Ford, whose sales plunged 18%, is suddenly No. 1 for September. That’s how bad it is.

By Wolf Richter for WOLF STREET.

Total new vehicle sales in September dropped to 1.01 million vehicles, down 37% from 1.6 million vehicles in March, when there were still enough new vehicles to sell.

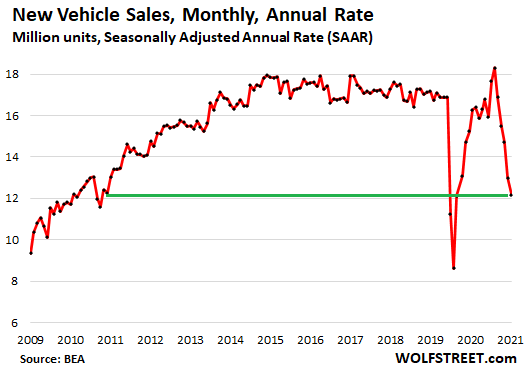

The industry-standard Seasonally Adjusted Annual Rate (SAAR) of sales – which adjusts for the number of selling days per month and for seasonal factors, and converts the monthly sales into what sales would be for an entire year – plunged for the fifth month in a row, by 29% year-over-year, to 12.2 million units SAAR, the lowest, outside of the two lockdown months, since June 2011 ,according to data from the Bureau of Economic Analysis.

During the Great Recession, it was a collapse in demand as consumers went on a buyers’ strike and decided to drive their vehicles for a couple more years instead of trading it in; and they kept doing it for years. Two of the Big Three US automakers filed for bankruptcy protection, along with many component makers.

This time, the situation is so screwed up that it is hard to figure out what demand actually is. We only know that it exceeds supply. But supply has been thrown into total chaos by the semiconductor shortage that has triggered plant shutdowns globally.

Over the past few months, inventories of new vehicles have collapsed. People were ordering and waiting patiently until the vehicle gets in. Others grabbed what was still available when it came in. And prices have spiked as automakers have cut back on incentives, and dealers are selling over sticker, and automakers are prioritizing higher-end models, which is where the money is.

There are indications that many potential buyers have had enough of this circus and stopped looking. They went on a buyer strike. But their numbers remain uncertain, and for now demand still exceeds supply.

Ford is suddenly No. 1 for September as sales plunged, that’s how bad it is. Ford reported today that total sales in the US in September plunged by 18% year-over-year to 156,614 units. Of them, 83,554 were pickup trucks and 70,260 were SUVs. It only sold 2,800 cars in September, having handed car production to Asian and European automakers, with the Mustangs and a handful of GTs being the only cars it still builds. It killed the rest of the car models.

But, but, but… despite the 18% plunge in vehicle sales in September, Ford beat Toyota (152,916 vehicles) and claims it beat GM in monthly sales as well (GM only released quarterly sales for September). And thereby Ford claims to have been the “No. 1 seller of vehicles in the U.S. for the month.”

Ford credits some recovery from its production problems, as retail sales in September were up 34% from the collapsed levels in August.

The inventory shortage and the sales for the month produce the fastest inventory turn Ford had “ever seen,” it said, with 31% of its retail sales coming from delivering vehicles to customers had ordered them previously – up from 6% last year.

But Toyota, which in September finally also took a hit from the semiconductor shortage and ran short on inventory, after having been able to get through it better than the others, reported that sales in September plunged 22% year-over-year to 152,916 vehicles, with Lexus Division down 8.3% and Toyota Division down 24.5% year-over-year.

General Motors reported that sales in the third quarter plunged by 33% year-over-year, and by 39% from two years ago, to 446,997 vehicles. That’s a monthly average of 149,000 vehicles.

Dealer inventory, including in-transit units, was only 128,757 vehicles. This would amount to roughly 26 days of supply. Considering the time vehicles spent in transit (depending on dealer location and where the vehicle is coming from), and the time it takes to prep vehicles at the dealer when they come off the car carrier, the average number of days’ supply is minuscule. But GM said that availability is “projected to improve during the fourth quarter.”

GM is holding on storage lots near its assembly plants a large number of unfinished vehicles that are missing a component or two related to the semiconductor shortage. When the components arrive at the plant, GM finishes the vehicles and ships them to dealers. In Q3, GM shipped over 68,000 of these vehicles to dealers.

And it prioritized higher-end vehicles and high prices, and cut its incentive spending: GM’s average transaction price (ATP) was $47,467 during the third quarter, up by 20% from $39,389 in Q3 last year – a sign that there is significant demand at those ridiculous price levels, given the inventory shortage.

Stellantis-owned FCA reported that Q3 sales plunged by 19% year-over-year to 410,918 vehicles. Sales by brands:

- Jeep: -11% to 196,687 vehicles

- RAM: -17% to 144,740 vehicles

- Chrysler: -51% to 15,502 (its sedan models have been killed)

- Dodge: -32% to 49,059

- And forget Fiat and Alfa Romeo

Tesla doesn’t disclose US deliveries; it only discloses global deliveries on a quarterly basis. It currently builds vehicles in the US and China. Vehicles from both plants are also exported to other countries. On a global basis, it delivered 241,000 vehicles, up 73% from a year ago. In the press release, it thanked its customers “for their patience as we work through global supply chain and logistics challenges.”

There is more supply coming, automakers are saying. The chip shortage isn’t going away just yet, but they’ll be able to make more vehicles, and they’re dangling the hope out there that inventories will improve. When production starts perking up, and inventories start building – for inventories to build, production would have to exceed demand – it should become clearer what actual demand is at these price levels.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In the UK, we are at the lowest number of new car registrations for 23 years – since records began in fact. Obviously this is mainly a supply problem at the minute the question will be just how long that minute is! Our incompetent PM tells us everything is just temporary too, the fuel shortages, the energy prices etc.

I will just keep driving my second car or 10 years into the ground. That depreciation just gets cheaper every month and now I am closer to the office my weekly mileage is the equivalent of my daily mileage. Keep going spendthrifts, our time is coming.

Just maintain your Vehicle,300.000 km is no problem.( if your vehicle is out of the warranty just change the oil filter twice a year, not the oil. The only thing that is missing are the additives, which will be added when you top up the oil lost from the Filter Change. Or waste your money by the specials.

NO, god no. Change your oil.

This person has obviously never got under a car and unscrewed an oil pan bolt and noticed the oil was a different color than when it went in the top of the engine. There are reasons oil turns black and it’s not the health of the motor.

New combustion engines are more durable but they can’t defy physics. Moving parts wear down. Burned hydrocarbons leave residual stank.

When I worked for the railroad we periodically sent lube oil samples to a lab to look for the presence of various metals. This gave us an idea of wear on the crankshaft bearings, cylinder walls, piston rings, etc.

Those old Alcos hold about 200 gallons of lube oil, so it didn’t get changed very often. Filters were changed regularly, and since they burned plenty of lube oil we were constantly adding new.

Agree on changing the filter twice a year (based on milage). And agree a maintained vehicle today can do 300,000km. But disagree on not changing the oil. Do an oil analysis, and it will prove that your theory that the additives are the only thing missing is incorrect, and that topping up will replace them. For example, oil is multi-viscosity today – the viscosity modifiers break down, and you don’t want that long term. There are so many reasons to change your oil

Now lets argue over which oil is best so we can go even further off topic. I’ll start: Pure synthetic. I use Mobile1.

I once had a 55 Chevy that was an oil change in progress every time I drove it… killed tons of mosquitos…

Probably gave anybody who was behind me cancer, too…

And don’t cheap out on the filter. I wouldn’t put a Fram on a coaster wagon. OEM or (in a pinch) Wix.

I change the oil in our cars twice a year – with a new filter. Costs a whole $40 per at the shade tree garage.

I was an engineer for one of the big three oil filters. We were a big supplier to Ford Motor craft. Ford would do 15,000 mile harsh test runs with NY taxi cabs and send them back for our review. Generally 90% of the oil filters were OK. Each manufacturer has their own specs. The OEM brands and big three name brands had higher filter specs than what you get at quick lube places. Filter can were stamped into cups and smashed a second time to make a can that was .0095″ thick and test spec was 200 psi.

We had a PhD that set up cold start test to measure instantaneous spike at at below zero temps. Filter has bypass valve to open and reduce spike but it is still quite high when oil is cold. The old stories of don’t floor engine when cold are true.

my dad ruined the compression on his 1967. buick’s v8 following the no oil change advice when i was a kid. the good news is that inspired him to take both of is to a continuing ed auto mechanics course st the high school. i’ve been a gear head ever since.

Does any of us remember the Franz toilet paper filters of the 1960′? Never change your oil only the toilet paper.

Ken,

Remember them? I still own a couple. Never use them as the toilet paper (some manufacturers) have a tendency to fragment and block the oil ports.

Absolutely ludicrous “advice”. If anything, change the oil and not the filter. Not that I would advise that, either.

I pay @$3 for an oil filter through my OEM employee purchase plan. Shipped to my house. No shipping charges. I would skip that step because??????

Do you not replace the crush washer when you change your oil either? You’d save an additional whole $.60.

Foolish advice Helmut. Water is a natural by product of combustion. Ever see water or water vapor come out of the tailpipe? Some of this water gets past the piston rings into the oil pan and if you drive short trips, the oil never gets hot enough to evaporate the water through the PCV. Change the oil and use a quality filter.

My Uncle was a mechanic in the Army and told me that they changed filters not oil in their vehicles in WWII. He continued to do this in his civilian life.

And how many of those vehicles are still on the road today ??

Seriously, not changing the oil is very foolish.

I’m hoping there’s downturn here in the US that leads to an over abundance of chipless ready to go cars that car manufacturers can’t sell in the next 12 months. I believe the primary issue driving lower sales is high prices as noted by Wolf and consumer stimulus money that’s dried up.

There is also a big demand shift happening, as consumers are wanting to buy BEV cars. Tesla Model Y ordered today is projected to be delivered in April of next year. Crazy.

The traditional car makers have been caught with their pants down regarding the shift in consumer demand to BEV. The lack of any competition in the BEV market in North America continues to keep Tesla sales high, in countries where Tesla has solid NEV competition – like China – sales of Tesla vehicles have already peaked. The overall market growth is coming from model diversity in NEV now. Plus, Tesla has no PHEV models.

There is pent-up demand for cars now, but I wonder once supply is back up to speed, if total demand has actually dropped. In my guess, consumers will be holding off on buying ICE cars, waiting for better NEV cars to hit the market. It doesnt make sense to invest money in the old technology, with oil prices moving higher and all the maintenance/repair costs associated with ICE cars. Just wait for a good NEV car in the low 20K range to hit the mass market.

The big change will come with autonomous networks, maybe in the 2025-2027 timeframe. That is going to decimate traditional car sales and any company that is not making oodles of money from autonomous vehicle networks will be in bad shape. The competition to build those autonomous vehicles is going to be very different than traditional ICE car manufacturing, marketing and service networks. All those billion dollar factories for ICE cars might not actually be the way most autonomous vehicles are built. Watch for major manufacturing changes.

Low inventory of cars?

In Europe it has been quite common that people specify the options, buy the car and the manufacturer then assemble the car for delivery some weeks later.

If the car is already made it may either sit in a central store or on the ship on it’s way from the factory if assembled outside Europa.

The car in the showroom is just for show and test drives.

Its mostly illegal in the US for a manufacturer to sell a car directly to a buyer. Something to do with socialiscm.

Harrold and veinung Skjervheim,

What Sveinung Skjervheim is referring to is very common in the US: 31% of Ford’s deliveries in Sep were a result of this, as I mentioned in the article. You go to the dealer and order a vehicle from Ford via the dealer. Or you can do it online, but you still have to pick a dealer to finalize the sale.

This is governed under state franchise laws, not US law. It’s designed to protect dealers from their own manufacturers. It was the dealers in the early 1900s that organized after their own automakers sold around them and undercut them. Fearing for their livelihood, dealers lobbied their state legislatures to protect them against their own automakers.

But Tesla sells cars directly to consumers after it found a way around those state franchise laws by making deals with each state (I don’t remember what the “exception” was that it invoked). It succeeded in most states. But there are still some states where you cannot buy a Tesla from a local Tesla store. You can buy one out of state and bring it in.

These state franchise laws belong to a different century. But the US Supreme Court has upheld them, and so they’ll be with us for a while.

Tesla got around the dealer franchise laws by not selling the car through their store fronts. They have “product presenters” that cannot take an order nor deliver a car.

Other manufacturers have done this by putting in “for display only” stores when they introduce a new model/product line. They were technically not a dealership because they didn’t solicit orders – just static displays.

Some states amended their laws to close that loophole.

Benefits one at the expense of others.

Imagine if all brick & mortar bookstores had lobbied legislators against direct/online selling of books.

Or all clothing stores lobbied against direct/online sale of clothes.

Or any other countless types of merchants/products?

Would be a different world.

Nice to have a strong special interest group on one’s side.

Tesla will also be selling on Native American reservations, using the same federal loophole to bypass state laws that casinos use.

Many automobile dealers are state legislators….. or related to them.

Yes, they’re politically very active and well organized. But the industry has been consolidating for decades, with huge dealers buying out more and more stores. These companies are worth billions and are playing ball at an entirely different level. Are we going to end up 12 dealers in all of the US? That’s not what the franchise laws envisioned.

Does anybody REALLY believe Elon’s numbers? I’m amazed how so many believe he is special and isn’t subjected to supply chain problems like ALL the major manufacturers that have networked (six sigma) for many decades. Many Elon just comes from a different breed (like Zuckerberg…)

Interesting, I think in Europe it is quite common that the automakers own their distribution channels or in other ways controll them. In other words, the dealer is part of the automakers organisation.

Truth to be told that’s not just a result of different supply channels, but also a result of different marketing practices. In Europe even mass-market cars come with

-2-3 different chassis (sedan, estate, hatchback, cabriolet),

-4-6 different trim levels (cheapo, budget extras, company car trim, well-off trim, “sport-event sponsorship” limited edition, “every boxes ticked” trim),

-and sometimes 8-10 engine options (small-capacity petrol, small-cc petrol with turbo, mid-cc petrol, sporty engine, small diesel, large diesel, hybrid, etc).

At some point I think the VW Golf had like 4-500 different trim/engine variants (options excluded), so it’s unlikely they could show you your exact dream car at the dealership, usually only the most sought-after combinations are kept on stock.

When I toured the Mercedes factory in Sindelfingen they had a delivery center for customers — it’s quite common to order exactly what spec you want then pick up your car at the factory. US buyers can also take delivery in Europe, do a road trip around the continent then they’ll arrange shipping it home for you.

Tesla is the only automaker in the entire with 5 figure sales volume and still growing. Well growing rapidly in fact while everyone else is plunging.

Tesla is perhaps the future Apple of automobile and it’s valuation is well justified.

Tesla ain’t s**t until it makes it into a country song…

It already has. Fancy Like being that song.

Thanks, Minutes…

Missed that one…

Kunal you’ve got this totally wrong. Tesla reports global, quarterly sales.

The others are reporting US-specific, monthly sales.

Big Difference!

Tesla is still tiny in terms of market share.

But a big question here will be which automakers can revamp their product designs and supply chains to get production & sales back up soonest. Those will gain a lot of market share.

Tesla seems like Apple in the early days of iPhone. Nokia and RIMM had 90+% marketshare in smartphones and still had no chance. The writing was on the wall. Market share means nothing if you have a losing game.

I myself was a Tesla critic but not anymore.

Tesla doesn’t have anything special that other manufacturers can’t create. Sure they are ahead on autonomous driving but that gap is being closed just as battery tech has. Apple and Android are the main phone players because of the apps available on each respective platform, this is why Microsoft’s phone couldn’t take off and also why EU sued Google for $5billion and won.

I don’t understand you Tesla stock fans…. I really love Tesla and am grateful for what they’ve done … but to think that the Germans can’t engineer anything and that Tesla will have so much more of the market is just absurd. They will have their share … but it’s not going to be 90% of the car market which would be necessary for their stock price to even start to make any sense.

I never said they need 90% market share to succeed. Apple has 15% market share of smartphones for a decade and not budging. Not sure why you are so stuck on market share.

And note that Smart cars are 10x bigger market than smart phones.

Apple manages to pull massive gross margins on their phones. I just don’t see those margins existing in the auto industry. The two aren’t the same.

The new Mercedes EQS electric is quite impressive.

Agreed. I was leaving specifics alone but both the Taycan and the new Mercedes EV’s like the EQS look absolutely beautiful! I know that unless Tesla made something that the others could not offer in any way I would much rather buy a Mercedes or Porsche than a Tesla knowing they have an established company behind it for service etc.

I mean these are their first offerings and they look fantastic. The interiors blow the Tesla out of the water! Tesla does have very cool details and new ways of doing things but they are not going to crush all the other carmakers so they are the only ones selling cars! This idea that Tesla has no competition is absurd! …. and yeah, for their stock price to even start making sense they would need basically the whole market since they are valued more than all the rest combined … and then it still would be too much!!

On net Tesla has earned negative returns on invested capital even with all the subsidies. I don’t like companies like that. Early investors have made out. I suspect retail stockholders will get the tech bubble Cisco treatment.

Capital investments in car technology needs a decade (or more) to earn a return. If you start with zero (like Tesla) than you you wont make a return for a decade and a half. How long do you think it would take GM between the decision to make a new gas engine and profits? The design of an engine or transmission often takes close to a decade

We will see. I just feel like have seen this movie too many times before.

One of the most ridiculous posts I have ever read anywhere, on any subject.

If Tesla had a 100% market share, absent price gouging from a monopoly which would not last anyway, it’s market capitalization would be less than it is now if it was actually valued sanely. The market cap attributed to the US auto industry (foreign and domestic brands) was a lot less before Tesla existed and there has been no volume growth since. All revenue growth is entirely attributable to artificially cheap money and lax credit standards which enables many (and maybe most) buyers to buy vehicles they cannot actually afford in a non-distorted economy.

The only explanation for Tesla’s stock price is the greatest asset, credit and debt mania, ever.

Electric car can get more money out of the car travel budget because there is less spending on fuel & third party maintenance. At least that is an assumption. There is also the fact that they are competing with companies who are not as good in making cheap batteries so their profit margins should be higher than normal in the car industry

Tesla is still ludicrous overvalued though. But that is true of most American stocks

TSLA current market cap is greater than F, GM, BMW, Daimler, Volkswagen , Toyota and Honda

COMBINED

Bad for who? Bad for automakers? Or bad for the planet?

Interesting that Hyundai reported only a 2% sales decline for September. Sales were actually up 4% for the third quarter.

Kia is knocking it out of the park. Slight decline in September sales but stronger overall sales YTD. The Kia Telluride is still flying off the lots with over 70,000 Telluride SUV’s sold so far this year. That’s a 52% year-over-year increase.

Chip shortages are obviously not hitting Korea as hard as America. Intel should have been building fabrication capacity instead of ginning up its executive compensation and stock through accounting gimmicks and share buybacks.

Chip shortages don’t appear to be hitting China’s automakers as hard either. Many of the chips are made in Asia. Tesla, perhaps because of its factory in China, had fewer problems procuring chips for its factory there, it seems, and that might have helped out with its US factory.

So is the “chip shortage” really a quiet “trade war”, with various chip producers selectively supplying favored customers, and “boycotting” others?

Wisdom Seeker,

We’ve already seen how Toyota managed to lock in its chip suppliers and not run out until late summer. Now it too ran out. We don’t know what deals other automakers made.

Why is Tesla not getting felled by the chip shortage? It (Musk himself) sure is courting China a lot. Did Tesla get preferential treatment? Or did Tesla pay more for more advanced chips to do things like door locks that a 1990s chip does in a GM?

Why are we not hearing more complaints by automakers about preferential treatment?

This is just one big pile of mysteries.

While there is a real shortage just like with every other product, it is also part of a trade war that began when the US banned TSMC from selling chips to Huawei. Since China imports about $300B annually in semis, many Chinese firms in every industry started hoarding chips, lest they too get put on the entity list.

At the request of the auto manufacturers, the White House just put out a request to the major semiconductor companies wanting to know a bunch of trade secrets, including vendor and customer orders. They want to see who has been hoarding. Predictably, the Koreans and Taiwanese are both balking, afraid that the information will leak to their competitors.

I’m guessing that Kia/Hyundai benefit from being best buds with Samsung and SK Hynix.

But don’t worry, Uncle Sam will be giving Intel, Samsung, and TSMC a bunch of taxpayer goodies to build chips in the US. EU as well.

Probably that and the fact they’re priced a lot better. Or where. I thought about one in the future. Love Toyota, but they’re so overpriced it’s not practical anymore.

This ought to teach the car makers that there are limits to the Just-In-Time supply chain model (Toyota had already learned this a few years ago in Japan after the tsunami and made some adjustments which helped it fare better than the other carmakers but it too eventually ran out of components).

One interesting observation is that vehicle transaction prices are up almost identically to what house price rises have risen (about 20%).

Strange times these are.

Toyota has recently announced a further retreat from Just In Time inventory management. Was in Automotive News this week.

Part of just in time might have come about when it cost company 18% pear year to finance inventory. At 3% finance cost having inventory isn’t such a big deal.

Just in time aids the production lines as the parts are put directly into baskets assigned to VIN’s – which follow the car down the line. If they were to warehouse all these parts on site, and then load the baskets, the floor space required would skyrocket. The way it is, they’re packed as the parts arrive.

At least where I once worked…..

Will be interesting to see if there’s any drop in demand now that extended government benefits have ended, and other stimuli are withdrawn.

Also, other factors will affect the demand side. For example, given reports about HSBC’s involvement with Chinese real estate developers, we will need to see if it will have issues. I do not know enough about the counter parties to HSBC to know if it could be a Lehman moment for the US, if HSBC gets stiffed by the Chinese real estate developers.

I am certain that the banksters are doing their best to keep the public in the dark as to their liabilities and shenanigans.

One more thing, if it is true that other, Chinese, real estate developers and financiers are trying to prevent the vicious circle of price collapses, not the CCP, by buying Evergrande and now Fantasia Holdings inventory, it will be like drowning men trying to each rescue the other. LOL

As to the uneven chip shortage, could the CCP have confiscated chip stocks within China for their manufacturing only?

It’s also interesting as not one major car manufacturer cares about market share anymore.

That used to be a The Prize.

Eventually, making less and less cars/trucks, even at higher prices, will destroy you.

We all can’t be Ferrari.

The observation that market share is not top priority may extend beyond car manufacturers. There may have been or is a shift to prioritize margins and profit. As long as all manufacturers stick to this “new” policy none of them gets hurt. Earnings may decline, but profitability is up.

The consumers on the other hand get less choice and less goods. If this shift of focus away from market share is real and persist we will see. It may be persistent if the underlying cause is shortage of cheap energy and cheap natural resources.

That’s probably a consequence of growing wealth inequality. When the top 1% has nearly all of the wealth, targeting them makes sense, whether you’re selling cars, igadgets, or whatever else.

This was the “Plutonomy” argument made by one of the consulting firms about 8 years ago or so.

“It’s also interesting as not one major car manufacturer cares about market share anymore.”

Baloney.

1/2 a bunch,

Total market share, you are correct…

Select market share AKA high profit, they do care about …

Otherwise, why even be in business…

The logic used to be.

Young person buys Camery (low profit).

Has a great experience and product life cycle.

Young with family buys a Sienna mini van (decent profit).

Has a great experience and product life cycle.

Older buys a Lexus (high profit).

Used to be called Total Brand Marketing and capturing a customer for life.

Some companies still do it.

Absolutely correct, 2b,

A vehicle that fits every life cycle…

And brand loyalties within families…

“ Don’t you buy no ugly truck!”

If China could just “decide” to take Taiwan, they would have done that 40 years ago.

It will be a brutal and painful fight and one China would probably lose considering they would never have air superiority and have to invade and island over 60 miles of rough ocean.

The war would last much longer than you think, would destroy the export of economy of China for at least a decade and they would probably lose anyways.

According to an expert on China I recently watched on Keiser Report, China is on par militarily with the US now. It has a larger navy,a larger army .It produces state of the art carriers at 1/8th cost that we do..I have heard our new line of carriers can’t launch aircraft due to a flawed engineering design..as well as the new line of jets that had to be scraped..our military industrial complex has been more interested in stock buy backs than investing in technology for years now

Taiwan is an island. With an excellent and modern air force. With subs. With anti ship missiles. With an army that has prepared for an invasion for 50 years.

The size of China’s army doesn’t matter.

The size of China’s navy’s doesn’t matter.

What does matter is that if China can control the air and sea lanes for an amphibious and aerial assault with near complete air/sea superiority.

China fails at both.

Next you have put men/material on shore and sustain them in a hard fight.

China fails again.

All while every Chinese port is closed and the world reacts by restricting future trade with China.

Every computer simulation of a Chinese invasion of Taiwan being thwarted by the US has ended with the Americans losing.

More people are buying e bikes stupid manufacturers need to make small commuter cars these stupid suv and gigantic trucks are a resource killer but profits are great

There is no market for small commuter cars.

No one would buy them.

No one is buying relatively cheap reliable small cars now. No one is going to buy an even smaller commuter car.

Ford just ended all sedan production except the Mustang.

“There is no market for small commuter cars. No one would buy them. No one is buying relatively cheap reliable small cars now. No one is going to buy an even smaller commuter car.”

Baloney, they are everywhere. Fiat, Mini, Honda Fit, weird ass smart cars, BMW i3.

Are you trapped in a bunker umbilically connected to all the bullshit on the internet, being forced to type whatever comes to your mind or no more pudding?

You do realize that WolfStreet is constantly publishing charts on the plunging/shrinking market share of sedan passenger cars as consumer demand has a vast preference for trucks and SUVs?

That major car manufacturers have either stopped making sedans or vastly cut back on models and production in favor of SUV/truck production?

Too Bananas, I realize that there are small cars all over the place. They didn’t just vanish. Also, I said that most of what is called an SUV fits my definition of a small car. They are small cars with high roofs and square backs. You can call them trucks but it doesn’t make them bigger or trucks.

otishertz,

“Baloney, they are everywhere. Fiat, Mini, Honda Fit, weird ass smart cars, BMW i3.”

Good lordy. FYI:

– Fiat sales in Q3: 401

– Mini sales in Q3: 6,445

– Honda Fit sales in Sep: 2 (two) — model was killed

– Smart sales in August: 1,197

– BMW i3 in Q3: 426

Total industry sold about 1 million vehicles in Sep and over 3 million vehicles in Q3, and not even a rounding error of 8,500 of them are these small cars you listed.

You see, there is REALLY NO DEMAND for these small cars in the US.

So maybe you can check the data first and then check your rhetoric (“Are you trapped in a bunker umbilically connected to all the bullshit on the internet, being forced to type whatever comes to your mind or no more pudding?”)

“ Are you trapped in a bunker umbilically connected to all the bullshit on the internet, being forced to type whatever comes to your mind or no more pudding?“

Otis,

I think you got confused…

That would be me…

And it’s not pudding, it’s bourbon…

otis:

Maybe 2b is talking of U.S. sales and, in that instance, he is correct.

Most of those little sh*tboxes were built for CAFE compliance, not market demand. Ditto hybrids, hydrogen, and EV’s. Companies like Chrysler were buying energy credits from the likes of Tesla (which, I might add was much of Tesla’s profit in prior years) to keep their ability to sell vehicles in states such as CA (which has their own emissions regimen along with 8 or 9 eastern seaboard states that adopted CA standards) and comply with the U.S. at worse, and to avoid massive fines at best. Or both.

The president of the company I worked for once sarcastically said that he wished customers would not buy our “EV” product because the losses were >$40K per unit (and that’s back a few years) on a unit that retailed for $40K before factory incentives. The volume was never sufficient to even recover the R&D costs, compliance costs (low volume still require NHTSA and EPA compliance testing), let alone the magnified manufacturing costs associated with a low volume vehicle.

There are buyers, but not enough makers because margins.

Ron is right, auto makers have ceded a lot of future customers to ebikes.

“ There is no market for small commuter cars.

No one would buy them.”

A lot of people I see couldn’t fit in them…

“A lot of people I see couldn’t fit in them…”

True, you won’t see many tiny cars in Walmart parking lots.

They do not have enough chips to make a small car. The margins are too thin. I found some 2021 Camaros on a dealer website for sale, about $46,000. A few $60,000 SUV’s too.

My 2015 Chevy Sonic is supposed to get 40 mpg on the highway.

That may have been true years ago, but it’s not today. Many of the SUVs of today get 35 mpg or better, as they’re not true SUVs, but crossover cars.

Crossovers are their own market segment. They’re defined as “car based” vehicles. Highlander, CR-V, etc., all fall into that category.

SUV’s (4Runner, Pilot, Lexus RX, MB C/E class, X5, X7, Suburban, Escalade, etc.,) are also segmented (base, luxury, mid size and large)

I think they also now have CUV’s (compact utility vehicles) for the tiny ones like HR-V, Lexus NX, etc.,

A lot more slicing and dicing goes on that most people think.

Agreed, I’m just saying that when the media reports that 90% of cars sold today are trucks or SUVs, much of that 90% is composed of crossovers, not true SUVs.

The crossovers fall into the “light truck” segment…. so, it’s technically accurate.

Even the Japanese are getting out of the small car game in the US. Honda for example, starting in 2021, has stopped selling the Fit in the USA, a car beloved by its owners, considered best in its class and always well-reviewed. Honda still sells a ton of them (as the Honda Jazz) in markets outside the US.

Most cars are small. When I pull up next to them at a stop in my 69 impala and line up the front bumpers, my drivers seat is usually aligned somewhere between their back seat and the trunk. This includes the ubiquitous near identical shoe shaped plastic media-mobiles comically called SUVs and trucks.

“ When I pull up next to them at a stop in my 69 impala….”

My man !!!

Can you still push the little button and make the front jump up and down…

I love those cars… especially the SS…

Hate to break it to you, but your 69 Impala is less safe in a collision than many smaller cars. Particularly an offset collision. Your Chevy has zero crush zones and, IIRC, the hood is narrower than the windshield…. (and doesn’t “fold” on impact).

There’s videos on the interwebz produced by IIHS that demonstrates that for you. It’s rather old, but puts a 59 BelAir up against a 2009 Impala in a head-on. Guess which one loses?

Not a 69, but the 69’s “safety features” weren’t much better.

El Katz, I’ve seen those videos and you are correct. It would not fare as well as a Prius or Sol or Leaf or RAV4 (small cars seen everywhere!) in a heads on and I would be in bad shape.

Still, so worth it. I’ve driven unsafe cars my whole life. Not dead yet.

Those small SUVs are still small cars, not trucks

One can put a feather in his cap and call it macaroni but no one can turn a feather into a macaroni by calling it a macaroni.

Honda’s are very common here in Thailand. My wife and her daughter bought a Honda BRV (“subcompact crossover SUV”). It seems kind of minimalist, compared to bells and whistles on many late model cars. That’s okay with me. The main thing I care about is air-conditioning, which is adequate on the BRV.

Small cars are a scary place to be as long as the rest of the vehicles on the road are giant trucks driven by inattentive drivers.

In years past, I owned a Mazda Miata. Sitting there staring at the lug nuts of the giant truck next to you was not a comfortable place, especially as I wasn’t sure that truck would NOTICE if it ran over my little convertible.

Downsize the rest of the vehicles on the road to match and I’ll happily drive a small car. Until then…

I didn’t buy it for this reason, but using a 50cc scooter will probably extend the life of my 2004 car past my goal of 2024 by a few years. With automobile inflation that might be a big deal as I usually try to buy high quality used vehicle about 10 years old.

I will do a fuel mileage check sometime but pretty sure it’s around125 mpg.

Perhaps the rush to electrify every automobile mighty be part of the problem(or a future one already imposing itself on manufacturers). I suspect that EVs are even more chip dependent than gasoline- or diesel-powered vehicles.

Just another wrench in the gear works.

That only models that are seeing massive growth rates are EVs.

Maybe small car owners and buyers are now just buying EVs. I don’t see truck drivers stepping into EVs. I don’t know many EV drivers but the ones I do know went from sub compacts to Leafs or Hybrids/plug in Hybrids. They are all well educated, environmentally minded, and willing to walk the talk. Perhaps this explains some of the small car sales collapse as opposed to assuming they have simply bought Rams or F150s.

Just remember where John Kerry or Mike Bloomberg lecture you on how disgusting you are to be riding around in something that gets 30 miles per gallon they are flying in something that gets between 1.8 and 4 miles per gallon and they are clicking the miles off 10 times faster than you.

Claims of hypocrisy don’t really work when comparing the behavior of dissimilar individuals against the general aggregate.

There are plenty of more worthwhile criticisms to leverage than a statistically insignificant group’s MPG numbers.

The virus shut down silicon chip testing and packaging plants in Asia.

Hurricane Ida disrupted GOM oil and gas production. Most of that production has been restored. Some offshore facilities are not fully operational after the worse hurricane for GOM offshore oil and gas. The price of gasoline increased.

Biden stopped issuing new oil and gas drilling permits for most Federal lands. Existing permits remained in place.

In just a few short years, all these behemoth American vehicles will be on the scrap heap of history; including SUVs that get 35mpg. That is because the world is fast running out of cheap oil. And anyone that believes we can power our society and transportation system via electricity….well, guess again.

This has been said every year since the 1970s.

One day, it will be correct.

“That is because the world is fast running out of cheap oil…”

The world long ago ran out of cheap oil, the stuff that comes up from 10.000 ft below sea level is not cheap oil. Probably only Saudi Arabia is still pumping really cheap oil from Ghawar but that must be getting rather low.

Well, it’s all in how you define “cheap.”

The cost of oil today is well below the cost of oil 20 years ago when accounting for inflation.

And, as you pointed out, getting oil out of the ground has become much more challenging – that is pretty remarkable.

The US military spends a lot of money and lives to make sure that oil remains cheap.

Saudis won’t publish crude oil reserve data. Ghwar and other Saudi fields are in waterflood to lift oil. Their day is coming, but still a long way off.

@2banana – I think cheap oil means cheap oil for the producers. I am guessing oil sector has more bankruptcies than any other business sector. For some reason investors like to invest in oil companies that pump out oil under cost and eventually go bankrupt. I am one of those dumb investors. I have been invested in at least 10 oil companies that have either lost 80% of their value or went bankrupt.

I even invested in one oil company that investment legend Wilbur Ross was buying big time. Just my luck but it is probably the only company he has bought that went bankrupt. LOL

Thus we get cheap oil because many oil companies sell oil at a loss. LOL

100 went bankrupt in 2020

42 oil producers went bankrupt in 2019

33 oil producers went bankrupt in 2018

…

…

…

I actually said that in 1973 when the price I paid for gas went up 20% overnight !

10 cents to 12 cents per gallon is 20% , right?

I…was…pissed…

Was that 10.9 to 12.9? 😁

Every time there is a runup in oil prices we start hearing about “Peak Oil”. Every time speculators move out of oil and into something else the “Peak Oil” story goes quiet again.

Peak oil was supposed to be 30 years ago. It never happened. Likely, it was just “surreptitious marketing” aka propaganda, by oil companies who would like to keep prices high and for you to believe their product is oh so precious and running out. It isn’t.

Peak oil happened some years ago, production is now dependent upon tar-sands, fracking and other such nonsense.

@2banana – price is just a function of demand and tells you nothing about the cost of oil

Correct. It is “cost” to get the oil out of the ground, that really matters. ( EROEI ) . Even with greater efficiencies, esp with shale costs continue to increase. All one has to do is look at capital spending budgets of all the majors + MLP’s that support and transfer the stuff. Reducing dollars on spending and moving those dollars to paying down debt and some share buyback. Also look at selected estimates of “costs” for various producers and governments. Best average number is now in 70’s. So even a SA with low cost ghawar, but with subsidies to population for food, fuel, etc., has high cost. The golden age of cheap oil is past.

The earth will NEVER run out of oil – it is making new oil every day.

“Earth making more oil…”

It may be, but it is certainly possible possible to use something faster than it is created, and we probably are doing that.

I liken it to cows on an acre or two of good ground. One cow will have unlimited grass to munch. A hundred will kill the grass and starve pretty quickly.

How much oil is being made every day, and how much are we using?

“How much oil is being made every day, and how much are we using?”

We know how much we’re using, we just don’t know the rate at which the earth is producing it. That’s something, in my opinion, that is impossible to know. We can certainly reach a point where it becomes too expensive to extract it.

only in the sense that ancient organic deposits are being slowly (millions of years) converted to hydrocarbons. So for our purposes oil is not being produced, merely used up.

Yeah, yeah, the Club of Rome said that back in 1968 and it was nonsense then and its nonsense now. Oil is abiotic. Many supposedly nearly drained pools are being refilled from the interior of the planet.

Anyways….Back to Ford. Saw another Mustang yesterday. Sorry Ford that is some kind of 4door SUV thing.

Also recently saw an ad for the Maverick and that’s some kind of low end “DIY friendly” pick up truck looking thing.

Wowza….What would the Deuce say to all this?

Island Teal,

What you saw wasn’t a proper Mustang but the new “Mustang Mach-E,” which is a completely different vehicle than the Mustang. It’s an SUV, and it’s a battery electric vehicle.

I suspect that Ford added the “Mustang” name because of its name recognition. This might have been a successful marketing strategy, but it’s a little confusing.

I think the names “Maverick” and “Mercur” are available.

The new Ford Maverick will be shipping soon. Its a small truck.

Jim Mitchell,

“Maverick” has already been given out. It’s the name of Ford’s new baby pickup.

https://wolfstreet.com/2021/06/08/will-americans-who-spurn-cheaper-new-cars-buy-a-lower-priced-baby-truck-i-dont-know-either/

Still waiting for “Merkur” (with a k because it was a Ford of Germany thingy).

Go long on the name “Edsel”.

“…it’s a little confusing…”

I think it’s a kind of blasphemy and just goes to show that marketers are some of the most despicable species on the face of the earth.

Cars and trucks aren’t the only way to get around. ATV (all terrain vehicles) tourism is real big in my area and they are allowed on many local roads. I’m in favor of this, because if they are on roads they are not driving across my hayfields.

The side-by-side ATVs are very popular although maybe a bit chilly in the winter. They are certainly cheaper than cars and trucks and much better than walking.

My Amish neighbors are still using horse and buggy; maybe they are onto something.

They also have zero emission controls.

And some of the most popular are two stroke engines.

Ford stock is up 65% ytd. Wow, can you imagine how high the stock will be if they shipped no vehicles. This is magic. Better hurry and get in the market. Next Bull market train is fixing to leave the station. The trains destination has to be 100k or 10k. There is no in-between. Place your bets. One way or another we are going to go Boom!

No need for China to reincorporate Taiwan. They have many other ways to get what they want. My nephew works for a giant German electrical and technology firm that recently purchased the worlds largest electronics logistics firm. This new acquisition is the middleman between much of the worlds users and suppliers of chips and electronics of all kinds. My nephew was just transferred to this logistics operation. He said that it is a widely accepted truth there that the biggest cause of the chip shortage is that China has strong-armed Taiwan in to giving them first crack at all of the semiconductors they want. Taiwan may be our diplomatic pal, but they are totally dependent on China for much of their supply chain fro rare earths, to steel to chemicals. Plus the huge Taiwanese owned firms located on the mainland (Foxcon anyone) give them another pressure point. So the semiconductor shortage will be over when China decides it will.

I saw James Bond get his a$$ kicked in China…

I knew right then and there these people were going to be nothing but trouble…

Perhaps governments are paying folks to not-grow semiconductors in order to raise semiconductor prices. Well intentioned governments do that sort of thing. ;-)

Oil and Nat Gas have taken off the past few weeks and we have are in the shoulder season. Wow.

I am guessing Oil still has a way to run. Nat Gas is at 6ish and if we start having a cold winter early….maybe hit $8 or higher?

I am hoping for $200 crude and $7 per gallon gasoline. Something needs to kick the legs out from under this speculative orgy economy we’ve got going.

It will be interesting. Nat Gas at 6 will probably mean a lot of people will see at least 25% or higher heating bills this winter if they heat the house with nat gas.

Peak oil happened some years ago, production is now dependent upon tar-sands, fracking and other such nonsense.

@2banana – price is just a function of demand and tells you nothing about the cost of oil

“Peak Oil” is crackpipe stuff. Kind of like MMT, and all the other clown show garbage.

wow (if serious).

I love that manufacturers are getting slaughtered. Serves ’em right. Done in by rapacious greed.

The automakers aren’t getting “slaughtered” nearly as bad as the line workers, parts suppliers, and peripheral businesses that suffer under the loss of volume.

The margins on the higher end stuff may make up the bulk of lost revenue due to no need for expensive incentives (many of which are invisible to the customer because they’re paid to captive finance companies and direct-to-dealer).

Automobile factories run on an production “balance” in order to remain profitable. If the model mix shifts too much in the cheap car direction, the plant becomes unprofitable.

It’s not always about greed. Often, it’s about survival of the entire supply chain. Once a company that casts aluminum control arms goes BK and shuts down their smelter, there’s no one running to the rescue. The cost to fire one of those up again is enormous (the one’s I’ve seen were electric furnaces).

Sometimes, it’s better to wait out a market to purchase if the model you want is unavailable. It’s better than the manufacturer going out of business and replacement parts and service going away.

IMHO,

The Chip Supply Chain will catch up in about 6 Months or so.

CHN will throw their Hat into the Ring; and change the Global (Auto/Computer/Consumer) Chip Market Landscape in about 24-36 Months.

As for TSLA – tracking Registrations may be prudent…

Wolf,

Thanks for reporting all-too-rare volume stats.

In many, many sectors price movements (almost always upward) are trumpeted over and over again by mainline media sources as evidence that “everything is humming along in a healthy economy”.

But price data divorced from transactional volume data is very commonly worthless, if not affirmatively misleading.

For everything on offer for sale, from autos to equities, there is *always* a wide array of buyers, displaying a wide array of ability/willingness to pay.

That is exactly why demand lines in economics have a slope.

So even if half of demand gets annihilated through economic catastrophe, there will still be half of demand existing…and most likely the half with the greater ability to pay.

Over time, demand collapse will likely lead to price declines (to keep volume levels of fixed production investments operating) but in the near term, all sorts of weird price distortions can result from demand collapse.

That is a major reason why Shiller Home Price indices use “matched-pairs” transactions…to make sure that changing “sales mixes” between low and high end buyers, do not distort median sales prices.

Along these lined, *used* car sales prices have been soaring…but do we have *volume* data for used car sales? Or “matched-sales” data a la Shiller? (I’m almost 95% certain the second doesn’t exist…although in the computerized title and registration era, it could.

Cas127,

In terms of figuring out where demand actually is, I’m overwhelmed by this data. I have never seen anything like this before in the auto business: a plunge in volume and a surge in prices, as inventories collapse.

I have no idea where actual demand is. If all dealer lots were suddenly amply stocked, what would sales be at those high prices? How far would prices have to come down to bring sales back to prior levels? Or will demand turn out to be very high, even at those high prices once inventories are back to normal levels?

I’m astounded every day by how fundamentally screwed up this economy is.

That’s the best thing about our system today, everything is so interconnected in some way. It is no longer even a multi-variable problem, you’d have to look for huge second and third order effects where before, those effects barely move the needle.

All this so the people at the Fed could make a few extra bucks trading.

I don’t know which is worse. House flippers wanting my house, or car dealers wanting one of my vehicles!

LOL! It’s almost like one has to keep the lights off, lock the place up, not drive, and get your food delivered these days.

LOL, it’s almost like they want me sleeping on the street, watching my car drive by!

I think this data shows that prices have outrun demand. The whole auto industry is set for a world of hurt. History does repeat itself. Inventories are low but there are still cars and trade in value has never been higher. Rental car companies have realized they can wait a lot longer than 20k miles to unload.

Only in economics 101 do demand curves have a slope by definition. In economics 303 you learn that they can be flat or even have a negative slope.

The vast majority of the time, demand curves correlate to price changes. That is why the general rule is taught in 101 and the rarer exception taught in 303 (actually, both are taught in 101…but that might be too subtle a point for the academically smug).

What do you MEAN, “that’s how BAD it is”? (lol)

Ford makes perfectly lovely cars,

there were decades of my life when it was all

I could afford. I know it doesn’t compare to a

Bentley, but STILL….at least I had a car in high

school and college.

Dutch Chappy,

Read the article and you might find out what I mean :-]

Been reading through chipmaker’s reactions to the situation, but the whole story stinks. Car manufacturers are mostly missing low-value chips, like 8/16/32-bit microcontollers that control elements like ABS, ESP, airbags, etc. Some of these can still be 1990s designs – imagine the benefits of using the same chip in your components for 30 years (2-3 or even up to 4 model generations) straight – you get a lot of experience with that part and you can push supply costs to rock bottom levels without having to redesign your PCBs too often.

However every semiconductor industry spokesperson seems to be treating the current circumstances as if the automotive industry would have a burning desire to switch from cheap and simple microcontrollers to expensive high-end processors built on the latest nodes…well, I don’t know about that. I’m not questioning whether the shortage is real or not (it most certainly is), but maybe the manufacturers who do nothing about it and invest 0 money into reserving supply capacity on the chip lobby’s recommendation may come out at top in the end.

Car companies cancelled chip orders. Then realized that was a mistake. Well back of the line you go.

The chip manufacturers have a substrate shortage. They can only make so many wafers no matter how old the design. The priority for the limited substrate won’t be to make 1% profit margin ancient microcontroller for cars.

They won’t be 1% profit margin for long. Time to invest into old fabs?

What frosts my cookies is that there used to be a big wafer fab plant in Salem Oregon that in its later years was owned by Mitsubishi. They shut it down in 2009 because they said it could not make the big wafers needed for the latest CPU type chips. It could only make wafers for the less profitable chips used in the automotive and appliance industries. We are sure smart

Even if that plant were still open, where would it get the raw materials needed to actually make the chips? The CEO of Intel has said that is the entire problem. Every building on Earth could be a chip factory and it wouldn’t solve this problem. Look further up the supply chain.

The plant in Salem made the silicon wafers by growing ultra pure silicon crystals and slicing them in to disks. These “wafers” are the things that are in short supply as the substrate used in all the chip plants ( fabs). The only feedstock they needed was water, power and polyslicon which is produced from special sand several places in the US. It is the shortage of factories to make these wafers that is one of the biggest problems.

True, my comment was refering to statements made by industry personnel such as Intel CEO, who said:

“I’ll make them as many Intel 16 [nanometer] chips as they want,”(…) “Rather than spending billions on new ‘old’ fabs, let’s spend millions to help migrate designs to modern ones”.

Which is a push in the direction that clearly has nothing to do with the root cause of the problem highlighted by you, it’s rather a cunning sales strategy of luring desparate carmakers into expensive products they do not need.

It’s clever if it would be priced appropriately. Intel has a load of 14nm capacity now that they are moving on to 10nm and 7nm and they might as well keep using these older and paid for tools. But….

Intel’s problem is hubris. They’ve never been a contract fab until now because they were arrogant. They famously turned down the chance to fabricate the CPU for the original iPhone. Their whole relationship with Apple is just about over now. They also have a long history of shady business practices against their x86 competitor AMD. Their 64 bit architecture Itanium was a collosal failure from their arrogance and AMD quite literally saved Intel’s own x86 architecture by developing x86-64. If I wanted a business partner to get my chips from, Intel would not be the first place I look. Intel also used to have the lead in technology by about 2 years. Somehow they let TSMC close that gap and pass them. Now TSMC is at least a year ahead. Samsung hasn’t given up on fabrication either and they make all of Nvidia’s latest chips.

Car companies should have either vertically integrated production of their old chips they wanted to hang on to, or keep moving their chips to the newer fabs. Now they are in no man’s land and up Schitt’s Creek so to say.

Isn’t interesting that chip manufactures have record sales yet people say then cannot get ahold of any.

I think part of the problem is chip manufacturer are preferring to make high end, high profit chips for things like crypto mining…etc. Even though car companies are having a hard time getting chips I can go down to the local MicroCenter and they have plenty of computers, graphic cards, and other items in stock.

Prof E

I too find this chip shortage little strange. Someone whom I sold my business to needed to buy a simple part, (a very basic FET driver chip) not nearly even at 8 bit microcontroller complexity. Got quoted a 44 week delivery time. That puts him in a world of hurt, possibly forcing him to a PCB for one simple part. I’m wondering if maybe there’s a little foot dragging to boost pricing.

Last night I saw something I have not seen in a long time. During the Monday night football game, a commercial break came on that consisted of three local car dealers advertising in succession:

Ford dealer: “The trucks are coming! Stop in and we will get you one!”

Chevy dealer: “Our lots are full! We have the deal for you! We will price-match anyone! (no mention of trucks)”

Hyundai dealer: “We have the cars you want in stock! Come in and make a deal…the best deal around! (mentioned Genesis SUVs in stock)”

I drive by the Ford dealer a few times per week. Their “truck lot”, which typically holds about 300 new trucks and it faces the freeway, had maybe 10 trucks in it last time I went by (last Thursday).

The big Chrysler/Dodge dealer near here had their own commercial spot. The owner and his overweight daughter were pushing RAM trucks, which their seems to be a good supply of.

After a long dry spell (during the pandemic), the auto dealers are now advertising on TV more frequently. This is the north side of Houston, TX where all this is taking place.

Model year-end clearance. They may have pipelines of vehicles on order that are not finished as yet (awaiting chips) that have to be disposed of.

The dealers want to build an order bank to facilitate that.

Dealer’s provide the manufacturer with a cash draft authorization against a line of credit. Once the order is placed (and is difficult to cancel unless the dealership becomes insolvent or the bank yanks the floorplan), the dealer is at the mercy of the manufacturer. The trucks ordered in May looked like a good idea, but not so much in October when the 2022’s are on the horizon. The manufacturers will play hardball to stop any attempt to Cx any wholesale order.

Plus, if you read the mouse print in the ads, you’ll find that they’re often showing a full sized truck but featuring a less desirable model in the ad. A local GMC dealer here in PHX shows a Suburban and a Tahoe behind him in his ad produced on the showroom floor, but the pricing and rebate $ are for a Terrain.

Wolf, I’m not at all surprised by your new vehicle sales graph–it’s just what I was expecting.

IMO your recent “Wealth effect monitor” post explains it perfectly. To oversimplify your conclusion: there are two classes in the US, a few rich and the rest who are poor.

The first big dip in the graph is of course explained by Covid.

The first blip up was caused by shortages together with purchases by the rich that if they want a vehicle, they buy a vehicle, and don’t care a hoot about price, together with sellers that are smart enough to take advantage of the shortages. That caused everyone (especially Republicans and Larry Summers) to yell “inflation, inflation.”

The big dip afterwords is the rest of the more normal people, who actually do care about price–simply because they can’t afford not to.

I still don’t know where prices will eventually land, but we have to wait awhile until supply returns to “normal.” Inflation? maybe yes, maybe not so much.

Your “Wealth effect monitor” post explained a lot.

Back in the GFC days I started a personal metric of automobile production and sales data.

My niche became seriously saturated. I deleted my research and moved on to lesser means of income.

No data to confirm my “heresay”.

Since 1992 the American car manufacturers has had its manufacturing shoved up its tail pipe.

Market share completely destroyed.

No cars being made by Ford in 2022. Recall when when, Ford, Mercury and Lincoln made the same car with slightly different appeal.

GM had a luxury Cadillac Cavalier called the Cimarron.

But a brilliant idea ensued.

Camry, Corolla

Sentra, Altima and Maxima.

Those names persevere.

Cavalier, Cobalt, Escort, Taurus, Focus, Neon, Cirrus, Spirit, omni and more…long gone. No loyalty, built without a future.

A foreign country took over our auto industry. They just did what we did – better – and never let up. Total respect.

Have we as a nation learned anything?

Have American car manufacturers learned anything new but bankruptcy laws?

Tesla? Market Cap three times Walmart – 20 x Toyota. Rye Toast.

I laugh until my “tighty whiteys” are stained. Fruit of the Loom.

Gary

Why do you insist on calling this a “buyer’s strike”? Its not like an organized movement. Theres no “Buyer’s Union”. It’s just plain everyday folks saying “screw this”.

“Buyers strike” is the technical term for a large number of potential buyers stepping back from the market. They don’t need a union to do this.

I know they don’t need a union but a buyer’s strike as typically used connotes an element of coercion, not as organized as a boycott but more aggressive than people just not buying things that they can’t afford.

Most definitions of buyers strike that I’ve seen place it between a boycott and simply that people can’t or won’t make a purchase.

You don’t need people “stepping back”. A lot of people have nowhere to step back to except a wall.

Wolf,

My comment vanished (not even “pending review”).

It was very non controversial – just highlighted importance of sales volumes as well as sales prices.

Wolf,

Never mind…fell victim to Caps Lock sensitivity of search function…

This should shock nobody. This country is descending into a corrupt 3rd world like country.

Note of marginal relevance…

I just came across this report which indicates that US banks are at an all time *low* in terms of their loan-to-deposit ratio,

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/loan-to-deposit-ratios-at-us-banks-drop-further-reaching-lowest-level-on-record-66365472

In other words, banks have an astronomical amount of idle deposits with which to make new, dumber, more doomed loans, fueling inflation faster.

And, yet, auto demand still collapsed in volume terms.

But those few knucklehead buyers paying an extra 15% yr over yr…had plenty of credit lubrication available (thus the 15%)

I have been receiving several offers from my 2 banks and credit union lately, for great low interest auto loans. You probably are correct!

I don’t know if this came through enough in the post…YTD sales aren’t the horror show that Sept sales were.

So what happened to push Sept off the cliff?

Just wonderin’…didn’t extended unemployment benefits just end where they were still in force?

Ditto national eviction prohibition.

Board members here don’t think like this…but could a *large* number (macroecon sized) of people have literally been using their unpaid rent and goosed unemployment benefits to…buy new cars up through Sept?

If so, sales are going to continue to collapse

Literally insane, but the sales collapse timing and scale both correlate with major Covid relief programs ending.

Cas127,

“So what happened to push Sept off the cliff?”

Nonsense question. Look at my chart: what fell off the cliff was June, July, August, and September. March and April were very strong. But in May, dealers ran out of cars. I post about this every month. And I explain it every month.

Maybe you are right Wolf, it might be that comparing YTD 2021 with YTD *2020* created a misleading impression (since 2020 had its own collapse, the YoY YTD 2021 might not look so bad through Aug).

I’ll have to think about it.

Wolf,

Still mulling it over.

Here are the Last Month and YTD stats I’m seeing…

My earlier point about 2020 sales collapse possibly skewing my perception of YoY 2021 YTD sales still holds…I’m still thinking things over.

Yes, YOY has turned into a freak show all around since the Pandemic.

Last night, I watched the biggest Toyota broker on Lease Hackr move a not in stock yet 2022 4Runner Pro in a matter of minutes for $10K over MSRP on a cash deal.

He said the Pro model is going $20K over MSRP in CA.

As far as Ford goes, we placed an order for a 2022 Platinum F-150 a few weeks ago, and it’s expected to be built the first week of November with the pre-build info coming in an email Monday, so things have turned around on F-150s.

As previously stated, it’s obvious they are prioritizing the high-profit vehicles, and I don’t blame them.

Tesla is still way out. Looked at Model 3 base. Estimated delivery April 22.

Ahh. But if you order the performance model for $15000 more, you can get it in November.