This mega-liquidity suck has mopped up cash amounting to 10 months of QE.

By Wolf Richter for WOLF STREET.

The Fed announced today after the FOMC meeting that it doubled the per-counterparty limit on overnight reverse repos from $80 billion to $160 billion per counterparty. There have been many indications, including in the minutes of prior meetings, that the Fed would increase the per-counterparty limit.

The Fed is also constantly increasing the number of eligible counterparties for reverse repos. Back at the end of June, it had already approved 74 counterparties. Now there are 128 approved counterparties.

The Fed’s counterparties are always the primary dealers, but with reverse repos, the counterparties also include Government Sponsored Enterprises (such as Fannie Mae) and money market funds.

All the new counterparties are money market funds. And it’s the money market funds that are the biggest users of the Fed’s overnight reverse repo facility.

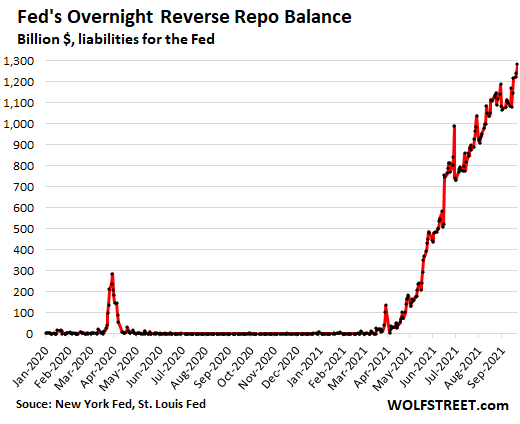

And these overnight reverse repos (RRP) are blowing through the roof. This morning, 77 counterparties handed the Fed a record $1.28 trillion in cash, in exchange for securities. These RRPs unwind the next day when the Fed gets its securities back and the counterparty gets its cash back. And then they engage in another overnight transaction of some other amount.

RRPs are essentially an interest-bearing overnight loan by the counterparties to the Fed – and they’re an indication of the gigantic amount of excess cash in the financial system, thanks to the Fed’s $4.6 trillion in money printing since March 2020:

RRPs have the opposite effect of QE: With QE the Fed creates cash (credits) and buys securities with that cash. With these RRPs, the Fed sells (effectively, lends out) securities and for the term of the RRPs absorbs cash and removes that cash from the financial system.

These RRPs are a way for the Fed to drain massive amounts of cash from the system.

With QE, the securities that the Fed buys are assets on its balance sheet. RRPs are a liability on the Fed’s balance sheet – cash that it owes the counterparties in exchange for the securities that it took.

With RRPs now at $1.28 trillion, the Fed has undone over 10 months of QE (at $120 billion per month), while it is still doing QE with its other hand.

In June, the Fed raised the interest rate that it pays on RRPs from 0.0% to 0.05%. At the time, the yields of short-term Treasury bills were dipping into the negative, as too much cash in the financial system caused a mad scramble to find something to do with it.

By raising the interest on RRPs to 0.05%, the Fed nudged up short-term Treasury yields into the positive. One-month to six-month Treasury yields have been in the range of 0.03% to 0.06% ever since. It was designed to keep these short-term Treasury yields above 0%. Unlike other central banks, the Fed has stated many times that it is going to avoid negative yields.

The New York Fed, which does the overnight RRP trades, discloses the total balance and number of counterparties daily. But it does not disclose which specific counterparty it dealt with that day.

The government discloses the per-counterparty data on a monthly basis for balances at the end of the month. So we know, money market funds are the biggest users.

Big asset managers run several money market funds each that are approved RRP counterparties. For example, Fidelity has 11 money market funds on the list of approved RRP counterparties.

The balances below reflect the totals of all approved money market funds (counterparties) by the five asset manager with the largest RRP balances on August 31. The money market funds of those five financial institutions alone accounted for $632 billion in RRP balances on August 31, or about 53% of total outstanding on that day ($1.19 trillion):

- Fidelity: $267 billion

- Vanguard: $102 billion

- Blackrock: $92 billion

- Morgan Stanley: $86 billion

- Federated: $85 billion

Part of the problem is QE: The Fed is still buying $120 billion in securities a month, after having already bought $4.6 trillion in 18 months, and thereby handing out $120 billion in cash that it created, which then piles on top of the cash that is already clogging up the financial system. RRPs are one way to tamp down on the enormous liquidity distortions that this gigantic amount of QE has unleashed.

The Fed should have stopped QE long ago and should be unwinding its balance sheet by now, and then this problem wouldn’t even exist.

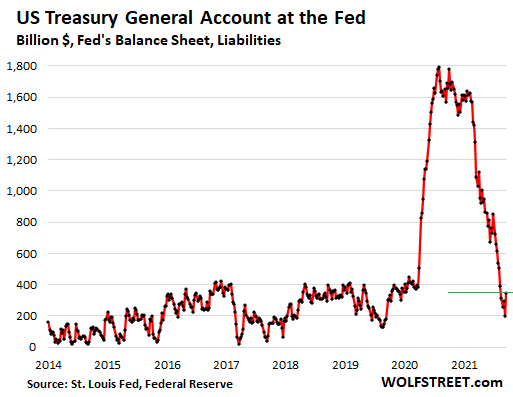

Part of the problem is the drawdown of the Treasury General Account, the government’s checking account at the New York Fed.

Last spring, the federal government issued $3 trillion in new Treasury securities to fund the stimulus and bailout programs, but it didn’t spend it all. The unspent amounts remained in the TGA which peaked at $1.8 trillion in July 2020, when before the pandemic, it had generally run below $400 billion

When the Treasury department decided to draw down the TGA by borrowing less money, the government effectively started spending what turned out to be $1.4 trillion without having to borrow that $1.4 trillion, which effectively threw $1.4 trillion in additional liquidity that had been stuck in the TGA into the economy and market.

After receiving my personal and corporate quarterly tax payments on September 13, along with those tax payments of a few other entities, the TGA jumped by $144 billion, to $345 billion as of September 15. This will be drawn down as my tax payments are getting spent over the next few weeks:

The purpose of the Fed’s RRP facility is to mop up the excess liquidity that the Fed has created. And it is doing that. But it works differently than if the Fed were to shed its QE assets as it had done from late 2017 through most of 2019. RRPs are overnight in-and-out transactions and affect short-term funding markets. With it, the Fed keeps short-term rate above 0%. Unwinding QE, would affect long-term yields across the credit markets, such are mortgages and 10-year yields.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Cool.

So theoretically, $20.4 trillion in RR possible.

They sure are planning for a ton of liquidity to be pushed into the system in the short-to-medium term.

A bit more 3rd grade math:

1) Current facility size is up to $20.4 TRILLION;

2) Was previously 5.9 TRILLION.

3) 1.28 Trillion was 21% of the entire facility previously;

4) Now its “only” 6.2%

5) If the expanded facility returns to the 21% threshold then that will be RR of $4.6 TRILLION

Given the reverse repo trades treasuries for cash – in order to make this work, the Fed will need a lot more treasuries, like trillions and trillions more.

So what you are saying this is a vicious cycle, the Fed needs to buy more treasuries (QE) in order to have paper to exchange for cash, (to avoid neg rates) creating more cash, and the need for more paper. Whats missing here is the difference in duration, (there’s the rub) between what the Fed buys and what they exchange. When RRP ends, then all the paper comes back to the Fed, And if the banks run out of cash (reserves) or investors shift out of MM, then they might need to sway those treasuries for cash, RRP again. The question is what happens when all this liquidity gets speculated, and an event occurs and liquidity does not match collateral. Or economic growth does not match the money supply.

Exactly – at some point the Fed will run out of short term paper. With the debt ceiling rapidly approaching the Fed may have no access to treasurys to lend if negotiations in Congress break down and they fail to come to an agreement to fund the country. The Treasury will have no ability to supply the Fed with the paper it needs.

Haus-Targaryen,

There is not that much excess cash out there. Only excess cash goes into this. The Fed will start to taper QE this year and be finished with it mid-2022. This ends QE. By about that time, or earlier, the reverse repo balance will start to decline. So the RRP balance will likely hit a high at the end of September (bank window dressing) and then it might hit another high at the end of December (bank window dressing), and then it will decline.

In don’t know where those quarter-end highs will be, and they might hit $2 trillion. But they won’t hit $20 trillion because there is not that much cash out there.

To me its just more crazy gimmicks. They are both taking cash out of the system and pumping it back in. What’s next? Worse mistake this country ever made was letting a privately controlled central bank issue money.

“The Central Bank is an institution of the most deadly hostility existing against the principles and form of our Constitution.” ~ Thomas Jefferson

“Paper money is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted.” ~ Thomas Jefferson

“A private central bank issuing the public currency is a greater menace to the liberties of the people than a standing army. We must not let our rulers load us with perpetual debt.” ~ Thomas Jefferson

“Whoever controls the volume of money in any country is absolute master of all industry and commerce.” ~ James A. Garfield

love it

ONLY overnight and then they exchange securities(click click click goes computer) and returns cash NEXT DAY

repeat and rinse forever???

Look for the extended version, like the repos up to 100bn/day in latter 2020 that started as overnights, then longer.

Anyway, this is just the old-fashioned open market operations on steroids, renamed. Pump n dump warp speed.

Wolf,

Good work as usual.

Though I still think that by combining “operational detail” posts (semi involved explicators of reverse repo mechanics) with “big picture” posts (DC is trying to mitigate huge distortions created by massive money printing) you might be causing some readers (and maybe a lot of post propagators) to get lost in the trees, without understanding the significance of the forest.

The meat of the post for a general audience is the macro impact (on interest rates, necessitated by money printing) while the operational mechanics of a reverse repo could simply be referred to in an “evergreen” reference post.

That way the whole weight of attention to the article falls where it should, on the macroeconomic implications for 330 million of us.

Could this be a wise decision to preserve capital, because the US stock market is also over-leveraged (by overuse of margin to buy stocks), trades over-leveraged, Western companies, has prices that no longer bear any relation to the real return on capital, and might also collapse? The US real estate market is also inflated: fewer and fewer buyers can afford to buy at current prices, so demand will decrease. The economic shocks from the Chinese markets collapsing might cause this, because they will NOT stop at our borders as a Wall Streeter just claimed.

I predict that the Chinese real estate market will continue to slowly collapse for months, because too many Chinese will now not want to “purchase”/”invest” in basically undeveloped properties, which the many real estate developers will then allegedly build into many buildings. Deprived of the cash of new “purchasers” to start or finish existing projects, one by one of the developers will run out of funds to operate and need to be bailed out.

The collapse in real estate prices in China as more and more fire sales occur, and even those wanting to purchase real estate hold off for months, will continue. The ordinary, hard-working people of China have come to see that their CCP emperor (grand crook) has no clothes.

I

I do not think that the CCP can bail them all out, even if it wished to do so. Inter-CCP-gang conflicts ensure that it will not bail them out. How do you say “illiquid” and “rapidly depreciated” as to real estate in Mandarin?

The US will continue to print and print until China, and others, demand settlement in Yuan. Then, it’s game over.

Dave,

Yes, the deeply ingrained political (and social) culture of DC does make it seem that DC will never stop printing (to paper over catastrophes, frequently of their own making) until the US dollar is so distrusted (due to systemic debasement) that people, both internationally and domestically, will start to prefer/demand trade in a more trustworthy currency.

This dynamic has happened many times in other countries and there is no magic that makes America exempt.

“Reserve status” is the legacy of prior productive superiority (creating vast demand for US products/currency) that also greatly engrossed the base of real assets legally denominated in dollars.

Once that productive superiority is lost (and the US has been losing it for 25 years) the foundations of “reserve status” erode.

But DC is too degenerate to acknowledge any reality that would compromise their primary mechanism of “peaceful” control – the ability to print “money” unbacked/unsupported by the creation of any real asset.

I agree that the printing of dollars by the banksters’ “Federal” Reserve will ultimately cause a loss in the world reserve status and more importantly, purchasing power of the US dollar. I do not see a mechanism by which China or others can require that existing US treasuries be paid for in yuan, if I understood you guys right?

Is this a way to take cash out of the system, or a way to help cover Treasury for lessening direct Treasury purchases by the public? Killing two birds with one stone?

It’s the way for the Fed members to close their insider-information trades at the top. For ethical reasons.

Money Laundering, one giant shell game.

How does the common person have any interest in these repo transactions?

Just asking as it seems very little comments.

“Just asking as it seems very little comments.”

I just posted the article a little while ago, and it’s in the middle of the night here. Let people get some sleep.

I’ve been interested in RRP since our first repocalypse in Sept 2019, but still don’t understand how these drain cash from the system, since the cash is given back each time. Mr. Wolff, could you please help me understand?

Jimmy,

The total amount outstanding is the amount of cash that the Fed drained. It changes every day.

I borrow $100 from you with a promise to pay you back tomorrow. Then tomorrow, I pay you back and then borrow another $100 from you, and the next day the same thing, forever. In other words, I borrow $100 from you in total, and we roll that debt over every day, until the day when I pay you back and then do not borrow from you again, at which point the debt goes to zero.

So if RRPs go to zero the next day, then all the cash leaves the Fed and goes back out there. But that is not happening. The balance continues to grow for now.

” This morning, 77 counterparties handed the Fed a record $1.28 trillion in cash, in exchange for securities”

Well, then these securities surely go missing on one of the FED’s balance sheets, right ? 1,28 trillion should show up somewhere.

They don’t ? That’s odd.

Vanguard and Blackrock, who incidentally hold some of that chinese property developer’s non-performing debt. That’s some coincidence.

These things happen. Nothing to see here. Move on. We have it all under control. The system works perfectly.

Ignore the iceberg.

Franz Beckenbauer,

“Well, then these securities surely go missing on one of the FED’s balance sheets, right ? 1,28 trillion should show up somewhere. They don’t ? That’s odd.”

Nope, reverse repos are right there. They’re contracts (“reverse repurchase agreements”), and they’re listed under liabilities. You just don’t look. And just because you don’t look doesn’t mean they aren’t there. I get that data straight from the Fed. This is a daily amount, and the Fed releases that amount daily. Every day, you can check here, and it will have the current daily amount:

https://www.newyorkfed.org/markets/data-hub

The amount on Wednesday gets published on its weekly balance sheet that is released on Thursday afternoon. So yes, on Thursday afternoon, when you go check the Fed’s balance sheet, you will find the RRP balance of Wednesday under its liabilities. All you have to do is look, instead of making up this ridiculous nonsense.

https://fred.stlouisfed.org/series/TREAST

That’s one hell of a dip with those 1.2 triilion of treasuries leaving.

Right ?

Franz Beckenbauer,

You don’t get it because you don’t WANT to get it???

Reverse repurchase agreements (RRPs) are contracts, as I said. The contract is to lend out securities overnight in exchange for cash, and then return those securities and get back the cash the next business day. These contracts are carried as contracts on the balance sheet under liabilities.

Just like regular repurchase agreements (“repos”) are contracts that are carried as contracts under assets on the balance sheet.

Neither “reverse repos” nor “repos” are carried as Treasury securities or impact Treasury security balances because they’re not Treasury securities. They’re contracts.

We know from past experience that a co tract doesn’t mean the instrument exists. Not sue then why you are citing a contract. Are you saying the Treasuries don’t move off the books to the counterparty?

With a repo, the asset is the contract; with a reverse repo, the liability is the contract. The collateral (securities) doesn’t move and isn’t impacted until the counterparty defaults.

Go easy on him Wolf. Big corporate accrual, double-entry, on-sheet, off-sheet, on-shore, off-shore accounting and government semi-non-existent accounting never agreed with common sense like cash accounting does.

He thinks if you sell something you no longer have it – common sense. You point out that it is just an agreement – pretending to sell something.

Question for you Wolf, if overnight the government defaults on the bond the Fed has contracted in a repro agreement and shows the bond as an asset on it sheet and the repro contract as a liability – who takes the bond loss?

“… if overnight the government defaults on the bond the Fed has contracted in a repro agreement and shows the bond as an asset on it sheet and the repro contract as a liability – who takes the bond loss?”

If overnight the US government actually were to default on its $28 trillion in bonds (won’t happen), the world would have a bigger problem than reverse repos. It would be the lights-out moment for the global financial system.

When the Fed pays for the loan, where does the money come from? If the Fed created the money as base money effectively, and its then deposited back at the Fed for interest, then there can’t be a debtor funding the interest (like a commercial bank acting as intermediary).

For each trillion, if the Fed pays at an annual 0.5% interest, then thats 5000 million being handed out each year to the financial sector and its not withdrawable money, not a reversible transaction.

Is this right? Because thats an extremely large subsidy. Or is this ignorance..

Not necessarily achieved through the repo mechanism, but I do think the vast idle/unloaned balances that the mega banks have been stuffed with via all the flavors of QE, do earn them essentially riskless returns when the Fed tries to mitigate/unwind QE…the riskless return being the “incentive/throttle” that keeps the mega banks from making truly moronic, hopeless loans (with all the QE money) far up the risk curve…which would greatly stoke inflation otherwise.

But…those riskless returns are essentially free money (billions and billions) to the mega-banks (that exits general “use”) and that is why people decried the whole planned QE/throttle system from the start as a stealth recapitalization/giveaway to the mega, TBTF banks.

Bottom line, it is (and has been) a massively f’ed up system that was put in place to avoid a large economic downturn that was needed to purge the rot, corruption, and waste from the macroeconomy (much/most of it created by previous DC “fixes”)

But downturns threaten political careers, so future ruin was guaranteed to delay present pain.

Which is pretty much the entire history of DC since 1945.

Wasn’t the financial crisis caused by a run-on REPOS? What if the counterparties fail to have sufficient collateral? Wasn’t that Morgan Stanley’s problem?

The counter parties’ collateral is cash. If they don’t have cash they don’t get in on (need) the reverse repo.

John Knox,

“repos” are the opposite of reverse repos. We’re talking about reverse repos here, with counterparites trying to get rid of cash, not borrowing cash.

@W

Isn’t it beautiful the way the Fed has been able to obfuscate to everybody that they have simply drained $1.2bn of cash out of the economy to take the demand side heat out of ‘inflation’ until the supply side shock ameliorates when they can put it back in again via Treasury purchases by counterparties.

MSM is still focussed on tapering and timing for rate rises. Brilliant!

Oops trillion-whisky?

Wolf, re: your last paragraph.

Thank you for the explanation of why the Fed gives with one hand and with the other.

What if anything would the banks do with their excess liquidity overnight, if the FED did not offer RRP?

Given that they get their cash back for the next days trading does the RRP achieve anything other than setting a short term rate, which the FED could do anyway?

An Englishman abroad,

This is mostly money market funds that are doing this. Banks get into it at the end of the quarter for window dressing.

The banks get 0.05% on these RRPs, but they get 0.15% when they put cash on deposit at the Fed (IOER = 0.15%). So they make more money parking their excess cash at the Fed as “reserves” than engaging in RRPs.

So do the banks forego the additional 10 bps in interest because they want to maintain liquidity?

How long is the money locked up when they park cash at the fed at IOER rates?

Banks might do so for the last day of the quarter for window dressing, meaning they want to get rid of some cash on their balance sheet for regulatory purposes.

We will see a spike in RRPs at the end of September and at the end of December for that reason. This is only for one day.

Literally no money ever changes hands, right? So this is just a computer program automated to says swap ‘A’ from account X to Y. Tomorrow close the contract and put ‘A’ back into X plus interest. from Y. Almost like pong.

You speculate that this might run up to the $2T mark. That seems like some crazy fancy kind of program. What could go wrong?

Nathan Dumbrowski,

“Literally no money ever changes hands, right?”

No paper dollars change hands. But modern money is debits and credits, just like your bank account and brokerage account and credit card. And on that basis, trillion of dollars change hands.

I don’t get it. I thought the fed is printing money and or buying treasuries in order to fund government spending. So isn’t this money getting used?

They printed way way too much.

It just occurred to me that (a) by sponging up the excess QE now via reverse repos, then (b) the Fed can “end QE” over the next 9 months and (c) still have a trillion or two in their pocket to smooth over any market issues that come up, (d) without having to “restart QE” which would be politically more awkward.

Basically, if there’s a market hiccup during the taper process, the Fed can unwind some of the reverse-repos, which will quietly pump the market, without calling MSM attention to what they’re doing.

This might also help smooth over the current FedGov issue of raising the debt ceiling…

But what if the Fed’s view of the market is incorrect? What if the Fed’s lent-out Treasuries are being re-re-re-hypothecated as collateral for other leveraged schemes? If the Fed recalls those Treasuries in exchange for cash, the net result may not be a net stimulus (from the cash) because a T-Bill shortage could trigger a contraction in the shadow-banking system built on T-bills-as-collateral-for-all-kinds-of-crazy-leveraged-schemes.

I seem to recall something like this being an issue in late 2018 when the market had a serious conniption…

Yes, essentially. Except reverse repos are demand-based. And if liquidity dries up in the market, there will be less demand for RRPs and the balance will shrink. The Fed doesn’t need to do anything. This happened last time when the balance sheet runoff began.

“The Fed should have stopped QE long ago and should be unwinding its balance sheet by now, and then this problem wouldn’t even exist.”

Agree whole heartedly. But why dont they stop QE now? They are talking out both sides of their mouth and seem bent on a flat yield curve.

The Fed’s third mandate is “moderate long term interest rates”…moderate meaning not extreme, up or down. They have hammered long rates to all time lows….immoderate levels..4000 yr lows as Jim Grant says.

The wisdom of this third mandate is to not allow EXACTLY what is happening today…the pulling forward of wealth from future generations to fluff the present, via massive debt creation at unrealistic rates.

It is incumbent on every generation to pay their debts….and this current generation of “financial geniuses” are raping the future…and no one seems to notice or care.

Historicus

‘no one seems to notice or care’

Wonder why there is NO basic finance taught in highschools, any where in the country (also NO social or civil studies including our Constution)?

Inflation is an indirect tax, along with reduce in the purchase power of US $. In the last Press Conf with Fed Chairman, this week, there were 25 ( along with major financial press!) reporters quizzing him.

But NOT a single reporter raised this important question affecting many, especially bottom 90%!? Their moral compass is missing and journalistic integrity. non-existing! What a sad event!

No challege and No outrage!

What we are all looking at is the result of decisions taken decades ago, which effectively created the financial services industry; where, before, your savings, excess finance held at home, were often held in your personal ownership of shares, often in local companies, equally often, under the guidance of your local stock broker. The concept of financial services was designed to break that circle of personal investment; into one where everyone is encouraged to hand their savings to an intermediary, who take their cut out of your savings, as their income from delivering your savings to a savings fund like a Blackrock.

Now the entire system is awash with personal “savings” in turn held by “funds”, which in turn, have set into motion the imbalances that required, first QE, and then when QE also ran out of control, the realisation that the entire financial services industry needs overnight propping up to contain the potential for further instability; which might, in turn, again, wreck major damage on the entire financial system . . . world wide.

Someone has to have the courage to turn the clock back and start again with personal, low level systems that were working, reasonably successfully; probably for centuries before the advent of the first London Stock Market.

History needs to be allowed to turn full circle.

Nice thoughts, but highly unlikely unless the whole current system is absolved

So, we are all boxed into being bailout beneficiary (auto-pay stimulus payments), and bagholder, in tiny nodes of some vast sprawling interlaced network, at the same time. Nassim Taleb spends much time critiquing this sort of setup. The well connected seem able to buy up and assimilate any real challenger to this status quo. But it isn’t the worst of worlds for most of us, so far ….

The world of financial services has come a long way since the Baily Savings and Loan in the movie “It’s a Wonderful Life”. Many of the changes have been for the better. But there have also been abuses of the system, with the greatest abusers being the politicians in Washington. It seems that every year or two, Congress brings the government to the brink of default on its debt with the nonsense of raising the national debt ceiling.

The numbers just keep getting bigger. It seems more injection then more withdrawal with each iteration.

It reminds me of watching a video of the Tacoma narrows bridge

We’re all just waiting for the steady wind that twists the system apart.

Good analogy. Both are taking a lot longer to blow up than people thought.

It’s interesting how the market is fixated with tapering but very few people understand what’s going on with reverse repos. I didn’t even know what they are before reading Wolf Street. It looks like giving with one hand (which everyone is aware of) and taking away with the other.

True ‘ nuff….

Where I come from reverse repo was when the guy in the tow truck never made it out of neighborhood…

As Petunia says, the Fed don’t work for you and me…

Seems to me that the Fed had a 3 alarm response to a trash can fire and kept hoping the fire gets bigger so they don’t look like the morons they have truly turned out to be…

Course on the other hand , I would be a moron not to take advantage of what the other morons juiced… I do realize not everyone had that privilege…

@COWG

LoL!!

All of these shenanigans are being done in the name of the people.

The people and the entities formulating these strategies and tactics and putting them into operation – do so, in the name of the people and citizenry.

And when all of these strategies and tactics fail as they inevitably will , the blame game will commence and the finger pointing will start.

These sort of financial shenanigans, are inept attempts to forestall the day of financial reckoning. The financial system is thoroughly debased at this point.

Capitalism created a problem. Let capitalism solve the problem.

Bailing out insolvent banks, bailing out insolvent nation/states, bailing out insolvent corporations – is only handing the bailout tab to Joe Citizen ultimately.

This is just juggling the books. Today I give you a digital dollar and you give me a digital certificate worth a dollar. Tomorrow we trade the other way. Next day we trade the other way again. Next day we trade the other way again. If the process was animated it would look like literal juggling.

No actual money is moving into a place where it can be spent for real things or services.

So why bother? Who are they fooling? They’re certainly not fooling the jugglers. Normal people don’t know it’s happening. Is this for the benefit of the financial journalists at places like CNBC?

Money washing at a government level is what I suspect. The money can be from wherever and whomever. It goes in dirty and comes out clean as a whistle with the blessing of the US government. So bring your dirty dollars here and we will clean them for you

Nathan D:

You expressed my thoughts exactly! Or in other words how much “illegal” money is being washed overnight?????? Isn’t this just a plain criminal enterprise scheme???? I’m not saying all that money is involved in that scheme but there’s bound to be some.

It wasn’t so long ago that a couple of corporations would merge in a deal for $20 billion, which seemed like all the money in the world circa 1990.

Both concerns actually made things and the marriage was fruitful, whereas now the amounts are simply staggering and the transactions are forced-not planned for success, more like foaming the water with Benjamins so incredibly rich people have something to hang on to, lest they drown in debt.

And behind that, is the Fed pumping in liquidity that hides the credit risk of these deals and entities. I see China doing much the same in its own way. Then if it all goes boom, guess who will be there with endless cash to bail out he (rich) afflicted? But some of that insurance, so to speak, does trickle down to we the commoners, holding up our house and stock prices. I just don’t (and fortunately didn’t pre-2008) act the greatest fool and overextend myself on this fragile wealth effect. However tenuous my savings are, they are legal tender that pays my debts and taxes, and I keep these latter in tight control. I don’t think there are enough fools with enough liquidity to keep this consumer economy at 1990-2008 levels. If the Chinese must rebalance to domestic consumerism, it is time for us to consider what our evolution might look like going forward.

All that said, there were plenty of foolish mergers back in the day based on ego and other follies (AOL-Time Warner?), and that is well documented in some good books.

The FED have no plans to taper, said it before

Agreed. I don’t believe for a second they’ll ever stop QE.

That’s why the stock market has taken off like it just got a massive dose of horse steroids. The FED signaled they will continue their zero rate nonsense until further notice, inflation be damned. Grandma won’t even be able to afford cat food.

A wise old man once said “actions speak louder than words.” Weimar Boy Powell is all words. He’s so full of sh!t his eyes are brown.

I say this about very few people, but I would have a drink to celebrate if he was diagnosed with Stage 4 cancer. He, along with Pelosi and Maxine Waters, are the embodiment of evil.

Tapering starts this year and will be completed by mid-2020. It’s going to go a lot faster than last time they tapered. This Fed is getting nervous.

Correction, WolfBurger: End of tapering, at least for now, by middle of 2022. Unless these Bozo’s have a time machine, and if they do, they owe me $573,012.36 in Unpaid Interest on my cash balances for the last 14 years!!! You do win the trip to Buffalo in February, though, by shouting from the rooftops that they are getting nervous; duh, the Inflation Genie had to hit them over the head with a spoon, multiple times, in fact. Not-So-Grande is causing incontinence also.

I am doing the civil thing and sending them all a multi-year supply of Pampers. The question is: how many of these buttheads are there???!!

If they were nervous, Wolf, they would be raising rates. This is intentional. They aren’t nervous one bit. They are putting on a show. They actually love what’s going on.

Just wait and enjoy the show.

Wolf. All the government and assorted assorted hanger on organizations ever do is promise you they will do something in the future: that procedures are in place, that it was the other guys fault but now they are working on it, that they don’t have precise facts and figures now but can give you them later, that a study group has been formed, that an investigation is on-going, that if you send them money the future will be bright. Anything to give them enough time to throw a new squirrel at you so you forget about it.

Do you see a trend here? This year is 3/4 over. If they were not lying they would have announced the start, not that they are getting ready to get ready to plan it.

They announced the likely start: Nov; and they announced when it will be completed: mid-2022. They just didn’t spell it out in the FOMC statement. They spelled it out in many speeches. This is baked in now.

It seems strange to me to talk about “draining cash from the system” when the cash comes right back the next day.

Would it be better to talk about “giving monster money-holders something to do with their money, that otherwise they could find no use for”?

Either way it seems to be a sign that there’s more money around than its owners need.

See my reply to Jimmy above for an explanation.

Reverse Repos are almost comical.

Historically, Repos and Reverse Repos were normal, ordinary, routine cash management tools for overnight bank lending. All banks want to put excess funds to use at the literal end of the day. These tools, with Fed cooperation, allow this to happen routinely. Bank A lends overnight to Bank B, who needs a little extra to balance its books for the day.

With Original QE, the Fed originally printed money to ostensibly stimulate the ‘economy’. ‘Economy’ is defined mostly as asset prices’ in this context. Amounts that do not go toward asset prices go into ‘Reserves’. The Fed pays interest to banks on these reserves. This is why the original QE stimulus could never create inflation, except for asset prices.

Super Covid QE put a lot more cash into the economy. Reverse Repos are needed to soak up what doesn’t have a normal flow into Reserves. The interest rate paid allows cash holders like Money Market Funds to avoid the need to pay negative rates. To a Money Market Fund, this much extra cash carries a cost they can not normally cover in the normal course of business.

So, here’s the implication and the problem.

QE was designed to gift money to Wall Street. Super QE coming from the Covid intervention is so massive that, for some, interest rates are officially too low for some of Wall Street’s major players. All the new cash is not only useless, it’s a cost they can’t cover.

In other words, the original crowd uses it to pump asset prices. The new crowd needs actual normalized interest rates to protect their business model.

This is going to get interesting. Which Wall Street faction will win?

All of them will win. The old saying Heads I win Tails you lose

Thanks for a view of how the QE is suppose to work and then the * covid version

I am an amateur in every way possible when it comes to finances. My take is this is basically a shell game to manipulate rates and maintain the current financial system status quo.

Am I hot or cold?

I would say you are definitely on the warm side. The Fed is trying to put off the day of reckoning as best it can. I spent my entire career in financial services and did well enough to be able to retire early, so I won’t feel so bad when the system eventually collapses.

Cold, Dave….

The Fed adjusts interest rates up and down ( and uses other monetary tricks) to achieve or influence specific goals…

Todays world is the result of adjusting way too far in one direction and not adjusting back once the goal was reached…

This why the monetary conditions are as they are…

Generally and very simply speaking, of course…

It has become a game of Calvin Ball for these guys…

Spent some time thinking what the hell are these FED up to. Perhaps this is the best they could create based on the inputs. They have totally hosed money into the market and created wealth of all home owners that allowed them to refi and pump this market into oblivion. Debt up to their eyeballs to keep up with the Jones.

Now comes the hard part of the roller coaster…..the drop. They know they built it up for this. So make sure to keep your hands and feet inside the car as we crest this hill into…..serious financial roller coaster!!!

What worriers me is, endless amounts of “money” are created at whim and juggled, to keep certain visible variables (such as Treasury interest rates) within certain ranges. These variables once represented more straightforward drivers from the economy. Now it seems the administrative tail is furiously wagging the dog, bigtime. Some tinkering around the edges seems to have become core to the dynamics. Something seems terribly backward about this chain of causation and the data it yields. It seems like a Potemkin village. I wonder what shock would dangerously expose its flaws, because the world has a way of piling up risk and producing just that shock.

The problem with figuring out a lucrative strategy (as in the “Big Short”) is, when the shock happens, most of us are like tiny tidal creatures caught up in it. I did manage to have a good survival strategy in 2008 ….

High Finance in the US of A today sure sounds like the original Potemkin Village. The facade was put up every evening, and taken down the next day.

Maybe instead of “Weimar Boy” we should be calling him “Potemkin Powell” ?

@ph

“What worries me is, endless amounts of “money” are created at whim and juggled,”

There’s a cure for that. Go down to your basement and forge whatever you need.

If they can do it ,so can you and that would keep everybody equal.

Just Sayin’

I have followed the Reverse Repo articles for months and Wolf always provides the basic definition of RRPs as a reminder of what they are.

If banks have to stabilize their balance sheets by offloading cash for treasuries, over and over again, to pass stress tests, why is the Fed continuing QE which creates this imbalance? Why create excess liquidity which must be constantly unwound? Should not a $1T+ RRP daily balance be enough to tell the Fed it’s taper time ??

Because Weimar Boy Powell is directly financially benefiting from his own policies. The longer he does QE and keeps rates low, the larger his net worth grows. He found his magic money tree.

“why is the Fed continuing QE…”

It should have stopped long ago. But it locked itself into place with its language saying that QE would continue until certain points were met, and then it would give months of prior notice that it would end QE. It started rolling out the first vague references to tapering this spring, and it has by now given the markets enough prior notice, and so tapering will begin later this year.

This Fed wants to be predictable and not spring any surprises on the markets. It doesn’t want to upset the markets. So meanwhile, it’s using RRPs to absorb the excess cash.

Wolf, Jay also doesn’t want Dallas FedHead Kaplan to lose his insider trading profits on his personal portfolios by the Fed not giving advance warning, to some degree, of its policy moves to the lemmings in the grossly-overpriced markets.

If it smells like a rat, it probably is a rat. DOJ will be asleep at the switch, so I am trying to put Judicial Watch on Kaplan’s tail, we will see.

“This Fed wants to be predictable and not spring any surprises on the markets. It doesn’t want to upset the markets. So meanwhile, it’s using RRPs to absorb the excess cash.”

Then this means they will never, EVER stop QE. Because the end of QE WILL “upset the markets.” They are build upon QE. It is the very foundation of their valuations.

Why not be one and done with these RRP? Why don’t set a rate and leave the money rather than the back and forth. Something will eventually break during this shuffle back and forth. Or is there a wink wink nod and they just pay the banks the “interest” for having the money there. It all seems so archaic

Makes it convenient for liquidity purposes. It allows money market funds to get rid of excess liquidity in the daily amount needed and earn a little yield, so they don’t break the buck. It’s just a routine, just like your checking account where you put money into it and take money out of it on a daily basis.

The whole repo market is gigantic. This is just a small slice of it involving the Fed. The rest of the market doesn’t involve the Fed.

@B

They put a few bucks in.

They take a few bucks out.

They do the Hoki Koki.

And that’s what it’s all about.

Just sayin’

As Wolf indicates, this is all done to prevent the Treasury money market funds from going negative. With the stock market wobbling, a lot of money is flowing into these funds.

I wonder how secure these funds really are. The treasuries in these funds are held in street name. Could they be leveraged? You can bet there are some shenanigans going on when that much money is moving around on a daily basis.

I won’t keep money in these MMFs. Purchase treasuries outright. A little bit more hassle to roll them over, but you own the treasury outright vs just a book entry.

I actually bought a 10 year Treasury note on a non-competitve tender basis through the Federal Reserve branch in San Francisco back in 1988. In fact all I got was a book entry on a statement. No fancy certificate with a picture of “Columbia” in flowing robes. Several years later, I decided to sell the note and had to go through a lot of hassle with my securities broker to be able to do so.

“…stock market wobbling…”

AHAHAHAHAHAHA!!! Wobbling? It’s at record highs!

Not reaching new records or trading sideways is considered “wobbling” these days.

“It’s at record highs!”

Not yet :-]

Well, true. Let’s give it a day, Wolf. :)

One more thing. A treasury MMF is equivalent to breaking the buck. Remember the Prime MMFs in 2007? You got 94c back after your money being locked up for 2 years.

Insert “negative treasury MMF” is equivalent to breaking the buck. Need more coffee.

If “money” is this fungible, why not just distribute a universal basic income? I am not a progressive, but either it all actually means something or it doesn’t.

There is no way for your average earner to do anything but finance this mess—at great risk—with his/her retirement savings, life insurance, mortgage, etc. if he/she is fortunate to have these assets.

LM,

It’s already happening with all the assistance programs…

It’s just not labeled UBI….

Simply writing a monthly UBI check to these people instead of having massive bureaucracies register, qualify, and distribute benefits would be a lot cheaper.

Why?? Simple. Two wrongs do not make something right.

Universal Basic Income has been the status quo until Sept 3 of this year, thanks to Covid stimulus. The result: People were paid to not work. Supplies of things to buy disappeared. Shortages are common today. This created inflation on Main Street. If it continues for a few more years, then the US economy will be loaded with lots of cash being spent by people who do nothing to earn it. That boils down to inflation like you have never seen before.

Low rates are a separate problem. They are a disease. UBI is not the cure.

cdr- on UBI-

The whole idea of social welfare tends to blur the connection between “economic value added” and “money” that one earns (to put it simply), after adding some economic value- either working or making a good investment, etc.

It’s the way you get the neofeudalism we have now. Enough rich people decide to have the govt redistribute- bread and circuses.

It is dysfunction on many levels.

When you start taalking “right and wrong” you throw a wrench into the machinery. It is a financal system of redistributing the wealth that benefit the nation as a whole. Ethics and morals are not part of it.

Good article Mr. Richter, the Fed is definitely trying to control both ends of the yield curve at the same time. Thanks for including the NY Federal Reserve link. I remember a while back that your Fed troll mentioned in your comments section that the Fed was keeping the money market from going negative and trying to maintain velocity.

Thanks Wollf! I love to read your posts!

Somehow the Federal Reserve, through Reverse Repo, is sucking money out of the system. Almost $ 1.3T today is “out of the system” of lending. Money that is taken from the real economy because is not offered to businesses and citizens. Probably because they don’t ask for it and the reason, perhaps, is because there is too much money in the system. So a deflationary Reverse Repo that increases more and more. I don’t know what it can lead to, but surely when there are abnormal numbers, something always comes out and the abnormal numbers that this “pandemic” has brought are now many.

I think the next crisis will not be caused by a major default but by a collapse of confidence in central banks and money. Central banks that tell you that they can print as much money as they want and that they can save whoever they want, they undermine trust in the system itself. What is the value of an asset (money) that has no growth limits and whose growth depends on the discretion of 5 main central banks? This is why central banks are rushing to the CBDC! My thought, of course.

“Central banks that tell you that they can print as much money as they want and that they can save whoever they want, they undermine trust in the system itself.”

and people speak of free markets and capitalism

“I don’t know what it can lead to, but surely when there are abnormal numbers, something always comes out ”

Very well said! I have been thinking the same.

Wolf, did everyone miss your tongue-in-cheek statement that your Third Quarter Estimated personal and corporate tax payments pretty much provided all the Governments revenue for that period! Good humor should never go unnoticed, but being a suffering soul like yourself in having to make quarterly estimated tax payments because I have two sticks to rub together, I feel your pain. Now if we could just get back some control as to how that moola is spent!!! These bozo’s with the Uncle Sam Credit Card are totally out of control.

Newsflash: Fed still considers 6% and climbing inflation as still Temporary. I consider Powell’s job even more temporary, especially in light of how the financial historians are going to treat his legacy.

The “financial historians” are hiding in Argentina.

b

“…did everyone miss your tongue-in-cheek statement that your Third Quarter Estimated personal and corporate tax payments pretty much provided all the Governments revenue for that period!”

Yes, seems like it :-]

@DWY

Awe Sh** Now you’ve gone and reminded me of my year end tax return!

Look at Money market mutual funds. Total assets in FEB 2020 were 4,016.6b. In AUG 2021 they were 5,010.5b up 24.7%.

Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level (WALCL) took a big jump last week.

https://fred.stlouisfed.org/data/WALCL.txt

Our means of payment money supply has doubled since Covid-19. The RRPs haven’t yet offset the growth in the money stock. Inflation won’t peak until Jan. 2022.

I think the delegation that went to China got told to eff off. And you can eat some losses gwailo. So we begin to strap on the crash helmets.

My guess is that -8k on teh Dow and Mitch will be voting for no debt ceiling, and the stimmie bill will fly through.

Meh… In other news, more than half of America is living paycheck to paycheck, will never be able to afford a house, and hasn’t paid rent in over a year.

Guess what, the financial shenanigan system don’t work, so don’t be surprised if a lot of people shrug at the latest “crisis”

Someday this war’s gonna end…

AllenM – I always appreciate your comments, but can you please tell me more about the war and when it will end?

I must have dozed off. I never saw it begin.

AllenM. I know it’s hard to differentiate between seriousness and sarcasm online, but my question is an honest one. Your comments are always excellent, but your sign off is a bit of an enigma. I’d love to hear the explanation!

The building of cash reserves in private banks through public purchases, QE, is still something we don’t understand, because it is illegal as hell. Assuming the Fed has pushed interest rates lower and the banks can’t meet MM fund obligations is the Feds problem, (we want low we don’t want negative) and so they push the Treasury paper, (purloined) onto the private banks for cash, which can’t be a liability because it was never an asset, while no private money was transferred at the sale. Fed puts its name on the bond, the Treasury prints the money. Meanwhile causing the taxpayers checking account to go up and down like a yo-yo. Fed has nationalized the banks while allowing them to keep the profits, ergo they have become what the national defense agency was in the 50’s, putting the bang in the American buck. Interesting that the dollar is a topic which doesn’t come up at Fed meetings.

“The building of cash reserves in private banks through public purchases, QE, is still something we don’t understand, because it is illegal as hell. ”

Ooooh.

Ha ! The Fed has got people trying to figure out a shell game that ends with one result . The result is the final home for the un-productive fiat ash that was left over after non-productive printing and non-productive consumption is a non-productive treasury. Selected financial parasites do get a cut for moving the shells around on the table . It is better optics also to confuse the “experts” with bull-shit shell games who give puffed up bull shit analysis instead of just saying it would be more efficient to have the banks burn the worthless shit out back in the dumpster and be done with it.

It boggles the mind reading about all these repos and reverse repos which boils down to money. How quickly the machinations of humankind have spun out of control.

A trillion here a trillion there; adds up to real money.

My bottom line is that the Fed is totally out of control as they are forced to finance massive govt spending by monetizing debt.

Fasten your financial seatbelts; rough years ahead.

B

Two questions:

Is this the reason for the “bail in” agreements now supposedly in place between government central banks that on the next collapse bank assets will be frozen as the only way to keep money flowing in the repo market?

How does the looming Congress-created US debt default figure in? Or does it even matter?

Also, just today another story about a mortgage lender, homeDepot, pulling 2008 style lending scams with no documentation . . .

Mr. Richter-

Thanks for these posts. I have a hard time understanding the machinations of the banking system, and guess I am not alone. I am reasonably good at personal investing, in spite of this.

I recall when they started QE, and many/most said hyperinflation was in store. I did some reading, including Wolf Richter, that explained how this “money” was held out of regular/main stream economic circulation, so would not cause hyperinflation- in the short term anyway- which was exactly correct.

Thanks again.

Hyperinflation usually takes a year or 2 to run its course historically, and methinks it won’t happen to us as it’ll be more instantaneous, whatever they call the new hyperinflation variant that nobody has ever experienced before.

M2 money supply went from about $15 trillion in early 2020 to $20 trillion this year. How can a repo soak that up? You need a bigger mop. The price of homes and autos is up. That soaked up some the money.

The Fed is doing asset purchases. Budget negotiations are stalled. In the past Congress agreed to fund the government with temporary spending bills until a compromise could be reached.

And another $1.352 Trillion today. What’s the end game here? Will it just increase until it gets close to the $160B/party limit and requires another increase?

It will increase until all the excess cash has been absorbed.

Just a word of thanks to Wolf for the excellent article, and for also taking the time to reply to points made by posters in the comments section.

I can’t speak for anyone else here, but Wolf’s articles and replies to posters questions brings a lot more insight and understanding of what are complex issues to the layperson such as me! So thanks for doing this, Wolf.

If I can somehow siphon off $10K a day from different institution in this repo process, I think I can do pretty well here.

First. let’s say it’s $100K total daily, compared to $1T, that’s not even a rounding error.

Second. Actually, there is no second, I wonder how one can dip their grubby little hands into that repo stream.

Banks borrow from the fed at 0% and now lend to the fed at 0.05%. Nice business if you can get it.

Not banks. Money market funds are into this. Banks lend to the Fed at 0.15% by depositing cash in their account with the Fed (reserves). Right now, almost no bank is borrowing from the Fed. They’re already awash in cash. They don’t want more cash.

Banks have been borrowing at 0 for over a decade even though it may have temporary stopped. They are taking that same cash and lending to the fed at 0.15%. Outsiders need not apply. Again good business if you can get it. The fed does not need this money, they do it to keep it from getting loaned out and causing inflation.

There are essentially now two different interest rates. When other country’s have tiered rates they are called banana republics.

What would happen if the fed did not give the banks a risk free 0.15% ?… bond prices would drop then the dollar. …. Then it all

I hope they know what they are doing. Hope they know how to keep that money from getting out …

I never make predictions but here’s what’s going to happen.

The Fed will get it’s tapering ended towards the end of 2022, just in time for the recession which will start to appear as all the supply shortages get back to normal around the same time.

The Govt will then have to put more money into the economy again but they won’t do it by QE (which has got a bad name). The RR’s will buy Treasuries which

they’ll use to make direct payments to households this time, your chance at last to get rich like the oligarchs did from QE.

Only a fool makes predictions!

Just sayin’

There is so much stimulus still floating around everywhere, including negative real junk bond yields, it’ll be practically impossible to have a recession for quite a while unless something big blows up.

23-24??

Exactly correct, Wolf. These trillions have some staying power.

We know the Treasury prints up bonds and sells them and they

wind up at the Fed.

The Fed buys the Treasury bonds by creating Federal funds.

I’m left wondering were all the new Federal funds wind up?

I can picture the Fed buys Treasuries, so the US Treasury has Fed funds. Now ignoring the Treasury just increasing their cash balance, they send the funds out to buy things (or make corona payments etc). The receipents are unlikely to keep federal funds

as they don’t generally pay interest, they use the federal funds to buy something (investment, food, etc) then that entity then has the federal funds (and needs to dispose of them too…)

Where do the federal funds wind up? They can’t just disappear…

Now we know, they go into the RRPs (back to the Fed).

george,

Two different activities:

The government sells bonds to the market and gets cash (credits) for those bonds. So the government winds up with the money from the bond sales. Always does. Then it spends that money, and that money enters the economy.

The Fed creates cash (credits) and buys bonds in the market (via its primary dealers) thereby distributing the cash it created to the primary dealers, from there the cash spreads to the markets, namely the sellers of those bonds, which then invest that cash in other stuff and prices go up.

Not seeing what the big deal is, instead of calling it a RR just call it short term treasury?

You describe the action like a sucking up the debt. That would make sense if we didn’t just empty the contents back onto the floor the following morning. What value do these transactions play in the bigger picture??

NOW 1.6T$!!!

400B$ added in just 1 week!!!

120B$ a month the QE and 400B$ Reverse Repo (Opposite of QE) in just 1 week!!!

Is this deflationary?