“Builders are wanting extensions on their accounts. Builders are asking for better margins. Buyers are down by 50% to 60%. Employees are scared and do not want to work. Everything we do is taking twice as long.”

By Wolf Richter for WOLF STREET.

The down-to-earth comments from executives of manufacturing companies in Texas show how the economy has diverged: Many segments are in a fall-of-the-cliff downturn while a few other segments have seen a sudden boost they suspect may not last. This divergence is one of the takeaways – beyond the fall-off-the-cliff movement of the indices – from the Dallas Fed’s Manufacturing Outlook Survey released this morning.

The surveys were collected between April 14 to 22 from executives of 115 unnamed Texas-based manufacturers of all sizes. They track how executives are viewing various aspects at their own businesses.

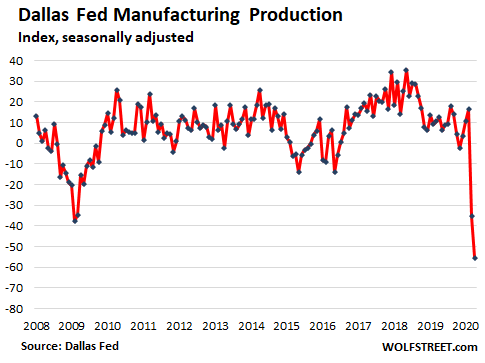

Of the executives, 64.5% said that their companies experienced a decline in production in the current month – by far the most ever. Only 9.2% said that their companies had experienced an increase (but they did experience an increase; more on that in a moment). This caused the production index, a key measure, to plunge from -35.3 in March to -55.3 in April, a historic low, blowing by the Financial Crisis low of February 2009:

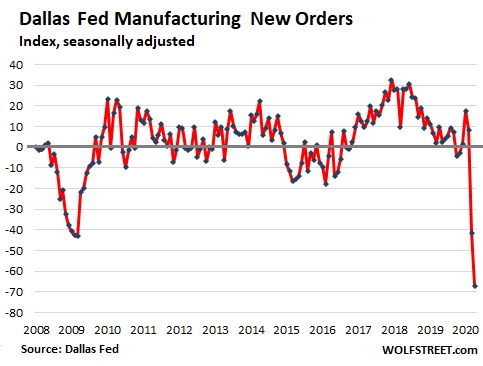

In terms of new orders, 72.2% of the companies experienced a decline, by far the most ever. It demolished the record low of December 2008 (55.7%). This caused the index for new orders to collapse by another 26 points from March, to -67 in April, the lowest in the survey data going back to 2004. It makes the Financial Crisis of 2008-2009 look tame in comparison:

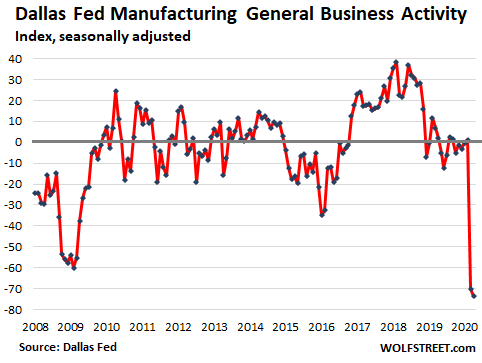

The General Business Activity Index, which tracks how the executives perceived the broader economy, had totally collapsed in March. In April, it dropped further to -73.7, a new historic low.

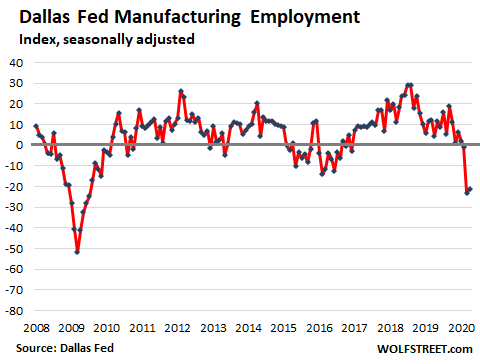

The labor market is rough. The index for hours worked plunged 18 points to -40.2, “signaling a notably reduced workweek length.” And staff cutting continues nearly unabated: 24.1% of the companies said they cut staff in the current month, and only 2.9% said they added staff. This left the employment index at a dismally sharp decline:

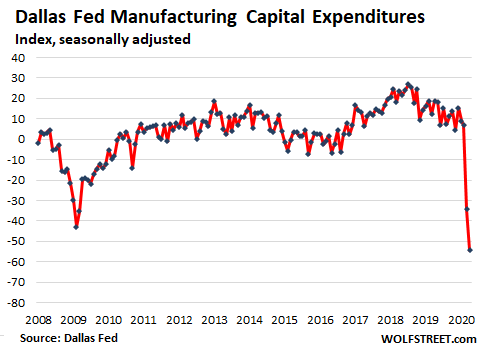

The capital expenditures index plunged 20 points to -54.3, blowing by the historic low of February 2009. Nearly 60% of the executives said they cut capital expenditures, and only 5.3% said they increased them:

In the comments, many of the executives outlined how their companies were feeling the full brunt of this lockdown, and how they’re trying to deal with it. But some companies in other sectors – such as food and computer equipment – got a boost even if they suspect that it won’t last. Here are some highlights:

Comments by businesses that got hit hard:

Chemical Manufacturing: “We have no visibility on orders and sales demand more than 30 days out. It is a highly uncertain and depressed overall business environment.”

Nonmetallic product manufacturing: “With 22 million new unemployment claims in the last four weeks and others underemployed, there will be a decline in construction/housing demand that will cause job losses not seen today.”

Primary metal manufacturing: “We continue to see customers push orders for large capital projects out. Although we have not experienced any major cancellations, the incoming order log has decreased by 62% since January, setting the stage for a long and tough second quarter.”

Machinery Manufacturing: “Sales are down nearly 50% due to COVID-19.”

Machinery Manufacturing: “We have a very negative outlook for the rest of the year as oil prices have plummeted significantly. Our quoting has been halved, and we are deeply concerned going forward.”

Transportation Equipment Manufacturing: “[W]e have reduced everyone’s working time and salaries for a while in the hope of keeping everyone employed and seeing a rebound in business activity within the next couple of months. We do not expect to see a full recovery for a long time in the aviation industry, and we will keep a much-reduced level of activity and investment at least for the remainder of 2020.”

Wood Product Manufacturing: “Things are looking bad. Builders are wanting extensions on their accounts. Builders are asking for better margins. Buyers are down by 50% to 60%. Employees are scared and do not want to work. Everything we do is taking twice as long.”

Miscellaneous Manufacturing: “We are 43% automotive in North America and Europe. It is dramatically affecting our business level downward. OEM [original equipment manufacturer] automotive has not been producing since mid-March, with uncertain dates to return to production.”

Companies that got a boost or least avoided taking a hit:

Fabricated Metal Manufacturing: “Plant employees are wearing masks, taking their temperatures every day, and working six-plus feet apart. The lunchroom was expanded to allow more room between all employees. Office employees are working mostly out of their homes. Overall, the virus has caused a lot of stress, but business and the health of our employees have not declined.”

Computer and Electronic Product Manufacturing: “We have seen a surge in demand as customers scramble to cover supply chain disruptions. We are using 2008 as a guide and expect a sharp and significant falloff in demand as customers work through a period of uncertainty.”

Furniture and Related Product Manufacturing: “Online retail remains our strongest sales channel as stores weather the proverbial storm.”

Food Manufacturing: “We have two businesses: pet food manufacturing and feed manufacturing. Consumers are apparently stockpiling pet food such that our volume was up 23% in March and we are behind schedule in making shipments. Conversely, our feed volume was down 9% as we believe ranchers are hoarding cash and buying less cattle feed as the warm spring weather is producing nice pastures for the cattle to graze on.”

Food Manufacturing: “We’re in the food business. There is increased demand, but it’s not clear if it will be sustained.”

Commercial mortgage-backed securities (CMBS) get to eat it all: And amid overvalued vacant collateral, there is a new thingy: Tenants delaying rent payments and landlords asking for forbearance. Read… How the Unicorn Blowup & Oil Bust Bleed into Commercial Mortgage-Backed Securities

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Shameless plug here: our fund earned +0.47% in March. We remain positive but with slightly lower returns as we are holding more cash than normal; we are being prudent on our next lends and want to make sure we have ample liquidity to fund our existing loans. As Australia Covid numbers stabilize and the curve is flattened, we see Australia with about 6,720 cases, of which 83% are recovered, meaning there are only about 1,000 active cases.

Not out of the woods yet but this is very positive, movement restrictions are currently being lifted and some normality will come in the coming month. As such we will be lending soon as Aussies get back to work, which will mean renewed building and lending! Building has been listed as an essential service.

Its niece to dream, reality might be different. we are not going back to the old normal anytime soon.

Massive Tipping Point to Asia Pacific will continue – USA 70% of GDP is internal, Consumer Spending, which is being hit more ways than we attribute – Massive Unemployment, Ramping Debt, “Contractive, Fear based thinking ie put off spending, as opposed to an expansive, buy it now and damn the debt mentality, Lenders pulling back, and Negative re enforcing effects, create a downward spiral…

Very few will spend on anything other than necessities, in this environment.

We Propose: Structured High Interest Treasury Debt Sandwiches, will be the taste choice for the masses and not too hard to swallow.

:)

Smells like DEFLATION. It’s time for the Fed to step in and buy raw materials.

That would be a true game changer. For the first time ever, a Central Bank would buy and store everything from hog carcass to plywoods.

#MakeCentralBanksGreatAgain

Good idea, but not really new. The central bank hasn’t done it before, but other parts of the government have done it often. The USDA’s food stamp program is really a farm surplus buying program.

They’re dumping all that raw milk. What a waste, Jerome could be taking a bath in it and save dairy farmers at the same time. Probably would still have too much left, so Trump could go take a milk bath too. It would turn the milk orange, but on the plus side they could probably sell it as a coronavirus cure in Alabama. They could probably sell some Pelosi milk in California too. Idk, the market potential is unfathomable, we’ve never seen anything like this before.

The Fed needs to buy all consumer debt and consumer mortgages directly from consumers and pay every household 5k per month for 12 months. That way there will be minimal defaults and the economy will do very, very well because people will spend know that they don’t have to worry about losing income. Further more consumer spending makes up a significant amount of the economy.

We don’t need to worry about debt. It’s only monopoly money! This is so easy why am I the only one recommending this solution?

Epic

Everything makes sense, except furniture, who is buying furniture?

I will tell you one thing you cannot buy, and that are freezers. Everyone is sold out of freezers. I expect people are going to be panic buying meat.

Jdog:

Funny here in Toronto, Walmart has signs up along their meat shelves saying due to supply disruptions in Canada, some meats may be imported from the US!

I’m betting that China has not bought the pork that they said they would ( and the grain). Tyson and Smithfield have major Chinese ‘connections’ and are untrustworthy..

Smithfield is owned by Chinese.

I live in California. I hope PG&E doesn’t cut the power, there goes their frozen meat.

PG&E is replacing Lucas as the king of darkness….

Ahhh !! Lucas Disease — The plague infecting all British cars a few decades back.

Just converted my gasoline generator to natural gas / propane / gasoline. Not taking any chances with the freezers and refrigerators.

Odd byproduct is that the generator runs better on propane than on gasoline, is quieter, and doesn’t stink as bad. Who knew?

Plus propane doesn’t go bad in the can (nor does it foul the carburetor)….. and you can always cook with it.

Propane has less power output though. Also, not as easy to handle. Works better if you have a large tank.

good job EK, but remember to run dry any fuel in your generator, gas or propane, before storing it even for a few months

otherwise, it will gum up the carb

and, as above, gasoline is actually quite a bit more cost effective most places…

the major convenience of propane is you can have your own 1000 gallon tank, and buy at right time of year, etc.

though many farmers have been buying gas and diesel that way for decades, and in that case, diesel works better $$$

The executives in the article sound like a bunch of blind men touching and trying to describe an elephant, a different part of the elephant. Their basic observations are interesting but not predictive.

Watch out for your pets if there are more problems in meat plants. Too many cultures view them as delicious, so if meat shortages occur, they may be toast — or more likely barbecued. As they say in Africa: “meat is meat.” :-)

I sure hope that the scientific reports as to this virus are just plain wrong. Otherwise, we are in deep trouble and sinking.

Too much partisanship has now pervaded (and skewed) all discussions of science and policy. While I have strong opinions as to fault, etc., we will all (Republican, Democrat, or other) suffer more if this is not resolved ultimately, and as soon as possible, in some positive way.

I do enjoy listening to Chris Martensen’s discussions, because he does try to strip out the baloney to remain critical, logical, and analytical as opposed to partisan and irrational and he deals with taboo subjects.

A commenter here the other day (can’t remember who it was) said that they’re buying a bunch of new furniture online to redo the house, now that they have lots of time to assemble the pieces that arrive in boxes. That part makes perfect sense to me.

It wasn’t me but we’ve also cleared out the garage and ordered 3 shelving units for the house. A couple weeks into the shelter in place we went for a walk and saw so much trash (old chairs, desks, computers, dehumidifiers, etc) in front of every house next to the garbage bins that we thought it was one of the two yearly large junk pickup days but it wasn’t. I have a feeling a lot of people are cleaning out their junk and ordering furniture to make life at home more pleasant. I have 2 small kids and I’m basically building a playground in the backyard. If you can’t take the kids to the playground you bring the playground to the kids… We are still coming out ahead given the money we are saving in childcare and we have to do what we have to do to survive being home with the kids 24/7.

When you are inside 24/7, a lot of things that are usually not noticed become annoying. Older, unstylish, or worn furniture is in this category.

A lot of home office furniture and computer

Equip being sold. Also parents dealing with college students coming home with schools closed.

Buying bedroom furniture.

Son is an airline pilot payed to standby at home thru Sept 30th…after that future is unknown. Daughter in law furloughed from work…working from home processing ny state unemployment claims at $18hr. Obviously that job will have a limited future.

The breath and depth of this is unknown. Its too soon to gauge. We are facing unforseen circumstances and unexpected consequences. Difficult to plan for either.

I was speaking with my sales rep at a custom cabinet shop. He said over the last month sales have increased, mostly people ordering new cabinets for their home offices.

Do they have a wife?

Have to keep Her happy, or else.

The simple creatures are always delighted by a new look for the home, quite why beats me. Evolutionary psychologists please advise.

I’m quite sure divorce lawyers are rubbing their hands in glee at the thought of future earnings after so much enforced and extended marital proximity.

Don’t divorce filings always go up after Xmas…..?

Since we aren’t dining out as much, we have more disposable income…. and we are doing our best to dispose of it.

Generator conversion, new vacuum cleaner (28 year old Miele finally gave up the ghost so we bought another ridiculously expensive vacuum), new area rug, rug pads, new lamp shades, new bedding (you can get some excellent deals on fine Italian linens that we wouldn’t ever look at due to the cost but now are “affordable”), a new refrigerator, looking at new laundry appliances….. finished some cabinet projects inside (custom work), some landscaping….. and upgrading the landscape lighting…. plus the spousal unit has washed, scrubbed, polished every surface in the house (with me screaming and kicking along the way).

We have a “dumpster” area with 5 large commercial sized dumpsters located in our community for people to place large items… and it’s been loaded to overflowing for weeks. We’re not the only ones cleaning out the old homestead and replacing / upgrading marginal items.

The joke here is “put the credit card down and step away from the computer….”

Yes. Buying 2 queen beds + bedding bumps the economy more than buying one. :-)

Wolf,

“That part makes perfect sense to me.”

Yep, the Ikea crowd focusing on free time to refurnish heavily mortgaged homes while others are talking about eating pets (see above)…sounds like Weimar America/ZIRP States to me…

only in america!

High demand for coffins, the final box.

It will be mass burial pits and quicklime ere long….

Not sure who is prepaying expensive funeral plans. As they say in Wyoming, when you hear the small plane overhead, put the cover on the sugar bowl.

Having seen that comment about freezers before, I checked a major UK store: 90% of freezer models are out of stock online (the stores are closed of course).

In the other hand everything looks like good news for DOW 40k to me.

Yup Mr market will see every bad news out there as oh well it’s not as bad and more excuse to pump that market up. Although based on these results from executives, the smart one probably already took advantage of the recent bounce and cash out their options or stock position. A look from the inside especially at executives level will probably allow you to see way more cracks than what they are telling the everyone else on the outside.

40k? You are too pessimistic.

400K is more like it.

Wolf,

Please take a look at the leisure and tourism industries. They have been devastated and may be the last to recover. I live in Las Vegas and the Local economy has been wrecked.

I live near a heavy tourist area. With the retraining of the american public to hole up if they see their shadow, I doubt many of the businesses will see another year.

Vegas? If you can move, and/or sell…do it now.

That is the safe play. Or hope Cali stays shut down until the last surfer is executed. Vegas may continue get some of the exodus.

Anyone selling in Vegas right now will get butchered. The selling feature of the town is the hustle, the current atmosphere is tumbleweeds.

Here is over coverage of the tourism industry (though we have not covered Las Vegas specifically):

https://wolfstreet.com/category/tourism/

A run on pet food. Just put a sheet a plastic in back of the telsa

and pick up a few road kills. Of course you might have to wait awhile

for Amazon to deliver that freezer.

With the reduced traffic around here, good, fresh, road kill is tough to find. And when it does become available, those damn buzzards always beat me to it.

Local veterinarians report a shortage of spare parts from road kills.

“If you’re looking to enjoy the spring weather with a newly assembled pair of Minnesota-made Riedell roller skates, you’ll need to wait a touch longer.

Afforded an early-bird chance along with other select businesses to open Monday (today) amid the COVID-19 pandemic, Riedell opted to continue to retrofit social-distancing strategies in its Red Wing plant and resume skate manufacturing as planned on May 4 (next Monday).”

We’re a manufacturer. We need to build a product to sell.” said Riedell President Bob Riegelman, “but we want to do it the right way.” -from today’s front page of the Minneapolis Star Tribune

OK, that pretty much sums up why I love Minnesota. Yeah, we make roller skates, and damn good ones, in this hockey loving northland. After all, the ponds and lakes are melted – there’s no outdoor ice until November. So if you want to skate for your workout, and a lot of people here do, roller blade away. And I got to give props to the boss saying, “… do it the right way.”

Another way to workout if you’re a nordic skiing Minnesotan is to roller ski. and a lot of people do this too. Word of warning: when cycling by a roller skier, keep an eye out for the skier’s pole, eh?

My wife is a figure skater, but the rink is closed, so she returned to rollerblading, which she hadn’t done in years. Bought a new pair to stimulate the economy and is blading now.

In cities all over Europe, skating rinks were being used to store the overflow from morgues. This year the Ice Capades became The Ice Cadavers.

Roddy, sorry to hijack your post but I wanted to clear a misconception about this macabre detail.

The two chief reasons mortuary services collapsed here in the most affected areas in Northern Italy were two.

First is due to a major bottleneck in crematorium capacity. While cremation has become increasingly popular over the past decade in Italy, capacity has remained exactly the same. Crematoria in less affected or unaffected areas only started to be tapped into 4-5 weeks into the lockdown, and some mayors with far more foresight than their colleagues (more on which in a minute) allowed for 24/7 operations to deal with the backlog: remember that people can’t be ordered to stop dying from other causes to make room. But tell that to French, Italian and Spanish politicians.

Second is the common problem all over the world: politicians panicked. Far too many mayors decided to do their bit to bring Hell on Earth and closed cemeteries down. Not to mourners or funerals: they closed the cemeteries to burials during an epidemic. Let that sink for a moment and you’ll understand why Italian politicians are now so terrified of their own citizens. Then people ask me why I am so mad and don’t sleep anymore.

I have a relative who died of a long-term illness at the height of the epidemic. His wife asked for cremation and while the ashes have long returned (from over 200 miles away), they are presently “on storage” because the local cemetery is still closed down and nobody knows when it will reopen: the decision rests solely with the local mayor who, like so many of his colleagues, seems to think not burying the dead is a mark of civilization.

Bailout Nation

Bailout the borrowers

Bailout the Lenders

Bailout the in-betweeners

Bailout those bailing out others

Who is going to bailout the TAXPAYERS

Sunny129:

Taxpayer’s are being “bailed in”!

Who is going to bailout the SAVERS?

Nobody, as usual S!

That’s one of the foundations/fundamental reasons we’re in this fine mess anyway you look at it.

Remembering the 6% I used to get on my savings account long ago in a galaxy far far away, and not being smart enough before spending a lot of time studying Wolf’s articles, I kept looking for why the banks get free money from Fed and don’t pay anything to saver’s.

Rather than pitchforks, I think we should INSIST all the folks responsible for lack of interest on our savings must pay back every cent or go to that prison camp in Yuma I have seen so often in the movies, and break rock for the rest of their natural lives, etc.

As if, eh?

Dr. Faust will be the Medicine Nobel Prize in 2020.

Thanks to him Houston & Dallas entered hell.

Noble prize. Noble.

https://www.nobelprize.org

It’s such a shame that all these industries are suffering. Shouldn’t they ignore all limits and keep going until the entire earth is paved over? After all, we need MORE, BIGGER, and NOW! There are no limited to growth! If we run out of Earth, there’s always MARS! At least, if you’re rich enough.

This vile machine, belching its way towards Armageddon for frivolous reasons, spraying and poisoning and devaluing everything for money, money, money. And if there’s no money to be made, then progress, progress, progress.

Because it’s definitely progress to support monoculture and Monsanto and trinkets nobody needs while destroying everything that might get in the way. Quality of life only counts if it’s for sale, right? If it can be put on the balance sheets.

That brief, tantalizing high that’s never high enough, from hitting the “BUY” button. Capitalism at it’s finest. We’re all mentally unwell from consumerism ideals, the sickness that spreads death.

Get “it” now, the future be damned. That “it” will look as silly as 80s workout fashions someday. But you really NEED it – or the machine might grind to a halt, and grind you up with it! Let fear be your guide, if you don’t bow to nationalism and advertising.

Someday they’ll try to figure out how to charge us for breathing the air, and call it progress.

Aren’t environmental taxes just that? Charges for breathing air?

@crv

No. They are charges for polluting the air. If you never add to pollution. Then you never pay them.

Well, we all exhale carbon dioxide, a pollutant, so…

Not everything is for sale you know believe it or not I had an elderly friend a single woman who was a writer and quite wealthy as a neighbor when I lived in Sag Harbor

She lived in a very interesting waterfront home and her neighbor was bought out by a CEO or something who proceeded in making a perfectly nice house into a McMansion with all the bells and whistles He sent his rep over to make my friend an offer for her house( perhaps to get rid of her) and was horrified to get her response upon offering her two million dollars She told him “ Son, some things are not for sale at any price” and knowing Glynn she meant it They just don’t make people like that anymore sadly

“They just don’t make people like that anymore sadly”

Oh, I dunno …

The non, indeed, anti-Capitalist Soviet Union also did a very good job of environmental destruction, and the citizens were not avid consumers.

The problem is industrialised civilisation; started by the British some 250 yrs ago.

Well, living in hovels would solve the Covid problem as the median age of death would descend to far below that of Covid.

Fantastic rant! When reading it, I heard it in my head as if it were being shouted through a bullhorn like a crazed street corner profit on a Saturday night in the forsaken part of town.

Many well oiled machines went to sleep. How will they wake up again?

Literally and figuratively.

Planes resting on unused runways or plane parking fields in the mountains of California.

Will they just fly again? 24hrs non stop only for maintenance and layovers. I’m not an engineer but well oiled machines dont just respond to the snap of a finger? Will they need further maintenance? And what about Boeing aircrafts will they just take off again? Or simply nose dive…

There are procedures in the transport industry called “hot layup” and “cold layup”.

The first allows an aircraft, a cruise ship or a cargo vessel to be put back in service on very short notice: for example Carnival Cruises has several ships in hot layup off CocoCay (Bahamas) because they expect them to be back in business at the end of June.

Cold layup instead allows one of these vehicles to be stored pretty much indefinetely. For example many of the Boeing 747-400 flying right now spent years in cold storage when Singapore Airlines decided to get rid of them: these aircraft were progressively sold off to other customers and usually turned into freighters, but in the meantime they spent years parked in the desert in cold layup.

I strongly suspect many companies will come to rue their decision of putting so much capacity in cold storage: to give a taste of an upcoming piece for Wolf Street the Dutch government will help out KLM only and if only the airline will resume “at very least 80% of pre-Covid-19 flights” by Q4 2021 and will be profitable starting immediately from FY2021. These provisions do not include low-cost subsidiary Transavia.

Like US carriers had to bite the bullet and keep on flying at roughly 50% domestic capacity to access funds made available under the CARES Act, more and more companies around the world will be forced to restart operations faster than they’d like to be bailed out: not all governments need to keep their countries locked up forever to avoid a change in management.

I assumed airlines would have to repurpose seating to comply with social distancing, yet I’m seeing pics of passengers appearing not to be in compliance?

Right now every airline has its own rules. It’s complete chaos and despite the emergency being over in many countries regulators have been slow to respond.

For example the EASA, the European FAA, was supposed to come up with a timeline of post-emergency rules, to be progressively relaxed as we leave this crisis behind us. But some governments are dragging their feet and while the EU is ready to reopen all internal borders plus those with Norway and Switzerland in June, some of those same countries are again dragging their feet.

But if Italy and Spain want that sweet €1 trillion “Recovery Fund” they’ll have to show Germany they are recovering and not coming up with more and more absurd excuses to keep people locked up to avoid the day of retribution.

Just to add a little more context to the topic.

We are a small/medium sized truck equipment manufacturer in the American Midwest. Our industry was already structurally headed for a dip in 2020 after several really strong years. Forecasted drops of -20% to -30% from 2019 were proving pretty accurate until the shutdown measures, which pushed things far more negative. April will probably land around -60% from recent years. Demand is simply evaporating, and the backlog is dropping by the day. I suspect we are not unique as the sentiment from customers and suppliers is similar.

To deal with falling revenue, we have completely slashed all nonessential spending – capital investment is dead. If this continues, we will have no choice but deep layoffs mid-summer.

Who knows how this thing will pan out over the long run, but the short run is looking rough.

I get the feeling many analysts, politicians, and media folks are missing this point. Restaurants don’t work on backlogs, but manufacturers like us do. The damage is coming just the same. It’s just takes more time here.

And we sell test equipment to companies like yours. We have seen your drop in capital expenditures, in our going-to-zero order book. And our suppliers are not getting any orders from us. When we finish the jobs we have in process we are going to have lots of spare time. Seems like this summer is going to be rough for a whole new batch of people.

Add bankers and economists to that list. They seem to think that if interest rates drop low enough that will encourage you to make those capital investments. Demand needs to recover for business to want to make investments and I don’t see it happening until companies recover, which will happen well after COVID-19 is addressed.

What came first? Demand or supply?

Say’s law not a law.

Looking at those charts, forget about the recession of 2008, this is going to be worse than 1929, much worse.

Our global economy is suffering severe convulsions, my only hope is that liquidity shots of central banks will be enough to avoid the heart attack and/or brain attack.

“Winter is coming”.

But then will come the Spring.

I was there then and now it’s here.

Again.

…and yet, some people (especially RE) think when we’ll open all the states, we’ll be back in LaLa land and consumers will take more debt. perhaps adding more debt by selling one of their kidney, jk

The Bureau of Labor Statistics will ghost 40million un-employed off the data base in no time. It will make no difference if they ever work again,the numbers will look good quickly. The American public will eat the shit sandwich and will believe it’s corned beef when the MSM/Government Media Security complex tells them it’s corned beef. ITS SCIENCE.

When their Unemployment benefits run out, they will disappear, and the PTB will declare “best economy EVAR” again.

We’re not going to run out of ammunition says a limping Powell.

Who is going to save capitalism this time around?

Last time it was China in 2008, though the Fed received all the credit.

Of course China’s intention was never to save capitalism but instead their intent was to replace foreign demand for products with domestic demand that it could better control.

What if the Fed and the world’s central bankers have been firing blanks all along? History must eventually give credit where credit is due.

George: right now (as in this very moment) there’s a veritable armada of container carriers headed towards Europe from China. Tankers chartered by PetroChina are lining up in the Persian Gulf, waiting to load dirt cheap oil and LNG. Domestic air traffic in China is picking up far faster than anybody expected. The huge Capesize bulk carriers have never stopped feeding the Chinese heavy industry and are now back to pre-crisis volume.

If the world doesn’t blow up first one way or the other we’ll still be debating in thirty years just how responsible the Chinese government was for this crisis, but one thing is for certain: China is the big winner this time around. Was this thing planned? No, but their leadership manipulated it in such a way to inflict the maximum damage upon the world and make a nice profit out of it.

And we fell for it like dumb marks: President Xi knows us better than we know ourselves.

Some governments around the world are waking up to the economic and social carnage they have wrought: they are (quietly) backpedaling on stimulus and making bailouts conditional to a relatively quick return to normal. Central banks seem more concerned with keeping interest rates in investment grade paper from blowing up than merely dousing the system in liquidity as originally promised.

But most government are only concerned with their own survival, no matter the cost for the country, and the media are still in full doom-mongering mode.

If we don’t want to learn how to speak Mandarin (and quick) we’d better start climbing to come out of the grave we dug for ourselves.

You can see all the ships and a lot of information about them on:

https://www.marinetraffic.com

and other sites.

A commenter on a podcast out of Canada referred to the crisis as a “plandemic.” An appropriate description, me thinks.

Planenema

The current mindset of the country bears no resemblance to that of the “awful” 70’s when I was a teenager. Yes, Xi knows. Himmler and Goebels would be astonished.

I know you lost your job I’ll give a hundred dollars for that car. We were buying generic cigarettes and beer. Then the gas ran out. The boys came home, not knowing they had PTSD, or Agent Orange, and there was no free love. My friend joined the carpenters union, (they still had hammers – swing one of those all day brother) and he remained an apprentice for five years, there was no work for journeymen. Gold went parabolic but no one had any money. Then the gasoline ran out.

He that rules only by terror;

Doeth a grevious wrong,

Deep as hell,I count his error.

Let him hear my song.

Tennyson

MC01: Your post awoke me to how China is handling its industrial precursors from Africa . I bet that supply chain is working. My small circle of contacts are of the belief that China is dead without the U.S. Market. My argument to them is that China is the largest middle class and need more of the fruits of their labor for domestic consumption. The Asian is not fated to work 14 hours a day for our consumption . They like us want time to live.

The one surprising thing that I haven’t heard from any of the Governors yet, (may be I’m just not listening to the news enough) is anyone of them offering incentives to industries to make face masks in their states or other PPEs. Seems like one easy way to jump start some businesses.

Then pass laws to mandate face masks when outside, or in stores, or some such thing.

While I’m sure some will scream crony capitalism or government overreach, it seems like the one way to get things started, and may be even get the economy to open up a bit faster.

In the bay area, I see local recommendations, and I see a lot of places like Costco now requiring masks to go into the store. I think it is literally a no brainer if you had to go to any kind of environment where you might be within X feet of someone. I’m surprised there isn’t a more uniform law in place, and cops issuing citations for not wearing masks.

Dunno if it is true… but that is the deepest thought I ever heard on this situation.

Thank you for sharing it.

(Was intended to MC01

Apr 28, 2020 at 2:17 am)

My Amazon Prime deliveries now take 1 to 2 weeks instead of days. Even Costco is taking weeks now. UPS comes to me home 10 PM or extremely early like the garbage truck. Everything is out of whack including the birds. Too little chirping yet.

There is primordial joy here in the country.

Tatjana feeds the birds every morning and chickadees twitter their greetings and alight on her shoulders.

It happened here as well. Deliveries completely collapsed, and not merely by retailers. Now things are starting to get better because the lockdown is starting to be eased, but Dear Leader is fighting tooth and nail against reopening the country, and with him all those who have to answer for this tragedy. Had not they ruined and killed so many I’d say watching grown and supposedly powerful men behave like spoiled brats desperately trying to escape punishment is downright pathetic.

Anyway back to us: the cuckoos returned a couple of weeks ago and the nightingales and Scops owls have arrived this weekend with perfect timing, albeit the latter this year are particularly noisey, drowning out the ‘gales most of the night.

And the blackbirds sang their song as they always did…

1) During Iran/ Iraq war, when WTI reached $40, there were new discoveries of oil.

2) New oil fields in Alaska, N.Sea, Siberia and the gulf of Mexico were

developed.

3) The US $ was too strong for oil.

4) When Japan flirted with China, Houston oil James Baker Ali Baba, kicked

Japan out of the US treasury in the 1985 Plaza accord.

5) US dollar kept falling until it reached its Climax Selling on Feb 1991

at 80.60. The response came fast. In July 1991 US $ popup to 98.23. 98.23 from 30 years ago, sound familiar to u ?

6) WTI dropped from $40 to $10 on Apr 1986.

7) The oil glut lasted 12 years, until Dec 1998 when WTI was $10.35, with one big fake, short lived pulse, in between, on Oct 1991 WTI reached $41.15.

8) The test at higher low @ $16.70 came on Nov 2001, during the 2000/03 recession.

9) WTI, after a long priod of tranquility moved up and had a bull run with x3 tops : at $147 in 2008, at $115 in 2011 and at $77 in 2018 // and x3 bottoms : to $32 in 2008, to $26 in 2016 and to $6 in 2020.

10) Since peak in 2008 WTI dropped in an A-B-C down, when wave C,

that started in 2011, had x5 waves.

11) On a LT 50Y chart, starting from the 1970’s @ $4 WTI, the 12Y period from 2008 to 2020 is extremely volatile.

12) Volatility lead to tranquility. Tranquility might last for 12 years, until 2032.

This is just from memory:

1 – WTI hit a low point in 1963 threatening to bankrupt the state of Texas.

2 – After November 1963, the price started to rise.

3 – Wars consume oceans of oil.

And “Just one word…plastics.”

1) Dr Faust will bring an end to an era of visitations, diagnosis,

pharma and surgeries in repetitions, that led to our GDP growth.

2) When senior citizens visit their Dr. they pant and sweat like

teenagers on a date. In less than half a hour they come out with

$7K to $10K of potential referrals.

3) Experts visitations lead to diagnosis, pharma, surgery in never

ending repetitions.

4) This crooked era that led to bankruptcy and death is reaching its

terminal point.

Donald wants businesses to take the loan so people don’t file for UE.

Can we just admit that our plundered economy was, starting in September of last year, already imploding? And the so-called “recovery” from 2008 was a giant lie? That all of the latest tyranny is providing cover for the collapse of our plundered economy? That the plunderers created a new boogeyman to blame all hardships caused by their plundering on?

The American economy will not “come back” as “back” was plundered. The new normal for the American economy will be at a level 25% from where it had been, and will continue to slip away. And will then be wiped out by hyper-inflation in a few years.

As for “pensions” and “retirement?” Now, that’s funny.

Next up: The tyranny’s planned for war with Iran.

That is the actual truth….. the distraction to the planned heist.

Massive Tipping Point to Asia Pacific will continue – USA 70% of GDP is internal, Consumer Spending, which is being hit more ways than we attribute – Massive Unemployment, Ramping Debt, “Contractive, Fear based thinking ie put off spending, as opposed to an expansive, buy it now and damn the debt mentality, Lenders pulling back, and Negative re enforcing effects, create a downward spiral…

Very few will spend on anything other than necessities, in this environment.

We Propose: Structured High Interest Treasury Debt Sandwiches, will be the taste choice for the masses and not too hard to swallow.

:)

1) From Oct 1961(H), from a peak @ 741.30, the DOW plunged to 524.55 in June 1962, because of the Nikita & Cuban missile crisis. Texas oil boom collapsed in 1962.

2) It started a banking crisis.

3) A new production of the Saudi’s oil compete with Iranian and Iraqi oil supplying Europe & NATO.

4) Ike 1957(L) to Aug 1959(H) was the best & cleanest bull run the DOW ever produced.

5) Since Aug 1959(H) until JFK election in Nov 1959, it was all volatility. After JFK election the DOW had another good run until Oct 1961(H) @ 741.30.

6) From the 1962 low, after a test, the DOW took off from 524.55 and within x4 years reached 1,001 in Feb 1966.

7) JFK high @ 741.30 // low @ 524.55 were the DOW backbone for the next x20 years, until 1982.

8) Nixon resignation double hump low hit 570.01 in Dec 1974

The Dow is down 20 points momentarily.

Where is the Fed with some new money?

One wonders where all this is going.

So far …

Fed: +2.6 Trillion

Treasury: + 1 Trillion

Banks (reserves): +1.6 Trillion

People: -X Trillion + shut down

I would just like to dwell in the mind of the Engel for one day. I am guessing it is like an all-knowing all-seeing LSD Trip where clarity abounds. It would be fabulous and scary.

Perhaps it’s like the brief split-second before a crash. You know it’s gonna happen. You can’t prevent it. Time slows down when it happens. All your senses take in an overwhelming amount of information at that short moment. Right afterwards, it keeps replaying in your hard-drive (brain).

Now, imagine that this was the normal and perpetual state of being. Fabulous and scary indeed.

I should have added that I do enjoy reading Mr. Engel’s comments.

1) Doc Brown 1985

2) The Engel 2050

3) Peak Beard occurs before Peak Oil

4) Caveman draws pictures

5) Text turns to speech

6) Guy named Steve creates pocket tool to replace everything.

7) Speech reverts to text.

8) Travel replaced by pictures.

9) People stay in caves all day.

10) Full circle.

One of the best ways I have learned to make money over the years is in situations like this. While everyone is focused on the bad news, I go through and pick up the diamonds. Here are a couple of examples in this situation. Industries close and equipment idles, but is there something that becomes worth more while it idles? Think trees and timber companies. Oil prices are crashed, but is there someone who could really benefit from this who could use the cheap energy now and store up the product they sell? Energy is a major cost of mining companies, especially rarer minerals. Think of the energy it takes to produce a 99.99% pure element from a 2 gram/ton ore. In the GFC, Goldman Sachs rented warehouses, filled them with aluminum and sold them for a huge profit a few years later.

“Think trees …”

Amen.

Been doing that for years and trees have done well, in good times and bad.

Self-storing, self-increasing inventory.

But where has the demand come from as the demand for newsprint has cratered?

New home construction ain’t been great shakes either, between demographic trends and economy driven collapse in household formation.

One of the great qualities about trees is that they do not depreciate while in inventory. they can continue to grow and await a better time to be harvested.

There are opportunities in every situation, you just have to look for them.

And of course accurately assess the situation. The second part is the hard one.

Interesting the pushback on virus safety. Seems the public doesn’t want to open the economy while the virus is still active.

Depends which public.

There is the public that has no worries about long term economic prospects. Govt workers, people in the medical profession and other recession proof industries. And news anchors with homes on the Hamptons (yes I’m talking to you CNN anchor Cuomo)). They’re the ones sitting on their guaranteed lifetime income scolding anyone who wants to get back to work. Or if like Cuomo they lose their job, they have millions to fall back on. It’s easy to pontificate about keeping the economy closed for the next 6 months when you’re in that situation.

Then there is the public that is on the verge of their business going bankrupt. Or their employer is on the verge of going under. Or they’re in sales and their income is off 50%. This public wants to open up, NOW!

Go back to the firing of the Amazon employee who led a strike over protective equipment. There is a labor management split here, a split between elected officials and health officials. Even Trump has tried to get on both sides of the issue, as though there were only two. Nobody wants to be a hero for minimum wage.

Public or Press? The Press thinks they are the public.

I have a small metal fabrication and machine shop. My customers are in three areas. Semiconductors, Artisanal Lighting, and small walk-behind garden tractor attachments for market gardeners. The Semiconductor and garden tractor orders are exactly the same as before, and the lighting parts are off 50%.

Petunia, JFK was assassinated on Nov 22 1963.

Hey Wolf

Can’t help but pondering your pail Keiser on his show coupla days back saying that now that everything was brought to the full max peak, the money will now be made in the destruction of everything.

Interesting idea.

I think that your due for a visit on there….

The main question is:

“Can we ‘bend the curve’ without ‘going around the bend'” (as a society)?