Sellers are suddenly coming out of the woodwork. Housing market is having a moment.

By Wolf Richter for WOLF STREET.

There is a lot of discussion about the low levels of inventory for sale, as potential sellers have pulled their homes off the market or are not wanting to list their homes at the moment, waiting for the Pandemic to blow over, or waiting for more certainty or whatever; or their mortgage is now in forbearance and they don’t want to make a move.

These discussions cite buyers who, after being kept out of the housing market for a couple of months due to the lockdowns, are now swarming around out there, stumbling all over each other, looking for homes to buy, jostling for position, and engaging in bidding wars with each other.

And then there is the widely reported move to the suburbs, or to small towns, and away from big densely populated cities, by those who have shifted to work-from-home, to work-from-anywhere, which blatantly contradicts some of the other stories of big cities being overrun by buyers engaging in bidding wars.

Those are some of the narratives we’re hearing, and they all make some intuitive sense. But this is not the case everywhere. So we’re going to look at San Francisco, one of the most expensive housing markets in the US, based on weekly data that was compiled by real-estate brokerage Redfin, from local multiple listing service (MLS) and Redfin’s own data, updated at the end of the week.

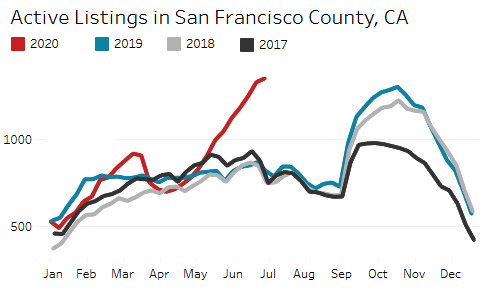

San Francisco is now flooded with homes for sale. “Active listings” surged to 1,344 homes in the week ended July 5, up 65% from the same week last year, and the highest number since the housing bust, amid a 145% year-over-year surge in “new listings.”

There normally is a seasonal surge in active listings after Labor Day that peaks in late October. But this month, the surge of active listings (1,344) has already blown by those peaks in October, including the multi-year peak of 1,296 in October 2019. This is “pent-up supply” coming on the market at the wrong time of the year when supply normally declines (chart via Redfin):

Redfin’s data doesn’t go back that far. But the 1,344 active listings would be the highest since 2011, during the final stretch of the San Francisco Housing Bust, based on MLS data provided by local real-estate site, SocketSite.

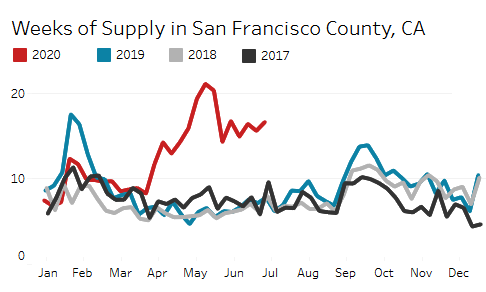

Supply of homes for sales has more than doubled, from 7.8 weeks last year at this time to 16.6 weeks now, at the current rate of sales. Note the spike of supply in May, a function of sales that had collapsed (chart via Redfin).

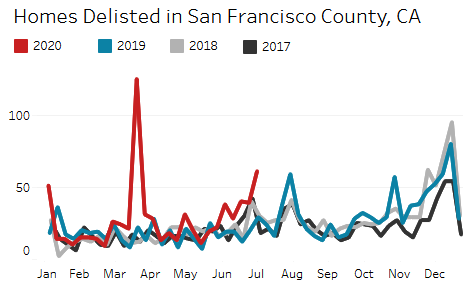

Homes are being pulled off the market again: 61 homes were delisted, over double the number in the same week last year. The chart below shows the spike in delisted homes that started in mid-March during the early phases of the lockdown. It also shows the normal seasonal spike of delistings ahead of the holidays in December – yes, inventory is low because sellers pull their unsold property off the market. But now, with the flood of inventory for sale on the market, the surge in delisted homes has started again (chart via Redfin):

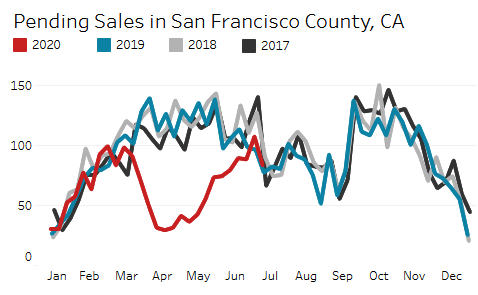

Pending sales lack pent-up demand. Pending sales had collapsed 77% by early April compared to the same time last year, but then started digging out of that trough. In early July, pending sales were still down 8% from last year and now are following the seasonal downtrend and appear to be back on track, just slightly lower.

In terms of the recovery, that was pretty good. But there is no sign of pent-up demand, and the home sales that didn’t happen during the collapse in March, April, and May have not created a surge in deals, and there is no sign of pent-up demand (chart via Redfin).

Buyers now have the largest choice of homes for sale since the Housing Bust nearly a decade ago. And there is no need to engage in bidding wars or other foolishness.

Sellers might be motivated, as they say. Among the sellers might be those who – given the issues of the Pandemic, or future Pandemics – are itching to leave the second most densely populated city in the US, and one of the most expensive, and head to cheaper pastures inland in California, or to other states, or to smaller towns with big price tags along the California coast.

There is lots of anecdotal reporting on these trends, including housing markets that have caught fire in places such as Carmel-by-the-Sea, a beach town on California’s Monterey Peninsula, on Highway 1, about 110 miles south of San Francisco and about 75 miles south of Silicon Valley.

And with work-from-home in place, it might be convenient too. It doesn’t take very long to drive to San Francisco and less long to Silicon Valley for the twice-a-month meeting, especially now, with work-from-home having cleared up some of the previously infernal congestion.

There are all kinds of anecdotal observations and theories people are spinning at the moment, trying to come to grips with the changes underway. But one thing we can now see: The sellers have come out of the woodwork in San Francisco. Just don’t look for the usual thicket of open-house signs on the sidewalk. The process has gone digital and by appointment only.

A torrent of 2.4 million people filed their initial unemployment claims under state & federal programs during the week. Federal PUA claims by gig workers are now 45% of total unemployment claims. Many people are hired back, but many are newly laid off. Labor market recovery remains hard to discern. Read… 32 Million People on State & Federal Unemployment, 2nd Highest Ever: Week 17 of U.S. Labor Market Collapse

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Markets go up gradually then crash in an instant as everyone runs for the exists at the same time.

Especially when the prior years of demand were artificially created by gvt suppressed interest rates, driven to laughably low rates (by G printing) even as absolute levels of debt (read default risk) soar and incomes stagnate.

Low interest rates are now normal. Here to stay. Tons of money and no where to put it. Tons of debt that requires low interest rates in order to avoid mass defaults.

The bond vigilanties never rode to the rescue. Another figment of financial dis-information.

Bond vigilantes aren’t really a thing when all of the major CBs are printing money to buy bonds. Who cares about bond vigilantes? Let them sell. The CBs will buy every bond sold, and then some, with money created from thin air.

It pains me to write these words, but I believe them to be true.

Forgot to mention a bunch of wall street/FedBanker types that have co-opted the politicians, and benefit by creating money out of nothing. Then they preach the virtue of “Free Market” Capitalism, while they are the antithesis of free markets, and print there way to Capitalism. For others they try to sucker pointing them to hard work, self sacrifice and delayed gratification.

The bond vigilanties have never been a thing; at least not in the last 30 years. They were a figment of the propaganda.

It is relative as most markets’ months of supply are measured in months, with six being equilibrium I believe.

6 months? 4 months was the equilibrium many years ago. Now transactions can be done much faster, from listing the unit to closing the sales might be days instead of months (“listing” used to mean get it printed on paper and distributed, which could be a month on its own). The industry had modernized and digitized.

Bond vigilante are not active since disinflation is dominant. Imagine the capital gain when(1982) the 10 y bond was around 15% and now to 0.25%.

Right now, those who listened followed Fed’s announcement and front lined it, since the middle/end of March are sitting capital gains of at least 20-30% in LQD- 0ver 3% div HYG, JNK – each over 5% div.

HYT High yield ETF from Black rock has over 8% yield/div and gained over 30%! ANGL & FALN – fallen angels ETFs gained over 30% and the yield. div is over 5%

Fed’s favorite – LQD, VCIT and USHY. Zh had published the list!

This ALL happened in the open. Check out their charts at yahoo/finance!They keep going up. There are 10-15 other corp ETFs with yields between 3 & 5% like SJNK and SLQD!

I favor short and intermediate ETFs over long term ones.

correction

when(1982) the 10 y bond was around 15% and now around 0.65%.

@ Sunny 129 –

1. Do you have any evidence of bond vigilanties? Who are they? Where are they?

2. What metrics support your thesis of disinflation?

3. Aren’t all the high yield tickers and ETF’s you referenced evidence of inflation? Aren’t they a direct result of FED money creation and infusion into the market?

True Story to illustrate ..

Years ago when it was new.

FOXTEL pay TV in Australia .. $100 per month.

Some time later .. a behind the counter ..FOXTEL pay TV service was available .. some tech savvy dude .. offered it for $36 a month ..you had to purchase a gadget / receiver for $300 & bingo FOXTEL pay TV in your home unbeknown to FOXTEL.

FOXTEL never caught on to the fact that a substantial number of potential customers were piggyback riders.

Why did they not realise ??

Because they believed themselves to be GOD “It’s Impossible”

Nothing is now normal. To believe that admits a fundamental lack of knowledge about cause and effect. The only constant is change, and now is no different. I have seen things go from one extreme to the other a few times, and I can tell you that we will be in a fundamentally different environment 5 or 10 years from now. Normalcy bias, is a illusion, and one that keeps most people looking in the rear view mirror as they drive their finances off a cliff. I can think of nothing more naive than believing for one second that the Fed has your back.

All capitalism descends into crony capitalism unless literally forced not to. Why spend $1 on marketing to get $1.20 profit, if 85c worth of bribery achieves the same effect?

The term “bond vigilantes” was coined by economist Ed Yardeni when he worked for one of the large Wall St. brokerage houses in the 1980’s.

Not to mention the portion of moneyed overseas buyers snapping stuff up sight unseen!

@ cb

Japan has been trying to raise inflation over 2-3 decades, but going nowhere. Yes, Inflation is there in Equity mkts, housing, education and healthcare. It is profitable for those in stock mkts and housing, but NOT for renters with NO real growth in wages since 90s! Fed has been trying for inflation (headline kind) since ’09. If there was ‘real inflation(or real economic growth) why would the 10y bond stuck below 1.0%?

There are no deficit hawks (GOP kind become visible only when a dem in the WH!) Has any POLITICIAN complaining about increasing deficit and or DEBT? NONE!

Those in bonds getting 20-30% capital gains besides 3-5% div yield( just since March!)

It’s those NOT in the mkts, living from pay check to next, retirees in the bottom 80%, savers are the big losers from the very beginning. Where is the outrage? No demand of accountability of Fed’s actions.

DEBT has been the panacea for all our financial problems (public/private) all over the world! Without continuous CREDIT(debt) expansion both Credit and Equity mkts will collapse- the same story since ’09!

I am nearly 50% cash (since I am retired) rest in Govt bonds, credit bonds(like above) Gold and gold Miners ETFs, both long and short against the equity mkt with tactical trading.

(been in the mkt since ’82) This is the SURREAL Bull mkt of my life time! Bubble mania in full swing!

@ Sunny 129 –

The 10 year is below 1% because of FED manipulation.

We have had continuous inflation sine 2009. The only things that might be cheaper are oil prices and interest rates. Both of these items allow more discretionary cash in some peoples pockets. Low interest rates have allowed homeowners, corporations and commercial property owners to refinance saving many of them from thin or negative cash flows and “saving their bacon.” At the same time rents and asset prices increased, further increasing cash flows and balance sheets, and making many otherwise imprudent buyers look like geniuses.

The 10 year is where it is because of massive amounts of money created by credit. At the point where money destruction really kicks in, which will happen when loan defaults begin to pick up speed, the money flooding the bond market will be needed elsewhere. At present the loan defaults are at a snails pace compared to what they will be in a year, or two, or three. The money destruction has not yet begun, when it does, nothing including the Fed will be able to stop it.

@ jdog –

Jdog said: “The 10 year is where it is because of massive amounts of money created by credit.”

____________________________________

thought provoking. I’m not challenging it, but I would like to see the ‘think through’ on this and understand it. Is it really that simple? Have the lenders extended to much credit, and has that created a corresponding new amount of dollars, and those dollars then chase 10 year bonds, which push down 10 year yields? Are those lender extended loans at an interest rate less than the 10 year yield?

Your statement, at it’s core has the ring of truth. It’s almost like a tautology. But I can’t grasp the flow and all the moving parts.

I would appreciate any clarification.

I’m thinking the low rates are due to the FED just digitizing dollars and buying assorted financial instruments, mostly bonds, which then shows up on the FED’s balance sheet.

I like to listen to central bankers to try to understand their thinking. The way I hear it they are going to try to run inflation at least 2 points over the feds fund rate for a long time. It’s going to be tough to hold zero risk savings for a long time, but it still might be worth doing until asset prices reset. You can see they saved it once this year, but some of the big tech valuations are so extreme I would say John Law couldn’t have done a better job than Elon Musk.

‘until asset prices reset’

?

They could have done that in ’09 but instead masked all the structural

problems/distortions in our financial/global banking system, with more debt on debt. They also suppressed the price discovery of assets. Suspended the mkt to mkt accounting standard!

Why can’t investors remember that this the same gang who brought the two previous boom-bust cycles in this century- 2000 & 2008!

This bubble will also burst. covid 19 is the pin for this bubble.

3rd time is the charm, right?

Sunny129:

At least are two of us!!

“Next time” there will be nor chance of “solutions”; only chaos!

Coming soon to a region near you!

I told you so as to the coming RE collapse. We are now at the scary point in the economic rollercoaster when we start to go down so fast that our stomachs turn over.

Except for the parasitic banksters, who will be getting their ‘Federal” Reserve bankster cartel to give them way below FMV interest rate loans to buy our businesses and homes at pennies on the dollar, for most Americans, the great financial pain begins. Abolish the parasitic, corrupt, “Federal” Reserve system and replace it with a truly publicly owned, independent , Federal agency.

Not happening here in Ottawa, Canada. Prices up 14-20 percent and going higher. What crash?

‘coming RE collapse’

?

Fed fight that all the way with unlimited capacity to produce digital$ out of thin air. ( Watch Powell’s interview, 60 min -CBS) May be They will start buying just corp credit bond Etfs!

RE is a big part of any Country’s economy. We know the consequence of housing bust in 2008 -GFC.

Btw:

Look at the chart of XHB (home builders) it is 2% short of it’s 52 wk high!

ITB (home construction) 2-3% below 52 wk high!

These charts tell where the action is and NOT just the words from prognosticators!

Remember: Fed is the mkt, now!

Are you not a dis-inflationist?

Mr. Mkt don’t care what you or me, think, wishful thinking or hope!

There is REALITY and then, there is perception management by vested interests aided by CBers! The latter are running the show.

The question is how any one profit in this contradictory investing environment? It is like determining the winner in a beauty contest. Not whom, I think (wish) win, but whom most OTHERS think, will win.

What the hell is a dis-inflationist? Do you mean deflationist?

Econ-speak:

Inflation: rise in consumer price index.

Deflation: fall in consumer price index.

Disinflation: slower rise (“less inflation”), but not “deflation”.

Success apparently is defined as a sustained rise in asset prices without inflation. However, in the absence of underlying growth that’s also the definition of financial inflation (to which most economists are blind). And, in the absence of mass prosperity, rising asset prices is the definition of “increasing wealth inequality”, to which most economists are also blind. Finally, inflated asset prices without underlying growth also mathematically implies sustained low future returns, that is “bubbles”, but economists can’t see those either.

A discipline whose historical roots emerged from Moral Philosophy really ought to be less blind, and have more to say about the ethical and moral consequences of this particular metric for “success”…

Jdog said –

“What the hell is a dis-inflationist? Do you mean deflationist?”

sunny129

“Bond vigilante are not active since disinflation is dominant.”

____________________________

Good point jdog. I hate FED speak myself. I was responding to an earlier post bt sunny129 and wanted to use the language he was using.

dis-inflation is slowing inflation, but is still inflation, and essentially theft of the value/purchasing power of your existing dollars.

QE is dollar creation, out of thin air.

We should avoid using FED speak. It empowers the larcenous bastards.

I hope that you are correct but RE consists of rights and obligations essentially: pay mortgage or rent, property taxes, etc., Then you get to use, occupy, or lease RE. The “Fed” banksters can buy the mortgages or RE and then what?

Evict the tenants or former owners after foreclosures? Then, they have empty non-income producing, white elephants until they sell them at the prices they can get based on demand.

Even at 2% interest, billions in RE require huge servicing payments. A lot of distress sales or foreclosures and eventually, RE prices will go down. (Of course, some areas are so desirable or occupied by such wealthy persons that they will be insulated from downturns.)

Ultimately, as more regular owners default then are foreclosed upon and tenants are evicted, the supply of RE on the markets will go up. The pandemic’s effects are ruining the demand for RE. Prices will thus ultimately collapse in most markets– except in some areas where the owners are somehow insulated.

The Fed banksters can delay this but not prevent it ultimately. A readily available, cheap cure, debt forgiveness for millions who defaulted, and stimulus loans at low interest rates to fund repurchases, new businesses, etc., may allow the economy to recover but not for many months. Meanwhile, RE prices will collapse in most places.

I hope I am wrong. I fear that I am not.

But housing is a basic human need, office space now less so, and our un-housed population “seems” higher than ever while the housing stock, esp. affordable housing stock, is still inadequate as residential construction has not kept up since the 08 bubble burst.

When the ACA passed, we found out lots of people were going without healthcare and working jobs only to get the insurance (voluntary part-time work went up after ACA). ACA was a big driver of employment during “the recovery.” The previous demand was there but the money wasn’t until congress put the money there and voila – healthcare and jobs.

Now, historic unemployment, looming evictions and foreclosures for a population already unable to house itself despite the vast financial resources spent on the arbitrage from earnest money to mortgage to mortgage backed security. All that “money” in the financial system generating very little in housing for actual people. Congress get moving.

Everyone knew people have been working jobs for medical benefits.

This was not a new revelation from ACA.

@lenert – Sure, ACA. And volia, insurance premiums skyrocket, deductibles skyrocket, insurance companies decline coverage by leaving many states. Many people can’t use their insurance because of the size of the deductible. Some middle class working stiffs go without medical insurance. — Unless you’re quite poor. Then you get subsidized.

Apparently you are not a fan of history. Do you really think this is the first time the Fed has gone hog wild and began making bad investments? It is not. The Fed is not the market, the Feds balance sheet is dwarfed by the markets.

Now, here is a history lesson. During the 1920’s, the Fed made a lot of foolish investments which became devalued or worthless during the depression. They basically became insolvent and needed to be re-capitalized.

The Federal Government confiscated all the gold in the country by force in order to re-capitalize the fed. The Chairman of the U.S. Congress House of Representatives Banking Committee brought impeachment proceeding against the Fed for their crimes, but the motion was never acted on.

The Chairman suffered 2 assassination attempts in the next 2 years before finally being found dead. Because humans basically act on the same basic impulses history tends to work in cycles, nothing is new, and everything has happened before.

Those who forget history are destined to repeat it. Following the great depression, the asset deflation was so bad it took the stock market 40 years to regain its previous level.

Amen. Kennedy, etc., all of those among the powerful that criticize or would take powers from the bankster cartel coincidentally frequently wind up dead.

The “Federal” Reserve was admitted to have caused the Great Depression even by Bernake and Friedman. Believe it or not, it was actually empowered to regulate the banksters.

It failed to oversee and regulate their gambling in derivatives and sales of mortgage backed securities, which blew up in their faces. See “The Fed and the Great Recession” in the current issue of ForeignAffairs.com. (Of course, while they were selling those securities to pensions, etc., [“dumb money”], at the same time, they were betting that those debts would not be repaid. See the Wall Street Journal’s ” How Goldman Won Big On Mortgage Meltdown

A Team’s Bearish Bets Netted Firm Billions.”)

Any other entity that failed as consistently and caused as much harm to Americans as the “Federal” Reserve would have been long since abolished and investigated until any criminal perpetrators within it were indicted. As Simon Johnson’s “The Quiet Coup” discussed, the Wall Streeters have gained control over the US government.

15-18 billionaires now own all media of any significant size. As Anand Giridharadas pointed out, they are now just trying to deceive most Americans into believing that they are acting in Americans’ best interests, while they only further their own. See Giridharadas’s “Winners Take All: The Elite Charade of Changing the World.”

Agreed, people getting high sniffing Jerome’s rear orifice forgetting these types of thing have been tried all throughout history.

I’m going to be a buyer of HY only when market value starts reflects the amount is collateralized: 90%-85% off current prices, I’ll patiently wait for the discount window cheerleaders to get wiped first.

It will likely take about 400 years not 40 this time around for the U.S. stock market to hit 2020 highs. Look for the year 2420 for the U.S. market indexes to retest todays highs.

Jdog said: ” Following the great depression, the asset deflation was so bad it took the stock market 40 years to regain its previous level.”

____________________________________________

Does the FED have the same set up as during the great depression? Forebearance, Loan modification, Modern Monetary Theory, The ability to buy any amount of money to buy any amount of “assets” and debt, etc.?

What crash? There’s no inventory here and it’s getting worse. Average time on market is dropping like crazy with many, many offers above ask (San Diego).

Sounds like BS to me. I sold my place in San Diego 9 mos ago. 100K under asking price after being on the market 6 mos….

Same thing in Houston; mulch producers here not accepting wood chips because everyone is full to capacity, this due to all of the land clearing going on all around the area. I am not talking about small tracts, these are 500 + single family tracts being developed. This is in addition to smaller tracts for retail/ industrial/ commercial. I keep hearing rumors of sales slowing, but doesn’t seem like it. I went through the 87 oil crash here as a pup in the construction industry, and I can assure you, it’s not the same animal. I think it’s mostly the mentality of “ don’t worry, the Feds got our back “ . A lot of people that you talk to just shake their head and say “ oil will be back to $100 by this time next year “ . I’m telling you 100% , every trade here is suffering for skilled AND unskilled labor, so , the question is, is everyone sitting at home living on severance/ state/ Federal unemployment ? I don’t know, just telling you what’s happening. Right now, if you want ANY home improvement/ remodeling done, your going to pay a 25% plus premium, just because everyone is so busy. Truck drivers here can name their price if they have just a mediocre work ethic and clean driving record /drug test. A sign at the road for one of the most exclusive subdivisions on Lake Conroe reads; “ Thinking of selling your home? Please stop by, our inventory is low”! I’ve been here all my life, never seen anything like it. Will it change next week? Anything is possible in this new world/ paradigm that we’re charging headlong into, but it definitely is still full speed ahead.

Also, while I’m sure a lot of these projects were in the pipeline prior to the oilfield crash ramping up that are under construction now ,just get a copy of the Houston Business Journal, tun to the back , in addition to the building permits issued, there is also a public bid section showing all the public/ MUD and school district work advertised for bid. This is work that is still weeks/ months out.

It brings new meaning to the phrase “ I feel like I’m taking crazy pills”

Wolf, you make such fascinating posts! That’s why I’m addicted to your site.

That being said, I think that you just describe “herd mentality. ”

Moo…

Edit: “described…”

I gotta slow dun…I mean down.

There has always been a big price difference between SF and the rest of CA. Yet that never really was a factor in the past.

Maybe quality of life does matter. The state reponse to the pandemic should be equal

So the local response.

And maybe something else that can’t be mentioned.

“given the issues of the Pandemic, or future Pandemics – are itching to leave the second most densely populated city in the US, and one of the most expensive, and head to cheaper pastures inland in California, or to other states, or to smaller towns with big price tags along the California coast.”

2banana

Not to mention an expensive, exorbitantly over-staffed & incompetent city government, poor schools, DA that won’t prosecute crime, homeless camps and…oh yea…human poo all over the place.

Javert Chip,

“human poo all over the place”

My son is a tech worker (not based in CA) who visited SF for business purposes last fall and that was his big impression of the city. Not something a city wants to be remembered for.

Don’t forget the homeless booked in hotels. Was reading about the Intercontinental near Moscone center, supposedly one of the hotels that is used to support the State homeless programs, and listed under the euphemism for front line workers.

This is going to put a damper on their business in the future. As for the city government, it is what it is. Another sign of the failure of long term one party rule. I would be curious to know when the last time a Dumbo held any kind of position of power in SF. Would guess it’s been at least three decades…

Rubbing my hands with glee, because this means that other than 1% transfer fees imposed on real estate, the Occupation Government that has controlled city hall and local politics is going to have far less money to spend on their civic decay. Can’t wait to see the legions of Bayview make-work jobs eliminated and real budget contraints imposed on the carpetbaggers that have infested the city government for the last generation.

Right now in nyc, there is concern that, because, a full one fourth of tenants weren’t paying rent since March. That property taxes income to the city will plummet. The can’t evict policy is the stated reason. If landlords can’t cover an entire one fourth of non-payers, the landlords pay choose property taxes as the thing they can fall behind on. If nyc doesn’t forgive their undue taxes, the renters market in nyc could implode.

Considering how generous unemployment has been, most delinquent tenants are probably simply choosing to get free rent in the meantime. The courts will be backed up for years and will probably have to throw most unpaid eviction bills away. The other possibility is the inability of the state to process unemployment claims adequately (A very costly mistake).

This whole situation is continuing to get worse as the unpaid bills are likely piling up for most landlords. I imagine SF is undergoing something similar, though not quite as bad. Many might be planning to leave the city and will have a bunch of cash to do so. The courts aren’t likely to chase them if they leave the state, when they are finally evicted (which might take until 2022, maybe longer). The reason, because, SF and NYC are likely to be the cities that won’t allow evictions until the pandemic is over (hopefully 2021), but, once that happens, imagine how long it will take to evict everyone. Can you imagine trying to evict a double digit percentage of a city? These cities may force landlords to forgive unpaid rent, possibly indirectly through non-enforcement. However, if they actually do that it could encourage more non paying, even the suggestion is dangerous.

All this and more, will cause mayhem. The actual outcome could be anything. It’s a developing situation that could result in unexpected things. At this point I am unable to guess, which way the wind will blow.

Well thought out Sir. Social justice coming back to sneak in the back door and bite its promoters in the butt.

Tech money is of the main engines along with property taxes, of the city’s wealth. There is a 1.5% payroll tax. Bank of America, Chevron, Charles Schwab and other big companies left the city a long time ago because of the decaying crap covered streets and lawlessnes. Tourism is now DEAD, and may be forever, if the pandemic is permanent.

When Tech leaves S.F., it’s game over, except for the homeless barnacles who arrive, but never leave, thanks to the billions of dollars spent on them–until that pool of money dries up.

if Democrats control house ,senate and presidency won’t they just crank up Dr Kelton’s MMT and bail out irresponsible cities and states?

Yes IMO WB,

And that is the most likely reason that SO many of the rich folks have now begun to throw money at the dems in spite of the tax breaks already received and likely to come from current pres party.

In that way, the bail out of local municipalities will be paid for by the working class shmoes instead of real/actual ”net” taxes on the rich going up.

With ALL the current political puppets controlled by the rich, how could it be otherwise?

Instead of the irresponsible, corrupt, and bloated Military/Security State .. to mention just one ‘industrty’ sector, right? Congress makes damn sure THEY get their MMT $$$ .. disclosed and otherwise.

This country’s priorities are totally f#cked up!, having evolved into One Big Grift Engine ….

“And then there is the widely reported move to the suburbs, or to small towns, and away from big densely populated cities, by those who have shifted to work-from-home, to work-from-anywhere, which blatantly contradicts some of the other stories of big cities being overrun by buyers engaging in bidding wars.”

Stuff California and the USA: work remotley in Barbados.

(Nice country, nice beaches, nice people, and a great place to take a vacation – I’d like to visit again!)

“But even as the pandemic continues to rage, the government of Barbados, a country in the eastern Caribbean, is sending a very different message: Come here, not just for a holiday, but for up to a year. Bring your laptop. Soak up the sun, the sea, the sand – and forget about the coronavirus.

Dubbed the “Barbados Welcome Stamp” and launching this week, the program will allow visitors to stay on the Caribbean island visa-free for up to one year. The aim is to attract remote workers, with a bill to be introduced in Parliament by the government that will remove the local income taxes that normally kick in after six months.”

And as noted in a comment in another story: unlike Hawai’i these places want visitors. Hopefully they won’t wreck the country though.

https://www.traveller.com.au/countries-such-as-barbados-to-offer-yearlong-working-visa-programs-to-attract-digital-nomads-h1pf4k

It always wrecks the country, Lee. At least that has been my experience. Especially in these times of social media when everyone has this compulsive need to share every new discovery with complete strangers.

Tourism was worth 34.6% of the 2019 Barbados GDP: no wonder they are coming up with all sorts of cunning plans to bring people back.

Apart from Cuba and Haiti (insufficient data) tourism was worth north of 30% of the 2019 GDP in the Caribbean, peaking at 62% for St Kitts and Nevis: most of these countries already have schedules to re-open their tourism industries like it or not because, well, they need the money.

The bulk of these tourists come from Canada and the US and won’t be coming back anytime soon.

I expect these Caribbean countries to have smoking hot deals on vacations as soon as the hurricane season is over. Problem is will there be any takers?

How many houses are there in San Francisco?

1,344 out of how many total houses?

Just off memory here, and I could be off a little: There are about 360,000 housing units (all types) in SF. I think 65% a rentals. So that would leave about 126,000 owner-occupied homes.

I’m in SLC. RE has gone parabolic. I just went to see a home and there were at least four other buyers during my appointment. The listing agent said in the last six hours he’s had three buyers that wanted to see the property from out of state. It’s very depressing to see what’s happening to my home state. It’s not the same anymore. I was hoping the virus would soften things up but that hasn’t been the case. The massive liquidity in the market is inflating homes to ridiculous prices.

What/where is SCL?

Salt Lake City. We’re getting overrun by outsiders.

SLC, not SCL.

Salt Lake City?

Tick tock tick tock…waiting for the usual suspects to post on here to provide counterpoint of how many houses in their neighborhood have bidding wars and 10 offers in 1 day..etc. The only thing that’s real is pend up demand, housing is as strong as ever.

The market here in Canada is off the hook. Bidding wars you name it. Its like boxing day but people are lining up for houses. Honestly. Im a buyer and its very frustrating. In one word the RE market here has gone parabolic. Never seen this before in my life. Born in early 70’s.

Throughmyeyes,

“Off the hook” in what way? Are people also leaving cities for the suburbs or even further out? Also, where in Canada are you specifically speaking of?

Just curious.

Thanks!

Off the hook is my slang for demand through the roof. Houses selling for well over asking and already up close to 20 percent from this time last year. Im looking in the suburbs but i know people who just sold in the city (small single with little to no yard) and got 8 offers in one day and sold 15k over. There are no more conditions. If you put conditions in your offer good luck unless you pay the piper. I live in Ottawa Canada but read and here this is going on all over Canada. Most likely USA as well. Oh and im not a realtor just a very frustrated buyer who is praying for a healthy correction that i dont see happening. Cheers

Canada’s gateway cities of Toronto and Vancouver have experienced massive influx of foreign money, and with HK crisis and pedal to the medal to bring in 500K immigrants per year (esp those with big bucks), the housing market continues. With Canada trading on it’s good name and flight capital friendly policies rather than real productivity, it’s all eggs in that basket now, locals be dammed.

Everywhere but Alberta. Resale apartments and resale townhouses are still selling at less than half of what they sold for way back in the spring of 2007, 13 years ago non-inflation adjusted. A new car costs the same as a resale apartment in Edmonton, Alberta.

I’ve heard many ridiculous comments on various sites about RE prices.

Remember that saying: “LOCATION, LOCATION, LOCATION”.

In some markets RE is going to be weak and prices are falling. In others the price action will be neutral, and in others the demand will outstrip supply and prices will go up. Even in the same city, state or country at the same time.

Happens in both economic booms and busts.

I have no doubt that people can provide numerous examples of prices moving up and down in their local areas.

LEE: (and others)

Wonder how “home” prices are in Appalachia?????

Anybody from that area????

Melbourne CBD property is generally going down as there is lack of demand for rentals as international students have basically disappeared and the impact of the virus on city living.

Yet, even in this crappy market there will be properties that sell well and at very good prices.

Here is an example from Melbourne:

https://www.domain.com.au/94-1-queensberry-street-carlton-vic-3053-2016334049

“A Phillip Island couple wanting a city crash pad have snapped up a rare apartment in the imposing and tightly held Panorama building in Carlton, right on the edge of the CBD.

The last sale in the tower at 1 Queensberry Street was in October last year. The next most recent was another 14 months before.

Unit 94 last traded hands 20 years ago when it was sold by its original owners for $370,000.

Nelson Alexander auctioneer and listing agent James Pilliner said three buyers fought hard over Zoom for that apartment on Saturday, not just for its view or reputation, but for the quality work done on its conversion from an office building in the 1990s.

“That building is quite possibly the most popular north of the CBD,” he said. “Carlton is starved for oversized apartments, because of developers who build smaller apartments for students.”

The auction began at $1.05 million and the two first bidders brought the price up past the reserve of $1.09 million with four bids.

“The people bidding seemed really passionate,” Mr Pilliner said. “The bids got a bit more aggressive after that and a new buyer came into it.

“They were waiting for it to become unreserved. [The bidders] took it up to $1.24 million, which was the selling price.”

The final figure was $150,000 more than the reserve for the two-bedroom unit. The home more than tripled its value over 20 years.”

IIRC more than 1/3 of CBD apartments sold this year were at a loss, but this unit had a good outcome.

PS:

Don’t you wish you had a million bucks to blow on a ‘crash pad’ in the city?

The bedroom communities of Indianapolis are selling homes within hours or days of listing, and prices are going up too. I don’t know how accurate Zillow is, but it shows our home increased in value by 20% just this year so far.

Zillow and Redfin both make money from buying and selling houses. I don’t believe their pricing anymore.

Don’t take our word for it. Check out the monthly housing stats from San Diego.

For West Vista in San Diego County:

Current inventory 1.2 months. Average time on market: 17 days. Inventory down 35%. Median sales price up 7.1 percent. If you really believe it’s going to the crapper in real estate, you’d sale now and sit in cash for the big crash!

We’re experiencing something different down here than other localities and those in those localities don’t see it therefore don’t believe it. I’ve written here’s several times with my observations and have been questioned every step of the way. I had a realtor call me to go through a place with her client in order to place a proper offer. They did and got outbid like crazy. This was for a 35 year old condo in Carmel valley near the 56. I’m a general contractor and have a lot of realtor customers and they’re all saying the same thing… no inventory and crazy high prices. You and I see it, everyone in San Diego sees it but those not living here don’t. We haven’t built enough inventory in the last 30 plus years so this is the way it’ll be. Look in any respectable neighborhood, there’s barely a single house for sale, unless it’s on a main drag or is a total piece of crap.

Please see my comment above, remember, this is taking place in the middle of a pandemic in our area, AND the biggest crash in oil prices in history.

And we are in the heart and soul of the “oil patch”.

Not trying to justify, glorify or divert the conversation, simply trying to comprehend just what in the hell is going on, and where this train wreck ultimately ends up.

And I ain’t no youngster anymore, been through a lot but everything I’m seeing today is screaming WTF ??

Everyone from the Bay Area is moving to Boise to work in the potato processing plants there.

Um…wrong part of the state. But a great place to contract the Covid19 virus.

A lot of them are coming to Texas. Especially those that work for Charles Schwab. And then there’s the LA crowd that’s coming here too.

“there’s the LA crowd that’s coming here too.”

…when Toyota North America moved from CA to TX…

Just like the 70s after the Vietnam war. Hey the cops don’t know what marijuana looks like.

In case the topic comes up (by timbers, et al.) — Just got this in my inbox: in Boston, months supply of condo and townhouses in Q2 has surged to highest since Q1 2012 (click on chart to enlarge):

Thanks. In my suburban town, I always checked the total listings once in a great while on realtor.com. Today it’s 140’s. But I’ve noticed it seems to charge quickly. New listings pouring in that for now at least are being gobbled up? But how long will that last? Been around there for a while, but 5 yrs ago I recall when I targeted this town my memory thinks it was 200-ish. One year later I purchased and recall asking my brother why haven’t listings reach last year numbers? Think they were 150-170. Two homes a block away just closed, neighbors told me one has Louisiana car plates…I should look up the selling price, and neighbor I border appears to have gotten multiple offers as soon as it listed, while asking noticably over what the Zillow says it’s worth. Mind you, I’m not disagreeing that urban realestate could get whacked. Just saying what’s happening in my neighborhood. IMO suburban will/is seeing a bump but at expense is Boston, SF, etc. And a suburban bump doesn’t necessarily mean real estate won’t decline overall. Anyway I really really love my house and neighborhood, it’s for living not investment. Many comment they had no idea this town has such a nice neighborhood.

timbers,

Your last line is exactly how people should think about their home — a place to live and enjoy, and not as an investment. Unfortunately, that has gotten lost in the efforts to financialize everything, which turned homes into investments, and the real purpose of a home gets lost, and everything is just about money.

I even have noticed single family price reduction & deals falling through lately in Boston metro but didn’t want to hurt SoCalJim and the other guy from the village, so kept it to myself ?

financialize? I hate seeing such a soft word used for a bunch of scumbags being able to steal legally. It has been nothing but the glorification of wall street/FEDbanker leeches being empowered to legally steal. They created and dispersed dollars to turn a large part of the country unto debt slaves.

Then they fabricate stories about what great creators they are. i.e Romney really believes he’s a “maker.”

Thank you.

Amen (as you well know, Wolf – I’ve been writing about that sentiment, for years).

Yes indeedy!

Ok boys n girls, repeat after me – ‘shelter’.. come on, you can do it, say it …

“SHELTER” …

I knew many of you .. could’nt.

CA RE (and some locations on the east coast) has been on an infrequently interrupted upward slope for ~80 years. If you could weather the interruptions (e.g. keep a job) during the downturns, you have been well rewarded for owning in those areas for almost a century.

In the rest of the country, the past ~ 30 years has been a situation where RE just kept up with inflation. Some places a bit more than that, some a bit less.

On the coasts the limited resource comes into play. Everybody wants to be in the limited water locales and the port cities historically have built up and started the other businesses (that don’t really need ports): show biz, silicon valley, financial business, biotech/pharma.

Location, location…

I even have noticed single family price reduction & deals falling through lately in Boston metro but didn’t want to hurt SoCalJim and the other guy from the village, so kept it to myself ?

For the past 2 weeks new listings north of SF are selling very quickly if they’re halfway decent. Usually overpriced, in the $350K to $600K range. I don’t think urban migration accounts for it all. I wrote a longer post with my suspicions of foreign buyers on your other article on freight supply.

There is also a virtual yard sale of tons and tons of luxury properties with very few takers throughout this area . This may be why there is such a glut in SF. All the wealthy are selling their extra multi million properties. An uncleaned chicken shack is worth 3 mil in SF.

as I posted on a longer thread of this in Wolf’s previous article on freight- I just randomly traced a buyer of multiple homes online and that company is linked to a company that is a shell buyer for a major Chinese company… Nothing at all is clear- but it’s there.

I strongly suspect leakage from both the US and Chinese bailouts are going towards US residential property acquisitions. Probably from corporate stock buyouts by the FED &… IDK about the Chinese system.

I think up until now ,what we have seen in the real estate industry has just been the wind-down from a period that began before the virus. Most transactions were the result of buying a house to replace one that had already been sold, or moves that had already been planned long before. Small jumps in price in a few magical burgs were caused by buyer momentum hitting a temporary reduction in supply caused by the lockdowns. Now the real story begins as the RE bag holders try and get out before they get crushed, but the exits are few and narrow and many of them will be taken to the woodshed.

The RE bag holders have been bailed out for several years now. The market has been supported by steadily falling interest rates.

Fed is actively supporting MBS and also CMBS mkts indirectly by buying various corp credit bond Etfs ( see my long discussion above)

Vanguard Mortgage-Backed Securities Index Fund ETF Shares (VMBS)

has a yield of 2.45% and it’s NAV at 52wk high!

30y mortgage rate is now below 3%!

As I have repeated more than once – FED is the mkt now!

We need way more inventory than this for the prices to start moving down.

Inventory is super low right now.

SoCal is hot with very little inventory and still prices increasing.

Houses are being overbid , its crazy.

I think patience is the key, lets see if San Francisco is the harbinger of more inventory for the rest of California.

It all depends upon Covid 19 and the state of the Economy at the end of this year!

We really don’t. Among my social circles I’ve held the position that real estate is actually more affordable in the Bay Area than SoCal. Reason: prices are fragile to begin with when thinking in terms of price vs incomes.

From that view, SoCal makes no sense. SoCal is heaven on earth so I suppose anything is possible.

The DEBT state of our BAILOUT Nation

When David Stockman (budget director) joined the Reagan campaign in the summer of 1980, the public debt was also $863 billion and it had taken 192 years and 39 presidents to get there.

The deficit figure topped $863 billion during the month of June alone.

So during the last 30 days, the Congress which passes for a government in Washington has actually borrowed nearly two centuries worth of debt!

Sure but that money is worth way less nowadays

Sure, but that is part of the problem. It is pretty clear that nearly all are seduced by modern central banking. If you have a printing press in your basement why should anyone in the family be responsible? Why should anyone have to layoff anyone? Why should anyone have to go bankrupt? Why shouldn’t education, healthcare, food and housing be free?

Old School:

Remember that in ’08-’09 it was the bankers not the commons that panicked…..they weren’t (and still are not) prepared to take the Castor Oil!

Now it’s too late.

(During Mussolini’s time he had intellectuals who disagreed with his policies and expressed them publicly arrested and force fed Castor Oil until, “….they were purged”!)

The use of castor oil went back to WWI, before Armando Diaz took charge of the broken and defeated Italian Army and reformed it.

Italian officers were known to be as uninspiring as they were brutal (just like their KuK enemies; Erwin Rommel, who served on the Italian Front in 1917, had extremely harsh words for both) and had devised a punishment for supposed “acts of cowardice”: the offending soldiers were tied down, forcefed castor oil, forced to soil themselves and then paraded in front of the platoon or company. It’s no wonder General Diaz called the army he had inherited “a blunt bayonet” referring to the low morale and his first act was to make such “off the books” punishments a court martial offence.

The Blackshirts, many of whom were WWI veterans, used the same “off the book punishment”: their victims were sometimes paraded around town but more often were simply dumped from a van with no license plates in the middle of a fancy and crowded street. The idea was not to punish the enemy but to humiliate him.

Tell that one to who has no or about to lose his/her job, with no savings or retirement benefits!

CNBC also bleats regularly about “people ditching cities, fleeing to suburbs.”

Anecdotally, I watch CT, Westchester, Portland, and SF North Bay, and see increasing price cuts in those suburban areas. (And now also in SF proper — previously unheard of.)

I hear it’s different in places like Denver, Salt Lake, South Florida… but generally the unemployment, crappy economy and COVID uncertainty are going to overwhelm any so-called pent up demand.

20% unemployed, rent/mortgage moratoriums ending, Fed unemployment supplement ending, GOP opposing new aid packages, no COVID plan — Q3 looking bad.

Who on earth would move to South Florida, especially now?

Exactly my thought.

Who on earth would move to South Florida, especially now?

Unfortunately, lots of people from NY, NJ, CT, MA. We need a wall on I-95 more than we need one at the Mexican border.

ya got that right Clete,,,

B.C. the number I was seeing was ”net” 500 people a day moving into FL,,, sure it’s a mess right now, but we will find out about that in another couple of months

all but one houses for sale in my local hood in st pete B.C. are sold, with cars with license plates states you mention, plus OH, IL, MN, etc., similar to the days before I-10, 95 and 75, when all the east coast USA went down 1 to east coast FL, mid&west down 41 to west coast

movement here to FL, as well as other southern states looks to continue, as folks want to get away from harsh winter and even harsher taxes now and going to get worse, eh

( Mr. Carrier’s engineering to provide ”relatively” inexpensive residential AC being the worst thing ever to happen to the paradise that FL was in my young days 40s&50s… Of course, dumping millions of tons of DDT and other pesticides made from chemical warfare components left over from war2 and Korea on us haven’t helped much either.)

Clete,

??

Anacondas ? .. Bugs the size of dinner plates?? .. Canadians???

I’m a resident of the Monterey Peninsula and as it states in the article real estate is booming here with many couples with children from the Bay area moving to to the area. Our local paper interviewed three realtors from the area and they all stated business was up significantly since mid June. One said it was 300% higher than a year ago.

Quote from the article,

“ DURING THE week of April 12 — when business- es were closed and the coronavirus pandemic had every- one sheltering in place — a paltry 13 home sales totaling $11,929,000 closed escrow in the Monterey Peninsula. Last week, 48 houses across the Peninsula sold for an im- pressive $78,775,000 — with 31 of them going for well over $1 million.

No one has mentioned yet that the sudden desire to sell property could in part be related to landlords in SF being backed into a corner, even more so with the pandemic now. They cannot evict during the peacetime emergency, which is understandable to a degree. But as I understand it, even after the peacetime emergency passes, they will *never* be able to evict for any unpaid rent from the peacetime emergency period. Landlords who went in as investors are being forced to be an extension of social services against their will. With rents and demand for rentals now decreasing, there remains little to no incentive to maintain rental property in SF.

There could be some rental properties in this batch, such as rented condos, but no apartment buildings. These stats are essentially capturing homeowners putting their home on the market.

Wolf, the famous $1 million question: are AirBnB owners trying to sell their properties to pay off their mortgages or are they merely putting them on the local rent market?

San Francisco seems to be a hotspot for AirBnB and by checking on their website rates are in freefall, albeit not as fast as in Florence, which however is an extreme case (18% of properties in the old city are listed on AirBnB… 18%!).

Since I doubt foreign tourists will be back anytime soon and that there’s much political appetite for helping out AirBnB hosts (they may have a slight image problem), how are they coping? Are those properties starting to trickle on the market?

Thanks.

MC01,

The increase in supply could very well include some Airbnb hosts that are trying to unload their units. I don’t have any data on this. But it would make sense. Home prices are still high, but when enough supply is on the market long enough, and owners need to sell (such as Airbnb hosts who can’t cover their mortgage payments), prices come down. A good part of the supply is lower-end units (below $1 million in SF ?), such as condos, so that might include the Airbnb theme.

Thanks for the reply!

MC01 said: “Wolf, the famous $1 million question:”

Wolf said: ” A good part of the supply is lower-end units (below $1 million in SF ?), such as condos,”

____________________________________________

Sadly a $1 million question isn’t much of a question in San Francisco anymore. I doubt you can find a decent two bedroom condo in a nice area of SF for even $1.2 Million.

I know you couldn’t pre-covid.

cb,

The median price of a condo in SF in June was $1.23 million, down 6.6% from June last year.

Median price means that half the condos (500 condos) sold in June for less than $1.23 million. HALF. That’s the middle. So there will be plenty below $1 million.

I just looked on Zillow. There are now over 1,000 condos listed for sale, which is a big number for SF. About 160 of them are offered below $700k. I didn’t even try to count the ones below $1 million. Just ball-parking from the number of pages, I’d say there are about 300 offered below $1 million.

The market has changed.

Thanks for that clarification.

Prices for rents for high end apts have start to drop here in Jakarta… I get to upgrade for less than I pay now as over leveraged owners look for cashflow to avoid liquidation… coming to all asset markets near you!

I figure they’re all buying in San Diego. The folks next to one of our rentals are SF transplants and just moved in a couple of months ago, so may be pre covid, but I see a lot of SF coming here. My wife’s cousin want’s to.

I just replied on your July 14 mortgage delinquencies post and figured I’d get moderated and did (I included the link to the place). That house we were both following in 92115 that got me moderated in the “hotcake” post back on May 28 finally closed escrow at $759K. I believe you had mentioned that you were going to follow it and maybe use it as a study.

I’m tempted to go over to the place and ask them where they moved from. Wouldn’t that be a hoot if they came from the Bay Area?

The show has just started

During last downturn it took 4 years for housing to bottom out.. started in 2009 bottom out in 2012

We are very early and this time is more scary

Good point Jone. We get caught up in the moment, forgetting that these sort of things can be slow-motion train wrecks.

Americans never got the point of time. This is an instant gratification society remember?

Correct Jone, When Wolf posts this information, it is a snapshot of where we are currently, and shows the beginning of movement.

The vast majority of people will always deny change is happening due to normalcy bias. They will prefer to attach some significance to the past instead of focusing on the data that shows the change currently happening. When you compile all the data about the economy and the factors affecting the economy, it is impossible to come to the conclusion that things are normal, or that positive economic outcome will be a result of current conditions. All markets fight capitulation for as long as they possibly can before accepting it and that when crashes happen.

4×25 even .. especially with no covid cure on the horizon. You’all can forget about a vaccine .. as was the case with polio .. it just ain’t gonna happen. What will happen, is moar Grift! ..

Thanks for the eagerly awaited data Wolf. I’d be interested in the data for more parts of the Bay area. Nothing too surprising in the data. People are looking to sell either because they can’t afford to because of unemployment or want to rush for the exit before the perceived loss in value due to the economic ills.

This can easily spiral down if the banks and financial institutions are affected and this crisis is just getting started.

If was the best of times, it was the worse of times. Some housing markets are hot, others are not.

National new housing starts continued to rise from their April low.

Coming from a country that has more people in it than actual property for most of them all to live in. On top of that, has a build of less than 100,000 homes a year which is not enough to cope with normal ordinary demand. On top of that we have a net gain in immigrants of around 300,000, plus 50,000 illegals. Now you can see why property is so expensive in England but home prices still fall everytime unemployment rises. How many unemployed are there now in the USA, 30+ million. If so prices will fall……and fall and fall…….until they don’t……

It’s called a market correction. At the moment it’s a flight to safety- not govt bonds safety, killer virus safety. Where’s the bottom? Who knows but probably 20-30% from the Sept 2019 peak is a fair guess.

And it will pass when the virus is controlled and life in SF can return to semi-normal. Who among us doesn’t believe that science will find a cure or vaccine within 12 months from today? It might take a while for society to adjust but eventually people will long to congregate in groups again and enjoy communal activities. Especially the younger generation. WFH is appealing to some but most people want to get out of their houses and mix with others. It’s a natural human instinct and breaks up the monotony. You don’t get that in the suburbs or rural and smaller markets. Sophisticates want to be near other sophisticates. It’s the higher order of human behaviour. I don’t think Zoom meetings are a substitute for in person meetings forever. You can’t flirt over Zoom. You can’t have an office romance or affair over Zoom. You can’t grab a beer after work with your buddy when you live 500 miles away. People want that experience. They also want to be near the world class hospitals of major urban centers.

Universities, restaurants, weddings, parties, sporting events, concerts, trade shows, conferences, etc will return. Yes there is a realignment and I predict some kind of guaranteed minimum income will emerge from this crisis as a lot of jobs appear to have lost permanently and that’s primarily due to tech.

Call it 5 yrs from peak to peak for Sept 2024 housing prices will be where they were in Sept 2019.

The virus will follow urban refugees wherever they go. We are witnessing that now all over the country. Nowhere is really safe and guess who’s getting things under control the fastest?

New York City.

Would it be a just ‘mkt correction’ if FED hadn’t showered the Economy with 3+ Trillions in mid March?

Every feed back is twisted and distorted due to FED’s interference in the mkts! Until price discovery is allowed no one will know the truth.

Of course we should all hope for an effective (whatever that means) vaccine. We should hope for a lot of things.

Listen very closely when Dr Fauci and other such qualified scientists speak of a vaccine. They couch their talk with caveats.

Those closer we get to politics and “the markets” the more hope we hear about a vaccine panacea.

The closer we get to science, the more caveats and skepticism we hear.

Over a century of effort, and billions spent, have not provided a vaccine for malaria, though we continue to hope. Decades and billions, no vaccine for HIV. We continue to hope.

I’m just wondering what is the problem Americans have with masks?

I lived in Japan and Korea and even years and years ago people wore masks – especially on public transport.

(Solved the problem by ditching public transport for a bike and never caught a cold or the flu after that!!)

And now for Victoria.

First, here in the People’s Socialist State of Victoria they told us that masks didn’t help, weren’t necessary, and only health workers should wear masks………………

Then people working in some stores started to wear them, but very few customers wore them.

Now from Wednesday this week, when we go out we have to wear masks…………………..

Great idea and about time, but the idiots who come up with these rules have no common sense.

We have to wear one when we go out – even when we are walking the dog at 10pm at night with no one around.

And we have to wear one driving the car by ourselves…………..wonder how that stops you from getting the virus or transmitting it someone…………..

Oh, I can hardly wait see the other ridiculous rules coming out as time goes by.

Oh, and of course, the most important part: the fine is $A200. So the State now has another revenue stream to help offset the huge budget deficit here.

>>Over a century of effort, and billions spent, have not provided a vaccine for malaria, though we continue to hope. Decades and billions, no vaccine for HIV. We continue to hope.<<

Malaria? Irrelevant. It’s a disease in poor countries. HIV is easily controlled and suppressed.

Covid @9 has shut down the world. There’s just no comparing the money and resources being thrown at it worldwide to anything in history. There will be a vaccine by Xmas and it will be available by Spring 2021. Watch.

“Who among us doesn’t believe that science will find a cure or vaccine within 12 months from today?”

Belief, hope and faith are not effective real world strategies.

Hope for the best; prepare for the worst. Unfortunately, those who are not prepared far outnumber those who are – and tyranny of the majority kicks in.

Dear grasshoppers, the remaining ants would like a word with you…

Checked with he county clerk (S.E. West Virginia) a few days ago. He said there is some uptick in house deed transfers, but he hasn’t noticed any increase in farm and large land holdings changing hands.

We’re pretty remote by most city folks’ standards so we don’t see “panic land rushes” here – not many “interlopers”.

And we benefit from an off-putting “hillbilly” stereotype.

We sold my father in laws place in 4 days? in Campbell River, Vancouver Island.. Subject Tos come off this coming Monday if the buyer obtains his financing which was co-signed by a relative with more money, I guess. We’ll see. Anyway, two days ago we were loading up some stuff from the carport and some lookie loos came buy on the prowl for their friends in Victoria who are selling out and leaving the city. Asked if they could snoop around outside? They were in their 70s. There is still lots of action even though an offer is pending. Lots of showings, a couple per day from what I understand.

Proposition 15 is top of ballot for November 2020.

https://www.bing.com/search?form=MOZLBR&pc=MOZI&q=proposition+13+reform+initiative+november+2020+ballot

That may be a factor as well, although I agree coronavirus+lockdown is the bigger one – particularly now that lockdowns are (unsurprisingly) extended.

It will be interesting both to see who publicly comes out against Prop. 15 and what happens when it passes.

The standard “grandma forced to sell her home” crap is negated since Prop. 15 only seeks to separate the $3m+ residential and industrial/commercial (but not farm) properties from the homeowner/small business tax rates.

Per the article above: 10% of commercial/industrial properties will generate 92% of the potential revenue increase of $12.4 billion a year. Such luminaries as Disney and Intel will be top of the list affected.

If Prop. 15 passes, it will be another nail in CA’s coffin. Business is already fleeing the state, and this tax increase will exasperate that, which will result in even fewer jobs. The really sad thing is how CA is being looted by the public unions who will be the ones getting the money from these tax increases. The teachers unions have been ripping the taxpayers off for decades and their greed appears to be insatiable. The inherent corruption that is built into liberal politics eventually always kills its host, as we are clearly seeing in most liberal strongholds.

“The teachers unions have been ripping the taxpayers off for decades and their greed appears to be insatiable.”

Jdog, it’s all about the children. Think of the children…

Yes, that’s right, we need more money for our classrooms, we need to think of the children, not corporations or for profit out of state entities. I have heard so many of these teacher union Ads I can recite them in my sleep.

They may as well bust out “we are the children.”

MiTurn,

“Think of the children…”

Whenever the teachers’ union coughs this one up, I am immediately reminded of Saddam Hussein pawing that petrified kid on his lap…

The T Union *loves* children…mainly as hostages.

Average support is around 52% approval. It takes 3/4 voter approval to raise taxes in California. Doubt it will pass.

Were it to pass, you can bet that the real estate interests, the teachers unions, the Mexiforniists, the welfare hustlers, etc, will push for going after Grandma’s house next.

If the residential exempetion is eliminated, you will have a free for all as all zoning regulations, meaning multi families and AirBNB, boarding houses and commercial rentals will come to residential areas as people try to pay skyrocketing property taxes on homes once covered by Proposition 13.

I believe it is 2/3rds, 66% not 3/4. If you believe the people of CA will not vote in idiotic taxes look at what they recently did on Prop 6. Regardless of having the highest gasoline taxes and outrageous vehicle registration fees in the country, they voted to not lower their tax… That was the point where I realized I had to leave fast….

Wrong and wrong again.

First of all, Proposition 15 is not about eliminating anything.

All it says is that residential properties over $3M valuation and commercial/industrial properties owned by large companies (small biz and farms excluded) are no longer governed by the same property tax regime as everyone else.

And for this group, Proposition 15 is proposing that these property owners have their properties reassessed per market value and that the existing property tax rate be paid.

Zoning is irrelevant.

Airbnb is ultra-irrelevant.

If what you say is true, then businesses would have already fled to California from Texas – where the property tax is 3% and reassessed every year or two (vs. the 1.1% or 1.2% rate which is the present California law).

In the real world – property tax rates affects valuation, not carrying cost. And in the case of Proposition 15 – only really expensive properties or very large corporations.

The difference is whether the bank gets the cash flow from mortgage interest or schools and local governments get it.

I think many are looking the wrong way. The wall street/FED/Bankster/Govt cabal loves the public unions for the usefulness provided to push continuous inflation through the system.

Pushing ever increasing monies and wages through these groups and their support systems provides increased effective loan demand, increased asset prices, increased rents and a self-interested stable voting block to drive big government and big inflation. This allows good cover, while assets shifts to the owning elite and debt ever entrenches among the working class and taxpayers.

@cb

Your understanding is so wrong as to be actually funny.

Asset inflation does not require “pushing” of anything through unions; the banks are perfectly capable of pushing credit to anyone whenever they please. The 2008 GFC and the decade plus windup to that point are a perfect example: NINJA loans (No Income, No Job, or Assets) were extended to anyone and everyone.

Economically, the 25% increase in M2 money supply itself is a powerful upward force on asset prices – although again, actual results are a function of multiple factors besides money supply.

In particular, it is 100% clear that money velocity will continue to fall. Velocity is what makes an economy vibrant or not.

C1ue: I’m reading Prop 15 as applying to commercial property of $3 million or more, and no impact on residential.

This will have wide support as a populist measure: “stick it to big business.”

If passed, could have substantial impact. I assume it applies to multi-unit housing, and $3 million would be most urban apartments over 3-4 units… Fallout will be fascinating.

@CZ

You are correct in that Prop. 15 does not apply to residential property at all.

The original ballot proposal was to include both high-value personal property as well as target large company industrial and commercial property, but reading the actual text of the ballot shows that *all* residential property is specifically excluded, including rental properties. This includes multi-unit rentals, so the apartment owners are not going to be affected at all.

The objective is still the same, however: to set a precedent where a subgroup of property owners can be “split” off from the rest of the property owner tax base and have different laws applied (hence “split roll”).

In practice, I strongly suspect that the “commercial/industrial” nature will still ensnare a significant number of high-value property owners, because at least a few of them have been putting their high-value land into corporations for the purposes of preserving the Prop. 13 low tax rates forever (the corporations can hold the land, without changing title, forever unlike living, real people).

I would also note that Prop. 15 also specifically carves out the resulting revenue for local use via placement of proceeds into a new State administered fund. This is very much a proposal targeted at raising revenue for school districts as opposed to the CA General fund.

In practice, the impact will be interesting because many of the high-value, low-tax properties are certainly in relatively wealthy areas. Apple’s and Intel’s properties in Santa Clara county are one example where the local school districts really don’t need more funds (?)

On the other hand, there are definitely districts which do: San Francisco, for example.

” couples with children”….

Shocking they are moving out.

I’m curious why you can close so quickly in the bay area?

Anything under 4 weeks would be a bullet train here.

I was wondering that too? Cash buyers? Cash always speeds things up. Our delay here are from inspections required by mortgage lenders. And from my experience inspection services are pretty bogus. They have to be certified, have insurance, and make a whole lot of checklists to submit with application. Buyers would be better off hiring a carpenter. Some inspectors don’t even go into the crawl space. It seems to be one more regulatory hurdle and expense.

According to Redfin data:

Average “Days to close” (from sale to close) nationally has been in the 26-29-day range for the last few years.

In the San Francisco Bay Area, average “days to close” has been in the 15-20-day range for the last few years.

A lot of the paperwork is now being digitized for the first time, and I expect for this metric to shorten further.

our last buy was in tpa bay area, FL in fall of 15, closed in 10 days with meet at star place near the buy, convenient only for us, as our good realtor and the paper manager had to drive 20 miles each for the face to face… we were cash buyers, seller had bought a courthouse steps a month previous

”most” of the SFR we liked were sold in days to hedgies or PE types, also all cash that time, something that really should be stopped for eva if we are to have any kind of rational home ownership going forward…

all the old housing in hood at least doubled, most tripled in ”mkt appraisal” since, to try to keep up with newly built, all but one now sold last couple of months, that one waaayyy over priced, new ones sold before they start building them,,, so far

you don’t need to get rid of cash buyers, but getting rid of “hedgies or PE types” would be an improvement for rational home ownership.

But the best thing you could do is to get rid of ALL subsidized lending for housing. Then, housing would drop like a rock.

The Feds updated contract with America: You pretend to go to school or work from home, and we’ll loan your employer the money to pay you.

SF is a shithole. You pay first world cost of living for a third world experience.

I hope word gets around. It’s way too crowded and congested here.

what did Yogi Berra used to say….something like ” nobody goes there anymore because it’s too crowded”

Getting less crowded by the day, though.

“getting less crowded by the day”….not anywhere near enough as I am a person who goes out of his way to avoid crowds. In fact, if there is a last judgement day, God will need to email me as to where I am going because I am just not going to get in that crowded line !!! No WAY !!!

Tourists are coming back — but they’re not flying in; they’re driving in, summer vacation by car, or something. Maybe also from other parts of the Bay Area and from the Central Valley. This weekend, I saw several cars parked in the hotel parking lot down the street, for the fist time in months. The traffic on weekends has definitely picked up. But it’s not nearly as crazy as it was last year.

Wolf,

Hmmm…what do the stats say about the percentage of median income needed to pay apt rent in SF…

SF proper is small enough that it might skate by, surviving solely on the carriage trade (think Manhattan) but the larger metro also suffers badly from RE cost disease (driven by CEOs’ blithe attitudes about siting decisions, from their seven figure perches).

Covid-work-from-anywhere is starting to change all that…but it could have started 20+ years ago…

If it wasn’t for all the fog, Mayor London would be trying to keep everyone scared of their own shadow, too, so keep her and her type in office and there won’t be traffic for a long while.

We were up that way in late June to meet family to go on a hike further north (lost coast) and we got from Oakland to the Sunset District in 15 minutes. You live in a beautiful place, no doubt, but there is so much control there to the point that it’s absolutely out of hand. Among other things, what had us laughing the hardest this time was the trash can inserts; they may as well just issue you all 5 gallon buckets for the trash. Nobody else on this site will even know what I’m talking about unless they live there or have seen them. This type of stuff just keeps getting crazier and crazier and it’s spilling into the rest of California and in time everyone who produces will move. Think Atlas Shrugged.