Now hoping for “corrective action” and “credit intervention” by the State of Texas.

By Wolf Richter for WOLF STREET.

The financial repercussions of the winter-storm electricity crisis in Texas have entered the confession phase.

Just Energy Group, the Canada-based retailer of electricity and natural gas that is heavily involved in Texas, announced this morning in an SEC filing that it might have lost $250 million over the few days during the “Weather Event” in Texas, and that “the financial impact could change as additional information becomes available,” and that “once known,” the financial impact “could be materially adverse to the Company’s liquidity and its ability to continue as a going concern.”

This “going concern” warning is a standardized accounting term for the acknowledged possibility that the company might not be able to meet its obligations and might not be able to stay afloat.

In terms of its “liquidity”: The $250 million loss over the past few days contrasts with just $78 million in cash on hand that the company reported in its most recent earnings report for the quarter ended September 30. It also had $780 million in long-term debt, a third of which comes due this year. And its balance sheet has been hollowed out to where its stockholder equity is negative (-$500 million).

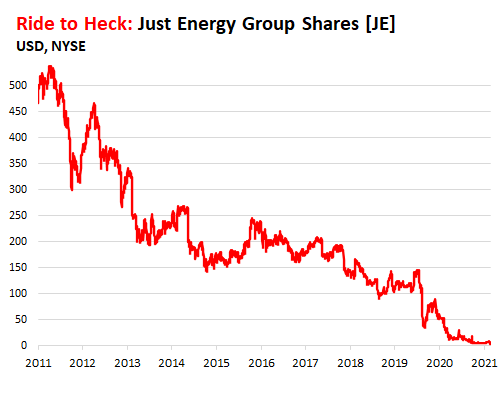

Its shares [JE] plunged 31% to close at $3.96 on the NYSE today. But Just Energy has long been dogged by issues, including five years of declining revenues that in 2020 were down by 32% from 2016; and steep losses in 2019 and 2020. Its shares have been on a long-term death spiral, where the 31% plunge today – from $5.77 to $3.96 – barely registers (stock data via YCharts):

So the company stumbled into this crisis with a hollowed out balance sheet, money-losing operations, and a crushed stock. So, as it warned today, it may not be able to absorb the losses.

“The Company is in discussions with its key stakeholders regarding the impact of the Weather Event,” it said. These stakeholders include the various companies that Just Energy bought the electricity from. It now needs to pay them – at prices that had spiked toward the big Texas sky.

And it added: “The financial impact of the Weather Event is not currently known due to challenges the Company is experiencing in obtaining accurate information regarding customers’ usage from the applicable utilities.”

“However, unless there is corrective action by the Texas government” – a Texas-sized bailout? – “because of, among other things, the sustained high prices from February 13, 2021 through February 19, 2021, during which real time market prices were artificially set at USD $9,000/MWh for much of the week, it is likely that the Weather Event has resulted in a substantial negative financial impact to the Company,” it said.

This is precisely the scenario on an individual-company basis that energy analysis and consulting firm Energy GPS had warned about over a week ago for the industry more broadly – that companies with “thin balance sheets” caught up in the fiasco could become part of a “cascade” of defaults.

“The financial carnage from this event will be significant – likely the biggest we’ve seen since the Western energy crisis both in terms of the number of entities under financial duress and the total dollars at stake,” Energy GPS said in its note to clients.

The Western energy crisis is of course what gripped California in 2000-2001 and led to the bankruptcy of PG&E and to a gubernatorial recall election, as a result of which incumbent Democratic Governor Gray Davis was ousted by Republican Arnold Schwarzenegger. Alas, in Texas, the governor cannot be recalled.

Energy GPS listed the “duration of the high prices,” along with “the market structure with fully de-regulated wholesale and retail access,” and “imperfect hedges” by power generation projects that “leave a mismatch between hedge volumes and physical capabilities,” and of “the thin balance sheets of a significant number of generators and retail electric providers” – such as Just Energy.

“These thin balance sheets may not have enough cash to weather this storm which may cause non-performance which may cascade throughout the market,” Energy GPS said.

That’s what the “stakeholders” of Just Energy are now worried about. They’re wondering if they’re going to get paid. And if they don’t get paid, those with “thin balance sheets” may not be able to pay their own stakeholders.

The dizzying spike in the electricity prices over the duration of several days made some companies enormous amounts of money, but it ripped into other companies – and even some consumers, such as the 29,000 customers of Griddy that were exposed to wholesale electricity prices – and therefore these price spikes.

And those companies with “thin balance sheets” might not be able to withstand it, and impacted consumers might default on their bills (that for some amount to thousands of dollars). And that concern of non-performance is now cascading through the system.

If this spirals out of control, Energy GPS said, “State credit intervention may be required” – which Just Energy this morning alluded to with its hopes for “corrective action by the Texas government.”

What ERCOT planners got colossally wrong was the availability of their fossil fleet: Gas and coal plants failed. Even a nuclear reactor tripped offline. Read… Who’s to Blame for the Texas Power Crisis?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I nearly bought Je many moons ago. The yield was great. But

the debt o my.

These companies don’t have a lot debt, they are “leveraged”, get with it. A.T.& T. is agreat example, their entire business model is built on huge amounts of debt ER excuse me leverage! If that one thing, low interest rates, changes, Uh Oh.

The best stock I ever had was ERF. Bought at 10, it was yielding 20%/p.a. with monthly payments. I dumped it too soon, thinking too much about “fundamentals”, and it eventually went on to 116 USD. I made my money back about five times in dividends the time I held it.

I would still buy a couple of thousands worth of JE at this level. The thing is, that this business is so shit, and everybody knows it is shit too, that literally *anything*, will project the stock price up 10x or more :).

Same with airlines, BTW. Long Vol (driven by Bailouts) is The Game today!

These electricity contracts with sky-high upper limits seem to have a lot in common with some derivatives. You can be patting yourself on the back for the big killing you just made, but it only works out if the counter-party can pay. Griddy brings in a whole other dimension in that it creates a whole set of counter parties with little or no financial sophistication or market backing. For the bigger guys to collect ,Griddy has to collect the $2500 from the guy in the single-wide.

Well, those consumers are just paying back all the money they ‘saved’ while smirking at their foolish neighbors paying fixed rates.

How do you know they “saved” it? Maybe it was all they could afford?

You seem to be a particularly vicious brand of capitalist…or just a troll…either way, did you get beat up a lot in grade/high school?

Tired of bailouts.

In the 2000/2001 Western energy crisis, they bailed out the bondholders of the utilities, and their shareholders too. Ratepayers, including myself, are STILL paying for that bailout. That’s how something like this can turn out.

Ahh the good old days. You forgot to mention that Enron was a key player in the process of blowing up the western energy market and the Bush DOJ’s role in enforcing the “free market” where CA taxpayers ended up on hook for x B$. I had forgotten about this in my mental book keeping of worst president since 2000.

According to wikipedia, former key figures (co-CEOs) within JE previously malpracticed their profession (and abused consumers) at Enron.

Small world.

I understand California is going back to the “free” electricity market?

Their Wikipedia entry is terrifying.

Wikipedia:

“Former Enron executives James Lewis and Deborah Merril were Just Energy’s senior executive, president, and Co-CEOs since 2007”.

Heckuva job Brownie!

Down here in FL, Duke Energy collected $1,000,000,000.00 from their customers to build a new nuclear plant and then changed their mind and kept the $1B.

Our “Public Service Commission” (who is supposed to protect us consumers) gave Duke the green light to steal the money.

If you can, see the 1932 movie “The Match King,” based on the life of Ivar Krueger. At the end, Paul Kroll (name changed from Kreuger to forestall lawsuits) tells his longtime associate that the first debt they acquired, to take over control of the first matchstick factory, still wasn’t paid off. The business debts were just rolled over, more and more debts made as the business expanded. The matchstick buyers or the utility ratepayers pay on the spot but companies like PG&E don’t even bother to replace wooden power poles (as shown in the photo from your window) or pay to harden their power distribution system. Instead, in Texas they spend billions on wind turbine farms that are a new and expensive technology rife with kickbacks and insider dealing. Don’t expect “woke” Hollywood to make a movie like “The Match King” anytime soon. The guy at Warner Bros. in charge of releasing pre-Code movies like “The Match King,” SVP George Feltenstein, just worked his last day at the company Friday, laid off by AT&T to reduce headcount costs.

Gerry,

The companies that own the wind turbines are not necessarily the companies that own the grid or the utility poles, or the nukes, or the coal power plants. For example, the German company, RWE, is a big wind power producer in Texas. This is an international business that attracted international capital.

In SD Ca they put the city grid maintenance up for bid, and I believe the host company retained control. The city is actually quite large. Our local Ute got in trouble for cutting off power in the backcountry during wind events, but then they have never gone bankrupt, or lost a community to fire. They also survived the crash which sent PGE bankrupt the first time. They are owned by larger energy company Sempra, which is also involved in LNG, and projects to build supply in Mexico, an underserved population. Some utilities do a good job, and perhaps one of the rules is that too much competition (lack of regulation) results in companies with the worst balance sheets, and no deep pockets, getting the lowest bids.

Gerry:

“…. but companies like PG&E don’t even bother to replace wooden power poles….”

Not sure where you live but PG&E up here in the foothills of CA Sierras where I live they replace wooden power poles all the time.

(Not a fan of PG&E since deregulation but do always back the line workers)

“…how something like this WILL turn out.” As a long time Texas resident, I’m reasonably sure that somehow this will fall on the taxpayers’ laps.

In Denton, where I live, our municipally controlled operator is begging for $300,000,000 in short term borrowing to cover energy purchases during the disaster. When that turns into a long-term repayment solution, you can bet it’ll be in the form of taxpayer-funded bailouts.

That’s especially galling in Denton, where they rammed a $250,000,000 natural gas generating station down our throats. Not only does that station operate at a substantial loss when debt repayments are factored in, but “owning” that station for did NOT stop us from massive rolling blackouts.

So, if you think about it, Denton residents will be paying close to a billion dollars in debt repayments over the next 20 years for something that apparently isn’t even FOR Denton residents.

Oh, and we banned fracking in Denton, but the “small-government, no regulation” hypocrites in Austin overturned the ban. Just throwing that in for flavor.

I remember when I used to be proud to be a Texan.

“Our local Ute got in trouble for cutting off power in the backcountry during wind events, but then they have never gone bankrupt, or lost a community to fire.”

Apparently you were not around in 2003 or 2007……

Wolf concludes,

“If this spirals out of control, Energy GPS said, “State credit intervention may be required” – which Just Energy this morning alluded to with its hopes for “corrective action by the Texas government.””

We’re going to use moral hazard to turn this republic into a mis-developed nation stuffed with zombie corporations and zombie state agencies. Where’s Schumpeter when you need him?

started with independence war — no worth continental, continued by The Bank of North America and by the First Bank of the United States in 1791.

and than other people jumped on a wagon, Congress first slapped a tariff on imported sugar in 1789,…

now everyone want it — which is impossible.

We should make Mexico pay for it ;)

You mean like we made Mexico pay for that wall we partially built?

:-)

You’ve shown me that I was super naive!!! It’s more likely Mexico will one day become a superpower and have us pay to make it happen!!!

Down ere in Texas we are brushing up on our Spanish speaking skills.

Nice isn’t it.

Structure your business so it can’t fail because the public requires it.

Then gouge the crap out of it and when it falls over the public pays.

Public needs it. Public pays out.

Here’s an idea, public take a controlling share in company, debts paid off, directors booted out, basically the most pain for the existing owners/operators short of collapse, public take over and make it good. Public utility. Never let it be sold again.

But I expect it’ll be ‘free’ money for these corporate cretins to feed off.

Why do the people of the USA keep on voting for this?

Sure, let the government take over. Then Karen gets installed in HR and turns the entire company into complicit robots that bark for benefits.

How about fire all the regulators and make them elected positions. Wild price speculation during a bad winter storm shouldn’t be bringing companies to their knees.

My power bill is $7k a month through a local co-op that is about 75% micro hydro turbine powered and overall about 99% hydro power from big dams on the Columbia.

Griddy customers face a 10x increase in their bill with no notice. Those bills are going to be unpayable for most commercial customers who had “imperfect hedges.”

Deregulation has been a disaster. Utilities were regulated for 70+ years and functioned in the public interest.

Now they are deregulated and have become an engine of exploitation and mismanagement. They are monopolies and should never be allowed to put the public safety at risk for the sake of profit.

Here’s a Karen for you, with an idpol bonus!

Geisha Jimenez Williams worked for Florida Power & Light (FPL), starting as a residential energy auditor. Williams joined PG&E in 2007. In March 2017, she became the first Latina CEO of a Fortune 500 company.

She is a director at the Edison Electric Institute the Institute of Nuclear Power Operations and the Association of Edison Illuminating Companies.

Despite PG&E losing more than $6 billion, Williams received a pay raise of 8.12% in 2018. PG&E filed for bankruptcy immediately after Williams’ departure.

Williams is criticized for a $10mm+ pay packaging including $2.6mm in severance pay when she left PG&E as the company prepared to enter bankruptcy. The Los Angeles Times reported that, “Williams’ compensation encompassed numerous perks, including a car and driver, a $51,000 security system for her home, health club and “executive health” services worth $5,453 and financial services subsidized to the tune of $7,980.”

Now “retired.” Sold her Marin County mansion, whereabouts unknown.

Devil made her do it.

Face it, humans have always been lousy at choosing good dietys. Maybe if we just ignore them all they will go away.

Alas, “public” power districts are just as subject to corruption as private suppliers. Ask rate payers in Omaha, Nebraska–assuming they even remember when Omaha’s rates were really, really competitive.

?But, but, but .. !!

Why are energy companies allowed to carry so much debt this is a reacurring problem I understand that we need energy but can’t compete with Middle East cartel lived through oil embargo should have been a wake up call to government but American oil companies control that product too what a mess turning into a third world country

Why? Because a sucker is born every day.

Debt should be creditors problem, but if they get bailed out by the taxpayer, no one has skin in the game , there is no limit to the amount of debt and credit that can be issued.

That no adult in the government is talking about restructuring debt and zombies it’s scary, every one seems to be waiting for an accident to happen and the system to collapse, we are so screwed.

Welcome to vulture capitalism ….. once you own the government and all its regulators, and all your insider trading multi-millionaire congress plus have the legal system in your pocket- this what happens.

Over and over and …….

Book – Harpo Speaks by Harpo Marks.

He was on a boat to Russia .. a card game starts up .. like every good Jewish boy in those days he plays .. one guy at the table was the chosen sucker .. Harpo took him aside .. “You are the chosen sap, they are taking you for all you got.”

The guy was outraged that anyone would even suggest such a thing .. these were his friends.

Governments are the chosen one .. & fools rush in.

“I just want to be loved by the big guys.” they yearn.

So who profited from $9,000/MWh? Speculators who buy/sell paper energy?

I believe Enron, in CA, rigged the price of spot energy by simultaneously manipulating the price of natural gas. Another company involved was Reliant Energy, later acquired by NRG Energy, which is active in Texas.

As long as there is no cap to spot energy prices, this will continue.

The “get mine” mentality served our nation well.

Copy to Congress

Well, for one, billionaire Jerry Jones, here’s an excerpt from the local paper the Fort Worth Star-Telegram;

Dallas Cowboys owner Jerry Jones is profiting big from a spike in energy prices during the historic winter storm that has struck Texas and surrounding states.

Jones’ company Comstock Resources Inc. has sold gas from its Haynesville Shale wells in East Texas and northern Louisiana at premium prices since late last week as forecasts called for unprecedented, sustained freezing temperatures, according to Bloomberg News.

“This week is like hitting the jackpot with some of these incredible prices,“ CFO Roland Burns said during an earnings call earlier this week. “Frankly, we were able to sell at super premium prices for a material amount of production.“

Oh, and there IS a cap. It’s $9,000 per MWH.

If they go belly up, their assets might be sold to the highest bidder. People went broke hedging electricity futures.

Louisiana was hit by Hurricane Laura in August. 150 mph winds and a fifteen foot storm surge caused $12 billion in damages. No wonder Louisiana is second poorest state in the union. There were power outages for weeks after some hurricanes.

David Hall,

At least it is warm in Louisiana.

I worked for Progress Energy in 2004 and some folks were without power for up to 3 months in Central FL after Hurricane Charley.

I was told the co. (formerly FL Power Corp., later bought by Duke Energy) was replacing infrastructure that wasn’t damaged because they could “bill it to the consumers” under the guise of “hurricane damage”.

Climate change hitting the bottom line now. Energy companies and competent management don’t seem to go hand in hand.

Much like a health insurance exchange you can go to choosetexaspower dot org and pick your power company but I don’t see JE in there.

Just Energy sells plans thru other providers. My daughter’s plan in Houston is from Reliant Energy for billing, but the plan is really from Centerpoint Energy. Just Energy can sell that Centerpoint plan. Go on Just Enery’s website and select Texas, zip 77389 and you will see a list of plans they sell. It’s complicated, to say the least.

“while you can choose your REP you cannot choose your utility company. Your utility is assigned based on the service area you live in. The delivery fees you pay to your utility company are set by the Public Utility Commission of Texas (PUCT).

Everyone pays the same delivery fee regardless of which provider they choose. For more information on the charges you’ll see on your bill, please see our Bill Information resource.”

Where we live we get juice from the city and they charge for both energy and delivery and it comes to 7.5 cents.

I don’t see any plans priced in bitcoin.

I found one lenert. Pay one Bitcoin per month. That worked in 2009 when one Bitcoin sold for 9 cents.

Can’t we all just marvel at the incredible web of requirements of ‘X’ owns billing but “Y” does this other thing.?

It’s like a government but its not.

Disconnecting Texas from the US power grid increased the liklyhood that this type of event would happen since power from other states would not be available during a statewide emergency.

From what I’ve been reading, this risk was by design. A feature, not a bug. Looking forward to seeing if Texas reconnects to the grid after the dust settles.

If many of the companies involved go bust, there may not be much of a choice. Maybe a gov bailout was always in the cards.

Just Energy is a Canadian company so maybe they won’t get a bailout.

Not so sure of that… You see, the Fed has a malfunction with the money making machine and they can’t deem to turn it off.

The problem with that is that all of the states bordering Texas also had blackouts. If the grids that Texas is supposed to connect to cannot supply sufficient energy TO those border states… then how are they supposed to get the energy THROUGH those border states to help Texas?

Are there no ways for companies in other states to sell power to Texas?

Gray Davis (DEM-CA) played a huge part in the Western energy crisis. He rode that major policy change into the Governors seat. And when it all went tit’s up, as had been forecast, he spent over a year tap dancing around it until recalled.

PG&E is still trying to recover from that fiasco with little success. Much of which is still due to political influence.

Nope, Deregulation was the love Child of the last GQP Govenor of California Pete Wilson.

There is literally decades of examples of utility deregulation farking over consumers money and safety… But conservatives continue to champion utility deregulation anyway.

Utlities provide public goods that are a result of natural monopolies. Natural monopolies should not be privatized because, power corrupts… But absolute power corrupts, absolutely.

https://consumerwatchdog.org/newsrelease/electricity-crisis-caused-1996-deregulation-californians-face-blackout-energy-industry-p

Power is created/transferred by means of government regulations.

A bureaucrat gets her/his power solely due to the regulation. Power that should have resided with the consumer, who are no longer free to shop around.

When the consumers are free to vote with their wallets, power stays with them. Providers in that scenario, need to provide better (more reliable/ cheaper/ safer/ efficient) solutions than their competitors to win the business.

I agree it’s harder to create competition and free market in the utilities space, but somehow blaming that on ‘deregulation’, ‘free market’ or ‘capitalism’ is misguided.

Ahh the Libertarian answer:

“A bureaucrat gets her/his power solely due to the regulation. Power that should have resided with the consumer, who are no longer free to shop around.

When the consumers are free to vote with their wallets, power stays with them. Providers in that scenario, need to provide better (more reliable/ cheaper/ safer/ efficient) solutions than their competitors to win the business.

I agree it’s harder to create competition and free market in the utilities space, but somehow blaming that on ‘deregulation’, ‘free market’ or ‘capitalism’ is misguided.”

Utilities are a natural monopoly. That is why this should be a subsidized service, it is essential infrastructure. The cost to people and business should be minimal to encourage economic development.

Encouraging a race to the bottom with your infrastructure, is exactly how you get the disasters in Texas and California.

You failed to explain how it is misguided. When literally again their decades of examples of utility deregulation resulting in terrible safety and usery level costs to consumers and business.

As someone else here said, the “Free Market” was working exactly as it should when all those “free” consumer’s “chose” to burn their furniture.

Why would the thermal plants be shut down as part of the rolling black outs. Taken off line, their equipment froze up.

Their equipment froze up first, namely instrumentation and controls, thus taken off line to prevent total failure. Liken it to your car going wonky. Whaddya do? Turn off the key and pull over.

Nothing wrong with going bankrupt. This isn’t the first company and won’t be the last. Hopefully, people will learn from this boondoggle.

The problem with going bankrupt is the cascading effect it might have, as Wolf points out.

The problem with going bankrupt is your screaming wife and kids.

The electric grid is more complicated than just electrical supply. The loads must be constantly balanced. Damages to the grid infrastructure is usually due to load being dropped and the resulting surge which overloads transformers and switches.

The old coal, oil, and NG power plants used to serve to absorb surges in the systems, kind of like giant batteries, but as they were replaced with solar, wind, and imported energy, the grids became more vulnerable to damage from dropped loads. A sudden drop in load from an infrastructure damage is very serious when nuclear power is concerned.

Nah, we’re Americans. We can’t learn…too busy watching tee-vee.

I thought Baby Bush the Lesser would be the intellectual basement for US Presidents in my lifetime.

What a naive fool I am.

Similar to the old 60’s joke about soap operas; “Those who don’t watch reality shows will be doomed to live in them”.

I love seeing a stock chart like that… dropping STEADILY from over $500 a share in 2011 to $4 a share today.

WHO ON EARTH invests in a company like that???

Seems like a much worse situation than Hertz or Gamestop, so watch for a 10x pump and dump by some Reddit pros (or, hedge funds masquerading on Reddit to scam a bunch of retail money).

It took congress over 400 days to complete an ‘investigation’ of 9/11 November 27, 2002, after victims’ families demanded it, but only a couple of days to demand one around hedge funds suffering from Gamestop.

Guess their donors losing money is more important than those troublesome citizens.

Wall street with money from retirement accounts would be my guess. They profit on the fees not the value I think. Who honestly buys stock in Uber? It has never produced a dollar, yen or peso of profit.

Everyone wants to put money into electronic phones and website stocks and electronic coins and electronic cars…we can worry about the robustness of the grid later. A lot of foam and very little beer in the markets and federal govt right now. Ironically, they’re still making great beer in Chicago. Madigan is out for a corrupt deal with ComEd…but…at least they’re putting in new transmission towers along the interstate.

Amen

Tom,

Cue the Beachboys:;

“If everybody had an electric car,

Across the U.S.A.,

Then everybody’d be rechargin’

Like Californi-a

You’d see them tearing their hair out

Heartache scandals too

A bushy bushy bond haircut

Sufferin’ U.S.A”

The free market demands poorly run companies apparently.

The free market is a fairy tale. Literally. Just sign over your firstborn child and it’ll aaaaalll be taken care of.

Keep paying forever is an American tradition, just look at the national debt grow grow and grow.

MMT is about keeping it growing and not having to pay it back!

I wish, as a citizen, I could do that too. But my debts are generally “due and payable” on a routine schedule. Is MMT going to change that for me?

Hard to see this resolved without federal help and hard to see federal help for the political honyocks who bailed out to Cancun. Ultimately the ratepayers will get bailed out, with a brochure for Biden Harris 2024 in the envelope.

And that bi(den)fold brochure will contain these three words on a stormcloud background: “Will • Not • Happen” …

From Houston Public Media:

“NRG Energy and Vistra Corp already control more than 70% of the market share. The Public Utility Commissioners indicated a desire to allow Reliant Energy, a subsidiary of NRG, as well as TXU Energy, a subsidiary of Vistra, to voluntarily take on more customers as other companies go under. In a press release, the commission said this “voluntary” method will lead to “a competitive rate, rather than the higher so-called ‘POLR rate.’

It’s unclear how many private electric providers are about to go out of business, but Morstad expects the fallout to be far-reaching.”

lenert,

I wanted to point out belatedly that the big old TXU, renamed Energy Future Holdings, filed for bankruptcy in 2014, one of the largest utilities to ever file for bankruptcy. TXU Energy, which you mentioned, was part of the bankruptcy.

NRG bought Reliant, which is the legacy retail business of Houston Light & Power, and TXU is the business that was formerly Texas Utilities. So 20 years after deregulation, the two largest retail providers are the former utilities and are trying to increase their market share. Why was deregulation a good idea?

Why was deregulation a good idea?

It made some folks richer!

RE: expects the fallout to be far-reaching.

I expect it will. Ohio GOP just had a wonderfully interesting political scam going by adding surcharges to everyone’s electric bills and of course the money was skimmed right to key political leadership of the GOP. Actually even is working its way through the court system, which is a real believe-it-or-not scenario. Seeing just the few corporate entities that have already been referenced, along with corporate leadership from ENRON, and GOP cone in TX, well, it’s gonna interesting. I wonder if the TVA will come to the rescue, if not maybe we’re looking at the “event” that pops the bubbles in 2021. This is gonna get hilarious! Especially with the PGE and Dems in good ole CA!

Another big issue with this whole situation, is I’m sure Germany now is taking the so called freedom gas off the list of available choices for major suppliers. In the EU, this blunder will make US foreiign policy seem even more ridiculous. Considering, the US has kept trying to force Germany to shutdown the nordstream 2 project.

But America has to protect Germans from being exploited by Russia selling them cheap gas instead of more expensive US gas.

Germany (and the EU) are not going to become reliant on the expensive American LNG, even if it was not the case that it might also be suddenly sanctioned for random reasons. They are talking words that the USA likes to hear while completing Nordstream 2.

Russia may not be exactly good guys, but, they do stick to their contracts, they were delivering titanium to the USA all the way through the cold war.

Anybody else for a second political party in Amerika ? Other than the two headed uniparty of multi-millionaires- the two branches being the Demopublicans and the Republicrats ?

Until a second party emerges, perhaps limiting nominees to people with assets less than a paltry million dollars, absolutely nothing will change.

As it stands- “Pull either lever, chump. We got it covered”

Certainly, Mo! The AuAg party…aka Amerika uber Alles group…aka Gold and Silver standards party. Mandatory arms and med training. Compulsory public service terms for every person who lives here. You want rights, you get responsibilties to go with them or pack your bags for the trip back home to the ancestral hell holes of the old world. No more rewarding thieves, crybabies, whiners and little shits who think they deserve to be placed ahead of the general welfare of the public body. Oh, yes…one more thing…full clarification that the “well regulated militia” has nothing to do with the defined military powers of federal or state governments, but is a line of last resort belonging to the public as their own protection against complete failures from above, and the right to bare arms is not to be abridged with b.s. from the lawyer class who serve their ninny masters. Don’t like criminals, then deal with them with harsh punishment and leave the lawful citizens alone. Now how do we convince the rest of us “idiots” to join?

The Two Party Scheme is the most brilliant system the American bourgeois ever came up with. Now, when capitalism fails, people can simply blame the party they don’t like instead of the system itself.

As America has a ‘first past the post’ voting system, this will tend mathematically to result in just two political parties.

So rather than form a new party, your best bet to effectuate change is to infiltrate one of the two existing parties and change it from the inside.

That is essentially what Trump did and is why it worked.

Getting in bed with the largest group of organized pimps and criminals is like believing someone can only get “a little bit pregnant”. Better to just pull that member out of the ship and find a boat that floats better than the old S.S. Concrete Carnival, which seems to have last been reported beached somewhere near the Jersey Shoreline. Ross Perot provided the last hope for defecting within the parties, but too many fools wading in the pool next door thought Frat Boy Bill was gonna be their sought after saviour. Hiding in the Bushes didn’t work out so well either. Might be smart to finally just walk out the revolving door of corporate headquarters and take business down the street where coffee comes in a cup manufactured by the locals and nobody tells you to speak softly in non-offensive forked tongues so no one gets upset.

Energy markets are interesting in the extreme variations that can occur at times and with very sudden effect. The Texas incident can probably be classified as a “Black Swan” due to its extreme impact but low probability and will make a few traders very rich and many very poor / bankrupt.

Selling electricity to retail customers is akin to being short an option, your upside is maximized to the premium you can extract between sales price and procurement price but your downside is unlimited.

Typically you sell power on a long contract priced off a contango curve and cover it on the short term market priced on spot, being exposed to the difference. However, once in a blue moon there is a supply shock and all your profits disappear in one blink. I spent 25 years in energy trading but never saw anyone become very rich from retail sales (short option). I have on the other hand seen many people become very rich from energy trading, profiting from these type of extreme events by being on the other side of the trade (long option)

In the end the biggest risk becomes one of liquidity. These type of extreme events can cause big players (Enron…) to go bankrupt, causing ripples through the system and in the end threatening the stability of the clearing house itself. There are many of these examples in energy trading through the years, but for good reading check out this article from NYTimes highlighting this exact challenge

https://www.nytimes.com/2019/05/03/business/central-counterparties-financial-meltdown.html

Speaking of RWE above, I notice that they too suffered through the Texas debacle. Jefferies estimates RWE EBITDA hit from adverse events at 100 million and 500 million euros ($121-$605 million). I wonder how much of this Black Swan risk was calculated into their spreadsheets before investing hundreds of millions of USD into Texas wind. I presume that this loss is more or less equal to all projected profits over the lifetime of the investment. If they had been invested into controllable energy they could instead have been long the option, benefitting from these extreme events.

Thank you for this concise summary C, and please continue to share your obviously well informed opinions with us.

In spite of having made a couple ”killings” in SM and RE over the last several decades, I find myself almost addicted to the wit and wisdom of the commentariat on WolfStreet.com, not to mention the articles I read to hope to be able to invest.

Keeping on learning, so far, and keeping in cash and RE, so far, both minor positions, but hoping to hedge against the obviously coming and long continuing degradation of USD.

That NYT link was absolutely great! I forwarded to my son too. He has been bugging me for quite a while by not recognizing that even the NASDAQ could burn in less than 4 hours. Yeah it’s kind of an understatement what just one guy at his PC can do!

Thank you very much!

Before energy was securitized and globalized by the Enron laws, grids were much smaller, and widespread cascading outages were PHYSICALLY IMPOSSIBLE. This particular “Weather Event” happens every few years. It’s not part of every winter, but it’s common enough that responsible managers need to be ready for it.

Municipal power plants WERE ready, and never had outages from plain old cold weather. An icestorm that pulled down the lines caused an outage, but nothing less.

I believe Kansas (of all states!) is almost 100% municipal owned power. Lots the matter with Kansas, but not that.

I think you’re confusing Kansas with Nebraska. Much of Kansas, especially the larger cities is served by Evergy, while all of Nebraska is served by public power district, the largest is Nebraska Public Power District. If I recall correctly, private companies were prohibited from even owning generation capacity in the state. Remember that George Norris, who pushed for the creation of the TVA was from the state.

NE has a great PP system. Best rates probably in the US too, lived there over 15 years- all elec house, 1890’s- that I renovated, had completely rewired etc., Trane Airhandlers- over 3,000 sq ft. No bill over 200USD, loved it.

Look at the volume spike beginning in September 2020 on the JE stock 5 year chart on yahoo.

Someone knew something.

https://finance.yahoo.com/quote/JE/news/

The “deregulation” of electric utilities was a fools errand. In my opinion, the main benificiaries were the lawyers and MBA money types.

The Texas model is totally hosed. The belief that every citizen would have the financial and risk savvy to make the right choice is beyond apprehension. Texan’s got sold a bill of goods.

Maybe someone with real leadership will turn the system back to a good old fashioned regulated utility.

Are people here getting the message that perhaps now it’s not business as usual:

The Times They Are A-Changing

And don’t speak too soon for the wheel’s still in spin

Which Wheel of Destruction is that .. the Wheel of lessorEnergy?, the Wheel of Psyence?? (waves at the all-knowing Tony F. …), or the Wheel of Wokeness??? – the spokes, all of which, are showing hecka fatigue!

It certainly doesn’t help matters, when the purple D.C. trans-mission lines breaks down now, does it.

I think it depends upon the Weal of the Common Folk.

Brant Lee – Amen, brother. We are in uncharted territory. Bailouts, elimination of bankruptcy as a cleansing force, moral hazard everywhere you look, loan forgiveness, absence of asset valuation fundamentals, MMT money creation to solve all problems… it’s just absolutely frightening. Live frugally and prepare for the worst.

“Capitalism without bankruptcy is like

Christianity without hell.”

I read that here a ways ago.

I think it’s more like phone sex.

This same situation exists in the natural gas market. Utility customers are going to “shite” when they get their February natural gas bills. The Texas PUC and the Texas Railroad Commission (which regulates the oil & gas industry) are going bonkers. The price for gas under which many of the utility gas purchase contracts are based was, from 2/13 through 2/16, $400 per MMbtu, a bit more than the usual $2.50 – $3.50. Our recommendation to the regulators was to get FEMA to pay the natural gas utility customers’ February bills.

Nooooo

A better recommendation would be for Texas (the State) to pay the utility bills and repay any necessary borrowing financing with a levy on all those bandits who have made such crazy profits. Then….re regulate the entire energy industry and maybe institute a small state income tax to pay for the things Texans now want the rest of the US to pay for them.

Fema does not owe Texans a free ride, especially a State that bashes everyone else as ‘socialist’, inept, crooked liberals, whatever.

Can’t implement an income tax in Texas. A bill passed a couple years ago and voted upon by Texans makes it permanently illegal to implement an income tax in Texas

I wonder what was ERCOT thinking when they decided the cap should be $9,000/MWh.

They thought that with a sufficiently high price cap, generator owners would invest in weatherizing their generators for days when other generators trip due to cold and prices hit $9000.

Instead, gen owners (and transmission owners) kept their equipment running with the least amount of investment possible, so as to boost short term profits. Hoocoodanode?

Why would they do anything other than buying electricity futures?

With crap generators and transmission lines, the potential upside of a “long electricity” position will only get bigger, does it not?

If the Fed classifies oil and gas and wind mill and whatever energy generation, as an investment, then there won’t be any inflation.

They did it for housing. They can do it for home energy use.

Janet should hire me as a consultant.

My son is a chemical engineer in charge of projects for a chemical facility that has its own power supplier in Lake Jackson TX. It is the largest in the continental US so you can figure it out.

He states that aside from the problems prolonged freezing temperatures cause in plants designed to operate in 90 degree weather for 10 months a year is the big crippling problem all plants had, no natural gas supply and no nitrogen supply. Both supplies collapsed and there is no petrochemical plant (that includes refineries and power plants) that can be run without both these products.

Natural gas is fuel for them naturally, but nitrogen prevents explosions in many areas of the plant. These plants were all under severe risk of serious damage from explosive incidents for several days.

There is one main line that supplies nitrogen too all the gulf coast states. That line went down completely.

Now nitrogen can be trucked in, and often is during plant/supply line maintenance, but in such an emergency that is a ridiculous idea naturally.

I learned much about the fragility of the system after this emergency. All it would take to cripple the bulk of the nations petrochemical supply is take out that one single nitrogen supply line.

Lets hope the no one else figures that one out.

Yes. The industry/ERCOT did a study about 10 years ago and recommended more freeze protection.

Obviously, they have to build in the usual “layers of protection”, e.g. they also have to protect against N2 and other utilities.

It seems like having a natural gas fueled heating system would be best for freeze protection. Backup layers may be needed.

It’s expensive to protect against 1/10 year or 1/100 year events. Maybe it’s necessary.

The simple fact is that if electricity was still regulated, this price spike would not have happened. Prior to deregulation, we did not have any of these problems…..

Deregulating a monopoly is an idiotic practice as we are clearly seeing….

Jdog- “deregulation” is an abused word because they typically only deregulate part of the business.

They heavily regulated PG&E, and it hasn’t turned out great.

“Line Utilities” are “natural monopolies”, and as such need significant regulation. There just isn’t a way around it if you want to be realistic.

There were pretty good regulations let’s say 40-50 years ago. They regulated profits, etc., in “trade” for the monopoly rights, basically. As a monopoly utility they also have to meet reliability regs, etc. The regulators can force safety compliance regs too.

If you over-regulate and/or turn the utility into a socialized/nationalized/government entity, watch for troubles.

Taxpayers and ratepayers will pay the cost of market risk, as usual, in the failed experiment known as “free market capitalism”.

”Get over it” bx,,, any real type of free markets of any kind have been on the back shelf of any and every guv mint entity that has existed since some time(s) in the era of Rome in the so called ”western ”world, and various and sundry other times in other ”worlds” before and since…

In the current age we have what is usually referred to in polite society as CRONY CORRUPT CAPITALISM, not in any important metric to be confused with ”free market” or anything similar.

Please be clear on that difference, mostly for your own benefit.

C’mon folks on here, at least try to be on the developing, once again, side of and for ”free” markets of each and every and all kinds.

That the situation in TX is not any kind of free market, except with re single families choosing any of the clearly bad choices on the basis of the least bad, should be evidence enough to let the TX guv mint pull back all or enough of the insane profits to pay off all consumer ”out of the ordinary” costs of the failed companies, as well as the companies profiting SO much.

You cannot by definition have free market capitalism in a monopoly!

There is no competition.

Free market capitalism requires competition, and energy companies have no competition.

They conspire among themselves to set rates and have been caught doing so many times. They simply pay the minuscule fines, pay off the PUC, and go on with their raping of the rate payers.

Texas privatized all the profits and took all the risks to the rich could get richer.

Now that the risk blew up in their face they want a federal bailout so the losses can be socialized where the Taxpayers of the other 49 states pay the cost.

Privatized gains for the 1%, socialized losses for the rest of us, the conservative way.

NOT any kind of ”conservative” way except the crony corrupt kind A.

Try to understand that both sides of the aisles of many many nations now consist only of statisticians and those corrupt enough to try to ”game” the system sufficiently to support them in the style to which they hope to become accustomed sooner and later.

Really and truly,, almost all are really just REACTIONARies and it doesn’t matter one bit on what side of any/the aisles they sit.

Wasting your time. Neither left nor right believers will ever wake up to the sucker ploy of the talking heads until they see the spoon pulled from their mouths and being used to beat them into submission by their overlords. We should have stayed home and let the Soviets give them all a real “old schoolin’ “. Sorry I ever carried a weapon to ensure freedom for these undeserving f**cks. Even more sorry for the ones who never came back….cheated!

I think a similar thing is going on with Boeing and all the airlines? Bailouts? Private companies? Paid by “your tax dollar”?

Bailout Nation.

I remember in 1775 you all paid 3% tax in total, but paying a tiny impost on tea was a tax too far, “no taxation without representation”, how has that worked out for you?, are you going to have another revolution in protest at all the bailouts, which are only a form of taxation, storm congress maybe?, oh yeah you did that already, you are all just serfs, worse than 1775.

I am opposed to bailing out either the citizens or the power companies. That’s just bailing out ourselves with our own money. Carve them up, screw the shareholders and bond holders and give everyone a piece of the company.

If they give a government bailout to Texas power companies they need to remember that there are about 2 guns for every Texas resident – man, woman, and child (and the transgenders and all the other alphabet soup).

Let the screwups pay for it. I don’t recall seeing this discussed above, but Texas power providers have no legal obligation to provide emergency power. So why spend money on winterizing your equipment? This was just pure negligence.

Negative shareholder equity. That puts them in the same category as companies like Boeing.

We are told it is a good thing these days.

Surely it would have taken ..”just” .. a little bit more than the winter shutdowns to make a mess like .. we may not be able to go on any further ??

Mismanagement & a layback approach even.

I hope that the energy providers and backers who are demanding that $9,000 per Mwh be coughed up will always have the memory of the eleven year old boy who froze to death next to his mother to remember this event by.

It is interesting that shale has been mostly mum about the hit from this Weather Event. They lost production and some have already reported that, but what about the hit from these electricity prices?

Sorry, I simply can’t pay this absurd electric bill. Please come and repossess your electricity. It’s on the east side of the house.

On the ERCOT website:”The CRR is a financial instrument that entitles the CRR owner to be charged or to receive compensation for congestion rents that arise when the ERCOT transmission grid is congested in the Day-Ahead Market (DAM) or the Real-Time Market (RTM). A CRR does not represent a right to receive, or obligation to deliver, physical energy.”

I find it totally illogical at the least as to why ERCOT did NOT restrict and hold the pricing level DOWN rather than escalate for predatory trading by the major trading and fund groups against the urban and other community groups on the ERCOT Market Participants listing, which is easily accessible as a nice .xls public list.