Work-from-anywhere, unemployment crisis, oil bust, people chasing a cheaper less crowded place to live, the land rush to buy homes.

By Wolf Richter for WOLF STREET.

There was even a story on NPR: People from big, densely populated, expensive cities showing up in small towns in beautiful rural areas for a few weeks to get away and then getting stuck, now that they can work remotely, and buying homes and sending their kids to local schools. These are just stories, and there are now millions of them. But it’s showing up in asking rents in those big expensive markets, where vacancies are rising and landlords have to compete with each other to fill their units, and tenants are moving within the city in order to get a nicer place for less money – the free upgrade they’ve been waiting for, after years of costly downgrades.

And I’m in awe of how fast rents are dropping. San Francisco has been the big shocker for months, but now it’s other cities too. And they’ve dragged the national average rent growth into the negative year-over-year.

San Francisco rents, despite steepest plunge, are still the most expensive in the US.

The median asking rent for one-bedroom apartments in San Francisco fell by 1.1% in October from September, to $2,800, after huge plunges in prior months, bringing the plunge since April ($3,500) to $700 or 20%, according to data from Zumper’s Rent Report. From the peak in June 2019 – which had barely edged past the prior high of October 2015 – the median asking rent for 1-BR apartments has plunged by nearly 25% or by nearly $1,000!

The median asking rent for 2-BR apartments in San Francisco fell by 2.9% in October from September, to $3,690, bringing the plunge since April ($4,540) to $850 or 19%, and the 12-month plunge to 21%. Since the peak in October 2015 ($5,000), nearly matched in June 2019, the median 2-BR asking rent has now plunged by $1,310 or by 26%!

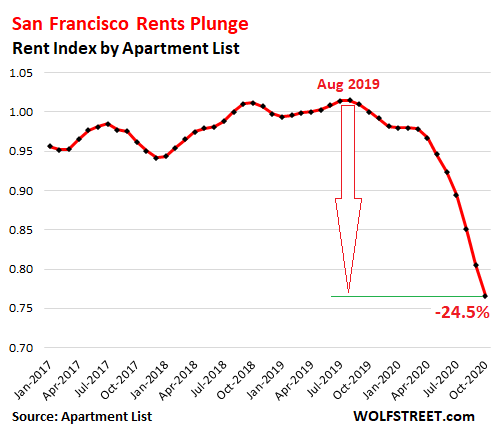

Seen from a slightly different angle: Apartment List’s rental index – which uses rent changes from the same rental unit over time, similar to the sales-pairs methodology of the Case-Shiller Home Price Index and reflects all types of apartments – plunged 23.4% year-over-year, and 24.5% from the peak in August 2019:

Despite the plunge in rents, San Francisco remains the most expensive rental market in the US, though there are a handful of zip codes in Manhattan and in Los Angeles that are still more expensive than the most expensive zip code in San Francisco.

Concessions are not included in the rent data from Zumper and Apartment List, such as “one month free” or even “three months free,” or “free parking for one year,” or whatever. These concessions have the effect of lowering effective rents but without impacting nominal asking rents. This is good for landlords who have to show to their increasingly edgy bankers that, despite appearances and reports like this, the bottom isn’t falling out from their apartments, so to speak.

New York City rents plunged.

For 1-BR apartments, the median asking rent dropped 1.9% in October from September, to $2,800, and 15.0% year-over-year, according to Zumper data. For 2-BR apartments, the median asking rent dropped 3.0% in October from September and 17.1% year-over-year.

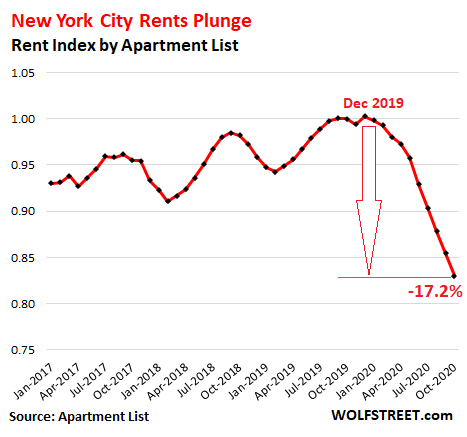

Seen from a slightly different angle: Apartment List’s rental index for New York City, which goes back only to 2017, peaked in December 2019 and has since plunged 17.2% with the sharpest drops in the past five months (the chart is on the same scale as the San Francisco chart):

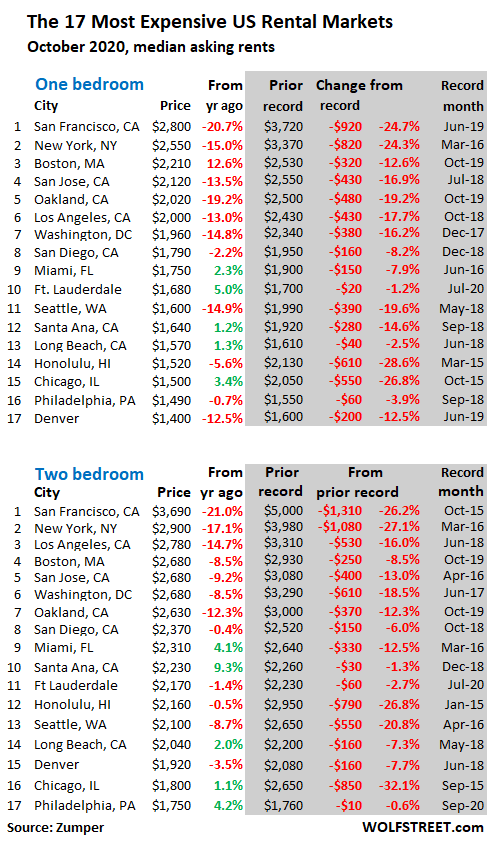

The 17 most expensive rental markets.

The table below shows the 17 most expensive major rental markets by median asking rents, based on Zumper’s data, plus the year-over-year percentage change, and in the shaded area, peak rent and change from peak. Chicago and Honolulu started their rental downturn in 2015. In 12 of the 17 cities on the list, 1-BR asking rents have dropped by the double digits from peak. Chicago and Honolulu show the biggest drops, followed by San Francisco and New York City:

“Median” means half of the asking rents are higher, and half are lower. “Asking rent” is the advertised rent. It does not measure what tenants are currently paying in rent and does not include concessions.

Zumper collects this data from the Multiple Listings Service (MLS) and other listings, including its own listings, in the 100 largest markets, but only for apartment buildings, including new construction. It doesn’t include single-family houses and condos-for-rent.

Rents in other Big & Expensive cities drop to multi-year lows:

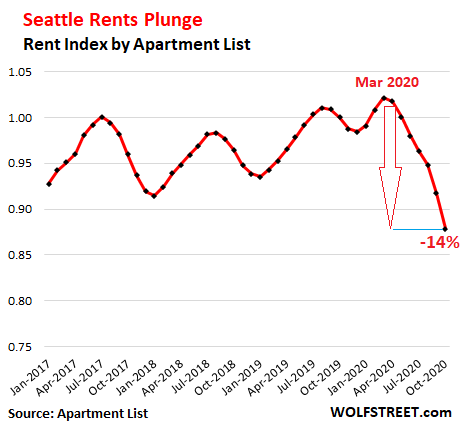

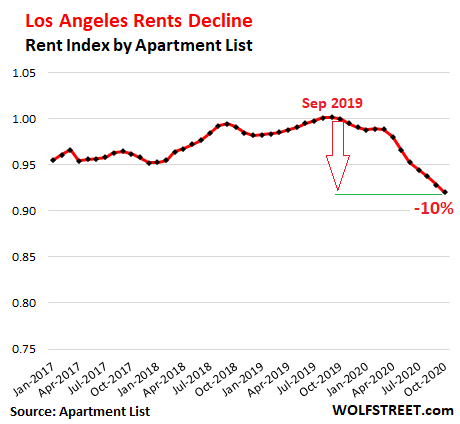

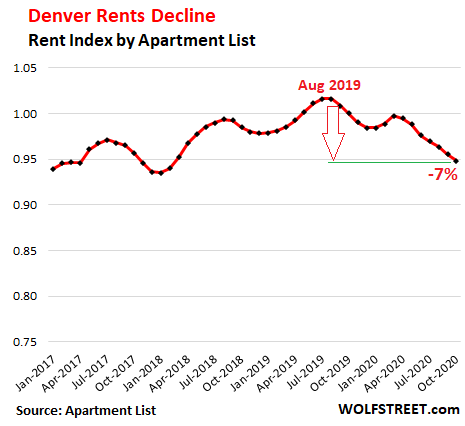

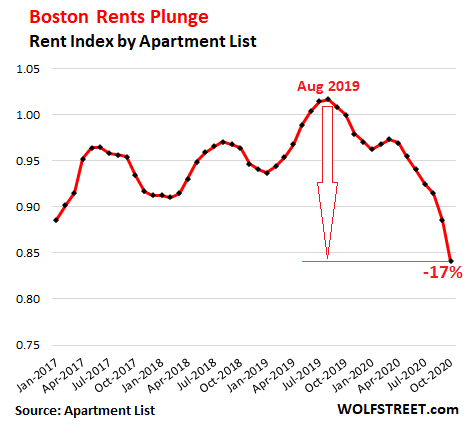

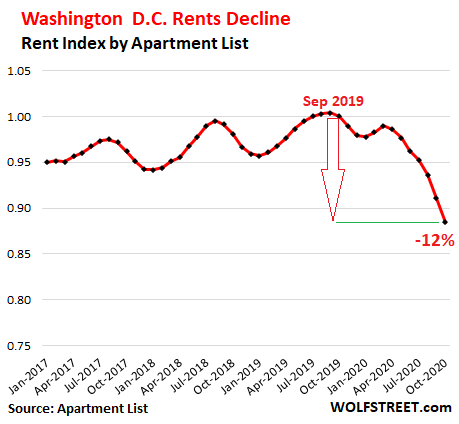

Below are charts based on data from Apartment List, which differs somewhat from the Zumper data, in part due to its methodology, which, instead of using median asking rents across the market, is using asking rents of the same apartment units as they change over time, which avoids some of the issues associated with median asking rents. Apartment List converts rental data into an index centered around the value of 1, with data going back to 2017. All charts below are on the same scale. They show change in rents but not dollar-rents.

Seattle rents plunged 14% since March:

Los Angeles rents declined 10% since September 2019:

Denver rents declined 7% since August 2019:

Boston rents plunged 17.3% from August 2019, including a 5% drop in October from September:

Washington D.C. rents declined 12% since September 2019:

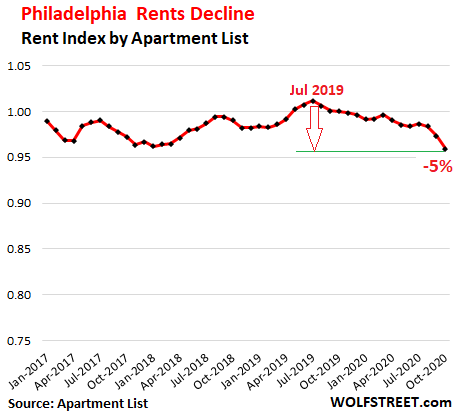

Philadelphia rents declined 5% since July 2019:

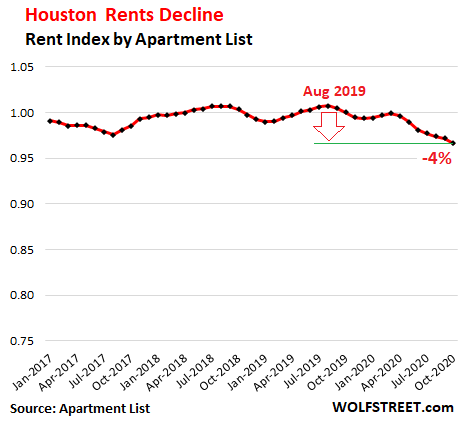

Houston rents dipped by 4% since August 2019:

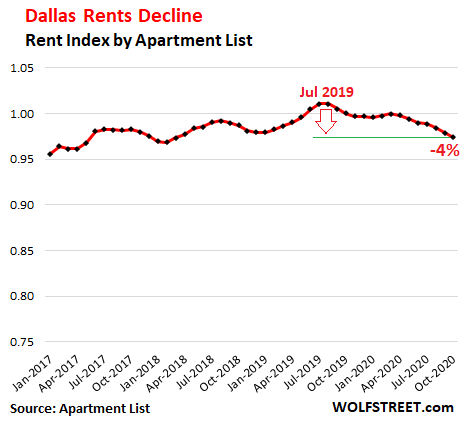

Dallas rents dipped by 4% since July 2019:

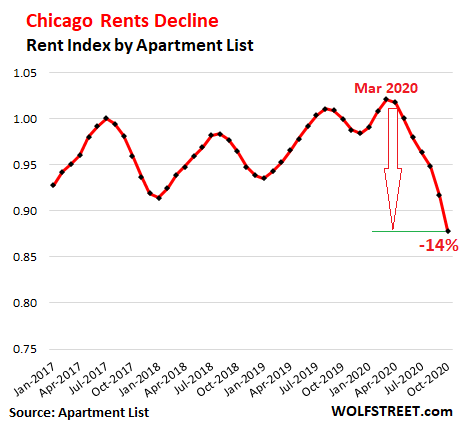

Chicago rents dropped 14% since March 2020:

But Apartment List’s data only goes back to January 2017. Rent peak in Chicago occurred in 2015, according to Zumper data, and rents started plunging in late 2015 and throughout 2016 before stabilizing in 2017. These moves in late 2015 and in 2016 are not reflected here.

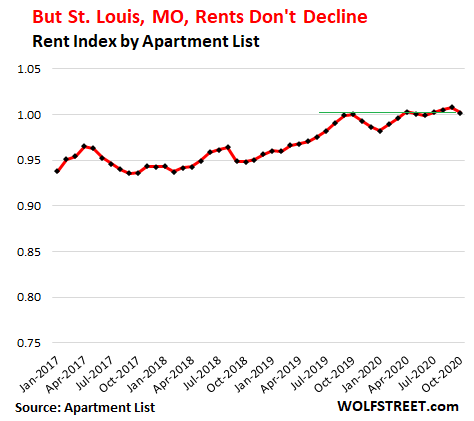

But rents in St. Louis, MO, have not declined over the past year:

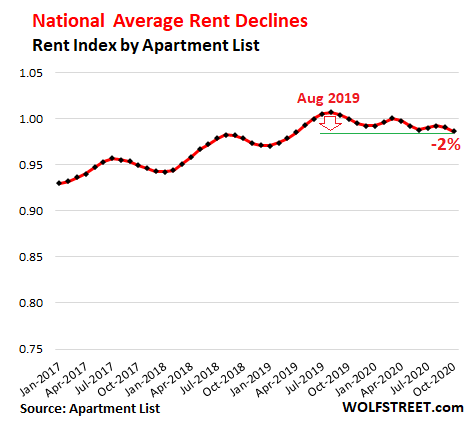

The National average rent dipped 2% since the peak in August 2019.

Rents in many smaller markets have increased year-over-year, and in some of them by the double digits. But declining rents in major markets are now outweighing the rising rents in smaller and less expensive market, and the national average rent in October, according to Apartment List data, declined 1.4% year-over-year and 2.0% from the peak in August 2019:

There’s a housing shortage until there’s suddenly a housing glut: see San Francisco et al. Read… Housing Market Goes Nuts, Everyone Sees it, But it Can’t Last

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How much longer until this shows up in a serious way in asking prices for real estate in these markets? I know they have been decoupled for rents for awhile but just like stocks can’t rise forever w/o corresponding increases in earnings neither real estate can’t be untethered from rents forever.

Sandu,

The link between rents and home prices is tenuous during normal markets, but there is a link, and this isn’t a normal market. I expect to see some reflection of it with some delay in the home purchase market.

True, the market is warped heavily too by forbearance and renters eviction pause programs. The longer they keep those programs in place the harder to resolve

these problems. Unless they start debt jubilee programs – which bring their own issues too. Student debt might be the first candidate.

I am totally sympathetic with not throwing people on the street during a pandemic when businesses are forced to close and people lose their jobs as a result. This comes though with the following situation: too often these same people end up spending the money they should have put towards housing or got from the government programs on things they don’t necessarily need, instead of saving to be in a better position when these programs end. Add to that the fraud and cheating from those taking advantage of these programs and you have a mix of bad incentives that can be so hard and painful to untangle.

we have few deadbeats(call em as I see em)

most got assistance so we’re not hurt AS BAD

but I have to admit with californians and others fleeing big city, they are providing plenty AMMO to RAISE RENTS much higher in Tucson.

I’ll get my 15% ROI no matter, but now I’m looking at super inflation(IE DEVALUATION of TRILLIONS OF NEW $$DOLLARS floating around to 1%)

gotta keep raising rents to my nose bleeds

That spending on things you deem in appropriate are keeping the economy puttering along right now.

“too often these same people end up spending the money they should have put towards housing or got from the government programs on things they don’t necessarily need, instead of saving to be in a better position when these programs end. ”

Good point. This is another reason why retailers are stocking up for the hoildays.

This past week the digital highway signs over the Interstate 95 loop around Boston were informing drivers where to go to seek protection from foreclosure or eviction. It’s quite telling when this information is deemed more pertinent to folks driving around Boston than the usual highway information which is normally displayed.

Each market has a unique mix of problems vs advantages in the infrastructure,localtax burden,crime,amenities and costs of the popular amenities,weather,appeal to various buyers so that it isnt as simple as flippers,downsizers,first-time homebuyers.Not as simplethe as condo,multifamily,mcmansion,singlefamily.Each locale”s ethnic and religious makeup had an impact as well.Coming out of cook county,IL,I know the area is a Big draw to Polish,Lithuanian,and other ethnicities as there”s already large communities/networks to welcome them.

When are REOs resuming and forbearance ending?

I want to see cheap housing ASAP. Imho affordable housing is much more important than affordable healthcare, which is all politicians seem to talk about.

Hoping politicians will get their priorities right soon, society cannot afford to fabricate more homeless. Every homeless men or woman is a person who will soon have deteriorating health, why put the $ on healthcare when housing isn’t secure?

“stocks can’t rise forever w/o corresponding increases in earnings”

The FED is doing a damn fine job proving otherwise so far…. emphasis on “so far”

Yeah, the PE ratio increases are keeping the goofy stock mkt afloat.

But nothing like the soaring PEs of 2009, after earnings fell 80% to 90% (after all those phony baloney corporate asset valuations got written down to something approx mkt value).

One difference seems to be with the timing of enormous destroy-interest-rates-to-save-the-economy/throw-savers-in-the-volcano-to-appease-Baal government actions.

In 2009, the PEs apparently soared because shareholders believed the earnings apocalypse was transitory/QE forever was right around the corner.

And they were.

But it still took yrs to crawl out of the earnings impact crater.

Now, the G has front loaded and steroided all the hair-on-fire-ism (unemployment paying 1.5 times employment, hundreds of billions in forgivable loans, etc.).

So the e(arnings) implosion has been air-bagged (for now).

But it is hard to believe that lasting earnings damage hasn’t been done.

My insurance co. posts update value on my home (cost to rebuild) and that number just took a huge bump, to roughly twice what it was at the peak in 2007. I would guess the equivalent rent is probably the same as it was ten years ago. Once we get some money in the pockets of the lumpen, (and their landlords) this thing can really take off. FYI I may live in a 1% buy zone, not sure yet.

Lumber prices and building materials are very expensive right now, most likely supply chain issues due to workers being out due to Covid. They will catch up. My understanding is the futures market shows this for lumber.

AB,

I wonder if your insurance premiums aren’t directly tied to the “cost to rebuild” numbers so helpfully/lustily supplied by…your insurance company…

Building materials have risen in price, but I am always wary of vendors trying to supply me with “disinterested” info.

“The louder he talked of his honor, the faster we counted our spoons” (Emerson)

…an observation that should be religious writ when dealing with DC emissions too…

Zillow puts it lower but not much. Their number is still a record high.

Real estate prices in California are different than a lot of places, and prices in SF in particular is going to be extremely different.

Proposition 13 makes it so that a huge part of the supply is tied up and will never sell – and the low property taxes in turn mean the carrying costs for these properties is not a factor in rent.

It will be interesting to see what effect Proposition 15 has, if it passes – even though it will not affect properties under $3M.

I opine that this pandemic will last but remember that will it will not be permanent. Over-inflated real estate prices in some elite areas or very high priced real estate that the generations after the boomers cannot afford will drop in price like stones.

However, I would not count cities out forevermore. Working from home is not ideal nor very practical even in the best, country setting. Maybe, in some future year when all records are computerized and robots can obey our instructions to file documents, etc.

Low and lower-middle priced real estate will probably rebound in price in mid-2022-2023, after the pandemic is controlled. It will also not decline in price as much, except in very undesirable areas.

My landlords at my 2 BR apartment in Sunnyvale tried to raise my rent in July as they had done every year. They wanted $3,200 for my small 650 sq ft apartment (a $100/mo increase on the $3,100 I had been paying). At the time they were offering “same day” new tenants (those who sign a lease the same day they view the apartment) $3,000/mo plus 1 month free for the same apartment, which is effectively $2,750 per month.

I wrote the landlords and told them that I would sign a 12 month lease at $2,800 per month, which is a little higher than what they could get from a “same day renter”. Seemed fair to me, even more than fair since I had been a good renter for almost 3 years and had never been late on a rent payment or caused any trouble. I would think that during Covid they’d be overjoyed to get a 12 month lease signed by a reliable tenant.

The morons rejected my offer. It took me exactly 1 day to find a better place and give my notice to vacate.

I observed with considerable schadenfreude their increasingly desperate attempts to get new tenants for that property after I left. They must have lost a lot of tenants during Covid.

Their offers got more and more generous until in September they were offering $2,800 plus two months free PLUS $1,000 off for the same unit, which is an average rent of $2,250 per month averaged over the year.

I cannot imagine why those idiots would refuse $2,800 per month from me only to have to beg for a tenant at $2,250 for the same unit later. Must be some amount of hubris in not wanting to accept a reduced rent offer from an existing tenant. Serves them right.

They thought you were bluffing & that $100 increase would be below the

“FU I’m out” threshold. Most people hate moving & avoid it at all costs.

The only bargaining chip renters (& workers) have is to walk.

Yup, the same pricing mechanism used by self storage companies. many existing tenants will absorb price increases b/c of the complications of moving.

Agreed.

Your average landlord has to actually lose x% of his tenant base before adjusting rents downward.

Market stats supplied by tenant almost always won’t be enough…LL’s get used to having the whip hand despite loud renter complaints and won’t respond until a notable percentage walk the talk.

Right out the door.

Well done you. My commercial tenants claimed financial difficulties and sought a rent reduction of about 10%. Their industry involves groups of people at close proximity to each other and I believed their claim to be true.

So I “happily” accepted. I still have a good and trouble free tenant in place. Getting a bit less than before but hey ho at least I am not desperately scrambling to get new ones in from a decreasing pool of available ones.

And yes, this does reflect on property prices, by my count, we have dropped 10% in the last 7-8 months. This is SW London, U.K.

Well in the U.K you have to add Brexit to everything. Is the side dish no one wants anymore but everyone gets … 10% is nothing compared to the post Brexit future.

No mate, that is all scaremongering. We are all getting a Covid hit, us in U.K., our French and German and other neighbours all the same. As well as our overseas neighbours in USA and OZ, and elsewhere.

Brexit hit is the disaster that doesn’t exist.

On 1st January, we’ll have some changes. These changes will go on for a few weeks or few months. Disruption to trade if any will be of similar duration and then all participants will find ways to overcome the politically unresolved technicalities.

I am talking about straight breaching of the sacrosanct EU rules, as set directly by Amon Ra, by the countries that need to breach them. Spain, Italy, France, Germany, as well as all the dependencies. You get the picture.

Smart move. Lots of people are figuring this out. This is in part why rents move so fast. It’s a fairly liquid market.

Wolf,

Any chance you could post the lower 80 Zumper mkts (as you have previously).

I applaud the use of ApartmentList data, since they historically covered many more mkts (although that particular 1+/- metric isn’t so useful…maybe AptList is making the actual rent data harder to find…).

The bottom 80 mkts on Zumper,

1) Tell us where to consider relocation to…and,

2) Unfortunately sometimes show the price hike impact of refugees from the Top 20 mkts

Both are useful bits of info to have.

Next project…lobbying Zumper to disclose data for mkts 101 to 200…

They had a personnel change and I didn’t get the data this time. I reached out to them… waiting.

The story of my life in the bay area.

I dont understand these things but maybe they want to raise the level of their clientele, while you are great at 2800, they are thinking can I raise the rent on this guy in two years or five years, or is his income ceilinged out? I know if I had a single tenant such as yourself I would take that offer in a second.

Just the start. Gonna crash like 7% or more.

Used to live in Palo Alto,CA.Drove through Sunnyvale.15years ago,there were a few affordable apts.Even the discountrent is Insane.Others are on point,it”s the inconvenienceofmoving that deters real negotiation.Exact same thing”s been goingon in mobilehomeparks as old/poor get squeezed for rent.Andy=supercorrect,called it in April.This is the tip of the iceberg and I say Good.Too many are being evicted from vastlyoverpriced,crappy places or they are homeless/precariouslyhoused.These trends are worldwide as big$ haschased realestate,driving too many out!Not everyone”s wealthy.

“These trends are worldwide as big$ haschased realestate”

Okay, but government’s 20 year policy of zero interest rates has supercharged those speculating big $ real estate players, who can now pay double for properties than they could in 2000 (since borrowing costs were halved).

*Then* the RE speculators, empowered by intentional gvt policy, can try and recoup by taking it out of the flesh of tenants.

As usual, the G is implicated up to its eyeballs.

Completely agree. Fee policy is the reason for the two consecutive RE bubbles of the last 20 years.

Wolf,

in some suburbs rents are rising rapidly. I can vouch for this. I own units in Riverside county, CA and rents have gone up about $400 since March, in the lower segment.

I also own units in suburbs of Phoenix,AZ where rents are up about $300 as well this year, also in the lower segment.

More expensive properties, like bigger houses, didn’t see as much of an increase.

These are steep increases, something around 20-25% up. We were surprised at how much they went up.

It seems to me people want out of the cities, not necessarily out of apartments. SUBURBS=FREEDOM is the rule today. In this case, people want suburbs and more square footage. My condos are all bigger than 1200sqft.

But then again, house prices are up 20% in Phoenix this year. So rents are following suit.

This will either end in

1. Permanent rise in prices, but with inflation such that a cheapest burger at McDonalds is now $20.

or

2. Massive crash, that no one is calling in right now. Somewhat unbelievable. I mean, 20% hike in house prices in a year in Phoenix, and no one is talking about this?? I think “Big Data” will realize this some time next year…. Pundits are always looking at housing markets in a rear-view mirror, like 20 miles behind…

But if you do the dirty work and actually dig into Redfin charts yourself, you’ll see all I am saying here is true.

I’ve seen plenty of news on the house prices in Phoenix. There is very little inventory and houses go in days with over asking offers. Most of the new buyers are from CA and they are pricing out the locals.

P (sarcasm not aimed at you personally),

And of course it will stay this way since,

1) The esoteric knowledge of how to build big wooden boxes has been lost to the mind of Man…and,

2) Phoenix is hemmed in by hundreds of miles of flat, empty land in every direction.

But the price hikes are on thin volumes, since stacking valuation stupidity upon valuation stupidity reaches the thin air quickly and there are fewer and fewer tainted Kool aid enthusiasts to buy in.

Paying 8 times HH income, is inherently less appealing than paying 6.

Especially when 3 is what makes sense.

My take is that this is exactly what Wolf is saying; extra expensive rentals and sales from NYC, SF and so on are loosing floor from under their feet, and that newly released money is finding its way into relatively and hitherto cheaper locations, like PC, AZ.

Prices then rise in such locations.

Then, 5 or 10 years later, when all the dross that follows the initially inquisitive and adventurous NYC SF refugees, those that initially bring genuine creativity, adherence to cultural locales and so on, floods the space with their imperfections and shortcomings (to be very polite), then the whole place will drop to heck in a straight line.

Plus, the folks in USA have a tremendous amount of unresolved baggage and shoulder chips to exarcebate what normally would be a pure commercial continuum. That’s where quantum mechanics kicks in, beyond resolving capabilities or Schrodinger or Feynman or such like.

We have friends that moved from a rental in North Beach, in San Francisco where they paid $3,200 for a two bedroom with one very tight parking stall in a garage, a miserable cold shaded concrete “yard”, to a suburban house for $2600. Advantages, In no particular order, two car garage, plus two cars in driveway if need be, a huge sunny back yard with fruit trees planted by the old guy that had lived there, plenty of room for veggies in the great soil, warm enough to grow tomatoes, a nice back deck to admire Mt. Tamalpais and sunsets, pleasant welcoming neighbors who actually talked to them rather than avoiding eye contact and scurrying behind locked gates as in the city, and their kids can ride bikes to a nearby excellent school along a beautifully maintained car free path.

What’s not to like, except their dumb choice to hang on in San Francisco for so many years to enjoy some advantage or other which turned its back on them year after year?

Both say rents on their old place could drop by half and they wouldn’t ever go back.

And futures are tanking… Paging just a random guy…

The bottom fell out of futures right after midnight. Asia tanked too. No clue what happened.

Yesterday was the dead cat bounce and people took profits. Today it’s back to selling.

Wolf,

I think the rents going down in these major cities coincides with your other articles of the exodus of people from them, along with the heavy demand for used vehicles, especially pick-up trucks.

Here in the Midwest rents have gone up slightly, and as far as houses I get offers to close on my house in 10 days, at the asking price!

A friend who has apartments is getting many offers from out of town realtors, about double the price he paid for.

I believe it’s mainly fear of COVID-19, and like you said folks can work remote.

The disparity between LA and the OC is pretty stunning and the further out you get from LA, the higher the price moves.

It’ll be interesting to see if and when this has an effect on real estate prices. Things are still to crazy right now to try and prognosticate about the long term future.

1) Where is Hunter : Hunter ski resort will open within a month, before Thanksgiving.

2) CA will open in the second quarter, after the inauguration.

3) The gun lobby on cease fire. Antifa will be neutralized. The road to the new moderation will be open. The extremes will be chopped.

4) CA, PA, NJ opening will contribute to the GDP. Yesterday 34% GDP jump

will send the US economy to a new all time. It will be in a sign of strength.

5) The new vaccine will save many lives. Those in their late 70’s and 80’s, who die within a week, save states coffer.

6) US Treasury pinpoint stimulate to people accounts accounts will

stimulate banks.

7) When WTI will cross above $42, well inside 2015 trading range, inflation will rise.

8) US defective yield curve blind the Fed.

9) When the Fed wake up, before it’s too late, Fed assets will start to expire.

10) When pigs fly the Fed raises interest rates above 4%.

Yes they are still fleeing. The calls have not slowed down.

1) The rate of cities plunge : SF rent : NYC rent ==> NR. SF rent tanked faster than NYC rent. NYC is a champ, but both are still drunk !!

2) SF Aug 2019 peak was an upthrust above 2015 high. UT job is to send price down. No fake news : it did.

3) When SF rent reached it’s zenith, WTI plunged since July 2014, because of their disconnect.

4) SF rent jumped, along USD jump Mar 2015 sign of strength, and with the high US rig count.

5) Zantetsu tells a great true story about landlords stupidity. Those who bought commercial RE at/near peak must command high rent, to

please the banks. When the landlord cannot bent his tenant’s will, the tenant leave. The space can stay empty for over half a year. New tenants will vacuum the place in repetitions. They go elsewhere, or unexpectedly sign contract during vacations, when they realized that rent can be 20% – 40% in other and nicer places.

This comment may:

1) be censored

2) cause the blog owner to admonish me

3) result in me not being able to post

4) be seen by others as mean spirited

5) be considered a smart aleck response

6) be an overreaction on my part

7) make me feel better

8) be taken as offensive to the poster it mimics

9) demonstrate how annoying this posting format is

10) be skipped over as people get annoyed with a poster who has to put a number before each of their thoughts

All I know is #7 is definitely true to me

1. Ha Ha

2. Well done

3. +1

4. This site is f’ing great.

Dave, by your insistent use of the word “the” and other parts of speech that can be dispensed with, we can see you still need practice to master the esoteric arts of chartists.

“Dave’s not here.” (…from the distant past.)

People say NY is dead. Well, I suggest the solution is cut rents by 50%. It’ll happen one way or another. But still see stories on YouTube of landlords not providing $1 of rent relief to business tenants.

I saw some Harlem landlords complaining their newly renovated buildings are half empty and the city still expects them to pay real estate taxes. They are begging for a stimulus deal with a bailout.

BTW, I also saw news that Chicago’s RE taxes are up 200-300%.

Up $52/year on a $250,000 home. All bets off for commercial increases.

Best Recession Ever!

In August, 352 (FHA) foreclosures were started, compared with 10,438 in February.

Yet the dirty little secret is forbearance provisions expire in 2021. Yet the dirty dirty bigger secret is they will be extended another 3 months. Yet the dirty dirty dirty biggest secret is they will be extended in 3 months again another 3 months then again another 3 months then again….and again…perhaps forever?

The forebearance on FHA were extended until Dec 2021 already. This is just going to tighten supply and artificially inflate housing costs.. which seems to be the Fed’s goal these days

Have to apply by Dec 2020 (formerly Oct). So, it won’t be available for those beginning to struggle in 2021, unless it’s extended again. I expect we’ll start seeing tangible effects by mid-2021. Many will have to have begin resuming payments thereabout. I imagine people will sell while they still have equity, causing supply to go up and prices start to begin fizzling. But who knows. This is new territory.

“This is just going to tighten supply and artificially inflate housing costs.. which seems to be the Fed’s goal these days”

Yeah, if they keep extending it. But will they?

ALL the extensions of the rent/mortgage relief type will stop after the election whom so ever wins, if anyone ever does with all the voting type extensions apparently now apparently either blessed or allowed by SCOTUS.

If incumbent wins, no need for more extensions from that side because cannot be re elected again.

If challenger wins, no need for more extensions because they can and will blame everything on the incumbent, as always.

Either way, in spite of the huge run up so far, over the next couple of years, ALL,,,ALL the RE will be going through some sort of ”adjustments,” the clear basis for which Nick and Wolf have reported so thoroughly so far.

Great bargains on the way for those of us who are savers, so keep your powder dry for now…

Dream on. Adults know there is no free lunch. For every action, there is an equal and opposite reaction. The seeds of forbearance have been sown and the reaping is forthcoming. It will not be pretty.

Adults are a myth in today’s society. Everyone is just a screwed up child in a mature human body.

Don’t be so grim JG!

As is clearly shown throughout his and her stories, people can and do ”grow up” to be full on and fully functioning adults; to be sure, some people take their whole lives to do so, others only minutes as is shown clearly by accurate military reporting and history and, especially well researched historical fiction from many very well experienced and qualified authors of the last genre.

As is equally clear to us of the war baby or so called silent generation, (1941-45) some people never become adults, no matter how high functioning, or not, they may be in biz, guv, or industry.

I am not sure if we will ever get away from some per cent of the population never actually becoming functioning adults for various reasons: genetics, including mutated/damaged genes, etc., being one reason; trauma, both severe and minor, and both early especially and late being another very clear impediment in my experience of many and many folks.

VintageVNvet – I agree, – since history this has been true.

The strong will rise up and lead during a crisis, and the weak will either “man up” and follow, or just get out of the way, and others will take their places.

I have lead during many crisis times and seen this.

Our revolutionary war was a bunch of hooch posh farmers who quickly became soldiers.

I sense that these children in adult bodies are yearning to burst forth in rebellion, rising up against the Titans of Crony Capitalism. If they only knew that the leader of the Titans, Jay Powell, once called Cronus (aka the time value of money) has already died, they would be much encouraged. Fear not. The time is near. We will soon all have to become adults, whether we like it or not.

We have to learn the answers to life’s questions the hard way some times.

Why do we separate private enterprise from government?

Why do we have private property?

Why do we have contract law?

Why do we have prices?

If price controls lead to a shortage of goods why does the Federal Reserve control the price of savings?

All the federal unemployment programs end at the end of the year. This includes the federal extensions. It’s going to be awful.

Rent control in NYC started around 1941. Right now Jared K is trying to get tenants out via Covid, to get the apartment off the rent control rolls. 60 years later, medecine warped the origional actuarial expectations.

Netflix, series called “Dirty Money”, epssode on his and his father’s slum apartment empire all over N.Y, N.J, and Virginia.

https://www.thedailybeast.com/netflix-takes-aim-at-jared-kushner-in-dirty-money-brands-him-a-tier-one-predator

With this kind of thing available for a month for the price of one movie ticket, without even counting parking, plus junk food, it’s no wonder that movie theaters are dead, plus the new revelations about aerosol transmission of covid indoors.

The original rent control was imposed by the feds as a price control program for the war. NYC made it a local program thereafter. The local nature of rent control is the reason it will become popular in many places because of covid. Covid will accelerate rent control but it was coming anyway because “the rent is too damn high.”

Meanwhile, in Victoria and Vancouver BC folks cannot find affordable rentals. Same in smaller cities around here. Lots of new rentals being built up Island and they are filled before const completed.

We have a shirttail relative who sold their long time owned house in Victoria in prep for retirement in a few years. They almost didn’t find an apartment ….at all. I heard they scored a place 2 days before vacate day. They spent 2-3 months looking. Oh, there’s lot out there (it seems) until you actually go to see it and discover it was rented.

There are no “affordable” rents in San Francisco either. But there are a lot of vacancies, and landlords are trying to fill units by charging still unaffordably though lower rents to people who still cannot afford them, hence the large and rising number of vacancies. Tons of vacant and for-sale condos on the rental market too. Eventually, something is going to give.

Good, once it does maybe there will be fewer homeless…or maybe everything will just become a megaslum and the US’ physical reality will finallu resemble the economic one.

Homeless crisis has almost nothing to do with rent and everything to do with drug use and mental illness

Landlords will keep the units empty rather than lower rent for as long as they can.

If they lower the rent in one unit, automatically they have to lower it for all similar units in the complex, that’s a bigger loss. Keeping the unit empty is a viable strategy until you get lots of empty units at which point you can lower the rent.

Real estate speculators (using supercharged ZIRP) pencil out their apt complex buys assuming the rent rates at the moment of their purchase can only really inflate (that is what makes them speculators).

When rents fall, their financials are a disaster (see, leverage) and they are slow to capitulate on rents because the are constantly thinking about just pitching the keys back to the lender and walking away.

Flipping a complex for 3x invt is fun.

Grinding out 2% a yr to avoid foreclosure is work.

And lenders so goofy as to believe in the initial financials (and lend to speculators) are goofy enough to forgo personal loan guarantees and smoke their own collateral valuations.

Don’t worry Paulo, the crash is late, but due to the cyclical nature of markets it is inevitable.

Jax,

I agree with you, but I have also been saying the same thing for the last 11 years, meanwhile, house prices are still climbing. I don’t think it will crash until interest rates rise to combat inflation like the late ’70s and early ’80s. And if people are still buying US dollar instruments, why raise rates? Furthermore, if US rates stay low the Canadian rates will also remain within a point or so. Low interest rates = high and/or rising house prices. I might be wrong and hopefully commenters will let me know it.

My son is putting an offer on a house, tomorrow. :-) The numbers scare this Dad.

And yet stawks ONLY go up!

Ah the magic….

At least for FAANGS, it’s somewhat justified. Their earnings seem recession proof. GDP drops x%, their earnings go up. GDP goes up x% their earnings go up. Foolproof really.

“Their earnings seem recession proof. ”

Yes, but in the end, there is no way to own 200% of advertising industry revenues, Google and Facebook.

Or long convince 60% of the planet’s population, Apple, that an annual $500 phone purchase is necessary when a one time $10 purchase also gets you a smartphone (ZTE Zfive C at Tracfone).

I actually believe and there’s facts to support this that web advertising is not very effective ……. after a certain point. There’s a very good article about this using eBay as a case study.

But as the article pointed out, a lot of people i.e. the marketing department at various companies are more interesting in having a job than saving the company money.

Single family homes in tony single family close in suburbs are skyrocketing. This is true in NYC, Boston, and LA/OC. The price increases are shocking.

They will, and prices in cities will go down, until some balance is achieved.

Good to see you back talking up real estate again!

People buy a payment, not the actual price. That is until they can no longer make the payment, or they realize they are upside down.

This will become problematic as high unemployment make salary reductions common next year…..

Simply not enough SFH to take in all those fleeing the cities. Lesson learned for those who expected law and order would continue just because. That bubble burst.

Not enough hospitals out there either – COVID patients in Idaho are being airlifted to Seattle.

Kind of a grim feedback loop. They head out to Idaho from Portland and Seattle in Uhaul vans then head back in an Ambulance when they get COVID.

Going to be a profitable year for medevac providers.

Amid patients BK’s from ‘sticker shock’ when they find out their health insurance does not cover transportation.

Hence why most medevacs operations are owned by investment groups/hedge funds.

Rule of thumb w/helicopter transport: $1k per mile

Comment for a Sam reply.

While waiting for tires this morning I read a story about a heli medivac from the BC Coast approx 110 miles to Vancouver General. The patient was a local guy who got chomped by a grizzly bear. His cost? $80 under BC Med.

I hope you folks get a public health plan in the near future.

He was in surgery for 9 hours while they replaced his severed femoral artery and filled in other dents and holes, and then required a 4 month stay in hospital to recover. Total cost to patient? The $80 transport fee.

They charge this ambulance fee to stop frivilous 911 calls.

Lenert, why are you assuming leaving cities means leaving civilization? Most people move to areas within 30 miles of a large city. No medivac needed. But surely not the city

Right now the entire state of Idaho is out of hospital capacity and critical care patients (COVID and other) are being sent to hospitals in Portland and Seattle. This is because Idaho’s infection and hospitalization rate is many times that in Oregon and Washington.

Is Boise not civilized?

@Seneca, this is not happening yet, but Idaho and Utah are very near capacity and if capacity is reached, OR and WA are the only available alternatives.

The only thing stopping this going faster is crappy Internet. And no, 5G won’t miraculous solve things, is just gonna make your bill more expensive and may actually be slower than 4G. Because 4G is an Umbrella term that covers stuff that’s as fast as 3G in a bad day to stuff that’s faster than 5G in a good day. And yes they are all different protocols all covered under the 4G Umbrella.

I would go in more detail but the post would get too long.

5G will be great – as soon as they get a cell tower within 500 meters of you. (Call it 1500 feet for Americans.) Unless, of course, you want it to penetrate a wall or a roof, then it’s less. Advertise 5G, deliver LTE.

But wait… we already got LTE ?

We increase shareholder value for the good of all.

In Phoenix, rental rates are up slightly on apartments. Up perhaps 5% on houses. But further out in Casa Grande and Eloy (70 miles out of Phoenix — middle of nowhere), rates are up 10% or more.

Best I can explain is that it’s cheaper in Casa Grande / Eloy so driving in is easier with traffic being lighter, and that you get more house for your money. As people find Phoenix, Mesa, Chandler unaffordable, and traffic workable they are moving further out.

And, tons of people moving in from out of town. Probably 40% of new rentals are going to people from out of the state.

I always did like Arizona, and I guess it feels warmer and more open than other places so rents are holding up quite well.

How much of the rent decreases result from a change in preferences, versus 20-30% unemployment? I think it’s more the latter. If you lose your job, you can’t afford that fancy apartment anymore. You move to a smaller modest apartment in the suburbs, or you move in with your parents, or you get more room somewhere with a roommate.

1) NYC died in Oct 1987, under mayor Ed Koch.

2) In Oct 6 1987 two feet snow storm shut NYC for two weeks. Cars were buried to the roof. U could walk in the one narrow lane in the middle of the streets. The major avenues were blocked by burnt car carcasses.

3) The city became a ghost town for two weeks.

4) Oct 29 1987 plunge was next.

5) From Koch back to Beam, to the BK court, within a dozen years.

6) Upstate NY RE is booming near Hunter. Hunter will open in Nov 20 for skiers and teenagers to beak snowboars.

7) Tanglewood MA prices are singing. Tanglewood golf course is closed. Bedminser NJ golf course is open, with negative cash flow, but the owners don’t care, because Bedminster RE is more expensive than NYC.

8) NYC retired police force will be replaced by young good people from

Bangladesh.

9) People from the Middle East will dominate NYC within a decade.

I hate to argue with a bot but, I was in NYC in 1987 and commuted by express bus every single work day. And it never snows there in October, although sometimes it does snow in the Spring. Update your AI.

Wolf, why have you not yet banned this nonsense list generator?

10) Bkly’n will sign a ME peace treaty.

Falling rents eh? This will perk up the Vulcan ears of Jerome quicker than Romulans in the neutral zone. Could de-flation possibly be afoot in the Empire? Falling rents with a falling stock market and a rising dollar. Could falling rents bring down their under lying assets? Is this the dreaded Mark to Market rearing its ugly head? This can not be allowed.

Jerome is now caught in Ben and Janet’s web, woven with lots of double-speak, contradictions, outright deception, and bluffing over a 15-year period.

He is now dumbfounded, and his brain numb. He’s left with the ability to speak only one word which he will repeat over and over – print, print, print !!!

The PRODUCT including its environment, has to be attractive enough to sell or rent.

Then, there has to be a reason to demand it.

If the environment has become unattractive due to taxes, regulation, insecurity, or mismanagement, that kills the initial draw.

If in addition, there is no need to “be” in a certain area that has become “unattractive”, then both have failed.

Wow, what a difference a few decades make! I remember when I moved to Miami in 1979, the rental price for a 2 bedroom apt was $350. Now that same apt probably goes for close to $2K

10-4 TT,,,

When I first moved to Berzerkeley, a lovely ”studio” apt, with full kitchen and bath and walk in closet was $50 per month, right across Bancroft from lower Sproul Plaza, where I went to play with the guys who brought their steel drums there every Sunday afternoon.

Those brothers/guys were SO cool that they let me sit in with their drums until I went and bought the cheapest bongos I could find, and then just played along with which ever drummer was leading each time.

That apt was $2800 summer of 19… no idea today, and others I know report vacancies for the first time in 20 years due to UC closures.

In 1975, I could have bought a nice condo in West Palm for $5K.

A $350 a month apt in Miami in 1979 was a penthouse with an ocean view. Even in Palm Beach that would have gotten you a nice house.

I am not much of a real estate investor, but I read a book once that tried to explain the theory. It was something like this. Find an up and coming city and get in early. Recognize when it is peaking (congestion, crime) and get out early.

And in 1980 I had a guy offer me a house in Prescott, Arizona for under $1000……………..

That is when Sedona, Arizona had one traffic light and one 7-11 too.

Looked at house prices in either place recently?

Yeah Lee. I was born in Gilbert Az when there were zero lights. It freaks me out when I go back and visit. I have always been thinking that rate of growth in a desert was unsustainable. I’ve been wrong so far…

“the rental price for a 2 bedroom apt was $350. Now that same apt probably goes for close to $2K”

But according to the Fed, inflation enriches us all.

And interest on our savings, impoverishes us.

Of course, what the Fed means by “us” is them (the G).

1) CA will have rent control, just a question of local or statewide administration.

2) In the event of a freeze landlords may actually benefit if rents continue to spiral lower.

3) Measure the health of the rent market by number of Hispanics per apartment. Eight or more in a 2Br the market is tight.

4) Like gas guzzling autos in the 70s, housing industry has too much of the wrong product. Problem is building supplies for a McMansion cost the same as they do for a high density apartment. New building technology, and standards are needed.

5) With climate change raising the base temperature more of us can live outdoors, or in shade cloth tents.

6) Blue state emigrants to Red states disrupt traditional voting patterns. However smaller states tend to develop more reactionary politics. Dividing CA into three states would make certain two of them are Red.

7) Most Red state voters couldn’t pass a citizenship test. New more open immigration laws will replace these people with a new class of immigrants. Death by opioids and Covid denial extirpates an entire underclass of people, which largely goes unnoticed.

8) America is an idea, mostly just a place in the mind.

I always liked the saying: “Government can never be big enough to do what a family should do.”

Not referring to a 27 year old black guy who left behind 8 children as a father could be construed as a “dog whistle”.

Commercial rent relief in Boston due to Covid? NO! Having been a store owner for 30 yrs, same landlord, rent paid in full,on time. I have paid all during covid, while having sales 20% of usual, this is below operating cost. I just asked for relief of sq ft rent for the next 6 mths, while paying CAM and Real Estate taxes. Answer….convoluted no. The proposal had to go before the mortgage holder. They refused!! What are they thinking? Two of five retail spaces have closed permanently in the building. However, the landlord himself, expressly told me he doesn’t want me to leave, and with a wink and nod, unofficially ( no mortgage holder approval) gave me permission to pay what I can. We’ll work it out, is what I was told. So, there is mixed thinking here, the landlord knows firsthand the blight in Boston, but the mortgage lenders obviously believe they are immune to this. So foolish. This compares to the above apartment renters, leaving for better deals, even though you offer the landlord a solution, that they reject. Commercial paper holders better buckle up, it’s going to be a very bumpy ride coming their way! Honestly, they deserve it!

I had a similar situation, tenant asking for small, time limited, rent reduction or deferral.

I told him I cannot change the lease or deal with the thing strictly correctly through the solicitors and such.

But I also told him, that should it by chance happen that next two or three quarter rents are shorter than the lease says, and providing the shortfall is adjusted as soon as possible, then I won’t be running to the solicitors to tell them to do what they are trained to do – kill.

This way, I feel, I have a grateful tenant, who also happens to have been on the button for last ten years, who I am sure will be happy to return the favour. More importantly I have continued income and full property that I don’t have to protect from squatters and such like.

I’d be very careful with a verbal agreement…

Mortgage lenders are going to need a much, much larger keychain.

1) A 6.6 earthquake hit Izmir Turkey on the Aegean sea.

2) There are more than 70 fatalities.

3) USD/TRY jumped.

4) Hostile countries offer help to Erdogan.

This comment is not relevant. This poster has made four useless comments on this one article alone. The comments section at WolfStreet should not tolerate this garbage. PLEASE ban further comments from this poster.

I keep hearing this “fleeing the cities” mantra and I have to wonder. I own a 2 bedroom condo in the heart of San Antonio, Texas. I get calls daily from people wanting to know if I am selling. Are they looking to get something cheap or what? I have zero interest in selling now or ever.

A lot of them are investors.

Since the pandemic my wife and I have been looking for an apt upgrade in SF and have been shocked by the sloppiness/stubborness of the LL’s and apt managers.

Unanswered emails, poor followup, no interest in negotiating. We have good credit/references and are even willing to pay first 6 months up front! Many of these apts are in old buildings with old appliances. Some have been on the market since April. They also switch around prices/pics of the units on Craiglist ads, which is confusing and wastes everyone’s time.

SF LLs have had it too good for too long and don’t seem to understand or care that the tide has gone out. Oh well, looks like we’ll continue to save and stay put in our same apt, meanwhile these overpriced units on craigslist remain empty.

Those apartment listings probably aren’t real, especially if they are swapping photos and prices. Modern CraigsList is rife with fake postings, which collect any info you provide to run scams on you.

When looking at an office space up here in Marin county two weeks ago, the female agent who showed it to me seemed to be about 25 year old, from somewhere in Central America (It’s no longer PC to ask people where they are from, so I didn’t.) Sad part was that she had an accent so think I could not understand much of what she was saying through her mask. After lots of effort on my part, I did get to the point where I realized she did not know many of the details of the lease. Instead of admitting she didn’t know, she gave vague and contradictory answers. That might be a cultural thing, something I’ve encountered when living abroad, so I let that slide. However, she spent most of the time staring into her phone, and didn’t even pretend to be interested in actually renting the place or knew what to do to appear professional. I can’t imagine what the poor girl was being paid. Probably peanuts. Back at the office, there was no “manager” to be found, just another untrained and uninterested person who didn’t know what to do beyond handing me an application. I felt like a cop who had stumbled into a fronting operation for stolen goods. Yet I know that this company handles lots and lots of space up here, and has been around for decades. So yeah, I’m thinking landlords and the owners of leasing companies need more time to adjust to the new situation.

Give them another 6 months

“The median asking rend for 2-BR”

Probably not the word you wanted but accurate nonetheless — those prices do rend one’s wallet.

Not only people leaving cities. Retail stores too. Some are getting sticker shock at next years insurance rates, and some will even get dropped completely. Insurance companies won’t take the damage hit more than once. Or how about all the Wallgreens moving out of downtowns, like SF from open theft. Going to be a longer trip for the meds if you live in downtown. Another reason to move out of the city

I think the economic damage from the virus has been swept under the rug by the money printing and fed govt debt. I think 2021 will be the critical year for some state and city budgets if the red team retains power. If there are not opportunities in a city, the population will migrate to where there are opportunities or to lower cost locations. A city with a rapidly changing population has a lot of problems, but better if booming than declining.

Has the price of refrigerator box housing also dropped in San Francisco?

The moratorium on residential rental evictions and trust deed foreclosures in Oregon was extended by the governor twice, and is set to expire a third time at the end of this year. Clackamas County, the second most populous county in Oregon, will be faced with serious delays in the county sheriff’s ability to process already-adjudicated writs of execution. Non-paying tenants have potential to live another year, AT LEAST, rent-free before the county sheriff even gets out there to change the locks, moratorium notwithstanding. This is going to be a disaster for the rental market here.

Now, let’s not talk about the student housing market.

And a couple years from now, people around there will wonder why there are no available rentals…….

Cities are in a schoolyard brawl with one arm tied behind their proverbial backs. Things have already started to stabilize in nyc and will soon in other cities once the vaccine arrives and life returns to normal.

Not sure why Wolf takes such pleasure in the pain and suffering of landlords.

No pleasure. Just reporting the data so that everyone can see what’s going on. This info needs to get out. Tenants and landlords both need to know what’s happening with rents.

For all of you interested in the price action of real estate in Hawai’i I direct you to look at the Honolulu Board of Realtors web site which has some interesting facts about house sales, volumes, and price points.

I’ve tried to post his data numerous times, but keep getting blocked every time I do so………………

lol the landlords are still trying to advertiste 3000$ price tags for 1 bed room in SF and they are sitting for like 4 months on the markets.

I just read that part of the Biden tax plan is the elimination of 1031 exchanges. That would make income real estate far less attractive at a time when it is not all that attractive to begin with. Can’t see how that is supposed to help renters….. Probably will not do a lot for REITS either….