Inflation ate my homework?

By Wolf Richter for WOLF STREET.

You saw this coming after today’s release of the Personal Consumption Expenditure inflation index. “Core PCE” inflation, which excludes food and energy – the lowest lowball inflation index the US offers and which the Fed uses to track its inflation target – spiked by 6.4% annualized for the past three months. In May alone it rose by 0.5% from April.

Consumers got some remaining stimmies and extra unemployment checks and other stimulus funds from the government in May, which still puffed up their income, but less than in prior months. Consumers then spent this income in a heroic manner. But inflation ate a chunk out of their spending in May, and adjusted for inflation, it fell.

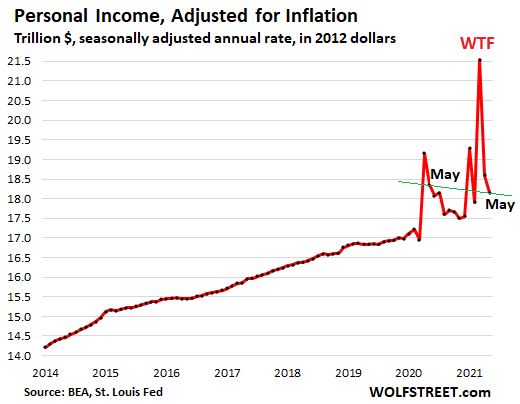

Adjusted for inflation, “real” consumer income from all sources fell 2.4% in May from April, and was down 1.1% from May last year, according to the Bureau of Economic Analysis today. Not adjusted for inflation, consumer income fell 2.0%. Each of the three waves of stimmies triggered a glorious WTF spike in income. Those stimmies are now petering out, but consumers are still receiving other payments from the federal government, including special unemployment benefits:

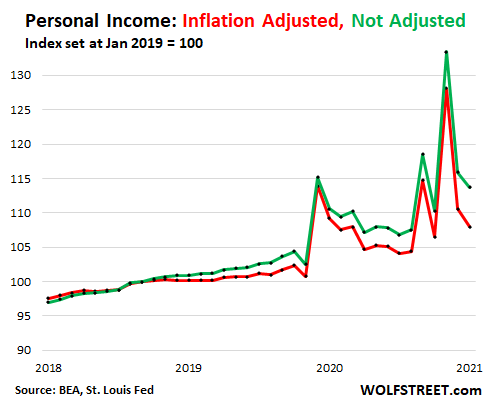

How this bout of inflation, the highest since the early 1980s, is starting to add up month by month, inexorably, and cumulatively, is depicted in the chart below. It tracks personal income from all sources, adjusted for inflation (red line) and not adjusted for inflation (green line), both expressed as an index set at 100 for January 2019. Note the sharply widening gap between the two lines. That’s the effect of inflation. I’m going track it that way going forward:

Inflation ate my homework?

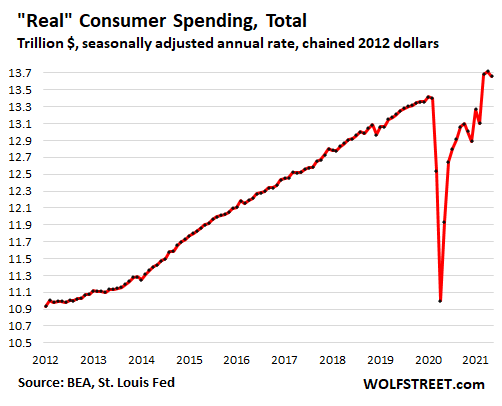

American consumers are still trying to spend heroic amounts of money as fast as they can – they just didn’t keep up with inflation.

Overall “real” spending on goods and services (adjusted for inflation) fell 0.4% in May from April, as “real” spending on goods declined and “real” spending on services barely edged up.

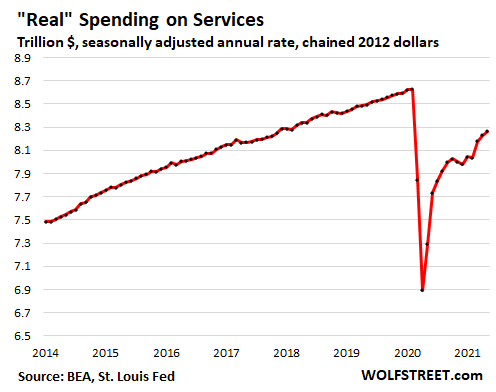

Real spending on services ticked up only a smidgen (0.4%), and was still roughly at the level of November 2018. Everyone expected the big shift from goods to services to commence finally. But not in May. Compared to May 2019, real spending on services was still down nearly 3%.

Services is roughly two-thirds of total consumer spending. It’s the biggie. But discretionary services took a massive hit – such as travel bookings, live entertainment, sports venues, movie theaters, etc. And they’re slow to recover. Movie theaters in particular, like many aspects of brick-and-mortar retail, may never fully recover.

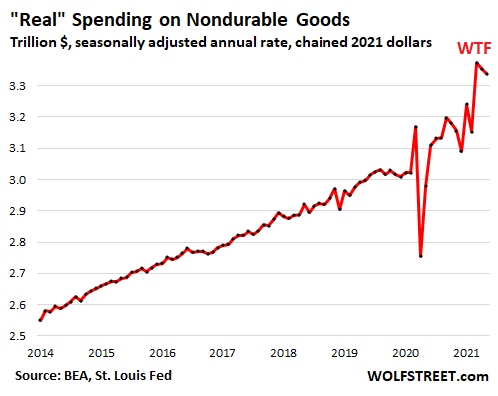

Real spending on nondurable goods fell for the second month in a row, but remained historically high. These goods are dominated by supermarket items, where spending during the Pandemic had spiked in an astounding fashion as consumption shifted from the workplace to the home after people lost their jobs or shifted to work-from-home:

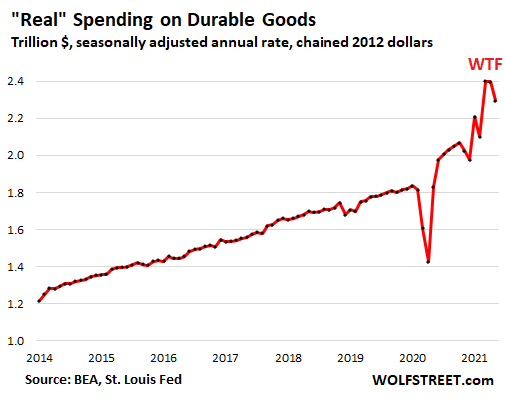

Real spending on durable goods fell 4.3% in May from the stimulus-powered WTF levels in March and April, but remained at red-hot levels as retailers are battling all kinds of supply chain issues, tight inventories, and shortages. This includes motor vehicles, where price increases have been particularly sharp.

Americans, still fortified from the stimulus payments, were out there spending with all their might. But they’re grappling with higher prices, and they are beginning to see significant inflation in the future.

In real life, this takes all forms as consumers are confronted with higher prices, smaller packages, or expensive but minor upgrades from an original item that no longer exists. And they’re willingly paying more as their entire mindset about inflation has changed for the first time in decades.

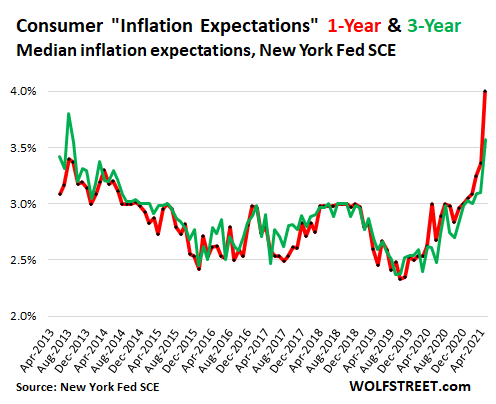

This is also starting to show up in consumer surveys, including in the New York Fed’s Survey of Consumer Expectations. Inflation expectations jumped to 4.0% for the 12-month outlook (red line), and to 3.6% for the three-year outlook (green line). They were a little slow in getting the drift, but they’re catching up:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Won’t the inflation stop once the stimulus does?

Idk, if enough people pay the higher prices the numbers can stay elevated while spending goes down. Debt is always an option as well.

People spent more when it was free money, stimmies and ppp loans. When it’s their own money, they are not so free. And now with the extended unemployment ending almost everywhere, expect less spending.

“extended unemployment ending almost everywhere”

Just checked – only 12 states ending it.

Enhanced federal unemployment benefits are slated to finally end everywhere on Sep 6. So you are essentially correct.

However, by this weekend about 20 states will have ended their extra federal benefits early.

A total of 26 states have announced they will end those benefits early (and all those 26 will cut off benefits by end of July).

This will cause some heartburn for folks wanting to enjoy their extra juice a little longer.

Demand destruction will occur if no new money appears (either by salary raises or free money). There is a magical force called competition which is then supposed to gradually reduce prices to their true equilibrium level.

At normal interest rates this rebalancing occurs quickly because time is money for a real business. But today’s zero interest rates allows companies to float along on debt and hope for getting higher prices for their goods.

Average wages will continue to rise for the simple reason that minimum wages are rising.

I hope that magical force works now when there are few retailers left running the show. The two largest, Walmart and Amazon have perfected the science of inflating prices through the years, now they are in overdrive mode.

Walmart advertises raising wages, then a year later employees are replaced by machines IE self-checkout, robot floor cleaners, etc. Few of the old former faces from the years no longer work there. The Walmart I was in yesterday looked like a ghost town for hired help.

Brant Lee,

You can see the inflation at Amazon by “saving” a few items in your cart. Amazon then tells you when there is a price change related to those items. I put a few things in there, and the prices went up 5% to 10% last week.

Everything seems to be going up in price or shrinking.

I’ve been a professional in a good job with a six-figure income for decades. I am somewhat worried about the financial and retirement situation, and the general uncertainty that prevails. I can only imagine how people less fortunate are feeling. Like frogs boiling?

The way people talk about automation you would think the wheel would have been the end of civilization.

No wages increasing also need to regulate ceo pay and boards pay legal theft

No one is going to regulate CEO and Director’s pay. You must be dreaming!

Its out of whack….but who are they stealing from?

Stockholders? Fund managers?

The corporate board game…

Jim you sit on Bill’s board

Bill, you sit on George’s board

and George, you sit on Jim’s board.

Vote yes on all compensations and we’ll all meet on the first tee.

I recall that years ago there was occasional discussion in the press regarding interlocking directorships and corporate collusion to raise prices. That sort of reporting now seems to be forbidden.

historicus,

They are stealing from the company, the customers and the public. Competition is broken in most industries in America, and prices are raised to keep the executives and stockholders happy. This also damages the company medium and long term and because corporations are the heads of the economy in America, it also damages the economy.

In order to justify those executive pay raises they have to do alot of things like putting off R&D, other investments, as well as encourage outsourcing; this temporarily makes the company richer, but usually damages it medium and long term.

Most of the stimulus has already stopped as you can see from the income chart.

I still think the child tax credit will have some impact.

I agree Janna, as well as student loan and mortgage forbearance, which the the equivalent of a stimulus.

Mortgage forbearance and eviction moratoriums have been extended through July although the Feds have said that this will be the last extension provided.

Max Power, yeah I saw that. Whether they stick to it or just punt it to the states (like CA which is promising to pay back rent) remains to be seen.

I could easily see the feds eliminating the moratorium on eviction but also creating unfunded mandates to tie things up in courts

Janna,

Yes, there are all kinds of things like that now. The child tax credit existed before, now it’s bigger. But it only goes to families with children, not to every adult, as the stimmies did. Then there are the rent relief programs at the state and local levels being implement, where the governments pay past-due rents. This will go into the fall.

There are all kinds of programs still going on, or now being put into place. But none of them have the universal sudden magnitude to the stimmies.

I still think the child tax credit will have some impact.

That and supply chain price increases due to shortages.

What about sticky prices and sticky behavior?

But the real question I have, is inflation not the easy way out for politicians?

In terms of your “real question”: Yes!

Especially since they don’t have to take the blame for inflation.

Inflation never stops! If it stops, it’s game over for the governments and central banks.

You are underestimating the central banks, there is a powerful evil ooze that runs through the veins of Central Bankers. So far that ooze has proven unstoppable. Recessions, Depressions, and mass deaths; do nothing to slow it down.

It might stop if the Fed takes the M2 down to pre Covid levels…..highly unlikely…

Who gave the Fed the minting powers? I thought they were delegated to short term liquidity issues….not unilaterally dialing up the nation’s money supply. What power!!

Likely, one man deciding. Is that our system?

The Constitution gives minting (and taxation) powers to the Congress, because Congress must eventually answer to the voters. Congress may not delegate minting or taxation (intentional inflation).

Kick the bums out show voting power

That money isn’t in the economy and likely never will be unless there is a major market event. Meanwhile as fiscal spending increases they bleed off some of that phantom cash the Fed printed, and those bonds they held on IOU get locked in, hence real monetary inflation, and the Feds balance sheet gets impaired as the principle value drops. The currency devalues, which is different than inflation. So they have to shrink the money supply.

By that time, we’ll start to see the effects of The Great Decoupling. Already starting to see shortages and sky high prices with fireworks. Can’t really blame that on the stimulus?

Been seeing the smartest people make arguments for inflation and deflation. We all probably need modesty about predicting the future because in financial matters the unimaginable seems to happen from time to time.

To some degree you have to put your faith in the Fed to do its job of keeping inflation in check to even participate in the system. It’s pretty clear we are at a new place with virtually all financial assets priced as if interest rates are going to stay low for a very long time.

It’s a fun exercise to plug the SP500 into a dividend discount model and to try to determine the hurdle rate to justify today’s price. It’s so low that you have to think no one is owning the stock market, they are just renting it planning on selling to a greater fool.

Inflation is the stealth tax that effects everyone. Check out trunthinaccounting.org…The Federal reserve will keep printing more and more Money which devalues the dollar.

I stopped listening to their fake numbers on inflation long time ago. What I did is cut my expenses by 50% and reinvested it all of it in long dated treasuries and CD’s 2.75% to 3.75% over the years.

I amassed $600,000 over the last 20 years working and this on an average salary of $45,000 a year. By the way I moved out of the big smoke, city and stopped subsidized expensive landlords and the city. It is simple but not easy to do this when I managed to live on $1,300 to $1,400 a month the last 8 years. I will be finding new ways to stop spending money and cut my expenses even more. I love being cheap.

Keep doing it until u have $2M in few saving accounts, without chocolate.

Richard, nice job of saving and cutting expenses.

” … when I managed to live on $1,300 to $1,400 a month the last 8 years. ”

Well done. As one cheapskate to another, you’ve got guts and purpose. Congrats.

But once you get hitched it will all go south unless your spouse is a rare bird with your attitude towards money (or rich already).

I retired a couple years ago and I’m discovering the limitations imposed by a fixed income. But fortunately I’m married to one of those “rare birds.” I have seen her squeeze a nickle into a quarter.

I am also a lucky partner to a “rare bird” who I have to convince to buy things she needs.. We also did the living below our means thing and worked until late 60’s. We have more than adequate income and resources and give to charities and our kids each year. We are still adding numbers to our accounts. I feel very blessed.

Doesn’t mean I am not worried about the future of our Republic. Things look very risky and unstable and all our hard work and saving could be for naught if things don’t start changing for the better.

The Fed Reserve wants your $600k nestegg. They don’t want you saving it for retirement or future spending. It’s you versus the Fed. They’ll be increasing the price of your food and shelter 5% a year, then telling you it’s 2%. Inflation is now above your CD rate, and your CDs will eventually mature, causing you to lose even more to inflation. Thus, it was a valiant fight, but it is ending. Jerome has been smiling the entire time across the battlefield because he knows he can print new soldiers at will.

My advice is to become a dependent of the state, so you get your food and shelter paid for, or become a billionaire so you don’t have to pay tax, and the Fed will then consult with you and maybe even let you design its next moves, although Goldman and Blackrock already have prime spots at that financial buffet.

Joking aside, I wouldn’t make any rash moves. As your CDs mature, I recommend allocating a small share (say 20 to 40%) into some inflation-protected instruments over time (commodity stocks, REITs, etc.). That way, you are more likely to offset inflation in the event the Fed is successful in continuing its interest rate repression policy for many years. If there is a market crash, you are still in the catbird seat with a lot of dry powder. Sleep easy.

REIT’s?????

The worst investment anyone can own right now.

SC, I’m talking about the small part of the portfolio that should hold hard assets as an inflation hedge. If there is high inflation or hyperinflation and the Fed forces rates down with yield control, REITS will do very well. Cash and bonds will get killed. There shouldn’t be any dispute about that.

Gold and silver.

One of our best investments was buying a rental unit at a bargain (about 2014, before the market got crazy). Get a good tenant, get the rent on time; everyone’s happy (plus side, the property price keeps going up). Every year or so we increase the rent a few percent (no need to be greedy, far more important to keep the unit occupied with a happy tenant).

Get a Really good tax accountant.

And yea,gold and silver!!

You could move back to the land, raise a few head of cattle, a few sheep, some chickens and raise a nice sized garden.. Then your worries are about fuel and power and replacement parts.

Great but now protect yourself against the coming inflation

It would be a sad story when in a few years you may have 700,000 but what you xan buy with it is half of what you can buy now

My approach is to buy things that I will need in the future but will not sell do not affected by capital gains tax.

It can be from expensive things to every day things. If you buy extra socks or shoes, just leave them in the wrapped box…

Bravo!!!!Positive news.My landlord in n.IL.Raised rent 7% even though I am sure some of her tenants did not pay all their rent due to covd issues.Looked up some local realestate data and it said quantity of rentals down.Late rents up.Rents flat or lowered.No dice.Timing different,we probably wouldve moved.Lots of prepper and frugality websites out there.Good luck! :-)

There’s been a lot of ink lately devoted to how willing the consumer is to pay the higher prices. Just wondering if that’s a misread of what’s really going on…at least in certain cases. Are they willing, or are they merely oblivious to the fact that the prices are higher. For example, if you took a survey of regular Chipotle customers, what percentage would admit to being aware of the 4% price increase Chipotle recently implemented? A lot of those customers don’t even bother taking their receipt. Do they even realize they paid more? And then there’s the trickery with extending the terms of auto loans in order to keep the monthly payments in a certain range, regardless of the list price increase. Customers are oblivious to the price increase, as long as it doesn’t increase their monthly payment beyond their expectations. Inflation is insidious, and the providers of products and services take advantage of that fact in a myriad of ways.

“And then there’s the trickery with extending the terms of auto loans in order to keep the monthly payments in a certain range..”

My first loan of any kind was a 4 year auto loan, no co-signer. I remember hating that payment. I cannot even imagine an 8+ year auto loan. It’s lunacy.

Especially with current payments at new car prices. I haven’t had a car payment in over 20 years now and never intend to again. On my second car during this time and hopefully will only buy one more, max.

Borrowing to buy a car is for suckers.

It is interesting to notice that the contents of some products has been reduced, but the size of the packaging and the price remains the same …

Called shrinkflation, I think.

Tillamook ice cream.

I contacted Tillamook regarding that very topic about two months ago. The *official* story is that the cost of ingredients (caramel, cherries, etc.,) went up and the product line became unprofitable.

They did try to cut the goodies (cherries, etc.,) but people complained about that… so they replaced the goodies to prior levels and then shrunk the package by 1/7th – which their “consumer panel” thought was the better solution. Price remained the same.

They were quite open about it.

I just wait for it to go on sale….. If it’s not on sale, I don’t buy it.

You are right. I have a very good memory, so I notice if the 7.39 Chipotle bowl goes to $7.79, but most people don’t. My wife is constantly amazed that I remember what the prices of things we bought were.

The Publix sub I order went from $7.99 to $8.59, a 7.5% increase. Most people wouldn’t take note of it, so the places can get away with it.

Yes I bought a Publix Boars Head Ultimate sub yesterday in NC and paid 8.59. I had a “feeling” I was paying more than last time 2 weeks ago, but nothing definite. I did note with some surprise that even though it was noontime, there was no line which was unusual. Coincidence?

Haha, that’s the exact sub I get. Funny!

They probably fluffed it with air filled fake bread and more lettuce.Overpaid!!

In the Olden Days every food item had a price sticker so it was very easy to see the food price inflation every week. There was a huge fight between the grocers and public interest groups over the removal of price stickers after bar codes became universal.

Obviously the grocers won and it is much easier now for them to increase prices without most people noticing.

You are right– without stickers an important paper trail piece is missing on rising prices– although there will be a sticker on shelf/bin for all items of same kind. So save your receipts to understand better how quickly retailers are bumping up prices.

I was both amused and dismayed the other day when I went to the canned olives section of my grocery store only to find they had recently raised prices from $1.79 to $1.99.

Underneath the olives shelf was one of those advertising banners– “New Low Price”.

Maybe you should stop eating that crap, instead of worrying about the price.

olives are crap!? hardly

maybe the “crap” is your eternal sour attitude

I work at a gas station in a low-income area in the midwest. The majority of my customers don’t notice any of the price increases. Blunt wraps have gone up from .99 to 1.19, cigarettes have risen quarterly about .20 Yes they have gone up almost a dollar in one year. Candy is up .10 and there are many more.

Also important to add is that my coworker who has been working there for many years said the customers were always penny wise since they were always short on money. With all of the covid money, we hit record sales numbers in the last couple of months. He expects sales to slow back down now that my state has ended the federal unemployment bonus. Our atm has also had record usage the last year. Every Tuesday when unemployment hits the machine is drained.

” Are they willing, or are they merely oblivious to the fact that the prices are higher.”

I suspect most consumers are not ignoring rising prices for items they routinely buy. The pocketbook is the most sensitive part of a consumer’s life.

You can divide most consumer purchases into two categories: wants and needs. The necessary items you still need despite rising prices (though you might penny-pinch a bit and buy less if you can).

After a while in an inflationary regime, it will dawn on more consumers that inflation in their wants category is whittling away their discretionary income. That moment is when anxiety really sets in and they start cutting back in a serious way (unless their income is keeping pace with inflation).

You makes some valid points, Heinz. In many ways, consumer price inflation is a frog in a pan of hot water scenario…you know the metaphor. Who knows…inflation in the post-pandemic environment may rise so rapidly that a critical mass of frogs jump out of the water before they’re boiled to death.

*make

Maybe it spawns a whole generation of minimalists that collectively raise the middle finger to inflation. Ya never know…

This Fed-induced inflationary impulse has gotten me to thinking about Jerome Powell and his illustrious Fed Chair predecessors and what they will be remembered for by future historians.

I think Powell could be the direct reincarnation of John Law, the infamous Scotsman who engineered the Mississippi Bubble/French economic disaster of 18th century.

As Wolf Street readers know, France was then heavy in debt and the French Regent (Congress) gave Law (Fed) exclusive rights to start a bank (Fed Reserve) and issue unbacked paper currency (USD) to boost the French (US) economy. Law (Powell) also started a speculative asset bubble (US asset bubbles) venture in then-French Louisiana territory which ended in disaster.

But it was Law’s (Powell’s) money printing that led to inflation raging across the country and asset prices shooting up.

By 1720 Law’s paper money (USD) had become worthless and left many people impoverished. Law had to flee the country in a disguise.

Powell better have his private jet waiting on the DC tarmac when his time comes.

I don’t spend much on the “wants”, though much of my current “needs’ budget is for my mother. My philosophy on discretionary spending is that if it doesn’t make my life or that of someone important to me better “sufficiently”, I can do without it.

It’s the big stuff that will aggravate them, like the 30% jump in used car prices, the rent increases, the boss saying she can only increase wages by 1%, as her stock options rise 200%, etc.

Everybody in the bottom 90% suffers, no matter how well off you are. Many people lose the ability to purchase an entry-level home, maybe permanently. Existing home owners lose the ability to move to a better home, a more desirable location, or obtain a vacation home.

It heads in the same direction for everybody in the 90%. Higher prices, more debts, less productivity, loss of career mobility.

Orrrrrrrrrrrr……..They have No choice on some items such as an unexpected,but very important car purchase or health insurance policy.

These graphs are awesome! The pandemic (and the heavyhanded policy response, and the associated supply chain disruption…) has wreaked havoc on the economy.

Will things settle down, though, or are we entering a time of tremendous dynamic change?

If the economy doesn’t heal soon from all the shocks, the inflation will eat us all.

My quibble with the BEA data team is that aggregated data conceal the many different fates people have had over the past year. Some lost everything, others got freebies, others sailed right through. If the economy were a tapestry, though it grew in “aggregate”, there are also large tears in the fabric!

Atop the hard feelings created by the unjust responses to the debt/fraud crisis of 2008, many of today’s policies are creating fresh injustices, which will leave long shadows in the minds of those who know they got screwed over by heavyhanded officials.

Americans always spend. Inflation, deflation, as long as they have money they will spend.

Socaljim is my landlord. Im sure he understands that my income can’t keep pace

Inflation does not go in a straight line. It compounds over time. It may be obfuscated, but the affects of years of inflation can not be denied.

Early hand held calculators cost hundreds of dollars in today’s dollars. Now there is a free calculator app on a smart phone that costs hundreds of dollars.

The price of a new home was not lowered by technology.

The HP80 cost about $400 when it was introduced in 1973 when gasoline was still about 30 cents a gallon in many parts of the country. It was a business calculator rather than a scientific calculator and was considered a status symbol among financial geeks.

If you are interested in cutting your TV bill, get yourself an Amazon Firestick and learn how to program it. There are numerous Amazon apps available online that enable you to watch free or low cost programming. There are even some websites that are dedicated to recommending specific Firestick apps.

Roku is similar. I also bought a Sling TV package with CNBC, Bloomberg and Fox Business; cheaper than the Comcast package I had.

I had a Texas Instruments hand-held calculator around 1980. It was terrific for calculating loan payments, interest, etc. I was shocked to see how much interest one could avoid, just by paying off the loan a little faster.

Comparing the monthly payments of 15 yr vs. 30 yr loans was extremely informative. I vowed to never sign a 30 yr loan. And I never did.

David..

and flat screen tvs were 2000 in 2000 and now you can get a better one for 400.

That looks like deflation, but it is the “bottle cap” model….

First one costs a million to make, the last one costs a penny.

And how many calculators did/does one buy…is it pertinent?

And tvs…….one every ten years..?

CPI and PCE are bad metrics IMO

I got an iPad during Black Friday 2019 for about $250. It is good for Internet research. It is more portable than a desktop with not as many bugs to fix. Thank God for big tech.

Got a Samsung galaxy tablet at Costco in January for 100$.

The “consumer debt slaves” series and the “real” spending/income series are my favorites.

If the inflation persists at this level, it’ll be a real tape worm in the economy. And if the FED tightens, things even a little, we will crash back to normal and get a severe recession. Reality ain’t fun.

Real consumer spending total :

1) On the left, since 2015, the trend is up, gliding effortless higher, without volatility, without corrections, with little input, on autopilot spending.

2) On the right, consumer spending have reached the previous trend.

3) After Feb 2021 jump, Mar, Apr and May are glued to each others, at stall

level.

4) Between Mar “starvation” and Sept 2020, consumer spending moved up in a strongest ever thrust. People were crazy, nuts.

5) After a break, between Oct 2020 and Apr 2021, their appetite was cut by a half, reaching saturation.

6) Tired of buying Chinese junk, spending on doctors referrals and fancy restaurants.

7) Some people can’t, others had a change of character. They put their money in the banks, $17T, selling stocks, or a house they bought in 1991.

8) They don’t care about Peloton, Iron Men bike, Ford pickup trucks, or a used car at peak prices.

9) The total spending might hug the previous uptrend, form a new trading range, or correct in recession.

What is really surprising is that the first chart seems to show that real inflation adjusted incomes increased 28% between 2014 and 2021.

Really!? That itself is astounding if true.. I don’t know many people (including myself) earning anywhere near 28% more versus the year 2014, after inflation adjustments.

Sea Creature,

Part of this growth is due to the growth in the working population. These are totals for the nation, not per capita figures.

Ah yes, amateur mistake. Thank you Wolf

In the mind of the “ mindless government “, they are trying to reverse the calamitous interference in the economy, off course to no avail.

Economies are a growing “organic biology “

as a manner of speak, once too many factors and variables are interfered with, the results can be just like those “ exploding water melons you see on YouTube “ :)

This half arsed attempt to flick-on the switch of the Economy, and keeping so much of their garbled restraints in place is doomed to abject failure.

If you don’t allow the multitude of market participants to make ( free choices) built on the Norms and logic of supply and demand, amongst other tried and tested methods, and anchored in the depth of ground economic realities, you’re fiddling and No longer can be trusted.

Until the consumers learn to stop bidding in a losing construct , you’ll have ongoing pain until the natural process takes its place and reverses the whole abnormality.

Our economy is now greatly abnormal, No time in history have seen so much convergence of utter destructive stupidity, hell bent on a path of creating large scale misery and impoverishment!!

I see that one of two paths will eventuate,

A decisive and fast collapse of the Market in the coming winter, or a prolonged and painful process to emulate the Japanese syndrome.

A deflated and hibernating economy will have very serious ramifications for the world peace.

Once the Chinese Economy enters prolonged low growth periods ( due to lack of demand in the West) , we’ll be in for earth shattering events in east Asia, that neither Europe nor the US are ready for.

Honestly why would you think the US government and the financial arms will stop tinkering with this experiment? They have gone to far with this surgery to let the original economy to return to normal. This is going to be a fundamental shift/changed game when they finally stop pushing and pulling.

Next stop…Moon and then Mars within 5 years after we have habitat on the moon. Then we go bonkers if you aren’t planning to have your grandchildren be part of the solar system colonization.

Or China will just produce for its own consumption.

MB

The Chinese consumer behavior is largely controlled by the government.

Further more their consumer mentality is different from the western consumer attitudes to life and self fulfillment generated by hoarding trinkets of no long term value( the western attitude).

The same can be said of Indian individuals, you’ll observe that even a dirt poor Indian citizens do buy gold as a security and for cultural reasons.

No Chinese will be rushing to buy PS BOX , when a more prudent choices are encouraged by the culture.

So your premise of manufacturing for the local market doesn’t hold water I am afraid! As it doesn’t generate the same amount of returns and profits necessary to reinvest and upscale technology.

It will take two generations of continuous growth in the economy to change the Habits of the average citizens, as well as the freedom to buy what you want from whence you desire.

Chinese Economy is very fragile and dependent on what happens in the west in the next 5-10 years.

There are long term plans of decoupling from this dependency , but that will require broader plans and an even larger master plans than their current B& R PLANS.

You can turn your mind to the Chinese investments in Africa and South America, as well as the Middle East.

Add to that the need to dislodge the US military from east Asia and particularly Japan. Hence the attempt to weakening and encircling of the Korean and Japanese by creating a larger areas geopolitically amenable to Chinese penetration in the pacific region.

Very good summary J,,, thank you.

Been a while since I was telling anyone i could, ”don’t send a nickel to China because it will come back as a bullet..”

Now a days, ,,, give it up, because the CCP will soon own ”majority” positions in every industry in USA,,, and, in fact, might me ”good ridance”

Export as a percentage to GDP has dropped from 36% to just below 20%.

You wrote a lot but it’s not supported by data. But hei, it’s the Internet no?

“Further more their consumer mentality is different from the western consumer attitudes to life and self fulfillment generated by hoarding trinkets of no long term value( the western attitude).”

I’d like a source for this besides your own misconceptions

The Chinese already planned for this when its export model collapsed during the Great Financial Crisis. The “dual circulation” model called for increasing domestic consumption, which meant enforcing higher wages, as well as using its excess industrial capacity to create new export markets.

The latter was a major goal of the Belt and Road Initiative. China would send workers throughout Latin America, Africa, and Central Asia to build out their infrastructure and economies in exchange for getting resources AT SOURCE. The US got caught it with its pants down by the success of BRI, which is why we’re about to enter Cold War 2.0

I love coincidences.

A while back Mr T put sanctions on China’s largest chip maker because of security concerns.

Join the dots and USA is stuffed for chips a short while later.

Annoying people you rely on is never a smart plan.

But don’t worry uncle Joe is going to replace them in a couple of months. As if!

Chinese DO Buy useless trinkets and hoard,if they can,in the form of fake lux goods,Chinese art,etc.Value and use of FU dogs or painted screens,or more than a few decent pairs of shoes?Practicality of fake lux purses unless you intend to rip someone off and sell as genuine?

They also buy the real luxury goods. China is now the biggest market for Louis Vutton, etc.

Also Nike CEO: Nike is a brand that is of China and for China.

Peasants in America will soon be begging for trinkets from anywhere.

Last year oil briefly traded for negative dollars. Now it’s back to a more normal level. So of course everything is marked up to that.

It’s not just congress-given stimulus, it’s also that they destroyed supply. Couple that with many more people moving around than normal, and it’s chaos out there. People are still afraid to go back to work, or they are loving the free cash.

What I’m trying to say is I think the inflation is temporary. I wish the people who want to end the fed would switch that to ending congress.

Mark

Oil traded negative on a storage issue…..

No storage….park the ship in the Atlantic or dish it at any cost.

Yep,I remember that.Inflation for most things will be permanent unless hordes go on massive buyers strike.Re. Oil,heard some buzz about $100. Barrel expectations.Just checked CME yesterday and it looks like short term corn and wheat futures are down.

Inflation is relentless, omnipresent, ruthless and destructive. One thing it is not, is… “temporary.”

There is also a huge number of people with Long Covid. Most will likely recover eventually, but there will still be a large cohort unable to work for a very long time, maybe permanently.

Many of those folks are the “essential” workers that were treated as disposable since there is always a large reserve army of unemployed to replace them. Well maybe not so large anymore after subtracting everyone with Long Covid.

The data is of course unreliable but one wonders just how many of those lazy bums who refuse to do their patriotic duty and return to work, are actually too sick to do so.

WTH is Long Covid ? A new category for SS Disability ?

Beardawg:Biorxiv.com is a good source.Longcovd is longterm,chronic,comingback symptoms like dizziness,shortofbreath,headache,extreme fatigue,arthritis,myalgia.Sequalae.Body is fighting something it can not get rid of.

Here in n.IL.,local pharmacy closed early due to staff issues such as calling in both sick and not,leaving early,just walking out.Third manager in a year.New faces all the time.Customer puched atm and broke it one of the Many times it was out of service.Lately it’s out of service more than in service.Staff feels for fellow workers who dont want to come in.The customers also abuse/threaten staff in between stealing and shooting up in the washroom.We will see more of all of the above as things degrade.Other local stores have closed early for same reason and combined with truck delivery changeswhich also occur at pharmacy.Pilots are dying.Airlines are cancelling many flights.Garbage pickup in this town was late last week by one day.Mail is taking longer.Prepare.

Flights are canceled because there is a shortage of pilots. They’re calling them back from furlough, but they have to be re-certified and there is a long line due to limited availability of simulators.

My kid just went through this.

Long Covid is a real thing but from what I hear the symptoms last for a few months and then subside. In other words, for most patients it is temporary and not a permanent disability.

I think the only thing we can be certain about the stimulus is that probably 80+% went into the top 10% coffers. Maybe the results are skewed for me but myself and literally everyone I know that wasn’t retired when the pandemic hit blew the money on toys or whatever or paid debts so they could buy more crap.

Seems to follow the trend that most Americans will make a lot of money in life just to send it down the road on stuff they don’t rally won’t or need. Guess it’s fine if you like working till you’re forced into a retirement with no money in the bank and have to be miserable in old age. I’d rather keep driving my 1980s beater, living in a 1000sqft cabin, and eating little to keep me skinny and with fewer health problems. And have the prospects of not having to work till I’m 80 if anyone would even let me.

Not everyone wants to take a vow of poverty.

We have a lot of wannabe monks commenting.

50% of Americans only have about $30K to their name.

How much of this is unrealized gains on primary residence… which could all go away easily.

“American consumers are still trying to spend heroic amounts of money as fast as they can – they just didn’t keep up with inflation.”

You said it all there, Wolf!

WTF is back…. although I think given the way people treated the Thiel Roth IRA news, you might have to make a WTF chart about his meteoric rise… heheheh

Tax professionals are now reviewing Peter Thiel’s situation, and several have concluded he probably violated the tax law. They say the valuations he set on the initial stock purchased by his IRA are indefensible. That’s common sense. Further, he appears to have violated the self-dealing rules in several respects. For example, if he invested IRA money in his hedge fund, as has been reported, that is a clear violation.

I’m not going to link the articles because Wolf doesn’t like that, but you can search it out yourself if you care to.

Personally, I consider Peter Thiel to be a negative role model, but I recognize there are many people in the country who support tax scams and view taxes as theft. These are the weasels in our society who look to place their responsibilities on somebody else.

Sure, tax professionals “are now reviewing…” Who the F are these tax professionals, and where have they been for years, obviously not being employed by the IRS cause you know, this has been obviously visible to the IRS for years. May be the tax professionals in the IRS have all been a bunch of stooges up until now, cause they’re too moronic to see that Thiel broke the law. Yep, that must be it.

As for the personal consideration, yeah, he made a bunch of money through legal use of vehicles available. So has a whole bunch of others, all of whom are now negative role models and weasels cause they played and didn’t break the rules in the process, let’s call it a scam, and tear them down, cause I couldn’t do what they did. Again, that’s a choice, but it’s also indicative of a mentality.

It’s odd though, isn’t it. Not more than a week ago, Propublica comes out with the hit piece on Bezos, Buffet, and whoever else, but now they decided to focus their ire on Thiel who is nowhere near the top in terms of absolute worth as billionaires, certainly nothing like Buffet or Bezos. I wonder why. Could it be because Peter was actually one of those who visibly donated to the Dumbos, while the others were contributors for the Jackasses. Wonder if someone got a phone call and told Pro Publica to focus on someone else who might not be quite as closely linked to the current power structure, but still a good and enticing target.

I thought we were having a reasonable discussion for a while there.

take the tinfoil hat off buddy.

Peter Thiel is a billionaire. He deserves every last bit of the ire directed at him. The majority who aren’t aspiring exploiters or cucks for billionaires would agree

If you want reasonable, it’s simple. I have far more objections to Thiel and his ilk (that includes Bezos, Buffet, Zuck, Gates, etc) beyond how they make their money. Their methods however people want to proclaim that it is grotesque is still within the law as it was set forth. If you don’t like it, get the law changed.

But seriously, I find those who immediately argue for change just because someone is deemed subjectively to be “too rich” also tend to be very short sighted as far as the long term consequences of those changes are concerned. Seriously, just look at what you see from the Sanders and the Warrens of the world. It sounds like they’re aiming for socialist paradise. From that perspective, it may as well be like those same guys who decided it was a good idea to put in a eviction moratorium and then distribute cash directly to those same renters who were now free to ignore their financial obligations.

If I wanted to object to Thiel, I can come up with two good reasons without even thinking, and never even come close to objecting to how he managed to avoid taxes. (if you want to talk about sins, avoiding taxes are the least of it here)

Facebook

Palantir

Just spent $800 on a new iPhone (previous 4 year old model inexplicably ended up in the washing machine somehow- nope, they aren’t waterProof). Doing my part to boost the almighty stock market!

Leader Tim appreciates your blind devotion to the might god of addiction that the prophet Jobs created. As the head priest at the church of Apple, he commends you for your effort and charity, although he would suggest more piety be shown by purchasing a new iPhone every two years, Leader Tim suggests that you can make up for this minor deficiency by indulging in Apple’s multiple smaller offerings… pay for more iCloud, get Apple Music, subscribe to Apple+, all methods of regularly demonstrating your faith in small bites.

To seek help, go to the nearest branch of the Apple church to talk to the resident geniuses, or if you are too far away from such a branch, there are many independent evangelists operating their own virtual temples of faith that can offer you guidance.

Know that your faith and devotion is smiled upon by the Prophet Jobs as he toils away in the afterlife.

Good one, I say as owner of a competing phone that works just fine. I’ll take the $600 savings and buy some commodity stocks. Maybe turn the $600 into $6000 at retirement.

I have a Samsung 7 that I use, another two spare. I paid £50 each. They all make calls, send and receive texts, take photos and my dictations.

Can they access faecesbuk toktik or other instruments of life wasting, who cares?

I am good for smartphones for next 5 to 10 years I guess.

B

Mr T, for ‘security’ reasons, banned Huawei who made a top class Android phone much cheaper than the others. Google chipped in and banned H from the App store.

H have now got their own OS and I bet, soon only US and it’s ‘military’ allies will be left using old and expensive 4g tech, but then you’ve got being a ‘Superpower’ to keep everybody feeling good.

Good for you.

Many will point out you could have spend less but this one you will keep longer

The $800 over the $600 model, what everybody forgets they also pay $50-$80 per month (remember it was only $25) for the data and phone service. If you have a crappy phone, you still pay $50-$80 so with a good phone you can better take advantage of what you have you have to oay every month anyhow

If, as everyone appears to say, that the USA produces very few goods, then that means the prices of goods are determined by importers. Spending may drop but imported inflation may not….especially if the dollar drops in value…..

Prices are definitely rising in the luxury markets, which are mainly imported products. But there is also push back from customers. The resale markets are growing and the entry point items are lower in price and smaller in size. While high end demand is strong, the brands are losing the marginal buyer to cheaper alternatives.

I stopped considering some items because, even on sale, the value no longer exists when compared to alternatives. Only customers with money to blow are paying the increasing full prices.

If anyone thinks inflation is spiking in the US, look at the rest of the world. The US is, as usual, exporting it’s inflation.

How much of that is a result of other central banks maniacally printing as well?

Exporting inflation of ruining a fiat currency used world wide?

1) In the last 40 years House debt service/ Personal income % normal range was between : 10% and 12%.

2) In Q4 2007 it peaked @ 13.2%. Fell to nadir in Q2 2020 at 8.8%. The latest data in Q4 2020 : 9.4%.

3) In the last 30 years normal unemployment rate was : 5% – 6.5%.

4) Jan 2020 low @ 3.5% was the lowest in 50 years, since 1969. Apr 2020 peak @ 14.8%, the highest since the 1930’s, is a one timer to ignore. Back to normal in May 2021 @ 5.5%.

5) The “Real” consumer spending, total chart tell us : Markowitz the “effeicient markets hypothesis” was crazy.

6) Household debt service/ Personal income % @ 9% indicate that

most of us are not debt slaves.

Nice graphs Wolf although you might also consider adding one for Personal Income Less Government Transfers.

It was getting to be too many charts. Here you go, not adjusted for inflation:

Thanks :)

Is the US too big to fail? Is that the strategy? If the dollar devalues, what then for the world? The American strategy is to sell the big lie to everyone, so that everyone is implicated.

Will that succeed?

1) The HK crisis in 1998 infected the Asian Tigers.

2) Until 2007 China export deflation, USD was strong until the early 2000’s, before the plunge to 2008 nadir. In 2021 China export inflation. Blame China for the charts above. It’s China fault, not our fault.

3) Nike have a moat is China. China love Michael Jordan and Lebron. AAPL will never lose a dime in China.

4) Ca RE will never fall. Stocks are good for the long run.

5) US FANG rule the waves.

6) Stock market losses are unlikely.

7) Loss aversion for crazy people.

8) Be happy and buy bitcoins.

9) There is no penalty for investing in FB.

Inflation was created in America not China. The American government gave free money to all the lowlife slobs who deserved zilch. Legislation should be brought in to make everyone who got free money pay it all back.

1) Side by side : USD/CNY is down since 2006, from 8.1 to 6.45. China is expensive, China export inflation to US.

2) EUR/CNY is down since 2004, from 11.22 to 7.7.

3) China should be phased out as a source of any type of goods.

4) China silk road is malinvestment.

5) The Chinese weapons relative strength is rising vertically since 2019 Xi show of the year.

Wolf,

Great charts, as always. Many thanks.

Consumption numbers surely suffer once eviction moratoriums and mortgage forbearance programs cease. Stands to reason those factors have been adding some jet fuel to consumer spending.

Also we have the expiration of the $300/week FPUC bonus coming up in Sep along with the termination of the PUA and PEUC benefits programs. 75% of all continuing claims for unemployment benefits are tied to these two new programs. Might not have to wait until Sep to see the impacts since 23 states have announced these will be terminated earlier (no later than July 7th).

Since there appears to be no appetite for further stimmies in D.C., stagflation may be the lead headline the rest of the summer.

Risk averse : save the lives of hundreds firemen & policemen and

billions in lawsuits that followed the Sept 11 2001.

We are getting exactly what we want. We as country turned our back on sound money. The electorate does not know the difference between currency or money . Their sovereign tells the electorate what money is which is the sovereign’s printed or electronic debt . Sound Money was their right in their Constitution that they willingly abandoned. Inflation is our reward . Enjoy.

We might one day explore the galaxy, but even then, there will be people who still don’t understand that there’s no such thing as a free lunch.

All the movie theatres in Canada will close because most millennials are spending more in rent in a year than they earn in a year. Everything was negative before Covid for movie theaters now things are hopeless for them as millennnials have less than zero income to spend in Canada. I’m waiting for a suckers’ bounce in Cineplex stock when they reopen in August then short it to zero or a couple of cents. If they last more than 18 months it will be nothing short of a miracle.

The interesting thing is that compared to more than a decade ago, the dollar is not lower relative to other currencies. But inflation in the USA has been higher than in Japan, EU etc. This means that the USA has become less competitive because producing something in the US has gone up, relatively.

The USA still produces stuff, but we import a whole lot more, which is why we have a huge trade deficit. Inflation is up because we printed a ton of money.

The point I was trying to make is that the US$ has lost more purchasing power domestically than internationally.

Great point; the USD$ is still strong and much desired in pretty much every country, particularly in developing/emerging economies. King Dollar!

A year ago the Canadian dollar was $.74. Last week it was $.84. Yesterday it was $.81. Cdn exporters like it around $.75. The low interest rates in the states forces Canada to also keep it’s rates lower than it would like, or should, just to keep our dollar in a good export position. This also impacts our inflation rate and RE boom by keeping too much credit available/affordable.

Canada is the US largest trading partner with a slight surplus by US.

After the huge housing price spike, I would expect lower single digit returns for a while. Some areas may see some small price cuts. So, if you are looking for a house, you should get a decent spot if you are patient.

Makes sense.

If you take a 70 year view there have been only two periods when average home price to average household income got above 6. Both times there was a blowoff top followed by housing collapse.

All large bubbles are fueled by debt. Most likely this time will not be different. All asset prices eventually have to be supported by income whether a stock or a home.

Except…

The Fed is STILL buying MBSs ($40 Billion plus) each month….essentially lending money to buy homes 2% below the inflation rate.

Last time inflation was in this neighborhood, 1999 and 2006, 30yr mortgages were 6%….NOW 3%!

The Fed is a different animal than before…..rogue, IMO. They will not “fight inflation” and honor their “stable prices” mandate. And, they have not or will not honor their “promote moderate long term interest rates” but rather pin them at near record lows, immoderately low rates.

They are rogue because there is no one to coral them. Not until inflation is roaring and damaging will the relent.

“corral”

Great blog. In the late 50’s economists knew that banks didn’t loan deposits. Nowadays economists don’t know a debit from a credit.

So the Keynesians have achieved their objective, that there is no difference between money and liquid assets.

Money products decrease the real rate of interest, have a negative economic multiplier, and reduce the $’s exchange rate. Whereas savings products increase the real rate of interest, have a positive economic multiplier, and raise the $’s exchange rate.

Velocity falls as bank-held savings are idled. That’s why velocity has fallen since 1981 and we have had increasingly subpar economic performance. It is an incontrovertible fact. All bank-held savings are lost to both consumption and investment until their owners, saver-holders, spend directly or invest directly or indirectly outside of the payment’s system. Banks pay for their earning assets with new money, not existing deposits.

Based on money flows, which anybody can calculate, the rate of inflation won’t subside until Feb. 2022. The rate of real growth peaks in July. Monetary lags are not long and variable, the lags have been mathematical constants for over 100 years.

Gatorade at Family dollar just went from 1$ to 1.20. I guess all drink more water.

Spencer Hall,

“In the late 50’s economists knew that banks didn’t loan deposits.”

That is correct in as far as “deposits” are a liability on the bank balance sheet, meaning a debt that the bank owes the customers. So the $100 you put into the bank becomes a “deposit” on the bank’s balance sheet – a liability because the bank owes you $100.

But “deposit” is only one of the two accounting entries when you put money into the bank (as per our double-entry accounting system).

The other accounting entry is “cash.” The cash goes into an asset account called “cash” or “cash equivalent” or similar.

The bank can buy anything it wants to with this cash, including Treasury securities, and it can deposit the $100 cash at the Fed (where that $100 would be called “reserves”) and earn the IOER on it. Or it can lend out the $100 cash. All of those are assets for the bank.

Banks don’t lend “deposits” (liability). But they lend the cash (assets) from their customers.

You have to distinguish between the two accounting entries, the $100 “deposit” (liability) and the $100 “cash” (asset). They invariably go together. There is never just one accounting entry.

Note: The bank collapses if it runs out of “cash” as too many customers want to withdraw their money – such as during a “bank run.” If another entity wants to bail it out, such as a central bank or a government, that entity would have to put new cash into the bank so it can pay its customers that want to withdraw their money.

“The bank collapses if it runs out of “cash” as too many customers want to withdraw their money – such as during a “bank run.” If another entity wants to bail it out, such as a central bank”

Which was the purpose of The Fed until 1978 when Congress mandated that it promote maximum employment, stable prices (which, as you have pointed out IS NOT 2% inflation… which is actually more because their calculations are fudged), and moderate long-term interest rates (which IS NOT 0.xx%).

Great insight Spencer!

6) How many t-shirts for one Chinese drone, military plane or anti-ship missiles.

7) The European are China’s slaves for the machinery trade.

Exactly..

“Trade deficits don’ matter” is the mantra…yet we send money to China for things that will be in a dumpster in a few years…they take the money and acquire “drone, military plane or anti-ship missiles.” They also buy INFLUENCE in the US, Congressmen….hard assets.

The cracks in the basement are the symptoms. The 12 balconies architecture – in a wind tunnel, salt, humidity, rain, hurricane… – the architect is the cause.

If you print too much money you get inflation. Why didn’t anyone think of this before?

I thought Uncle Miltie said that. He wanted to put a machine with a formula in control. Jerome may have the formula but I think the inputs are whack.

DB

Not if you make more stuff than you print money.

If you make twice as much stuff it should only cost half as much at the same total amount of money.

Couple of quick points that might be relevant.

Current inflation is normally the result of actions 12 to 18 months ago. Looking at the charts this could mean, what we are seeing now, could be the result of the first smaller 2020 peak of income, which begs the question, Yazoo when the big one comes along.

I’ve been hearing folks say that US citizens have saved and paid down debts with their stimmies, No doubt, W will have a chart for this sometime, but my point is the saving helped to constrain current inflation. It also means these folks have the capacity to spend savings and re-borrow which could make future inflation higher or longer ,or both, who knows?

The Fed increased M2 by 27% in less than a year for the COVID emergency.

Emergency now passed….will they retrieve that money? Not a chance…..even though that would be the proper course. IMO

The Fed, Treasury and Congress are all enjoying the free money game here…sadly.

No, Wolf. Inflation affects everything but debt payments. Incomes and expenditures. Inflation for the last decade has been well below optimal. See the inflation hysteria following Fed moves in 2009 for an example of how perceptions of inflation are screwed up by statistics, not reflected by statistics.

Alan Harvey,

Optimal inflation = 0%. Then neither side gets favored. True price stability.

Inflation is an insidious evil for a big part of the American population, but it’s good for other others. Zero inflation is fair for all.

and what is “fair for all” is a normality and historical course set by free market forces.

For over 75 years, the Fed kept rates equal to or in excess of inflation…

Then 2009……and the emergency…that never seem to end.

If we cant have 0% inflation, then the Fed should have rates equal to inflation. For it is wrong to steal the value of past labors and current earnings…..but it seems to be the sport of the Fed today.

I’m pretty sure they tried to achieve 0% inflation in regimes like the Soviet Union, or other socialist experiments….didn’t turn out well for most- like the current fad, MMT.

The Soviet Union was operating on a version of MMT in terms of funding. In terms of economy, it was all screwed up.

1) $NYA dma50 and dma200 are both rising, parallel to each other, far apart. Death crossing probability is low.

2) NYA stocks > dma50 suddenly plunged in Jan 29 to 52.92.

3) In June 18 dma50 dropped to 44.81. NYA bounced back up > dma50. Fri candle was small, smaller than the previous ones, on twice the volume, the highest since Nov. Something is wrong. More stocks are falling behind, not participating, while the Nasdaq celebrate a new all time high in a wild party.

4) Traders imitate each others, herding in a crowd behavior, creating expectation for a quick profit in a self organized groups, in their trading rooms, connected in a positive feedback loop, amplifying the output.

5) Investors self fulfilling enthusiasm build castles in the air.

6) In 1929 the market crashed because of the utilities. In 1987 : de-regulations and Drexler’s wild traders. 2000 : the dot.com.

7) Every bubble need a backbone to build on, for support, for referrals.

8) The unsustainable growth lead to a build up of hidden forces and instability, that the Fed dare not control and suppress.

9) When the market reach a critical point it’s ripe to a sudden crash.

10) Why : reasons don’t matter. Any reason. The cause : endogenous destructive instabilities.

Great, fantastic; bring on the crash;…all the while the stock market is going nowhere but up. Unless your insight provides a timeline measured in months, just line up behind all the other prognosticators and doom-mongers.

Never mind, Wimbledon is starting tomorrow, the summer has finally arrived.

Netherlands vs Czech now. ESPN, Belgium vs Portugal

2:30 ABC.

Daniel Lacalle in English, u tuba, June 25 : $6T steam.

Store the $6T steam in the freezer, until the SPX plunge 25% – 35%,

thereafter reach a compromise. Last week was chapter #1.

The same people who created the bubble also anticipate a crash will form an “anti bubble”, an inverse bubble.

Wonder why the 10 Years treasury yield not moves higher.

The 10 year US treasury will be 2% by Dec-2021, 2.5% by June-2022.

Printing money destroys the country, and makes life miserable for the masses. It does nothing to help anybody with the exception of the wealthy.

Both International and Domestic transportation (Air, ocean, LTL, Full truck and flatbed) are all going up in costs. Ocean is going from $3000 avg. to $7000 avg. Air also doubled, and the domestic costs range from 10% up to 100% depending on mode.

Lack of drivers, lack of dock workers, and lots of retirements also in the industry.

demand is crazy to get Xmas goods and inventories back up.

This may be a local story, but at my Walmart, they always had Top Sirloin Steak at $6.94/lbs for at least the past few years.

It’s not the best tasting meat but it’s decent enough for me to use on various meals, and I thought Walmart was doing a good job compared to other grocery stores.

This past weekend, the price of the same meat was changed to $8.94/lbs. That’s a whopping 29% increase.

I surely hope this is “transitory” and the price will come back down, but something tells me I’ll be disappointed.