our last home for decades in what is usually referred to as ”flyover” country on here.

Use it up, wear it out, make it do or do without.

Senator Feinstein from CA just sold her weekend home in NV for $36M. Senator Manchin from West Virgina drives around DC in a Maserati. Senator Romney from Utah once bought a $23M tear-down in CA.

Does anybody think these people are in public service.

If you want to know why “the people” act financially irresponsibly, it’s comes from the very top.

Amen. It may be true that oil prices and transportation delays due to oil and shipping industries manipulations are causing part of inflation. However, the reported creation of about one THIRD of all US dollars ever created from 2019 to early 2021 by the banksters’ “Fed” (privately owned cartel) must have hiked inflation by increasing the supply of dollars, while fewer goods were available due to the pandemic.

I spent some lockdown time cleaning out old files. Came across a bank statement from the early 90s, and my plain, ordinary passbook savings account was paying 5.2 interest. I sat there blinking at that, thinking how I would kill for that kind guaranteed yield today.

To be short: the dollar, the euro, or any other modern currency is no store of value. And hasn’t been since the GFC (2008). So hold your savings in those ‘assets’. They are for transactions only.

As alternative stores of value some like crypto’s, others like precious metals, because those have the lowest maintenance costs and the least counterparty risks.

We live in changing times where nothing is like it used to be.

Adapt to cut your losses, or lose it all.

Wolf,

It seems that the Fed can’t raise rates without tanking the economy, nor can the printing stop because then the govt can’t pay its obligations. What is the plan (if there is one)?

Are they planning to inflate away debt/GDP from 125% to ~75% so they can then do a Volcker without destroying everything? Even if debt/GDP goes down to ~75%, it seems they’ll chicken out on pulling the trigger on a substantial rate raise because of today’s political cowardice.

So is sustained high inflation the norm going forward?

The “economy,” as measured by GDP, can handle higher rates just fine. There are many economic benefits of higher rates, including higher incomes to people who would actually spend that additional income, namely retirees with conservative investments, such as savings and Treasury bonds. Stock prices and home prices may not be able to handle them, but that’s fine because they’re not the economy. They’re just asset prices.

We necessarily have regulated capitalism.

Fantastic Article

World Class 4 Trillion $ Thunderbolt published

Let the Games Begin / Return not expropriate

Get out of jail Free Cards to be issued or not ? Who said make America great again and look at what happened . Do the culprits walk ? run ? or just continue…

Well done Alex

calling it from 2008 overstates it. only in the past year are we really seeing repression way below the inflation rate. the fed is nearing a point at which it protects assets or the dollars. there is no third choice. people are starting to realize what’s happening, and if they don’t stop it now, we’ll end up in a crack up boom.

Look at the data. 0% on savings became the rule in early 2009. Inflation as measured by CPI was much higher than 0% since then, except for a few months in 2009 and for one month in 2015. During most of that time between 2009 and 2020, CPI ran at a rate between +1% and +3%, while the rate earned on savings was near-0%.

i agree, but -1-3%, while bad, is a far cry from -6-7%.

A sign of “enough is wnough”

Must read

“How the Fed Rigs the Bond Market” WSJ 11/18/2021

“the Federal Reserve’s second quantitative easing program began in 2010. Since then, Fed purchases of Treasury debt have funded as

much as 60% to 80% of the entire government borrowing requirement. In other words, Fed actions have crowded out private-sector price discovery for more than 10 years, pushing yields to lows and stock prices

to record highs..”

“Some suggest that the Fed has no choice but to keep interest rates low

and allow inflation to erode the value of government debt. But this course of action would keep real yields shockingly low and allow asset-price inflation to remain a powerful force driving both wealth creation

and inequality. More painful and unpredictable financial market volatility would restrain growth and job creation. Worse, if the Fed has delayed a

financial crisis, the fallout will be even more damaging when it does come.’

The sad thing is that many savers have believed for a long time that the government and central banks had their backs, and that this would be only a short transitory episode for the common good.

Now that nobody can have any doubt anymore about how the fruits of a lifetime of hard work and frugal living got stolen, they are panicking into bubbles like stocks and real estate right at the peak of the bubble. And all this is not an accident but deliberate government/ central bank policy!

These people who always did the right thing will be left with almost nothing when this thing finally crashes. It is totally immoral behaviour of government and central banks, but nobody cares about that nowadays. It is sickening.

it only works once though. once people realize what they’re doing, it stops working, as people are no longer willing to save, or even work for money, if it has no value. at that point, you have hyperinflation, and a collapse. that’s where we’re headed. so it won’t just be people who did the right thing who have nothing. nobody will have anything.

I agree. The people who are gloating now because “they got theirs” will soon be crying too.

Yushan

Indeed.

The gunslingers that caused the 2007-08 debacle were rewarded in the end….the prudent and the savers punished. All by decided policy, not by free market action. Free market action can be anticipated….

BUT WHO KNEW, for the first time in history, the Fed would shirk their duties? Many knew, IMO, for the amount of “All In” calls and the locked down bullish bravery ….seemingly all knowing…….assured somehow that the Fed would NOT lift a finger.

I think it all changed to this in March of 2020 with the allowing of certain outside parties into the Fed’s “tent”.

For 7 decades the Fed brought fed funds up to meet and sometimes exceed inflation…….then they didnt. What happened? For if they did, where would real estate and stocks be?

Certainly something behind the scenes occurred. We are left to guess.

Yushan

“The sad thing is that many savers have believed for a long time that the government and central banks had their backs, and that this would be only a short transitory episode for the common good.”

Yes.

There was an emergency, and the savers understood that and swallowed their “hit”. But then it never ended. (except for late 2018)

Now all we hear is that they can NOT raise rates, there is too much debt out there. Ridiculous.

The fake interest rate and the Fed have subsidized a major debt problem…over 21 Trillion in 12 years…..

The SOLUTION to subsidized debt creation can NOT BE more of same.

The solution to the problem can not be the cause of the problem.

Yep, everyone is being tricked into going into the casino right near the top. The Lemmings are all lining up for the slaughter. Reminds me of the British army at the battle of the Somme, young recruits, conscripts going over the top and losing 60,000 casualties on the first day.

Btw, this is the moment of truth for the MMT crowd. Let’s see how intellectually honest they are:

The MMT answer to inflation is to tax the excess money out of the economy. So they are going to do massive tax rises while people are already struggling because of high inflation? Really?

Fuel cost have doubled? They now have to slam tax on it so it will double again.

Of course they won’t do this. That’s how you know that whole theory is bogus.

Helicopter money was not enough so it has morphed into B52 money. A few decades from now people will look back at this episode laughing their asses off how stupid this generation was. But for us it is a lot less funny. And I think the people who are gloating now because “they got theirs” will soon be crying too.

but people got “free” flat screen TVs and new iphones!!!

Meh. I trust the wealthy’s supposed concern for the poor about as much as I would the Walrus crying as he’s scarfs down the lion’s share of the oysters in Through the Looking Glass.

When rates go up, who do you suppose gets most of the interest payments? Like Mosler says, “interest payments are welfare for rich people.”

So you’ll excuse me if I don’t get terribly enthusiastic about the “think of the poors” narrative from bankers with an eye on their bonuses every time they call for interest rate increases, which is ALL the time …

nonsense. higher interest rates mean you can afford more, because assets are reasonably priced. it only hurts people who go into unnecessary debt.

Kudos. Economists don’t know a debit from a credit. Bank lending is inflationary. Non-bank lending is non-inflationary.

The FED’s monetary transmission mechanism is interest rates. QE is interest rate suppression. The transmission channel exacerbates a Cantillon effect, boosting asset prices.

Inflation of asset prices accelerates the process by which wealth is concentrated among a smaller and smaller proportion of people. FAIT is the enemy of the people.

Secular stagnation is the deceleration in velocity. But the FED’s monetary offset to a decline in AD, is to inject new money. That is backwards. The correct response to a decline in velocity, to a flight to safe assets, is to drive the banks out of the savings business. This makes the banks more profitable and doesn’t reduce the size of the payment’s system.

Excellent article Wolf. I own stocks and benefitted from this insane runup, but I still whole heartily agree with you, the Fed has gone way too friggen far with this printing money and no interest bull sh#t!

He and his buddies are laughing at us right now!

Excellent and thought provoking article. Thank you!

Thinking about the effects of suppression of savers rates vs inflation makes my head hurt.

One positive effect is on homeowners with mortgages.

With 30 year mortgage rates suppressed to below 3% and inflation at 6%+ a mortgagee is paying off their house with much cheaper dollars.

If Savings rates do increase to above 4% (compensate for taxable interest) , then there would be no benefit to paying off your 30 year mortgage early.

Also, if you have a large enough mortgage, you can even write off the interest against your income for Federal Taxes.

My parents experienced this during the high inflation 70’s and 80’s. Their mortgage rate was at 6% and the government secured savings rate was at 10%+. They did not pay off their house until the 1990’s even though they had enough cash to pay it off much earlier. I don’t believe there was a mortgage interest deduction back then.

The winners with high inflation are the homeowners holding fixed mortgages with low rates. Will fixed mortgages be abolished and adjustable rates become the norm if rates rise? What effect will this have on lenders holding sub-3% loans for 30 years?

The losers are the lenders which are likely Freddie or Fannie.

This is why my head hurts thinking about the ramifications and possible outcomes.

We have avoided alot of a bigger loss to lower interest rates since we locked up most of our my IRA’s and CD money, 80% of it, 20% left in a 10 year laddered CD’s for future cost pressures of cost of living.

We don’t know why but Obama and Bernake did make us lock in that 80% of my IRA’s and CD’s money, $875,000 at 4.66% to 4.71% 30 year US treasuries back in 2010. This rate lock really help me retire earlier. We get our $20,496 every 6 months or so and pay our taxes, living expenses. We are debt free, own a modest house with my wife just retired 3 years ago getting her $1,700 a month social security but when I retired at 56 and just got my social security 5 years ago, $1,895 a month. Over these last 11+ years, we have managed to not spend down none of the 20% portion of our laddered 10 year CD’s but have managed to save up more CD’s from my treasury bond interest and social security money, my wife’s employment and some social security money from $218,000 to $657,000 accumulated in our CD’s portion. We are up $439,000 in 11.75 years or 40.05% total. Now at we are in our later 60’s, we are easily putting aside $3,200 a month to our total CD’s portion of my total assets.