Massive Pandemic Shifts that triggered plunging rents in the most expensive cities and surging rents in cheaper cities still on display.

By Wolf Richter for WOLF STREET.

Has the turmoil in the rental market, triggered by work from anywhere and an exodus from the most expensive cities, settled down? Have rents in those cities hit the bottom of the canyon yet? That’s what everyone wants to know. Rents are not going to zero. At some point they stop dropping, as a majestic churn takes place, with people switching apartments to upgrade for the same rent or maintain the same level of quality for less. This churn is taking place in big cities with sharply dropping rents. High lease activity doesn’t mean people are suddenly coming back. It means tenants are switching apartments for better deals.

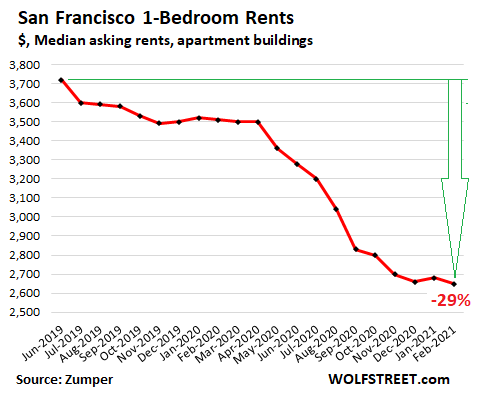

In San Francisco, the most expensive rental market in the US, the breath-taking downward spiral, after an uptick in January, ticked down to a new multiyear low in February, according to data from the Zumper National Rent Report: The median one-bedroom rent declined to $2,650, down 24% from a year ago and down 29% from June 2019:

The median two-bedroom asking rent in San Francisco remained at $3,500 in January, down 23.6% from a year ago and down 30% from the peak in October 2015 that, after a big dip, was nearly matched in June 2019.

These rent declines in San Francisco now exceed those during the dotcom bust, when rents plunged over three years – from Q1 2001 through Q1 2004 – to get there, and then spent over a decade in the hole.

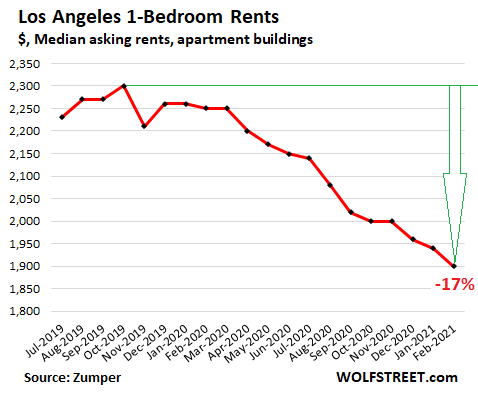

In Los Angeles, the 1-BR asking rent dropped further in February, to $1,900, down 16% from a year ago, and down 17% from the peak in October 2019:

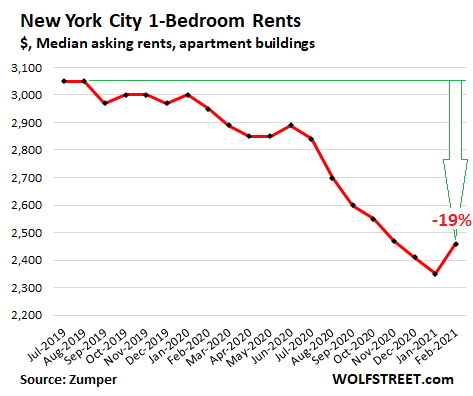

In New York City, the median asking rent for 1-BR apartments bounced off the multi-year low in January, to $2,460, but was still down 18% from a year ago, and 19% from July 2019.

But rents for 2-BR apartments in New York City continued to fall, hitting $2,550, down 23% year-over-year – further narrowing the spread between 1-BR and 2-BR rents, which has been going on for several years. The 2-BR asking rent had peaked in March 2016 at $3,980. At the time, the spread was $610. Since then, the 2-BR asking rent plunged by 36%. And the spread is now down to less than $100.

In San Francisco, the spread between 1-BR and 2-BR rents also narrowed, but less so, from $1,300 in October 2015, to $850 now.

“Asking rent” is the advertised rent of a rental apartment, but does not include concessions, such as two months free, which have the effect of reducing the rent, without the reduced rent showing up in the data. “Median” asking rent is the middle asking rent, with half of the asking rents higher and half lower. The data here covers apartment buildings, including apartment towers and new construction, but not single-family houses for rent or condos for rent. Zumper collects this data from around 1 million listings on Multiple Listings Service (MLS) and other listing services, including its own listings, in the 100 largest markets of the US.

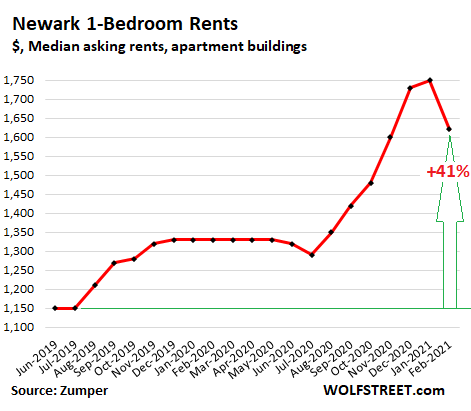

Newark, NJ, a relatively small city just across the Hudson River from New York City, ended up being the target for a relatively small number of rent refugees from New York City, but given the small size of Newark’s rental market, rents were upended by the influx, and the median 1-BR asking rent skyrocketed by 52% from July 2019, which catapulted Newark into one of the top ten most expensive rental markets. Newark! The price jumps were clearly overdone, potential tenants lost interest, and a correction was overdue.

So in February, the 1-BR asking rent plunged 7.4% from January, but was still up 20% from a year ago, and 41% from June 2019:

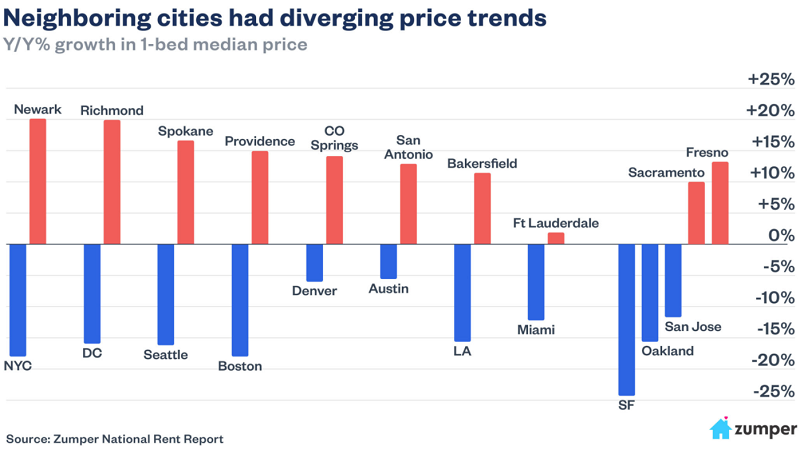

This phenomenon of surging rents in smaller cities that are near large expensive cities has been playing out across the US, as part of the work-from-anywhere shift, where there is no reason to pay the huge rents if you don’t have to commute to work anymore, or have to commute only infrequently. Zumper compiled this comparison of the most expensive cities (chart below), where rents dropped sharply, and their less expensive neighboring cities, where rents shot up.

Note that in the Bay Area, rents are down sharply in the three largest cities (San Francisco, Oakland, and San Jose). But in Sacramento, which is about 1.5 hours by car on a good day from San Francisco, and in Fresno, which is about 2.5 hours by car from San Jose, rents have surged (click to enlarge):

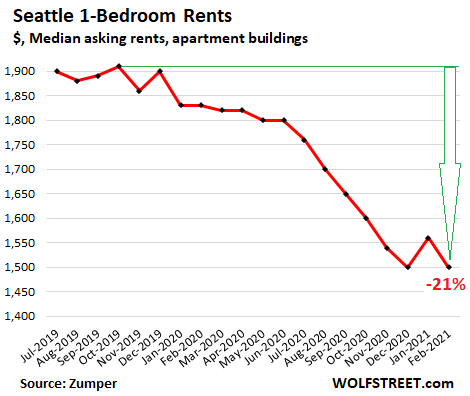

In Seattle, the lonesome uptick in January, after spiraling down for months, was neatly undone in February, with the asking rent for 1-BR apartments dropping back to $1,500, down 16% from a year ago, down 21% from October 2019, and down 25% from the peak in May 2018.

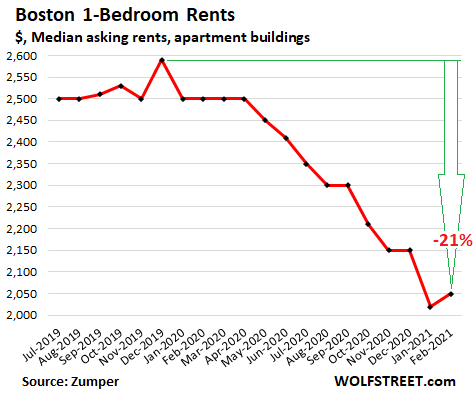

In Boston, the median 1-BR rent, after plunging in January, ticked up in February to $2,050, still down 18% from a year ago and 21% from the peak in December 2019:

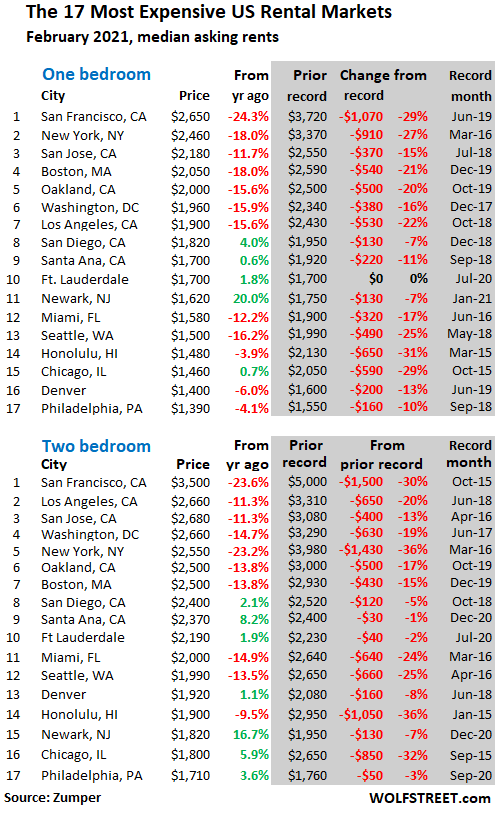

The 17 most expensive rental markets.

This list also shows the month and year of peak rent in the shaded area and the decline since then. This is an important figure because in the year-over-year comparisons, the history gets lost, such as the massive declines from their peaks in Chicago and Honolulu, where rents have been bouncing along the bottom of the range for well over a year. Of the 17 cities, 14 experienced double-digit declines in 1-BR rents from their peaks (shaded area):

The 26 Cities where 1-BR rents jumped by 10% or more.

Beyond the most expensive markets with dropping rents, there is another reality: surging rents. Of the 100 largest rental markets, 1-BR rents rose in 72 of them in February, compared to a year earlier. And in 26 of those cities, rents surged year-over-year by 10% or more, topping out at 20%-plus in three cities. These are huge rent increases, a testimony to the distortions going on in the rental market.

But those three biggest jumps, topping at +22.2% in Indianapolis, are down from the year-over-year jumps in January of 31.6% in Newark, 26.8% in Detroit, and 22.3% in Cleveland. But still crazy:

| The 26 Cities where 1-BR rents jumped by 10%+ YOY | |||

| 1 | Indianapolis, IN | $990 | 22.2% |

| 2 | Durham, NC | $1,230 | 21.8% |

| 3 | Newark, NJ | $1,620 | 20.0% |

| 4 | Richmond, VA | $1,330 | 19.8% |

| 5 | Virginia Beach, VA | $1,190 | 19.0% |

| 6 | Boise, ID | $1,210 | 17.5% |

| 7 | Spokane, WA | $920 | 16.5% |

| 8 | St Petersburg, FL | $1,200 | 15.4% |

| 9 | Henderson, NV | $1,300 | 15.0% |

| 10 | Providence, RI | $1,390 | 14.9% |

| 11 | Cleveland, OH | $1,080 | 14.9% |

| 12 | Jacksonville, FL | $1,020 | 14.6% |

| 13 | Colorado Springs, CO | $1,140 | 14.0% |

| 14 | Tampa, FL | $1,250 | 13.6% |

| 15 | Greensboro, NC | $840 | 13.5% |

| 16 | St Louis, MO | $1,020 | 13.3% |

| 17 | Fresno, CA | $1,120 | 13.1% |

| 18 | San Antonio, TX | $970 | 12.8% |

| 19 | Milwaukee, WI | $1,260 | 12.5% |

| 20 | Kansas City, MO | $1,040 | 11.8% |

| 21 | Arlington, TX | $950 | 11.8% |

| 22 | Detroit, MI | $950 | 11.8% |

| 23 | Mesa, AZ | $1,070 | 11.5% |

| 24 | Bakersfield, CA | $890 | 11.3% |

| 25 | Sacramento, CA | $1,430 | 10.0% |

| 26 | Chattanooga, TN | $990 | 10.0% |

The Largest 100 rental markets.

The table below shows the largest 100 rental markets, with 1-BR and 2-BR median asking rents in February, and year-over-year percent changes, in order of the price of 1-BR rents (if your smartphone clips the 6-column table on the right, hold your device in landscape position):

| Rents, Top 100 Cities | 1-BR $ | Y/Y % | 2-BR $ | Y/Y % | |

| 1 | San Francisco, CA | $2,650 | -24.3% | $3,500 | -23.6% |

| 2 | New York, NY | $2,460 | -18.0% | $2,550 | -23.2% |

| 3 | San Jose, CA | $2,180 | -11.7% | $2,680 | -11.3% |

| 4 | Boston, MA | $2,050 | -18.0% | $2,500 | -13.8% |

| 5 | Oakland, CA | $2,000 | -15.6% | $2,500 | -13.8% |

| 6 | Washington, DC | $1,960 | -15.9% | $2,660 | -14.7% |

| 7 | Los Angeles, CA | $1,900 | -15.6% | $2,660 | -11.3% |

| 8 | San Diego, CA | $1,820 | 4.0% | $2,400 | 2.1% |

| 9 | Santa Ana, CA | $1,700 | 0.6% | $2,370 | 8.2% |

| 10 | Fort Lauderdale, FL | $1,700 | 1.8% | $2,190 | 1.9% |

| 11 | Anaheim, CA | $1,680 | 4.3% | $2,000 | 1.0% |

| 12 | Newark, NJ | $1,620 | 20.0% | $1,820 | 16.7% |

| 13 | Long Beach, CA | $1,600 | 2.6% | $2,000 | 3.6% |

| 14 | Miami, FL | $1,580 | -12.2% | $2,000 | -14.9% |

| 15 | Scottsdale, AZ | $1,520 | 3.4% | $2,070 | -0.5% |

| 16 | Seattle, WA | $1,500 | -16.2% | $1,990 | -13.5% |

| 17 | Atlanta, GA | $1,500 | 6.4% | $1,880 | 5.0% |

| 18 | Honolulu, HI | $1,480 | -3.9% | $1,900 | -9.5% |

| 19 | Chicago, IL | $1,460 | 0.7% | $1,800 | 5.9% |

| 20 | New Orleans, LA | $1,450 | 5.1% | $1,700 | 11.1% |

| 21 | Sacramento, CA | $1,430 | 10.0% | $1,820 | 19.7% |

| 22 | Denver, CO | $1,400 | -6.0% | $1,920 | 1.1% |

| 23 | Providence, RI | $1,390 | 14.9% | $1,710 | 3.0% |

| 24 | Philadelphia, PA | $1,390 | -4.1% | $1,710 | 3.6% |

| 25 | Portland, OR | $1,380 | 0.0% | $1,700 | 6.3% |

| 26 | Gilbert, AZ | $1,360 | 7.9% | $1,590 | 7.4% |

| 27 | Chandler, AZ | $1,330 | 7.3% | $1,560 | 9.1% |

| 28 | Richmond, VA | $1,330 | 19.8% | $1,500 | 11.9% |

| 29 | Nashville, TN | $1,320 | -5.7% | $1,450 | -0.7% |

| 30 | Henderson, NV | $1,300 | 15.0% | $1,390 | 2.2% |

| 31 | Minneapolis, MN | $1,300 | -5.8% | $1,800 | 0.6% |

| 32 | Orlando, FL | $1,300 | 3.2% | $1,410 | 0.7% |

| 33 | Charlotte, NC | $1,280 | 9.4% | $1,520 | 16.9% |

| 34 | Dallas, TX | $1,270 | 4.1% | $1,690 | 1.8% |

| 35 | Milwaukee, WI | $1,260 | 12.5% | $1,310 | 12.0% |

| 36 | Tampa, FL | $1,250 | 13.6% | $1,400 | 7.7% |

| 37 | Plano, TX | $1,230 | 2.5% | $1,620 | 2.5% |

| 38 | Durham, NC | $1,230 | 21.8% | $1,280 | 15.3% |

| 39 | Boise, ID | $1,210 | 17.5% | $1,310 | 8.3% |

| 40 | St Petersburg, FL | $1,200 | 15.4% | $1,580 | 15.3% |

| 41 | Austin, TX | $1,190 | -5.6% | $1,540 | -0.6% |

| 42 | Virginia Beach, VA | $1,190 | 19.0% | $1,320 | 10.0% |

| 43 | Baltimore, MD | $1,180 | -0.8% | $1,330 | -4.3% |

| 44 | Irving, TX | $1,140 | 0.9% | $1,460 | -1.4% |

| 45 | Chesapeake, VA | $1,140 | 2.7% | $1,240 | 2.5% |

| 46 | Colorado Springs, CO | $1,140 | 14.0% | $1,370 | 13.2% |

| 47 | Aurora, CO | $1,130 | 3.7% | $1,500 | 4.9% |

| 48 | Fresno, CA | $1,120 | 13.1% | $1,330 | 14.7% |

| 49 | Salt Lake City, UT | $1,120 | 1.8% | $1,400 | 7.7% |

| 50 | Houston, TX | $1,110 | 3.7% | $1,390 | 6.9% |

| 51 | Fort Worth, TX | $1,110 | 7.8% | $1,420 | 13.6% |

| 52 | Madison, WI | $1,110 | -0.9% | $1,410 | 7.6% |

| 53 | Pittsburgh, PA | $1,090 | -0.9% | $1,310 | 0.0% |

| 54 | Cleveland, OH | $1,080 | 14.9% | $1,150 | 15.0% |

| 55 | Raleigh, NC | $1,080 | 8.0% | $1,270 | 5.8% |

| 56 | Reno, NV | $1,070 | 7.0% | $1,470 | 14.8% |

| 57 | Mesa, AZ | $1,070 | 11.5% | $1,350 | 14.4% |

| 58 | Buffalo, NY | $1,050 | -1.9% | $1,110 | -14.6% |

| 59 | Phoenix, AZ | $1,050 | 7.1% | $1,290 | 5.7% |

| 60 | Kansas City, MO | $1,040 | 11.8% | $1,170 | 14.7% |

| 61 | St Louis, MO | $1,020 | 13.3% | $1,280 | 7.6% |

| 62 | Jacksonville, FL | $1,020 | 14.6% | $1,200 | 17.6% |

| 63 | Rochester, NY | $1,000 | 3.1% | $1,230 | 10.8% |

| 64 | Las Vegas, NV | $1,000 | 5.3% | $1,200 | 3.4% |

| 65 | Norfolk, VA | $1,000 | 8.7% | $1,110 | 11.0% |

| 66 | Chattanooga, TN | $990 | 10.0% | $1,120 | 12.0% |

| 67 | Indianapolis, IN | $990 | 22.2% | $1,040 | 16.9% |

| 68 | San Antonio, TX | $970 | 12.8% | $1,200 | 10.1% |

| 69 | Anchorage, AK | $960 | 5.5% | $1,170 | 5.4% |

| 70 | Arlington, TX | $950 | 11.8% | $1,230 | 11.8% |

| 71 | Detroit, MI | $950 | 11.8% | $1,130 | 13.0% |

| 72 | Cincinnati, OH | $930 | 3.3% | $1,140 | 3.6% |

| 73 | Glendale, AZ | $930 | 8.1% | $1,170 | 9.3% |

| 74 | Spokane, WA | $920 | 16.5% | $1,190 | 17.8% |

| 75 | Louisville, KY | $910 | 9.6% | $1,000 | 7.5% |

| 76 | Bakersfield, CA | $890 | 11.3% | $1,110 | 7.8% |

| 77 | Columbus, OH | $880 | 8.6% | $1,100 | 2.8% |

| 78 | Corpus Christi, TX | $880 | 4.8% | $1,120 | 6.7% |

| 79 | Des Moines, IA | $850 | -1.2% | $900 | -1.1% |

| 80 | Syracuse, NY | $850 | 1.2% | $980 | 2.1% |

| 81 | Greensboro, NC | $840 | 13.5% | $940 | 13.3% |

| 82 | Knoxville, TN | $830 | 3.8% | $1,020 | 7.4% |

| 83 | Memphis, TN | $830 | 9.2% | $880 | 8.6% |

| 84 | Baton Rouge, LA | $820 | 7.9% | $950 | 8.0% |

| 85 | Augusta, GA | $810 | 8.0% | $910 | 8.3% |

| 86 | Omaha, NE | $810 | -1.2% | $1,000 | 1.0% |

| 87 | Tallahassee, FL | $800 | -5.9% | $910 | -2.2% |

| 88 | Winston Salem, NC | $800 | 3.9% | $890 | 7.2% |

| 89 | Lincoln, NE | $790 | 2.6% | $900 | 0.0% |

| 90 | Lexington, KY | $780 | 8.3% | $1,000 | 8.7% |

| 91 | Oklahoma City, OK | $770 | -3.8% | $900 | -4.3% |

| 92 | Albuquerque, NM | $750 | 7.1% | $950 | 10.5% |

| 93 | Tucson, AZ | $730 | 7.4% | $960 | 7.9% |

| 94 | El Paso, TX | $720 | 9.1% | $890 | 11.3% |

| 95 | Laredo, TX | $680 | -4.2% | $970 | 3.2% |

| 96 | Shreveport, LA | $650 | 4.8% | $750 | 7.1% |

| 97 | Lubbock, TX | $650 | 3.2% | $850 | 6.3% |

| 98 | Tulsa, OK | $630 | 0.0% | $840 | 3.7% |

| 99 | Wichita, KS | $620 | -4.6% | $750 | 7.1% |

| 100 | Akron, OH | $600 | -3.2% | $750 | 2.7% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have been searching for a house for the past 2 months, even signed a couple contracts pulled out of one, and one was a backup offer. One thing I saw last month was a frantic rush to buy everything. Maybe it’s just me but it doesn’t seem so frantic this week as it was during the crescendo of last month.

This week in California along the coast something changed. Schools are opening back up all over; and the next few weeks all the schools will be open again. People are getting vaccinated and are more comfortable in restaurants and stores. With the vaccination and the end game insight, perhaps the great reverse has begun.

Along the California coast, I am seeing increasing buying … an impossible market for a buyer looking for a fair deal. They are overpaying for garbage.

My daughter, her house husband and new baby rent a small 2br in Berkeley for $2,500. She works remotely for a major bay area tech company. She recently bought a small house in downtown Asheville, NC for $300,000. She said the California fires had made her a “climate refugee”.

Her PITI is $1,250. She has it rented, month to month, unfurnished, for $1,400 per month. Once she and her husband are vaccinated, they will be moving there.

They have never lived in Asheville, but they have vacationed there and believe that it has the same kind of political vibe as does the bay area; just on a much smaller scale. She absolutely loves San Francisco, but she doesn’t believe she will ever be able to afford a house there. She won’t be moving back. Many of her friends are also moving to places where they can afford to buy a house and someday raise a family.

Switching gears, it’s hard to imagine that anyone would actually pay to live in Fresno.

Lovely. So the politics she supports has made California unaffordable, so she’s moving to North Carolina and plans to propagate the same failed political ideas there.

“Fresno”

Newark!

(Unless you are dumping a body)

RightNYer, how many people do you hound daily with this same tired rhetoric?

“plans to propagate the same failed political ideas there.”

It’s “Revenge of the Joads”

$1.9 trillion has never been tried before. Ever.

Cas127, LOL, that’s funny.

Timbers, was that reply in the wrong place? If not, I’m not following.

Thank you Idaho Potato. Get off it RightNyer.

I’ve been to Asheville. It’s like a miniature Berkeley right in the middle of Appalachia.

Stay in CA. We dont want you or your politics in the south. Build the Mason Dixon wall.

Coastal garbage still gets bikinis, Fresno and Bakersfield – hahahahahaha!!!

“Lovely. So the politics she supports has made California unaffordable, so she’s moving to North Carolina and plans to propagate the same failed political ideas there.”

Yes. She has unlimited power, and plans to turn Asheville, a granola liberal town, into an even more liberal town, and then corner the granola market.

The law of supply and demand might have had something to do with making California unaffordable. The amazing tech compensation packages might have had some culpability in making the bay area so unaffordable. And now the well paid California refugees have been making cities like Austin, Denver and Phoenix more unaffordable.

rich,

RightNYer has this cut and paste somewhere. S/he repeats it ad nauseum. S/he needs to make it a signature. Wolf, maybe you should allow that on the comments form.

Rich, it’s actually more the building restrictions that have made California unaffordable.

Idaho Potato, I have no idea what you’re talking about.

Idaho Potato

I can think of at least 2 valid reasons for RightNYer being repetitive on non-Californians not being overjoyed to be invaded with California politics:

1) People like Rich keep pointing out highly destructive CA politics are headed toward their neighborhood

2) RightNYer has a valid (if repeated) point.

For example, here in Florida (where schools are open), parent’s primary concern is for the quality of their kid’s education. In CA (where schools are closed) the primary concern is how many “I’m a girl today” boys can cram into what used to be the girls bathroom.

Javert Chip,

“In CA (where schools are closed) the primary concern is how many “I’m a girl today” boys can cram into what used to be the girls bathroom.”

Nope. There is a HUGE battle going on in CA right now over how and when to open the schools. And that item hasn’t even come up.

Mortgage application data confirms your observation, although that could be just because it was butt cold in much of the country. Or the 35bps increase in interest rates. Or the bottleneck in inventory because of the foreclosure moratorium.

Cas127

Of course, I should have said sunsets and walks on the beach – by scantily clad real live social primates.

“People are getting vaccinated and are more comfortable in restaurants and stores. With the vaccination and the end game insight, perhaps the great reverse has begun.”

That’s so fabu to hear because as we know that totally means the Fed will pronto undo all it’s “emergency measures” QE, ZIRP, etc and stocks will crash and all those unduely enriched will finally get what’s coming to them!

I don’t know, I feel it’s QE and ZIRP into the future here. Just keep the presses going and feed the banks.

Luckily ZIRP, QE aren’t causing it all – vaccines are.

Sadly, it won’t hurt the 1% much who can tolerate a 50% drop in their stock portfolio. If stocks crash, it will wipe out the already over-stressed pension funds and IRAs for the working people.

I am certain that there will be a great reverse, because after the pandemic, the idea of working from home will be seen to be a fad for most Americans. However, you may want to see the interviews of Dr. Osterholm and Canadian health authorities’ comments, if you do not read peer reviewed scientific articles. I would not count on this ending soon but I am hopeful about (praying for actually) the vaccine modifications.

Nevertheless, read about the 1929 crash and the documentaries about it. I think that we are living in a period about like early 1929 or 1928. We will see what will happen to real estate and rents if another depression comes about. I feel sorry for our leaders: it will be like trying to stop an airliner by pushing on it. Which will win as to real estate, hyperinflation or an economic crash?

K

I haven’t (and don’t intend to) read any peer-reviewed articled on WFH, but I think a generous estimate is maybe 20- 25% of US workers can effectively (productively) work from home; probably another 15-25% could be coerced (employers expecting employees to perform in less than optimal circumstances) into working from home.

The coerced cohort will present an interesting productivity problem.

please delete!! I’ll post a cleaned-up version…

Cleaned up (I hope):

I’m dubious that rents have “leveled off” or are increasing in a meaningful way, and not just because zumper is not a neutral party.

Winter in general is slower, so there are fewer data points to determine market direction.

Last week, in an article on wrongful evictions (

link

), the executive director of the San Francisco Apartment Association’s said, “We’re [the SFAA] running a 25% vacancy rate.” It’s inconceivable the SFAA would overstate their own vacancy rate.

A walk down any down any residential street in the central neighborhoods (Mission, SOMA, Hayes Valley, etc) will reveal numerous obviously vacant (and often unlisted) units; there are surely more vacant units that are not obviously vacant (e.g. off-street/staged to look lived in/blinds pulled/timed lights, etc).

Many units have been vacant for nearly a year. Many units have been pulled after sitting for months. A look on zillow shows many units sitting for months with no applications and few, if any, inquiries. For many listings, even recent ones, there are numerous reduced prices. Look for yourselves. Nothing is being listed higher than it formerly rented for (the only exceptions are recent vacancies after long-term tenancies).

Meanwhile, while not at last summer’s frenzied pace, there are still lots of moving vans loading out. Parking is still much easier, despite the loss of hundreds of spaces to parklets.

Each week, there are more, not fewer, For Rent signs on buildings where such signs have never been seen before. After the winter lull, For Sale signs are again popping up. I’ll be shocked if this spring doesn’t set a record for most listings at one time. We shall see.

There is also an incredible amount of remodeling activity going on right now – future units coming to market.

While there will be some return to the office. WFH is here to stay for many, especially for those companies that don’t have infinite funding rounds to rely and that have to begin to show a profit at some point. Expect more announcements of corporate downsizing and relocation.

Rent check got lost in the mail?

The landlord just forgot the rent was paid?

“in an article on wrongful evictions”

I identified the source for the quote from the executive director of the San Francisco Apartment Association. Maybe you don’t understand, but the SFAA is a landlord organization.

Your point would be…?

There are many reasons other than non-payment that a landlord persues eviction. And yes, they can be illegal. I see a lot of evicting families for landlords wanting to move into a unit (usually a family member). But in this time of Covid where there is a public health component to not throwing people onto the street, you can’t evict a family for non-payment if they have proven a loss of income from Covid restrictions (per the CDC order). Some landlords are working around these protections by using illegal tactics like locking out the tenant & /or removing toilets, turning off water, electricity. Tenants are incredibly vulnerable & frequently don’t have access to representation in court to protect them from these maneuvers.

With tricks like those the landlord runs the risk of plaster of Paris in all the drains.

Lisa, plaster of Paris? Amateur hour.

San Francisco buildings have sewer vents on the sidewalk, covers held on with a screw. Drop wet blob of quick drying cement down that and sewer backs up. Only solution, remove sidewalk and dig down three feet or more, hole large enough for man to work in, replace section of sewer pipe, refill hole, redo sidewalk.

My buddy got massively cheated by a building/restaurant owner and that’s how he got even early one Sat morning on 3 day weekend.

I don’t know if work-from-home will continue forever. Maybe a hybrid version, but not a dominant way of doing business. I believe the competitive advantage is in the traditional business model of going to a physical location away from home.

I think this because when we consider the abysmal work product from students from kinder-college the last 12 months, meaningful work is not achieved at a home environment. If you’ve ever taken an online college course, you know how they are only as half as educational as showing up into a physical class with projects and teams. Teachers of online classes automate grading so there is no specific tailoring to the needs of students. It’s a low rent education with a high price tag.

One thing I know to be a fact in life is that adults are just big kids. If they work from home, they typically will not perform at the same level. Think about your zoom meetings and how much attention you spend in zoom conferences. If a business wants to do WFH good for them, but the smart competitor will get back to work just like the kids have to get back to school.

“how much attention you spend in zoom conferences”

How much attention do you think was spent in pre Zoom conferences…

Cas 127 you sure have a lot to say, doncha -??

The competitive advantage is in being able to hire top performers whose work doesn’t suffer without someone standing over them.

Well run companies manage professionals by how well they meet performance goals and objectives, not by how much time they can burn in an office chair.

I have worked from home since 2001 and saved major Telecom companies like VZW millions of dollars.

People are not just big kids. I realized early on that after I started working from home that I NEVER wanted to go back to the old way of doing things.

So I worked harder than ever before. Lots of people in Telecom WFH and the results are fine. Meeting up once a week or twice a month is fine. But you have no possible way of knowing how workers all over the country perform or don’t while WFH.

Saying “they typically will not perform at the same level” is wrong. Some of us perform better! Because we appreciate being given the opportunity to not spend 500 hrs/hr commuting, fighting road ragers, being micromanaged, etc. WFH is long overdue. I called it “The wave of the future” in 2001. Just saying….don’t generalize!

Yes, adults are just big kids. I see it all the time, as do you.

Okay, I won’t generalize about WFH. But I have been working from home this past year, as have my coworkers. I know, from this experience and past experience, some work gets done at home- like having a home gym. But for most, real work gets done at work, away from the home, unless you are a farmer….

These things I know from experience and this is an obvious fact from living.

Home school has nothing to do with remote work. WFH is here to stay, people are not ever going back to 5 days a week in office.

But a hybrid with a few in person and several remote days seems likely long term. Saves businesses rent money for office space, and allows much more flexibility in where people live if not commuting daily.

I think you’re probably right to a certain extent. My hunch is some companies will adopt a hybrid model allowing their employees to work from home a couple of days a week. This could affect housing prices/rent by making it more feasible for people to live in the suburbs. If they only have to commute three days a week, instead of 5 they might decide the money they save on expensive suburban rent is or home prices is worth it. If enough companies do this, traffic will also decrease making the commute even less of a drag.

two beers,

“I’m dubious that rents have “leveled off” or are increasing in a meaningful way, and not just because zumper is not a neutral party.”

READ THE ARTICLE BEFORE YOU DISCUSS THE ARTICLE!!!!

At least look at the pictures and tables, for crying out loud.

Some rents hit new lows, such as San Francisco and LA, other rents spiked.

And if you had read the article, you would know that the data is from the MLS and other listing services including Zumper’s listing service.

It’s OK to comment if you haven’t read the article in full, just don’t comment on what you THINK might be in the article.

The rest of your comment is interesting.

Apologies I wasn’t clear, Wolf. I wasn’t questioning your take, but reacting to RE industry hacks elsewhere spinning the same data.

Local media was full of fluff stories this morning invoking the zumper data and implying that good times are here again for landlords in SF. Headlines from SF Gate, “SF rent prices may have finally hit the bottom,” and “prices stabilizing,” while the Ex tells us, “Bay Area rental market rebound — why?”

From the spinner’s perspective, a less precipitous drop is leveling off. You point out that rents aren’t going to zero. A slower rate of decline could be expected as rents drop further.

Not rental, but looked at what’s for sale on realtor a few days ago in my city. I was struck that what is listed is mostly what I call junk. Seems a big change in quality mix in recent listings.

I saw a bidding war for a home on a 4 lane highway. So stupid.

So, RE’s still hot hot hot in So Cal?

Generalized mania from money intoxication. The only cure is a larger dose.

People from Texas will be heading to the Golden State now.

They have realized that playing cowboys and Indians is impossible when you are freezing.

It’s 60 degrees in Texas today.

So? Some people didn’t even make it through the freeze to feel today’s 60 degrees.

Texas for the win?

Yep, those 11 straight days of sub freezing TX temps (50 yr record?) led to widespread cannibalism (BBQ sauce helps with *everything*) and my CA based realtor assures me that TX also has an emerging zombie problem…that $800k 1200 footer in Donner Pass, CA is looking better all the time.

-25 deg F in Chicago area 25 months ago. Electric and gas worked. Not many I know had any issues with pipes freezing. Private building contractors generally know how to build a house around here past century or so. I get off when I see a place with a boiler and cast iron radiators.

75 F here today (Conroe, Texas). I just finished a round of golf!

The weather is nice, but its Wednesday and 8.7 million Texans still have to boil their water before they can use it.

When all the Californians get here with their expensive bottled water, there will be no need to boil the tap stuff. Upgrading….

Those “boiling advisories” are always put up when water pressure drops for any reason (anywhere)…on the small chance that untreated ground water may migrate into the pipes and also have some contamination that survives large dilution.

They are widely given (in every state under similar circumstances), widely ignored, and usually to little or no widespread consequence.

They aren’t “nothing” but they aren’t the apocalypse either…just like the whole shebang.

But thank God AOC came down here to reintroduce the concept of the “blanket”.

Cas127,

Sure’s easy for you to talk about Texas, living in Nevada as you do.

Just wait when summer heat sets in. No grid, no ac?

Those folks from California will feel at home, except for the fires.

The evil AOC raised millions of dollars for your fellow Texans while your own Senator Ted Cruz fled to Mexico for a vacation with his college roommate!

And blamed it on his kids and was caught in the lie.

It’s too bad Ted Cruz isn’t as smart and decent as AOC.

I don’t live in TX and never would, but they do have a grid built around hot summers, that they are prepared well for.

Yeah, they can’t wait for rolling blackouts due to 100 plus heat waves.

Our infrastructure stinks too in case you don’t know.

There’s a petition now to change the name of the Texas electrical grid to ‘Uterus’ so that the politicians will regulate the hell out of it.

One hundred year weather events are no joke, but Texas recovers as fast as any place.

I’m a native California living in Texas for several years and would like to say that your comment is funny at best. Maybe you’ve been watching the national news, I don’t know. I first realized that “disaster reporting” to those clowns is actually *entertainment* when I saw how different Charlie Gibson’s reporting was from the local reporters while my part of Southern California was burning.

PS. I am actually planning to move back to California but, believe me, for nothing but family. My taxes will go up $20,000/year and for that gift the the Glorious State, we’ll receive a lifestyle downgrade, unless we can pay five times as much for the same kind of house in a comparable neighborhood. It’s an idiot move, but I love my family.

LA & SF have their charms, but can’t hold a candle to Bakersfield & Fresno in terms of desirability.

Man, that is some dry humor. Can you imagine leaving the Bay, settling in Fresno- paying too much for a house because “Hey Clovis isn’t Fresno, it’s better” then waking up in July when it’s 112 degrees and realizing, “Oh my God! What did I do!”

“112 in Fresno”

Hold it!

I have been informed that extreme weather is not permitted to exist anywhere within the taxing jurisdiction of CA.

It is part of the Social (SoCal?) Contract.

I’d rather live in Clovis than Los Angeles. It’s not like it doesn’t get hot going east on 210. I was in Azusa for two weeks and between the 100+ dry heat and pollution, I had a bloody nose half the time. If it’s gonna be like that, I’d rather pay $350K than $700K. And I’m sure people have more sense in “It’s Not Fresno” than any part of LA County.

Rent is still too damn high !

I live in rural Idaho and you can guess what has happened recently with local property prices and lease/rent rates — through the roof! But all of that has suddenly stopped as realtors have jacked up the prices of what is still available. Other folks have decided to jump into this mania, but asking prices are now too high. This evidently is a limit. Sales have stopped. Rentals are non-existent, except for an one old house that I’m familiar with. The asking rent is 3x what it was before this latest influx of urbanites.

“The asking rent is 3x what it was before this latest influx of urbanites.”

My guess is that the newcomers are mostly California retirees with deep pockets. As far as I know Idaho is not a mecca for jobs. Correct me if I’m wrong.

There must be a lot of resentment against all these sunshine people driving up the cost of living. The minimum wage in Idaho is still in the $7 buck range.

They’re mostly from Seattle and Portland — ‘not woke folks’ — and retirees. And always Californians, always.

No one pays minimum wage. The starting wage around here for fast food joints, e.g. McDonalds and Burger Spleen, is $13.50. That’s what they’re advertising. Same with grocery stores. If only minimum wage were offered, you’d get no employees…at least not ones you’d want.

Inflation.

“Idaho is not a mecca for jobs.”

Boise is one of a tiny handful of metros that have more jobs than a yr ago while LA is off 9% and SF off 10%, yr over yr.

https://www.deptofnumbers.com/employment/metros/

To be fair, there’s a lot of resentment amongst SF/LA/OC residents towards all the techies & out-of-staters moving into CA for jobs and weather, jacking up the cost of living.

Everyone bemoaning the effects of buttloads of people moving to AZ, TX, TN, etc (anyone notice Bozeman Montana, of all places, becoming an “unaffordable housing” story in the media? ) & driving up rents/housing need to realize that’s exactly the what happened to us. The proof is in the pudding as rents drop when people leave.

Wolf has done his part by praising every needle, sidewalk-poop, and $5 avocado towards encouraging people to move out ?

Oh come on, *facts* encourage people to leave San Francisco. The abysmal, craftily creative demoralizing gang ridden public schools, rising crime with few arrests and fewer prosecutions, the “unhoused” that have flocked in from all over the Western Hemisphere, what’s there to keep people starting out in life, or trying to raise children, in San Francisco, now that WFH is here to stay.

“The fact that SF is also sheltering more (8,000) at-risk people than almost any metro region in the U.S. (only LA and New York City do more) is certainly significant. But this only underscores exactly how bad the problem is.” That’s the good version; for the worse see “San Francisco’s Homeless Encampments Expose The Failure Of A Liberal Utopia”

A third of a Billionsspent on homeless in 2019, yet the problem gets worse and more come. San Francisco is a failed city that placed its bets on the wrong chips; corporate business towers and tourism, while making itself a magnet for the wandering failures from everywhere. Still, it’s beautiful and the weather is great if you love wind and cool air.

BryantStreetBoy,

I just love to hear people who live 1,000 miles away pontificate about San Francisco :-]

They call it ‘BozeAngeles” now

Bozeman here. RE sales and rent prices are crazy by Montana standards, but it doesn’t yet compare to the run-ups that places like LA, Denver, or Miami have seen in bubble 1 or 2.

It’s taken roughly 6 to 9 years for homes to double in value here. My own home built in 2014/2015 is approaching double of its original value but isn’t there quite yet.

“Wolf has done his part by praising every needle, sidewalk-poop, and $5 avocado towards encouraging people to move out”

Congratulations Wolf!! You’ve made it to the exodus root cause list!! What power you wield!! (Imagine a big smile emoji here).

Rents are obviously low in big cities and going up in rural areas or smaller cities/towns.

In general rents and real estate won’t be at lower prices in the future. FED won’t let assets deflate.

CA government will Pay 80% of the backed up rent to landlords. This government won’t even put a vote up for the people paying taxes to vote on it. LLs should take the hit. It’s the cost of doing business.

I guess, pretty soon we will be back to paying high rent and LLs raking in all the monies form the plebs… back to normal, pay 50-60% of income on rent.

About the rents/home prices going down, I thought the same in 2008-2009 and we all know how did it all end.

I’d say never say never.

It’d be interesting to see how the assets would do in next few quarters when all the moratoriums are lifted and the checks stops coming in

Wolf, you are right about the churn. I live in a 2 year old apartment in the burbs of Portland near the big Intel complexes. Before the pandemic the other renters were mostly Intel employees and employees of support companies. Since the flu, there has been a constant stream of people moving out but they are constantly replaced by people moving out from inner portland looking for something cheaper or bigger for the same price. But the apartments in Portland seem to be getting emptier all the time, with a lot of the new ones recently finished almost totally empty. Those seem to be in a state of suspended animation with the landlords waiting for the pandemic to end before they resort to lowering prices.

The boarded up downtown business windows at street level is not attractive.

The buying panic in SoCal beach cities continues to reach new heights. Renters with a down payment are in a panic. Realtors have stopped returning calls to buyers. Realtors are banging on doors looking for listings. Sellers demanding all cash only. Many homes are going into escrow before hitting the MLS … all insider deals. This is just crazy. In the short term, prices need to go higher. In the longer term, it is anyone’s guess. Boston has next to nothing listed. I have never seen anything like this.

“. Sellers demanding all cash only”

How do you go about demanding only all cash buyers need apply? Can you put it in the listing? I’d still want to go through an agent though, noting that agent-free listings never sell in my area.

Although I’m on the east coast I’m wondering if I can legally sell my home to an all cash buyer to avoid delays. Might be considered discriminatory.

Bet it can be done. 5 years ago before this crazy tight market, I was house hunting. I encountered brokers insisting on various things like can close in…oh can’t recall…a week or something like that. My house was under agreement and I couldn’t make that time line as I needed to close first.

Robert,

Not sure about your state as laws do vary state by state. But here in Minn. You have the options of financing you as a seller will accept.

VA loans

FHA loans

Conventional

CASH

Pick just one or all or whatever you want.

You can list your home yourself on the MLS and save tens of thousands of dollars. You can set whatever conditions you want. It’s not discrimination…if you want to buy this home, it’s sold under these conditions.

Most of the discounted foreclosed (aka damaged homes) sold here in SW Florida are cash only deals.

I looked at a property today that has had 4 sales “fall through”…waiting to find out why, probably something to do with passing an inspection/insurance.

Agent free listing will sell, you just need to include a commission that makes it worth their while. My home was on a big beautiful river, the home sold itself…the agent had very little to do.

“You can list your home yourself on the MLS and save tens of thousands of dollars”

Thanks for the reply but everyone thinks of this but the reality is that real estate agents in many areas WILL NOT WORK with sales by the owner. I have a friend in California who’s a broker who told me this and it’s pretty obvious in my area as FSBO listings can sit for a year until they are replaced by agent-listings. Agents black-list the FSBO listing.

Real estate agents assume home-owners don’t know how to sell a home. They want to work with another agent, who generally knows the time-lines. Most agents spend quite a bit of time looking at comparable homes in the area. Home owners don’t, which means you know nothing about the market.

And where will the sales contract come from if you don’t have a selling agent? It’s usually is a boiler-plate REALTOR contract or Century-21 type contract that all the agents know is ‘OK’. Many agents are barely college educated and won’t accept your attorney’s contract because they’re not educated enough to critique it.

You’re relying on the fact a home buyer without an agent will be the person you’re negotiating with. The reality is that most home-buyer have agents who want at minimum a 3% cut. But as I said, money isn’t the issue here, its hassle. Real estate agents have a ‘quick money’ mentality and don’t want to deal with pie in the sky home owners who don’t know the market.

Real Estate 6% commission is the biggest scam especially in California where a home would be easily 1 million or more.

If I am selling or buying, I’d still prefer real estate agent but would go for discounted brokerage which are available in dozens now a days

The US. rental vacancy rate is 6.5%.

“People earning a $50,000 salary take home about $39,129 each year.” Voice of America (2019)

David Hall

Did you have a point, or do you just spend a lot of time listening to VOA?

I’m shocked New Orleans has rising rents, when everybody is unemployed, on rent moratorium and not paying. I read the NOLA news and the numbers not paying there are in the tens of thousands. The city is essentially shut down. I went through there 4 months ago and it was dismal, worse than ever. Comparatively, Baton Rouge should be priced higher because at least they have some safe areas, and NOLA really doesn’t.

NOLA doesn’t have “any safe areas”? Hmmm, I’ve been going there for years and having a great time (Jazzfest for instance).

I’ve never had a problem or not felt safe.

It seems this website has a lot of folks that just love to generalize when it comes to throwing entire cities under the proverbial bus.

Like every city, it’s about the neighborhood, time of day and if you have any common sense as to whether you’re “safe” or not. No disrespect intended, I’m just not buying what you’re selling!

I’ve been to NOLA lots of times. I would never visit that city alone, ever. You are right that after dark it gets even more dangerous. I know guys who live in LA and visit the city often for work and play, and they try to be out of there by dinner time.

The garden district is beautiful, but not any more safe than any other part of the city. With the recent shutdowns, the city really looks like a city in decline.

Never been, but feet on the ground told me once that me there are safe ‘hoods; it’s just that they’re out of reach for the middle class so folks take a long drive north over the lake.

I can’t for the life of me figure out how rent in New Orleans is more than Austin and Portland.

“I’m shocked New Orleans has rising rents, when everybody is unemployed, on rent moratorium and not paying.”

Maybe, but just maybe, “simple supply & demand”* isn’t the only factor that influences RE market pricing?

*S&D is rarely “simple,” but anyone who says it is, is, in fact, simple.

Even the lowly barn yard chicken has more sense than to scratch over there and eat over here. Emptying San Fran and other localities over c19 was foolish. The fools will return because fools get up earley and work hard all day to stay a fool.

People seem to be migrating to crappy exurb corporate colonial bs faux particle board dead retail McGhost towns based on the lists in this article indicating fabulous Newark and other dream locations.

Apologies to homies in Newark.

It’s interesting that rents are -15% in Los Angeles but +4% in San Diego. What’s going on?

I live in San Diego and what I’m seeing is that “work from home” has caused many people to move out of LA and SF and come down to SD. SD is a discount compared to the other California cities. Despite what a lot of people say, not everyone in California wants to leave the state, they are simply pivoting what region they want to live. I have done 50 wire transfers in the past month from people in the bay area who are buying up homes in SD. They see 700k homes and $1700 rent as a steep discount.

@DontFightTheForces – That does make sense. I was wondering how San Diego could have more of an inventory shortage than LA. San Diego still has some areas to build, at least. Not quite true of LA.

@Javert Chip – Hah, yes; spent most of my life in SD so I get you. I told my wife when she was job hunting years ago that I’d go anywhere except Los Angeles. Those are **angry** people up there, my love!

Turtle:

Ever been to LA?

Ever been to SD?

‘Nuf said.

\\\

A friend in high-tech said that now to obtain a PERM (a step in justifying the hire of foreign citizens as specialists) one needs significantly more effort and legal support. This will halt rapid expansion of the workforce as seen in recent years. How much that would affect the market, i do not know, but it’s a factor to take into consideration. According to his telling the throw-money-at-startup phase in SF is over, as well as serious shifts in work mindset are noticable.

\\\

I work in hi-tech and went through green card process quite some time back.

The true spirit of H1B is widely abused by big corps to replace us workers by cheap workers.

Only during the 4 years of Trump’s presidency, the true spirit of h1bs were really enforced and thus it was difficult for big corps to bring in cheap workers replacing americans

Now Trump is gone, Biden is undoing all those admin/executive orders and would lax again H1B and employment based green card rules

BTW, I am one of the beneficiary of lax rules of H1B.

LouisDeLaSmart

I have no idea how this impacts PERMs, but in case it hasn’t been noticed, the US has hundreds of thousands of out of work (carbon) energy dudes (ok, and dudettes) who will soon be FULLY trained in the thing called “coding” (probably take a week or two to spin them up to speed).

We will soon be up to our eyebrows in “coders”.

Well, ok, maybe hundreds of thousands of out of work (carbon) energy dudes (ok, and dudettes) will not be FULLY trained as “coders”, but they will certainly be 100% out of work.