Its unsecured bonds crashed 53% since Feb 14. It has been living off its real estate portfolio of “owned boxes” for years by selling them.

By Wolf Richter for WOLF STREET.

Macy’s, the largest surviving department store in the US, and still clinging by its fingernails to the last rung of the top 10 ecommerce retailers in the US, down from 7th place in 2019, may never reopen many of its stores that it hadn’t already decided to shutter before the crisis.

In 2019, 26% of its $24.5 billion in sales were online sales, up from 23% a year earlier, according to its 10-K filing with the SEC. In the second quarter (February through April), as all its stores were closed on March 18, the percentage of digital sales to total sales will surge. But it won’t be enough.

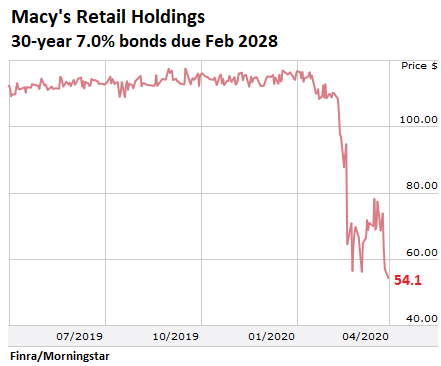

Investors have lost faith, demonstrated amply by the crash of its 7.0% senior unsecured 30-year bond due in February 2028. The bonds have been in deeply distressed territory since mid-March. Since February 14, they have collapsed by 53%, to a new low on Tuesday of 54.1 cents on the dollar, giving them a yield of 18.6% (chart via Finra-Morningstar):

Macy’s is not out of cash. At the end of its fiscal year on February 1, it had $685 million in cash and cash equivalents on hand. On March 20, it said that it drew its entire credit line of $1.5 billion as “proactive measure.” So that would be close to a total of $2.2 billion in cash. But part of the cash has already been burned.

The bond market believes that there is a decent chance these $2.2 billion and whatever else Macy’s may be able to pull out of its hat – more on that in a moment – will get it through the first part of 2021 without filing for bankruptcy. This is shown by its $500 million in senior unsecured 3.45% notes that are due on January 15, 2021. These notes traded at 92.5 cents on the dollar today. This indicates that the market still sees a decent chance of getting paid face value in January, 2021.

It’s never comforting for bondholders when the Chief Financial Officer of a company in distress suddenly departs. But that’s what happened on April 7, when Macy’s announced that CFO Paula Price would “voluntarily depart,” effective May 31. Macy’s is now scrambling to find a successor. After her departure, she will stay on as an advisor for six months to smoothen out the transition, for $510,000 in advisory fees and other benefits worked out in the agreement.

Ms. Price was likely instrumental in Macy’s decision to lay off “the majority” of its 123,000 employees after it had closed all its Macy’s, Bloomingdale’s and Bluemercury stores on March 18.

Macy’s vendors, if they’re worried about getting paid for their merchandise and want to obtain credit insurance, face a new challenge: Two of the largest credit insurance providers, Coface SA and Euler Hermes Group SAS, have stopped writing policies to cover Macy’s, said people with knowledge of the matter, according to Bloomberg today. This is a sign that insurers have lost faith in Macy’s ability to pay its vendors.

This whole thing is going to be a mess. If Macy’s stores reopen in the summer, the merchandise – the part it couldn’t sell online – will have been there for months. With some things, that’s OK. With other things, it’s not. But vendors might be getting skittish, now that credit insurance is harder to come by, or more expensive.

Vendors may begin to protect themselves, limiting their exposure and demanding shorter payment terms – the opposite of what Macy’s had announced in March, that it would be “extending payment terms” to stretch out its cash. This will make it even harder for Macy’s to restock its stores with appropriate fresh merchandise before they reopen.

To stay out of bankruptcy court, Macy’s is now trying to pull a big rabbit out of the hat: borrow up to $5 billion, secured by stores it owns and by merchandise, sources told CNBC and Bloomberg last week.

The sources said that $3 billion of the debt could be backed by inventories as collateral. And that $1 billion to $2 billion could be backed by real estate.

Macy’s owns 342 of 775 stores it still operated as of February 1. None of these “owned boxes,” as it calls them, were encumbered by a mortgage, it said in its 10-K. It also owns some other properties. For years already, Macy’s has been “monetizing,” as it calls it, this real estate portfolio through the sale of properties.

In one of the most expensive property markets in the US, San Francisco, Macy’s already sold three of its four stores:

- 2016: its 263,000 sq. ft. Men’s Store on Stockton St. (now being redeveloped into offices and mixed use) a couple of blocks from Union Square, for $275 million.

- 2017: its 280,000 sq. ft. store at the Stonestown Galleria (an aging mall with plans to redevelop it, including possibly into housing) for $41 million.

- 2019: its historic 250,000-square-foot I. Magnin building at Union Square for $250 million.

By now, the proceeds from those sales have been used up. Macy’s still owns its last remaining store in San Francisco, its flagship 700,000 square-foot store facing Union Square, the largest department store in the Bay Area.

Its other crown-jewel “owned box” is its Herald Square location in Manhattan. But the source that disclosed the efforts to raise up to $5 billion said that it would not be used as collateral. The remaining “owned boxes” are much less valuable, and some of them may have little value.

Macy’s has been living off its real-estate sales for years. But it still has significant resources in its property portfolio that it could leverage, including, if push comes to shove, its San Francisco Union Square store and its Manhattan Harold Square store.

This comes in an era when, according to Green Street Advisors, mall properties across the US have lost about 30% of their value since 2016, and 20% year-over-year in March. With the total brick-and-mortar meltdown now under way, and with the new uncertainties of the health crisis going forward, and with the current issues in the commercial mortgage-backed securities (CMBS) market, selling retail properties is going to be tough; using them as collateral for new debt might be easier.

Macy’s might burn through $2 billion in cash this year. It has to refinance the $500 million bond in January 2021. It also has to refinance a $450 million bond in January 2022. And it will continue to burn cash in 2021. So the cash proceeds from the $4 billion or $5 billion in new debt, if Macy’s succeeds in selling it, may get it through 2021. But then what?

It will be getting close to the end of its rope. For a while longer, it can continue to burn its furniture to stay warm, so to speak, and like Sears Holdings, ruin its brand and collapse into worthless debris.

If Macy’s can use a bankruptcy filing sooner rather than later to shed most of its stores, keep a few flagship stores, lighten its debt load, and concentrate its remaining resources on building its online brand and fulfillment infrastructure, it might have a better chance of staying relevant as an internet brand — and forget the department store.

The old saw that dividend stocks are good for bear markets is actually a high-risk gamble. Read… Dividend Massacre in This Crisis is Already Breaking Records, But it Just Started

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

There is a typographical error in this sentence:

“It also has to refinance a $450 bond in January 2022.”

Even Wolf isn’t perfect lol

Depending on the rest of its balance sheet, the refi on a $450 bond in January 2022 might be a matter of grave concern for the next CFO. Or the one after, or the one after.

C

“It also has to refinance a $450 bond in January 2022.”

Is actually correct.

The more worrisome bond is for $3.50 on March 5, 2023. It’s projected there will be no takers.

And the headline: “bonds cashed” – “crashed”

Thanks!

I’m surprised its online business gets any traction, because its prices are not competitive. Right now, for example, a “Cuisinart® Chef’s Classic 1.5 qt. Covered Saucepan” sells at Macy’s online store for $45, but don’t worry, they have a special promo code “FORYOU” which gives you 30% off – so it comes to $31.50. But since it’s over $25, you get free shipping.

Over at Bed Bath and Beyond’s online store, it sells for $20. If you raise your spend to $39, shipping is free, but even if you don’t, shipping is only an additional $6, for a total of $26 – still 17% cheaper than Macy’s prices with the gimmicky promos.

Yes, and as my sister-in-law would say, “but its a Cuisinart® Chef’s Classic 1.5 qt. Covered Saucepan from MACY’S!, not Bed Bath and Beyond”.

Meanwhile Amazon is selling the same (possibly grey market) Saucepan for 19.99 free shipping and no tax.

I collected little postage-type stamps a few years ago ina local supermarket.

After about £100 of groceries, that I would have bought otherwise, I redeemed the stamps, added a few of £10, and got a 10L cast iron ceramic lined, Dutch oven.

Works beautifully both on the hob and in the oven.

Meh, who needs Cuisinart…..

MM,

True, I am surprised cooking ware is still a thing at clothing stores.

But, if I go to Macy’s and have an account already, I might prefer to just use that even if somewhere else, has it $5 cheaper, rather than have yet another online account. It’s also easier to return stuff if you have a local store in the area.

Personally, I don’t care about brands for stuff like that and probably would just find it cheapest anywhere.

As for Amazon, my biggest issue continues to be, their very extreme out of control counterfeiting problem, there is counterfeit almost everything on Amazon, alot of people don’t understand how Amazon third party seller thing works and just avoid it. I definitely get that, Wal-Mart online unfortunately has third party sellers now, and it’s even more of a mess. One advantage of B&M in-store is no counterfeits. Amazon’s continued blindeye to counterfeits though, I consider to be criminal.

The ALWAYS ON SALE SCAM started in the mid 1990s. Boston Store was an early adopter and is no more.

Incorrect….Boston store is still there and operating. True, they downsized from the previous Jordan marsh. Correct all dept. Stores started the sale. Began on wed. At filenes, then Jordan’s copied . Then campeau bought jordans. Then they bought may stores. Then Macy’s bought them. All the while consolidating, closing stores, reducing inventory selection, and everything on sale with an added 25% off with a coupon!

I’m just a nobody from a flyover state and for the past several years I have been trying to shine a light on a serious issue I see with Macy’s, I can’t buy most of the furniture online at Macy’s because they are unable to ship to my rural address! A hundred years ago Sears could ship a house but in 2020 I can’t buy a mattress online and Macy’s doesn’t offer store pickup so I’ve been curious about how many millions of people does is ridiculous policy effect? I think if my business was in trouble I’d try to figure out shipping or at the very least offer store pickup!

MM’s comment is a good segue into a point that occurred to me about the effort to borrow $5b against inventory and property, that for some reason well beyond my ken they actually own outright (wtf??? are they a company whose core business is selling goods or are they a property manager?). The question is how can / could anyone have confidence or faith in the valuation of collateral? Of both kinds – the inventory and the CRE? Both asset classes are going to be in flux, but it’s a safe punt to say the flux is downwards. Who lends into that kind of run on asset prices?

Macy’s Deathspiral Watch will return in… The Last Department Store. Episodes streaming on Amazon Prime.

C

Macy’s has been owning most of their own real estate since the late XIX century: I think that company policy changed and only partially so after they filed for Chapter 11 in 1992.

Macy’s not only owned their own real estate but when they started gobbling up department stores all over the US they gobbled that real estate as well. This is old real estate, meaning centrally and well located, meaning the land alone is worth a fortune: it makes for great collaterals and that’s why Manor AG still hasn’t got rid of their department stores in Switzerland.

But inventory is another matter, for no other reason Macy’s doesn’t sell bolts and nuts or light alloy billets. It sells stuff that is out of fashion in a few months and Chinese manufacturers are back in business and eager for new orders. Valuing this collaterals is tough, even when factoring in depreciation: what’s worth $100 million right now will be worth $10 million in three months and maybe half a million in five. In a year it will be a liability as it needs to be disposed of.

This means that Macy’s will have to keep on rolling over collaterals, an hazardous choice: we literally have no clue how the post-emergency depression will be. If consumer spending lags for a long time inventories will need to be readjusted and with them collateral values. In short Macy’s may find itself either posting more valuable real estate as collaterals or caught ordering stuff from China and Indonesia just to have something to post as collaterals, leading to ballooning stocks etc.

I hope the yield on those loans is adequate to the risk.

Shopping in a department store is only fun if it is alive with people but will people want to be in that situation in the immediate period after C19? And there is the whole shift to e which has taken place during C19. The period after C will be interesting.

So you think fashions are changing during this shut-down? That’s a big assumption. Why would fashions change if nobody knows what others are wearing?

Instagram, Facebook, Twitter….

“Why would fashions change if nobody knows what others are wearing?”

Agreed, as things stand now “Formal Fridays” means people wear…pants.

If a business is the long- term user of the RE, it can make perfect sense to own the property. A property management company usually manages other people’s property: it is neither owner or tenant.

Of course, the market has swung against commercial RE, but not as violently as against retail.

As for Macy’s legacy decisions to own its retail venues, where it would be without them?

Death & buried.

The savings on property taxes alone on their California owned stores is no doubt tremendous.

Harold,

Actually no. Thanks to Pro 13 (1978), property taxes on real estate that companies and individuals have owned for decades are minuscule.

Any new owner of record will pay not only the 1% transfer tax but the new property tax based on the sales price.

That might help discourage the sale of these properties. Besides, who is going to invest in a new building to be converted into empty offices, or perhaps grabbed by the city of San Francisco through eminent domain to house the homeless?

My predication as a San Francisco native, the city is going to suffer horribly as tourism dies in the CoviDepression, the homeless stick around to feed off the taxpayer’s tolerant teat, tech departs for cleaner pastures, and throw into that another earthquake. Wolf, which way is that infamous power pole leaning?

It’s important to note, that only parts of California are at risk for the major damage from earthquakes, unfortunately these areas are some the big ones, some companies like Apple, I think, put their headquarters out of the major damage zone. Although earthquakes, can shake throughout the whole state, my understanding is that because of the earthquake standards, most of the state is pretty safe.

These businesses put on so much fat in the good old days that they take ages to depart. The US is just the same, the decay is there but it will take decades to die.

There is a lot of ruin in a company…or country.

1) Where is the beef; where are Archie soft tp; can covid19 unleash

inflation, hiding inside an underground Bunker.

2) When JP induced inflation expectations in Jan 2018, the German

5Y snubbed him and turned down. From +0.13 on Jan 2018 to (-) 1.0 in Mar 2020, dragging the US yield curve down. The German 5Y Mar 2020 low came after a Sep 2019 stopping action. It might become a support line. The response was violent, positive & fast. It might become a resistance line.

3) Fill the tank for < $20 as long as WTI is between $6 and $15, before America open and in May cheap oil will go away.

4) Can the Nasdaq correct by a self driving machine inflation.

5) Can both the DOW and the US bond market turn down together.

6) US 10Y might have a Selling Climax in May 2020 @ 0.54. It popup fast to

1.18.

7) Both US 10Y and TIPs misbehave in Mar, moving in to the extremes.

8) Covid19 broke down so many things we used to get, but not anymore, but they are gone. America is going to be stun and puke in disgust.

9) Xi Xi China locked down the American people and re-educated them.

10) We will have to start things all over again, things are not the same, but we don't know if we can.

10) We will have to start things all over again, things are not the same, but we don’t know if we can.

As Donald Rumsfeld said about Iraq years ago and was jeered for: “You have you’re known unknowns in addition to you’re unknown unknowns” in play.

US big box stores can glance at their future by taking a look at Japanese department stores. They can’t be too much difference between them as customers age, but at least the Japaanese ones have great food basements. Some have good restaurants. Ours can have health centers and small hospitals as their futures.

America is over-retailed. In some cases, 4X as many sq. ft. of retail space per capita as European countries. This is a healthy, necessary, and unavoidable thinning of the herd.

I don’t know about thinning of the herd. This looks more like one of the last of an endangered species.

Macy’s Union Square in S.F. once had a great basement , cafe. But then so did Woolworth’s a lunch counter, then there was Blum’s, Liberty House and The City of Paris had a great lunch. There used to be such a thing as a Free Lunch; bars provided it to people who bought booze.

Each generation has no idea of how good the preceding had it, in the economy, prices, hours worked and general standard of living. It’s high time we armed and formed the MLF, the Middle Class Liberation Front.

1) Where is the pot of beef.

2) TLT ETF weekly line chart :

a Bearish Divergence : prices are moving up, but RSI is down.

3) The German 10Y % rate, weekly line chart :

a Bullish Divergence : price is lower, deeper in negative territory, but RSI is higher.

4) Something is wrong with this plague.

The reason we no longer hear about “Hydroxychloriquine and a Zpac” during the daily cv19 briefings is because they are ineffective and lead to increased mortality.

Sir,

Your posts are very interesting but too much shorthand makes them more of a puzzle than a post. Please feel free to add a few more words for general understanding.

I’m sure they are both well intentioned and well informed, but I have no idea what he/she is trying to get at most of the time.

Tony:

RE Mr. Engels posts:

“Financial Roku”

Well at least more people will learn the difference between mortgaged asset and an asset… the vultures swimming around these carcasses do… at least until banks are ready to lend to the heroin junkies again to start the game again!

To use the modern vernacular: “Macy’s is a dead man walking”

Wolf, a fan’s request please. You are uniquely qualified to write about how closely we’re following Japan’s playbook from the lost decade. I propose Japanese invented (or discovered) the Modern Monetary Theory so to speak. Did gold help, or perhaps Tokyo real estate after crash. If you could share your thinking on the subject that would be very educational. Many thanks in advance.

As far as Macy’s, I bought few long term $10 calls, because Macy’s is America, Thanksgiving parade and such, but sold after they doubled. May buy again.

Bought back nice juicy Google put for $850. Same one I sold in March for $7,200.

Hmm, I’m not Wolf, but maybe I am qualified to answer this one, lol..

I lived in Tokyo about 20 years, from the 1990s to the 2010s and worked in the financial industry, so saw all this unfold in real time.

Firstly, Japan’s economy at the street level is very different than America’s. There is great socialized health care, very high levels of safety (I used to joke that a Japanese girl could walk from one end of Tokyo, to the other at 3AM in her high heels and mini skirt, and nothing would happen to her… not as true these days as before, but still Japan is very safe). There is some homelessness in Japan, but it is very rare, and nothing at all like the levels seen in the United States, and without the ‘psychotic crazy’ that is typical in places like San Francisco.

Drug use is low (though increasing recently).

It is a mono-culture, with little immigration (though this is increasing now), which though not politically correct, helped things as the society did not get so divided.

There is less of a rich / poor gap than the US (though these days, this is also changing for the worse as many new jobs are ‘temp’ rather than ‘perm’ (same as is happening in the USA).

There is also an absolutely excellent public transportation system that is extremely safe, spotlessly clean, and with very frequent and on time service (why this matters, I’ll get to later).

So the result was after the bubble burst in the late 80s, a slow degradation in the economy. There was deflation in housing, and some goods, but masses were not thrown out into the streets. Salaries and bonuses got cut. Wives who used to stay at home, started getting part time jobs (which now is causing the same sorts of problems with badly raised kids that the US first started encountering 30 years ago).

Real estate prices kept falling each year (until recently when the Chinese arrived and started buying everything.. though that may stop now with the Covid recession). The stock market went sideways for years and years, with very very high Shiller ratios. I wonder if the US stock bubble could rage to Shiller levels or 60 or 70, and then slowly grind down over the following decades.. that would be a boomer and Gen X bankrupter.

Interest rates were insanely low (same as they are in the US now, but in Japan, started 20 years earlier).

So the best way to make money, was to invest in other countries at the time. It was very hard to make money in Japan, unless you found a way to sell to consumers directly (the internet helped a lot with this, and Amazon, Rakuten, Yahoo Auction were the runaway successes). Made in China was a thing there too, with places like Don Quiote (think Walmart), Uniqlo, Muji being big hits for cheapness.

This hollowed out Japanese manufacturing (though not as bad as in the USA so far), as all the cheap Chinese hit the shores.

Despite all this, for daily life, it wasn’t as bad as it probably will be in the USA in the same situation. Infrastructure was very well maintained, the streets were safe, you didn’t need the high cost of owning a car since public transit was so safe and so good. Areas of the city except where certain foreigners worked or lived were all safe (I know, not P.C, but i am telling it like it actually is… )

The govt borrowed tons of money for crony infrastructure projects (highways and tunnels to nowhere), and then monetized it (Bank of Japan bought most or all the bonds…it will never be paid back). So lots of Japanese debt is really just printed new money, and not really debt in the conventional sense. The USA is going down that road now. The end of the road will probably be sooner for the USA though given all America’s deficits in trade, foreign owed money..etc, which is less of a problem for Japan.

The post bubble blahs and deflation hit younger people a lot more than older folks, especially young males, who cannot get real jobs, start their lives and get married.. they live in very small rented apartments (roommating is not really a thing in Japan), or with their parents.

Now with the rest of the world getting the same way, its hard to decide where to invest if the US is Japanifying too. Other developed and relatively well governed countries with low CAPE ratios might be the best bet over the long term. There are some in Europe and East Asia..

As for the trend in the US, it is worrying, the country is not unified socially, infrastructure levels and safety are relatively poor. I imagine it will look something like Brazil in about 20 or 30 years, another very interesting country I spent lots of time in..

Wow, great write up, Sea Creature, many thanks.

And yes, you are qualified :)

Please do share your Brazil perspective when you have time. Very interesting.

Re: Brazil.. I did not spend as much time in Brazil as I did in Japan (and though I can speak and read / write Japanese very well for a white guy, I can only read Portuguese (it resembles French very closely, which I can read fluently) and cannot speak it), but I still know something about the country. So I may not be as ‘on target’ about Brazil as I can be about Japan, but I can give some idea..

Firstly, the United States resembles Brazil, far more than it does Japan (as anyone who has been to all 3 countries will tell you). It functions similarly, and looks a lot the same. Just there are more poor people (though the US is quickly catching up).

Unlike the rest of Latin America, Brazil is not Spanish speaking. Being in Sao Paulo, you could easily mistake yourself for being in any American city. Nice neighborhoods (gated) with normal US style looking houses. Downtown, there are tall condo towers and office buildings, shopping malls. They have a good subway, highways and formally good but decaying infrastructure (same as the USA).

Brazil’s history is similar to the USA too, European immigrants, and a large slave trade of Africans for farming, though % wise of the population, much more than in the USA historically.

It has similar problems of diversity, racial and social cohesion..etc. You go to the more ‘white’ areas, things work better and are cleaner, and go to the mixed or black areas, it gets worse, American urban ghetto like. Safety is large cities is a problem, but it feels more American in appearance than say, Mexico. Some places like Porto Seguro, Salvador, are very very cool and not really ghetto’ish at all though, with a very African colorful feel, and safety is not as much of a problem since they are smaller.

Many of the poor in the Favela are mixed race, black.. very similar problems to poverty in the United States. Whites (and Asians of Japanese descent) usually are educated and have good jobs and live in nice areas in nice houses and condos, same as the USA, but all gated or with good security surrounding them. Same for the malls, they have guards in front (though the Westfield Mall in S.F. California now has that too… part of Brazilification of America I guess..).

Go out in the street in Sao Paulo, and it is well… like San Francisco or LA. In fact, it so really similar to that, you could easily confuse being in Sao Paulo or California major cities.. they look that much the same.. except for maybe more street people in Sao Paulo, but SF is even catching up to that now..

There is corruption in the government, things don’t really work well. Sao Paulo airport is probably better than LAX and works better (though that’s not saying much). Highways are broken, there’s people living in tents under them.. walking around at night is not really adviseable depending where you go..

Another place that is similar is post apartheid South Africa (Cape Town or J’burg)..similar racial divisions and social issues, safety issues, infrastructure issues.

That all said, Brazil is a lovely country and I love going there, the energy of Samba, the people, dance and music is one of a kind, and I always look forward to it each time I return..

There are enormous segments of the population that are very very poor though, and that is what the USA is looking more like each day.. (or here in California at least)

Good analysis! Thanks!

Someone finally comes to the rescue. With all these guys saying what if we end up like Japan, I’m tempted to say: you should be so lucky.

One disagreement: Japan’s manufacturing is very robust like the other mega-exporter, Germany. They don’t compete on price with China’s Walmart and Dollar Store stuff.

Outside of autos, the reason the consumer doesn’t see either countries name on stuff very often is because their customers are manufacturers.

Their weird experiment with Magic Monetary Theory is not recommended for any country not having a huge trade surplus and holding its debt internally in its own very hard safe- haven currency. i.e., not for all the broke countries that see it as a cure.

yes thats right.. the cheap stuff is imported from China now-a-days..just like here.

Alot of Chinese companies are opening factories in cheaper places like Vietnam and Mexico, soon Chinese stuff won’t be the cheapest anymore.

Question: How can they create all those cheap dollar stores?

I found this the most interesting phenomenon (are those built in China by Japan)?

Daiso is a Japanese dollar store sourcing goods from China.

Some Chinese guy from Shanghai copied the concept and that’s how Mini So(u) was born.

And yes, I agree, Japan is not perfect and it’s debt is mindblowing, but they will “recover” faster, as long as the US does not blow them to kingdom come. Why the US? Well notice the presence of the US military there?

Ironically having less people will better prepare them for the future.

Really appreciated this, thanks.

Thanks to Sea Creature, if that was not clear….

Sea Creature

Excellent recap of Brazil. I lived there for 3 months in the 1980’s and even then it was exactly as you describe. As our middle class dies off – that wealth / class divide will get stronger. that said, I agree with you that the people of Brazil, by and large, are happy and cohesive. That is refreshing compared to the political social divides which define the USA – even within WS posts from time to time. :-(

Yes,

‘And this is wot ‘appened to Japan…..’

…

in the context of today would be interesting.

Bonds CRASHED not cashed?

Grandma used to take me to lunch at the 5 and ten.

“they have collapsed by 53%, to a new low on Tuesday of 54.1 cents on the dollar, giving them a yield of 18.6%”

I’m still shocked at how low of a rate investors demand. At what rate would you lend to Macy’s? And have you actually bought any Macy’s securities lately?

I’d say 100% – 200% for secured bonds, and not at all unsecured.

RT,

While I agree that the mkt has badly underpriced default risk for a long time, no company could survive 100% rates – a big rationale for ZIRP (besides keeping our economically deranged gvt alive…) is to keep a *lot* of mostly dead companies…half alive.

Those companies would be long gone in a pre ZIRP world (circa 2000 and for decades earlier) of 7 to 8% rates…what do you think we are, an economically healthy country, with a currency that can be expected to hold value?

DC (and increasingly the US economy) is a gut shot junkie clinging to life through sneak thievery.

Not to worry folks. The Fed will backstop them. Haha.

Read somewhere that since the Fed jawboned by setuping it’s SPV’s to buy junk, much said junk has nearly returned to pre Covid values. Our very own Fed – Land of the Zombies. It’s a good movie but really aweful policy. “Extend and pretend”

Btw as zombie movie fans well know, the only way to kill a zombie and stop it from spreading is to shoot it the head. Guess no one at the Fed or Washington watches zombie movies.

Stock up on twinkies. Save the wrappers for later.

Sears thought they were a real estate powerhouse as opposed to a retail powerhouse. Look at how that turned out. A double whammy of conceding their place in retail to Amazon and precipitating the collapse of malls. Macy’s is Sears 2.0.

JC Penny is Sears 2.5 and Neiman Marcus is Sears 100.0.

Will anyone be flocking to those stores to purchase the Spring 2020 look in Summer 2020?

In fact are any soft goods retailers going to do well this summer?

I hear as China is opening up, some luxury retailers are bouncing back nicely. I don’t expect that to be the case here in the US. Not when we need a govt bailout to buy new tires and a pair of Sketchers.

social distancing will be the death knell for many a retailer

that has any reliance on brick and mortar.

with online, AMZN has verified that PRICE and PERFORMANCE are

the main drivers of success in the online market.

Really? How come grocery stores have record sales while maintaining social distancing policies?

Bobber,

C’mon…because people have to f*cking eat.

It isn’t rocket science.

I have stopped being an Amazon fan (what with increased overpricing and lobotomized valuations) but the future is clearly online…whenever possible (can’t eat through an internet connection).

People are perfectly fine going to any store and staying 6 feet apart. Heck, last time I was at a Kohls or Macys, or even Target, there was hardly any time I was within 6 feet of a person, and that was before the crisis. Little adjustment is required for social distancing. You put some tape on the floor by the registers, wipe the register after every customer, just like the grocery stores do, and you’re in business. People will come.

The coming year will be a tsunami of bankruptcies, but there will be tremendous opportunities with new businesses and business solutions.

In an ordinary environment I’d say absolutely, but this is not an ordinary environment.

I am not so much afraid of the epidemic itself but of the politicians. Why should I invest in anything when a lockdown can be re-imposed at any moment and for the flimsiest reasons? And then what? More and more months of massively reduced cashflow before seeing some signs of recovery, all the while looking nervously over the shoulder for another lockdown? No thank you. I’ll just soldier on until I die or I can retire.

I know good deals are made in bad times but I fear the bad times are here to stay: we could adapt to a “new normal” if our leaders worked hard to give us some certainties, but these folks have provided catastrophically bad leadership so far. Threatening and insulting people daily for two months while at the same time doing absolutely nothing useful is not good for the morale. Listen to French and Spanish politicians: they are one bad idea away from ordering their countries to just lay down and die. In Italy the government is melting up: we get contradictory directories and rules every day, mixed in with the usual abundant threats of ever-increasing fines. In these conditions most people won’t re-open because the uncertainty is just too much.

In the meantime China continues her march to beat us all into submission: schools have started to re-open and the Imperial government has decided to once again allow commoners near their sacred abode in Beijing. I am sure they’ll get cracking deals when they’ll come here as our new overlords.

A 7% Bond selling for 54 cents on the dollar yields 18.6% annual? How does that work ?? Yield sounds like 46% + 7% =53% to me ?

7% on 54 sounds more like 14% to me. Plus youemoney back in 8 years(!).

Beardawg,

That’s not how it works. There are several ways to express bond yield. The most basic way is the “current yield.”

Current yield works like this: $1,000 bond with 7% coupon pays $70 a year in interest. When you buy that bond for $541 (54.1 cents on the dollar), you still get $70 in coupon interest. So the annual “current yield” is $70/$540 = 12.96%.

But wait… At maturity, you get face value of the bond = $1,000 that you bought for $541. This gain is included in the “yield to maturity,” which is a calculation that includes the maturity date (duration) and the face value of the bond. This used to be hard to calculate by hand. My HP 12c calculator that I bought in 1985 made it easier. Now there are yield-to-maturity calculators on the internet that make that a breeze. You just put in the data and go.

So in this case, for the bond that matures on Feb 15, 2028 (7 years and 9.5 months), the yield to maturity is 18.6%.

The problem with internet calculators is that they don’t allow you to enter partial years, such as 7 years 9.5 months, or something. Instead you have to choose the closest full year. So they’re not totally accurate but close enough. You can try it out here:

http://www.moneychimp.com/calculator/bond_yield_calculator.htm

They will give you $70 of your one grand back (or the price you bought the bond e.g. $540) and default on the reset. /sarc

Wolf, statistically (or historically) how many discounted bonds can be considered money good at maturity. Do they simply borrow more to redeem you and operate like a Ponzi scheme hoping you will reinvest?

“Wolf, statistically (or historically) how many discounted bonds can be considered money good at maturity.”

That is actually a very good question – what pct of sold off bonds hitting some arbitrary distress measure (70 cents on dollar?) ever pay off at maturity?

I don’t think I have ever seen an SP/Fitch/etc rpt discussing it – but those conflicted players have more than one blind spot when it comes to honestly looking at the true state of the credit mkts.

“Do they simply borrow more to redeem you and operate like a Ponzi scheme hoping you will reinvest?”

I would have to say ever increasing debt is the default presumption – the big increase in aggregate indebtedness has to come from somewhere.

When you look at historical interest rates demanded, there are actually relatively few, narrow windows of time when rates truly spike – it is only the unlucky corps that *have to* go to the debt mkts during those crises that end up being shut out of debt rollover or going BK in a yr or two because they could only re-borrow at spiked rates.

Now, if the mkts were pricing risk correctly…those narrow windows of hugely elevated rates would become barn doors…

Iamafan,

Not sure about the number. But there is another thing bondholders have: the hope of recovery in a default.

With a bond that is secured by assets, such as property or inventory or an oil field, you get some value and might get close to face value.

With an unsecured bond, you get what’s left over after all the secured creditors were made whole, so you might only get assets worth 10 cents or 20 cents of face value of the bond.

Distressed bond funds do this math all the time, paying 10 cents on the dollar for a bond that they hope will give them access to assets worth 30 cents on the dollar of the bond’s face value. If that works out, they tripled their money. But bankruptcy courts can be unpredictable, and this is a real gamble.

Thanks Wolf !! My “Bond Ed” continues. :-) That was a valuable illustration. I hope others benefitted as well.

Eccellent tutorial Professor Wolf. Thank you.

Wolf, just curious, would it be possible for Macy to buy back those senior notes out on the market if it fell enough?

I am assuming basically if it did that, that would be like the equivalent of cancelling out the debt because the debt market has deemed it worth less than before.

Is that legal?

I know it does burn through some additional cash to do so, but it might stave off bankruptcy a little longer?

MCH,

It cannot buy them back secretly. It can do a tender offer and it could do a debt exchange. If this involves a haircut for current bondholders, which in your scenario it would, this would be considered a default. Anytime a company stiffs a bondholder (paying anything less than face value) it’s considered a default in one form or another.

Ah, boy, sucks to be them…. and to be the bondholders.

Actually no. Thanks to Pro 13 (1978), property taxes on real estate that companies and individuals have owned for decades are minuscule.

I know they’re looking for $5B in bonds but what are the chance they will actually get it though? It’s quite a risky proposition for investors even in this risk ignore market right now. This is a retailer that’s doom to fail much like JCP. If they don’t get majority of that $5B, will they last until 2021 before filing for bankruptcy?

On the other hand, wonder how Nordstrom is doing in comparison. Since this market back in melt up mode, they had quite a turnaround in the stock yet most of the stores are still not operating.

Nordstrom may benefit. The times I have visited their stores I have been mostly impressed by the service and product selection. Nordstrom Return Policy is very liberal too for credit.

Answer: “No”

“Cost Momentum” has this, and similarly conditioned firms, headed for the ground. As soon as the Helium (cash) escapes, this heavy balloon will fall.

Hey, but if the Chinese bail them out, they could import exclusive Italian fashion labels*, and staff Macys with imported workers from Wuhan.

*Exactly the model they employed in Milano Italy’s fashion houses..

Macy’s unsecured bonds were reduced to BB+. Commercial real estate in a city where the subways do not run is not drawing multiple offers. The homeless have been sleeping in the NYC subways.

US pending home sales dropped over 20% in March. Hard to believe this is really happening.

20%? In a market that’s ever fishing for not so bad news as excellent news to find an excuse to prop this bubble up, here’s how you spin it..but mortgage application is up from last week…see people are still buying..

https://www.ccn.com/housing-market-fiercely-bullish-news/

This is only tangentially related to this story, but I have a question about the loans that businesses have been getting from the U.S. government.

It’s my understanding that the government is creating money hand over foot right now to lend to businesses to keep them afloat.

Presumably this is only temporary money creation as the money would be paid back to the government and thus go out of circulation.

But – what does the government do with the money after it is paid back? Is it on their ‘balance sheet’ and can they then just spend it on whatever they want (more tanks and bombs or what have you?). If so, doesn’t that mean that each conjured dollar meant to prop up a business is now a permanent part of the money supply?

Similarly, what happens if companies fail and don’t pay the government back? Then surely that money stays in circulation because there is no way for the government to get it back.

Macy’s Associate: Welcome to Macy’s. How can I help you?

Me: Do you have these socks in gray?

Macy’s Associate: You can check online.

Me: I’ll just take them in white. Can I use this 20% rewards coupon?

Macy’s Associate: No, that doesn’t apply to anything we sell here.

Me: Okay, I’ll just take the white socks at full price.

Macy’s Associate: They can ring you up over in jewelry…

Remember Sear’s Associates? Trying to get someone in the lawn equipment department so I could buy a $3,000 tractor, I had wandered over to the only visible Associate in the Menswear department. When asked if anyone could help me with a tractor purchase, he said, “oh, they are on their dinner break”…… I left.

At least HollywoodDog was able to have a conversation with an Associate.

I suspect however, that his Associate conversation is merely an early stage of the same disease Sears had resulting in its demise.

Buy hey, if you can now get almost a grand a week on unemployment, what is a 40,000 per year job worth?

More than $1K in some states. For example, in Washington the max UE benefit at the state level is $700/week. Add in the $600 fed UE and that’s a nice solid $68K a year income for doing nothing. Then add in mortgage forbearance at say $2500 a month and you’re earning 6 figures while watching Netflix all day. Or more likely working under the table somewhere.

Why on earth would anyone want to go back to work?

This is nothing new at Macy’s. I bought a Gucci watch from them in the early 1990’s and they put it a small paper bag. They didn’t have one small shopping bag on the whole first floor. How’s that for an upscale shopping experience.

When their merchandise finds its way to Marshalls it will be priced at about 10 cents on the dollar.

Piling up the losses on what it’s supposed to do: sell stuff not sell real estate. Well, they should get out while the getting is good. Sell all the real estate to Amazon. That would give Amazon prime real estate in prime markets to cater to it’s Prime customers and make Bezos even wealthier at the expense of me (and you).

The name Macy’s might survive, but the current form won’t.

TL:DR.

If they own real estate outright at least they won’t take a hit when social distancing measures require them to rearrange counters, etc.

In the end the retail experience will reflect the class system we currently have. There will be super high end stores like the ones at Beverly Hills, whose clientele would stop by on an appointment basis. The rest of the population will shop at Amazon/Walmart.

They can just keep dousing customers with perfume when they walk in the door, as usual in the good old days.

Can’t remember the last time I was in a Macy’s. 5 years maybe. Retail dinosaurs like Macy’s were going to fail eventually with or without the ‘Rona

“Can Macy’s Survive this Crisis Without Filing for Bankruptcy?”

Wrong headline: “Can any company in the United States survive this Crisis without a bailout”

Fixed it for you

I really thought I was going to open this article up to find only one word:

No.

?

1) There is a lot of activity out there, because the weather is nice and people preempt, before its too late.

2) Its almost June/ July. Its time to fix the house.

3) Roofers work on long ladders. They do not zoom from their living rooms. They don’t Google GoToMeeting online conference calls. They either work on top of the house, or stay home. There are no Anderson windows to go.

4) The first calls will get a discount. There is already a waiting line.

5) Those part time workers, who want to sleep with the gov can do so on their own risk. They will GoTo the back of the line if they start to bs, because the next $1,200 will never come.

6) There are signs that America is already waking up, but QQQ is shortening the thrust.

7) Wall street fixed its roof for May day.

Interesting how they did not include Herald Square location in the collateral. Wonder if it has anything to do with their plans to build a skyscraper on top?

I like going window shopping see where prices stand and get a physical pulse for the shopping atmosphere and get a live update where the market stands. Are people just taking pics or walking with bags in hand?

In December 2019 my daughter and I went for the window shopping experience @ Macy’s herald square. The typical sea of people taking selfies and no bags in hands.. but of course they have online pick up and that had a very sufficient line, long and moving quickly.

off to the upper floors – now this is where the real shopping occurs the street level is mostly tourists. No lines no crowds, and most importantly no deals.

Looking out into the sea of merchandise and no people, I described to my daughter higher better use vs the existing use and this is how it worked prior to the internet and how the floors are holding merchandise that now sits in warehouse behind the images you click online. This might even be getting close to the last time you stand here on this cemetery floor of merchandise.

Now let’s move on to a wealthy enclave in long island that has a very old outdated non tourist Macy’s. All you have to do is go to the parking lot right before opening and no matter what time of year they’re plenty of shoppers waiting to go and spend that money!

Hmm.

Macy’s in trouble.

Italy’s sovereign credit rating has today been downgraded in supplemental announcement by Fitch.

What happens if the ECB or the rest of the EU dither for a to long…

This morning I contacted my lawn guy if he could do some work for me. I need some landscape work. He said he could come by and give me an estimate but he’s booked solid for the next 3-4 weeks and won’t be able to get to it until June.

Also read today that mortgage apps for purchase were up 12% this week.

This is why DJIA is within spitting distance of 25K today. The dire predictions are simply not coming true. And now, with most states having opened back up, or about to shortly, business is back to normal. Give it another month or two and this will all be a distant memory.

Just Some Random Guy,

I’ll post the mortgage app data in a minute. It’s up 12% from dismally low levels of the past three weeks but is down 20% from a year ago, and down 34% from the end of January.

In New York: -50% YOY. In Washington: -37%. In California: -34%

Not only that. Microsoft, Facebook, and even Tesla posted strong results. Putting aside the Tesla BS (they’ve always been BS), Microsoft saw pretty much no impact, and Facebook’s saying that ad numbers this month mirrors last year’s, which is surely a drop, but still, the fact that people are still buying ads at a high level when 20+ million people have dropped off the work force is just astounding.

That’s why I said again and again, tech stocks are immune from the economy’s gyrations.

Softbank imploding, with many startups firing people? No problem, spends on AWS and Azure continues to skyrocket. Companies cutting server costs Yelp, Uber, Lyft, Gap, etc, no problem, cloud computing continues to skyrocket, I mean I could be misunderstanding what Microsoft meant by “Intelligent Computing”, but I thought that whole SETI thing died a long time ago.

In this zero interest rate environment, I believe Macy’s will get the loans they need. If I am correct, the stock should jump 20-50% in the short-term from these very low levels, even if they have to include some warrants or additional collateral to close the deal.

BK is certainly a possibility in the long-term, but it’s nothing near a likelihood in my opinion. They already have 30% on-line business, so on-line migration is better than most retailers. Amazon would love to have that premium on-line retail footprint. Landlords will be providing lease concessions and deferments on existing stores that are leased. They’ll also reduce the store count and continue migrating business to the off-price space, which was growing prior to COVID-19.

B&M competition will be reducing as retailers like JCP and NM go under and close stores.

In my opinion, now is not the time to sell Macy’s stock. The bad news is priced in, and then some.

Also, once a few states start opening the economy, as they are now, the other states are not going to stand by and watch. Once someone goes out on the dance floor, the rest follow quickly. This will be supported by continual advancements in testing and vaccination.

I own some Macys stock, but not a ton. The stock is clearly in the speculative category.

Also, I believe (but am not sure, that Macys is one of those former BBB rated companies that is eligible for credit support from the Fed. Why would the Fed specifically extend credit eligibility to former BBB companies if it did not intend to support them?

This would be another factor indicating Macy’s is not a short-term BK risk.

Damage from Credit markets will subdue things more than you think. The money and credit is not there to buy.

Maybe, for the time being.

Investors are wise to keep in mind stock valuations should be based on the total stream of cash flows, and 2020 is a small portion of that.

What will Macy’s earnings be in 2023 and forward? That’s The relevant question.

I see Macy announced it just opened 68 stores on April 30. Things are opening up. I think this puts pressure on other states to open up.

Aw, sh*t! An essay test??! I was hoping for True or False on “Is Macy’s dead?”. Guess I failed this exam. But wait, with TP now out in extra soft 1200-sheet rolls, who needs a diploma to wipe their a** now?

Thanks Wolf for the San Fran landscape. Waiting on 1:30 central time for opening stores Friday.

Wolf, Thanks for another very good article. Macy’s does have some great real estate. I would add that in order to “monetize” those stores located within malls they have to overcome the challenge of getting the multiple stakeholders to agree. They may own their box and a portion of the common areas but so do several of the other anchors, and the mall owner often only owns the shops and pads. Each party is restricted for uses and can’t just tear it down and start over without violating covenants made to the other parties.

All the parties have created redevelopment teams to try move the ball forward but very few have gotten off the ground. The mall owners are already upside down on many assets and don’t want to recognize the loss until they are forced to, the same with the lenders. That was in a good market!

On another note, do you think the Simon purchase of Taubman will close? There must be one giant breakup penalty if Simon is sticking with that.

I think all mergers are now at risk. I’m not a lawyer, but if force majeure can be invoked and passes muster, I think a lot of those deals still dangling out there will fall apart.

Although some mergers will be at risk, I think M&As will soar this year as companies consolidate to better survive the future landscape.

Former Macy’s employee here. Wolf – too late for your good recommendation. Macy’s has disbanded its dot.com team during the last round of layoffs and handed the site over to people who have no idea how to run a website. Two decades of hard and visionary work, which has made Macy’s one of the top online retailers, got destroyed overnight by the current leadership. Two decades of institutional knowledge got lost with one poor decision. I saw this coming and left the ship on time, but it’s still heartbreaking to see how incompetent leaders destroy companies and employees’ lives. Macy’s could have survived the brick-and-mortar meltdown. Not anymore.

Virginia,

Yes, I covered the shut-down decision in February of Macy’s SF tech center and the layoffs of the 1,000 people working there. We may not fully see the impact yet, but I think you’re right, we will see the impact.

https://wolfstreet.com/2020/02/04/another-major-employer-leaves-san-francisco-1000-tech-jobs-vanish-macys-shuts-tech-center-in-broad-optimization/