Prices in San Francisco Bay Area, Seattle, Chicago, New York at early-2018 levels. But Phoenix, Tampa, Charlotte show surging house-price inflation.

By Wolf Richter for WOLF STREET.

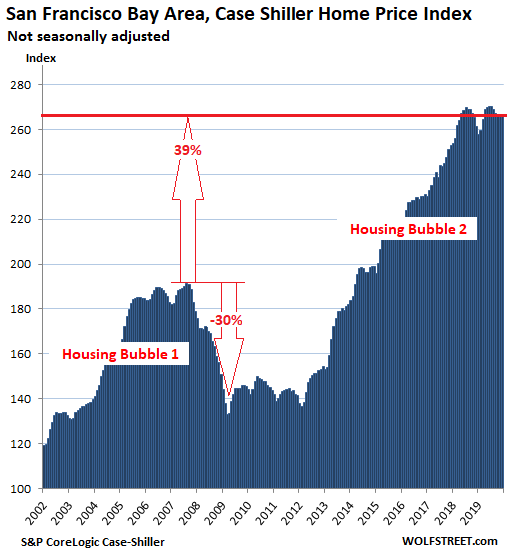

House prices in the five-county San Francisco Bay Area – the counties of San Francisco, San Mateo (northern part of Silicon Valley), Alameda and Contra Costa (East Bay), and Marin (North Bay) – were unchanged in December compared to November and were below where they’d first been in May 2018, according to the 20-City S&P CoreLogic Case-Shiller Home Price Index released today. Note the double peak:

The way the Case-Shiller Index is structured – based on “sales pairs,” it compares the sales price of a house that sold in the current month to the price of the same house when it sold previously – makes it a less volatile index than “median price” indices that can move up and down wildly. In addition, the index is a rolling three-month average: Today’s release includes closings that were entered into public records in October, November, and December.

The index was set at 100 for January 2000. Today’s index value for San Francisco of 267 means that house prices in the five-county Bay Area have soared 167% since 2000.

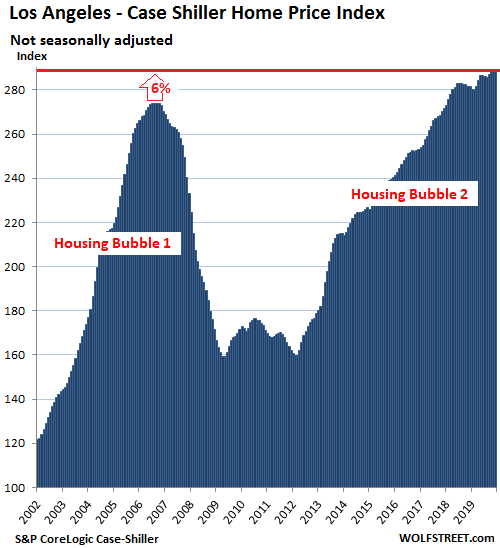

All charts here are on the same scale, with the vertical axis ranging from 100 to 290. Los Angeles is now within a hair of hitting the top of the scale, making it the market of the 20 in the index that has risen the most since 2000.

Los Angeles House Prices:

House prices in the Los Angeles metro remained flat in December compared to November, at a record level, and were up 2.7% from a year ago, and up 189% since January 2000:

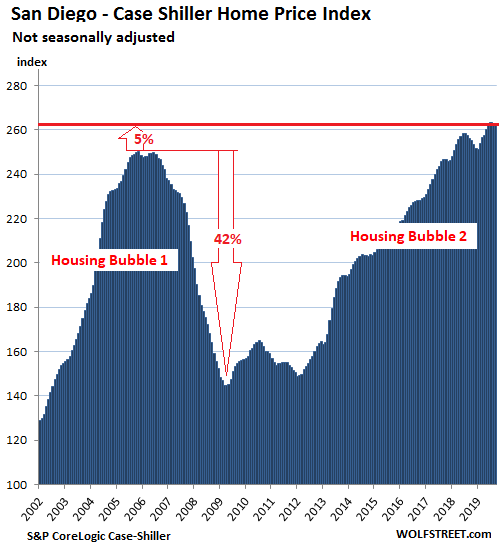

San Diego House Prices:

House prices in the San Diego metro have essentially remained flat for the past six months but are up 4.7% from December a year earlier due sharp price increases in the first half:

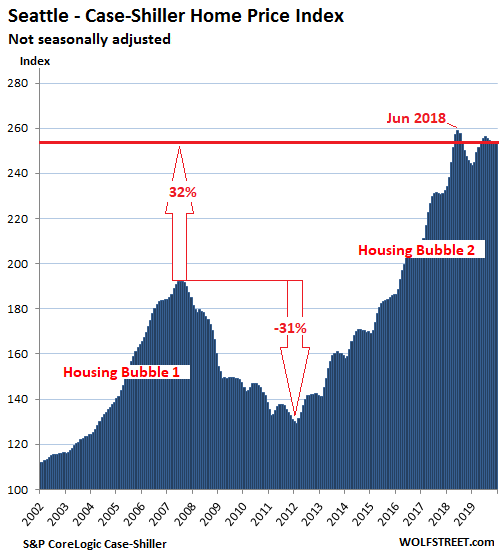

Seattle House Prices:

The Case-Shiller Index for the Seattle metro ticked up 0.2% in December from November but remains below where it had first been in May 2018. Also note the double peak:

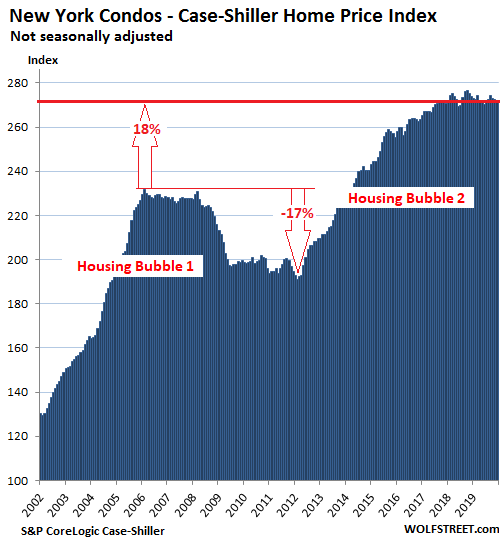

New York Condo Prices:

Case-Shiller uses a custom area for its New York City index that includes numerous counties in the states of New York, New Jersey, and Connecticut “with significant populations that commonly commute to New York City for employment purposes.” This area is far more diverse than Manhattan by itself, and the turmoil in the Manhattan condo and co-op market amid rampant oversupply of newly built high-end units is only one of many factors impacting the index.

Condo prices in the metro ticked down 0.5% in December from a year earlier and were back where they’d first been in January 2018:

This is “House-Price Inflation.”

Because the Case-Shiller Index compares the sales price of a house in the current month to the price of the same house when it sold previously, it tracks how many dollars it takes over time to buy the same house. The house didn’t get twice as big, but it just takes twice as many dollars to buy the same house. In other words, it measures the purchasing power of the dollar with regards to houses. This makes the Case-Shiller Index a good measure of “house-price inflation.”

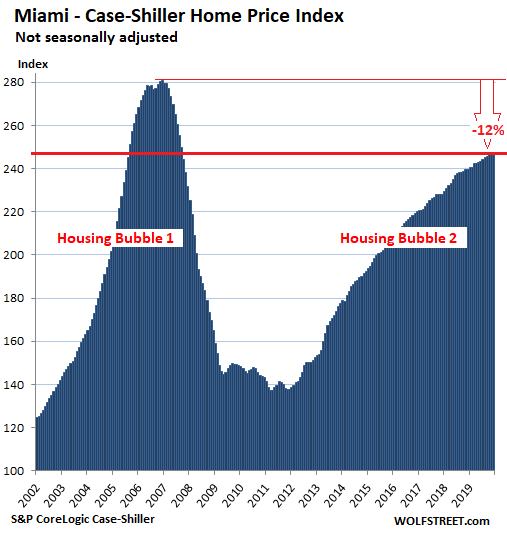

Miami House Prices:

Single-family house prices in the Miami metro edged up 0.1% in December from November and rose 3.2% year-over-year. The index is still down 12% from the craze at the end of 2006. Note that the index doesn’t track condos; but in the condo market, oversupply of newly built luxury units is creating very tough dynamics.

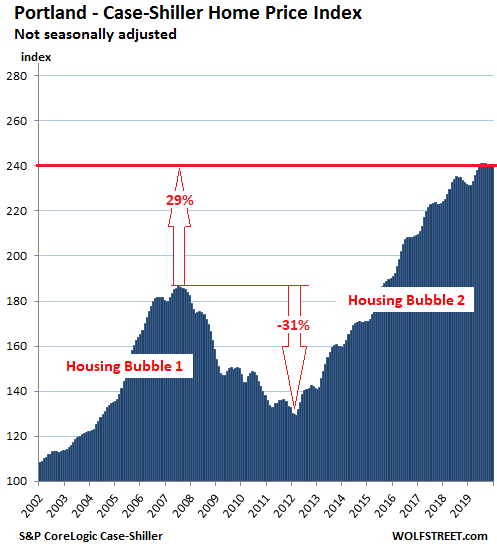

Portland House Prices:

House prices in the Portland metro ticked up 0.2% in December from November, have remained essentially flat for the past six months, and were up 3.7% year-over-year:

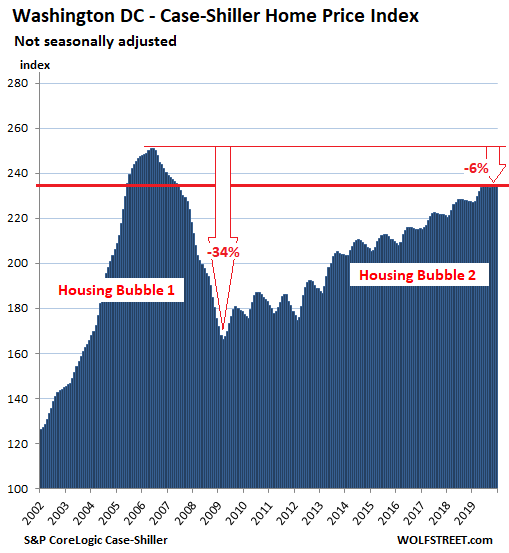

Washington DC:

House prices in the Washington D.C. metro ticked up 0.2% in December from November, have been essentially flat for seven months, and were up 3.4% year-over-year:

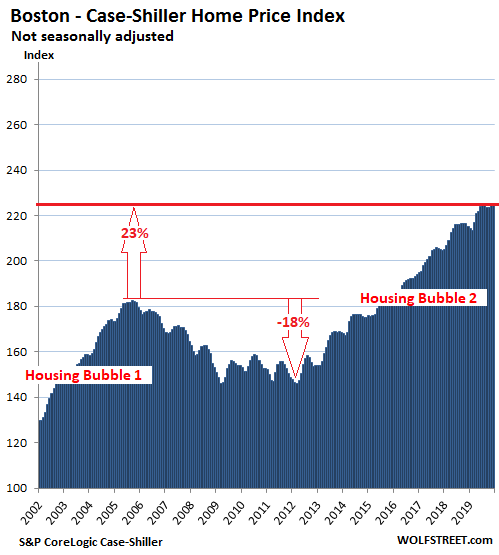

Boston House Prices:

The Case-Shiller index for the Boston metro has remained essentially flat for five months and was up 2.6% year-over-year. Boston’s index value of 256 means that house prices rose 156% since January 2000:

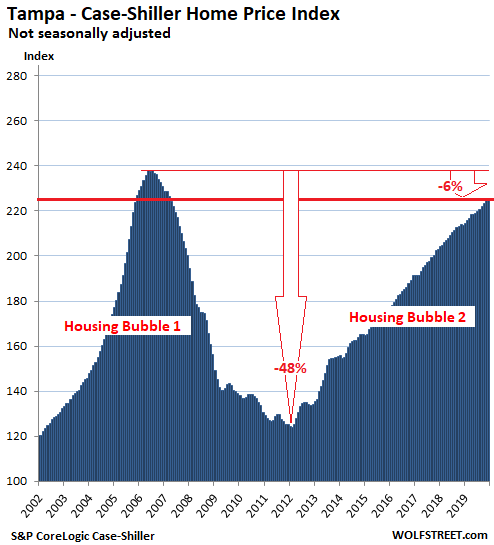

Tampa House Prices:

House prices in the Tampa metro inched up 0.1% in December from November and were up 5.2% year-over-year, the third-largest year-over-year increase of the metros in the 20-City index, behind Phoenix (+6.5%) and Charlotte (+5.3%):

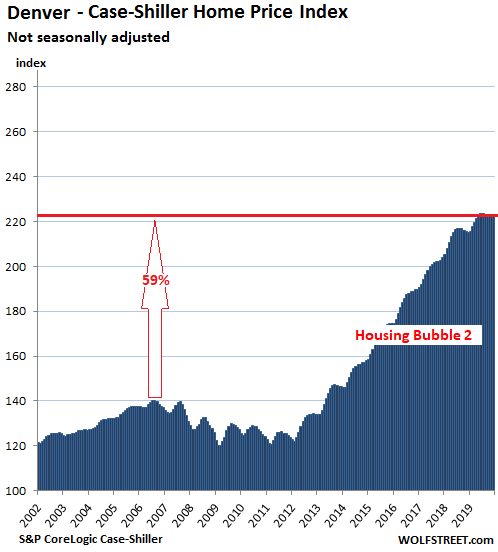

Denver House Prices:

House prices in the Denver metro ticked down in December from November, have been essentially flat since May 2019, and were up 3.7% compared to December 2018:

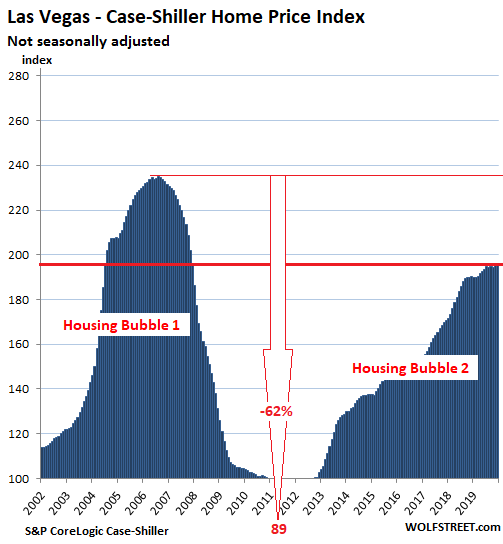

Las Vegas House Prices:

The Case-Shiller Index for the Las Vegas metro edged up 0.1% in December from November and rose 2.6% year-over-year, having been essentially flat for six months:

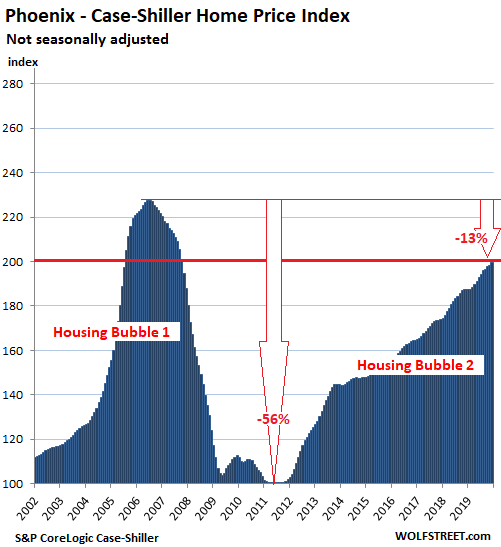

Phoenix House Prices:

House prices in the Phoenix metro rose 0.6% in December from November and were up 6.5% year-over-year, the #1 fastest year-over-year house-price inflation among the metros in the 20-City Index, homing in on the mad levels of 2006, having doubled since September 2011:

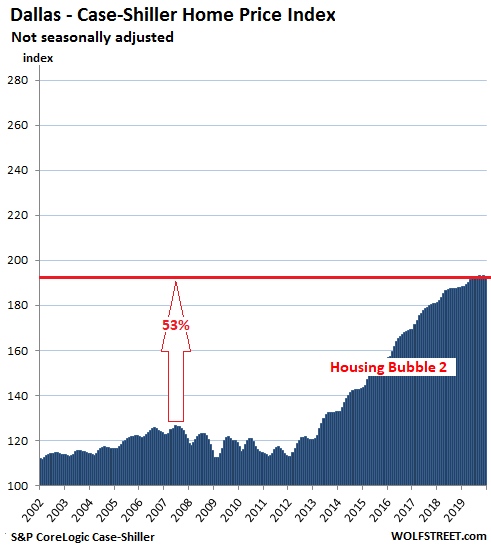

Dallas-Fort Worth House Prices:

The Case-Shiller Index for the Dallas-Fort Worth metro – the counties of Collin, Dallas, Delta, Denton, Ellis, Hunt, Johnson, Kaufman, Parker, Rockwall, Tarrant, and Wise – inched down 0.2% in December from November, which whittled the year-over-year gain down to 2.6%. The index value of 193 means that since 2000, house price inflation was 93%:

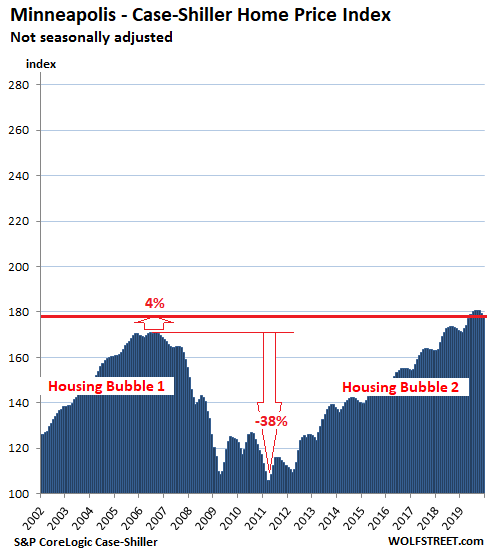

Minneapolis house prices:

House prices in the Minneapolis metro fell 0.6% in December from November but were up 3.7% year-over-year:

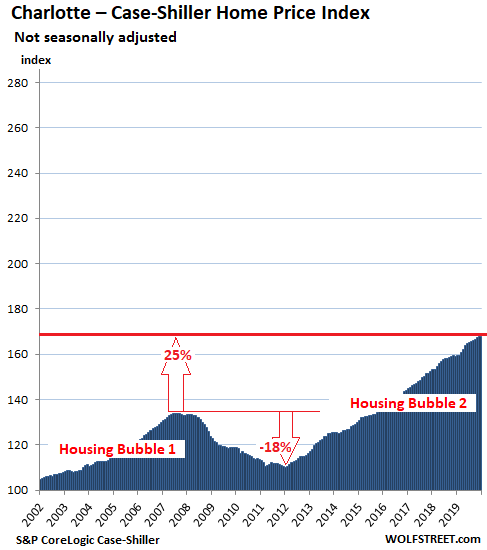

Charlotte house prices:

House prices in the Charlotte metro were flat in December from November but were up 5.3% year-over-year, the second-fastest house-price inflation in the 20-City Index, behind Phoenix:

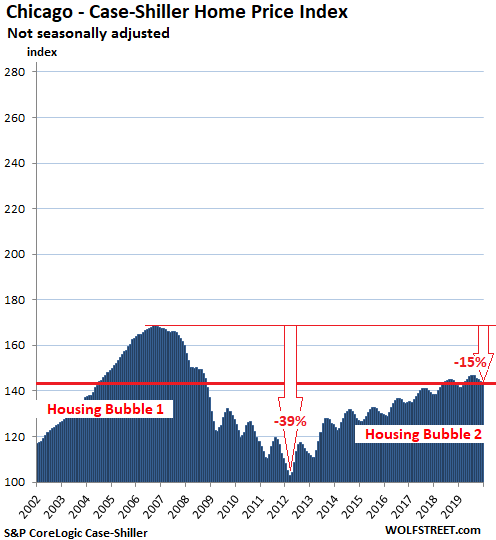

Chicago House Prices:

House prices in the Chicago metro – the counties of Cook, DeKalb, Du Page, Grundy, Kane, Kendal, McHenry, and Will – ticked down 0.1% in December from November and were up 1.0% from a year earlier, and back where they’d been in May 2018:

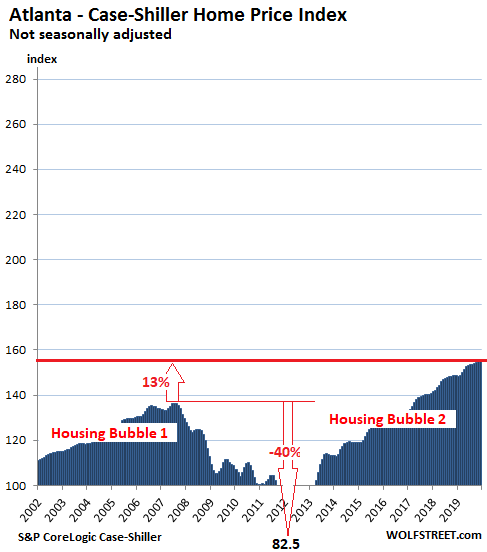

Atlanta house prices:

House prices in the Atlanta metro edged down 0.1% in December from November and were up 4.1% year-over-year. During Housing Bust 1, the index had plunged 40% to an index value of 82.5 in March 2012, back where it had been in 1996. But since then, it has surged 88%:

It’s clear from the way these charts look – the way they’re wildly different – that there is no unified “national” housing market, and that any measure of “national’ housing market averages out these wildly different local dynamics. But it’s also clear that these local markets are subject to national dynamics, such as the Fed’s monetary policies which have led to over a decade of interest rate repression, and hence low mortgage rates, and hence surging house price inflation.

It’s not only Chinese tourists, business travelers, and property buyers who’re not showing up, but also travelers from all over the world who’ve gotten second thoughts about sitting on a plane. Read… Coronavirus Slams Airbnb, Airlines, Hotels, Casinos, San Francisco, Other Hot Spots

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems like every month we’re going to see the turn, and it seems like every month we see the same result. I just don’t see this bubble popping. Honestly, I just don’t think it’s a bubble. Homes have (unfortunately) become an asset class.

Paint takes a long time to dry when you watch it. Prices are up against resistance. That seems like progress to me. Homes are no different than quantitative easing, interest rates, and quantitative tightening…tools. They will use those tools until something breaks. So long as homes outpace wages…its a bubble.

Hi Penny, I share you feeling. I don’t see anything on the radar to indicate an imminent bubble burst, nor any indication that what is causing these high prices – Fed policy – is changing.

I do think, on the other had, that the Fed might find a pretext to change policy and raise rates and reduce QE, should the “wrong” person get into the WH. That person and his policies will have to be discredited by the billionaires class who run our government.

Many families in these inflated housing markets often can barely afford their mortgage payments or rents. They make the payments because they technically can and standards have relaxed even though by traditional standards they may be overburdened. As long as they keep getting their paychecks then it’ll continue as usual. The same as last time though if unemployment goes up for whatever reason (and remember this is America where most people don’t have savings) you get marginal foreclosures and dried up demand, and therefore prices would drop. Any speculative energy that brought these prices up in the first place would also have the reverse effect. It’s all in the cycles, but this time if the fed wants to prop the housing market then it’ll have to take mortgage rates even lower if it can. This is a poor substitute for wage growth, and wages are still primarily how housing gets paid for, so again, how will the housing market continue this rapid inflation when the fed has had so little influence on wages? For real, the only thing that would prop up the housing market over the short term amidst a recession is qe for the people.

Auto bubble will pop before the Housing bubble. Auto’s probably in the process of cratering with housing by the end of the year. Gut feeling that housing will drop maybe 15% at most and then stay static because people remember what happened in 2008 and don’t want to pay the piper. But I base this on the Detroit market and it’s always atypical here so I may be full of it!

I agree with rhodium. There’s nothing about the housing market that will pop itself. What is worrisome to me is how much it has slowed with the economy still good, and prices at rock bottom. This tells me that when there is a recession, all of the 3.5% down, 40% DTI buyers are going to be in deep trouble. Inventory will spike when less people are looking to buy, and prices will come down as quickly as 2008.

It will take a long time to come down, and probably a long time thereafter to come back up. My feeling is, if you bought before 2016, hold. If you’re currently renting, continue to do so.

The US could still move to 0% down, almost-0% mortgage rates and full government mortgage insurance against price declines like in the Netherlands. Politics could also use tricks to make renting outside the social housing sector FAR more expensive than “owning”, so that most people have no alternative.

I bet that would give US home prices another push. Never underestimate how far politicians and banksters will go to buy themselves some time (and retire as millionaires before the bubble collapses).

One percent mortgages coming soon so it will keep going. Young people are screwed. Personally, I have a low priced townhouse 25 miles from nyc. Price hadn’t changed in ten years because property manager rackets make the maintainable feed go up so fast. The property tax goes up real fast too, 6000 for market value 250k. Town just built a recreation center for 32 million and is planning a high school football stadium. There is a college football stadium they could use two miles away.

MIAMI-DADE

Total home sales increased by 15.6% year over year, from 1,607 sales in January 2019 to 1,857 sales in January 2020. Condo transactions increased by 16.4%.

Inventory of existing homes decreased by 13.6% for single-family houses — from 7,265 to 6,277 — and 9.8% for condo units — from 16,518 to 14,902. That equals 5.6 months of supply of single-family homes and 12.5 months of supply for condos. A supply of six- to nine- months is considered a balanced market, meaning the market still favors sellers.

Median prices continued to rise. Single-family home prices grew by 7.1%, from $350,000 to $375,000. Condo prices increased by 6.5%, from $230,000 to $245,000.

As a seasoned speculator, I can tell you one thing: When you believe the price of an asset will never go down again, it definitely will.

Wolf, why don’t you ever include Houston,TX house prices? DFW is a different market than 300 miles south of them.

The Case Shiller Index only measures a small number of metros – I do not think Houston is included.

A very, very, very rough proxy of housing cost inflation might be found by using the historical apt rent data available by metro (since 2011) at RentJungle.

It is not useful for SFH prices but you can make an argument that home MTG costs and apt rents might move in rough parallel in terms of annual inflation (otherwise people would shift heavily from one to the other).

Anthony Aluknavich,

Cas127 is correct. Houston is not included. Back in the 1990s, when the CS was designed, they ran into big problems getting public records data in Texas, which doesn’t allow public access to deeds. But that’s where the CS data comes from.

To get the data for the Dallas metro, the CS people at the time worked out a deal with a Realtor association to get data from their multiple listing service.

And in terms of Houston, one of the founders of the CS said this:

“And when it was all put together, the decision was that was a bit of a hassle, so we’d stick with one city,” he said. Also, “we had Boston, New York and Washington so we decided that was enough for the Northeast, with apologies to Philadelphia.”

https://www.marketwatch.com/story/the-man-behind-case-shiller-on-why-the-housing-index-has-no-houston-and-why-thats-no-problem-2018-10-30

Sale price is not made public in Texas, but deeds can be looked up at the county courthouse.

Tax assessments could possibly be used in place of sale price. Tax assessments are available online for most counties and if the sale price is higher than the previous tax assessment, the tax assessment is automatically adjusted to the sale price.

Houston is 4th largest metro in the US. I can understand the DFW kluge during startup conditions, but now it seems like Case-Shiller should up their game.

Agreed – with the Zillows of the world mining re sales database data, there probably could/should be more comprehensive price/volume data for more locations.

My minor guess is that low volume data would expose the vulnerability of high prices and most re mkt players make their money from being perma bulls.

But just think how crappy the data landscape was pre internet…buyers were unbelievably at the mercy of sharks.

In theory, with Big Data at their disposal in 2020, including MLS, the Case-Shiller people should be able to create that kind of index for every city in the US.

I really like the sales-pair approach, much more than median prices, and and I wish we had more of it, for more cities, and with less delay.

Wolf: Thanks for the explanation. I forgot all about the fact that home sale prices in the Houston area (and presumably all of Texas) are not public information. Makes sense now.

Without ever appreciating housing prices…who are going to pay these insane property taxes?

I guess the last greater fool.

Until they cry victim, declaring themselves as victims and walk away.

“pay these insane property taxes”

You have put your finger on a major incentive that local governments have to manipulate the supply of housing via permitting, code regs, etc. In order to maximize their property tax revenue…which is by far localities’ major source of revenue.

In Netherlands they do this the other way round: property taxes are extremely low (<< 1%) and realized property gains are untaxed, it's easy money as long as prices continue to go up. But you pay in another way, with outrageous high land/home prices that are fully controlled by politics due to zoning and other manipulations like a severe shortage of rental homes. But who cares, almost anyone can get a no-money-down mortgage at near-zero interest rate, and with a free put option for all homes up to at least 300K euro. Buyers assume prices can only go up even more, so "buying" means NOT paying. Local government gets rich from land sales and zoning over here, not from property taxes.

Probably more clever politics than the US approach, but more dangerous when SHTF.

Which is why I loved it when trump limited local tax deductions even though it would hurt me. I thought it would put pressure on the state to reduce or at least slow the growth of local taxes. No sign of that happening in New Jersey.

Anybody expecting a housing bubble burst would be better off understanding that the Fed would rather finish destroying the remaining purchasing power of the dollar before ever allowing that to happen. There is no way out of this is except serfdom. Assets are for the 1% only.

The American housing bubble is imploding without or without the Fed.

For example – The Australian housing market is in a 2+ year collapse…despite near record low interest rates.

Is that so?

2 years of collapse?

https://www.businessinsider.com.au/house-prices-australia-domain-2020-2

Prices rose rapidly in Sydney at the end of 2019, particularly in higher-priced areas, with this momentum continuing into 2020,” Wiltshire wrote.

In fact, 8% seems to be the magic number. Prices both nationally and in Brisbane are set to grow by that figure. Perth, where the property market has been ailing for years, is also tipped to see “the fastest price growth since 2014” at 5%.

While those priced out the market might be incredulous the market could go so much higher, the latest data appears to support it. On Tuesday it was revealed new home lending shot up 4.4% in December last year, as low-interest rates attract homebuyers like moths to a flame. Meanwhile, the trajectory of prices nationally is on track to become the “fastest market recovery on record”, according to researcher CoreLogic.

What do the sales volumes look like?

In any mkt, absurd price increases may occur…but sustained by lower and lower volumes.

So applying those inflated prices to the whole mkt…is terribly misleading…there are likely nowhere near enough buyers willing to pay inflated prices if more supply hits the mkt.

This really has little to do with the Australian real estate mkt per se…it has more to do with misunderstanding the dynamics of marginal pricing.

I’ll second Rob Shorten’s comment. I was in Sydney visiting a friend that just spend an absurd amount on an SFH 15 minutes north of the bridge. Prices in the central parts of Sydney have indeed rebounded.

Eventually the coked-up hamster dies on the wheel.

Rubbish!

You obviously don’t read the Sydney Morning Herald’s ‘Domain’ or The Australian ‘Mansion’.

Real Estate is booming. Booming!

Buyers camp out for days just to bid on a bit of Aussie dirt. True! In the news a couple of weeks ago.

The average Oz wage is about $85,000 and burger flippers get the min wage of, what, $18 plus ? Something like that, who cares, we’re all too well off to worry about a dollar here or there..

And those – quite a lot actually – whose life-style choice is not to work, are supported by cheerful taxpayers year in & year out, until they all go on the Pension then drink together at the local footy club with nary a bad word – coz sport is wonderfully cohesive.

So Australia lazily slips into yet another decade of care-free affluence, led by wise & caring politicians who will seamlessly guide us through any slight turbulence of silly virus’s, supply chain hick-ups, or threats from aggressive & powerful neighbours.

And real estate will continue to boom.

But what if the 1% are now distributing their RE assets near the top? I think this is happening everywhere nowadays, in my area people are snapping up homes at ridiculous prices (highest ever, both absolute and relative to incomes) within days of them coming to the market. Buyers are some large foreign speculators (investment funds) who may plan to split homes in small apartments and rent them out, plus many small local speculators who try to avoid the coming Dutch NIRP policy for savings accounts. The elites are probably getting out of the market except for their own home (which usually is just a small percentage of assets for them, so no problem if prices fall). Talking to some experienced RE moguls in my area my impression is that most of them stopped buying years ago already and have just a few high value properties left, the rest has been sold in the last few years after stellar gains.

Questions: In the US, in the case of a bail-in, what accounts would we expect the gov to go after? Traditional savings accounts, money markets, or both? Is it likely they will disallow the taking of CD money if it expires around that time? Will they hit retirement accounts? If so, which types of retirement accounts? I cannot imagine they would go after checking accounts, since they could end up bouncing checks, but they could limit withdrawals. Would they be able to touch large managed pension funds?

kristine,

This should be the least of your worries. There is a lot of scaremongering about bank deposits, because it’s a lot of fun to scaremonger. Reality is this:

In the US, when a bank fails, stockholders get bailed in first. So they take the first loss. Then creditors are next – first unsecured creditors, then secured creditors. Depositors are unsecured creditors, but they’re INSURED by the FDIC up to $250,000 per account (follow the rules).

FDIC = US government backed by the unlimited printing press of the Fed.

Even during the big bad Financial Crisis, no insured depositor has lost a dime. One of my banks was one that failed and was taken over by the FDIC. Happened on a Friday evening. On Monday, my CD had been sold to another bank. I never knew the difference except the name changed. Just make sure you stay within the FDIC rules.

RE is local for sure. The Phoenix rise puzzles me, but I suppose it involves the entire area and not the airport neighbourhood where one should not even go out at night. What do I know? I only stayed there overnight on a layover and the hotel suggested I don’t go out after dark, at all.

I just read this article in The Guardian. Teaser headline: “Plight of Phoenix: how long can the world’s ‘least sustainable’ city survive? ”

Then, the Sierra snow pack has declined to 64% of normal for CA lovers.

Las Vegas, what is there to say about anywhere in Nevada?

Houston floods several times per year. Crime, shootings, homelessness, in every major city. And now Covid 19. This list is endless. Tulsa OK, crime 152% average. Miami, one of the highest crime rates in the Country.

I don’t understand why anyone would live in a major city, and never will.

Paulo, Huston doesn’t flood several times per year. That’s an old wives tale. But when Houston floods, it REALLY floods….(Harvey, 9/2017 – 55″ rain).

Do you yell at kids to get off your lawn?

What’s wrong with that ?

Jobs are why people live in cities.

“don’t understand why anyone would live in a major city, and never will.”

Jobs.

The corporate decision-makers who decide HQ locations tend to be very, very well heeled and to a remarkable degree allow personal preference and convenience to determine siting locations. (There are more than a few historical instances of new CEOs relocating Corp HQs to the city where they already resided…which is a rare display of arrogance and power).

Since these decision-makers are rich they tend to be (initially at least) amazingly insensitive to cost-of-living considerations for their employees.

Look at how long hyper-expensive, really fairly squalid NYC has hung on as the predominant Corp HQ location in the US, decades after technology undercut almost any location based network effect benefits

Telecommuting can only replace some jobs, you do want people in the same building, as it is inherently more productive.

Bigger cities can be better, more efficient places to live, the issue is that rental and home prices are allowed to spiral out of control. Even worse it’s usually encouraged. There is also a point at which a city becomes too populated, and network effects are outweighed by other issues. In America “with house focused cities” an ideal city would be several hundred thousand people, In Europe “apartment based cities” probably between 1 and 2 million. These sizes are based on cities i’ve seen.

“you do want people in the same building”

To an extent (as you pt out) but there is less reason to have a high pct of those bldgs all be in the same city (despite theoretical network effects…as you also point out).

But a 20’s era relic like NYC has really managed to hang on long past its sales date in term of Corp HQ siting.

NYC is the Pinnacle of pre-automobile city planning….100 yrs after the intro of mass auto ownership.

There are advantages to its mass transit and densification but it has become vastly hypertrophic relative to those advantages and the cost, quality of life, and political pathologies are well known.

Yet, I suspect the CEO class does not care so much since they have the wealth to live above the daily squalor. So NYC remains the capital of Corp HQs.

What does it matter if 85 pct of the company’s employees hate their lives…so long as the CEO can (theoretically) see live theater…American Corporate Decision-making as driven by “CATS”

Telecommuting often works out about as well as the paperless society predictions: optimistic. Too often it happens that the telecommuter is dumped after a judicious period of time (and learning curve) for the previously junior on-site person that now actually works the nuts and bolts in IT and other skills.

Goofing off in your pajamas sounds great, but as always, watch your back!

Some possibilities…were these that hard to comprehend?:

Proximity to more attractive women/ men, better paying / more rewarding jobs, better live music / entertainment , international cuisine, more stimulating intellectual environment, more better / varied night life, better, higher quality of education…

Big secret: major cities are not 100% high crime, congested slums.

No, those are not that hard to comprehend. Sometimes people are just willfully ignorant when such ignorance furthers their own bias.

I will admit that I sometimes do it too …

“Proximity to more attractive women/ men, better paying / more rewarding jobs, better live music / entertainment , international cuisine, more stimulating intellectual environment, more better / varied night life, better, higher quality of education…”

Everything you discuss is only propped up by the everything bubble. Most cities and the jobs in them are only in existence because of large inflows of government money…… who is broke. Take that away and all of your reasons for living in a city go poof.

Also i think they only still want people to come into skyscrapers because otherwise the value of the buildings would go to zero………

The city mouse and the country mouse tale is as old as Aesop; lesson: to each his own.

It only depends on which neighborhood in a city you live in; people have a tendency to ghettoize themselves and the social atmosphere is accordingly different. I’ve lived in small towns, the bush, and right downtown in the big city. All have their merits, but I’ve usually ended up back in the city for the activity, attractions, and anonymity.

We’re downtown now, and have been for years, on a quiet tree-lined street with historic houses that have all been restored by their young occupants (looking out the window and ignoring the new cars it could be a hundred years ago), the miles-long beach is a few minutes away by bike, kids play in the street, parents are out there supervising while they socialize and have a cocktail, kids walk to school just like the old days, we can walk to dozens of stores, without paying the huge premium in prices that the country or beyond demands, and without driving 50 miles to pay them. A block away is a medical facility, a hospital or two are 10 minutes away, there are a half-dozen dentists to walk to, and several drugstores and supermarkets … once you get to a certain age, things like that are important.

If you want to sell, it doesn’t take years; even in the worst markets, like 1992 or 2009, things here sold in weeks or less. Not that we care – it costs peanuts a month hard costs to live here.

Friends of ours moved to a small town in the country many years ago, to a lovely area. Prices are cheap, and the properties are nice, but they’ve been trying to sell for 5 years now without success at progressively lower prices in the hottest overall national market in years.

That really sounds lovely, and I have to wonder does such a place really exist? If so, where is it? You don’t have to name the neighborhood, just the city would suffice.

We live in Santa Clara, Ca and it sounds a lot like our neighborhood.

Toronto.

Respectively, most of the places I’d like to visit are up.

San Diego housing is pretty hot this spring. Nothing stays on the market, multiple offers, etc. There is limited supply and lots of people willing to leverage themselves – especially with 30 year mortgages 40% of take home pay. One job out of two gets jeopardized and that home is back on the market.

The investor class is a different story. The fed has made clear they will be protected.

“One job out of two gets jeopardized and that home is back on the market.”

Yep, there are a lot of mortgage debtors (more accurate term than home owners) tap dancing on the razor’s edge.

And that is what the Fed/DC considers healthy/normal economic activity that all maximum efforts must be hewn to.

We have all been living in the Fed’s pathological delusion for 20 yrs.

Parade of Homes time out here. A mortgage broker at one of the houses told my wife that banks/lenders are now able to qualify borrowers at 60% of their disposable incomes. Not that long ago, that maximum was 40%, said the broker. That razor’s edge is getting stropped keen.

Northern Virginia is crazy as well.

I keep thinking that if I loose my lease at some point or rents get too high, I might look to live illegally in a commercial space. Like MacGyver. Those rents probably can be had lower.

City of Chicago seems to stick out like a sore thumb!

Guess the serfs are leaving to escape their rising debt burden?

Yep…and the supply of buildable land is greater…and the surrounding localities more growth friendly…allowing an escape valve for rising Chicago prices.

Most of the most price toxic metros have serious land supply issues and development hostile suburbs.

Chicago / Cook County and “collar counties” residential properties are getting killed on property taxes and we are only in the pre-game festivities.

Go to realtor dot com and input Lake Forest, LaGrange, Hinsdale and Orland Park. Check what house sold for about 10 to 15 years and property taxes from then to present.

Hinsdale, Lake Forest, Orland & LaGrange are some of the most expensive towns in the entire Midwest. Hinsdale & Lake Forest have very little business as they are bedroom communities, hence the high residential property taxes. They are also quite beautiful and therefore, desirable.

Also, Case Schiller references Chicago Metro which is a vast area. Not just City of Chicago. Grundy, Kane & Kendall Counties have a lot of farm country remaining.

If you go to Realtor and input Chicago Heights, I would wager the property taxes there are quite a bit less. :-)

Weinerdog 43, The taxes are lower, the rates aren’t. I know you put the happy face on your message, so I think I get it. Similar to your example are Riverdale, Blue island, Midlothian, Dolton, Ford Heights…

US new home construction surged in January 2020 compared to January 2019. Home construction rose at double digit rates – US Census.

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

Adjusting for inflation is a better indicator.

Social Nationalist,

THIS IS AN INFLATION GAUGE, “HOUSE PRICE INFLATION”

Read the subtitle. And read the paragraph just above Miami house prices:

This is “House-Price Inflation.”

“Because the Case-Shiller Index compares the sales price of a house in the current month to the price of the same house when it sold previously, it tracks how many dollars it takes over time to buy the same house. The house didn’t get twice as big, but it just takes twice as many dollars to buy the same house. In other words, it measures the purchasing power of the dollar with regards to houses. This makes the Case-Shiller Index a good measure of “house-price inflation.””

It’s NUTS to adjust one inflation gauge for another inflation gauge, such as adjusting CPI for PPI, or adjusting “House Price Inflation” for “Consumer Price Inflation.” All that tells you is which is worse./ If the outcome is zero, it doesn’t mean there is no house price inflation. It means that both house price inflation and consumer price inflation have moved in the same direction by the same amount. And so what?

But, but, but…..

Works for Chicago. In other words, roughly no price increase in real terms for 18 years compared to CPI, so no ‘house price inflation’.

This time next year will likely look a lot different. The economy is a slow-motion train wreck, and coronavirus may push it over the edge. The stock, which basically is the economy at this point in the Everything Bubble, also appears to have just completed a blow-off top.

*stock market, I mean

coronavirus may push it over the edge

Agreed. And that’s looking increasingly probable.

The US CDC has warned that 40-70% of the global population could become infected. You had better hope they’re being unnecessarily pessimistic, because fighting it would quickly become the world’s biggest industry and most others would be seriously compromised. Risk to the US is very high because of the lack of a robust health care system and the administration’s budget cuts to pandemic preparedness.

Alex Kimani’s article on OilPrice has warned that the epidemic seriously threatens the global energy industry. Demand for oil in China is down 20%. Prospects for natural gas were already weak and could get worse. A great deal of Chinese industrial production is under lockdown, and most of the world’s solar panels and lithium-ion batteries are produced in China.

Other industries can be expected to have similar stories.

“lack of a robust health care system”

US health care gets 20 pct of the 1st or 2nd highest GDP on Earth.

The money may get stolen or insanely misdirected, but to say that US healthcare is underfunded is the same statist bullshit that teachers unions have been shoveling down the public’s gullet for decades.

Yes, definitely OVERfunded (just like over here in Netherlands, teachers etc. same story …). Cut the funding and health and education levels could improve instead of staying on the current downward trajectory.

I think his point is tens of millions of American don’t have access to health care because no insurance and high deductibles.

This is unique to America.

IMO a big part of the problem started in the 1980’s when the spread of for profit healthcare was encouraged.

Japan, for example, has a “robust” healthcare system, but NOT America, because ALL it’s people have access to healthcare (and I don’t mean insurance which is not the same thing as healthcare.

So IMO that is what unamused meant by “robust.”

And robust healthcare, America is not.

Timbers, emergency care in the US is required even without insurance due to EMTLA, if there is a large Covid-19 outbreak here, hospital care for the uninsured is a legal requirement for those ill enough to require it, and for those not ill enough, there is no treatment needed, the need is isolation.

The US healthcare system is better equipped than almost any country on the planet for a viral pandemic who’s main risk is prolonged ICU care, we have more ICU bed capacity than every country on earth with the possible exception of Germany. More than twice the capacity of France and the UK for example.

And our population is so much less dense than Europe and Asia that the overall risk of transmission is lower.

Not to say it wouldn’t be dreadful to have a pandemic here, it would, but Asia and Europe will be far worse off.

And health insurance per se would not be a major determinant of appropriate care.

Happy1,

“The US healthcare system is better equipped than almost any country on the planet for a viral pandemic who’s main risk is prolonged ICU care…”

You forgot to add “for those who have access to it.”

Tens of millions do not have access to healthcare, and in fact emergency care is being segmented and outsourced into “out of network” coverage for major price mark up by hedge funds and others, because higher profits. If you think laws requiring emergency care means those tens of millions will get the same care as the rest of us, and some people will avoid using that so called legal access to avoid becoming medical debt slaves, IMO you’re 100% mistaken.

Also, those of us who DO have insurance often avoid visits let along emergency visits, because we have to pay for them out of pocket.

That lack of healthcare in America – by tens of millions of folks – is unique among the wealthy nations. If you think this does not make America more vulnerable, think again.

In contrast, folks in Japan/France/Germany/Sweden/etc are MUCH better prepared to protect their people…because EVERYONE has access to mostly the same level of care.

Having the most for-profit technology (for the rich) doesn’t mean it has widespread access.

Happy1,

“And health insurance per se would not be a major determinant of appropriate care.”

True, but that’s not what I wrote.

What I wrote is, insurance is not healthcare. In other words, having insurance does not = access to healthcare.

But it does – like a parasite – cost money and divert funds that could used to provided health.

And health insurance per se would not be a major determinant of appropriate care.

It already is, but you keep telling yourself that.

The US healthcare system is better equipped than almost any country on the planet for a viral pandemic

Only about a dozen states have the tests necessary to check patients for the virus. Chances are, yours isn’t one.

Happy talk doesn’t cut it, ‘Happy 1’. Your bleatings are typical of the disinformation about the pandemic issued by the administration and his other flacks these days. I could have a field day with it, but unfortunately this is not an appropriate venue. But the Senate isn’t buying it, and neither are the equity markets.

“And health insurance per se would not be a major determinant of appropriate care.”

“It already is, but you keep telling yourself that.”

Thank you, Unamused.

I should never have granted Happy1 that point. It was a mistake on my part.

I got over twenty thousand in bills so far from an unrequested visit to the emergency room after fainting at a sauna. All I did was lye on cot in emergency room and a couple X-rays. Remains to be seen what my insurance will pay.

Mikey,

Don’t be surprised if some 0.000001%’er owns the Hedge Fund or Private Association that got an outsourcing contract from the emergency room hospital you went to – so they could bill you much higher rates “out of network” (meaning you pay it all, your insurance pays nothing).

That’s called “healthcare” in America.

Timbers,

“some 0.000001%’er owns the Hedge Fund”

Other than to feed in to some politically useful mythos…why would it take a billionaire…as opposed to some exploiting Doc with a share in the hospital or inflated hospital costs tied to mandatory overstaffing required by a nurses union, etc.

There can be villains all up and down the supply chain line and to think otherwise (like thinking “nonprofit” means honestly priced) is to invite ruinous public policy decisions that don’t make things better…but simply shift more graft to factions with better PR.

cas127,

“why would it take a billionaire…as opposed to some exploiting Doc with a share in the hospital or inflated hospital costs tied to mandatory overstaffing required by a nurses union…”

Because

1). Billionaires have more $ than nurses who allegedly do the things you accuse them of, and they like to move their income into hedge funds so they never pay more than 15% tax like I explained to you the other day…

2). I DID also include Associations and such, because it’s not just members of the 0.0000001%.

Your nurse pot shot is a laugh riot funny…AS IF. You’ll have to do better than that. You would have better luck with “why not the homeless who pool their food stamps to start hedge funds to outsource emergency rooms to jack up rates?”

cas127,

Oh…and because there are actual examples of hedged and private money from the super rich, doing just what I mentioned, in health care.

That’s why.

From the Miami Herald:

A man in Miami went to the hospital to receive a test for the coronavirus after developing flu-like symptoms, only to receive the news that he didn’t have it — **and a $3,270 medical bill**, the Miami Herald reports.

Why it matters: The man had just returned from a work trip to China, so took his symptoms more seriously than normal, which is exactly what public health experts want people to do.

The episode would be a great parody of the health care system, if it wasn’t real.

The man has a short-term health insurance plan, which usually have skimpy benefits in exchange for lower premiums, and **don’t have to cover pre-existing conditions**. (thanks to the current administration)

The hospital told the Herald that the patient is only on the hook for $1,400 based on his insurance, but his insurer told him that first, he must provide three years of medical records to prove that his flu didn’t relate to pre-existing conditions.

And more bills are probably coming.

The kicker: The patient works at a medical device company that doesn’t offer health insurance to its employees.

Timbers and Unamused,

Not arguing that our health system isn’t screwed up, it is, and some sort of universal coverage would be better for long term health outcomes for sure. I’m not making a political argument.

You are saying that our health system is “not robust” in the setting of a viral pandemic that requires ICU care. Our health system has faults, but acutely ill people who present to an ER in the US get ICU care regardless of insurance, this is the law, and I have 30 years of practice that says it is also the practice, with no exceptions in my career.

And the US has better overall ICU access and care than any country in the world per capita except possibly Germany.

So for a pandemic reliant on ICU care, the US is quite robust. And most informed people would not want to be in either Europe or Japan for their care at the moment, as they have generally less ICU capacity.

It doesn’t matter how much America spends on healthcare, almost 100% of pharmaceuticals are imported or are dependent on imports. With Chinese factories not working at full capacity, how long until America runs out of supplies of pharmaceuticals and everything else it imports. As well as the fact we already know that China will hoard many things like the face masks for themselves. America can make face masks, but it’s a sign of what’s to come.

Happy1

You are saying that our health system is “not robust” in the setting of a viral pandemic that requires ICU care.

Except that I didn’t say that. You said it. The US health care ‘system’ is characterized by the US NIH as the world’s most expensive yet least effective compared with other nations, dropping to 27th place and getting worse. WHO ranks it 37th, below Morocco but above Slovenia.

So for a pandemic reliant on ICU care, the US is quite robust.

Saying it doesn’t make it so, and the evidence is clearly against you. Even CNBC reported five days ago that only three states were even able to test for the disease. Hawaii is trying to get test kits from Japan. And that’s on top of the shortages of nurses and doctors.

Numerous business news sites characterise the US health care ‘system’ as ‘broken’. Google them up yourself, starting with Forbes.

Your definition of ‘robust’ is so severely flawed on so many levels that you’re too easily dismissed as an administration flack.

Un,

I find it interesting that you don’t trust much of what the U.S. government says or does, and yet you do trust US CDC estimates. That’s an interesting MacGuffin.

Not all of the US government is corrupt. Hence the need for purges and loyalty tests, typical of oppressive governments like the Soviet Union and Red China and now a feature of US politics. Agencies and persons who are not completely corrupt either resign, shut up, or are forced out. You know, those who criticise or contradict the party line.

The US CDC contradicts the party line, and therefore may lack the corruption of, say, the Justice Dept., at least for now. It’s far more credible than an administration that can’t get its facts straight even when it isn’t busy ignoring, spinning, or inventing them.

BTW, it’s not a MacGuffin. It’s superficially a paradox, easily resolved by most people. Wikipedia can explain a MacGuffin for you.

He’s not trusting “the CDC” per se. The CDC’s estimates are backed up by every reputable epidemiologist on the planet (and their quantitative models), by the lived experience of the Diamond Princess passengers (before they were evacuated), and by the historical 1919 pandemic flu records.

The infectiousness of the disease is hard to quantify but that it’s far more infectious than influenza or other recent outbreaks is not in question. COVID has broken containment and begun spreading worldwide. Those who understand how these things work know a pandemic is inevitable and are warning as loudly as they can. Even if they aren’t calling it a pandemic just yet.

I see 3 main issues ahead:

1) How can leaders and media best raise public awareness to promote adequate non-pharmaceutical risk-mitigation measures, without triggering panic and chaos?

2) Will the public take the necessary measures to limit the final severity and death toll? It appears to be absolutely critical to slow the spread so that the limited supply of ICUs and oxygen support systems isn’t totally overwhelmed. (It won’t matter what insurance you don’t have if there’s no place that can care for you…) Comparing the Wuhan data vs. the rest of the world, it appears that once all the hospital support systems are overwhelmed, the risk of death rises 5-10x.

3) What changes will result globally in the aftermath of World War COVID? To stay on-topic with housing, consider that older people are more at risk, which might lead to additional housing supply coming onto the market. On the demand side, single-family residences are probably safer from epidemic diseases than more-crowded condo and apartment complexes, and nursing homes too. Depending on how chaotic the cities get, that could be a factor in future demand as well.

I’m of the opinion that we’re going through a watershed historical event, likely to rise to at least the same magnitude in terms of social and economic impact as the Great Recession. Hopefully not much greater.

Why the bay area index does not include cities like Palo Alto/Los Altos/Mountain View?

I wonder what the Case-Shiller graph would have looked like in Germany during the Weimar Republic quantitative easing period. Talk about splendid bubbles.

Your analysis is flawed- as is the C-S

Trend

(Avg home value x # of units + Avg rent x # of units x occupancy rate) / (Avg household income x # of households)

The chart is very different

What you will find in most markets is the number of new properties is lagging number of house holds. Supply vs demand. Low supply vs high demand leads to increased prices.

Marston Gould,

That’s a fantasy formula that works only in your own mind.

LOL, must be a professional liar, I mean, Realtor (TM). Supply vs Demand, say the people whose professional qualifications start and end at a 6 month training course. And somehow, we’re supposed to listen to them for advice related to economics.

But why the low supply?

It may just be a timing lag but home prices and apt rents have been soaring for a while – yet the supply response has been very slow.

And it isn’t like demographics are hiking demand…quite the opposite.

Good point cas,,, as a long time analyst/estimator/former carpenter, etc., it seems to me that the current lag, as opposed to other decades, is mostly due to the amazing amount of ”red tape” that has been put in the way of ALL construction, even remodels in the last 5 decades or so.

Building new apts in Gainesville in the early 70s was easy, and also quite cheap, as many very good $5/hr workers came, quite literally ”out of the woods” in nothing but overalls and boots, and local guv mint wanted more housing, and helped expedite… don’t know much about that area today, but the last house I built in CA, in 90, took six months and $22K in ”fees” just to get the permit, and I was told the same area is now more than triple that $$, perhaps even more.

Working up an estimate for multi-family housing in SoCal last year, the wood framers were about 6x per SF than 90, and the lumber folks were telling me minimum six months to get the sticks OR trusses, because, they said then, it almost all had to come out of Canada and was subject to limits due to politics…

This supply challenge may change now that many former wood frames are being specified as ”engineered wood” or metal, from studs to joists and rafters.

Here’s my take on Covid-19 and the Real Estate Market.

It’s going to take a big hit, a 50% decline in transactions by June 2021 and a 25% drop in the median price is well within the range of possibility.

Here’s why, the virus will not be contained and the supply chain disruptions have just begun to show their effects, if China stays in turmoil for another two months it’s going to effect every one big time.

The US healthcare system is in no way prepared to deal with a pandemic.

People buy homes when they feel confident that they will still have a good paying job and that home prices are either stable or going up.

Who is going to show up at open houses when the panic hits ( And we are close to that now), or when they worry about whether they are going to be laid off because their company can’t get essential parts or materials?

Axios listed 150 medications whose supply has been disrupted because they are only made in China…

The decision to buy or not buy a home is essentially an emotional one and when people are scared they are unlikely to make the biggest purchase of their lives.

Yup, I am sticking my neck out (Again) just as I have since 2004 on the Sonoma Housing Bubble Blog and for years after that in the comments at Calculated Risk.

Tom Stone,

It will be very interesting to see this play out here in the RE market. The coronavirus impact coincides with the downturn in the startup scene and the shutdown of numerous local startup companies, which started last year, and with other companies moving some or all of their people out of the Bay Area (incl Schwab and Macy’s Tech center).

Already happening Wolf: a friend selling a house in a good area of Santa Cruz, very reasonable compared with ”over the hill” got one offer, apparently with a lot of contingency, as opposed to the ”bidding war” expected.

Wolf,

Houses in Bayview and Silver Terrace Area now going for 1.3 million. I didn’t think it would get this bad, but it has. Hyperinflation is here, along with the mass of shell companies still buying real estate in the Bay Area…will be interesting to see how this plays out. My instinct tells me not good, but the fed and the financial economy continue to pump this market full of “liquid” debt.

The current housing market, like the ghost of chutulu from the depths of haloscan, will eventually succumb to the reality of shifting demographics and stagnating income.

Hoocoodanode?

In my country the shifting demographics means that wealthy boomers buy up the housing stock, corner the market to force prices higher and doom younger people to rent forever while paying a multiple of what it costs those boomers to own their investor properties (or they could go into debt they will never be able to pay off, unless one cheats).

Actually, the demographics should have been undercutting housing prices for over a decade now, between Boomer retirement and the collapse in youth household formation.

That is one reason that we are near to a brittle peak in housing prices, with thin transaction

Tom, my neck is sticking out right next to yours on this one… May we both be wrong.

Iamafan:

Title: The Menace of Fiscal QE

Read it. Fed policies can take control of government appropriations out of the hands of Congress. There go the last tattered remnants of US pretenses to democracy.

Tom Stone:

a 50% decline in transactions by June 2021 and a 25% drop in the median price is well within the range of possibility.

That could already be baked in.

Here’s why, the virus will not be contained and the supply chain disruptions have just begun to show their effects . . . The US healthcare system is in no way prepared to deal with a pandemic.

Your DOTUS has left key positions that would be tasked with managing the response to the virus vacant for years, and has shut down 37 of 47 global anti-pandemic programs. Yikes, you might say.

Mr. Markets is hoping interest rate cuts will help, but it’s fooling itself. Marketwatch reports that the Fed can’t do much to counteract the economic hit from coronavirus because its interest-rate tool is designed to address aggregate demand and can’t do anything about aggregate supply, the main impact of the disease. The Fed can’t produce parts, reopen factories, provide factory workers, or stimulate Chinese demand for US products.

The Fed can take on more trillions in financial toxic waste though, so there’s that.

This is a question from somebody who never owned a house in the US (I rented when I lived there), but can anyone tell me how often are property taxes and junk fees reassessed these days?

Out of curiosity I looked at the closest place I could find where I lived in San Diego and I found property taxes to stand at $1,036/month right now. With a mortgage payment of, say, $3,000/month that’s a nice extra kick to the wallet, and I doubt it can be paid in Blue Apron shares, WeWork bonds or something lame like that. City governments generally only accept bezants, aka cold hard cash. But what happens if the present trend continues? I honestly doubt the City of San Diego would leave property taxes unchanged on a place that appreciated 20% or more in four years.

Both maintainable fees and local property taxes increase about seven percent a year where I live in New Jersey. Pretty small compared to the state college costs which have gone up as much as eighteen percent in one semester.

This is a question from somebody who never owned a house in the US (I rented when I lived there), but can anyone tell me how often are property taxes and junk fees reassessed these days?

Under California State law (Prop 13), real property is reassessed only when a change-in-ownership occurs, or upon completion of new construction. Except for these two instances property assessments cannot be increased by more than 2% annually, based on the California Consumer Price Index.

Out of curiosity I looked at the closest place I could find where I lived in San Diego and I found property taxes to stand at $1,036/month right now.

SD property taxes are about 1.25% of the purchase price. You can calculate your monthly tax payment by multiply the purchase price by .0125 and dividing by 12. For example, if you purchase a $500,000 property, the taxes will be around $520 per month.

A monthly bill over a thousand would mean you’re looking at a million dollars for a home, which gets you a shack in some places.

CA’s average property tax rate is 0.76%, among the lowest in the US, compared to Montana at 0.84% and Idaho at 0.72%. Texas is at 1.81%, much higher than San Diego. So the problem isn’t tax rates. The problem is sky-high bubble prices.

I neglected to include references. Sorry.

http://www.welcometosandiego.com/for-buyers/california-property-tax-info/

https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/

I’ll believe anything I’m told, unless it’s contradicted by more reliable sources or doesn’t pass the smell test. These days the reek is incredible, so one has to be careful.

Zantetsu

You’re not wrong, exactly. You just weren’t quite correct. But now you are. Thanks for issuing the correction.

I still don’t think tax rates are all that onerous, not compared to house prices. I wonder how people can afford these things, and then it occurs to me, they can’t.

But the places with the sky-highest bubble prices also have the highest tax rates. I’m not sure what “problem” you were referring to, but where I’m sitting, it’s a Big Problem. It significantly reduces my incentive to buy.

I want to buy a three bedroom townhouse somewhere along 85 between Mountain View and Cupertino. That’s 1.5 million, and the monthly property taxes are $1,562 per month, which is half my current rent.

Prices around here *only make sense at all* if you believe that you will get a windfall profit when you sell 7 – 10 years from now, which is by no means guaranteed.

So basically the only way to own a home around here is to bet your financial future on it. And you either get completely wrecked or win big. That’s the risk you have to take just to own. It sucks.

Thank the Fed and CA zoning policies.

They have turned a semi-stable mkt for a necessity (housing) into a bet-your-life casino.

But the places with the sky-highest bubble prices also have the highest tax rates.

Not true.

Nebraska’s average rate is 1.77%, half a point higher than San Diego. No bubble there.

Wisconsin’s average rate is 1.91%, even higher than Nebraska. No bubble there either.

Hawaii has the lowest average rate in the US at 0.27%. The median price for a house on Oahu went over $700k a couple of years ago and CoreLogic expects it to surge another 5.6% this year. Bubblicious.

Your turn.

I think this is true for many housing markets in the developed world nowadays: prices only make sense if you assume continuing fast appreciation, so you never have to pay the principal (assuming one is buying with maximum mortgage).

In my country “owning” is now often 2-3x cheaper than renting on a monthly basis, with zero-down mortgages available for almost everyone. While many brag about their virtual gains from buying, the higher cost of renting should tell people that something is wrong and that there may be a hidden cost for owning. In my market a HUGE stable income is required for renting anything decent, while you can sometimes get a mortgage based on social security allowance or just one year of self-employed income.

For me the situation is even weirder, because I find it nearly impossible to rent something nice despite having enough capital to pay the rent basically forever – I have no official income at the moment and that’s the only thing that counts in Netherlands. Most people with no income (like all the new citizens from abroad) get a free home from the government, but if you have some capital and have paid lots of taxes in the past you get nothing and are not even allowed to rent – undoubtedly to force as many as possible to spend all their capital on buying a home.

So yes, if you want to own you have to bet and assume there is no risk in the housing market. Which is true if you are prepared to cheat, very easy over here to shift the burden of negative equity to the taxpayers; at least until the real declines start and everyone tries to get out from under their mortgage by cheating.

Unamused: you are correct, I am wrong. I should instead say “the places with the sky-highest bubble prices sometimes have high tax rates too”.

MC01 — Most places do some kind of reassessment every year: some do only digital, some do every property by inspection, some likely do both.

As mentioned above, property taxes are the main source of income for many local jurisdictions, both cities and counties, so they are usually very interested in maximizing that income in order to be able to spend other people’s money.

That’s why some of us call them ”guv mint.”

I live in what Silicon Valey considers Podunkville (Boise, Idaho), but property values here have gone up 12% over the past 12 months alone. A lot of retirees are selling and going to cheaper neighbouring towns where property values are lower. A friend has seen her parents’ property taxes double over the past four years.

This sets off a chain reaction where it raises home prices in those neighbouring towns. Plus a lot of people from CA, OR, WA and CO are moving into this area and surrounding towns, causing home prices and property taxes to to go up everywhere. It is a vicious cycle.

If you are a retiree or someone who has lived in that property for a while and don’t have the means to pay those rising taxes, it is a dire situation.

The galling part is no refunds on the property (really home wealth) tax if values fall…and no netting out of mortgage debt needed to acquire home in first place.

In a lot of ways, the property tax is uniquely abusive…but the scam has been running so long people no longer recognize it…

I live in San Diego and I can tell the property taxes are raised yearly.

Property tax rate is usually 1.01 % in SD and many of my friends are paying Mella Roose and Hoa on top of this.

Mello Roos is a special tax for people who buy homes in new (some are now old) developments where the builders got a law passed that encumbers the new home buyers to pay for schools and other public structures rather than the developers. It was a special law passed long after the Prop. 13 limit of 1% tax was established in parts of San Diego County. The money is used to pay-off bonds that were used to build the buildings while development was underway. That tax is in effect from between 25 – 40 years. There are developments where one home may have been built and sold before the law was passed, while the neighbors may be in the same model home, same neighborhood, but in a phase that is under the Mello Roos obligation.

1) As long as QQQ daily above the cloud, SF RE is still troubles free.

2) As long as the Nasdaq inside a 6Y chart, no harm is done :

Nasdaq monthly : draw Mar 2014(H) @ 4371.71 to Apr 2015(H) @ 511983

and a parallel line from the of Oct 2014(L) @ 4116.60.

3) Yesterday SF got lucky, it escaped an earthquake.

4) But if SPY daily have troubles getting in the cloud and above, US RE troubles will grow, despite falling mortgage rates.

5) UST yield curve is defective. It does NOT predict inflation.

The supply chain might be infected, causing shortages and basic

commodity inflation, but the Fed is blind.

6) China industrial might will be transferred back to US thanks to the coronavirus, but its a slow process.

7) It take time to plan, raise capital and build a plant.

8) Gravity will pull US yield curve to NR in Europe. The yield curve will cave in the middle, but cost will rise,

Covid-19 spread in the U.S. and its possible impact on the economy with cities under quarantine, schools closed and factories shutdown along with hospitals unable to maintain high levels of service would make the current market sell off a minor event. The fact that our current President and adminstration is more concerned about the stock market reminds me of how the leaders in China reacted to the initial outbreak, head in the sand.

It’s also sad to see that Extinction Rebellion are treated like terrorists while farmers who protest aggressively against a proposed reduction of their huge CO2/Nitrogen emissions, or stricter rules for poisoning the environment or bad treatment of farm animals, are treated like royalty; by Dutch politics and media, probably much of the same in many other countries.

Too late to reverse the trend indeed.

A real bust in the housing market (>> 50% down) could have a positive effect by forcing people to rethink their priorities; which of course is the last thing authorities want, as the current priorities (maximum consumption) are exactly how the elites want it.

Unamused:

did you happen to hear about Tony Heller? His video “My Gift To Climate Alarmists.” He shows that if we take into account earlier weather data, current trends are not abnormal.

It’s like markets – what looks like crash today, may be just a blip in the week etc. I didn’t have time and much desire to go deep into this, but from my experience even simple models can fail, let alone the models of a global scale.

And I think everybody would feel better if near term (2 to 5 yr) projections were made that could be sequentially verified instead of 100 yr projections of cataclysm screaming for instanteous changes.

If the models are working, there is little reason not to make near term, testable projections.

Climate change? Are hedge funds shorting real estate in Miami or buying tundra in Canada? Until they are I think the property market will revolve around other more salient issues, like governments worldwide debasing their currency to oblivion.

RE is a bifurcated market (along lines we could debate) in the process of becoming a national market, where price is fully commoditized, say dollars per sq foot, adjusted for the local economy. Assuming there is a mean price in RE we can guess that when HB2 is lower, prices might revert (higher) to the mean, and where HB2 is higher, prices might drop in price. Or we could have a shock to the markets which lowers, or raises the value of all markets, some more than others. Low interest rates help people already in housing, but high prices act as a obstacle to entry. The standard formula goes if value is constant, then a change in mortgage rates offsets the price, and the only way you can change value is by changing the money supply. A lot of moving parts, climate change, interest rate policy, market volatility across all asset classes but perhaps this one national market idea will tend to pull the extremes together.

Roughly true, but things like job mkt and buildable land supply tend to vary a lot from metro to metro (at least for the insane price metros).

For me, the more interesting metric is cost to build per sq ft – it represents the cost to add new supply…and seems to have inflated at a rate unjustified by any component element (labor, materials, even land).

When you look at component cost inflation it really looks like the only mjr thing driving home construction cost inflation…is dumbass Fed policy that allows monthly pmts to stay constant while home construction costs mysteriously double.

The Fed’s ZIRP has really only made homebuilding companies very, very rich (and saved the butt of corporations buried up to their ass in debt).

Everybody else…including cautious savers…screwed.

Any mystery why more and more Americans want the blood of the Establishment?

Permit fees are high. Environmental studies, etc etc. The spread between vacant property and existing housing has widened. In places like Vegas the city planner asks the developer where do we get the water? In Miami, how do we keep the water out? You are correct cost per sq ft doesn’t reflect inflation in wages or materials. Keeps the insurance companies on their toes, like what it does to your building costs when your mortgage is insured through a high risk lender? You just paid $300 a ft on your 2500 ft dream home, and your insurer dropped you.

On the west side of the Portland Metro Area many real estate listings start with the claim “Close to Nike”. Nike is facing a triple whammy to its bottom line in the form of cratering asian markets, disruption in it’s supply chain and the prospects of the cancelation of its main promotional venue ( sports competitions). I can’t imagine it will be long before this flows through to local employment and then I imagine these “close to Nike” RE claims will then disappear.

I would like to see data on property tax payments across all these zones. Are there any noteworthy patterns?

I would like to see an analysis of housing affordability.

The United States has a housing affordability problem. Even the National Association of Home Builders says Housing affordability is at crisis levels.

Home prices are rising faster than wages in roughly 80% of U.S. markets, according to ATTOM, a real estate and property data company. Almost two-thirds of renters nationwide say they couldn’t afford to buy a home if they wanted to.

The prospects aren’t much better for renters, either. Approximately 18.5 million households were spending more than half their income on housing in 2016. There’s not a single county nationwide where a minimum wage earner working 40 hours per week can afford a “modest” two-bedroom apartment without being cost-burdened, according to government standards.

By themselves, RE bubbles only tell part of the story. And that story is a tragedy for millions.

My daughter and her boyfriend make over $250,000 in combined incomes in the SF Bay Area. Even with that income , they can afford only a fixer upper in the nearby suburbs or have to suffer a horrible commute to live further away. They are not staying and will leave SF at the end of the year when he gets his PHD

It really is amazing some of things you find yourself saying around here with a straight face.

Even the usual ‘escape hatches’ from the Bay Area (Portland, Austin, Seattle, Denver) are overpriced at this point, but it’s all relative. An $800K price tag in Denver has people up in arms in Colorado, but coming from here it would be a game changer in terms of affordability, and people see it as a bargain.

I know it’s never been a cheap place to live, but everything is upside down. The offshore money sloshing through the market, the rampant NIMBYism of current owners to stop any new supply in its tracks, the next generation of out-of-college workers choosing to avoid SF for Boise or Nashville so they can afford to have a life. It feels like something has to give soon, even with the amount of cheap money floating around. Who knows?

Same story here in Netherlands. A two-income household with two pretty average jobs, one of them part-time, can nowadays only afford to buy 1-2% of the homes that are for sale in the cheapest part of the country – which of course is usually not where their work is. In much of the country basically none of the listed homes are affordable for them and the cheapest ones available are often already 50% over budget. Teachers – who have relatively high incomes – can no longer afford to buy a home in most of the big cities, let alone rent (which is often even more expensive) – which is causing big problems for education.

Renters (outside social housing) on average spend close to or over 50% of their income on rent and in the big cities one would have to spend around 100% (which some people do out of necessity, as a temporary solution). People living on the street or living in with family out of financial necessity, with no solution in sight, are becoming common. And our government does everything to make things worse, after all this is great news for the big RE speculators. And obviously, most homeowners are cheering along and bragging about their wise decision to buy. But in the long term, this is destroying the economy and when the bubble pops the whole Dutch economy will go to hell with it; Tulip Mania 2.0.

Just like the stock market , the housing market will crash and crash hard.

Housing costs in many of these areas have consumed a larger and larger % of consumers incomes . This is not sustainable

Housing has become almost as financialized and leveraged as the stock market. When sentiment and employment change, unfortunately housing prices will crash.

1) NYA opened a gap below Jan 2018 high and cont further south below Sept 2018 high and July 2019 high.

2) NYA daily cloud : market makers sent chickou (Japanese), the lagging line, to the bottom of the cloud at 4PM. Meh !

3) NYA might cont down below to the weekly cloud, building a very large cause.

4) NYA is also likely to test the support line from Dec 2018(L) to

the weekly Aug 19 2019 close !!

5) This line became resistance. There was never an open gap like that on NYA, the DOW, SPX and the Nasdaq. This gap might never be closed.

Joshua/WOPR: A strange game. The only winning move is not to play

That pretty much sums up my experience with investing money in the housing market. I’m out of it and looking at more affordable alternatives to live off grid and invest my money elsewhere that gives better ROI.