Repos zilch, gone. Dollar liquidity swaps on their way out. SPVs flat for five weeks, but composition is changing. Treasuries edged up by smallest amount all year. MBS rose.

By Wolf Richter for WOLF STREET.

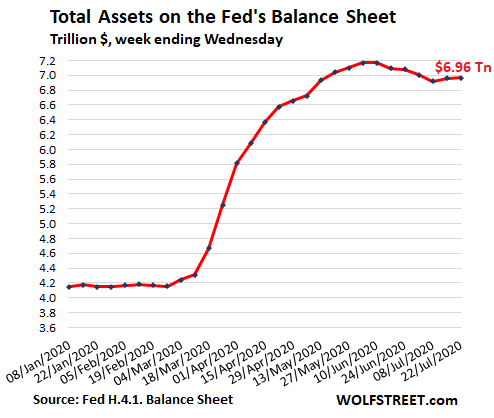

Total assets on the Fed’s balance sheet for the week ended July 22, released this afternoon, edged up by $6 billion from the prior week, to $6.96 trillion. Since peak-balance sheet on June 10 (at $7.17 trillion), total assets have declined by $204 billion:

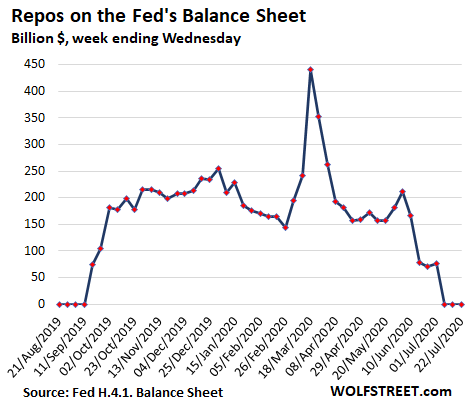

Repos are gone, zilch, third week in a row.

Back in mid-June, the Fed made repos less attractive by raising the bid rate. The Fed is still offering huge amounts of repurchase agreements every working day, but there have been no takers for the third week:

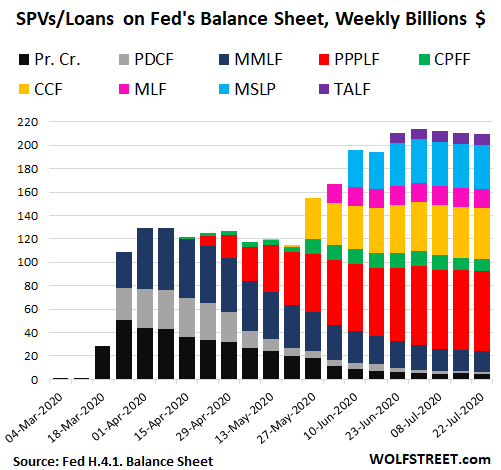

SPVs & Loans Declined by $1 billion, flat for 5th week.

This is the Fed’s alphabet soup of Special Purpose Vehicles (SPVs) – LLCs that the Fed lends to, and the SPV then buys assets or lends:

- Primary Credit (abbreviated “Pr. Cr.” on the chart below); loans made directly to lenders.

- PDCF: Primary Dealer Credit Facility

- MMLF: Money Market Mutual Fund Liquidity Facility

- PPPLF: Paycheck Protection Program Liquidity Facility

- CPFF: Commercial Paper Funding Facility

- CCF: Corporate Credit Facilities: includes the SMCCF (Secondary Market Corporate Credit Credit) and PMCCF (Primary Market Corporate Credit Facility). Buys corporate bonds, bond ETFs, and corporate loans.

- MSLP: Main Street Lending Program

- MLF: Municipal Liquidity Facility

- TALF: Term Asset-Backed Securities Loan Facility

The overall balance has remained essentially unchanged for five weeks: $210 billion in the week ended July 22, slightly down from $211 billion five weeks ago, in the week ended June 23. But the composition has changed. The original three entities are being phased out, and new ones were added:

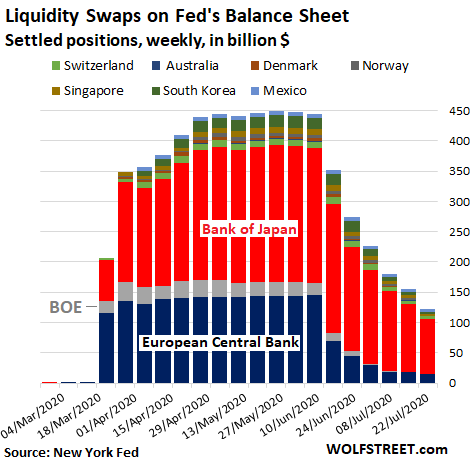

Central-bank liquidity-swaps drop by $33 billion, getting unwound.

The Fed’s “dollar liquidity swap lines” – implemented to provide other central banks with dollars – are no longer needed. As swaps mature and are not rolled over, the balance drops. This was the sixth week in a row of declines, now down to $122 billion:

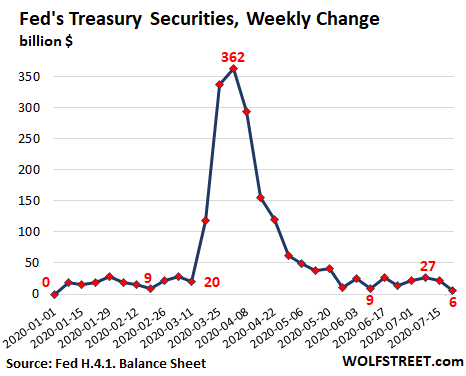

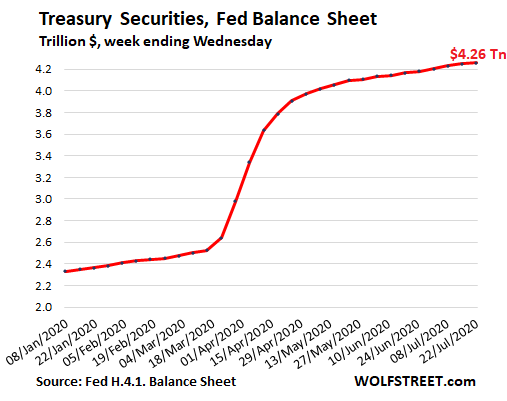

Treasury securities edge up by $6 billion, to $4.26 trillion.

Since early June, the increases in the balance of Treasury securities have been range-bound between $9 billion and $26 billion a week. This week, they edged up $6 billion, the lowest amount since January 1, 2020:

Treasury securities reached $4.26 trillion. In this gigantic portfolio, large amounts of securities mature every month and are redeemed. If the Fed didn’t buy any Treasuries, the balance would dwindle fairly rapidly, in particular since $326 billion of them are short-term bills (one-month to one-year) that the Fed replaces constantly as they mature. So just to keep the balance flat, the Fed would have to remain a fairly heavy purchaser:

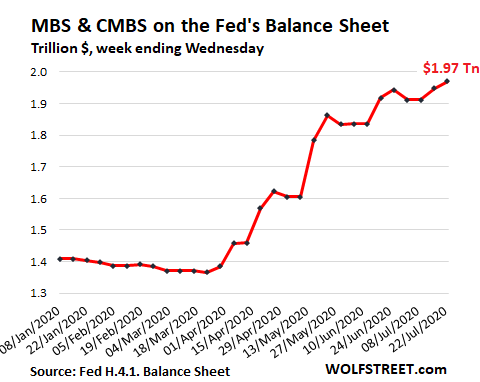

MBS rose by $22 billion, to $1.97 trillion

Mortgage-backed securities are the most erratic part on the Fed’s balance sheet, for two reasons:

Pass-through principal payments. MBS holders receive pass-through principal payments as the underlying mortgages are paid down or are paid off. The current refi boom has unleashed a torrent of these pass-through principal payments, which reduce the balance of MBS. Just to keep that balance level, the Fed has to buy large amounts of MBS.

MBS trades take 1-3 months to settle. And the Fed books MBS trades after they settle.

So the change in MBS on the balance sheet today is mostly due to the mix of current pass-through principal payments and of purchases from 1-3 months ago that settled during the week:

I get tired of lazy reporters or lazily programmed bots who don’t read beyond the second paragraph of Labor Department press releases. Read… Media Continues to Misreport Unemployment: 31.8 Million People on State & Federal Unemployment Insurance. Week 18 of U.S. Labor Market Collapse

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Speaking of repos, whatever happened to Iamafan?

right.

And where’s Michael Engel??

I’m guessing Michael, aka Michel, time traveled back to 1555 to finish his book Les Prophéties

I’m worried about him. He had had an emergency heart problem last year and barely made it through it, from what he said. He lives in the NY-CT area, and had some contact with Covid. Not sure…

Wolf,

Talking about missing persons, do you have any idea what happened to Unamused? I miss him.

No. I don’t know these people. He/she/it never said anything about himself/herself/itself (sometimes it was like a bot). Started grinding on some commenters, and there was a little rough spot if I remember right.

I recall him mentioning the only reason he was posting, is because he was going thru a rough spot and some time, that it might end at some point.

Or am I mixing that up with someone else?

Wolf et al,

Being that I have been helping with care for very elderly in laws, and seeing the same thing, anguish, that Una was expressing on here sometimes, from them, I suspect he was at or near his ”end game”…

Una was certainly one of the more erudite commenters on Wolf’s site, and it may be that he was not near the end, but, rather, just not happy that some of his comments were not received well…

Just goes to show that in each and every case, the main focus we might cultivate to help ourselves as individuals is to do our best to understand that this and these are just wonderful opportunities to ”cultivate non attachment to the results of our efforts.”

Unamused, if you are reading this, I liked your comments and would welcome you back.

Micheal Engel was intruiging albeit baffling. Would like to hear more from him too.

Not sure why those worthy posters are gone but my dreck is still here. Meh.

And yes Timbers, Unamused did say refer numerous times to his dejected viewpoint on life, made me a bit sad.

I wish the commenting system here worked differently. A real forum like atmosphere with the ability to search would be so helpful.

And I miss IAmNotAmused.

Wonderful article and charts Wolf. Well done

I’m always impressed when the Fed can actually unwind stuff. I don’t think it will last forever, but love to see J Powell victories on that front.

Wolf, do you know why the BOJ is still leaning on the swap lines pretty heavily compared to many of the others?

I don’t know for sure, but it might be because Japan is bring back manufacturing it had outsourced to China. I think we are encouraging Japan to do it. New factories cost lots of bucks.

The rumor is that US banks have been borrowing dollars pretty heavily from overseas

This appears temporary from next month it will start its journey upwards again as the stiuilus cheques start poring in.

The Fed doesn’t get or send out the stimulus checks. The Treasury does. They won’t show up on the Fed’s balance sheet. What does show up is if the Fed buys Treasury securities.

The treasury isn’t sitting on a pile of reserves. We know how this works. The treasury will go to the fed. More bonds will be issues to “pay” for this.

What is the leveraging of the SPVs ? and does what they purchase (ETFs) show on the balance sheet, and if not, where?

historicus,

Each SPV is listed on the balance sheet. The amount it shows is the amount that the Fed has lent to the SPV. Leverage is up to 10x, so the minimum equity capital contributed by the Treasury would be 1/10th of the SPV line item.

The balance sheet does not show what exactly is in each SPV. The Fed publishes other data on its CCF facilities periodically (corp. bonds, bond ETFs, etc.), and I have covered that before. We’ll get another blast of this at the end of the month, and I will likely cover it.

Thanks Wolf.

SO the SPV show up full value on the balance sheet, though leveraged 10xs.

Created money by the Fed to then leverage up…

trying to wrap my head around any prudence in this…

Is that the Queen of Hearts sitting on the 3 of clubs?

historicus,

Just to make sure this is clear: It’s the Treasury Department’s 10% equity stake in the SPV that the Fed leverages up 10-1 with loans to the SPV. It’s that leverage part that shows up in the SPVs on the balance sheet.

I find it a little amusing that the lady that is being floated for the Fed has a lot of opposition because her opinions are out of the mainstream of central bankers. Nearly everything the Fed has done the last ten years was unimaginable 20 years ago. Not really sure how to think about it. It is kind of a joke to hear the Fed talk about wealth inequality when Bernanke specifically implemented the wealth affect policy. If gold jumps to $2500 you will know people are voting the Fed has lost the most important thing it has which is confidence in the dollar.

The Fed is a bad joke at this point, but at least it appears to be apolitical. One of the big problems with Shelton is that her views change with the occupant of the white house.

Both Bernanke and Powell made statements distancing themselves from dollar policy. Bernanke was reversed by Bush. Implied is the protean role of the Fed in domestic economic policy, which none of us here could consider viable. They have to care about the dollar or why “dollar swap lines”? Talking up gold puts you in domestic Fed. If you are a globalist it makes no difference, you trade in the best currency. I suspect you want to own gold in a foreign currency when a flawed unit like the dollar, gets hyperinflated.

As far as wealth equality is concerned, Jeff Bezos is worth $180 Billion, and that is after his devorce. Wealth effect succeded beyond wildest beliefs. Bernanke wrote the book praising his courage to act. He should get the medal of freedom. Bezos too.

Agree.

The pumping and stock market elevation act keeps people from being able to enter and invest at reasonable levels.

And to the rates be zilch…..

In a land far away and long ago, one had the choice of interest bearing or equity investing. One could, with patience, save his way to some modicum of wealth, enough to then do some investing as well. That avenue is SHUT.

All of which widen the wealth gap, artificially.

These arent markets anymore, they are arrangements managed by central bankers (and Blackrock)

While we are the subject of unwinding, how will the federal unemployment payments get unwound and when? I think it will be a permanent entitlement program.

The last time we had a major economic crisis unemployment was extended to 99 weeks… Under specific circumstances. I fully expect them to be extended at least that long for formerly full time employees. For the gig workers much less, maybe 52 weeks.

In Big Picture terms the Fed has expanded QE by about 70%, plus various subsidies from Congress to the Fed for the purpose of making the stocks go up.

And stocks are about where they were pre Covid, but in much worse financial condition, higher P/E ratios I would expect too – but intensified application of earnings fraudulation can partially/fully address that.

Probably some or all at the Fed are privately pleased by what they’ve accomplished. They think they shot a relatively low load, front loaded, to achieve their Prime Directive to make the stocks go up. This success, as they see it, leaves them with lots of ammo to terminate future unauthorized stock market declines.

Some Fed members – maybe Powell – might be concerned about Congress and Da Prez, due to their inability to realize continuous fiscal stimulus that benefits the non 1% is need otherwise things may spiral down which will require the Fed to step in to use more of it’s QE to keep the stocks up. Unfortunately, like the Fed, Congress and Da Prez believe their job is to make the stocks go up, and when they do that means the economy is by definition perfect, the greatest ever and everything else takes care of itself.

Unless this dynamic changes, wouldn’t be surprised to see a lot more Portland-like Federal “police” events happening.

Primary Credit (abbreviated “Pr. Cr.” on the chart below); loans made directly to lenders.

PDCF: Primary Dealer Credit Facility

MMLF: Money Market Mutual Fund Liquidity Facility

PPPLF: Paycheck Protection Program Liquidity Facility

CPFF: Commercial Paper Funding Facility

CCF: Corporate Credit Facilities: includes the SMCCF (Secondary Market Corporate Credit Credit) and PMCCF (Primary Market Corporate Credit Facility). Buys corporate bonds, bond ETFs, and corporate loans.

MSLP: Main Street Lending Program

MLF: Municipal Liquidity Facility

TALF: Term Asset-Backed Securities Loan Facility

When the FED was formed in 1913, it had three objectives: maximize employment, stabilize prices, and moderate long term interest rates (source: Wikipedia).

Well it appears it is doing a lot more, and has become much more Byzantine. Collapse of the dollar will be blamed on COVID, but I can think of another reason.

“moderate long term interest rates”

the intentionally forgotten and completely ignored THIRD MANDATE.

(we are constantly told their is only the “dual” mandate)

Imagine the normalcy we would have if there were “not extreme” long rates (moderate = not extreme, up OR down)

A balance between borrower and lender, a guard against massive irresponsible debt creation. And here we are.

The entire Fed is a shell game and the consumer is the fool. Just like watching 3 card monte on the streets on NY…watching unassuming tourists get taken for hundred of dollars (even saw someone lose her jewelry)…Why would anyone want to believe anything written on the Internet today? The corruption in Washington is still rampant and it has now spread nationwide through the BS programs offered by the Fed…companies who are not deserving are receiving money…in the end the Wuhan virus has proven one thing…Germ warfare works…

Great conclusion. Unfortunately we missed the big lesson from Sept. 11…airplanes are inherently deadly and must be monitored with due diligence. Put these two together and you have a flying petri dish. Now we will have to monitor all of the human interactions at every level. Got spy microscope?

I flew to SF to Akron OH on Jun 24 and Akron OH to SF on Jul 15, with my two kids. No ill effects. I think you’re paranoid.

And I think you could use a new job burying a heck of a lot of dead people. Or did you think they were just napping? This desire to put everyone else at risk just so you can do whatever the hell you please is exactly what has put us in this mess. Your rights go hand in hand with responsibilities. If you don’t like it, you’re free to pack it out of this country and see who else is willing to let you gamble with their lives for your pleasure. Or is it too much for us to expect you to act like an adult?

Zantetsu,

“No ill effects.”

Be grateful for it!! Don’t think of it as an encouragement to do stupid things.

Thank for invoking the tired old “if you don’t want to do what I think is right then you should get out of the country” baloney. Makes it easy to disregard the rest of your rant.

Wolf, what exactly is stupid about flying in an airplane?

Zantetsu,

Don’t twist things I didn’t say. What I said was this:

“Be grateful for it!! Don’t think of it as an encouragement to do stupid things.”

Not trying to twist what you say, I genuinely don’t understand your point then. I stated that I flew without issues in response to someone else implying that flying was inherently dangerous now due to covid (“a petri dish”). Then you seemed to confirm this opinion by saying that I should feel grateful for not getting ill and that I should not feel encouraged to “do stupid things”, by which I thought you meant flying. So then I asked what you thought was stupid about flying.

To try to add clarity here, I thought this debate was about whether or not it should be considered inherently “unsafe” and “stupid” to fly in an airplane. I personally do not believe it is so and I think that calling things like flying inherently dangerous is adding unnecessary hysteria to the whole COVID issue, which is why I made my initial post. I am looking for some real counter points but honestly I am not seeing any, I’m just seeing accusations. Please, enlighten me.

No one is saying flying itself is stupid. But we have air traffic control precisely because of the dangers built into aviation. What we didn’t have was true comprehensive protections against what could be brought onboard from a community and then vectored out to all other communities. We have expectations of reasonable conduct in all public areas but still have to monitor situations without destroying rights. No one is thrilled about excess watchdogging, but we are not a wild west show with playtime shells. Those unseen bugs are like real bullets flying through a crowded pavillion. It’s not paranoia. It is the new facts that we now face. Singing “I’m Alright” is no longer useful argument for protection of all the other people who live here, many of whom are the very ones who protect and advocate for your freedoms and rights. Clearer?

I do not want to extend this debate, but I do wonder what anyone ought to be allowed to do at all if there is inherent danger in every human activity from coronavirus. But I do appreciate your thoughtful response.

Wolf, I wouldn’t change a single chart here. I would, however, appreciate a 20 year history chart of the FRB balance sheet just for reference. We should have a constant reminder of just how terrible is our indebtedness and that it’s not just a short term virus response thing. Or not if it’s a bother.

Agree LH, and,

That against a chart of the rise and fall (if it ever did) of the horrendous inflation since the beginning, with perhaps the last 20 years or so enlarged will tell us exactly how bad the Fed has been for WE the PEEDONs (Unamused’s word) since the beginning.

My understanding is 99.9% inflation of ”real dollar” since 1913.

Thanks again Wolf for your very helpful explanations.

Thirteen years of Fed balance sheet – from the Fed’s website:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

It was roughly a half trillion when Greenspan left I think.

There’s more to a balance sheet than just the assets – namely liabilities and that’s important here:

One big liability on the Fed’s balance sheet is “currency in circulation.” These are the dollars in your pocket (“Federal Reserve Notes”). The banking system must have enough currency on hand to meet demand (ATM, foreign holders, etc.). The Fed supplies this demand. There are now $2 trillion in currency in circulation, up from $580 billion in 2000.

When the Fed supplies currency to the banks, it gets Treasuries from the banks (banks don’t get this cash for free). This is how the banks pay for this currency. So $2 trillion of the assets on the Fed’s balance sheet are just the counter-entry to the liability of currency in circulation.

And currency in circulation has nearly quadrupled in 20 years. So people who think that the assets on the Fed’s balance sheet should or could go back to where it was in 2000 or in 2005 don’t understand how the balance sheet works.

Currency in circulation is just one factor. There are others. A bigger economy with a bigger banking system needs a bigger balance sheet.

So to get from where we are today to where the Fed should be without QE, you’re going to have to take all this into account. The minimum balance sheet possible today with the $2 trillion in currency and large enough reserves from the banks might be $2.3-$2.5 trillion.

Fed balance sheet trend is up not down. Dollar is now showing weakness against gold like all other currencies have been doing for a while. This means that gold may be taking its place as the only money.Talking Heads believe that gravity will be defied by the Gospel of Fiat and its patron saint Jerome. The Money Printer has to keep going Brrrrrrrr…….Next round coming up if Congress does stimulus. Will the Fed save the dollar by raising interest rates and removing liquidity…..Whoa Nellie , that whopper was used a decade ago by Saint Ben. Is it possible numbchucks will do an emergency announcement at 2am on a Sunday morning that the Dollar is now backed by 5% gold. Numbchucks has seen our gold reserve and told us we are loaded. 5% fractional gold backed dollar would be a good deal for us since the dollar has lost 97% of its value compared to the last year of a fractional gold backed dollar. . 1971 gold =$41 oz. Today’s price =$1900oz.. The Fed got control of the gold price in 2011 and kicked the can into 2020. Can it do it again? Or perhaps like locust Wing Nuts like me appear ever so often then scurry back to their holes when all is well.

It’s DOWN $204 billion. Look at it.

Rounding error or maturing paper?

LOOK AT THE CHARTS

Securities are always maturing. Read the article. It explains it

I think Dr. Doom was insinuating that the ‘trend’ was still up. From a completely technical perspective, he’s right.

Unless the balance sheet moves beneath 6.7 trillion, and subsequently stay below that level, then the trend is still up and even a non-economist can predict with some accuracy that it will continue to grow in the near term based solely on the dynamic of trends.

Curses upon you, Unbeliever and Doomsayer. May thine nuts shrivel in their sack and bring forth no offspring with whch to taint the Purity of The True Teachings.

The Message of the sacred Gospels of the hallowed Saints Ben, Janet and Jerome shall withstand with Fortitude and Disdain the unabending scurrilous Assaults upon them.

Why, upon the Morn of this very Summer Solstice it is regaled that Saint Jerome Himself stood upon the Holy Promenade of Law and there performed a Sacred Ablution of Debt, therewith heralding upon us the Invigoration of rhe Dawn of Debt by blessing in His Own Holy Person the Creation of farcloads more.

He spake thusly before an awed Assemblage: ‘Hark ye all, and renounce ye the Evils of selfish Gathering. Embrace ye better the ravages of the Money Printers, and embrace ye also the Deluge of Free Monies upon the Favoured and the Droplets upon The Hopeful, for thereby shall ye be cleansed of the vile teachings of Sound Enterprise, and ye shall be left with renewed Fortitude with which to assail the teachings of its False Prophets. I hereby bestow upon ye the Deluge and the Droplets both.’ Whereupon the Holy Financiers wept for joy and went forth to bring His message of Hope to The Markets.

And The Messiah, sent in his Earthly vessel to absolve us of our subservience to the Eastern Despots, proclaimed unto the World the Joyful Accounts of Complete Victory over the Forces of Evil that had gathered in force with the sole Covetous Desire to cast down the Holy Markets from their Sacred Pedestal.

*Clap clap*. That’s a piece of work right there.

The bump in treasuries may be a push back in yields, (preemptively) the yield curve has dropped and is taking a lower trajectory. XLF remains positive under market selling pressure, banks need QE not YC. The flow of money into this market on down days is nothing short of remarkable. Gold is not a panic play, it is simply undervalued in a monetary flood. We could see S&P 4000 by election day. That’s how bad things are.

Thanks Wolf. Hopefully I can read your charts right. Seems a swing to commercial, corporate, and main street. But who is left buying sovereign debt?

So far, there have been lots of investors buying the US sovereign debt — hence the low 10-year yield. If that yield suddenly shoots up, it’s a sign investors don’t like to buy at current yields.

The SPV chart is revealing.

The majority of support is focused on paycheck support, corporate credit, and “main street” whatever that is.

Wouldn’t it be nice to have trust that “main street” truly means mom-and-pop operations getting the same support as the behemoth corporations? But really, what is the likelihood of that?

Wouldn’t it be nice to believe that paycheck protection actually keeps everyday working families afloat? I’m sure it does *just enough* to provide a fig leaf for all the grifters who siphon off most of it between the time it leaves the Fed’s window and when it arrives on the paycheck of a real person providing actual goods or services.

Some of that main street would include medical and dental practices that people have become used to in our “insurance can fund everything” new world. We’ll have to see how that plays out with rising unemployment.

SOFR gonna catch the Fed sleeping again… everyone rushing into on the run bills collateral on leverage… 50% of SOFR transactions at or over EFF… gonna get wiped lol

do u have any idea y DNR bonds are pulled. Morning star showing no data for dnr bonds. Very little movement in common stocks….

I can see the bonds on Finra/Morningstar, but there have been no trades in any of its bonds all day today. Last trades were yesterday at the close. Strange. I don’t know why either.

Everything I’ve read seems to indicate the Fed will only be expanding its balance sheet in the future. Small declines in the balance sheet are pullbacks not trend reversals. I see nothing to indicate the Fed cares at all about fiscal restraint.

Jim Bianco compared the Fed to a doctor who will never quit on his patient. The Fed will keep pumping money into the economy until the patient recovers or dies.

The Fed is killing the dollar to support stocks. It has suppressed cross asset volatility by killing off volatility in the debt/bond markets. We’ve got surging unemployment, a possible war with China and companies with no earnings, yet JNK is up today. That tells you everything.

I have no idea why anyone would think the Fed is attempting to shrink its balance sheet.

@ Robert

I agree with you. Fed is supporting Corp Credit mkt at any cost, b/c credit mkt is the foundation upon which Equity Mkt is built!

Gold hit $1900 today. JNK went up again just 5 bucks short of of it’s 52 wk high while the rest of the mkts tanked.Ecen the worst junk bunds like fallen angels – FALN and ANGL went up close to their 52 wk high.

I have bought a lot of ETfs credit grade, high yield and junk kind. since April. They all steadily going up,(with minor blips) even there is turmoil in the equity mkts like today. Amazing!

Marketwatch today

The Federal Reserve has proven it knows how to keep credit flowing during a crisis.

Look at the record debt already issued this year by highly rated and speculative-grade U.S. corporations during the pandemic.

But bond investors now also expect the Fed’s unprecedented stimulus sloshing around financial markets to turn the tide on the credit cycle, namely by preventing more companies from going belly up than was expected only a few months ago.[..]

FED is the mkt now!

I still don’t see an explanation of the real purpose of USD liquidity swaps. I have read all the usual verbiage from the Fed and other “experts”, but I think it is mostly rubbish and doubletalk.

It’s a way of the Fed of locking in a loan of USD at a fixed and high exchange rate against a foreign currency due, made possible by flight to safety in the USD. The swap will limit a further rise in USD, but it will also give the Fed something of a guaranteed profit.

AFAICT, the Fed never reports the exchange rate and interest rate on its dollar swaps. That is quite interesting.