The “minimum book tax” on reported earnings would be a tax incentive to produce realistic earnings reports. Wall Street will fight it furiously.

By Wolf Richter for WOLF STREET.

I was no fan of money-printing interest-rate-repressing Fed Chair Janet Yellen, though she did hike interest rates and kicked off the Fed’s balance sheet reduction. But she’s now getting huge brownie points as Secretary of the Treasury for trying to deal with the catastrophic corporate tax code by including something I have been jabbering about since 2012:

Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income they report to their shareholders under our glorious accounting principles GAAP, rather than paying no taxes, or even getting paid tax benefits, on the losses they report separately to the IRS under the tax code.

Small corporations, such as my WOLF STREET media mogul empire, use the same accounting principles for earnings and for taxes, or vice versa, and we have no illusions, and there is no reason to inflate income.

But Nike reported $4.1 billion in pre-tax income to its shareholders over the past three years and had a three-year effective tax rate of minus 18%, meaning the IRS paid Nike large amounts of money, the so-called “tax benefits,” instead of collecting taxes from Nike, according to a report by the Institute of Taxation and Policy. There were 55 companies of this type in the report.

Yellen’s approach isn’t as radical as mine would have been. Since 2012, I have been arguing, throw out the entire corporate tax code and replace it with a tax on the inflated and puffed-up income that companies report to shareholders under GAAP.

Yellen isn’t going there. But she proposed to impose a minimum tax of 15% on “book income” – namely the inflated puffed-up income that corporations report to their shareholders. This measure would apply to “large companies that report high profits, but have little taxable income.” The proposal calls it the “minimum book tax.”

“This minimum book tax is a targeted approach to ensure that the most aggressive tax avoiders are forced to bear meaningful tax liabilities,” it said.

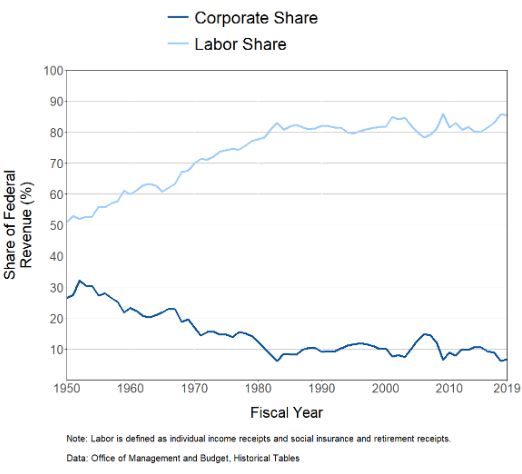

This was item #4 in the 7-item Make-Corporate-Taxes-Great-Again plan… no, just kidding, I mean in the “Made in America Tax Plan,” which came with this chart that we have seen a million times, showing how the share of federal taxes that labor pays has soared to 85% and how the share of federal taxes that corporations pay has collapsed into the single-digits:

Yellen’s proposal goes on to explain:

“In a typical year, around 200 companies report net income of $2 billion or more. Of these, a significant share pay zero or negative federal income taxes, despite reporting hundreds of billions of dollars in profits to shareholders in the aggregate. This is because significant gaps in current tax law, as well as the presence of offshoring incentives, provide large and profitable corporations with many ways to decrease profits exposed to tax liability—in many cases, to zero.”

Back in 2012, I introduced my article on our corporate tax dodge code this way — and the issues have remained the same:

Between 2002 and 2011, Boeing reported to its investors that it earned $31.8 billion. But it reported something entirely different to the IRS and didn’t pay income taxes. Instead, it received tax benefits of $2.06 billion, an effective tax rate of -6.5%. Other companies were similarly agile. Bailed-out GE earned $10.5 billion, paid zero taxes, and received $4.7 billion in tax benefits….

These companies are presumably doing nothing illegal; they’re just using GAAP to show huge profits to their shareholders, and they’re using the tax code to show huge losses to the IRS. The tax code encourages them to do that.

Yellen’s proposal goes on to lament (what I lamented in my obscure corner nearly a decade ago):

Corporations have at their disposal two kinds of reporting rules (book and tax reporting) that provide for a variety of allowances that shield them from meaningful tax bills.

Corporations are simultaneously able to signal large profits to shareholders and reward executives with these returns, while claiming to the IRS that income is at such a low level that they should be freed from any federal tax obligation.

The proposal explained how it would work in conjunction with the regular tax liability:

Large corporations that report sky-high profits to shareholders would be required to pay at least a minimum amount of tax on such out-sized returns. Under this proposal, there would be a minimum tax of 15 percent on book income, the profit such firms generally report to the investors. Firms would make an additional payment to the IRS for the excess of up to 15 percent on their book income over their regular tax liability.

And the proposal put a number to it: “In recent years, about 45 corporations would have paid a minimum book tax liability under the President’s proposal.” And “the average company facing this tax would see an increased minimum tax liability of about $300 million each year.”

Secondary benefit: more honest earnings reports.

And this is where the fun begins: If large corporations have to pay 15% minimum income tax on their profits as reported under GAAP, it could possibly bring some honesty and reality to financial reports because, under the 15% minimum tax on book income, companies that inflated and puffed up their income would have to pay 15% taxes on that inflated and puffed-up income. This would be a costly disincentive to inflate and puff up income.

It would make CFOs think twice. In theory, GAAP financial statements could become more honest, policed by the threat of having to pay 15% in taxes on puffed-up income. And that could be a game changer – when there are suddenly tax incentives to be realistic with financial reporting. And that’s why Wall Street will fight furiously to sink this thing.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great idea! I like your version better, Wolf, but Yellen’s would be a step in the right direction.

To go one step further, let corps deduct what they pay out dividends, and let recipients pay regular rates on them. This would eliminate both the incentive skewing managements towards buybacks to benefit insiders receiving stock options, and also the optics of giving dividend recipients a preferential rate while eliminating the double taxation of dividends.

I don’t think that would eliminate the management incentive to favor buybacks, but it would reduce it.

Imagine if there were also a modest 10% tax on all “profits” used for share buybacks, with a simultaneous prohibition against using borrowed funds for buybacks.

So what’s wrong with comanpies giving shareholders back some of their money via buybacks or dividends (which are essentially the same thing)? And why should non-shareholders care?

Now that extra tax on dividends would perhaps bring all those “Offshore” tax reduction locations back home too. Mind you the likes of the Republic of Ireland, for example, would not be so happy.

ZIRP was responsible for the biggest debt to equity swap in history. You can’t blame corporations if Fed is going to allow you to leverage up at 3% interest rate. What are they supposed to do? Build a factory when China already has excess capacity.

Plus my opinion the stock market SP500 is worth close to 1000 than 4000. Corporate tax hike and inflation ought to be enough to prick the bubble and that will solve the wealth inequality problem, but everyone will fell poorer unless you are part of the mafia.

That’s part of the problem Old School …………..

We are quick to give a pass to those who steal legally and lie truthfully,

rather than call them out for the socially ruinous bastards that they are.

I had to do a double-take on your prediction of the SP500 dropping to 1000. That is a massive drop. So I ran some quick calculations.

Assume the up trend for SP500 began on3/9/09 with a closing price of 676. The bottom was actually 666.

Assume that the closing price as of today is the top: 4097. I’m definitely not saying it is, just an a assumption.

Assume the SP500 drops to 1000.

The percent retracement of the prior uptrend would be 90%.

Retracements of even 50% are very likely to turn into 100% retracements or more.

Therefore, if the SP500 drops to 1000, a 90% retracement of the prior uptrend, I would surmise that it will test and violate the low of 676 set back on 3/9/09.

1000 is a nice round number so the index would like bounce around in that region a bit, but eventually go lower.

Conclusion: If it drops to 1000, I’m even more bearish than you are!

Man ‘o man, 1000 is a long long long way down!

As an alternative method of valuation, look at enterprise dollars of income, or cash flow, or gaap earnings, and capitalize that at an appropriate pe.

Also solves eps buyback inflation.

I am shocked deeply. I may have to rethink my very low opinion of her. I still think that Clinton, Yellen, and that administrations’ other political cronies (along with others who have prevented genuine reforms) are primarily responsible for the prior and the coming financial catastrophes.

Her support for the repeal of the Glass Steagall Act and then opposition to the re-enactment of a replacement version with similar terms really had me convinced that she was as corrupt and evil as the banksters. See “Yellen’s Dangerous Glass-Steagall Repression” in the daily reckoning.

2 + 2 = whatever you want it to be.

This was a great article, Wolf. Thank you

I wonder if Yellen reads WolfStreet? Someone should send her the link of this posting.

Which of you readers has any connections with Yellen?

One of our commenters here had Yellen as econ prof back in the day at Berkeley. Can’t remember who that was.

This would be a terrific fix….which is why I’m very skeptical it would happen, it’s surprising it’s even being discussed. Makes me think Yellen might actually be naïve enough to believe her own nonsense and think she’s doing good work…I always wonder.

As an eighteen year old student at the U of MN in spring 1981, I had JFK’s economic advisor and a chair of the Council of Economic Advisors, Walter Heller, as my Econ 101 professor. He was a Keynesian and a critic Milton Friedman. I was in my fifth year as a street hustler of tickets, and we had a quite different philosophy on how free markets actually worked.

To his credit, Prof. Heller enjoyed debating with me when I’d question what he was teaching to the class, and he would begrudgingly agree with my perspective once in a while as I explained my case, based on the time-limited markets I knew from experience.

To his credit, my Prof. helped create the Marshall Plan and this brought West Germany back from destruction. R.I.P. Walter.

Yellen is the perfect example of the wonderful line from the old Ghost Busters movie after they blow up the lab:

Now we are going to get fired….

Don’t worry, we’ll go out there and get jobs….

You mean in the real world….

Yes…

Oh I don’t know…I hear they expect results…

Yellen (and any other Fed chair or Treasury person) gets results, unfortunately the wrong kind for most people.

six degrees of separation ………..

this site to Yellen is probably less ………

Another part of the treasury plan is to tax US based companies on foreign profits?

Did I read that correctly? Is that an incentive to bring manufacturing or other ops back domestically??

There are several tax reforms in this proposal that would undo incentives to import and would encourage exports. That’s my understanding. It’s not just one item.

I’m kinda shocked by it…

The horse was “let” out of the barn starting in the 70’s with tax changes favoring corporation outsourcing and able to deduct foreign taxes paid from US liability, including bribes. Also Nixon opened the door to China. A bit of help was also supplied in the outsourcing game with the aid of CIA’s involvement overseas to mold governments for corporate interests, some of the ops were really bloody. This has escaladed for years with ops like NAFTA and abolishing Glass Steagall, and continued tax changes thanks to lobbyists and the cooperation of our Congress.

To think those players are going to wrestle that fat horse back to it’s barn is a fairy tail. I’m afraid that our situation will get much worse before the masses will assemble to get the ship righted and the horse back in the barn.

I have to add one more thing, my “much worse” goes to the fact the our Nation is more divided than ever due to the polarization of our people. We are being divided and conquered in the present time by our leaders, by design or some other reason beyond my ability to see. Only unity can prevail against our common enemy or we will all march to a road to serfdom, maybe not me at 72 but my offspring.

Panamabob, I agree about the division in our country. It seems contrived.

The current playbook aimed at destruction of USA is directly out of the manifesto, or whatever it was/is called that was widely disseminated after WW2 and Korea.

We got tons of it labeled as ”communist propaganda” starting in high school in the 50s in order to ensure that we knew the intentions, policies, and practices, divide and conquer being the most basic,, meant to take over the USA by the ”reds.” And, thus, what we were supposed to prepare to resist.

Some will say/add that the global oligarchy, nominally completely against any ”ism” other than capitalism, saw how close to world domination a couple of smaller countries came in WW2, and actually helped to move as much as possible of the industrial/manufacturing/resource extraction AWAY from USA, the thinking being that IF USA kept the extreme, almost total, global manufacturing dominance that existed at the end of WW2, it would be relatively easy for USA to do what Germany and Japan failed to do.

They likely based that analysis on the rise of ”populist” / ”nationalist” politicians in USA, another more recent example of that potential just experienced, but Huey Long and similar were at it in the 1930s, and others before and since seem to prove the point, or at least provide a lot of support for the theory.

Will those same global oligarchs ”allow” USA to continue as it is currently???

Wish I knew the answer to that question to advise the offspring, that’s far shore!

It’s gone to heck in a straight line from the Powell memo to the waste lagoons.

My sons Peter & Joseph each purchased a bench top water purifiers online from China = approx. AU$80 each.

To purchase the exact same product from the US = AU$260 odd each.

The US is making good mark-up money.

?

Great article ✔

It’s high time we did this. We should also close an important loophole and change the way buybacks are accounted for. Personally, I think they should be illegal as a form of stock manipulation, but it might make more sense to tax them. This may sound weird, but so did depreciation when it first came out.

Stock buybacks are OK in my opinion. The problem is the government rescues corporations that don’t keep sufficient cash on their books to weather a storm, Boeing being a good example. Boeing stock holders should have got completely wiped out in 2020.

Muilenburg has a $240m SPAC to buy up, get this, aerospace suppliers.

The BA problem started in 2009 with then then ceo and board with decision to do buybacks rather then spending 50 billion to re do the 737 fuselage.

The recent ceos just cannot easily fix those problems, and then embark on their own.

How long before something this radical could be implemented? This sounds like a lot of hot air to calm the people…

Pleasantly surprised! I find Biden’s modest tax increases on corporate income and rich Americans a welcome surprise.

Some libertarian sites (Mish) portray these tax increases on the tax payer subsidized rich and tax payer subsidized corporations as taxes on working folk. They go on and on as if working folk will pay these taxes on the rich.

They actually make you think taxing the rich is unpopular. They couldn’t be more wrong.

Corporations apparently derive income from sources other than their customers, so none of the income lost to taxation is transferred to them. That is very comforting, to be sure.

Post customer economy. One thing I can’t stand is listening to a business complain that it doesn’t have enough customers. Dur, (productivity/wages)=price except when you try to keep massive profit margins that don’t get reinjected into the circular money flows of the economy. Then the circulating supply perpetually drops and so do the prices people can afford (so either they can’t afford it or maybe they just don’t like the product). Economists are ripping their hair out over this (as if it’s a mystery), and we can see that it is happening by the unfathomably low money velocity and massive cash reserves/income statements of huge corporations.

The funny thing is, this dam of money supply just being squated on cannot be spent by those accumulating it without causing massive inflation and devaluing what they think is worth a lot more (because the value of money is all relative to the actual output stream). They’re crack (FRN) addicts. I could wax on, but what I think everyone needs to existentially ask themselves in an economy gone mad is “what actually truly has value to me?”

Excuse me, it’s (wages/productivity)=price.

Fortunately R, when I was at Cal, AKA Berkeley, I was studying what is colloquially referred to as ”hard science”,,, not the Econ that Yellen and SO many others have made up TO FIT THEIR AGENDA…

So, sorry Wolf, can’t help ya out with a connection to the Yelling one, ( and I also suspect she was there considerably after I was. )

Some folks on here would have us be able to defy the laws of physics in various and sundry ways: NOT going to happen with less than atomic powers,, so very unlikely.

OTOH, clearly, there are many folks quite capable of defying the ”laws of economics” which are neither laws, nor in fact anything other than anecdotal opinions collated and dissected to support A point of view.

rhodium,

It isn’t funny at all…

a) It is being spent – in the housing market.

b) They are very much aware of what you are pointing out. Faced with an imminent reduction in the real purchasing power of these holdings they will chase hard assets with it at a dizzying velocity.

c) Other countries – those with some semblance of a real economy – are getting wise to this and, while certainly welcoming of hosting corporate earnings in the banks, they are beginning to place restrictions on how *individuals* (or their institutional agents) can host that money in their country.

So, really, it’s not all that impossible to foresee a cataclysm a few years from now when…

1) Faced with imminent hyperinflation the super-wealthy attempt to shift their holdings to the new Chinese digital currency

2) Fearing the effects of instability of such a large shift, the Chinese forbid it

3) Thus thwarted, the super-wealthy buy up every available hard asset in the USA – making “a” even worse.

The “unfathomably low money velocity” is a “metastable” situation.

If the superwealthy can continue what they are doing to accumulate money they will – as long as said money has a good prospect of maintaining its “real” power both here and abroad.

If the real purchasing power is under threat – this dam breaks quickly. We should be noticing the ground beneath our feet getting rather wet right about now…

Corporations charge based on the market will bear.

Corporate taxes are largely passed through as increased costs to customers. It’s actually somewhat controversial how much of that tax comes out of dividends for shareholders. Suffice it to say that an increase in corporate taxes is at least partially a class on the middle and lower class who buy corporate products, not a tax entirely worn by the wealthy.

And the party of Biden and Yellen is also loudly clamoring for an increase in SALT deductibility, which is massively favorable to the wealthy in a few high tax states, on balance, it seems doubtful to me that the rich will pay that much more if this also passes in addition to the other ideas.

Happy1,

“Corporate taxes are largely passed through as increased costs to customers.”

So why did corporations not pass the TAX CUT of 2018 through to customers????

This theory is bunk. Prices are set in the market place not by taxes and costs. Companies have to figure out how to survive and thrive with the prices they can get.

It’s about time. Companies like Facebook, Twitter also need to be taxed to oblivion, while Google needs to be broken up.

Why not make the corporate tax progressive like it is for individuals? Maybe trillion-dollar corporations should pay a higher rate than small businesses. If they did, it might moot the necessity of a lot of complicated and expensive and antitrust actions.

There’s definitely some positives to that plan, however, a big issue is that, it would incentivize the government to let big corporations go wild. In order for the American economy to do well, there has to be competition to keep consumer prices down. If the prices on consumer goods were kept down, that would greatly benefit the rest of the economy, the inverse is true though as well. And as always, the corporation will try to find ways to hide income if you let them. You always have to consider with any law being passed, that supposedly taxes corporations more, is there a deliberate loophole? Most loopholes are deliberate.

Most small businesses are actually a single person, and even in most multi people businesses, the owner chooses to get taxed as an individual (pass-through income). So the corporation tax wouldn’t effect them. Some small businesses (even some very small ones), however, do choose to be taxed as a corporation and all the money after the corporation tax is instead capital gains tax.

Most economists would agree that capital gains, should be taxed as ordinary income, but good luck with that happening any time soon.

There’s no inherent reason anti-trust would have to be complicated or expensive.

I could sign on to taxing cap gains as ordinary income, but only if adjusted for inflation. As it stands real cap gains rates can easily exceed 100%. For example if an asset is sold for a 6% nominal gain over a period in which inflation totaled 6%, any tax at all amounts to an infinite real rate. No real gain, divide by zero.

The current “preferential” rate is merely messy, partial, compensation for this. So sure, tax cap gains at the same rate as ordinary income, but only real gains.

I totally agree with Finster, and have thought such for years. It only makes sense, so I don’t expect it…

Makes sense, alot of details would have to be worked out.

“Most economists”? Hardly.

I don’t necessarily agree with this. In the first place, Facebook, Twitter and the Private Equity guys should not exist.

If they go back to progressive, make them truly progressive. Please don’t go back to the faux progressive rates that taxed the small business owner at the highest rate (see the table below).

https://taxfoundation.org/selected-federal-rates-2012-2013

Facebook and twitter and Google need to start paying me when they share my information.

Facebook should pay when I post a picture and somebody else reads it. We are the content. I am thinking I need to start putting trademark watermarks on my pictures.

ru82

Are you listening to yourself when you say what you’re saying? REALLY?!

No one is forcing you to put your face on facecrap or twatter, is that NOT TRUE?

It really amazes me that people like you exist ( even though I read and listen to multitude of stories from media and through the community around me , stories of utter invasion of privacy by these companies)!

Remember when you signed up to these free services?!

If you haven’t yet figured out that the PRODUCT they SELL is YOU , then we’re in prolonged pain for years to come.

Read comments like “ MONKEY BUSINESS ‘s” here on his/her opinion on companies like your beloved facecrap and twatter!

Better still , inform yourself on how to de-digitize your life! and try living in the real world a little bit more!

I am sorry, that this sounds like patronizing, but it aches me when I see people clamoring to put their lives on MEDIA THAT CAN BE RETRIEVED and thrust upon them , used against them! And all for what?

There are many real people who lived and still do without these TOTALLY NOT NECESSARY “tools of destruction “ to ruin their lives!

I would up the minumum tax to maybe 20-25%. The alternative tax rate otherwise might be bureaucrat hemp neckties – complete with complimentary lamppost, and ceo pitchfork kabobs!

Honestly, the powers .. as such, need to get their act in gear, or they might well be pulling different strings altogether. They’ve just about screwed people beyond the breaking point.

In general agreement, though…

1) The “book earnings” tax aspect might make financial reporting more honest but…why not directly address the tax “loopholes” that allow very low standard tax due?

I’m a little bit wary of leaving those in place (why, if illegitimate?) and relying on the “book earnings” tax to create something of a catchall failsafe.

If current corporate tax deductions/credits are illegitimate…get rid of them.

My guess is that this approach might be political cover…all those “illegitimate” deductions/credits are constantly brokered by Congress members, trolling for donations. Yellen keeps the political corruption intact while providing something of a revenue generating failsafe.

2) Along these lines (political cover) taxing intermediaries (corporations) while not addressing intentional “flaws” in the taxation of end recipients (insiders, shareholders) looks a bit suspicious, while at least generating some failsafe tax revenue.

If the fundamental complaint is that insiders/shareholders are merely using the corporate entity as a tax avoidance device, then directly change the tax laws that regulate the tax status of corporate distributions. But pretending that somehow a tax on corporations isn’t in the end a tax on *somebody* is just political gobbledegook.

By hiking individual rates and hiking corporate rates, the G is taking two bites at the apple while pretending to only take one.

3) And what of Biden’s personal favorite tax avoidance technique, the S corp? There the income passes through the corp entirely untaxed because, more or less, it is fully passed through to insiders/shareholders (where it is taxed).

(But don’t look too carefully at self-employment and medicare tax implications…)

In general the changes are probably an improvement for a fiscally dying government (poisoned by its own profligate corruption) but they go out of their way to preserve the corrupt processes while reaping some desperately needed new revenue.

In terms of publicly traded companies, the HUGE benefit about taxing GAAP earnings is that companies want to report them as high as possible. The IRS really wouldn’t have to even audit them. Companies are not going to under-report earnings under GAAP. You could tax GAAP earnings 20% and forget the entire rest of the tax code.

Excellent thought. Is this even considered by our taxing authorities?

Thank you Wolf.

My once a year comment was made two months ago, but that is precisely what I’ve advocated for the last decade regarding the individual IRS tax code.

The only exception I would add is that there should be a baseline minimum of a living wage (yes it is hard to establish a fair and uniform one depending on where in the USA one resides as cost of living differs) that incurs no federal tax liability. That’s my ‘Moderate Libertarian’ speak for providing a safety net to those who are just getting by.

Your last sentence is perfect, but replace GAAP earnings with all income from all sources to read, “You could tax all income from all sources 20% and forget the entire rest of the tax code.”

I’m going to use that as my new mantra Wolf. Thank you!

Wolf,

Hmm…well, maybe.

But every dollar taxed away is a dollar that can’t be used to buy back shares in order to lift/prop up share price.

(GAAP “income” can’t be used for buybacks).

So insiders are going to have pressure running both ways.

And, on a related note, these taxes are likely going to hit share prices, at a time of historic valuation exaggeration.

Not saying that is bad, just that it is another element introducing volatility into the overall macro economy.

Excellent proposals from both Yellen and Wolf.

Maybe to take this a step too far:

I’ve always wondered why people are taxed based on income = revenue, while corporations are taxed based on income = revenue – expenses.

If corporations are people, then maybe they should also be taxed on revenue.

Forcing companies to report income for taxes as the same as reporting for shareholders would imo wind up as a bifurcated situation. Eg accelerated depreciation for tax vs books can go either way. But treating exec options plans as a charge to retained earnings is a real expense.

Things are blurred but in the end many companies do not have sufficient cash to continue to report the higher earnings should this go thru.

And as a surprise result, tax revenues will not increase that much, however, earnings and eps will decline, especially when there is less cash for buybacks.

And that goes back to the stock market haircut which arguable is at a high multiple for the low economic growth we have. As it is, when interest rates go up and the benchmark 20 year, if it still has relevance, is 7%, do PEs fall to 10

We have a lot of excess in system due to fiscal and monetary policy, and the payback for the 40 year euphoria will unfortunately be meted out in a short period of time. IMHO

There has been this talk of a global minimum tax structure from treasury for a few days. It sounds hilarious, as if some other countries that has the advantage would actually cooperate. Let me know when China comes aboard. Nyuk nyuk nyuk.

?

God forbid that governmental entities be allowed to compete on corporate tax rates.

When financial reporting is on the blockchain which allows for one version of accounts, this sort of debate is a moot point and a distraction from generally unacceptable accounting practices. Once blockchain rules the world over take effect we can discuss what guidance should look like for different tiers.

Principles not practices

Wisoot

Because 95% of American investors can’t/don’t read financial statements, you & that cohort have the common but grossly uninformed concept of “one set of books; now we’ve added the laughable “blockchain…one set of books”.

As the (retired) CFO of a firm that did business in all 50 states, each one had property tax laws that differed, and most had corporate income tax laws that vastly differed. Each required a “…set of books….”. In fairness, most started off with “adjustments” to the IRS books.

The number of sets of books grows if you do business internationally.

Then you have a set of books for the IRS.

Finally, you have the GAAP set of books (what most think of as THE COMPANY BOOKS). Oh yea, and all the sets of books have to reconcile.

Then, depending on how many states wished to audit the firm in a given year, there could be 20-25 different sets of auditors crawling over the numbers. The IRS also audited, as did our internal & “independent” auditors.

In all fairness that chart is pretty much the same since about 1983.

It might, but the average individual has lost a lot of purchasing power to corporations since then. That leaves a lot less money left over for the individual to pay taxes.

Individuals ultimately own corporations.

Individuals are the only people you can tax.

Selective individuals own corporations, those peculiar collectives, which gain economies of scale through collectivized capital and then use the power of the collectivized capital, limited liability and perpetual life to compete against common individuals.

Why not a bit extra tax on selective individuals who choose to compete in the marketplace under the cover of government created rules that provide limited liability, perpetual life, collectivized capital and the best regulation that bought lobbyists and politicians can provide?

Yeah. What happened in 1981-2? Remember?

Bad recession. Mortgages hit 18%. The ARM was invented. And the US started the whole deficit-based growth thing that is near its end.

Oh and bell bottoms were still cool in eastern Washington — I didn’t even have to take my shoes off when I switched into shorts for gym class!

Yes it is serd3,,,

and that chart supports exactly the concept that the global oligarchy was very grateful for the clear sacrifices above and beyond the ordinary of WE the Peedons, and let us actually reap some of the rewards of our combined efforts of the WW2 era;

but, if you look, only for about 20-25 years after that war, and the Korean UN ”peace keeping effort.”

With the help of the consummate kiss act actor/politician, ron guy ray gun,,, after that, WE the Peedons have just been peed on exactly as before since for eva,,, so, these days, pretty much back to business as usual for we peons and the global masters.

The real ray of hope these days is the incredible increase in the availability of real time communications between WE peons, at all levels,,, compared to the excusive communications systems set up in the past and used completely by the oligarchs to corner markets and otherwise use that advantage, along with others, to keep wages/compensations for actually doing something as low as possible as long as possible.

So many conservatives have such fond memories of the amnesty granter and deficit spender …………..

The war against private enterprise began in earnest with the income tax in 1913. For 108 years, corporations and wealthy individuals have fought back. They created “K Street.” They created a 45,000 paragraph tax code. They have been brilliant in taking the tax code to federal courts.

Yellen and the woke left are too feeble to change this. Of course GAAP and the tax code come from different galaxies and can’t be harmonized. I know what I am talking about as a retired CPA. Set up a mobocratic tax code and, over time, the big boys pay less and less and the middle class more and more. The mob lives on resentment and they earned the resultant unfairness.

Retired Beancounter,

Great comment, I wish everyone here read this and understand it.

I have written a long comment to expand on your views here, but judged it premature to be posted since I hate to rain of Herr Wolf’s parade !

He seems to be enthusiastic enough to believe that crooked Yellen cares much about the average US citizen’s Economic welfare and does what is required to bring the “ TAX CODE” out of the 20th Century dungeons to the light of the 21st!

By simplifying the TAX CODE, and garnering the proper BIPARTISAN support to do the right thing by the average American!

Alas ,

I hold NO SUCH HOPE.

My only hope is that I am proven to be wrong.

BTW, if half of the recommendations are passed into law the NASDAQ will drop anything between 10-20% as a first step!

The fight is going to be grueling

Retired Beancounter said: “The mob lives on resentment and they earned the resultant unfairness.”

_____________________________________

They earned it, or they had it imposed upon them?

Blaming the victim?

Robert C Solomon devoted five pages of his classic book “The Passions” to resentment. The mob that enjoyed feeling a politician’s resentful diatribe earned the noose that is now around their neck. This represents the only kind of justice that exists — poetic justice.

Oh Wolf, think of those poor poor corporations. Why do you insist on punishing them by advocating for them to pay a more fair share of the tax? After all, it’s the negative tax rate they are enjoying that allow them to trickle down and reinvest in layoff effort. Without these favorable tax rate, how can they afford all those severance pay they need to pay out or buy back more of their own stock. They can’t do it all with Pus boy Jerome’s interest free money borrowing, not paying fair share of their tax and free borrowing is like Macaroni and Cheese, goes hand in hand.

In any case, I am so jaded that I am going to bet the farm that this will not come to pass. Both sides of the aisle will fight tooth and nail to protect the hands that feed them.

Is the word “jaded” a synonym for realistic?

“The power of accurate observation is commonly called cynicism by those who have not got it.”

George Bernard Shaw

“You can observe a lot by watching.” – Yogi Berra

As a retired CFO from a real-world company (we sold services that people actually wanted at a price that genuinely produced real-dollar profits), I am stunned that I’m in conceptual agreement with Yellen.

I’ve long contended that 95% of American investors can’t even begin to read basic financial statements (Income, Balance, Cash Flow), let alone that they actually think it’s possible to present a single number (accurate to 2-decimal places) that accurately represents financial performance of a global, multi-billion dollar enterprise. At this juncture, with socialism banging on the door, any reasonable change to make corporate financial performance clearer to the American investor is a huge step forward.

Even on Wolf Street, I frequently see obvious examples of posters who literally have no concept of finance or financial statements getting tangled in the willfully misleading corporate double-speak for earnings (EBTDA, “Adj earnings”, “earnings excluding one-time items”, operating earnings, yada yada yada, etc).

Unfortunately, this is one of those issues that sounds so common sense (Why didn’t we do this a long time ago?), and looks pretty easy (How hard can it be?)…BUT the same government that wants this clarity also imposes timing restrictions on profit recognition that gums up the whole effort. It would also be nice if the SEC actually enforced some meaningful reporting commonalty & consistency.

Simplification & clarity is desperately needed, but it ain’t gonna be easy. Not to mention a whole crowd of managements (we’re talking you, UBER) who have absolutely no intention of trying to disclose how the corporation is actually performing.

Statement of Cash Flows…most ignored/misunderstood financial statement but frequently the most important.

My personal experience is that accounting is horribly taught in college, primarily because profs never say upfront that goal of accounting is not financial accuracy *at a point in time* but *across time*…leading to a host of necessarily dubious assumptions that open the door to abusive accounting treatments.

But accountants/corporations like it that way, because it allows them to use obscure/insidery techniques to “message” the actual cash-money performance of the companies.

So, over time, GAAP has become heavily convoluted crap.

(Now that I think about it, I wonder if GAAP has gotten so bad that a fiduciary breach claim could be made out…”Generally Accepted” usually descends into “disparate, deceptive insanity”.

I don’t follow accounting standards closely anymore because it’s all window dressing with very little accuracy. But once upon a time, the Financial Accounting Standards Board(FASB), was the arbiter of truth in financial statements, or at least of consistency. Never hear much about what they are up to these days. Have they become another captured institution, looks that way.

I don’t know if this is true, but wouldn’t GAAP have to be consistent with FASB. Or am I still too gullible?

After the great financial crisis I believe they became the fantasy accounting standards board.

Yes. Mark to HumptyDumpty!

GAAP standards are developed by the FASB (a creature of the accounting profession). Federal law requires that publicaly traded firms issue GAAP financials. The goal is “accuracy” and “consistency” – that’s a tough circle to square.

Any thought that strict adherence to GAAP actually produces an “accurate” statement of expenses like legal liability, loan losses or various write-downs is just nuts. What you’re after with this class of expense is “defined realistic process used for consistent derivation”.

Over the past 20 years (especially with start-up and acquisitions), companies have knowing & deliberately used non-GAAP descriptions of (especially) profits.

Example: EBTDA used to be a fairly obscure, rule of thumb measure of free cash flow, and was useful in back-of-the-envelope acquisition financial analysis. This vastly misleading number is frequently used in corporate earnings communications. To say the least, the SEC has warned companies about its usage, but it’s been MIA in meaningful enforcement.

Totally agree with the part about ignorance of We the Peedons of USA JC!!

Taking over a construction technology class about 30 years ago, I found that most of the students, required to be 16 and over, could NOT do basic arithmetic.

NOT talking ”math” here, just addition and subtraction…

Came to realize most of these high school kids (and adults in this ROP class ) were not actually intellectually challenged, but just cast aside when they did not respond correctly to the teaching ”methods” of the moment…

I did not last long at that job after the schools required me to attend their weekly staff meetings where I made clear my opinions…

The good news is that I was able to ”turn” about 15% of the 100 or so students away from a life of dope and despair,,, and some of those ones, at least, went on to very satisfactory careers, and LMK about it for the next 20 years or so.

I grew up in a family that had the idea that, ”those that can, do; those that can’t, teach” but after that experience came to consider that teachers are very likely the very best people,,,

JC-hence the great rise in popularity of casinos and lotteries (of ALL types, for ALL manner of people) since THE 1970’s…

may we all find a better day.

No one wants to be taxed themselves, but everyone wants everyone else to pay. I don’t get it, giving more money to the government isn’t a solution to grow the economy. The focus should be on helping individuals earn more money themselves, not robbing it from others for our benevolent and efficient government to redistribute fairly like we know they always do.

Hold on a minute- arnt the tax books used to determine tax liability prepared according the way the IRS and congress say it ought to be prepared? The big difference from GAAP being the depreciation schedules.

I guess a boring adjustment to the depreciation schedules wouldn’t generate the plaudits they so need from the base. What a joke.

GAAP and the tax code are completely different animals for large complex corporations.

Indeed they are completely different. But lets admit that the tax code, as written by congress and enforced by the IRS, drives the preparation of the tax books.

The uninitiated is led to believe that companies ‘cook the books’ for tax purposes and this simply is not so.

Tax avoidance is legal (individuals do it all the time when they use the mortgage deduction); tax evasion is not. The line between the two is…somewhat ephemeral.

FinePrintGuy

Fair comment here, and Wolf’s reply is No doubt a very ( underline that very please) distilled answer to your comment.

I’d like to add to this interaction by saying this:

By nature the TAX CODE is a very ( living document) very dynamic, say like any constitution.

It gets tested in a verity of ways, by individuals, corporations and community organizations..etc.

Every now and again the IRS gets taken-on on its interpretation of the “ guidelines that are called CODE”!

As you can imagine these create precedences and so on .

In the long run “ smart cookies“ also known by their other unloved name ( lawyers)! get to work hard in reinventing the wheel and adding cost benefit to their clients in what the general community of WS here calls unashamedly

TAX AVOIDANCE!

so there you have it , even in the tightest possible legal frameworks like the humble tax code you’ll find holes big enough to drive your favorite HUMMER through!!

Off course this level of play is ( unavailable to mere mortals like you and me!

Unless the IRS’s reps visited a great unjust upon you( GOD FORBID) , then the course can be corrected.

It’s all part of the FUN that Capitalism should allow to exist in a fair and equitable way!

I expect a face-ripper rally tomorrow on the news!

The Dems look like they’re serious when it comes to making the rich pay and Wall St appears to be in denial at this point. Powell is now part of the administration so (while he may be an uber dove) he isn’t going to go against his masters’ wishes by bailing out markets when they realize they pandered, censored and bent a knee for a party that only cares about buying votes.

Powell’s only hope here is if yields rise fast and high enough that it provides him cover to expand QE before reality sets in. Maybe that’s why the Fed’s been united in egging on yields to go higher…they can paper over unruly interest rates but the optics are glaringly bad when it comes to printing more QE to offset taxes for the rich.

Of course we all knows this ends in yet another multi-Trillion $ BTFD but the stage seems set for lots of whining and crying from the MSM before the Dems turn the Fed loose to clean up their mess.

“The Dems look like they’re serious when it comes to making the rich pay and Wall St appears to be in denial at this point. Powell is now part of the administration so (while he may be an uber dove) he isn’t going to go against his masters’ wishes by bailing out markets when they realize they pandered, censored and bent a knee for a party that only cares about buying votes.”

Ahahahahahahahahaha!!!! I needed a good chuckle this morning.

1) If u work in China u spend in China, pay taxes in China and deduct it in US.

2) Taxing the GAAP ==> reduce market cap.

3) That will hurt the Bezus and reduce 401K.

4) Zero income from saving rates in the banks and higher taxes on dividends will hurt the old.

5) Negative capital gains and lower income from dividends reduce Total Share Holders Return (TSR).

6) Falling TSR and lower corp profit will chop NDX.

7) Falling stock markets promote fomo and cut labor.

8) The first to go is WFH and their RE.

9) The winners : USD and US 30Y Bonds.

10) Relying on China and the Asean nations for critical supply is a failure of

strategic imagination.

11) If u raise the min wage u have to raise tariff to protect workers.

GOOD ONE ME,,, very glad to see you and your ”riffs” back here,,, and, truth be told, glad to see at least some of your comments on WS are a little bit easier to translate, though I did enjoy the challenges of figuring out what you were ‘gittin at” formerly…

Keep up the good work,,, and, please, do not in any way consider this comment a criticism. Just the opposite in ”old guy” talk!!!

Thank you,

Exactly. The implications for #3 alone and the “donor class” would alone scuttle the system.

I really hope she can pull this off (although Wolf’s GAAP proposal is even better).

However, I have become quite disillusioned especially after the GFC. I find it hard to believe that corporations won’t bribe a few new loopholes into the legislation. They have paid millions in speaking fees and they want some return on that investment.

But I will be the first to cheer Yellen/Biden if they actually get some of this through.

Wolf – I couldn’t agree more. The amount of time it takes these companies to come up with their tax disclosures and the complexity around it is also ridiculous. Great article.

Reporting commonality and consistency are being applied in existing blockchain use cases in shipping, peer to peer electricity, contracts ( AIG, IBM), property, and of course digital currencies. Accounts packages like Sage and Zero have standardised reports in a plug and play scenario. Accountants creativity was a phenomenon of the C 20th. The building blocks are in place to strip away peoples health privacy. China already on a social score system. Accounting and banking are ripe. General public has not yet been let in on the know. Signs are obvious if you care to look. The implementation ends up where users own their data and there becomes a clear line between personal data and shared blockchain data with a double cyber boundary between the two. However even personal is voice driven and dependent on AI. Its either this folks or we take the whole satellite set up out of orbit which could happen and humanity returns to local farmers markets. The GAAP are intended to be complex enough so that standardisation can not occur. What a shock is coming.

Gimmie your deep thoughts on blockchain loan loss provisions. Or goodwill write-downs. Or legal liability/expense.

Good luck.

Javert Chip

Thanks for your earlier reply and for this one. I surely would not be able to offer sufficient depth of reply to satisfy your sharp intellect. If you feel so inclined to research further “search ICAEW and blockchain” or “AICPA and Blockchain and Distributed Ledger Technology” there may already be pools of discussion around the areas you raise. Also search “Deloitte and Blockchain and its potential impact on the audit profession”.

Of note there is a rolling plan in Europe: https://joinup.ec.europa.eu/collection/rolling-plan-ict-standardisation/rolling-plan-2021

Ricardian contracts, also referred to as “advanced document technology”, allow a legal contract to be interpreted digitally without losing the value of the original legal prose. They are unique legal agreements or documents that can be read by computer programmes as well as humans at the same time. Ricardian contracts can interweave computer language and human language, which can make transaction costs much lower, contribute to faster resolution of disputes, and allow agreements to be executed more efficiently. The use of cryptography helps to keep the risk of fraud to a minimum.

And finally: https://www.tradefinanceglobal.com/tradetech/distributed-ledger-technology-dlt/

“There is not going to be one network to rule them all. It is going to be a network of networks.”

“Within shipping, mining, banking, purchasing and other fields, there is a large number of industrial parties with different specialized platforms, each of which has its own rulebook. For these to communicate effectively, a standardized rulebook of rulebooks and a standard of standards are needed. “

wisoot

Ok; I read a bunch of your links and learned a lot about ICT standardization (Information and Communications Technology standards), and ICAEW and blockchain, making ownership of assets easier for auditors.

I’ll certainly concede there are niche applications in finance that would benefit from a “blockchain-like” approach (eg: ownership of home mortgages as mortgage servicing is sold, re-sold and re-re-sold among banks). In all of this word salad, I found nothing of substance in this word salad regarding improving accuracy, readability or meaningfulness of financial reporting.

Blockchain in the context of this thread’s topic is an alleged answer in search of a problem.

So the much ballyhooed stock market rally of the past few years has mostly been a sham given that it has come as the result of multiple expansion. With the CAPE already sitting at a very lofty 37, this tax proposal would take it to the moon.

Pretty nice disincentive to borrow to compensate for offshore cash, and an incentive to bring back untaxed profits.

“Nike reported $4.1 billion in pre-tax income to its shareholders over the past three years and had a three-year effective tax rate of minus 18%, meaning the IRS paid Nike large amounts of money, the so-called “tax benefits,” instead of collecting taxes from Nike…There were 55 companies of this type in the report.”

This is so shameless! Completely amoral behavior. Wait, doesn’t that define psychopathy?

MiTurn

Let me applaud you for terrific virtue signaling, albeit a less than tenuous grasp of the nexus of corporate taxes, accounting and campaign contributions.

Our US politicians responded to tsunamis of “campaign contributions” (which I consider to be nothing more than public bribes) by loading up the tax code with special loopholes (R&D tax credits, executive stock options…). THEN CORPORATIONS ACTUALLY USES THE LOOPHOLES PROVIDED BY OUR POLITICIANS TO REDUCE THEIR TAXES.

Imagine that!

Is anybody here surprised our politicians respond to cash & make these benefits 100% legal?

1) US & China marriage lasted for almost 50 years.

2) China winter Olympic is next year.

3) Boycotting the Olympic is racist, because it will hurt black athletes.

4) US & China golden jubilee celebration in 2022 will improve the atmosphere.

4) There is no reason to break up this long successful marriage. It might need comments moderation, but there are no real hostile actions. Mrs. Martingale, seeking total power, will slow down and mature. She will realized that she isn’t invincible and need this marriage.

5) The sugar islands is a 250 years old option. US, Canada, Mexico and the sugar islands might change the weight of US business plans and lead to a new direction. Tariff can help to solidify this plan.

6) That doesn’t mean that we have to have a nasty divorce with China.

7) This option will lead to : higher profit, less illegal immigration, just in time, less friction and more security.

@michael engel

I do not know what you are really saying – but I suspect I do not agree ;-)

I think one need look no further than recent PRC actions towards Tesla (Elon Musk) and Jack Ma. And their subtext is pretty clear..

“If you are going to use the PRC as a means to grow your business and protect your wealth…do so…but do so early and with the understanding that it will be done on our terms”.

The implications are obvious, of course. They are not be wholly-welcome to the recipients, certainly, but will rapidly seem to be a very good deal in light of emerging alternatives.

Comment moderation : the golden jubilee will not be celebrated, because it will revive Nixon and expose WaPo.

3) Most skiers are white.

Depends. Almost all skiers in Japan are Asian. Almost all skiers in India are Asian. Almost all skiers in China are Asian. Many skiers in the Lake Tahoe area are Asian, including my wife. There is some good skiing in Morocco, and most skiers there would be North Africans. So it really just depends on where you go skiing.

There’s some great skiing in South America. And I imagine a lot of South Americans go skiing there. I saw some of the ski resorts in Chile and Argentina, but that was during their summer.

@Wolf,

I skiied at Valle Nevado for three days in 2017. The most striking aspect was the near total-absence of actual Chileans amongst the clientele.

I skiied at Zermatt in May, 2001 and May, 2015. In 2001 – it was clear that the vast majority were from the continent. In 2015, it seemed that at least one-third hailed from the Far East – even if I did not know their precise nationality.

Skiing is not Football (Soccer). It has more in common with auto racing – i.e. it is very much a rich man’s game.

Bravo! Teach the esoteric writer to give a little more thought to the message, and the receiver of that message.

Can anyone explain why we’re taxing inanimate objects- corporations – in the first place?

Why not tax the people that own the corporations including all benefits received from corporations?

Yes. That’s easy. Corporations are not “inanimate objects,” as Citizens United has proven. They’re huge powerful organizations. And if they were “inanimate objects,” no problem, we also tax other “inanimate objects,” such as buildings and land and cars.

Didn’t the Supreme Court give corporations the rights of citizens? Tax them like a citizen.

Wolf,

Well what do you know. Always wondered about that Gaap. Thanks Wolf, what a cluster coming up, I don’t know how this market stays here.

Sections 452 and 462 of the Internal Revenue Code of 1954 allowed accrual-method corporations to effectively report book income. Because that decreased tax revenue, sections 452 and 462 were repealed retroactively in 1955. Professor of Law Calvin Johnson of the University of Texas has proposed a better idea—tax publicly traded corporations on the value of their outstanding stock. The stock value of listed companies is much more difficult for companies to manipulate.

Not a new concept: alternative minimum tax (for businesses).

Seems pretty easy to implement (except for the political opposition)

I assume the current tax code would have to be changed for this plan to become real, and I would guess that kind of thing has been proposed many times without success.

I wish someone here who is “in the know” could list the reasons why this plan of Yellen’s possibly won’t come to fruition (I’m not knowledgeable enough to come up with that stuff).

Most probably because the Supreme Arbitors of Justice favor alien lifeforms over human existence and Yellen is not Ripley. Good luck trying to cage or tame something that is legally freed from the bounds of natural laws in perpetuity. It will have you cocooned before you can get off the first rounds.

Anthony A

“…I wish someone here who is “in the know” could list the reasons why this plan of Yellen’s possibly won’t come to fruition…”

Changes to the tax code are, by far, the largest drivers for political campaign contributions. Even if, at some point in time, we had the PERFECT tax code, it would be quickly modified to encourage…wait for it…political campaign contributions.

JC, thanks….good point about political contributions. That alone should help shut this proposal down or at least add loopholes. I guess these Fed and government mouthpieces are really just petty actors who couldn’t make it in Hollywood.

Wolf, the trenchant chart on THIS page should be shown more often – I rarely see it.

The shifting of taxes to labor is a CORE problem. Time to reward hard work again!

Dom

You do realize that the bottom 50% of income earners pay 0% of Federal individual income tax?

False

But not that far off…

cb

I appreciate your respect for precision & hereby revise my statement:

“You do realize that the bottom 50% of income earners pay 2.9% of Federal individual income tax?statement “, and here’s my cite:

https://taxfoundation.org/publications/latest-federal-income-tax-data/

Can’t wait to see your cite.

Of course – top 50% made 87.5% of all AGI while bottom half got 12.75 of all AGI.

Why did you not cite taxes the bottom 50% does pay?

https://www.financialsamurai.com/how-much-money-do-the-top-income-earners-make-percent

Please reread chart in this article which shows corporate revenue ( which on a pro-rata accrues to the wealthiest share owners) from the treasury.

Wolf,

You probably should do another article explaining to your readers exactly where and why the differences in profit for tax purposes vs profit for press releases arise in the first place. Some of these reasons are mentioned, but scattered, in the comments above mine. You could take a single best example of this behavior and dissect it down to the penny. I would nominate Apple for this purpose, or Google.

Very good comment YW,,, and I totally agree!!!

My only concern would be for the welfare of anyone doing any such clear explanation, especially WR, who is my fave above all others at this point…

So what would this Yeller proposal do to the gimmicks, maneuvers, and accountants that make a living out of minimizing Taxable Corporate Income via the grossly complicated U.S. Tax Code today??? If a corporation knows it is going to have to pay 15% heck or high water on GAAP earnings, aka Wall Street Earnings, then they are going to fire half of the accountants because their operations are going to be simplified. Do accountants have a PAC in Washington? YES, and they may own K Street.

Now my Michigan corporate tax accounting is a little rusty since I ran a Sole Proprietorship for 30 years and did all the mumbo jumbo IRS filings myself (thank you TurboTax Deluxe!), but the Tax Bill Reduction Squad at the Corporate Level is going to operate very differently under this tax reality. May not they switch gears to actually minimizing GAAP earnings since with Free Money from Uncle Joe and Zero Cost Money from Thumb-in-the-Pie Powell, MULTIPLE EXPANSION IS ALL THE RAGE AND TOTALLY ACCEPTABLE ON WALL & BROAD.

There is a website (name available for a $100 contribution to Wolf Street, non-tax deductible) that shows a running P.E. ratio for the S&P 4000 (very inclusive index!) that gets adjusted by a Cray Supercomputer every time there is a relevant corporate earnings report. THAT NUMBER IS CURRENTLY AT 74.9 TIMES 12-MONTH TRAILING EARNINGS. Now you say if this swath of companies grow by 30% in the next 12 months, that P.E. ratio is really only 57.6 times Don’t-Hold-Your-Breath EARNINGS, so buy, buy, buy and leverage the house some more to do so.

Any way you cut it, even if this proposal passes Congress in any recognizable version of Yellen’s Proletariat drum beating, GAAP reported earnings out of Corporate America will not bring rational valuation applications to American equity pricing. This stock market is so far out in the stratosphere in its pricing of earnings by any metric (and any definition of same) that the outside barometric pressure is a better motivator for Stock Chasers than GAAP Earnings given a slap to the side of the head by a Minimum Corporate Tax of 15% to 20%. If you have taken LSD, don’t try flying a plane.

Me, bad, the P.E. index is the S&P 500 as usual. Author was referring to 4000 level on the index. Avoid aging at all costs.

Wolf,

Sadly – even if such a thing were possible to ratify, and you could create some sort of closed-loop system where the taxes can’t exit the system – there is pretty large negative consequence that I am surprised you haven’t picked on. And my surprise stems from the fact that it concerns a topic that you post on with some frequency.

Basically, it’s this…

a) Such a system would require capital controls to work

b) Capital controls are largely-incompatible with a currency’s ability to act as a reserve currency.

Indeed, it’s quite possible that China might have already supplanted the dollar had it not continued to be so insistent on maintaining its capital controls. To an extent, BRI becomes necessary to work around that – i.e. “if you want access to all the raw materials from Eurasia and Africa – you must hold the PRC’s currency…regardless of how he choose to manipulate and control to our own benefit and not yours”.

Nevertheless, do not feel about missing that implication. It is far less forgivable a transgression for you to have done so than for the USA’s Treasury Secretary.

Al said: “a) Such a system would require capital controls to work”

_______________________-

Please explain why.

The idea that this old crank has some sort of answers for any of the problems which ail us is laughable. I don’t say this as an affront to you, Wolf, I say this as a person who believes in “fool me once, shame on you, fool me twice, shame on me.” The FED – all of these disgustingly corrupt, vile human beings – have created a “heads I win, tails you lose” environment where the rich take everything and everybody else is left to fight over some crumbs.

Every day. Every, single, stinking day I read articles and comments of people who are being financially destroyed by what is taking place in the housing market, and these central bank scvmbags continue to promise us that they have plenty more of the same policies in store which are destroying millions of lives. This hag needs to be in prison. Instead, we are cursed with her hideous smiling mug on a repeated basis. She is proof positive that libs have only the interests of the wealthy in mind, because she wouldn’t even have a job otherwise.

Too true.

And you know what? She’s not even *clever*.

As I’ve pointed out above – this scheme is ultimately-incompatible with a currency being able to maintain it’s reserve status.

If you’re going to be a grifter…at least understand how your grift *actually works*. It isn’t clear that she actually does.

It would be nice to see Apple, Amazone, Nike, Google, Faceplant, etc pay up a couple of dollars. I doubt it will happen. If it does, Yellen will lose all those $400,000. luncheon chat fees. I’ll bet Uncle Buffy, aka the world’s leading plastic polluter, is on the phone right now.

Slightly off topic, I notice that Biden’s “infrastructure” mega-thingee does not mention clean up the garbage.

Norma lacy

“..It would be nice to see Apple, Amazone, Nike, Google, Faceplant, etc pay up a couple of dollars. I doubt it will happen”.

You’ll have to say that in a hushed voice!

Don’t wake up Wolf from his “sweet dreams “???

Economist Dean Baker has proposed taxing corporate stock returns instead of profits.

“It makes little sense to have a high tax rate that is easily avoided or evaded. This simply encourages companies to spend large amounts of money gaming the system. This gaming is a complete waste from an economic perspective.”

Instead:

“We simply apply whatever tax rate we are targeting to the returns that shareholders receive in a given year [or an average of last four or five years of returns]

Let’s say we have a tax rate of 25%. Suppose a company’s stock has a market value of $100 billion on Jan. 1 and $105 billion on Jan. 1 of the following year, and that it pays out $3 billion in dividends over the course of the year. This means the returns to shareholders have been $8 billion over the year, which would make its tax bill $2 billion (25% of $8 billion).

This calculation is about as simple as it gets. It requires no complex accounting and leaves no room for companies to rip-off the Internal Revenue Service unless they are also ripping off their shareholders, in which case the government will have some powerful allies in collecting the taxes owed.”

“If 60% of the company’s sales, on average, have been in the U.S. over the last five years then 60% of its stock returns in the current year will be subject to this stock returns tax.”

“by switching the focus from corporate profits to stock returns we can both make sure that the corporate income tax is collectible and radically reduce the resources required to administer the process.”

news.bloomberglaw [DOT] com/daily-tax-report/insight-the-simple-fix-for-corporate-income-tax-tax-stock-returns

There are innumerable logical conclusions to a more fair tax system, NONE of which will ever be adopted. Because the very people in charge of the system financially benefit from the status quo.

“Everything is a rich man’s trick.”

I have quite a lot of respect for Dean Baker…but I really think he’s failing to factor some psychology into his thinking here.

And it basically boils down to this…

The largest abusers at present are run by CEOs/founders who have the mentality of 16th Japanese Shoguns. They would prefer to burn their keeps and strongholds to the ground then let the enemy army take it.

How does that mentality play out?

Let’s say I’m Elon Musk at Tesla. Faced with the prospect of such a scheme and a massive stock valuation, I will dump a small, but not-trivial portion of my stock and be nothing less than crystal clear that I am doing so because of the tax scheme.

Well…faced with the prospect of big losses (and let’s not forget how widely some of these stocks are by institutions)…the upper middle-class and upper class starts screaming bloody murder. That’s the “donor class” folks, and their disquiet would quickly repeal this tax scheme.

Why were companies moving to Ireland?

For the sandwiches:

“For more than a decade, Dutch, Irish and U.S. tax law allowed Google to enjoy an effective tax rate in the single digits on its non-U.S. profits, around a quarter the average tax rate in its overseas markets.

The subsidiary in the Netherlands was used to shift revenue from royalties earned outside the United States to Google Ireland Holdings, an affiliate based in Bermuda, where companies pay no income tax.

The tax strategy was legal and allowed Google to avoid triggering U.S. income taxes or European withholding taxes on the funds, which represent the bulk of its overseas profits.”

reuters [DOT] com/article/us-google-taxes-netherlands/google-to-end-double-irish-dutch-sandwich-tax-scheme-idUSKBN1YZ10Z

Ah, remember the old adage “You can’t tax a business”? The idea being that it just flows down to customers as higher prices. There was a time that I fully agreed with this and used the line in discussions. But in my older years and experiencing the problems we have in today’s economics I bite my tongue at the thought.

You think the owners take less income because they have a tax to pay? Of course they increase prices if their business costs increase.

Now if there profits come partly from overseas, then you are pushing some tax out of the US on to other parties. That’s the only benefit I see.

This is Yellen employing the jawboning technique that she used so well as Fed chair. Placate the masses with words that are never intended to be converted to actions. The republicrats are not about to bite the corporate hand that feeds their primary (only?) objective – re-election attained by massive amounts of political contributions. If, by chance, any legislation is actually advanced on this, it will be along the lines of Dodd-Frank (so called) ‘wall street reform’ and the end result will be worse for main street than what it was before.

More Charlie Brown, Lucy and kicking the football…

+LifeSupportSystem4aVote,

It actually *might* actually be converted into action – but to toxic effect.

One such scenario…

1) China – whose competitiveness doesn’t depend upon corporate tax rates at all – feigns opposition to it.

2) The USA drops its tariffs w/ China on the condition of agreeing to it

3) China has improved its competitive position (however, modestly) and probably has delivered the USD’s reserve status a solid body blow to boot (see my comment above concerning capital control incompatibility with reserve currency) above.

Right, because everything is a sleight of hand trick with these people, where the moneyed special interests get even wealthier. That’s why the bills are 800+ pages and you have to pass them to know what’s in them. It’s over. The whole country. Nothing will change until we burn it all down. I just hope it’s more along the lines of a peaceful transition like the USSR, vs a violent, ugly revolution.

I think at you look at the real numbers, BOTH SIDES OF THE AISLE GET MUCHO MANA FROM CORPORATE AMERICA. The CorporaCrats hedge their bets to make both Elephants and Donkeys beholden to them. Corrupt political system, what are we going to do about it????

40% of all Canadian government bonds owned by the central bank of Canada is ludicrous.

Is demand for Canada’s sovereign debt not sufficient enough to entice more non-CB buyers?

Japan is the outlier for sure. But I’m surprised that Canada has adopted this policy.

I wonder what the ECB percentage of Eurozone sovereign bonds is?

Incidentally the GDP argument isn’t solid.

Here in Ireland GDP numbers are phenomenal, but this is due to opaque accounting, brass plate registered company, taxation exemptions. In summary it is multinational worldwide sales being parked in Ireland for tax avoidance purposes.

The reality is those GDP figures only create a minute benefit solely for the audit firm’s filling statutory returns for those multinational companies in Ireland.

For the remaining 99.9% of Irish citizens this GDP has zero effect/benefit in their daily lives.

Wasn’t Paul Morphy a famous chess player

So, this is basically welfare reform for corporations.

“Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income…”

inflated and puffed up income? Translation: Falsehoods, lies, deception.

One needn’t wonder why the stock market has become nothing more than a “puffed-up and inflated” casino.

A famous stock market operator, can’t remember his name, regarded fundamentals as funny mentals.

Now I have a better understanding of why I receive a dozen or so class action lawsuits in the mail every year. I just shred ’em. One merry band of thieves out to rob the other.

They use as-reported or pro forma operating earnings as well as GAAP. GAAP might come closer to what they report to the IRS.

Another way in which this plan could get toxic fairly-quickly…

The scope of this plan really only affects a modest number of multinational corporations – all of whom know they are being targeted.

There are already OECD tax reforms that are being discussed and that have acquired some measure of support in the EU. These OECD reforms have not come to fruition yet, but *do* have the support of quite a number of pols. And these propose reforms do have larger scope in terms of the number of multinationals that they would affect.

So the impact of all this – as I see it – becomes:

a) Yellen’s proposal will be seen as “sandbagging” the OECD reform and is going to rankle the egos of technocrats and pols who have been involved in the OECD tax reform talks. If you think ego-rankling is not destructive – I invite you to contemplate the dog’s lunch that the EU vaccine rollout has become as a result of just that.

b) Pols who have backed the OECD tax reforms who be accused of being sellouts because Yellen’s tax proposal will target fewer MNCs.

c) a + b have the potential knock-on effect of disrupting “digital tax” talks between the EU and the USA. There are plenty of Silicon Valley operatives in the Biden admin – and not under particularly-deep cover at that – so maybe this is the reason why there is such broad-based support for Yellen’s proposal in the administration to begin with? Maybe not.

Here’s a more radical / better solution. Do not tax corporations at all. Corporations don’t really pay taxes, they only remit taxes on behalf of individuals (shareholders, customers or employees). Only entities that can vote (i.e., individuals) should pay taxes — individuals should understand the full weight of taxes they are paying (vs those paid indirectly – e.g., buried in the price of everything they buy). Then they would be better informed voters. And then corporations would then largely get out of the lobbying business. Also, federal income tax revenues from corporations currently pay a relatively small amount of total government revenues.

Corporations influence the vote through PACs. Remember the Citizens United court ruling. So they are indirectly exercising their right to vote. PACs spent almost $ 250 for each vote in the most recent election.

They also influence the accounting standards so that it’s closer to the figures reported to the IRS. The biggest disparity may be in how the banks value illiquid assets.

I want competition. Business should compete on price and governments should compete on tax rates. I don’t want a global minimum tax. Both consumers and taxpayers benefit from competition.

Minimum tax rates is a great idea.

Minimum tax rate is like Anti-trust laws, it keeps any one company (or country) from winning which maintains competition.

“I have been arguing to throw out the whole corporate tax code and replace it”

Kudos Wolf.

The UK tax code needs a van to transport it. There are myriad consultant, adviser and lobbying offices for every section of the code. So what chance of reform has anybody got? Some parts of a personal return can be so complex that a professional is essential. Which must be illegal for any compulsory activity imposed on citizens, although legally, in the UK, we are ‘subjects’ and not citizens like you guys.

What is it about modern life that we end up buried in all this BS for every single thing we do?