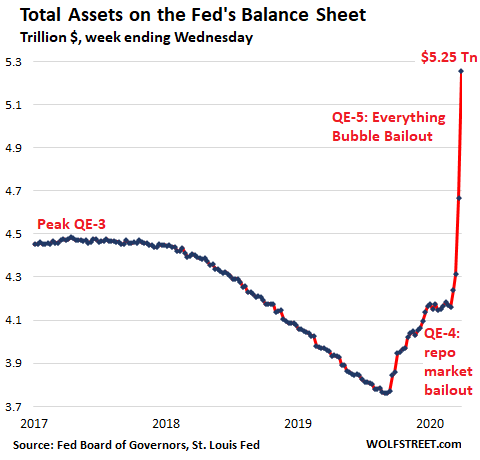

Fed’s assets spike to high heaven to bail out the imploded Everything Bubble it had worked so hard to inflate over the past decade.

By Wolf Richter for WOLF STREET:

Total assets on the Fed’s weekly balance sheet, released this afternoon, spiked by $586 billion in one week, to $5.25 trillion. This doesn’t even include yet the bulk of the mortgage-backed securities (MBS) the Fed bought over the past two weeks because the Fed books them when its trades settle, and MBS trades take a while to settle. So they will show up later.

Over the past two weeks, total assets have ballooned by $942 billion – again not including the bulk of the MBS it bought during that time, which will be booked when they settle. Money creation at its finest:

If the Fed had sent that $942 billion it created over the past two weeks to the 130 million households in the US, each household would have received $7,250. But that didn’t happen. That was helicopter money for Wall Street.

Since mid-September when the Fed started bailing out the repo market that had blown out, total assets on the Fed’s balance sheet soared by $1.41 trillion. If the Fed had sent that $1.41 trillion to the 130 million households in the US, each household would have received $10,840. But that didn’t happen either. It was helicopter money for Wall Street.

Total assets on the Fed’s balance sheet are composed mostly of:

- Treasury securities, which include Treasury notes and bonds, short-term Treasury bills (T-bills), Treasury Inflation-Protected Security (TIPS), Floating-Rate Notes (FRN)

- Mortgage-backed securities (MBS)

- Repurchase agreements (repos), both overnight repos and term repos.

- A newly active line item, “Loans.”

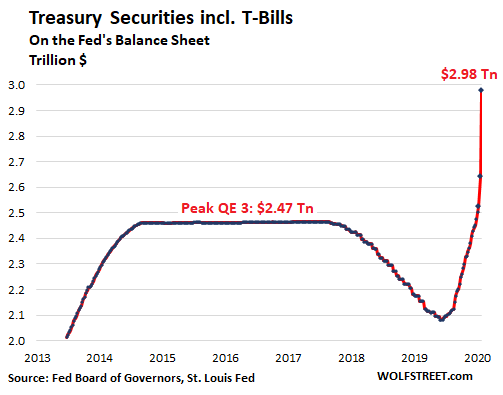

Treasury securities spike, but T-bills flatten

Over the past week, the Fed added $338 billion to its Treasury securities, buying all types and maturities. Since the repo market blowout in mid-September, the Fed has added $877 billion in Treasuries. The total balance spiked to $2.98 trillion:

The Fed is now purchasing Treasury securities of all kinds, and of all maturities. But within that group, T-bill balances have remained nearly flat over the past two weeks, after soaring at a rate of about $60 billion a month since the repo market blowout. In other words, the Fed is only replacing maturing T-bills with new T-bills and is now adding nearly exclusively longer maturities.

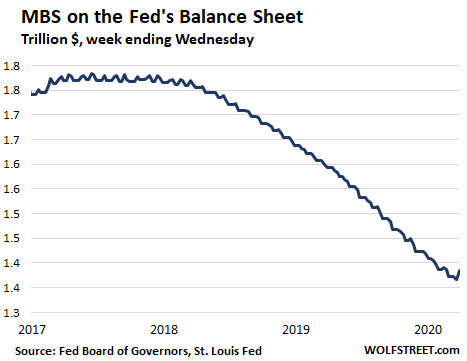

MBS are not yet fully reflected.

After reducing its balance of MBS by about $20 billion a month, every month all last year and into this year, the Fed announced that it would again pile into MBS, buying hand-over-fist to bail out the MBS market – both residential and commercial MBS – that has been imploding.

But it doesn’t show yet to the full extent. It takes a while for MBS transactions to settle. Since the Fed puts its new MBS on the balance sheet when the transaction settles, the purchases since this has restarted are barely starting to show up. Last week, the MBS balance fell to the lowest level since October 2013. On the balance sheet this week, MBS rose by $18 billion to $1.38 trillion, a barely visible uptick:

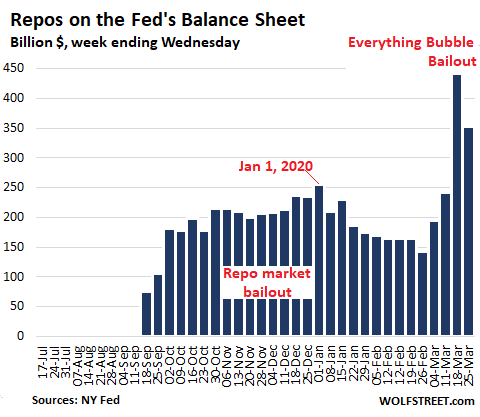

Repos fizzle.

The Fed is now offering overnight repos and term repos of combined over $1 trillion a day. In other words, nearly unlimited cash for the repo market. But there are few takers, and most of the repos are now by far undersubscribed. This has caused the repos on its balance sheet to tumble by $90 billion from the prior week, to $352 billion:

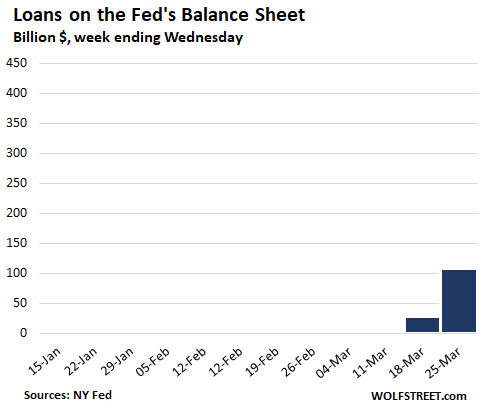

The newly hot bailout “Loans.”

During Financial Crisis 1, the Fed’s asset account “Loans” contained large balances. Those loans were eventually paid back to the Fed and the balances then dropped close to zero and remained there through two weeks ago. But last week, this account jumped from zero to $28 billion. And this week, it jumped to $109 billion. These are the amounts the Fed has lent out as part of its new bailout liquidity programs and direct lending programs. It even provides some details:

- Primary credit: $50.8 billion

- Primary Dealer Credit Facility: $27.7 billion

- Money Market Mutual Fund Liquidity Facility: $30.6 billion

This chart is on the same scale as the repo chart, with plenty of room for these loans to expand, as I expect they will since these programs just kicked off:

The Fed has become a full-bore record-breaking global market manipulator with its printing press to keep the Everything Bubble it had created over the past decade from imploding, or imploding further, or whatever. And it’s all helicopter money for Wall Street.

The new unemployment claims are out. No one has ever seen anything like this. Read… A Word About the Horrid Spike in Unemployment Claims and Why it’s Even More Horrid Than it Appears

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Trump 2016: Ban the fed

Trump 2020: Jay Powell good job

Trump 2016: Drain the swamp

Trump 2020: the swamp was the American people!

I just read that inside the stimulus bill is a real estate tax deduction for the 1% who make over $500,000 per year that will cost the treasury $170 billion over 3 years. This will benefit Trump and his son in law Jared Kushner and billionaire real estate moguls who may not have to pay taxes over the next 3 years.

I was referring to the $2 trillion stimulus bill that the house is scheduled to vote on tomorrow, Friday.

Joan:

Now you know why it took the politicians a week to craft this bill!

They weren’t fighting over how much to spend!

They were fighting over how much they each got!

boo hoo – you didn’t get squat

welcome to merica – or 99.9%

nice try

We’ve reached the point were all is revealed:

Wall Street does not need mainstreet or any sort of “economy.”

The American economy can vaporize right now, before our eyes, and vanish from the universe.

So what? Wall Street wouldn’t care less and neither would the Fed.

All Wall Street needs is endless QE from the Fed, and bailouts.

Who needs America?

Not Wall Street that’s for sure.

It’s not just about being rich. It’s about total power over the people. Obviously the very rich want people to grovel to them. To beg. Keep em poor. Keep em hungry. That’s total power.

But most of you don’t believe people at the very top are that way. They have such a nice smile.

Powell 2017 / 18k Dow: Asset prices are elevated! Hawkish gradualism!

Powell 2020 / 18k Dow: ZIRP, QE Infinity, bailouts, Repo and assorted lending up the woozo!

Who is this Congressman Massie taking a stand against all the bullIES in the school yard?

P.S. Rand now we know ye

Brilliant!

Long Pitchforks… and bile.

Cong voted on a secret ballot. Republic is dead.

Keep calm and go back to CNN Money.

Just let all everyone log on to their bank accounts and add zeros, legally. That will get demand up and Americans can then pay all the taxes DC needs; just add more zeros. Conjuring money out of thin air doesn’t come with any downside…right?

Seriously, what downside? If there was any, we would have seen it already. This a new world, a new system, a new reality where unlimited money printing and bailouts work. Old rules and logic no longer apply.

The downside is that some of are required to ‘work’ for that unlimited money. It’s a form of financial bondage. Those that get the unlimited money hold immense power over those (of us) that are required to work for it.

That is clearly true. If only a portion of the population is allowed to counterfeit they benefit at the expense of those who actually create wealth.

Yes.

There’s also the fact that if no company goes bankrupt, the inefficient are kept in the game, reducing the efficiency of the economy. This is a long term drag, not today’s problem.

Worse, in some cases, the interventions are picking winners and losers. It’s being done openly based upon arbitrary reasons. The power of being able to pick winners, company by company, state by state, as the current administration likes to do is that all business has to grovel a little bit, just to play it safe.

The old “it’s different this time” “analysis” (I’m actually assuming you are being sarcastic).

Human nature doesn’t change hence financial cycles fundamentally play out the same way every time. Humans make undsound choices based on misleading information (manipulated rates of interest) then change their choices once the error becomes evident…every time. As a consequence heavily leveraged financial markets collapse…every time.

The trillion (billion is so passé) dollar question:

“change their choices once the error becomes evident”

How would that realization of “the error” come to be when everyone is a winner?

ei2pi above wrote:

“The downside is that some of are required to ‘work’ for that unlimited money.”

Well, there are plenty of people willing to work, even if their purchasing power stagnates for decades. It’s okay for the new generation to not own a house or a car, they adapt. They have cheap Uber, they have cheap AirBnb, they have cheap Netflix and they will still have cheap Made in Asia widgets.

Ed above mentions “market inefficiency”. The inefficiency is heavily diluted beause the “efficiency” in web economy and in “Made in Asia” more than make up for that inefficiency that the latter is barely noticeable.

Agreed. Generally acceptable accounting principles. Balancing the T with extra legal zeros. You can’t eat money.

As long as the free money is kept out of the hands of the grubby peasants, and they remain indebted up the their eyeballs, then prices of day to day items won’t go to the moon. The money printing increases the prices of investments and assets that the peasants do not own. Nothing wrong with that as long as you do own them, eh wot.

That very much depends on how much, relative to economic activity and where it goes. The last time the Fed quadrupled it’s balance sheet we didn’t see much of any inflation in industries that compete on price (it seemed to happen in other industries like healthcare which do not state prices and therefore have limited competition/incentive for efficiency) and why didn’t we? Money supply is driven more by how the monetary base is leveraged up by debt in the system. The money supply sure as hell rose, but not nearly as fast as the monetary base did on a percentage basis. So loans were being made but not to the same extent relative to historical norms, and the economy grew but slowly. Meanwhile, wages barely increased for most people and slow growth kept labor demand down for the better part of the decade. We’re a “consumer economy” remember, and the consumers, aside from a little help from consumer debt, can’t spend more than they earn. So if they weren’t getting raises, where would the inflation come from? That extra money supply was not being used to buy labor, increasingly it was just finding a spot to roost, hence why money velocity just keeps falling and falling. The Fed can blowout its balance sheet all it wants, but depending on where it lands, inflation will still be limited to assets bought by the people and corporations who act like money sinks. It’s the flows that are broken, not the supply.

+trillions:) They can restore the money but it takes a lot longer to restore the flow. Inflationism is the essence of the flow, creating slightly more credit than the system needs, keeps asset prices levitating in a steady advance. The reason inflation has not shown up in CPI is the labor tradeoff, deflation in China/Mexico labor costs, which is a one time event. When the window closes and the global wage spread narrows, and the limits of automation are reached. A robot to replace a $20 hour worker is good, at $10 hour breakeven? They make credit available and cheap, which is deflationary of credit and therefore money, which was sterilized in T Bonds when it was sent to China. Money gets cheaper (too much) add a supply crisis (Covid) and you have inflation.

Granted, yes a supply crisis can create temporary inflation, but that’s the result of production idling. These factories we already have can be brought back online at any point and have the same input costs. The the capex has already been expended so to speak, so what’s going to drive up prices except demand in excess of production capacity? Unless the government starts regularly handing out checks to Americans, where is the money going to come from? A deluge of credit card debt? This situation, beyond temporary shortages, is still inherently deflationary. Budget constraints will not go away. I will not expect sticker prices in the stores to increase unless the fed dollar printing system is extended to consumers. Banks don’t buy cars for themselves, and airline CEO’s are unlikely to eat more than one hamburger a day! This expanding monetary base only serves to replace collapsing money supply as it exists under normally leveraged conditions as credit dries up. This is in order to avoid cascading bankruptcies, but unless credit is extended (and right now it’s probably ground to a halt) then the money supply is probably shrinking faster than the fed can balloon its balance sheet. That means deflation now! We’ll see about inflation in the future if conditions change.

The reason price inflation hasn’t surged is confidence in the currency hasn’t collapsed, yet (all that support fiat). This outlandish surge in dollar debasement combined with DC’s fiscal lunacy should do the trick this time. Central banks have hit the zero bound; endless debasement or deflationary collapse are now the only alternatives. Stay tuned, it won’t be different this time.

Price inflation is where you find it…

less competitive industries (medicine, which has barely been required to post prices after decades),

government subsidized industries (higher education, whose relentless tuition inflation is inevitably ratified by gvt loan limit hikes),

and, especially, asset value/interest rate tied industries like housing (where rent/home mortgage cost is similarly relentless, but more inescapable because shelter is much less optional than higher ed).

Goods inflation has been restrained because of soaring international production capacity and competition (mostly China but other countries as well).

But the Fed papers over/obscures the underlying trends via periodic interest rate guttings…which only makes the long term inflationary problems worse.

Cas your point on protected industries (government) and the amplified transfer of government wealth into corporate bonds, amidst falling revenues vs expenditures. The outcome quasi privatization? Imagine if you had to pay for your childs K-12 education?

Interesting note, on this day of record unemployment, we had another record. Today the Dow enters a new bull market, ending the shortest bear market on record. The blue-chip index achieved a gain of 20% from its low in just three trading days, for the quickest bear market low to bull market entry on record. This bear market lasted for 11 trading days, making it the shortest ever. There was just so much pent up demand for stocks, especially Boeing! LOL.

record unemployment claims

NYC ghost town

US virus infections hit record

Record discount window activity…

and the boyz stuck declare new bull market?

What good is it to bailout the airlines? People do not have much food in their pantries and are out of work.

As I understand it, the deadline for pension funds to yearly rebalance between bonds and stocks is until March 31st. So they are in the market to buy stocks along with all of the traders that are front running them.

But let’s face the facts. The individual investor has been CORRECTLY conditioned to not panic and never sell. What I find most interesting is that the stock market indexes fall to a 3 year low and everyone is pleading for a bailout.

If it be true that the little guy don’t sell well then who? Certainly not the pension funds as they took it in the shorts.

IMHO its the sovereign offshore funds, that have a 8% loss projection, and then bail out, and tip-toe back in when it look clear.

But somebody SOLD, and sold a lot. I think a lot of people do sell, especially newbies who just got their inheritance, they park it in S&P500, its a sure thing they’re told, then they lose 15% in a few days, so they sell, but when the sell they actually lost 20% cuz they sell at ‘market’. They usually don’t come back, but don’t worry cuz there are tons of new inheritances shoved in the pool daily.

Most of us have been around know well that this happens all the time, but if you HOLD really good company’s, that have a really good ‘moat’, and that pays a healthy consistent dividend, then what’s the worry?

Even during the great-depression some stocks did well.

The problem of course is Unicorn’s and Tesla, and Apple, … The problem is California mindset. Got to bail them out. Even two years ago the iPhone became the “Dud Phone” in Asia, and its not even Huawei now, everybody I see wants an OPPO now. The fact is most American products what are left, are not wanted.

The only problem is the KHC, Bayer, MMM; Sometimes even the real good companys can go down, and you don’t see it coming like the J&J fiasco.

But seriously people who did all the selling? Well we sort of know, during all the prior 3 months when TRUMP&Kushner were telling you the “flu” was no big deal, them and all their crony’s were selling.

IMHO Trump blew the stock-market sky high, and then deflated it, and he’ll probably do it again in his next term. Everybody near Trump becomes a Billionaire, and some like Kushner become a Trillionaire ( owns massive virus vaccine interests )

The Oil price war started a multi-trillion dollar margin call feedback loop. Long oil was a favorite diversification strategy, and a 30% overnight haircut meant a call from Mr. Margin. I don’t think anyone would have even modeled such a move in crude. A 30% increase, yes, but not a haircut.

‘but if you HOLD really good company’s, that have a really good ‘moat’, and that pays a healthy consistent dividend, then what’s the worry?’

Yeh. That’s right but in good ole days under the true, genuine American FREE MKT Capitalism, NOT under the Crony kind, where price discovery was actively suppressed and or made irrelevant by insane cheap credit infusion!

Going for ward in the post corona world, where do you think, the GROWTH & EARNINGS ( from which yield and dividends) will come from? You think MOAT Cos won’t be affected by Corona?

Mkts have to fall another 30 – 40% before one can even talk about FAIR prices! It is NEW post corona world. we are in uncharted waters!

Big picture the potential economic hit looks as bad as the last one. Not much of anything was fixed last time. Who is to say SP500 isn’t going back to 666 neighboorhood? Long term treasuries indicate future isn’t looking too good.

There is an umimaginable amount of new money entering the system. The only question is where will it end up. My bet is in the SP500. Even if it did end up in the hands of the working peasants (it won’t) then in that case it would only be a matter of time and raw necessity that it’s spent and trickling back up to the SP500.

Well, at least everyone is straight on what the priorities are.

“You load sixteen tons, what do you get?

Another day older and deeper in debt

Saint Peter don’t you call me, ’cause I can’t go

I owe my soul to the company store”….+ taxes, insurance, health care, CC debt, loans, car payment, rent etc etc etc

B E A U T I F U L – couldn’t say it any better

read it again SHEEPLE OF STORE

The best trap is the healthcare trap. The only way to afford to live is to work at a big corporation until you’re 65. Do anything else? You could literally die.

And the sheep learn to love their bondage and keep voting in only the people who will keep the chains tight around their throats.

We have the most immoral healthcare scam going in the world. They have a license to steal from and bankrupt the most vulnerable people in America, the sick. This system exists courtesy of our govt.

Petunia- right about bad government regulation being the cause.

EVERY market imbalance (i.e. some entity is over-paying and/or some entity has ridiculous profit margins), is caused by lack of competition. To guarantee lack of competition go to “single payer”.

The government regulators could set up a marketplace that incentivizes/requires competition. Because healthcare more and more is seen as a “right”, the government “must” (incompetently) control it even more.

A pox on the elite government peoples’ houses.

wkevinw,

I would rather have a universal system than the system we now have that only covers the better off. If you have a good source of income, you are covered, otherwise you are locked out of the system. Sorry, but I no longer trust the govt or private sector to do the right thing. We need to insist that money be spent/wasted on us before others.

Petunia-“I would rather have a universal system than the system we now have that only covers the better off. If you have a good source of income, you are covered, otherwise you are locked out of the system. Sorry, but I no longer trust the govt or private sector to do the right thing. We need to insist that money be spent/wasted on us before others.”

I guess I’m confused. We only have two choices: “govt or private sector”.

My guess about a “universal = government system”. These systems are similar to drug addiction (it takes a while for the bad side effects to show), and the advocates generally mean well(!).

First- services get more evenly distributed. Some time later: 2. lack of innovation and 3. corruption (due to lack of any market competition) starts to make the system rot.

After some time (usually years to decades), the opportunity cost gets to be obvious; like cars in Cuba.

A market needs to be defined by proper regulation for private firms to participate in.

The Canadian system covers everyone for most things at half the cost of the US. Right out the gate the US blows 8 % on insurance admin vs about 3 in Canada.

Many Americans have so little idea how the C system works it’s kind of strange. When US politico Rand Paul went to Canada’s Shouldice clinic for surgery, this apparent endorsement of its quality met with a barrage of US explanation: “It’s a private clinic!’ they explained, not one for the general public.’

OF COURSE it’s a private clinic! Almost all Canadian clinics are privately owned. And of course it does surgeries every day for the Canadian general public that will be 100% covered. Needless to say Paul wasn’t covered and chose it for its reputation.

The vast majority of Canadian doctors are in private practice. It’s only the insurance that is public. Like the rest of the developed world ex. US.

One shocker: the US price for insulin is 1000 percent of the Canuck price.

Personal anecdote: few years ago my wife had trouble breathing. Ambulance comes at 2 AM. Takes her to local hospital. Two days later she is taken by ambulance 60 miles to Victoria Jubilee. Next day has stent put near heart via wrist. Two days later discharged.

Next week back to work (office)

Total cost: zero incl ambulance.

Of course there is no free lunch. This all has to be paid for and it’s expensive.

Too expensive to waste on a zoo of private insurers.

wkevinw,

The problem with govt vs private is that eventually all systems collapse. They both get too corrupt and expensive. I have no problem with getting both govt and insurance companies out of healthcare, a real market will then take hold. But we both know healthcare is a control mechanism for govt and that’s not going to happen anytime in the future. So let’s stop pretending the current system is working and let’s cut out the most expensive layer.

St. Peter don’cha call me ’cause I can’t go…

I owe my soul to the governments, all of ’em

Just give every American citizen $1 million dollars at just 333 billion problem solved. End corruption in business and government. Or give every American citizen $1000 a month for starters.

sorry but no BI for you

Your math is a bit off. $1M per person would be $333 TRILLION.

I’m pretty sure the only thing your solution would solve would be to finally increase inflation.

SG – NBC’s Sr. mathematician

Just sitting here. Retired, no debt, plenty of cash, PMs, safe place to live. Doesn’t matter if I open my eyes, watch tv, or read the comments of dozens of people. Priorities? Yesterdays or today’s. Choices to be made? Based on what? If we are in Heck, then where do we go from here?

got enough bourbon?

Similar to DEL, but, NO,,, I didn’t invest in enough ”wine futures” when this virus event came to my attention 3 weeks ago, so not enough wine, whiskey, or even brewskis…

Lucky to be living in an era where numerous vendors will actually deliver to, my front door, whatever adult beverage I desire,,, usually the same day if I order by noon!!!

That and that alone should tell us how really and truly blessed we are,,, and, yeah, I know some people have to walk a block or two.

And don’t forget, “In wine there is wisdom, (obviously lots of wine drinkers on this site;) in beer there is strength, ditto; and in water there is bacteria –everywhere except USA, here it is PFAS, etc.)

Appalachian country people do so many things for themselves outside “the system”. Production of moonshine is one of them.

And they are good at staying under the systems radar.

In the super the other day, limit two gallons of water, but the beer cooler was well stocked and no limits whatsoever.

Yeah Buddy, RD:

I lived in TN for 16 years, and my best friend/neighbor– ever ”had a friend” who made THE very best shine I have ever tasted, before or since, at least 120 proof, (but we never did check) it was $40 per GALLON!

Friend stopped when his divorce started, and then we had to pay $60 for lesser quality…

Those were the days my friends!

This time I got one thing right. On the shelf: 7 flavors of armagnac, 3 of calvados, 2 single malts (12 & 15), Campari, grappa in the fridge, 2 dark rums, and sundry.

I have about 20 cases of homemade Asian Pear cider, juiced up to about 10% alcohol with honey. This year’s pear production is just now budding. It takes only a dozen trees or two and a bit of labor so easy that someone in their late 70’s (like me) can accomplish.

On the other hand, it does take patience.

And, guess what! You can’t buy it!

I know you are living the good life because you earned it.

However, if you are not in debt, how can the government forgive your debt or inflate it away? Or give you a debt jubilee that you can benefit from?

And how come no mention of your guns and ammo to protect yourself and your PMs? I learned my lesson in 2013 after the Newtown tragedy to make sure I have enough guns and ammo.

Your guns will be useless.

If the society collapses to the point that you would have to use your gun, armed gangs will be roaming the streets everywhere, you wont stand a chance.

Better to use you guns and ammo to protect your food supply from varmints. Oh! Wait! You don’t grow your own food? Hmmmm…

People need food, shelter, heat (in colder climes) and (apparently) human community. Without that, they seem to die. All the rest is embellishment.

So, let me elucidate my initial sentence a bit. A ‘varmint’ is something that goes after my food. That might include certain people.

couldn’t agree more

looking for NEW opportunity if FED doesn’t destroy it 1st

Like re-inventing merica supply chain to keep stuff in merica again

MAGA

to bad we can’t get corrupt congress on board to streamline re-entry

Agreed, it will be nice to sit on the porch, sip mint juleps, and watch the plantation hands have panic attacks. Good times. Maybe if I sneak over to the shotgun shacks and peek in, I can watch them cry themselves to sleep. It’s awfully cute. I don’t want to brag, but they chose their own paths.

“ Safe” is relative I have the same exact situation but I’m thinking the cash is a problem as the FED seems intent on destroying its purchasing power faster everyday

Buy insurance. Junk silver.

Buy insurance. Plant a garden !

If you’re young and fit enough invest in arms and sell insurance.

These are crazy times. While the Fed is asking the banks to hand out money to small business owners, the banks will pull back from making loans. Why? Because they have no idea if they will get repaid unless the gov’t guarantees it.

betcha I could get loan pretty much of any size I want

The BOJ balance sheet equal that of their annual GDP

we, strangely, have been following them.

So, it is not difficult to imagine the Fed balance sheet meeting our annual GDP (last was 19 Trillion) right around the $12 Trillion mark….about January 2021

I’ve been saying to my friends “We’re Japan now.”

They chuckle, give a wave of the hand, and change the subject.

From charts I have seen the 2020’s was always going to be the decade that debt and demographics were going to smack us in the face. Who knew a virus would kick it off the first year?

To be expected in the Roaring Twenties.

The observation about demographics is correct. The total fertility rate is the number of children a woman is expected to have in her lifetime. For a stable domestic population, or in other words exactly zero population growth without immigration, it needs to be about 2.1000 per woman, as some newborn babies do not survive to reach adulthood. In the USA in 2018, it was only 1.7295, and it has been declining steadily for years.

That may not sound so bad, but it’s less than 83% of the babes needed just to get to zero population growth. Without immigration, we’ll be the next Japan. The compound interest effect is brutal.

If there were 1000 mothers in a village with our total fertility rate of 1.7295, and it held constant, the next generation would have 823 mothers, the second next generation would have 678 mothers, and the third one would have 558 mothers. It’s like coronavirus in reverse, with a time scale measured in decades rather than weeks.

We have been, in essence, doing the same thing with motherhood that corporations have been doing with manufacturing: we have outsourced production to cheaper foreign labor.

It’s also darn hard to find this information. The latest stuff I could find was here, on page 23, Table 8:

https://www.cdc.gov/nchs/data/nvsr/nvsr68/nvsr68_13-508.pdf

An older report is here:

https://www.cdc.gov/nchs/data/nvsr/nvsr68/nvsr68_01-508.pdf

The TFR dropped from 1.7655 in 2017 to 1.7295 in 2018, or about 2% a year, which is about the long term trendline. IOW, the rate of change is also negative, i.e. the problem is getting worse over time.

An extra $1200 per person won’t do anything to solve this problem.

That explains the V shaped recovery in the markets. So much for them being “out of ammo.” Hopefully the Fed can keep us out of another bear market for another decade. Apparently, you can marvel, criticize, but not fight the Fed. I am learning to wait for a stock market crash, and the day the Fed takes action, you buy like crazy. Got it. Things really aren’t different this time.

if you think MMT is ammo then think again

setting up new world order with SDR as settlement currency

meaning u.s. $$$ is toast

My personal opinion is the SDR will split the financial world into those that use it and those that don’t(do not mean those that can’t use it). It will be a big boost to currencies not in the basket, because they become the obvious alternatives to the currencies that are in the basket.

Instead of crypto, it will be other currencies fueling commerce. While the IMF manipulates relative values in the basket, the rest of the world will be transacting outside of their system. Just like the end of the Roman empire.

… and some of us in macro economies of our own devising will be transacting without regard to any of the conventional currencies.

I always wondered what the Fed would do if it ran out of bullets. Now we know – a Super Soaker.

When they float SDR they will double the global monetary base. SDR is issued on top of sovereign, not in lieu of. Dow 40K instantly.

There is a theory that dispersed risk is safer than concentrated risk. It’s all riding on central banks now. If they make a big mistake it takes us all down with them.

OS – That is one heckuva observation! Kind of like putting everything you’ve got in one blue chip – Boeing for example, or maybe GE.

I wonder why theres a need for the markets or wall street anymore? If the fed can conjure up money to buy anything and everything with no worries whatsoever about the downstream of it all, of what possible use are traders?

Can’t help snickering at trump who told us this isn’t a socialist country. Look at that moron now. Hes quite good at socialism! Makes Bernie look like a piker lol.

My understanding is Fed is creating cash and shoving it out into the world by buying up assets. It is like a hot potato in that nobody likes holding it when assets are appreciating but it is like oxygen when asset prices start falling. Can’t live long without it.

I’ll take a cold, freshly dug home-grown potato, over a hot exploded Fed spud and day …

‘any’ day ..

sorry, need moar cofefee.

“I wonder why there’s a need for the markets or wall street anymore? If the fed can conjure up money to buy anything and everything with no worries whatsoever about the downstream of it all, of what possible use are traders?”

Just a logical step farther and you reach the historical terminus: “Official” money is Degraded near to worthless. Barter for awhile, then (historically) transact using gold and silver as the abstract representation hard money) for actual goods and services.

Or just work for a bowl of soup. Until you die.

So where does the fed get these trillions of dollars to buy up all these assets?

They digitally create it.

It’s not money. It’s nothing.

Money is many things. It’s primarily an accounting fiction. In situations where you’re required to have it, money gets real when you don’t have any.

It’s power. Power of the Fed, banks, and those receiving the ‘nothing’ over those who do not receive the ‘nothing’. The former get to make the rules and call the shots. The latter must work.

They have someone make them in the back room.

“Money Market Mutual Fund Liquidity Facility: $30.6 billion”

Consider transfering any money market funds to FDIC insured bank accounts.

Why? The Fed. It can’t fail.

Better yet Get it OUT of the bank and into physical Precious Metals When you have people from the FDIC coming out and announcing not to worry I’m worrying even more

Quality wampus, always increasing in value.

Duh – wampum not wampus.

Now there is a neat channel to write off gains on Wall Street against losses on real estate investments for America’s richest real estate investors. It will cost taxpapers an estimated $170 billion. Meanwhile, they turned down a potential arrangement with GE and Ventac to manufacture ventilators for $1bn. Can’t have anything going to the plebs without a huge cut for themselves.

Per NYT:

Senate Republicans inserted an easy-to-overlook provision on page 203 of the 880-page bill that would permit wealthy investors to use losses generated by real estate to minimize their taxes on profits from things like investments in the stock market. The estimated cost of the change over 10 years is $170 billion.

Under the existing tax code, when real estate investors generate losses from gradually writing down the value of their properties, a process known as depreciation, they can use some of those losses to offset other taxes. The result is that people can enjoy big tax breaks stemming from only-on-paper losses, even if they enjoy big cash profits in the real world.

But the use of those losses was limited by the 2017 tax-cut package. The losses could be used only to shelter the first $500,000 of a married couple’s nonbusiness income, such as capital gains from investments. Any leftover losses got rolled over to future years.

The new stimulus bill lifts that restriction for three years — this year, and two retroactive years — a boon for couples with more than $500,000 in annual capital gains or income from sources other than their business. That group comprises the top 1 percent of taxpayers, according to Internal Revenue Service data.

A draft congressional analysis this week found that the change is the second-biggest tax giveaway in the $2 trillion stimulus package.

They did the same trick for the big Home. Builders in 2009. That is why you should never buy a home from Toll Brothers.

Depreciation and capital losses are not giveaways. Sort of like giving money to charity or social benefit programs and deducting it from gross income is not a giveaway.

The ‘cost’ of doing this is not a cost, it just means the government takes less of what is yours. The idea that anything that reduces the government take is a cost or a loss to the government has been embedded in the collective psyche, as has the idea that any amount the government spends benefits the nation.

“the government takes less of what is yours”.

They got huge tax breaks since 2001, then cleaned out the cash registers with buybacks while loading up their companies with debt, and now demand that the government refill the void with taxpayer funds. If they want handouts, it is not strictly “theirs”.

Some surely did. I’ve been railing on against buybacks for the last 15 years. Nobody seemed to think they were a racket except a few renegade analysts. Real analysts.

The government now officially owns the US economy. So much for anything I was taught earning my finance degree at the University of Illinois fifty years ago. Its all gone.

Next up……five year plans. Comrades.

The Fed is not the government.

Correct they aren’t I thought by now everyone knew this Especially Wolf Street followers who tend to be more awake

Every central bank has driven interest rates to zero, enabling deficit creating governments, the governments that empower them, to borrow at zero, to the delight of those governments.

The Fed is not the government? A distinction without a difference.

The Fed is not the government.

I think they are. They are management.

DP,

“The Fed is not the government.”

The Fed is a hybrid organization.

The Federal Reserve Board of Governors is an agency of the US government. Powell and the other members of the Board of Governors are federal employees with federal paycheck and federal pensions.

The 12 regional Federal Reserve Banks, such as the New York Fed or the San Francisco Fed, are private organizations owned by the banks in their districts.

Wolf- thanks for they “hybrid organization” statement.

They are often called “quasi-government” organizations. Several have regulations that carry force of law: environmental organizations (for water testing-WEF), medical organizations (for treatment standards-AMA), etc.

The Fed is one of those.

The Fed is a Hydra, gobbling up all sustenance from the Commons .. and grifting it to its’ close buddies in Crime ! .. both Corporate & Gov.

Fixed

Isn’t the “ownership” divided up among the 12 regional banks according to their capitalization? I assume that gives the whole pie to the NY Fed – except for 11 little tiny slices.

Lisa_Hooker,

Maybe I misunderstood your question. So I’ll try:

Each regional FRB is owned by the banks in its own district.

The New York Fed is owned by the banks in the State of New York, part of New Jersey, and Puerto Rico. That’s Goldman, JPM, etc., but also banks in Puerto Rico. They’re the owners of the NY Fed. Each one of these banks owns shares of the New York Fed. How many shares each owns depends on the size of the bank. These banks vote for the board members at the NY Fed.

The FRB of San Francisco is owned by banks in its district, which spans Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington, plus American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands.

“The Fed is not the government.”

Close enough. They were created by the government, with a support from private party banker beneficiaries of course. They are condoned, protected and supported by the government.

Five year plans have worked marvellously for the Chinese as they picked up all the manufacturing we decided we no longer needed and that people with degrees in finance were more worthy than people with degrees in engineering or science subjects….

That the bean counter and the speculator were more important than the innovator.

Maybe not such a bad thing, then those 5 year plans?

China is being run by engineers. The USA is being run by lawyers. Would you expect different results from what we have now?

I don’t think that’s the difference.

U.S. capitalism is being run by managers with a very short-term, lowest cost goal. Exporting expertise and jobs pays.

Chinese capitalism is being run in a mercantilist fashion by government strategists. Building expertise and jobs gets you a promotion. The government helps in it’s key 5-year-plan areas of business as much as it possibly can.

The U.S. system might work better if China didn’t have a heavy hand on the scale, but even if China desisted, U.S. manufacturing jobs would still flow overseas because employees and localities don’t have a voice against the overriding goal of “shareholder value”. The flow is much slower out from a country like Germany in large part because everyone has a voice in the board room. They’ve protected their machine tool industry, for instance, while the U.S. just let it disappear (a lot of it) in the ’80’s.

David Kinley Hall…

finance, supply demand price discovery, a Fed held to its mandates…

dream world

All the brainiacs in government and PhDs in economics seem to think in macro economic terms and are fools at the street level. At the street level it is about incentives to get your rear out of bed and to go play ball in the economic game. Being a tax donkey or debt slave loses its appeal after a while and more people crawl up into the wagon instead of pull it.

After a while some donkeys figure out that the carrot is always out of reach.

Lisa-thanks! (…and I bellow a hearty: “Hee-Haw!!!”).

may we all find a better day.

Setting up the next giant bubble. Early ground work…locked and loaded. Much like Fast and Furious, we need every sequel to be grander and worst than the one before it.

Blockchain education on the double

Watch the dollar. Traders are praying they can get out close to the 103 mark not 99. They will have to capitulate if they can’t . The dollar sinks and there goes your buying power. The invisible silent hand of the market place clutches gold not fiat. Fiat has not been re- invented. Neither a lender nor a borrower you be. It’s an old true story.Buckel up cup cake. For the record this may be a bear market correction. Go back to 1929 and put the eyeballs on what happened in the stock market in 1929 forward.

Lol, during the next selloff, when the dollar rises again, I will laugh at this post.

But you “ know NOTHING” as our beloved Mr Cramer would shout

I bet you will. You’re good at sneering at people.

Hysterical laughter through your tears.

Bold words for a keyboard warrior.

Dr. Doom:

With the Fed’s unlimited Repo, holders of Japanese Gov Bonds are refusing to sell their JGBonds because they can use the JGB for collateral in the Fed’s Repo to borrow USD (T-Bills) cheaply (@ 0% or negative%).

The Fed may have created unlimited demand for USD!

Is this by accident or by design?

You are correct. But why would anyone want to buy the dollar , given that the US will probably run a 4 trillion dollar deficit. And the FEd is determined to keep interest rates at irrationally low levels , so expect the Fed will be the only buyer of Treasuries. .

Because the world is based on dollars and we have a shortage since 2015 much less now.

Rcohon:

To front run Fed and take free money being offered by Fed that for now refuses to sell T-Bills below par (0%) even though market pricing T-Bills at negative % or below par. It is an Arb trade.

Pretty much sums it all up Dr Rubini

The Fed is like a giant Borg cube space ship. They drop out of warp speed and proceed to annihilate every prudent saver who resists. Then they assimilate every weak wall street banker and crony money manager, and warp out until the next crisis.

Fine Print……yes yes indeed. Save? that’s so 20th century.

This helicopter money eliminates interest rate pricing in the bond market.

The yield curve is whatever the Fed says it is.

The yield curve says no inflation for 10 years.

What could possibly go wrong?

We will have shortages due to supply chain interruptions.

This will lead to higher prices (exception oil).

The price rises will be explained away, though real.

Before the drop, YOY inflation was 2% or higher. Yet Powell was saying how well the economy was doing. So why rates held below inflation then, if everything so go then?

Central bankers are immune from inflation, they have their inflation protected pensions….courtesy of us…but what of us?

The Fed is doing nothing. Amazing how the short squeeze no volume is being blamed on nonevents. Come on try harder. Markets need to rise inside a bear market.

Or basically I am saying it’s all sentiment based on selling volume losing interest with prices so low. It creates a low volume environment until prices rise high enough for shorting.

The most vicious rallies are bear market rallies.

I agree. This is a classic bear market rally. The market will test new bottoms for sure.

Listening earlier today to Nancy:

‘We can go bigger!’ Nancy Pelosi hints at a SECOND round of emergency checks to all Americans saying ‘we haven’t seen the end of direct payments’ as unemployment hits 3.3 million.

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Looks like we are going for the total catastrophe of the currency.

Yeah right and 75 cents of every dollar they spend goes to Wall Street

It is amazing. They just authorized a $6.2 trillion bailout package and there will be more. There are still a lot of companies that will need hand outs. The car manufacturers haven’t even asked yet. This will be unbelievable. I wonder what will be written in the history books.

Wolf; Only my second time commenting, but a long time reader. The news about US troops being possibly sent to the Canadian border . I’ve coined a new name for people who might want to leave the US in the coming crisis- Daft Dodgers! I know it is off topic, but I just couldn’t resist! Sorry! (Yes, I’m a Canadian!)

Mad:

It is the only way to force Mr. Open Borders to actually close his borders!

Yes, that is our very own pot smoking PM!

Mad Puppy,

I think it’s important to read more than just the headlines on these kinds of stories — to in fact read the whole and entire story to see what it says.

Here from the WSJ today:

“The Trump administration dropped its consideration of plans to send U.S. military forces to the Canadian border to help with efforts to combat the new coronavirus, a U.S. official said Thursday, disclosing that decision after Canadian officials had strenuously objected to the idea.”

https://www.wsj.com/articles/canada-objects-to-u-s-plan-to-put-troops-at-border-11585247654

Nice to know the Trump/Rev. Jim Jones Administration listens to our Canadian brethren to the North once in a while.

As a resident of Seattle, Martin Luther King JR. County we already have a heavy military presence in Western Washington combined of

Fort Lewis Army Base

McChord Airforce Base

Whidbey Island Naval Air Station

Bangor Nuclear Submarine Base

There’s more to add to that list.

The NW region is handling this crisis remarkably well from a personal health point of view. There are equipment supply issues for sure, but the hospitals are not overflowing, yet. My friend who is a medical employee working at Harborview Medical Center is NOT looking forward to going back to work next week. I remember hearing complaints about mid/upper level management by my friend in the very recent past I might add.

Layoffs have hit Seattle and the region HARD this week.

This, as Seattle has positioned itself in many respects as the Tourism/Tech Hub economy poster child for the Jeff Bezos Cult.

We already have a Houseless crisis, I can’t wait to see what’s around the corner this summer. It makes me shudder to think of it.

The tourism/local food&bar industry is devastated, along with the Cruise Ship business cancellations(presumably). Pro sports(Mariners, Sounders, Seahawks) who knows?

Hat tip to the City of Seattle, for almost doubling the size of the downtown Convention Center starting last year. I hope it gets used in the next five years. They seem to have picked up the pace on construction remarkably enough given the current environment.

To add an overt troop presence at the border would be absurd. That’s what US Customs and ICE does. And quite thoroughly I might add. They caught Ahmed Ressam after all. Go Team!

The fact that the crooks in DC and the Statehouses don’t see the writing on the wall is really quite astonishing. Did I mention these people who are now “taking one for the team” are armed, many well armed. Forget what happened in ’08 & ’09, this is “Fool me once, shame on you, fool me twice, shame on me” time. Aren’t we a prideful people we Americans? I thought we were.

I’m a pacifist myself, full disclosure.

In summary, Its going to be a summer of the ages coming to a town near you. At least there won’t be any tourists, oh wait!…..

.

Inserting troops and other absurdityies with funs

My apologies, Wolf. I usually give great consideration to all elements of the ongoing discussion. Not dogmatic, just in need of a bit of levity in these trying times!

Mad Puppy, no problem, and I did see the humor in your comment — the “Daft Dodgers — which made me smile. Humor is good, especially in these times.

Considering the fact that Westchester County, NY alone has more coronavirus cases than all of Canada, maybe it is Canada that should send troops to its southern border, if it had a decent sized army. Westchester County is where many of Wall St.’s senior executives live and has some of the highest property taxes in the US.

Historically, countries have always feared foreign troops massed at their borders. Rightly so.

Trump is worried that Canada will invade and burn the White House down like they did in 1814.

He likes to threaten America’s allies. It gets him a lot of attention. Besides, he’s more comfortable with autocracies.

OTOH, Canada has oil and can be smeared for being socialist. That makes it low-hanging fruit.

Unamused,

At the risk of yelling beyond my wheelhouse, it will be decades (perhaps never) for the ill feelings created by Trump to dissipate.

We have learned never to equate the American people with their politicians and corporate privateers, but it has been getting much harder to do these past few years.

I used to think people were pretty much the same world over when you scratched down to the basics. Then I saw what happens when you replace tinfoil with red ball caps. Now, not so sure.

He didn’t create those social divisions, Paulo. He just cultivated them and exploited them. It’s an old tradition in the US, going back to its founding. Without those social divisions the South would not have had enough soldiers to fight the Civil War.

It’s never been a secret:

Mother Nature was on our side and she let loose a hurricane and tornado. The rain helped put out fires. But it messed up the British ships, and they returned to them. -24 August 1814

“If the Fed had sent that $942 billion it created over the past two weeks to the 130 million households in the US, each household would have received $7,250. But that didn’t happen. That was helicopter money for Wall Street.”

After this , Powell is able to say “”The Federal Reserve is working hard to support you now,” on NBC’s “TODAY”

How cheap can one get…

Will we get a “Go Eat Cake” moment?

Will we get a “Go Eat Cake” moment?

You’ve already had several. You just can’t take a hint.

“You’ve already had several.” Agreed.

Let me ask differently

When will we have a “last straw on the camel’s back” moment?

Clearly what the Fed is not sustainable and cannot go on for ever. There will come a moment when all your intervention or tools will not stem the tide or there will be pitchforks.

Nobody can do anything about it because they’ve bought off or excluded everybody who would or could, so it doesn’t have to be sustainable. You’re the camel, not them. They’re not afraid of pitchforks. They have a deal.

Next up : Brunch !

Stimulus Bill Allows Federal Reserve to Conduct Meetings in Secret; Gives Fed $454 Billion Slush Fund for Wall Street Bailouts

“Why does the Federal Reserve need $454 billion from the U.S. taxpayer to bail out Wall Street when it has the power to create money out of thin air and has already dumped more than $9 trillion cumulatively in revolving loans to prop up Wall Street’s trading houses since September 17, 2019 – long before there was any diagnosis of coronavirus anywhere in the world.

The Fed needs that money to create more Special Purpose Vehicles (SPVs) — the same device used by Enron to hide its toxic debt off its balance sheet before it went belly up. With the taxpayers’ money taking a 10 percent stake in the various Wall Street bailout programs offered by the Fed, structured as SPVs, the Fed can keep these dark pools off its balance sheet while levering them up 10-fold.”

https://wallstreetonparade.com/2020/03/stimulus-bill-allows-federal-reserve-to-conduct-meetings-in-secret-gives-fed-454-billion-slush-fund-for-wall-street-bailouts/

No, BS. I explained this already days ago. See link below.

#1. The money the Fed lends to these SPVs is on the Fed’s balance sheet. I just discussed that in today’s article (above). They’re under the line item “Loans.”

#2. The Fed needs this money from the US Treasury as loss protection. The US Treasury has to provide the equity in these SPVs so that when losses occur, the Treasury (taxpayer) takes those losses and not the Fed. It’s part of Section 13(3) of the Federal Reserve Act.

This is not a secret. I explained this here:

https://wolfstreet.com/2020/03/23/what-are-all-the-feds-corporate-investor-bailout-programs-and-spvs/

There are a lot of things to gripe about in terms of these bailouts. It’s not necessary to just make up stuff.

You don’t want to be in cash or bonds here. You really, really don’t. Buy stocks while you can. Dollar cost average over the next several weeks. Otherwise you are going to get fleeced.

We can complain, or we can take action to protect our wealth. It is a choice.

No, sentiment is more important. You want to load up when the market becomes profitable to short again. Monday, it was becoming tough to short.

Keep:

For large cash sums, you do not want to take the risks involved in parking your cash with a bank. Safer to buy US T-Bills even if negative %.

The part about stocks well. … . My stocks are killing me!

I get the T-Bills, even negative – return of capital.

Just thinking about this one –

If one is possibly closing on a house in 30 days or less, all cash deal, where would one best keep it? Cashiers checks from multiple banks?

Thank you in advance!

30 days is a very short time frame, I keep large sums like a house down payment (or cash buy) in a Treasury Money Market fund. You could also spread it across FDIC insured bank accounts, but that is not very efficient.

Close the deal and it will be held in escrow. You get the house and lose the problem. :-)

Well good luck to you if you want to play in this insane casino.

You may well get lucky make money and if you do you will no doubt count yourself an investing guru; one of the smart guys who saw an opportunity and acted.

But be aware of the fact…you just got lucky. Nothing more.

All the fed and has done is save the essential pillars of the world economy to stave of a world depression. All the other crap below is still going to implode and lead the world, shortly, in to a greater recession.

The fastest move back to a “bull market” ever after the fastest drop in to a bear market is just an extreme version of all other bear markets given the extreme moves by central banks.

I would suggest that we all heed history because his time is never that different.

Wall Street gets the bulk of the help, and Main Street gets crumbs. Big Surprise? Not really. However, despite all this money printing US dollar fallen what 2% against other currencies. How long can they print money to artificially support the dollar values of public companies with no customers, workers, cash flow but lots of losses? I don’t know, but the end may come quicker than we think at this rate of printing.

Augusto:

The Fed only needs to print a little slower than the rest of the world’s central bankers!

All I can say us that all this vast amount of future money being spent is obscene beyond words.

How are we ever going to pay back all this debt and QE?

In my part of the country, most things are shut down. The numbers of COVID-19 are now in the hundreds and double roughly every 4-5 days. Simple graphing says we are about a month away from an Italy- Spain deluge

Even healthcare is not immune to this financial squeeze. The ER is very light, the hospital semi-deserted. All routine procedures have been shut down, as we wait for the deluge.

I saw Kashkari on 60 Minutes almost screaming “we will print MORE MONEY! Whatever you need!”

Ugh. All the bulls and dip buyers and “you can’t fight the Fed” folks (yes Wendy, welcome back). forget a few key facts:

1. Money is not going to cure this pandemic.

2. If the pandemic drags on for more than a few months (and it absolutely will, see note above about graphing the numbers) another panic will set in. The answer will be obvious- throw more trillions at it

3. Does anybody remember that the only thing that we produce that the rest of the world really wants is the US Dollar? What happens when the Fed creates a gazillion trillion dollars out of nothing? I predict that’s when the USD turns into US Zollars

Amen. As Bill Gates pointed out if infected areas are reopened in April, the virus will grow very rapidly, particularly because we have no idea where the virus has traveled: e.g., possibly with the fleeing New Yorkers. Too many people just do not comprehend the growth rate of this virus due to its extreme infectiousness if there is no absolute lock down (except for essential travel/delivery.)

As so many recommended, and Bill Gates just recommended, the country must shut down, except for absolutely essential services like food delivery, medical care, etc.: that is the fastest way to reduce the number of cases of infected and total deaths before the virus overwhelms more and more medical systems in more and more counties. This gigantic price and the gigantic price of very extensive testing in such a populous nation must be paid to minimize the harm to the USA.

Thank god for Bill Gates! I hope people with less understanding will listen to him. The incremental changes “so we do not devastate the economy that much” proposed by others will be disastrous if Bill Gates is ignored too.

I forgot to add the solution to the financial disaster caused by this epidemic is medical (a national lock down, because we will not partition the country or create blocks at county lines), not financial. That is why these bailouts will not work as the prior commented stated.

All inbound international travel must be stopped or travelers must be quarantined for long enough to make sure that they are not infected and then not infectious.

Bill Gates’ interests are not your interests.

Mike:

Re: Bill Gates

Easy for him to say “shut it down”.

The country could shut down and BG wouldn’t feel a thing….not so much for the rabble…….

If it carries on for months there will be a pandemic of mental health issues, violence and all kinds of societal repercussions.

People will NOT stay indoors for anything approaching this length of time, unless you physically force them to.

Still – it appears the stockmarket is stabilized. And apparently that’s the apogee of human endeavor these days. Keep them speculators sweet, so their largesse will continue to provide us with low-paid retail and service work they need from us.

So that’s OK then.

No, people will not stay indoors.

Usually at the noon hour on a weekday, there are not that many people outside by the Mississippi and lakes in Minneapolis. But today and for the last couple days there have been the same numbers as one would expect on a Saturday afternoon.

Minneapolis is closing off River Road alongside the downtown to motorized traffic in order to open up more space for pedestrians, runners and cyclists to get out and exercise.

Moment of zen @ 1:30 today: slowed down a bit on my bicycle as I rode around Lake Nokomis to watch a bald eagle enjoying a fish for lunch while it stood on an ice patch 30 to 35 meters from shore! Good times for the eagle. Not so much for fish.

Outside wide open areas must be created for people to exercise with fines for approaching too closely. The sun’s UV light eventually kills the virus.

Aside from providing some protection to wearers,even home made face masks can catch most sneezes and coughs. People are not standing far enough away and a powerful cough or sneeze could aerozalize the coronavirus to stay in air up to 3 hours.

Their use would reduce the infection’s growth rate. That is why the apparent war against any face masks in the US is foolish.

Outrageous acts of the FED should be no surprise at all when you consider their past acts, and the amount of equally outrageous cover they have been given for those past acts by otherwise very intelligent people.

1) The Fed offer $1T repo/day, but there are no takers.

2) In Jan 2020 junk was beautiful, but in Mar junk is junk.

3) Only US treasury can provide fresh new supply of 3M, 6M…10Y ==> good collateral for repo.

4) US 10Y minus the German 10Y @ nadir, @ capitulation.

5) When US treasury will replenish the empty shelves, US 10Y minus the German 10Y will popup.

6) The Fed will sell 3M from every corner store.

7) The first corner store will open on……

In 2020, the US economy was a ponzi scheme of over-inflated asset prices.

The use of neoclassical economics and the belief in free markets, made them think that over-inflated asset prices represented real wealth accumulation.

The FED are trying to maintain the illusion over-inflated asset prices represent real wealth accumulation, but it’s not easy.

They are doing the best they can.

At the end of the 1920s, the US was a ponzi scheme of over-inflated asset prices.

The use of neoclassical economics and the belief in free markets, made them think that over-inflated asset prices represented real wealth accumulation.

1929 – Wakey, wakey time

This is what the FED are trying to avoid.

Today I purchased thousands of “forever” stamps at the Post Office. Some day when stamps cost $100 each thanks to MMT I will sell them for a fortune. ;-)

You’re assuming the PO will still be around. At this point it’s not a good bet. Their pension fund is over funded and that makes it a target.

Fed’s assets spike to high heaven to bail out the imploded Everything Bubble it had worked so hard to inflate over the past decade.

I like my theory: they created a problem just so it would cost trillions to solve it.

Boom-bust cycles are the traditional method of consolidating and confiscating the world’s wealth. It takes a lot of capital misallocation and correct positioning. Sometimes it backfires on the tycoons when it gets out of control, as it did in 1929. Since then they’ve learned their lesson and aren’t going to let that happen again. They figured out that all they have to do is throw enough taxpayer money at themselves, and anybody who tries to stop them gets paid off or bankrupted. Sometimes both.

They were careful to load up everybody with debt and get fraud legalised. The difficulty for them this time was that The Plague forced their hand before they were ready. So they had to accelerate the program, even though it meant exposing themselves. But the crash would have happened anyway, and it would still have been big enough so they wouldn’t have to keep repeating the cycle.

The US Treasury used to fill the role now taken by the Fed, which took over because Treasury wouldn’t play ball. The bankers couldn’t have simply privatised the Treasury because that would have made the game too obvious.

Conspiracy theory, you might say, but as Stephen Jay Gould correctly pointed out, sometimes a theory is also a fact. It all makes sense when you realise that pathological greed really is infinite.

Futures are down again. Maybe they need more trillions.

By accident or otherwise, events are showing the Fed is moving ever closer to what we can observe:

The Fed doesn’t care about the “economy” and neither does Wall Street.

The Fed only cares about Wall Street and the rich.

Soon, there may be no economy.

So what? Who cares? Not the Fed. Not Wall Street. As long as there is the Fed with QE, rate suppression, and endless bailouts for stock buy backing Wall Street and assorted shenanigans, all is well and Fed World and The Land of Wall Street.

If the Fed can make the stocks go with no economy to speak off, it’s MISSION ACOMPLISHED.

Soon, there may be no economy.

They were liquidating the US economy anyway. That’s what off-shoring, share buybacks, tax cuts for the rich, tax evasion, and legalised white collar crime are for. This just speeds up the exsanguination.

They’re not in favor of abolishing the economy. They just want to shrink it down to the size where they can drown it in the bathtub.

Mr. Market is having a sad. Either he needs changing or it’s time for another feeding.

Unamused- basically we agree.

The entity with the power is the government. If all these elite (“white collar”) bad-actors would meet legal, negative incentives (e.g. fines, jail, bankruptcy), a lot (all?) would be solved.

The buck stops at the government. They have sold out.

(further wonky note: the growth in financial activity since ~1850 has made it so the loot can move around on paper or electronically. Prior to that the only significant way to preserve/carry wealth was via resources- land mostly.)

The entity with the power is the government.

Maybe you just haven’t been paying attention. The entity with the power is the banking cartel and other transnational corporatists. The government is merely their proxy.

The buck stops at the government. They have sold out.

Not the Chosen One. He’s above the law, cashing in and looking forward to a promotion.

Unamused- “Maybe you just haven’t been paying attention. The entity with the power is the banking cartel and other transnational corporatists. The government is merely their proxy.”

The banking cartel only has power that the government sold out to them. The government voluntarily gets hired to be a proxy.

The government has any and all power (force of law) needed to correct/prevent this.

You’re blaming the victim, wkevinw. The corporatists who have corrupted your government appreciate that.

The group you refer to cares little about the “economy.”

They care about ownership.

The FED is there to make sure ownership is in the right hands.

I’m aware that you know this. Just a little clarity.

Unamused: “You’re blaming the victim, wkevinw. The corporatists who have corrupted your government appreciate that.”

So the “corporatists” victimized the people controlling the largest budget, biggest law enforcement, legal/judicial system and military in the history of the world.

OK, that’s a good one.

wkevinw said:

So the “corporatists” victimized the people controlling the largest budget, biggest law enforcement, legal/judicial system and military in the history of the world.

OK, that’s a good one.

__________________________________________

No,,,, the corporatists bought the people controlling the largest budget, etc.

It is the taxpayer and citizens that they victimized.

For the conspiracy theorists, David Adair talks about his 1% conversations and where all the money is going.

YT

Venezuela’s only satellite… whoops … just went out of orbit and is not transmitting. Coincidental timing to announced prize for Maduro arrest.

Folks make the most of the internet, we may see satellite reductions.

YT

Rocket Engineer Whistleblower Reveals Secret E.T. Technology at Area 51

“pathological greed really is infinite.”

IMO that fundamental truth is the Achilles heel of capitalism. There’s nothing better though – borrowing from Churchill: Capitalism is the worst economic system in the world – except for any other.

The achillies heel of Capitalism is concentrated wealth and power.

Churchill had a catchy way with words, but that doesn’t make him right. I don’t know what country we could point to support his dictum. Great Brittain was a Fuedal society that evolved to a landed aristocracy. They used a powerful military force to control a large part of the earth and it’s resources. Was that Capitalism?

The US has been a mixed economy with a great deal of Socialism, perhaps more for the rich than for the poor.

Capitalism is a wonderful sytem ………….. as long as you have a good amount of capital. If you don’t have capital, then you are left with renting yourself to one that does.

Cb:

The source of Bristish power came from being the first to create a central bank along with the legal concept of corporations.

This provided the British with the ability to borrow to finance wars that others could not afford.

The rest is history!

“It is easier to imagine the end of the world than the end of Capitalism.” -Mark Fischer

Looks like we’ll need a fresh Dark Age to ruminate on our mistakes.

Wolf….

You say repo activity is down…

But discount window seems to have been resurrected and is quite busy…

any thoughts on this?

Yes, the Fed has been publicly hammering on the banks to start borrowing at the discount window and it lowered the rate to 0.25%. And so the banks are finally doing it. That is a smoother place for banks to borrow than in the repo market. They should have done it all along. That’s what the discount window is for.

Agreed, but where is their penalty for constant use? Isnt that part of the deal, keep your house in order?

Also, is the backstopping of money markets and commercial paper also taking the activity out of the REPO facility?

Thanks.

In the old days, borrowing from the discount window was the walk of shame. It meant no other bank would lend to you. Now its free money.

With these measures they make the biggest bubble of all time grow even bigger. The account will come shortly….

Good luck to all the people from Greece. Corona virus it’not for laugh.

in 1960 the average factory wage was $6400. You could buy a nice 3 bedroom 2 bath home for 18 to 20,000. a new car for 2500. For the last 40 or so years all of the increases in productivity has flowed to capital with very little to labor. Result half of Americans earn 25 to 30 thousand instead of 80,000 that they would need to keep the same metric from 1960. Wolf you’re the data man. Would love to see you do a study on this.

I just came across an ad for a web developer job (not exactly a “low skilled” role) where the hourly pay range starts at TEN dollars an hour — https://www.indeed.com/m/viewjob?jk=01e0df7bbdd91418&from=web&tk=1e4e52m9mnkl6800&dupclk=0

Considering that I earned $12/hr as a secretary in Boston back in 1992 (and $15/hr in 1996), I’d say there’s something seriously wrong here.

The pay range in the ad: $10-$15. This is “fully remote” — in other words, you can be in India to do this job. In India, this is pretty good pay.

It is also a good pay in Brazil .

Yes, in many places.

The US had very little economic competition in 1960 because the rest of the world was recovering from WW2. Low level factory work can be done anywhere in the world now, their is much more competition for basic labor in the US. It will never be like 1960 again.

the “healthcare trap” is why i gave up being self employed. . it doesn’t make sense for me to juggle clients and pay about $1000 per month more in healthcare expenses.

With Medicare For All you wouldn’t have had that problem. Without it, people can be coerced into giving up their independence to work for employers who can provide medical insurance, making people dependent. Cheap-Labor Conservatives fight any kind of social program because those reduce their control over labor, and control of labor is an overriding consideration. There are many examples.

It all starts with health. The most basic decency to be provided for anyone you care about, or any fellow citizen is to make sure they are cared for when ill. It would seem to be a hallmark of a civilized country.

But what do I know. I havn’t been sufficiently indoctrinated with rugged individualism.

The problem is the linkage of employment to health insurance. This should be completely unlinked and market based. If people were paying the cost of their own insurance completely out of pocket, costs would plummet. One of the fundamental problems with the US system is that the end user doesn’t pay for insurance. This promotes wasteful behavior.

If it’s a free market you want, why promote the insurance collective. Just go direct and have the end user pay for health care.

They don’t send the money it is imaginary money, aka it doesn’t really exist, and if they had to actually print it to make it real money the inflation would rise so high it would be ridiculous even compared to current inflation.

And while yes, the government could expend that ammount on real money, why would they?

It would be a different tale if elections were close by… oh wait, they are!

Does anybody know what it would cost a person to be hospitalized and treated for Covid19? Those on Medicare would pay? Blue Cross catastrophic? No insurance? Would the debt be worse than?

Bankruptcy assured.

This year my Medicare Advantage plan has an upper limit on out of pocket expenses of $4,900. For people without insurance, a stay in the hospital for Covid-19 would probably bankrupt many households. I don’t know what medical costs related to the virus that the new stimulus bill would cover other than testing.

It would depend on length of stay. And level of care. And deductible. Uninsured people typically don’t pay for acute hospital care, collections from people without insurance are in single digit percentages for most hospital systems. The bill for a 20 day stay with significant ICU care would be tens of thousands of dollars, possibly more than 100K, but no one would pay that amount. A few unlucky uninsured people with assets might declare bankruptcy. Most uninsured have no assets and don’t declare bankruptcy, they just wait the debt out and never pay it, or settle with a collection agency for pennies on the dollar.

Happy1:

I wonder what the average hospital bill is for the Italians that have been hard hit?

Mr. Richter:

Isn’t “MC101” in Italy?

Couldn’t that commenter give some insights into the hospital charges the Italians face??

I did a hasty review of the 880 page passed “emergency” bill and copied and pasted what looked questionable, with amounts where identified. Added what department apparently benefited as best I could. If you have a problem with these, don’t complain to me, call your representative.

ANIMAL AND PLANT HEALTH INSPECTION SERVICE $55,000,000

EDUCATION STABILIZATION FUND

EDU ‘‘Student Aid Administration’’, $40,000,000,

JOHN F. KENNEDY CENTER FOR THE PERFORMING ARTS $25,000,000

Smithsonian Inst ‘‘Salaries and Expenses’’, $7,500,000

National Endowment for the Arts and Humanities ‘‘Grants and Administration’’, $75,000,000

Labor Dept Training and Employment Services’’, $345,000,000,

Labor Dept ‘‘Departmental Management’’, $15,000,000

EDU GOVERNOR’S EMERGENCY EDUCATION RELIEF FUND

EDU ELEMENTARY AND SECONDARY SCHOOL EMERGENCY RELIEF FUND

EDU HIGHER EDUCATION EMERGENCY RELIEF FUND

EDU CONTINUED PAYMENT TO EMPLOYEES

EDU SAFE SCHOOLS AND CITIZENSHIP EDUCATION $100,000,000

EDU ‘‘Gallaudet University’’,7,000,000,

EDU ‘‘Howard University’’,$13,000,000

EDU ‘Program Administration’’, $8,000,000

EDU ‘‘Office of the Inspector General’’, $7,000,000,

‘‘Corporation for Public Broadcasting’’, $75,000,000,

Institute of Museum and Library Services’’, $50,000,000

‘‘Railroad Retirement Board’’, $5,000,000

Social Secturity Limitation on Administrative Expenses’’, $300,000,000,

US CONGRESS Senate ‘‘Sergeant at Arms and Doorkeeper of the Senate’’, $1,000,000