The industry exhorts the government to call out “can pay, won’t pay” retailers, many of them global brands that avoid paying rent despite their cash reserves.

By Nick Corbishley, for WOLF STREET:

Until two years ago, Land Securities was the UK’s largest listed commercial real estate company by market cap. It owns and manages more than 26.5 million square foot of property on the British Isles. The problem is that much of that property is in the worst possible sector — brick-and-mortar retail — at the worst possible time: now. And it’s showing. In its results for its last fiscal year, ended March 31, Landsec posted an £837 million loss — roughly seven times the £127 million loss it posted in the previous year.

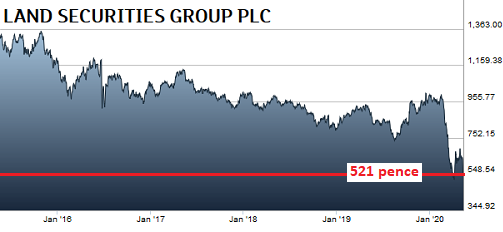

The company’s shares have fallen 17.5% over the past three days, 48% since February 14, and 62% since since May 2015. Intraday today they traded at 499 pence, a new low, and closed at 521 pence. So the problems didn’t just start — but they just got a lot worse. Five-year stock chart via London Stock Exchange:

Besides its retail properties, LandSec owns a vast portfolio of London offices — including Deutsche Bank’s new London HQ at 21 Moorfields — and specialist assets consisting of hotel, leisure and other properties. Those specialist assets, together with its retail properties, represent about half of the portfolio’s total valuation. With the exception of supermarkets and pharmacies, most of those assets have been taken out of action by the UK’s lockdown measures.

“Our leisure and hotel assets were generally closed with turnover-related rental income severely impacted,” said CFO Martin Greenslade during a full-year earnings call. “In retail, shopping centers remain open for essential trading only and footfall all but disappeared.”

A year ago, LandSec’s property empire was worth £13.8 billion. Today, it’s worth £1.18 billion less. According to property valuers CBRE, £380 million of that write-down can be attributed to the lockdown; the rest is due to pre-Covid-related wear and tear, particularly in relation to the company’s retail and specialist assets — those hotels, leisure and other properties. Its retail portfolio lost more than 20% of its value over the last year, with some regional malls down as low as 28%.

By contrast, its office portfolio saw a 1.1% increase in value. But even that line of business faces huge uncertainty going forward. “We have kept our office assets open, but the level of usage is well below 10%,” Greenslade said. “Our development program has been delayed as our contractors adapt to implementing social distancing on site.”

The company hopes the vast majority of the tenants of its office buildings will keep renting more or less the same amount of space as they have done until now, even as they cut back on staff and keep many of their workers at home. Even so, the company expects a 20% fall in office rents over the next year.

That pales in comparison with the 75% slump in rents it envisages in its worst case scenario for its retail portfolio. Many tenants have already stopped paying rent. Just 38% of its retail tenants had paid their first quarter rents within 10 days of coming due, compared to 90% for the same period last year. Even if you include offices, the total amount of rent collected was still just 63% in March and early April. A year ago it was 94%.

Like many of its peers, including the struggling UK mall giant Intu, Landsec puts much of the blame for its vanishing rent collection on the government’s decision, in early April, to grant retail tenants a three-month moratorium against eviction. The moratorium was a vital lifeline for many retail businesses that had seen their incomes dry up as a direct result of the lockdown. But it also spread the locus of immediate financial stress from tenants to property owners and their lenders.

For the moment, the banks are willing to cut the property owners a little slack. The alternative option, of calling in the debts when many of the firms cannot pay them, would risk triggering a cascade of defaults that could bring down some of the country’s biggest and most indebted commercial property owners and would produce large losses for the banks. Even Intu, with its £4.5 billion debt overhang and its share price that has plunged to just 4 pence, has been given waivers on its debt until late June.

But the day of reckoning has merely been postponed. With time fast running out, UK commercial property owners are now politely asking the government for a lifeline of their own. “The government needs to support the economy as best it can,” said Landsec CEO Mark Allan, who’s just one month into the job:

“I don’t think landlords have a particular right or obligation to be at the front of the queue, but I do think government needs to be aware of some of the implications of some of the measures it has taken, and the moratorium on enforcement action is the most obvious one because that is going to create more cashflow strain for landlords than might have been the case,” he said.

The British Property Federation, of which both Landsec and Intu are both members, has exhorted the government to call out “can pay won’t pay” retailers, many of them global brands, which it accuses of taking advantage of the government’s moratorium to avoid paying rents despite the huge cash reserves they have on hand.

As the bitter standoff between retail chain stores and their respective landlords escalates, the UK economy, like just about every other national economy, slips deeper into the mire. It already shrank by 2% in the first quarter and by a record 5.8% in the month of March, despite the fact the UK government did not trigger the lockdown until the final week of the month. Economic activity in April, the first full month of total lockdown, will be much worse.

The brick-and-mortar retail sector, already reeling before the lockdown from a toxic cocktail of intensifying online competition, low profitability, high costs, escalating rents, and maxed out consumers, will be in the thick of the carnage. For the real estate firms most exposed to the sector, including Landsec, the pain has only just begun. By Nick Corbishley, for WOLF STREET.

A big driver behind soaring rents — the “Airbnb effect” that removed countless properties from global cities’ long-term rental markets — reverses. Read… Airbnb Gets Disrupted. Hosts, “Super-Hosts” Try to Survive. Apartments in Prime Locations Suddenly Flood Rental Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Modern Western Economy: Indebted Welfare Queens.

This is why there is a new generation begging for the enslavement of Socialism. They see Big Gov giving Big Business free sh!t all the time.

Enough is enough.

Yes, it does seem that socialism is on the march as property rights are slowly been eroded.

The rental eviction provisions being put into by the states are wholly unnecessary and utterly skews incentives in a way that makes no sense. Landlords are usually not so stupid as to kick out a tenant just like that, especially given the circumstances, if a landlord has a decent tenant, who has been paying on time until this situation, evicting the said tenant doesn’t do anything for him. It literally forces him to go out and find a renter at the worst possible time ever. It literally makes no sense.

So, while there is incentives for the tenants to not pay, the landlords have no such benefits. After all, property taxes are not suspended, the local government has to squeeze or it falls over. So pity the fools who own assets, time for the reaper to come and collect.

The can has been kicked for 30 years. They keep borrowing massive amounts of debt to build more road.

It has to end soon.

“But the day of reckoning has merely been postponed. With time fast running out, UK commercial property owners are now politely asking the government for a lifeline of their own.”

Try some, Buy Some, Fee-Fi-Fo-Fum

Talk about…Pan Businedemic!

London, New York, Paris, Munich

Everybody talk about…Pan Businedemic!

Don’t pay,screw em’.Deflation is another way to say it when it’s not worth the price. The means to pay is not material.Lay this at the feet of the Bank of England. Screw them also,twice for good measure.

Well, I’m sure there are some MPs in the UK that are perfectly happy with the Landlords defaulting, after all, they are evil capitalists mooching off of the hard working…

Alas, so are some of their tenants.

Anyway, England has this thing called the house of lords. Think, landlords in charge of the upper house of parliament. All very feudal and proper, old chap. That’s why it’s still called the house of lords and not the Senate. Nothing gets through without their say so.

The working and middle classes in England are screwed. I fear the workhouses may come back. The old “incarcerate the debtors, make them work hard and starve them to redeem their lost faith in our glorious impunity” approach to maintaining the power of the ruling class.

BTW, look at the things they used to say about debtors back then, only around 150 odd years ago. Has their underlying puritanical utilitarian nature really changed since then? They had better hope so. Unfortunately…

A form of debtors’ prison still exists in England, whereby it is still possible to be sent to prison for non-payment of Council Tax (a form of property tax). Imprisonment for non-payment of council tax is not competent (i.e., applicable) in any other nation of the United Kingdom.

I wonder how many people are subject to the council tax? If you can’t pay for food, make sure you can pay your council tax.

Hahhaha!

Excellent speech Comrade Fat Chewer!

Pity it’s backed up by total ignorance of the parliamentary system in the UK.

Keep flying the Red Flag old chum!

Incorrect. I grew up with your Westminster system in my own country. I know EXACTLY how it works. Fortunately for us, there were enough people from the other nations of the UK to dilute the English desire of oppression of the masses. You never proved me wrong. You declared I’m wrong. Just like an English lord.

Council tax is not a property tax, as not only property owners have to pay it; if you rent your home, you are also liable to pay.

To answer your question, pretty much everyone is subject to council tax.

Council tax pays for services such as street lighting, bin collections, road maintenance, libraries and myriad other things too.

How about sending them to the penal colony called Australia

Please dont we have enough politicians here.

Why not Washington DC, that’s where most of them are now anyway, they’d fit in nicely.

shopping centers opened up this week in Denmark. Sales were roaring as pent up demand was unleashed. So there’s a flicker of light at the end of lockdown.

Not making up for the losses of course, but eventually we will back to business as usual, and forebearance and moratiums will help us get there.

We are about to see that as well here in Italy as most retailers should be (should be) allowed to re-open on Monday. This government has a nasty habit of reneging on their promises at last minute without justification.

But the big problem I see right now is what the Italian government calls “Phase 3”, the normalization phase that should start in July or August: by then the damages should be apparent to all and for retailers they will include a lithany of problems which include lack of stocks: while East Asia-Europe shipping routes have re-started it still takes about four weeks for a container ship to get directly from Ningbo or Shanghai to Rotterdam. I predict a lot of empty shelves over the Summer, even Amazon is really struggling keeping warehouses stocked right now.

There wont be back to normal. Western governments* fucked up by not being though enough. The virus is now established here and it will now a very long time to exterminate the virus. That time (if we are very lucky 6 moths) will be long enough for the economy to settle into another mode and with it loose untold number of jobs and careers.

ps. It is that the UK left the union otherwise it and Sweden should be kicked out and behind a really big fence.

*except Greece and parts of Eastern Europe

Do you mean that really big fence that is going to be made by a group of nations who get on so well, share immigration and debt burdens?

That group of nations who have common agreed plan for how to proceed looking forward with Italy and Germany in a fiscal boxing ring and getting on so well? with the Visegrad group of nations applauding from the stalls….?

…and besides, the Swedes are cool, so yah boo sucks..

That big fence of ours is in Greece and a) standing b) policed by Europe’s “finest”. Our politicians are at least sometimes successful. Unlike Mister “Make China Great Again” or the one before him.

ps. Always look ten years in the future. Germany has a big problem with “Stuttgart” and their banks. Italy has fewer problems so fiscally they are more likely to complain about Germans high deficits.

About swedes. They are okay when not drunk so can enter Fortress Europe after 3 weeks quarantine.

choice has always been great for business and the consumer, with Amazon and the likes getting a boost with all this except customers are a funny bunch online and or bricks and mortar take away 1 and after a while people start getting bored with the online choice, so as soon as these monsters awake they will have everyone down to look at them and buy, buy, buy, we will see this all go back to normal and everybody will be out as if nothing happened.

The REIT that I own had a good balance sheet and a big unused credit line. The average interest cost of all unsecured loans is 3.1%. They suspended next quarter’s dividend and said they can go two years if they don’t get a dime of rent. They gave zero interest loan offer to all tennants for April and May rents to be paid in Jan and Feb. Thought it was a pretty good way to make lemonade out of lemons.

They have made two fat dividend payments in 2020 and as long as they can get dividend started back after about a year I will be OK with it.

The landlord is in a pretty strong position in the US if he has a strong contract written and the market is strong enough to replace the tennent once he vacates.

I wouldn’t be so confident if I were you. You have not accounted for tenants seeking bankruptcy protection or legislative action in favor of tenants(for a change).

Petunia, you sound to much as if the tenants wont pay out of choice. A lot will simply have no money

Moot point if you’re on the (not) receiving end.

It is not a moot point. You can force somebody to do if something is possible. If you try to force somebody to do something impossible than he wont succeed so using force is a complete waste of effort.

I agree it could go bust if the virus has people staying home in two years. I bought it after stock had fallen 75% so if they just get back to paying any kind of dividend it’s better than a CD or treasury.

Bankruptcy doesn’t get you completely off the hook from your contract. It’s an interesting read what happens in bankruptcy to rental agreements depending on what type you file. As the song says “lawyers work out all the details”.

I agree with your premise that the courts will favor the well protected. But you are underestimating the amount of animosity that exists in the renter community against the mega landlords. My animosity was well earned after only one miserable year.

Cognitive Dissonace is a bitch.

Somewhere, in a cold dark place, tweetypie just done snuffed it…

“But it also spread the locus of immediate financial stress from tenants to property owners and their lenders.”

…which is only right and proper because they are the owners of the assets and are providing a service which can no longer be paid for…

That’s capitalism! TS.

The really irritating thing about everyone out there begging for bailouts is that, after many decades of quite deliberately using monetary and fiscal policy to cause an increase in aggregate debt in order to short-sightedly drive GDP, corporate profits and tax takes, then essentially the only model operating out there now is to embrace fragility and load up balance sheets with ever more cheap debt.

And that fragility now requires ever greater central bank and/or government action every time risks come into play, which otherwise would be just the times that those with saved capital reserves could weather and subsequently thrive off.

Had these central institutions just stuck to what really should be their role, which is to set a clear regulatory framework and nothing else, then there would not be the need to regularly go in and ‘fix’ the problems they created in the first place by being activist in their approach. But of course, politics would never have permitted them to sit idle whilst politicians lose votes, government bodies lose funding, and powerful industrial and financial entities lose money during the hard times.

The larger and more powerful and controlling the central institutions become, the more power and wealth concentrates in the hands of those who are able to pull their strings, and therefore the more activist they become in their role of preserving and expanding existing patterns and concentrations of power and wealth.

Question: Does retail pay the same rent every month or is there a seasonality in it. Asking because the REIT made a loss same quarter last year. If the rent is always the same than 19Q4 would be more appropriate.

A lot of REITs make gaap losses but positive free cash because of accounting charges. The balance sheets are pretty simple and you should be able to tell if their revenue is roughly the same each quarter. Sometimes they will write down a real estate asset because it is permanently impaired and take an accounting loss but still have positive FFO.

Sometimes they will sell a property which might be increase in profit. I like using free site Guru Focus as they show you bar charts for about 15 years of revenue, earnings and free cash flow data. Just type Guru Focus and company ticker and you will get more data than you need. Probably other good sites out there.

The publicly traded REITs are beholden to a rule set known as GAAP when it comes to reporting to investors. GAAP rules are written by a group called FASB. The SEC is tasked with enforcing GAAP rules.

My take: GAAP rules are written by criminals, for criminals. The SEC does nothing, ever.

I may never invest in a publicly traded company again. The 10Q’s and 10K’s are most often times riddled with word salad with the sole purpose being to keep investors in the dark.

She a-howlin’ about the front rent,

She’ll be lucky to get any back rent

She ain’t gonna get none of it!

John Lee Hooker on the album Endless Boogie – House Rent Boogie.

What do I win?

You win:

One bourbon, one scotch and one beer.

A Bourbon and a Scotch in the same prize? When even those who drink Scotch dislike each other depending on who drinks blended and who drinks single malt?

An old college friend of mine runs a real estate firm. The company sets up an individual partnership for each deal they do. They raise cash from investors and put 20% down on a shopping center and borrow the 80% mortgage.

They didn’t get April rent. They didn’t get May rent.

It sounds like every partnership they have will bankrupt. They didn’t have extra cash on hand to fund mortgage payments without incoming rent. Rinse and repeat nationwide.

My friend is very bearish on office REITs because everyone in the biz is expecting tenants to downgrade square footage as their leases expire.

Wolf,

You mentioned “non paying tenants”. Speaking of which, have we heard anything about how its going for the WeWork gang and by association, the Softbank investments?

I bet WeWonk’s solid base of highly qualified lessees are keeping their revenues right up there, eh?