But low-tier prices of single-family houses in the vast New York City metro explode by 15%, powered by fleeing Manhattanites?

By Wolf Richter for WOLF STREET.

The headlines are everywhere: The housing market has gone nuts with silly bidding wars and ludicrous price increases. Record low interest rates last year and $3 trillion of the Fed’s miracle moolah triggered that phenomenon, along with people leaving some big expensive cities for the suburbs, outer areas, and distant places, whose prices soared under the influx, while many leavers haven’t yet put their vacant old homes on the market, hoping to ride up the price surge, thereby constraining inventory for sale. But not all things are equal, as we’ll see with condos and houses by price tiers in the San Francisco Bay Area, Los Angeles, and the New York City metro, based on today’s S&P CoreLogic Case-Shiller Home Price Index.

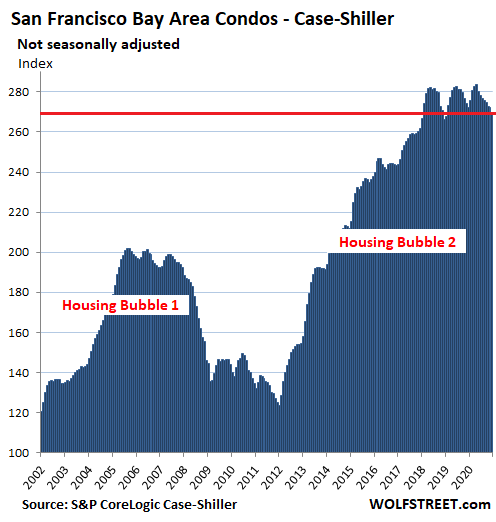

San Francisco Bay Area condo prices sag.

Condo prices in the five-county San Francisco Bay Area dropped 1.2% in January from December, the eighth month in a row of month-to-month declines. The index is down 1.5% from January last year, down 5.1% from the peak in May 2020, and roughly back where it had first been in February 2018:

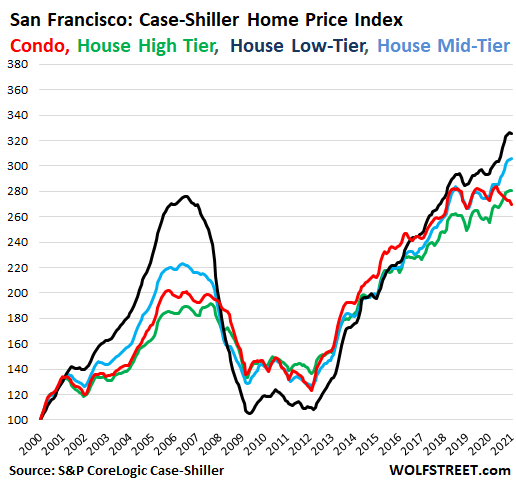

The Case-Shiller Index for “San Francisco” covers the counties of San Francisco, San Mateo (northern part of Silicon Valley), Alameda and Contra Costa (East Bay), and Marin (North Bay). It doesn’t cover the southern part of Silicon Valley, including San Jose, and the largest portions of the North Bay (Wine Country counties of Sonoma and Napa) and Solano County.

In San Francisco county, condos are the majority of the market. In the other counties, houses are the majority.

Quite a few people have moved from San Francisco to the outer regions of the Bay Area. The move to Marin County cancels out because it is included in the index. But people have also moved to the other counties that are not included in the index, such as Sonoma County, whose housing market is red hot in part due to the influx of people from San Francisco.

Prices of all single-family houses in the five-county San Francisco Bay Area, ticked up 0.2% in January from December and rose 9.5% year-over-year. By price tiers:

- Low-tier prices (black line) fell 0.4% in January from December, the first month-to-month decline since 2019, after having surged the most in 2020. The January drop reduced the year-over-year gain to 10.8% (from 11.4% in December)

- High-tier prices remained flat with December, and were up 7.9% year-over-year.

- Mid-tier prices rose 0.4% in January from December and were up 10.8% year-over-year.

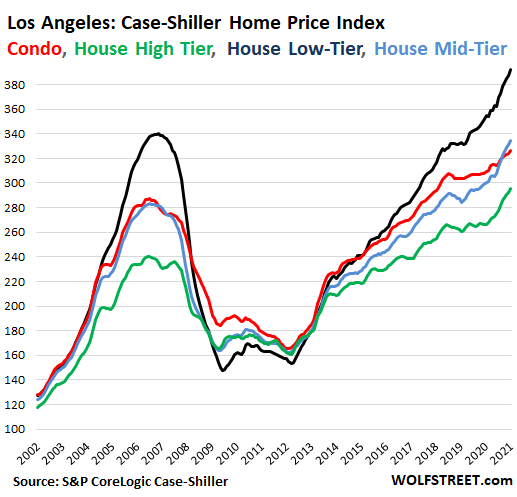

Los Angeles condo prices left behind by house prices.

Prices of single-family houses in the Los Angeles metro rose 1.0% in January from December and 10.8% from January 2020. By price tiers, different trajectories become apparent:

Low-tier house prices show by far the largest surges during booms and by far the largest plunges during busts, having collapsed by 56% from the peak of Housing Bubble 1 to the bottom of the Housing Bust. Since then, they have skyrocketed 163%, nearly quadrupling since January 2000. In January, low-tier prices surged 1.4% from December and 10.4% year-over-year.

High-tier house prices are the least volatile. They have “not even tripled” (this sounds nuts) since January 2000. During the Housing Bust, they plunged only “33%” and since then have risen “only” 84%. In January, they rose 0.9% from December and 8.7% from a year ago.

Condo prices rose 0.6% from the prior month and 5.2% year-over-year, about half the rate of the year-over-year price gains for mid-tier and low-tier houses.

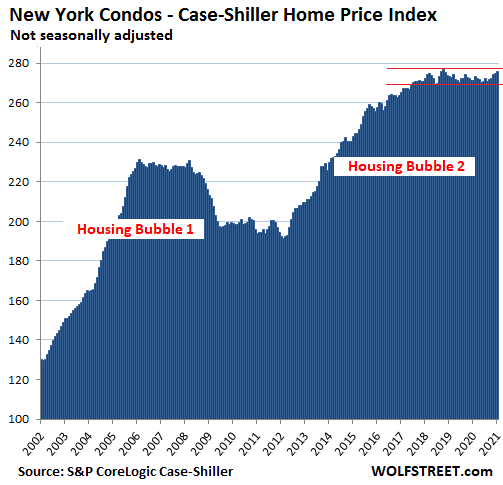

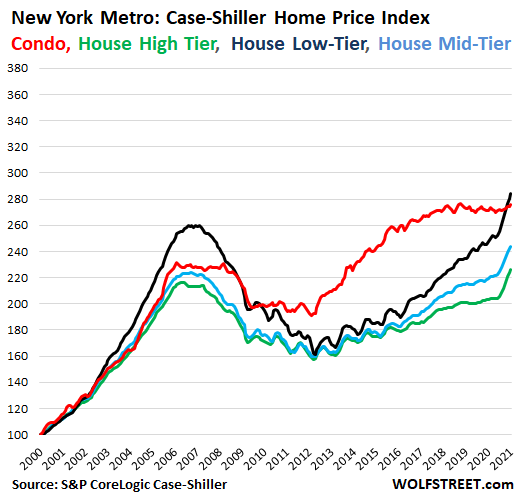

New York City metro condo prices still range-bound.

The Case-Shiller Index for New York City covers New York City and numerous counties in the states of New York, New Jersey, and Connecticut. This is a vast and diverse market.

Condo prices in the area rose by 0.5% in January from December and are up 1.7% year-over-year, remaining in the same narrow range since January 2018, speckled with some bigger moves up and down:

But prices of low-tier houses in the New York metro in January jumped 1.4% from December and 14.9% year-over-year. This includes houses in lower-cost areas of the market where Manhattan leavers have scurried to, thereby driving up prices.

Mid-tier house prices jumped 11.2% year-over-year. High-tier house prices jumped 11.3%; it is just over the past few months that high-tier prices began to exceed the peak of Housing Bubble 1. But condos did not participate in the price surges that houses reveled in.

The chart is on the same scale as the equivalent charts for Los Angeles and San Francisco, to show just how much faster prices have surged over the years in the two California metros than in the New York City metro. But since 2020, house prices in the New York metro are on fire across the board, though condos are not:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It is interesting to note that the new proposed tax increases, if it holds for couples making more that $400,000 a year, will hit these most bubble markets the hardest.

I have also not heard any proposals to do away with the SALT deduction limitations which, again, hits these most bubble cities the hardest.

And yes, fundamentals don’t have much to do with anything anymore.

Per “TheHill” today on SALT changes:

A growing number of House Democrats are threatening to withhold support from President Biden’s $3 trillion infrastructure proposal over a tax provision affecting state and local taxes.

Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax (SALT) deductions to $10,000, which was enacted as part of the 2017 tax law signed by President Trump to help offset the cost of some of the tax cuts in the package.

Reps. Thomas Suozzi (N.Y.), Bill Pascrell (N.J.) and Josh Gottheimer (N.J.) on Tuesday issued a joint statement vowing to oppose any efforts to change the tax code unless the SALT deduction is restored.

well they may eliminate SALT but they will bring back AMT. bringing back AMT effectively eliminates the upside from the SALT deduction.

SALT deduction has existed for forever. The 2017 law was to directly punish those states. You can’t complain that they are fighting back.

Why should every other state subsidize rich NY and CA for their high cost governments?

“Existed forever”

Or abused forever? A traditional scam is still a scam.

Perhaps, but property taxes increased exponentially in high cost areas that decided they needed to pay their public sector unionized employees huge pensions to retire at age 48.

Cities and states should not be able to offload their profligate spending onto the federal government.

And for what it’s worth, I oppose the tax free treatment of municipal bonds as well.

“Why should every other state subsidize rich NY and CA for their high cost governments?”

I don’t buy this argument, and couldn’t disagree more. Salt deductions punished Blue States and those people who lived in those states. Many of them were good citizens who played by the rules. Blue states by and large paid more to DC in taxes than the Red states Now the rules were changed. Very unfair. This 2017 tax bill was a disaster in more ways than one. They also took away the personal exemption, forcing everyone into the standard deduction which allows for the IRS to audit everyone automatically.

Cas17

“Why should every other state subsidize rich NY and CA for their high cost governments?”

NY and Ca send more money to DC than they get back. The Red States are subsidizing the Blue States. In other words, they are welfare recipients. Texas is the only exception, and that is because they can pump money out of the ground. It is not because of any prudent financial management.

So…you lost me.

The rich should get tax cut and “not pay their fair share” because…

Geography?

I think you meant to say that the Blue states are subsidizing the Red states? Definitely true.

Links, please!

“I have also not heard any proposals to do away with the SALT deduction limitations”

I have to admit, considering the absolute centrality of NY and CA to Dems winning ntl office, that I thought Biden would have personally rammed through property tax deductibility on Day One.

Considering the line up of announced proposed legislation, undoing Trump’s prop tax changes may be a distant fourth or fifth priority.

Which is pretty interesting.

NY & CA are in the bag. It’s the states on the margin that count.

New payroll tax on San Franciscans working from home and on their companies if headquartered there.

From the City That Knows How–To Destroy Itself:

S.F.Comical story

“San Francisco voters decided to hike the city’s gross receipts tax, its primary business tax, in November. As someone who actually reads tax codes for a living — yes, I need more hobbies — I worry they had no idea what they were doing.”

“Backers of the business-tax overhaul, which Mayor London Breed and others pitched as a needed reform, noted that it got rid of the city’s payroll tax. But it kept the basic structure of the gross receipts tax untouched, and for most companies, that tax is a stealth payroll tax.”

“That’s because San Francisco asks businesses to calculate their gross receipts tax burden in part on the portion of their overall payroll that’s earned in the city. This apportionment factor helps determine how much they pay.”

“Let’s say a Salesforce employee who lives in Oakland comes into a San Francisco office two days a week. Will Salesforce count 40% of her payroll as a factor in its San Francisco tax bill? That’s my reading of the tax code: It’s based on the working hours an employee spends in the city proper versus anywhere else.

Salesforce is joining other companies in allowing permanent remote work.”

“Ah, unless she’s a salesperson whose commissions vary considerably. In that case, San Francisco considers the volume of business. What if she’s working from home at the end of the quarter when deals usually close? Will those escape the apportionment factor, and lower Salesforce’s tax burden accordingly? It seems like enough of a loophole that we might see some memos encouraging workers to time their days in the office very carefully.”

Nuts is the flavor of the century. When will this ever end? The way things look and how often I have seen these housing bubbles from Wolf over the last couple of years comparing bubble 1 to where we are at now, I just have to guess not in my lifetime and I am in my mid 40s

Guess it’s too much to ask for trying to find a decent place to buy to raise a family without being in debt forever, overpay for a POS and time the market to perfection..What an Amercian Dream

It’s called the American Dream because you must be asleep to believe it – George Carlin

Timing helps, I bought my place in 2010 at fire sale prices. Now with prices up and interest rates down if you buy you should be sure you are going to live there for a long time. Otherwise wait until prices correct.

Even with Covid and WFH the high end areas are still going to demand a price for the quality of living. People self sort and the more highly educated and earning folks are not going to be happy living in fly over land if their neighbors have not evolved in the past 50 years, despite the fact they could have more house there. There is more to life than money.

True, we passed over a lot of properties. We are willing to pay a premium for a nice neighborhood if the comps are just a little out of whack. But I’m not paying an extra 150,000 for a house that sold 2 years ago for 500,000 that has 50,000 of upgrades, in an undesirable part of town. I can’t stomach it, even if potential rents check out.

I’d rather wait this one out. My wife won’t let me buy the inexpensive pockets of land I want, so I’m stuck renting.

My sentiment exactly. Just because I can afford it doesn’t mean I should. Not overpaying for a piece of crap place over way above value. Some of the Redfin listings in SoCal areas like Sherman Oaks or OC are pure comedy gold. 800sq ft, built in the 50s and looks like nothing was done to it since then asking $1.3M. Just because you can pay for it, doesn’t mean you should. Just like I can easily take a dump in the middle of the street but probably should.

That’s the whole con about this real estate boom, keep that supply low and it’s always low, low in 2008, 2015, 2020, super super low now. They are just copying a page out of Rolex….forever in a supply crunch so prices will get jacked up forever. Unfortunately, unlike a Rolex, kind of need housing to raise my family.

“an extra 150,000 for a house that sold 2 years ago for 500,000 that has 50,000 of upgrades, in an undesirable part of town. ”

But thanks to SuperZIRP, it is only a low, low extra $1.79 per week…

:)

Sounds like you might be one of the highly educated and high earning folks.

@Lance

“…the more highly educated and earning folks are not going to be happy living in fly over land if their neighbors have not evolved in the past 50 years…

What a curious statement. It reads like “refined and cultural people are not going to live among- and thus descend to the level of uneducated deplorables in their rural backwaters”.

Perhaps I read you wrong and misunderstand, in which case I apologize in advance. For the record, I live in rural France, but I am one of those people who left an extremely well-paid position to live in a sort of flyover area and I love every minute of it. My neighbors may be “unevolved” and uneducated farmers and workers, but I find more hard-earned wisdom between them than the bunch of “highly educated and earning” morons that surrounded me in my old job.

There’s probably something wrong with me.

There is probably a big difference between rural France than Evansville IN.

Agree with you totally JO!

Raised in an area then and now known for the extensive array of arts and culture, and then similar in SF bay area finishing my education,,,

We chose to move to very deep fly over to homestead above 900 feet above sea level on low priced farm and forest lands in 99.

Turned out the ”locals”,,, some on the same dirts for five or more generations, knew exactly what was happening, and did their best to stay as far away from the shallowness of it all, especially considering that many of them had had no ”mortgage” for the last couple generations.

IMO after experiencing that,,, ”many and many,” if not the solid majority, know exactly what is happening globally and especially nationally, no matter where in the world they are.

Nothing wrong with you, Jos.

My wife and I did the same 16 years ago.

We could not be happier!

Phoneix_Ikki— we’re in the same boat. Keep chins up, I’m betting on us being the beneficiaries when all this overpaying hysteria blows up. Good luck to you.

Same here… married, kids, job, mid 40’s renter w/substantial savings and living overseas. We planned to come back this year, but might delay a few more years.

Once forebearance, ultra low rates, saw mill capacity, Work from home & tax increases play out…home prices will go back to average.

That’s if fundamentals matter ever again, or maybe the gov will try to print us into prosperity.

Glad I’m not the only one. I have saved cash for a down payment and still renting for a lot less than it would normally cost in a desirable neighborhood. As soon as it was time to buy prices of houses skyrocketed about 15% higher in months. I can afford it but don’t want to pay for it. Something smells fishy

Good for you. Don’t give into this crazy housing disaster. Your time will come just like it did for me. Just remember, even though this isn’t the same as the late 2000s, these are the same idiots that made poor financial decisions that drove us into the ground last time. You can bet when the feds give this spoon feed nonsense of forbearance, a tidal wave of homes will hit the market. Just be ready then.

That’s it right there.

Ignore the mania and max out on cash, I say. We’re finally able to buy in SoCal but spending nearly $1M for 2 beds and 1 bath draped in utility cables is just not appealing. What are people thinking, anyway? I’m guessing they’re afraid of interest rates, inflation, getting “priced out forever”, etc.

I’m not afraid. We’ll wait for prices to start reverting to mean. I think many of the “winners” of today’s bidding wars will later feel like shmucks. Many of the factors are “different this time” but reality is always the same. Reality always shows its face.

@Caveman Where overseas, if I may ask? Low cost of living?

We’d not have been able to save to buy in SoCal if we had not left for Texas. It really helps to live in a LCOL area. I haven’t any idea how the average family can save a downpayment while paying HCOL rent. Thank God for portable work.

All the best to you.

Phoneix, based upon my recent research … the rapid technological advancements in 3D Printing of homes, buildings, walls, fences, pools, etc, will soon have a major impact on the costs of same.

It appears, said impact will be … significant reductions in the cost of new construction, thereby, causing significant decreases in the value of currently constructed/improved real estate.

I believe … you will soon be able to afford a reasonably priced “decent place to buy to raise a family without being in debt forever …”

It appears … 3D printed construction has several advantages over traditional construction, to wit, lower initial construction costs, much faster construction, more design options, stronger, more weather and fire resistant, lower maintenance costs, lower insurance costs, lower property taxes, less stress regarding all the aforementioned, etc.

I believe you would be wise to be patient.

I am all for prefab concrete homes, but wait till they find out what a massive CO2 emitter concrete is, hopefully technology will improve this in future, otherwise if they ever end up introducing a carbon tax concrete construction will be a severe disadvantage.

Also if you look at the costs they are they are not that much cheaper than traditional stick construction. At best maybe 20% cheaper, do to savings in labor not necessarily material costs.

This has me thinking the new infrastructure bill is going to massive greenhouse gas emitter, I wonder if the green part of the bill can make the the whole package carbon neutral. I am sure that never comes into their calculus.

Sure, the building codes and labor unions will instantly adopt the new prefab printed construction saving us all a lot of money and reducing the RE tax take.

What happens if everyone starts selling just as everyone started buying a year ago… started slow… and then it took off as people realized benefits of low rates. Now that benefits are mostly played out, will people shift to selling to capture the gains in housing all at once? Or will everyone just keep rushing to buy even though there is no longer any benefit to rush?

I can rent for under 3000 or I can put down 20%- 30% + closing to pay 3,000-4,300 on a mortgage.

If I love the house and feel I could live there more than five years, then yes. But that isn’t happening.

What I found interesting is there is also low inventory in physical gold and a 90-120 premium on each oz. The man on the phone said bars are not worth buying because they are hard to get rid of…

The only thing there is a lot of is bitcoin, tesla, and gamestop

There is talk about increasing the SALT deduction limits, but it does not look like it will be eliminated as that would definately be a huge tax break for the top 1%.

What is much, much more facinating for housing and all capital gains future taxes is the Senate Sensible Taxation and Equity Promotion (STEP) Act, which I think could pass this year.

The “STEP” act limits tax free status on capital gains for house capital gains up to $500,000, then you pay 39.6% if you have capital gains over $1million. The STEP act does not allow any step up basis on any capital gains for stocks, farms, land, valuables, etc beyond $1 million. So for example if a farmer has a 90 acre corn field they want to give to their son, and it is worth $12,000 per acre, the son will be paying 39.6% capital gains tax on the amount over $1 million. To be nice, Uncle Sam has proposed allowing 15 years for the son to pay those taxes, because for a few hundred acres, it would be hundreds of thousands of dollars of taxes due. Ironically, the last stimulus had $5 billion to pay off “Socially disadvanted” farmer USDA loans 100%. Talk about some extreme bills, one pays everything off for some farmers, the other takes 40% away from others. Govt picking winners and losers, that is what govt’s role is now and I think it will end in tears as at some point people will be tired of winning or losing depending on what flavor of law is passed each and every two to four year election cycle. At some point, we are all going to need multiple personal assistants to keep up with team red and team blue rule changes, not very productive use of our limited time on this Earth, is it?

Search CNBC today for “Senate Democrats propose capital-gains tax at death with $1 million exemption”

In the end, why worry about getting ahead as unless you reach that 0.1% status, the govt will find a way to nickle and dime it all way at some point, most likely when deceased. The top 0.1% will own everything of value via c-corporations with billions of legalized bribes via mafia lobby tactics. So the rest of us can just be healthcare, wage, and debt slaves and continute to be cogs in the corporate America wheel as both team Red and Team Blue are hellbent on making sure the bottom 99.9% own nothing of value, and if they do have something of value, it will be taxed so heavily while alive or it will have to be sold at a discount to Corporations at death…

Yort,

USDA loans are not just for farms and agricultural properties, they are used for homes in rural areas all over the US. It’s common for homes in the south, even in the cities, to qualify for these loans. These loans are popular with poor and minority borrowers, but many people use them. They are the ones who have been bailed out with this stimulus bill’s loan forgiveness.

I must have missed that. Loan forgiveness?

I bought my first home decades ago with such a loan. I only needed 5% down, which I could just do. It was a great start. I was very appreciative of the opportunity, otherwise I would have remained a renter.

Winners and losers indeed. Only to piss off the right voters, though, to ensure they remain on the right team. Who cares about taxes after death though? That’s silly.

“The Road to Serfdom” explains how governments, of either team, always end up picking the winners and losers. It’s worth reading. Again.

According to one report, San Francisco’s housing price to annual rent ratio was 53 in 2020. 53 years worth of rent to buy a house.

No wonder some people would rather work remotely from Kokomo, IN than San Jose, CA.

Well, to really save money I could work remotely from San Quentin, but I don’t think I would enjoy it.

Lance, you bring up an interesting point. What exactly is the lifestyle difference between WFH in a cushy low security (white collar) prison ( if such a thing were legal) and WFH during a virus lockdown from a 250 square foot urban studio apartment. I guess with the latter you can order food but the former is free.

3 hots and a cot. Library. And you don’t have to buy insurance – of any kind.

Alcatraz might be repurposed for that…communal living reminiscent of being in the military….but nice view of SFO.

I think San Quentin is a cute little burb. Waterfront property.

Based on the old rule of a property being worth 10X the rent, most homes are overvalued. In my area, homes are valued for tax purposes at 30%+ more than the value implied by the rents.

Rents must be pretty low then as that ratio is annualized.

As for a crazy anecdote to chip in, a realtor gave my friend some advice the other day. “DO NOT sell your house unless you already have something securely lined up to buy, or rent. Secure…it is yours. Otherwise, you will be living with friends”. This is on Vancouver Island.

Friend of my wife sold her house 2 weeks ago. Bidding war and it went for 50K over asking. She turned around and tried to buy a patio home, something about 1/2 what she just sold in quality and lifestyle. She had cash in hand. The bids started at 75K over asking and she didn’t get it.

There is absolutely nothing for sale here, and definitely nothing with any land is even remotely available. Nada.

Which is why a lot of people are not selling their houses, especially those holed up in the nice suburban houses with gardens that everyone would quite like right now, along with older people in similar nice big homes who would normally be downsizing, but are terrified for their health.

This has had the rather predictable effect of creating a shortage of the type of properties most people would like to buy right now. Add into this a whole lot of printed money, and a good dose of realtor induced FOMO and away we go.

Can’t speak for the USA, but in the UK if you sniff around you’ll quickly realise that the retirement home market has completely stalled. Nobody wants to move into these COVID incubators right now. So a large portion of the family home supply that would normaly be liberated by downsizers has dried up. Since you can’t slow ageing, those homes will come on the market sooner or later.

There is a magic number for figuring house prices. It is 2.2X median household income in the area. Some areas have a higher multiplier, but most of America follows this old, old rule. Long term periods of being overpriced are followed by gut-wrenching corrections. Beware the reversion to the mean. It’s a MF.

Google “magical 2.2 housing ratio”.

Yes, this 2.2x was pretty much spot on for most places forever until funny money loans and housing speculation took over. The town I grew up in is now like 10x or so.

LOL…2.2X I think we will have to be living in Mad Max Fury World type of world to see real estate in Southern California be anywhere near 2.2X

Although by then, your median income will probably be whatever water you can hoard when Immortal Joe open that water flood gate for brief seconds..

It is troubling to see county appraisers (assessors) currently jacking up property valuations (= property taxes) in lock step with these crazy overbid house prices.

In housing crashes (like 2008 crisis) assessed valuations seem to hold sticky. For example, short sale sold prices (situations where owners about to be foreclosed on are convinced to sell for less than ‘market’ value) are tossed out of so-called comparable price data (used by county appraisers to determine neighborhood valuations like what is being done now). So market values are propped up.

Of course, local gubbermnts just love the gravy train tax revenue increase from all this. I’m sure they will spend their windfall prudently.

Petunia – the old back-of-the-envelope calculation I am familiar with used to be 100x rent ie an $800 rental was an $80,000 house. I have never heard of 10x. That seems awfully cheap.

She meant annual rent . I use it now as a starting point

to for dividends.

Where I live you can buy a condo for about 400. You can rent it for between 3-4 grand per month.

You can also buy a house for about 700-900 and rent it out for about 3-4 grand per month.

Strange times.

1) RE is on sugar high.

2) Oct 1987 was the DOW backbone. 1998 was the DOW second backbone.

4) The DOW formed a H+S between 2000 and 2010/ 2011. // 2000 was the left shoulder, Oct 2007 was the head, and 2010 or Apr 2011 were suppose to be the right shoulder, according to Mr.Robert Prechter, but the DOW kept moving up.

5) Sugar was on sugar high between 1967 and Nov 1974. After Gamal Abdul Nasser got a heart attack, sugar is no longer on sugar high. It’s currently trading at 7, indicating that there is no inflation, like 1974 @47, as result of closing the Suez canal.

6) TY (US 10Y price) keep rising without any backbone since the 1980’s.

7) TY is the RE backbone. As long as TY is high, RE is on sugar high.

8) Europe NR is the lever that keep TY and RE on sugar high.

2-

The backbone of the Dow is the productivity of the American worker past and present. As the baby boomers cash out in retirement, the Dow will go in the crapper.

5-

It’s amazing how fast they cleared the Suez Canal, once the Russians offered to escort ships thru the Arctic Sea Route.

The backbone behind all backbones is the ability to tax the American. As the baby boomers cash out in retirement, the backbone will go in the crapper.

Interesting watching zillow prices. Prices are moving up very fast and zillow’s algorithms are unable to move prices up fast enough. Redfin’s are even worse. Their algorithms put too much weight on prices from a year ago and seem to be throwing out most recent sales as outliers … dumb algos.

That is exactly what we need at this point in time, an online real estate pricing and listing service more bubbly and ridiculous than Zillow or Redfin. Maybe we could get Elon Musk to run it.

Obviously, the real estate AI’s aren’t intelligent enough yet to huff paint.

Or maybe Disney? ?

The Marvel Cinematic Universe ;-)

Zillow prices are grotesquely inflated. Who are you kidding, shill?

I am seeing some homes selling above the Zillow estimate.

Zillow is also behind on prices here in metro Denver

It would interesting to examine mapped analysis of US 2019-20 migration patterns and numbers involved, broken down by income and county.

To put it in perspective:

Those who track these things tell us that the average American moves every 5 years.

According to Census Bureau, out of a population of 307,243,000, 35,918,000 Americans moved between 2012 and 2013– 11.69% of that total population. Of course it fluctuates year-to-year but that is a good benchmark to start with.

Furthermore, if there were that many and probably many more Americans moving during a terrible 2020 pandemic and recession, it begs the question of just how those extra jobs/wages and houses materialized in right places just in time for massive 2020 moves to greener pastures.

With millions on unemployment, many small and medium businesses on life support or closed permanently, and a labor force participation rate of only 61% (Sep 2020)–it is puzzling who is doing all this relocating and buying housing at nosebleed prices.

I haven’t seen an adequate explanation for this mystery yet.

Or how about all the 400,000 in claimed excess Covid deaths?

Does Covid only kill renters?

Why haven’t tens of thousands of Covid victims’ homes been added to the for sale inventory in NY, CA, etc?

Claimed? I guess that’s why we see doctors and nurses holding their heads and crying….it must be the frustration watching nobody dying in emerg.

cas127,

1. The inventory numbers don’t tell you why the home is on the market or who is selling it, and why other homes are not on the market. There were likely plenty of homes listed for sale whose owners passed away, but YOU don’t know. And YOU will never know.

2. Covid rarely wiped out whole households. One person dies, and the rest of the family continues to live in the home.

3. When a homeowner living alone in the home dies, the home becomes part of the estate and is dealt with that way. It might not be sold for a long time as others in the family might move in.

4. In California, property tax laws are such that the family will try very hard NOT to sell the home but transfer it to some family member.

5. A substantial portion of those who passed away lived in facilities for the elderly, such as assisted living facilities and the like. This is well documented, and the whole thing has become a huge scandal.

Etc. etc.

BTW, your excess deaths number is from sometime last year. Excess deaths since March 2020 are now in the 650,000 range.

1) Landlords wouldn’t sell because there is no alternative to RE.

2) They will not sell their properties and put their money in the stock markets, because DOW is crooked. SPX dividend is less than rent.

3) Landlord don’t trust a gov which freeze eviction time after time.

4) Despite the bs, landlords collect 100% rent.

5) Many surf on the big wave since the 1980’s, or the early 90’s.

6) Nothing in the world will convince them to sell and lose their power.

7) Their assets belong to them, on their name, in up trends and downtrends

8) Got it ?

About #7: RE belongs to local taxing authority. “Ownership” is hidden by paper trail of “names.”

Please, you house flippers, leave us multi unit owners alone! You must be nutz thinking I we would accept pre-flip values at these current market offers! Go Away!

Bubble looks more like salmon swimming upstream. Even NY real estate after WFH exodus is a placid lake (no pun intended) with minor ripples.

Rents not keeping up with valuations, except in the Midwest, but even those margins are shrinking a bit. Buying a rental property post-2019 is like gambling in the stock market casino now.

“We won’t take the punch bowl away.” – The mostest wokedest San Fran Fed member of them all, Mary Daly who tells us the Fed has created millions of jobs thru inflation money printing. Maybe Mary Daly can come here to my home town and hold an Open House for the $200k plywood shack for sale, with no access to public street. J. Powell & J. Yellen could come on over and plant the For Sale sign and make everyone sign in.

Dumpster fire seems the appropriate term for the housing fiasco going on now.

So timbers check this out.

784 sqm

Land for Sale

$725,000

This 1/4 acre lot is in an awful suburb. It is 100 meters away from a CAR RACETRACK (easily over the EPA 100db loudness cutoff), it is under a flight path, has not just a railway 100 meters away, it is a dead end street that leads to the train station (hell in rush hour). The street is also full of apartment buildings and dodgy characters walking to and from the station. Very little OSP because of the station and many apartment blocks with little to no parking. There are no shops within a ten minute walk. You would not build your dream home here. Because of course, you still have to build the house.

A bargain at $750,000 dollars. The first offer is likely to be significantly higher.

Our central bank says it doesn’t see any issues with the cost of housing in Australia. It is keeping a close eye on developments though. ?

My brother and I were discussing whether we should tell our mum to put her $800,000 house up for a private sale at a ridiculous price like 2.5 million or so, just to see if she gets it. Is that ethical?

Ethics are as far removed from this housing bubble as you could imagine.

Greed is good.

Do an “owner carry” sale, you’ll probably get close to what you seek given the present FOMO/YOLO temperament.

“The market has no morality” – Michael Heseltine

A Berkeley house just sold for 2.3 million, 1 million above asking price.

Insane.