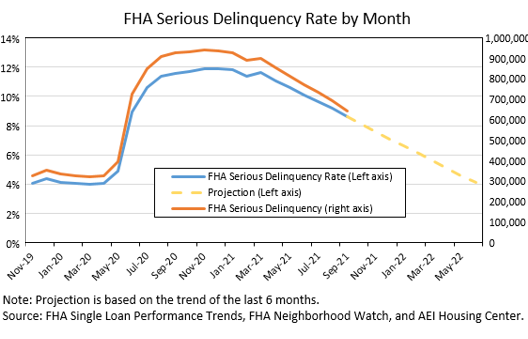

8.5% of FHA mortgages are still seriously delinquent — accounting for half of all seriously delinquent mortgages.

By Wolf Richter for WOLF STREET.

The FHA – a government agency that insures 7.5 million high-risk, low-down-payment mortgages, including subprime mortgages – has been at the core of the pile-up of delinquent mortgages during the period of the foreclosure moratorium and forbearance, when borrowers didn’t have to make mortgage payments.

Among FHA-insured mortgages, serious delinquencies (90+ days behind) have been dropping since the 12% peak in February. By the end of September, 8.5% of FHA mortgages, or 632,000 mortgages, were seriously delinquent, according to a report by the AEI Housing Center. This is still far higher than the rate before the pandemic of just over 4%, and accounted for over half of all seriously delinquent mortgages, though FHA mortgages account for only 17% of all mortgages.

The foreclosure moratorium ended on July 31. When the forbearance period ends for each mortgage depends on the borrower and when the mortgage was entered into a forbearance agreement. For more and more of these mortgages, forbearance is terminating, and this is when the borrower needs to deal with reality, of sorts.

How can a borrower exit the forbearance agreement?

Given the surge in home prices, many borrowers can sell the home for more than the balance of the mortgage; and they would then pay off the mortgage in full, thereby fix the arrearage, cover the selling expenses, and may even have some cash left over. This might be a great time to sell a home, after that kind of run-up in prices. And it solves the problem.

If borrowers can resume making normal payments on the existing mortgage, the missed payments will be added to the end of the mortgage, which moves the mortgage into “current” status.

If borrowers cannot resume making normal payments, they can work out a deal to have the mortgage modified to stretch out the term of the mortgage and lower the payments. If that doesn’t work, they can sell the home and pay off the mortgage.

Borrowers face foreclosure if they cannot meet the requirements of even a modified mortgage, and cannot sell the home for enough to pay off the mortgage.

The rampant price spikes of homes in most markets not only support the sale of the home to cure the delinquency, but also make mortgage modifications easier because many borrowers now have equity in their homes as a result of the home price gains.

Given the surge in home prices, a huge wave of foreclosures – as during the financial crisis – cannot happen. Home prices would have to fall broadly below mortgage balances before foreclosures become a mega-issue, which is what had happened in the run-up to the mortgage crisis.

How are FHA mortgages foreclosures doing?

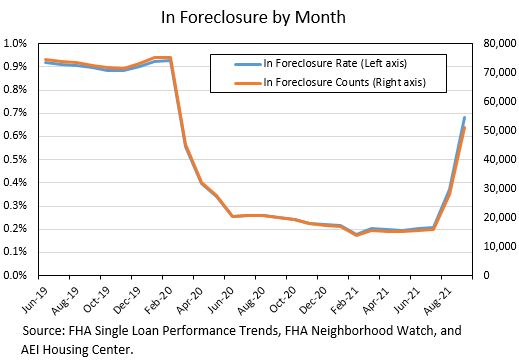

Foreclosures among FHA-insured mortgages surged in August and September following the end of the foreclosure moratorium on July 31, but they surged off the very low levels (in the 15,000 range) during the foreclosure moratorium. By the end of September, there were 50,910 FHA mortgages in foreclosure, according to the AEI Housing Center, but that was still below pre-pandemic levels of around 75,000 foreclosures.

The foreclosure rate tripled in two months, from 0.2% through July, to 0.7% at the end of September.

The trend shows that over the next few months, foreclosures will likely surge beyond the pre-pandemic levels but are not going to reach the mega-proportions during the Financial Crisis since home sales, after the price gains, provide a functional cure for most distressed homeowners.

But foreclosure rates vary dramatically by market. And some markets have far higher foreclosure rates than the national average of 0.7%.

The table shows the 15 metros with the highest foreclosure rates among FHA-backed mortgages at the end of September. It also shows the number of FHA mortgages in those metros, and the number of those mortgages that are in foreclosure (data via the AEI Housing Center):

| Metro, foreclosures in September | FHA count | # in fore-closure | % in fore-closure | |

| 1 | Tallahassee, Fl | 9,644 | 164 | 1.7% |

| 2 | Minneapolis-St. Paul-Bloomington, MN-WI | 77,943 | 1,246 | 1.6% |

| 3 | Chicago-Naperville-Evanston, Il | 171,768 | 2,669 | 1.6% |

| 4 | Albany-Schenectady-Troy, NY | 23,256 | 334 | 1.4% |

| 5 | Oklahoma City, OK | 50,738 | 722 | 1.4% |

| 6 | Syracuse, NY | 20,194 | 272 | 1.3% |

| 7 | Cleveland-Elyria, OH | 65,552 | 870 | 1.3% |

| 8 | Jacksonville, FL | 47,153 | 620 | 1.3% |

| 9 | Columbus, OH | 57,938 | 735 | 1.3% |

| 10 | Pensacola-Ferry Pass-Brent, FL | 12,741 | 159 | 1.2% |

| 11 | Tulsa, OK | 33,118 | 406 | 1.2% |

| 12 | Little Rock-North Little Rock-Conway, AR | 26,575 | 316 | 1.2% |

| 13 | Palm Bay-Melbourne-Titusville, FL | 17,004 | 201 | 1.2% |

| 14 | Indianapolis-Carmel-Anderson, IN | 77,024 | 892 | 1.2% |

| 15 | Akron, OH | 10,420 | 253 | 1.2% |

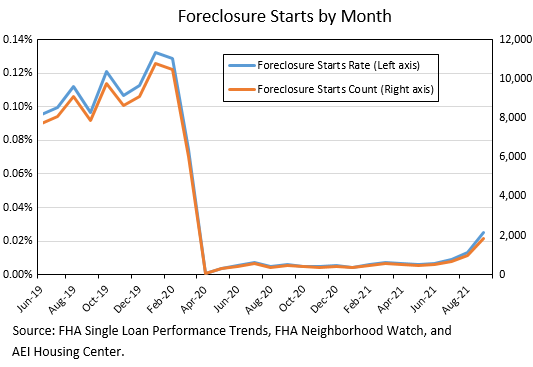

Foreclosure starts among FHA mortgages have also jumped, but from ultra-low levels during the foreclosure moratorium, to 2,000 starts in September, compared to the range of 10,000 starts before the pandemic.

So foreclosures will continue to surge as more FHA mortgages come to the end of their forbearance plans, but they’re surging from the historically low levels during the foreclosure moratorium, and given the massive amount of home-price inflation during the pandemic, are not going to build into the tsunami of foreclosures seen during the Financial Crisis.

This assumes that home prices in those markets don’t head south over the next 12 months.

The Fed engineered this home price inflation with its $4.5 trillion in asset purchases, including purchases of mortgage-backed securities, to repress long-term interest rates, including mortgage rates to record lows, thereby driving up prices. It also created an enormous amount of excess liquidity that needed a place to go, and some of it piled into the housing market, driving up prices. And the Fed thereby bailed out mortgage lenders and their guarantors once again.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Extend and pretend worked out!

(Unless u are a first time home buyer, a teenager, a child, a baby, or someone that hasnt been born yet… then u r f’d)

Sorry kids, current aMEricans cannibalized the future to make themselves whole.

that’s the part that the wall street who worship the fed don’t get. the fed can’t actually fix problems, all it can do is transfer pain from them to someone else. but eventually, the pain comes back around, as it’s still out there.

If you Own a home/Mortgage now..

You have a nice fat target on your forehead..

Gov will want a lot of taxes and fees going forward..

They are Gonna be very hungry for money..

Middle Class with a home??

Yum, Yum…

Already happening with property taxes based on tax assessments based on insane bubble prices.

A nothing special 4bed/2bath home in a decent school district in Northern NJ, Long Island or Westchester County easily has $25,000 per year property taxes.

That’s obscene because there is nothing in those areas worth that kind of money.

you also get to pay $50 in tolls for the privilege of driving a few hours to dc

But it keeps the roads so clean and well maintained…

“you also get to pay $50 in tolls for the privilege of driving a few hours to dc”

Payments to teacher’s union crafted golden pensions.

“you also get to pay $50 in tolls for the privilege of driving a few hours to dc”

That’s if you had enough equity in your home to borrow for a new $80k pickup + sales tax, fill the tank every other day at $150, then pay the $50 tolls.

I left NJ precisely because of this.

The state was insolvent due to the pension obligations and the destruction of businesses before the rescue plan. Then it got billions and now it’s trying reincourage businesses it taxed and regulated out of the state back into the state through the same tax credit and policies that made it insolvent to begin with. All while continually raising taxes ad nauseum. A 1600 square foot home in Bergen county pays over 15-20k in taxes a year. The state government has never seen a spending proposal it doesn’t like.

Question for Wolf ….. will all the states now jack up the vehicle blue book figures even on older cars ? – to get even more out of their captive tax prey ?

Blue Book and other pricing guides follow market pricing (usually weekly auction prices to get wholesale prices) and then add for trade-in and retail prices. Auction prices have shot up across the board. So yes, the entire pricing guide scale has moved up and continues to move up – so yes trade-in values have moved up and retail prices have moved up, even for a 10-year old Honda Civic.

New Jersey is utterly ridiculous for property taxes. Years ago I remember a friend paying somewhere north of 1,000 a month for property taxes. For this value he had the privilege of taking his own trash to the landfill and plowing his own street whenever it snowed.

For comparison, in the corner of Idaho I escaped to, property taxes on a $400,000 house would be a bit over 200 a month (and 400k buys a lot more house out here than in NJ).

I just paid the property tax bill for my families ranch ( or original homestead) in the Centennial Valley of Montana. 288 acres with a trout stream with its original native stock. I decided to save time and pay the whole years tax bill with one $184 check.

Those NJ property taxes…nuts! And people say property tax in Texas is high.

Heck, for my 2,000 square foot 20 year old brick home in a nice area, I pay $4,000 annually in property tax.

Petunia, Westchester County is one of the wealthiest counties in the US. The movie “Goodbye Columbus” (1969) was set there. I still remember the highway marker at the beginning of the movie (Route 120), which is near the upscale suburb of Rye, NY. The late Edgar Bronfman Sr. had a 600 acre estate in Westchester, but i suspect that it has been subdivided since his death. Mr. B had lots of children and grandchildren, and then there would have been estate taxes to pay.

anon170, chicken and egg. it’s now one of the wealthiest places in america because the taxes have gotten so high that no one else can afford to live there, outside of the poorer cities like yonkers, mt. vernon, parts of new rochelle, peekskill, and so on. up until the 90s, there were many middle class people there. they have been priced out.

now it’s a playground for masters of the universe from wall street and other financiers.

10 acres in Oklahoma with a 3 acre pond, 3000SF pond, 2 seasonal streams, 2000SF 3b/2b brick home, 2400 SF horse barn, and 1500SF insulated shop. $320k appraisal, and I pay $1000/year

Jake,

As a NYer I am familiar with Westchester. It has a lot of nice areas, next to not so nice areas. A lot like Long Island, but without the ocean. It’s nice to drive thru on a Sunday in the fall, but that’s about it.

so here’s difference

I have nice 4br, 2ba in TUCSON

our taxes went up 8% this year

$2,500

have a nice day suckers

Wonder what the property taxes are on my Levittown cape cod home I grew up in Westbury LI. ? Orig price on the home was $8,000.

My public tax on my house (e.g. real property tax) went down this year (bc of CARES Act funding), but the private tax (insurance) went up 20%.

Look for the cost of insurance to keep increasing too with all the destruction from natural disasters ie hurricanes, fires, tornados etc not to mention fraud

Negative real rates cause insurance companies to have a negative return on their “float”. Insurance companies going to try to pass that along to customer. Another way that Zirp is taking money out of your pocket.

As long as I stay where I am, I am reasonably protected from high property taxes by California’s Proposition 13. Theoretically, it could be repealed by a 2/3 vote by the legislature and the governor’s signature, but I doubt that the big spenders in Sacramento would dare to attempt such a vote. It could also be repealed by a vote of the people, but that is even less likely.

Prop 13 is a way of transferring the costs from one group of people to another. So everyone who buys a home at these ridiculous high prices gets hit with huge property tax bills.

CA is just waiting for a drop in the stock markets that have propped up the home equity prices. And higher interest rates. Just waiting for the bubble to pop.

If you look at stock market and I would guess to a lesser extent housing market there are long trends of over and undervaluation when using a 120 year mean trend line. For example roughly 1970-1990 was an era of undervaluation to the trend by as much as 50%. Since 1990 we have been in an over valuation period for stocks sometimes by a lot, but so far every extreme over valuation multidecade period is followed by an extreme under valuation period.

If fate shines kindly on you, you are a winner if you invested in the undervalued period and retired going into a long over valuation period. The person that retired in 1970 had a tough 20 years on an investment portfolio. The person that retired in 1990 should have done well. It’s all going to look very different at some point in the future.

The shift in more recent years has been for many jurisdictions to move from the old-school assessment method to market-value assessment. Built-in bracket creep for properties providing tax revenue, but the question is: if housing stock values drop severely, as they have a couple of times in the last generation, will they freeze or rescind market-value assessments?

The local governments are hooked on spending all tax revenue plus debt to pay outlandish pensions and benefits for employees while ‘services’ to taxpayers are declining. Many municipalities are technically bankrupt but for the ability to raise taxes.

The other problem, cash flow for older people, is that they can’t spend equity; it’s just a number unless they sell or take out HELOCs.

And though the post 1990 stock market may have done well for some, there have been several wipeouts along the way, with many ordinary investors often losing everything.

It was not “current Americans” who cannibalized the future: it was the banksters and the Wall Streeters. During the 2008, real estate crisis, the holders of the subprime securities and the owners of the real estate lost their shirts as the real properties’ fell down by huge margins, e.g., 50%, in fair market value.

Since then, the pensions and other holders of securities have apparently realized their losses or are still holding the same, garbage securities in some cases. The banksters would not be pleased to recognize losses loans to in homes and see reduced income on their banks.

“Coincidentally” the banksters’ cartel, named shamelessly the “Federal” Reserve even though a political leader once said it is as “federal” as “Federal” Express, created inflation for years. We can argue as to the level of inflation this past decade. However, any losses due to the reduction in the value of real estate that was never realized, in securities against that real estate or in due to holding that real estate, would be minimized if inflation ran high.

This inflation has eaten up the value of Americans’ wages and (as to those who invested in CDs, treasuries, bonds, etc.,) eaten most of the value of Americans’ savings. Now, since the ultra-rich in America are like the French aristocrats before the French Revolution, and they are essentially above the law and do not have to pay a fair share in taxes due to loopholes that they caused to be created, if interest rates on rolled over treasuries go up to tame inflation even 4%, then the US will have to either massively raise taxes on those Americans who are not ultra-rich or else CANCEL programs like the US Airforce, or Medicare or others.

Needless to say, the mortgage backed securities that the “Federal” Reserve bought the last two years, totaling up to $2.5 or more TRILLION, would reduce the net income of the US government, so it might not be just a matter of cancelling Medicare or the US air force if interest rates go up; it might be a matter of cancelling Medicare AND the US air force if taxes are not significantly raised and if the “Federal” Reserve must stop printing dollars and allow interest rates on rolled over treasuries to rise to tame inflation.

We are nearing the end of this national, Ponzi-like scheme. I just hope that Americans will keep their eyes open, examine all of the evidence, and decide if it is fair that persons like the owners of Apple AND HUNDREDS OF OTHER COMPANIES have avoided paying ($40 BILLION or more as to Apple per Gizmondo in) taxes via loopholes while the owner of the florist or cafe on the corner had to pay his or her full taxes for decades.

China’s real estate sector implosions might contribute to the troubles here. Desperation will soon reign among the Wall Streeters and banksters, unless they can control Americans better than I expect. Are you a good, loyal dog of theirs; bark woof if you are.

To clarify, if the government actually guaranteed and eventually pays for most of the $2.5 or more TRILLION mortgage backed securities (“MBS”) purchased by the banksters’ cartel, the “Federal” Reserve, in the last two years, that payment of say $1 TRILLION for less than half would eat up the US government’s budget for that year or maybe, more than one year.

Then, even less funds would be available to cover US budget items, like Medicare. I will not even comment about what was estimated YEARS ago, to be over $200 TRILLION in liabilities of the US government which are going to be coming up due to many items and which would reduce the available funds from the US budget even more. What will happen if no wants to buy US treasuries except at 10% to 20% interest and the “Federal” Reserve cannot buy them due to its need to tame hyper-inflation?

The US government has been painted into a corner. It is just a matter of time unless inflation is not tamed or some major discovery has positive effects and so increases US government tax revenues massively: e.g., we “cure” death. LOL

“Sorry kids…..”

I’ve said it before. As a future human I would MUCH rather have a trashed manmade “bookkeeping system” to try to fix than a TRASHED non-manmade PLANET.

The real damage isn’t in our rather petty (in the BIG picture) monetary systems when compared to threats to our entire species.

But millions of entire species have come and gone, over 3-4 Billion years, and the physics guys guess the planet (Sun) has another 4-5B, so it’s no big deal LIFE-wise…..I just have a built in prejudice for ours, I guess.

So I scream “Immediate Enforced Green New Industry and Lifestyle Program with all supporting requirements and let the economic chips and lifestyles fall where they may.

At least at this site I’m largely ignored, at others I would be cursed. This country went to the moon with rather pathetic technology compared to today, and didn’t five a damn what other countries did….let’s do a big one again.

And if you are still all worried about other countries doing nothing, consider this observation of human nature from Dick Gregory, who was commenting on how religions proselytize excessively to recruit new members.

“If you have something that is really good, you don’t have to SELL it to people, they will STEAL it from you.”

Saving the planet for our species is the only religion worth having, and keep the racism out of it. Talent and creativity comes from ALL Homo sapiens, and we’ll need lots of it.

Well a third bailout may be coming soon if the trend of GDP keeps going down. In fact the scary slope of the trend down would be headline news in more normal times. Will it auto-lock around the 2% moribund channel of not dead but not alive rate as in the past? It seems it doesn’t matter because all eyes are focused on over valued assets. Sumpin’ gonna happen and I ain’t got a clue. I just feel it in my bones.

Long term growth is pretty predictable for a country. After each crisis in US with the Fed printing it’s dropping. I think long term US growth rate is down to roughly 2%,maybe slightly less.

I am thinking Fed’s not telling us their new inflation target is going to really be 3% so that they get nominal GDP up to 5%.

I think the number to watch that wheels are coming off are alternate currency holdings combining precious metals plus Bitcoin. Once the combined total gets big enough to start affecting Fed policy, they are going to have to put them in a headlock.

Maybe the wheels are coming off a baseline of growth that turns out to be fanciful and unsustainable. Postwar growth was like a prairie fire that does not last forever. Spewing kids thoughtlessly and complacently, traveling the world casually at will and arrogantly, leaving all externalities to just fall where they may, was a sort of theme park fantasy that has run into constraints. So now we go into a frenzy of externalizing blaim for the failure of our fantasies to come true? Must be stupid, evil government, alrightie. And things, we see in the data here, and costs, are adjusting around the cirtcumstances. What is so bad about limits on that self-worshipping childlike consumerist arrogance? It is finally a maturity superimposed on the “gee whiz” fantasies of the Enlightenment. Media (less enlightened than this blog which is incredible) has turned peoples’ brains into goo. Everything has to neatly fit into and confirm a house-on-fire narrative of blame theater.

phlep-elegantly stated.

may we all find a better day.

“Spewing kids thoughtlessly and complacently”

Since 1970, the US birth rate has been below the replacement rate of 2.1 children per female.

“Must be stupid, evil government, alright.”

Part of it…

“self-worshipping childlike consumerist arrogance”

There’s another part.

“Media (less enlightened than this blog which is incredible) has turned peoples’ brains into goo.”

One feeds on another, a synergistic effect.

“phlep-elegantly stated”

Yeah, that was brilliant… /s

Winston-everything’s peachy, then. Got it.

may we all find a better day.

It’s almost like Obama was right when he said we should get used to 2% growth as a mature economy.

Or, we could elect a president who passes tax cuts that skyrocket the deficit for a temporary sugar high in the name of a few years of higher growth numbers.

More par for the course. A fake financial system on top of fake wealth and a fake economy.

Reminds me of suspending mark to market accounting in 2008. Pretend the loan is “cured” and “current” by adding missed payments to the back of the loan.

Yet another reason government guaranteed mortgages should not even exist.

Most Canadian mortgages are govt guaranteed. The current foreclosure rate is about 1 %. But unlike Freddy or Fanny they were never told a large percentage of loans HAD to be subprime.

I expect the number to rise as this whole RE corrects or crashes but not as far as US.

It’s a combination of factors not one but don’t think that just because historical foreclosure rates in Canada are low, it’s “safe”. This is equivalent to pre-GFC where US prices “couldn’t” decline.

The biggest problem is the one you state, enabling buyers who cannot afford to buy and who have no business buying getting a mortgage.

Anyone who makes less than at least a 6% down payment in the US is already “underwater” the minute they close and cannot actually afford to buy if that’s all they can bring to the table.

It “works” until it doesn’t.

Nitpick. FHA loans are purchased by Ginnie Mae (not Fannie or Freddie). And insured by FHA (HUD – taxpayer).

“Affordable housing program”s are a major part of the welfare state. I am surprised Canada hasn’t tasted that easy strategy to win votes yet.

Does the Canadian government guarantee mortgages with 3% down payments like FHA does in the US?” From your comment, it appears that the answer is no.

‘and given the massive amount of home-price inflation during the pandemic, are not going to build into the tsunami of foreclosures seen during the Financial Crisis.’

True, because the house can be sold to cover mortgage plus some cash (motive to not walk away)

But it will result in more sales because a lot of these folks will still be broke and prob wouldn’t qualify for HELOC.

The bankers I’ve spoken with say they’re not interested in HELOCs right now.

I think that would depend on the client and equity. Mind you, the person that doesn’t need a loan is always the one who is qualified, and vice versa. :-)

The bankers I’ve spoken with say they’re not interested in HELOCs right now.

If so, that could also explain the drop in vehicle sales levels.

Over 40% of refis are cash out thus far in 2021. Bankers are hardly being stingy right now.

Yes, they are not interested because they can’t offload the risk to someone else.

Funny how this works and it still isn’t even their money.

Without government guarantees, there would be no 30 YR mortgage or it would be a lot more expensive. The only natural buyer for this buyer I can think of are maybe pension funds and insurance companies with similar fixed long term liabilities.

Buyer for this paper

Can it? I’m not so sure the housing market is anywhere near as great as it’s being touted I’m seeing lots of price reductions in many areas Things may turn down this winter I believe

I live in North Carolina. Resort and second home locations at the coast or in the mountains are still booming from what I can see. Might be part of migration patterns or people feeling rich and buying second home.

Right now everyone is getting richer selling homes and stocks to each other as imports hit new record. It’s the biggest bubble in my 65 year live time. America is selling off the farm an acre at a time.

Agreed. I was just comparing neighborhoods yesterday while living down in Florida.

We are renting & waiting to buy.

Anything that’s attractive to snowbirds & rich people as a second home (beach areas/golf course communities) is $300k higher for the same house.

Fortunately the regular folks neighborhoods have only gone up a lot, but not doubled.

It’s a terrible time to buy, hopefully that changes. At least they are building more down here.

It’s not just the biggest bubble in the last 65 years, it’s by far the biggest aggregate bubble ever: bonds and debt, stocks, real estate, and other “investments” such as Crypto.

This mania is a continuation of pre-GFC which was a continuation of the dot.com, as it never ended.

If anyone claims otherwise, I’m dying to know which one was bigger, as I am familiar with prior history and none even come close.

Just saw a RE agent out of Austin, TX comment on their hot market, both RE and jobs, RE down 13% as of Sept. The median price went down from 560K to 510K, still ridiculous but at least dropping. This is in the hottest tech job market in America.

Appears Austin has reached it’s peak Pet!

Both temperature and, as you say RE dropping, eh?

The TPA bay area also dropping temperature, thank the Great Spirits!

Hoping that Woods is Wrong and the saintly part of that bay does NOT take over the tech part from Austin, silly cone valley, SF, etc., as there are already waaayyy too many people living where there were and likely will be soon again swamps.

Petunia,

In the sometimes hot real estate market in north Idaho where I live, the “newly reduced price” signs are starting to be hung on existing for sale signs.

Makes me happy. Too many people as it is.

Things still going $100k+ over ask the first weekend with no contingencies here in the north/west suburbs of Boston. Atypical for the October-December period, which is usually the slowest time of year.

Spring will be interesting.

who are the people buying? people who want a house to live in, or speculators?

I’ve been looking for a new rental (halfheartedly). I just had a person offer me their house for less than the mortgage on it, so they would be subsidizing me to live there. They were one of the couples who ran out and bought a pandemic house on 5 acres because they thought they wanted to be away from the city. Now they’re back in the city. They gave me an asking price and said it was “negotiable.”

i’ve heard of this a lot in the exurbs of major cities. they like you because you’re responsible, they know you’re not going to trash the place, that you’ll pay the rent, and since you’re a tradesman, they know you’ll be able to fix things like running toilets without bothering them constantly.

But long term, losing on a rental isn’t sustainable.

This is a huge assumption Wolf: “ This assumes that home prices in those markets don’t head south over the next 12 months.”

In your Zillow piece I think you may have argued that the real estate bubble is already leaking. What if we see a massive wave of selling for covering foreclosures, and zillow’s overbought houses, and, and…what is your take on the likely direction and magnitude of home prices over the next 12 months?

Is selling as a means to cover foreclosure going to last as a strategy if prices start unwinding faster than expected due to economic slowdown, rising mortgage interest rates, and the easing of QE?

Yes, this is a big issue. If home prices head south, the show will get a lot more complicated. But home prices move slowly. The last housing bust took 4 years to play out, and during the first year the declines weren’t huge. People that sell early would then be better off, which might further weaken home prices in that market. So this will be interesting to watch.

but the last bubble only took 12 months to inflate, so it stands to reason that everything is happening on an accelerated timeframe this time.

I bought in FL in ’03, price doubled by ’06, then started to decline in ’07, slowly at first then all of a sudden in ’08. That’s not 12 months considering the market was inflating years before we bought.

Agree with Pet on this one, and WR’s comment too, after watching RE in FL off and on since mid ’50s.

Slowly building bull bubbles can burst dramatically,,, but only if not paying attention to the early signs clearly visible in 06 to the point I was warning friends to sell ASAP: Some did and were fine and buying again by 09,,, others walked away from very large deposits to buy in the same building for less than the loss of deposit.

Many building left undone in various stages for several years or forever from every FL RE bust from ’29 to the oughts…

sorry petunia, by last bubble, i meant this last one, meaning the one we’re in now.

Jake,

Maybe where you are this RE bubble is only 12 months old. In the south and the coasts it has been accelerating for the last 5-10 years.

In Canada for the last 10 years, and in Australia for the last 20.

JAKE W

I disagree. Fed has MBS in their quiver now. Like with the stock market, if RE begins to wobble or God forbid drop 5-10% in the broad market, MBS purchases will stay stable or even increase.

MBS purchases are the replacement for the TARP of old. No need to buy troubled assets (TARP) when there is a TARP “maintenance” fund. Gotta keep prices high so property taxes stay high.

We are still in a pandemic. They will not stop QE until they are sure we are out of the pandemic and it is under control by vaccines or immunity.

The FED is tapering but I bet they would stop in an instant if the economy gets dicey.

I know several people who have good jobs and good credit and want to buy a home but keep getting overbid. Any increase in foreclosures could be mopped up by these type of people. If I know 2 in my close circle….there has to be many more. These group of people will quickly step in on any price drops. For housing to go down, we need this group of home buyers to get their home orders filled.

I am keeping a close eye on their success.

We are approaching the endemic phase of COVID. It isn’t going away and will be part of life going forward. If there is not long lasting immunity from infection or vaccination, there will continue to be COVID, albeit probably less.

we’re not still in a pandemic. nobody cares about it anymore. everyone i know, even the most cautious, are back to their normal lives. a sizeable portion of the population never cared about it in the first place, and some of them suffered the consequences.

i do agree with you that any drop in price will be mopped up by dip buyers as long as interest rates don’t rise. that’s the key.

C19 is now endemic. We have no sterilizing vaccine for it. Everyone in the next 5 years will get it. There Will be no eradication of the virus. Ambulatory and prophylaxis treatment which reduce the severity of the C19 will be Pharma’s next big move. Scientific studies on present treatments caught up in red pill and blue pill bullshit will eventually decide if these are legitimate treatment options. We need everything that works,period. The present vaccines are just a prophylaxis which reduce the severity and death outcomes for the elderly and other compromised people. Getting 3 or 4 shots a year ain’t going to make it with the vast majority of people who are not at much risk . We are going to live with it and hope that science will deliver antiviral and ambulatory and at home therapies that will keep the mortality in line with H1n1 A and B which is also endemic and we just live with it. Hopefully the c19 vaccine can be combined with “regular” seasonal flu vaccines on the mRNA nano-engineered packet delivery platform so it will be 1 shot a year before the flu season we always have. This is as good as it gets. Stephen King wrote it and Morgan Freeman said it.Get busy living or get busy dying.

Recall if you were old enough and paying attention at the time, that 15 years ago the same sentiment existed aka that enough people would buy into a small dip in RE prices and therefore support the market. It did not go that way. It snowballed in the completely opposite direction. Consumer psychology is a tricky thing.

Once confidence in price appreciation is lost things will likely unravel pretty fast and those who need to sell won’t be able to Thats what I see happening And after that it could turn into a bloodbath of lower prices

Crap…

You caught me…

But that was a DAMN nice truck…

My gut tells me a lot of the forebearances were opportunistic, as opposed to necessary. Why repay your loan if the government is going to forgive it some day? Same dynamic as student loans.

Well, having missed payments added to the back of the loan when the borrower might be dead later is as good as loan forgiveness.

Many who will sell prior to payoff and end up underwater (if it happens) also live for the present anyway and do not care.

New problem.

Then these folks have to find somewhere to live.

“many borrowers can sell the home for more than the balance of the mortgage; and they would then pay off the mortgage in full, thereby fix the arrearage, cover the selling expenses, and may even have some cash left over. This might be a great time to sell a home, after that kind of run-up in prices. And it solves the problem.”

Rent for a year or two or three and then buy at a lower price?

You should read these reports of rent going up out the wazoo, except for Newark.

Yeah, that’s a problem too. For people with a distressed budget, it’s rent payment v. mortgage payment plus expenses. Depends on where they are whether one or the other is bigger.

Terrible terrible advice.

If things go south in the mortgage market, Fed simply will start buying MBS again.

This sucker isn’t going down anymore as stars are aligned for the Fed to have unlimited powers when it comes to housing.

They get the moral high ground by pretending to do whatever it takes to save the people while in fact bailing out the irresponsible lenders and banks.

Two birds with one stone. This will never end.

If inflation continues to be 5%+, the Fed isn’t going to buy anything. They’re going to raise rates.

Oh, for God sake Inflation, get here.

These sorts of comments have been right for too long

inflation has always been here. it’s just now at the point where it’s becoming a political problem.

“They’re going to raise rates.”

HAH! They’re still QEing – PUMPING INFLATION – for another 8 months.

You obviously have no understanding of human psychology to believe what you wrote. It’s another version of “it’s different this time”.

FRB does not operate in a vacuum and FOMC is not composed of robots.

In the real world, there comes a point where people have to make choices between only bad options and try to choose the least bad one. To this point, “printing” has been easy because there don’t seem to be any negative consequences or it’s been minor.

The day of reckoning still lies ahead.

augustus, i agree. what the fed cares about more than its rich buddies are people’s perception of it. if they think they’re at risk of losing their power, they’ll change course. i think at some point the political pressure to do something about inflation might be too great to resist. the consequences to printing are now staring us in the face. they’re no longer minor, and people are waking up to it.

There is always a black swan. The Fed is not omnipotent. What and when? Who knows, but conditions are ripe for a nasty negative reaction.

Why should these people sell their homes for a profit and pay back their mortgages?

I’m pretty sure if they just demand the government forgive their debt and keep their homes for free. We live in an ask and you shall receive economy, and many see housing as a human right that should not require work to obtain.

I am near certain that people paying their mortgages are just suckers, just like those who are paying off their student loans.

Don’t pay your debts, this is America.

It sounds good but so far it hasn’t worked out for the folks that decided not to pay.

Very few student loans have been forgiven. Penalties, fines and amounts owed still piling up.

Even less government mortgages have been forgiven. Plenty of evictions now going on. You really want to fear every knock of the door?

And as I told my children, the government doesn’t do nothing for free. You will pay a price if you depend on government to pay what you voluntarily agreed to pay. Lots of strings will be attached

When people say don’t pay what;s owed, I always think of the Michael Moore film about the last debacle (forget the film name) when they showed the eviction of a couple that was then hired to move their stuff out to be hauled way and destroyed. I think they received $1500 for the heartbreak. It happens, has happened, and will happen next time around. Ordinary people who don’t pay their bills don’t skate.

I sold our house in town just before the GFC and people kept telling me to hold out for more money. The timing was luck, actually, as the housing appreciation continued for at least another year. It was a cash sale and we moved to a rural reno project. I took the excess cash and put it in term deposits to avoid any temptation for urge buying. Lo and behold, two years later I was approached by a debt junkie to buy his property for the official tax evaluation (very low number) plus another 20 K for road improvements, etc. He had all the receipts. People again said we were crazy and not to buy. We did and still just pretend we don’t have the extra 16 acres of zoned residential as it has increased in value 5X as is, and 20X if we developed 1 acre building lots. I have a renter whose rent covers taxes and insurance, for our house too. The guy who sold didn’t pay income taxes for about 5 years….just didn’t get around to it, but he sure had a nice truck to drive. He just didn’t pay his bills.

No one has a crystal ball or a special pipeline info. I didn’t and don’t. But if your debt levels are low the odds of being lucky and being insulated from events is high, plus you have autonomy….freedom. As a great past customer remarked to my employer one day, “It isn’t what you own, it’s what you have paid for”.

2banana

Well stated. Living on various forms of the “dole” is a legit choice, but lacking in freedoms. I would choose homelessness instead.

One reason this isn’t going to happen is because everyone’s debt is someone else’s asset.

I default on my mortgage and someone else’s pension, life insurance policy or mutual fund takes a haircut.

Hindsight is 20/20 I guess.

Should have started my own LLC and scraped off some of the cash for business loans like I knew a lot of other people did. I’d figured jail time was in the works for scamming uncle Sam but nope. Should have screwed over my landlord and stopped paying rent to have extra cash flow with no real detriments. Should have bought a 50k dollar diesel pickup and then sold it today for a profit. Should have bought a house a couple years back to not have to pay the mortgage for a year just to be able to sell it for a profit and stick it to the banks. Should have bought worthless buttcoins that are only good for laundering money and criminal enterprises and made millions. Should have bought Tesla stock with its p/e ratio of eleventy billion and made thousands.

What a crazy time to be alive. The more financially irresponsible you are, the wealthier you become. Is this what wealth effect truly is? Borderline criminal financial behavior is rewarded with free money?

There is something to be said for living beneath your means, being out of debt and knowing when you wake up every morning, that what is around you won’t go poof when the latest scam blows up…

Cough….Squidcoins….

Squidcoins consume more energy than all the solar panels and windmills produce. If one is a “carbon is bad” environmentalist and also invested in crypto, they have some issues. This “Save The World” from carbon blather runs a little thin if you’ve got a couple of bitcoins in you back pocket.

Not a criminal thing.

Values.

Ethics and morals.

They be gone.

(Remind me, what was the point of them, anyway?)

The foundation of civil society, otherwise you’ve got anarchy and where that traditionally leads.

Yup, they’re gone alright in 90% of the population anyway Have been for awhile It’s one reason my wife and I left and started a new life in her home country Now I don’t have to worry about my materials and tools growing legs anymore I’m still paranoid PTSD I guess from 60 years of being abused

Capitalism value, only the bottom line counts.

No ethics, no morale, just maximum profit.

If you don’t like capitalism then buy all your stuff from someone that doesn’t use capital and you will quickly revert to a subsistence farmer living in a crude cabin.

old school, i do like capitalism. we don’t have capitalism here in this country. capitalism allows poor choices to fail. we’ve decided that we won’t.

Capitalism value, only the bottom line counts.

No ethics, no morale, just maximum profit.

By any means available. Why should poor choices fail if the bottom line is better if they do not?

Repeat, only the bottom line counts.

By all means available.

That is capitalism.

LW,

You forgot behavior…

So much poor behavior everywhere you look….

The rudeness and crudeness today are shameful. I’m old and remember polite times.

Basically, ethics and morals are nothing more than ”codifications” of laws or theories of Karma…

Many of the saints and sages from every religion or spiritual practice, from the most ancient civilizations of our species everywhere on earth, Africa from when our species started, to India, China, the Americans,,, basins of rivers in which lived all ancient societies have almost exactly the same laws or theories of Karma…

Having been, ahem, somewhat wild in my youth and in court and/or jail a few times until I understood the realities in this lifetime,,, it certainly seems to me in my current elderly senescence that some folks never learn, and while some folks never have to learn , the vast majority of our species learns sooner or later.

This will ruin financial system

Well said. Bubble markets reward stupidity

This country is rotten to the core. The media and financial sites are pimping and pumping crypto to the masses.

They sure are doing that Constantly bombarding us sheep on Facebook and trolls posting on YouTube about how Mr or Mrs so in so has made them millionaires overnight How naive do you have to be to Whatsapp these fraudsters ?

This is going to sound dumb, and maybe it is, but how does one interpret the “foreclosure rate”?

Right now I don’t see a clear mapping between the rate charts and the more complete underlying reality of stock and flow.

Can a single home remain in foreclosure for multiple monthly data points? If it can, the “rate” could vary by multiples simply depending on how quickly foreclosures are processed, even though the bottom line would be the same.

Can a single home be foreclosed and taken off the books within a few days and thus not end up in the monthly figure at all?

The full picture includes cumulative 1) foreclosures 2) loans paid off and 3) new originations, which can then be parsed a number of ways, for example by vintage year, or delta rather than cumulative, or by asset value in place of percent.

PS – “foreclosure starts” partially addresses this, but you would also need “cures” and “foreclosure completions” to fully understand the foreclosure part of the pipeline.

“how does one interpret the “foreclosure rate”?”

# of foreclosures divided by total FHA mortgages: 50,910 foreclosures divided by 7.5 million FHA mortgages = 0.7%

These are all existing foreclosures, including foreclosure starts. It takes a long time to get a foreclosure completed. This is a cumulative number. Once a foreclosure is completed, it comes off the tally.

For foreclosure starts in that month, look at the bottom chart.

Thanks, I do/did understand that part, what I’m getting hung up on now is whether cure rate can be nonzero or substantive once it reaches the “foreclosure started” phase.

My original post was longwinded because I missed the “foreclosures starts” graph.

ivan,

I think I understand your question. Once a foreclosure starts it is always counted as a start because the property was impaired/defaulted before the start. Even if the owner pays up the next day and the foreclosure is dropped, it is counted as a start, and out of foreclosure in the same time frame. The time frame is short but the property went in and out of foreclosure, same foreclosure process as a longer foreclosure.

Man, I thought the housing situation was bad in the US, but this weekend, I was doing research on housing/employment in the Europe. The rot that started in the South, has moved to the core. The youth unemployment and percentage living with their parents are off the charts.

It’ll be Neo-feudalism or subsistence farming for a lot of them within a generation.

In my opinion the EU zone is economically and socially doomed.

It is a quarter of the size of the USA.

It has a population of 500 million.

It has few minerals or resources.

It is dependent on gas and oil from Russia.

It has a massive problem with immigration of the wrong kind that is costing the governments a fortune.

And what is really funny is that the western media, especially American says that Russia is threatening to attack Europe.

Why would Russia want to attack the EU zone with all the problems the EU zone has especially when Russia receives monies from the sale of gas and oil.

Brussels needs to have talks with Russia about joining That would be something to cheer about but with the psychos in charge that will never happen Peace isn’t profitable enough for them

Yet I keep reading how the US should follow Europe to guarantee “rights” to “free benefits” when the country is already broke.

Give it another generation or two and the demographic/cultural conquest will be complete.

Good thing I’ll be dead by then, because I sure don’t want to live in that future.

I saw the chart on the biggest winners and losers since the EU started. Looked like Italians got screwed over the worst. It was slick move by Germany to get a weak currency to become a huge exporter.

The lira was a weak, second tier currency before the euro. All real estate etc. was priced in US$. Just before the euro they came out with a 500, 000 lira bank note, a sure sign of a collapsing currency.

You hear a lot of talk on WS comments that Italy and Greece would be better off going back to the lira and drachma. These are WAY more popular ideas outside these countries than inside them, especially with both their bloated public sectors who do not want to get paid in either.

“The trend shows that over the next few months, foreclosures will likely surge beyond the pre-pandemic levels but are not going to reach the mega-proportions during the Financial Crisis since home sales, after the price gains, provide a functional cure for most distressed homeowners”

Well.

That in a way sort of depends on where house prices go, right ?

But as we all know, house prices only go up.

Just ask Zillow.

I did ask!

And my house went up $2k just for asking…

Looks to me like the fed’s plan worked out pretty well. Foreclosures were a non event, in spite of the total shutdown of the economy and the world!

Homes not only maintained their value, they went up in price because people didn’t panic and sell like all the doomsayers hoped they would. It’s the folks that keep waiting for the “inevitable crash”⁰ who are missing out on the best wealth creating market in centuries. The price for eternal pessimism is high.

That is true. Very few pessimist get rich. Over the long term though investments whether stocks, bonds or housing will return to income based, because excessive leverage can’t deal with economic shocks which are inevitable.

Let’s not confuse pessimism with being prudent…

I’m not trying to win…too much crazy from a prudence viewpoint….

I’m just trying not to lose…

Way too many rabbits for this turtle…

he’s right that in the past 10 years, being prudent has been punished, and the worse you behave, the more you are rewarded, not just financially, but from a social perspective. look at the rioting in the summer of 2020, as an example.

that can’t last, as society breaks down if no one is incented to be prudent. people who think this can go on another 50 years i think are going to be very sorry.

nonsense. the houses did not go up in price. the value of the dollar just dropped. all the fed did was print money. this is nothing new. doing so devalued the currency, like every other time in human history it’s been done.

there is no “wealth” being created. all of the supposed wealth is based on permanent zirp and qe. watch what happens when that is stopped.

People here have been waiting for “the big crash” for 9 years now. Imagine paying escalating rents, missing low rates, and watching property values soar.

Maybe in another few years they’ll finally get a 10-15% dip in prices when interest rates rise after watching prices go up 90%+. Too bad their monthly payment won’t be any cheaper.

i don’t know anyone who has been waiting for the big crash for 9 years. in fact, in 2012, condos were cheap. i bought one then. it’s only in the past year or so that i’ve heard of people saying they’re sitting it out.

posts like yours are really getting irritating.

This is the kind of “na-na-na-na-na!” schoolyard gibberish which I’ll be so happy to see disappear once all these reckless gamblers go broke and disappear into the ether.

depth charge, everyone thinks they’re brilliant while they’re riding up a bubble. by definition, very few of them “get out” in time.

it’s just common sense. if a large number of people tried to cash out, the values would plummet, and there’d be no buyers. ponzi schemes are only good for those who get in early.

So if the Fed owns $4 Trillion in mortgage backed securities….

and foreclosures start cutting into the interest payments on those securities….what are those securities worth?

Look at what they did in the GFC. They paid face value for everything at the stated interest rate. It’s a clue.

The current value of MBS on the Fed’s books is $2.53 trillion (28 October: ‘Fed’s Assets from Crisis to Crisis to Raging Inflation: Balance Sheet Update’ by Wolf Richter’)

Think about this little “market-manipulation.” The Fed holds the amount of paper for ownership of over seven million median priced single family homes in the USA. Why does the Fed sit on the $2.53T MBS paper? Why doesn’t the Fed allow free market forces to operate in an open and capitalist economy?

Wolf has answered those questions,

“It has been a mind-boggling amount of QE designed to repress long-term Treasury yields, mortgage rates, and long-term interest rates of any kind, and to inflate asset prices, and to create the biggest wealth disparity ever via the Fed’s ‘Wealth Effect Doctrine.’

The Fed increased their balance sheet almost twice over from March 11, 2020 according to Wolf’s report. At the same time, my portfolio which is pretty conservative and very diversified, has gone up over 25% (yeah, if sold and cashed out of as gains are only realized when taken).

And just think – Bernanke said QE and the increase in the FED’s balance sheet were temporary, and that within a year or so these “extraordinary measures” would cease. We’re now close to 15 years in. The FED needs to be dealt with. They have destroyed the free market.

The Fed (and the ECB, which is far worse) have turned into giant bad banks. Good thing they never get audited.

If they made a sequel to “Margin call” today, instead of “sell it all” the solution would be “call the fed”.

But if the only reason for the money printing is to keep shitty assets from having to be written off, that will in the end kill the currency.

Got gold ?

For the Fed, it makes no difference since taxpayers guarantee those mortgages. It’s taxpayers that will pay for it, not the Fed.

correct. the fed is not allowed to take payment obligor risk. it can only take value risk, meaning the risk that the value of the bonds they print for go down.

Yeah, right. That’s why they bought them in the first place.

These MBS will never be paid or bailed out by the “taxpayer” just like in 2007 no ” taxpayer” bailed out anything. If you define inflation as a tax ( which it is) you’re right. But that’s not about bailing out MBS.

The fed will keep them on their books ( and keep adding more) until the dollar implodes.

If the FED must write down their entire balance sheet of MBS to zero, what have they actually lost? Bookkeeping rules say they have to put it in the column of losses, but the FED can issue the amount of money to make up for it. If not, there will be deflation as a lot of money exit the books, but that may relieve some of the inflationary pressure on goods and assets.

They can even issue the money straight without a counterpart if they really wish. A side note, the central bank of China did just issue money without a counterpart until 1992 and may still do it to some degree.

Bubbles are very seductive. The norm is that bubbles have blow off top that sucks the least financially knowledgeable in at the wrong time.

One thing I noticed in the new bill is there is nothing to reign in speculation. There should be a 50% fee on stocks roundtrip traded in a short time period, I would say at least one day. Holding a stock for less than 24 hours can’t serve a useful purpose to economy.

Good Start OS, and certainly appreciate your perspective and ”atta dude”…

The other thing that would really put a permanent stop to the entire madness of the single family residential ( SFR ) market similar to your proposal to tax stocks, would be legislation, perhaps even constitutional amendment, to require all SFR to be owner occupied and only owned by folks living there.

Sure, let the long term MFR be owned by condominium or coop or some other similar, but that too must be owner occupied.

With the ”total location of people tech” now very prevailing and likely to become even more dominating every minute, if only because of it’s clear commercial value, it will be very easy to see where folks spend their time.

After, if they can enforce mandates for experimental vaccines, they certainly will be able to enforce automatic ”chipping” of every newborn — for their safety of course!!

So, maybe, real ”time share” for short term vacations, etc., to add some additional fun with the protections,,,

Think this will not happen to people?

Already happening to our ”master species” (that anyone who walks a dog these days already knows, ) as opposed to just a few years ago when Dylan asked, ”Dogs run free, why don’t we?”

“Reign in speculation?” Bwahahahahahaha!!! The Dems want Lael Brainard to run the FED. You ain’t seen NOTHIN’ yet, if she gets in. She’s a dove who makes doves blush.

Lael Brainard will be the next fed chairman.

There is indeed a very useful purpose to owning stock less than 24 hours — providing liquidity to the market. So you’d need a market-makers exemption. But even then, it would still be a bit like banning short selling (because “what useful purpose does that serve?”), which is needed for price discovery. I don’t like all this fast trading strategies/algos, etc., but I DO like the liquidity they prove. Less liquidity = bad, IMHO.

Market timing a home purchase? Has it come to this?

I know folks in Seattle who are still waiting on the sidelines with growing regret, now priced out even with a drop in prices.

Doesn’t matter what it is, if you can make a leveraged bet at 30:1 you are going to get a bubble.

The Real Estate market is BROKEN, IMO.

People who have a house cant sell it because of the sound reasoning you dont sell your biggest hard asset in an inflation.

People who wish to buy can borrow, courtesy of the Fed, at 2.5% below inflation. They will take all they can get.

Broken, irregularities, disfunctional…..stupid, IMO.

Many who think they are macro smart are going to find out they are micro stupid…

Looks like an opportunity is coming to buy the dip.

You mean for dips to buy? Only suckers would dip their toes in anything right now.

The time to buy is like COWG and I did back in 2010/2011 when on a typical residential street of 20 SFR’s, 5 were for sale by owner, by bank RPO, HUD sale, and RE agent sale. Of the five, typically three were vacant and needing cosmetic or some repair work.

And these homes were not in ghettos.

If we see that again after this bubble, then either mortgage interest rates are 5% or greater or the all FED bankers and board members cashed in their “booty” and moved to New Zealand.

House prices don’t fall unless monetary flows recede, volume times transactions’ velocity. There have been 11 boom/busts in housing since WWII. They have all been caused by the Federal Reserve monetary policy blunders.

As Larry Summers said: “Real interest rates would have fallen much further in the last half century if governments had not expanded social insurance programs and taken on more debt.”

Alvin Hansen’s secular stagnation is upon us. The “neutral rate” is defined as “the rate which balances desired saving and investment and thus leads to full employment and stable inflation”

Secular stagnation is chronically deficient aggregate demand. Secular stagnation results in an excess of savings over real investment outlets. That, in conjunction with the FED’s monetary offset, QE, excess propels asset prices.

I don’t believe there is much excess savings. It’s mostly a mirage of fake wealth. Perpetually increasing accumulation of financial claims (supposed “savings” but actually mostly debt) against a mostly stagnant capital stock, at least in the West.

Given that most data is estimated and some of it distorted, it’s impossible to actually know.

My suspicion is that, take away the manic optimism and the fake wealth that goes with it, this country is actually getting poorer.

This is somewhat reflected in “real” median household income since 1999 which is up a whopping 6% (in total) by the government’s data. It’s taken a 5X increase in the national debt and a 12X increase in the FRB balance sheet since 2000 to generate this mediocre performance.

And it isn’t just income and wealth inequality either, not by a long shot. There is no possibility of far more equally sharing the fake wealth and prosperity to increase living general standards because the production of real goods and services doesn’t exist to remotely accommodate it.

exactly. the top 1%s “wealth” would quickly overwhelm any ability to provide goods or services if they actually used it for that purpose.

“WASHINGTON (JUNE 16, 2021) – Decades of underinvestment and underbuilding have created a shortage of housing in America that is more dire than previously expected and will require a concerted, long-term nationwide commitment to overcome”: NAR

Yes, the NAR would say that. However, as I posted elsewhere:

Housing has become a financialized international asset class. Investors are buying houses for investment purposes. If they put them on the rental market, fine. But if they keep them as vacant investments to profit from price increases, etc., it poses a problem. People own multiple homes, and live only in one, and don’t rent out the other – that’s a problem. Overseas investors like to buy US homes as investment without living in them – that’s a problem.

Once housing is treated like stocks, you can never build enough housing during a bull market.

The solution is for the Fed to unload its balance sheet, including ALL of its MBS, to allow long-term rates to surge to where they below, and to raise short-term interest rates, and thereby allow home prices to adjust. Once housing turns out to be a money pit for investors, they’ll get out of it, and then suddenly there’s a different housing crisis, called a housing bust. We’ve had this before.

Hey Wolf,

Is there data showing how many homes are vacant?

Curious Jen,

Even defining “vacant” is subject to a lot of discussion.

If I own four homes, and I live in one of them all of the time, and I visit the others a few days a year each, if at all, and I don’t rent them out, three homes are vacant, but they’re not counted as vacant by the Census.

People who bought a new home and aren’t selling their old home and aren’t renting out either home, sit on a vacant home. And there are now a lot of these people (“second home buyers”). But depending on who is doing the counting, the vacant home may not be considered “vacant.”

On the other hand, “vacant property taxes” define vacant by the actual use of the home — this can be determined by electricity usage patterns, for example. I have never seen national data on this.

Spencer Bradley Hall

Why do people keep posting this BS on this web site, parroting losers like Lawrence Yum of NAR. As I posted before, there is no shortage of housing in the DC Swamp. Nearly every property we have appraised in the last 2 years has been EMPTY! That means the person who has the deed to the property owns or occupies at least 2 homes. When the interest rates normalize all this shadow inventory will hit the market as the carrying costs will be prohibitive.

I’m old enough to remember when you had to pay your bills or get out of the house, lose the car, etc. What a putrid, disgusting sham they run now.

I still maintain that you’ll know this whole bubble blew up when cryptos drop off a cliff. Not happening, yet.

the thing the crypto shills can never explain is that if the “value” can go from $30k to $66k in two months, why can’t it lose that, or more, in two months?

I call it the crypto rypto….

They did drop off a cliff a few months ago, but then they jumped back onto the cliff ;-]

Not sure how reliable that indicator is.

We’re in uncharted territory, Wolf. Never before have we seen such excesses. But I am confident that crypto is the ultimate speculation, worse than the tulip bubble. Once the greatest fool buys at the top, the entire thing is going to crumble into oblivion. These speculators are literally buying and selling NOTHING to each other, for larger and larger amounts. I’d rather buy an overpriced house at this juncture.

One thing to remember is that statistics are lagging indicators. Things are happening in real time right now that won’t be known by the statistics for a few months. House prices ARE FALLING in many areas. When I pull up the mls now, I only see “price reduced.” This past year, you would see none of that, even “price increased.”

The $4 and $5 per gallon diesel and gasoline has to be affecting people, too. The last economic meltdown in 2008 was brought on by the spike in crude oil prices. Not enough light has been shed upon that fact. This country – this world – runs on crude oil. Now we have prices at the pump nearly as high, while oil is barely above half the price it was back then. A spike in crude will rip the heart right out of this whole thing.

DC

All the people who bought way out are now getting cold feet and looking to move back closer to their jobs and the cities. One thing that is affecting them is $5/gallon gas heading for $7/gallon. Add massive traffic jams, and the end of the pandemic.

ALL of this is the direct result of implementing a fiat currency monetary system. They have always failed, and they will always fail. Just as you cannot build a house on a faulty foundation and have it last more than a few years, so too, you cannot build up a society on a fake monetary system, and have it last for more than a few years.

When we have a fake society that is run by a 100% corrupted legal/banking system, we are going to witness a very painful collapse of it.

right. this current nonsense has gone way longer than anyone thought possible because we started out from such a position of relative strength.

but you cannot beat gravity in the end.

I think people vastly underestimated the effects of this many trillions of dollars of money printing. It’s got legs, especially since Weimar Boy is still pumping.

Sorry to bring some reality to your analogy R, but, currently living in a 70+ year old house/home that was built as a ” temporary winter cottage” but is still providing long term shelter and likely to continue to do so for many more decades for my beloved,,, that analogy does not work…

Houses can and frequently do go WAY beyond any reasonable/rational life expectancy because, inter alia, the love and attention to detail applied by our species, many of whom do NOT want anything to do with our homes as just another ”asset class.”

”STARVE THE BEAST” as Petunia has said on here!!

STOP buying all the BS and the short term products of all kinds…

Thank you…

Stonks shooting up. Wealth effect continuing. Fence sitters who think they knew better can only kvetch.

“Kvetch?” I’m a fence sitter who is ELATED to watch the melt-up. The bigger the run-up, the bigger the crash. It’s going to be epic.

Need to stop assigning ONE thing as “THE” cause of delinquencies. Low and middle income folks only have so much budget for everything.

When gas has gone up at least a dollar plus per gallon, nat gas is rising quickly, and food is up across the board the net income starts to get real thin. In a word, it is inflated prices that are squeezing the entire budget, not just mortgage rates or forbearance schemes coming to an end.

It takes time for all that stimulus to go away. Many people ended up with more savings than they ever had in their lifetimes. Slowly those accounts will dwindle and dry up over the course of the next 6 months. I think by late spring things will be looking dire insofar as consumption is concerned.

I was just reading an article about all of the cars and trucks GM is building then putting into storage until they can add some chips when they come in. Does anybody really think that all of those cars, once finished, are going to have a buyer waiting for them? Absolutely not. I think we are going to see some of the best deals on new cars and trucks in history, as buyers will be as rare as hens’ teeth.

There may not be buyers for all of those cars waiting. But what if GM after they have got their chips and finished the cars and trucks in storage announces that the model line is shut? Well actually that the production line is shut down.

At the same time they announce that new models are in the pipeline, but only after the manufacturing line have been set up for the new models. That will be produced at a rate to meet demand, but with no excess.

I am a big fan of Wolf and appreciate the efforts he puts to write these illuminating articles which MSM would ignore on purpose.

Wolf does not provide any investment advise nor does he mean it even implicitly.

But the bottom line is:

if you take clues from Wolf’s articles and put your money accordingly, you’d have lost a ton by missing on the opportunities.

People are looking for stock market crash/ asset crash/real estate crash and rightfully so. The value of all these things are lost, highly elevated, lost bearings.

But FED is committed to keep this fraud going on along with other central bans in the world.

They won’t stop.

so dont fight the CBs.

The real inflation on the ground is 20 plus percent for common Joe but FED sees 5 plus percent.

There is no meaningful hike or tapering coming. stock market can be volatile but don’t see real estate crash coming as it is amply supported by Govt.

A lot of people made a lot of money in one of the first bubbles, The Dutch Tulip Bubble. A lot of people made a lot of money in the Great Florida Land mania of the mid 1920’s and then in the booming stocks of the late 20’s.

The only ones who got to keep it were the ones who passed up opportunities and got out.

Each of three bubbles and others ( South Sea etc.) had this in common: a slow acceleration, then a rapid acceleration and then a relatively instant implosion.

Should I go “all in” bro’?

US Department of Defense publication from 1962 “The Effects of Nuclear Weapons” included a special-purpose circular slide rule for calculating blast effects, overpressure, and radiation exposure from a given yield of an atomic bomb.

I wonder if it is possible to re-purpose this slide rule to calculate the effects of Fed QE:

$100B MBS taken off the bank balances by Fed monthly = 100 Kt nuclear air burst…

Radiation = moral hazards everywhere and strong desire to get something for nothing w/o having to work for it …

Overpressure is proportional to the yield in Kt and inversely proportional to the distance cubed – Taliban remains unaffected despite of $3T mineral wealth discovered in Afghanistan…

Brand-new housing developments rased to the ground due to lack of buyers…

Swilling beer from the trademark WS beer mug & using this slide rule – what is not to like ???

Jerome Powell as Dr.Strangelove and me feeling like USAF BG Jack D. Ripper ( played by Sterling Hayden-my favorite actor 😁 )

Re: real estate: The Evergrande crisis and Fantasia etc. plus the top ten developers in China cut off from dollar bonds, the seizure by creditors of the stalled Oceanwide projects in NY and SF, the Zillow debacle…

Is there a pattern here?

The Fed has everything under control, per Bloomberg:

Homeowners are taking advantage of a global housing boom by pulling equity out of their homes at the highest volume since the financial crisis.

In the U.S., homeowners withdrew $63 billion in equity from their properties through more than 1.1 million cash-out refinances in the second quarter of the year — the largest quarterly volume since mid-2007, according to data company Black Knight. Just under one in five American homeowners say they have pulled money out of their properties in the last year, according to a survey in late October by market research firm Harris Poll, with another 18% saying they are considering it.

As I see it, the Fed always bails out the banks and other property related rentiers. Our brand of socialism is socialism for the wealthy. Condundrum is that unregulated capitalism feeds the top class with a form of socialism. Aristotle and Socrates both noticed that societies tend to end up with oligarchies. Democracies included. Lincoln financed the northern army with a fiat currency, called a Greenback. He said he feared the northern bankers more than the confederate soldiers. There was some inflation, but then we were at war and the government was buying up everything it could. History never repeats itself exactly, but it rhymes a lot.

80% of all bank loans are for property. Existing property. No real productive investments. About the same percentage goes for all financial, property and commodity wealth. Outside of extraction, no real productivity gains. The owners are the same. The oligarchs. Once they create (by voter subtraction) a single Republican party government Democracy will be dead. So too will the planet itself. The sixth extinction baked in the cake.

Selling a home is not a panacea for paying off a motgage for most people. If they do this, they will probably have to look for an apartment. And apartment rental costs have risen substantially. They may also have to sell or give away much of their furniture annd other household belongings that they had in their house. Either that, or they will have to pay expensive storage costs. And all this on top of the toll on their health caused by the trauma of dealing with all that. Many people have died shortly after moving to a new home.

I know, because I have been through all this when rising maintenance costs forced me to sell my house. I did not die. But two of my neighbors did shortly after selling their house.