Driven by Corporate America and the most grotesquely overstimulated consumer spending ever.

By Wolf Richter for WOLF STREET.

Back when offshoring production by Corporate America to cheap countries was hailed as good for the overall economy, rather than just good for Corporate America, any fears about potentially exploding trade deficits were papered over with visions of the new American Dream: America was great at producing and selling high-value services – the financialization of everything, movies, software, business services, IT services, etc. Exports of these high-value services would make up for the imports of cheap goods. And trade would balance out.

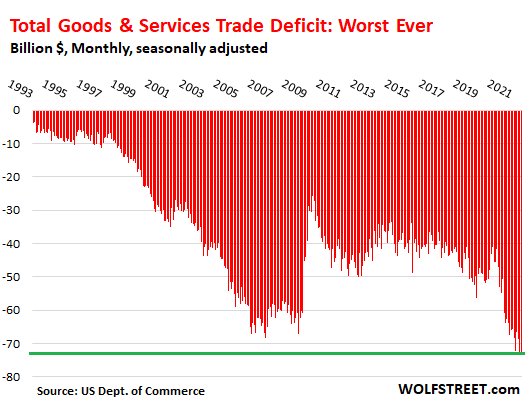

Today, we got another dose of just how spectacularly this strategy has failed. The overall trade deficit in goods and services hit a new all-time worst in August of $73 billion (seasonally adjusted), according to the Commerce Department today.

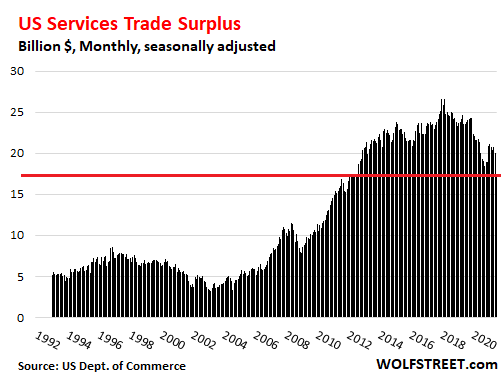

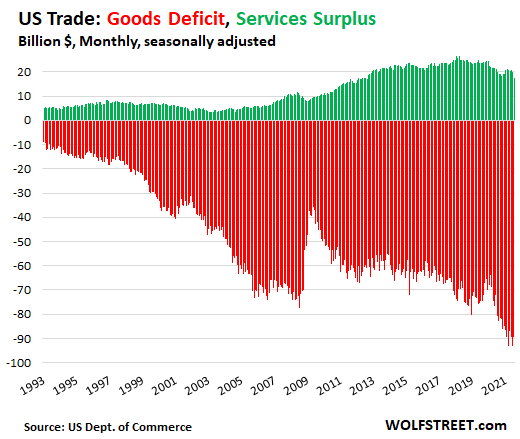

The trade balance in services deteriorated to a surplus of only $16.1 billion, the lowest since 2011, while imports of goods reached the worst ever $239 billion, and exports of goods edged up to a record of $150 billion, thanks to $33 billion in exports of crude oil, petroleum products, natural gas, natural gas liquids, products from the petrochemical industry, and coal.

Following the Financial Crisis, the overall trade deficit improved substantially, as imports plunged as consumers cut back on buying imported goods. That was the one major strength in the GDP formula for those months, as nearly everything else cratered. But it didn’t last long.

During the Pandemic, the opposite happened: Consumer demand exploded, fueled by $4.5 trillion in monetary stimulus and $5 trillion in borrowed fiscal stimulus, for the most grotesquely overstimulated economy ever.

It fired up imports of goods and boosted foreign manufacturers and caused the worst supply-chain problems and transportation chaos ever, but did little for what would really move the needle: US exports.

Trade deficits are not a sign of a growing economy, and they’re not a sign of economic strength, but a sign of continued large-scale offshoring of production by Corporate America of consumer and industrial goods to cheap countries.

Imports are a negative in the GDP calculation; exports are a positive. And GDP in Q2 was hit hard by the record trade deficit and disappointed expectations.

Services: the American Dream-Not-Come-True.

The trade surplus in services (exports of services minus imports of services) in August fell to $16.1 billion, the lowest since December 2011, and was down 33% from the average month in 2019. And it was dwarfed by the immense trade deficit in goods (exports of goods minus imports of goods) of $89.4 billion.

Exports of services, the product of American genius, ticked down to $64 billion in August, and imports of services rose to $47.9 billion. The difference between these exports and imports is the fizzling and small trade surplus in services:

Turns out that in this American Dream-Not-Come-True, it wasn’t the American genius of exporting the financialization of everything, IT services, business services such as consulting and auditing, that would dominate, though they’re clearly very good. For example, Chinese property developer Evergrande, whose shares are traded, I mean were traded, in Hong Kong, was audited by an all-American institution of genius, PwC and got a clean bill of health. So these are truly high-value services exports.

But no, that’s not what is dominating US services exports. So what is dominating – or rather was dominating?

Foreign travelers coming to the US for business, personal, educational, or healthcare reasons; their spending on lodging and other travel expenses in the US, and spending by foreign students on tuition, room, and board in the US are part of “services exports.”

In 2019, travel spending by foreigners in the US was the #1 category of exports and blew away the American genius categories of #2, business services, and the distant #3, financial services.

Then in 2020, foreign tourism in the US collapsed as borders closed. Over the first eight months in 2021, foreign travel spending in the US was still down by 70% from the same period in 2019. And in August, it was down 68%.

Business services, financial services, and fees from the use of intellectual property – the #2, #3, and #4 services exports in 2019 – grew this year, but not enough to make up for the loss in the travel category.

The table shows the major categories of exports of services in August 2021 and year-to-date 2021, compared to 2019. This is the American genius that is supposed to balance out the massive trade deficit in goods (if the 7-column table gets clipped on the right, hold your smartphone in landscape position):

| Exports of services | Billion $ | % Diff | Billion $ | Diff % | ||

| Aug

2019 |

Aug

2021 |

YDY

2019 |

YTD

2021 |

|||

| Travel | 16.2 | 5.3 | -68% | 132.8 | 40.2 | -70% |

| Other Business Services | 15.7 | 17.3 | 10% | 123.5 | 134.4 | 9% |

| Financial Services | 11.2 | 13.6 | 22% | 90.6 | 107.1 | 18% |

| Fees, Intellectual Property | 9.5 | 10.8 | 13% | 76.5 | 82.7 | 8% |

| Transport | 7.6 | 5.2 | -31% | 60.8 | 40.2 | -34% |

| IT services | 4.7 | 4.7 | 1% | 36.0 | 38.2 | 6% |

| Maintenance, Repair | 2.3 | 1.0 | -59% | 18.2 | 7.9 | -57% |

| Gov. Goods and Services | 2.0 | 1.9 | -9% | 15.0 | 15.4 | 2% |

| Personal, Cultural, Recr. Services | 1.8 | 2.3 | 22% | 14.9 | 16.3 | 9% |

| Insurance | 1.6 | 1.9 | 17% | 12.2 | 14.5 | 19% |

| Construction services | 0.3 | 0.2 | -16% | 2.1 | 1.8 | -15% |

Services surplus v. goods deficit.

The declining and small surplus in services (green in the chart below) and the huge and worsening deficit in goods (red in the chart below) paint the picture of US trade: Out-of-control imports of goods by Corporate America lead to out-of-control trade deficits in goods despite the surge in exports of products based on petroleum and natural gas. The exports of American genius — services — have never come anywhere near even papering over the massive trade deficit in goods. And it’s not even going in the right direction:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Facebook is one of our most highly valued creations. Nuf said?

And how many H1-B visa holders does FB, Google, Microsoft, Oracle, Salesforce, etc employ? At any given time, there are more than 1 million of these persons. Why? Because tech companies have lied to Congress that there’s a shortage of American talent. That’s garbage and gives our education system reasons not to invest in making our students more capable and justifies firing Americans who are doing a perfectly good job for the sake of making more money.

Newsflash: You have to deal with the good and the bad of globalization. You can’t just exploit all its benefits and reject all its consequences.

I work in tech, working with clients (telecom, finance, insurance, tech, gov, utilities, retail, etc.) around the world and I can tell you that, for the last 10-15 years, the vast majority American “engineers” I’ve worked with are NOT capable, nor competent in what they do. The outsourced ones (usually Indians) are not much better.

There are various reasons for this but I think mainly, it’s that tech is hard and there is just a limited number of people with the right mind and the right taste for it. The best people I worked with where during the dotcom bubble pre-2000. The promise of getting rich quick attracted the best and brightest into tech. Obviously, the opposite happened when the bubble burst. Now, the field has fewer “best and brightest” and they are highly concentrated in a few companies. So you have smaller talent pool and a larger market (tech adopted by every sector of the economy).

You are right there is a disconnect with the education system and the changing demands of the market — not promoting tech enough. But for the education system to change gears and produce more talented tech workers takes time. There is also this strange “get-it-and-forget-it” belief in (mostly traditional) businesses that tech is just a tool for saving money, without a need to really invest in it for the long term. In these companies, the IT “techies” are some weird socially inept outsiders operating in a dark corner of the building, forgotten by and isolated from the rest of the company. (The TV series “The IT Crowd” illustrates that effectively.) That treatment and the stereotypes do not help in attracting talent into the field.

The good news is that I see all this (education system and public perception of tech workers) slowly changing for the better.

Sadly, the decline of the American engineer has been noticed in the tech industry.

What you describe has ruined many a company and industry. IMHO, it’s the MBA’s moving into “leadership” positions – trying to fluff their compensation packages at the expense of the company.

Seen ’em. I referred to them as the “frat boys”… with apologies to frat boys.

@i

I would argue that there is a very strong co-relation between the number and quality of a country’s engineers and it’s prosperity and dominance in the World.

eg UK steam 19thC, USA oil 20thC.

Russian and Chinese heavy engineering are currently awe inspiring with Germany keeping the western flag flying IMHO.

My definition of engineering is the harnessing of the resources of the universe for the benefit of mankind. (unbridled by politics)

While lobbying Congress for more H-1B visas, industry claims that H-1B workers are “C class or S class [Mercedes]”. Come payday, however, they’re entry-level workers.

The wage rules for H-1B and green card sponsorship are broken down into wage Levels I, II, III and IV, with Level III being the median. The Government Accountability Office (GAO) put out a report[1] on the H-1B visa that discusses at some length the fact that the vast majority of H-1B workers are hired at the entry-level wage level (more recently confirmed by the EPI[2]). In fact, most are at “Level I”, which is officially defined by the Dept. of Labor as those who have a “basic understanding of duties and perform routine tasks requiring limited judgment”. Moreover, the GAO found that a mere 6% of H-1B workers are at “Level IV”, which is officially defined by the Dept. of Labor as those who are “fully competent”.

This belies the industry lobbyists’ claims that H-1B workers are hired because they’re experts that can’t be found among the U.S. workforce.

From the EPI reference:

“A majority of H-1B employers—including major U.S. tech firms—use the program to pay migrant workers well below market wages”.

[1] GAO (2011). H-1B VISA PROGRAM Reforms Are Needed to Minimize the Risks and Costs of Current Program, GAO-11-26, January 2011.

[2] Costa, Daniel; Hira, Ron; “H-1B visas and prevailing wage levels”, Economic Policy Institute, May 4, 2020

News Flash: I don’t have a problem with foreign born persons being able to come to the US and work. But, I have a major issue with the tech industry lying their asses off and having well qualified American’s fired from their jobs and be replaced by Indian born H1-B’s. Ton’s of qualified Americans are looked past. That’s a FACT!

My parents are aging, so I’ve spent a fair amount of time in hospitals the last 18 months. I am STUNNED at how many doctors are Indians. I saw an interview from a US born pre-med student who couldn’t find a residency. She said that the data had over 6,000 American born medical school graduates not being able to find residenciesin2019. Why? Because hospitals are doing the exact same damn thing the tech industry is doing by hiring foreign born doctors who are willing to work for less money, and that doesn’t make them better.

We can point to a ton of reasons why all this is screwed up. Some are education related but primarily H1-B visa as taking good paying jobs from Americans and giving them to foreigners.

It’s like Section 230. Everyone knows the tech industry is using it to shield themselves from the censorship they carry out and all sorts of other bad deeds. But, our country is SO divided that we don’t have the political will and consensus to do something about it.

America is SCREWED BIG TIME. In the next 5-10 years, it’s going to become increasingly evident that China is eating our lunch in all sorts of tech & science. And, a significant cause of these gains is that so many Chinese work in the US and are stealing our IP.

And now, China has gotten away with the ultimate backdoor: COVID. It’s utterly stunning that America and its allies aren’t working together to hold China accountable. In 7 short years, China’s GDP is expected to surpass ours. WOW!

Biden wants to pass $4.7T in totally un-necessary pork and non of the proposed tax increases are going to close the Medicare Part B $500B a year in the red. However, it’s going to make the donut hole even bigger by adding Dental, Vision, & Mental Health care. We spend $550B in interest on the debt. Just absolutely stunning.

Someone who has seen this IT/HiTech World from inside, still working in one of the big MNCs, I can tell you for sure that visas to hi-tech workers are mainly, not always, used to replace American workers with cheaper engineers.

@Jay Worley

And I’m telling you this is global capitalism. You reaped its rewards for decades, now you get a taste of the other side of the medal. And “you” wanted unregulated “free” markets and less government intervention too.

“And, a significant cause of these gains is that so many Chinese work in the US and are stealing our IP.”

Right. Because innovation is exclusive to Americans.

“And now, China has gotten away with the ultimate backdoor: COVID.”

And the US got away with the Spanish flu. That type of blame is childish.

The US is falling behind in vaccination rate, compared to most western countries. Who’s to blame for that?

You get it backwards.

The only reason the US economy is still on top is because we use the H1-B visa to steal the rest of the world’s tech talent.

The US education system might be great at producing Gender Studies graduates but it is awful at teaching math & science. The vast majority of Americans can’t understand basic statistics or even get their credit card bills right.

The only thing keeping this economy afloat is how the USA steals the best and brightest from around the world and convinces them to contribute to our economy, pay our taxes, and devote their skills to proping up our stock market.

Attorney General Garland’s son-in-law is co-founder of a firm that peddles critical race theory (CRT). Along the way, it hoovers up analytics on students. Now AG Garland has sicced the FBI on opponents of CRT, especially parents of K-12 school students. No wonder Garland gave up his cushy job as a chief circuit court judge.

@A

Yup.

Even at the very top of the pyramid: Elon Musk, Google’s CEO and one of its founders, MSFT’s CEO, two of the three Youtube founders, are all imports.

So the US tech industry wouldn’ be as strong without talents from abroad. That has always been the US’ secret of success: attract talent from the rest of the world.

A –

If workers come here voluntarily, and are better off in doing so, that isn’t “stealing”.

The word you might be looking for is that those workers are defecting from their native countries to come here for a better life.

People are not the property of their home countries; they cannot be stolen.

You ”nailed it” A:

Have said similar in my career industry for our Latino bothers and sisters for at least the last 30 years or so…

Had the experience of having to actually physically push down to take a ”break” youngsters from out of USA, including Latino, Asian, SE Europeans, etc…

Compare that with USA kids in 1950s-60s who delivered 100+ newspapers by bike, then went fishing, then went to school, and then ”biked” their mower, etc., to do yard maintenance until it was too dark to work…

Surely, some on here remember those days,,,

SO, what can we old farts do to help young farts understand the value of the work ethic of those days,,, and the clear rewards there from???

Remember what Eldridge Cleaver said a couple decades ago, ” If you are not part of the solution, you are part of the problem.”

Hard to teach math when some in academia actually argue its racist. You know concepts such as basic math becoming political talking points is end stage stuff when it comes to a society. And don’t even get me started on what common core actually is and is not.

The only reason to single out gender studies here is if one has a problem with gender minorities, their issues, and their ongoing civil-rights effort. Humanities education is actually being increasingly starved for funds as universities lavish resources on STEM fields, much of the time with utterly self-interested corporate donations. Meanwhile, K-12 is increasingly oriented toward passing standardized tests and a whole generation has been surrendered to a vast experiment in digital-media shallowness and distraction. It’s hardly a mystery why American children reach adulthood without any self-understanding or passion for learning.

VintageVNVet, in a word:

Video Games.

ok that’s two words. But under the new new math, its whatever I want it to be. /s/

We didn’t have the internet when we were kids. And it will be our downfall.

To teach math and science, you need teachers qualified in math and science.

It’s that simple.

The problem is worldwide, and has been the case in the USA for over 30 years. I know, I was a math and science teacher. But me and every other senior physical science teacher I knew have retired early.

Four main reasons.

1) Lack of student discipline, and no support from teaching senior management when you have to deal with it.

2) The syllabi and enforced teaching methods are badly wrong, and all one can do is prepare kids for a rubbish exam, not teach them science.

3) The admin load is ridiculous, and is counterproductive.

4) The salaries are uncompetitive with other occupations scientists can do, but government and the teaching unions are utterly unwilling to pay shortage subject teachers more than other teachers. When I worked in private schools, they created a new salary point to pay me more, but I was asked not to tell other staff that.

Those are the problems in rough priority order.

A further problem is that companies would rather pay H1Bs peanuts than employ any of the few good scientists and engineers that G7 countries do produce, even though they are better. This drives intelligent students to do other subjects.

BS. I bet you’re Indian.

Our biggest educational issue in the US is that we don’t track students. I’m a HS math teacher, and we constantly get students who are promoted into accelerated that isn’t based on merit. This has been happening for many years. And now, it’s accelerating due to the liberal agenda that’s being forced into education. It’s not about merit anymore which is and will continue to destroy America.

In the US, kids should be tested to get into accelerated and then they should be subsequently tested to stay in accelerated which DOES NOT HAPPEN, at least not broadly. I know it doesn’t happen in GA, where I teach.

There’s nothing about the liberal agenda that’s going to give education the opportunity to correct the shortfalls we have that have to be closed in order to hire more from in the US.

Be that as it may, H1-B visas are what’s killing the a large portion of the American dream just like decades long illegal immigration.

Had Reagan not granted Amnesty and instead made border security a major policy while also pushing the education system to encourage lower performing students to get training in construction and other building trades, America would be much better off today. We wouldn’t have nearly the problem today with poverty, crime, drug use, etc.

I am a good friend with an Indian worker at Intel who is here on a visa and he freely admits that the reason he is here and getting paid a high salary is because the US is not properly investing in the education of its people. I’m very much inclined to agree. The cherry on top is how we’ve allowed higher education to become a mere tool to extract the future wealth of generations via indentureship and dilution of the value of a degree.

So the USA is basically a bigger Spain? A Tourist land?

Not just tech far shore JW:

Was only blacks and whites in construction when I started out in the 1950s.

Hardly a black or white to be seen these days, as the browns have literally taken every ”merit based” job.

While we may debate a ton over the why, the fact is that the vast majority of ”Americans” do NOT want to work, or work ”hard” as was the case in former decades, while SO many of our brown brothers and sisters know how to work and are com fort able with working hard and well…

Just one illustration from (OK, know it’s anecdotal, don’t go there ): In SWFL in ’92, almost all workers were black or white, with the blacks clear leaders in the ”trowel trades”, especially ”flatwork” because of their lifelong skills; 10 years later it was all browns because of their attitude and work ethic, including by then many bilingual crew leaders, forepersons, and even contractors…

Having tons of positive experiences with first and second generation ”Latino” immigrants, legal and otherwise in CA, I was and continue very com fort able with our brothers from another mother ”south of the border” welcome each and every one who comes here TO WORK!

VNV,

Some body downstream was lamenting the loss of American values, I posture that it’s still there, just not necessarily in the color you’re looking at…

If you ask me, the Latino community might just save this damn country…

They work hard, take care of family, save money, and do more with less than anybody I know…

Sounds American to me…

And not to slight anybody else who does the same, but generally speaking, that group takes everybody’s crap (and crap jobs) and still want to succeed…

I’m so tired of hearing this drivel. It’s nothing but a bunch of lies perpetuated by people who have no idea what they are talking about. It has nothing to do with “work ethic,” and everything to do with “low pay.”

I have a friend whose dad was a drywaller. My friend was raised in the trade. It went from getting paid by the piece where you could make a fantastic living as a middle class family to being displaced by $7 per hour Mexican labor throwing up drywall that would collapse on a family’s kitchen table a few years later.

Dr. Horton and Co. are leading the charge in substandard, garbage construction. I’m sure some place there are “Guatemalan craftsmen,” but they certainly have not migrated into the USA. What we have are dopers, drinkers and know-nothings pretending to be carpenters. It’s extremely pathetic. That’s why I see teardowns in new developments. Yes, new houses that are complete teardowns because they have been deemed uninhabitable. But those corporate builders don’t mind, so long as they get their bonuses and their share prices are high.

Can a 18-year old white english-speaking kid with no experience walk onto a construction site and get work? How about a spanish-speaking migrant? If the entire crew speaks spanish who will get the job? If the foreman likes speaking spanish who will get the job? There is more to it than just being a hard worker. The culture of the work site plays a large role.

True

The American Dream is just that, you have to be asleep to believe it.

“The plain fact is that education is itself a form of propaganda – a deliberate scheme to outfit the pupil, not with the capacity to weigh ideas, but with a simple appetite for gulping ideas ready-made. The aim is to make ‘good’ citizens, which is to say, docile and uninquisitive citizens.” ~ H. L. Mencken

Thoughts are told in this country, people forgot or never learned to think for themselves. Nobody but the masses are to blame for our problems. You cant expect to have your hand held your entire life and then cry about it when things dont go your way.

Its really simple we have the power to institute a new government, but you have to fight for freedom. Not sit back and have your hand held and expect the government to lead you to safety.

“Timid men prefer the calm of despotism to the tempestuous sea of liberty.” ~ Thomas Jefferson

“What country can preserve its liberties if its rulers are not warned from time to time that their people preserve the spirit of resistance? Let them take arms.” ~ Thomas Jefferson

“But a Constitution of Government once changed from Freedom, can never be restored. Liberty, once lost, is lost forever.” ~ John Adams

“Our countrymen have all the folly of the ass and all the passiveness of the sheep.” ~ Alexander Hamilton

“When a government betrays the people by amassing too much power and becoming tyrannical, the people have no choice but to exercise their original right of self-defense — to fight the government.” ~ Alexander Hamilton

“War is when the government tells you who the bad guy is.

Revolution is when you decide that for yourself.” ~ Benjamin Franklin

Everybody needs a history lesson. All have forgotten why and how this country was formed. What i see is men who want there hand held and be led to safety. As the movie the warriors put it “I knew they were wimps” and today that phrase fits perfect. There are few men left but lots of wimps. The freaking truth hurts one last quote.

“Free speech is my right to say what you don’t want to hear.” ~ George Orwell

Can’t wait for your movement conservative readers to blame the government for all our ills.

What does Facebook really produce? Meaningless ads? or our personal data? China, on the other hand, produces tons of REAL goods.

I am looking for window blinds and curtains at Home Depot for my new house. Guess what? Most of blinds or curtains that I have seen are “Made in China”. Show me a window blind that made in elsewhere in the world. I would love to see it.

ps: Don’t trust anything about inflation data from the mainstream Economists. Trust what you personally see. I witness at least 10% inflation on grocery and dining, as well as empty shelves.

I’ve started reading a few books about the enduring American oligarchy (what was originally called the “Money Trust,” composed of robber barons who built financial empires via monopolies, financial crimes, illegal activities, etc.).

It seems clear that American oligarchy does not give a damn about the average American. They care about profit only, and American economy be damned if that profit is threatened.

The ultra-rich, or at least their lieutenants, are very smart. They know that they can get away with murder, worse than murder, if they can divide everyday people — keep people fighting about culture, racial issues, etc. And keep people whoring themselves for cherry salaries from on high.

How long can the oligarchs keep screwing American people and using the global dollar reserve status to bully the world in order to reap profits? It seems like the only solution is for enough people to recognize the real enemy. The domestic ruling class whose iron boot has has been grinding the American economy into oblivion for decades.

One of the biggest whores of it all is and has been the liberal professors of our “free market economics.”

What a croc all of the business major machine has been over the years.

The amazing truth of the Intro to Business courses was the clear admission that most business will fail and at the end of 10 years only 1 of those who started out in the cohort will be left standing.

If I had it all to do over again I would have gone to the community college system and majored in air conditioning, plumbing, and electrical along with the General Contractors license I already had INSTEAD of starting the college system with the goal of being a CPA/Tax Attorney.

Once completing this plan I would have planned every house built to be sold every 3 to 5 years to take advantage of the home sale capital gain exclusion as on investment strategy (this still is viable for now). Next, I would have gotten the Real Estate Brokers license to round out the ability to increase my ability to maximized the buying and selling of real estate in the many forms possible.

Oh, and to make sure you have good medical and a great retirement make sure your spouse gets a really good government job so you get maximum value at the end of life….. Works really well especially when you use the maximum deduction of business tax deductions against earned income….

Thought charging 250$ for tax guidance was the way to go but could not sit still in front of a computer for hours on end.

All that is left is the slowing shrinking/dying of the “Great Empire.”

I am so thankful for this website so I can see how it is playing itself out in the “psychological landscape” with FEAR, ANGST, ANXIETY, and all the wonderful variations of the same.

So I ask you the one question everybody is trying to answer somehow and some way:

WHAT ARE YOU GOING TO DO ABOUT IT IN YOUR SITUATION??????

What I see here are a bunch of chickens screeching about what they know is to come. And some are those who have already experienced the “head chopping” or are about to in what is now happening….

WHAT ARE YOU GOING TO DO??????

Adam…

Indeed. If you can repair/install an AC or a Furnace, you will never go hungry. Blue collar jobs are the secret vs the big college loan worthless degree route.

And to your question, “What to do?” Get small, get the “Kids off the street”, “swim close to shore”…and have a generator and a well.

Imagine if you could build those things.

That would be better.

Yes, very insightful….

I am amazed at seeing many here in the last phase of life living, yet knowing this cannot go on…

Wish I knew how to do the “puts” that Wolf does as this world that appears to be intellectual bets on what will happen are still viable money makers for now…

Fight on battle weary trojans…..

I would have become a fireman in a large east coast city.

An overtime spiked pension of $200,000+.

Retire at age 55.

Tax free if “disabled.”

Free medical for life.

Study hard, get a job, work hard, build things, pay taxes is for suckers.

My area in North Idaho is full of retired California cops and firefighters. There are so many of them, that they have their own breakfast clubs and neighborhoods. They call themselves ‘Blue-line North’ or ‘Red-line North.’ They even have their flags flying. They got the nicest homes and nicest trucks in the county. They’re the rich folks that moved in and bought up the place.

California Community College Professors can tool….

You can see it on the California State website showing all State Workers salaries earned….

One told me it is possible to make 250K BEFORE all benefits and retirement are factored in….

The $250K salaries aren’t the half of it. Many of them work for 20 years for the State Highway Patrol (CA) and then “retire” and get another job with a municipal police department, and retire from there at 60ish. Both jobs will earn pensions. Take a look at how juicy those are, with health care and inflation protection. Guy across the way was a fireman in CA. Has a 5 car garage with lifts.. spent a cool mill on a house that isn’t nearly built as well as my crackerbox…. but it does have granite counter tops.

The husband of a woman I worked with retired as a CA cop following the above strategy. In the early 2000’s, he retired with a pension of $250K…. per year…. which explains the three houses.

Adam…

I am getting out of Dodge. As I type this I am sitting on a train heading to the Philadelphia airport enroute to Ecuador. If I can’t spend the next 6 months in Ecuador, I will be in Colombia for 3 months and Mexico until the Philippines finally reopens for tourists. Four years from now I might – repeat – might bring my Filipino family to the USA for a vacation….. Depending on what the USA looks like by then.

The wife has her eye on Costa Rica. I’m sure we’ll end up there at some point.

For MC and Reef,

My brother looked hard and very hard at both Costa Rica and Ecuador almost 10 years ago. His waterfront life in BC was just grinding him down. :-) He had cash, was aging, and was looking at numerous properties. He would send me the listings and viewing pics for at least a couple of years.

His conclusion? The ‘deals’ and opportunities had already been sucked up 10 years before that…..by Americans. My contribution to the discussion was in times of hardship and decline, if you are not ‘really’ from there, you will always just be another vulnerable. If the rule of law and opportunity is selective and weighted for the influential now, what do you think it will be like in those countries in hard times. Frying pan and fire.

These aren’t hard times. Angry times, maybe and for sure. Living situations are sometimes crappy and maybe in decline, but doable. It can get a whole lot worse than this, imho.

Paulo,

That was a very insightful post about being an outsider in a foreign place during truly hard times.

Per Wolf’s Zumper rental survey updates, there are still more than a few places in the US where rents are just 25% to 33% as expensive as the coastal glory holes.

That is a *lot* of savings, while still being in the US and therefore less of a vulnerable outsider.

The problem is that rents are accelerating moronically fast in many places in the US (landlords trying to recoup Covid rent losses and vast property purchase overpaying is my guess).

And the *median* rents in some passable foreign countries are sometimes as low as 25% of the *median* US rent (or maybe 6% of the US coastal glory holes).

There are a ton of unknowns and risks when moving overseas but vast economic stupidities here in the US are greatly increasing the costs, dangers, and risks here in the US as well, at a threateningly accelerating rate.

There is No free market in the USA. It is all monopolies (the Fed) or oligopolies.

“Free Trade” was the death of Middle America.

Soon to come the only American services will be 2 Chinese Laundries on opposite sides of the street, washing each other’s clothes.

Kam, I concur. Go into any auto parts store — any of them — and all of their parts are made in China or Mexico.

MIT ,

Replaced some front control arms on my BMW…. Made in Turkey…

Looked at a shotgun… made in Turkey…

All high quality…

Turkey? Caught me by surprise…

All I can do is try to be happy. I can’t solve the root cause(s) ie; political donations, and the voting public is too dumb to notice. The public is mad but they don’t know why so they lash out at the easiest targets (pregnant Mothers, the poor and disabled, migrants). We have “clever” corruption, in part thanks to clever tax attorneys, plain and simple. Corruption ruins organizations, communities and Countries. Honesty was once a trait to admire and helped make this Country great. Today we seek to take advantage of wording issues in the rules. We should just do the right thing even when no one is recording. We still have a decent legal system, compared to other Countries, so look on the bright side

Lord, grant me…

The serenity to accept the things I cannot change,

The courage to change the things I can, and

The wisdom to know the difference.

(One of the reasons why I’m a “Wisdom Seeker”.)

Maybe a bit older than you AS, but had gone rural in a wonderful mostly wooded area with good soil, springs, and best rain pattern ever seen,,, tons of ”Old Order Amish” in the county was a clue to be able to ”dry farm.”

Had to leave to take care of elderly parents ( in same house since married in the 1950s ) back in FL and my increasing physical challenges, but suggest to all under 50 that is one way.

Now without any debt at all, all $ ”needs”, so far OK+ from SS alone, and looks to be OK until death, so other capital increasing, albeit slowly.

Agree totally re Wolf’s Wonder, and send him $-$$ semiannually (as budget allows ) to support his work!

Having been far in the country, ( ”farmed out” as we used to say in the early 70s as an alternative to ”far out” ) several other times, finding the place, rural or city with good neighbors is the most important part of any location; not particularly easy, but can be done.

Good luck and God Bless all y’all!

Thank you. Got it!!!

Those “free market professors” didn’t arise by accident.

Bought and paid for.

Just look at who endow the various tenure and chair positions and/or have names on MBA buildings.

The corruption of the professorial class was accomplished by corporate America buying off the professors with summer jobs, research assignments, and consulting contracts. The richer the school, the worse it is, but it is really everywhere.

What am I going to do? Enjoy my remaining years in Thailand happily married to my Thai wife, whom I found and married as I was retiring. (come with a nice hedonic rebate).

I like Yogi Berra’s advice: When you come to a fork in the road, take it.

LOL, love it….

I have lots of academia experience….

Influenced by my USC PhD father-in-law….

He was an old pastor’s son in small town farm communities where hard work and the Great Depression made it so hard work and integrity were required by all the people you lived around….

AS…Gonna make sure my son reads your note. Excellent!

@A

The first priority for all western citizens should be a demand that QE should be stopped once and for all and never ever repeated.

The second priority should be to ensure that there is a ‘real’ reliable return to savings for all individuals.

This can only be achieved by ‘forcing’ your politicians to do it without fail.

I think you will be amazed by how quickly everything will ‘come right’ with these 2 simple propositions.

Just sayin’

Amen. China’s CCP found this weak heel and has “invested’ in Western asset managers, the avaricious rich, and Wall Streeters to rape Americans financially.

China has a dominant position in steel mfg. They started closing inefficient steel plants and the price of steel almost tripled. The price of iron ore went down.

China has a dominant position in polysilicon used in solar cells. They reduced production and the price of polysilicon tripled from $11/kg to almost $35/kg. The high cost of solar cells caused some solar electric projects to cancel. China is building more coal fired electric facilities.

A Chinese electricity shortage may lower industrial output causing further price hikes. They shutdown crypto mining as it wastes electricity.

Just ramp up production at the American facilities…

Oh wait…

The fall in iron ore prices is at least partly due to the Evergrande Ponzi/MLM contracting. Evergrande was way overbidding land prices because the ultimate costs would be borne by real estate companies and retail buyers; the increased prices in turn spurred both of Evergrande’s customers to want to buy more.

Plus China is in a very public trade spat with Australia – who *was* the largest source of imported Chinese coal.

PRC is at the apex of its’ power economically. The world is finally realizing that doing bidness as usual with the CCP is bad for business. They are going to lose the population for France in productive workers and add an equivalent number or more into an aging population. Demography is destiny. One child policies have consequences, and they will never acheve ROK of JPN status before a precipitous decline. Danger in the near furure, near irrelevancy 100 years from now…

I question how legit the power shortage really is. They know further supply issues will keep our inflation hot.

Only in the US ? It is worldwide, the criminal Parasites all have the same mentality. ENTITLEMENT.

Modern billionaires would be happy to watch America burn. They’re locusts who corrupt the federal reserve to give them billions then corrupt the politicians into letting them pay zero taxes.

Every year they squeeze the middle class into getting less money and fill their back accounts with more.

They’ll drain the USA dry until there’s nothing left, leave us in chaos, and just fly to their summer villas in Milan, taking all their stolen money with them, when the whole system collapses and the rest of us are stuck in the rubble.

History shows that the billionaires always get offed when “the whole system collapses”, as it will in Milan also. It’s quite simple – their skills are useless in a collapse, and their influence no longer matters.

So we’ve got that going for us ;)

Look up Rothschild,s got to be first to go king pins of corruption ask putin

First of all dp, it’s all the oligarchs globally these days, as opposed to just locally a few centuries ago; certainly, Andrew Jackson was the last POTUS of USA to realize and try to work against the global oligarchs, especially the global banking cartel ”taking over” the banking industry of USA.

His effort was cur tailed by/during the ”run up” to WW1 and then the global challenges of WW2, when, similar to the global banking cartel ”dictating” to the royalty of England due their owning the debt of that royalty, the global banking cartel took over the vast debts of USA from wars…

I get a good laugh at the various and sundry efforts to identify the ”wealth” of the the global oligarchy that is SO clearly hidden behind SO many clever layers that no one will ever be able to find the vast majority of their holdings.

Remember very well the first time I walked through ”downtown” Nassau in 1961, and could not figure out how and why SO many ”companies” were listed on the bronze placards on the front on SO many buildings there…

My Bahamian mentors knew exactly what was happening then, but ignored it all to bring fish to the market, and I still love them for instructing me how to do so,,, all RIP, but remembered.

Maybe take that house-a-fire photo* from the ad copy and shift it up among the charts where it would be so appropriate (*c/o Classic Metal Roofing Systems)…my shameless plug for those good folks supporting Wolf Strasse. Or perhaps it’s about time for someone to yell out “Traaaaiiiiinnnn!”.

But Wolf, why go to the bother of making stuff when those foreigners seem perfectly happy to give us their stuff, and gladly take dollars printed up by the Fed. Which they apparently just use to buy treasuries.

Oh wait, they don’t even have to print it anymore–just a few clicks on a Fed computer.

It baffles me. We’ve been getting away with it since the 1980’s.

Exactly !!!!!!

China makes real stuff using real workers who slave away for no benefit to themselves and the USA pays them with promises of paper, not even real paper. This is as good as it gets. Switzerland buys real shares in real companies by printing Swiss Francs which it then exchanges for dollars and spends in the USA. Also a glorious business model. The Swiss though do not have the world reserve currency and could come unstuck. The USA has no such worries.

Why worry about deficits? I don’t understand.

It’s different this time, right?

Individuals can’t live beyond their means forever but this doesn’t apply to the United States collectively, does it? After all, this is “America” and the reality that applies to everyone else or at least to the non-developed world doesn’t apply here, right?

There really is something for nothing, even if it contradicts not just common sense but physics?

Ask yourself this question, if what you seem to believe is true, why didn’t anyone do it before? Are current central bankers and policy makers such geniuses now while their predecessors were a bunch of morons?

The only reason this exists is because of psychology enabling this behavior. When it ends (and it will), there will be a day of reckoning in store for American livings standards.

Same thing for other countries with similar reckless policies. Only question is who is going to find out first.

The Swiss franc is a stronger currency than the US $.

There seems to be a lot of people (maybe not you) who don’t realize that the US$ was in lots of trouble in the 70s. US tourists around the world were asked to pay in local currency. One couple in Italy delighted the hotel manager by paying in lira! The US$ had fallen 3 % during their stay.

There is often reference to Volcker having an inflation problem. This is just another way of saying he had a weak dollar problem. Negotiations with Saudi re: oil price in US$ became heated. No doubt some talks were private.

Silver hit 50 US $ oz. ( Not this high in Swiss F) When the Hunts announced a silver- backed bond, Volcker ordered the Chicago exchange to cease orders for accumulation, only for liquidation.

To shore up the US$ it borrowed but the bonds were denominated in Swiss francs. (Carter bonds) The interest rate to borrow in US$ would have been prohibitive.

The Swiss probs with the franc have always been with it being too high. It used to be tied to gold but by referendum this ended.

But there aren’t enough S francs for it be a convenient world currency.

Trivia that is kind of funny. Not ages ago the Swiss Minister of Finance had tried to solve the high franc by pegging it to US$. Pegging has probs which I don’t pretend to understand but I guess he had to sell S F and buy US$.

After a while he mentioned to his GF he was going to end the peg. So she went out by herself and went long the Swiss F!

He resigned. As far as I recall no one thought he knew about it or blamed him except for his pillow talk.

Many Asian countries find it more valuable to build industries to provide mass employment for their populations, than to maintain a trade balance. Industrialization also provides valuable work for engineers, industrial designers, and all the folks in supporting industries. The mass employment also leads to a higher standard of living.

Many countries simply are willing to just give us their production. But in exchange, they get the mass employment, essential skills, etc… and we lose them. The American people may be the only people in history willing to give up their livelihoods in this manner.

It is corporate Greed that builds the the best modern factories in other countries. Then supply them with all the manpower and technologies.

Uses the best psychologists in the world to get the Pleebs to want things they really can’t afford.. Then loans the the Pleebs the money to purchase all those imports.

What a wonderful system they have built.

While most people haven’t a clue they are slaves to the dopamine induced desires that are triggered daily by their masters.

Kent A very smart answer!

And historicus too: Both of you are saying we’re NOT getting away with it. Obviously intelligent individuals aren’t yet completely extinct.

But stocks are going up like crazy. Playing serious political games with debt ceiling limits. Rich people getting SO much richer. Printing money at $120B per month. But we can’t tax people who have the money because they own the politicians. The only (so called civilized) country without basic public health care. In rich SF poor people in the streets.

Never dreamed it would come to this when I was in college 60 years ago.

Ralph

“We’ve been getting away with it since the 1980’s”

We’ve been going backwards since the 80s….losing manufacturing, and as of late, printing our brains out to create the money to import these goods upon which we have become dependent.

Light bulbs, spark plugs, F22 parts….

Because those dollars can be used to buy oil. Petro-dollar standard, remember?

Of course, Saudi Arabia’s largest customer and the largest importer of oil these days is…China.

I didn’t think you can get blood out of turnip– but honestly didn’t know you could squeeze oil out of computer bits.

@RH

Buying your treasuries is OK but, when they start buying your houses, offices, factories, farmland, etc. and you end up being a tenant in your own country that’s when it hurts.

At least in UK we still get to look at all our historical stuff.

Already happened

In which of the above tabulated categories do exports of advertising services via search and social media get accounted for?

NARmageddon,

Good question. I would think online advertising and the tech infrastructure (mostly Google, but also Facebook, increasingly Amazon, and a few others) that runs it would be under “Other Business Services” or maybe under “IT services.” This industry is called “ad-tech” for a reason.

People who read my site in China, see Chinese ads. And people who read it in Japan, see Japanese ads. Search and social media are the same. The tech makes this possible. Not sure how much cross-border advertising money flows there are. Everyone in ad tech gets a cut. But if a Japanese advertiser (for example, Toyota of Japan) advertises to readers in Japan on my site, how much of that money stays in Japan? I will get a micro-fraction of it; and the middleman (some in Japan, some elsewhere) will get some of it. Google USA will get a big part of it.

A guess, as much as possible of the revenue will end in a tax heaven.

@W

Look after the micro-fractions and the millions will look after themselves.

Scottish wisdom.

Yesterday’s Facebook outage can only add to the deficit. 6 hours of outage means that people didn’t get to see a gazillion ads.

America’s loss is China’s gain…

The “red” part of that goods deficit in the charts is largely going to China — a communist dictatorship (like the USSR) — who is going to be the world’s top no.1 economic, political and military superpower by 2025…

R2D2…

What we dont hear anymore…

“Trade deficits do not matter.”

Now, I understand the professorial view that the dollars must return, therefore we are getting cheaper goods and the consumer benefits, etc etc.

But what these Ivory Tower Academics miss is the real world ramifications….

WHEN THE DOLLARS RETURN, OWNERSHIP and CONTROL often changes hands.

The Ivory Tower Academics cant seem to quantify this. They miss that your country declines as the trade deficits and your “IOUs” fall into the hands of others.

We import disposables and things that will end up in a bin in a few years. The collectors of dollars buy hard long lasting assets.

A good example is in Chicago. The city of Chicago sold the Chicago Skyway tollway to a foreign entity about 20 years ago. They took the money to cover deficits and put out flower pots. How’s that working out? The citizens then pay the stiff tolls for the road way.

Largest pork processor in the US? Owned by Chinese.

And another use of dollars by foreigners……the purchase of US Congressmen via lobbyists loaded with those foreign held dollars.

Countries with trade surpluses ascend, those with deficits decline and must print TRILLIONS to sustain themselves.

That is manifest.

Correction:

There is NOTHING communist about the CCP or the PRC.

It is a fascist regime par excellence.

Such stinging words. I am sure Xi is losing sleep over what you are thinking about him.

If you want to point fingers about bad actors… suggest you start at home in the US… if that’s where you are from. There is a lot to choose from no matter which of the Hatfields and McCoy clans one belongs to.

Oliver,

The communists destroy everything they touch, the fascists grow the business sector. That’s why all the large companies that supplied the German/Italian/Japanese war effort still exist today.

Evergrande, not so much.

Don’t forget the Worlds reserve Currency. ;)

I am not that optimistic about China, but that does not mean they will collapse either. We will collapse first. Also they are not like the USSR. The USSR was never able to generate economic growth on the level of China. Westerners don’t care about the increasing prosperity experienced by common people in China, but that does not mean that prosperity is not legit.

RU did not have the ”Clintonistas” helping them to anything and everything they might want,,, especially any of the ”basic industries” of USA as did China after they paid the Bill & Hill team appropriately.

This has been as well documented as possible within the total corruption of the so called MSM,,, and even to some extent in the ”legal system” of USA, formerly known as ”Justice System.”

How this is any kind of mystery is absolutely a mystery within an enigma, etc., etc…

Every time I read these type articles I want to buy more physical AU/AG. It’s not if, it’s when this house of cards tumbles down. I’m shocked the US financial system has held together as long as it has. If Moody’s and S&P accurately rated USA debt is should be CC with probability of default. They say “we can always print more money” which is true, but your purchasing power will be zilch, effectively equivalent to a default. Looking forward to gov shutdown and trimming the fat.

Reliance on international service income is fatal in a crisis like this. Firstly, nations will start to require internal providers, if only because of political pressure by their own oligarchs on their own politicians. Secondly, an increasing proportion of the population will simply stop paying for services by ignoring the government requirements.

But this is a worldwide financial ponzi.

Every major nation has effectively been living on credit for decades, except China. However, China is communist, so their finances are whatever the CCP says they are. Thus far, sufficent investors have decided to believe them. Evergrande will be the start of the change there. If the Chinese energy crisis plus the continuing worldwide shipping problems reduce the dependability of Chinese exports, then that will be a major further step change.

As the wealth continues to transfer upwards, the middle classes become incapable of providing the necessary taxes to keep the credit coming. Inflation from money printing follows. All this is exactly what happened to the Roman Empire, except that the inflation came from the reduction of actual precious metals in the coinage. Everything else we see today is what happened in the late stages of the Roman Empire – mass illegal immigration, nobody willing to work in core industries, dismal performance by the once-mighty military, etc.

What’s to be done about it? Well, no one can fix it. We’re already at the stage where international solidarity has gone in the scrabble for the political power lifejackets. Europe’s getting ugly, and a quarter of the world’s nations are now either dictatorships or de facto failed states (including Belgium, for example). And fixing a worldwide problem needs a high level of co-operation from stable nations.

You need to be self-sufficient in a rural area, nowhere near big cities. Those are the only people, historically, who survive the collapse of empires reasonably well. In post-Roman Britain, within 40 years there was no one living in cities, towns, or villas. Yup, the billionaires don’t survive – they are generally ‘offed’ by their own security. There was no money (not even gold), just barter of food, goods, and skills. That, or you need to become a warlord after the collapse.

The only remaining question is When?

Self Sufficiency is FREEDOM.

Reliance on cheap foreign goods, an arrangement likely crafted by the Chinese, is DEPENDENCY.

Trade deficits do matter as they make obvious the reliance and dependency.

Who cares about all that stuff as long the Gouvernment keeps sending me my entitlement Cheques. Now that there are more Pot shops then Banks, why worry. If i really need food i take my SUV to the Food Distribution place ,operated by and financed by working taxpaying Suckers.. i mean the minority persons.

It is obvious that the oligarchs run the Country, not only in the USA. The paid of Politian’s are the Messengers.

You must mean our president.

:)

Ever read the study about Rats in Paradise?

Yes.

The root of the problem with humans is that we didn’t evolve to cope with our current situation. For all of our evolutionary history, we had to deal with living in small bands, hunting and gathering, and frequently under significant threat from animal or natural hazards. We have a large number of mental shortcuts which deal very well with that situation, like the fight-or-flight response, and confirmation and bandwagon biases. Many of these responses lead people to take entirely the wrong actions in our current complex, densely populated, technological world.

Au/Ag have gone nowhere in the past decade of printing – so the correlation between PM prices and inflation is…zero to negative.

As for default – never going to happen.

Greenspan said it very clear: we can always pay back in dollar debts, we just cannot guarantee what those dollars will buy.

Makes you wonder if they’re being censored, like anything else the PTB don’t like these days.

And here I was thinking all those containers were heading back to China empty…

I’m so stupid that I couldn’t see they were stuffed to bursting with services…

We sell China hocus- pocus …

They sell us reality…

@COWG

Get them on your haircuts, that’s a winner!

Janet Yellon will fix all of this. When they come after your bank account for any transaction over $600 they will have so much money there will be no more deficits trade or otherwise.

Wonder where they came up with the $600 figure??? I got the answer.

Swamp Creature,

Curious minds are awaiting your revelation.

Obviously new on here MG; otherwise would know SC has some very clear and very relevant observations re RE mkt in our putative capitol area, AKA Washington DC,,, but not much in the realm of philosophy.

Likely IMO because he/she/they are too close…

That is most likely the case as has been very very clearly the situation from ”reporters” for eva,,,

Otherwise, SC an obviously ”merit based” person, as are most of us on WS.com, and most especially us of the older, pre boomer, generation,,, and, lately IMO many or most of the younger folks on here, whose gen descriptions seem to obscure their very ”old school” work and other ”ethics.”

Saying that mostly because now knowing many youngsters, 20s n up, who are not only working hard, but also very successful, way beyond my paltry attemps at their age..

Really don’t know where the concept of these young and younger folks, including boomers, NOT doing well is coming from, when I see SO many younger folks doing well by working hard???

So people can walk into a store and STEAL up to $900 and not get prosecuted…

But if you run $601 dollars through your account, you get attention.

Got it? This is the idiocy that is rife through our upside down country.

SC,

Will there still be banks when the government switches over to e-currency?

Probably doesn’t county when you pay a mortgage, utility bill or a credit card.. Only Cash? Does it count when I take out over $600 or just deposit it?

I appreciate IRS enforcement, but they should quit focusing so much on the little guy. Big Technology companies like Apple pay an effective tax rate that is half the legal rate. Where’s the enforcement there?

Big company lawyers are too smart for the IRS enforcement people. IRS can bully small guys like us with no pushback that has any teeth in it.

The loopholes in the laws are put there for the politicians, and their cronies and donors, to exploit. Needless to say, non-government operations like big business and organised crime are better at exploiting them.

I think it comes from the extra unemployment amount of $600. You could surmise the distribution of this money gave them enough data to track the spending of those people.

Another thought is the IRS reporting of 1099 income at the $600 threshold.

Anthony A

You got it! Looks like I will have to cough up anther donation for the Wolf street Report. This crowd is smarter than I thought.

SC, when I had my own business, I used to hand out 1099’s to my subcontractors. Some didn’t like that I did that for even small amounts (over $600), but I had to justify my IRS business deduction for “outside services” in case my business was audited.

I’m waiting for someone to come up with the answer to my question about the reason for the $600 figure. So far the batting average is zero. Hint: it is tied to another IRS regulation. I’m in a generous mood today. If anybody comes up with the correct answer I will give Wolf another small donation booster shot. He deserves it for all the hard work he has put in to keep us properly informed on all the media disinformation that is pounded into us every day.

SC, see my post under Petunia’s avove.

It seems to me that the REAL disruption will be when everything “reverts to the norm.” In fact toe “even out” things will have to go Negative for a bit.

One example… Chinese manufacturers who have ramped up to produce more goods for a world awash in cash… what happens to them (and their nation/government) when not only is the stimulus gone but so is the QE?

@SG

They start to sell to their growing (rapidly) middle class, It’s in the plan.

China has been and remains vulnerable to international markets because of the rapid expansion. Sanctions or similar during this time would cripple China and cause the failure of the Communist government. As soon as they have a large enough middle class, they can “export” to themselves if sanctions occur, becoming economically self-sustaining.

Of course, the CCP expected to have achieved this sanctuary state before now, quietly forgetting the lesson of the Soviet CCCP that larger size equals even more inefficiency under socialism.

I am not at all sure that ANY communist system can become self-sustaining, and in any case Xi making himself Dictator-for-Life puts a temporal pressure on the whole business that I am pretty sure will collapse the CCP within 10 years. The USA may spoil things by collapsing earlier ;) And now you see why Xi might have a reason to collapse his buggest customer.

This one’s for all the marbles.

Yes… I am aware that is the plan. But plans are hard enough to pull off when everyone is rooting for you. They are a lot harder when you have a major competitor working to undermine you.

Our ambassadors to the world, corporate America, have set the course of human standards for years to come. Instead of negotiating workers’ rights, working and living conditions in the various past world trade agreements for all mankind, our darling corporations have been America’s loudest voice.

A few have been made rich in foreign countries, but most people have been further enslaved to live out their lives in unsafe fire hazard sweat houses, cramped, dirty work and sleeping conditions. Fish processing ships leave port for months on end wherein workers don’t see the light of day until the ship returns. Women are stuffed into garment factories along with child labor working unending hours at the mercy of constant preditors.

What’s a corporation to do if slave labor has been outlawed in your own country? You set up shop abroad where no one can see.

Long term trade deficits eventually have to mean a lot of inflation in imported goods. For a very long time we have been borrowing and piling up foreign debt to pay for all these goods. How and when does it get paid back? Everyone seems to assume that a system that has been getting more and more massively out of balance can keep on doing that forever. In theory, it all rebalances when people in other countries don’t want to lend us more to buy their stuff. Then the value of the dollar falls, and everything we import gets more expensive. And this means lots more inflation. Those imports keep getting more expensive until enough people stop buying them to bring the massive trade deficit down, and then SOMEDAY, to a surplus, so we can at least start paying China and Southeast Asia for all of that stuff we have already bought by paying off our debt. This HAS to happen, but everyone is pretending that it does not, because for decades it hasn’t. Planning to get infinitely out of balance is not a good strategy.

That would be in a functioning marketplace.

Additionally, all those fiats will eventually come home to buy anything of value. So, again, inflation as the locals have to compete with trillions of overseas fiat.

It’s not like this has ever happened before.

Post WWI Germany, the locals were freezing despite having more coal than they knew what to do with. It was all sold for export. There are stories of German coal trains being hijacked and diverted to local towns.

Post WWII Germany. The debts were forgiven.

Right you are.

But the Ivory Tower Academics will argue against that common sense…

This actually IS the textbook view. When I studied Econ back in late 1980s, this is what everyone talked about with reference to Japan. What happens when international trade gets out of balance is easy to predict. It is just that it is in the individual financial interests of many to keep the train heading towards the cliff. And we have been heading in that direction for so long that most people are asleep on the train. This is a danger to US creditors as well. China has built an economy that is dependent on this unhealthy dynamic. They should want to find an orderly way to unwind it, but they don’t seem to.

You have many mis-apprehensions in your post.

1) The US debt is not owed to foreigners, it is owed to Americans. In fact, almost literally all of the new debt piled up since 2012 has been bought by non-foreigners.

2) Balance is a term misused by libertarian idiots. When you can unilaterally create dollars, there is no need to balance anything. Yes, there is a consequence eventually but clearly it is much further out than any of those idiots think. And the end game isn’t going to be “collapse” or “default” – it is going to be some substantial portion of those foreign dollars coming home.

So the only part of what you wrote, that is likely, is inflation. But even then, it isn’t going to be Weimar style inflation. More like Mexico, but probably not (quite) as bad.

Additionally, a lot people are going to be able to avoid much (but not completely all) of the inflation…

@SS

The current a/c deficit has to be balanced by a capital a/c surplus, eg Chinese must buy enough treasuries, properties, assets, etc to balance the overall books. If there is nothing they want to buy, they will reject your dollars and they will lose value. Don’t worry though there’s still a lot of USA to sell.

“Those imports keep getting more expensive ”

Indeed. And I believe a great part of these “bottlenecks” is not necessarily logistic created alone…

I believe businesses KNOW that this inflation if on the brink of runaway in nature, and they are trying to buy and inventory as much as they can…

because to hold cash when the Fed DOES NOTHING with this 5% inflation is to go backwards…but to INVENTORY as much as you can puts you in an increasing value situation.

So the “bottlenecks” are ramifications resulting FROM THE INFLATION itself driving business decisions…..not the root cause, IMO. It certainly adds to the inflation…

and this is all the bad things that come with a PROMOTED inflation by a rogue Fed allegedly bound to do just the opposite…FIGHT inflation.

So much would be cured if the rules were followed….especially in Washington DC and quasi govt agencies.

I am doing another Engels here. Hold on…

1. China became the worlds manufacturer only because western nations in particular US let it be.

2. Labor practices in china are so bad. If India had any nets to catch the falling workers, all the western nations will issue economic sanctions to India. Western nations look the other way about the labor conditions in china.

3. The one child policy is not a policy but a rule enforced by the unimaginable means. If an African country ever to impose such a rule they will be wiped out from the earth.

4. Literally, all the intellectual properties were “shared” with china. Can you have the same agreement with other countries? China’s development comes not from the basic research but intellectual property rights sharing. US is giving the designs to china for manufacturing.

5. All these because the unions demanded pay raise of $5. Oligarchs will rather ship the entire manufacturing offshore rather than giving a small pay rise to employee here.

6. Even with the bug and supply chain chaos, no benevolent politician is willing to talk about bringing back the jobs. All they say is if China is bad, then send it to Vietnam.

7. All the universities in western world and ivory towers are not talking against china because, then china will stop sending students to those universities. Economics know which side is buttered.

8. Elephants or donkeys in power, the manufacturing is not coming back. They will jump through all the hoops of environment and climate change to justify offshoring.

FYI. China has rescinded this policy/rule.

“The one child policy is not a policy but a rule enforced by the unimaginable means.”

But despite the official demise of the 1-child rule, the birth rate remains very low.

Yes, even Chinese parents know they have to feed and raise those additional kids and many have decided one child, or none, is the better alternative.

The minimum wage in India is about $2.80/day. The average monthly wage is $437.

Restaurant food prices are much lower in India due to cheap labor.

Because of fuel switching to renewable biodiesel, it is difficult for the poor to afford cooking oil.

A Tata Nano mini car costs about $3300 in India this year. They used to be much cheaper.

DH,

Please keep on here posting you very good additions to the conversations.

Especially your additions of what WE can hope are accurate descriptions of various and sundry data from at least ”out of our normal channels”…

Very helpful to this old boy trying to figure out IF to get back into SM after SO much ”disinformation” the last 40 years or so…

Thank you.

Warren Buffett recommended buying shares of an S&P 500 index fund if you have a long term horizon of more than ten years. That recommendation was years ago. The market might be at a different valuation today. It might go up or down, no way for me to know where it will be next month. Is it a bubble or relatively cheap? How will government policies affect the market? Will they loosen or tighten?

Can’t say I agree with almost any of your points.

1) China became the largest manufacturer because they’re good at it. Yes, the US/Clinton helping China join the WTO accelerated the process but it is far from clear it would not have happened anyway.

2) Labor practices in China are bad? In China, if you screw your workers too much, they literally hold you hostage. In the US, don’t let the door hit your butt on the way out to the unemployment office.

3) Way out of date, nor do you have any idea of the types of social and legal enforcement which China used (in the past) for this outdated policy.

4) Sharing is sharing if the other side signs the agreement. If they don’t, they don’t get to sell to the ginormous China market. Don’t see what your problem is with that.

5) $5 pay raise: idiotic. The offshoring happened long before $15 minimum wage was a thing. You’re 20+ years too late.

6) Politicians in the US do what they’re paid to do. And who is paying them? The corps that sent the jobs out to start with.

7) It isn’t even that simple. China is far smarter about managing their public image than most people know about. For example: chinese companies put money into pretty much every major film. And surprise! no Chinese villains unlike Russians or Mexican mobsters etc. Next time you watch a major film, pay attention to the production (i.e funding) companies.

8) Total nonsense. Mercantilism works fine whether you are growing like the US up until the 1960s, or Germany/Japan today.

Nice…. But Dumbos and jackasses are also appropriate descriptors I think. Those evoke more contrast.

I am waiting for the inevitable realization that will eventually hit the middle class in this country that we… the US that is…. need capital control to keep assets in US and limit capital flight to a few hundred thousand a year. (Let me know if you know of another country that does this).

The reason will be to make those absurdly wealthy pay their “fair share.” I say hit the middle class because long before this idea can ever metastasize in the brains of the jackasses and dumbos, the 1% would have offshores their assets and as needed renounced their citizenship in this country.

Cause the exit tax is 24%, and a one time thing. Whereas our inevitable trajectory is going to cause a much higher tax rate on assets and everything else…. At some point, the math will not longer make sense.

@CP

If you want to infuriate a Chinese engineer tell him he copies from the West.

Nah! he would probably just laugh.

I’ve taught business law in community college 37 years. It is a basic a “here is how contracts, business, the Constitution and rule of law work in the USA” survey, sorely needed even by many domestic kids (increasingly narcotized with online junk, and now doubly burdened with the COVID frictions). It was flooded with foreign students into the 1990s and 2000s and I was proud of being part of our services exports and cultural exports (plus all the other spending done here by these students). The $20k a year I take home (in Southern California) plus paltry/nonexistent benefits (I pay my health and all expenses of technology, training upgrades, etc., so, it is a labor of love) is not a dime more than it was 15 years ago. It has been steady, but so much for he “overpaid government employees” trope as far as my life is concerned. I have worked another job for significant parts of these years, now thankfully not.

Easy to see in retrospect, I see bad strategy and races to the bottom on both sides of the China/USA divide. I have had something of a conversion experience as I consider the particular top-down globalization “destroy all boundaries” mania (backed by huge US lobbies) is showing its ugly facets (online trash colonizing our kids’ brains, not least). It breached all reasonable limits. After 9/11 the foreign students dwindled and are now almost none. Post-COVID there are basically zero Chinese students, and I see that as a loss for both sides. China has elastic demand toward our services and can now do substitution with domestic sources (though probably polluted with their heavy nationalist-ideological filtering). This process seems to me to be festering.

Thanks for the reply. Just as Amazon cannot be rated based on a sincere worker, Universities are judged by different standards. Yes, there is no doubt that Professors, adjunct and TAs are the pillars of University. Its true that Universities now has annual target and quarterly model just as any other corporate company. They have endowments added every year, athletics facilities and progressive agenda which has no relationship to the education. Again, you are right. I am also saying the truth.

“Today, we got another dose of just how spectacularly this strategy has failed.”

Add in the dire situation revealed in the books:

Stealth War: How China Took Over While America’s Elite Slept

The Hundred-Year Marathon: China’s Secret Strategy to Replace America as the Global Superpower

and you see where short-sighted profit seeking allowed by a bought government has gotten us.

Indeed….a “bought government”.

And you can see that the Chinese learned a very important economic lesson…

The US Congressman is for sale.

And to reiterate, these “bottlenecks” are not the CAUSE of the inflation, though their cost increases certainly add to the mess.

The CAUSE of the bottlenecks IS THE INFLATION. Buyers of foreign goods sense the dollar decline and are saying to their suppliers…

“We will take all you got at today’s price.” For to have inventory is good in inflation, and to have cash is bad. But the Fed could fix this situation, but they dont lift a finger. And 1/4pt limp in raises will not have ANY EFFECT, IMO.

Winston,

‘The Hundred-Year Marathon: China’s Secret Strategy to Replace America as the Global Superpower’

Makes me wonder where Taiwan fits into this. Would the US really attempt to prevent a Chinese takeover of this ‘renegade’ province?

Taiwan is a part of China…. Its plain and simple. That said…. The current approach of sending large fleets of combat aircraft on a daily basis into the ADIZs make very little sense.

There are multiple path to reincorporate, the current path seems to be a little too much, a little too aggressive. But this is likely driven by internal dynamics with things like Evergrande bubbling up to actual consciousness.

MCH

Where do you get these bogus pronouncements from. When I was in Taiwan I noticed there was not a single Tiawanese that agreed that they were part of China. In fact I noticed armed soldiers on nearly every street corner with machine guns waiting for the next war with the mainland.

Yeah well, stop reading those conspiracy theory books. You have to remember what’s good about America…. Our values, our culture, all the great things taught in our school…

You know, not math, not science, but arts and culture, and made up history… AKA fiction… in fact, math and science should be banned altogether because they promote competition and bad behavior…

MCH, under “great things” you forgot to mention gender studies.