Triggering a showdown — Government of Mexico v. Central Bank — over paper dollars, with ramifications in the US and globally.

By Wolf Richter for WOLF STREET.

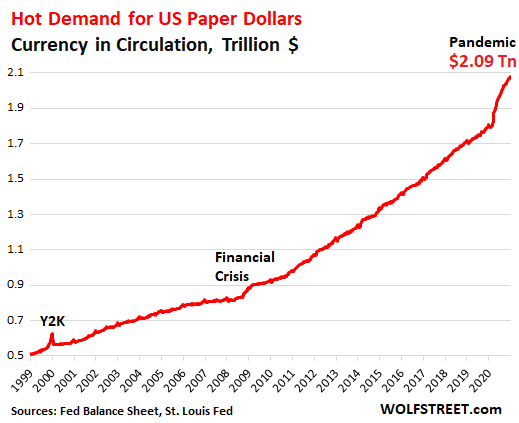

The amount of “currency in circulation” – the paper dollars wadded up in people’s pockets and purses, stuffed under mattresses, or packed into suitcases and safes overseas – jumped again in the week ended December 30 to a new record of $2.09 trillion, according to the Federal Reserve’s balance sheet, where currency in circulation is a liability, not an asset. This was up by 16%, or by $293 billion, from February before the Pandemic. The amount has doubled since 2011:

This amount of currency in circulation is a function of demand – and that demand has been red hot: US Banks have to have enough paper dollars on hand to satisfy demand at ATMs and bank branches. Foreign banks will also request paper dollars from their correspondent banks in the US, or return unneeded cash to them.

When there is demand for paper dollars, banks buy more of them from the Fed. They pay for them usually with Treasury securities they hold or with excess reserves they have on deposit at the Fed.

The surge of paper dollars is a sign of hoarding, not of increased payments. In the US, the share of paper dollars for payments has been declining for years, replaced by electronic payment methods, such as credit and debit cards, PayPal, Zelle and similar systems, all kinds of smartphone-based payment systems, the automated clearinghouse (ACH) system, and checks every now and then.

During periods of uncertainty, people load up on cash, as they have done leading up to Y2K, during the Financial Crisis, and now during the Pandemic.

But much of the hoarding of US dollars takes place overseas, with demand for those paper dollars then winding its way to the US banking system via the correspondent banks. These paper dollars also lubricate all kinds of corruption, drug trafficking, and other activities – and laundering this cash is a big profitable industry.

But these paper dollars overseas can pose their own challenges, such as in Mexico where the Bank of Mexico is now facing off against the government over the paper dollars at a Mexican bank that can no longer unload them.

Here is Nick Corbishley’s report on this paper-dollar showdown in Mexico:

These paper dollars appear to be causing all sorts of headaches for one of Mexico’s biggest domestic lenders, Banco Azteca, which is sitting on a growing mountain of dollar bills. But the bank’s owner, Ricardo Salinas Pliego, is Mexico’s second richest man and wields a lot of influence, particularly with Mexico’s current government. Three weeks ago, the government unveiled a new draft law that will force Bank of Mexico (Banxico for short) to become <u>the buyer of last resort</u> of U.S. dollars that commercial banks cannot return to their country of origin. Banxico would be forced to buy those paper dollars, regardless of how these banks had obtained them.

Defenders of the law say it would help Mexicans shut out of the financial system, such as illegal migrants and hospitality sector workers paid in dollars, to save cash. They also argue that it is necessary after a crackdown on money laundering in the US led some U.S. banks to cut ties with their Mexican counterparts, which are now struggling to offload their surplus paper dollars.

But the law’s critics, including Banxico’s Deputy Governor Jonathan Heath, argue that it could undermine the central bank’s independence and risked tarnishing Mexico’s reputation with international financial authorities. Plus, it is only really intended to benefit one bank: Banco Azteca.

“There are plenty of arguments against the proposed central bank reforms,” tweeted Heath. “One of the most important is that it’s wrong to change the law only for the sake of one company, especially one that has already had a run in with the SEC.”

In 2005, Salinas Pliego delisted two of his companies, Elektra and TV Azteca, from the U.S. after settling fraud charges brought by the U.S. Securities and Exchange Commission without admitting wrongdoing. In 2011, the U.S. Office of the Comptroller of the Currency investigated Banco Azteca’s ties with its then-correspondent bank in the U.S., Lone Star National Bank and unearthed numerous money laundering risks, which led Lone Star to sever its ties with Azteca.

Since then Azteca has been without a correspondent bank in the U.S. and has been unable to offload hundreds of millions of cash dollars, according to the newspaper Proceso. But that could all change if the proposed central banking reform becomes law. The draft ruling has already passed the Mexican Senate but its final passage has been held up by a storm of protest, not only from Banxico but also from other banks in the country as well as overseas financial institutions.

Moody’s warned that the reform would be “credit negative” for Mexico’s sovereign debt because it would compromise the bank’s autonomy in a country that underperforms on rule of law. Mexico currently only complies with 5 of the 40 recommendations issued by the Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog, says the head of Mexico’s Financial Intelligence Unit (UIF), Santiago Nieto Castillo.

Given the power of organized crime in Mexico, Banxico is loath to buy commercial banks’ surplus foreign cash without being able to verify its source of origin. Not only would it make it easier for the proceeds of illicit transactions to flow into Mexico’s financial system; it would mean they could end up forming part of Banxico’s international reserves. And that could expose the central bank to money laundering sanctions and even disruptions to its dollar swap lines with the U.S. Federal Reserve.

Most members of President Andres Manuel Lopez Obrador’s Morena party still believe the reform is worth pursuing, ostensibly to help Mexican migrants get dollars into the banking system. Yet according to Banxico, which tracks money entering Mexico from overseas, 99.3% of remittances arrive electronically, meaning that less than 1% arrive in the form of cash.

On Thursday, Mexico’s finance minister raised an additional objection: the draft bill “would only transfer the problem commercial banks have to the central bank because the central bank would have the same problem: how to export dollars.”

But the law’s backers have a solid majority in both branches of Congress. And they seem determined to use it.

“We are going to approve the law. This we want to make clear,” said Mexican senator Alejandro Armenta, who heads the senate’s finance committee. “We cannot put the concerns of the financial system at the center of our interests while the population suffers from the problem of exchanging dollars when they return from the United States, after working and leaving their families. We have to find a balance.”

The senator added that the bill will pass in February and will include amendments to ensure that it does not facilitate money laundering.

“What is their use if the reserves are just saved, sitting in vaults or as electronic data? The Bank of Mexico is one of the country’s institutions that has to adapt to the changes that the country needs,” he said.

Some of the law’s most strident opponents warn that its real purpose — as depicted by Armenta’s words — is as a trial balloon to gauge the reaction of monetary authorities and investors, both within Mexico and beyond, to government moves against Banxico’s independence. What Mexico’s cash-strapped government really covets, they claim, is Banxico’s $194 billion of foreign currency reserves — and they are mostly assets in electronic form, such as US Treasury securities, that can be easily sold globally.

The government, they say, has already exhausted most of its financial buffers during this year’s virus crisis. Yet it needs to find more money to maintain its social welfare programs and continue supporting struggling state-owned oil giant Pemex. And the last thing it wants to do is to significantly increase Mexico’s public debt load, which would make the economy more vulnerable to macroeconomic risks. Hence the move by the government on Banxico’s reserves.

The dollar’s share of global reserve currencies declined again. But other options are also shaky. Central banks are leery of the Chinese RMB, and its share is still irrelevant. The euro’s share is stuck. But the yen’s share has been rising. Read… US Dollar as “Global Reserve Currency” amid Fed’s QE and US Government Deficits: Dollar Hegemony in Decline

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Dollars are getting less fungible every day. It’s not good news, it’s not bad news. It’s reality.

Fantastic article. Best one of the year!

What’s the trend in Mexico life for a stage person? When I went for two weeks in in the late 70’s I think exchange rate was 8:1 and now 20:1. Has standard of living deteriorated there the last forty years substantially?

Oops. Spell check.. for an average person not stage person.

well 1st of all 8:1 was in like 1994-95

1st devaluation was in 1993 – were it went from 1.5:1 to 3:1 overnight – RIGHT BEFORE CHRISTMAS

then in dec 94 – boom again this time to 7:1

since then it has floated upward to today at 25:1

Was over half way down Baja in 2008 with Canadian friends who built a small house in Bahia Asuncion. It was around 12-13:1 then, I’m pretty sure. People lived frugal but pretty happy and friendly there, were kinda like Mexican Rednecks with their own little “Baja races” using custom desert racing rigs…Jose’s Meat Market, etc, as sponsors. Very unlike the mess in TJ.

Really adds to the value of somehow using those “excess” dollars, anyway.

The exchange rate isn’t what I’m talking about. USD in a Mexican bank isn’t worth the same nominal dollar, even if they are part of the same series/printing batch, as a USD in the US.

yah because using cash = bad, criminal, ???

remember that when they comes to merica soon

I for one will do BARTER if have to

You obviously don’t know the meaning of “fungible.”

I can’t say that I agree.

Because of so much “policy” (government control over money worldwide), this article points out that an FRN dollar bill in a Mexican bank is not as acceptable to a US bank as is an FRN dollar bill I walk in with here in the States. If you understand what fungible means (i.e., indistinguishable from each other), you understand how the dollar is becoming less so over time.

Crunchy,

You touched upon a fascinating concept… degrees of fungibility, if you will. Yes, “money” is fungible. But “paper dollars” are individual FRNs, each with a unique serial number. So they’re only fungible if one wants them to be. And if not, they can be tracked individually, and holders may have to prove where they came from, etc. which reduces their fungibility. Fascinating. I’m going to stew over that for a while :-]

Wolf,

Even electronic dollars have to come from a designated account…so if you are on a Gvt’s sh*tlist, your ability to transfer/move that USD could theoretically be blocked (keyed to name associated with sending acct).

Granted, in the paper dollar context, the individual serial number means the G could block innocent/semi-innocent third party holders/recipients (keyed to the serial number).

But I think the same “banning” can happen electronically (with more efficiency!!) if the US has control/influence over the international USD electronic transfer system (see Iran, NK, etc). The transfer system simply blocks certain sending accounts (creating stranded, nontransferable dollars which become effectively worthless).

On a semi related note…I would love to see a post on Venezuela’s promised/threatened full monetary digitization.

The Venezuelan G won’t be doing it for any reason beneficial to its savers (see stranded, worthless savings above).

And it is very relevant to US readers because the context, dynamics, and operationalization of such a move applies to any nation that has abused its existing fiat in the service of political ends.

Ahem.

Means prone to being eaten by fungus, you know, like a rotting log.

??

oh boy, um, N Webster NBay, I know you each have a computer and/or a smart phone. Aside from “fungibility” being an ECON 101 term you may choose to highlight and “search Google” now and then…

Both physical USD and the globally traded USD appear to have fungus problems.

NBay/Dave- “…the fungus among us…”, indeed.

Mars-can’t crack even a little smile?

may we all find a better day.

Oof. Read the article. Fungibility when referring to USD is about USD to USD. In this case if it’s in Mexico’s hands it’s not worth a whole dollar.

Best of the year? It’s the first story of the year.

OK, so it’s a backhanded compliment. My mother-in-law was a master at that craft.

But the article was a fine read! Keep it up, Wolf!

I was complimenting Wolf while making a joke. If it was posted on December 31st it would have been last years best article. The amount of valuable information in this article is damning to say the least.

Thanks for understanding fungibility.

Banxico or bust.

Reminds me of that old Clint Eastwood Spaghetti Western, and a good one at that, “For a Fistful of Dollars”…

Nice, but you don’t get Tuco the Mexican with his dirty deeds and ill gotten gains until “The Good, The Bad, and The Ugly”, and even then he can only operate freely because the guys in the north are engaging in a senseless War with each other instead of working for a common good for all. Sound familiar?

For a Few Dollars More you can get a real Mexican bank robber.

How about instead the movie Death Wish? Constantly amazed how many nations surrender their sovereignty by funding their public selves on currency not their own.

Yes, that’s not a good place to be.

I find it funny how the MMT crowd always points out that government debt supposedly doesn’t matter because you can print your own currency. The fact that so many countries cannot issue debt anymore in their own currency is exactly the argument against MMT, because that’s where MMT usually leads to.

You don’t need debt to issue currency. Peru prints quite a few US dollars.

So does North Korea.

Hi YuShan,

If I understand MMT correctly, I think it means something a bit different, namely that a sovereign currency nation can never go bankrupt because it’s central bank can buy and hold it’s own debt to infinity, thus making infinite deficit spending possible.

If true, those nations who use USD instead of their own sovereign currency, lose this power and can’t do that with USD because they can’t issue it and hold USD debt to infinity since they can’t issue or create USD.

And that implies these nations that USD instead of their own currency, might have liquidity problems precisely because they are not using MMT.

I think.

I think also Lisa Hooker has a point, in that at least in the US the Treasury can “issue” as much currency as it wishes without even going thru the central bank (Federal Reserve). Like the billion dollar coin proposal. But I’m not totally sure of this.

timbers,

These MMT freaks always ignore the impact on currency and inflation. Yes, a sovereign can print unlimited amounts of its own money, and those countries borrowing in their own currency can never go bankrupt.

But countries that default on their debts are those that borrow in a currency that they don’t control (Greece, Argentina, etc.).

Countries cannot borrow in their own currency if they trash that currency by MMT because no one wants to buy that crap. See Argentina. And they trigger massive inflation by printing every larger amounts of ever more worthless local currency because they cannot borrow anymore in that currency because no one is stupid enough to lend to that country.

MMT leads to a trashed currency and heavy inflation. See Argentina. Argentina has been practicing MMT for many many years, with a few pauses in between. MMT freaks need to study Argentina. That’s the perfect MMT model. There is nothing “modern” about MMT. And there is plenty of recent proof as to how well it works.

The side effect is that MMT trashes the economy. See Argentina.

I think the Weimer Republic tried the MMT. We saw what that let to. At least they had some good entertainment at the Caberet’s in Berlin and pioneered some innovative architectural designs.

Wolf,

The MMT’ers are half-wits thinking they are putting one over on quarter-wits (“can’t go bankrupt”).

The only place this sophistry flies is on DC approved MSM “news” sphincters.

For the record, the other 329 million of us don’t care if the country is ruined through “impossible” bankruptcy or MMT fairy dust induced hyper-inflation.

What matters is that the country/economy is *ruined* by a given policy.

Anybody who understands that the total supply of money in relation to the total supply of real assets (or real effort, if services are included) sets prices, understands this immediately.

At *best* MMT’ers are hoping to dupe individuals into undertaking new activity by diluting the rights of existing savers.

Talk about misleading! Using Argentina as the example of MMT is stacking the deck. Its debt is in DOLLARS and EUROs, i.e. not in its own currency! The United States is the example to look at. It is now taking on debt (in its own currency!) at levels never before seen in human history and until now (which is all that counts) is having no problems maintaining its economy – in fact, its technically booming! And the inflation that everyone has been predicting since 2008 (and earlier) never seems to materialize! In fact, impending DEFLATION has been the problem! And that debt, as is the goal of MMT,, led to the lowest unemployment rate we´ve ever seen (until the pandemic).

Barry Fay,

Argentina is the prime example for MMT. It’s just in a later phase of MMT: It has blown its own currency through inflation many years ago and therefore it CANNOT borrow in its own currency without paying huge gigantic interest rates … 40% a year.

So it borrows in foreign currency to get lower interest rates — and then it defaults on that foreign currency debt. This is EXACTLY what happens in the later stages of MMT … after MMT has rendered the plentifully printed local currency worthless.

MMT freaks only want to look at the first two years of MMT when government money printing solves all problems. And then they walk away from the consequences of MMT and say, “this is not MMT.” How disingenuous!

MMT freaks cannot admit to the well-established consequences of MMT. That’s been the case for decades. Nothing new about MMT.

According to one MMT source, “Our spending limit is inflation; we mustn’t exceed the time, materials and human resources available to produce what we fund.” In an alternate universe where people control their government, MMT allows debt-free money to be used for public needs, infrastructure, defense, etc, limited by the need to minimize inflation.

In the universe we inhabit, MMT would be kind of like the system we have now, irresponsible spending leading eventually to inflation, but at least there’d be no federal debt to pay interest on.

The MMT freaks is a title reserved for the people putting a different name on military industrial complex, late stage capitalism.

About 1 week before AOC says anything about MMT, Republicans were raving about the miracle of debt expansion and that a “government’s debt is not the same as household debt”. She called their bluff, she’s more or less not in the picture and some still choose to turns around and point at her while calling her the MMT freak. It’s a complement. She rattled the debt addicted monkey out of the tree.

And finally, just because you provided good reasons why Argentina borrowed in dollars and euros does not change the fact that when they made that decision they were no longer following MMT orthodoxy – and it is thereby NOT an example of “late MMT” at all!

Barry Fay,

After MMT blows up the currency and the economy, you can no longer follow MMT because no one wants to have the currency you want to issue (massive inflation). That is what is happening in Argentina.

BTW, and I have said this before, MMT is an economic religion that requires a leap of faith. It only makes sense to believers. For nonbelievers, it’s just nonsense. And I don’t allow religious proselytizing on this site.

Anyway to bring that sanity north?

And, as a FYI, Mexican elections use a biometric ID card and allows only in person voting.

“And the last thing it wants to do is to significantly increase Mexico’s public debt load, which would make the economy more vulnerable to macroeconomic risks. Hence the move by the government on Banxico’s reserves.”

That is not entirely accurate. Mexican living in the US can vote using mail in absentee ballots, however they can only vote for Federal President.

Americans will never accept a national ID. Any politician supporting that would no doubt be met with violent armed protests.

I needed to provide fingerprints to get a driving license in Texas, yet Americans would violently resist a national ID?

You blew the Texas IQ test…supposed to bring a paper bag with someone else’s fingers. I love the test question where before you back out you’re supposed to go check behind the car. Logically, everytime you go back to your seat, the rule must repeat in an enless loop of re-checking. I’m fully convinced it’s a trick question to see how many people blindly agree.

August 2020 U.S. Patent approved for blockchain vote tech by the U.S.P.Office! :-)

But they have one anyway.

Is called Social Security number and is unsafe as hell.

So for not wanting an ID they have one anyway only it has been outdated for over a century.

Its always amazing to me the number of people who violently oppose government censuses (censi?) and ID cards.

Fact is that Google, Facebook, Apple et.al. have more data (including thumb prints and retina scans if you have ever used these “security” features) which is better organized for data mining than any federal agency. Your every move can be tracked using your cell phone and IP address. There is no escaping it.

The data is far better administered than the federal stash.

re: ” Your every move can be tracked using your cell phone and IP address.”

Not necessarily. When you connect to a Wi-Fi network router the router has a single (unique) IP address it uses to send and receive data on behalf of all the devices connected to it; your device gets a subnet IP–usually 192.168.something–and a port number, which is meaningful only to that router. Only a MAC address is unique (though it can be spoofed).

I’m not as familiar with CDMA networks, but your phone would need a unique identifier, possibly based on its MAC; that’s why cellphone tracking is so effective.

@CB – it’s called the IMEI number. Much like the ethernet MAC address it is unique for every cell phone and is independent of CDMA or TDMA.

This is intentional. The government and corporations are already tracking everybody. By holding off on the national ID, it allows the ignorant masses to feel free.

Actually most modern computers have a “find me” app. When loaded in background it occasionally pings its cloud server address and delivers a traced route (through tcp/ip) which can be used to trace its local router address.

I know apple IOS comes with such an app and have seen it used to trace a stolen computer.

If you have an emergency support app in your car or even satellite radio you can be located via satellite GPS. We are never alone.

what do you think the ‘real ID’ is?

Your DNA.

And it only takes a small fraction of your total DNA, just guessing here, but likely less 1% of it, to put you in the chair.

Sorry, that and me are wrong, I was thinking about something else….I really don’t know about legal electrophoresis or whatever technique(s) they use.

But it is your ID as a member of the biosphere, not just a nation state.

‘You know the OPC!” Other People’s Currency…

Remember when the music stops the one who doesn’t have a safe place to sleep and ample non financial resources will loose. Pieces of paper are just pieces of paper.

Bearer Bonds are also just pieces of paper S ate legal judgments and printed laws.

“are just pieces of paper”

DC demonstrates this every day.

When we finally arrive at the great social state nation of Nu MexiCaliTexaCandaradozonatah, there will be one monetary system east of the Missassipah eliminating all exchange problems. Everyone else in the no-fly wasteland based around Smithsoniana can have the British “Pound”, but that doesn’t imply backing by an actual weight of Sterling silver. There’ll be no problem with drug traffik $$ ’cause everyone will be so bug eyed already that it all seem like a hallucination.

Gotta admit – I just don’t understand this one. So commercial banks (Azteca anyway), give USD (actual paper) to Banxico and get Pesos in exchange so Azteca can fill their ATMs and make loans in Pesos to the peeps?

I don’t see the problem there ? Banxico can use the cash to buy US or other Treasuries. It’s not Banxico’s problem to prove where the USD came from. The US issued the notes, not Banxico.

Wolf touched on this already as part of the article i.e. there could be money laundering at play here.

Let’s not talk about Mexico and hundreds of millions of dollars, there are laws in the United States that require banks to report cash deposits over a certain amount in a single day or over a number of days.

Beardawg,

Imagine the allegations that Azteca got suitcases full of dollars from customers in unsavory businesses. And these suitcases full of cash pile up. ATMs dispense pesos, not dollars. But the US correspondent banks have cut Azteca off and won’t take those dollars because of money-laundering issues. So now Azteca is stuck with all this paper and cannot do anything with it.

Given Azteca’s history, the allegations are that this cash is from money laundering. If the Bank of Mexico buys it, it becomes complicit in money laundering, and it will be ostracized. Banxico can forget the dollar swap line with Fed, and forget anything else. It cannot trade cash dollars for Treasuries. Mexico has a lot of dollar-denominated debt that is very fragile. If this happens, Mexico is in deep trouble.

Seems like scapegoating and a step in a myltistep trap.All the bad stuff mentioned happens-tarnished rep.,no swaps,no Treasuries,cornered.Mexico has debt crisi blown Up.No $$ for basic government functions like covd payments,education,etc.Someone swoops in makes a Devils deal with Mexico and Pemex is now Not state property.???

Like Salvador Allende?

WOLF

Thanks for the supplemental explanation. I guess what does not compute to me is that the US can print actual paper USD at will, but when a bank (any bank) wants to use that same $$ to pay a debt, the “alleged” (not proven) source of the acquired USD can quash the transaction.

Perhaps it’s more of a legal question than a bank regulatory question. No one in the world finds it to be illegal for the US to print $$ at will to pay its debts, so why the US banks (Fed) can quash transactions based upon allegations befuddles me. Da rules is da rules I guess, and Banxico apparently has no say in makin da rules.

Beardawg,

If you in the US have $500,000 in cash in a suitcase and want to deposit them at your local bank, you will be asked to prove where this cash came from. Large amounts of cash raise lots of money-laundering suspicions and are very difficult to deal with. The bank may refuse to take them because it doesn’t want to get rolled up in a money-laundering chain. If you try to do this and you already have a money-laundering conviction that the bank knows about, good luck. You’d be no different than Azteca.

Surely a better way forward would be for the US to issue new, as here in Europe, plastic dollars, and make the existing stock of paper dollars time limited for replacement?

That would be a great way to stimulate the economy, because all of that cash floating around would be spent under the table in short order.

Chris Coles

That’s a very expensive (financially & emotionally) one-time-only fix. With “new” dollars, the problem would simply quickly re-appear

It’s not the physical dollars themselves; it’s the chain of custody of the physical dollars.

All US businesses & US banks have the same requirement (using a supermarket as a simple example):

1) During the day, the supermarket accepts 50,000 of cash in exchange for retail product sold; AFTER HAVING SET UP A LARGE CASH BANKING RELATIONSHIP, the supermarket now deposits $50,000 in it’s local bank

2) The supermarket has had to satisfy the local bank that $50, 000 is a reasonable amount, and that, if audited by the bank, the supermarket has the ability to show for a given day that cash sales + bankcard (credit/ATM/gift) sales + checks = retail product out the door.

3) Regulators monitor (and sometimes audit) cash deposits

If your local barbershop started depositing $25,000/day at the local bank & writing personal checks to a bunch of people, the bank should react almost immediately to challenge & understand the vastly increased cash deposits; regulators will give the bank time to investigate, but they’ll also be quickly involved.

It seems that the only thing that the Mexican government can do now is to seize Aztecas dollar reserves and hand it over directly to the U.S. Treasury and whatever happens to Azteca is because of their own doing.

But can’t it use those dollars to pay debt?

Or do a cash swap with another country?

The obligation to explain the origin of the cash simply moves to the new receiver of the cash (ya can’t just say “we just a barn full of $100 bills from some itty bitty bank in central Mexico”). To remain compliant with the Fed, the new receiver needs an acceptable chain of custody from the original bank.

This is becoming more difficult to do for billions of drug profits.

Maybe Deutsche Bank can help out?

I’m CERTAIN DB can and will.

I’ve always thought that laundering goes on in the Ultra High Net Wealth departments (aka “Funds”) of banks. If they don’t keep their mouths shut about the transactions going thru there, then they don’t get to process (and take a % of it) the much larger amounts of money these types of people accumulate…..however they do it.

Bank laws are for little people, I show up with $10,000 cash to deposit and questions get asked.

NBay

You are very close to learning an adult fact of financial life:

Any so-called “little person”, “big person” or business that had not yet established a “large cash deposit” banking relationship would get asked the same questions.

I just can’t imagine the horror of a little person showing up with $10,000 and being humiliated (possibly strip-searched) trying to deposit it. Bummer.

Thanks Chip, but I’ve never really wanted to be an adult, and it was my choice.

I mean, what do you expect from someone who was raised with redneck loggers and has never worn anything but jeans and t-shirts all his life?

Heck, I’ve even been homeless and in jail. I flunked out of JC because I was down on Haight St partying, lost my student deferment and ended up in the Army in the Delta in Vietnam.

Unlike you I’m an economic loser and in a 500 sq ft low income hotel style apartment, but I do have some savings from the off grid house it took me from ’90 to ’06 (I sold at the peak, having no idea what was going on with housing…pure luck) to build from bare land, and still have 40 acres left with an unfinished 5 stack container (2-2-1) home because I finally trashed my back for good working on it.

But I’m happy as hell now and for everything I did in my life, including 526 skydives (had to live in a bread van to afford it), played 30 years of 6-2,5-1 volleyball, raced dirt bikes, etc…..fun stuff.

But I’d hate to be a kid now, that’s for sure, we had it easy, there was always some little factory to work in back then.

So thanks for the hopeful words, but I’m just here to learn what I can from Wolf and his collection of commenters about what’s going on financially and how it works, and whatever else comes up, not make any more money. I’m just trying to keep what I have to give to nieces and nephews, and not doing well at it since I don’t have enough to risk in stocks.

Sounds like Deutsche Bank and RE loans to certain politicians. Wells Fargo phony accounts. Stock Trading on inside information by politicians. Citizens United and constant lobbying.

Why does every US senator and many in ‘the House’ seem to retire as millionaires?

How much did Janet Yellen just make in speeches made to private banks?

Why did not one crooked banker go to jail in the GFC, even the Countrywide crook Angelo Mozilo?

And people worry about Mexican banking corruption? Seriously?

RE: Banxico can forget the dollar swap line with Fed, and forget anything else. It cannot trade cash dollars for Treasuries. Mexico has a lot of dollar-denominated debt that is very fragile. If this happens, Mexico is in deep trouble.

Sounds like a setup for predatory financiers on the bargain hunt, kind of what happened to Greece.

I know I am cynical but follow your nose. It’s all freaking corrupt. Or like the little fridge magnet says at my buddies house, He who holds the gold makes the rules.

There is more to this story, imho.

Paulo,

What you just did is is a perfect textbook example of a logical fallacy called “whataboutism.” Google it.

Paulo

You have a bad case of being righteously indignant about money laundering, whether or not the authorities are diligently responding to it.

Just a guess – you’ve never had to go thru a compliance audit and have no idea how rigorous it is; as a CFO, I have. Interesting that someone with with zero knowledge or relevant experience can use a random, fact-free process to decided it’s “…all corrupt…”.

Of course the US is a prime money laundering target; paraphrasing Willie Lowman, “that’s where the money is”.

Nobody even tries to launder a few billion US dollars a day thru Sera Leone.

I didn’t even have to look that up….anyone who has argued with his wife or girlfriend can guess what it is…..Paulo just followed “his nose” outside the domain of the article, and it’s issue at hand.

Easy to do in these stressful times, lot’s of people do it.

You actually might deserve more credit for moderating this site than writing the articles. I wouldn’t want to do either. Thanks for both.

Why the indignation towards Paulo?

Who here can not recognize the corruption of the FED/Wall Street cabal?

“Why the indignation towards Paulo?”

Because people don’t like deflection, which is essentially what his entire comment was.

Paulo is just casting light on the gradation of sleaze oozing about the money and banking business. You have the sleaze of money laundering. You also have the sleaze of the being a beneficiary of being associated with FED/Banker/Wall Street money and debt creation crowd.

Wolf said: “Mexico has a lot of dollar-denominated debt that is very fragile.”

_________________________________

What does this mean? Who owes the debt? The Govt Mexico? Mexican companies?

Why can’t Azteca loan the dollars to the Mexican entities that owe the dollars so those Mexican entities can use those dollars to pay their dollar denominated debt?

1. The government of Mexico issued this debt (it borrowed this money from investors), which is denominated in dollars, euros, and yen. This debt is held by pension funds, bond funds, including developing market bond funds, and the like.

2. Doing large commercial transaction in currency is nuts, except for drug dealers that don’t have a choice.

Wolf said: “2. Doing large commercial transaction in currency is nuts, except for drug dealers that don’t have a choice.”

———————————————-

I agree that it is burdensome, but it seems a simple solution for a bank (Azteca) that has a need to offload physical dollars and borrowers desperate for any type of dollars to payoff obligations. Transportation and securities costs have to be absorbed, but that’s a cost of doing business.

cb,

It takes two to tango. Why would any company engage in a large cash transaction with Azteca when it could be done much faster, cheaper, and much safer with an electronic transfer? How would you even guard $100 million in cash in Mexico? Bring in 2,000 US Special Forces and a dozen Apache helicopters?

And then do WHAT with the dollar cash in Mexico? Pay employees with paper dollars stuffed in envelopes?

Well, sure, you could pay some politicians that way, but politicians as we know are cheap.

Which should make anybody with a stash of dollars nervous. I suspect that the strategy of the Treasury dept. is more about keeping those dollars in Mexico than in curtailing money laundering.

And you’d be wrong.

The Fed does not want money laundering in US banks or any banks using the US system.

Azteca has accumulated hundreds of millions of US dollars without being able to document legitimate sources (wild guess: THEY’RE DEPOSITS FROM DRUG DEALERS) and Azteca has been shut out rom dealing with the US system (Note: burden of proof is on Azteca to document acceptable sources of its cash).

If Azteca does any kind of cash transaction with Bank of Mexico, the fed will require Bank of Mexico to document how Azteca got the cash (the documentation problem doesn’t go away just because Azteca deposited at Bank of Mexico).

If Bank of Mexico can’t document the cash, there’ll be repercussions with the US Fed (including being cut off from the US System. If you wanna use our system, you have to play by our rules.

There are ATMs in Mexico that dispense USD and/or MXN.

In addition, a lot of people in Mexico are happy to take USD as payment.

Lastly, they could use those US dollars to trade with another country (e.g. – China , et al)

Happy Holydays

People constantly confuse $50 with $500 million. It’s the latter that’s the problem.

It’s called M1 at the Federal Reserve.

Just print peso’s and blow them out along the highway with a snow blower. What’s a mere 194 billion of fiat lying on the side of the road matter any way. At least it could be used for butt wipe which is valuable.

DD, that would have been even funnier if it was USD instead of pesos being blown along the highway.

This is what happens when you run out of other people’s money and are desperately trying to find “new other people’s money” to steal.

When asked to define “business”, Alexander Dumas (easily an 0.01%er and successful businessman of his time, replied, “Business? It’s simple. It’s other people’s money”. Thatcher/Reagan types stole his line, and spun the meaning into the sound byte you just blurted out, having no idea in hell what you are talking about, or about this excellent article you ostensibly read. I never took any Econ classes (except here) and I get it. Try a re-read, ok?

You most likely are unaware, but Dumas was famous for some other things, too…..en garde!

Sorry about that. Have now read some of your other posts and was just set off by that phrase. My bad.

A dollar sure doesn’t buy much bitcoin or Tesla shares these days.

QUOTE: When there is demand for paper dollars, banks buy more of them from the Fed. They pay for them usually with Treasury securities they hold or with excess reserves they have on deposit at the Fed.

With the utmost respect for this blog, the above is partially incorrect. A member bank cannot go uninvited to the Fed with UST securities and ask for USD paper currency. The only monetary instrument that is equivalent to USD paper currency is RESERVES. Reserves gets created, over time, when Fed accepts (more) UST (or certain allowable USG-guaranteed debt instruments such as certain MBS bonds) as new collateral for issuing new reserves. The reserves are BACKED by the accepted bonds.

This is what MONEY IS. It is a claim on something, and in the US, that something is US government debt. (Money historically used to be a claim on GOLD held by the reserve bank, but that is a whole other topic).

It is not automatic that Fed will issue new reserves when a bank shows up with some UST bonds they want to convert to reserves. This operation is at the very core of what the Fed does: Controlling how much “real money” there is. Reserves and paper currency is the ONLY “real money”, and the sum of the two is constant(*).

If bank wants paper currency from the Fed, it must pay with reserves. If a bank deposits paper currency back to the Fed, it will get the amount credited to the bank’s reserve account. This is how it works.

(*) Now, as is often a topic at Wolf Street, the Fed has been known to conduct “Quantitative Easing”, which is a euphemism for increasing the amount of money (“printing”). The Fed says, hey, this month we will accept up to $80B worth of USG bonds and issue new reserves against them. At that point, the banks that sell UST to the Fed gets reserve credits in return, and can at will ask for USD paper currency against the reserves.

The above is hugely important to understand correctly. It is the essence of what the Fed does. It is also the cause of our greatest economic ills: Taxpayer-backed Wall Street speculation and rampant asset price inflation (in stocks, binds and housing, primarily). Asset inflation IS wage devaluation. Or human devaluation, if you will. But I digress.

See 12 USC §411, 412. It is short but sweet on how federal reserve notes are issued, and what is used for collateral.

https://www.federalreserve.gov/aboutthefed/chapter-5-federal-reserve-notes.htm

Wrong!!, Reserves stay as reserves & CANNOT be swapped for cash Dollars, holder of UST sell them in the market & swap them for USD, they do not go to the FED, only primary dealers sell to the FED in QE 7 get reserves which cannot be used only for backing loans issued, loans issued by banks creates USD but at risk of no payment & loss, so you’re correcting people when you’re wrong yourself.

Some rich hard money person should open a central bank museum as close to Fed HQ as possible and explain the history of central bank failures across the last 300 years. Explain the down side to modern central banking. Put up an electronic billboard outside with real time value of a dollar being 2.37428 cents or whatever it is.

“Asset inflation IS wage devaluation”

True. And none of the celebrity economists in the MSM ever calls this out for what it is.

A few days ago I read on the BBC News website “House price growth is 10%”. House price GROWTH! “Growth” sounds so nice, as if something is created. But it’s just inflation, paying more for exactly the same house. They should have written that peoples wages, savings and pensions have just been devaluated by 10%.

Exactly.

NARmageddon,

You’re in a different topic — your own theory of money creation. But paper dollars are not only an IOU (called “Federal Reserve Notes”) but also a manufactured physical product with a set price based on face value; and that product is very costly to ship (requiring armored vehicles, armed guards, etc.) and is neutral for money creation, as counter-intuitive as that may seem. Here’s why — boiled down and simplified (this is not an all-encompassing treatise but a comment):

All banks have regular business relationships with the Fed, including through their regional Federal Reserve Banks. They constantly deposit excess reserves at the Fed or withdraw them, daily, as needed. Banks also hold large amounts of Treasury securities.

The reserves on deposit at the Fed and Treasuries are the two primary methods by which banks pay for paper dollars (post these assets as “collateral” at the Fed). They can also use other agreed-upon assets as collateral. It’s very routine. It’s like an exchange between a merchant and a customer involving an IOU and collateral, not money creation.

Paper dollars are neutral for money creation. Money creation takes place digitally and doesn’t involve paper dollars.

What happens on the Fed’s balance sheet when a bank obtains paper dollars:

On the Fed’s books, paper dollars are a liability (money it owes), which is why paper dollars are called “Federal Reserve Notes.” The Fed issues these Notes to banks that request them.

When the bank obtains $1 million in currency (these Federal Reserve Notes) from the Fed, the liability of “currency in circulation” goes up by $1 million. In modern double-entry accounting (debits and credits that must balance), there is always another entry, depending on how the bank pays for the paper dollars.

If the bank pays for the paper dollars via its reserves on deposit at the Fed, also a liability on the Fed’s books, that reserve account declines by $1 million. In this situation, the liability side of the balance sheet remains unchanged: the liability of “currency in circulation” goes up, and the liability of “reserves” falls by the same amount. And the balance sheet remains in balance.

If the bank pays for the paper dollars with Treasury securities, the account for “Treasury securities” (an asset on the Fed’s books) rises by $1 million. In this situation, the liability of “currency in circulation” rises and the asset of “Treasury securities” also rises by $1 million, and the balance sheet balances.

Wolf, what you are saying is a very complicated and not very illuminating way of saying exactly what I said, with a couple of caveats:

“If the bank pays for the paper dollars with Treasury securities,”

This never happens. If a bank shows up willy-nilly at the Fed with a stack of USG bonds, electronically or otherwise , the Fed is under no obligation to accept them as collateral for new reserves. Indeed, Fed is under no obligation to create more reserves at all. But, as I said, the extreme willingness of the Fed to create to new reserves is at the core of all our economic problems.

“Money creation takes place digitally” . This statement just adds confusion. The ACCOUNTING of the creation of money takes place digitally. But the actual creation takes place by the acceptance of collateral for the money.

For the last, oh, 13-14 years the MSM press has been spouting about the Fed “creating digital money”. That just adds to the confusion that the average citizen has about what money is. It is the accounting that is digital. The money is always backed by SOME KIND of collateral. If the public would just understand that, then maybe we could get somewhere.

I think I’ll stop here. Readers can decide for themselves whether my simple but completely accurate description of money creation is better or not. I think it is.

NARmageddon,

You keep conflating two concepts. Read the link Aaron posted under your original comment. It explains in much greater detail than my comment how the system of paper dollars works. It’s from the Fed itself. If you disagree with it, argue with the Fed over how the Fed is doing this.

Wolf said: “All banks have regular business relationships with the Fed, including through their regional Federal Reserve Banks. They constantly deposit excess reserves at the Fed or withdraw them,”

_______________________________________

What is an excess reserve? A reserve beyond what?

What form can the excess deposits and withdrawals take? Can they be in the form of a dollars?

Are not all reserves in the form of dollars, Treasuries or Mortgage Backed Securities? (There are those who intimate that when the FED buys Treasuries with reserves, those reserves are not dollars. ie Jeff Snider, Steven Van Metre, etc.)

“What is an excess reserve? A reserve beyond what?”

“Required reserves” is the cash from depositors that a bank has to deposit at the Fed. The Fed normally requires that a bank keeps 10% of its deposited cash at the Fed as “required reserves.” This can be and has been changed during crises to 0%. A bank’s reserves on deposit at the Fed above the required reserves are “excess reserves.” The Fed pays the bank interest on those reserves. The interest rate paid on reserves is decided during the FOMC meetings.

Would just like to point out that the first time (ever) the Fed started paying interest on excess reserves (IOER) was because of the GFC when the Fed started accepting all kinds of “questionable” assets in exchange for cash to prop up US banks’ reserves. The Fed provided an incentive to keep the cash from potentially inflating the general economy more than usual.

Happy New Year, Wolf, and please pardon my uninformed cynicism, but isn’t all this ‘the horror, the horror’ over Azteca’s money laundering just some kind of bitch slap for not being in the right time zone, I.e., GMT or something. I mean HSBC just pays its fines and keeps calm and carries on…..

Oh, and thank you for your articles even if they do strain my brain…?

Or D Bank….perhaps an even better example than HSBC.

And a valid point.

El Chapo was as good a CEO as Jamie Dimon, if not better, he just didn’t get invited to Davos.

The problem for Mexico still remains, however.

LOL, no.

Jamie Dimon, in order to compete for his ‘share’ of the ‘pie’ has to outmaneuver other competitors intellectually, i.e. he has to be smarter than them, for some definition of that term, or, use systemic advantage that he or his predecessors have built up.

Chapo, to compete for his ‘share’ of the ‘pie’ can simply murder his opponents, or their families, or both.

To compare the two as a generic term like ‘business men’ is lunacy.

Another reason for the high demand for US paper dollars internationally is the US endless amount of sanctions against “disobedient” countries like Venezuela and Iran, basically countries that refuse to hand over their oil resources to US oil companies.

The sanctions generally have the form of forbidding the government of said countries from settling trades in US dollars. Such settlements eventually take place by netting reserves at the NY Fed, and the member banks (foreign or domestic) must then prove that the transactions being settled did not involves sanctioned entities, or else be denied or themselves sanctioned.

So: Much of the international trade involving sanctioned entities is settled by transferring partial claims on a literal bale of USD bills sitting in a vault somewhere abroad. This is the only way to get trade done in USD without involving the electronic eyes and ears of the NY Fed.

Funny anecdote: Some 20+ years ago, I happened to visit Vietnam and went into a bank for some reason or other. The bank had on display, behind some very thick plexiglass, some big shrink-wrapped bales of USD bills, I think mostly $20s or maybe $100s. The bales were under heavy armed guard by some seriously tough-looking guys. At the time I did not at all understand what was the point of this display. Now I do. The point was to show the customers in no uncertain terms that their USD-denominated deposits and payments were backed by the real thing.

For the real work they don’t use bales. They shrink wrap entire pallets of currency. Easier to move around with fork lifts. Gives one a perspective of the value of the currency.

Mexico had close to 4% inflation in first nine months of 2020. Full year 2019 inflation was 3.64%. The Mexican 10 yr. bond pays 5.417%.

Thanks Wolf and Nick for this excellent article on this Mexican bank problem. And thanks NARmageddon for that clear and concise explanation on how the Fed issues/creates money. This is stuff they don’t teach in school.

I don’t have anything to add to the topic, but I sure am gaining insight on these global issues.

Anthony A., they do teach this in school, or at least they did when a schools’ purpose was to impart knowledge on its students. This area of study is called “economics.”

When I went to high school it was 1957 – 1961. I don’t recall that type of economics. In college, I had Engineering economics in my M.E curriculum. No Fed speak where I went to school. Maybe today this stuff is taught?

I would guess if one studies government finance, this area would be taught. When I got my MBA, I recall a course in Cost/Benefit Analysis which was tailored to government project funding and funding payback evaluation.

Thank you, I’m so happy it is appreciated.

Anthony A.,

Note that NARmageddon was discussing “money creation.” But “money creation” happens electronically and has nothing to do with “paper dollars,” which are IOUs (Federal Reserve Notes) and a manufactured physical product that banks have to purchase at a set price. He erred in conflating the two. Paper dollars are neutral to money creation. See my detailed reply to NARmageddon.

I did, thanks. I guess its a digital world for sure.

OK I’m going to wade into this swamp. First, thanks Wolf for the informative article. “Paper Dollars are IOUs (Federal Reserve Notes) ” The term ‘Note’ is obsolete and comes from a time when dollars were actually backed by gold or silver. For example, in the past, a silver certificate dollar could be exchanged at the Bank for a silver dollar hence the Fed had an obligation and liability related to the paper currency. In fact, todays dollars are backed by nothing but the good faith of the population in the government. Today, the Fed has no financial obligation related to paper currency except to issue new paper currency when torn or mutilated currency is presented. Strictly speaking, although Accounting for dollars continues to be done as a liability, it is no longer a liability, but retained earnings (also a credit), related to excessive seigniorage.

Is not a paper dollar or an electronic dollar both dollars? And are they not both IOUs?

A paper dollar is made out of paper. You have them in your pocket. They have a serial number and are unique. Each one is known. The total quantity out there is known, and is over $2 trillion (see chart). The Fed’s future digital dollar is going to be similar to a paper dollar in that each will have something like a serial number and can be tracked and the total amount is known. The electronic dollars used today to pay for nearly everything are credit-and-debit book-keeping entries without serial number.

Digital smigital, they did the same foolery in paper ledgers long before electronics. However, now the foolery takes place soooo much faster, paper is slow to move.

@ Lisa_Hooker –

Exactly. Legitimate dollars, paper or digital, represent the same value. The fraud to savers, is in their dilution by the FED and treasury, by the constant increase of them. This is also the advantage to asset holders and borrowers.

And you are right, digital dollars, whether recorded via paper or electronically are simply digital.

I must correct. Here is what I said: (A1) ‘Reserves and paper currency is the ONLY “real money”, and (A2) the sum of the two is constant(*).’

Where (*) being a longer remark I made that can be succinctly stated as “modulo money creation”.

This statement is a slightly more detailed than Wolf’s statement

B: “Paper dollars are neutral to money creation.”

But Wolf’s statement is a consequence of my statement. A2 implies B. B implies A2. They are equivalent. We agree. I think it would be a in internet tragedy (:-)) if this is not recognized. Thanks.

Can’t they just use that pile of real dollars to hand out loans to home buyers all around the globe and work down the pile of paper money to get back digital money in form of morgage payments on those loans? Maybe I did not really understand what the problem is, but the US can’t police the money flow all around the globe, right? So someone would want the paper money, right?

You mean, like keep laundering it until it’s bleached raw?

The fed number for paper dollars abroad is not very trustworthy.

Among other things: the illegal drug trade is largely denominated in dollars and is $1.5 trillion a year biz.

I would not automatically disbelieve if actual paper dollars in circulation abroad was several multiples above $2 trillion or more

The Fed knows exactly how many paper dollars are in circulation at any given time. You can look it up on FRED. The only uncertainty may be about old currency that has been lost through accident or other misfortune and therefore is not really in circulation.

There is a definite uncertainty is about how much paper currency is held domestically versus internationally. And I agree that this uncertainty COULD be substantial.

Remember that travel document you are supposed to fill out if you are bringing more than $10k in paper dollars in or out of the US? That is to help keep track of how much USD currency is abroad.

No, they don’t.

They know issuance but they have no idea how much is at home vs abroad.

For that matter, the amount of fake currency is non trivial.

What they likely do is sample, but even then it isn’t terribly accurate since people who hoard dollars don’t rotate them out frequently.

c1ue,

You’re confusing a “flow” such as “drug trade” — meaning dollars getting handed around over and over again from entity to entity — with a “stock” such as as paper dollars in circulation. You can do $1.5 trillion in drug trading a year with maybe $100 billion in paper dollars that keep circulating.

Wolf,

I don’t think your view that only 7% of the illegal drug trade’s money flow is liquid is accurate.

For one thing, once you get past the first / pusher level, the proceeds are largely unbanked.

Money laundering is a very non trivial consideration.

Secondly, you also are assuming for a single year. While certainly at least some of the mid to high leve proceeds are successfully laundered, equally at least some is not.

The illegal drug trade has amassed a really huge pile of profit over the past generation.

I used this as an example to illustrate the difference between “flow” and “stock,” that you had conflated.

I don’t know if your number is accurate either, I don’t know if anyone knows since this is the black market, and it doesn’t matter to my comment because my comment explained the conceptual difference between “flow” and “stock.” And that’s all it did.

Wolf,

I didn’t conflate anything. $1.5 trillion of revenue per year means both a huge amount of dollars in the operation flow as well as huge amounts of dollars built up as “savings”.

One cannot exist without the other.

Read what I wrote again: tens, hundreds, possibly even thousands of millions of people outside of the US use US dollars to hedge against their own government issued currency. This is accumulated capital built up for multiple decades.

Immense amounts of money is routinely lost in the drug trade due to theft, confiscation, loss (literally, the people that know where the physical money is hidden die), and literal rot (Escobar’s partners talked routinely of burying hundreds of millions of dollars only to come back years later to find them rotten beyond use).

I don’t believe the $1.5T number. As a global business, this would put over 10% of the global population using $1500 a year in drugs. A ridiculous number, that’s a billion people doing $1500 of illegal drugs. If you limit it to the US only, that’s 100M people doing $15K a year of drugs, ridiculous everywhere except California.

Petunia

Wolf used $1.5T as an illustration; his next comment acknowledged that nobody knows what the number is.

On the other hand, that seems somewhat plausible as a wild-ass-guess. A $1.5T global illegal drug trade is only a little less than 2% of the global “legal” economy (ie: an even smaller %age of the global black + white economy).

This link from a UK newspaper put the number at something between $1.5-5.0T. To coin a phrase, those are big numbers.

(LINK:https://www.independent.co.uk/news/drugs-trade-the-third-largest-economy-1072489.html)

Real good info Chip. Kinda puts the prohibition era gangsters to shame, eh?….unfortunately. Don’t know what the methodology was to come up with those numbers, but even the lowest estimate is, like you said, a “big number”.

All I can say is that maybe when too many are left out of “the game”, they do what they can to either try to better their situation (the entrepreneurs) or just become users (the lazy ones lacking the entrepreneurial spirit).

Too much money in too few hands, like Lincoln feared would be the result of “enthroned corporations”?

His words, not mine.

NBay

Of course, it could also be a bunch of unethical, immoral gangsters violating all laws and terrorizing the law-abiding population to generate cash (some by smuggling to US) the normal, tax paying economy.

This is how you run a mob, not build a civilization.

Here’s some thoughts by a real builder of civilization:

“Wealth is the parent of luxury and indolence, and poverty of meanness and viciousness, and both of discontent.”

― Plato, The Republic

You haven’t thought this through, nor do you apparently observe drug users in the wild much.

First of all – you’re focusing on retail. The US national GDP does not comprise what people buy from stores – it comprises the value all along the supply chain from China to freighter to Amazon to UPS delivery to the home (a limousine liberal example).

The drug trade includes growing the core product: coca, opium poppy, marijuana etc or manufacturing the precursors (meth etc); the refining of base product, the smuggling into the Western markets, the retail process to get it into the hands of the individual consumer. Then there’s more value add as the proceeds have to go through money laundering back up the retail chain to the suppliers and bosses.

As for scale: California sold $3B in legal marijuana last year. Legal marijuana represents about 20% of the MJ market by weight but possibly 50% of the MJ market by revenue. $6B/40 million = $150 per Californian – $75 of which is documented. $150 for the whole world would be $1T itself. And this is only the retail part.

Cocaine is a bigger drug by overall revenue – its users are doctors, lawyers, banksters etc and they likely spend 50x more even if the absolute numbers of users is likely less than MJ. There’s a reason why there are heroin and cocaine cartels but not really marijuana…

So net net – $1.5 trillion is not at all unreasonable.

c1ue

You’re, of course, correct that illegal drug sales (and, BTW, prostitution) are not reflected in US GDP. You’re also correct that I don’t spend a lot of bandwidth on this topic.

However, GDP is a useful macro proxy for the US economy, and that is how I used it (I’m not writing a PhD thesis here).

Apropos of nothing, the IMF has been encouraging nations to include illegal drug dealing and the aforementioned prostitution in GDP. Since 2014, Eurostat has pressured EU nations on this point. My assumption is this is more an attempt to size the black economy, as opposed to including it as a “legitimate” business activity.

As for the bank in question: I’m not saying they’re clean, but all of the big banks have been busted for money laundering offenses without being delisted or cut off from dollar swaps.

This is more likely political nonsense (I.e. lack of US political power by Pliego)

Could also be Mexico has a bigger money laundering problem than HSBC or DB…

…I’m betting on Mexico here.

I actually am not sure about that.

First of all, let’s not be naive: at least some of the drug money gets laundered in the big banks, too.

Secondly, the big banks are money laundering for a lot more causes: terrorism, 3rd world dictators, middle eastern princes, arms dealers, etc etc. as well as the more run of the mill billionaire and decamillionaire tax evaders.

c1ue

I agree with most of your statement. Big banks process hundreds of thousands of transactions a day and need a system to identify & report exceptions, which are then screened for appropriateness. Obviously, some big banks (DB & HSBC in particular) aren’t too rigorous about compliance, and have paid billions in fines.

A little bank, like Azteca, is a different kettle of fish. A huge chunk of their balance sheet is undocumented cash. Management obviously is aware of the situation and allows (encourages?) it to continue.

Any implication that all big banks are complicit is probably incorrect. This is a fast-moving global game, with ever-changing compliance rules & evolving laundering techniques. Mistakes (some honest, some not) will be made.

@Javert Chip

There is zero possibility that the big banks are not complicit.

They commit crimes every day just in the trading departments; the sheer scale of what they have been caught at shows clearly that they are complicit in money laundering as well.

The reality is that large banks are criminogenic organizations: the encourage and enable crime.

All you need to know is Sandy Weill’s Traveller’s acquisition: illegal at the time but stockholders were reassured that this would be fixed. And it was.

Given Mexico’s major sources of income are selling drugs, oil production, U.S. welfare fraud, and human trafficking (all dollar-denominated activities), the logical solution is for Mexico to adopt the US dollar as it’s official currency.

I’ve been to Mexico about 40 times over the past 40-50 years; I have NEVER had a Mexican vendor refuse USD as opposed to pesos.

And I’ve done transactions in some obscure places (buying marlin bait from a partially submerged panga at dawn in Cabo San Lucas harbor – $2/fish)

Perhaps the Yen is rising, because of Yen supply in circulation, thus fewer Yen creating greater demand and value, versus too many dollars and less demand, less value.

It’s a complex web made more chaotic by pandemic shocks.

If you’ve never read about Trading Sardines, it’s a great way to understand our weird world of financial betting/trading:

““There is the old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

Clearly the spoiled sardines in this story are worthless, but nobody bothered to look. Or nobody seems to care. It makes me wonder — Are we all just sardine traders, passing around worthless cans of ‘rotten fish’ at higher and higher prices? Is anyone actually checking to see if today’s ‘trading sardines’ are any good?”

==> Thus, in this world of high frequency pandemic bubble chaos, nobody has a clue how to value sardines, but that hasn’t stopped the trading game!

A lot of the financial “industry” is there to feed on the rest of the economy. If you think about the money finance people made on the three boom and bust cycles of the last 25 years it’s amazing. I think Greenspan started the doom loop of easy money, but would he really have started it if he knew we would end up here. It’s really allowing politicians to spend resources from the economy that people wouldn’t vote for through taxation. Lower middle class in the developed world have lost the most I think.

I heard there were more than 1 million people employed in the US with the title of “Financial Planner” or something close to that. What are these people contributing to the prosperity of the American people. Zero

When I sold the off grid house I built and had some money, I started looking at Vanguard index funds. The first thing that struck me as weird was that 35-40% of every fund was “Financials”. I figured every corporation listed had to have it’s own totally complete bean counting department or it couldn’t function. So I really wondered what the hell it was all these “Financials” did.

The GFC occurred a couple years later and I really got my answer to that question…in spades…social parasites, and damned dangerous ones at that.

As long as the Fed backstops the sardines, who cares if they are rotten?

I forgot about the moral hazard aspect of trading sardines, or tulips — the FED/CB’s backing rotten investments is obviously an entirely new paradigm!

From sardines to camels, borrowed from somewhere on the web:

“In the story, a man seeks shelter from a sandstorm in his tent but leaves his camel outside. The camel asks permission to put his nose in the tent, and the man gives it. The camel then progressively asks permission to put more and more of his body in the tent and finally the man has to leave the tent because his camel is taking all the space.

The moral of the story is “Don’t allow even small malpractices, because they will grow big eventually.” (The focus is on the “don’t allow” part).

So the phrase means that what is happening is a mistake, which although small, should be stopped.”

A well dressed rich business man came to a remote village offering $10 for monkeys which has a great marker overseas somewhere in China. Next week, villagers captured few of them and to their surprise paid on the spot. The businessman told them the trade overseas is heating up and he need more monkeys. When he left, another businessman showed up with an offer no one can resist. He will sell monkeys for $5 which the villagers can sell to the first businessman for $10. Handy profit with lesser work. The trade goes on for a month. One day, the first businessman came to town and asked for 100 monkeys. A huge order from China the next week. Obviously the second businessman came up with all the monkeys to the villagers and got paid. He left the same day on some urgent business. Next day, the first businessman never showed up as promised. Now villagers lost $500 and have 100 monkeys in cages without any buyers.

Jack London has similar story with eggs during the Klondike gold rush.

I think a dozen eggs went for its own weight in gold at one point. And turned out to be rotten in the end.

Nothing to do with “traditional waters.” “Trading sardines” were/are a feature of the California prison system. Perhaps it spread outside of California.

Not clear to me that your analogy is relevant.

Japan may have a huge budget difficult internally, but they have a huge trade surplus and also a huge balance of payments (I.e. the Japanese own a huge amount of revenue generating investments abroad.

Short term Japanese yen “strength” is not to Japan, Inc’s interest and I would believe that the short term strength is more a function of Japanese to/from foreign investment flows rather than anything “monetary”.

Or in other terms, Mrs. Watanabe’s investments in Japan (reference to the Japanese retail investor) is what’s doing it.

” settling fraud charges brought by the U.S. Securities and Exchange Commission without admitting wrongdoing”

Settling a fraud crime with a bribe to the prosecuting party is bribery.

Bribery is a crime.

joe2

You might want to hang on to your day job; your attempt at lawyering just isn’t working out.

Azteca needs to sell itself for dollars, at a discount, to a foreign bank. Dollar Washing Squared.

Wolfstreeters need to pool money together and buy Azteca’s paper dollars for 70 electronic cents on the dollar.

Then we invest in sardines and wait for caviar.

Banxico should take it’s 194 billion and buy bitcoin removing it from greedy government hands and maybe doubling it in the process.

Just to mention another distortion: Bitcoin now above $31000.

I love that BTC bubble! I won’t participate but I hope that the price goes much higher. Hopefully to the point that central banks finally start worrying about their unsound monetary policies and bubble blowing.

The marketcap of all cryptos is already approaching $1T ($824 billion as I write this). That means a collapse could have real world consequences. It’s not completely irrelevant anymore now that the market cap is more than half as big as all student debt. OK, it’s still only about the size of Tesla but it’s making headlines now and millennials are pouring their already scant savings into this pit. It won’t be long till people remortgage their houses (at the top of the housing bubble) and use the money to go all in BTC. It’s the only way to FOMO now because savings and pension is already invested in Tesla.

Or is this prescient? Probably too off topic………

From The Guardian: So they have become nomads, a new American tribe roaming the country in camper vans in which they sleep, looking for seasonal work in bars, restaurants and – in this film – in a gigantic Amazon warehouse in Nevada, which takes the place of the agricultural work searched for by itinerant workers in stories such as The Grapes of Wrath. Zhao was even allowed to film inside one of Amazon’s eerie service-industry cathedrals.

Don’t forget the vagrancy laws for those camper vans that stay too long in the Wal-Mart parking lot instead of the lots provided for the “fruit” pickers at Amazon.

Paulo-the late H.S. Thompson had an incisive article on this facet (a larger nomadic workforce than we like to think about) of American life many years ago (detailed, as i recall, in his “The Great Shark Hunt” compendium)-entitled ‘Boomers’ (written pre-contemporary use of the term).

My step-nephew and his partner are living the Sprinter life as we speak, making a go of it so far…

may we all find a better day.

“It’s the only way to FOMO..”. Love it.

Please do not use $$$ to measure Bitcoin market cap. You don’t measure real money with fake fiat dollars made out thin air.

Bitcoin = pure faith, God = pure faith, therefore Bitcoin is God?

I bought two bitcoin in July at 10k each and tripled my money in six months. I don’t regret this speculation. I also own gold but it became clear that it’s price is suppressed I don’t regret that purchase either it has for my entry point tracked inflation for twelve years about a seven percent annual return.

All bitcoin does is track the expenditure of energy needed to solve an equation(s) which tracks the order of bitcoin transactions themselves. Over time the equations become more difficult to solve and thus require more energy (computing power). The way they are designed a bitcoin can only go up in value.

As an anonymous way to do business bitcoin is a good idea, but the IRS now wants a piece of the action, so the anonymity has been lost.

The bitcoin currency is a “flash in the pan” (FIP) currency. It’s like burning a gallon of fuel and then saying, look I’ve burned one gallon of fuel so I earned one FIP!!

BTC may be going to the moon, but it’s the stupidest justifications for a currency imaginable. I’m working out my new hamster based currency (HBC), in which for every revolution of the hamster wheel I’ll make one HBC unit. Over time we make the wheel heavier and heavier so that HBCs are worth more and more.

Bitcoin now above 33,000.

When you think about it, maybe Bitcoin is how younger generations can deal with the bag of financial shXX they’ve been handed. They’ve been loaded up with national debt which they had nothing to do with. We’ve sent their manufacturing and service jobs to foreign countries. All we offer them in return is a low-paying gig without benefits.

USD’s are more of an anchor than an opportunity for the young.

Perhaps they can transfer the existing USD wealth from Boomers by devaluing USD and propping up Bitcoin. This can happen largely before older generations figure out what’s going on.

Ultimately, any currency or store of value rides on faith. To keep that faith, governments have to manage a currency in a fair manner that does not pit one generation against another by creating massive wealth disparities.

If the younger folk have faith in Bitcoin, and they are able to stick with it, because it’s the ONLY appreciating asset that hasn’t been hoarded by older generations, then Bitcoin might have some staying power.

The Fed and legislators have really made a mess of our financial system over several decades. They’ve had many chances for reform, but they continually fail. Perhaps people should have more faith in Bitcoin than the failed ramblings of the Fed and legislators.

“When you think about it, maybe Bitcoin is how younger generations can deal with the bag of financial shXX they’ve been handed. ”

That’s an interesting thought!

However, the government still has a monopoly on violence and can always tax individuals on whatever form of wealth they are holding. This tax has to be paid in the government’s official currency, so the younger generation cannot avoid being screwed by boomers.

However, as time progresses, the f*cked-over younger generation will form an ever increasing percentage of the population and will eventually be the most powerful. It remains to be seem how sympathetic they will then be towards boomers and their assets. Given the bag of financial shXX they’ve been handed, I expect that sympathy to be quite limited. What goes around comes around.

Right, every dog has his day. But I don’t see the next generation being less corrupt than the current. After all, they have been taught well in self interest and corruption if not science, humanities, logic, philosophy, and other stuff.

Meet the new boss, same as the old boss.

Agreed. Therefore I have no doubt that they will screw the boomers back once they get the power. And with some justification.

The young are the children of said Boomers. They will inherit everything the Boomers own. There will be no material change. Greed in, greed out.

“The young are the children of said Boomers. They will inherit everything the Boomers own.”