Holy moly, that was fast. Too fast. Desperate Fed rolls out biggest bazooka yet.

By Wolf Richter for WOLF STREET.

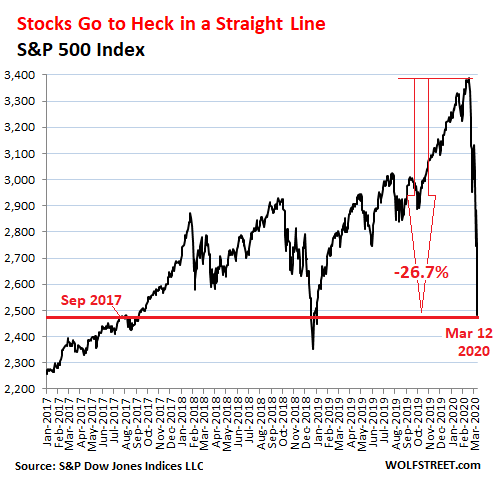

The S&P 500 plunged 9.5% today to 2,481, where it had first been in September 2017. It has plunged 26.7% in the last 16 trading days since its peak. It has plunged 14% in just two days. That was fast, too fast, based on our WOLF STREET beer-mug dictum, “Nothing goes to heck in a straight line”:

So, shortly before the market closed, I covered my short positions I’d taken out on December 30, when I shorted the ETFs SPY and QQQ, for reasons that I spelled out here at the time. I’ve had enough. This kind of volatility gives you a queasy stomach day after day. Here is what I got today:

- Bought SPY at $250.80 for total gain of 26.5%.

- Bought QQQ at $180.10 for a total gain of 13.1%.

To summarize the experience that came with having published for the first time ever a trade I’d made – a contrarian trade that I’d taken out near the peak of market euphoria when most folks thought I was nuts – I will quote from our illustrious and often hilarious WOLF STREET comment section.

A commenter asked a few days ago: “Wolf, how are your shorts?” – and among the replies was elysianfield’s who said laconically in my place: “Stained.” And that’s about the truest thing ever said.

Folks, looks like we’re in the middle of a crash. But nothing goes to heck in a straight line, as proven and documented beyond doubt by our 15 oz. WOLF STREET beer mugs that can be used as shot glasses on days like these, as has been suggested by our illustrious commenters.

More seriously, here is why I covered my short positions:

One, I’ve had enough. I hate shorting. It makes me nervous. The risk-reward relationship is out of whack. Many people consider it a despicable heinous act when you bet against them. And you’re mocked when it blows up in your face. Back in the day, I swore I would never short again. But then I did it anyway. Now I’m relieved I’m out of it.

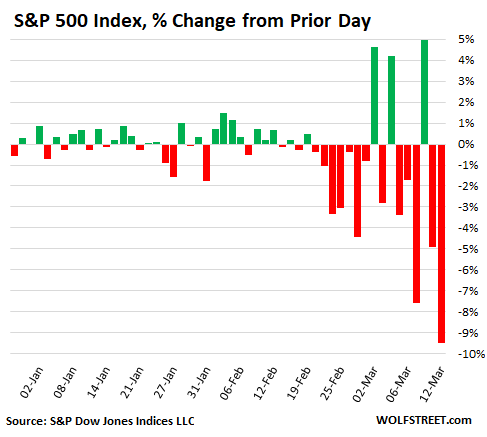

Two, look at the chart. It shows the percentage change of the S&P 500 index compared to the prior trading day. Note the horrendous volatility, the violent bear-market-bounce days (green columns). We’re due for another bounce-day, and this one could be humongous:

Three, the Fed rolled out its biggest bazooka ever. It announced today that it will use the repo market in a big way to try to support whatever needs support. In addition to the increases in its repos announced in prior days, this afternoon it rolled out its giant bazooka, which I will address in a separate article shortly. We’re now talking trillions of dollars.

My dictum – nothing goes to heck in a straight line – could be wrong. Maybe tomorrow, stocks will go to heck in a straight line. But I doubt it. It was too much, too fast, and now the Fed is stepping in. And so I suspect that soon, there may be a violent bounce. But I have no conviction about it. I just suspect it.

So, while I was at it, I bought some of the worst beaten-down crap for a short-term trade that I hope to unwind over the next few days without getting drawn and quartered: The most beaten-down airlines, a sunk cruise-ship operator, a crushed automaker, abandoned hotel REITs, a crushed aircraft maker, a near-collapse shale-oil driller, a wrecked rideshare outfit, an internet furniture-retail cash-burn machine, etc. I would not want to have this stuff in a long-term portfolio at this point, but heck, the market is ready for a fake bounce.

Please don’t follow me in my footsteps. Watch the spectacle from a safe distance. I’ll try to entertain you with the results. And if you did do the same thing, and we both get our faces ripped off, please don’t blame me. This market is crazy: it was crazy on the way up, and now it’s unwinding in an equally crazy manner. And no one knows what comes next.

Of immediate concern is how much cash Boeing is burning due to the 737 MAX fiasco and now the coronavirus, and how much cash it can pile up to avoid a liquidity crisis. Read... Boeing Crashes: $43 Billion in Share Buybacks Turn into Existential Threat

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for the update and good luck!

What about the ^VIX now at 75, that’s like the highest ever??

Straight line not, first they came for the black-swan, then they came for the abby-normal.

QQQ & VIX are all synthetic’s which means they can evaporate to zero tomorrow, with a click on a computer

Not highest ever but quite high.

However gold and silver did not perform as advertized in a zombie apocalypse.

I guess puts were much much more valuable for such a scenario.

good job wolf

Seriously – thanks for sticking with convictions

what youngin’s don’t get is up is up until it ain’t

and down is down until it ain’t

to many times I didn’t like stomach feel and got out only to watch another 30% go down tubes

“Straight line not, first they came for the black-swan, then they came for the abby-normal.” Nice!

Great job, Wolf.

And yeah, if we thought you were crazy, it was only for potential volatility ride, not for the logic.

Good luck on the bounce.

Now who’s shorts are “stained”? Hope you stocked up on toilet paper. (I hear it’s in short supply?) My BITCOIN just cracked in half…talk about needing a a TALL shot glass. Just wait until Deutsche Bank starts running loose bowels! Merkel will need tons of toilet paper to wipe up that excrement.

I’m happy for WR but glad he did not make a fortune else he might retire and

let Cramer take over. Cramer is rumored to have made a very large offer for the site and WR’s market calculus. Who wouldn’t?

BTW: I am working on a piece for ZH that wonders the apparently miraculous timing of WR’s short and the problems in China.

What did WR know and when did he know it?

Please kill me. I sold my 12 QQQ March 20 puts last Friday.

I guess you saw the Fed (il) liquidity coming.

Thought it would come sooner. Surprised by the muted market reaction to the rate cut and the $500 billion repo being way undersubscribed today.

500 billion repo today, 500 tomorrow. This reeks of desperation.

gonna be an interesting weekend for sure.

Lol. You, and everyone else.

The announcement was a fake. Only $78.40 billion of the said (planned) $500 billion was lent. Reverse repo was about $21 billion.

They scared the shorts.

They scared the shorts.

Only for a time. The DJIA went up 1400 points in a few minutes before Mr. Market remembered that monetary policy is useless in these situations. Then the Dow tanked an extra couple of hundred points lower than it was before the Fed announcement.

You’re just lucky that the cov-19 crisis is so “totally under control” that the WH can still confidently insist on a 15% cut to the CDC.

You know, when I saw that I figured, how on earth can the repo market participants digest half an additional half a trillion on such short notice? I seems they couldn’t. Tomorrow is gonna be HUGE in the repo market. And they may be ready for it.

Of course, the kicker would be if no one wants the cash… Then I’m gonna regret having covered my short today.

Tomorrow is gonna be HUGE in the repo market. And they may be ready for it.

I think it’s doubtful the new Fed policy can do more than kick the can down the road a bit, since it does nothing to address the serious structural problems. Mr. Market could be keeping something like that in mind, knowing that cov-19 is only one of the many available risks. Dow futures have fallen another couple of hundred and futures markets reported by Bloomberg are down across the board.

real blood is coming in 3-6 months

when everyone realizes its over and shout I borrowed another ???

only to find NEW ECONOMY won’t support new debt payment

tic toc mr. market

btw I’m ready = and patient

The FICC GCF repo is only about $200 billion in a good day AND that has sponsored repo.

Where will the dealers get a trillion of Treasuries and MBS. It will take time to setup these match books. Sounds to me this news is only for the clueless in chief.

I wish to add, what happened to the other lenders? The Fed will replace them with a trillion or more. I guess the money market is now “nationalized”.

Not to worry, Wolf. There’ll be plenty of opportunities to short again, as long as you’re willing and able.

I have kept most of my shorts – PUTS, inverse ETFs and BEAR MFunds with some active trading to take some profits but also buy whenever there is hopium of FAKE bounce. I have almost 70-80% in cash, 5% long and the rest short. Been in the mkt since ’82! Been doing great for the past 2 weeks! X-mas in March!

This is a long way to go towards the ‘reversion to the mean and then some, south” Debts are at record levels unlike any time in human history! 1st qtr GDP is predicted to be Negative 4%

I read John Hussman over a long time. his retrench in the range of 66%. Of course not straight but over the course of time. This 3rd largest ‘everything’ bubble has a long way to go!

STAY TUNED

That line on the right side of your chart looks pretty much like a straight line!!!

It’s amazing we crash with good numbers, what will happen when the bad numbers come out.

Like a spike in unemployment and plunging home sales?

Buckle up, we’re just getting started. The anecdotes of neighbors selling their homes over asking are about to disappear in favor of short sales.

Home sales have been limited for the past 2-3 years due to low inventory. What makes you think prices will plunge?

Not sure if this is a serious question or sarcastic? I am terribly afraid it was serious.

RECESSION on the way!

1st Qtr GDP Negative 4%

House bubble – bust 2.0 going to start, just a matter of time. My puts on XHB are already shining

All bubbles burst in the end. This one is also!

People not having jobs or money might do it , don’t you think?

Glad it worked out Wolf. Totally relate to the gross feeling of betting against the market. You’re 100% right it feels like we should see a big bounce soon. Seems odd that the markets keep shrugging off these big Fed liquidity injections. Doesn’t bode well… and what the heck is going on with yields today? Selling to meet margin calls?

Would be curious to hear your thoughts on credit markets (esp. corp/high yield)

Credit market piece is coming, likely tomorrow.

the fed is loving this. debt is their only product.

Maybe the mug needs a dialog bubble above the wolfs head that reads something like ” IS THAT SO ?”

I discovered a hole at the bottom of my mug today when I filled it up with Repo IPA Liquidity, and then a few minutes later when I looked at it, the liquidity was gone :-]

when I saw the chart at the top of this page, I instantly thought of stickering it over my mug.

BTW, seriously, print that trade chart out, mark it, label it, frame it. Well done.

Remember to celebrate your victories.

And, yeah, don’t mind if I skip my generous donation for this month. :)

Brother, can you spare a dime?

Wolf – you’re my hero – but W? Seriously? Why not someone making a profit that got beat-up?

This is a trade of 1-3 days hopefully. Long-term W would be a short (for someone other than me). But the worst crap bounces the most.

Outside of the prepper group there is not one person in my contact list prepared for any of this.

Hi Betty,

Stay safe! Good to hear from you again. Say hi to T-town for me.

No one is really prepared for this. Being in earthquake country, we always have plenty of food and water in the house. But still, no one is prepared for the economy just shutting down in bits and pieces.

I think stocks are still way overpriced. Need a few more big drops before I buy.

Mr. Richter, no more skid marks in your shorts? Late this afternoon, just before the market closed, Bloomberg announced the Fed was going to provide $5 Trillion of liquidity. No, that’s not a news error either.

Really? 5 trillion to prop up the top 10%?

Would those people be the same who bitched and cried bad Bernie bad socialist?

Hmmmm, all for them and nothing for you…..

Wes,

The Fed actually announced it in the middle of the afternoon. Hence the 6% jump in the S&P 500 in 20 minutes, which then it fizzled re-collapsed.

I’m going to do the calculations in a little while. But $5 trillion seems high if the program ends in mid-April as indicated. Several trillion yes. The thing, much of this stuff is coming all at once, now, tomorrow, and next week. It’s not a drawn-out slow process like QE.

I’m guessing that you will cover this in your credit mkt piece, but what are the mechanics here?

Is this all short term repo financing – if so, that just suggests that the traditional repo lenders got heavily scared out of the short end (what is normal daily/weekly volume in Repo mkt relative to Fed intervention size?) and/or needed to withhold lendable funds to cover their own internal issues.

Either way it sounds oddly huge…again, the repos are secured by Treasuries, so any default would result in quick/clean foreclosure on this collateral.

Maybe that fact is more of a clue that the repo lenders’ problem is internal – they need to hold back funds normally lent into Repo mkt, in order to address forecasted defaults on their own internal loan book.

Either way, it is the short term repo borrowers in danger and who the Fed is riding to the rescue of. I wonder what pct of that borrower demand goes to speculative players funding long invts with continually rolled over cheap short term repos.

Not exactly the population that merits multi-trillion bailouts/”guaranteed” low cost funding.

Letting a few of those habitual repo borrowers get priced out would be a decent object lesson.

This is a HEALTH crisis. NOT crisis to access Fed’s balance sheet!

Their bazooka was DUD! they are clueless and helpless!

Can they restore supply channels ? NO!

Can they prevent spread of the virus? NO!

Rate cuts and more QEs are useless and probably counter productive revealing the FED is LOST completely OUT of CONTROL!

Mr. Richter, great work on your calculations of the $4.5 trillion Repo facilities. So what’s half a $trillion to the Federal Reserve these days, a rounding error? LOL

And this from a Fed that has always denied monetizing the debt. Your feeling of guilt over shorting the QQQ is noble (and congrats for pulling it off), but taking a short position is nothing more sinister than being a skeptic and putting your money where your mouth is. What people do not realize is that the NY Fed runs one, if not the largest trading desks and, IMHO is using billions to selectively burn out the shorts, making it especially dangerous, at least as far as the FANG and Dow elements go. They are still regarded as the Good, (if at times misguided)Fairy, and the obviously inflationary effect of creating new trillions is ignored as stock prices drop, but it is also true they could have engineered the whole crash.

Here down under I also disposed of my put option yesterday and added to gold miners long position but looks like I was a day too early. Today will be a wild roller coaster after that -10% trading day in the US. I’d rather be a tad early then being a minute too late though. I’ll report back how it turns out. All the best with your trade Wolf.

Any chance the repo market gyrations a few months back were “practice” for this?

Anyone been in a Walmart recently? Parking lots full, stores jammed with shoppers, grocery carts filled with stuff, and most importantly, the shelves are not bare. You’d expect that but WMT is keeping their shelves well stocked.

So I checked the charts. Not bad compared to the broader market. This is definitely not a beaten down stock. When the media-induced hysteria fades I think WMT might recover fairly fast. Their Q1 earnings release could be interesting.

Wolf, like you, I’m looking for select opportunities here. This may be a great moment to start legging in to some of these great American companies. Tread carefully, don’t be greedy.

I did the same thing today. Bought crap. XOP got beaten down so bad, there isn’t much room but up.

Buy the dip is alive and well, and will continue as long as the Fed keeps pulling these financial stunts. They are stunts you know, and will never be paid back. Eventually its all gonna collapse.

Yes, now the news is equally in the other direction. Everywhere u turn there saying were in a bear market. It’s a good move to cover when u hear all the bears roaring, but probably tomorrow or monday we bottom..and only very short term. MAn there are some good superballs falling! Tomorrow is a good day to Die..i mean Dive.

Glad you made a good Profit! You had it coming from giving us all the good stories and facts! See, you got a tip from KArma..even though i don’t believe in it.

I don’t think the Feds work will do much beyond a short bounce or two. I think this pull back is long term for awhile yet, maybe not with the velocity we’ve seen, but the trend will stay down.

It took just 20 days to drop into bear vrs 200 days in 2008. However, back then the Fed had interest ammo to goose things back up and thus help promote liquidity. Now, the banks are in better shape but their customers borrowed like utter fools for the past many years. So, they will have more borrowing ability but no customers and a disrupted supply chain on top of carrying unheard of debt?

As a Canadian this is what really amazed me. The WH was quick to reaffirm Covid testing will be free, but treatments will still require co-pays. Unbelievable. What happens when the ‘free enterprise’ for profit health system is overrun with patients? Army field hospitals for the poor? In short, free testing for tests that have not yet been done and won’t be done for weeks, but any real treatment will still be paid for by patients (who may not have jobs and coverage)?

And, how is it that the Utah Jazz basketball team all received their Covid tests, but WA first responders have not yet been tested for the last 3 weeks?

No worries, next week is infrastructure week. I’m sure all congress will get together and create some WPA infrastructure work for those who will lose their jobs at Disneyland, ball parks, arenas, theaters, restaurants, airlines, schools etc….. and all those infrastructure work camps will be virus free.

How this doesn’t change the US economy forever defies my imagination. The powers can’t run “it” in good times, let alone in crisis.

Just in case anybody thought holding solid gold mining stocks was a safe place to be lately.

I am down more than 30% compared to the the market’s less than 30% losses.

Smaller gold stocks easily down 40% to 50%.

Of course today gold was smashed down about $60 thanks to the Fed. No surprise there.

Just like 2007.

I would say my face got more than ripped off!

WES, I know your pain. My PM miners and explorers are all down more than the market indexes, so yes, their reaction so far is a duplicate of the GFC. Remember tho, the reaction for PMs and miners was even greater to the upside after the bottom. Gold didn’t hit its $1,900+ high until 3 years later. I am going to wait it out.

The retail demand for physical has exploded this week and this is not being noted in the news. There is a big shortage of Silver Eagles and premiums on gold items has jumped for both buyers and sellers.

I’ve been feeling the pain for 10 years too.

A few calcs to cheer ye up.

If Andrew Yang became president, and he implemented his UBI (universal basic income) $1,000/mo. plan to all USA citizens over 18, (pricing gold at $1,000/oz) how long does it take for all these newly minted $USD to be swapped out for ALL of the physical gold in existence?

Let’s take a quick look:

330 million Americans.

% Americans over 18 = ~60%

Total Americans over 18 = 198,000,000

Hypothesize: If each of these citizens took their new $1,000 USD and swapped it for a gold oz., how long till we have reached the bottom of this gold filled barrel?

Assuming the there are 190,000 tonnes of gold above ground, as reported by the World Gold Council,

https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold

This translates to 190,000 x 2,000 x 16 = 6,000,000,000 oz

So, take 198,000,000 Americans with $1,000 each X 12 months,

and see how many long it takes to run through 6 billion ounces of gold…..

Answer; “2.55 years, and its gone…”

So, yeah, of course most Americans are way to clueless (and poor) to actually make that swap. But the salient point, IMO, is how it demonstrates the undervaluation of gold. Some “smart math guy” from Silly Valley can literally flap his jaw about giving away ALL the world’s gold in just 2.5 years to already relatively exorbitantly wealth Americans because…..because we’ve had a rough go of it lately, and wouldn’t it be nice to be nice to the nice????” to quote Frank Burns from M*A*S*H. And no one cries “Foul”?

Fuck.

Check out where $1,000/month puts you on the global scale…

about #36. Just for fogging a mirror.

https://www.numbeo.com/cost-of-living/country_price_rankings?itemId=105

If there is a selloff gold will also be liquidated.

Congrats. One of the best shorts ever.

I thought February might be a bad month so got a little defensive, but I didn’t the Corona crash coming…

This is a real crash (not just a big bear market).

The only other two I would put in this category are ’29 and ’87.

Here’s hoping you picked the bottom- (for the good of everybody!)

Interesting play there Wolf, and I agree that the risk-reward is heavily skewed against shorting. I was well over 50% cash heading into this week, and I’ve been buying anything with a relatively safe dividend yield all week. This morning I finally went all in, exhausting my margin as well.

I’ve got to admit, the news keeps getting worse and I’m nervous about tomorrow, but I’m thinking these will be the first to bounce if anything does. I’ll definitely lighten up a good bit if a bounce comes. However, all I’m seeing is news about America shutting down and cancelling everything, so I wouldn’t be surprised to see a continued plunge as discretionary money won’t want to hold over the weekend. I just scheduled a transfer of a little bit more cash into my Ameritrade account just in case I need the buffer to avoid a margin call.

Yo, always enjoy your column!

I have been buying into this terror onslaught.

All blue chippy dividend stocks with good yields. Ex. WFC, XOM, DOW, UTX, RTN, MMM, BP, RDS, EMN, etc.

I calculated that the yields will more than cover my margin, and with covered calls, still ahead, after all taxes.

Write off margin against dividends as well.

It has taken some sack. I pray it does not fall too much further.

GLTA!

Wolf,

Maybe you should consider buying the shares of a company that is going to be in business next year!

Maybe buy MIC stocks. Like I said last week, this will now support war. I just read this on the dreaded Zerohedge:

“And separately Gen. Kenneth McKenzie told a Senate hearing Thursday morning: “The Iranian proxy group Kata’eb Hezbollah is the only group known to have previously conducted an indirect fire attack of this scale against U.S. and coalition forces in Iraq.” The major attack had utilized at least 15 Soviet-era rocket artillery and further left a dozen wounded.

The top general said the Iran-backed militias were to blame and that the US can identify the culprit with a “high degree of certainty”.

Later in the day Defense Secretary Mark Esper told reporters at the Pentagon: “I have spoken with the president. He’s given me the authority to do what we need to do, consistent with his guidance. And, you know — if that becomes the case,” according to Reuters.

So, they’ll attack Iranians somehow and Iran will attack some oil installations or tankers, and here we go. Maybe the Afghan drawdown troops can just stop in Iraq?

Boeing drones look good… (sarcasm)

I guess none of you optimists have been to Italy recently. The rest of Europe hot on its heels, and the USA – you just don’t know it yet. May the force be with you.

Nice trade!

You’re early on this, Wolf. We’ll get a sharp relief rally in April when the R0 values come in. But the structural damage will be done by then.

Long-long-term chart suggests firm support at 520 on the S&P 500

Just like 2008, we should see some interesting policy innovations at those lows.

Hey Wolf, how many torpedoes is all of West Coast RRE taking today from the hits on RSUs and free vaporous pretend monies?

And if you’re not hoarding Hayek *now*, you will not make it to the other side of the crisis. Get extra for loved ones.

This market sure will turn a normal person into a bi-polar psycho. Two months ago I was feeling like the biggest moron on my short put options on DB, HOG and GE, all were well into big double digits loss and figure I’ll just take a hit as tax offset for my long by the end of this year when it expire. Comes today…my HOG put is up 124% and DB up 63% and GE still down since my put option was super aggressive at $3. All were bought long time ago. You’re probably right though Wolf, nothing goes to heck in a straight line and who knows, in a matter of couple of weeks I’ll probably end up going hero to biggest moron again. For now, I am just betting on this administration will F up and make things much worse and this will be a aggressive downtrend for the next 30-60 days minimum.

I did not go shopping for a new car today. Warren Buffett used to keep his car ten years to avoid dealer’s fees and sales taxes.

The Fed was using emergency measures before there was an emergency. Now there is an emergency and they jumped into action.

We may need Chinese medical tech as they are past peak infections.

China’s medical tech had nothing to do with it, their government mandated quarantine is what stopped the spread. The virus does not create an immunity, so once the quarantine is lifted the virus can reinfect again. They have testing kits as well. The US is woefully under prepared, and a large number of people seem to believe that only the elderly will suffer and to hell with them. So the outcome is dubious on several counts.

1) Today market makers opened the day with a huge gap and a close

at the low of the day, deliberately. It was technically done in the DOW, SPX, NDX, IWM…by the market makers.

2) In the next x3 days the market can go wherever it want to go,

but on Wed Mar 18 the close must be lower than today close.

Not too sure about 18 March; INHO, the early peak of this virus will be about two weeks after the end of ”spring break”, though to be fair, that may only be true in CA, FL, other warm areas.

The extension of the supply/demand challenge would seem to follow that date by at least a couple of months, but, due to the underlying lack of health of the financial economy, we may be looking at a much longer date, TBD.

Glad to see you are out of the shorts Wolf, mnever been come fort able with that concept either, but not so glad to see you long on some of the current max losers, as mentioned above.

Wolf, you wuss, you. :) Speaking as a fellow late-last-year crazy-eyed shorter (readers can cf. my comment to Wolf’s “My Conversation with MarketWatch About my Hair-Raising Contrarian Short Positions” piece yesterday), the May 15th strike $300 Telsa puts I bought on 20 Dec when TSLA was $450, which were down as much as 90% a short (pardon the pun) month ago finally went green today, up ~30%. I’m holding and completely calm about things, for several reasons:

1. As I noted, this was a “strictly gambling money” short – around 1-2% of my net worth, enough to be ‘interesting’ and annoying in case of total loss, but not enough to lose sleep over;

2. I expect there will be many whipsaw moves to come in the next few months – heck I expect tomorrow will have another crazy-rebound move on whatever promises-of-goosing-equities the Fed rolls out – but it’s now very clear that this crisis is going to absolutely hammer global GDP, and the nuttiest-valuation tech unicorns should suffer disproportionally;

3. After getting destroyed during the early-year real-truly-madly-insane share price rampage from the 400s to nearly $1000, I’d mentally written off my wager as a total loss. So if things get really surreal and the fed starts buying equities and decides $1000/share is a fair price for TSLA in the program, ah well, I’m no worse off than I was last month;

4. On the flip side of [3], there is a pretty decent chance that TSLA will test the $300 strike price between now and 15 May. Having p*ssied out on the opportunity to “back up the truck” on more puts when shares tested $1000, I don’t want to pass up the opportunity to at least make a nice chunk of change should shares hit, say, the $200 range. 100% downside potential (in fact likelihood, for this kind of gamble) means I don’t want to settle for a mere 30% gain. “Lose it all or score a 10-bagger”, that’s this kind of trade.

Oh, lastly, lest anyone accuse me of crowing about a win while never disclosing a loss – like Wolf, I had sworn off shorting the market forever … because the last time I did so, I “fought the Fed” in 2009, and lost my a** doing so – my net worth will never recover from that no matter what TSLA shares do in the coming months, or what markets do in the coming decade. So it was only a ridiculously obvious example of bug-in-search-of-windshield bubble valuation that prompted me to dip a toe again at long last – and the stakes this time around were utterly tiny compared to the last time. So I stand to lose a month’s rent on the downside, or possibly make a year’s rent on the upside.

Funny TSLA is now like you can’t discuss the stock-market for a minute without TSLA coming up.

TSLA is a canary-in-the-coal mine, they don’t make anything and they sell hope and fantasy, they’re California “Fantasy Island”

You will know the PUMP is over in USA, when TSLA goes to zero, for now the machine will continue to pump the likes of TSLA because it perpetuates the lie that the USA makes stuff.

This pandemic will be over in a few months. China’s already in recovery mode. Stocks will look very cheap at today’s prices in a few months.

It’s not just pandemic. It’s overvaluation and overleverage.

Yeah, but the Fed will continue to pump liquidity into the system, so when the virus runs its course and things get back to normal, stock valuations should eventually head back to their previous highs IMO.

How many near death experiences does it take before dare devil investors start to rethink their lifestyle?

People do eventually learn.

Dumb. Are we going to implement China’s draconian lockdown? Trump blew it. The downstream economic impacts of this will be felt for the rest of the year if not longer.

It’s also the bust of the everything bubble. Just wait for the ripple effects…energy companies, real estate, zombie companies, airlines, hotels, etc etc.

I’m a hotel consultant – most of my work is appraisals. We always factor in a rebalancing of the market in our forecast (because we know there are always cycles and revenues will go down at some point) but we could have never seen this coming. Hotels are generally leveraged with somewhat prudent debt levels (60%_65% LTVs) because of the risk. But when your revenue goes down by 60%~80% for god knows how long (typical revenue recovery in last two cycles was 4 years!), there is no way you can come out of it and pay your debt service. If revenues drop just 25% that puts most hotels below their level required to cover their debt. Think about all the people In Hospitalty that will be laid off. That alone can cause a recession. Add everything else. We are already getting ready for the influx of foreclosures.

This collapse is not only about he pandemic It’s long overdue and I don’t believe it’s over yet by any means But he all means buy the dip bigly and good luck to you Marc

WR:

Out of Spite, Bought Some Crap for a Bear-Market Bounce

It would have to be out of spite, because it can’t be out of any real expectation of making a profit.

G:

It’s amazing we crash with good numbers, what will happen when the bad numbers come out.

Same thing, only more so.

Pilgrim:

I think stocks are still way overpriced. Need a few more big drops before I buy.

A few more days of this and you’ll be able to haul them home from the dump for free.

Mike:

Eventually its all gonna collapse.

It’s not a prediction when you make it after the fact.

Paulo:

What happens when the ‘free enterprise’ for profit health system is overrun with patients?

They resort to the ‘billionaires first’ triage system.

And, how is it that the Utah Jazz basketball team all received their Covid tests, but WA first responders have not yet been tested for the last 3 weeks?

Entertainment is a higher priority than public health. Keeps people’s minds off their problems.

wkevinw:

The only other two I would put in this category are ’29 and ’87.

You can scratch ’87.

Claud Brahman:

Maybe you should consider buying the shares of a company that is going to be in business next year!

Roadside fruit stands don’t do IPOs.

Marc D.:

This pandemic will be over in a few months.

At this rate of collapse the stock market will be over in a couple of weeks.

Thanks for the brief summary, I really like your happy end, LoL

It would have been nice to see how your trade

works out without covid 19.They don’t ask how

just how many.

Hockey cancelled, Basketball cancelled. Election cancelled.

While I certainly hope you are wrong about the election ME, I am beginning to think it really is a possibility when even Disneyland is closed, not to mention MLB; on the other hand, it seems to me that with all the electronics and digital genius folks staying home for weeks or a couple months or so, they should be able to come up with some rational method of voting from home, etc.

We need some leader such as WLS Churchill, but appear to have WC Fields, (not to knock Mr. Fields, just the roles he played.)

Wolf, if you like risky contrarian plays there could be some huge upside potential to $DB. Deutsche Bank’s current CEO Mr. Sewing is doing a great job of cleaning the house and the investment banking division saw its first year over year growth in years.

But doesn’t DB have quadrillions in derivatives that are about to or have already blown up? That’s what I’ve been hearing and wouldn’t touch them with a ten foot pole

DB has to be worse on the derivatives now than AIG in 2008.

UK. I’d love to understand and be able to short but I am not mathematically / arithmetically adept. Instead i’m going to take out an each way bet, buy a few shares in the London Stock Exchange Group, closing sp approx GBP 64.00. Last time I bought in the sp was GBP 2.40 – sold too soon of course.

Two black swans colliding. I shorted the S&P last fall (SDS). When I read Wolf shorted I doubled down. I had just returned from China, Indonesia, Thailand after a six week home exchange. I GOT THE VIRUS 2 weeks after I got there. WARNING. Its not the Flu. There are two strains, one is neurological. I woke up with the worst earache, jaw pain, and half my head was numb and felt like a half a head cold. (I was bummed as I had slepped my scuba half way around the world. ) The transmission mode was either the constant fingerprinting in China or the bats that dipped in the pool at sundown. I gained 20 lbs from the severe lethargy. Flying back thru China I got it again and am still recovering. I am 62 with a weakened immune system from Lyme. I should of sold today, but when I saw the mass graves from space in Iran I’m holding. They have lost control of the market and you can’t cure demand with stimulus. Who knows maybe a dead BAT bounce Monday and I will be sorry but there is no way this is over.

So, Chinese cases are dropping for real? Do they have the virus on the retreat? Sounds fishy compared to Iran and Italy or else they have a cure kept secret.

Who Knows maybe they are all taking forsythia. My boyfriend got it on the plane coming back. It attacked his brain stem, ( still in a neck brace) high fever, sore throat, vomiting, nausea, no appetite We both still have vertigo, good days and bad days. Because of my $1,000,000 workup for Lyme always telling me “I’m too pretty to be sick “I started doing research on our bizarre sudden onset symptoms. The meningitis shuts down your body functions like breathing and heart beats. We are in San Diego and have been walking around since the middle of December . Im sure we are not the only ones.

If you trust the statistics coming out of China Many don’t

Get well soon.

Wishing you well. I too am under treatment

For Lyme and co infections. Was recovering from a bad head cold three weeks ago and now sick again. Taking temp every hour.

My immune system may not be the best

Hunkering in my bunker

You can almost feel the fear in the air. This is crazy stuff. I have almost no doubt now that this is going to go from bad to worse to horrible.

How does the fed bazooka save anything but the banks when a large chunk of the world is shutting down? Remind me what is the world debt to GDP?

I simply do not believe they have what it takes to save the stock market form going full GFC 2.0 given the chicanery filled bubble they have blown.

I think you have to be one brave man to go long in almost anything.

We blue collar types are taking this in stride but the Seattle techies are hunkering down like the world is coming to an end.. and maybe they’re right. I think something is afoot that modern humans have never seen before, not since 1918 (possibly). Yahoo yesterday said it was too soon to talk recession but I think it’s time to talk something much worse than that.

I think worldwide debt is in the range of $250 trillion but not sure how that breaks down but betting a large chunk of that will evaporate before summer.

@David Calder

“We blue collar types are taking this in stride but the Seattle techies are hunkering down like the world is coming to an end.”

—

Really smart people – and especially in concentration I would think, tend to be cowards. It’s not a insult. They have a better understanding of the “known unknowns and unknown unknowns.” Lot more fears to manage.

The world is a dangerous place. I think that’s by design.

For case in point, pls see post by

Ambrose Bierce

Mar 12, 2020 at 7:42 pm

There is more to go here…

————-

On your keyboard you can do a Ctrl-F to do a quick search.

Forget the bazooka They need to get “ Big Bertha” out of mothballs

One chef in Seattle with 12 restaurants is laying off 800 people because his business is off by 90%. Asian restaurants in the ID said days ago their business was off by 50%. Photographer friends have seen their businesses collapse. Same with Uber drivers I know. One friend who works for an airline company (not Boeing) shipping parts overseas had the entire plant shutdown until things start up again. I realize western WA has been ground zero but this virus has been around for only a few weeks and look at the damage already. I guess the Fed is firing it’s biggest bazooka but I don’t see how that is going to help anyone that I know..

Happy your shorts paid off.. maybe tomorrow the COVID test kits will show up but right now I’d settle for some Purell which we can’t get. Store shelves have been stripped of bleach, alcohol, disinfectants, and wipes of all types.

“Please don’t follow me in my footsteps. Watch the spectacle from a safe distance. I’ll try entertain you with the results.”

This is awesome!!!!

Such honesty. I can actually learn stuff from this site.

Let us know when you get a call from Marketwatch. Or better yet, one from Cramer. :0)

they and CNBC (among others) can take a few lessons in journalism instead of the typical fearmongering in the bad times, and cheeerleading in the crazy times.

1) SPX, up from Feb 2018(L) @ 1810 to the peak @ 3,393 = 1583.

From the peak to today low = (-) 914.

914 : 1583 = 57.7%.

2) If SPX will drop to about (-) 62% at the bottom, SPX will move higher,

to a new all time high > 3,600.

3) There is hope that SPX will not drop to 2016(L) area, or below.

Saudi Arabia kicked the legs out a crapload of macro funds that were long oil, starting one giant margin call chain reaction.

Just like there were no models back in 2008 for broad real estate depreciation, I can’t imagine anyone models a 30% overnight haircut for crude. A 30% overnight increase yes, because of random Houthi or Iranian rockets.

Wolf,

Congrats on the gains.

Investment grade bonds finally participating in the decline but they’ve got lots of catching down to do. Likely end up with the tail wagging the dog on these IG Bond ETF’s. Redemptions trigger forced sales in the underlying securities while liquidity hightailed it out of town. Tough to unload corporate bonds when there’s a yawning chasm between bid and ask. We’re not there to that point yet but when it arrives, will trigger another leg down in overall market.

Liquidity, in general has gone MIA this week. Noticed a number of REIT’s that sat for long stretches with no trades due to widened bid/ask spreads.

Agreed, a bounce is likely. How long it lasts is another matter.

Think you may have another opportunity to short again before long, if you desire.

Liquidity, in general has gone MIA this week.

Which seems counterintuitive, given the rock-bottom interest rates. It might be there’s deleveraging going on in the background, so it might be helpful to get some data or insights on that.

Unamused,

Don’t know why my brain typed REIT’s. Meant to type ETF’s. Must be all the rain we’re getting today. Soggy brain.

All sorts of ETF’s just sat for long stretches with no trades. Quite unsettling, to say the least.

Why assume it’s a lack of liquidity? Dollars don’t just magically disappear from the system. It’s just a lack of demand at the asked price.

Good point.

I think that the intent of the Fed’s 5T bazooka is to get the hedgies to use the $ to buy the dip in order to stop the down-momentum.

In considering the Fed’s offer, the hedgies have to ask themselves “Do I feel lucky today?”

It looks like the hedgies are thinking twice, and that’s why bazooka #1 (the $500B) was a dud.

If bazooka #2 mis-fires – and it’s looking a partial success here in pre-market – if it does fizzle out again we’ll be getting some more vertigo.

I’m staying short.

At times like these it is awfully hard to take a step back, put things in perspective, and stick to your guns. In 2009 it looked like the financial world was coming to an end. It looks like that again. However, there is great opportunity. It is supposed to happen like this in order for an investor to have an opportunity. This is another bear market. They are all slightly different. Different records get broken. Great American businesses are on sale. The real winning is just ahead. Just think, the term “Unicorn” will never be used again, except in vain. Same with “sharing economy” and “gig economy.” It will be refreshing.

“Great American businesses are on sale.”

Name some ,,,,,,,,,,,, say the top 5.

I’ll name 500 of them, every one of them in the S&P 500. Never ever bet against the USA long game.

So I went to cash/stable value for 85% of my 401k and taxable portfolio somewhere last year when the market was at around 26000. It just seemed so overpriced and I figured there would be a crash coming (and that Trump would screw up and make it worse), didn’t think it would happen so hard and fast. So when to get back in, I don’t want to catch the falling knife. 16000? :)

Wolf, long time reader here. I’m not much of a finance guy and have learned a lot from you and your knowledgeable troupe in the comment section. And perhaps among them are military historians who can find you a better metaphor, because I’m not so sure bazookas had wheels.

(Sorry if this was already mentioned in the comments.)

Also, congrats on your shorting victory. Hoorah!

-S

OK, lugged out the bazooka? But then someone will tell me that a bazooka is really a small weapon compared to something like an 18-in naval gun, or whatever.

Sooo, what does a lowly pleb, who only has a few quid saved in a small regional bank, and dosesn’t play the markets do ?

Pull it all, out of fear of an impending ‘holiday’, rather then see it ‘gone allgone’ ?

Use it to light the woodstove ?

Blow it on a cruise ?

What ?

@polecat

“What?”

—

I’d suggest walking to the library, check out a book that covers the Greek Stoics. It’s a useful perspective if you sort through it. Cheers

I sold everything last summer. A little bit of FOMO not gonna lie when I did, but paid off my house with the proceeds. At 41, don’t know any friends anywhere near the position I’m in. Been dollar cost averaging ever since, might make a bigger play soon. At the end of the day I’d rather stay sane and just enjoy life, rather than chase the dragon for some big gain, which won’t mean much either way if I’m sitting in a dirty hospital gasping for air. Found the company of a rather fit 25 year old a few times a month instead, who has me gasping for air in a good way, good god when you keep things simple, the world looks different

They say investors are selling their profited gold positions to help cover the margin calls, hence the falling gold price. Meanwhile, the U.S. mint is shipping out bullion coins in almost record numbers for the last few months. It was interesting to see precious metals slide along with everything else today. But this also happened in 2007 until gold reversed to the upside until 2011. If the DOW falls below 20K, Gold has to kick in, right? It’s going to be a LOOOONG weekend.

Smart move Wolf, congrats getting out with four years of average gains in 10 short weeks. I myself have been selling OTM puts on high yield dividend stocks (that are aready 50% down), and making a killing while hoping they actually fill at some point this month. I also think we will get a huge bounce, yet not sure it will be Friday and if so it might be intraday only, as it would be scary to hold over the weekend. I agree that shorting is not easy as there are 10x more “golden swans” (fed, govt, etc) that can manipulate the markets up versus natural “black swans” that can make it mean revert. Unfortunately for Mr. Market, this black swan is immune to free money policy…

Is it kinda pathetic that I likely know exactly which companies you picked up in hopes of a bounce? And can we do a fun geeky contest with a prize for the person who guesses the most correctly? Like a beer mug, maybe? (Full disclosure: I do not trade, have never traded, and have no interest in trading — which makes it all the more pathetic, I suppose.)

It’s not pathetic, Paula. It’s purposeful :-]

There is more to go here. The money flows have left the market, the Fed can reinject the missing cash with a trillion but it would take ten trillion to restore the flows. Congress is preempting debate over any bailout program with their own social spending bill, and thankfully so. There is still a virus, a recession of unknown duration or depth, and a panicky Fed playing with money it doesn’t really have. There is a crisis of confidence at all levels of government, and our geopolitical rivals who aren’t adverse to seizing opportunity. The next crisis is government spending, you blow a trillion on the banks, how do you keep the lights on at home? It’s going to be a bumpy night.

Painfully accurate take.

“There is still a virus, a recession of unknown duration or depth, and a panicky Fed playing with money it doesn’t really have.”

To the extent that the national debt can be expanded the Fed has as much money as it wants, which is as big a recipe for corruption as can be imagined.

you know when Trump calls this the greatest economy ever I just want to scream! U.S. steel at 5.00, Ford motor at 5.35. Exxon 70.00 in Jan now 38. Yes sir just exceptional!

Re: The most beaten-down airlines, a sunk cruise-ship operator, a crushed automaker, abandoned hotel REITs, a crushed aircraft maker, a near-collapse shale-oil driller, a wrecked rideshare outfit, an internet furniture-retail cash-burn machine, etc.

I’m surprised you didn’t wait for a lower VIX.

But, I like this especially the airline, cruise line, and the hotel. All you need is a slight recovery.

I’ve been following Wolf Street for at least 4 years and take Wolf’s columns as a supplement to my own research. It’s nice to read and I often am coming to the same unprofessional opinion. I’ve made boat loads of off some of his insights. When I read the article you are referring to in this piece I bought some fairly large positions in UVXY, SQQQ and SPXS. I’m up 150% so far.

I am not jumping out quite yet. I might sell half of my positions and the rest is gravy, unless I have to eat it.

In no way do I think that this route is over. The disruptions of the covid-19 virus are far from over and I think we are just starting to see the USA and worlds stark new reality. I think it will unfold over the next few months and when we have sustained community spread, I think that will probably mark the “bottom” of the bear market. Better buckle up folks!

I tried going through all the comments…Im not sure if anyone mentioned this but throwing money at something like what the fed is doing does not give the “hysteria” piece of mind. People react toward fear. It’s quite obvious. People are buying toilet paper, not traveling, not going to events, schools closing l, travel bans, etc…..this will go on at least for thirty days. I sold my Puts last week, but I took profit and bought another Put….why not.

It sounds like a massive (maybe short) squeeze. Why take the bazooka out. Is China or Japan selling its position?

Nice trade wolf!

I’m still long puts on HY bonds, took some off days ago, the rest are a free trade… this is far from over. HYG made a new 5 year low yesterday lol

46% BBB “IG” is getting taken to the crematoriums in wuhan lol

“Premature capitulation.”

This is just the beginning.

Blame this entire fiasco on the Federal Reserve. The market was at this level in Dec 2018 when they were raising interest rates gradually. He chickened out, however, and thereby encouraged stocks to climb another 30% as a result of his dovishness. Now, here we are at the same stock price level after going up 30%, then down 30%.

It’s clear that the actions of the Federal Reserve only serve to increase volatility. They caused the 2000 bubble and burst, the 2008 bubble and burst, and the current bubble and burst.

They allowed so much leverage to accumulate in the system that companies can’t even afford to let revenues drop a tiny bit without a major financial crisis.

Blame this entire fiasco on the Federal Reserve.

Everything you say is true, but it doesn’t matter. They didn’t have a choice. The distortions caused by the financial sector were so extreme in 2007 there was no other way to delay a severe depression from setting back the US economy twenty years.

I say delay, but not prevent. The situation can only really be rectified by implementing structural changes in the economy to end the abuses of capitalism and create a stable system. That’s not going to happen. Breaking the hold of predatory capitalism would require breaking the economy, defeating a major goal of reform before reforms even begin.

The distortions have escalated, ensuring the eventual depression will be even worse than it would have been otherwise. With the pandemic the Fed is overwhelmed and deterioration into a depression is probably inevitable. But don’t blame the Fed. They’re just the proxy for the US banking cartel. Blame them. That won’t matter either.

Good comment.

Sometimes dead cats don’t bounce. they just go SPLAT.

Wolf, congratulation, you are the boss! Any employment offers from financial sector yet?

About risk/reward ratio out of whack when shorting, there is easier way, non leveraged, usually slow moving etf: HDGE.

Risk/reward is in your favor, you can lose only what you put in, but gain multiple. I was in HDGE and bailed out two days before it started, bummer.

former,

“Any employment offers from financial sector yet?”

Ha, I’m the top honcho CEO mega-boss tyrant of my WOLF STREET media mogul empire, and I love it, and I’m not open to discussing other opportunities :-]

If the global market were a dog,

we’d take it out behind the barn

and shoot it.

There’s no difference between

” negative interest rates + negative risk premiums ”

and painkillers like heroin and religion.

It’s what we give old, dying men.

IMO, the best way to create a market parachute at this point is for both parties to shake hands and combine forces. This pandemic is not a political event and shouldn’t be used for political gain. It’s a natural catastrophe in motion, which has barely hit the less developed countries in SE Asia, Africa and S. America, is suicide. It will mean hunger and riots and refugees. America must get unified, and fast!

Wolf – I’d meant to ask you back in January – what risk control measures did you use? How did you determine your stops? Since the market kept rallying into Jan and Feb, seems like you would have been noticeably under water, so where was your breaking point?

I shorted very broad ETFs that don’t move all that much, not on margin with plenty of liquidity in my account, and no carrying costs and no premiums (unlike options). No other risk control measures were necessary. I never use stops anymore because when you really need them, they’re not there for you, such as a gap open or a sudden crash when bids vanish. I was willing to take a 20% loss, and at that point I would have covered them and cried into my pillow. And that would have been it.

I hope people – esp. you younger folk – pay close attention to what Wolf just said. A lot of spilt blood went into that short paragraph of wisdom.

This is why people like you, Wolf. And don’t let it go to your head.

:)

Glad your pillow stayed dry!

Yawn, this will, like all other flu epidemics pass and the economy will come roaring back. Lots of doom and gloom on this site, which is too bad because many opportunities will present themselves. The hysteria is media driven (fake news) and has been planned since the impeachment failed (this too will fail to unseat Teflon Don).

You mean to tell me after all the carnage the economy will come roaring back and opportunities will present themselves?

That is some deep insight. Where did you get it from, history?

Yeah, it’s all just a hoax, right?

Eternal optimist Wish you are proven correct but my gut since 2004 or 5 tells me you are wrong This virus is just the catalyst that did the job of the free markets, which do not exist of course And I’m a political atheist because I believe it’s mostly if not all BS

Nicely done Wolf, the relief rally likely won’t live long, IMO.

Good luck with your bounce theory, Wolf. I sincerely hope this furious descent jags enough for you to make a few shekels. You’re a better/braver man than me.

So let me get this right, if I buy this QQQ lotto ticket I’m always a winner? Right?

I know in your case you sold the lotto ticket short, but isn’t that a fools game, limited return ( no upside ), and 100% loss?

I’m at a loss while you have dedicated so many months about this ‘bet’ of yours people buy lotto tickets daily, and 99.999% lose, and maybe 1% get back $5 for a $1 ticket; Lotto is a tax on fools; Going short is a brokers tax on fools.

You could have made more money just buying VIX which was 30 a few days ago, and now 75, that’s 250% return, without the problem of going short, e.g. limiting return, and maximizing loss.

I wonder how many poor people are now going to play the ‘QQQ’ lotto game because ‘Wolf’ has made it look intellectual and daring??

Remember kid’s the safest thing to do, is not to play.

The solution to what the Fed wants to do is OBVIOUS:

The Fed must buy stocks.

Just this week, my Fed President of Boston said exactly this, he said QExxxxInfinity will not be as effect as the Fed buying stocks.

And since the Fed has never been audit in any real sense, NO ONE can say the Fed has not already bought stocks.

The Fed must buy stocks, if it is to do what it wants to do.

I am 66.

Just had the flu. Coronavirus?

Piece of cake.

All bullshit, including market going up for first month of virus, while big players took the short position off early suckers.

Are you sure it was Corona and maybe just generic flu? Glad to hear you’re feeling better Now get out there and support this economy ?

It always amazes me how similarly all of these different times end.

We’ve got a blind date with destiny… and it looks like she’s ordered the lobster ..

Nice timing Wolf.. Futures are limit up overnight.

“One, I’ve had enough. I hate shorting. It makes me nervous. ”

Thank you for writing this. The emotional/psychological aspect is as important as the analytical. I still viscerally remember the thrill of shorting the housing market back in 2008 even though it was a small bet. It became less and less fun as everything around me went to hell. This time I have mostly stayed on the sidelines of this rally and have been sleeping better than ever these past few weeks.

Good call Wolf…looks like you’re absolutely right, almost 2k pts back up at the end of today…a glorious rip your face off rally/bear squeeze. Will this continue on Monday? Probably, looks like plenty of people found reasons to buy the dip.

Mr. Richter timed his entrance and exit from his position with almost supernatural precision.

I understand why CNBC’s talking heads tout ‘investing’ in Powell’s gimcrack ‘market’ as that is how they skim their living but why any sane person would put money into this casino while the global economy outside is collapsing escapes me.

This market is too crazy for me. I’m out. I’m going to watch it from a safe distance.