Investors bet on this outcome for years. Covid-19 just sped it up by a few months. Department Stores Are Toast.

By Wolf Richter for WOLF STREET.

I’m in awe of how long these publicly traded companies with access to hyperventilating capital markets can hang in there and burn cash and ruin their brand and drive away their customers, and make expense-cutting their business model, and present this expense-cutting to investors to get more cash to keep the charade going, over and over again, before finally investors refuse to throw good money after bad. And then it still takes nearly forever before these companies can’t breathe any longer, by which time their brand has been turned into a liability suitable only for hanging on a scarecrow.

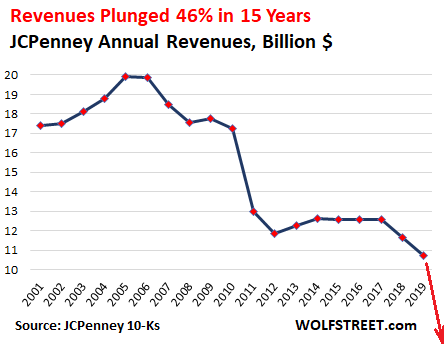

Yup, it finally happened. J.C. Penney announced Friday afternoon that it had filed for Chapter 11 bankruptcy protection, after nine years straight of net losses, totaling $4.5 billion. Its revenues plunged from nearly $20 billion in fiscal year 2006 to $10.7 billion in its last fiscal year ended March. Now its stores are closed, and when the stores reopen, it will be closing more stores permanently, and there will be even fewer customers. And sales this year will collapse, to perhaps less than half of the $10.7 billion (red arrow):

Another once-iconic American department store, and once the second-largest catalogue business behind Sears, after decades of ruining itself and failing to get on top of the ecommerce wave, is telling its shareholders, second-lien bondholders, and unsecured bondholders to go take a hike. They already got mostly wiped out before the filing.

This is a “pre-packaged” bankruptcy. The company said that it had come to an agreement with about 70% of its first-lien creditors. These are mostly distressed debt funds, hedge funds, and PE firms that bought this first-lien debt for cents on the dollar, expecting a debt restructuring and bankruptcy would allow them to exchange this debt for equity and new debt in the restructured company to then be unloaded to others while the unloading is good, before JCPenney files for bankruptcy a second time to be liquidated.

These funds include Sixth Street Partners and the credit-investing arms of KKR, Apollo Global Management, Ares Management, and H/2 Capital Partners, people familiar with the matter told the Wall Street Journal.

Part of the deal is a $900 million debtor-in-possession (DIP) loan – “which includes $450 million of new money,” the company says – from these first-lien debt holders. This and the $500 million in cash the company says it still has will get it through the bankruptcy and restructuring process with its trashed brand and irrelevant ecommerce presence.

As part of the deal, JCPenney “will explore additional opportunities to maximize value, including a third-party sale process.”

The company will seek bankruptcy-court authorization to pay its “non-furloughed” employees, “provide certain benefits to all associates,” and pay vendors “for all goods and services provided on or after the Chapter 11 filing date.” Vendors that are waiting to get paid for goods and services provided before the filing date have to get in line.

Shareholders have long been wiped out by the collapse in the price of the shares to the $1-range in December 2018. They closed at 16 cents after hours on Friday. And they will be left out in the cold as the first-lien holders and other creditors will likely get most of the restructured company. Everyone knew this was coming. Covid-19 just compressed the process and forced the company to get it over with.

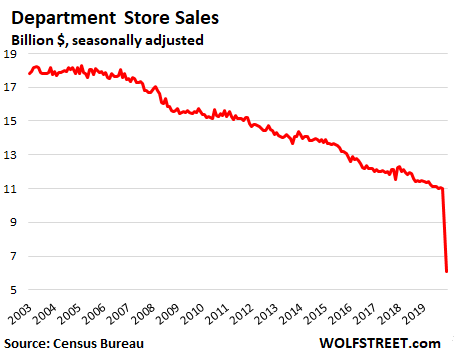

All department stores, including JCPenney, have an industry-wide problem, namely that they’re toast. This started in 2001, when department store sales peaked. By February 2020, department store sales had plunged 45%. Consumer preference for buying online what department stores were selling did it. Covid-19 was just the final straw:

The company had $3.8 billion in long-term debt and $2.7 billion in future minimum payments of non-cancelable operating leases, for a total of $6.5 billion according to its annual report. The bankruptcy restructuring will likely make the funds that bought the first-lien debt at cents on dollar some money. The others in this group will get short-changed, including landlords with their non-cancelable leases that will have more empty spaces in their zombie malls.

JCPenney has been shrinking itself to death for years. The store count plunged from 1,560 stores in 2002 (1043 department stores plus outlet stores and catalogue sales centers) to 846 stores as of February 1, 2020, with many more stores to be closed permanently post-Covid.

The headcount plunged from 155,000 in February 2007, to 90,000 pre-Covid, as of February 1, 2020. And to a fraction of that post-Covid.

This has been a long-drawn-out process. JCPenney has been on the list of bankruptcy candidates for years. In July last year, I wrote: I’m in Awe of How Long Zombies Like J.C. Penney Keep Getting New Money to Burn. But Bankruptcy Beckons

Covid-19 just forced the company to finally get this over with a few months before it would have had to do it anyway. The funds that bought its distressed debt for cents on the dollar some time ago had no idea Covid-19 would be coming, but they knew a bankruptcy filing would be coming, and those that sold that first-lien debt for cents on the dollar to them also knew it.

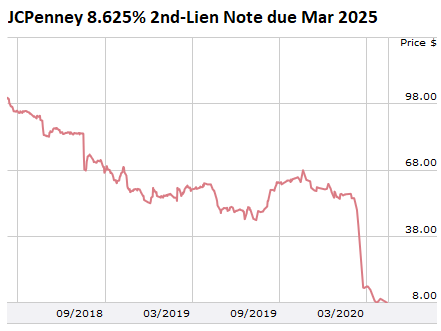

Some of its bonds were trading at distressed levels (80 cents on the dollar or less) since August 2018, for example this $400 million second-lien note, issued in March 2018 at around 100 cents on the dollar plunged to 68 cents just five months later in August 2018. The last time it traded (Wednesday), it was at 8 cents on the dollar. Clearly these investors expect next to no recovery in the bankruptcy process (chart via Finra-Morningstar):

So blaming Covid-19 for the bankruptcy is nonsense. Investors have bet on this path and outcome for years, as documented by the price evolution of the stock and the bonds. Covid-19 just sped it up by a few months.

Years of brick-and-mortar meltdown get compressed into a few months. But ecommerce is booming. Read... Here’s What Collapsed, Spiked, or Hung On in 12 Charts of Retail Sales (Yes, Department Stores Were Already Toast)

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I was waiting for this article. I’m pretty sure I read where exec bonuses were paid just a few days before the actual filing.

regards

People keep mentioning that failing retailers “missed e-commerce,” but that’s rarely true. JCPenney has an excellent mobile app and easy-to-use web site with good prices on their store brands. Same for Lord & Taylor, another storied department store about to disappear. Even Sears and Kmart have pretty good mobile apps and web sites.

TJMaxx and Marshalls, both retailers that are absolutely booming, have no significant e-commerce operations. Burlington even shut theirs down entirely.

E-commerce has been “table stakes” for years. It is less about e-commerce and more about relevance to, and relationships with, consumers.

Department stores like Penney (middle class) and L&T (upper middle class) lost touch with their core consumer. They cheapened out on the store experience, and cut staff. Most of what they sell can be bought anywhere, so Penney customers went to better customer service locations like Kohl’s, L&T customers went to Nordstrom, Sears/Kmart customers went to Walmart and Target.

I think the author hit on the core problem quite well — you cannot cost-cut yourself to greatness. Once you’ve stopped investing in your store and your people, time to fold. Once Penney and other failed retailers cut salaries and reduced staffing to bare bones levels, there was no reason to shop there instead of at any other store that carried the same stuff but had a better customer experience.

You have to remember that clothing stores have attitudes and demographics associated with them, JC Penney and many others are often thought of as old people store’s if you change the look of your store you might lose some of your current customer base. If you don’t, eventually your current customer base dies out. In America, where your quarterly earnings matter most, it’s easy to predict which thing will happen. Revitalizing the company and ensuring a future is too expensive for the third quarter. By the time you are forced to make a change, it’s too late.

Right now there is simply too many clothing stores and almost all of them are uncompetitive. Once most of the current crop of B&M clothing store die out, more competitive B&M clothing stores will arrive. Some stores like TJ Maxx will likely thrive and are much closer to what will eventually win. Though, TJ Maxx isn’t in the clear yet.

In the end, because, people are less well off on average now vs 20 years ago; I expect, the cheaper way to win in the B&M vs Ecommerce battle, but, they both have distinct advantages and so neither can wipe the other out completely. In the end, my prediction is the market will be 66-75% B&M 20 years from now for clothing by volume.

Do you account seen-in-shop-bought-online to B&M or online?

Even than i don’t see how 2/3 could be B&M. Another problem for clothing is that some sellers sell clothing so cheap that fashion starts to loose its magic

I don’t think it’s the attitude of the store. People are getting squeezed so they adapt.

I was a Penny’s shopper, my Mom bought all my clothes there so that’s where I always went. The attitude of people in the store doesn’t matter I have mostly avoided all stores for 10+ years. The reason is because cash is so insanely tight due to hyper expensive housing, healthcare and cars that we only buy stuff including clothing from massively discounted online sales. What fun is going to a store if you can’t afford anything? What happens to a stores sales if their ideal customers- large families with lots of kids – can’t afford their prices? Sorry blue jeans at $30 are not happening! We pay $15 for jeans and $5 – $10 for t-shirts.

1. To have a large, growing, and vibrant online business requires a LOT more than just having an app and a website.

2. They missed the train to ecommerce 15-20 years ago.

Wolf – I worked with these Jackasses years ago.. at the Corporate level… As the internet started to take off… their arrogance, and pure stupidity were mind blowing.. I was among a group trying to get them to understand that the Light at the end of the tunnel.. was the proverbial freight train…In additon, many times an exec would explain over drinks.. that the Capital Group doing the latest takeover, had made sweet offers to all the senior people on the decision level..at the targeted takeover, in essence.. they were incented – to say yes, to a very bad deal for the targeted company.. in order to gain advantage for themselves…

To have a large, growing and vibrant online business requires infrastructure AND customers who want it.

People who shop at Penney, Sears, etc. aren’t technological early adopters.

Walmart and Target made the transition because their customer bases were tech forward.

“Walmart and Target made the transition because their customer bases were tech forward.”

I have to disagree with that, as a former Walmart employee. They both had NO choice with Amazon taking business away from both. Walmart acquired Jet.com and have built up their online presence but they still have a ways to go.

@Canadian

I have never been to a Walmart because i have never been near one so i can’t say if what i say is correct but the image i get from the media of the average Walmart shopper is poorer, more rural and more conservative than the average American. That does not sound to me like early adopters.

Paulo,

If true, BK law allows clawback of improper pmts occuring up to 18 months prior to the BK date. Creditors have every incentive to go after that money.

I am pining for Kmart and Shopko.

I am pining for honesty, integrity and a real rule of law..

Can we not say (Really) That there are Two Games Afoot? A large retail or chain entity, that some expect to be run like a businesses.. and… Big Wall Street and Capital Players, that know how to milk and milk and milk the system…

I will bet a significant number of Big Players… made a Ton of money… all the way down.. playing the legal system and revolving debt.. letting small players get hurt, and hurt and hurt.. all the way down.. When you say, that suppliers, from before the filing date..get in line.. what you really mean.. are businesses, trying to survive.. selling with a Gun to the Head to a large group like JC P – are now ruined… Tragic, and deeply criminal – I saw hundreds of Businesses taken down, by supplying Sears.. (We know how that story ends) – One businessman I know.. spent 20 years building a wholesale business… and watched as Sears spent a few years Raping him, and then leaving his business with debt and millions in returned merchandise.. significant legal expenses to get possession of his OWN product, and then.. eventually Bankruptcy…(All while the man is fighting spinal cancer.. as his dreams are immolated).. Do we call this the rule of law, when gangsters are allowed to game the system so horrifically?

Sounds like the stories of Native Americans and African Americans!

Welcome back to the Party! INDENTURED Again!

The c19 virus seems to be proving itself as a zombie killer … the pin that did pierce the bubble of bubbles ….

Hollywood had it wrong all along. Viruses don’t cause zombies, they cure them (by killing them).

The last recession was followed by increased downsizing/”cost cutting” and larger jumps in the use of automation. Swaths of unemployed should keep costs plenty low for business as people fight over even simple jobs. This will force more idealists to be realists and work where there is actual labor demand. According to the bls they’ll have a good shot at becoming home health aides. Let’s hope boomers can afford to hire them and put the country back to work. I can tell you the value of labor definitely doesn’t seem to be in a bubble.

“According to the bls they’ll have a good shot at becoming home health aides.”

Home health aids are part time, sub-minimum wage jobs with no benefits. As you say, this is ideal for employers as these folks will have no bargaining power — and increase inequality. Yeah!

“sub-minimum wage jobs”

How does that work?

What it says on the tin.

Well, one *could* take out life insurances on the cared-for and then make sure to pick up some Corona when doing the rounds, A.K.A. The Swedish Model!

So many unwanted stores.

So many unwanted people.

It’s so bad, even our schools are shut down,

with no opening date in sight.

Borders are shut down, as if to say:

> We’ve got plenty of people here already,

> thank you very much.

And it’s so very “green”,

Greta Thunberg must be tickled pink.

It’s early but you are currently front runner for irrelevant comment. Or is Penny closing related to climate change, pro or con ?

I don’t think he was linking JC Penney to climate change, but rather referring to how the lockdowns have improved air quality, etc.

Nick Kelly, Michael Gorback,

The Fed & Congress are fighting deflation.

If you don’t understand that,

we’re done here, just move on.

Deflation stems from an excess of supply

( from China ) and a lack of demand

( from discarded people ).

Don’t you see the unwanted people ?!

Are you too secured behind your walls

to see the zombie apocalypse outside ?!

Do you know why the borders are shut down ?

[ hint: it’s nationalism, not a virus ]

There’s no re-opening date for schools.

What kind of message do you think that’s

sending to our (not-so-precious) youth ?!

Do you know why “the fertility rate”[*]

is so low, and dropping fast ?!

[ *: babies/womans_lifetime ]

If you’re Al Gore and/or Greta Thunberg,

deflation is the ideal scenario; to wit:

Beijing’s air is almost breathable now,

even without a mask.

Not even a global economic catastrophe, or an article about the implosion of a department store chain, can distract him from smug lecturing and sour resentment of environmentalists.

Relf, show me on the doll where Greta Thunberg hurt you.

Jeff, Finely Outdone

I’m starting to wonder if any wall that has been built is more to keep Americans out of Mexico more than the opposite.

It was a trick that Mexico played and got the U.S. to pay for it.

“Unwanted people”…

Unusual and compelling term…

In ancient Rome unwanted people were those unable to pay taxes. So they were sent to fight in wars.

As The Wolf conveyed to the thug suits stripped down to “geek” status in Pulp Fiction, “Gentlemen, I see a taxi ride in your future”. [Not a direct quote, but the meaning is clear.]

Gimp not “ geek” I believe

Yea; Rommel got one of those, too.

Patton?

Now there’s an idea…yellow jeeps for hack-hire all over Manhattan! Should reduce some excess auto inventory. But watch out for that truck that sweeps from the side like velociraptor. (Do we need to put the Jurassic Park logo on the jeeps?)

Well it’s sad. I’ve been getting clothes from pennies all my life, going back to before shopping malls when they had a store in old town Alexandria. I grew up on Sears and Pennies.

Guess I’ll be wearing walmart clothes now. I’ll just have to ask for their ‘deplorable-wear’ department and buy t-shirts and sweat shorts.

Just a small data point.

I shop at Salvation Army and Goodwill for clothing quite a bit. And not because I can’t easily “afford” new name brand clothing.

– The stores (at least around here) are nice, clean and designed well.

– My money goes to a good cause.

– Obviously, inventory varies. But i have found great stuff that fits. And high quality too. And there is tons of it. Name brands if you like that stuff.

– If you are eating out (someday soon hopefully) and someone spills red wine on you – not that end of the world.

– And when you are sick of it – just wash it and donate it back to the store. Talk about being GREEN!

In “antique” (read old timey stuff) stores, don’t overlook their clothing, if they have any.

My wife likes “retro” fashion and found some beautiful, ca, 1920s dresses in such a shop in Blackstone VA.

The mall shift was largely meaningless…more debt to get those more dollars for a blip in the long term story. To see ahead, groundfloor employees detect the sown seeds of destruction well in advance and are usually long gone before it all unfolds. As for their name brands…always had some, always shifted in time to new names, loyalty is rarely more than two decades and peters off. And while Wallymart has turned toward “recycled trash-bag” materials, you actually could (previously) get better quality at lower prices if you knew what you were examining…same stuff in the malls, just a different tag to throw a curve ball. Pretty much over now.

First Sears, now J.C. Penney, and then, the once upon a time American icons, Ford, GM (again) and GE, will all become BK.

Possibly, once Ford’s insolvency is there for all to see, there will be some fire sale deals on the yet to be offered Baby Bronco. I love the photos, and that ecoboost engine has me more than a little enthused.

After all, one man’s loss can be another man’s gain, as long as that man isn’t losing, too. Unfortunately, it ain’t just the former American Icons that are going BK. Those folks, who are in control of this winner-take-all kind of capitalism. are more than adroit at spreading the pain far and wide.

Why?

They all get there close from the same sweatshops in third world countries.

The name of the company means little these days.

Yes, once attending an Environmental Economics lecture I made a casual survey of all the feet wrapped in Nike shoes..something I had been well acquainted with from the early days when they sold that stuff to track teams. What a laugh!

Yup, when I visited the local markets in Karachi or Phnom Penh, you can buy seconds from the clothing factories (ie. where workers toil for $2 a day)…. All major brands available that you’d find in a typical American shopping mall, all for a few dollars each item, piled high to the ceiling. I see no problem with old industries dying away, they are no longer suitable… likely, they never were.

Me too Eastwind, thanks for the memory reminder!

that exotic french store, known far and wide as ”jay cee penay” and sears, both about 2,000 SF if memory serves, were on the same block of main street when mom started buying me two pairs of khaki shorts and shirts at pennies; that was it for the school year except for a pair of 501s for when i absolutely had to wear long pants; (the pennies shorts lasted longer than the 501s for some reason,) ,, and then, a couple decades later, THE best HD carpenter overalls, with the pockets in front for nails, and plenty of loops for tools, etc. came from pennies…

SO sorry to see it go, but their merch has been second rate at best for a long time, and prices not so good; been a while since I have gone to one of their huge glitzy stores, as opposed to the small one of my youth.

Not sure if any retailer, other than WM, and Target — ”where folks are willing to pay a little more so they don’t have to go to WM” will ever need to have a big box, as has been mentioned here??

Sure, some folks will still want to squeeze the fabric, etc., before they buy,,, but there is plenty of opportunity to do that at Salvation Army and similar thrift stores, eh?

You can still get all the sweatshop-made crap that Penney and Sears sold at Kohl’s, TJMaxx, etc.

Penney and Sears haven’t done anything truly new or interesting in a half century. They’re laggards in everything, and customers dumped them for newer, better products and vendors.

Surprise it took JCP this long to file for bankruptcy, kind of like Sears, they hung in there longer than I would expect. Interesting thing about JCP, I remember couple of years ago, they brought in Ron Johnson from Apple to turn it around. Another company that became victim of rescue me savior CEO complex, not only didn’t Ron save the company he actually helped sped up the demise we are seeing today.

With retail sales in April worse than expected and May probably down the toilet, wonder which of the big guys remaining will last for the rest of the year. Wonder if Macy will have enough money to last till end of the year before the inevitable.

Heard that it is Macy’s expensive properties that is keeping the wheels squeaking along.

Kinda like Manor: their business model is completely outdated, but the land under their department stores is so valuable it’s keeping the whole group together.

But retail has changed in Switzerland like everywhere else, and Manor’s fashion brands are stuff nobody under 60 would touch with a 20ft pole, so here we have a highly leveraged company with steadily declining sales, a bunch of completely stale fashion brands, a core business that entered an unstoppable decline two decades ago but excellent hard collaterals.

The show can hence go on for a bit longer, but the day of reckoning is looming.

Johnson sought to change the brand quickly to give it a shot at relevance. The changes were “too much,” and the board wasn’t willing to see them through. Johnson was fired, most of the tech he came out with was removed, and Penney went back to selling dowdy cheap clothing to lower middle class women aged 50+… The very business that was in decline and led them to hire Johnson in the first place.

Now, that business has run its course. Penney doesn’t have the new business Johnson was trying to build, and its old customers have largely stopped shopping there. It’s over.

Johnson got rid of coupons.

EVERYONE loves using coupons to save money. Even if it costs a little extra.

Coupons are one of my favorite scams. When Johnson was booted, they sent clerks around to mark up merchandise throughout the store and then issue “coupons” that allowed buyers to purchase items at the pre-markup price. All the old shoppers were excited that they “brought back bargains.”

Let it never be said that humans are “rational actors.”

Wasn’t he the guy who was commuting to work in a Gulfstream?

They brought Ron Johnson for what he did at Target, not what he did at Apple. He built the “shabby chic” image which still benefits the chain. JCP was in big trouble when they called him. After Target and Apple, three was not the charm.

Wolf, you could do an article about the almost dead business that got a “Coronabump” because they do home delivers.

Or just a general “Who is making money during this pandemic” article.

I particularly like watching Papa Johns (PZZA), which now has a P/E of 2500 or so, apparently predicted on the belief that Americans will live entirely on breadsticks and baked cheese for the next 2000 years.

Sold shares of PZZA short when they came to CA, and learned a valuable lesson. If the concept is popular, there are never too many of anything. People cannot get enough pizza. We had one Barbecue place in town, Famous Dave’s, and it’s closed. Is fatty red meat in sugar sauce a better lifestyle choice? We are all a mess of contradiction. I kick myself for not buying JACK on the bounce. They are expanding out of the state. In the Depression when people lost their homes, and their kitchens, they ate in diners. The shift from restaurant sales to grocery stores might be temporary.

Grocery stores are now delivering prepared meals. I can order from any number of grocery stores for lunch and dinner items via DoorDash, at prices well below what restaurants are charging. I wouldn’t count the grocers out.

Yes, that would be interesting.

I heard that food delivery companies got a big boost in business, which caused them to lose even more money :-]

There are businesses that are doing well because of the pandemic, including newspapers that sell subscriptions (WSJ, NYT), a lot of internet-based businesses that could scale without running into extra costs, etc. But unless these companies are publicly traded, it’s really hard to get data on profitability. Second quarter earnings reports will give us some clues.

We have already heard from several commenters here about bicycle shops, that saw a large jump in business.

Retailers that are well-positioned on ecommerce and were able to fulfill orders without running into extra costs did very well.

Grocery stores made a killing in March and April, but that’s now slowing.

A lot of ad-supported websites — and that includes WOLF STREET — have reported a sharp increase in traffic but lower or much lower advertising rates because readers weren’t clicking on the ads because they were focused on the chaos, and because advertisers pulled their ads. So there is this dichotomy between increased traffic and lower ad revenues that many companies have already discussed.

But it’s hard to go beyond anecdotal observations here. For example, I’d love to see national data on bicycle shop revenues, but I don’t even know where to look.

Bicycle Retailer is the industry rag, they usually have annual summaries based on deeper consultant research done by a fella named Jay Townley, although he just retired.

Thanks.

Mike,

Probably depends on where you are located as to pay for HHA, CNA, etc.

Friend in TN getting almost double, and no one that I know of in FL is getting minimum wage, all are above it by some margin depending on experience, and likely ”reviews” by previous family members of person cared for.

It is a growing service area, for sure, and I would think, with proper supervision will continue to grow in both pay and professionalism, as it should.

There are some bicycle franchise outlets? This crisis will be great for Wall St franchises, you can already see how the money doesn’t flow to privately owned SBs. The local eateries in my area are closing, some for good, but the franchises are open.

Decathlon is a very big seller of bikes. A bit the Ikea of sports and like Ikea privately owned.

Just Eat gave data in April and i remember that dutch news had an item about bicycle sales being great and unsurprisingly that included data. But i don’t think the Netherlands is a normal bike market. I doubt that it is normal to see tv adds for bikes on national tv.

Exports from here in Thailand of instant noodles have skyrocketed

No mention of the private equity hack job? Saddle with debt from buyout (why isn’t this illegal?), charge massive management fees, stop capital investment, watch it die.

Was JCP also a private equity play? Forgive me but I forgot… Can someone refresh my memory?

Actually JC Penney was a publicly traded company. Bill Ackman and Vornado bought a quarter(?) of the stock back in 2010, brought in new management and vowed to turn the company around. New management failed and the company was saddled with a ton of debt.

Not enough differentiation, bad management, and weak consumers are some of the factors that I can think about that led to the downfall of the company.

Once the culling is done, I would not be surprised if we were to see Amazon Department Stores opening up across the country. Some people would love the new convenience of being constantly tracked as you move around the store. Others won’t.

I am not against department stores. They can be done right. For example Japanese department stores are amazing. Incredible service, high quality goods, and those food halls in the basement. Even Amazon will have a hard time competing with those. American ones? Not so much.

I don’t think so.

Let’s see:

o 30 minute (minimum) drive to mall

o 5 min walk in rain, cold or summer heat to get into mall

o wander around 25 minutes to find 6-pac of underwear (50% probability of finding exactly what I want)

o 5 min checkout

o 5 min walk in rain, cold or summer heat to get back to car

o 30 minute (minimum) drive back home

Total: 100 minutes (1 hr 40 min) total “Mall Visit” overhead with a 50% chance of getting exactly what I want

vs

10 minutes on Amazon.

ps: anybody even considering eating in a mall “food court” is simply beyond desperate.

Shopping is entertainment for a lot of people.

Suzie,

Actually I’m surprised that physical showrooms have not made at least a bit of a comeback in the internet era – for the “entertainment” reason you cite.

Suzie Alcatrez

I strongly agree with your “entertainment” observation.

However, it’s been a LONG time since I’ve been “entertained” in a mall: in my view, almost every mall has a couple hundred stores displaying essentially the same bland offerings. Knowing some malls are more upscale than others, even all malls easily begin to look alike.

@cas127

I think instagram is showroom of the modern age. But i’m to old to find out.

Japanese department stores of the kind of which you write are located in or next door to commuter rail/subway stations through which incredible numbers of people pass every day. Hugely different from US department store mall location customers need to drive 20+ minutes to get to.

MonkeyBusiness

“For example Japanese department stores are amazing….”

What’s amazing about Japanese department stores are the basement food floors (“depachika”) that offer a huge variety of fabulous foods of all kinds. You can sample some of them too. They’re always crowded. And some of those people might go upstairs.

Isn’t that a bit of the standard department store layout.

Basement food floor

ground floor cosmetics

then a floor or two/three/more of cloths.

a floor of household

and topped of with a restaurant

DanS86,

JCPenney is publicly traded and was never subject to an LBO from a PE firm. There is no PE firm involved in JPC’s fall. JCP did that on its own :-]

Supposed it’s somewhat of a miracle that JCPenney still had that much in sales at this point. I think the last time I went there was something like a decade plus ago. Right around the time Ron Johnson left Apple to become the CEO of this place.

Well, the good of fire to clean out the deadwood at some point there’s not necessarily a bad thing.

Probably was a rude shock to Ron Johnson to learn that young people who’d camp out for days to buy a $800-1,000 iPhone weren’t the people who shopped at J C Penny.

Gee, imagine that.

Johnson (and the BOD) knew the customer base was 40-50 year old women and that the company had no future unless they could attract a younger customer bases and differentiate themselves from the other mall anchors.

In the seven years since they got rid of Johnson, the have done nothing but thru CEOs.

It was too late. They lost the customer base under Johnson.

Suzie

Once established, the value & power of a “brand” is it sends a very strong & specific message about a set of products.

Undoubtedly, Penny’s BOD realized they needed different (eg: younger) customers, but my business management experience is successful massive retargeting of a brand is a very, very rare (and expensive) achievement (I’m a finance guy, not a marketer).

Most attempts involve starting new-but-related brands (eg: Cadillac as an upscale Chevy). Degrading a brand (eg: Neiman Marcus) is a hell of a lot easier than upgrading,

Johnson opted to bet the company on attracting new customers. The board got cold feet halfway through the painful transition and went back to its aging and shrinking traditional base.

Bankruptcy was only a matter of time; the COVID situation just accelerated it a couple of years.

Penney’s only chance to survive was to become more appealing to Gens X, Y and Z, and when they kept Johnson from following through with that goal, it was all over.

@javert chip

We are talking about clothes. If you want to survive longer than 20/30 years that you have to do it. Any brand that is more than a century old has done it multiple times. It is not rare if you want to survive.

@Canadian

Cold feet is not the right term. The board new it was the right way to survive but choose for the short term for personal reasons

Worked for Penny’s in the 50’s Great small town store.

We new that James Cash Penny had gone under years before and restarted based on his personal reputation.

Sorry to see it go

This is reminiscent of the GFC when GE said the dividend was safe, then before they cut the dividend the insiders sold.

Maybe we should vote with our wallets.

I swore I’d never buy another GE product. Maybe someone can start a Hall of Shame site and urge people to boycott these companies. Maybe dox the executives.

Well, unless you are in the market for a jet engine or MRI machine, you really can’t buy GE anymore.

They sold their lighting business and appliance business long ago. As part of the deal, the new owners could still use the GE “meatball.”

I can’t even buy my locomotives from GE anymore :-]

A good hobby store with model railroad stock…should be able to find all the U-boats GE ever built. Add some weights if that’s not enough!

In the Twin Cities, we switched from Bombardier light rail trains, which were made in Mexico by a Canadian owned (at the time) company to Siemens S70 light rails trains. So now our trains are made in Florin, California by a German company.

The last five were ordered in 2015 at $4 million per.

On bikes, Quality Bicycle Products is a privately held wholesaler and distributor based in Bloomington, MN. They do hundreds of millions of dollars in business each year, but yeah, getting figures on what’s been happening lately with the company’s sales numbers is no easy task. I will ask around in the next few days and perhaps find some answers???

GE (I believe it was that genius, Immelt) made a giant deal with the Indian government to sell them lots diesel locomotives. India has a huge rail system, and Immelt wanted that market.

BUT, the deal he made was to build the locomotive factory in the worst, most remote, backwards, inaccessible part of India. That didn’t stop GE, though, and the company spent lots of money getting the project ready.

Years passed. Then, one day, India woke up and decided that rail electrification was what they wanted. GE ended up with non-recoverable sunk costs, no factory, and not a single locomotive sold.

A true genius, that Immelt.

Couldn’t a diesel locomotive factory build electric trains? Or is it more a question that electric trains are much cheaper and easier to build than diesel(electric) trains so less profitable.

ps. this hinges on the assumption that diesel trains are all build as an electric train with an on-board diesel generator. I don’t know if that is true or if the generator part is much more expensive and difficult than the part that gets power from the wires. But as an outsider that seems to be logical

And Cramer said “ buy Bear Stearns” too right ? Good luck listening to these carnival barkers

It’s amazing the legacy that Neutron Jack has wrought. Tommy Ed would have been fired under Welch.

His immediate lieutenants have wreaked havoc upon American industry, the trail of destruction is unbelievable. 3M, Boeing, Home Depot, Chrysler, oh, and did I forget to mention GE itself.

The only thing more amazing is that some of these had the luck to actually recover to an extent and thrive again, others are limping on, went under, or is still suffering under the effects of that management.

And to think those companies at one point or another were all very much admired…. I suppose in the case of Home Depot, it is still admired because they righted that ship.

JCP ride to bankruptcy from a premier retailer to an also-ran to a zombie mirrors the US middle and working classes in the 21st Century. So buckle America the extend and pretend of revolving and non revolving debt bankruptcies by the aforementioned classes is only months away.

Penney didn’t disappear because the middle and working classes disappeared. Penney is disappearing because the middle and working classes abandoned it for other options, just like they did to Sears, Kmart, Bon-Ton, etc.

1) Zombie Europe don’t care about the Nasdaq performance.

2) On Mar 26 the German 2Y was (-) 0.62% and the 10Y was (-) 0.278%.

3) On Fri, the 2Y was (-) 0.746% and the 10Y was (-) 0.537%, deeper in NR.

4) SPX weekly showed the first warning signs. SPX either taking a break, before resuming the uptrend, or startproviding big red supply bars. The Nasdaq 100 bull run goes on without interruptions, so far.

5) US yield curve is flattening, but the Nasdaq is up. It might close the Feb 21/24 open gap above, or make a new all time high. On Mar 26 the 3M/10Y was : 0.839% minus (-) 0.028% = 0.877% // the 2Y/10Y was 0.839% minus (-) 0.038% = 0.515%.

6) JCP BK might spread like a virus.

7) A new $3T stimulus will not save the markets.

8) If the global banking index BKX will breach the 1998(L), we will be in

financial troubles.

9) When the bullets stopped flying in 1919 the copper kings lost money.

Corn went from 1.85 to 0.42 in 1921. Wheat from 2.56 to 1.03.

10) A global recession induced by the virus will send commodities even lower.

11) Gravity with NR might send US 5Y & the 10Y underwater. Interest On Excess

Reserves might follow.

The tragedy is that as JC Penny goes, so go the employees that got the money, that could buy stuff at stores– that is killing off the others too.

The internet has made things wonderfully efficient–that we can do the same with 1/4 the employees. Thus 1/4 the money. Thus 5X the unemployed.

So Bezos will be the first trillionaire. What happens to the rest of us who have lots and lots of free time but no money?

I have NO IDEA where we go from here…… Does anyone else know?

Well, the US could use a lot more $150k starter homes and there are plenty of semi-skilled jobs in res construction.

Labor can redeploy with a small amount of help

Very few people want to live where you could build a place for $150k, and even fewer can find jobs in those places. And building $150k houses in neighborhoods where the average house is 3-4 times that is a non-starter.

CA has Billions of dollars in funds to build low cost housing. They can’t spend it. Nobody wants lower cost housing killing their equity and more poor/homeless in the neighborhood.

You can buy a house in Topeka, KS (or St Louis, or Youngstown, etc) for less than $100,000. But unless you have a steady source of income you can’t live there. And if you try to raise a family there you will never catch up with the income generation and opportunities wealthier areas consist of.

This is why third wold countries, in many of which the GDP has risen drastically over the past 50 years, will never be able to compete with the leading economies. They just can’t make enough to get the education, healthcare, technology, etc that only money provides.

I see the lower income States becoming the new retirement zones for those who can’t (or won’t) leave the USA and their pensions and Social Security can’t keep up with the taxes and inflation imposed on them by governments (big and small) that are unable to be fiscally responsible. Other countries (and lower income States) would be wise to beef up their healthcare capabilities and housing, and start attracting retirees. It’s worked for Florida, Costa Rica, etc…

“Very few people want to live where you could build a place for $150k …”

Thank the lord!

Those lower cost states will attract vast legions of telecommuters who will bring their California or New York wages to buy and own a nice home and good life for their families outright.

As a result, they’ll boom and California, New York and other high cost states will have a bad time (and probably see significant real estate deflation).

It’s a rebalancing that is long overdue. Craptacular 1 BR condos in mediocre South Bay suburbs like Milpitas, originally built for secretaries at early tech companies, now sell for over $600K. When those are down to a more rational $100K or so, we will know the rebalancing is complete.

Telecommuters* need to go to the office** regular for meetings. You can’t do that if it takes a day to get there.

*telecommuters of the covid generation. Previous telecommuters had only very specific jobs that did not require that.

**more a Wework style office than a traditional office.

@Canadian

Totally agree with your comments in general.

What is unsaid in this is that someone is going to be a loser there. Because at some point, someone who paid the $600k will have to take a hit to suffer that loss.

And what is worse, California will have to take a hit as property taxes go down.

Of course I do not *know* but I have a vague idea.

Over decades, a lot of infrastructure has been built. Building new is glamourous. Now, all that stuff needs maintenance and upkeep, which is a lot less glamorous. It has thus been ignored or skimped upon for years.

Even Amazon is going to be in trouble when the country’s communication infrastructure deteriorates, their water supply goes down or gets poisoned, their wastewater doesn’t get evacuated, their electricity supply comes with rolling blackouts, their delivery trucks fall through dilapidated bridges and need four-wheel drive to negotiate the potholes.

Now that trillions of dollars are suddenly raining down from the heavens, maybe some of this loot can be diverted to serious infrastructure maintenance, -rebuild and -upgrade projects. If that happens, this will require a significant number of serious and useful jobs. Linemen and engineers becoming more important than MBA’s and layers. Producing things that go “thump” when they fall on the floor instead of vague plans and wondrous strategies.

Mowing each other’s lawn and walking each other’s dog isn’t going to cut it anymore.

The employees are also different. Much less female at Amazon than B&M. And distribution centers are such big employers of mainly low paid jobs that they bred poorniss. Unlike B&M were the job was more the second income job in the family.

So Bezos will be the first trillionaire. What happens to the rest of us who have lots and lots of free time but no money?

We will all get to pay rent to AWS/Azure/Google for access to running the digital assembly lines we will need to perform our totally essential work as piece-work symbol manipulators!

Maybe not much per month, per person, but, everyone gets to pay Bezos something.

The thing is, few today can beat the cost and convenience of operating IT-services in The Cloud and tomorrow nobody very few can beat the costs of renting design tools running in The Cloud on AWS Appstream.

Glue work-flows / task-bidding / and task-manager onto The Cloud and everyone with a browser can become fleshy robots working odd-jobs for The Market.

The growth phase of the “Amazon” part of retail is nearing its end. It is not a certainty that amazon will be as successful in the next phase.

Their website as a retail experience sucks in my opinion. It sucks on an epic scale.

Their distribution is grand but it has three issues. It has been build over 25 years, clean sheet would be more efficient. It is national, a distributor that only targets say the Las Vegas area would be more efficient as it wouldn’t need as much airfreight or delivering to a hamlet in Alaska. And Amazon has a problems with fake. That is less of an issue if you only sell on your own account or for only a select group.

AWS will likely split from Amazon

Is CBL next ?

If JCP open i will buy x3 pairs of Levis 505.

I can’t believe they are restructuring versus liquidating. I guess the JCP execs want another round of bonuses before taking the final bow out of business.

Maybe they are simply banking on there being enough consumer sentiment out there to provide just enough revenue to make whatever emerges from bankruptcy proceedings attractive for future bond sales.

Just enough sentiment to make what’s left of the company look appealing enough to be lent to.

If they can pull that off, won’t they have extra time, such as in a soccer match, to load the remains with new debt before the final whistle?

Sound crazy? It would mean that the purpose of restructuring has nothing to do with selling pants, but more trying to sell an investment idea that is, well, pants.

Could try the idea of going small back to Main Street, carrying only American made goods that are needed, and dealing in cash only. A big restart from their roots. Not much to work with but, hey, they’re up against Wall-to-wall Crap Mart in any other approach. If they made it to X-mas they could break out singing “Jingoist Bells”.

S, I think that is what you meant anyhow. Just couldn’t resist a pants analogy..

This doesn’t make sense to me either. JCP will never be able to compete with discounters like TJMax, Ross, Burlington, etc. The discounters carry better merchandise for a lot less in every category.

Those stores are always hit or miss on sizes and styling. You can never know ahead of time what their inventory will be that week.

You can say that about all the stores now. The stores all direct you to their website when they don’t have inventory. I learned that if you do the online order while still in the store they don’t charge for delivery, no limit.

You have to get the post-bankruptcy stock in the hands of the “greater fools’ before you let the fat lady sing.

Put it this way: if this is a pre-packaged bankruptcy and 70% of senior creditors have already come to an agreement with the J.C.Penny management liquidation won’t happen this time around.

In a Chapter 11 bankruptcy a liquidation usually happens for one of two reasons: either a restructuring plan cannot be agreed on or the senior creditors cannot come to an agreement with management and/or among themselves.

J.C.Penny senior creditors are not a big problem: the remaining 30% will either have to accept whatever deal they have been offered or prepare themselves for a lengthy legal struggle with an uncertain outcome. Junior and unsecured creditors will have to get in line, as they knew would happen.

And since this is a “prepackaged” bankruptcy it means a restructuring plan has already been agreed in principle among all parts involved. Now it’s just a matter of ironing out the details.

Nothing strange in short.

Liquidation is never done lightly since even first-lien senior creditors can end up with big losses if asset prices are down, the liquidation process doesn’t go smoothly or there are legal hurdles, such as lawsuits to settle outside of court for a conspicuous amount of dollars.

It is retail. Liquidating means in retail that the first-lien creditors are lucky if they get any money

My local mall is now missing a Sears and a J.C. Penny. A small storefront near the Sears end is boarded up. It used to be near the foot traffic of shoppers going to and from Sears doing window shopping along the way.

Ultra Petroleum filed for bankruptcy; the second time in four years.

In Florida stores should reopen from 25% capacity to 50% capacity. I have not seen some of these stores at full capacity anyway.

The local mall here had a Sears and a JCP.

The Sears is now an RV store.

As for the Pennys , I was always surprised when it wasn’t on the list of store closings during previous downsizings.

As for the mall in general, when I moved here 17 years ago it didn’t seem viable.

Awhile back I had a big fight with my adult daughter. She started screaming “I just wanna be alone! ALONE!!” I told her to go to a Sears or a JCP…. she did and she felt way better.

?

I had an employee in the late 80’s that needed my help with a home purchase. He owed too much money to several stores in our local mall. His total of revolving credit- a couple of dept. stores, a couple of jewelers and a couple of men’s specialty stores was over 10 thousand dollars.

It cost him a lotta money to hang out at the mall.

Is business financed revolving credit counted in consumer credit?

Penneys has been doing a good job of online sales. I quit using Amazon a long time ago and switched back to real stores. I’ll be sorry to see them finally disappear.

They won’t disappear for now. They’re restructuring. The old shareholders and some bondholders will disappear. The company will likely emerge from bankruptcy and, unless a miracle happens and they become a successful online-only retailer, they will burn through some more money and then file for bankruptcy again — and that will be the last call. But for now, you can continue to buy there online.

They had a pretty good big and tall dept — at least for what I was looking for. I’m 6′ 4″ tall and they’ve sold polo shirts in size XLT for years. Early on it was only St John’s Bay (which I suspect is a store brand) and later added Foundry (maybe another store brand, don’t know). Prices generally aren’t that good, but every once in a while I’d get an email where I could get them at about $10-$12 a shirt with free shipping. I’ve got about 40 of them in the closet, still in plastic. I’m almost 62, so I figure that should be a lifetime supply! OTOH, I haven’t actually set foot in a Penny’s store but one time in the last decade — and that was because I was waiting for new tires to be installed on my car and I was bored….

Fareed Zakaria, prescient in 2011 book about a post-american-world

https://www.npr.org/2011/06/30/137522219/what-does-a-post-american-world-look-like

I stopped watching Zakaria over 25 years ago because he seem pleased that the rest of the world was growing fast, but didn’t mention anything about the US trade deficits that nurtured the world at the expense of 90% of Americans’ well being. In this book in 2011, he mentions how precious manufacturing is to a nation’s wealth and how increasing taxes on the rich was necessary. To this day, he is still a globalist.

My wife and I spent the last ten years before retiring working in JCP’s supply chain, the largest part of the company. The public, and all the “financial experts” never see this part, only the last step of the process at the store. The supply chain goes from the factories in China, Vietnam, Cambodia, and Bangladesh, and all around the world by cargo ship, truck, and plane to the store in the mall. There are many steps in the process that involve thousands of workers, machines, buildings, ships, planes, trains, and trucks. Every step has a “cost per unit” to move the goods to the next step. This is total cost divided by number of cartons. JCP’s total cost per unit is very high for the industry because they did not keep up with advances in technology. Add this expense to the company’s almost 4 billion debt that needs to be serviced and you see why they can’t sell much for a profit. Only Sephora and store brands made a profit. In retail you have to put more money in the register than you spend. They couldn’t do that. It had nothing to do with styles, demographics, product mix, etc. Other stores sold the same merchandise for a profit. They burned about a billion dollars in cash a year until they ran out in the past year. That was the end of the line. The virus just speeded up things a bit. Their stock was under 30 cents a share before C19. My wife and I dumped ours at $82. Not cents, dollars.

Good for you, Happy that you were able to get out while the getting was good.

As for the shareholders and bond holders, well, Sometimes there is no way to cut the losses. After all what is your last about half, it’s easy to justify holding onto the rest in the hopes that it’ll bounce back.

I haven’t been in a JC Penny store in at least 20 years and I am their target market. Nuff said?

What do I ever buy in department stores these days? A suit or a tie but that tends to be mostly at Macy’s. If I needed a large appliance (which I normally don’t) I’d consider Sears. These guys are definitely toast.

But what happens to malls with them gone? Do I really want to go there for a bunch of stores selling candles?

I’m surprised there has been no mention of Costco’s clothing offerings. Sure, they are sometimes ‘picked through,’ but they usually have some name brands–Champion underwear, Skechers shoes, ‘designer jeans,’ for instance–and, of course, the prices beat most and you can stock up on liquor and other essentials while you’re at it (still out of TP AFAIK).

Champion? Isn’t that on the big list of names we will have to explain to future generations…Jantzen, Pendelton, White Stag (Hirsch-Weiss), Hang Ten, Ocean Pacific, Catalina, Levi Strauss, Brooks Brothers, Florsheim…..???

I am sure they’ll make great material for future Grandpa Simpson vignettes.

I liked the Kirkland brand better, but haven’t seen it in my Costco for a couple years. OP, hmmmm … haven’t seen any of their stuff in years, but Levi and Florsheim are still around methinks.

I got to thinking about it, and Costco has become a ‘department store without departments;’ just floor space for general categories (and stuff you didn’t know you needed until you were forced to walk by it to get to the paper products ‘department’). Sort of like an ‘open office as opposed to the loathed cubicles (which seem like a pretty good idea in hindsight).

Never been the same since Gloria Vanderbilt stunned the jeans market. And the purists who differentiate between big “E” and little “e” would argue it’s not been real Levi Strauss for long before that. So trying to convey what it was as to what it is, socio-psychologically speaking, just leads to blank stares. Ozimandius was here at Kilroy’s tea party for wayward rabbits.

Congradulations Wolf, the people at Marketwatch are citing you. And your logo can easily be seen.

1) Going out of business bring a lot of bargain seekers. People buy stuff they don’t need, because 50%- 70% discount smells good.

2) Face masks replaced makeup. Spraying disinfection chemicals instead of perfume .

3) Covid 19 froze JCP activity during winter inventory liquidation. Covid 19 closed many liquor stores

4) Winter & spring inventory in June/ July have zero value, but LVMH

Sephora high markup products are good as gold.

5) The biggest loser from covid19 JCP BK is Mr.Bernard Etienne Arnault, the richest man in the wold in 2019 and Jan 2020.

6) Since Macy’s diet, Estee Lauder & LMMH are stuck in the Titanic. China 1.4B peopl on face masks and chemicals.

7) Aceton, instead of mascara or perfume.

8) The global shutdown brought a systemic change to EL & LVMH.