To let some hot air out of the markets? As long as it isn’t “disorderly.”

By Wolf Richter for WOLF STREET.

It seems to be a rare sight that a Treasury Secretary and a Fed Chair color-coordinate their comments about rising long-term yields. On Friday, Treasury Secretary Janet Yellen in an interview on PBS NewsHour echoed what Fed Chair Jerome Powell had said on Thursday in an interview with the Wall Street Journal.

When Yellen was asked about the rising long-term yields that the crybabies on Wall Street are getting so nervous about, Yellen said in her quiet manner: “Long term interest rates have gone up some, but mainly I think because market participants are seeing a stronger recovery, as we have success with getting people vaccinated and a strong fiscal package that’s going to get people back to work.”

“Rising interest rates don’t concern you?” she was then asked.

“I think they’re a sign that the economy is getting back on track, and market participants see that, and they expect a stronger economy,” Yellen said. “And instead of inflation lingering below levels that are desirable for years on end, they’re beginning to see inflation get back to a normal range of around 2%.” And inflation may rise more than that, but it’s going to be transitory, she said.

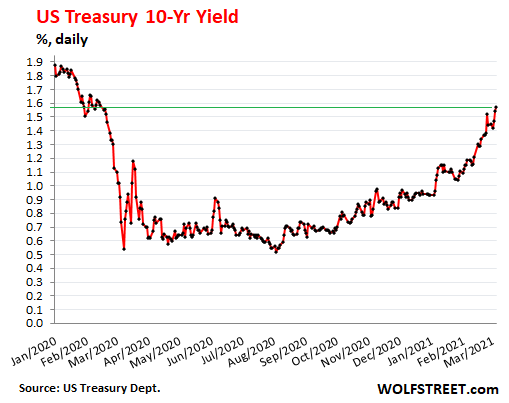

So on Friday, the Treasury 10-year yield rose to 1.57%, still ludicrously low, given the outlook on inflation, and given the Fed’s insistence that it will let inflation run over 2% – as measured by “core PCE,” the inflation measure that nearly always produces the lowest inflation readings in the US. But that 1.57% was nevertheless the highest since February 14, 2020:

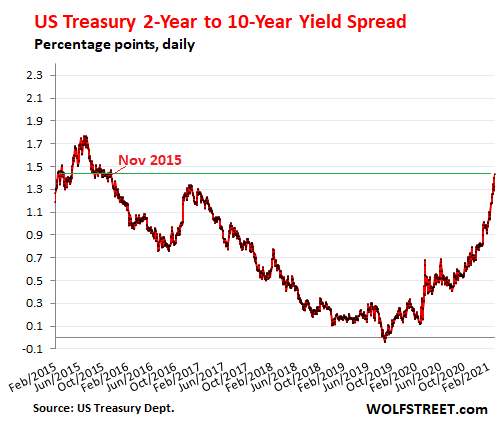

The spread between the Treasury 2-year yield (0.14%) and the 10-year yield (1.57%) widened to 1.43 percentage points. By this measure, the yield curve is the steepest since November 2015:

This rise in the 10-year yield has set off clamoring among the crybabies on Wall Street for the Fed to do something to bring them down. They have already outlined the remedies, including prominently another “Operation Twist,” where the Fed sells Treasury securities with short maturities and buys Treasury securities with long maturities. This concentrated buying of long-dated Treasuries would raise their prices and thereby push down their yields.

The Wall Street crybabies are clamoring for this because massive highly leveraged bets on Treasury securities are producing massive losses.

Even mundane conservative-sounding Treasury bond funds focused on long maturities are taking growing losses. Since the low point in the 10-year yield last August, the share price of the iShares 20 Plus Year Treasury Bond ETF [TLT] has dropped by 19%.

And the 10-year yield is still just at 1.57%. Back in November 2018, it was over twice that and hit 3.24%. In April 2010, there was a day when the 10-year yield went over 4%. Now those were the days! All we’re talking about now is a measly minuscule 1.57%, and the crybabies are out in force to get the Fed to quash these pesky yields that went the wrong way.

The Fed has been responding in a unified voice to indicate that rising yields are a sign of strength, and that as long as they’re a sign of rising strength and not of some tightening in the financial conditions, it would let them rise.

It’s amusing that Yellen has now coddled up to Powell and is singing from the same hymn sheet with Powell to push against the crybabies on Wall Street.

Her expression of comfort with higher long-term yields and rising inflation expectations came the day after Powell laid out the Fed’s position in an interview with the Wall Street Journal.

The Fed expects inflation to move up for two reasons, Powell said in the interview. The “base effect,” with the inflation index having dropped in the spring last year; and a “spending surge” that could lead to “bottlenecks” as the economy reopens, which could create “some upward pressure on prices.” But the Fed is going to brush off the “one-time effects,” and any “transitory increase in inflation,” and it’s going to be “patient” with rate hikes, he said.

To address the rising bond yields, he said: “I would be concerned by disorderly conditions in markets or persistent tightening of financial conditions that threaten the achievement of our goals.” The phrase, “disorderly conditions” came up several times.

The speed of the rise in long-term yields “was something that was notable, and caught my attention,” Powell said. “But again, it’s a broad range of financial conditions that we’re looking at, and that’s really the key; it’s many things. We want to see and would be concerned if we didn’t see “orderly conditions” in the markets, and we don’t want to see a persistent tightening in broader financial conditions. That’s really the test,” he said.

So the Fed would let long-term yields do what they might and see them as a sign of economic strength and welcome higher inflation expectations, as long as conditions are not “disorderly,” as long as the 10-year yield zigzags up in an “orderly” manner and doesn’t go overboard, and as long as a “broad range of financial conditions” remain accommodative – and they’re still “highly accommodative,” Powell said.

On the other hand, if markets become disorderly again, as they were in March, “the Committee is prepared to use the tools it has to foster achievement of its goals,” he said.

He refused to nail down at what level of the 10-year yield the Fed would get nervous and start rummaging through its toolbox. But apparently, that point isn’t around the corner just yet.

The effect is that higher long-term yields are letting some of the hot air out of the markets. And the Fed may be encouraging it, as long as it’s “orderly.”

The bond market has been getting hammered for months, with big losses scattered across Treasuries with long maturities and investment-grade corporate bonds. The housing market will eventually respond to rising mortgage rates, and mortgage rates started rising in early January.

But junk-bond yields have barely ticked up from astounding record lows. Demand for these instruments remains red hot, amid record issuance so far this year. This enthusiasm for junk bonds – which allows all kinds of wobbly companies to fund their cash burn – is a sign of “highly accommodative financial conditions.”

When the average BB yield doubles to 7% and the average CCC yield doubles to 15% (my cheat sheet for bond credit ratings), financial conditions are getting tighter, funding for cash-burn machines is getting tougher and more expensive, and the Fed would be getting nervous. But that’s not happening yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Here is the game..

First inflation will be denied….(and has been for years, we are leaving this step now)

Second, inflation will be declared a welcome sign of heighten economic activity and a victory for the illegal mandate of 2-2.5% inflation.

Finally, after a period of not addressing inflation, contra to their obligation to do so under their “stable prices” mandate, the Fed will “limp in” with ineffective and behind the curve 1/4 pt hikes.

then what?

Then the worthless dollar is repudiated world-wide. 1.57% interest is a joke compared to the actual on-going inflation of at least 8%.

We’re already at -6.5% debasement of the currency as we stand now.

Thanks Alan, Ben, Janet and Jay

A job well done – the rich are in awe of you efforts

You know – if there’s anyone out there who hasn’t seen this prophetic routine by George Carlin – now is the time.

It just gets better every time you see it. (Which isn’t good).

We do not have 8% inflation… I was buying butter for 3 dollars a pound back in 2012 and I can still get it for exactly $3 a pound in 2021. Bananas are still 55¢ a pound. Car prices inflating due to whizmos and gizmos? Sure. Look at commodities though, not 8% a year. Energy, no.

I used to be convinced we had far higher inflation than official, more like shadowstats numbers. Other than maybe healthcare, regional housing costs, and certain popular goods, I’m not seeing massive inflation from over the past 10 years, it’s mostly only in assets.

So there’s no inflation except in health care, education, property taxes, housing, and financial assets.

“Other than that little incident Mrs. Lincoln, how did you enjoy the play?

In agreement with Mark, whether you look at money supply, national debt, world net worth, everything is growing at 7-10% per annum when you look at decade-long timeframes. So who cares if CPI is 2% or some the interest rate triples from 0.7% to 2.1%? If you’re not getting your 7-10%, you are losing.

Also in agreement with Rhodium, food prices are heading to zero. It’s one of the most cost-effective subsidies for the government. For a few hundred billion dollars, the government could keep food prices low and affordable and keep the population under control (for the most part, automation and the population’s willingness to work for low wages have kept prices low so far). The price for butter is whatever you want to pay for it. If you want to pay $6 a pound for premium organic butter, I’m sure you can find it. Kroger and Albertson’s keep sending me my personalized coupons, where I get an extra 50% or 65 cents off their already low sales price, so the price per pound comes to $0.99 to $1.49. I’ve been getting these prices consistently (maybe 6 or 7 times per year). If you want the food for free, you just join the 40 million Americans on food stamps.

“We do not have 8% inflation…”

Probably right. It’s likely closer to 10%.

“So there’s no inflation except in health care, education, property taxes, housing, and financial assets.”

Don’t forget cars big time. They list the base models but the don’t exist because of the chip shortage. So you gotta get the 20-30% higher priced same model with stuff.

Timbers, exactly. There is no inflation only in food that is subsidized (imported food still costs a lot more), in Chinese made durable goods, and in electronics.

EVERYTHING else is up. I don’t consider everything to be hunky dory because you can buy a cheap flat screen TV.

I disagree. Education has gone up because many states are pulling out of local funding plus schools offering a “lifestyle” with football and fancy gyms and high pay for the admin.

Cars aren’t really going up, they are often going down from what I can see. New cars are still pretty cheap and start at $15k (Kia Rio). Trucks are not a good show of what’s “normal” because those have high profit margins and are upselled with all the gadgets. The average american get’s a lot of extra fancy gadgets. The cheaper end hasn’t changed for the last 10 years or so. The mid range with all the extra gadgets have changed a lot with financing. At this point they offer a 9 year loan compared to the old 7 year max that they did before.

The housing market has been going up because building has been chronically low. This isn’t really market forces. Builders have been financed less because of 2008 so they aren’t just given cash to build as fast as possible to create a glut.

Because of less housing and more renters, there’s a new need for tax base from the smaller amount of home owners. Since it’s all tied to house value that keeps going up due to construction specifically being kept low, it’s a new outsized cost.

Healthcare has been increasing 2% every year. Insurance companies have always known they can squeeze people because if you don’t have insurance you’re not going to be able to afford the overpriced expenses. They are a for profit companies and their profits increase every year. It’s not inflation, it’s them just profiting.

Then nothing. The Federal Reserve dictates bond yields, not the secondary markets. Bond buyers are supplicants. Traditionally you want to have a rising yield curve. The inflation meme, to me, is unconvincing. We have had asset inflation because the One Percent enjoy tax rates and tax avoidance schemes to shelter their wealth. And they buy financial assets. Not to worry, the stock market should let some gas out anyway. The One Percent will simply sidle back in as it goes down. As for the bottom half, they are shedding their credit card debt, but they still are not paid a living income. So I have no clue where the demand for higher prices will come from. My bet is we are in a long drawn out ‘debt deflation’ caused by incompetent governance and the now solidly Libertarian GOP.

2023 I presume

You’re right. The Fed needs to change.

The ECB has shown us the way: 0.01% rate hikes should be the norm.

And 30 year mortgage rates will skyrocket to 8%

10% less than what I had to sign for in 1981. 8% is still OK with high inflation.

That was 18% on a house that cost $50k probably for what today costs $600k and a salty that is only 10% higher. You’re being a fool of you think there’s nothing wrong with 10% on houses that are heading to avg. $1M in every urban center where the only decent paying jobs still are.

SO,

Basically right, if a bit aggressive.

The overwhelming reason that home prices have been able to double over one of the worst 20 yrs for employment in US history is because DC has artificially destroyed interest rates through money printing of one sort or another.

Remove that moronic 2.5% mortgage rate (with the US most heavily indebted ever, and therefore at worst risk of default) and artificially inflated home prices collapse…because buyers only paying attention to monthly pmts evaporate.

Normal rates = normal home prices = 2001 home sale prices.

This for the suspicious guy:

Exactly what happened for us, buying a house in Berkeley ”flats” for $50K, with 20% down and mortgage at 18%; fixed it up nice, sold it for a bit over 2.5 X two years later,,, now ( actually a year or so ago, ) valued at over $800K…

But, of course, there is no inflation involved,,,

CRAZY times, far shore.

Yes, but artificially increased housing prices should also be a massive incentive to build more of them. Ultimately that should bring prices down. I’m not seeing a ton of housing starts after ten years which should have been enough time for home builders to get in the market.

The problem with or without high interest rates is job concentration in urban centers. The costs associated with land scarcity and housing density, particularly when issues of expanding utility systems come into play, and zoning laws to boot, mean that housing no matter what is going to be expensive. There’s plenty of cheap housing out in the boonies but the jobs aren’t there. Do jobs need to be located in population dense cities or are these people just fools that like raising the cost structure?

Rho,

Agree with essentially everything you said.

The biggest mystery is the relative lack of affordable new housing supply over the last 10/20 yrs…even after prices nearly doubled from the bottom of the bust.

1) Partially it is the idiot overconcentration of better jobs in the most expensive 5 or so metros (ground zeroes of land scarcity = insane housing prices). Hopefully C19 has finally awakened some CEOs to remote work (evidence suggests this) but we’ll have to see the actual extent.

2) Even beyond the jobs distortion, lenders are probably gun shy in the wake of idiot bubble #1…but with mortgage rates at a Fed poisoned 2.5% …surely somebody in a nation of 320 million ought to be able to build a $200k (vs. $400k house)…and then proceed to be able to sell another 100,000 of them.

Why this hasn’t happened for 20 yrs of ZIRP is the mystery of mysteries.

Granted a GC probably finds it easier to build 1 moronically overpriced McMansion at $400k than 2 carefully penciled out $200k homes…but every other mkt tends to have multiple price point products…but 95% of the Builder 100 seems only interested in building for the top 20% of the US income distribution.

It is amazing that 20 yrs have passed and essentially nobody in the US has raised (let alone addressed) the issue.

Cas, many corporatised home building companies buy huge tracts of the greenfields around big cities 20 years before they sell them, creating an artificial land shortage. I had never heard of this until recently and I suspect it is a stitch up between the developer’s lobbyists and the government. Guess who some of the biggest investors in those companies are.

FC,

I agree that enormous “Master Planned Communities” are definitely the trend and that huge greenfield buy ups are the first step.

And I would have zero surprise if local politicians have financial interests in those MPCs (obscured of course)

But, at the end of the day, it is kinda hard to corner the mkt on land in most places…there is just too much of it.

Heck, most metros even have a decent abundance of vacant *infill* land.

Plus, even small areas can be used for smaller footprint/higher density housing (townhomes, fourplexes, apts)…but the build side seems almost utterly uninterested in such developments…at least at price points below the high end mkt.

There just seems to be near universal agreement among the Builder 100 to focus solely upon ZIRP exploitation and build the minimum number of homes for the maximum amount.

But even that is a bit of a mystery…because there are a lot of GCs in the world below the Builder 100.

@Cas – building one million-dollar home requires one (perhaps slightly larger) crew of skilled labor. Building five $200,000 homes requires five times the skilled labor and it’s not available. I may be wrong, but it seems to make sense. Methinks the profit percentage is also higher on the single home.

Can’t seem to reply to @Lisa_Hookers comment direct, but she’s dead on. All your housing cost are in the walls. That’s where you have multiple trades all interesting and they’re required on every project. For example, if you build a 2000 sq foot home that has a base build cost of $150,000 for structure, mechanicals, and a blank “shell” and your finish packages are either 25k for cheap grade or 45k for high end, that’s a difference of only 20k which is about 10 to 14% of the project value swing between mid and high grade. That means 80-90% of your project cost are in those “fixed” cost to build the home no matter what. This doesn’t even account for the land purchase cost. These figures are obviously made up but aren’t far off reality.

We were at 11.5% in southern Cal ….. refinanced later at 7.5 %.

This was way before everyone’s legitimate return on money was stolen, and given to the Feds friends – Wall Street, The Too Big To Jail Banksters, and the Military Industrial Complex.

Consumers will just start using ARMS … who needs a 30 at 8%.

Yep, then we can finally catch up with Canada.

My first mortgage was for 12 3/4 %, which I didn’t mind because people were paying as much as 18%. about 3 years later I became a Realtor when rates were at 12%. Business was booming, average home on the market 18 days. Rates came down to 8 point something after a few years, but the high interest rates never slowed down the market, which was fueled by real demand.

This will eventually puncture the real estate bubble and the junk (and quasi-junk) bond bubble as rates rise and fewer buyers can qualify to buy and junk bonds face competition from rising rates in savings, treasury, and quality bonds. It will also likely eventually puncture the stock market bubble as bonds start to pay interest rates that seriously compete with the puny returns of stocks given the outrageous price-earnings ratios of most stocks now.

We are now about to start the downward slide in our economy thanks to the (not government owned) “Federal” Reserve’s prolonged thieving from the American people to funnel funds to its banksters, e.g., the $2 TRILLION to buy their worthless mortgage backed securities in 2019-2020.

Typo: treasury. Treasuries’ rates will rise and will compete with junk bonds and the higher quality of treasuries will drive the rates of junk bonds sky high. It will also make existing, very low yield, junk bonds dramatically lose value. Those companies will have hugely rising interest costs as they have to roll over their debts.

10 year Treasuries should be at least at 3%+ today…right now.

“So on Friday, the Treasury 10-year yield rose to 1.57%, still ludicrously low, given the outlook on inflation, and given the Fed’s insistence that it will let inflation run over 2% – as measured by “core PCE,” the inflation measure that nearly always produces the lowest inflation readings in the US.”

$1.9 Trillion ….the bill. Where comes the money?

Jerome, can you see what is going on here? Easy money first fueled the stock market, and now the politicians want theirs for vote buying schemes like this bill.

Yes, the ten year should be, at this point, about 3%, and Fed Funds should, as they were up until 2009, equal to or in excess of the REAL rate of inflation…thus circa 2% and rising.

Yes, and that’s why I’ve been saying this $1.9 trillion bill is the start of the downfall of the country. The previous CARES Act, while very wasteful, at least was predicated on the pretense of COVID relief. This isn’t, at least not in good faith.

It’s pure “Vote for me and I’ll print money to give to you.” Now that politicians see that that works, they’ll continue it until it doesn’t.

If Republicans under Trump can run up the debt at twice the rate of Obama, shouldn’t Democrats under Biden up the ante and accelerate the debt at twice the rate of Trump? If not then Biden might be a “chicken” who can’t deliver the goods to his constituents.

Nah rnyr,

Start of the downfall of USA was when Andrew Jackson lost control of our money to the international banking cartel.

Our money has been on a less than straight line to heck every since,,, just accelerating more and more, especially since the creation of the so called Federal Reserve Bank by the corrupt minions/cronies of those same folks in 1913.

From what I read, since I was not there, in spite of feeling like I was at least around then, you could buy a good loaf of bread for ONE USA penny that year, now about six dollars.

When I was a bag boy at a supermarket in 1961, you could buy a 24 inch loaf of sandwich bread for 10 cents, that I am certain of from personal experience…

As to the $3/# butter comment above, can we suppose that has something to do with the massive tax payer support for the entire dairy industry, including all the sources of feed for those cows???

That’s because there is no moral hazard for this sort of thing. When one party gets away with it, then the other wants to do it too. This is where a supposedly independent institution like the Fed is supposed to be on guard ensuring that the govt doesn’t go crazy. Unfortunately, they don’t care either because there isn’t an entity who isn’t being bought out in the name of someone’s agenda.

Vintage, it’s gotten much worse lately. And rhodium, I’d agree with that

It all started on December 12, 1791 with Alexander Hamilton, the (First) Bank of the United States, and the belief that the educated elite must be in control.

Don’t worry. You don’t have to pay the interest. Your children and their children will have to deal with it.

Can, meet road.

“10 year Treasuries should be at least at 3%+ today…right now.”

Hard to justify that rate when the German 10-year is at .301 vs U.S. 1.57. Until our major trading partners stop buying USDs, the Fed will probably not change the game. On the other hand, one of the best gauges of inflation could be seen by monitoring the M2 money supply. Less than two weeks ago, the Fed stopped monitoring the M2 money supply. In other words, the Fed, by choice, will see no inflation.

On the 31st, the Fed’s relaxation of the Supplementary Leverage Ratio (SLR) policy (to the TBTF banks) will expire. If the Fed extends that policy, then another Operation Twist could become a greater possibility.

Yeah, the difference is that foreigners are buying USDs as a store of value. If they don’t serve that function, they won’t anymore.

Isn’t that against the law or something?

“funding for cash-burn machines is getting tougher and more expensive…”

“When the average BB yield doubles to 7% and the average CCC yield doubles to 15% (my cheat sheet for bond credit ratings), financial conditions are getting tighter, funding for cash-burn machines is getting tougher and more expensive, and the Fed would be getting nervous. But that’s not happening yet.”

My guess is the Fed will step long before then.

In 2016, the Fed didn’t step in at all when that, and worse, happened. The CCC yield nearly tripled to over 20%. But it deferred 3 of the 4 rate hikes that were planned for that year.

I believe that is the point Summers keeps making. He likens the Feds inflation policy to the 60s and 70s. First you let a little inflation, then you have a lot. They missed the chance to normalize, and now they are forced to watch inflation from the sidelines. Same macro problem the came with winding down massive government spending, which is the apex we are at right now. This is peak stimulus.

Wolf,

A new post about junk bond rates and defaults (and pseudo BBB perfidy) would be really welcome.

No so much because your audience is junk bond speculators, but because the nature of junk bonds tends to make junk bonds the canaries in the coal mine for structural distortions in the fixed income mkt.

And, I kinda wonder about the proximity in time between recent record low junk rates and the Fed’s subsequent new found serenity about rising 10 yr rates…

This is in illustration of what Wolf said about CC yields, scroll to 2016

https://fred.stlouisfed.org/series/BAMLH0A3HYCEY

Overall, I like what I am hearing. The government should start working to get the interest rates back towards open market rates. Now, if they can start controlling wasteful spending, I would be overjoyed. That, however, is a dream yet to be seen.

Kenn wrote

Now, if they can start controlling wasteful spending, I would be overjoyed.

as would be like 300,000,000 mericans

congress CONTROLLING SPENDING – now that’s laugh

……someone said this as “method” to control congressional spending…..

Do NOT put “many items” in a spending bill for congress to decide upon………Put “each individual spending item” on a line in an Excel Spreadsheet. Members of congress could then vote yes or no on EACH line of the Excel Spreadsheet. This would “clarify” what is being decided upon instead of the many “pork spending projects ” that are included in many bills.

…….just a wishful thought….Lobbyists for “special interest groups” would probably lobby against this idea in force.

That would be a very good start toward some control of our mostly corrupt crony congressional politicians bending over for any one contributing a million $$$ or so to their election P-16,,,

Suggest we make an amendment requiring every bill presented in either part of the congress be read, in full on the floor of that chamber by and only by the representative or senator sponsoring that bill.

IMHO, that would stop the current idiocy of having bills that are thousands of pages long.

Considering The Constitution is about 4 pages, it is crazy to have all these hidden items in these huge bills become law.

“…the Line Item Veto Act of 1996 was held to be unconstitutional by the U.S. Supreme Court in a 1998 ruling in Clinton v. City of New York.”

“…the U.S. House of Representatives passed a bill on February 8, 2012, that would have granted the President a limited line-item veto; however, the bill was not heard in the U.S. Senate.”

Porcine politicians do not want limitations on their profligacy and mendacity.

I think you may be having wishful hearing, although I join you in wishing it was true.

‘So as long as conditions are not “disorderly,” as long as the 10-year yield zigzags up in an “orderly” manner, and doesn’t go overboard, and as long as a “broad range of financial conditions” remain accommodative – they’re still “highly accommodative,” he said.

‘As long as this, as long as that, as long as ‘n’

This word salad is so full of qualifiers…it doesn’t commit the Fed to anything. Is a 20% drop in Tesla orderly? Probably not, even though it would have to drop 80% to be even vaguely investable.

This Fed has been ‘jawboning’ so long, it may no longer know the difference from lying. As George Costanza says: ‘it’s not a lie if you really believe it.’

nick kelly,

Nothing ever commits the Fed to anything. It does what it wants to do. But the Fed is jawboning. That is its biggest tool. Powell, when he talks, is jawboning. He is using jawboning to get higher long-term rates in order to keep the markets from going haywire altogether. In the press conferences, he has been blasted with leading questions about letting markets go haywire, including the housing market. So now he acting on it without acting on it.

“Now, if they can start controlling wasteful spending, ”

The wasteful spending springs from the low cost of borrowing…the fake low cost created by the Fed.

Put rates where they should be….and Green New Deals, endless wars, Reparations, etc. will be cost prohibitive, even for these spenders.

Carbon costs will stop being subsidized. Semiconductors, oil, transportation, and meat are all subsidized to offset the cost of carbon. I’m not talking about a green new deal. I’m talking about the government not caring if you can afford to put gas in your car to get to work. Subsidized carbon is the only thing cost prohibited in 2021. Petrodollar is what the fed is watching not equity markets.

Your wasteful spending is my necessary program. :-)

Aircraft carriers good, bridges bad.

Farm subsidies good, food programs bad.

No soup for you. No health coverage either.

As long as the rich increase their wealth, all good. Just make sure Wall Street gets tipped off so they can prepare and leave pension plans and retail investors holding the bag. Now, who’s cynical?

Maybe I’ll get some return on my savings one day. (Seriously)

“Maybe I’ll get some return on my savings one day. (Seriously)”

you will never get a return on your savings again. ever. not because of evil bankers or dumb politicians, but because savings don’t have a yield. only investments do. we are entering a world where this will be made perfectly clear. if you want yield, take risk. if not, buy gold.

giving yield on savings is literally giving money to people because they have money. now who’s serving the interests of “the rich”?

WTH? No, savings DOES have a yield, because money is a commodity that other people pay to borrow. It only doesn’t in today’s bizarro world because the central banks have manipulated it as such that there is no value to money.

Do you actually believe this nonsense?

RightNYer,

no, i dont believe your nonsense :P

we don’t live in a ‘bizarro world’ and money doesn’t have value.

borrowing comes with risk of non-payment or loss to inflation. risk. or in other words, not safe. do you store your savings somewhere safe, or somewhere not safe? (why aren’t you a bitcoin billionaire already?)

on the one hand people expect deposits (and loans) to be guaranteed, on the other hand they expect a yield. over time, the two are mutually exclusive. we are at the end.

“savers” (though in fact they are investors) complain that they aren’t making money on their savings. if you want to make money, try working. investing is a type of work. saving is not.

there is a lot of confusion regarding money and the world. we are watching this confusion get cleared up in our lifetime. very exciting.

“giving yield on savings is literally giving money to people because they have money. ”

From 1950 to 2000, the US was not so economically diseased that a yield on savings was inconceivable (because the G had to print money/destroy rates in order to save its leprous self).

My goodness.

“we don’t live in a ‘bizarro world’ and money doesn’t have value.”

Really? Then why have people paid interest to borrow money for millenia?

“borrowing comes with risk of non-payment or loss to inflation. risk. or in other words, not safe. do you store your savings somewhere safe, or somewhere not safe? (why aren’t you a bitcoin billionaire already?)”

Yes, it comes with the risk of non-payment. That’s why making a loan is as much an “investment” as buying equity.

“on the one hand people expect deposits (and loans) to be guaranteed, on the other hand they expect a yield. over time, the two are mutually exclusive. we are at the end.”

This is a dishonest representation of that. People expect a yield of some sort guaranteed, but then they expect higher yields as they take more risk. So if a guaranteed yield was 3%, a very safe one would be 4%, and you’d go up from there. Only in a bizarro world should junk debt go for 4%.

““savers” (though in fact they are investors) complain that they aren’t making money on their savings. if you want to make money, try working. investing is a type of work. saving is not.”

WTH? So buying stonks in the S&P 500 and expecting the Fed/Congress to bail you out is “hard work” and “investing” whereas lending money is not? Please listen to yourself.

Wow, I must have missed the part about the God given right to open a bank. And here I thought that we granted charters as a matter of public convenience to ensure professional intermediaries and avoid an uncontrolled system of usury. Well, if we don’t need that system now…cancel the charters, stop the printers, put all the bank assets in a payback fund (pledged against those dollars held in paper and digits), and start paying labor in gold and silver again. Oh, yes, the public assets will also need to go for sale to retire a lot of debt…the Van Goghs must go. Then we can all decide where to place our “money” in investments, and usury made legal. The mob would have loved it. And the Louisville Slugger could replace the eagle on the flagpole.

do you think things are going to go “back to normal”? [heh heh].

once you end the fed or something? write some new, more fair regulations? forget it. it was unfair in OUR favor before. and it’s over.

you ask:

‘why have people paid interest to borrow money for

millenia?’

answer:

because they need it now, (duh).

here’s a better question:

how have people stored purchasing power for millennia? the answer:

lots of things!

but not someone else’s debt. that’s a terrible place to put it.

that’s for investors.

it’s a simple thought. and it’s true. why do people feel they deserve a profit with no risk? and if you say that there is risk, then i ask you again, what the heck are you putting your savings at risk for? risk means you can lose. the literal opposite of savings.

as for Cas127’s comment, it is true that people earned a yield ‘without risk’ through that time… or did they? the risk had to go somewhere. and so it was transferred to what the debt was denominated in; the dollar itself. everyone got their guarantee, paid to the last penny. now, when i get a penny (post-1981) i throw it in the street.

this may drag on, it may blow up tomorrow, but this is happening. look at the wazoo charts. it’s not turning around. and it isn’t going back to the way things used to be. so choose your savings medium wisely.

The same people saying “Why do you deserve a profit with no risk” are those who go screaming for bailouts/central bank intervention every time one of their “risk” investments goes south. LOL.

i assure you, i want those crybabies to be given something to really cry about just as much as the next guy.

Fair enough. I can’t say your belief system seems particularly consistent to me, but whatever floats your boat.

bungee, you misunderstand “guarantee.” All “guarantees” are only as good as the guarantor. There is nothing you can do that is without risk. “Savings” (in a bank) have a lower return as there is less risk, but they are at risk. Appetite for risk appears highly correlated with age. TANSTAAFL.

Lisa_Hooker,

there are a lot of people who complain about not getting a yield on savings. it is them who do not understand what you wrote. they’re taking miniscule risk but then complain about miniscule yield. it’s unhealthy.

most of them blame the fed for low rates. but why do we have such low rates? why does junk only yield 4% like RightNYer complained about? it’s because everybody and their brother saves in the safest, most liquid debt they can find. that in itself pushes rates down and makes investors starved for yield. so they do crazier and crazier things for less and less money pushing yields down more. it’s what policy makers mean (i think?) when they lament over ‘too much savings’. it’s also going to blow up, if it hasn’t already.

so if you are old and have low risk tolerance, maybe get away from debt instruments? or dont. but it is hard to read otherwise intelligent people complain about virtually zero yield on something that has virtually zero risk of non-payment. it’s the same sound the wall street cry babies make. peas in a pod.

This is going to be my last response to you. If rates were really low because of market forces, i.e., too much cash, why would the Fed need to print $8 trillion to buy those debt instruments?

to any other conservative readers out there,

re-read this thread and decide for yourself if they aren’t trying to get a free lunch. do whatever you want with your money. but going forward how are you going to preserve your purchasing power? inflation is going to eat you alive if you can’t grasp the very simple concepts talked about here. going broke and then complaining about the fed isn’t a plan. the fed is going to keep the system together as long as possible. and if that means whittling down your savings, then so be it as far as they’re concerned.

adios

You’re moving the goalposts. First, you are saying that money has no value, and that rates should be 0%. Now you’re acknowledging that it’s only the case because of Fed intervention. You can’t have it both ways.

RightNYer,

i write this stuff for people like yourself. you’re so close. but I’m out of time.

*back to work. ttyl

TBT up 26.6% YTD (UltraShort 20 year Treasury). LQD, the Fed’s favorite corporate bond ETF, down 5.6% YTD. I am in the process of moving my TBT gains to LQD, as the Fed allows the bond pendulum to swing treasuries and corporate bonds (except for HY Junk, as yield starved investors are holding the junk and refusing to let go…yet). I’m betting the Fed “does something” at the 1.88% to 2.12% 10 year Treasury Fibonacci levels, else it could get back to 3.23% level recent high, and that would be catastrophic for the Fed’s global inflation experiment.

I cost average in, usually doubling my buys on the way down. Risky I know, yet saving a ton of money not flying to Vegas anymore to gamble as J-Pow has legally brought Vegas to our laptops. J-Pow has a history of bluffing, yet highly probable he folds to the Wall Street “Crybabies” once they create enough chaos in the markets…TBD.

So place your bets, uh I meant “invest wisely”…=)

Already did :)

Once the 10y yield reaches 1.75%. Mkt’s jittery will increase!

Is it b/c of inflation related to growth in the economy or stagflation due to no or weak growth?

Mean while newly mutated strains are increasing, with some of them refractory to vaccinatons and many not being detected by the usual PCR tests!

Stay tuned!

I always bet on red and double down if it’s black or the zeros. After I’ve won enough I take my money off the table. ;-)

The best way for the Fed to stop long rates from rising too fast would be to start raising the Fed funds rate.

If as Yellen stated, that rising rates are a sign of strengthening economy, then why doesn’t she demand Jerome raise rates to improve the economy and pledge she will if he won’t? Because she’s full of it and she knows it. I’d have more respect for her if she stayed on message and said inflation creates jobs.

I thought increasing demand created jobs. Like billionaire Nick Hanauer says “Businesses only hire more people when higher demand forces them too.”

There is always something to do if you are an investor and that is usually research. Things are never easy, but we have to keep our wits and realize the active Fed and a spend happy Congress are a reality.

Fed is probably going to cause a lot of people to make bad investing decisions since they have suppressed risk for so long and that usually causes bigger problems.

I urge everyone (EVERYONE) in this forum to read and re-read and UNDERSTAND this comment.

Top mark old school. Thank You.

risk based lending left the game in the 90’s….

I laugh at what underwriters buy today compared to when I was buying a-c paper….yield cannot match todays risk, its a canard

Cd

Hence you do your research, and if you decide:

“ every other person in the stock market is a gambling addict!” You choice will be ( NOT to be one) ,

and adjust your exposure accordingly. That is what old school is trying to espouse in his contribution above.

investors (usually speculators and gamblers) study the wrong things before committing their money. The most important thing that moves stock prices is the action of large groups of stupid people. Momentum might be most important, or perhaps a degree in psychology specializing in group psychosis.

RISK happens first slowly and then suddenly!

My beacon is 10y yield inching towards 1.75% and beyond. Once it reaches 2.5% game over!

Reminder:

Fed is always known by history to be REACTIVE or NOT pro-active like Mr. Volker!

‘On the other hand, if markets become disorderly again, as they were in March, “the Committee is prepared to use the tools it has to foster achievement of its goals,” he said.’

There are people who read this and see an incentive to make markets disorderly. And some of those people have the means to make it happen. Of course Powell will fold.

There’s a sequence they are following:

Peace

Order

Justice

Powel and Yellen say “Party on drunken sailors”!

Yellen has no plans to take away the punch bowl from the drunken sailors.

She will keep filling up the punch bowl as long as the sailors are orderly!

The rising water is a sure sign of a growing economy, not the ship sinking!

Once the ship reaches Davey Jones’ Locker, Yellen will have her NIRP!

As song goes wheels onthe bus go round and round now there falling off manipulation at its finest global digital currency coming or biggest war yet as Russia Iran China won’t play ball going against Rothschild dollar interesting

The Fed has always worked to control interest rates and unfortunately have suppressed them. The quick increase in the the 10 year yield is an indicator that they are losing control of their rate. I love how they try to spin it as it a show of strength in the economy or temporary inflation.

I’ve always thought that the biggest bubble is the bond market and that it would cause our next financial crisis. Rates should never have been left so low for so long but now I don’t see a way out of it. At least not one that isn’t extremely painful.

Noelck…

right you are.

on all counts.

“I love how they try to spin it as it a show of strength in the economy or temporary inflation.”

Pathetic Yellen and Powell – It couldn’t be they debased the currency by printing 40% of all the dollars in existence in the last 12 months, and now another 1.9 trillion to hand out, could it ?

Well, Congress could tax those dollars out of existence, right? Like the One Percent is going to let that happen. The money in your bank account is just money Congress created but didn’t tax away. Pretty simple really. The Libertarian/GOP is anti government and they want to starve the government of funding. Not going all that well right at this moment. That’s because they have no clue how a monetary sovereign finances its spending.

One thing Harry Dent said that made sense is that defaulting on bad debt and working it out in bankruptcy is a slow process, but the equity market can hit bottom in a month or so. Financial assets are at 6.2 times real economy. That 6.2 multiplier is heavily influenced by Fed operations. If they took their hands off the wheel it would probably go to 3 or 3.5 and a lot debt and equity would go poof.

Running an economy with 6.2 multiplier doesn’t seem to help the economy grow more than running it at 3. You might could say it causes a growth spurt and then collapse like Japan. The easy answer is always let the central bank paper over the losses.

‘The quick increase in the the 10 year yield is an indicator that they are losing control of their rate’

Right on!

This is in spite of buying 120 Billions every month! think!

Though Fed and Treas jawboning is annoying, when you compare the general financial health of all strata of our country, not too many are struggling. Not sayin’ J-Pow and Yoda Yellen are perfect, but when compared to 2008-2011’ish, most would say this economic challenge has been more predictable and easier to maneuver through, on an individual basis.

Oh, yeah, absolutely. I mean, the 350,000 homeless in CA alone are finding it incredibly easy to maneuver. What are you on, anyway?

First of all DC, people without homes in CA are ”unhoused.”

Secondly, even though I suspect the number you cite is actually LOW, the recent attempts to count in LA and SF only came up with approx 70K and 60K IIRC.

Please cite your sources for the 350K.

And BTW,,, most of the smaller towns in CA I have been in in the last 5 years or so, from Barstow to Weed, and especially along the coast from Arroyo Grande to Crescent City, have very good facilities available for support of their unhoused populations,,, a TON better than anything I have ever seen anywhere else,,, especially when I was on the streets of various cities of USA, UK, and Europe many many years ago…

Thank you.

“have very good facilities available for support of their unhoused populations”

Nope. We just have more bushes to hide the tent communities. I know- I know several of our local homeless, who are semi-organized. And yes, you do know counting the homeless is like herding cats- no reliable statistics, especially since the pandemic. Most of the homeless in rural areas are not out and about as often since Covid.

We do however seem to have less international trimmigrants coming into northern California since Covid. Especially those from Europe.

“unhoused” assumes that these folks once had a house. I think they’re part of a larger group that are simply “structurally challenged.”

Too early to tell.

Let’s see what happens once the stimulus stops, forbearance ends & evictions begin.

Another $1.9T coming our way as of today ….definitely makes things easy to maneuver.

Gasoline prices are rising. People went and bought gas guzzler vehicles when oil was cheap. Not an efficient economy.

A savings account pays half a percent interest.

In the year 2000 a one year CD paid 5% interest.

and when the market made its all time high in 2007, fed funds were 4%.

Then in 2018 the market couldnt handle 2% fed funds,.

Now, 1.5% fed funds, or lower, would crush the market.

The threshold gets lower and lower for what this fragile, everyone long, market can handle.

Half of a percent? Commerce (Kansas City? pays 0.01% .

In 2006 I had a savings account paying 5.5%. At CountryWide Bank, no less!

I wonder how many retirees whose CD ladders are rolling into sub 0.25% are being forced to equity dividends and/or corporate bonds to prop up living expenses. With consequent risk exposures.

Many are getting caught up in either lambasting the farce from the talking heads, or accepting it… not really looking to deep into whats going on… thus completely ignoring the dollar/collateral availability situation that wont be cured with open throat ky jelly operations or the kinder toy toolbox set…

Wolf,

Great writing! Keeping it simple. I didn’t realize tightening, till your last few lines on yields rising on junk bonds. I agree with the your comment on Yellon and Powell! Federal Reserve independence!?, I think not.

“…lambasting the farce from the talking heads..”

Bloomberg and CNBC are the CNNs and MSNBCs of the financial world.

As opposed to the legendary credibility and good faith of Fox, OAN and the likes ?

Come on let’s be serious here…

But yeah, we are reaching the limits of the financial degeneracy now, NFT’s being among the latest signs. Whichever way this is going to end will probably be one of the biggest firework one will be able to witness in a lifetime.

Only little sad thing is that main street will be the one feeling the most hurt, as usual

After the Biden bounce, we could have the greatest depression the world has ever seen…………basic maths….

You can throw all the money in the world at a tulip bulb but it will still be a tulip bulb…..

OK Anthony, please share what should be done to save the USA.

Tell us your plan!

I hear lots of complaining…perhaps all these smart people should do more than complain and explain, in detail, what’s the recipe for success?

I certainly don’t know and would love to hear some solutions.

To start, close the borders entirely except to people with very needed skills.

RightNYer:

“To start, close the borders entirely except to people with very needed skills.”

That would mean harvesting our crops, taking care of our elderly, babysitting our children, and any other “low cost” jobs that most Americans consider beneath themselves to do.

Our borders are kept open (despite walls, etc) by corporate America to combat any advancement of organized labor to build/re-build the middle class. That is labor history of the US since it’s beginning.

The economy:

There is great pent-up demand since the start of the Covid Pandemic. Increasing amounts of vaccinations will assuredly by the end of summer 2021 release that demand on the markets all over the globe. Look for a surge in markets for a good period of time then a general pullback. Reality of how much debt we are all shouldering will necessarily return and then the markets may render unto Caesar what is needed. Then also we will see more general societal unrest. Be prepared.

If you don’t pay people to not work, they’ll take any jobs.

Regarding “pent-up demand,” Wolf has detailed why that is wishful thinking, and not based on reality. It was a few days ago.

Been following this blog for a long-time. Here’s a contrarian perspective:

As far as I know, the moratorium on mortgage payments ends 31 Mar 2021 (has this changed?). Per the deflationist argument, this will create a huge demand for dollars, leading to a dollar spike and all risk assets falling. QE will not help because there is apparently a dollar shortage outside the US, since oil is only priced in USD, and until that changes, there is an artificial demand for the USD.

Anyways, the inflation we’re seeing looks like supply-demand driven, rather than credit driven, hence the argument that its “transitory”. But then, one has to ask how long is transitory because healthcare, tuition, insurance and rent all seem to stay elevated. However, banks aren’t lending per the Fed’s H.8. Of course, they are lending to the govt, only to flip those bonds over to the fed, the deflationists argue its just a reserve swap, rather than “money printing” as we would all conventionally understand it.

Who knows, they’ve kept the plates spinning since 2009, when I was a naive student at a top business school in the US. I’ve now moved to the other side of the planet, become debt free and I’ve been waiting for the “resolution” but I’ve been wrong is far. If they keep it going beyond 2021, maybe its a Japan all over again, even though they have a trade surplus creating a demand for the JPY, and perhaps the happy days continue until 2040-2050, without the bouquet of consequences all the so-called observers have been warning about.

Wish all my American friends here all the best. The debt is going up and up, yet no one seems to care. Perhaps I’m just stupid.

If yields were rising in anticipation of growth then surely Wall Street would be happy?

I thought yields were rising in anticipation of stimulus and debasement.

Either treasury buyers want higher yields because USD is seen as risky.

Or the snake starts eating it’s own tail and the USA buys all its own USD debt with printed money, which drives yields up.

It’s USD risk that is driving yields up, surely?

Not a sign of growth?

I see “them“ letting inflation run away to get some debt devalued, get rates up a bit, let the market correct a lot more (they won’t catch it this time)

Blame it all on covid19 and trump.

Then they can lower rates back to where they are, get the market back on track, and be heroes again.

Yay. Heroes.

I mean to say, USA printed debt buys it’s own USD debt, which puts downward pressure on yields, but everyone else won’t want it as everyone sees its higher risk… so existing debt is priced accordingly.

The 30 year rate is far from where it was during the booming Trump economy, and even the 10 year rate is below the July 2018 3% rate. Hard to know, tho, how much is due to Fed manipulation and how much to market sentiment.

Stock market probably was fully valued five years ago. Since then total return on SP500 is just under 17% annually on an economy that thanks to covid is not much bigger than it was five years ago. All money printing. What to do? What to do?

Anti-crypting Fed speak, What’s going on trial? Who’s on first?

Bailout Yells: ‘All rise!’

Powell Line Loan thunders: ‘Order! Order in the court!’

On Trial today is mischief communication in the markets, and a failure to get the money to worthy recipients.

The docket is cleared for the next 2-1/2 years…

we’re going to do some serious re-weighing around here.

If there is drop of 10% in the stocks, a correction or the real bear market, rates will be back to low, ultra low and even negative. Biden might not tweet everyday about stocks but behind the closed doors, he want a good stock market like any other good President. Enjoy the higher rates while it lasts. If all the elites are fearful of inflation they must raise the rates even before COVID during the 2018? At the top, there are no blue or red, everyone values only money for themselves.

The biggest component of the CPI is shelter, which is determined by moves in rent prices.

Right now we have built up the greatest discrepancy in many decades between the change in rents and the change in housing prices (with housing price rises far outpacing the rise in rents).

As such, if rent prices begin to catch up with the underlying asset price, that could cause a very large and unexpected rise in CPI which would catch the Fed by surprise. Big time.

“As such, if rent prices begin to catch up with the underlying asset price, that could cause a very large and unexpected rise in CPI which would catch the Fed by surprise.”

That problem has been fixed. Keep wages of the sort of folks who rent low, and prices can’t go up.

If for an unforeseen reason that no longer works, Fed can always classify rent as an investment. Or food as an investment. Or gasoline as an investment.

You get the idea

Inflation problem solved.

The U.S. probably has some of the highest rental square footage per person in the world. Ever been to a 3rd world highly populated area with poop running down the streets? We’re at least five years from that over-used utility capacity situation from over-crowded apartments, we just have to be. No worry.

Instead of rents rising to catch up to meet asset prices, I am seeing the opposite in one of the hottest markets in the country, Austin, TX. I was there last month and checked out home prices and rents.

My informal calculation, last month, was price/rent ratios for houses renting at about $2k were ~12X-14X rents. Just checked again, and the ratios are 11X-12.5X rents. Lots of the new rentals now are new homes that are supposed to be selling for 300K-400K but are being rented instead. That’s a big drop in just one month.

I don’t think the Fed is losing control of the bond market. Quite the contrary. I think it is letting the 10 year rate rise a bit to cool things off before the planned big wave of spending starts.

High gold prices are always of particular concern to the Fed so they want to push them down before the next wave of inflation. Housing costs/bidding wars have be frothy and so they’d like to tamp that down a bit. And of course the stock market could use a little caution.

So in my opinion, this is all planned and we’ll see the 10 year come back down in yield probably in a few months.

How do you figure? Do you not think foreigners will react to the bond market or the dollar any differently now that it’s clear we’ll spend trillions every year, for no reason other than vote buying? At one point, there was at least discussion of paying back the debt. Now there’s not.

Wolf wrote plenty of articles on this very topic. We have plenty of buyers in the US. I agree with Mike R that this is not the Fed losing control. If that were true, we would be seeing much higher interest rates at this point.

Has the yield ever nearly tripled in 8 months before? To me, that’s the Fed losing control.

And it’s not just a matter of having buyers in the U.S. We need foreign buyers if we’re going to be able to export our inflation and buy all of our imports with those printed dollars.

Tripling from a low number does not mean anything. Sure a couple of funds here and there have lost money, but as Wolf said the rates on junk bonds are still making new lows. That’s really the real canary in the coal mine.

That’s because they expect that even that junk debt is Fed guaranteed. Do you really think there’s no end to this game?

Will there be an end? Of course there will be, but that does not mean it’s now or soon. Junk bond buyers will be the first to flee if the Fed were ever to lose control.

Precisely and is nothing more than supply and demand, bond yields are more attractive. We are already seeing money flows into the bond etfs, which would accelerate if stocks sell off. Riding the rodeo bull, too much liquidity, and the Fed wants to move investors further out the curve. They raise their rates, and the yield curve reinverts.

Rising strength in the U.S. economy is what? Eating out more and taking expensive vacations? America is back, at our best.

There should be a huge glut in shipping containers in about what, 2025? When the stimulus runs out they can make decent living spaces I suppose, better than cardboard. Just have one parked somewhere with a scenic view close to a porta-potty. 20, 30, or 40 footer deluxe, your choice.

The stimulus will NEVER run out, because now the economic numbers are based on that stimulus. In other words, the stimulus/UBI creates a “baseline” set of numbers, and any drop will be considered problematic. If people used that free money to splurge on durable goods, durable goods spending will be decreased next year, and that looks bad. So they’ll have to renew the “stimulus” in perpetuity, until no one wants the dollar.

That is the end game.

I think this movie has been played out several times in the world of Fiat. More debt equals a growth spurt followed by collapse and then greater debt is required. Eventually psychology turns when people realize the expected income stream was only a dream and the asset is worthless.

All of my mostest smartiest friends tell me manufacturing can never ever come back the U.S., and something tells me that’s just what the folks running things in Washington want everyone to believe.

So then yes, good US economy is Fed printing more money so we can all go to brunch more often.

‘manufacturing can never ever come back the U.S.’

No secret here!

US labor cannot the match the difference b/c of global labor arbtrage, pulling wages down!

The manufacturing of band and woodwind instruments has been offshored to China over the last 20 years. At first the quality was not as good as the U.S. manufactured items. But over time, the quality control has improved to the point where I can not tell the difference between one manufactured in the US and one manufactured in China. The dealers are making way more profit pushing the Chinese imports because of the vast difference in the burdened labor costs. So the entire US band instrument is headed for destruction, unless something is done to even the playing field.

timbers,

manufacturing can thrive in the US, and there are plenty of examples, but it will be largely automated. Instead of 20,000 people, the plant has 1,000 people, and the jobs of those people are different, and include taking care of the machines.

What isn’t coming back are basic manufacturing jobs, such as those stitching clothes together. They’re going away in China too.

Don’t forget medical manufacturing. Bristol Myers in Massachusetts is hiring boat loads of folks to make customized cancer treatment drugs, that are based on the patients cell characteristics.

Yep. The big myth is that Chinese wages are so low that it’s not worth automating. That isn’t the case anymore.

“Yep. The big myth is that Chinese wages are so low that it’s not worth automating. That isn’t the case anymore.”

RightNYer,

Thank you for proving my point the a $25 minimum wage TOMORROW would not destroy jobs.

Manufacturers in the US don’t pay minimum wages. Minimum wages are paid for entry level service jobs, such as fast food or lodging. And they cannot be offshored.

“What isn’t coming back are basic manufacturing jobs…”

Don’t agree. For example, iPhone production could be moved entirely to the US and made so that the ones who pay any additional cost are stock owners who have been unduely enriched by the Fed and over paid Steve Jobs.

“Manufacturers in the US don’t pay minimum wages. Minimum wages are paid by entry level service jobs, such as fast food or lodging. And they cannot be offshored.”

True, but not the point. The point is, raising minimum wage to $25 will not affect job loses in manufacturing….as RightNYer implies because those making far less are already being automated – because he says we lose jobs that pay much less. And you just wrote said we can’t offshore the jobs that pay minimum wages…So these jobs are captive, meaning raising it to $25 won’t kill those jobs.

More to the point:

“We can’t bring back manufacturing jobs.”

Martin Luther King:

“Only because people like you say that.”

I wouldn’t call iPhone manufacturing “basic.”

It doesn’t prove that at all. It’s worth spending the money automating things when labor costs will be more than the automation/maintenance of the equipment.

As Chinese wages have gone up, so has the scale in favor of automation.

At $10/hour, it might be worth having an extra cashier at a store. At $25/hour, it’ll be worth replacing them with kiosks.

I’m going to build my highly automated manufacturing plant in Vietnam with German and Japanese (and some American) machines, then export.

Also, a 20:1 ratio for automation reducing labor is pretty poor. 300-400 to 5 or 6 is more like the target. Lights are going out.

pretrial motion

1. The United States of America is no longer a Corporation. I’ll grant you to do a bit of research on this matter.

And it’s no longer a Republic of autonomous states.

Exactly, Ambrose. We once were a cooperative republican Federation of sovereign states. Until the interstate commerce clause fixed all that.

I pulled up to the pump of my favorite gas station and noticed the price was over $3/gallon for regular gasoline. It was $2 just 6 montsh ago. I couldn’t care less. I hope it goes to $5/gallon. Less traffic on the roads. Less chance of getting smashed by these maniac drivers in the Nations Capitol. If those people who bought those monsterous SUV’s start complaining about having to pay $100 or more to fill up their tanks, I’m going to tune them out and turn on some hard rock music on my radio so I don;t have to listen to their whining.

Gonna go buy an older V8 Truck to crush the EVs, IDC if gas gets to 100/gal

I wish I still had my 1981 VW diesel. 50 mpg around town. I could run it on fryolator oil if I wanted.

Truly one of the very most efficient ”everyday” vehicles ever made r2/3!

I too wish I could even get my hands on one today, now with a very good shade tree mech a nick right down the street to keep it running forever,,, he even knows how to forge and machine parts, similar to the wonderful mech a nicks in Cuba for the last gazillion years.

What a wonderful world we live in this era,,, eh?

Makes me very nostalgic for the 1950s era in SWFL, when the great guys in the machinist shops could come up with literally anything needed to keep our vehicles going for another few years, not to mention being able and willing to fab up whatever we could think up to make some new mock up…

Here’s a crazy question. Do some on Wall Street think that the point of my existence, or even Janet Yellen’s existence, is merely to enrich them?

Yes, they do think that. They produce nothing; all they do is skim a piece of every facet of production for themselves.

This is the end, my only friend, the end. Sending out an SOS, in a container. Landing on the Moon. Ill be back, guard my stash. When I return something Irish and cream, put me to bed, naptime dream.

Great reporting Wolf!

It should be possible based on current GDP projections and implied tax revenue receipts to figure out at what interest rate (Fed funds doomsday interest rate X), the US will start having to borrow to pay the interest on the national debt. (the higher the Fed Funds rate, the more the US must pay in interest on its debt)

So if inflation gets out of control and the Fed is forced to raise rates, that doomsday interest rate is the number we should all really be keeping an eye on. All hell will break loose if the US has to borrow to pay its interest. Notably the US dollar should fall off a cliff.

Anyone have a number for that interest rate? 5%? 10%? on Fed Funds?

You nailed it Robert. If the rates go up then everybody including the government pay higher interest rates. The government is OK with this massive borrowing to help bridge us since they too benefit from near zero interest on the “loans”. The rates will leap up in the near future unless ZIRP. The government is also responsible for paying down the rates but when they have to start paying the piper it is going to be an apocalypses situation. Rates go up the loan interest goes up then payments have to come from taxes (kinda) and then we UP like an airplane slowly but until we reach cruising altitude of 15%

If the fed is buying the long end of the curve as interest rates rise, then they will benefit from the lower prices and higher yields. Eventually, the fed will make a profit and the treasury will save money on the bonds.

The disgusting part of this story, is all the homes purchased in the last few years at inflated prices at low interest, will now deflate as interest rates rise. Those home owners might deserve the disappearing equity, because you could see this coming a mile away. But it will be difficult to watch the swindle, again.

Yep, homeowners will be stuck with a huge loan for 30 years duration on a property that is underwater and which they can’t sell when they have to move to get a new job, or any job. They will wind up defaulting on the loan, short selling or handing the keys to the lender and walking away with wrecked credit just like they did in 2008.

You are seeing the lemmings lined up for the slaughter.

March 7, 2021

Great question, Robert. Attempts to quantify, always good.

Maybe the short answer is that so far The Roadrunner has not “started to fall”.

(and I’m assuming here that the Fed, the Treasury, and/or perhaps some unrecognized cogs in the wheel of U.S. Finance, is/are already borrowing money to pay the debt on the interest on the debt and so on. Kind of like using a HELOC to pay monthly minimums on your credit cards ?)

But Gravity is not just a good idea; It’s the Law.

Maybe it will be a long-range comet; maybe it will be a neutrino…….

some perturbation will disturb the apparent equilibrium; and then you have to start thinking about the acceleration of Gravity.

None of this government abuse and spending would be possible if the government had to borrow/tax the money for their gargantuan pet projects.

This is only possible because the Fed is enabling it.

Fed must be restrained before they destroy our country.

Keeping interest rates below inflation is maddening.

Fed is looking more and more as a criminal enterprise.

it always has been, created at 12AM on Xmas…..the pigmen will never stop going to the trough. Debt pushers sleep with the devil and the sheep jump in bed with them for an epic debt gangbang….then the collapse….

‘Fed must be restrained before they destroy our country’

LOL!

By whom?

The deficit spending loving Congress?

The people clamoring for more stmmy checks?

Top 1% who own 53% of Wall St wealth?

Top 10% who hold nearly 93% of Wall St wealth

THe US Multi Nationals supported by easy-peasy money policies since ’09!?

20% of S&P 500 are ZOMBIES again courtesy of Fed!

Seems to have approached the point where there must be big borrowing just to pay the little promises of dividends, interest, cash back, etc.. But there can be no justification for further extensions unless you can say someone will be buying almost immediately in short order. There must be constant turnover at ever increasing rates. So we have arrived at the place where there are official calls to spend even that which you do not have (stimuli ad infinitum) and avoid any form of real savings (hand it over to the best liars). And do it electronically which

equals instantly ’cause we need it now. Guess it could assume the title of the “Please Order Something” E-conomy, aka the POS Plan. Sure beginning to smell like it. Puts Powell straight in the waste management business.

the fed will never announce yield curve control. They will do it but never announce it for that would send gold up and they don’t want that.

Gold has crashed from it’s peak of over $2010 to under $1700!

A 30% DROP!

Isn’t this amazing. considering 1.9 trillions being dumped, any time soon into economy?

Wonder why?

Only one blogger pointed out b/c there is acute US $ shortage outside USA and the US$ is rising! Hence gold is going down.

I mean 15% drop

I never have understood the supposed “relationship” between the value of the dollar and the price for gold. Frankly, I think it is made up as cover for massive shorting of the gold futures to hammer the price down.

One thing I do know, the US Government does not want gold to become a true proxy for fiat “value”. In that case, all bets are off for the dollar.

The serious difference of opinion seems to about pent-up demand. Wolf has their take on manageable growth. Yellen said if GDP did print high, that would only be transitory, hence inflation. The assumptions would be for a strong(er) dollar, tamping down gold, the fear index and the animal spirits. One of the salient causes of GFC was the private creation of money, credit, got away from the Fed. Now with Bitcoin, and bulletproof corporate HY issuance, are we there again? Not to mention the hyped RE market, massive liquidity, and not just IOUs, 1 1/2 T in cash sitting idly at the Fed. The question in a crisis can they get the money in the right places, with an obstructionist Congress?

Color me Stupid on bonds… because I really am. But isn’t a sharp rise or fall in bond prices more a sign of traders following the herd rather than any real change in a nation’s financial fundamentals?

I mean if this were all a sign of inflation worries or central bank concerns inside the U.S. then why are the ten-year bonds for Germany, Britain, Japan, and France showing the exact same magnitude of rise over the course of 2021?

Those currencies are disconnnected with the dominant (60+%) global currency – US $!

Besides there is acute shortage of overseas (Euro dollar) pool + rising/strong US$!

Wonder, why Gold goeing down 15% from 2010 to under 1700!

Actual dis-inflation vs worry of increase in expected inflation!?

The Fed has become the LEAST crazy part of the government this year. After 12 years of leading the loony parade, it’s trying to step away from the clown car. I would never have predicted this change.

It’s the 64-million dollar question, isn’t it? YCC or raising interest rates. I’m reading a near-consensus opinion in the financial media that it won’t be the latter due to the indebtedness of the nation and due to the risk of a total market crash. If it is going to be the former, then you have to ask yourself the question, got gold?

Got Gold!?

Gold has crashed from it’s peak of over $2010 to under $1700!

A 30% DROP!

Explain!??

(see my comment above)

I mean 15% drop!

Other than during the covid pandemic over the past 13 months, rates on 10-year US Treasury bonds have been above this current level nearly the entire time period since the financial collapse in 2008-09. The failure of Congress and successive administrations to pass legislation to rein in highly speculative, debt-levered “investments” and derivatives by large Wall Street banks and shadow banks that are leading to their incurring speculative losses in a rising rate environment garners no sympathy from citizens who have been paying attention, and certainly no support for more hidden corporate welfare subsidies for them to realize further financial gains. Instead, it simply leads one to again question why the nation’s depository and payments system has not been separated and shielded from such exposure to speculation.

I was contemplating why Jay Powel would not eliviate the pain for stocks just a little bit in his latests interview. It was a really harsh “NO”.

My theorie below:

With margin debt is at all time highs, probably due to Robinhooders, margin calls and falling stock prices will hit people with excess money, e.g. those that did not use the previous stimulus checks to pay utility bills.

The FED and the Bank are working as a team. Banks earn money on the latests volatility. I the current rising interest regime the banks basically scoop up the excess money, left over from the last stimulus checks.

This is a transfer of money from the FED to the Banks (which is good for their balance sheet), hidden in plain sight. I heard no gambler complaining so far. New money is comming in ;)

If a few weeks or months, the FED will ask the same banks to finance future bonds offerings and help them to keep rates at bay, with the money the FED just handed them via the Robinhooders aka gamblers. This way the FED also makes sure banks can grab some safe income for the next few years, before 10Y rates go south again.

So, the banking system is fixed… eh?

Anyway the long term trend of lower and lower yields is still to be challenged by some new invention, like the iPhone, that creates new opportunities for a lot of companies and kicks of a renovation cycle in a multitude of industries. I believe we’re lacking “simple innovation”, that is simple enough to alow something like 90% of menkind to participate of a larger timeframe. Everything else is local, continuing improvements, and therefore rather deflating.

I think the real purpose of the Powell-Yellen tag team allowing interest rates to rise a little bit, is to “obscure the ability to measure the real interest rate”.

To take their game to the next level the Fed needs to do 3 things.

1. It needs to suppress measurements of inflation (done).

2. It needs to suppress the price of gold (done).

3. It needs to obscure everyone’s ability to measure the real rate of

interest (starting).

To reach the third level, the Fed needs to make it hard for anyone to accurately determine what the current real interest rate is. Is it positive or negative.

Volcker said the biggest mistake he made was in not suppressing the price of gold. Greenspan, Bernanke, Yellen, Powell have all suppressed inflation measurements and gold prices.

To buy more time, to kick the can further down the road, Yellen and Powell must now suppress the ability to measure the real rate of interest.

These are dangerous times. At least during the Bambam administration there were efforts to block runaway spending and adhere to some degree of budget control, even if were fake. Short government shutdowns occurred and then the spending spree resumed. Now we don’t even have anyone even bring up the issue of the runaway spending and lack of any budget control. I fear we are headed for a Weimer style runaway inflation or national bankruptcy, maybe both at once. I’ve completely given up and lost confidence in all of our national leaders. I’m looking at personal survival in this environment, nothing more.

Where is that pop up ad on Wolf’s site for Mexican Peso gold coins? Haven;t see the ad in a while.

That’s the way I feel. I already have plenty of guns and ammo, but am looking to buy real estate in the middle of nowhere, along with some more physical gold.

I don’t think this game will last another 50 years, like Fed worshippers think.

So much inflation… 3m UST at 3.5bps… EM pairs a dumspter fire… To Big To Not Slob On Jeromes Knob banks and their clients levered to hilt on fewer and fewer long dated UST… FRBNY stick up SOFR culo daily… months of brokest-dealers buying long dated UST at auction at 8bps or less… lol