We don’t know how much total leverage there is, but from the trends in margin debt, we know it’s huge and ballooning.

By Wolf Richter for WOLF STREET:

A big part of the leverage in the stock market is not tracked and no one knows what it is. Occasionally, a tidbit bubbles to the surface when something blows up, such as the Archegos fiasco.

Another part of stock-market leverage, “Securities-Based Lending” (SBL), can be found on bank balance sheets if banks choose to disclose it. But not many banks disclose it, and no one tracks this in a summary figure, and we don’t know what the totals are. But they’re big.

For example, Bank of America disclosed $45 billion in SBL in its 10-Q filing with the SEC for Q1. This was up 25% from a year earlier. The bank says that securities-based lending has “minimal credit risk” for the bank because the collateral – namely stocks and other liquid securities – has a market value that is “greater than or equal to the outstanding loan balance.”

On this basis, a customer with a portfolio of securities valued at $1 million could borrow up to $1 million against these securities and then take the money and buy something else with it, including real estate or cryptos or pay for a divorce settlement. When the market value drops enough, the customer has to either bring in new money or start selling securities in the portfolio – which is when forced selling sets in.

Wells Fargo includes its SBL under “other consumer loans,” totaling $25 billion, which consist “primarily” of securities-based loans, as it says.

JPMorgan, in its 10-Q filing, does not separate out its SBL, but only says that it grew in Q1. Goldman Sachs, in its 10-Q filing, does not separate its SBL out either.

So no one knows how much leverage there is in the stock market in terms of these securities-based loans. There are many other forms of leverage, including those that took down Archegos Capital Management and caused banks over $10 billion in losses – $5.5 billion in losses at Credit Suisse alone.

But there is one form of stock market leverage that is tracked: Regular margin loans at brokers that are reported by brokers to FINRA, which then reports them on a monthly basis, which it just did, and they’re a doozie.

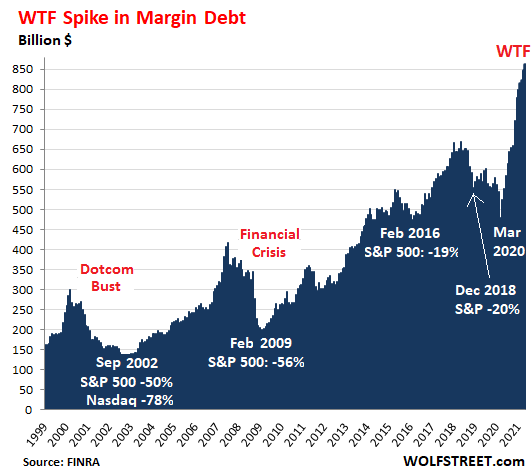

Stock market margin debt jumped by another $14 billion in May, bringing the historic spike to $862 billion, up by $202 billion in seven months, and up by 53% from January 2020 before the sell-off started.

In this chart with a time span of over two decades, what’s important is not the absolute level of leverage back in the day, compared to today, because the purchasing power of the dollar has diminished. What is important is the trend – the steep increase before every stock market sell-off.

Margin debt is the only known stock-market leverage measure that we have, and is only an indicator of the trend in overall stock-market leverage. It just shows the tip of the iceberg.

A big surge in margin balances precedes sell-offs. They don’t trigger sell-offs and they don’t predict sell-offs. But leverage pumps up stock prices by creating buying pressure as borrowed money surges into the market; and then when the selling starts, forced selling by leveraged investors creates selling pressure and amplifies the sell-off and triggers its own downward spiral.

The Fed – whose policies have purposefully encouraged and contributed to this spike in leverage – warned out of the other side of its mouth about excess leverage. In its Financial Stability Report, it warned specifically about the vast unknown parts of leverage among hedge funds and insurance companies, and it pointed at Archegos as an example of what happens when something goes awry.

Neither Credit Suisse nor any of the other prime brokers disclosed ahead of time how much leverage they were backing in the case of just one client, Archegos. The amount of leverage didn’t come out until it blew up the fund and caused over $10 billion of bloodletting among the prime brokers. Prime brokers have many clients. This type of leverage was just one example. It wasn’t even related to SBL. That’s a different example of stock market leverage. Margin debt is another example of stock market leverage. And there are other forms out there. We don’t know how much leverage there is, but from the trends indicated in margin debt, we know it’s huge and ballooning.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How can I short this!?!?!?

I won’t worry about this until 30 year rates are negative 10%. Until then stocks are a buy.

Watch the “Margaritaville” episode on South Park.

I found it to be much more comprehensive than the movie, “The Big Short”, and FAR better for one’s health.

By the way, how many TBTF corporations do we have left, and who owes them favors?

(South Park left that out and used the headless chicken default).

Seems that banks can only do limited speculation in the stock market *themselves*, but apparently it is legal to lend out money that is (a) secured by stock assets (b) probably will be used to by the borrower to buy MORE stock assets.

Is this how Dodd-Frank works in practice? If so, the risk is the same as before.

The money borrowed in a PLOC cannot be used to buy more stock at the brokerage where the portfolio is held, after that anything goes. The difference between margin debt and PLOCs is night and day. Brokerages will not be in hurry to mark to market loans during periods of stock market losses. Brokers can bridge clients stock losses, and banks are monetizing US debt through RRPO. Risk is being spread.

Risk is being spread until “contagion” hits and the dominoes start falling. When psychology turns “for good”, no one including any central bank will be able to keep asset markets inflated. It’s a long long way down to “fair” or “reasonable” value with a probable “overshoot” due to the greatest asset and credit mania in the history of civilization.

“Risk is being spread until “contagion” hits…”

On a marginally related note…the illusion of safety in “liquid collateral” (stocks, etc).

During “normal” times it may be relatively easy to liquidate stock-based collateral without gutting the mkt price.

But in a hugely overvalued mkt (see housing 2007) almost everyone is *primed* to head for the door on a hair trigger…because everybody knows the valuations are BS,

So everybody heads for the door at once and at the same time.

The result? That “safe” collateral collapses just when it is needed.

It happened in 2009 (housing illiquid and overvalued) and it can happen again now (stocks “liquid” but hugely overvalued).

The risk is different as the Dodd-frank legally puts the taxpayer as a first in line defense when Wall St needs bailout money for their reckless behavior………

Not that it was any different than before, but now it is coded into law.

Lol, “or pay for a divorce settlement”

Next hot investment vehicle will be divorce / alimony CDOs?

Getting married is about the worst long term financial decision a man can make nowadays. The odds of divorce and the family courts are both stacked against you. If your wife of ten years gets tired of your crap she can take your kids and half your stuff with a few well placed crocodile tears.

Yes and no. A friend of mine put it this way, “I have a great retirement plan. It’s called staying married”. He did, and does have an excellent retirement situation. :-) So do many others.

One thing I learned during my California divorce in the early 1990’s is that “community property” does not mean a 50 – 50 split of assets and other crap. It’s what you can negotiate and the court (usually the judge) approves.

Only if it’s a happy marriage. A lot of marriages stay intact due to inertia, the cost and hassle of divorce, or other factors. A lot of married couples are at best indifferent to each other.

These marriages are characterized by a sex life that consists of saying “F you!” as they pass in the hall. ?

Pre-nup!

As Rodney Dangerfield said, next time I feel like getting married I’m just going to find a woman I hate and buy her a house.

Thank you MG for making my day, I read your comment and cracked up. I needed a good laugh today

Or simply don’t give her any crap to get tired of and then she can’t get tired of it…

There are already companies that allow you to invest in lawsuits, and a divorce is based on a lawsuit.

If those CDO bets are made, judges and lawyers would likely make a lot of money, probably a LOT more for “taking a fall”, if it’s an ultra rich couple…..and having a helicopter and private jet ready.

And one can’t ever begin to guess how much leverage there is behind the “dark pools”.

“Dark pools are private exchanges for trading securities that are not accessible by the investing public. The name “dark pools” in these exchanges is a reference to their complete lack of transparency”.

“In the United States alone, estimates suggest that 40 per cent of all executed trades are completed in a dark pool, and about 20 per cent in Europe. In other markets across the world, dark pools aren’t as common, but in any market that sees growth in equity trading, dark pools are sure to show up.”

“The bulk of dark pool liquidity is created by block trades facilitated away from the central stock market exchanges and conducted by institutional investors (primarily investment banks).”

Hmm,

Anyone concerned this may be a side show compared to shenanigans in China?

This world runs on WTF…there are so many black swans candidates, really hard to pick the next one to cause the next shoe to drop or at least drop a little until the almighty FED decide to come to the heroic rescue.

Market is full of hubris, these numbers don’t seem to phase anyone, just like valuation, margin debt…etc.

Just wish someone would unplug this matrix already..getting really sick of it.

Agreed.

There are five more things to consider about Black Swans.

1. Stats such as GDP, unemployment, and inflation have become almost completely disconnected from the factors they were originally designed to measure. This is quite deliberate by governments, in order to hide either their own incompetence, or things they are no longer able or willing to change. This means both more black swans, and that the government is deliberately, albeit indirectly, not even looking for blackswans.

2. The lack of moral hazard since 2008 means that the kind of people and institutions that may trigger black swans do not care whether they do, as they get paid and avoid jail anyway. The inevitable additional risk-taking also increases the likelihood of black swans

3. The Fed, and other CBs, flooding the markets with money both increases risk-taking and encourages greed.

4. The mainstream media are both less capable of and less likely to give fair warning of situations where black swans would occur.

5. The interconnected policies of both governments and major corporations increases the chances that a big black swan somewhere will bring down the whole shebang.

In summary, neither I nor anyone else can be sure where the next black swan will appear from, but it can reasonably be surmised that both the number and size of them are increasing.

the black swans are coming home to roost?

“…wish someone would unplug this matrix alread…”

Um, that someone is Jesus. You sure it’s a good idea to wish him back already?

From what I understand many of the “cash” buyers of homes outside of those purchased by the big funds ( blackrock etc.) and offshore money are people using SBL’s to win the home bidding war in a tight market with the plan to obtain a regular mortgage in the future or quickly flip the home for a profit. On zillow these days I see a lot of fancy homes that were purchased a year or two ago that are being resold. Often these are for very small gains that only cover the RE fee or some at break even. I had always wondered why people would do that, then it occurred to me that some of these people are using SBL’s to buy homes that are too expensive ( trust funders?) for their income to support a mortgage . If so, these will cause a whole new kind of crazy when the RE market takes a big dip.

Why would some one want to get a traditional mortgage after having a paid off house? Or why sell it to break even?

I’m not seeing how one makes money or acquires a home through this process.

If they can break even after living in the house a year or two, the gain is the rent they didn’t pay to live in the very nice house. If they make more that’s gravy.

Seems pretty implausible in the real world outside of blog comment sections.

Forgive me for being ignorant, but what’s an SBL?

Ugh! Disregard my question above—-brain fart on my part!

Oh no you don’t! When it’s the title of the damned article, everyone knows what you do first here.

At least be honest about it, I’m sure you aren’t the only one.

It’s in the second paragraph of the article. People take a loan on their stocks. The thought in the comment above is that people paying cash don’t have cash from savings but rather took out a non-mortgage loan backed by their stocks so they can buy the house in cash and then refinance and get a mortgage to pay back the SBL.

What is the advantage over simply realizing a gain and using the proceeds to buy the house for cash? Is it the expectation that future gains will more than offset the interest paid on the mortgage?

“Securities based lending” — the topic of the article.

Check out Orchard.

https://homeopenly.com/Reviews/Perch

I wonder how many of the people who buy houses for cash while still owning their old house and not renting it are in the Orchard fly trap.

Leverage/margin buying is a very, very sharp double edged sword. Great if you are winning…not so great (understatement) if you are losing. All things turn eventually, and when they do, just wondering how much bailing out the Wall Street crybabies will receive?

How much bail will they get?

Millions of billions if 2008 is any guide. Add to that inflation and further inflated financial sector and the increased control of our govt the the wealthy…more.

Brahmins get as many financial Mulligans as they need, we couldn’t afford to lose their keen abilities.

That is the problem. If we would just allow people who gamble with their savings to lose it all, then they would not be controlling assets in the future and would not cause the next bubble. Learning lessons is an important part of life.

Margin is a double edges sword when the market is functioning. These people apparently decided that market is beyond salvation, and the FED has their back, no matter what happens.

This mind conditioning has been going on for more than a decade, and there is no sign of a change.

Add in inflation talk, and they are holding onto something solid. Because it has been telegraphed: we don’t give a chit about inflation.

Also there is nouveau tool forward guidance, which makes sure, no gambler is left behind.

Question for anyone on here… I’ve heard it’s possible to take out a securitized loan against your 401k and use that cash to buy real estate. Has anyone actually seen this being done? There is this feeling that there are an exorbitant amount of cash offers for real estate and I have to wonder, these can’t all be “investors”.

What happens in this scenario when the stock you borrowed against drops in price?

I was just talking with a retired friend of mine who is intending to do just that and said many of his friends have done it. He has a “paid for home” in a higher value urban area, he plans to continue living there until he gets the house in wants in the “lower cost” town where he will live out his years. He will use the funds in his 401k and IRA to get a SBL to purchase his new house, move in then sell his old ” higher value” house and pay off the SBL. Will probably work out fine unless the house market and stock market take a big dump before he sells the old house.

My sister who is not financially savvy told me a few weeks ago that she is planning to do just that to purchase a 2nd home. That was my thought…if the market tanks while the deal is coming together it could become a costly mess.

You can purchase real estate thru an IRA, but not a company sponsored 401k.

There are a lot of rules.

He’s not talking about using the 401k to buy real estate. He’s talking about borrowing money, using the 401k as collateral, and using that borrowed money to buy real estate.

You can “borrow” up to $50,000 from your 401K. You are required to pay it back but if you can’t, it’s not a default in the traditional sense because your account balance is reduced with the distribution of the loan proceeds. In a default, the outstanding loan balance is treated as a taxable distribution, subject to the 10% early withdrawal penalty.

Amortization is either up to five years or 15 years for a real estate loan.

This is from the 401K where I have been a participant. I never borrowed for real estate, so don’t know about the documentation.

The “funny” thing is that when I tell people that the stock market can easily drop 50%+, they think I’m crazy. When I then point out that a 50%+ drop has happened TWICE in the past 20 years, I get a glassy stare.

People have such short memories. And the situation today is WAY more dangerous than it ever was in 2008.

Their memories are fine. These people saw the market quickly come back after the drops in 2000 and 2008. That’s what gives them comfort.

They are not thinking about capitalizing on a market bottom, which is probably top of your mind YuShan. In a way, you are speculating, they are not.

Given the extent of overvaluation and structural deterioration in the economy, however, I worry the next market drop won’t be so transitory, so I would never recommend being 100% in stock, no matter what your investing timeframe is. I have no problem with a buy and hold 60/40 portfolio for somebody that otherwise might get a bad case of FOMO at the wrong time.

Not sure about quickly. Didn’t the S&P take 13 years to recover after 2000?

That is not quite an honest assessment.

While the market may recover, because losing stocks in a index are replaced by winners, the individual stocks within the market, and the individual mutual funds people are invested in may not, meaning the people who were invested in them never recover.

People who were heavily into WorldCom, Northpoint, and Global Crossing are probably enjoying their retirement in a single wide mobile home down on the bayou…

They think you’re a party pooper, out to spoil a good story. That’s how their brain works.

Not only that, but according to Avi Giburt over at Seeking Alpha, this market (at least the S&P500 anyway) has another 40% upside and a few more years to go before the bears finally take over for the next few decades (think Nikkei circa 1990).

History tells us that stock market can fall 50% and then more than another 2/3 for a total of 89% decline (great depression). I think many are vulnerable to this scenario because recent history has been to buy when down 50%. Could be too soon. Have to be careful.

Many are fooled by greed and feeling left out financially.These are unprecedented times.There will be A Great Crash of Everything.Many will be devastated.Taxpayers will Not Bail out any bank.IMF cabal has been pretty clear anout not wanting commercial banks around.Euro vs. FEDvs China and Russia in mad dash for gold as Basel3 kicks in.Some banks will fold from these new requirements as theyre short on gold.Do not forget unpredictable effects of covd viral challenge to jabbed peoples’ bodies. Read the data.Meanwhile,more humans are remembering all the govt. Lies and are atanding up for their Basic Human Rights.What happened in Columbia and Myanmar?

Mommy, that man over there is threatening to raise rates again.

Thanks for this analysis Wolf. I just reduced my brokerage margin 25%. Beer coming your way.

SPX took out 8 SL.

Well looks like the party will last quite a bit longer….Weimar Powell is not taking away that punch bowl anytime soon, the transitory narrative gaslighting effect is still in place. Rates still 0, not thinking about thinking until 2023, $120B a month continues…this freaking guy…stick his head to the pike already.

Guess we will be seeing even more WTF as outlined here for the next 2 years, a central planner that better suited to be call Central “WTF” enabler.

After 20 years why would they abandon their wealth effect nonsense now? That Fed put invites leverage. I won’t venture but it’s not because I’m intelligent.

The way I understand it at some point excessive debt starts turning $1 of spending into 99 cents and then any more debt just starts becoming 98, 97, 96 until you decide to take your medicine and write off the bad debt and let the economy start naturally functioning with a real hurdle rate for projects.

Never considered an SBL. I cannot imagine my bank would loan me dollar for dollar what my stock portfolio balance might be. Do banks loan like 80% LTV or something similar on SBLs ?

If you’re worth $500 million, a broker will do almost anything to get your business. Maybe you’re not there yet?

:-]

I’m only wealthy enough for the bank to waive the fees on my near-zero interest-bearing accounts.

Long way to go. So far one of my best investments has been installing spware on my phone. Drivewise by Allstate monitors your driving and pays you for good driving habits. I’m up $54 since late April.

That was hurtful !! (and true – hee hee)

At JPM its up to around 50% depending on the volatility of the underlying securities.

Considering the cash in the system (excess reserves) its hard to imagine a problem with margin.

For whom?

Thanks for the correction. Macrotrends uses inflation adjustment dollars to distort reality.

Maybe next year they will try to tame inflation. They overshot their 2% inflation target. Am not sure what they were aiming at.

What is a safe investment? Gold was priced over $2100 an ounce in 1980 and has not regained its 1980 high to this day. When the price of metal goes up, miners get busy.

Nice try, but didn’t the barbarous relic top out @ around $800 in 1980?

He is probably trying to use inflation adjusted dollars.

$800 in 1980 is equivalent to about $2,500 today.

Gold is at $1,830 today.

In 1980 inflation was 13.5% . That’s what it takes to really move the needle on gold. You need double digits to really goose gold, or a high level of fear.

Average inflation between 1980 and today has been far less, about 3%.

Gold was well on its way until the Draghi speech. Then everyone stopped being afraid and gold cratered by about $500. But it’s b-a-a-a-ck and higher than before Draghi’s BS speech. Up about 50% in the past 2 years.

BS works for a while but you can’t outrun math. 5% inflation isn’t enough to move gold, but fear of 10% is.

We all know what currency debasement means. The truly frightening aspect is not the Fed but the decision to bypass the Fed with checks written by Congress.

DH

Theoretically, the bonds of the financially strongest nation on Earth define the base for ‘safety’ of investment. Every other investment should carry a risk premium above that no1. Trouble is, the US has so screwed up this relationship over the years that nobody 100% knows where they stand any more.

Personally, I think land is potentially safest, they don’t make it any more, and people always need to eat and live somewhere. If you’re into ‘Green’ there will be a lot less of it when the sea level rises 20feet.

“land is potentially safest”

Dollars are backed by potential for collecting taxes. If the government should ever get serious about its debt, it might become interested in taxing something that is (1) unlikely to be moved into a shelter and (2) whose ownership is, ultimately, traceable.

Dotcom Bust + Financial Crisis = Financial Bust?

Or an upcoming “Greater Recession” or “The Great Depression II”?

Gotta get our terms right.

IMO “this time is different” because not just the speculators but the Fed too believes it has found a way to keep stock prices rising forever and prevent selloffs. And they think they can do it even as they tank the economy in the process.

Most of us may be living in cardboard boxes and struggling to afford food, but by god they’ll keep the stock market up.

IMO what is different this time is that the economy doesn’t matter, just the market.

There are many world’s in finance,and many actors.

Does it mean that SBLs are covered (while times are good), whereas broker held margin is not?

Even if covered, how does one broker know, that an account holder doesn’t deal with multiple brokers similar to Archegos?

Collateral securities must be held in-house

“On this basis, a customer with a portfolio of securities valued at $1 million could borrow up to $1 million against these securities and then take the money and buy something else with it, including real estate or cryptos”

So you buy some crypto or real estate using equities as collateral. It would seem you could then get another line of credit using the crypto or real estate you just bought on margin. That would double your leverage.

Then you could buy some more crypto or real estate and get a line of credit based on that – now you’ve got triple the exposure. You can scale this to any level you want, even hundreds of times.

You can become very rich so long as all the assets in the chain appreciate. I’d say for many people such a scheme to harvest infinite wealth would be very appealing and worth the risk of bankruptcy.

If inflation is temporary then why is the Fed thinking of raising rates in 2023?

The year 2023 might as well be a millennium from now. A lot of volatility is likely to happen in 2021 and 2022.

Have the Fed’s two-year projections ever been close to accurate? The Fed said it cannot see bubbles, so it operates as though they don’t exist.

If they raise rates that will cause a drop in inflation, and to meet their inflation target “on average” they must let inflation run a bit hot, above 2%. The rise in inflation is transitory, inflation is a constant. They manage an inflationary monetary policy. The question then is why will it take two years and umpteen trillion dollars to push the inflation rate above 2%? Well most of that money isn’t real cash that will be released into the economy. Money velocity is near zero, which means money is leaving the economy. It will probably be 2023 before real economic growth returns. The Fed does provide liquidity to keep lending as robust as possible. They could cancel several trillion in phantom cash and no one would notice, if only the economy would take up the slack.

I don’t think they will tank the economy in an election cycle.

Oh oh, wait a minute. The election cycle never ends.

The comments about money velocity forced me to review the concept of entropy. I thought the following was pretty funny, especially ‘selective information’.

In this page you can discover 17 synonyms, antonyms, idiomatic expressions, and related words for entropy, like: randomness, kinetic-energy, flux, selective information, information, wave-function, s, potential-energy, perturbation, solvation and angular-momentum.

perturbation: anxiety; mental uneasiness.

I kind of prefer, “What goes up must come down”.

Isaac Newton….investor

It is the Fed’s responsibility to manage margin rates— “ removing the punch bowl when the party gets too frothy” as it did in earlier years.

Raising rates to 60-70 percent was a bit of a deterrent but markets didn’t topple until the 10 year interest rate went much higher.

Also you couldn’t borrow against your stock portfolio to buy real estate.

With rates so low and high inflation the stock market could well continue higher.

But Paul Tudor Jones says buy commodities, Bitcoin and gold.

(Slightly OT) Question: In 2008, what was the pin prick that burst the bubble?

(And a rhetorical comment). How the F*** has this bubble not burst yet?

Deregulation if the financial industry, subprime mortgage lending blowup, banks engaging in selling securities, etc.

Bond market will adjust interest rates already fired a shot across the bow

Wow, back to back WTF, we’re starting to normalize these WTF moments.

I think you need to add a letter to the acronym to make it stand out more.

WTFH for example.

WTFIGO is another. (IGO stands for Is Going On)

Heh heh, insanity doesn’t begin to describe this situation. But it’s other people’s money right? OPM is always good to burn.

I invest in an old Scottish invention called an ‘Investment Trust’, some of them are over 150yrs old, many starting life to invest in American railroads.

They are to ‘investment’ what Scotch is to drinking.

They are closed end fund companies, with a board of directors who hire in a fund manager to run the fund. It is fairly normal practice for them to use ‘gearing’ whereby they borrow from Banks or even issue their own debt against the equity portfolio. It magnifies gains in rising markets and vice-versa on the way down, thus giving the manager another lever to manage returns.

The level of gearing is very tightly controlled by the Board, usually with a limit of around 10-20% of the fund equity. Gearing is quoted and can be used to assess risk. Many can use options, foreign exchange and derivatives to glean further returns.

For non-millionaire private clients, the banks and stockbrokers play ultra safe by only lending a limited percentage of the share value, what they want, same as housing, is their money back, their arrangement fees, their loss insurance and their interest payments. It’s a win, win, for them and sucker bait for the shmucks who ‘BET’ on the market. Just sayin’

It might be an exaggeration to say this is how Carl Icahn has for decades been paying his utilities without showing the US a penny in income.

Market rallying again!!!

Happy times will always be here.

Rallying? Dow -350 points, or -1%, S&P -0.5%. Only the Nasdaq is still in the green, but losing it.

But who knows what’s going to happen in the next 10 minutes.

wolf,

Excellent article as always.

One consideration: what does the presence of entities such as robinhood mean in terms of margin debt?

The “democratizing” of derivatives to millions of noobs would certainly accelerate margin debt since – I believe – these types of “investments” are all margin based.

Secondly – thoughts on timing. Administrations generally prefer a crash early in their term. It allows blaming of the predecessor.

While 2021 isn’t over yet, there are none of the signs of government policies designed to deflate bubbles (not that said government really does that any more).

So does this mean we might have 2 or 3 more years of this nonsense?

The SPAC collapse has begun but doesn’t seem to be affecting the overall market.