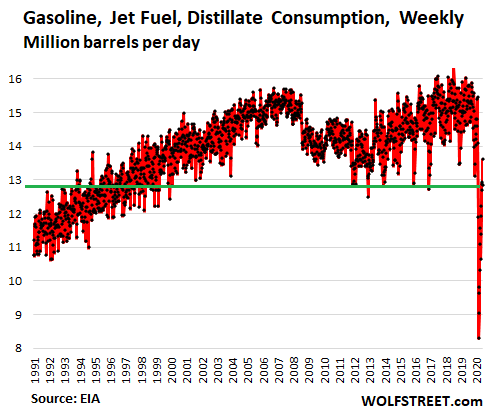

Folks started driving again – including those who used to take mass-transit. But jet fuel demand is still in collapse-mode. And overall consumption remains way down.

By Wolf Richter for WOLF STREET.

Ridership on San Francisco’s Bay Area Rapid Transit (BART) trains was still down 89% in June, compared to June last year, according to BART. Not because the Bay Area economy has collapsed by 89% — it has not — but because many people are working from home, and those people who do go to work are driving to avoid the infection risks associated with riding on a commuter train. Driving-instead-of-taking-mass-transit is playing out across the US. And we’re seeing some of that in gasoline demand. But jet fuel consumption is still in collapse mode. And diesel consumption has been down sharply for over a year.

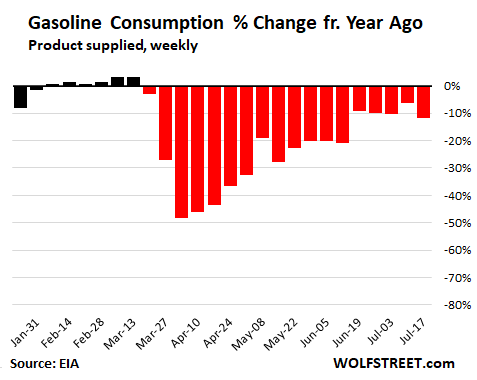

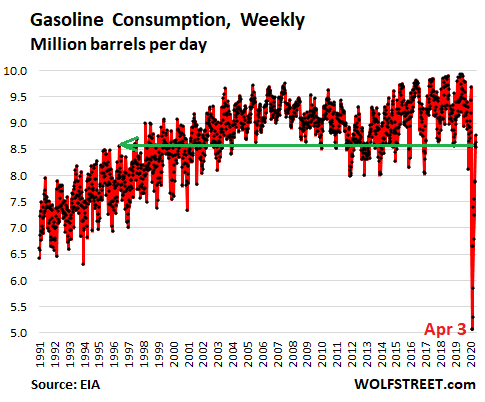

Starting in mid-March, demand for gasoline collapsed in a historic manner. By now 32 million people are claiming unemployment compensation under state and federal programs, and many others switched to work from home, and both groups quit driving to work. Gasoline consumption at the low point in the week ended April 3 plunged by -48% year-over-year, to just 6.7 million barrels per day, the lowest in the EIA’s data going back to 1991.

Folks started driving again, bit by bit, to go to work, and because it’s summer driving season. In the week ended July 17, gasoline consumption, at 8.55 million barrels per day, was down 11.6% year-over-year, according to EIA data. Consumption of gasoline has been in the minus-6% to minus-12% range now for the fifth week in a row, with the latest week being the steepest decline:

The EIA tracks consumption in terms of product supplied by refineries, blenders, etc., and not by retail sales at gas stations.

At 8.55 million b/d in the latest week, gasoline consumption was back near the low end of the past few years, a volume first reached in the mid-1990s, which shows that selling gasoline in the US is not a growth business, even during the Good Times. Gasoline consumption has now left nearly all of that historic WTF-collapse in March and April behind:

Jet fuel.

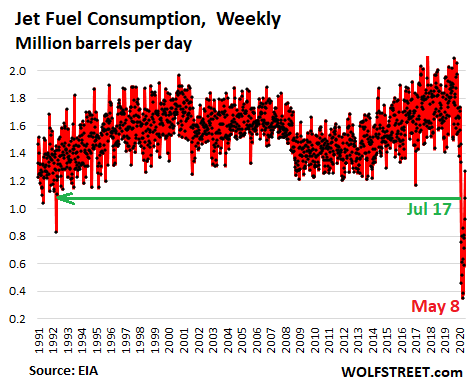

Kerosene-type jet fuel consumption in the week ended July 17 was still down 41.3% year-over-year. As huge has this decline is, it’s only about half of the worst declines in this crisis, which maxed out at -80% in the week ended May 8, when consumption collapsed to just 352,000 b/d, by far the lowest in the data going back to 1991. At 1.08 million b/d in the latest week, a big drop from the prior week, consumption was still at multi-decade lows:

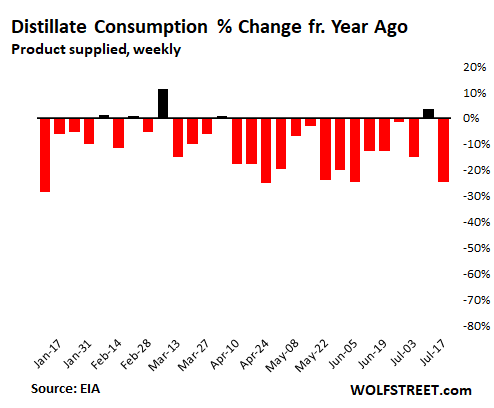

Distillate.

This category of fuel includes diesel fuels used by trucks and some cars, railroad engines, equipment for agriculture, oil-and-gas drilling, construction, diesel generators, etc. And it includes fuel oils, such as for space heating and utility-scale power generation, where demand is very seasonal and impacted by the weather.

The trucking and railroad business has suffered through a year-and-a-half long downturn in the freight sector. And the pandemic sharpened that downturn.

In the week ended July 17, distillate consumption, at 3.22 million b/d, was down 24.4% year-over-year, after an uptick in the prior week (3.69 million b/d). But these declines pale compared the 48% plunge at the worst week in demand for gasoline and the 80% collapse in demand for jet fuel in early May. The drop in distillate consumption never got anywhere near that:

Gasoline, jet fuel, and distillate combined.

Combined, consumption of gasoline, jet fuel, and distillate in the week ended July 17 dropped from the prior week to 12.85 million b/d, still down by 18.5% year-over-year:

As far as the US oil industry – and the global oil industry – is concerned, this decline in demand in the US, though it has abated from the fall-off-the-cliff weeks, remains huge.

In addition to the short-term challenges, the US oil industry now faces several structural issues, including work-from-home that is becoming an established practice for an increasing number of jobs, a new corporate reticence to send employees willy-nilly on business trips and to conferences, and the increasing sales of EVs. All automakers now have models on the market and are aggressively pursuing this segment. The petrochemical industry will continue to use petroleum and petroleum products. But for petroleum-based transportation fuels in the US, demand may not return to the highs established in 2018 and 2019.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

if distillates keep building like this, would not be surprised for a another leg down in CL

and consumers are getting soaked at $2.50 gallon

Ah you poor people in the USA……………..paying $US2.50 a gallon.

We in Oz in Melbourne are now paying around the equivalent of US$4 a gallon.

We also have wide price swings that go in cycles where the price will gradually fall and then jump by 30 to 35 cents per liter in one day.

You read that right: 30 to 35 cents at one time or about US$1 per gallon.

After crashing to around 80 cents a liter in May the price has gone up around 85%.

And years ago people were able to get coupons that discounted the price of gasoline by how much they spent at affliated supermarkets – from 4 cents to 20 cents a liter.

The anti-trust people, who were ‘looking out for the peoples’ best interests’ (in other words total BS) stopped the practice and limited it to a maximum of 4 cents per liter per voucher as some people didn’t shop at the big super markets.

That has probably cost people billions of dollars in savings over the years.

Any here is a chart that shows the price swings – the prices are averages so it doesn’t show the actual highs and lows.

There are big prices differences between stations just a few hundred meters away sometimes that amount to 20 cents a liter or more.

https://petrolspy.com.au/map/graph/melbourne

PS:

The cheapest gasoline I ever bought since moving to Australia was about 25 years ago in Queensland when was around 49 cents a liter – about 1/3 of the the current price.

I don’t see how in a market with only a few supermarket and gasoline chains you would have “savings”.

Anti-trust people where obviously right.

Why do you think Max was Mad? The price of filling the tank of MFP V-8 Interceptors was entirely post apocalyptic! You might as well be living in the waste lands.

This is a great cover for part shale peak oil redux – demand destruction. The virus scan is so useful in so many fronts. What an affront.

Post shale *

The funny thing is the fear of the virus has temporarily trumped things like environmentalism. Aside from mass transit, stores went for a while back to providing shopping bags, but now they are starting to charge for those shipping bags again. After all, can’t be an environmentalist is you are dead.

But as pointed out, the virus is a non-discriminating equalizer. The oil industry is being whacked hard thanks to things like reduced air travel. I am sure somewhere, there are legions of economists salivating at the Petri dish that C19 has created and the little experiments they could run.

Who knows where this will end for future fuel average prices. It seems oil prices are bouncing back well, but not high enough or soon enough to save the U.S. oil industry.

Now if we can only add plastics production to this pyre

Currently losing about $80 mil/month rate at refinery I work at. Can’t last. There will be a shake out. Crude and retail prices will continue to fluctuate. Gas taxes certain to go higher. Not a rosy forecast for most points of view.

Thanks for the front line insight…please keep it coming.

Anecdotal evidence to add to these charts:

By this time last year I had used approximately 300 gallons of gasoline; 15 g so far for the 2020 to date.

Multiply by 10MM, it’s easy to see where this is going, though in truth, I would be going ASAP if it were safer, and I were not concerned with potential/apparent roadblocks/checkpoints, public and private.

What kind of roadblocks, VV? What are they for?

re: “What kind of roadblocks, VV? What are they for?”

Fed goons making sure you have an acceptable ‘social score’ (a MAGA hat is acceptable)?

Paulo,

They are appearing all over, both private and public:

FL had I-10 blocked to anyone from LA early on, and there are currently suggestions to do similar on 75 and 95, though IMO it is way too late.

Others appear to be both ‘hood’ types, region types, and others being done by folks who don’t want any ”outsiders” into their local situation.

Check out the AAA maps to see the ones that have been acknowledged, but, with those as basis, and having been through similar in my past lives, I am suspecting there will be more that are never acknowledged except when ya get there,,,

And, of course, you are already familiar with the challenges continuing at borders near and far, eh?

Wow, this is news. Are law enforcement or private citizens blocking roads? is it just interstate highways or smaller roads? The way you describe it, sounds like vigilanteism. I grew up in the South, and it reminds me of the reflexive fear of outsiders that typified my birthplace.

link to covid travel restrictions map from AAA

https://gds.maps.arcgis.com/apps/webappviewer/index.html?id=2ec42826968d4d0980ccca0fbbfe0c7c

The I95 Georgia Florida border has had a Covid check point since late March. It appears to still be active. You were screened by front bumper auto tag. It was speedy and efficient when the NE democratic states led the country in active virus cases. Now it is just show so the Governor can pretend to be effective in combating the spread of the virus. NOT.

VVN,

The AAA map is interesting…to listen to the Decaying Corpse Media, you would think that everywhere not NE was an uninterrupted stretch of psychopathic non-responsiveness to C19.

That map tells a much different story (but those aren’t roadblocks…they are mask orders…)

Not roadblock but we in Ma. effective August 1. Quarantine orders for 14days if from essentially everywhere!

Speaking of gas usage….

Autonation had a blowout quarter and stock is up 8% this morning. People are most definitely driving again and doing so in new rides. Also, boat sales, which use a ton of gas as anyone who has owned one knows, are up 75% in 2020 vs 2019. And I don’t know the % off the top of my head, but RV sales are booming as well and up YOY vs 2019 as well.

People may not be flying but they’re certainly still spending money on travel/leisure.

Boats are getting cheaper in the Puget Sound area. Likewise I’m seeing an increase in boats and trailers being given away. There may be some increases in boat ownership, but I’m willing to bet that’s due to people being home. My read is there are more getting out from under those marginally used or project items to conserve cash.

Sales of **NEW** boats is up 75%. What you said makes no sense.

I don’t know about “making sense”, but everything I said is easily checked. I can find dozens of boats (some with trailers) being given away on sites like craigslist daily. And while some are obviously in bad shape, not all of them are. I’ve had a nice 27′ sailboat offered to me just for promising to take care of it. (I passed.)

Likewise, a quick look through sites like boats.com and boattrader shows a fairly large percentage with reduced prices.

Now. you say that sales of new boats this year, is up 75%. The National Boating and Marine Industry says 2019 total sales was 280,000 units. (The best since the all time high of 2007.) That means (according to you) the industry is on target to move just under half a million units. I seriously question that. Please provide a source for your figures.

The problems I see with your numbers are; 1) Where did the inventory come from? 2) Where did the money come from?

I know something about the state of boat building, and have been shipping 24′-44′ boats internationally for some time. The builders I deal with have had a very difficult time this year having product ready to meet required delivery dates due to shortages of material and labor due to C19. There is no on hand supply of these boats to sell “off the shelf”.

Likewise, just like car loans, boat loans are getting more difficult to obtain. Car sales are down, and I would expect, since most people do not pay cash outright for boats, those sales would follow suite. Boats are a luxury item; I see nothing indicating a record breaking (upward) year in their sales. I find it much more likely that next year will be a record breaking year for boat repossessions.

“boat sales, which use a ton of gas as anyone who has owned one knows, are up 75% in 2020”

Are they *house*boats, JSRG?

Dear Penthouse,

The realtor and two Swedish twins seductively swayed as they set foot upon my “Open House”boat…they had come looking for action and were eager to…spend. I directed them to my waterbed on the water…

I’m curious to see in time how the use of EVs impacts energy production. While EVs obviously do not consume fossil fuels, power plants do. Currently about 63% of all electricity produced in the US comes from using power plants burning fossil fuels.

I suspect that if demand for EVs increases, and with the subsequent increased demand for electricity, there will be a corresponding increase in the use of fossil fuels to make that electricity. Basically shifting fossil fuels from fuel tanks to power plants. At least in the near future.

Just a thought.

The Tesla tailpipe is a smokestack.

MiTurn,

Yes, it will be interesting to see.

Power-plant fossil-fuel use is mostly natural gas, and secondarily coal. Fuel oil is used rarely these days, and usually only as backup when there is a shortage of natgas, as it can happen in New England, for example. So power production won’t impact demand for crude oil.

In addition, coal has been declining for two decades as fuel for power plants. First, it couldn’t compete with natural gas; now it cannot even compete with wind. What we’re seeing is a power-generation portfolio that is shifting away from coal toward natgas, wind, and solar, with hydro roughly stable, and nuclear slowly declining as these old nuclear power plants are being decommissioned one after the other over the years.

Makes sense! I’d overlooked natural gas, which is abundant and cheap. Thanks for the read.

It is cheap because it is a by-product of the production of of shall oil. If that disappears than cheap gas will also disappear. The situation that there is more than what is needed will also disappear

It’s still amazing to me what bad press from four decades ago (although I suppose Fukushima is more recent) is still doing to nuclear. It is one of the cleaner sources of energy out there if people are really concerned about climate change, yes, it has other dangerous byproducts, but so do all of the other options.

On the other hand, that hasn’t stopped China, they have like a dozen nuclear power plants under construction compared to the two in US.

Worldwide, there are something like 50+ of these things under construction. The ones in the US take a lot longer (for good reasons), but that’s another area of technology that we’ve given up the lead in. First to the French and Russians, and now I’m going to guess China, because that’s just not the kind of skills you can retain if there is no one actively designing and building these things.

MCH,

You need to read about the massive quantities of nuclear waste generated by this “clean” fission nuclear energy.

Fast neutrons splitting atoms in a chain reaction releasing more fast neutrons is at the heart of fission nuclear power.

These fast neutrons will hit anything and everything around them, and in a very high percentage of interactions, produce an unstable radioactive atom with variable and often very long half life. That means water, pipes, casings, radiation protection suits for workers, everything, becomes radioactive

The byproducts of the fission in the nuclear fuel are also unstable radioactive isotopes.

So the spent fuel, and everything that comes into contact with this nuclear fuel, or even comes within range of these fast neutrons, becomes radioactive, thus generating massive quantities of radioactive nuclear waste, both highly radioactive (spent fuel and water coolant are the main offenders) and medium to low level radioactivity.

Some 250,000 tons of radioactive waste are stored worldwide in various conditions.

Getting rid of this radioactive waste is a HUGE problem, even in highly pro-nuclear countries like France, which produces up to 72% of its energy with fission nuclear energy. And generates 2 kg of radioactive waste per year per person in France

Where does all this radioactive material go? Surprise! In democratic countries like France and the US, nobody wants this radioactive waste anywhere near them, nor do they want this radioactive waste SHIPPED through their neighborhoods, and so both countries are still stuck in the planning stages of starting a deep geologic burial site – Bure in France, Yucca Mountain in the US

France has other “temporary” storage sites right now. A lot of the waste, especially in the US, is stored on the premises of the nuclear power plants. Whether in pools or barrels, there it is, right next to that “clean” energy nuclear power plant, piling up for the ages while the deep burial sites wait to be opened

I’m pretty sure that China, being China, will just dump their radioactive waste wherever

PS, this problem with fast neutrons being generated is also a problem with “clean” nuclear fusion, although on a lower scale. That’s the basis of the promise of aneutronic fusion with boron, with the main problem that very high temperatures/ energies are needed to accomplish this

“It is one of the cleaner sources of energy out there if people are really concerned about climate change…”

You are right. Radiation poisoning and cancer are not part of climate change. Bonus! The more people die, the less environmental damage. Just look at how nature has returned to the area around Chernobyl!

Wonder how many billions of barrels of oil were burned to build Fukushima, to mine, process and create its fuel rods and to attempt to clean it up?

Tepco showed, even before Fukushima, that the Japanese are not driven enough to deliver the quality workmanship that nuclear power generation requires. So if even the Japanese can’t do it than who can?

Then there is the problem of the last ten years that nuclear is so much more expensive than solar and wind that it makes absolutely no financial sense to even try it

So those 50 that are being build are or Russian, Chinese, a few in the West and the rest are for countries for which one or two nuclear power plants are absolutely not a form of nuclear weapon program

@Gandalf

Not discounting the fact that nuclear has its problems. Yep, no one wants the waste. Just remember, this same could have been said of fossil fuel, the waste is socialized into the atmosphere unless you have the occasional oil spills. But there isn’t such a thing as free lunch. Everything has a trade off.

The only real question is the metrics associated with the trade offs. Have seen statistics on deaths associate with nuclear power vs other forms of energy generation. But that can be fairly subjective depending on scope of study.

@char

“So if even the Japanese can’t do it than who can?”

Duh, China.

Have you checked where all your wonderful consumer electronics are manufactured lately? How about telco equipment? Optical fiber?

In case you didn’t know. C***a.

Shhhh, don’t tell anyone, it’s a secret.

seriously though, China has no problems trying to build and fail and keep doing it until they get it right. There are areas that they still lag far behind, semiconductor for example, they are still far behind in the field, but they know it, and they are working to get caught up any way they can. The same with nuclear power, they brought in expertise previously to learn from, and over time, they’ve started to supplant those expertise.

Would they be so far behind in fifty years from now? I wouldn’t count on it.

Can do it safely. That last bit is the hard part. Everybody can pick up some hobo’s from the street but you will have to deal with run-away reactions.

Gee, just wait until the renewables put the base load power plants out of business and see what happens to the price of electricity when there aren’t any alternatives or when there is a lack of wind or cloudy weather.

South Australia did this and put the cart before the horse and saw the price of electricity there soar for years until more capacity came online.

In Vicotria there was a big plant that took 20 – 25% of the state baseload power offline when it shut down and the current Premier said back then that the ‘price of electricity might go up 5%’……….

(This is the same dork that put in place policies and guards at hotel quaratine that let the virus out into the community and resulted in the current lockdown.)

Oh, it went up, about 20% one year and another 25% another year and then it finally went up only 5% the year after that.

Funny thing though that Victoria has had a huge investment in solar (private and solar farms) and huge wind farms and the retail price of electricity just keeps going up every year!!

Oh, and I forgot to add that the state gives huge subsidies for electricity to the big aluminum smelter that us peons pay for every year. (Gotta keep those union jobs after all it is the Labor Party in government here.)

They are the biggest user of electricity in the state and if they closed the retail price of electricity would probably fall by 30 to 40%………………………

When there is a mismatch between demand and supply than prices go haywire. But consumers pay average price (or if you look at the importance of electricity for the economy and the way it is paid for a tax.) And i don’t know if the average price for solar/wind is higher/lower than it is for nuclear or coal.

Smelters use an ungodly amount of electricity but only during periods of cheap electricity. They make demand follow production which leads to less wasted investment in production capacity and less wasted produced electricity. So even while it is true that they pay much less for electricity than retail it would lead to higher retail electricity prices if they were not sucking up demand during periods when production is much higher than demand.

Oil is sold in barrels. Gas in mmBTU. There are around 5.5 mmBTU in 1 barrel of oil and a high price for gas is $10 per mmBTU while $55 for a barrel is cheap. EV’s impact on energy production is that oil production will crash as all the expensive oil is not commercial viable to use as a source of electricity.

“expensive oil is not commercial viable to use as a source of electricity.”

Oil is hardly used as a source of electricity at all and then usually in the form of diesel for emergency generation.

South Australia turns theirs on when the wind doesn’t blow and the sun doesn’t shine to prevent bow and blackouts.

If you go EV than they may be powered by electricity generated by carbohydrates but that is unlikely to be oil so oil demand will plummet.

Goodbye refinery margins – if consumers don’t find a way to burn a lot of jet fuel (maybe the airforce could keep flying all their planes 24/7) that market will absolutely get destroyed. They have a few months, maybe 1-2 years while product stockpiles can keep balancing the sudden change in demand.

But in 2-3 years most new cars sold in the EU will be powered by electricity. And diesel is death

“But in 2-3 years most new cars sold in the EU will be powered by electricity. ”

Really?

New model cars. Transition will go surprisingly swift. Maybe it is 2026, but it will be clean which way the wind will blow by 2023

That’s a brave forecast.

We don’t know what will happen to middle class’ income in 3 years.

Besides, it is equally possible that most of car market in 3 years will be repossessed old vehicles, leaving perhaps 3% of transactions to VE … or horse powered vehicles.

A new shot of 3 Trillion simulus and the falling dollar at .80 (DXY) is going to be driving this bus. $80 oil in the near future makes as much sense as $43 oil does today. The Fed has invented a dynamic adjustable inflation basket of things we don’t need to salve the sheep in the sinking economy that was sinking before the virus hit. When distorted,dis-connected markets begin to even slightly correct to actual supply/demand metrics the chaos will began. One thing for sure the Corporate\ Security Comples MSM will inform you after the bus runs over you. Wolf Street analysis might help one to get out of the way of the bus. Nothing is guaranteed and sometimes just plane old luck works best.

Why don’t you follow NG?

I do. Just not as often by itself — it’s mostly combined with oil and gas, and the issues are similar: shale production and a collapse in price due to overproduction. Been posting on NG since 2011.

So much for all the peak oil morons.

You think there will be more oil refined in this environment?

Conventional oil peaked in 2005.

Shale etc is scraping the barrel using debt to offset costs, and investor hopes in search of yield.

Now the industry is imploding.

Debt does not replace the nearly free $5 per barrel oil of the past.

The reset is going to be ugly.

regards,

Another Moron

(that lives in one of the few energy sustainable countries)

You really need to look at the underlying data.

Oil usage, worldwide, has grown continuously since the 1970s.

The 1970s break was the only major dip down since oil started being consumed en masse in 1900.

If Wolf’s numbers are accurate, the US’ oil consumption is down under 1 mbd (vs 20 mbd or so). Even if this represents worldwide reduction in oil consumption, it would still put world oil consumption higher than 3 years ago.

The COVID pandemic has taken out a huge chunk of oil consumption worldwide. World oil consumption is rising again, but still not at 2015 levels yet.

https://www.eia.gov/outlooks/steo/report/global_oil.php

Nationwide shutdowns in literally almost every wealthy and middle tier nation for months, and the daily consumption has fallen less than 10%?

Hardly earthshaking, long term.

Doesn’t anyone remember $150 oil, pre-GFC? That didn’t retard oil consumption significantly either.

Shale oil fracking? I always think of it as “sucking the rocks dry.”

Per the eia Short-Term Energy Outlook:

“Annual average global consumption of liquid fuels rises in 2021 by 7.0 million b/d from 2020 levels. This increase reflects forecast GDP growth and increases in travel. However, any lasting changes to transportation and other oil consumption patterns once the effects of COVID-19 and associated mitigation efforts end present considerable uncertainty to the increase in liquid fuels consumption for 2021. EIA expects global oil inventories to decline at a rate of 1.8 million b/d through the end of 2021, eliminating most of the surplus that accumulated in early 2020. These inventory draws will likely put upward pressure on oil prices, but that pressure will be partly offset by high existing oil inventories, particularly in the second half of 2020, and a large amount of spare crude oil production capacity.”

Further in the report: “The trajectory of both supply and demand are highly uncertain”.

Fancy rhetoric for We Have No Idea What’s Going To Happen but we’ll continue to forecast & report numbers favorable to the oil industry.

2020 is a very strange year. Is that 7 million for that what was expected in January, The expectation now in July when we still have massive unknowns (will there be a big lockdown in the US, a big recession or a vaccine next month) or real demand over 2020.

I would rather they give out a real number and compare demand for 2021 with 2019.

Green new deal accomplished. So no need to spend $90T to make it happen anymore. Hooray.

Gents,

Oil is acting exactly as one of the most astute Peak Oil articles I read from more than ten years ago, (that I can’t find) but the gist of it was a prediction that was spot on – with the rollercoaster ride, price rises, over investment, gluts, then market collapse and a looming price spikes from systemic bankruptcies.

All of this Peak Oil process is playing out.

Basically ALL of the Majors had embraced Peak Oil and would do anything / drill anywhere / take on any amount of debt to avoid the inevitable industry annihilation.

Same goes with American Empire – oil-seeking actions dominate, because the value of the dollar is based on World-wide control of oil resources.

Thus the political-class’ focus on Venezuela and Iran.

There may be a problem with distillates but not crude, https://www.reuters.com/article/us-china-oil-ports/chinas-oil-port-congestion-to-stretch-on-as-record-imports-strain-facilities-idUSKCN24O0WJ

“people who do go to work are driving to avoid the infection risks associated with riding on a commuter train”

So, that Transit Oriented Development that the state Democratic Party has been pushing is turning out to be a fraud.

“Transit Oriented Development is the exciting fast growing trend in creating vibrant, livable, sustainable communities. Also known as TOD, it’s the creation of compact, walkable, pedestrian-oriented, mixed-use communities centered around high quality train systems.” (Quoting the Development Finance Industrial Complex’s website. TOD.org)

An NBER paper on the use of public transit and the virus:

https://www.scribd.com/document/467246856/w27407#from_embed

I’ll note that the current outbreak of cases in Melbourne which has resulted in the current lockdown started in the western and northern areas of the metropolis which have lower socio-economic characteristics.

One of which is the reliance on public transport.

Yet, Japan which has heavy use of public transport has not seen the huge number of cases as the USA or other countries.