Funded with debt: Share buybacks totaled nearly $5 trillion since 2012. Over same period, corporate debt soared by $4.5 trillion.

By Wolf Richter for WOLF STREET.

The big four banks are out. And other companies are out. But Big Tech is in, as big as ever, and Warren Buffett’s Berkshire Hathaway, after pooh-poohing share buybacks for years, is now the second largest share buyback queen.

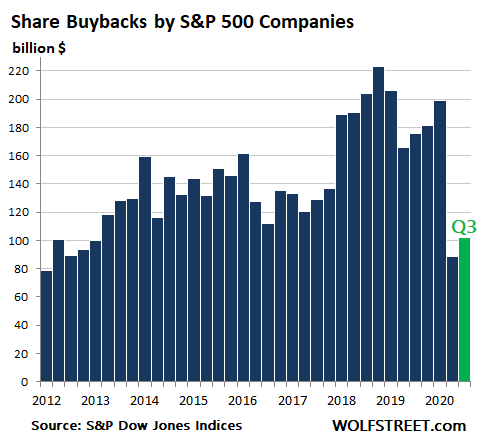

In the third quarter 2020, companies in the S&P 500 Index bought back $101.8 billion of their own shares, according to S&P Dow Jones Indices this morning. While this still sounds like a lot of share buybacks, it’s down 42% from Q3 last year, and down 54% from peak share-buyback mania in Q4 2018 following the corporate tax cuts:

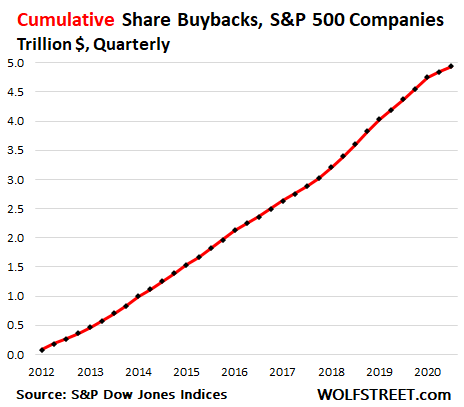

Since the beginning of 2012, the S&P 500 companies have bought back nearly $5 trillion of their own shares.

How much is $5 trillion? It’s nearly one-quarter of US 12-month GDP in current dollars. It’s about equal to the amount by which the US government debt has exploded over the past 12 months.

These $5 trillion could have been invested in expansion projects in the US, and in labor, and in training, or God forbid, in reducing the debt that Corporate America has loaded up on in a historic manner.

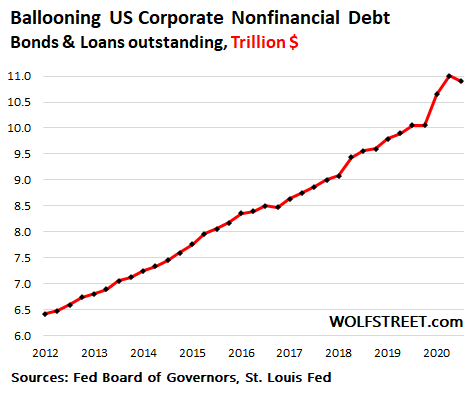

Many companies have borrowed heavily to fund these share buybacks. Nonfinancial corporate debt (bonds and loans outstanding, owed by companies other than lenders) has soared by $4.5 trillion since Q1 2012:

Corporate debt levels have been showing up in the Fed’s Financial Stability Reports. The corporate “debt overhang,” as the Fed calls it, frazzled Fed researchers in 2019 and it is now again cropping up in Fed research papers, including by the New York Fed a few days ago.

“We find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along,” summarize the researchers at the New York Fed. It was another research paper duly ignored by Fed Chair Powell.

Last year, the four big banks – Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup – occupied the #2, #3, #4, and #7 spots on the Top 20 list of our share buyback queens. Now they’re gone from the list, having been told by regulators to stop share buybacks to preserve capital to absorb the coming losses from the Crisis.

Big Tech and, ironically, Warren Buffett dominate the list. Apple retains its top spot with $17.6 billion in share buybacks in Q3, bringing the 12-month total to $76 billion.

Yes, Apple has one of the most solid balance sheets of Corporate America, but it’s $25 billion less solid than it was a year ago. Over the 12-month period when Apple bought back $76 billion of its own shares, its cash and short-term investments dropped by $10 billion (to $90 billion); its short and long-term debt rose by $14 billion (to $122 billion); and its shareholder “equity” – the difference between its assets and its liabilities – plunged by $25 billion (to $65 billion). That’s what share buybacks do; they hollow out the balance sheet, even the strongest balance sheet.

The scheme is top-heavy.

The top 10 share-buyback queens bought back $65.6 billion of their own shares in Q3, accounting for 64% of total share buybacks, up from 39% a year ago.

The top 20 share-buyback queens bought $78.7 billion of their own shares, accounting for 77% of total S&P 500 share buybacks. According to S&P Dow Jones Indices, historically on average, the top 20 account for 46% of total share buybacks. Everything nowadays concentrates at the top.

Number 2 on the list, Berkshire Hathaway, entered into this game in 2019 after pooh-poohing it for years. In Q3 it bought back $9.0 billion of its own shares, up from $5.0 billion for Q2; for the 12-month period, it plowed $17.8 billion into buying its own shares:

| Top 20 Share Buybacks, in Billion $ | ||||

| Q3 2020 | 12 months | |||

| 1 | Apple | [AAPL] | 17.6 | 76.0 |

| 2 | Berkshire Hathaway | [BRK.b] | 9.0 | 17.8 |

| 3 | Intel | [INTC] | 8.0 | 15.8 |

| 4 | Alphabet | [GOOG] | 7.9 | 29.3 |

| 5 | Microsoft | [MSFT] | 6.7 | 24.8 |

| 6 | Oracle | [ORCL] | 5.4 | 19.8 |

| 7 | Charter Comm. | [CHTR] | 3.4 | 9.2 |

| 8 | [FB] | 2.7 | 8.7 | |

| 9 | T-Mobile US | [TMUS] | 2.6 | 19.9 |

| 10 | Dominion Energy | [D] | 2.3 | 2.4 |

| 11 | Mastercard | [MA] | 2.1 | 4.6 |

| 12 | Procter & Gamble | [PG] | 2.0 | 6.4 |

| 13 | Visa | [V] | 1.5 | 8.3 |

| 14 | HP Inc | [HPQ] | 1.3 | 3.1 |

| 15 | Biogen | [BIIB] | 1.3 | 8.4 |

| 16 | L3Harris Tech | [LHX] | 1.2 | 1.9 |

| 17 | Cigna | [CI] | 1.0 | 2.8 |

| 18 | Allstate | [ALL] | 0.9 | 2.5 |

| 19 | Dollar General | [DG] | 0.9 | 3.3 |

| 20 | Cisco | [CSCO] | 0.9 | 3.3 |

| Total | 78.7 | 268.2 | ||

It’s all about Financial Engineering. When a company buys back its own shares, it pays cash for the shares. But the shares usually get canceled and are gone. As far as the company is concerned, the cash is gone too; someone else has it now. And “stockholder equity” – the difference between assets and liabilities, reflecting the company’s equity capital – drops by that amount.

That’s not a huge problem for a cash-flow rich company, such as Apple. But it’s a potentially mortal problem for many companies when they encounter rough water.

Share buybacks lower the share count, and so earnings are divided by fewer shares, to produce higher earnings per share (EPS) and a lower P/E ratio, and thereby hopefully a higher share price, without actually having to sell more or earn more.

There is an opposite to share buybacks: Issuing new shares to raise cash. This strengthens a company’s capital position, but dilutes shareholders and earnings per share. Young companies do this routinely after their IPO, but for a big mature company, it’s generally anathema – except for Tesla, whose CEO walks on water.

For example: The airlines, after buying back their shares at very high prices (the big four airlines bought back $44 billion of their shares between 2012 and early 2020) to drive prices up, entered this crisis in a precarious position. And to raise cash and survive, they not only issued tens of billions of dollars in new debt, but they also sold new shares, but at far lower prices. Buy high, sell low.

They were lucky they could sell new shares – thanks to the blistering rally the Fed created in the market. Normal markets are very unforgiving when teetering companies whose share price has been cut to a few bucks try to sell more shares to survive.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So companies are following the lead of their master, the Fed. What a surprise!

The Fed hollows out the dollar and companies hollow out their share(holders).

Actually opposite.

Less shares means the shares held by the remaining shareholders are worth more (in earnings).

Indeed, but if you take the billions in stock options bestowed on the people running things, they kinda look like wealth transfer mechanisms.

And worth less in book value. Nobody cares about that, when a company gets in trouble they load UP on debt and try to attract a buyer. Hussman barely mentions book value, stocks are a claim on future earnings, and he is a quintessential value investor. Book value is like a gold bugs hedge against financial apocalypse. At that moment who cares?

And Boeing….don’t forget Boeing.

I think Berkshire is a special case. Buffet always runs a conservative balance sheet. It is one of the few companies who has not leveraged up the last decade. He nearly always makes purchases of companies with all cash. His interest coverage on debt is 12:1. If he is buying back shares that means he can’t find any long term investments that will give a better return than what he can get on his shares which is mid single digit.

Not to defend Berkshire, but it’s price-to-book ratio is lower than the S&P 500. Buffet talked about price-to-book as a metric he considers for share buybacks. Also, now that Berkshire now competes with the Federal Reserve for financing in times of liquidity needs, why hold the cash. That business is gone.

Very good point.

I feel same about Apple and other cash rich companies. If they want to do stock buybacks instead of dividends, who cares? Either way the investor gets the opportunity to cash in.

But companies without a stong balance sheet who borrow to do this, totally different to me.

Reviving the old canard about the missed opportunity for training and jobs… it’s the private sector version of the government paying people to dig ditches and then refill them.

Regardless of the motivations, lets remember that the shares are exchanged for cash. Investors redeploy that cash into new investments. New investment at the highest and best return outside a mature industry, will spur new jobs.

I don’t think companies that buyback their shares ever consider, that all that cash, may be going to invest in their competition. The reason those shares were available for purchase is because that cash is going to a better place.

That buyback list is a list of future zombies.

I’m not saying it directly benefits management’s stock options, but… it does.

That’s only the first degree of lack of fiduciary duty, aiding the competition is the second degree of deliberate mismanagement.

OK Pet,,, not too bad for someone claiming to be, ” just a consumer running around town… etc., per a thread or so ago…)

All seriousness aside, you don’t need the commas after either competition or cash in your comment above,,, (per grammar nozzle or something,,, LOL.)

But I want to make clear that I, for one, really do appreciate your helpful hands on comments on WolfStreet, to which I turned to try to learn if I could invest in the SM again, after pretty much deciding in the early/mid 80s to get out of it after 30 years or so.

Have stayed out of it since, investing only in physical PMs and RE, with which I have made some good profits, some very good profits, and, of course, some losses, due mostly to timing and liquidity issues with the RE…

Way ahead to this day and finally ”fully retired” after 2 times earlier being SO boring, etc., so thought maybe to put some $Ks into play,,,

So far, SM gambling not gonna happen in spite of or perhaps because of Tesla, et alia, being so crazy, not to mention the absurdities of 2020…

Uncle who started me in SM in late 1940s was an absolute fundamentals investor, retired very early and only ”traded” when fundamentals indicated.

Thanks again,

That ignores the fact that all of these companies are weakening themselves drastically, so that (if as I predict, the congress will not pass a sufficiently gigantic bailout to rescue the tens of thousands of businesses and reportedly, at least 40 million needy Americans), a huge number will become legally insolvent. Many will close and cause massive loss of jobs.

Of course, investors might find another place in which to put their cash. That is always the case, but you are ignoring the manipulation that is occurring through these share buy backs: by getting into debt and giving away necessary cash, the stock price of many, many companies has been inflated to ranges that any third year undergraduate student of finance should be able to figure out are insane.

Even the fake PE ratios cannot support most companies’ valuations. Most real PE ratios (when they ever come out, if ever) of large companies would show their prices to be insane.

Thus, it would be good for investors to invest in more competently run companies. However, where?

I am sufficiently familiar with preparation of current financial statements post-Enron that I no longer believe in most of them. Any company that is not obviously booming might have hidden, fundamental weaknesses.

Despite my knowledge and experience, I see only a few, absolutely sure investment opportunities for an investor that cannot just take over companies, like Mr. Buffet. (I already bought all of the Amazon stock that reasonable diversification would allow long ago when I figured out that a financial disaster might not harm it much.)

The executive order taking away gold in the 1930s from its owners, then called “hoarders,” means that metals are not safe. Holding dollars now means you are giving money away, because the banksters’ “Federal” Reserve is effectively robbing all savers through the oncoming inflation that will follow the recession/depression.

The US faces such oncoming demographic and bankster-corruption-caused cliffs that few companies are clearly, absolutely safe: diversification must be used, with the acceptance that some investments will not be recoverable.

Musing: I wonder if the coming (or already extant AI?) AIs will be able to catch the massive, Enron-types of financial fraud ongoing from publicly available information? Alphazero’s reputed abilities mean that we are at the very least climbing nearer the human-level intelligence summit and computer processing power doubles rapidly every year or so.

I am actually surprised (and a little spooked) that nothing much is being discussed in the media about an AI that taught itself games by playing them. Finance, logistics, military strategy, and even litigation consist of games-like analysis of positions and moves, so the potential of this AI with supporting narrow AIs (and quantum computer software) performing more specific functions is already amazing.

It will be like having two (or a dozen) Gen. Douglas MacArthurs in a box in terms of military planning. Maybe, before the ultimately-likely obliteration that an AI with super intelligence will cause as Musk warned, the lower level AIs might rescue us from many, current dilemmas.

Sure wish that there was some AI-created cure possible for the Wall Streeters’/banksters’ toxic, absolute, consuming greed: complete asset forfeiture for all corporate officers, corporate lawyers, and corporate-control-group-members whose corporations became legally insolvent or are convicted of fraud or misconduct might do the trick.

I was reading your comment and thought:”when AI becomes so clever that us humans will never be able to ‘win’ from it, why play the game then?”

Or AI must become so clever it will leave just enough to keep us playing the games. But then there will be no difference with the current investment casino. Then AI will have made no difference at all. The modern day algo’s can be optimized by AI, but these optimizations will make no difference to the people. They get fleeced either way.

We will get fleeced, because the public will not benefit from AIs, only the rich and powerful. As another commenter pointed out, the current, narrow AIs are neural nets trained with datasets. MuZero and Alphazero are remarkable in that they can learn games on their own: well enough to beat all human players with a few learning hours WITHOUT HUMAN TRAINING. Games are remarkably similar in use of analysis of existing data to many pursuits like finance.

AIs would need access to all trading information to identify abnormally successful investors and spot insider trading and separately, access to a lot of financial data to identify instances when entries in a company’s financial statements do not correspond to actual results: presuming that all of that company’s records are available to the AI. The information that private databases collect is amazing and might be enough with publicly available and governmental data. I bet the banksters could access a lot more data through the banks and private financiers.

Critically, AIs like MuZero, et al., are rapidly becoming so very powerful now that there will be accelerating development of AIs, because the goal of AI researchers is now in sight: MuZero would already be games changing if used by the US military for logistics and strategic planning (e.g., allocating resources), so China and Russia will want equivalent AIs. They do.

Putin said that the country that achieved the development of advanced AI would dominate, or words to that effect. Translations are always iffy. Russia is working on AI development.

China is rapidly investing in AIs. The banksters will seek AIs too, because they have the trillions of US taxpayers’ resources that they control through their domination at their “Federal” Reserve.

There will be no limits put on AI development: greed and lust for power will dominate all the wealthy/powerful to rush AI development recklessly. At least, it will be a long time before any AI can exist for long without our infrastructure, so those predicting immediate catastrophes (or wishing crazily that we could be accurately uploaded from their miserable lives to digital “paradises” in disregard of the Heisenberg Principle and without considering who will pay for the electricity, maintenance, etc.) are probably wrong.

I think AI’s ability is limited to the training set. It is the shortcoming that’s often overlooked.

I am sure it can be trained to uncover the next Enron or Wirecard.

But, it doesn’t have the next BIG fraud in the dataset, therefore it will miss it.

A very interesting notion, (not that I believe AI is ever going to match human brains except in specialized areas like you speculated on), but I seriously wonder what self respecting 1%er (or .01%, or far less) is going to invest his money in catching himself?

His money is much better spent on buying Congressmen and others who can be “helpful” to him in his (their) insane quest for ever more money.

FinePrintGuy,

“… will spur new jobs.”

Hahahaha, that was funny. But wait… The money from share buybacks goes to the seller of those shares, and ends up in their brokerage account or 401k or index fund, and they’re just going to buy other shares with that money. They’re not taking this money out to invest in plant and equipment in the US. These are two different types of “investment.” Trading stocks doesn’t create jobs.

Bingo! Classical economists identified what they considered real investment, versus unearned income. That’s all gone now. Financial economist Micheal Hudson believes we are already in a ‘debt deflationary’ environment. It does appear that bond, stock, derivatives and property are all inflated. That’s what happens when Congress, Treasury and the Feds aim their wealth transfers up into the One Percent’s assets. The wealth transfer should be directed at labor and the so-called middle class. Aimed so as to replace lost demand caused by all the supply side malarkey of neoliberal macro. Instead we get an artificial bubble in the asset classes the rich own. The deflationary stage comes once those bubbles a pricked.

I think its a new playing field now. Money printing and helicopter money is taking on a more formal consistent role within our monetary/financial system, even though the Fed and Treasury won’t admit it.

While QE increases assets of the 1%, QE combined with fiscal deficits gives free money to recipients of government spending (i.e., stimulus recipients, SS and Medicare, government contractors, etc.). This provides direct benefits to the lower classes and creates inflation. When the Fed’s money printing sparks inflation, the Fed’s little game is over because it will have to raise interest rates.

Peter Schiff made a good point this week. The Fed pretends it can let inflation run above 2-4% for a while before lowering rates back down to 2%. But, the Fed cannot reduce inflation once it starts. The Fed’s only inflation fighting tool is the interest rate, and it cannot raise the interest rate without causing a deflationary collapse at these super-high debt levels. Thus, the Fed is completely bluffing about it’s abilities. Once inflation sprouts, it will run wild and the Fed cannot do anything about it.

I’m positioning for an inflationary spiral, or a deflationary bust (i.e., barbell strategy).

Professor Hudson is one of the few economists I don’t consider to be a High Priest for Capitalism. Instead of endlessly promoting dogma that has zero evidence, he has spent his long career studying actual financial/social systems and how they operate, both current and ancient.

His book “Super Imperialism: The Origins and Fundamentals of U.S. World Dominance” is available free on his website, along with a large collection of essays.

“unearned income”

Marxist Doctrine That Only Manual Labor Is Productive

“Earned income” is held to be wages and salaries. Profits, interest, and dividends, on the other hand, are held to be “unearned income.”

The basis of the distinction is that the first two are perceived as being received by virtue of the performance of labor. The last three are perceived as being received without the performance of labor.

If I work and save ( do not spend all that I earn ) and than invest in something is honest/moral act.

FED creating money out of thin air is immoral/robbery/theft/debasement

Every time I see “helicopter money” mentioned I am reminded of the Mark Twain quote (paraphrasing here); “Go ahead, give the poor all the money you want, the wealthy will have it before nightfall, anyway.”

Green New Deal!!!!! (Green New INDUSTRY)

And on a ball in space, what rational person gives a rusty about the bean counting?….the clock is ticking.

Yes, which is why it drives me crazy when people refer to buying stocks as “putting money to work in the economy.”

nothing wrong with buying stock — problem is what is money being used for.

If IPO offer you to buy company which is going to expand business — nothing wrong with that.

of course there are bad people everywhere — Caveat emptor is Latin for “Let the buyer beware”.

Hi Wolf- or consider that plenty of big mutual funds, mega money managers, pension funds that will unload the shares of maturing companies that they think are over valued and redeploy that cash in growth companies. Think about the vanguards and black rocks that participate in the Silicon Valley startup scene. The stock market isn’t just 401k indexers…

The big money for the tech scene is coming from somewhere…

Yeah, but unless the company is issuing new shares (as Tesla did, for example), redeploying that cash into shares of a “growth” company doesn’t help them grow at all.

There will never be another normal market again till the country collapses.

From here on out, it’s To Infinity And Beyond. Remember guys, you can make money in a Ponzi scheme, as long as you are not the last one out.

600 hundred more dollars coming soon for people to buy junk they don’t need.

In all seriousness, how long do you give it till it collapses?

Back in 2012, when it was clear we were never going to pay for our stuff, I said 2030.

I think it might be sooner now.

I thought back in the early 1990’s Bear Stearns would blowup in 5 years. It took a lot longer, 2008.

So far, I’m not looking forward to next year.

Have faith… the lieutenant of the Audacity of Hope will be in charge again, and all will be well.

Just take the vaccine, wear the mask, and do what you’re told. Cause it will no longer be baseless, it’ll all be grounded in science from now on.

Sheesh, your guy lost. Get over it.

“Sheesh, your guy lost. Get over it.”

Dirty Russian.

@ Apple

Why should I get over it.

My guy won. My guy was grounded in science, his words weren’t baselss, and he practiced what he preached… enjoyed embracing feminism since the beginning… literally, and was endorsed by the audacity of hope. He was a true believer in justice, equality, and his version of the American way.

Yes, I voted for the winner. Cause in CA, there is only one possible winner for those EVs. And it sure as heck ain’t going to be the current incumbent. Yes, that means I also voted for the loser 4 years ago… but that’s how it goes in CA.

And most of all, I am honest, I am voting my pocket books. Cause I like to get that part of the tax code back the way it was, and guess who isn’t going to do that for me.

how long do you give it till it collapses?

can not be predicted:

my former country SFRY lasted from 1945-1992

USSR existed from 1922 to 1991.

A few years ago I had a conversation with a fellow who went through the currency collapse in your country. Graphic details. Wasn’t pretty.

“600 hundred more dollars coming soon for people to buy junk they don’t need.”

$600 dollars is an insult to the American people. It’s almost a joke in terms of the real costs of medical expenses, mortgage or rent payments. These politicans are in La La land.

All those investors who thought the Democrats would unleash a tidal wave of spending are sadly mistaken. Pelosi negotiated down to a package half the size the one offered by Trump. Austerity for the poor and unlimited wealth for corporate donors is what they stand for. The democrats only show their ‘working class roots’ when they are in the minority.

$600 would be great these days if you had everything paid for, (like the mortgage and car) and carried no debt. You just need some cash for food and maybe winter coats for the kids.

Other than that it is a spit in the ocean.

My Dad, regarding the Great Depression…..modest modest farm house, no debts, lots of food, “We always had enough to eat, we just never had any money for anything”. Of course their clothes were 1-2 pairs of overalls and always mended, nowadays folks just toss them. Grandpa lost his fuel oil business when people couldn’t pay him for what they needed in a Minnesota winter. He just delivered the oil until it was gone and there would be no more. My Dad and Grandpa finally found work in a Twin Cities slaughterhouse.

My mom had one dress and 1 pair of gumboots to wear to school.

I think there is still a ways to go with these interest rates and available debt. For awhile. People are lining up at food banks in pretty nice cars. The only protests and violence is about politics.

The thing is, when a train goes off the tracks it’s pretty hard to get it back on. Lots easier to keep it going. In hindsight.

What, 3500 people died of Covid in the States, just yesterday, and not a word was heard by the tax cutter in chief. And some people here on WS still talk like the situation is viable. Like the virus is about freedom vrs masks, or doesn’t even exist.

Wait a month. That’ll be another 100-150k dead and overrun hospitals. If we’re still talking share buybacks and closed dining in, there is little hope for the system to continue much longer.

A one-time $600 payment is a spit in the ocean. A lot of people sitting some capital made $1M or much more simply by pushing a few buttons on their computer when stocks hit the lows this Spring.

We truly are dealing with two financial worlds. There are people who have wealth, and so the money falls easily in their lap, in return for nothing. In the other world, people are searching the job boards for a low-paying job, trying to make a rent payment, while their dream of a better life (a home, a decent car, and education, a dignified retirement, etc.) moves quickly out of reach.

Capital has been favored way too much in our society, at the expense of societal harmony.

The deal is reached to avoid a government shutdown. Note the GOP wants a binding clause on Federal Reserve spending, and that as much as anything is contributing to the drop in equity prices.

Pelosi’s “crumbs” are getting smaller and smaller.

Actually the Democrats only show their “working class roots” when in campaign mode for an election.

Besides, $600 is not an insult. It’s enough for a lunch for one (with cheap wine) at the French Laundry.

You may not need it, but I do.

People who need the money should not be given 600. They should be given 2 or 3 thousand a month. That way they can pay rent on top of other things.

BUT, that money should come from somewhere and not printed. Like for example: requiring our biggest companies to pay tax, or how about a reduction in defense spending?

It depends WHY they need the money.

These people were working and locked out of their jobs by govt. If they are not allowed to work, they need to be paid a livable sum.

A lot of people are spoiled in developed world. Maybe I am lucky, but I structured my life to where I need about $750/ month. It’s a very good life as I consume all the goods and services that I want. Usually I spend more than $750 to give back to others, but my base budget is $750. Most people that are broke really are consuming above their income level living in nicer digs than they can afford, consuming services they can’t afford.

Everyone should be given $100,000.00 immediately. It doesn’t amount to much for the 1%, but it would mean ever so much the the out of work. /sarc

Very informative; thx, Wolf.

So many of your posts make me feel like I should just unload most of the stocks that are now in my IRA. When I bought the Intel, many years ago, Andy Grove allegedly worked from a cubicle like much of the rest of the workforce. He was not primarily a financial engineer. Intel was the only semiconductor company still located in the U.S..

Those were the stories, anyway (I still like to think that there was some truth in them) . They tell you not to buy stocks because of their stories, but most companies are ABOUT something. You like to hold stocks that you don’t just feel cynical about.

Times have changed. ….OK, FinePrintGuy, you have a point. Maybe it’s just time to re-shuffle. Of course, that’s got to be after reassuring myself that the whole house of cards (thanks, Fed) is not just about to come down….

@WSKJ

A Tail insurance is vital behind any ‘fat’ portfolio in the over valued, over hyped and over bought, zone where now (S&P) PE is around 38 or more! Mkt cap to GDP is nearing 180%!

Go Figure!

(Been in the mkt since ’82)

BTW, risk comes more suddenly than in many investors’ radar. Sudden decline in March was just a preview. Vaccine(s) or NOT, Covid’s damage to global economy will continue. surprising many in the coming months. Stimulus will be just a bump. May be I am wrong and it could be different, right?

At a minimum it looks like the future long term real returns on stocks, bonds and cash will be very, very low at current asset prices. If you are retired you and are going to spend down your assets starting at 65 you have to use a conservative number somewhere around 2 – 3% of total assets and don’t make a big asset allocation mistake along the way.

Funny thing about that list of companies you have there. Half of them are led by leaders who are “socially responsible” in the eye of the media. Wasn’t it Buffet who kept saying he doesn’t pay enough taxes. Now, he goes in a splurges on share buy backs.

I’m not sure if this is irony or not, but I can certainly tell you it isn’t investing in America. Although conspicuously absent from this list is AMZN, I wonder if that’s because Bezos is too busy expanding his empire and putting his money to better use than the rest.

Anyone who goes on public media to complain about not paying enough taxes is human scum. All one has to do is write a check to uncle Sam.

That notwithstanding, with inequality at the current obscene levels, its only a matter of time if the distribution will be that of wealth through taxation or of poverty through revolution.

That’s a silly position. It would be ineffectual to decide to just send more money to the US government. What you want is for everyone to do it, just like you; that makes a real difference.

Your argument is akin to me saying that it’s silly to complain about trash you see on the street. You should just spend your whole life cleaning trash rather than complain … right? No, what you want is for everyone (including yourself) to do their part; not only is it actually fair, it’s the only way to be effective, since just one person dedicating their life to cleaning trash is not going to have a significant impact on the amount of trash on the streets of the world, but is going to ruin that one person’s life.

I would vote for all kinds of policies that cost me personally, because I believe in all of us doing these things together. That doesn’t mean that I’m going to go rogue and impose laws and rules on myself that no one else has to abide by, that’s just silly.

I see, how about you yourself be the change you want to see on other people and spare the virtue signaling for everyone else?

No one is preventing Buffet to cut a 10billion dollar check and send it to the treasury. Not only that but billionaires perpetrate a bigger scam on the taxpayers by not paying taxes at all through their non profit foundations.

They tried that in Norway as millionaires were complaining they were not taxed enough and the finance department open an account for voluntary contributions, guess what, at the end of the year there were $1325 of voluntary payments by the millionaires, here is the Bloomberg link

https://www.bloomberg.com/news/articles/2017-07-06/-voluntary-tax-plan-as-expected-fails-miserably-in-norway

Memento, you do that most effectively by advocating for and effecting rules changes.

Also you completely ignored my entire point when you said “No one is preventing Buffet to cut a 10billion dollar check”. Since you’re going to ignore my point, I’ll stop engaging in this conversation now.

This. Publicly state that your taxes are too low but privately do all possible to minimize your taxes. Whited sepulchre much?

Bezos gets lots of hate but at least he is about making money via growth, granted partly funded by taxpayer, but at least he is growing something. The rest of captains are just over paid biz admins who think they are in the same league as bezos.

People need to remember that for every bezos there is 9 waltons who inherited their money to live large while the rest of us do the w2 neo feudal slavery

Bezos gets hate because he is rich, nobody seems to give a shit about the fact that he went from a nobody to building one of the largest company in the world in less than 30 years while making himself a fortune. And in turn creating millions of jobs.

All the whiners complain about is how unfair Amazon is and how Bezos is everything wrong with the US. Yes wonder this country is going down the toilet when genuine innovators are looked upon as leeches.

The same goes with Musk, if every one of his detractors did a hundredth of a percent of what he did, the world would be in a better place.

This is what we get for the crappy educational system we have where the teacher union are running things, their members are mostly incompetent and care more about social issues than doing their actual jobs.

Musk was born with a silver spoon in his mouth and Bezos is a leech. Are you another one of those temporarily displaced millionaires this country overflows with, so you feel the need to be their apologist? Lest one day someone come after you in your dreams when you are an oligarch?

Yeah, and how many jobs did bezos eliminate?

@RightNY

You can make the same argument about the ICE and ask how many horses were killed because of it, or electricity and ask how many candle makers were put out of business because of it, or the telegraph and ask how many couriers were put out of business because they could no longer deliver messages.

You can’t stop progress, and you can’t stop an entrepreneur from entrepreneuring….

I call bullshit on the jobs. He just streamlined with online and predatory control and moved jobs from an existing sector into his own empire, If anything, there are fewer jobs…just more amazon employees.

And this!!!! “This is what we get for the crappy educational system we have where the teacher union are running things, their members are mostly incompetent and care more about social issues than doing their actual jobs.”

Oh, I get it, you went to school so you are an effing expert on education? And just how is the “teachers union” running things? CA has scripted learning, standardized testing, and their teachers have no control or say in the curriculum. It is stand and deliver, do what you are told or begone. The only thing the Union does is try to provide a livable wage and stop teachers from having to bend over and grab their ankles to keep their jobs. In the Bay Area they had to provide barracks because teachers couldn’t afford housing.

15% of teachers quit after 1 year….50% within 5 years. Those are the stats.

@Paulo,

I’m happy to admit I’m no expert on education. At the same time, one can’t possibly deny the state of education in the US is in decline, and has been for years. Ask yourself what they teach, I’ve made numerous posts about how they neglect basic financial education.

If you look at where CA ranks in spending in term of per capita spending, it’s certainly not in the bottom of the pack, and it’s results are consistently lower than such spending would indicate otherwise. So, as people so often like to say, it’s data that matter. As for scripted learning, I don’t know enough to comment, but I would be curious enough to ask the question, who decided to go with scripted learning. After all, given the clout of the teacher’s unions in CA, one would imagine that they have all sorts of say in how learning is conducted in school.

As for the BS on jobs for Amazon. I’ll agree he has decimated industries, and in turn built out his own empire. Do you begrudge him for streamlining services and building out things like the cloud infrastructure? But sadly, that’s progress. History is littered with examples.

The PC industry as a whole has terminated so many jobs, a simple example is for data entry clerks with things like spreadsheets, should we ban excel for taking away manual data entry jobs.

How about the cotton gin or all sorts of farming advances that put tons of farmers out of permanently out of work. Perhaps we need to label Eli Whitney a job killer and a destroyer of livelihoods.

Fancy robots in factories, guess what that’s going to do. Yep, cost factory jobs. Should companies stop investing in those, perhaps protest at places like ABB and demand they stop making robots because it’s causing untold suffering on manual labor?

But getting back to the point, if it wasn’t Bezos, it would be someone else doing similar things. Would you condemn him because he is made things more efficient?

The rest of the captains had to pay tax while Bezos got away with not paying any. And no I am not talking about income tax, I am talking about sales tax.

He can also thank the Gods of the Financial markets for keeping his stock up there while sh***** on his competitors.

Bezos is one of the best there is, I would agree, but let’s not put him on a pedestal. He had help.

Not putting him on a pedestal, simply giving credit where it is due. And that no sales tax thing… it apply to everyone else as well.

That he benefited most from a law that applied equally to everyone should not be a mark against him. People don’t give baldy enough credit for his vision.

Unlike the Google boys, he didn’t just walk away or waste his time on vanity projects.

He leveraged vision and grit to get to where he is. If people can’t appreciate that… then the US is not the right place for them.

“putting his money to better use than the rest.”

Or that Amazon doesn’t have anywhere near the cash that others do.

Amazon works on small margins despite its huge gross revenues.

It is hard to buy back many shares when your PE is around 100…you don’t have enough cash.

Cas127

Sometimes knowing what you’re talking about prevents you from saying silly things:

A quick read of Amazon’s 3Q2020 balance sheet shows “Cash & Equivalents” $68.5B, up from $25B in 2016.

With an ROE of 25%, I strongly agree with MCH that Bezos puts his money to better use than most of the rest.

J Chip,

Amazon may have substantial cash in dollar terms…but place it in the context of its ultra huge market cap (share price * number of shares). $70 billion cash is significantly less than 5% of its market cap.

To prop up that market cap (a function of share price, itself a function of its PE, which at Amazon is huge) via buybacks, Amazon would have to use some/all of that cash to offset any future selling pressure…but cash is less than 5% of market cap.

My general point is that the higher the PE ratios go, the harder it is for companies to defend their share prices via buybacks…because market caps at higher and higher earnings multiples (earnings being ultimately the only true source of cash) rest upon *proportionately* smaller ratios of cash.

JC, nothing you said changes that.

$70 billion is a lot of cash…but not so much if 5%+ of Amazon shareholders wish to sell – that would be in the neighborhood of $80 billion looking to exit, selling pressure that buybacks are designed to defend against.

And the situation is much, much worse for the much more typical high PE company of today with nowhere near $70 billion in cash.

@Cas127

I think the obvious point is if Bezos decided today to stop investing in his air force, his tons of warehouses, forget this crazy second HQ in Virginia, all of a sudden, the cash comes flooding in.

Bezos got to where he is by willing to burn cash on things that nobody thought would be worthwhile. Infrastructure for delivery, are you nuts? Cloud infrastructure to support Amazon’s e-commerce business so the site doesn’t go down during Christmas, why would you do that?

Most of those things cost a bucket of money when he couldn’t afford it, yet he did it anyways. Robots for warehouse… hey, I know, I just go buy the top company in the market, make them only do robots for Amazon. What has that done.

Bezos is not too different from a Musk, or a Jobs, he is one of those rare visionaries who didn’t end up in a padded room, and now he dominates. If eventually he gets taken down because of politics, that’s not because he didn’t work hard to put Amazon and himself where they are at today.

MCH,

I’m not particularly anti Bezos, I just think that Amazon is a lot more fragile (especially at these PEs/Market Cap) because it is fundamentally a middle man, in an era when the internet works to disintermediate middlemen.

I don’t think the the huge PE’s/Market Cap reflect that.

I think Amazon’s thinnish margins do.

And as much cash as Amazon has…it pales in comparison to mkt cap.

Your pt about margins being misleading (if only Bezos would stop spending like a drunken sailor) might have some truth…I would have to root through the financials.

But Amazon’s essential character as a middleman in an era of internet disintermediation is unlikely to change.

You could argue that Amazon’s enormous warehouse/fulfillment operations make them more than a middleman.

Maybe.

But I do wonder about the day when Google or some such turns its basilisk gaze upon Amazon’s essential functions and duplicates the website functionality and coordinates with manufacturers to provide production/storage.

MCH

I enjoyed and agree with your response to Cas 127, who has a fantasy about how “fragile” Amazon is (as it continues to plow under B&M retail).

Cas 127 may have a minor technical point about Amazon margins (easily solved: stop the CapEx spending), but as long as Bezos gets 25% return on equity, he’s doing exactly the right kind of spending as he continues to innovate and invest in his retail vision.

People like Cas 127 have a congenital case of the red-ass about Bezos (…spending like a drunken sailor…) and are simply living proof that everybody isn’t cut out to be a successful entrepreneur. While Bezos + ex-wife own about 15% of AMZN, they aren’t obviously manipulating the stock; 3,400 investment companies & millions of small investors determine the market cap.

JC,

You continue to claim that I have some sort of anti-Bezos bias…despite the fact that I disclaim it.

My argument about high PEs undercutting companies’ ability to support/manipulate share price isn’t especially about Amazon…except to the extent its huge mkt cap makes it an outsize example.

The same dynamics apply to any ultra high PE company…it becomes harder and harder to support share prices via buybacks as PEs escalate into the irrational…because earnings (ultimately the only true long term source of net cash) lag further and further behind share price (the very definition of high PE…it is a mathematical identity).

Higher share price and lower earnings (covid related or not) means less cash buying fewer shares means less price support coming from buybacks. It is just simple math.

You could argue that any given company’s ultra high PE isn’t due to share buybacks but from ultra high (and arguably irrational) valuations/expectations of growth from external shareholders.

Okay…that at least makes conceptual sense.

But the existence of hundreds of billions in annual buybacks, yr after yr, and decade after decade, suggests there is widespread “share price support” going on across many, many companies.

Yes, buybacks are tax favored over dividends, so that can play a role.

But looking at the timing and percentage share of buybacks (vs. Other uses such as dividends or retention for capex) suggests that “price support” can play a major, major role.

For these reasons…Amazon’s astronomical PE *is* fragile…thin margins mean that huge revenues don’t equate to huge earnings…and thin margins are to be expected for a middle man in the era of the internet…when price searching and competitor switching is always a serious threat.

Amazon may be kicking BandM ass (although not really Walmart) but that says nothing as to Amazon’s future vulnerability to online niche competitors (of whom there are many and will be many, many more as Amazon continues to try and fatten margins).

Astronomical PEs imply astronomical future growth…which is very hard once you are already at $250B+ in sales and harder still when you have to hike prices for fatter margins.

(PS When you repeatedly, studiously ignore what I actually say…in some detail…and then engage in name calling based on something you imagined rather than anything I said…you sound more and more trollish.

If you can’t engage on the basis of the arguments I am making, be an adult and just say so.)

Cas127

Well, I’m still an adult, and still claiming people who revert to flaming ad hominems have basically defaulted on the argument.

1) Your claim the AMZN is “fragile” because of it’s low cash-to market cap ratio is your personal made-up metric. While mathematically accurate, it’s financially meaningless.

2) You also claim AMZN is fragile due to thin margins. AMZN’s current 4-5% margins could be instantly higher if Bezos stopped the heavy CapEx. AMZN is essentially creating a whole new way of doing retail that the American public (excepting you) love, and Bezos’ massive CapEx returns an average 25%.

3) You claim GOOG could easily overwhelm AMZN if it so chose to do so. Highly unlikely. GOOG would have to enter an entirely different business than advertising, duplicate AMZN’s already-existing network of mfg & vendor relationships (very expensive & non-trivial activity), and, even more complex & expensive, compete with Bezos’ logistics machine which delivers goods in a day or two.

Just because GOOG is good at advertising says nothing about their hypothetical ability to do retail.

4) Unmentioned in any of the above is WHY AMZN actually does most of it’s share buy-backs. AMZN uses restricted stock grants (options, whatever you want to call them) as an integral part of compensation for various classes of employees (they’re a normal business expense). Share buy-backs prevent share dilution.

I look forward to your next round of baby-talk ad hominems.

JC,

“low cash-to market cap ratio is your personal made-up metric. While mathematically accurate, it’s financially meaningless.”

Fairly damn important metric for buybacks.

Also, you want to anchor the entire high PE/buybacks issue solely to Amazon…that wasn’t and isn’t the discussion.

And, as to Amazon itself, I’ve laid out some pts of vulnerability (any vulnerabilities are pretty dangerous for stocks with insanely high PEs) and people can agree/disagree as they will.

Keep tap dancing on that razor’s edge.

Cas127

Congratulations: you got thru a post without an ad hominem.

You have a fixation with your personal “stock buyback” metric, but nobody else in the financial industry even tracks it. For the record, Amazon’s board has given standing approval for buying back up to $5B of stock; however, AMAZON HAS NOT DONE ANY BUYBACKS SINCE 2012. So much for the “buyback” metric.

A somewhat sophisticated reader of financial statements would understand there are at least 4-5 reasons for Amazon’s admittedly very high PE ratio:

1) Amazon remains an amazing growth company; revenue doubles about every 3.5 years

2) Amazon growth & Bezos vision requires huge capital expenditures, generating a 25% return on equity

3) Amazon has been profitable for all but 1-2 of it’s early years (unlike UBER, LYFY, et al), with “net income for shareholders” margin currently running around 4+% of revenue (fyi: Home Deport, my gold standard for retail, runs at 8-9%)

4) For the last 5 years (as far back as I can see), Amazon CapEx has been 145-400% as large as “net income for shareholders” – PLAINLY, AMAZN COULD INSTANTLY DOUBLE THE 4+% MARGIN BY SIMPLY REDUCING (not eliminating) CapEx by 50%

5) I’ll concede there is “investor enthusiasm” for AMZN stock

Calling a juggernaut like Amazon “fragile”, when it’s forcing a (profitable for Amazon) secular change on retailing, collaterally causing hundreds of retail bankruptcies and resulting in the closing of tens of thousands of retail outlets just isn’t credible.

Starting with downtown department stores, retail has gone thru 5 secular changes in the past 70 years: mall department stores, catalog stores, big-box stores, and now, e-tailing.

I have no doubt e-tailing will not be the end of retail evolution, but that’s 20 years away.

Will this country ever be in a place where this is viewed as a corrupt practice? This cycle of stock option grants, inflation, and share repurchases seems like a too-sweet deal anymore.

Lou Mannheim

I’d be very interested in hearing in this thread what in your (and well as others) mind is the difference between share buybacks and paying dividends

If they either both financed with massive amounts debt (like most have this cycle), they only create long term tail risks for those specific companies and for the markets overall not to mention the whole hosts of mal-incentives and moral hazards present today…

I have no problem with buybacks or dividends paid for with cash from profits.

When they borrow money to buy their own shares, they spend an asset (cash) to get a liability (ongoing debt service expenses.) The salesperson who sold them that is a genius.

If either are financed with debt (the vast majority today), the only present long term tail risks for the specific company and for markets in general (setting aside all of the mal-incentives and moral hazards it creates…)

I’m fine with buy backs and/or dividends paid for from profits.

JC,

While they both transfer cash out of the company, buy backs (because they are ad hoc’ish and opaquely operationalized) can be used to directly prop up share prices in a way that dividends can’t.

That creates a false impression of the solidity of demand for the stock…since the power to buy back evaporates as earnings do…the very moment when outside shareholders are inclined to dump shares anyway.

My guess is that there are academic studies showing that buy back companies have more volatile share prices than dividend payout companies.

It’s the difference between a farmer eating their seed corn and a farmer eating piecaken from their corn sale at the market.

Harv, you have introduced me to piecaken. My world will never be the same. Between turducken and piecaken, I see that America certainly holds it’s own in international cuisine.

What they said ?.

I would add Corporate Finance 101: never fund a corporate action like dividends with debt. That’s straight from Brealey and Myers.

Javert,

To me it is simple. Paid dividends are cash added to the portfolio (yes, you can turn the cash into more shares). Share buybacks are not cash added to the portfolio.

As I’ve commented, my largest equity position is with Cenex Harvest States. A Minnesota Ag coop that pays out a $2 a year dividend; stock @ $29.80 now. I own it for the dividend.

Enough bad stuff happens in business without the Fed gushing out Zirp and Congress back stopping big corporations when they can’t me their debt payments.

S&P has zoomed nearly 400% since ’09, partly courtesy of 4 Trillions injected thru QEs with 4th QE still going on now ( 120B/month until next Sept ’21).

Nearly 50% of rise in S&P apparently came via BUY-BACK shares over the last decade! What’s the contribution of ‘real’ productive Economy if one excludes all the various ‘financialization’ engineering done by Fed?

Global debt is over 277 Trillions with it’s GDP around 100 Trillions!

I don’t know if the hidden TRillions of derivatives (CDOs, CDSs and swaps++) are accounted in this or not!?

When (not IF) the down cycle begins with reversion to the mean, wonder how many think, the party at WAll St can go on, no matter what, b/c of Fed’s put!?

Bezos deserves a lot of credit for building Amazon into the monster business it has now become. That said I do think he could do this country a service by paying a living wage to his Amazon employees. It is sad that full time employees of some of the largest companies in this country still qualify for some form of government assistance. Given that the net worth of Bezos has increased by $90 billion during the pandemic you would think the least he could do is share some of that money with his hard working employees.

Bezos is the embodiment of the ‘trickle up’ theory of tax cuts.

BTW: Amazon announced over 2 years ago its minimum wage was raised to $15/hr.

Living wage is a fantasy; I have an ex-wife who seriously (and I mean SERIOUSLY) considered a six-figure income “not nearly enough to live on”. She was also highly upset at my investing in Berkshire Hathaway (since mid-1970s) because “her friends” told her internet stocks doubled every month.

Needless to say, she quickly (and I mean QUICKLY) burned through her entire property settlement. As soon as I get the Covid vaccine, I’m back to traveling the world.

Can you set the bar lower than “do the country a service by paying a living wage”? If that’s where the bar is set that’s where every other employer is heading not the other way around. We’re fucked.

Well said.

“Global debt is over 277 Trillions with it’s GDP around 100 Trillions!”

It is like the world’s worst production of the Broadway show “The Producers” where the Western Governments have all sold 300% of the rights in the show.

But instead of seducing the little old lady backers…they just shoot ’em in the head and take their purses.

Problem “solved”.

“We find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along,” Golly gee wiz wonder how that happened. Well if the Fed won’t normalize rates maybe it’s time to jubilize them by castrating one of the tools in Fed’s tool box – namely ZIRP- by declaring a debt Jubilee. And if necessary, declaring a debt Jubilee anew each and every day at precisely the same hour each day forever and ever until the Fed realized it’s ZIRP tool is gone forever.

I hope FRBNY buys all the UST, because then the institutions that right now that are extremely short collateral and have bought 10-30Y UST at auction at 8bps for the last 3 long dated auctions will nuke it all because Jerome wants to play team save a h0e with credit markets and leave none for the brokest-dealers xD

~1.21% of the HY market today had a high low yield spread of 30bps (15 issues in HYG)

~80.9% (1005 issues in HYG) of the HY market today had a high low yield spread of less than 4bps (around 72% less than 2 bps)

So much inflation with credit tails wagging the HODL dogs…

– WFTLF-US947075AP29 197 bps

– AMC-US00165CAP95 111 bps

– NBR-US62957HAF29 105 bps

– LPI-US516806AG11 104 bps

– WAIR-US97789LAA44 84 bps

– PBFENE-US69318FAJ75 59 bps

– NGL-US62913TAP75 56 bps

– PBFENE-US69318FAG37 40 bps

– X-US912909AM02 33 bps

– LPI-US516806AF38 32 bps

– RRC-US75281ABG31 32 bps

– FGP-US315292AR32 31 bps

– TLN-US87422VAA61 31 bps

– NGL-US62913TAJ16 31 bps

– X-US912909AN84 30 bps

lol

Having worked in Operations for 30+ years in Sillycon Valley there was a time when the design, manufacturing and sale of the products was how the companies made money and a profit. Today so much of it is total BS. The product is now the stock. A lot of us can name these experts in financial engineering. I’ve said it before that the last act of EM will be the roll-up of his empire and the unloading to Uncle Sam in name of getting to Mars and Building Back Better ???

Ha-ha! He better get a sex op first if South Park has it right, as they usually do.

With companies like Apple, that do make very large profits, buying its own shares seems a bit dim. I would have thought buying $20 billion worth of say Amazon over the years or Google would have been a better financial way…

What could bring this thing down?

I think an interesting tail-risk that apparently nobody expects is that central banks might actually gets their wish and CPI-inflation finally creeps up in the CPI, caused by the massive fiscal spending.

Suppose inflation goes to 3% or higher. This will spook the bondmarket and yields rise sharply. The Fed then cannot suppress that yield by buying bonds, because that means printing more money, which adds oil to the fire.

The Fed would have no choice but to tighten monetary policy. Especially because everybody now expects that the Fed will be reluctant to tighten policy, which will drive inflation expectations up quickly once CPI-inflation creeps up.

Massive corporate debt is nice when you have ZIRP/NIRP, but many companies would have to deleverage (i.e. issue shares). Also, high P/E rations constitute a high “duration risk”, i.e. massive downside in stocks.

Inflation feeds on itself when you don’t get on top of it. That’s the lesson from history. But many investors have not lived that history. The bond market will force the Fed’s hand when it happens. It will be a completely new paradigm for many investors.

The massive balance sheet that central banks have also means that when inflation picks up, rates will probably have to be higher than would have been the case with a smaller balance sheet, because there is so much more liquidity that has to be removed from the system.

All the manipulation that central banks have done in the past decennium was only possible because we had a disinflationary environment. But once they get their wish of higher CPI inflation, they will lose that power and their hand will be forced by the bondmarket.

YuShan,

You are likely right in the intermediate term.

But initially, DC will simply lie – and redefine inflation out of existence.

How do I know…because that is what DC has been doing already.

Look at the housing mkt.

While it is an asset for some, it is just an expense for many…yet only the asset inflationary effect of ZIRP is publicized…while expense inflation is studiously ignored by the MSM sphincters of the State.

Exactly. The inflation number is itself made up, so anything flowing from it is not based in reality.

Exactly! The new revised CPI will exclude all items that have increased in price.

The G measures inflation, ex inflation.

Ummm. Don’t taxes fight inflation? Create fiscal space for government spending.

You have hit the proverbial nail on the head, YuShan. The Feds of the world have backed themselves into a Debt Trap with their uber-loose monetary policies since 2000. Inflation is already bubbling to the surface, emitting poisonous gases to equity and bond investors in the Swamp of Monetary Money Printing. Just look at the Greenback. See what imported spirits do during the Holidays regarding prices, and not talking about Charles Dickens spirits.

They can fudge, as they routinely do, partially to keep Social Security cost of living adjustments low, all of the Inflations Stats that exist, but We The People, where the rubber hits the road, will feel the pinch in our pocketbooks way before the CPI shows 5% to 6% annual inflation. 2% target my eye!

why can’t US be Japan?

Wolf,

I don’t think you opined on the difficulties that high PEs create for most companies looking to buy back shares during an earnings downturn (higher share prices and lower earnings/cash means less share volume support).

You did point out that the mega buybackers are doing well and laden with cash…but a lot of other companies buy back shares to prop up share price…and many of those are not doing very well at all (PE is in essence a quasi metric of the mismatch for such companies).

I wonder if there is a free site (or paid tool) that isolates buy back activity at the individual company level (I know this could probably be done in one off fashion by looking at press releases…but we’re looking for more sweeping overviews).

> I wonder if there is a free site (or paid tool) that isolates buy back activity at the individual company level (I know this could probably be done in one off fashion by looking at press releases…but we’re looking for more sweeping overviews).

I automatically crawl for 10qs and 10-ks to get get balance sheet stuff (debt, revenue, cash on hand) occasionally, but never bothered to get much else.

Probably have to crawl SEC EDGAR filings and parse out share repurchase info from: Forms 10-Q, 10-QSB, 10-K, 10-KSB, 20-F, and proposed Form N-CSR:

“Rule 10b-18 addresses this problem. In 1982, the Commission adopted Rule 10b-18,2 which provides issuers3 with a safe harbor from liability for manipulation under Sections 9(a)(2) and 10(b) of the Exchange Act, and Rule 10b-5 under the Exchange Act, when they repurchase their common stock in the market in accordance with the rule’s manner, timing, price, and volume conditions.4 Rule 10b-18’s safe harbor conditions are designed to minimize the market impact of the issuer’s repurchases, thereby allowing the market to establish a security’s price based on independent market forces without undue influence by the issuer.5

Although the safe harbor conditions are intended to offer issuers guidance when repurchasing their securities in the open market, Rule 10b-18 is not the exclusive means of making non-manipulative issuer repurchases. As the Rule states, there is no presumption that purchases outside of the safe harbor violate Sections 9(a)(2) or 10(b) of the Exchange Act or Rule 10b-5 under the Exchange Act.6 Given the widely varying characteristics in the market for the stock of different issuers, it is possible for issuer repurchases to be made outside of the safe harbor conditions and not be manipulative. Nevertheless, we understand that issuers generally are reluctant to undertake any repurchases without the certainty that their repurchases come within the Rule’s safe harbor.

Based on our experience with the operation of Rule 10b-18 and to reflect market developments since the Rule’s adoption, we propose to revise Rule 10b-18 as described below. Our proposals would allow issuers whose securities are less susceptible to manipulation to stay in the market longer and to repurchase a greater number of shares during periods of severe market decline. At the same time, our proposals to modify the volume and price provisions are intended to maintain reasonable limits on the safe harbor while furthering the objectives of the Rule. Moreover, the proposed amendments to Regulations S-K and S-B, Forms 10-Q, 10-QSB, 10-K, 10-KSB, 20-F, and proposed Form N-CSR seek to enhance the transparency of issuer repurchases.7 Our proposals also are intended to continue to allow issuer repurchases (under conditions that are unlikely to create manipulative effects on the issuer’s security’s price or market activity) without imposing undue restrictions on the operation of issuer repurchases or undermining the economic benefit such purchases provide investors, issuers, and the marketplace.”

Yes, companies that run into trouble stop share buybacks — and some, like the airlines are then forced to do the opposite, selling shares, as I mentioned. Other companies, such as banks, stopped share buybacks in order to preserve capital, as I mentioned.

Each company generally discloses the amount of money it spent in the quarter buying back its own shares. This is part of the 10-Q filing. So you can check that out.

Through YCharts, I have access to historical buyback data for individual companies — and that’s where the data for my buyback charts for the airlines, Boeing, GE, etc. come from, as I always point out on the chart or in the text. YCharts is behind a paywall https://ycharts.com/

Worries about a government shutdown, eviction crisis and foreclosures are worse threats than share buybacks. Buying back shares may increase EPS. If it does not bury a company in debt, that would be nice. Product development is another way to spend money.

This is all bs narrative stuff.

One of the first things you learn in college finance is capital structure optimization. A good cfo is going to go for the correct debt/equity structure to get the lowest cost of capital on a risk adjusted basis.

So when the federal reserve makes the cost of debt near zero, what is the cfo supposed to do? Is he just supposed to ignore that? Of course he’s going to replace equity with debt, or he’s a dumbass.

The question of management compensation is a separate issue. They are crooks trashing their fiduciary duty and enriching themselves. They’ve been doing that long before the share buyback craze started.

It was the lying liar bill clinton who got the law passed to lower cash compensation and skew it toward options. He’s as much as fault as anyone.

I don’t know what the answer to most of this is, but i do know the answer to the biggest part of it. End the fed.

Those who got rich from the Feds printing machine

are basically trust fund babies, like Karl Marx;

they’ll spend & spend, until it’s all gone.

Next, the state will own all long-term assets,

and everyone will bend over backwards to

suck the life out of it, before someone else does.

Then “Rome” falls, and ” The Dark Ages ” begin

because ” The Tragedy of the Commons ” brings

down every DoomsdayCult/HippieCommune.

Apparently Dec 21st is a very big deal in terms of Astrology.

The West will supposedly go into a major downturn starting Mar/Apr 2021

If that does happen we’ll soon see “who has been swimming naked when the tide comes in” to quote Old Warren himself.

We will not only see “who has been swimming naked when tide goes out” but we will get a gander at their “shortcomings” as well.

The Great Conjunction of Saturn and Jupiter on winter solstice, Dec 21 2020 will be first time they form a ‘double planet’ (from their visual closeness to each other) on our sky dome in 800 years.

What it portends is not clear but it is not an insignificant cosmic occurrence.

Heinz

“…What it portends is not clear but it is not an insignificant cosmic occurrence…”

Part of what it “portends” is a bunch of loonies will strap on loin-cloths, dance around the fire, get all sweaty, dusty and drunk, just like they pretend to think their ancestors did. During the ensuing intense hangover recovery, it is assumed that aliens built the pyramids, dig the Grand Canyon, build Stonehenge, construct Atlantis, crash spaceships into Area 51, and continue to abduct humans for body-cavity inspections from the territory now known as Alabama.

ps: given the size of the visible universe, there are probably about 1,000,000 significant cosmic occurrence every earth day

Markets are completely distorted by Federal Reserve’s suppression of rates. Newton’s law will have it’s way. “To every action there is an equal and opposite reaction.”

Buybacks outpaced total economy wide R&D spending in the US from 2014 through 2018

Warren Buffett — sweet old snake. I’ve never understood why he didn’t end up in prison after all his AIG theft .. and now decades of more corruption. Seems like only a year ago that he was bitching about his failure at Kraft and his illegal accounting methods …. obviously crooks like him need bailouts, OMG!

I think Warren is one of the more moral business people. You may have him confused with someone else on AIG. One thing I like about him is 90% plus of his investments are in USA and once he buys a company (not a stock) he will never sell it. If it’s not a moneymaker he will just let it not have anymore capital and it gets right sized. All his companies other than rail and utilities employee minimal debt.

Well, that AIG history was buried in honey and the KRAFT fraud covered with cheese.

The case centered on a so-called finite reinsurance transaction with General Re that investigators said allowed AIG to improperly boost its loss reserves by $500 million in 2000 and 2001, smoothing and improving results.

“When the truth about this fraud and other AIG manipulations was made public, the price of AIG stock declined,” Cordray said in a statement. “Investors, including Ohio’s pension funds, had been deceived and suffered significant financial losses.”

Warren’s interpretation of Kraft GAAP, was fraudulent:

“A new GAAP rule requires us to include that last item in earnings,” Buffett wrote, referring to generally accepted accounting principles (GAAP). “As I emphasized in the 2017 annual report, neither Berkshire’s Vice Chairman, Charlie Munger, nor I believe that rule to be sensible.”

I read all of his annual reports and I don’t think you are stating things correctly. For example in annual report on Kraft he reports GAAP and then explains why he disagrees with the GAAP methodology in this case. That’s not fraud. GAAP rule changes now make his quarterly earnings oscillate wildly based on mark to market of stock values. It’s very misleading to a novice and makes you have to do extra work to dig further down into operating earnings to figure out what really happened in the quarter. I don’t like it.

Martha Careful

(Full disclosure: I’ve owed BRK/A for 40+ years).

Hard to understand how Berkshire Hathaway’s compliance with a GAAP reporting requirement that Berkshire management fully disclosed they disagreed with, qualifies as fraud.

Kraft definitely was not one of Buffett’s better investment decisions. Even though he strongly disagreed with the mark-to-market reporting, he never blamed that strategic investment mistake on the technicality of GAAP reporting.

This whole history of Stock Buybacks is solid evidence that many corporate executives are grossly overpaid. Prior to this financial engineering mania, the C-suite was able to improve Earnings per Share (EPS) by actually increasing Earnings via operating efficiencies, steady growth in sales (if even by SMART ACQUISITIONS that were truly accretive to existing operations), debt management, constant product development with a stream of new & improved products, i.e., OLD SCHOOL MANAGEMENT.

But once we started getting premadonnas in management that had greater opinions of themselves than their actual skillsets warranted, the introduction of Executive bonuses via Stock Options turned priorities upside down. So the Corporate Charter/Mission Statement that said one of the key responsibilities of corporate management was to: MAXIMIZE SHAREHOLDER WEALTH, allowed these self-serving Elites to realize they could maximize their own wealth through share buybacks.

When you reduce the number of shares outstanding in the EPS ratio, you automatically, without having to actually work to produce another $1 of profit to the bottom line, the Earnings part, increase Earnings per Share. Duh, great work if you can get it. So the way most stock option programs are structured, you have x number of shares granted you the Almighty Executive that you can exercise or purchase after a specified period of time at very favorable prices. So as the C-Suite gooses the company’s stock price by manipulating EPS via stock buybacks, and the executives get very, very rich. New sunroom for the mansion in the Hamptons.

However, the gross earnings of the company in question may have flat-lined during this period (or DECLINED), yet the boys and girls behind the wheel get very wealthy all the less. And, this point is very key: the financial condition of the company gets progressively worse during such a period because these insiders are using primarily debt ($4.5 Trillion out of $5 Trillion) to line their own pockets. As I have said on these very pages, and Wolf as adroitly pointed out, CORPORATE DEBT IS AT A RECORD HIGH. Duh, CORPORATE STOCK BUYBACKS HAVE BEEN A PRIMARY CONTRIBUTOR TO THIS DEGREDATION OF BALANCE SHEET STABILITY.

So you say that the shareholders are riding the stock rocket ride as well and that is true, BUT. The company whose equities they are holding is in worse financial shape as a result of this Financial Engineering, vs. Operations Management, AND THE DEPRESSION WE HAVE ENTERED IS GOING TO SHOW ROCKET RIDERS WHAT HAPPENS WHEN THE JET FUEL RUNS OUT. It has already begun to run out in 2020 with the 42% decline in total share buybacks in the U.S. because the corporate boys and girls in a significant number of U.S. companies have seen their revenues drop like a rock (vs. rockET). They have gotten a wake-up call to adding more debt at this time. Tech stock prices make no sense at this junction, so what they do in the C-suite to enrich themselves makes little sense also.

So the financial capability of the company in question is gravely compromised with a mountain of debt that still has to be serviced in 2021 and beyond with the cashflow part of the equation gravely compromised in one of the fastest and steepest economic declines in the history of mankind (womankind, too!). So the public stockholders will ride the rockets until the terminal speed is reached in January, 2021, and you know what spent-fuel rockets do. CRASH.

So unless you have been prudent, wise, and sane enough to turn stock market gains into hard cash (esp. with the NASDAQ stocks!!!) and buried the decaying Dollars in the backyard (God forbid in banks!), you are going to be personally looking for those C-suite boys and girls who will get other executive jobs in other companies that they can bleed dry.

Warren Buffet’s Berkshire Hathaway is a giant holding company from days of yore. Obviously, the individual company components of this Buffet ETF must be struggling with actual growth in earnings and cashflows, otherwise, Warren would not be engaged in this once-criticized behavior.

I THINK THE BUFFET CANARY IN THE COALMINE HAS SUNG (I will leave the Fat Lady out of it this time!) Another sign of a market top, and certainly a top in the U.S. economy which actually was “in” by the 4th Qtr. of 2018. GOT PUTS???

I vote the SNOW IPO as marking the insanity of the insanity but I’m sure I’ve said that before.

Ivy League boards and ceos do round robin appointing each other to the board or ceo positions continue to enrich themselves same with govt citizens keep electing same croonies what do they say about doing same thing and expecting a different outcome wake up quit crying make a change

Buybacks won’t help the 885,000 people who filed for first-time unemployment benefits last week in the USA,,,,,if it keeps on like this it makes the USA look doomed and then, of course, it dooms us in England, as we always follow the USA…

1) Carl Ican convinced Tim Cook to pay him dividends and start a buyback program. Debt for free is almost unlimited with low interest rates, but AAPL cannot compete with the unlimited gov debt.

2) US & China exchange cyber attacks and agree to disagree on South China maps, but there is no shooting war between them. If China buyback of US politicians will bounce on their face, AAPL with target on their back, will pay a price.

3) Tim Cook, a logistic genius, in distribution for three months. // AAPL buying climax was in Feb 2020(H). Sept 2020 is an UT.

4) Online sales are up 22%, but Amazon issued more shares. AMZN sales and EPS are popping up. AMZN have a habit of dripping more shares, because only Jeff can get away with anathema like that, even during an online bubble.

5) AMZN Retained Earnings is growing thanks to cash from dilution and the online bubble. Next year Y/Y AMZN might be Cisco beyond 2000.

6) After over a year of accumulation, AMZN was grudgingly falling down

to Mar 2020 low @1,600 and jumped in 6M to 3,500 in Sept.

7) Amazon market cap have reached : 500M shares x $3,500 = $1.75T.

That pale in comparison to AAPL @ $2.1T (17B shares x $125).

8) AMZN shareholders equity is 29% of the Total. // AAPL is down to 20%. AAPL Retained Earnings are trending down.

9) AAPl previous competitor Motorola was left in the dust. Motorola Solutions (MSI) shareholders equity is NR (-) $800M.

10) Collier WB buyback for Bill Gates. WB started buying back after :

“I am falling and I cannot get back up”.