Wow, that was fast: In default is a $650 million portion of a $2 billion loan package, signed in 2018.

By Wolf Richter for WOLF STREET.

“20 Times Square,” a newly built tower at 701 Seventh Avenue in Manhattan, has six retail floors, two underground and four above ground, totaling 75,000 square feet of rentable space. On top of the retail space is the 452 room Edition Hotel. Work started in 2015, when Manhattan’s brick-and-mortar retail properties were still flying high.

The property features “200 linear feet of wraparound frontage” with a “25-foot-tall glass storefront,” plus on the outside of the building – this being Times Square – an 18,000 square foot high-definition LED screen. “Be in the heart of the heart,” the property’s website says, in terms of renting retail space at Times Square. “Retail with the power to move you,” it promises.

Alas, 90% of the retail space is vacant, according to a foreclosure lawsuit filed on Monday. The lonesome tenant is a Hershey’s store, after the NFL Experience Times Square (by the National Football League and Cirque du Soleil) moved out of the 40,000 square feet of space it had rented because there weren’t enough customers.

And you know what’s coming next.

In 2018, the property, which was still being completed, was refinanced with a $2 billion loan package, led by French investment bank Natixis, according to The Real Deal at the time. This loan was used by Maefield Development to buy out partners in the deal, including Steve Witkoff, Michael Ashner’s Winthrop Realty Trust, Howard Lorber’s New Valley and the Carlton Group’s Howard Michaels. It turned out to be the largest real-estate loan in Manhattan in 2018.

Now a $650-million portion of this loan package – the leasehold mortgage – is in default, according to a lawsuit filed in Manhattan by the lender group led by Natixis, according to The Real Deal and the Wall Street Journal. The lender group – which includes Korea’s IGIS Asset Management, Israel’s Harel Insurance Investments & Financial Services, and Taiwan’s Cathay Life Insurance Co. – filed the suit to foreclose on the property. The suit claims:

- That Maefield failed to lease the retail space by the deadline on September 9, and that 90% has been vacant, despite assurances to the lenders that it was “negotiating to finalize and execute” a new lease.

- That the failure to lease the space by September 9 triggered the default.

- That Natixis had sent a final notice of deficiency in September.

- That there were “numerous undischarged mechanics’ liens recorded against the property,” filed by contractors that had not been paid.

- That Maefield has failed to sufficiently fund the reserve account to pay for construction expenses and complete the project.

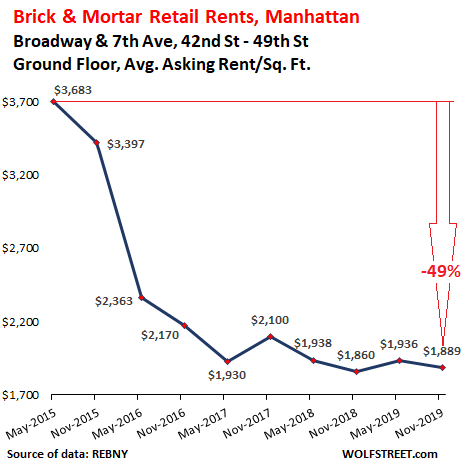

Brick & mortar retail in the Times Square Bowtie area (Broadway and Seventh Avenue, and West 42nd to West 47th Streets) has been among the worst hit, in the already hard-hit Manhattan retail scene. According to Cushman & Wakefield, the vacant retail availability rates for direct and sublease space jumped from 22% in Q3 2018 to 31.1% in Q3 2019, “its highest point historically.”

According to the Real Estate Board of New York, in this area of Midtown, average asking rent plunged 49% from $3,683 per square foot per year in the first half of 2015 to $1,889 in the second half of 2019:

A foreclosure proceeding takes time. If the lenders cannot work out a deal with the borrowers, the lenders may end up with the property, which, given the current situation in the Times Square area, is unlikely to be a desirable outcome for the lenders. So they’re motivated to try to work out a deal.

The whole thing is complicated for the lenders. Due to how ownership is structured, the loan isn’t actually backed by the property, but by an entity that leases the property.

Maefield’s CEO Mark Siffin owns the entity that owns the land that the tower sits on, and this land is not part of the deal. The land is encumbered by a separate $900 million in debt, according to the WSJ, citing bond filings. Siffin also owns the entity that owns the actual building. And this entity leased the building to another one of its entities for 99 years, and it is this entity, according to the WSJ, that Natixis filed to foreclose on.

Asking rents for ground-floor retail space have plunged as landlords struggle with vacancies. Read... Brick & Mortar Rent Meltdown, Manhattan Style

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Maybe NYC can raise their taxes or raise the minimum wage to help out. I am sure the retailers can handle that.

gotta love this entanglement

entity owns land – with separate $900 million loan

entity owns building did 99 year lease with another entity

each getting its own financing

which one is in 1st position and can take rest to cleaners???

my guess cleaners(suckers) are the Korean, Israeli and Taiwan cathay entities that lent stupid money

That’s a ridiculous comment.

Instead of addressing the issue of rents that are out of control (thousands of dollars per square foot), you chose to focus on minimum wage labor (a few pennies more per hour).

@Gary

Well. Raising the minimum wage abd taxes would mean that the companies have less money to spend on real estate bubbles.

As Miltion Friedman said. Ideally you want to lower taxes in bad times and raise them in good ones.

The left has forgotten the first half and the right the 2nd.

Higher minimum wage create inflation pressure. Something needed for rents that are to high.

Gary,

It was sarcasm :)

Do people still wade through the poo in SF to go shopping? I know Seattle is now a ‘no go zone’ as the cops now refuse to arrest common shop lifting, so shops have to either hire their own security (COPS), or they have to close, or only buzz in clean looking customers ( like gun-shops in UK) and in PDX they’re openly selling heroin in the McDonalds on Burnside, cops have been told to stand down.

>or only buzz in clean looking customers

Then the criminals dress like that.

When I was working in retail some of the best dressed, most polite, and least threatening customers were the scammers.

“…Do people still wade through the poo in SF to go shopping?…”

Not me; I moved to FL. Of course FL doesn’t have a hi-speed train, like CA (well, FL sort-of has a lower-speed hi-speed train at Disney World).

nor the taxes

Yes SFran is really disgusting. It reminds me of India in the old days. It is the worst place I’ve seen in this country. I wonder how far the rot will spread.

The Opioid Industry is the leading growth sector of the US economy, aside from Banks. You could buy stocks in Pharma, but distribution and retail is where the real money is. You can’t buy stocks in that. Personally I wouldn’t want to get that dirty, but I think that most investors wouldn’t mind.

Nothing to see here. Jay Powell can fix anything…

Hey, did ya see that Chevron is writing down $10 billion in assets? Of course, Jay can easily create that in the repo market in 15 minutes tops. If ya think about it, a $1,000 a month in MMT is nothing to the Fed.

Commercial leases in NYC, Boston,Miami, Seattle, San Francisco and LA are too high. This in turn leads to higher vacancy rates and more defaults on loans

Rcohn,

Yeah – at $300 per SF per month (now marked down to a bargain $150…) the rents are fairly insane.

An equivalently priced 500 SF apt would cost $150,000 per month…but of course you would be in the center of all the glamour and eminent poop-ability of NYC’s Deuce (sole lessee…Hersey’s).

And imagine trying to fight your way to your dubious collateral through that convoluted ownership chain/debt stack…

Speaking of which, it takes an overleveraged age to traffic commonly in terms like Debt Stack – collateral asset overvaluation is virtually guaranteed when multiple yield starved lenders are desperate for their own little collateral tranche.

Boy, is Mrs. Katz going to be mad !!!

This is a story of insanely rich people doing insanely risky things with their money using insaley convoluted schemes.

That’s what causes the 2008 catastrophe, that’s what causes the 2000 tech bubble catastrophe, and that’s what will cause the next catastrophe. The minimum wage has never caused an economic collapse.

75,000 square feet of rentable space.

At 1 dollar per night, it will house all the homeless kitted out with camp beds providing a one stop shop to getting back to rented accomodation and work.

Better than vacant space.

Good idea, that would shelter about 1000 people I reckon. It’s a shame that those involved won’t let it happen.

“won’t let it happen.”

Not when it could be used as a (crappy) hotel @ $150 per night (even shitty Manhat hotels get insane rates since 12 pct of the Fortune 1000 have made the financially insane decision to out their HQs there).

Not to mention…CATS.

Ian

Here’s another good idea: shelter a few of those homeless by letting them move in with you. More could move in during the day when you were out at work!

It’s a shame that those virtue-signalers won’t let it happen.

Loan secured by a renter, another owns the land, another owns the building, the air inside is owned by yet another, perhaps “goodwill” is also listed as a tangible asset. What has the world come to with these sorts of labyrinthine shenanigans seeming to be now de rigueur. Maybe I’m just naive.

It’s a Russian Babushka nesting doll of corporations, an old, old trick designed to deter lawsuits, creditors, tax collectors, you name it. Not new

Where can I get one of these ‘entities’ that let you own something except when it goes bankrupt?

They are just cheap (£1) “Ltds” (or equivalent).

The problem is “Joe Sixpack”, who’d like to buy a property using his £1 Ltd., to save on future sales/inheretance etc. taxes, because the Ltd will be sold, not the house, gets laughed loud out of the banks.

Been there, know that.

These lawyers are real slick at passing on liability. Like the leaning tower in San Francisco, the small print said they were on the hook, not the developer. Eventually a settlement was reached between city and developer I think.

Hershey might go bankrupt because remaining tennant might be on the hook for all maintenance. Just kidding, but you have to know what you are doing when you sign a contract.

Should have said people who purchased apartments were on the hook.

Where’s the due diligence on the lenders? Who in their right mind would lend into such a convoluted pyramid scheme? All it takes is a title report to see that who you are lending the money to isn’t the owner of the land and if you are lending to anyone other than the owner of the land, you really have no real security.

This building could end up in courts and lawsuits for years and be for all intents and purpose off the market.

Are those rent figures per year? Even so, am I figuring this correct that 1000sf at current rates costs $150k / month? That’s beyond absurd.. and that is half of what the price was? If so, that is some high end profitability. Waaay beyond my meager ability.

Were is MichaelN (aka WeWork) when you need him !!!

Lucky the City’s tax, and regulatory policies, and support for law enforcement, is drawing so many new, incoming residents and businesses.

It will be OK, trust in NYC Government.

Sure seems that you are rippping on the greatest city in the greatest country in the world. Our economy is the envy of the world. A little humility and gratitude is in order from you sir.

If Bebe were from the UK, that would be sarcasm. But alas…

If you define greatest as propped up by fake numbers and hundreds of billions of dollars of share buybacks and trillions of other stimulus gimmicks then yep, you have a point

This, and crises at WeWork, NYC’s largest commercial renter, suggests formidable and possible structural problems for this sector. As a resident of the city, it’s impossible not to see the street-level retail carnage every day.

Time to short commercial REIT’s exposed to these players?

After sorting through that last paragraph, what a shell game.

If you were dumb/corrupt enough to lend$$, man do I have a deal for you.

There is an banker adage: “Bad deals are made in good times.”

When property prices can only go up and when US brick-and-mortar retail will be forever strong (despite what WOLF STREET has been saying for years), you can’t lose money lending on real estate, right?

These are the “highly” educated making these loans?

Maybe they should put a few of us country hicks on their corporate boards. We come a lot cheaper than a phd or politicians kid.

They’d call us “naysayers” and boot us out :-]

Thank you…now let’s all read “The Best and the Brightest” about the brilliant geniuses who gave us the Vietnam War.

We need to learn that lesson over and over…

A drop in retail rents from $3800/ft to $1900/ft in four years is astounding. I wonder what explains it. It seems to conflict with the strong economy theme.

Maybe Times Square is getting a bad reputation again.

What is really astounding was $3,800/sq foot.

That added up to $3,990,000/year for a 30 by 35 foot space .

Even at $1,900,the lease is almost 2 million/ year for that space.

Now figure out how many Hershey’s Kisses need to be sold each year to cover the rent.

2million/year is around $6000 a day. 20 hours a day open (makes calculations simple but is ludicrous) That is $5 a minute.Are Hershey’s kisses That expensive?

Three options how this is possible:

Rent is not as high.

Hershey looses money on it but sees it as advertising

Laundry.

char

“…That is $5 a minute. Are Hershey’s kisses That expensive?…”

I believe the French ones are.

So how much were rents in 2007 just to bring it full circle

Similar drops have been experienced in other Manhattan retail corridors. But a few did better. There are 14 charts in this article on 14 major retail corridors in Manhattan. Most of them look terrible, but not all:

https://wolfstreet.com/2019/11/27/brick-mortar-rent-meltdown-manhattan-style/

Wolf, I don’t see how those numbers ever worked. How does a retail store only 1000 sq ft size generate enough sales and profit to pay $2-4 million in rent per year? You’d have to be selling some very high end stuff to the super rich, or drugs

We have to factor in that a business could lose money at the location but make money overall because of the advertising and brand build on Times Square. Think of all the traffic that walks by. This helps the business in other locations.

How much would a national business pay for a year-round sign in the middle of Times Square?

Gandalf,

I agree with Bobber. These are flagship stores. They’re used as ads, and they cost money at that location, rather than make money. The idea is that other locations benefit.

There are some high-dollar fashion and jewelry stores that might make money at these locations. If you sell little doodads for $50K – $1MM, with huge profit margins, I would suspect that there is profit in there somewhere, if you can sell enough of them.

Plus it’s a tax write-off, no?

It has nothing to do with the economy. It’s the death of mall retailing. It started out in the malls that were cheap (¬ so profitable) and now it is going to the high rent places.

PS i know some will hope that Times Square gets its bad reputation back but porn shops are experiencing the same death as other mall stores. Maybe even worse as x-rated magazines and dvd’s aren’t even published anymore. What is likely to happen is that the ground floor on the street will be rented out for much less money and the other space will be empty.

A rising tide lifts all boats–except those in which the owners have drilled holes below the water line.

A look at google street view and you know why it’s struggling: street meat carts and clothes vendors jamming the narrow sidewalk with their crap. No shopper is gonna venture down that street and look at the wide storefront displays. Because they simply will not be able to see. Across the street, the side walk is completely uninviting with another construction. Potential lessors can see all this from their office. And then because the ground floor is vacant, no other lessor is gonna take up on the other floors.

It’s amazing how easy real estate ought to be.

Wait a sec…fundamentals matter?

FPG,

The NY Fed ought to snap it up for use as a post QE suicide bunker…a la the Third Reich.

It isn’t like the Fed can’t just print the purchase price.

They are there because it isn’t rented so nobody is complaining to the cops.

I predict no deals will be worked out.

“That Maefield failed to lease the retail space by the deadline on September 9, and that 90% has been vacant…”

“which, given the current situation in the Times Square area, is unlikely to be a desirable outcome for the lenders. So they’re motivated to try to work out a deal.”

Looks like New York is getting the same treatment as we did in Walmart land. First when Walmart comes to town, literally every other business shuts down, leaving rows of vacant retail shabs on main st, along with the homeless camping outside. A few years later, Walmart wants a supercenter close to the new interstate bypass, leaving another vacant massive drab unsaleable structure for everyone’s viewing pleasure.

At least Walmart builds stores they think will make money, when they don’t make money they get shut down. These other guys are building spaces knowing they will never make a profit, they don’t care, it’s not their money. There are no consequences for the malinvestment, cash in your paychecks, bonuses, fees, and get out before the whole thing collapses.

It seems like as long as developers and middlemen can dip their scoop into the money stream while the project is “alive” and fill some of their pockets along the way, the ultimate fate of the property is not of any consequence. Exit the project before the slow moving lenders move in to claim a meatless carcass.

In recent times, Neumann showed the process. Run heavy and deep with OPM, then exit quick. Plenty of others doing the same I’d say.

The entirety of silicon valley is based on this model. But they too are only an extension of the endless expansion model built on Wall Street money, our money, not their money.

GB- I’d say that describes a “winning business model” that has been developed and legally refined for at least 40 years now. Having a large enough tap into all the many creative money pipelines invented and no cares whatsoever about any pesky “accounting details” that may result from whatever it is at the ends of the pipelines.

And it’s all perfectly “legal”.

“Alas, 90% of the retail space is vacant, according to a foreclosure lawsuit filed on Monday. ”

Is it because they won’t lower the price/ sqft (greed) or is it that they can’t (below the cost of profit). It seems that many streets in Manhattan have vacanices.

I was told by one merchant that the companies who own any particular vacant store own whole portfolios of real estate, and always assume a certain percentage will be vacant. It would seem that if ownership is spread out thinly enough ( say every vacant store-front is owned by a different company), then appearances may we worse than the economic reality.

To lower the rent would be to acknowledge their projections were wrong and that they’re going to lose money at market rates.

By leaving the rent high they can pretend that profitability is right around the corner when they find the right tenants.

The Rent is Too Damn High.

That’s usually the case, only most CRE owners are still stuck in their 1999 mentality, meaning they really believe tenants will be lining up to get their stores and pay whatever price they want to charge.

However this 1999 mentality extends to an amazingly large number of people involved in retail, starting from franchisees. The amount of seriously dumb money pouring into brick and mortar retail and being wiped out is not merely astonishing but growing as well.

These folks have learned absolutely nothing, they refuse to adapt (like many successful brick and mortar retailers are doing) and seem to think they’ll beat Amazon, eBay and Etsy merely by opening more stores and building more malls.

This is attrition warfare of the surreal Blackadder kind, and we know how it will hopefully end.

It is not greed. Getting rent that is lower than the mortgage payment is a very hard sell to the bank if you can’t pay the mortgage. but they may give you more time if you can’t find somebody who can pay enough rent to pay the mortgage. It is the difference between certain foreclosure and likely foreclosure

With real estate, sometimes the write-offs to offset capital gains from other owned packages, are quite advantageous. The loss for NO-RENT, but available to rent can come in very very handy to support personal depletion allowances. Write offs galore can put real money where you want it, and when you want it. You can also push real losses of course on to others, who don’t know about all of your corporate offsets, as certain investors don’t see any of the big pie, just their tiny slice, or crumbs.

Hershey’s Chocolates and NFL Experience sound like the occupants of a downscale strip mall in most cities.

Hershey’s chocolate has got quite bad in the last few years. At least Google has Android and a decent search engine. Hershey’s has crap chocolate at premium prices.

Anyone from California has been at

Richard Donnelly Fine? Are they good?

Why are such rococo ownership structures even allowed? And why don’t potential lenders see them as a warning sign to stay away?

Oliver,

“And why don’t potential lenders see them as a warning sign to stay away?”

The structures are insane – really only providing security to the lawyers hired to battle their way to the alleged loan collateral.

But two decades of ZIRP (see NY Fed suicide bunker comment above) have more or less driven institutional lenders to desperate insanity.

Try hitting the 8 pct minimum necessary return CALPERS needs to pay off on hundreds of thousands of politically corrupt pensions made over decades.

When DC money printing has had TBonds at 2 pct for a decade (and maybe 4 pct for the decade before that).

Thank God the US political leadershit class has been there to guide us.

Because some people are still stuck twenty years in the past and they fail to realize the days the middle class went to these kinds of stores in droves is over.

They tend to say TV Land is a decade stuck in the past, stupid investors double that.

I’d never hear of the NFL Experience, I looked on tripadvisor and 160 out of 255 reviews rated it as Excellent. Strangely, just about all of the excellent reviews are by visitors to the US.

“Come on, the reviews on Amazon were great!”

“Yes, the ones you posted.”

The only reviews you can believe are the negative ones.

So what’s the NFL Experience?

You walk into the store with your wife and someone hits you over the head with a helmet while someone else beats up your wife…and the owner spends all-day in a message parlor with a funny name?

In times like these with debts incredibly high I wonder what kind of scam is involved here. How fully protected were the lenders? I can’t imagine the temptation to lend overcame the objectively researched risks. What’s that foul odor?

“What’s that foul odor?”

ZIRP induced despair.

Home depot sales are $447 per sq. ft. If you grossed 50% that would leave you $213 for rent, taxes and profits. How can someone pay $3000/ sq ft rent?

You need to stack stuff on the floor roughly 15 times as high. It’s called making it up on volume.

I can’t even form a mental picture of what kind of shop might theoretically have been there based on the very point you’re making. The tenant would have to bring home a profit after paying those rates.

Home depot is a DIY store. They have low sales per sq ft

DIY .. as in having to explain to the help how stuff is supposed to work, being that the Depot, in their bean-counting wisdom, no longer hires knowledgeable employees ..

Knowledge outsourced online, polecat. :-) Youtube, to be exact. Although, they do have nice bathrooms and every store has the same layout so you can find them. It’s best to go to a real working supplier if possible.

I once read a smart person who said that since WeWork was a big player in the NYC commercial real estate market, that if they failed or pulled back then that could have major impacts on the overall market in NYC.

Hmmm, so now Softbank is trying to figure out how to rescue WeWork and is having them pull back and spend less money …. and what’s happening to NYC commercial real estate?

And, oh, by the way, JP Morgan was big on propping up WeWork do the benefit of their local NYC clients. The money going into WeWork helped keep the NYC market kinda-sorta stable …. for awhile.

I get the impression that the whole NYC commercial real estate market was badly distorted for some time due to JPM and WW’s shenanigans. Now the correction happens.

The key question is, “How leveraged are the landlords who have those long-term WeWork leases?”

The dominoes will fall if/when WeWork collapses, and highly-indebted landlords can’t fill that space.

WeWork is seriously fake collateral on Softbanks books. How much of Softbank does the BOJ ultimately own ? If Softbank is a systemically important bank, which central bank’s printing press will gaurantee its continued solvency ?

Maybe the Bank of Israel will step up and save Softbank & WeWork and NYC. Somehow this seems unlikely.

Unfortunately NYC has an extraordinarily inept government.

Slowly destroying the city with more and more taxes. leading to an exodus of taxpayers and growing an immense population on some kind of welfare.

That includes illegals.

Add to that, that new yorkers avoid times square like the plague.

And yes, rents are insane.

Taxes are not the problem in NYC. It is the extremely high rent and high wages that need to be paid. The city could lower rent, and wages would follow, but it wants real estate to be high priced and going up.

Times square is a tourist attraction. Locals never go to tourist attractions.

Should have asked for some more reap-o’s

“Brick and Mortal” LOL,nice!

This is one of my infamous Freudian typos. I’ve been doing this for years. It just keeps happening :-]

Brick Immortar (close to Brick and Mortal) is actually a YouTube channel covering dead and dying malls and other retail outlets.

“You can never go wrong buying real estate in NYC” A classic line used by thousands of brokers in all real estate product types. The market has shifted dramatically and that famous adage will be proven wrong in the next 6 months if it isn’t already happening.

You can never do wrong getting me my commission checks.

– Real estate expert

Almost $190,000 for 100 sq ft per year, after discount? The only way I could make $190,000 using 100 sq ft in a year is with a counterfeit dollar printing operation. I would probably be caught before I good bust into the black a $190,001. I bet crows have to pack a lunch when flying across mid-town.

Sounds awfully 2009ish….almost the same words that described sub prime mortgages

The Fed is not ready yet to admit the danger to banks from CRE, but they are getting closer. I think they are missing the point that if CRE rolls over there are going to be other concurrent effects to the banks.

https://www.federalreserve.gov/econres/notes/feds-notes/assessing-the-resiliency-of-the-banking-industry-to-a-commercial-real-estate-price-shock-20190530.htm

“Overall, the results presented in this note suggest that the banking system is resilient to a CRE price shock. However, the most conservative model implies that solvency-constrained banks would hold a substantial portion of CRE loans, and those banks are more concentrated in certain geographic areas. These pockets of concentrated risk may be more adversely affected by CRE price declines.”

Lance Manly,

Boston Fed Prez Rosengren has been pointing at CRE since 2016 — that there is an overvaluation issue there, and that some smaller regional banks that do concentrated CRE lending are heavily exposed to their area’s CRE, and that it’s those regional lenders that could get in trouble when CRE turns down.

He has used this to support his rate-hike votes. And he was considered a dove. At first, they brushed him off. Now they take him seriously. His concerns have now made it into the Fed’s Financial Stability Report, where it’s still not seen as a big risk to the overall banking system.

Also, the banks have offloaded a lot of the CRE risks to CMBS holders and insurance companies that invest in CRE. So the risks are now scattered all over the place.

It depends what kinds of banks you are talking about.

Big US banks have cherrypicked the best commercial real estate (ultra-prime offices, well positioned healthcare etc) and as such run minimal risks. That’s why the Fed is unconcerned about CRE: it’s not their problem anymore.

The problem is everything else: small regional banks, shadow banks and foreign investment banks. I have found Natixis’ involvement particularly telling: Natixis, a major French investment bank, was bailed out by the French government to the tune of €7 billion back in 2011 already precisely because of way too many dubious investments such as 20 Times Square. This is on top of all the help they have got from the ECB in the meantime.

Proverbs 26:11

I think the fed is aware of the danger, might want to drop a note to congress nudging your concerns further into the abyss. ms vojtechs article pre dates the Final Rule (below) effective November 25, 2019

“While the annual Dodd-Frank Act stress test (DFAST) process assesses the resiliency of large bank holding companies (BHCs) to a CRE price decrease, BHCs that are not subject to DFAST (non-DFAST BHCs) hold more than half of the CRE loans in the banking system, and a much larger percent of non-DFAST assets are held in the form of CRE loans “

II. Background

Prior to the enactment of EGRRCPA, section 165(i)(2) of the Dodd-Frank Act required a financial company, including an insured depository institution, with total consolidated assets of more than $10 billion and regulated by a primary federal regulatory agency to conduct annual stress tests and submit a report to the Board of Governors of the Federal Reserve System (Board) and to its primary federal regulatory agency.

Section 401 of EGRRCPA amended section 165 of the Dodd-Frank Act by raising the minimum asset threshold for banks required to conduct stress tests from $10 billion to $250 billion.

Section 401 of EGRRCPA also changed the requirement under section 165 of the Dodd-Frank Act to conduct stress tests from ‘‘annual’’ to ‘‘periodic.’’

Consistent with proposals by the Board and the OCC, the final rule provides that, in general, an FDIC-supervised institution that is a covered bank as of December 31, 2019, is required to conduct, report, and publish a stress test once every two years, beginning on January 1, 2020,

EGRRCPA amended section 165(i) to no longer require the FDIC to include an ‘‘adverse’’ stress-testing scenario and to reduce the minimum number of required stress test scenarios from three to two.

what little of d/f that is left is quickly being legislated out of town.

‘set up, like a bowling pin’

Caring not at all for the public good is slow suicide. Our system is obeying the famous words of Morgan, “THE PUBLIC BE DAMNED!!”

Maybe the Indians would want it…they have the guts to build those buildings, maybe they can tear them down.

I think Gunlach said something like there are no bankruptcies as long as you can keep rolling over the loans at lower and lower rates. We are on a 35 year rollover of debt. He said Fed is trying to kick can as they know it’s a severe problem. The road runs out in 2020’s as the government promises run off the cliff.

The drama in DC goes on with squabbling between law professors about how many angels can dance on the head of a pin in the constitution.

It was with no surprise there didn’t appear to be too much open debate about $738,000,000,000 defense appropriation bill making it thru house and senate. Included in the package is 12 weeks paid family leave for federal workers. That’s a little tough to swallow on the day the inspector general says FBI screwed up from top to bottom and if I heard correctly the guy that altered documents for the FISA warrant is still employed.

Old school

He’s not only still employed, but you will soon be paying for his family leave.

Several years ago I was doing contract work at State Street’s Copley Mall office in Boston.

Many of the store fronts were boarded up with fancy signs reading like “Something exciting is coming here soon!”

The second floor of the Mall in particular was substantially empty…maybe 25% empty. Haven’t been to Copley Mall in years but I doubt something exciting came.

But this real estate is very centrally located and could easily convert to hotels and such.

Side note: State Street’s Copley Mall office was the 2nd State Street office I’d worked in, that has a location where all the Indians (H-1B imported workers to replace American workers at lower wages) were placed in a back out-of-the-way room. I stumbled onto it when I decided to take a tour of the place on my own. I wonder if they American workers the Indians replaced were told – as many State Streeters have told me they were instructed to do – that they would be training their Indian replacements?

Here in Chicago, a minor league outpost of the high-glam retail world, I note that a lot of retail space that is no longer useful for selling socks and shoes and underwear has been colonized by massage parlors. I wonder if Wolf couldn’t devise a fancy-schmanzy gauge that uses counts of message parlors as a metric for brick and mortar retail decline.

Near where I live the scuba shop couldn’t afford the rent, so now it’s CH Foot Massage (Chinese Foot Massage.) I’ve always assumed that these massage places are A. probably selling sex and B. possibly using trafficked girls. But no idea.

55 years old. Last weekend downtown Chicago, Magnificent Mile. I kept thinking “I don’t want to be here.” as I walked with the masses. As I looked into retailer’s displays “I can buy this stuff online.” No need to be among the masses.

We stayed on the 20th floor. Pittsfield Apartments. Told wife “No interest in visiting big cities for another 3 years. No interest living in big cities. The rich and young can have this.”

All I want to do is walk my dogs in a quiet neighborhood away from tall buildings and the masses.

I thought it would be appropriate to re-post my favorite two cows:

You have two cows.

You sell three of them to your publicly-listed company, using letters of credit opened by your brother-in-law at the bank, then execute an debt/equity swap with associated general offer so that you get all four cows back, with a tax deduction for keeping five cows.

The milk rights of six cows are transferred via a Panamanian intermediary to a Cayman Islands company secretly owned by the majority shareholder, who sells the rights to all seven cows’ milk back to the listed company.

The annual report says that the company owns eight cows, with an option on one more.

Meanwhile, you kill the two cows because the Feng Shui is bad.

And the show continues…

The answer to this is simple. The citizens of New York City are delusional in thinking that it is a great place to live.

Rational humans know NYC is a dangerous overpriced cesspool and have no desire to move there.

Those rich enough or smart enough to leave do so.

Silly Wabbit, The debt in all of these deals has been sliced and diced so many times that like the entity responsible for actually paying the debt, you cannot find it. So what happens is the big write down and “Deep Pockets” comes in and buys the remainder. Now relieved of payment problems the space is leased out in deals that no one ever sees. Rent prices stay up but back end deals reduce it to managable levels. The people who take the write down in investment (some big guy(s) already bought the tax benefit of write down) get a 1040 for the loss as it becomes income to them. Capital Gains softens the blow and as the money invested is in the aggreate they may never see what is actually happening.

As for the lenders who financed the deals they simply are not smart enough to say no to the complications of the deal written like this one and pass. The basis of lending is the origional words of Ability, Stability and demonstrated Willingness. If you do not have a clear and clean line to guarantees backed by fungable collateral sufficient to pay the vig walk away.