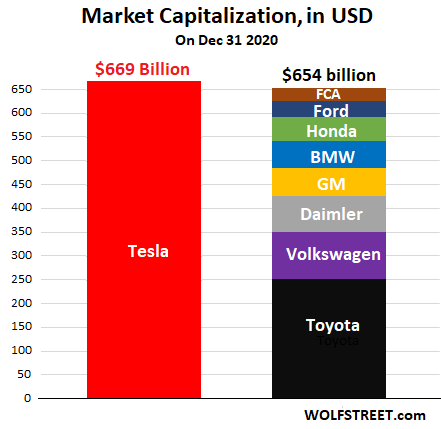

But Tesla’s market capitalization is higher than the combined total of Toyota, Volkswagen, Daimler, GM, BMW, Honda, Ford, and Fiat-Chrysler. The zoo has gone nuts.

By Wolf Richter for WOLF STREET.

Tesla announced today that it finally almost reached 500,000 deliveries in a calendar year, with its 499,550 vehicles delivered globally in 2020, and that it finally hit its target of producing 500,000 vehicles a year – two years behind its promises. Back in May 2016, it had promised in its quarterly report that it would produce 500,000 vehicles in 2018.

But it didn’t happen in 2018, far from it, and it didn’t happen in 2019 either. It finally happened in 2020. That promise in May 2016, like so many of Tesla’s and CEO Elon Musk’s promises, had caused its shares to surge.

Every promise Tesla and Musk issue is worth many billions of dollars in the company’s market capitalization, which then allows the company to raise many more billions of dollars by selling more shares. In 2020 alone, it raised $12.3 billion through share sales, on top of the $20 billion or so it had raised since its IPO.

Never mind that these promises either don’t happen at all, or happen finally years behind the promised date, by which time many more promises were issued that drove the shares even higher, allowing the company to raise many more billions. Musk walks on water, and the SEC is blissfully asleep.

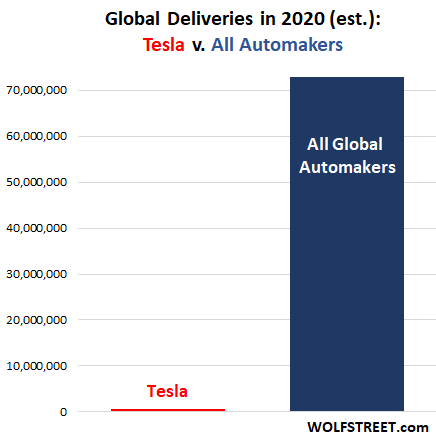

This 500,000 in deliveries globally is a big number for Tesla. But it’s a minuscule number in the overall global auto market, which in 2020 is estimated at 73 million deliveries. Tesla’s global market share in 2020 has reached a whopping 0.7%.

Tesla doesn’t even rank in the top 20 automakers. It’s a small automaker, it’s growing, and that’s good especially in a year like 2020, but it’s just very small. Someday, Tesla might achieve a global market share of 1%.

At the close of trading on December 31, Tesla’s share price of $705.67 created a market capitalization (share price times outstanding shares) of $669 billion. Its market cap is now bigger than the combined total market cap of Toyota (Toyota and Lexus), Volkswagen (VW, Audi, Porsche, and many other brands), Daimler, GM, BMW, Honda, Ford, and Fiat Chrysler Automobiles. And each one of them blows Tesla away in vehicle sales. What a sight:

Tesla did accomplish a huge feat, however: It shook up the legacy automakers and got them to take EVs seriously. This is a true feat. GM and others dabbled in EVs years before Tesla came along, and EVs have been around since the 1800s when they competed with steam-powered cars, but the modern automakers vacillated between laughing off EVs and focusing on diesels and how to cheat on diesel emissions tests. But they finally got it. And that’s Musk’s doing.

They’re all now producing EVs. And prices are coming down. Tesla has cut prices throughout 2020 to remain competitive. This has resulted for the first time in the makings of a real market for EVs, with lots of innovation and pricing pressures all around.

EVs are a lot simpler to assemble than ICE vehicles. EV powertrains are cheap compared to ICE powertrains. Battery technologies have been advancing rapidly. And the charging infrastructure is getting built out for people who cannot charge their EVs at home or at work.

But this is also producing enormous turmoil in the legacy auto industry that will spread over the next few years, including large-scale job destruction in the global components industry that is supplying assembly plants of internal-combustion-engine (ICE) vehicles; and it is creating different but far fewer jobs in the EV space.

Legacy automakers are now investing billions of dollars each in EVs. Volkswagen alone earmarked $86 billion over the next five years to EVs. They finally got it. And they will see to it that Tesla remains a small automaker. But Tesla’s share price is another sign that this zoo has gone totally nuts.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The only question with Tesla valuation is at what point it craters. This is a true story stock, but the story might have a little more legs as the Model Y rolls out to all markets. That will increase the growth. The fall in Tesla valuation comes from 2 parts – one is slowing growth after Model Y is rolled out and the second is falling market share within the EV sector as competitors continue to arrive.

Tesla still has very little real competition for the Model 3 and Model Y. Most of the competition, like Audi and Mercedes, etc are priced much higher and have poor specs. It will take the next three to four years for competitors to reach parity.

It’s important to note that we are still four to six years away from price parity at point of sale between ICE vehicles and EVs so the other automakers do have time to catch up.

Ah, the non-believers have yet to grasp the true and unstoppable revolutiionary zeeal of Tesla. The sales will come, when it’s time.

:)

How many Tesla’s have gone on fire? have bits falling off them? have recalls ignored or quietly fixed under the radar? Lexus the leader in Hybrid and Fuel cell vehicles, finally have an EV SUV, why would anyone now buy a Tesla?

It’s not just car sales. The Tesla zealots believe the company will take over the entire Energy sector.

I really hope Tesla succeeds as a company. I won’t say Musk “deserves” it (because nobody does) but he has certainly “earned” it. Go Tesla!

But yeah… The valuation is ridiculous. Good for Musk for selling more shares and using this exuberance to make the company even more viable.

An EV comprises of a battery and a motor and a control unit.

All can be bought off the shelf.

Tesla buy the motors and batteries and control gear in.

Tesla do develop the software for self driving that has not always turned out to be trustworthy.

‘The only question with Tesla valuation is at what point it craters.”

The question is.. to which point it craters. I say it goes negative.

Crashes like Coyote in Looney Tunes.

Bhahahaha!

Nice one Andy.

The story of “Wolf Street “darling (Tesla) :).

Is the story of a confluence of various ideologies and technologies together with the current URBAN dilemmas that our metropolises are grappling with.

The genius of MR “ Jesus “ the preferred name for pot smoking Musk on Wolf Street vocabulary is as Wolf himself admitted times and again the :

“Reviving of the consciousness of the masses to the damages caused by millions and millions of ICE MV’s” both to our health and to the health of our planet “

That and ( keeping quite about the damage done to Enviroment from mining lithium and other rare earth minerals that goes into the making of EV’s drive gears)!!

However, that being said our cities’s transport problems will NOT be resolved by EV’s as a sole measure to alleviate the destruction Done to them through years and years of lack of planning in areas as diverse as ; jobs , entertainment, services of all kind including health services and the like.

To get back to the point of TESLA, the real battle and the decisive one at that will be ( the Energy Storing device).

Whoever solves this problem, and I don’t mean the current forms of lithium batteries only, will be the real master of our universe for the next 100 years!!!

That is until the human race masters the most visible and effective way of creating ENERGY. The HOLLY GRAIL ,

The fairest of them all.

FUSION

Do you think Tesla’s stock can actually go negative like WTI crude oil did on April 19, 2020 when it reached negative -$40.37 per barrel? That meant if you bought a barrel of WTI crude oil at that moment you received one barrel of WTI crude oil and $40.37 all for free. The only problem is that you needed to take delivery and a place to store it. You also needed a commodities trading account to take delivery of a $40.37 check for each barrel of free WTI crude oil you took delivery on. A couple of months later you could have sold your barrel of WTI crude oil for +$40 per barrel and pocketed another $40 for a total profit of $80.37 with no risk. Multiply this by 100,000 barrels of oil if you had been set up to take delivery, and you got $8 million risk free.

Spot oil held about $11, only the futures were negative. The same scenario could play out in S&P futures. While supply exceeds demand, buyers like pension and hedge funds are fully invested (the inflationary lift suddenly falters) and there is no storage for the underlying. The contract expires with longs paying the Fed to take shares.

Once it does reach parity it won’t just be a matter of price but maintenance, people won’t be changing EVs every two years but every three to four years so the company offering better long term support will win the race.

Why should any car be replaced after 4 years?

My newest car becomes 18 years next month, has 410000 km (250000 miles) on the clock and is still going. Just good maintenance and care is all it needs.

My oldest car is 38 years old, has some minor problems, but will go for another decade at least.

Maintaining your car is much cheaper then buying a new one every time you only need new tires.

OK both don’t have infotainment systems on board. But i don’t care. If i want those i can install after market devices.

U obviously don’t live in Michigan. Where the combination of salty snow plowing & pothole roads everywhere accelerate wear & tear on the vehicle. We also have wild swings in weather, where extreme cold can hurt the internal components (try getting out of bed & going on a jog full sprint without proper warm up). The weather wreaks havoc internally as well as externally. Further, Michiganders are notorious for living far away from basic necessities, so that vehicle mileage increases quickly. Usually vehicles hit 250k miles in half the time u describe.

Congrats on such long lasting vehicles!

Exactly! A friend smacked up his new Model Y (hit a deer) in late October. Body shop said the car would be fixed mid-December due to having to get parts from the Anointed One. Well, 12/31/2020 still no parts and friend is “not happy”.

(Oh, no new date given of repair completion)

@Anthony A.

Tesla could have given that poor guy a new car, to compensate for the unreasonable delay.

I guess Tesla is at a point past the “bait and switch” tactic, a typical strategy in business whereby the company would offer above and beyond service, incentive and perks (above and beyond profitability) to early-adopters, hopefully turning them into brand ambassadors. But we saw that coming, didn’t we? They’ve gradually “phased out” benefits (free charging, free software features, free build options, etc.) to new customers.

A Tesla on autopilot is ten times less likely to crash per miles driven than those using other vehicles.

In as much as some lawyers make a living suing people for millions of dollars over negligence allegations, investing in a little more safety might not be a bad idea. Tesla is a leading innovator.

Musk is THE leading innovator. You have to go back to the South Sea Company to find innovation like this.

The contrarian view is that the entire American economy since 2008 is just debt finance. By that reasoning, stock price should reflect the amount of liquidity/leverage available to a company. Tesla is very good at attracting money. Thus, it’s very valuable. The cars are ok, but not really the point. This point seems to be lost on Tesla fan boys and critics alike.

The self-referential quality of this feels like the end of capitalism — and it is. It’s neoliberalism: it’s asset price growth managed by cooperation between the CBs and equity holders. Janet Yellen got $7 million from Wall Street in the last two years. Powell is rich and long American equities.

There is no way in hell these two are going to allow equity prices to collapse. And they may have a point — how many people want to know what their house is worth in a “free market” or their 401K is worth in a “free market”?

If they buy out the legacy firms in a roll up who knows what it will look like.

Lawrence, here in Norway Tesla has recently been bludgeoned by the Audi E-tron, which completely turned tables on sales compared to Model 3 last year.

Tesla sold 11 517 Model 3s in 2019 and 2 081 in 2020, whilst the E-tron sold 3 228 in 2019 and 7 149 in 2020. The E-tron has also started 2021 with 54 sales vs. 0 Model 3 cars sold (with 359 Electric cars sold in total by 4th Jan). (From the car registration statistics: https://ofv.no/registreringsstatistikk for 2019/2020 figures, with https://elbilstatistikk.no/ for the 2021 numbers).

I must apologise for an error in the numbers I wrote, as I had selected from the wrong month for the data set I quoted.

The correct numbers for Model 3 for the full year should be 15 683 for 2019 and 7 770 for 2020 (a massive 4 200 in December 2020 alone, which seems a bit odd).

And the correct numbers for the Audi E-tron should be 5 377 for 2019 and 9 227 for 2020.

So it’s still a flip in leadership, but less pronounced than my incomplete initial figures indicated.

Edmunds recently rated the Ford Mustang Mach-E ahead of the Tesla Model Y (both are in the same price category). Basically proof that if the traditional automakers really put an effort into it, they can come up with a product that’s competitive with Tesla’s.

Elon’s fanboys insist no automaker can ever catch up to Tesla (and therefore the ridiculous market cap is justified). This is of course a completely ridiculous notion. Competition is coming.

The Mach-E is made in Cuautitlán, Mexico, so Ford will have an advantage on payroll.

As a counter-move, Musk is threatening to move manufacturing to Texas. So this Ford advantage will be short-lived. ;-)

Assembly is peanuts (1k for an ICE, less for an Ev)

Fanbois only care about one thing – the high stock price. It’s no different than the crypto fanbois. All they care about is rising prices. It has nothing to do with fundamentals. The high price is the only justification needed.

It’s a stock market company. The cars don’t even matter. They are junk quality. Decades behind even the US companies before Toyota and Honda forced them to improve. The fancy dashboard *app* appeals to younger people who think that’s innovation.

Any sensible consumer stays far away once they find out the reality of spare parts, service availability, charge locations and battery range under real-world conditions.

Exactly!

Tesla’s valuation is ridiclous.

I can’t fathom why people think there will be no competition for Tesla. So all the German and Japanese engineers that have been making superior products to ours for the last 50 years and have all the resources and industry experience plus logistics setup etc. …. are all going to do nothing!? I bet just the next entries from the majors blow past Tesla. I think what Musk has done is great in many areas and am thankful for him but the valuation etc make so little sense it’s astonishing.

The basic problem here is that us boomers just don’t get it. 2020 will go down as the year that changed it all.

We don’t need to “ get it” we’re olde ?

Touché

Tesla’s most potent advantage right now is their SuperCharger stations, combined with a nav system that knows how to find the nearest station. The owner of that Ford Mach-E will have to use their smartphone to find a third-party charging station, with unpredictable availability and charging times.

Even so, once the rest of the industry gets rolling, this isn’t going to be enough to save Tesla. Their build quality is crap, cost to insure is sky-high, and I’m not a fan of the Model 3/Y design…putting all the controls/display into a single giant center-mounted touchscreen is dangerous and clumsy.

I also ruled out owning a Tesla after finding out that they refused to release service/repair manuals to customers, and getting parts for independent repair (either shop or customer) can be problematic. My target for owning a car is >10 years, and that’s a lot of out-of-warranty ownership.

Third party charge locations are built-in to the Mach-E’s navigation. Like Tesla it also does OTA updates. It also has technology in it that does automatic identification and payment – all you do is plug it in (I believe it is the first non-Tesla vehicle to have this capability). There is a YouTube video of a guy who already tried this a few weeks ago.

Cynical Engineer,

Are you privy to Tesla’s model Y software?

Or other defects in their other software?!

This will be the actual battleground for all the EV’s in the next phase as the battery battle continues in the background.

any ideas?

My take as well. Most EV’s have terrible resale value. Only Tesla’s maintain a decent value on trade-in. The super-charger network is one of the main selling points for a Tesla over any other brand. Charging for other brands is a balkanized arrangement where you might need 10 different apps on your phone to cover all the different charging networks.

It was eye opening watching a friend try to charge his i3 at a new charging station. It took 15 minutes before he could even start charging.

There was an Israeli startup which tried the swap an empty battery for a full one, on the way in 10 minutes. It failed. When the automakers get that people cont want to sit around f I r 20++ minutes the EV industry will take off. ONE BATTERY STYLE FOR ALL. Or maybe 15kW, 45kW, and 60kW depending on size of vehicle. Easy peasy

Yeah, I like that approach also…..a LOT! Fast charging is hard on ANY battery, the excess heat produces extra chemical reactions that are mostly undesirable and probably expensive to counteract, in the battery itself or the electronics. Logistics might have to be worked out, but I see no big problems with transfer trucks if needed.

Standard sizes and proper maintenance of the packs left at changing facilities!…use existing gas stations where possible…..plus lotsa jobs. Just slide it under from the back, everyone likes the SUV style, anyway

I’m also a fan of those limited speed and short range (around 40 mi) vehicles which cover 90-100% of a lot of folks trips…just around town and 35mph speed max. Easy overnight charge without a lot of electrician work or extra equipment, or massive current draw. Sure there is no crash stuff, but people ride motorcycles…and much faster

Plus they are extremely light (EFFICIENT) yet can carry 4 people. I only saw one up close (and a few on the road) when I was taking auto shop in 2011 or so, and it even used lead acid batteries. Not sure if the car companies got rid of the law that allowed them…here in CA…hope not.

Excessively hot or cold climates? Well, batterys have a hard time in both, dress warm or use a swamp cooler….you and your groceries are out of the rain at least.

Regenerative braking is the real key to all this. That energy has to come from somewhere, and what we are really after is transportation EFFICIENCY.

F-1 is really pioneering ways to recover braking energy, hope the car companies are as well.

23 charging locations

new report has taken a deeper look into Tesla’s Supercharger network and Canada is one of the countries with the most chargers under construction. In Canada, there are 23 charging locations under construction, which lags behind the United State’s 52 in-progress locations, but is still more than most other countries. Once all of these planned projects are complete, Canada will have the third most superchargers in the world behind the U.S. and China. Currently, Canada has 64 active chargers, 23 under construction and 11 in the permit phase. The U.S. has 693 active chargers and China has 273.

Read more at MobileSyrup.com: Tesla currently has 23 Superchargers under construction in Canada

What a sales advantage. (sarc)

Canada is a really big country. Having 1 in Monaco is more than enough. Size matters with countries

I read a piece by an engineer who said that the touch-screen stuff was, in his opinion, very dangerous, but he had to do it for marketing reasons – looks cool, etc.

We are after all, just irrational monkeys.

It’s really because software is MUCH MUCH cheaper than wiring harnesses and knobs and buttons. In ALL electronics. The notion that it is “cool” is just being sold by marketing types to……….well…….lots of monkeys, I guess.

My guess is that you’ve never had to budget for the development, regression testing and debugging of sophisticated software. Note: software needs electronics to live.

No. I’ve always been builder/fixer worker bee. But I have programmed an 8081 in hex, for a class, and have pretty much been involved in electronics since tubes, microwave radio, RF, multiplexing, etc. I even ran apps on an IBM 360 using punch cards. And was good at changing parameters on VMS OCRs and writing little command language programs in same. Also worked on a lot of discrete component circuit boards, logic probes and o scopes and such. Also watched the evolution if the router and worked with T-1, Ethernet, and CAT 5 and fiber optics a bit, building LANS and connecting to WANs. I could babble on, CO2 lasers, thin film optics, CMM, machining with punch tape, anodizing, etc,etc, but you get the era, I’m sure. When it all went to windows and super CPUs I was locked out of it all, and I lost interest, and so have been out of the game since ’02. and just moved off grid and built my own systems on a breadboard for fun on rainey nights.

But I still stand by my original point, once that program is written and “debugged”, it’s free forever.

Hardware is more costly, why else would it be disappearing from everything electronic from alarm clocks to dashboards?

Feel free to set me straight if it really is driven by consumer desires and not cheaper manufacturing….or just tell me I’m an electronic relic from another time :-)

PS-I always get the dumbest flip cell phone I can and it even has more menu “features” than I care to memorize.

Oh, just a kinda funny side (that help might explain my thinking and possibly prejudices)

Nearing my last days punching a clock, us E. Techs hated reading software documentation and when there was just no way around it, would throw dollars into a pool until someone said, “OK, I’ll go do it”.

I was never the one who read it.

Very good point about serviceability. Tesla is like Apple: when it’s time to repair your Tesla years down the road, you’re at the mercy of the company. Of course, they’ll make it so that it’ll be more tempting to buy a new one instead of repairing the one you have.

And yes, Tesla build quality is subpar. I experienced it first-hand.

I too have a nav system that can find charging stations; it’s called “Google Maps.” Another great example of Tesla selling ice to Eskimos.

Ummmm…I dunno…

As an BMW M8 driver, Tesla and Mustangs appeal to VERY different audiences (I have NEVER been challenged to a stop-light street drag by a Tesla driver, some of whom are legitimately faster).

On average, Teslas seem to be owned by the 40+ crowd; Mustangs, well, let’s just say “younger”.

I can’t be the only one on the planet to note the Mustang Mach E styling looks like crap, and here’s the killer: it’s specs say it’s slower than all Teslas.

If the car can go 100mph, most buyers don’t really care about max speeds.

Ford will be coming out with a GT variant that will be comparable to the Tesla Y performance (the fastest variant is expected to do 0-60 in 3.5 seconds).

Personally, I like the look of the Mach-E better than the Model Y.

I wouldn’t get too hung up on the name. The important thing is that Ford’s very first attempt at a from-the-ground-up EV is very commendable, even some die hard Tesla fans have admitted as such (check out some of the videos on YouTube). And this is just Ford’s first try. I have no doubt that as EVs get closer to price parity with ICE vehicles over the next 4-6 years we will see other automakers catch up to Tesla.

The only way Tesla moves forward is to use it’s massive wall of cash is to buy bitcoin( per Max Keiser).. the problem for Elon Barnum is that in the face of massive $$ printing is the macro loss to inflation..not to mention the legacy auto makers entry in the EV market. As 1 commentor points out this EV craze is burdened by a rare earth production issue..maybe the fuel cell alt will actually be the future( Scoty Kilmer).

To be clear, I’m dumping just on the Mustang Mach E.

The ICE Mustang has a long & storied history, and has captured & maintained a very classical look (and performance options).

Are there any Tesla quality stats like:

# of Tesla’s exploded in fire?

# of Tesla’s locking drivers inside their cars?

# of Tesla’s veering off and colliding other vehicles?

# of Tesla’s with bumpers falling off while driving?

My favorite Tesla feature is the flaming projectile batteries. A few weeks ago a Tesla in Corvallis Oregon hit a tree and split open shooting small red hot battery cells everywhere. Two homes were almost incinerated. A bunch of the flaming batteries crashed through one families living room window, burning holes in the sofa.

Was it on autopilot when it hit the tree?

No, the driver was stoned.

Ah, a different kind of autopilot!

The real point is that the driver was doing something like a 100 mph and survived. The Teslas are very safe vehicles.

I thought the real point was that Tesla’s autopilot would have prevented all this. (sarc)

BB

Mustangs have also had their teething problems:

“…Ford has been sued more than 70 times by people burned in rear-end collisions in classic Mustangs. Most suits have been settled out of court, without publicity…”

https://www.cbsnews.com/news/mustang-a-classic-danger/

The lowest priced Tesla, Model 3, most basic model has a $37,990 purchase price.

Average/Standard Tesla prices are around $50,000 per vehicle.

“EVs are a lot simpler to assemble than ICE vehicles. EV powertrains are cheap compared to ICE powertrains.”

You’re comparing across categories. Tesla’s vehicles are “luxury” (S, X, high-end Model 3) or “near luxury” (low-end Model 3). They compete with BMW and Mercedes, not Chevy.

Can’t bring any of this up to my long TSLA and long BTC friend. He’s laughing his ass off at my 60/40 balanced portfolio…

He won’t be in 10 years…

He wont need 10 years. A few years long BTC and TSLA will be enough.

If I listened to my coworkers on Wall Street several years ago when I started to accumulate BTC, I would have left a boatload of money on the table. To each his own.

You’ll get to laugh your ass off some day :-]

We must have the same friend. My good friend has been long Tesla and BTC since December 2018, when he tried to convince me to go all-in on both. I declined on both. Can’t say that was a smart financial decision on my part thus far. Apparently fundamentals don’t matter at all, you just get rich for nothing.

Maybe this time IS different….

But to me it all looks eerily similar to the dotcom bubble. The religious belief in “sure things”. I have seen people going from nothing to millionaire and then back to nothing.

For me the current bubble is the third mega bubble that I have experienced in my investing life and arguably the biggest and most scary one. Unfortunately, I never believed in 2009 that they would blow another one after the GFC had made clear the lasting damage that asset bubbles cause, but here we are.

Famous quote from Paul Krugman in 2002:

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

We still have the same type of people in charge with the same type of “solutions”. I’m bracing for what is coming, but there is really nowhere to hide in this “everything bubble”.

I hate Krugman. He’s a crackpot.

It’s fun to criticize the CBs and Wall Streeters, et. al. for the decisions they made.

Every one of you armchair QBs knows the situation we’re in.

Now, let’s wave the magic wand, and you are now the Decision Maker.

Tell me how – for the U.S. economy – you rebuild:

a. HH income

b. Economic competitiveness West .vs. East

Keep it real, no slogans, please. Let’s hear it. Please insure that your answers are politically possible, and economically viable.

Tom,

A Comprehensive Green New Industry would be a start…..and with all the intensity and dedication of a WW2.

Yeah, many will feel cheated, ripped off, screwed, etc, etc.

So what’s so new about that?

That’s easy, Tom. If I were in charge of the FED I would immediately start raising rates, and I would reduce speculators to a crying mess when I signaled with my forward guidance that the target would be well above 5% and that we would be raising for years to come. The DOW might fall to below 10k. Deal with it.

I would gut regulations and red tape for all businesses, but especially small businesses. I would abolish all income tax and institute a consumption based tax, however there would still be capital gains taxes. You would be rewarded for hard work, not so much for speculating. CEO’s would be back to getting paychecks instead of stock options, etc.

I would penalize all American companies so heavily for producing abroad that it would be cheaper to produce in the US than pay the onerous amount. I’d raise tariffs on all imports. I’d also end most visa programs to import cheap labor. This would be in conjunction with completing the wall on the southern border. Companies would be forced to use e-verify and the penalties for employing illegal labor would be so strict that a 2nd violation could put them out of business.

I’d end all social programs for undocumented immigrants. If you are not here legally, you get nothing. I’m sorry. Go home and get in line to immigrate legally. It’s going to be tough, but that’s life. All other countries do it, c’est la vie.

I’d make payday loans and other high interest loan shark operations illegal. I’d ban all crypto.

I’d make lobbying a crime. No more buying off politicians who work for special interests and foreign countries.

I’d end all government subsidies for businesses. No more federally backed student loans, and housing loans, etc. Nope, that just drove the price of everything up. We’re going back to the old free market, where a lender has to hold the loan and eat the loss. Don’t like the subsequent housing market crash? Too bad, it’s about affordable shelter now, not $800k starter homes.

Are we having fun yet, Tom? This was just off the top of my head, and I’m tired. I could go on for hours.

Tom: no need for a revolution for the big obvious fix: health care.

Harvard did a study of US health care that noted every billable item or service is more expensive than anywhere else in the world.

Some of the numbers are mind boggling. I questioned a number on WS only to have it confirmed: prescription drugs are 12 % of TOTAL wholesale. 12% of everything!

A posterchild is insulin, which is ten times the Canadian price. One US state has just made it acceptable (subsidized?) to travel to Canada for meds. But that is a band aid.

When a well- known US Senator (Rand Paul I think) travelled to the Canadian Shouldice Clinic for surgery, a number of US online comments ‘explained’ this by saying it was a ‘private’ clinic and not part of Canada’s public system.

Of course it’s a private clinic. The vast majority are (the far north may have exceptions) The doctors are not gov employees, most of the specialists are incorporated. The only part that is nationalized is health insurance, which will cover most of the cost for any Canadian at Shouldice. But not for Sen. Paul (R) who travelled there because of its excellence.

But why Tesla? Musk hasn’t invented one damned new thing…nothing!

I think he is just some kind of marketing (BS) expert that has sold a whole lot of “I honestly don’t know what”, because I sure wouldn’t buy in if I did do stocks.

PT Barnum would even be amazed, I’m certain of that.

NBay

4 thoughts for you:

1) The mere act of somebody “inventing” a brand-new gizmo doesn’t mean anybody will buy it (ie: the new thing becomes a “who cares’)

2) Your statement “…Musk hasn’t invented one damned new thing…nothing!,,,” is factually & wildly incorrect, and Tesla, SpaceX, and the Boring Company have hundreds/thousands of US Patents to prove it

3) Of course Musk is a marketing genius. Congratulations! You have now demonstrated a firm grasp of the super-obvious.

4) Whatever you do, do not quit your day job.

Yes sir.

I think we should all buy a Tesla to help China’s economy. We should reward them for inflicting a pandemic on the whole world.

Tesla has a plant in Fremont and building another in Austin. Buying a Tesla here probably won’t help China.

Oh come on, if factories make the majority of the profit of products the first world countries would never outsource manufacturing. The truth is the ultra rich got 1.8 trillions rich since the pandemic, they run Wall Street and Congress, way beyond what any factories got.

Top auto exporters to US: 2019

Japan: US$39.9 billion (22.2% of total US imported cars)

Mexico: $38.1 billion (21.2%)

Canada: $37.8 billion (21.1%)

Germany: $18.1 billion (10.1%)

South Korea: $16.3 billion (9.1%)

United Kingdom: $9.9 billion (5.5%)

Wolf,

What do you think is realistic revenue for Tesla’s FSD at $10,000 once or $1000 per month if it finally works? I think FSD is the only thing that might save the stock.

I think people buying FSD from Tesla are nuts and are risking their lives with a beta product.

What is FSD? I bet there are many reading this that have no idea.

I was, however, very impressed with your use of jargon.

Full self-driving

Customers may be foolish now, but would a successful FSD bring in enough cash to support the stock?

Where can I test drive one of these?

LOL A $10000 feature that would make the fun-to-drive experience, the thrilling acceleration and the precise handling of an expensive car, all non-factors, essentially turning a luxury sports car into a luxury taxi.

How many will really find this proposition attractive when it’s finally ready in 2029?

Full self crashing…..

why not spend it on cold fusion (or hot fusion for that matter, it’s a big money sinkhole like Reagan’s Star Wars Defense, only it never went away) I know a guy who spent his whole career woking on it at Livermore…..PhD in tritium….loved his job but didn’t think it would ever work…..even got to take lots of trips to the South Pacific and brought steel OD colored gal cans of 95% ethanol to our Abalone feed parties….Not denatured.

Could Depend on the product liability insurance premiums (reference impact on Piper & Cessna small aircraft market)

Pbfurn:

Full Self Driving. Looked it up for ya…

In his book “The Invisible Rainbow: A History of Electricity and Life, ”

author writes about the untold and forgotten history of electricity. He deals especially with the potential hazards of exposure to electricity in even small doses. So now we have vehicles with electric battery packs loaded with energy powering metal vehicles. In effect, bathing the occupants with stray electricity. Just as when radium first came out and was used to x-ray people willy-nilly, nobody thought of the possible adverse effects of exposure to radiation from a new technology.

Until the Rockefeller-funded Flexner Report of 1910 came out, American medicine was a wide-open area where research was done on homeopathic medicines, the effects of electricity and on all potential causes of disease. The Flexner Report ended that openess, turning medical schools over to Big Pharma. Medicine became a religion, no longer a science. Among other things, Alexander Flexner thought blacks were unfit to be doctors and forced the closing of 5 of the 7 black medical schools in America. So today, doctors know pretty much nothing about what happened in medicine before 1900. Back then, doctors knew about how hazardous electricity could be even in small doses of continuous exposure to EMF radiation. I wonder if anyone did any study of Tesla drivers to check on their cancer rates.

Flexner might have been a racist, but the Flexner report was instrumental in a full century of American medical science superiority. Medical education prior to 1900 in the US was largely a sham.

Pre-antibiotics, which came even later of course, doctors mostly butchered and murdered people, or -the best ones – held their hands very kindly as they died.

Isn’t a car essentially a faraday cage?

Bet:

Yes, and if you play AC/DC loud enough, it will nicely power the car!

Hence ‘Thunderstruck’, WES?

Yes, but inside, using Bosch’s CAN Buss, you have a complete high frequency LAN, with a main computer and 6-60 slave computers (actually the number of slave computers and what they each control is unlimited).

But one intermittent short or open on that buss and all sorts of weird things happen. Wipers go on, lights flash, or as in one famous and shoved under the rug incident, full throttle. No, it wasn’t a floor mat.

NTSB bowed out to the car makers, but there was still a huge cash settlement

How does one get bathed in electricity?

“How does one get bathed in electricity?”

We are all continuously bathing in deleterious electrical fields 24/7 nowadays without any effort.

Wireless communications technology uses radio frequency microwave EMF radiation. There have been incrementally large exposures in power density and frequency with successive generations of this tech– 2G, 3G, 4G, and now 5G.

Despite wireless industry’s counter claims and faux innocence, numerous studies have shown the adverse biological effects of even very ‘low-level’ RF/MW radiation exposure.

This is the largest biological experiment in history. And you are the guinea pig, without your informed consent.

I will take my chances now with a life expectancy of about 80 over the life expectancy in your wonderful pre 1900 era. What was it ? Maybe 55?

And don’t forget the RF/MV mankind has been constantly bathed in from astronomical sources—including such sources as the Big Bang, black holes, quasars, neutron stars, novas, super novas, and our sun. Just remember to keep your tin-foil hat on.

RE: bathing in EMFs:

Keep in mind folks that in addition to the EMFs, WE the Peedons are also constantly bathing in oceans of germs of every kind, as your mom probably told you and any bacteriologist or microbiologist will confirm; micro plastics of every kind, as has been clearly recently reported; tons of different varieties of animal kingdom hormones, both synthetic and natural; and, unless in a really clean city, tons of pollens and other plant hormones of many kinds; human skin detritus anytime inside almost any building, reported to make most of household dust… etc., etc…

No wonder Unamused came up with the name on here of, “We the Peedons,” eh

Shouldn’t you move away from the keyboard?

Stand in the sunlight.

That’s pure EMF, not electricity that can also produce it.

From what I can gather Tesla has destroyed capital for at least 12 years in a row. Worse than that Musk is forcing other car makers to deploy additional capital to make the product which is an automobile. If we want to fight global warming it could be worth it. That’s above my pay grade. I can say it violates everything I have ever read on investing. For example Warren Buffet talks about “owner earnings”. Maybe you might be willing to pay 15 times “owner earnings”. Money you keep having to dump back in the business is not an “owner earnings” that can be put in your pocket. Tesla doesn’t have “owner earnings”. This is one of the first mistakes Buffet made when he purchased the textile business Berkshire Hathaway and dumped the latest technology in it year after year. Finally he just closed it down because it was a lousy business to be in. Tesla is a speculation. Maybe caused by Janet Yellen. When the economy was doing pretty good she could have transitioned the US back over to real interest rates but she kept interest rates pegged below inflation and the malinvestment will continue on. Politicians deploying capital with credits and handouts as we eat up the real savings in the country.

Old School:

From Wolfe’s “graft” above, we can see that Musk is forcing all the world’s other car makers to destroy shareholder value!

Sheesh!

Radium does not produce x-rays. As radium decays, it produces alpha particles, beta particles and gamma rays, but not x-rays.

Learn Science

Gamma rays are generally more energetic (ionizing) than x-rays.

Sorta like E=hc/wavelength?

Maybe the pot eating/smoking is prophylactic. Or at least they can tell themselves that.

It depends on the “monetary value” that economists attribute to human life.

“Cost-benefit analysis hinged on an ever-changing calculation of the monetary value of a human life. If a life could be shown to be expensive, regulation could be justified. If not, it would be blocked or scrapped. The EPA, in 2004—to allow for more lax air pollution regulations—quietly sliced eight percent off their value of human life, and then another three percent in 2008 by deciding to not adjust for inflation.”

https://newrepublic.com/article/155205/tyranny-economists

in-reminds me of my childhood (’50’s, world population ? 2-3 billion) and my elders (military and domestic vets of WWI/II) often commenting about ‘…how human life has so little value over there in Asia…’ (curiously not giving equivalence to the concomitant human carnage in Europe of WWI/Spain/WWII). Little wonder, now that global population is knocking on the 7 billion level that an individual’s worth is appearing to be more and more linked to a monetary calculus (China’s ‘social value’ score a harbinger- At last, here’s something that will let government be run as a ‘business’-no more ‘citizens’, only ’employees’!).

may we all find a better day.

Arthur Firstenberg, the author of “The Invisible Rainbow,” did not complete medical school due to illness, which he attributes to electromagnetic hypersensitivity brought on by receiving over 40 diagnostic dental x-rays. [wikipedia] So he has a bias against radiation, unlike our paid off politicians. The comment above about America’s medical superiority are seems at odds with all this talk lately about many people having co-morbidities that make the people sitting ducks for CV-19. The Flexner Report was NWO crap. A major reason for the increase in life spans in the last 100 years was public sanitation, clean water and unadulterated food.

No argument with last sentence…..in fact if you take out infant deaths, there is no significant change at all between then and now. And I don’t know about the higher frequency stuff like cell phones……so far so good, and I’ll likely be dead before the facts are in.

When I was real little shoe stores had x-ray machines you could stand on to see if the shoe fit.

Or the women who were hired to paint radium on watch dials and licked their brushes to keep them straight.

Most everyone too exposed to either got cancer.

Nasty learning curve.

Sounds like a wild read, but no thanks. I’ll just sit here and soak up the 60 cycle EMF…..ahhhhhh……

PS-Radium doesn’t produce X-rays…..X-ray tubes do. Think radium produces alpha particles…..not usually a problem unless you inhale or eat it.

I do hate big Pharma, though, with a passion.

Wolf – What do you expect SEC should do?

I admit that I am a Tesla and SpaceX fanboy. But I do agree the stock price is way way way overvalued. Sooner or later, the stock price will be adjusted by reality. And Musk can be somewhat of an ass and workaholic.

A couple of other things to add to the conversation:

* Tesla also builds utility-scale battery installations. An installation helped an Australian province cut costs and improve service by quickly providing electricity when demand spikes. The batteries are charged by solar and wind.

* Tesla also has a solar arm (he acquired a relative’s solar company) and Tesla has had problems getting it off the ground, but from what I’ve read they make a pretty good solar build that includes Powerwall batteries. The grid can lose power and your home can still have electricity.

* Musk also changed the rules of the game in the space industry via SpaceX. He cut costs significantly by building a first stage that can land on its own and be re-used. It’s forcing space agencies in other countries and aerospace companies in our own country to change and become more competitive.

It’s easy to find faults and problems with the person and his company’s products. But he’s done at least a couple of things that nobody reading this blog, including myself, would be able to do.

Even from the chart above you can see that all the market cap on the right is probably in the right range to value all the world’s automotive capacity. The Tesla bar on the left is excess funds ($600 billion) that people are paying for earnings from auto production that most likely will not materialize. The unknown is how how much government subsidiEs the profit of a car. If instead of profit per vehicle being $2000 the government subsidizes profit up to $4000 forever then maybe you could justify paying twice as much market cap for automobile industry. With government throwing out money right and left a $600 billion handout to the auto industry isn’t beyond the possibility with green new deal.

Actually, asset markets are perfect destroyers of excess liquidity, and bubbles. They’re preferable to hyperinflation. Overvalued inefficient companies burn the cash by spending it into the real economy. Once the mania dies off, trillions on paper will be wiped out. This will clear out the debris accumulated in the financial system and the deadwood in the economy, with limited impact on the currency. They just need an excuse to let the controlled implosion happen over the course of a few years. The alternatives, debt default or hyperinflation are uglier.

OK- so what, he’s done ” at least a couple of thing that nobody reading this blog, including myself, would be able to do.” So what, It’s paying off for him, but is it really worth anything to anybody else, even if they aren’t reading this either?

He’s leaving a trail of junk on land and in orbit, that everyone else will have to clean up, because he sure won’t.

That’s a really good question. What long term value are Tesla and SpaceX producing for humanity? And what are the long term consequences?

I do agree that new technologies continue to produce more garbage and damage to the land, just like the preceding technologies from which we benefit. In the case of SpaceX, it does look like there will be more stuff in orbit that will affect our view of space.

For the benefits, in the case of Tesla I would say that we benefit by having less pollution (e.g., less car exhaust, fewer coal plants) as car manufacturers shift to EVs and as energy storage for solar and wind becomes more practical.

My assumption is that the production of this technology is less damaging and expensive than what it takes to produce current internal combustion engine (ICE) cars and their fuel, and to mine and transport coal. So I could be wrong.

For SpaceX, we as a species will continue to explore space. The benefit is that SpaceX is driving down the cost to do so (less waste in human labor and materials) and driving development of technologies that will indirectly benefit us, just like the US space program has indirectly benefited us up to this point.

What I don’t know is how damaging it will be to have hundreds of rocket launches per year in the effort to build something on Mars.

Yeah. The extra computer power and precision servos and stepping motors now available allow that fancy relanding stuff. I guess it’s cheaper than the throw away solid fuel boosters on the space shuttle, don’t really know…no “O” ring problems, anyway.

But it’s all just similar to off the shelf military hardware used on their new aircraft….no pilot could react fast enough to do the maneuvers they can do, or even fly some of them. I watched an F-18 fly the length of the runway at around 45 degrees AOA 100 ft off the ground, at maybe 100 knots, and that was 10 years ago.

But how much of the other stuff you mention goes with the car company valuation when you buy it? I really don’t know, but if buying TSLA only gets ya into the car action it’s a screw job for sure, I think.

Teslas would be much more affordable if they got rid of the expensive exploding battery and replaced it with a Ford Pinto gas tank. They would still crash and burn, so customer satisfaction would not be affected.

ICE vehicles per mile have more fires than EV vehicles. Many more.

I’ve had gasoline powered cars in my garage for 60 years now and not one of them have started burning in the middle of the night spontaneously. I know, I must be “lucky”!

Data is data, regardless of what your personal experience is. I can warm my EV up in my garage and not have it kill me from carbon monoxide poisoning. Can you do that with your ICE vehicle?

“I can warm my EV up in my garage and not have it kill me from carbon monoxide poisoning. Can you do that with your ICE vehicle?”

Yes I can. It’s called a block heater, and my truck is plugged in all winter. It doesn’t need to be running. I start it up and leave and I have heat right away.

Too bad I can’t post a very well done spoof video of a Mercedes AA battery powered car!

I think Wolfe’s commentators would enjoy the laugh.

The opening of the TSLA truck factory in Austin Tx has been delayed . It’s car factory in Germany has been delayed due to water pollution issues.

It has been forced to lower prices on its cars produced in Shanghai.

It’s stock price has almost doubled since early Nov. based ONLY on forced buying by passive index funds .

The delays on their new factories are not that significant and lowering the price in Shanghai was possible due to increased manufacturing efficiencies. The real pressure has been put on their competitors to stay up.

Tesla will have enough market cap to buy out Uncle Sam one day.

I can see it already.

President Musk.

Nope. Foreign-born. Constitutionally barred from becoming US Senator and US President.

President, yes, but there is no natural-born citizenship requirement for U.S. Senators.

Thanks. Noted for my upcoming campaign for US senator :-]

There is a God somewhere I hope! OMG thank you wherever you are, or will never be!

Ok, ok…..understand, but maybe he could run the Fed instead. He can turn tweets into dollars in a round about way.

??

But once he’s bought out Uncle Sam, he can write his own constitution …. ;)

Tesla is the honey pot company blessed by Wall Street who shall buy out its competitors and or the significant tech related to the ev car business. Just putting a positive spin on this…

Other manufactures are taking up EV’s not because of Tesla so much – it’s because of Government mandates.

They would have probably preferred Tesla to remain a niche maker.

TSLA are Peaking or have Peaked as a Car Company.

It’s no longer the EV Top Seller in the DEU Market; and the European Makers are just starting up.

DEU are also going to use H2 via NS2.

CHN just Licensed HFC Tech from Toyota. CHN Makers are Rolling Out BEVs as Well…

JPN Makers are already Producing BEVs, PHEVs, and HFCVs. Shining Example is the Honda Clarity, which are available in BEV, PHEV, and HFCV Variants – Excellent Production Strategy.

NewGen TM_Mirai have Ranges of 850KM/530ish-Miles.

That leaves California (where 90+% of All BEV Sales were made, IIRC). All AutoMakers Rolling Out their USA_BEV Models there.

2021/2022 should be the Years we see some Competition in all Pricing Classes of Alternative Energy Vehicles.

Just don’t Short the Stock – ROTFL!

I’m still waiting for BMW to make an F30 sized, saloon shaped EV.

So far their efforts were a weird cardboard interior, mini mpv i2 with expensive panels, and is useless for a family, or an i8 which is useless for a family.

Both had silly blue accents and daft ‘ev’ styling which will date badly.

I saw an Audi etron thing the other day with cameras for wing mirrors and then in each door interior had a little tv screen… yes ‘cool’ but just daft unless it has pattern matching AI running to do warnings, helping you to parallel park, maybe as a dash cam etc etc.

When the mainstream get around to making EV cars that look normal, are normal, and aren’t styled like some ‘future vision’ then they’ll do a lot better.

Ironically Tesla are the only ones making a ‘normal’ looking EV right now at somewhat normal prices.

The only EV I’d buy is still a Tesla S… which is why I don’t own an EV yet… because there is no way I’m paying £££ for a car that I might not be able to get fixed or buy spares for in 5 years after reality bites.

The mainstream car manufacturers are still 5 years behind.

They need to get moving before Tesla get any further forward.

– “Tesla did accomplish a huge feat, however: It shook up the legacy automakers and got them to take EVs seriously”

Was it Tesla or the legal pressure on the ICE cars in developed countries?

I lot of time big egos make lousy CEOs. Remember the esteemed Jack Welch who ran GE stock value up to be the biggest in the country and never missed an earnings estimate. He left a deeply flawed company that would have went bankrupt in the great recession unless saved. He got filthy rich and got a younger wife out of the deal. Some people still respect his legacy, but the grandma’s depending on the stock for retirement lost 90% if I am notistaken.

They run off with the swag.

The defrauded grandmas lose heart and are buried.

Thus it has always been.

Business has never been a morality play, much as we would wish it to be.

The more money, the less heart.

‘When men invented money, they went mad’ as the Ancient Greeks said.

Great post. Greek thing especially good…..remember where you got it?

I find Tesla an interesting case, but that has nothing to do with the vehicles they produce!

The interesting thing about Tesla is that they can print their own money. It’s a weird self-fulfilling prophecy. Because their stock price is so high, they can “print” $10 billion by issuing more shares and only dilute their share capital by 1.5%. And that money can be used to invest or buy real things of value. No other car manufacturer can pull that off, so in a kind of self-fulfilling logic their share price goes up.

The other car manufacturers are selling way more cars and many are profitable, but they are laden with large amounts of legacy debt and they have to invest billions to make the transition to EV. These investments are not going to increase their profits, because EV will simply replace their existing ICE business. Disappearing ICE business also means stranded assets, but the debt only grows, so this will be a problem.

To make things worse, EV cars have less margin than ICE and I expect that will remain so in the years to come because they are much simpler and more prone to commodification. You’ll end up with a couple of electric engine and battery manufacturers. Much of the added value will have to be in branding, styling and features. Here you are going to compete with well capitalised new players like Apple. I also expect some Chinese OEMs to emerge that will serve the low-end at ridiculously low prices (almost zero margin) in a few years time.

To me the EV car market looks like a really lousy industry to be in, that requires massive investment but probably low margins and lots of competition going forward. Tesla at the moment has a clear advantage over the other manufacturers as long as they can keep their high share price (=money printing press). But I expect that eventually you’ll end up with a low margin business without much of a protective moat. Tesla is not going to be the Amazon or Google of the automobile industry so it shouldn’t be valued as such.

You got the new business model in 25 words or less, You get the gold star for today! maybe for this century!

“Because their stock price is so high, they can “print” $10 billion by issuing more shares and only dilute their share capital by 1.5%”.

Countries (Germany, Japan, China) will help their national champions, and protect the jobs. Also, the EV craze also helps legacy auto makers who play their PR cards well. Look at GM’s stock price. So printing money is not exclusive to Tesla.

“Investing billions”, you mean like what Tesla must do as well?

Debt and profit matter little if legacy automakers successfully give the impression they are in the EV game, especially in these times of inflated assets.

Intosh, I think his point was that Tesla doesn’t need to “invest” its own money in the traditional sense. All that it has to do is issue new shares.

I don’t think you can call machinery and equipment “stranded assets.” They are depreciating assets that get replaced regularly by the automobile companies. Approximately one-third of COG is depreciation.

Tesla reminds me of a company from 20 years ago called Nortel. It was in communications and got hot when fiber optic networks were behind deployed. Weren’t making money but stock market went up to $398 billion Canadian. Went bankrupt pretty quickly with a 98% wipeout for shareholders. It was originally a boring telephone company so when it went belly up it hurt a lot of pensioners. It got to have 1/3 market cap of canadian total stock market and then all that “wealth” evaporated.

Evaporated is the wrong word to use, transferred is what happened, what always happens :-]

Yes, and the new Nortel is called Ring Central (RNG)

One of my neighbors in Los Altos had 34 million in Nortel options in 2000. Ended up with pretty close to nothing.

A very close friend of mine in the Reserves had the same thing happen to him. He was part of a company that got bought out by Nortel before their stock went to the stratosphere. One of the other Reservists was a stock broker who BEGGED him to diversify but he kept saying “the price is just going to keep going up and up and up!”

You can guess how the story ended. That phrase is almost always the sign of a bubble.

Worked at a company whose VP of operations was a former Nortel Exec. A total incompetent. He managed to drive that company into bankruptcy.

The main problem here is that we boomers just don’t get it. 2020 will go down as the year that changed it all in the stock exchange.

How so?

I think “Old School” may have nailed it here…

My next door neighbor drives a Tesla and drinks the Tesla Kool-Aid. On New Year’s Eve I asked him, “Would you invest $1000 of free money into Tesla?” He was quiet for a moment and then quietly and maybe with some embarrassment said he would not invest the free money into Tesla stock.

Even the believers have become dismayed by the unbridled stock price.

Social media loves a good story to build up only to then knock it down. Once all the Tesla cars hit the road and it doesn’t have the infrastructure support for first, second and third owner cars, the shiny veneer will wear off when Tesla owners cannibalize the brand on social media and potential EV customers start turning their attention and purchases to other automakers.

McKay’s “Extraordinary Popular Delusions and the Madness of Crowds” should be required reading for anybody with any kind of investments, especially E/V’s, Bitcoin, and marijuana.

In the US, it is easy to believe that Tesla is dominating the E/V market in China. It is always to believe in something you can’t see first hand. In reality, it is easy to see on the street in China because E/V’s have a special license plate that is visible from a great distance. In a long day of traveling around the city of Qingdao I used to see 1 or 2 Tesla’s all day. Now it is harder to find the “Tesla Of The Day”. On the other hand, I can easily see several E/V’s from Chinese companies every MINUTE on any busy street. These are huge state-owned companies. Who will prevail in this contest?

All the sarcastic mud thrown at Musk and Tesla is perfectly justified (great article!) and well-deserved.

But one simply has to realise that it is NOT about car making at all.

It is really a psy op, psychological and social engineering, and, of course, a wonderfully lucrative scam – with full official sanction.

Some have commented elsewhere, on another blog, that while it has become clear that government can no longer function well (see the Obamacare rollout, and now the pandemic response) and the societal rot now on full display, the resultant anxiety is making people search for magical solutions and god-like figures.

Could it be that Tesla owners handle the multi-faceted anxieties of these times (wanting to be seen as hip and woke yet also needing a status symbol, but owning a Tesla only confirms their uneasy privilege) they identify with the pot smoking Jesus-Elon who offers the psychic solution.

Does being a true believer in Tesla and buying the stock makes one feel like they’re handling things just fine. Or have rich kids always sported that cavalier “what, me worry?” attitude?

I’m probably over-thinking this.

People were Tesla fanatics well before the pandemic. Not saying the pandemic didn’t affect thinking, just that it isn’t particular to the pandemic.

Human behavior, on the whole, does not change unless forced to change (Zoom during Covid) or the change requires minimal physical technological effort (Zoom and Uber).

That being said, The sleepy 800lb gorilla automakers are being forced to wake up based on the amped up antics of the 1lb monkey that slipped into their cage.

The best thing to happen for Tesla in the short term is to have become the zoo’s main attraction. The worst thing to happen for Tesla in the long term is to have become the short term attraction.

Kudos to Tesla for being a disruptor and creating change. But, in capitalism, you don’t get a “get out of jail free card” for being first, better, faster. If anything, you become a bright target for others to aim for. In the long run, Tesla needs defendable and distinguishable differences from other EV automakers at a competitive price to stay relevant.

“There’s a sucker born every minute” — quote attributed to PT Barnum.

Updated for today’s environment that should read ‘every second’.

PT Barnum did not say it, but embraced it.

“Hungry Joe” vaguely credited for the origin.

Espoused from (late 1800’s London confidence men) “Every new day a fool is born.” Ymmv.

A pretty good indicator to me is the yahoo conversations page for a stock. If you are buying for the long term you probably want to do your homework on the business. You can learn some information from other stock holders on the message board. There are companies that are off the radar screen and go days without a new post. Tesla’s message board has several posts per minute. Plus you can get an idea of how much is just foolish gambling and bragging.

When you buy Tesla you are buying Musk. Corporations have always been a personality cult with their CEOs. This new age even more so. When Neumann tried to bring WeWorks public his own private narcissism caused the underwriters to pull out. Tesla without Musk is the catalyst for a more realistic valuation.

So Tesla will collapse once Musk hops on a rocket to Mars?

Hopefully that happens soon ;)

It’s a scam. Maybe not to the degree of Herbalife ripping off poor people with pyramid schemes or Benny Hinn and Creflo Dollar and the rest of those sleazy satanic evangelical prosperity creeps that steal sick people’s money, but a scam in the sense that Tesla is selling you something more than a normal car. Tesla sells environmental morality for the pretentious liberal class, so they can drive comfortably in the knowledge that they did something for the environment while waiting half an hour sipping a shitty drink to recharge their crappy EV. It also sells “technology” to generation ZX or whatever the f*** they are called now, and for the low low price of 30000USD you can also get a car. The only reason other car makers chose to go along for now and produce EVs is because they want to get in on the scam that Tesla started. Nothing praiseworthy about it. Tesla is not environmentally friendly it doesn’t save the polar bear and the spotted snail or prevent ice caps from melting, in fact it probably is more harmful than a petrol. It’s just that the pollution doesn’t come from the exhaust of your car but from the plants mining lithium far away in some third world country whose government Elon probably helped overthrow.

Yep. Isn’t it wonderful when you reach a point in life you see people (all people) and their actions for what they really are?

For me, the phrase that defines 2020, is “virtue signaling”.

Ripped from a headline:

Virtue Signaling Is Now A Cheap, Prolific Substitute For Actual Virtue

The less prone we are to self-examination, the more self-aggrandizing we become in our denunciations.

Kentucky i can’t decide if you are in agreement with my post or you are being sarcastic. If it is the later, let me say that i didn’t do anything as grandiose as a “denunciation” mate, unlike you in your reply.

Ha. Agreement – no sarcasm. Cheers.

“The unexamined life is not worth living for man” -Socrates. (Plato)

Kentuck-

“…self-deception is the root of all evil…”

-r.a. heinlein

may we all find a better day.

BINGO ..

Is there anyone out there who has invented a replacement for the humble battery ??

Who has even an idea .. no matter how ridiculous or unfeasible.

It’s time to upgrade.

We have not yet discovered everything, invented everything & to say “its not possible / it’s 50 years too soon is rubbish.

There is definitely something out there waiting to take over.

Q: – Galileo:

Who was Galileo faithful to .. God or the Church ??

the fed is ” pot committed ” at this point. Just watch the 10 year treasury trade and you can spot fed footprints all over it. At some point they either have to let interests rates rise or the dollar is toast. Which will it be? This will effect Tesla’s stock price.

They’ll probably let the dollar drop, but this is a double edged sword. I think in the near future (perhaps by June), the US will be a net importer of oil again. Why? Because fracking is toast. I can see the dollar dropping by 20% next year easy.

Tesla might benefit from that actually.

Once we increase oil imports, we can expect higher gasoline prices. That should increase EV sales.

Just commenting that I read over 100 posts and all were engaging and thoughtful (with the standard 1-line funnies). :-)

Thanks to all of you W-Streeters and to you Wolf for providing the fuel for our fires (pun definitely intended).

Still wondering, exactly where are the Nevada lithium claims that Tesla announced, on Battery Day September 2020, having acquired (“We got rights to a lithium claim deposit in Nevada- over 10,000 acres.” as quoted in elektrek article.)

In an article at Mining.com, September 23, 2020: the company, on Battery Day, “signaled that Tesla is officially getting into the mining business”.

Curious about all of this from Tesla, I recently googled whether EV heavy machinery actually exists. Well, yes, Caterpillar for one has started to build these for mining. So, Tesla, where will the mine be; and when can we expect permitting and pre-feasibility studies, and will the mine be all-EV ???

It will take a couple of years and lots of hand wringing to permit a new open pit mine in this country. Maybe longer. I worked for Anaconda (copper mining, manufacturing) years ago and mines are a “dirty” word in business.

Besides lots of BIG earth moving equipment necessary, an ore processing facility will have to be designed and built. New mines take a very long time to bring into production. And in the U.S., successful completion is hindered by environmental groups, state and federal permitting rules, and environmental impact evaluations.

Good luck to Musk with an adventure developing a new mine.

Will they provide charging stations for the protesters?

Your problems are SRK’s “gold mine”. Ex girlfriend worked mostly in their Tucson office, but they are worldwide.

Lithium is the new gold .. if we still have some ??

Teslaron.

Yeah, just don’t know where it fits in the Periodic Table…..or maybe it’s like an electron…..subatomic…..along with the quarks and the “god particle”.

What’s going to happen when the FSD software learns how to text while driving?

Oh man…..that was good! AI to infinity.

In my college years, I played for the University Football Club.

People loved us or hated us as “a football club with a drinking problem”. Being anti-establishment, we proudly called it “a drinking club with a football problem”.

Borrowing that theme, it seems Tesla is an “hallucinogen company with a car problem”.

Start selling short TSLA here and sell more on the scale up.

I can guarantee that all those who caution against selling short have never sold short and do not understand the economics nor the psychology of selling short. I estimate that I have sold over 20 million shares short in my trading career. The best time to sell short is when traders are both clamoring to buy and when the economics are not keeping up with the stock price.

TSLA is hardly the only stock on my list . There are any number of stocks which meet that criteria.

In the next 2 years there is going to be blood on the streets

We’ve heard this “blood on the streets” thing for the last 10 years and yet the market keeps going up.

It’s pretty clear why. It’s either the stock market going up or it’s the dissolution of the country. What do we have really that’s working well other than the stock market?

If you were a bit more circumspect about it you might be more convincing.

And its up almost 5% today. I cant wrap my head around it.

Musk should just buy Apple. If someone gives you funny money, might as well make use of it ;)

It would be interesting to figure out Elon Musk’s net worth if you priced his Tesla shares and options at an appropriate dollar amount. The story reminds me an awful lot of the Bernie Ebbers/MCI saga… one where an innovative CEO built a company by being a leader in a new technology (fiber optic transmission lines) only to get overextended cash-wise when his company’s growth couldn’t keep up with his lifestyle.

Unlike Elizabeth Holmes and Theros, MCI (and Ebbers) were not a scam… they were building out the actual backbone of this thing we call the Internet. But paper wealth is not real wealth until it is converted to cash.

This year has been good to Musk ON PAPER… but what happens if that paper value collapses?

Tesla would not have survived if not for all of the Billions it received from other manufacturers (mandated by government).

Time will tell if Tesla survives without having to rob Peter and Paul to support Elon.

TESLA .. makes me think of the movie .. The Producers .. about a failing producer & his accountant who scam a group of elderly women out of their nest eggs by convincing them to invest in a horrendously offensive musical, secretly intending to bomb the moment it opens.

They sell way too many shares .. the musical is a big hit ^ they end up in prison.