One of the largest central banks ends QE. End of an era for Japan: Large-scale money printing was one of the three official legs of Abenomics.

By Wolf Richter for WOLF STREET.

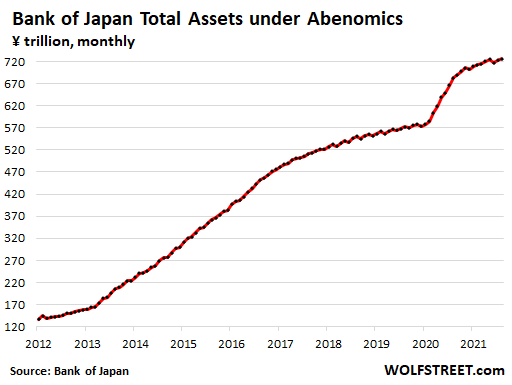

In terms of the absolute mountain of assets the Bank of Japan purchased over the years, it is one of the top three QE monsters, along with the Fed and the ECB. In relationship to GDP, the BoJ’s total assets are #2, behind the tiny Swiss National Bank, which runs the unique racket of using the overhyped strength of the swiss franc to print large amounts of it and buy securities denominated in foreign currencies, including large amounts of US stocks; but it’s not buying securities denominated in Swiss francs.

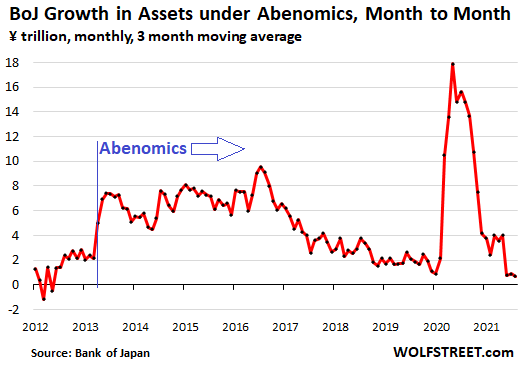

Total assets on the BoJ’s balance sheet generally decline every third month as large amounts of long-term bonds mature and are redeemed, which is when the BoJ gets its money back, and the bonds come off the balance sheet. For this reason, we look at the three-month moving average of the increases in total assets.

As of its balance sheet through August 31, the three-month moving average of total assets increased by an average of only ¥690 billion ($6.3 billion) per month, the smallest increase since 2012, before Abenomics became the economic religion of the land. This marks the end of Abenomics QE:

The BoJ’s blistering QE binge started with “Abenomics,” the economic religion imposed on the land in 2013 under Shinzo Abe, Prime Minister from September 2012 to September 2020. One of the three official legs of Abenomics was massive amounts of money printing. It culminated with the huge burst in the spring of 2020. But all that is now history.

While the Fed has set the stage to begin tapering its asset purchases later this year, and while the ECB is ogling the Fed for inspiration, the Bank of Japan, without making a lot of hoopla, has already cut its asset purchases to the bone.

Total assets as of August 31, a monstrous ¥726.7 trillion ($6.6 trillion), were up by an imperceptive amount from May. And in September, due the large redemptions of long-term bonds, total assets are going to drop:

Other central banks that had engaged in these QE binges have already cut their asset purchases. The Reserve Bank of New Zealand did so cold turkey in May. The Reserve Bank of Australia announced today that it would cut its weekly bond purchases from A$5 billion a week to $4 billion a week.

The Bank of Canada, which started tapering its asset purchases in October, has cut the purchases of Government of Canada bonds from C$5 billion a week to C$2 billion a week, ended its purchases of MBS entirely, and unwound its holdings of short-term Canada Treasury bills and repos, with the effect that total assets on its balance sheet have now dropped by 15% from the peak in March.

But these are small central banks. In terms of the developed economies, the heavy weights are the Fed, the ECB, and the BoJ. And the BoJ has cut its QE to near nothing as Abenomics fades into history.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What do you, or other readers think will happen as a result?

I would suspect interest rates will rise and put pressure and the other biggies to do the same or face devaluation.

Then, here we go……

Now, this is interesting! I wonder if this will continue. I did not see this (the end of QE, anywhere) coming. Thank you Wolf, for your excellent coverage

Japanese interest rates rising was predicted way back in 2013.

I don’t know, but you can see that having a few ounces of gold squirreled away would have worked out pretty well in Japan the last 20 years.

Japan is still in the midst of deflation.

No, Japan has had price stability for the past 20 years, with a some inflation followed by a little deflation followed by a little inflation.

The Japan CPI was 97 in 2001 and now it’s at 99.7. Over those two decades, Japan had 2% inflation, while the US had 55% inflation.

As Wolf says these bonds were bought on margin. Much like the Fed “buying” bonds. This money can be erased almost as easily as it was created. There are a couple reasons for the global pullback in liquidity, they are just switching liquidity providers, since crypto has no forex footprint. Very soon the global markets will equalize valuations, labor especially. That does not bode well for the US dollar probably why the Fed is the last man standing on QE. They don’t want crypto and they don’t want prices reset lower.

Summary: The above reads like a word-salad ramble to me, full of illogic and contradictions. I’ll ask some questions to illustrate everything that is wrong with the above diatribe.

————————————————————————————

“Bought on margin”

Wolf did not say that

“This money can be erased almost as easily as it was created.”

Only by selling the bonds or letting them mature/roll off.

“Switching liquidity providers”?

From whom to whom?

“since crypto has no forex footprint.”

When you buy/sell crypto, some specific currency is needed.

“Very soon the global markets will equalize valuations, labor especially.”

Equalize valuations of what? Labor? Well, QE is in effect all about reducing the value of labor relative to assets, so if QE stops then maybe labor will indeed rise on a relative scale. But equalize globally? I very much doubt it.

“That does not bode well for the US dollar probably why the Fed is the last man standing on QE.”

I can agree that USD will drop in relative value if everyone else stops printing/QE. And that is supposed to be why Fed is still doing QE?

Isn’t “last man standing” usually meant to indicate the winner?

” They don’t want crypto and they don’t want prices reset lower.”

Who are “they” and what do you mean “don’t want crypto”? What prices are you talking about?

————————————————————————————-

If after this, Ambrose Bierce always hates me, this is why. But I thought his stream of nonsense had to be called out, once and for all.

Thank you, my thoughts exactly.

But I’ve seen Ambrose make interesting comments (this is one too, makes you think), so just a bit more clarity in his comments would have been helpful.

Thanks Narmageddon, for that excellent, though charitable reply. I am inundated with this kind of chatter,from millenials and usually don’t have the energy to respond.

Excellent. Wolf is a clear communicator. He needs a moderator for the comment section though, to weed out a lot of misleading information, completely wrong information and stupidity. and to kill the use of acronyms.

Interest rates won’t go up unless money printing goes down to at least half. And free government money due to Corona dries up.

It seems like all the lessons of central banking are there to be learned from by France around 1720. John Law through dishonest banking blew out the Mississippi stock from 500 to 10,000 and back to 500 in about two years. He doubled money supply as part of the deception and created high inflation. It all ended in financial disaster.

Fed chair as a minimum should be thrown out of USA for causing asset bubbles and inflation that rob the serfs.

Old School. If you can figure in advance what will be in the best interest of the Big Banks and the richest 1%. Then you will know what path the Federal Reserve will go down.

They don’t care at all what happens to the “serfs”.

Paulo,

Not a bad bet.

Since QE has the incredible power to alter the ratio between 1) all the money and 2) all the goods and services in a given currency’s Zone of Use (ZoU acronym is going to be useful as all the monetary f*ckery-pokery by various central banks is going to incentivize big changes are in ZoUs) then all the major central banks of the world have to be ultra cognizant of the steps taken by other members of the coven…

Otherwise each nation-state can see its productive capacity either, 1) be bought by foreigners ridiculously cheap (excess domestic money printing forcing FX rate *way* down, causing a surge in unprofitable exports or, see its productive capacity stunted in its growth due to *inadequate* money growth (forcing FX rates way up, strangling exports).

The strange bias has been for CBs to “print baby print” in order to cheapen their exports and, presumably, capture world scale economies of scale in production.

But…I’ve always found that huge bias a bit strange, since it sees nations undercut the sales price of the own labor and raw materials (that go into discounted exports)

And in exchange for what?…colored pieces of paper currency that foreigners can discount at will, simply by printing *their* domestic fiat?

And if these intl trade pathologies reach the “America Stage” there may not be all that many foreign goods/productive assets to really buy with that foreign paper currency…except for some real estate from which to view rotting foreign factories.

Cas127-seems to be another case where our long-term obsession and focus on the tools has resulted in near-total mission amnesia…

may we all find a better day.

Cas127, this is good stuff you are writing.

Looking at the 1st graph at the period from late 2016 to begin 2020, the BoJ was already steadily lowering it’s QE. To my knowledge that didn’t have much impact on the world stage. Why should it make a difference now?

My best guess, as companies can’t access free cash, bond yields skyrocket, stock market will react, and behold QE ad infinitum.

So basically deflationary crash to be prevented by massive money printing and then we have the inflation we’ve all been waiting for running wild.

I would love to hear more about what the ECB is doing and what is happening with all those negative interest rate instruments. It is my theory that as interest rates begin to rise, investors will be selling those negative rate bonds first, along with lower quality credit. It is also my guess that due to inflationary pressures, the central bankers have no choice but to allow interest rates to rise, but that they now do not control the process at all. They cant increase QE to hold down long term rates. They can set the short term rates, but the markets set the long term rates, so we are simply going to get a steeper yield curve soon.

gametv,

Investors can also hold those bonds till they mature, at which time investors will get face value, unless the bond defaults. Most negative yielding bonds were bought with a small or no coupon interest payment, but at a premium to produce that negative yield. Investors who bought at a premium and hold till maturity when they will get face value will pocket a capital loss. And throughout those years, they’ll get little or no interest income. And now inflation is rising even in Europe.

Speculators who bought those bonds did so on hopes of ever more steeply negative interest rates, and at some point, they could sell those bonds at a profit. Those hopes are still there, but they may not be fulfilled.

My first two assumptions for investors to own negative yielding European bonds are:

1. the manner in which capital flows within Europe. example: Italians/Greeks not trusting their respective governments and putting their savings into German negative yielding bonds.

2. Investors betting on a devaluation of the dollar and keeping their money into Euros through the bond market in essence playing a long term FX bet.

This is just my opinion, but that is the only logical explanation I can come up with for people buying negative yielding European bonds outside of big institutions maybe being required to hold some bonds as a percentage of their portfolio.

Looking at the central banks lately, I doubt people still believe yields are heading into more negative territory.

There is a theory that “sovereign treasury yields” would have been deep into negative territory without central bank QE. Money flight to safety would push these government bonds into negative territory while corporate bonds would be in double digits hell. Then we would have a deflation in the real economy and negative yields in government created debt(safety).

So central bank QE was injected into the corporate/private sector to stimulate demand as it would otherwise have collapsed while retail investors are keeping the treasury market up.

Does that make any sense?

Etf TBT for the medium term.

@L

In the old days the 2 strong men of Europe were the Swiss Franc and the German Mark. Old habits die hard.

W has explained how the Swiss are cashing in on their traditional kudos but it is much more complex with the Euro. Basically they are trading on the implied promise that Germany will be good for the Euro but there are huge tensions between the German state bankers and the ECB bankers, they even tried to take them to court over the legality of QE. As a naturally anti-inflation country the Germans are extremly miffed about the way the Euro is being run and IMO this will be the straw that breaks the camel’s back.

Germany reported 3.9% inflation with an election coming up. Watch the fireworks!

Tecnically, do not those that have bought a bond with negative yield faced monetary deflation that pocket them a capital loss?

the only good reason for investing in negative rate bonds was for security and for capital gains. i think when capital gains become losses, there will be only sellers and rates will move fast.

i played Jenga with my family on vacation. right up until the moment that thing collapses, it looked quite solid, but finally there came a moment when there wasnt a single bar that could be pulled without the whole thing collapsing.

the ability of central bankers to run QE endlessly is somewhat based on other countries following the same path. once Japan and the US move rates higher and stop QE, it becomes real difficult for the EU to continue.

You have to wonder if the Swiss situation eventually becomes a big problem.

If you think about it, we are still running off the remaining Treasury balances, so it makes sense that rates have been dropping, but i see bond yields starting to form a base and edge back up, despite the lack of supply. Feels like a tightly-wound spring to me.

Without a doubt, buying negative yielding bonds at the current time are the dumbest investment anyone has made since the beginning of time.

Its a lose, lose, lose investment.

Yes it seems that way, but things can blow up the other way and stocks can lose at least 89% of their value as in great depression. Then getting clipped a fraction of a percent on a sovereign bond might look pretty good.

There is simply not much of a choice. If stock valuations return to normality you are looking at a 75% loss. A -0.5% negative bond yield is the price you pay for relative safety and the “option premium” to be able to take advantage of a return (if ever) to normal valuations.

Many institutions also simply have no choice based on their charter etc.

I will try to be as brief as possible an will not read answers, so just FYI.

ECB will most likely do ‘virtual taper’, or better said no taper at all.

Details:

– ECB will signal cuts in 80B EUR [$95 billion] monthly bond buying

– 1.8T EUR Pandemic Emergency Purchase Program(PEPP) will start shrinking

– ECB has been running some 20B a month Asset Purchase Program(APP), even before pandemic and in parallel with the PEPP

– while ECB will taper PEPP, they will likely increase APP by 60-80B a month to keep governments stable

Zero sum game, taper will be no taper at all.

Misses WatanAbe

Wussies!

Yup, don’t expect you to act anytime soon…can’t stop this gravy train now especially with potential black swan event coming out of China and causing the next GFC. You got all the cover you need to continue with QE infinity.

This will also get you the next nomination for another couple of years too, great timing for sure.

Aren’t Black Swans by definition things that occur that were not anticipated to happen?

Harold is right. Entities like the CCP’s Evergrande Real Estate with a reported $800+ BILLION in loans as of 2020 are better called gigantic, dead ducks not black swans, as they get sucked in the jet engines of China’s economy and cause an explosion.

I wish we could boycott them then watch the mass lynchings of CCP crooks.

Pleeeaseee god no! At any rate, I think that the QE tactic is starting to render less and less benefits, aside from pension-destroying inflation.

Given the news about Evergrande Real Estate and other white elephants in China, one does wonder as to the reasoning for choosing right now to do this. While Japan is wisely cutting many of its ties with China’s economy, it still has substantial manufacturing there and probably, significant product sales of Japanese companies will be affected if China goes down.

That said, as to the CCP, it could not happen to a more deserving bunch of evil men if the Chinese economy collapses like one of the CCP’s tofu-dreg constructions. Since so many Chinese people’s life savings are in real estate with tofu-dreg construction, it is natural that public anger would flare as those buildings start to collapse more and more.

Note that the monetary system in China is not organized as it is in the USA. Neither is law or politics. Crash in real estate value in China may then play out very different from one in the USA.

Do not most buildings in China sit on land leased from the state? Now, what do happen if the leastaker go bancrupt?

The Chinese have centuries of history with fiat money and know that those money systems come and go. Could be that a crash to them just is an oportunity to reform, and then carry on without large drama.

There will come a black swan, a white swan or a scapegoat? The last pandemic was not much of a black swan. Pandemics come now and then, it’s only the exact ttime that is not known. It may have been a white swan event, but probably even more a scapegoat of the problems that followed.

It was a black swan, but its consequences haven’t fully panned out yet. I suspect that when we look back at this a few years from now, it will prove to have been transformative.

That temporary drop in the stock market wasn’t significant at all. What IS significant is the permanent changes this has brought in how the population sees the world. For example:

– Money can be printed and handed out without apparent serious consequences (for now), so why work? And why raise tax at all? Why not spend even more? More disastrous policies ahead….

– Every time a crisis happens, all the wealth flows upward. This happened after 2008 and again now. But this time it is even more obvious and also obviously intentional. This has shaped / transformed many people’s political beliefs. I clearly see this in my own environment.

– People who thought they were solidly middle class now fear the future

– Young people feel even stronger than before that they had to sacrifice for the same people who f*cked them over. Don’t expect any mercy when they get in power

– Free press is an illusion when oligarchs control it. We always knew that, but the past two years have made it even more obvious

– The crisis response has resurrected crypto and other parallel currencies as monetary alternatives. They have entered the mainstream now and won’t go away.

– Policy makers have now fully embraced moral hazard as a policy tool and this is now recognised even by the main stream, setting us up for the mother of all crashes when it turns out even the central banks cannot defy economic laws.

Power!!! Muhahahahahahahahaha!!!!!

I think the criticism of the gold standard was it was too rigid. When this is over economists will probably sat the problem with fiat is it’s too flexible.

Didn’t Kuroda hit pause on the BOJ’s ETF purchases in May? Would that have had a significant effect on the chart? Asking because I don’t know and have not run the numbers yet.

I do know Kuroda has been increasingly aggressive with ETF buys since 2012 to the tune of close to doubling purchases from 2012-2020.

Staying tuned to see if there will be a significant policy change or whether its a mere pause or one-off.

My guess is the Japanese has coordinated with ECB, BOE and USA. As far as I can tell combined balance sheet is still expanding. Money is fungible.

TheFalcon,

ETF purchases were always relatively small though they got a lot of attention since it’s unusual for a central bank to buy equities. In total, equity ETFs and J-REITs combined account for 5% of total assets as of Aug 31.

Since May, equity ETFs and J-REITs were roughly unchanged.

Over the same period, its holdings for Japan Government Bonds (JGBs), by far its largest position, declined a tad.

thanks Wolf, does not appear that ETF purchase decisions will move the needle measureably.

So the end of an era…

Just what was really accomplished for all that printing/debt?

“Total assets as of August 31, a monstrous ¥726.7 trillion ($6.6 trillion), were up by an imperceptive amount from May.”

Politicians were able to get re-elected. USA military/security budget was able grow faster than inflation. The rich were able to upgrade mansions and Gulfstream s.

Hey, watch it! I’m still using my old Gulfstream. We’re not all show-off spendthrifts. I learned that the hard way when Dad punished me for flying my helicopter in the living room of our gigantic mansion. He took away my Rolex for a MONTH. What kind of monster does that?

The same kind that says it’s ok for the members of the FED to trade stocks while their decisions are influencing the direction of said stocks.

You asked.

A lost generation.

What was accomplished? The survival of non-viable businesses. It’s like forest fires. Sometimes you need to let the dead wood and undergrowth burn if you want to avoid disaster later.

Just what was really accomplished for all that printing/debt?

Finished building out underground facilities – underground maglev’s – largely without the public noticing the earthquakes, but more – not noticing factories, farms and energy generating facilities materials and tooling dropping off market circuits. Last year has been great cover for completion.

@2b

I sold out of the Nikkei @ around 39000 in around 1990ish I think it was. It closed at 29900ish today, so I suppose the answer to your question is, nothing, so far as shares are concerned. They’ll say it would have been a lot worse without QE which is what they always do.

My recollection of 30yrs ago was that the property crash was the big one which nearly took down the banks, so I suppose you could argue that Japan managed to struggle along keeping things together for as long as it took.

I haven’t looked at Japan for investment since, having done well up to 1990. Won’t be looking either until that balance sheet is somewhere near normal.

What country has a decent balance sheet

“so I suppose the answer to your question is, nothing, so far as shares are concerned.”

What a ridiculous statement.

So you sold out of your Japanese shares and then missed some of the biggest gains in history.

Lots of shares moved up 10 or twenty times in price in that time period.

Even companies that were having trouble over the years and recovered have beat the US NASDAQ.

Just look at a couple. Take Sony it sold for US$18 or so in 1991. It then zoomed up to around US$120 in 2000 only to fall back to under US$10 in 2012.

The price is around US$100 now.

What about that car company, Toyota?

In 1991 is was around US$15. Today it is around US$180. Guess another 10 bagger that was missed while the Japanese share marker was “doing nothing”

There are many, many others that have had even better performance.

Too bad you missed it all.

@J

I don’t invest in individual shares, never have, it’s a miugs game akin to betting on a horse race IMO.

I diversify into an economy with an expert manager and Japan was a ‘miracle economy’ impossible to lose, up to 1990ish, after which it wasn’t, so I went elsewhwere.

The Japanese money went into UK property, as it happens, which made 3x in 12yrs, so please don’t feel sorry for me missing out on your 10 baggers, I like to sleep nights.

Like betting horses they only talk about their winners, they never tell you about their losers which are usually way bigger. I got Kia for cars(Hyundai) and TSMC which is the most spectacular investment ever but, always well diversified to get through crises.

So far as my ridiculous comment is concerned, the Index is the official statistical measure of shares so my comment was entirely statistically correct unless W deems otherwise here.

It appears to me that many of the Abenomics policies are the same as being pursued today in the US , only worded and dressed up differently…

Only it’s happening 10 years later…

I would guess the Yen will rise and other currencies fall in relation, then interest rates will have to rise to attract investment. Of course and just maybe countries will print indefinitely until it no longer works.

@P

The Japan ‘carry trade’ was famous for years. Because the Yen was a safe currency, the idea was to borrow huge sums at low interest in Japan and invest the money in high yield overseas assets. Take your profits and repay your yen debt later. It dropped out of fashion when rates started to drop everywhere.

Didnt Japan go to zero interest in the year 2000?

When Powell took Fed Funds up to 2% in 2018, the arbitrage was to borrow in Europe, convert, and then buy US Treasuries…lock in the yield.

This is why Powell’s valiant and final attempt at normalization failed.

But now, with that arb no longer in play…and foreign central banks changing their tune, the coordination and the rising of US rates is very likely indeed. Add in the gifting for idleness ending, and labor returning…the false reasoning to keep rates low to promote employment disappears as well.

The Japanese Nikkei 225 peaked at over 39,000 in 1989. Today it reached over 30,000 in an intraday high.

Japanese housing prices peaked in 1991.

The Japanese population peaked in 2010 and has declined since the Fukushima nuclear meltdown in 2011.

What is different between Japan and the US is that Japan has a trade surplus, almost always.

We, alas, do not.

We print so we may buy cheap….but the supply lines and the suppliers (China) both grow “unreliable”.

Last I checked their economic growth per Capita was better in Japan than in USA, so don’t think we in the USA should gloat because we are importing so many people.

There are so many differences between Japan and the US it would be a good idea to stop using it as a comparable. Try Germany instead. More similar Western culture. Up until covid, was running a 2% budget SURPLUS.

Half the high school grads go into apprenticeships. Not every kid wants to be a lawyer/ politician or stock broker. The country is not a big player in social media outfits, ( although no doubt a customer) Many more medium manufacturing outfits that deliver EXACTLY what the customer wants. Not the cheapest, will tell you that up front.

When a few years ago there was a political tie, the two largest parties governed jointly for 6 months: ‘The Grand Coalition’

The place ran as normal.

Jesus.. did I say to use it as a model for US? Anyway, closer than Japan.

They might be nervous about inflation. The only way to control that is to retain the value of your currency.

This is especially important for the U.S.A as it

needs to buck to be a reserve currency. If it loses

that battle it will be challenged in all other areas as well.

Yep. I expect the USA to sell citizen well being down the river if needed to make sure USA maintains superior military through technology. Already $1 trillion if you count everything and they will grow it to $1.5 T pretty fast if required even if it takes home prices doubling again.

I suspect this “end of QE” will be like one of those “end of all covid restrictions” most countries have every six months.

Japan’s the case study on how to spur domestic consumption in a depopulating economy. I guess just have the BoJ buy NFTs?

Price discovery 30 years late is still price discovery.

A suggestion, buy NOK, Norwegian Krone, it is basically a bet on oil, commodities should rise in an inflationary world, oil already has, but with the advantage of a CB that doesn’t print, and the worlds largest SWF, all the expenses of everyone in Norway could be paid for 60 years just out of the SWF.——- This is not financial advice you will lose all your money if you follow it.

What’s SWF ??

Sovereign Wealth Fund

Sovereign Wealth Fund

Is there a Delphi Oracle drifting about in the WS ether that in 20 words or less explain what the BOJ move means and for a bonus what the Chinese Evergrande Junk Bond collapse means. I have not a clue.

Your first – article May21 in Nikkei Asia on semiconductors Japan chip material makers ramp up output in South Korea and Taiwan. Waĺl street on Parade article title starts 248 china – to your latter.

A lot of Dollar and Euro holders will be looking for more stable currencies to invest in. Apparently some CB’s understand that and want to make their currencies more attractive. One side effect will be that those currencies gain value against the Dollar and the Euro and that might be bad for trade. But I’m sure they have made some calculations that tell them this is better then to play the game following the ECB and FED tactics, which will impoverish their populations ever more as the game progresses.

It feels like the ECB and the FED are trashing the Euro and the Dollar as if they know they will be replaced by something else anyway. Other CB’s seem to opt-out from this path. Just a guess based on a hunch.

There will come a time, perhaps soon, when countries will be competing for stronger currencies. They will be competing for limited resources on the world market. It really doesn’t make any sense to thrash your own buying power in a finite world!

Yu…

“Strong countries have strong currencies.” Stephen Forbes.

He was right.

This sport of depreciating your own currencies to pump economic numbers is coming to an end.

And that “sport” is the driving force behind CRYPTOs.

What is different between the inflation of the late 70s and the current inflation?

In the late 70s we had a Fed that FOUGHT inflation…

now we have a Fed that PROMOTES inflation….what happened?

Dereliction of duty by Fed Chairman…starting with Bernanke, followed by Yellen and Powell.

Wolf, you have crossed the Rubicon from serious financial analysis to unjustified criticism!

The Swiss are doing what they always have, which is to protect their citizens. ‘The racket’, ie the way they have controlled the value of the Swiss Franc has so far ensured that their export industries remain competitive. It also yielded a $48 billion windfall for the first half of 2021. Much of this sum is distributed amongst the Cantons and which helps to keep my taxation down.

Does the FED give a fig for you?

I rest my case. Thank you for confirming: A racket is good for the racketeer.

Lots of gold buggers here. The Japanese central bank owns almost all of the debt. It can do whatever it wishes with that debt. They could wipe it all off the map without affecting in any significant way government spending. The most important word governing economic health is absent in this discussion; Resources. Do you have any, or not? Instead, 90% of the discussion here boils down to ‘swapping financial spit.’

Won’t Honda and Toyota prices spike in other countries? I would think, yes. Does this resemble the 1973 OPEC oil spike in some manner, in terms of sending shock waves across the bow of USA consumers? Are the USA masses about to be exposed as consumer-(supposed) emperors with no clothes? This would circle back to suggest, Japan finally throwing up its hands (like 70s OPEC) and pulling the plug on the old order? I just don’t see what Japan’s next alternatives for export are.

Wolf, I’m guessing you do not mean “monthly” on the 2nd graph?

I re-read the 2nd paragraph, and it looks OK to me. There is no “monthly” in it. It’s a “three-month moving average,” meaning three months added together and divided by three. Maybe I’m not seeing what you’re referring to.