But the Trade Fiasco with China was the least terrible since 2013.

By Wolf Richter for WOLF STREET.

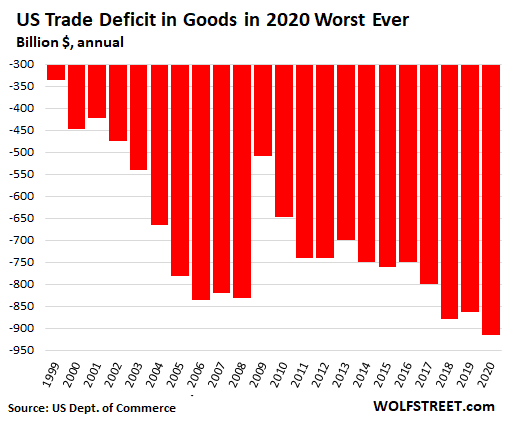

The US trade deficit in goods worsened by 6% in 2020, to $916 billion, the biggest and worst ever. Exports of goods plunged by 13.2% to $1.43 trillion, the worst since 2010. Imports of goods during the year fell by 6.6% to $2.35 trillion.

Half of the decline of imports was driven by an $80 billion or 38% plunge in imports of petroleum and petroleum products, to $127 billion, the lowest since 2002, caused by the collapse in crude oil prices, the collapse in demand, and US production from fracking. Combined with US exports of petroleum and petroleum products, it produced the first annual US petroleum trade surplus ($18 billion) on record, according to data by the Commerce Department.

US exports to the rest of the world add to GDP, and US imports are a negative for GDP. Every country wants to export itself out of trouble. And the US has been eager to make this possible for other countries – driven largely by Corporate America’s three-decade binge to globalize its supply chains to fatten up its profit margins.

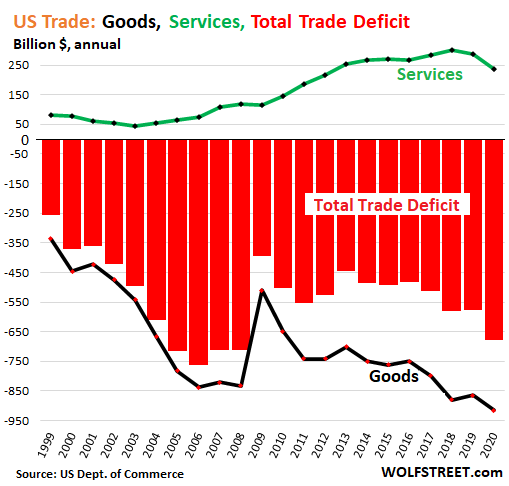

The US services trade surplus in 2020 plunged by 17.5% to $237 billion, the lowest services surplus since 2012. Imports of services plunged by 21.8% to $460 billion; and exports of services – which include spending by foreign tourists and students in the US – plunged by 20.4% to $697 billion. This was the second year in a row of declining services surplus.

The total trade deficit of goods and services worsened by 17.7% to $679 billion, the worst since 2008. The chart below shows the total trade deficit in goods and services (red columns), the trade deficit in goods (black line) and the trade surplus in services (green line):

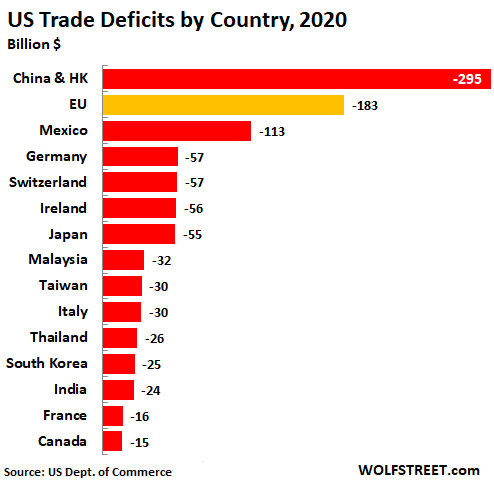

The Goods Trade Deficit, by Country.

Below are the 14 countries plus the European Union (yellow bar) with which the US has the largest trade deficits in goods. The opaque nature of international trade transactions, such as trans-shipments, trade invoicing via third countries, tax dodging, etc., can produce peculiar results, particularly with small countries such as Switzerland and Ireland, as you can see below. Compared to 2019, the trade deficit:

- With China & Hong Kong fell by 7.8% to $295 billion (more on that in a moment).

- With Mexico rose by 10.8%.

- With Germany fell by 14.9%.

- With Japan fell by 20%, which put it below the trade deficits with Ireland and Switzerland for the first time.

- With Ireland rose by 5.7%.

- With Switzerland jumped by 111%, which put the tiny country on par with Germany.

- With Canada fell 44% to just $15 billion, with large volumes imports and exports nearly in balance.

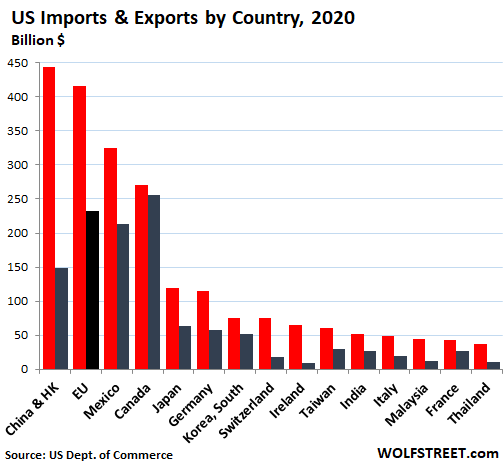

Imports and Exports of Goods, by Country.

The chart below shows US imports from (red) and exports to (black) the major trading partners, plus the EU, in order of the magnitude of imports. The trade relationship with China is the most out of whack; the trade relationship with Canada is the most in balance, with just a small difference between imports and exports:

The Goods Trade Deficit with China & Hong Kong.

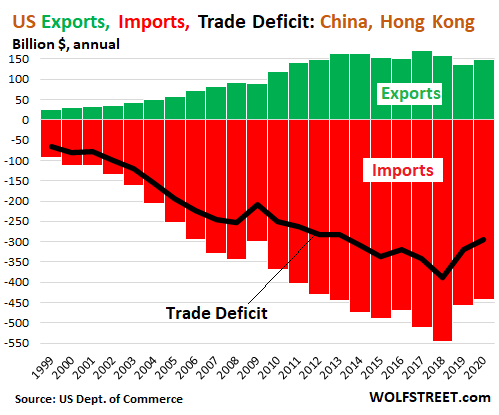

Imports from China and Hong Kong combined fell by 2.8% in 2020 to $443 billion, the second year in a row of declines (red columns below). Some of the imports have been rerouted via Vietnam and other countries. Nevertheless, that’s a big improvement.

Exports to China and Hong Kong rose by 8.3% from 2019 – which had been the worst year since 2010 – to $148.6 billion, roughly on par with 2012 (green columns). So there has been no improvement in exports to China since 2012.

The goods trade deficit (exports minus imports) with China and Hong Kong improved, or rather became a little less horrifically terrible, for the second year in a row. And at $295 billion, it was the least terrible trade deficit since 2013 (black line):

The year 2020 was a milestone in the sordid history of the long-running US trade deficits in that the goods trade deficit set a new historic most terrible record, despite a 38% collapse in imports of petroleum and petroleum products, and despite the first-ever petroleum trade surplus. As the rest of the world cut back on buying US goods, US consumers were doused with government money, and they switched from buying services — from haircuts to plane tickets — to buying goods, a large portion of which was imported.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The ideological fashion of the day is to declare “trade deficits don’t matter” for the dollars eventually return and the exchange of our dollars for goods is efficient and good for the consumer.

But….

With the return of dollars often comes a change in ownership and control.

The dollars came back to the US when Chicago sold the Chicago Skyway toll bridge. Now foreigners control a tollway in Chicago.

Dollars came back when Smithfield meats was sold .. ..and the largest meat processor in the country is owned by Chinese.

As for the exchange of dollars for consumer goods, the gratification is brief. Dollars for electronics and clothing that will soon be in a dumpster. Those dollars come back to the US to buy hard assets, ownership, and controlling interests in industry. Long term, not so good for a country.

Professors in the Ivory Towers never mention the change of ownership and control that comes with the “eventual return of the dollars.”

Excellent observation.

Notice how lumbers prices in the US have almost tripled in just one year? No, it’s not just because of the 20% tariff the Trump Administration placed on Canadian softwoods. That’s only a minor factor. Yes, builder demand for lumber in the US is up, but what’s really happening is that Canadian companies are buying up US lumber mills. Here’s just one example:

“According to analysis by Forest Economic Advisors(link is external), with the purchase of Gilman’s six mills in Florida and Georgia in 2017, West Fraser’s production capacity now exceeds seven billion board feet. This means one company now controls a little over ten percent of all lumber production in North America.”

Companies like Canfor and Interfor are have been producing lumber in both the US and Canada for years.

Then there is the huge problem with shipping. Many containers, that in the past would be exporting US goods to China, are now going back to China empty, because the demand for containers to China far outweighs the demand for US exports in China. Shipping costs are skyrocketing, and the situation is not going to get any better.

When shipping all but collapsed, during the Great Recession, shipping companies consolidated. Now there are only three large shipping cartels, and instead of small ships, that could travel at speeds of as fast as 24 knots, these companies are using huge ships that can’t go much faster than 17 knots. When these huge ships arrive in California ports, there isn’t enough storage room for their cargoes. Inflated prices of imported goods is becoming a reality.

Those mills in the Southeast US don’t make structural lumber products like 2×4 etc.

They make lots of paper products from those trees.

Structural lumber comes from the western US and Western Canada.

“Softwood tree species, predominantly the southern yellow pines (Pinus spp.) in eastern North Carolina, supply lumber for use in residential and commercial construction.”

From an article in: “North Carolina Lumber Production, Consumption, and Revenue Trends”

Rich is correct,,, SYP is the preferred structural lumber, when available in SE USA,,, Southern Yellow Pine, even in it’s almost always at least 2nd generation now, is somewhat stronger than Douglas Fir for the same grades, and quite a bit stronger than the SPF, Spruce Pine Fir most available and cheaper these days.

Ever heard the derisive logging term, “pecker poles”?

Trade deficits DO matter, for ownership and control are lost with the return of the dollars.

It is clear that countries with trade surpluses tend to be on upward trajectories…while countries with perennial trade deficits must print Trillions to offset the damage. They also lose control of critical industries.

I always remember when a Japanese firm bought Rockefeller Center in the late 80s. They top-ticked the market at the time and eventually sold for a loss – I’m not saying this happens all the time, but generally it’s more about dollar asset risk than control.

If foreigners are convinced that our dollars will be inflated away, or will lose value relative to their own, it might make sense to buy U.S. assets like real estate as a hedge, even if they don’t time it perfectly.

Buying real estate at the peak is not a plan.

Neither is holding U.S. dollars that become progressively more worthless every day.

There are more than two options.

But Yellen said she was for a strong dollar. /s

The unelected central bankers are destroying their currencies to the benefit of some and the great damage to others. They have decided.

I remember the 1980s/90s when that well-known Japanese economic juggernaut was in full swing.

There were warnings in US then that Japan was using its trade wealth to buy up America and many were convinced that they would do a massive corporate takeover.

But after Japan’s massive asset bubble burst in 1991 (and their ‘Lost Decade’ that followed) the warnings and cries faded away.

No sane country would let foreigners buy up significant amounts of critical economic segments like industry and farmland.

Except for maybe …

Americans control all the strategic businesses in my country, all the coal mines, all the oil business and they also get to force a government on us through corruption and bribes and sometimes even openly declare support for one party over the other, and during certain times they overthrow a government and replace it with their friends. It’s only fair that some ‘foreigners’ also get to buy some businesses such as golf courses defunct hotels, and certain dying industries in the US. Whatever happens to you these days just always remember you have done far worse to others.

Never have read a more paranoid bunch of comments as in here. Foreigners buying you out when you can crush every country on earth, you set the rules the standards that others must follow or else you cut them from the dollar funding system, you can destroy with just a fart my country and a dozen or so other countries similar to mine, you own most assets on the planet, your companies face no hurdles anywhere on earth except for North Korea, your banks facilitate most businesses around the world, you control all trading routes patrol all the seas and now want to control all of the sky as well. But yet you complain, some of you are even ready to do away with private property rights for some ‘foreigners’. What should we do then in my country if you the number one country in the world are unhappy with the state of affairs?

Sir.PiratePapirus, you are correct, and for that I am sorry as an American. Ever since I read confessions of an economic hitman I’ve known that the U.S. does some absolutely brutal stuff as a way of enforcing a sort of open secret style imperialism. I get the impression that most people think I’m being melodramatic when I call the U.S. a plutocracy, but that’s what the evidence suggests to me. It already seems like a minor miracle that there still appears to be a sense of democracy in this country. Whatever you do though, don’t count on the American people as a whole to ever wake up one day and hold their overlords morally accountable for what has been done and is done to other peoples around the world. They do a very good job of programming Americans with a culture of vanity and pride.

Exactly. Michael Pettis does explain that the Capital Account Surplus is the same as the Current Account Deficit. This export of capital means the sale of companies, land, and other hard assets to those outside the US. Part of the reason though is that Capital in the 21st Century, a book by Thomas Picketty, explains how people and their capital perpetually flows back to the safest and wealthiest countries, regardless of trade flows.

GERALD

I think “safest” country is the key. Most Americans are reticent about owning assets outside the US for fear of govt instability / nationalization of assets. Most outside the US do not have that fear about owning US assets. Not sure that won’t change in the future, but we’re still the cleanest dirty shirt.

BS. Americans are just ignorant. Next you’ll tell me that if I own assets in Western Europe, they can be seized any time or places like Japan, South Korea, Singapore and most of South East Asia.

People invest here partly for stability, true, but a lot of them are also motivated by pure greed, they don’t give a crap about this “cleanest dirty shirt” business.

And talking about great returns, investing in Vietnamese real assets over the last 10 years would make you a winner.

This is partly correct.

The EU and democratic East Asia is safe ground for investment for the most part.

But China and Russia and everywhere is not. Doesn’t mean you can’t make money, but contracts and rule of law outside of the above-mentioned places are not guaranteed.

Stable governments which respect private property and rule of law are where people and money flow. And those places become wealthy as a result. It’s cause and effect. See Switzerland as the classic example, poor farmers scratching a living from the dirt 100 years ago, ditto for Japan.

Watch wealthy people in China. They all look for ways to get US or EU or UK citizenship for their children, and they keep property as a bug out measure. There are still people there who remember the communists confiscating all private property in 1949. And they see you what happened with Jack Ma the last few months also.

I wonder how many U.S. investors/businesses own property or assets in China? Anyone have a guess or facts?

Here is a partial list of American companies doing business in China.

AT&T, Abercrombe & Fitch, Abbott Laboratories, Acer Electronics,Ademco Security, Adida, ADI Security, AGI- American Gem Institute, AIG Financial, Agrilink Foods, Inc. (ProFac), Allergan Laboratories, American Eagle Outfitters, American Standard, American Tourister, Ames Tools, Amphenol Corporation, Amway Corporation, Analog Devices, Inc., Apple Computer, Armani, Armour Meats, Ashland Chemical, Ashley Furniture, Associated Grocers, Audi Motors, AudioVox, AutoZone, Inc., Avon, Banana Republic, Bausch & Lomb, Inc., Baxter International, Bed, Bath & Beyond, Belkin Electronics, Best Buy, Best Foods, Big 5 Sporting Goods, Black & Decker, Body Shop, Borden Foods, Briggs & Stratton, Calrad Electric, Campbell’s Soup, Canon Electronics, Carole Cable, Casio Instrument, Caterpillar, Inc., CBC America, CCTV Outlet, Checker Auto, CitiCorp, Cisco Systems, Chiquita Brands International, Claire’s Boutique, Cobra Electronics, Coby Electronics, Coca Cola Foods, Colgate-Palmolive, Colorado Spectrum, ConAgra Foods, Cooper Tire, Corning, Inc, .Coleman Sporting Goods, Compaq, Crabtree & Evelyn, Cracker Barrel Stores, Craftsman Tools (see Sears), Cummins, Inc., Dannon Foods, Dell Computer, Del Monte Foods, Dewalt Tools, DHL, Dial Corporation, Diebold, Inc., Dillard’s, Inc., Dodge-Phelps, Dole Foods, Dollar Tree Stores, Inc., Dow-Corning, Eastman Kodak, EchoStar, Eclipse CCTV, Edge Electronics Group, Electric Vehicles USA, Inc., Eli Lilly Company, Emerson Electric, Enfamil, Estee Lauder, Eveready, Family Dollar Stores, FedEx, Fisher Scientific, Ford Motors, Fossil, Frito Lay, Furniture Brands International, GAP Stores, Gateway Computer, GE, General Electric, General Foods International, General Mills, General MotorsGentek, Gerber Foods, Gillette Company, Goodrich Company,Goodyear Tire, Google, Gucci, Guess?Haagen-Dazs, Harley Davidson, Hasbro Company, Heinz Foods, Hershey Foods, Hitachi, Hoffman-LaRoche, Holt’s Automotive Products, Hormel Foods, Home Depot, Honda Motor, Hoover Vacuum, HP Computer, Honda,Honeywell, Hubbell Inc., Huggies, Hunts-Wesson Foods, ICON Office Solutions, IBM, Ikea, Intel Corporation, J.C. Penny’s, J.M. Smucker Company, John Deere, Johnson Control, Johnson & Johnson, Johnstone Supply, JVC Electronics, KB Home, Keebler Foods, Kenwood Audio, KFC, Kentucky Fried Chicken, Kimberly Clark, Knorr Foods,K-Mart, Kohler, Kohl’s Corporation, Kraft Foods, Kragen Auto, Land’s End, Lee Kum Kee Foods, Lexmark, LG Electronics, Lipton Foods, L.L. Bean, Inc., Logitech, Libby’s Foods, Linen & Things, Lipo Chemicals, Inc., Lowe’s Hardware, Lucent Technologies, Lufkin, Mars Candy, Martha Stewart Products, Mattel, McCormick Foods, McDonald’sMcKesson Corporation, Megellan GPS, Memorex, Merck & Company, Michael’s Stores, Mitsubishi Electronics, Mitsubishi Motors, Mobil Oil, Molex, Motorola, Motts Applesauce, Multifoods Corporation, Nabisco Foods, National Semiconductor, Nescafe, Nestles Foods, Nextar, Nike, Nikon, Nivea Cosmetics, Nokia Electronics, Northrop Grumman Corporation, NuSkin International, Nutrilite (see Amway), Nvidia Corporation (G-Force), Office Depot, Olin Corporation, Old Navy, Olympus Electronics, Orion-Knight Electronics, Pacific Sunwear, Inc., Pamper’s, Panasonic, Pan Pacific Electronics, Panvise, Papa Johns, Payless Shoesource, Pelco, Pentax Optics, Pep Boy’s, Pepsico International, PetsMart, Petco, Pfizer, Inc., Philips Electronics, Phillip Morris Companies, Pier 1 Imports, Pierre Cardin, Pillsbury Company, Pioneer Electronics, Pitney Bowes, Pizza Hut, Plantronics, PlaySchool Toys, Polaris Industries, Polaroid, Polo (see Ralph Lauren), Post Cereals, Price-Pfister, Pringles, Praxair, Proctor & Gamble, PSS World Medical, Pyle Audio, Qualcomm, Quest One, Ralph Lauren, RCA, Reebok International, Reynolds Aluminum, Revlon, Rohm & Hass Company, Samsonite, Samsung, Sanyo, Shell Oil, Schwinn Bike, Sears-Craftsman, Seven-Eleven (7-11), Sharp Electronics, Sherwin-Williams, Shure Electronics, Sony, Speco Technologies/Pro Video, Shopko Stores, Skechers Footwear, SmartHome, Smucker’s, Solar Power, Inc., Spencer Gifts, Stanley Tools, Staple’s, Starbucks Corporation, Steelcase, Inc., STP Oil, Sunkist Growers, SunMaid Raisins, Sunglass Hut, Sunkist, Subway Sandwiches, Switchcraft Electronics, SYSCO Foods, Sylvania Electric, 3-M, Tai Pan Trading Company, Tamron Optics, Target, TDK, Tektronix, Inc, Texas Instruments, Timex, Timken Bearing, TNT, Tommy Hilfiger, Toro, Toshiba, Tower Automotive, Toyota, Toy’s R Us, Inc., Trader Joe’s, Tripp-lite, True Value Hardware, Tupper Ware, Tyson Foods, Uniden Electronics, UPS, Valspar Corporation, Victoria ‘s Secret, Vizio Electronics, Volkswagen, VTech, Walgreen Company, Walt Disney Company, Walmart, WD-40 Corporation, Weller Electric Company, Western Digital, Westinghouse Electric, Weyerhaeuser Company, Whirlpool Corporation, Wilson Sporting Goods, Wrigley, WW Grainger, Inc., Wyeth Laboratories, X-10, Xelite, Xerox, Yahoo, Yamaha, Yoplait Foods, Yum Brands, Zale Corporation

They may be “doing business” but my question has to do with owning the assets (physical locations, land, etc, not just operating there. You know, taking title as owner.

JVC Electronics? The Victor Company of Japan?

Pioneer Electronics? パイオニア株式会社?

Since when did they become an American companies?

But that wasnt the question…

“…own property or assets in China? ”

the question was “ownership” in China. And I’ll bet you will find they dont own ANYTHING free and clear.

If you do business in China, you usually must have a Chinese partner, for starters.

search for this…

saporedicina.com/english/how-to-start-a-company-in-china/#companyinchina-6

If a company does business in China then it’s technically own by China. Or to be blunt, The Communist Party.

Thousands of companies from America and Europe are pouring into China to do business. What do they know that you don’t? It’s a growing economy. It’s easier to start a company and get rich in China than America.

The Japanese bought 7-11 decades ago. The Canadians bought Circle K.

Fiat bought Chrysler’s Jeep, Dodge and Ram.

Amazon, Google and Facebook have customers overseas.

There are Starbuck’s shops in China.

Exactly. Take a look at Sri Lanka when the Chinese collected the collateral – a major port – on their “foreign aid”. The US always feels like it can nationalize foreign owned assets if things get too bad, but that’s a pipe dream.

“The US always feels like it can nationalize foreign owned assets if things get too bad, but that’s a pipe dream.”

I do think this is at the back of what passes for DC’s mind and what allows them to luxuriate in indifference towards many, many decades of worsening trade deficits and concomitant increases in foreign ownership of domestic US real assets.

But seizure would result in embargo…to a country where imports were long necessary to survival/quality of life.

I agree that DC is mistaken about who actually holds the whip hand.

We can certainly nationalize foreign owned assets, but we could only do it once.

Embargo, probably, but think about retaliatory seizures probably validated by the WTO. Think of the IP physically present in China or accessible to it. It would be one wild ride. Question is, is this the time for China to pop the trap on the US like they do to other smaller countries? If so, it would be a bleed out trap. They play a very cautious encirclement game. Come to think of it, it’s Go.

There is a saying in Arlington Texas, “you only own your house until a rich billionaire wants to put a stadium on it”.

Never underestimate the power of 12 people on a city council.

You dont own your house.

Try not paying the property taxes.

You will find out who the real owner is.

This will all lead to war China massively building military look at iron ore purchases qwe romans are entitled buying junk count your cars tv s computers hardly any made in America but we have right to bear arms as long as we stay United unbeatable still best country in world but with idiot politicians no common sense

Thucydides Trap.

Rising powers always make war

historicus, more historic relevance would be needed to back up your claim. The insurgence of returning dollars during the 70’s-80’s from Japan didn’t fit your model. Sure many claimed that California would soon be owned by Japan, as the influx of cheap goods and better cars came here. The U.S. consumer won in that they had a better choice selection in these disposable products, and during the oil embargo period, drinking less gas and oil added up to more dollars in American’s pockets. The technological advance in the U.S. commerce far outweighed the supposed intrusion of foreign investment. Using less or our natural and human resources to deliver the same or more product and service is a benefit to the U.S..

“California would soon be owned by Japan”

Do you really, really know the % of high value real estate that is owned by foreign nationals? Behind corporate holding companies?

I’ve never seen any data concerning this.

If you are a foreign exporter to the US, what would *you* do with your bales of USD?

1) Accept forced conversion into currency that is systematically undervalued by your own gvt? (China).

2) Get bent over by *foreign* gvt? (US, via ZIRP).

3) Keep offshore and away from control of own gvt…keep away from US ZIRP…and put into US real assets, at least currently confiscation free.

A prudent man diversifies his assets.

The data from the U.S. Department of Agriculture show that foreign investors control — either through direct ownership or long-term leases — at least 28.3 million acres, valued at $52.2 billion. That area is about the size of the state of Ohio.

That took 5 seconds.

we traded that for now outdated electronics and cheap clothing.

Now in dumpsters.

Might be more difficult to find out office buildings and sky scrapers owned in Manhattan or Chicago.

But lets take Vancouver for an example of foreign money buying up a city….and driving housing prices away from the citizens of that city and Country. Same in Toronto.

Hist,

Excellent post.

The “change in ownership of domestic US assets” is key…it is the literal manifestation of the figurative “selling our (asset) birthright for a mess of (trade deficit) pottage”.

All people have to do is put themselves in the shoes of Chinese exporters (or Chinese gvt, viewed more cynically).

1) You are making huge annual bundles from essentially perpetual US trade deficits.

2) a) As a Chinese exporter what are you to do with these bales of US dollars though?

If you bring them home, the Chinese G forces you to convert them to Yuan, a fiat the G manipulates for their goals.

If you put them into US Treasuries, you get zero yield (US Treasuries being a fiat that DC manipulates for *its* own purposes).

US stocks are vastly overvalued (nobody knows this better than you…you have been kicking these US companies’ asses for 20 yrs)

So you put your trade deficit proceeds into the remaining few US real assets with a semi reasonable return.

2) b) The Chinese *gvt* faces same conundrum of what to do with USD export proceeds that it *does* get from forced conversion to Yuan.

What to do with bales of this dumbass gaijin money? (I know gaijin is the Japanese word…what is Chinese equivalent?).

Recycle it into zero yielding Treasuries of Opium peddling DC? (*China* is the Victor of Opium War 2.0, bee-yatch!!)

Nope.

What’s left? Shrinking residue of remaining worthwhile domestic US real assets.

3) DC, sitting there in delusions of competence, smugly pats the hand of its trade deficit opium addicted public and tells us, “Don’t worry about it…you get cell phones/computers/machinery and all China gets is ZIRP…and we’ll seize the foreign owned real assets if things get out of hand…go back to sleep in the opium den.

4) End result – China ends up with productive factories and a shit ton of claims on a decaying, degenerate, and ultimately defaulting US.

US ends up with a shit ton of used, obsolete, trap-doored electronics and machinery…and no capability of building its own goods any more (see…surgical masks).

I believe the word you are looking for is “laowai”.

The Chinese learned a very important lesson in economics..

The US Congressman is for sale.

Lobbyists are the authors of most legislation.

“The US Congressman is for sale.”

Not even sale.

CA Rep Swalwell (“DC has nukes, you citizen peasant bastards…now shaddup!!”) got turned out by a Shanghai Six.

(Although that Six really, really proved her love for the CCP with her previous assignment…Google the pics…*that* is why China will win…)

Americans have very little idea how much of America is not owned/controlled by Americans.

Someone, not Jefferson, wrote the following about the Federal Reserve grift-machine:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

Someone was very wise and prescient.

hint: the person on the $20

Exactly. If they only taught history and shared the wisdoms of smart people who came before us.

We now have UNELECTED central bankers running the entire show, ignoring their mandates, self authoring new ones, and constantly expanding their own powers.

Unchecked, and as long as the stock market rises to the delight of fully invested Congressmen, unnoticed.

And with each “emergency” the powers expand.

But look at what they are doing to the vast majority of people in this country…they are destroying the currency, gleefully it seems.

We all know why, but that doesnt make it right, just convenient for “them”.

“We now have UNELECTED central bankers running the entire show,”

How many armored divisions does the Fed have?

The Executive calls the shots regardless of what the “rules” say or the MSM excretes.

The political/military class ultimately controls the Fed…if the Fed ever really opposed their will…new Fed Governors.

Now, the *Executive* branch only has 1 (or fewer…) elected officials…so *that* would be a legit complaint.

Good graphics and explanations.

I wonder if any American administration could stand up to the corporate class, close the borders, and practice Autarky, or self sufficiency?

Andrew, your thoughts have been used to the detriment of the world in general before, the Great Depression was facilitated by a hands off, America first economic and social model. At the time Hoover and his followers believed the same thing, the result of closed borders and trade tariffs= depression. During the late 30’s the same out swelling limited the amount of trade and assistance the U.S. had with England, French and Europe, Roosevelt was a shroud politician but was unable to supply our neighbors with the needed supplies to arm themselves for the Nazi invasion, only after Pearl Harbor did the climate in the U.S. change to benefit our friends.

Freedomnow..

Lend lease began well before Pearl Harbor.

Tariffs didnt cause the market to crash in 29. The tariffs may have been unwise, but not to the magnitude of creating a depression.

If that was the case, the immediate removal of tariffs would have quickly reversed the situation. It didnt.

Overleveraging was the issue…people who shouldnt have been fully invested were. It appeared a free ride. Up every day. People getting rich doing nothing. BTW, how much higher did the market open today?

Autarky isn’t required, just something significantly less than the meth-fueled disregard of *any* level of trade deficits, for *any* number of decades.

Honest to god, your average painting huffing 15 yr old behind the 711 gives more thought to future consequences than the US G has for *many* decades when it comes to trade deficits.

Does ‘self sufficiency’ override the search for profits for US Mulrti-Nationals? Who shipped factories and jobs since 2000? NOT china but US Multi-Nationals with the complicit of GOVT – both parties!

Yep, and DC had every anti currency manipulation tool/law necessary in place to stop/calibrate the damage that was done yr after yr since 2003…and DC did less than squat.

DC has essentially been religiously committed to doing squat about uncontrolled trade deficit growth.

Although the problem started much before Amazon, Amazon has made the problem far worse. By selling at lower prices and making it so easy to BUY BUY BUY, it has allowed Americans to buy more than they really should (or need). China with its subsidized economy and shipping charges is laughing all day long. As long as it keeps people employed it does not care if it makes a profit or not.

There is a simple way to stop the trade deficit but it is politically impossible – a national sales tax (or VAT). By increasing the price of purchased goods (exempting food and necessities), people will have to buy less and the trade deficit would drop. For now America subsidizes consumption (though most folks have no idea) with the resultant costs to be paid later down the road.

OMG a VAT is regressive and a bureaucratic nightmare. I definitely would not want to see the US going in that direction.

I agree that overconsumption is a problem, but it’s a bit odd to say that the core problem here is that prices are low. Generally that’s a good thing!

Low prices being low is a bad thing if the government uses the decreased prices as justification for causing inflation.

Yep, DC made sure that US consumers never really received the true “China Price”.

It is like increasing inflation has become the Fed’s life work.

DC is the only place where “lower prices” turns into “Deflation – Destroyer of Worlds”.

Cas127, yep. It basically means that nearly all of the benefits of the “lower prices” inured to the capital class.

Wages haven’t increased much, so any “savings” on “stuff” goes to higher housing, insurance, and education costs.

Not much of a deal.

Nonsense, respectfully uttered. :-)

A VAT on Goods and Services could be fine tuned to level the playing field for educational opportunities, infrastructure, etc and a good way to finally impose a fair level of taxation on those adept enough/rich enough to hire an array of accountants and lawyers to avoid paying their ‘fair share’ toward maintaining a Country that provided their wealth in the first place.

These days of computer analysis simply removes the idea of anything like this being a bureaucratic nightmare.

On one hand, poorer consumers pay a higher % of their income towards a VAT, however, tax credits based on income are easily adjusted to negate this. Those that consume more should pay more, pure and simple. Furthermore, there are many states that jockey the playing field by lowering or simply not having income taxes which also attracts higher earners who coincidentally enough seem to have higher tax deductions for political contributions.

In Canada we have a VAT called GST, which is a goods and services tax. It is deferred all along the production chain until the final point of sale. Businesses simply have a GST number that magically charts the progress and end result of their submissions. Our VAT was actually imposed by a right wing Conservative Govt, and was instrumental in their election defeat. Nevertheless, 30-40+ years later it remains. Some provinces have a ‘harmonised’ GST and Provincial Sales Tax, and some have kept them separate.

The idea that some states have no income taxes (for political gamesmanship), or crazy high property taxes (to make up shortfalls), or no to little fuel surcharge taxes (that pays for motoring infrastructure), or local funding of schools (by county thus insuring rich areas have good schools and poor areas have shite schools), or no federal funded universal medical plan (single payer)…is absolutely mind boggling to me. This could ALL be eliminated with a VAT, and fairly applied across the spectrum.

I leave you with this about VATs:

Canada. #1 in Quality of Life Rankings. …

Denmark. #2 in Quality of Life Rankings. …

Sweden. #3 in Quality of Life Rankings. …

Norway. #4 in Quality of Life Rankings. …

Australia. #5 in Quality of Life Rankings. …

Netherlands. #6 in Quality of Life Rankings. …

Switzerland. #7 in Quality of Life Rankings. …

(All Have VATs)

US # 15

Quick search: As there are thousands of US sales tax jurisdictions which often, confusingly, overlap each other, there is a huge combination of rates.

This is compounded by the states, counties and cities making no attempt to harmonise the rates they charge on the same products. Lastly, US states and tax juristictions like to tweak their sales tax rates frequently – often monthly in states like Alabama.

This makes calculation even more complicated given the likelihood that rates have changed. VAT rates are simple to track – pretty much every country as has a single, standard rate for most goods and services.

Paulo, those “quality of life” statistics are worthless if they don’t control for our demographics.

Let’s compare the statistics for Sweden and Americans of Swedish descent.

Paulo,

My problem with all kinds of sales taxes is that they can be avoided. I live in a high sales tax area. I generally wait for a sale of 10% or more before I buy anything. I am pushing the burden of paying the sales tax on the merchant. Not only do I generally avoid the tax, but I generally do a lot better than 10% off.

By pushing the sales tax to the merchant, I am also lowering the income taxes the merchant will pay. He will make less profit and pay lower taxes on his income from the sale. This is the part the local govts don’t get. The higher the sales tax, the bigger the incentive to wait/negociate for a better price.

If the sales tax wasn’t such a huge burden, I would probably just buy what I need right away. Instead I always wait for a sale.

These countries are all a fraction of the size of the US and don’t share a southern border with the 3rd world. Pretty easy to have it good if you are thousands of miles from Africa in Northern Europe. Or Canada for that matter.

VAT also for Italy and Greece BTW. It’s not a magic key to prosperity. And VAT is hugely regressive in all of the EU.

The countries on your list are small population states and many of them are also linguistically and ethnically homogeneous. VAT is the least of the reasons they are great places to live.

Agree with you, MarMar. Tax corporate profits. Heavily. Especially “offshore profits.” Tax the rich. Heavily. No regressive taxes like bay.

NOT possible when Corporatocracy (top 0.1%) is running the country!

Corporations do not pay taxes. Corporations are a non-corporeal legal fiction. The Corporation’s customers pay the taxes. A Corporation merely remits these taxes to the State. With this method the consumer never sees how much tax he/she is actually pays.

Not that the prices are low, but the credit is easy.

Are you actually calling the EU policy around VAT regressive and bureaucratic? How dare you.

It’s done wonders to keep the citizens of the EU from overconsuming. I think the US needs to adapt it pronto, so that we stop buying those cheap yet high quality manufactured goods from China. Cause you know, Joe is going to provide fierce competition to China, and a VAT could be a great way to kick things off.

see historicus’ comment above – a better way to close the deficit would be to tax the dollars when they return to the US. last year there was even a proposed bill to tax indirect foreign investment inflows – if US assets are more expensive for foreigners then they’re more likely to buy US consumables instead

Agree. The other issue is that the welfare states in Europe that liberals like to laud have extensive VATs. In America, we basically want the spending without the resultant taxation. That’s why our insane printing is getting even worse, and getting worse relative to other countries who are also engaging in insane printing.

Didn’t word come out of DC a little while ago that a tool the authorities could use to fight rising inflation (they are causing) by increasing taxes?

And I believe they indeed try that, as insane as it sounds.

As usual, the little guy and gal are the sacrificial lambs in the plutocrats’ scheme.

james wordsworth, Amazon has accomplished the near perfect business model in our capitalist economy. We should be learning from Bezo’s not denigrating his expertise. China wishes they had a Amazon.

They do. Taobao.

Trump and Navarro were on the right trail, IMO.

Their end goal, always left off the story, was NO TARIFFS.

But, in the mean time, as long as the EU and China put X% on our goods, we will respond with X% on theirs.

Why is turnabout not fair play? Why are we the trade suckers of the world?

And where did our manufacturing base go, btw?

After many decades I am still struggling with how much I REALLY SHOULD buy. Perhaps the Government would help me out with this?

The problem with buying cheap Chinese made consumer products online, is 20 minutes later you’re hungry for more.

Ha!

That’s why Amazon has the “one click” buy button!

In 2016 the USA elected a big angry man to go yell at all the other countries. We were told all we needed was someone to bully everyone else into cutting us great trade deala.

After 4 years it was all a con job and the trade deficit got worse as smart countries like china just took advantage of the big dumb oaf in the white house.

To solve this lack of progress by the big angry man we choose to elect a man with alleged influence peddling payments from China that could become a fulcrum for leverage by the party. Not sure that will work out much better.

A,

Trump was the first president with the guts to stand up to China and other big exporters. And that is an accomplishment by itself — but he bungled it in many ways, including because he was soft on Corporate America since stocks were all that mattered.

But it was Corporate America that globalized the supply chains – Walmart was on the forefront of this decades ago. China encouraged it but didn’t force it. The solution is to reduce the incentives on US companies to globalize supply chains. And that takes a lot of time and political capital, and it’s hard to do in face of corporate opposition and the ceaseless propaganda against it.

A president with strong populist support, like Trump, could have done it. He could have used his huge megaphone to run over Corporate America’s resistance to get it done, especially after or with the tax cuts, but he just didn’t want to get tough on Corporate America because stocks were all that mattered, and so, as I said, he bungled it.

But it was a start, and a reversal of 30 years of policy, and presidents behind him might ease forward in the direction he had laid out.

Wolf Richter, hope it was a start is more like it. To think his vision will be carried on is provocative at least. Nixon and his envoy established the first diplomatic and commercial ties with China, a response to the growing concerns of world leadership and the influx of commerce with Japan, amongst many other social/political/business ties. Here we are 50 years later wondering, “Is this right”. The Trump trade tariffs did little to balance commerce between the two, and increased political/social strife as they always have, with the virus worldwide China is way short of meeting the goal of goods they purchase from the U.S.. What next? Arms and military build up in South-East Pacific, the word is out already.

“Across more than 600,000 product lines, US exporters face higher tariffs more than two-thirds of the time. India applies higher tariffs 90% of the time, China 85%, thereby helping to block many American companies from selling goods at competitive prices to more than one-third of the world’s population”. WSJ May 29, 2019

Freedomnowandhow…..what would you do?

Not a Trump fan but salute him to stand up to China. Infact, many of my friends around the world, although they don’t like Trump but applaud how Trump stood upto China.

Or at least diversify our sources of import opium.

I mean, if there was a time when a home could be fully mortgaged to three different banks in full, surely the US ought to be able to con 2 additional large foreign nations into selling to us on (dubious, oh so dubious) credit.

I only mention this because it is by far easier, and therefore the most DC-probable outcome.

Just confirms that Corporate America is stronger than any prez, any party or govt!

A Corporation is a CITIZEN and the money is free speech. Rest are are rentiers and debt slaves!

Shhh, Wolf, it almost sounds like you’re praising Trump… better watch out for the cancellation mob.

I know you really care about those types of things. :)

Amen!

Trump is the nationalist canary in the coal mine for a lot of these countries… and the “globalism” crowd in this country. He might have failed because of his own ineptitude and the fact that every one of these countries just waited him out… they can read polls too. But there is little doubt that other politicians in this country will be looking at how Trump rallied such support in the American electorate and decide to try to adopt postures to co-opt it. Their alternative is to watch their own competitors adopt such policies and force them out of the political arena.

Was really disgusted with Trump when on the campaign trail he called the stock market a “big, fat, ugly bubble” but then turned around and blew it even bigger, then bragged about it as some sort of grand accomplishment. That was unforgivable.

Yeah. I still have a hard time discerning whether it was his insecurity, inability to acquire and motivate sufficient talented staff, or just the wholesale apoplectic, insane hatred that opposed him.

It was his big mouth. And Twitter. If he had kept 80% more silent he would have kept his base and would now be President. For better or worse.

The problem is no one framed the issue properly, including the previous administration. The consumer should have been educated to the benefits of buying American even if the prices were slightly higher. Keeping the money recycling in the American communities has many positives. Instead we are constantly bombarded with the “lowest price in town” propaganda. If you survey people, most shop by price and are unaware of the benefits of buying American.

Swamp Creature, during a Depression, which I think we are solidly within, it is almost impossible to change consumer behavior regarding buying at the lowest price possible, quality/delivery/warranty considerations being equal. The thesis of Competitive Advantage, where companies seek manufacturing & services where supply chains are shorter, input costs of materials lower, and, the 800 lb. Gorilla in the room, WHERE LABOR COSTS ARE LOWER, INCLUDING BENEFITS.

As time has progressed over the last 20 years, outsourcing from China and Vietnam has become less advantageous on the labor cost front as wages in these two countries have risen. But the gap is still significant, especially when one considers the benefit packages that Americans receive. Not undeserved, just a cost point.

So we put tariffs on the offending countries’ products, and some of it gets re-routed through other countries to avoid the tariffs. But in the end, this practice raises costs to American consumers, so it is not a win-win activity.

What we need more in America is higher productivity, fewer barriers/costs to entry into an existing industry, and more innovation. BUT THAT WILL NOT HAPPEN UNTIL WE SLAY THE DEBT MONSTER IN THE ROOM; excessive debt stifles normal economic activity.

Remember that increases in personal & corporate debt historically have only occurred AT THE BEGINNING OF ECONOMIC RECOVERIES, and not ballooned throughout WHAT CAN BE SEEN SINCE 2000 AS SUBSTANDARD ECONOMIC RECOVERIES with below historic real GDP growth rates.

Why are we below historic growth rates for the U.S. economy?? Because too much time and money is being consumed to service EXISTING DEBT. One reason for sure.

David W. Young, you left out a few important parts in your economic model. The Federal Government has the exclusive right to produce new dollars by spending that carry no debt burden. All economic recoveries in U.S. history have included more “National Debt”, and that debt is easily serviced and always has been. I add quotes to National Debt, as it is misunderstood by you. Federal debt is savings in U.S. Treasury notes and bond’s held by the owners as a safe means of protecting the dollars used to purchase them, backed by only the full trust in the Federal Government. The interest paid to service that debt is created and added to the economy out of thin air, the Treasury issues instructions and the Banks add that interest to the holders accounts. Private debt has a shortfall, it creates debt that must be paid back by people who don’t have the dollar printing press.. Both debts increase the money supply and are needed for economic growth. More dollars=more growth.

DY

“Because too much time and money is being consumed to service EXISTING DEBT. ”

And when interest rates normalize, even more money will be needed to service existing debts.

I want to buy all american made but the problem is two fold:

1) difficult to find american made items

2) If it is available, the price is 10 times for example in comparison with china made.

I tend to be minimalist and don’t believe in accumulating objects.

Unfortunately many American made products are no better if not worse than their foreign counterparts. And they are considerably more expensive.

Jon-

America is too expensive for manufacturing now. The horse is out of the barn. The jobs can’t return.

This is for Freedomnowandhow above: Please pass the opium pipe you are smoking, my friend. Your “understanding” of DEBT is naïve at best and fatally flawed at worst.

And look what you are subsidizing when you buy a My Pillow for instance.

YEP!

Taxes eliminate money. If you want to reduce the income gap, that’s what you do–increase taxes on the wealthy. Taxing wealth is probably the most efficient way–as opposed to taxing consumption. As for employment and income, Congress needs to take some costs off private corporation balance sheets. Taking over health care would fit this bill nicely. Investing in infrastructure would also help. Ending the insane desire to pummel nature into extinction would also help.

Thank you Chris, good to know you’re out there. They never use that side of the argument that single payer healthcare would be like a giant corporate stimulus and free up a lot of money for Americans to get the raises they might have gotten if it wasn’t eaten up by those costs. Infrastructure and green anything would also be huge job creators and maybe the only thing that could save manufacturing jobs in the the US….not to mention bankrupting all our enemies overseas. They never use the right messaging for any of this.

Corporations just don’t pay anywhere close to their fair share. Go ahead and tax them / change their egregious policies and the stock market can fall 50%, so what!? Then we can build from a reasonable foundation instead.

So if you had asked me ten years ago, I would have said to eliminate corporate taxes entirely, and that they’re unnecessary double taxation that ultimately just leads to higher prices.

But, now that our government has made it clear that public corporations will not be allowed to go down, and will always receive free bailout money without the government taking an equity stake (the way any private investor, like Warren Buffett would), then it’s totally reasonable that corporations pay taxes, as you can look at the taxes they pay as being a form of “insurance” against insolvency.

I’d rather just eliminate the public bailouts, but it’s clear that isn’t going to happen. So in that case, tax them at the same 37-39% as high income individuals.

Agree with both ends of your solution rnyr, and it’s about damn time these corporation ”persons” step up and do their share to support the systems, from labor to infrastructure, ( NOT the corrupt politicians) that has made them possible at all and has made it possible for them to make gazillions in profits.

And would add that ALL profits made by sales in USA must stay in USA, and taxes paid on them appropriately BEFORE disbursements of any kind.

Corporations do not have a fair share. They have customers. Tax Corporations and they will take it out of their consumers. Lord, this is so obvious. It’s an indirect tax on consumers.

The solution is lowering tax on income and taxing capital.

I thought taxes redistribute money, but since you can fund spending without revenue you may be right.

The cheap Chinese merchandise sold in North America has, however, spawned tremendous growth in one industry-storage facilities. In Ontario at least, storage facilities have sprung up like mushrooms on former contaminated gas station sites. People actually pay to store the junk they bought because it was such a great buy and storage companies amass a huge inventory of formerly prime real estate in the hopes of windfall gains when the sites are declared safe by future regimes.

In Texas self storage places have also sprung up alongside highways like bluebonnets!

And the new ones are not small, the are 4-5 stories. And the 1st month is free.

I just cannot fathom what people are storing in such places.

There’s a saying in Florida “There are self-storage units full of furniture and other crap that should never have been moved to Florida in the first place.”

The interesting thing about “over buying” and “subsequent self storage” is that they are a function of people believing (strongly enough to pay storage fees for it) that “prices can only rise” – so grab (and keep) the good price goods while you can.

Or, relatedly, keep those old things…so we won’t have to pay *more* for current equivalents.

To a certain extent, people haven’t really internalized a world where goods’ prices might fall…and continue falling. So that buying *now* (and storing) doesn’t make sense.

Now, granted, the Fed has made re-igniting inflation its life work..

New storage client estimate their stay at four months.

Average stay is two yrs plus before abandoning contents.

10×10 cost: $110-125, 10×20: $180-218 [July ’20 data national adjusted avg.]

So, about $2600 for 100 SF, for 2 yrs, before pulling the plug.

Behold, the power of monthly pricing!!

Btw, I kept my collection of old porn and college term papers (of obvious interest to future scholars) for 8 years before pulling the lease…

Crap

Another reason for the proliferation of storage facilities is the combining of households. I was talking to the manager of a Cubesmart location. She told me that young couples move back in with parents and put their stuff in storage. $1000 a year is cheaper than $1000 a month for rent.

I remember a day not long ago when a Trillion was a lot of money. Now Trillion dollar trade deficts mean nothing to a centrally planned global financial ponzi scheme.

Soooo many distortions. Just today oil up 2%, corn up 2%, yet ethanol down almost 11%. I wonder what they make ethanol from…(hint—yellow vegetable that rhymes with born). The system is so manipulated, we are nearing the peak of absolutely zero real world price discovery. Consequences may seem hidden, but once corn hits 100% rise soon in 7 short months and oil hits $65, I’m betting those $6.50 boxes of corn flakes and $3.5 gasoline when the attention of consumers. This is going to happen across the board on virtually all products. Low productivity gains, low real economic growth, high real world inflation. The patient/consumer is currently bloating, and next comes flatulence…and it is going to stink for everyone…HA

Welcome to Stagflation States of America…

Stagflation, taxes, and lies (kudos to Jason Burack for that brilliant sound bite) are our future.

I don’t expect hyperinflation here a la Aufpumpen in Weimar Republic, but rather a steady, insidious drumbeat form of inflation and taxation.

Like the well-known ‘boiling a frog’ analogy, the public will be cooked so slowly that they won’t catch on to it before it is too late.

The Weimar Aufpumpen…wasn’t that a prop gag in the first Austin Powers movie…(“Honestly, it’s *not* mine…”)

This is why smart people have already bought years worth of goods ahead of time, or, are doing so now.

Not only inflation, but decreasing quality and non availability. Try buying a freezer, refrigerator, 8′ bamboo poles, 3-M medical masks, toilet paper and most gardening supplies for example. You can’t even buy certain models of car because of chip shortages.

One big earthquake, plus Covid, means that those who shop every week expecting items to be on shelf, or if they are, count on electricity to use their credit cards, might starve or lead a very uncomfortable life for a long while.

Organize a lending club in your neighborhood; Need a power tool for a project? Don’t want to have to buy it, or rent it for a half the price new? Borrow it from a neighbor and let them hold cash equal to the new price until you return it, thus smoothing out the anxieties of loss or non return. Another thing in time of shortages, borrow an item others have in surplus with a promise that you will replace it in the future.

All very good advice– barter, trade, borrow, and share needful things among a community of like-minded people is winning.

Many don’t want to hear advice about frugality, simplicity, and focus on basics of living because our gilded society has been accustomed to decadent material abundance for so long (by living beyond our means).

My strategy these days is: if what you desire to acquire can not be stored as food or fuel surplus, be used in daily life as tools, or be used in farming/gardening, or be used for warmth and shelter then it is given low priority.

The nice thing about lending tools to your neighbors is that you find out who knows how to use and take care of tools. The hard way.

“zero real world price discovery”

The Fed has short circuited supply/demand price discovery in the Federal debt market by creating fake demand and sopping up supply. This leaves a fake interest rate environment which has now permeated through out the economy and markets. Things are skewed, and the ground zero is Fed policy. IMO

When WWI broke out without warning, Serbia and Austria were trading partners. They had to suddenly switch to other sources for their imported goods shortly after June 28th 1914 when Austria declared war on Serbia. The Serbian pig farmers were impacted severely. Has anyone done an analysis if there was some serious international incident which required even a temporary suspension of imports and exports from China? How would you like to be long in the stock market when this happened.

I think we all know the answer. Need I say more.

I was on the phone with some college buddies and we were having a discussion as to what the next “shot heard round the world” would be.

How about Gray Swan financial system collapse in China?? Not a Black Swan because not at all unexpected.

Shot:

How about the first hundred billion shifted from USD Bank deposits to crypto?

Chaser:

Subsequent 5 trillion shifted in next 30 seconds…

Dollars cannot be “shifted” into crypto. For each dollar that is used to buy crypto, someone else is selling that crypto and takes that dollar and puts it in the bank. But you can drive up the price of crypto.

China is dependent upon Middle East and Africa for energy imports, it’s probably their weakest link. Slow/halt oil/energy imports and instantly cause China a recession/depression.

China has their eyes on a very low populated continent…

starts with an “A” and ends in an “A”. And its not Africa.

I think you can look to the UK right now for your analysis.

When I was in Taiwan several times in the 70s I noticed the people then were perinoid about an invasion from mainland China. There were armed troops on nearly every street corner in the Capital Taipae, some with machine guns. This was when there was little or no threat from China. I wonder what its like there now? We don’t have many fake news reporters there.

After what happened in Hong Kong and the South China Sea I would be really worried, if I were a Taiwanese.

Even paranoids have enemies.

I will say that it is a LOT harder to invade Taiwan than the talking heads in the news media think. Ian Easton wrote a book a couple of years ago that really changed my thinking on this. “The Chinese Invasion Threat” makes clear that the Normandy landings were a cakewalk compared to an invasion of Taiwan.

First off, Taiwan has been preparing for seventy YEARS… not seventy WEEKS like Hitler’s generals had. Secondly, in the days of satellites and whatnot, the chances of staging such an invasion force in SECRET are practically nil… nor is Taiwan likely to allow such a force to stage without attacking first. Thirdly, given tides and typhoons there are only a couple of months out of the year when a crossing of the Taiwan Strait is even feasible. Lastly, there are not very many good beaches to make such a landing on… and the defenses on those are formidable!

There are a LOT of other problems as well. The PLA is more of an internal security force than a professional expeditionary army at this point. .. that will take quite a bit of time to change. Nor does it have the amphibious ships needed to get to Taiwan (yet). And if a battle bogs down, does China have the forces to reinforce… without losing control of Tibet, Xinjiang, Hong Kong, and/or other regions not endeared to Han control? To say nothing of stopping India and other border nations from redrawing the map?

I spent a lot of time in the Navy specializing in Amphibious Warfare… and it is not easy even when you have the best troops (Marines) and equipment to do it with. That is not to say that the PRC leadership won’t try it. The big fear has to be that they decide to take a gamble and order the PLA to go for it… come what may.

First laugh of the day albeit a bit of the dark humor kind.

No doubt Serbia’s pig farmers were impacted severely, but they weren’t alone and the impact was worse than lost business. After first defeating the armies of Austria- Hungary, one of the greatest victories by a much smaller adversary. Germany came to the rescue and Serbia was finally occupied.

‘Serb sources claim that the Kingdom of Serbia lost more than 1,200,000 inhabitants during the war (both army and civilian losses), which represented over 29% of its overall population and 60% of its male population,[18][19]

These were the highest percentages of any combatant.

Serbia started the war and they got paid back big time. We should learn from history, Don’t start wars!

GWB/Cheney are you listening.

Without Serbia where would Americans have put Camp Bondsteel?

War between China and the US is unthinkable. mainly because corporations would not allow it, and also the consumers would lynch our so called leaders because of the sudden end to cheap imports from China. Does anyone really foresee Joe doing anything to endanger the flow of donations coming from the power centers. He’d be saying “yes sir, no sir” to Tim, Jeff (soon to be Andy, but really still Jeff), David, etc faster than they can call him up.

There might be a little dust up here and there, but it’ll be calmed down before the week is out. Besides, how could the US function without iPhones, that alone would trigger the collapse of America.

MCH

“mainly because corporations would not allow it”

It may be just the opposite.

If China starts to take over the operations, seize investments of those corporations in China….it may be the corporations that DEMAND it.

So what happens if China invades Taiwan? Or attacks one of our carriers and kills sailors? Do we just sit back and add trade sanctions?

Get real!

oh, there will be some minor retaliation, blow up a ship here, shot down a plane there.

Don’t worry, the stuff you mentioned is highly unlikely right now because the correlation of forces is still against the PRC. The worst case now is a bit of saber rattling, may be a drone gets shot down for violating Chinese no fly zone around their military exercise.

Or a ship gets bumped slightly in the South China sea. Worst case, you get a repeat of 2001, where a Chinese aircraft accidentally bumps into a P8 or a EC-135. You get a loss of crew, there is a bit of rhetoric, and then cooler heads prevail.

Cause nobody wins if there is a shooting war. Everyone knows it. And if one or two operations in China gets nationalized, so what, China has done much worse by literally killing a majority of the optical based telco industry in the west with their tactics in the late 90s/early 00s, and literally nobody gave a crap, not Clinton, not Bush. Years later, they whine about Huawei, but what difference does that make.

Let me know when there is something more than “fierce competition” jawboning. But in reality, the US can’t do much, the consumers are too dependent on cheap stuff from Asia. No one is going to risk getting lynched because Amazon can’t ship laptops made in China.

Medications.

The trade deficit does make it easier to sell US debt. A trillion is not going to do it, with the Fed taking in 1.5T a year in QE, we’re getting close. The only part that bothers folks is the ratio to GDP, but that will improve. Just monetizing that number would be a victory. We need a breakdown in US exports, with high wage earners getting a disproportinate share of productivity, how much of their goods and services is exports and how much is high dollar? The meme on stock market cyclicals is misleading, industrials and materials lag, while energy and financials are making gains. Is foreign investment in US financial products a growth industry ? I esp like the credit bureaus if we don’t throw them into the same waste basket with fossil fuels.

So now with the Fed monetizing debt, how ridiculous is it that some of that “debt” is given away in foreign aid, and hidden in these omnibus stimulus bills?

The Fed “creates” the money to be given away? To whose benefit?

$1.9 trillion divided by 332 million is $5722.89 more or less. We’re getting another $1400? Who is getting the remaining $4322.89? And don’t tell me it’s going to schools and cities and government because those entities simply pass it on to people – employees, vendors, &c. Some folks are going to do a lot better than you.

Well, we already know that the shareholders and bondholders of airlines will continue to get their “fair share” as in the prior stimulus packages. Taxpayer capitalism.

Wolf, can you calculate how much the humongous Trade Deficits subtracted from GDP in a $’s and % view in 2020? And I wonder out loud how much of the Import side is purely what would be considered Luxury Goods? If the luxury goods category of imports went up significantly in 2020, one has to wonder out loud how misdirected the Stimuli payments really were, as well as never ending ZIRP perpetually goosing the net worth’s of the One Percenters via the stock market in particular.

Aid is not filtering down to those who need it most unless it is in extensions of Unemployment benefits and time-limited extra benefits. Rent forbearance is just a ticking time bomb or a homeless can that keeps getting kicked down the road. What about the landlords & the banks/mortgage companies involved in the daisy chain of non-payments???

David W. Young,

There are a lot of complications and adjustments in the GDP calculations. So you really can’t do what I’m going to do now. But at the most basic level:

GDP = Consumption + Investment + Government Spending + Net Exports.

Net Exports = exports minus imports, which is the US trade deficit in goods and services = $679 billion in 2020.

Nominal GDP (not adjusted for inflation) in 2020 = $20.93 trillion.

If Net Exports had been $0 (balanced trade), nominal GDP would have been $21.61 trillion; so a balanced trade would have added 3.2 percentage points to nominal GDP growth.

Nominal GDP fell by 2.3% in 2020. So with a balanced trade, nominal GDP would have grown nearly 1% in 2020, instead of tanking.

But remember my caveat: GDP calculations are too complicated to reduce them to this level. But it gives you an idea.

Thanks, Wolf, you are the best! It took me longer to formulate the question, than for you to come up with an answer! But we can see that the impact is significant, and we as a country would be much better off if we either increased our exports substantially or cut our imports substantially. The devaluation of the Dollar will assist on both trades flows, out and in, if we do not have a systemic collapse.

The next question, when we get another GDP print for 2020, revised, WHAT WAS THE TRUE DECLINE IN GDP IN 2020 vs. 2019 or the 2009 thru 2019 average GDP print??? This truth will unfold as we progress thru 2021’s first half. Some slick adjustments for Government and Fed created money will be needed, though.

I have my own anecdotal GDP estimate which may differ from the fake GDP numbers that the government puts out. The same government that puts out bogus unemployment numbers of 6% when the real rate is over 20% or actually closer to 40% if you add those who could work but are unable or too lazy to work or have left the workforce.

There is a commercial strip of businesses on a main artery from Bethesda to Rockville Maryland, which I travel nearly every day. This is in the most prosperous county in the country, Montgomery County.

Half the businesses on the strip have closed since Feb 2020.

More closings on the way. The ones that are still open are on reduced hours of operation and are hanging on by their fingernails.

That’s a 50% drop or more in GDP for that strip of commercial businesses.

If you believe the phony government figures for GDP in 2020 then I got a bridge over the East river in NYC I’ll sell you.

Swamp, which bridge? I might be interested in that classic old stone one if the price is right.

Mr. Richter, How does interest paid figure into your simple schema?

Spending on interest is accounted for under “consumption” by consumers, businesses, and governments. For example, the amount consumers spend on interest goes into Personal Consumption Expenditures. PCE account for a little less than 70% of GDP.

However, if USD circulating in the US is under $500 billionUSD which was a most recent amount that I had read somewhere, probably not here though- the GDP is outside of the “ballpark”, and untouched by the majority of US citizens earning less than 150,000 per household (2 people employed).

The ball is bouncing around everywhere else, and only the empty can is getting kicked around in this ballpark.

I also hear a lot of dribble about cheap Chinese Goods. This may have been true at one time, but not any more.

I have collection of Chinese knives which are the best on the market. I carry one my car when going into bad neighborhoods in the DC Swamp (Ward 7,8). Since guns are outlawed in DC, the only protection is mace and knives. If some dude comes up to your car and threatens you, you can pull out one of these “cheap” Chinese imports and you’ll these m$fruckers running like scaulded dogs.

One of the few really transparent and price deliniated markets out there is for machine shop tooling. For a given item ( collet chuck, drill bit, end mill etc) the supplier catalogs often have 4 columns of the same item from worst to best. At the bottom are what are termed imports ( most often China), Then USA, then Japan and Finally Germany. These vary significantly in price with the German stuff often costing 3 times what the Chinese stuff does. As you go up in price every aspect of the tool improves from accuracy, balance, fit and finish and longetivity. I find that with most things the “made in the usa” choice is the best tradeoff of price vs performance . If you need it to hold the tightest tolerances, cut the hardest materials and last the longest I buy the German stuff.

Maybe true for your specialty machine tool stuff sc, but IMHO the Japanese chisels and (manual) plane blades are better than any others I have ever seen. Same with kitchen knives, although an entirely different media.

Granted, Leica was, emphasize was, the finest camera lenses, but the early F Nikons were right up there with it also.

Other earlier German stuff, such as the Hasselblad 4×5 graphics cameras back in the day better than the ”Speed Graphic”, etc., not to mention earlier cars, too,,, not so much any more for the consumer products that appear to be following the planned obsolescence model these days.

BTW, exact same chisel purchased for $40 in mid 80s now over $200 in the same store in the bay area,,, FWIW

Still hand made in Japan by the same family last few centuries!!

Wiki:

“Victor Hasselblad AB is a Swedish manufacturer of medium format cameras, photographic equipment and image scanners based in Gothenburg, Sweden.”

There’s more about it on Wiki.

Rodenstock (Germany) has and still makes the finest professional camera lenses. I feel they are a bit better than Zeiss although the Zeiss are very, very, very good. Zeiss made the lenses for Leica. Nikon are good.

Wouldn’t your conscience be better assuaged if the shiv was domestic made?

Every month China sends us junk and we send them money. We are creating the next superpower.

Wolf, why are there no statistics for Taiwan,

which is a large trading partner?

Cancel that. Haven’t had coffee yet!!!

“US Trade Deficit in 2020 Worst since 2008, Goods Deficit Worst Ever Despite First Ever Petroleum Surplus. ”

I wonder how much of this trade deficit is due to imported goods costing more and more in US dollar terms? Is this where dollar debasement is manifesting itself?

Yes, and the opposite is also true, for example in petroleum imports, whose costs ($ per barrel) plunged in 2020.

Oh, my poor, poor country.

Trade deficit, budget deficit or DEBT doesn’t matter Fed is ready to print!

Just look at the Mkt indexes, just zooming every day!

Irrational investing is winning/has WON in this irrational mkt, at least for now! Never thought I would say this!

Going along with numerous div paying ETFs+ Healthcare, Robotic, net security ETFs, gold, silver, some crypto along with hedges + enough cash for my livelihood for the next 5 -8 years since I am retired!

(been in the mkt since ’82)

HOPE for the BEST and PREPARE for the WORST!

What would you do with 1.9 tril? We got some real forward vision going on in Congress as they sit around and argue about which income group gets some free stimulus. In three months the money will have mostly evaporated with nothing to show in real substance.

What if we could look around today and see some benefits from the first blown ten trillion deficit? Or the second ten tril? Highways, bridges, inner-city projects, waterworks, those silly things that actually stimulated the local economies at the time and would continue to do so. Every citizen should at least still be driving a Cadillac at the kind of money spent. The U.S. could have cornered the gold market many times over. Heck, the U.S. could have cornered EVERY commodity market, stockpiling all nonperishable goods at the money spent. It would be nice to drive for ten minutes past a heaping ten-mile mountain of copper if we needed to blow the money on something. That’s how stupid all of this is. But we have our leaders sitting around at this same moment doing the very same things as before.

Exactly. There’ll be nothing to show for it. If the $2,000 “stimulus” came in the form of EBT type cards that could only be used at restaurants, bars, or hotels and the like, I might be on board. Is it a good use of taxpayer money? Unsure, but much better than giving people money so they can buy Chinese made durable goods and iPhones.

The real problem with globalization is that it isn’t working fast enough to prevent a melt down of financial proportions. The standard of living in EM nations is still far too low. Entire continents like Africa are tribal enigmas. The IMF and World Bank have an inglorious record of forcing debts on nations which can never repay them. If we have ended the use of the term Colonization we still haven’t ended the practise. The problem with debt is there isn’t enough of it, or rather the quality of debt is very low. The guarantees are express, hard not go guarantee a faulty product. The Fed accepts monetized debt, and no one has a stake in this country any longer. The quality of all debt by implication, is equally flaccid. No real debt, no real growth.

When you think of what the LONG-LASTING effects are, the face that our country no longer imports (net) petroleum augurs well. Trading partners will come and go… or at least rise and diminish. But eliminating the need to import the juice that sustains an industrial economy is simply critical.

The “long-lasting” effect of sucking all the oil out of America is that it will be used up while other countries still have some. Is American oil inexhaustible?

Hi Mr. Wolf Richter,

Your list of countries by trade deficit misses Vietnam, which should be in number 4 with -70 $billion.

https://www.census.gov/foreign-trade/statistics/highlights/toppartners.html