At the current rate of outflows, the out-of-money date is in mid-October. “Extraordinary measures” might extend it into November.

By Wolf Richter for WOLF STREET.

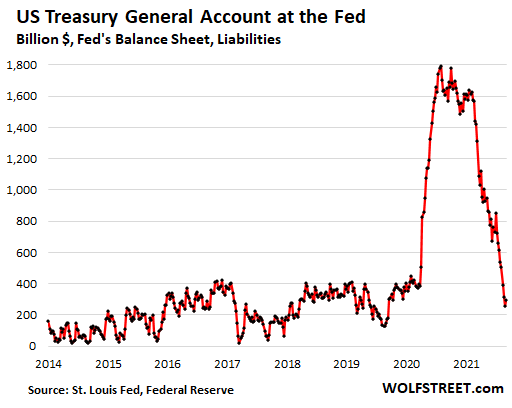

The balance in the US government’s checking account, the Treasury General Account (TGA) at the Federal Reserve Bank of New York, plunged by $240 billion since the end of July, to $297 billion, according to the Fed’s weekly balance sheet.

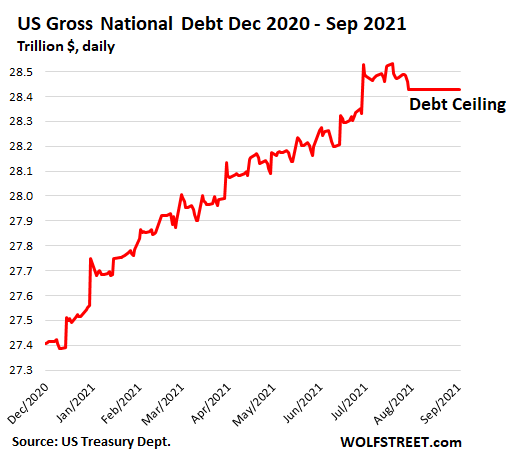

On August 1, 2021, the amount of the gross national debt outstanding, a monstrous $28.43 trillion, became the “debt ceiling” that cannot be breached until Congress raises it, suspends it, or changes the definition of what “debt” means, as it has done 78 times since 1960. The government is now paying for the deficits, not by issuing new debt, but by drawing down the TGA and by using “extraordinary measures” (more on those in a moment).

At the rate of decline since August 1, the TGA balance will hit zero near mid-October. This out-of-money date could be extended by “extraordinary measures” into November, which is when the US government would begin defaulting on its bills:

The TGA has been through huge gyrations. In the spring 2020, the Treasury Department issued $3 trillion in new debt to fund the biggest stimulus and bailout programs in history, but spent only part of it, and the TGA ballooned to $1.8 trillion by July 2020. In January 2021, the Treasury Department began drawing down the TGA by reducing the amounts it borrowed to bring it back to the normal range by summer.

During the “Debt Ceiling Farce 2017,” just before Congress lifted the debt ceiling, the TGA had only $39 billion left in it.

Given how huge the daily US outlays are, that was uncomfortably close to zero. This time around, the outflows are vastly greater, and associated with much more uncertainty.

So now we get to watch “The Debt Ceiling Farce 2021,” as it unfolds before our eyes. The suspense is in how close the TGA will get to zero – the moment when the government begins defaulting on its bills – before Congress raises the debt ceiling.

But the ending of the farce is already known. Congress will avert default more or less at the last minute, as it has done 78 times without fail since 1960, after everyone got through extorting concessions from the other side.

It’s a farce because Congress appropriated the funds to be spent and to be borrowed, and told the Administration in detail how to spend those funds, including on all the pork-barrel spending for each member of Congress, and then Congress said: No, you cannot borrow the money we told you to spend.

It’s nuts, and foreigners look at this farce with befuddled amusement as one of the quirks that the crazy Americans invented as part of their messy politics.

However, the debt ceiling never ever reduces deficit spending. That’s decided by Congress. But it temporarily limits new borrowing until Congress decides that it’s time to raise the debt ceiling again.

If Congress doesn’t raise the debt ceiling in time, the US government would begin to default on its bills, and financial markets around the world would have a hissy-fit of historic proportions, and every member of Congress, the richest on top, would lose a massive portion of their assets in a matter of days or hours. And that’s precisely why these honorable members of Congress will never let this happen.

Since August 1, 2021, the gross national debt outstanding has been locked in at a monstrous $28.43 trillion. The US government cannot add to it, but it can refinance its maturing debts:

During this debt-ceiling farce, the Treasury Department is allowed to use “extraordinary means” to keep the government from defaulting. On August 2, Secretary of the Treasury Janet Yellen explained to Congress what the first of these “extraordinary measures” would entail: Raiding the contributions made by members of three big federal retirement systems, the Civil Service Retirement and Disability Fund, the Postal Service Retiree Health Benefits Fund, and the Government Securities Investment Fund (G Fund) of the Thrift Savings Fund that are part of the Federal Employees’ Retirement System.

At some point, as money runs low, Yellen will inform Congress of other “extraordinary measures” she will take. And then, the extraordinary measures that can be taken will have been taken, and all the money the government has left is what is in the TGA.

So we’re going to watch what’s left in the TGA to see how close it will get to zero before Congress votes to lift the debt ceiling.

In the days after the debt ceiling is lifted, the government pension funds will be made whole. And then new debt gets issued, and the gross national debt spikes to make up for all the lost time.

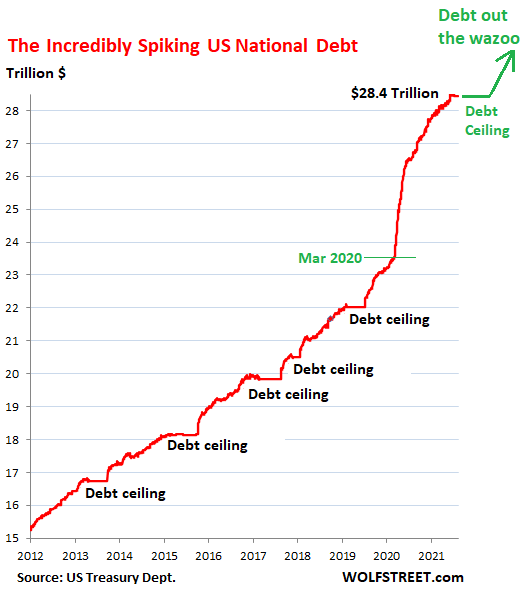

And for your amusement, I’ll get to write another post-debt-ceiling article, as I have done in prior years, with headlines like in 2015, “Gross National Debt Spikes by $340 billion in One Day.” But in 2015, the debt was $18.2 trillion. Now it’s $28.4 trillion, and the deficit spending is much huger, and the spike in the debt after the debt ceiling is lifted will be a sight to behold.

Already, it’s a burning question in these crazy times: Who Bought the $5 Trillion Piled on the Monstrous US National Debt in 15 Months?

For your further amusement, this is the monstrous US gross national debt, along with the ridiculous debt-ceiling flat-spots since 2012:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Perpetual movement machine, yes it does exist.

Wouldn’t it be more of a perpetual notion machine?

precisely why these honorable members of Congress will never let this happen.

really mean ‘corrupt’ congress

Members of Congress, with rare exception, are little more than corporate lobbyists masquerading as political leaders. President ( insert name here ) is no different.

The fight will eventually be revealed to be over taxes upon the ultra-rich, who have avoided paying US taxes for years and want that legal avoidance to continue. That way, the US will be on the road to become the pure kleptocracy of the banksters’ dreams, like the CCP’s mainland China with its arks of doom filled with gold and wealth stolen by the CCP crooks from the Chinese people hidden all over the world.

Just remember that most of the ultra rich’s “wealth” is in the form of assets, the value of which is propped up by the credit bubble, ZIRP, QE, etc.

If that collapses, the tech billionaires $100 billion goes to $20 billion. That’s not to say that the tax system shouldn’t be fair, but just that this perspective shouldn’t be ignored.

They still borrowed hundreds of millions against the portfolio at the peaks. Which they paid less 1% on, pretty great tax rate. So tired of hearing “iTs iN StoCKs” ok how do they purchase these 100M mansions on their $1 a year salary? Surely they are spending this money somehow right?!

Great info as usual Wolf! While the Japanese started the MMT train in 1990, we now have most of the world’s largest economies doing the same experiment as Japan. My take is there will be a lot of financial pain and the poorest will be worse off.

If America continues to worship the (M)agic (M)oney (T)ree permanently like Japan, I would love for anyone to explain why there is any need to collect taxes of any kind (beyond the usual reason of controlling individual and group choices). Would not having zero taxes be fair at that point if money has no time value and thus becomes “free” (which also means labor has not time value as it is currently tied to USD)??? Would not the hidden “Stealth Inflation Tax” act as a equal opportunity tax on all entities buying products and services, and thus replace the need to continue the quasi productivity tax via income wage/labor taxation?

I use to think a Value Added Tax (VAT) could substitute for the income/wage taxation best (along with a 99% wealth tax on incomes above say $50 million and apply that money into carbon capture technology on a global scale). But now with the Fed printing money to infinity and beyond, the stealth inflation tax is already substituting for both the income/wage tax, and currently acts like a VAT on each end every type of monetary exchange across the entire globe. Is not inflation the most pure and omnipotent taxation to rule them all…

If we are going to destroy the value of the USD, why would any govt want require citizens to pay back worthless USD paper…what is the point of such curious experiment other than population control? Are the current day pharaohs just keeping the wage/debt slaves distracted building digital USD pyramids that will not stand the test of time…

It is not just the USA, it is all Central Bank in the west printing money at the same rate so it doesn’t devalue the US dollar against other currencies; just all currencies are falling together.

Saying that, for some reason gold still is low that logically doesn’t make sense.

But nothing seems to be logical anymore.

There is a need for taxes because the government wants power to give (via free printed money) and take (via taxes). It’s a higher level of control.

It’s modern monetary theory in action. The theory says money can simply be printed to solve our economic ills.

Just one request for the MMT theorists. Tell me again how you deal with runaway inflation without triggering a massive crash in asset prices.

The real issue, which Wolf barely mentions here, is who is going to buy all this debt and more important, at what interest rates?

My guess is that the Treasury will start to auction debt and find that as they try to raise huge sums, the market begins to demand much higher yields to absorb the debt. Since the Federal Reserve is boxed in by higher inflation, they cant just have the Fed buy more than the $100 billion they are already buying. So who buys it? Japan – not anymore. China – no they are selling. Domestic banks – they are up to their eyeballs in the stuff.

What people also dont talk about is the knock-on effects of needing to raise a ton of capital at market rates. As yields begin to rise, bond prices rise. So investors in bond funds see losses. What does that do? It encourages investors to pull money out of bonds, which means that yields must rise to find buyers. Then what happens next? The uptrending support lines that have been in place for bond prices break-down through support and the 30 year trend of the bull market for bonds breaks down. Ok, what is the next knock-on effect? Well, instead of paying lower interest rates on newly issued debt, the US government begins to pay higher interest rates on newly issued debt, so projected interest payments start to balloon. So what does that cause? Larger budget deficits and a crowding out of spending or the need for larger budget deficits.

The net-net of this whole thing is that central bankers have been getting short term gains for long term pain, but the reversal of this market is going to be very painful for most. This is setting up the “sell everything” market where it all falls at the same time. Bonds, stocks prices, real estate, bitcoin, everything. Sell it all. Sell it fast.

The only thing that offsets this down-cycle is that there is still a ton of negative yield debt in other countries that makes higher interest rates in the US more attractive relatively. So I would guess that the negative rate bonds will scream much higher in this process, as investors sell that debt to buy higher yielding US debt. As a result, the dollar will see a rebound in currency markets, as investors sell foreign currencies and buy dollars. I havent looked at the total amount of that negative yield debt to see how much of a buffer that will provide versus the amount of debt we need to sell.

The US is still the most trusted country for your money, so I think that the need to sell massive amounts of debt in the US will actually hit debt in foreign countries and in lower credit debt harder than it hits the US Treasury market. Treasuries will indeed move higher, but then the higher yields will start to pull money away from lower rated credit and lower yield foreign government bonds into Treasuries.

So many countries around the globe are all raising interest rates at the same time and that will be the next source of crisis/trend. Much higher cost of debt will also kill some companies that are over-leveraged/ unprofitable and companies with earnings that are largely projected in the distant future.

Will the implosion of the debt bubble also impact real estate prices? Seems likely. All that debt that is financing overpriced real estate could get hit very hard.

What should the central bankers do about this? Nothing. Let it all collapse and revert to normal economics. Discredit the MMT economists once and for all. Of course, that is highly unlikely. They will need to find a way out of this mess for the rich and powerful, like increasing taxes on the middle class.

“What people also dont talk about is the knock-on effects of needing to raise a ton of capital at market rates. As yields begin to rise, bond prices rise. So investors in bond funds see losses. ”

I think you meant to write rising yields equate to FALLING bond prices and thus the losses. No?

Don’t underestimate the effectiveness of money printing. If asset prices dip, they can just print and spend more money to keep the economy going. Deficit spending and QE are here for a long time. It’s actually sustainable for a long time if you print just enough money to offset natural deflationary forces in the economy. If inflation arises, you back off a bit and print less.

The main problem with money printing is that the wrong people get the money – the scammers, the front-runners, bail-out recipients, the business lobbies, the war machine, various meritless welfare recipients, etc., and that will eventually create enough friction and resentment to stop the train at some point.

The central bank had a goal and it is the opposite of the person that desires financial security.

Dave Ramsey has a simple plan for financial independence, although there are other ways. His is be aggressive about getting out of debt, live below your means and invest 15% of your earnings. It’s pretty much a slam dunk for obtaining financial security over a couple of decades.

Federal Reserve desires just the opposite for citizens. Get in debt, live beyond your means and don’t worry about your future.

You are assuming people can have surplus budget. My understanding that this is unattainable for at least 50% of the country at current wages.

But it seems nobody is willing that this true. back 2008 this rate was about bottom 30%. I think once rona settles it will be pushed up to 70%. as in 70% of US will be breaking even on living costs or going into debt. The only way to avoid this is NOT to have children. That’s how i was able to pay off student loans and accumulate a little something but how long can i keep this up. I am a middle aged man with a middle aged woman, she is ready…

And the trillions transferred in QE has led to investors running through the housing market looking for alpha, so now housing is unaffordable to many people as well.

I have only two questions for people who say they cannot save money. Do you have an iPhone? Do you buy your coffee at a coffee shop?

If the answer to either question is “yes”, you do not have a saver’s mindset.

Why would you want a saver’s mindset? To earn 0.1% interest and fall miles behind inflation? You need an investor’s mindset. $5 per day on coffee can never touch the gains you can make from stonks like GME.

“I am middle aged man with a middle aged woman, she is ready………..”

Why would anyone want to have children in this society and with their future?

Without children you will have no purpose or motivation to work harder and earn. For most, children are the greatest motivators of ones entire life. Maybe that’s the reason you don’t have enough.

I would like to hear Jeff Booth interview with Wolf please. Can you do a book review article Wolf? He is making the podcast rounds. Saying we need to allow deflation to occur as its a natural outcome of technological production improments. But we have a hard target of 2% inflation. Which leads to money printing madness.

Bobber. Isn’t the cure for triggering an asset crash to never have allowed the bubble in the first place? Just like the cure for the national debt would have been to tax money back and not let it accumulate at the top.

Everyone is complaining about a housing shortage while houses are being snapped up to create vacation rentals. The cure is easy, raise property taxes on second homes 4-10x. This promotes owner occupied home ownership, but curbs speculative excess.

Az used to have a two-tier property tax system for real estate. 6% for owner-occupied and 10% for investment homes. I don’t know what it was for commercial or industrial.

Then they changed it by increasing the owner-occupied tax up to 10%.

Florida has sort of the same thing…

Although the tax rates are the same, owner-occupied residences get a homestead exemption while non-owner-occupied residences do not.

Pretty easy to steal retirement savings of working class people in digital monitization press a couple buttons retirement savings social security gone or reduced while we let them do it pathetic

Given how much the Fed now owns of US govt. debt, the Federal govt. now has another method to extend default – selective default to the Federal Reserve. This can probably buy them another year of extensions.

Thanks for pointing out there are no fiscal conservatives in congress. The only thing that divides them is what they spend it on.

Of course, the next farce will have a stimmie for the downtrodden. They have to buy votes for the midterms. And some tax cuts for the super rich, because they need the extra money, to use to impoverish the rest of us.

What did someone say here the other day? Repubs look after the top 1% and the Dems look after the top 10%.

It’s like Aladdin’s Lamp. You rub my back, I’ll rub yours and poof, may our wishes come true. Every year.

Top 10% is the modern working poor, good sir. It is hard having to buy 1milly house inside the beltway, day care expenses, health care too, 401ks. At least these people are generous enough to eat out and shop, otherwise the servants would be starving and homeless…

Fiscal conservative, how do you define that? Except for a couple of rough areas (panics, some say engineered and deliberate), 1907, 1921 (stand out, there were many others), America ran on gold and silver as a monetary base. It didn’t hurt us then; we grew strong. Was America goldbug or silverbug, back then, going back to the Money Act of 1792? Because we have been weaned off metallic money (America is getting weaker) and every time I mention gold or silver to get back on fiscal track, the slurs come out: goldbug; silverbug. The cult programming against gold and silver is the reason we will never see fiacal sanity again. Yet fiat paper money is like communism: never worked right anywhere, yet everyone believes it can and will work right if you just find the right secret sauce (hint: there is no secret sauce).

TS,

If you are pricing your bug asset in fiat money, what difference does it make?

Please explain how keeping score in dollars, oysters or bushels of corn is making your gold or silver superior to anything else…

The minute you convert to whatever exchange is revelent today, isn’t it a wash?

I just don’t see it…

Petunia: agree. The empire minted coins with less and less gold.

Everyone knew this but as the power of the state grew, it could command them to be accepted. ‘Fiat’: Latin ‘command’

So we get ‘seigniorage’ or this govt privilege of giving a piece of metal a higher value than intrinsic. A privilege it guarded with the death penalty for ‘coiners’

‘With the mass production of currency, the production cost is weighed when minting coins. For example, it costs the United States Mint much less than 25 cents to make a quarter (a 25 cent coin), and the difference in production cost and face value (called seigniorage) helps fund the minting body. Conversely, a U.S. penny ($0.01) cost $0.015 to make in 2016.[1]

Guess you could say taking a piece of paper and printing $100

on it is where that leads. So there is now zero intrinsic value, all that remains is the fiat, but the fiats or ‘commands’ of the US have doomed powerful empires.

As to why gold instead of oysters to reply to another comment: All gold once refined and poured is the same. Oysters vary.

Gold never changes, it can lay in salt water for centuries and emerge clean and shining (not silver) Oysters change.

It is very rare, and rich new discoveries are dwindling. Oysters are plentiful and renewable.

Gold is extremely compact or dense, about 1. 5 times heavier than lead. This makes it convenient to transport (and to hide)

So as means of storing and exchanging wealth, it is not bad.

You are ignoring the debasement of gold and silver coins during the Roman period. Your dependence on the idea of metals being rare and therefore, always more valuable is a myth. Debasement of any money comes from corruption in government, whether paper or metal.

The elephant in the room are the people which we keep electing over and over, even though we know they have lied to us, over and over.

You can’t debase gold, at least they couldn’t having no access to tungsten. At 1.5 times the density of lead, nothing else is as heavy. This was how Archimedes proved the crown, supposedly of gold was alloyed with cheaper metal. He could weigh the crown, but how could he find its volume. By immersing it in water and seeing how much the level rose. Of course, you could probably fool an average joe by covering lead with gold foil or paint etc. but this would never pass proper exam, even in Roman times. You certainly couldn’t fool the world’s central banks who used gold as money until Bretton Woods.

The offence re: gold coins was filing them, thus the little ridges around the circumference to deter that. Newton, in his day job as Master of the Mint, once had a filer dis-emboweled.

Silver, very different. Silver reacts with other elements, unlike gold. It is not as heavy as some other metals. So making a shiny coin that is only 80% silver is not easy to detect. Silver has been the favorite target for debasement.

In the late 18 hundreds there was an attempt by some countries, The Latin Union, to fix the value of silver coins vs gold at the high value of 14: 1. This broke down when govts began debasing the silver coins, one of the parties being the Papal States.

Gold IS rare and can be exchanged for any currency anywhere in the world with very low transaction costs. Of course low cost refers to bars and does not apply to jewelry which is usually not pure gold.

Petunia,

That debasement of coinage was a form of fiat currency, wherein a newer, crappier coin was deemed by “a higher source” (government) to be the same value as the older coin. Same shit, different millennium.

Pet,, and the crunch:

EXACTLY correct on both counts and comments, and I just add another ”kudo” to Pet, and and a new one for crunchy:

Thank you both for increasing my knowledge of all the very clear crimes of the so called fed, and all their obvious enablers, may they all rot in hello…

PS: the standard money of the Roman Empire was the silver denarius. About the size of a quarter, it was originally very pure with about 4.5 gms silver. By the end it was only 5% silver. Then an Emperor had an idea: he gave it a face value of 2.

In the modern era, the entire Industrial Revolution, from the first primitive steam engine to AC power. was done under a gold standard. Britain had close to zero inflation for over a century.

Soooo… were gold and silver chosen because of an intrinsic value ( once again, we’re talking about it’s worth what someone says it’s worth), or was it used for durability, prettiness, and availability?

Don’t think Caesar knew what platinum was back then…

NK,

Gold coins in the Roman period were regularly debased by making them lighter and lighter. Gold coins had differing weights during succeeding reigns. Therefore, you can debase coins because the holders tend not to know the exact weight of every gold coin. Remember these people weren’t speculating in gold, they were transacting regularly or holding them as wealth.

We will never go back to a gold standard. Going off the gold standard removed restrictions to printing money.

If we were still on a gold standard we would never have been able to fund all the CIA and military incursions of recent decades.

Wolf,

You call the debt ceiling a farce and operationally it is (debt ceiling hiked 78 times).

But…it does have the significant virtue of perpetually bringing the whole debt *level* issue to the fore, over and over again.

The most disgustingly corrupt and degenerate things in DC are done in the dark.

Without the debt ceiling limits being publicized again and again (and again) the debt *level* would be even *less* discussed publicly than it currently is…and therefore the problem would be *even worse*.

It would be just another DC monster lovingly handfed in the dark, tended to only by the high priests of MMT.

They would just say over and over (and over) again, “nothing to worry about, we can handle it, and, in fact, it is good for you.”. This mantra would be repeated over and over again until the actual day of collapse.

(See US military and 2 20 yr wars against non-industrial foes).

@c127

If they didn’t laugh out loud at themselves after reading this article, they would have to be severely rationally impaired.

Maybe that’s a characteristic of going into politics for a career in the first place.

Farce??????!!!!!! This “farce” is extremely useful for me and my homies in Congress to continue our run in power!!!!! Hahahahahahahahahaha!!!!!

“Extraordinary measures” do that include the tax man from Hagar the horrible? Just go and collect the necessarry founds from whoever have them?

Then we reach a point where no one wants those dollars and the debt ceiling crisis might provide cover for that. Then the government would issue script, like the old ration books in W2, or perhaps IMF starts handing out SDR, though it was never intended for the lumpen. Politically its a hot potato and neither party wants the blame for shutting down government. That was probably the most ignorant thing the last president did. So pile on more debt but the only takers are grifters and scam artists then you are near the end.

Ya it will take a run on the greenback. One way of ranking a currency is oil-equivalent. Every time the US prints a $100 it can trade it for about 1.25 barrels of imported light crude (Brent) As long as that continues…party on!

you mean like this? The Board of Governors of the IMF has approved a general allocation of Special Drawing Rights (SDRs) equivalent to US$650 billion (about SDR 456 billion) on August 2, 2021, to boost global liquidity

@G

Got it in one Geo

So long as they are all in it together, they can keep it going forever.

In the old days, individual countries doing debt monetisation got hammered by ruthless devaluation, but if they all monetise together nobody gets hammered relatively.

Unlessl somebody breaks ranks (China??? Russia???)

Russia??? In early 2015 the Russian CB rate hit 17%. Do you recall a world- wide scare about rates rising along with it?

This was the tail end of the 2014-2016 Ruble crisis, not the 1998 Russian default.

Russia is relevant for nukes and oil, its currency and interest rates are close to irrelevant. If the Bank Of OZ or even New Zealand raises rates, this is relevant to other central banks.

@NK

I think you may have missed my point.

Which was, that there is no ‘sound’ currency when all countries print money together, therefor there is no place for an investor to go to preserve the value of their money. Nobody can escape the tyrany of inflation. I’ve said I’m too old for BTC on many occasions but that is what BTC is all about for those that get it. Anti-fiat.

By, a country “breaking ranks”, I meant NOT printing money and I made the mistake of mentioning Russia and China solely because IMO they are currently furthest from western hegemony and most likely to try to buck the current Swift sanctions cabal.

I think I’m on a loser for Russia and China here so I think I’ll give up.

GDP has grown around 47% during this period. Adjust for GDP, and the debt problem is half as serious.

When you are the bottom 80% and living hand to mouth, government propaganda stops working.

But tell us about how much over asking people are paying for Cali real estate this summer.

It’s not people paying over asking, it’s mostly LLCs used by hedge funds to obscure the mega landlord empire. Eventually, they will price themselves out of business.

Ma’am, in this here country an LLC is a person for freedom of speech purposes, at least, and sometimes for taxation but thats optional

Let them get bankrupt, love to see it, who made our life a hell.

Meanwhile in China, they are pushing for a more equitable distribution of the wealth. Nothing makes the people more loyal than being better off this year than last year or ten years ago. The rich will still get rich in China. They might have to limp along on 5 billion instead of 10 billion. There will still be plenty of incentive to make capitalism work. Companies like Apple (Alphabet) have nearly a trillion dollars. They have so much money that they have to hid it in Ireland and other boltholes.

No Rody!

You’re sorely mistaken there my friend, the Chinese leadership is Not in the business of making its own people feel better this year than what they were in the last.

The Chinese government is clipping the wings of the likes of Ma and the other Chinese oligarchs , just a lesson learned from Mr Putin.

The consequences of having a population that demands more each year can be extremely dire for the politburo in the long run.

and they are Not about to make that mistake.

Everything in China is heading towards an economic and fiscal failures , that are driven primarily by the short term objectives of the leadership to subjugate and control inflows and outflows of capital , a game that will spill disaster to the Chinese financial markets.( quote me on this , if they don’t reverse their trend sooner rather than later)!

On the other end of the scale, the clamber of these Chinese billionaires to tow the communist party’s line

“ in sharing the wealth “,

is but a token meant to avoid the

“ head of your horse”

treatment that is meted to whoever disobey the orders.

Make NO MISTAKE, China is Not an economic Nirvana that you should look up to.

In saying that, the American citizens have to make their government accountable to the myriad of policy failures and inadequate foresight.

For a nation that purports to lead the democratic, free market capital nations, America, “sadly”is doing an appalling piece of work.

Jack Ma relinquished “ownership of Alibaba’s legal structures” as reported in the financial times. Others also have lost huge portions or most of their fortunes in China due to the jealous CCP cadres, e.g., in gaming and tutoring industries. Thus, mainland China does not have capitalism and most, legitimate investors will soon flee it.

We also do not have capitalism, because connected banksters can gamble in US finances for YEARS, sell trillions in garbage securities to gullible or bribed pension administrators using fake AAA ratings from their corrupt, credit-rating agency cronies, (while betting that those securities will never be paid via derivatives) then get bailed out by secret TRILLIONS of dollars from their privately-owned “Federal” Reserve, which refused for years to disclose such bailouts. That is not capitalism: that is a kleptocracy or oligarchy.

As to Apple and other entities, they are actually seeking to avoid US taxes, because there has been a GIGANTIC, tax loophole for DECADES excluding their foreign income from all US taxation, so long as they kept it out of the USA. That is why most US factories AND manufacturing jobs were moved to other countries, and due to the slave-labor, subsidized factories, ultra-low interest, CCP loans, permission to pollute, etc., those jobs eventually ended up in mainland China, whose leaders are more immoral than the Cosa Nostra, Triads, or Yakuza ever were. (Of course, the CCP’s links to the “red mafia” helped.)

Apple had a lot of money because someone gave them money for their products usually at a premium price. If they don’t pay taxes legally that is not their fault, but Congress and IRS. I don’t have Apple products.

Responding to Old School,

Sure, and Apple never spent a dime lobbying to ensure that its profitable, tax avoidance loophole was untouched. A website called statista disagrees.

On another subject, to those who claimed that they would make money in mainland China, read about what is now happening on Sept. 7 to Evergrande Real Estate Group.

Jack: Interesting take on China, so Xi Ji is trying to get out in front of their populist backlash, by giving a slap on the wrist to China’s Wall St? I wonder if at some point they try censoring him. He wants to make every student read his philosophy, I can guess how that plays in the board rooms. Do they call this guy a Mao impersonator, and who wants another Cultural Revolution? Anything that hurts China GDP is not going to be policy for long.

When Reagan took office debt was 1 trillion. The real economy is not 28 times larger. Prob is every time the gov spends, it adds to GDP. There is no necessity for an actual ‘product’ and increasingly there is less correlation with even nominal GDP. All the stimmy money adds to GDP.

@NK

” All the stimmy money adds to GDP.”

Can you spell out precisely how it does that?

Auldyin,

When the stimmie money gets spent, it becomes part of consumer spending, which is the biggest part of the GDP formula.

When the stimmie money is saved or used to pay off debts, then it doesn’t become part of GDP at that time.

‘Understanding Gross Domestic Product (GDP)

The calculation of a country’s GDP encompasses all private and public consumption, government outlays, investments, additions to private inventories, paid-in construction costs, and the foreign balance of trade. (Exports are added to the value and imports are subtracted).’

Investopedia

I entered ‘what is in GDP’; to get that. So virtually all expenditure is in it. I think the stimmie will count at least double. It will count when the govt outlay occurs and then when recipient spends it ( consumption )

My fav for GDP. A recession is defined as 2 quarters of neg growth. A few years back the UK narrowly missed a predicted recession. It was a cold winter and fuel bills were just enough to push GDP slightly positive.

The people were worse off but they ducked a recession!

You could miss one anytime by leaving windows open.

You got me, W.

I suppose I was being a bit cheeky.

If I wanted to be even cheekier I could say what happens to the stimmies that add to the deficit for LG tv’s, in which case they could actually reduce gdp. Just jossin’!

@NK

Spot on but it’s easier to deal with as a formula.

C+I+G+(e-i) = V*P= Gdp

Stimmies could end up in C or I which is +

but they could also end up in i which is a –

V is physical output which is what counts in the real world but P is the big variable which connects the money world to the real world, if it goes up we call it inflation, if it goes down we call it deflation. All these Phd’s spend their entire lives trying to figure how the money world can influence and control the real world.

Just sayin’

SocalJim,

There is NEVER a debt problem because the Fed can always print the government out of trouble as it has done since March 2020. The problem this causes is with the currency (loss of purchasing power). Not right away. But eventually. And now, “eventually” has commenced.

This is just money to pay the bills we already incurred, and the economic growth we stimulated. Economic growth lags the growth in money supply. The 1980s were the first really huge expansion of government deficits, but the economy and stock markets didn’t react until the mid 90’s. Then the deficit gap closed in the late 90’s but the debt rolled on. It’s possible to close the debt gap if they shrink the money supply, but the immediate hit to markets and economy would be catastrophic. Obviously the only way to escape is deface the currency, which will require expanding the dollars usage, and that means more and bigger wars to spread influence and create the illusion of empire. Now the empire is the dollar.

Ambrose Bierce said : “It’s possible to close the debt gap if they shrink the money supply,”

—————————————-

How do you close the debt gap by shrinking the money supply?

For as long as you can pump credit – a.k.a. ‘demand’ – into the system without crashing the value of money, GDP can be pretty much ‘whatever you want it to be’.

Where would GDP be now without the $5tn of covid ‘stimulus’?

Each $1 of GDP “growth” has been bought with upwards of $3 of public and private net new borrowing over the past twenty years. Even that metric excludes rapid expansion in shadow banking “assets” (= liabilities of the nonfinancial economy).

Debt/GDP is a distorted measure, because its components are not discrete, i.e. increases in the former inflate the latter.

@T

Good point

What’s worrying is that, as time goes on, it is taking more and more borrowed dollars to produce a dollar of Gdp, currently around 5 to 1 I believe.

Borrowed dollars need not have anything to do with GDP.

(copyright)

I am having a hard time with this. If we can’t stop debt at current level and have a functioning economy does that mean that we are in a death spiral? I think we are close to a Minsky moment. Maybe months or a hand full of years, but somewhere before 2034 when social security starts hitting the wall the gig will be up.

Social Security and Medicare are already cash flow negative, meaning they are already paying out more than they get in payroll taxes.

Thanks for the laughs, Kenn!

Considering Dick Cheney’s two (2) bloody and expensive failed wars, Dubya (baby bush the lesser)’s disastrous tax breaks for the wealthy (first Prez to start a war and cut taxes) AND Trump’s disastrous tax breaks for corporations and the 1%…..WITH ALL OF THAT, you’re still gonna try to peddle some lies about the 2 most successful public programs in US history?!!

You decide two (2) things that actually help regular people is what you want to complain about?

Next time try fact-checking instead of just regurgitating what Rupert Murdoch told “tucker” to tell ya’…..

You bring up fact checking, yet you dodge the core of what Kenn said, which is 100 percent accurate. In fact, social security has been cash flow negative for quite some time.

Second, Dick Cheney and George Bush had authorization from Congress to conduct the wars, called the AUMF. Coincidentally, Biden voted for both of them, which were later used to conduct offensive military operations in 19 countries under both Obama and Bush administrations.

Lastly, while you can’t fact check opinions like your assertions of “disastrous tax cuts”, I would point out that federal income tax receipts increased every year under Trump’s presidency. Not saying they were good or bad, but maybe tone down the rhetoric a bit.

No decent…

Zerohedge had an article yesterday that showed the cash projections for social security. We are at the apex with a slow rollover that will be minimal for two or three years then start accelerating like a roller coaster cresting a hill. It probably can get kicked politically to 2024 election, but will need to be patched up before 2028, maybe 2026.

Nonsense. SS and Medicare not “successful” in any sense other than that they’re popular, as people love getting free stuff paid for by other people. SS and Medicare are middle class welfare. Even if the taxes paid in were invested (which they’re not, it’s a pay as you go system with any surplus used to purchase treasuries), most people drawing draw far more than contribute.

It’s a classic ponzi scheme which requires more and more people paying in.

Werd!

A Ponzi scheme is defined as an intentional scheme where investor money results in profit from a legitimate business enterprise but its investors are actually paid from other investor’s money. It is deception and a fraud.

SS was designed when the US economy was on its knees in recognition that it might be prudent to set aside money for hard times for the less well off. One may disagree with government mandating such a requirement for business and individuals, but after nearly 100 years, the program can be evaluated on its merits without equating it to an investment fraud. Maybe, if the US middle class was now firmly transitioned to all those high paying “information age” jobs they were promised long ago (promised in exchange for losing those mind-numbing living wage manufacturing jobs), SS would be laden with a surplus to support those less fortunate for the foreseeable future. It hasn’t turned out that way though, but we still may want to make changes to keep our commitment to that safety net.

@n

Saw the first estimated total bill today for Afghanistan, Caleb Maupin on RT International (censored for you I think) $16k for every man woman and child or $64k for an average family. That’s only $26 per month if you want it on a pay as you go plan.

Uk’s share has been well hidden so far on MSM.

@n

Oops that should be $260 a month, hit wrong key

I thought it looked cheap!

Kenn,

Social Security was cash-flow positive through 2017 and has been roughly cash-flow neutral since then through the fiscal year ended Sep 2020. In early October, we’ll get the current fiscal year data, and we’ll see if it was cash-flow positive or finally cash-flow negative in that year. I’ll report on it in early Oct as I do every year.

Wolf,

Didn’t SS go cashflow negative earlier?

That article you linked was from March 2010. Not sure what it was talking about, maybe quarterly, may be some other period… I didn’t read it. According to the official data from the SS Administration, in the period the article was discussing, there was a net increase in the Trust Fund on a fiscal year basis, which means the fund was cash-flow positive for the fiscal year. I will cover the topic in early October when we get this fiscal year’s data, and you can then look at my chart going back to 1990.

And it would be in much better shape had the Fed not kept the interest rates on the government bonds in the trust fund post-inflation negative for most of the last 20 years.

Yes, that’s a massive problem for the fund. Thankfully, it had a lot of long-term securities with higher rates, but they’ve been maturing, and are being replaced with low-yielding new securities.

I read the government over the years has borrowed 2.9 Trillion form the Social Security fund. Not sure if that is correct but I have read this in several places.

————————————

Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there. Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund. But the government, thrifty group that they are, didn’t cash the bonds in, they simply borrowed the money and promise to pat it back.

This $2.9 trillion, put back into the fund, would solve the problem for another 5 or 10 years. Add to that time extension the falling number of recipients as the Baby Boomer generation passes on, and that number can be extended even further. That leaves the question of whether Congress can put the money back without damaging the national budget.

So how has Social Security gone from being such a successful program to an outright mess? One postulation is that the federal government is to blame.

You see, the Social Security program has accrued close to $2.9 trillion in net cash surpluses since its inception, with nearly all of this amount being generated over the past 35 years. Put another way, the program has collected more money than it’s expended every year since 1983.

Where is this money? That’s the big point of contention. By law, these net cash surpluses are required to be invested in special-issue government bonds and, to a lesser extent, certificates of indebtedness. In return, the federal government gets access to $2.9 trillion in borrowing capacity that it can use for normal line items in its budget. In other words, Social Security’s Trust has $2.9 trillion in asset reserves, but not a red cent of cash in the vault, so to speak.

ru82,

“I read the government over the years has borrowed 2.9 Trillion form the Social Security fund. Not sure if that is correct but I have read this in several places.”

This is always so hilarious. The quote you cited is from a braindead author, to be precise. Yes, the government borrowed from me personally because I have some Treasury securities. If you have a bond fund in your portfolio, the government borrowed from you via the Treasury securities that are part of the bond fund in your portfolio.

The SS Trust Fund too invests its cash in Treasury securities, and thereby the government borrows from the SS trust fund. Treasury Securities are considered the most conservative investment and a very liquid one. The government pays interest to the SS Trust Fund on the Treasury Securities the Trust Fund holds. The Trust Fund is doing exactly what it should do.

Make sure you read my article in early October when I cover the SS Trust fund as the fiscal year data will then be available.

It’s not necessarily a death spiral for the economy, but it’s a death spiral for the mantra of ‘growth in perpetuity’. We’ve been using credit and monetary gimmickry to fake ‘growth’ over a very long period. In so doing, we’ve put the financial system at great and worsening risk.

If we carry on buying ‘growth’ with $3+ of net new debt, plus $3+ of other net new financial commitments, we create a widening gap between the cumulative financial promises that we’ve made to ourselves and the wherewithal for delivering on them.

That divergence leads to a point of hard (formal) or soft (inflationary) default. There’s no other way it can end.

We will go through closing the national parks and making life miserable for everyone…

Not one government paycheck will fail to out or failed to be made up.

Not one government pension will fail to be paid.

Not one entitlement check will fail to be mailed.

Last time this happened, it was due to the “government shutdown” not the “debt ceiling.” Government shut down occurs because Congress cannot agree on HOW to spend the money. Debt ceiling occurs because Congress refuses to allow the administration to borrow the money that Congress told the administration to spend.

There are years when a government shutdown and a debt ceiling farce come together. Buy one, get one free.

Could we possibly see a Republican sabotage to the Biden stimulus plan using the debt ceiling as collateral?

If Republicans in Congress cause the US government to default, the resulting crash of asset prices across the board would be a hoot of historic proportions. Not sure if Republicans want to wipe out the wealth of all their rich donors and their own wealth like this, in one fell swoop.

Sure, they will huff & puff for a while. Then extract some pork for their efforts.

If they actually went all principled, there would be at least 50 unexplained “toaster in bathtub” incidents, car crashes and small-plane crashes. They know this, apart from one or two of the Qanon candidates.

Time to shut the whole government down. Sooner rather than later. Need to send a message loud and clear that we are tired of this bull s$it.

‘there would be at least 50 unexplained “toaster in bathtub” incidents, car crashes and small-plane crashes.’

When they don’t want you to know it was them, the real masters in this field push you out a window. Maybe he was depressed?

I’m worried Congress will start selling off the national parks, etc. Like they have the American people. Heck, the national parks may already be used for collateral to China holding our debt and we didn’t even know it.

A majority of nations are deficit spending. A few are generating surpluses.

President Clinton had balanced budgets with surpluses, not Trump or Biden.

“He had budget surpluses for fiscal years 1998–2001, the only such years from 1970 to 2018. Clinton’s final four budgets were balanced budgets with surpluses, beginning with the 1997 budget. The ratio of debt held by the public to GDP, a primary measure of U.S. federal debt, fell from 47.8% in 1993 to 33.6% by 2000.” Wikipedia – public domain

It was Clinton vs. Gingrich plus the unsustainable tech bubble plus the social security accounting that got us to government surplus. Wasn’t going to last because it was built on a bubble.

And then we had a recession. When the government runs a surplus, the non government private sector runs a deficit (i.e., runs up private debt). Taxes are used to lower income inequalities, and to influence spending and investment. Example, lowering capital gains taxes retarded investment spending. Raising taxes puts more money into retained earnings (avoiding a tax), which increases investment spending.

I can’t follow any of this post beyond the first sentence. It seems the exact opposite.

Clinton did not have a balanced budget if you exclude the surpluses in the Social Security budget, which was a freak occurrence due to the Boomer generation being at the peak of their earning years.

Isn’t it pointless to try and attach economic success or failures to presidents? There’s a multi-year implementation lag for any policy, so a president’s work will not be seen during his term. Some changes are hugely beneficial in the short-term, but have great negative effects in the long-term, including policies that promote deficit spending (i.e., debt-funded tax cuts or spending). Most Republican and Democratic politicians are masters at managing that perception game. They do the tax cuts and spending, take the credit for cheap economic activity, then leave the cleanup for somebody else. Preaching to the choir, I know.

I fully agree. The President gets way too much credit for what goes right and too much blame for what goes wrong. The Democrats love to meme that “The Republicans screw the economy up, and Democrats have to fix it,” but as you noted, there’s a latency period after policies go into effect.

How does a a social security surplus impact the Federal budget?

The true farce will come when the US Government comes begging to China for a loan in RMB.

Or perhaps when the IMF gets called in to bail out the US.

You have no idea what you are talking about. If China decides to ‘cash in’ its Treasuries, all China gets is dollars in return. Which sit in some Chinese public bank, until China figures out how much to shift over to Euros or some other foreign currency, or how much Yuan or Renminbi to buy. Or they could increase purchasing of products or minerals owned by other nations.

Or they could use the dollars to buy U.S. real assets, which is what they’ve been doing.

Well, there is another scheme. China “cash in” it’s US Treasuries and use the cash for investmenst around the world. That make the US dollars circulate and shift the previous monetary inflation into product price rise, often called inflation.

This may or may not reduce the US dollar purchasing power in such a way it can be considered a devaluation.

On top of it, those foreign investments made by China can be made by loand from China, paid out in US dollars but given as Yuan, Chinese currency. Shifting debtor from the US monetary sphere to China trade sphere.

@MB

Internal debt ie budget deficit does not need to be financed externally by foreigners because Govt can buy it’s own debt.

External debt ie trade deficit or foreign spending must be financed by foreign holders via buying govt debt or buying assets. External books must balance, printing money can’t make it right like it can for internal books.

US abuses and excesses are bought and paid for by the world’s central banks that continue to accept our treasury bills.

So shut up, stop bitching, keep printing, and say thank you.

It is going to get pretty close to zero this time. Republicans are right that you cannot really expect them to have no say whatsoever on the size of the Reconciliation bill but then have them authorize raising the debt limit to cover it. When Democrats decided three weeks ago to separate raising the debt limit from the Reconciliation bill they sparked a giant game of Chicken… with none other than Mitch McConnell.

(cue Darth Vader music)

Time to get some popcorn.

Last time they were mad obama was black, what is it this time again?

I thought we dont talk politics like that here…

We will never run out of “money”. It might be toilet paper feed stock , but we will never run out. I tuned out the bloviating pablum that will soon be gushing from a congressional orifice on the dire circumstances we are in. Print it, borrow it or what the hell just lie and be done with it. While the press is warmed up better run off a few more trillion and air drop it to keep extend and pretend alive.

It is incumbent on every generation to pay their debts.

But alas, the watchers allowed the Fed to raid future generations with this idiotic debt creation….because they too got the “nod” …

I recall Motley Fool gave an “all in” bull call on the market after it had just gone from (Dow) 18,500 to about 26K…(about March of 2020)

all of a sudden they were wildly bullish.

What happened? IMO, people learned that the Fed would go rogue, and dismiss their mandates and pump and accommodate till hell wont have it…..and they did.

A decision made to dismiss historical norms and ignore mandates.

No generation ever pays of their national debts, it is almost always the next. The British issued bonds designed never to expire, perpetual interest only.

@h

“It is incumbent on every generation to pay their debts.”

That is only true if future generations get nothing for the money they become liable for. eg a historybook of Afghan occupation in US’s case. OR a complete system of hi-speed trains for example in China’s case.

It’s not what you borrow, it’s how you spend.

Just sayin’

Well, yes, but somehow, I don’t think the future generations are going to benefit from the fact that we handed our trillions of dollars so people could buy flat screen TVs while sitting home unemployed.

I am not sure about high speed rail in China. You have to be careful building infrastructure like passenger rail. If the routes aren’t really economical you build a BOAT (Bust Out Another Thousand).

Politicians usually like the flashy new project, but maintenance and operating costs are with you forever.

@OS

I’m biased, I’m an engineer (retired) and I think building physical stuff is the greatest thing humans ever do, from the Ancients onwards.

Money is just bits of paper that accountants argue over, signifying nothing in the grand sweep of time. The Channel Tunnel went bust many times but now it’s a permanent geographical feature.

For military spending, ignore everything I just said. When I see stuff that took years to build being deliberately destroyed, I despair for the sanity of mankind.

Future generations are are raided by past created debt if tose future generations adhere to the terms.

Rules change.

The longer the deficit continues the longer the USA can run a trade deficit.

The longer the trade deficit continues the more China can deplete the USA’s manufacturing capacity.

And the weaker the USA gets when jaw, jaw turns to war, war.

georgist…

EXACTLY!

21 Trillion in new debt financing what? The stock market?

To your point…..

We just don’t hear about “Trade deficits don’t matter” from the “academics”….

THEY DO…and the fact that countries with trade surpluses ascend, and those with deficits decline settles the issue.

Manufacturing, especially in national security products and industry, must return if the US is to survive. And that will be an expensive endeavor, but necessary.

Large chip manufacturing facilities being built in AZ are a step.

Hopefully the Federal Govt gets out of the way and lets free market capitalism take effect.

Werd!

The Empire looks at the hard facts that 3000 dead soldiers in Afgahanstan generated 2trillion in cash flow to the MIC/Security State over a 20 year period . Another hard fact is that Americans didn’t give a shit . This is the Cheney/Bush business model and a damn good business model for the next one on the drawing board. And it is on the drawing board and when it is launched Americans will love it. They do not know or care that de-basement and inflation is silently stealing from their future to enrich the Empire’s selected few. Only massive and I mean massive pain not yet remotely experienced will wake them up. When they awaken it will be too late. They will find they have been harvested as they always have been through history. It is their fate whether directed by a King, or a government . They must be by their hand willingly allowed to be harvested .

The Cheney/Bush business model? Weren’t there a few days of Obama sprinkled in there? About 2900 days? I guess he was too busy fixing American health care.

No, that can’t be it; he fixed health care in 2010.

OH yeah. Obama kept the Cheney/Bush franchise rolling. Look at the compensation Obama is getting for it. That was a really good harvest for The Obama clan. Best medical care the Empire has to offer was also laid at the feet of Mr Magic. When its harvest time there are no political parties.

It is WAY easier to get into a war than out. As we know from Pentagon Papers, the admin knew Vietnam was lost 2 years before the end but stayed in for sake of US prestige. Judge a Pres by the ones he starts, not the ones handed to him.

Can’t leave without noting hysterical reaction to end of Afghan mission. ‘Bloody and chaotic’ screams CNN etc.

Check out Dunkirk for bloody and chaotic.

@DD

Some say the current withdrawals, Iraq next, are tidying up in preparation for concentration on the Obama instigated pivot to China which already involves 400 bases. They’ve even pulled off the use of the NORTH ATLANTIC treaty organisation to operate in the SOUTH CHINA SEA. How Orwellian is that?

The graph above is approaching a parabola to infinity. Looks like Weimer Germany 1923. At the rate we are going we will have to replace the dollar with a new currency just like they did.

We’ll know when you can’t trade a hundred US for a barrel of Brent.

The German marks in 1923 wouldn’t buy anything outside Germany.

The foreigners look befuddled at yet another aspect of the farcical ancient system, which is badly in need of a reset.

China took a lot of our excess dollars and loaned them out to the third world rather than invest those dollars back into US treasuries like we needed them to. Great ploy on their part. Releases them from fealty to America and makes debt slaves of third world. Also, the euro zone allows their financial system to make loans denominated in dollars. When the dollar spiked temporarily at start of COVID the Fed had to issue all kind of swaps to cover foreign demand for dollars!!!

If..err— When there is a crash in world economy there will be a huge, huge, huge demand for dollars. And since dollars are only measured in relation to other currencies you are likely to see the dollar strengthen as foreign dollar denominated borrowers seek dollars to refinance or payoff their debts. Debts that are rapidly becoming burdensome as the local currency crashes. Foreign borrowers earn revenue denominated in their local currencies and use those earnings to pay back dollar loans. If their local currencies become weak compared to the dollar you best believe they will scramble to obtain dollars as quickly as possible before they get too upside down. They will offer any and every asset for sale/trade so that they can obtain dollars.

It’s perplexing but in that environment I can see the price of gold and silver drop as the dollars used to buy them strengthen (takes fewer dollars to purchase same oz). While the prices of silver and gold in other currencies spike.

I have no idea what it does to other assets like stocks and treasuries. I just imagine that a stick market crash is a trigger and once foreign markets tank and contagion spreads there will be a rush to delever and then the dollar spikes. Cash will be king if but for a while.

Inflation???? deflation???? What happens when treasury tries to sell new notes, bonds, bills and foreign buyers are looking for cash too?! Will rates go up? When rates go up does Govt cut spending because of debt service burden, or raise taxes to generate the cash it needs to keep spending? Will banks loan their cash hordes or buy the newly issued government debt that finally pays above inflation?

Cash will be king again but what comes after is anyone’s guess.

Your gold, your guns, your stocks won’t save you. Your best defense will be knowing your neighbors and pooling resources, forming tribes. The erstwhile prepper that is an island will be overcome because he’s an island. Watch “Walking Dead” early seasons…you won’t survive on your own because you can’t eat gold and you can’t drink stocks. And if you get injured your solar panels won’t nurse you back to health, we need each other. And if you have food to eat and water to drink and your neighbors don’t….how long do you think you can hold out, how long before they do what they have to do to feed their families? Talk to your neighbors, get to know who would make great allies and who you need to watch out for on day 1.

Do you have a tribe?

Maybe you have about 10 to 15 years before this thing goes tits up…don’t rush it, and don’t look forward to it. It won’t be good times.

China may play a financial game. They have lent and paid out US dollars, they may “convert” the loans to Remimbri.

Second, those nations that have natural resources may see their currencies rise as the price of natural resources inflate measured in US dollars. They can then pay of debt cheaper and return US dollars to USA.

…or turn your screens off once in a while and stop paying hollywood to fear frame you.

Alex said: ” Also, the euro zone allows their financial system to make loans denominated in dollars.”

—————————————————-

Any entity that owns dollars can loan those dollars.

But only select groups, like FED chartered banks can create new dollars into existence through loans.

What are you talking about? If you are saying the Eurozone allows the creation of new dollars through loans please explain how this happens.

European banks make loans denominated in dollars without actually having the dollars. They give the borrower dollar credits to spend. That’s how they create dollars.

Petunia,

That sounds like Snider’s amazing fiction.

No, European banks don’t create dollars. They TAKE IN lots of dollars because Europe has a huge trade surplus with the US, which moves dollars to European banks (as European companies deposit the proceeds from their dollar sales at the bank), and because European companies sell to countries that may pay in dollars, such as China, South American countries, Japan, etc., and because European banks and companies, including Russian banks and companies, issue bonds denominated in dollars, and whoever buys those bonds hands the banks and companies their dollars.

So there are large amounts of dollars being washed around and being put on deposit at European banks, and some of those dollars then get lent out and others get invested in dollar-denominated securities, such as Treasuries, US stocks, etc.. There are no dollars being created here, just shuffled around. That’s how that works. There is no magic to it.

And yes, all these processes work by debits and credits, with each transaction being an equal amount of debits and credits. You debit this account and you credit that account by the same amount. That’s home money moves.

Wolf,

I did hear about the European dollar shortage from Synder’s videos. It was easy for me to believe his analysis, considering I worked in Bear Stearn’s derivatives group, where selling income streams that statistically would never exist was normal.

European banks don’t have to have the dollars they lend in reserve. They can buy them when they need them. So they can lend dollars they don’t have, and buy them when the borrower spends them. That was the case Snyder made, and nothing in my own experience in banking and finance contradicts his analysis.

Petunia,

Yes, European banks can and do borrow — or you said, “buy” — dollars. This happens via deposits from their clients that earn revenues in dollars (exporters), and via dollar bonds that they issue, via dollar-loans from other banks, etc.

The “dollar shortage” was not a shortage in the sense of “not enough dollars,” but during the panic borrowing in dollars by non-dollar-based entities in foreign economies got suddenly a lot more expensive.

A lot of bets didn’t work at those rates. This was also an issue with developing economies’ dollar-debts. In addition, when dollar-debts need to get rolled over, a much higher rate can be lethal for the borrower.

Steeply higher rates to refinance dollar debts could have triggered a series of corporate bankruptcies and possibly sovereign defaults (in addition to the six or so sovereign defaults that occurred since March 2020).

During that time, junk bond yields in the US also spiked for the same reasons: fear of a massive chain of defaults. US BB yields spiked from 3.5% in February to 9% in March 2020, and CCC yields from 11% in February to 20% in March. Dollar debts in Europe faced similar upheaval during the panic.

Local central banks cannot print dollars force down dollar-borrowing costs. So the Fed offered liquidity swaps with foreign central banks. The two biggest counterparties were the ECB and the Bank of Japan. This brought down those dollar borrowing costs in those countries. At one point, $450 billion in those liquidity swaps were outstanding. Nearly all of them matured and unwound by late last year.

Jeff Snider (with an i) at Alhambra case anyone was wondering

Petunia said: ” I worked in Bear Stearn’s derivatives group, where selling income streams that statistically would never exist was normal.”

______________________________

Yes Petunia, but Bear Stearns received dollars for the sale, even if the income stream quality was dubious. They sold a product for real dollars.

How does one spend a dollar credit? Does not the seller of a good or service require an actual dollar for the good or service sold?

Maybe you are talking about an lending institution trying to play a float. ??

@ Wolf & @ Petunia –

Snyder, Kalinowski, Johnson, Van Metre ……. there are a host of guru’s speaking a narrative about the Eurodollar, collateral shortages, and about QE having no effect on inflation because they get trapped as bank reserves and can not be enter the economy. Other guru’s. Gammon etc., repackage this information and present it as fact, sometimes through paid subscriptions.

I have asked everyone of these guy’s what bank reserves consist of. No answer.

The only one who ever gave a direct answer to this question has been Wolf, who identified bank reserves as dollars. (Which seems obvious to me.)

cb,

I was describing the mismatch in income expected and income received, not the price of buying in or the currency involved. The price and currency are irrelevant.

The dollar creation in Europe is a result of a mismatch as well, between the dollars pledged by banks to borrowers, and the dollars available.

Petunia said: “European banks don’t have to have the dollars they lend in reserve. They can buy them when they need them. So they can lend dollars they don’t have, and buy them when the borrower spends them. That was the case Snyder made, and nothing in my own experience in banking and finance contradicts his analysis.”

_______________________________________-

This narrative, roughly, I have also seen pushed ….. by seemingly smart and well intentioned people. But I see no proof being offered.

Is there anything in your experience in banking and finance that supports his analysis?

How do you lend in reserve? What does that mean? particularly, what does it mean if you have no dollars in reserve?

cb,

You need to check our Synder’s analysis, whether you agree with it or not. I found his work credible.

Also, check our Prof. Richard Werner’s work on bank money creation.

Thanks Petunia. I have watched 73 episodes (Eurodollar University I think it is called) featuring Jeff Snyder hosted by Emil Kalinowski. Both guys are very smart and I appreciate their work.

However, there are unanswered questions. 1. Jeff is quick to tell us that Quanitative Easing (QE) created Bank Reserves do not in themselves expand the money supply, and is not inflationary. Yet he never identifies what bank reserves are. I think QE does expand the money (Inflation 1) and increases prices (inflation 2).

Also he makes assertions about the eurodollar system, as you pointed out that I see insufficient explanation for and that don’t make sense to me.

I really like Richard Werner and thinks he is correct. I don’t think Wolf sees Richard Werner in the same light I do.

cb,

You have watched more of Snyder’s work than I have. But you seem not to understand that QE doesn’t create reserves, which are a percentage of deposits, because QE are outright security purchases to create profits for the banks.

Snyder also cites a recent study by the House of Lords in the UK, on the impact of QE since its inception by the BOE. It didn’t sound like they were impressed.

Since 2008 in the US, QE has shown to create asset price inflation, not consumer price inflation, and not wage inflation. And the specific official purpose of QE is asset price inflation to create the “Wealth Effect.”

It might eventually create consumer price inflation, as it did when the Fed practiced QE and yield curve control in the 1940s as part of its WW2 effort to fund the government. CPI eventually jumped to something like 17% in the late 1940s, which is when the Fed ended it.

Petunia said: “But you seem not to understand that QE doesn’t create reserves, which are a percentage of deposits, because QE are outright security purchases to create profits for the banks.”

———————————————

You are right Petunia, I don’t understand it. I don’t think QE has to create reserves unless the Bank(s) decide to convert the dollars received into reserves by placing those funds on deposit with the FED. Also the reserve requirement at this time is zero, so there are no requirements to hold significant reserves if any at all.

cb,

Regarding the term “bank reserves,” what I know to be the official definition is a required percentage of depositor money at the central bank.

However, having worked in banking, there are looser definitions of reserves which constitute pools of money held in a bank’s treasury accounts for specific purposes. Technically these funds while earmarked for a specific purpose, can be used as working capital if the bank deems it necessary.

It can be confusing to outsiders what reserves are being discussed, but in a bank there will be context. If a bank has no central bank reserve requirement, they may keep their working capital in the bank’s treasury accounts.

**Treasury Account is just another bank account for internal purposes. Not to be confused with money only used for treasury bonds. See what I mean, about loose banking terminology.

Wolf said: “Since 2008 in the US, QE has shown to create asset price inflation, not consumer price inflation, and not wage inflation. And the specific official purpose of QE is asset price inflation to create the “Wealth Effect.”

It might eventually create consumer price inflation, as it did when the Fed practiced QE and yield curve control in the 1940s as part of its WW2 effort to fund the government. CPI eventually jumped to something like 17% in the late 1940s, which is when the Fed ended it.”

Regardless of the CPI (a manipulation that should be scoffed at) there has been substantial money expansion (inflation 1) and price increases (inflation 2) since 2008. Rents, healthcare, education, etc. up, up, up. And asset inflation is still inflation and makes your earned money and savings worth less, if not worthless. Prudent people are being robbed and the fabric of an honest society is being diminished.

The ability of citizen individuals and families to become financially independent is being trampled upon, and replaced with debt and wage slavery, for the benefit of a governing and corporate elite (redundant I know).

I said the eurozone allows loans to made in dollars…I should have said “In Europe some loans are made in dollars”…I thought it was understood that the dollars are there and not printed. The only entities that can magically create dollars are in America, I thought that was axiomatic.

My larger point was that once those dollars are loaned out (I don’t care their origin), but once dollars are loaned and the borrower spends them…that same borrower will need to obtain more dollars to service and retire the debt. If they aren’t selling widgets or services for dollars then whenever the crash happens they will need to de-lever quickly. That creates a lot of demand for dollars and fire sales will drive down asset prices in the pursuit of raising dollars to retire or refinance debt.

It’s all about the trigger. After the US raises the debt ceiling since the Treasury General Account is just about empty, and most of the outstanding debt is short term…the US will need to sale an arse-load of notes and they hope bonds.

Whether folks are panicking and there’s a flight to safety or markets are still going up, or the dollar rapidly appreciates….you just can’t tell how it all plays out.

I think so many people are 100% convinced that we are heading into a period of inflation, others are 100% convinced that we are heading into deflation…yet others think the dollar will lose it’s reserve status. My currency opinion just cautions that there’s another view that I don’t think the 100% crowd is factoring in.

Financial assets versus real assets.

The need for US dollars to pay down loans may create demand for US dollars.

On the other side, if natural resources or food get in short supply and the exporters demand payment in a different valuta than US dollars the US dollar may be devaluated.

Actually, both can happen at the same time and there will be a resuffle of wealth around the world.

I think if there was a requirement for a paper dollar bill for each electronic dollar, it might make things easier in a way.

During the GFC in 2008 the Fed’s demand for 100$ bills exceeded the ability of the US Mint and some had to be farmed out to Switzerland.

Printing on special paper is costly.

That’s why as a currency weakens you get huge denominations. Just before the Ital lira joined the euro, there was a 500K note. Imagine going into McD with a 500K US $ bill!

But if you mean would it be more honest (harder to fake?) No. Printing of scrip has a long and dishonorable history. If you can make 98 $ by printing a C note, you can afford the paper and ink.

🤣🤣🤣

Excuse me sir, how much did you say was that Big Mac meal again?!!

🤣🤣🤣

Despite what people smarter than me keep saying, I don’t understand how this debt monster, money-printing spree can go on for much longer without causing massive unbalances and chaos in the financial systems. I just don’t understand how this can go on without dramatic consequences.

I think we are pretty much in a place of complacency before the “event”. It’s a psychological phenomenon similar to the space shuttle exploding on lift off because people pushed the launch temperature parameters a little too far.

Previous successful launches caused over confidence, but when they looked back the warning signs were there of weakness in the O-Ring sealing system.

Central banking is built on a fatal foundation that you can improve the real economy by centrally planning the value of debt and savings (dishonest money).

Alvaro,

It can go on because the people overpaying for assets all believe the new higher value is right. While a bunch of people think bitcoin is worth $64K, or a gold coin is going to $50K, it can go on. When people think a broken down house in a bad neighborhood is not worth millions, it stops.

Temporary Asset value is the transaction price today. Long term Asset Value is closely related to real stream of income it can produce over a few decades. Sometimes there is a big difference.

Just thinking out loud…

How about the Fed do a RRP for $2 Trillion, and take that money and fill up the Treasury account?

(half kidding)

Leaving the dealers with some federal paper…..

with no where to go….

Then maybe we could see where the real market is…

@h

I don’t think you are kidding.