Asking rents for ground-floor retail space have plunged as landlords struggle with vacancies.

By Wolf Richter for WOLF STREET.

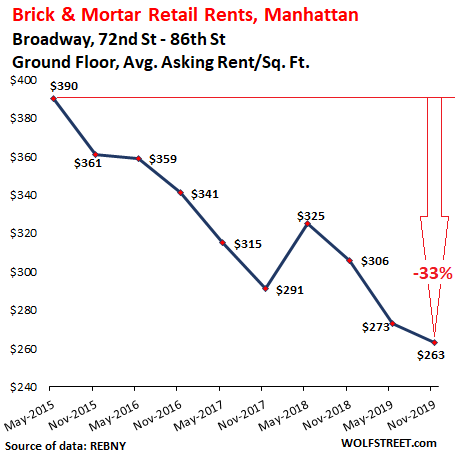

These are major shopping corridors in Manhattan, and in nearly all of them, asking rents for ground-floor retail space have been dropping for years – and in some of them by half.

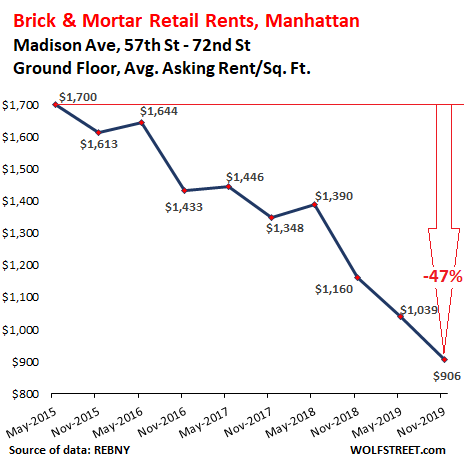

For example, the average asking rent on Madison Avenue between 57th Street and 72nd Street, plunged 22% in the second half of 2019, compared to the same period last year, to $906 per square foot per year, and is down 47% from the first half in 2015, according to the bi-annual Manhattan Retail Report released today by the Real Estate Board of New York:

The REBNY report points out, “An increased amount of leases expiring has contributed to the high availability rates [meaning, vacancies] that has led owners to lower asking rents and offer more short-term lease agreements.”

Falling asking rents and better terms in the Madison Avenue corridor – better deals for prospective tenants – help bring out prospective tenants, according to the report: “Softening rents has led to increased absorption as recent leases consist of retailers relocating to smaller-sized storefronts with better co-tenancy. Notables tenants such as Akris, Mont Blanc, and Morgane Le Fay indicate that apparel tenants still dominate this corridor.”

The report is entirely focused on ground-floor retail spaces. Of the 17 shopping corridors in Manhattan tracked by the REBNY, average asking rents fell in 11 of them. But since 2015, asking rents in all but three of them have dropped sharply. But two of those three have reached new highs (and we’ll get to them in a moment):

- In Downtown: on Broadway between Battery Park and Chambers Street

- In Harlem: on 125th Street, from the Harlem River to the Hudson River

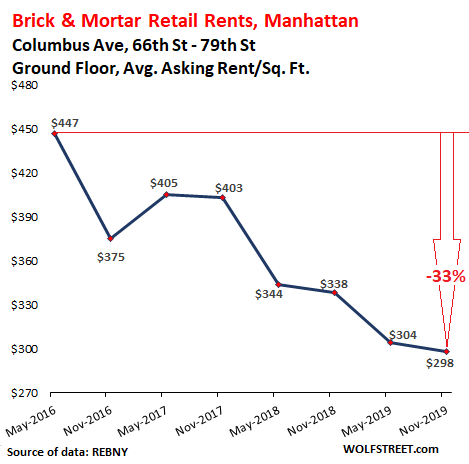

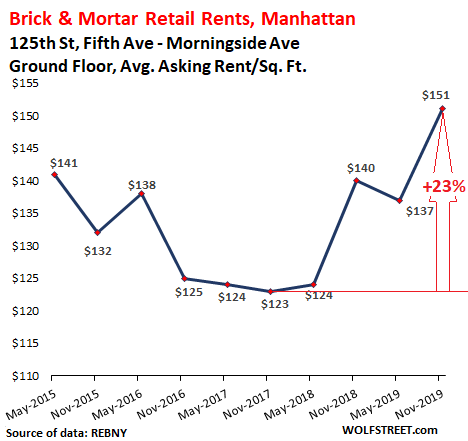

Here are more samples of the 17 shopping corridors that REBNY tracks, showing average asking rents per square foot per year, for available ground-floor retail spaces.

Upper East Side.

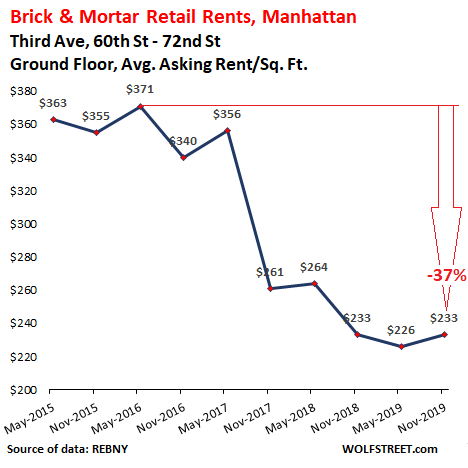

On Third Avenue, between 60th and 72nd Street, according to the report: “In order to fill vacant spaces, owners are becoming more flexible with a steady amount of deal-making occurring with new tenants such as Wells Fargo, TD Bank, and Tudor Salon.” Alas, those three operations are services, two of them financial services, which are booming, not retail (sale of goods to consumers):

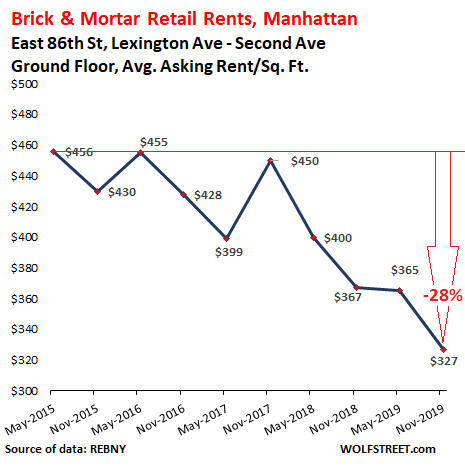

On East 86th Street, between Lexington Avenue and Second Avenue, the average asking rent fell 11% year-over-year adding a big portion to the decline since the first half in 2015:

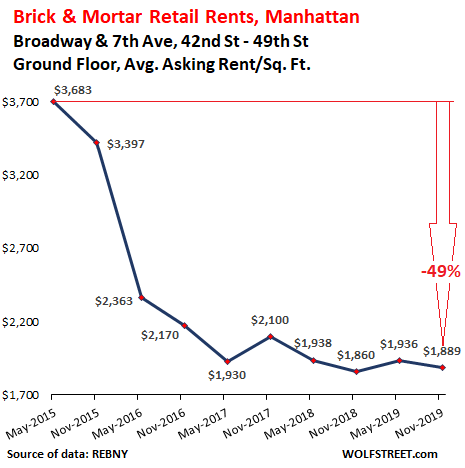

Midtown.

Some of Manhattan’s most expensive shopping corridors are in Midtown, but they have not been spared.

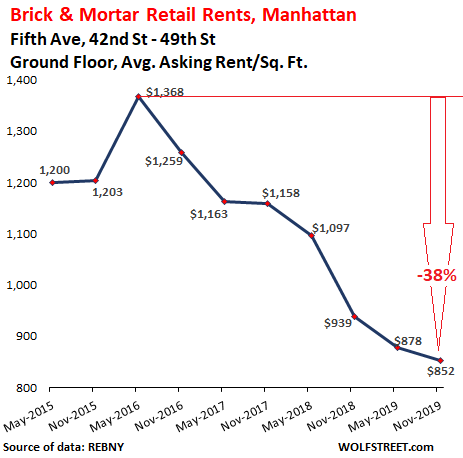

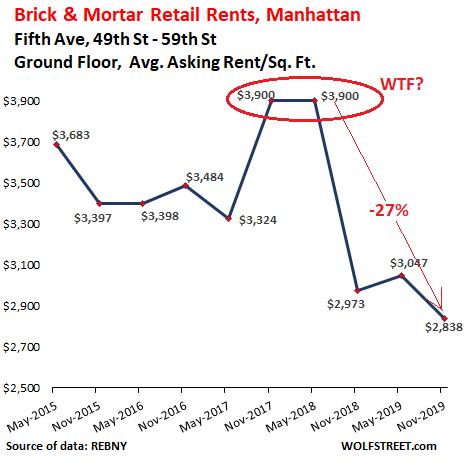

And the two stretches on Fifth Avenue, between 42nd Street and 59th Street:

These are asking rents. It doesn’t mean that tenants agree to them. In the second half of 2017 and the first half of 2018, valiant but futile attempts were made on Fifth Avenue between 49th Street and 59th Street to ignore reality and ask for record rents, but apparently that didn’t work out, and aspirations then got slashed by 28% in two years:

Midtown South.

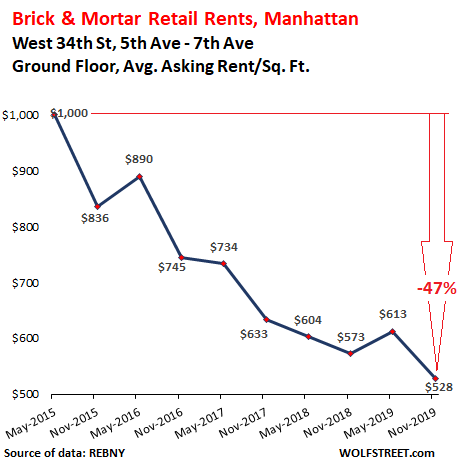

Asking rents for ground-floor retail space along West 34th Street between Fifth Avenue and Seventh Avenue are among the worst-hit in Manhattan in terms of the plunge since the first half of 2015:

Downtown.

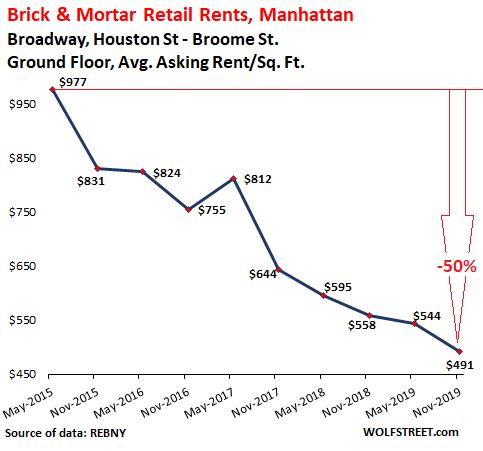

Concerning the 50% plunge since 2015 in SoHo on Broadway, between Houston Street and Broome Street (chart below), REBNY reported:

Broadway is composed of loft buildings with large retail spaces that are difficult to subdivide due to historic regulations. Further complications stem from restrictive zoning that places limits on food/beverage uses in SoHo.

The decline in asking rents is attributed to post-recession asking rents nearly doubling to historic peaks, as flagship brands were considered ideal tenants capable of affording expensive large retail spaces. As asking rents continue to adjust, Broadway is witnessing increased activity by pop-ups and digitally native brands experimenting with retail space.

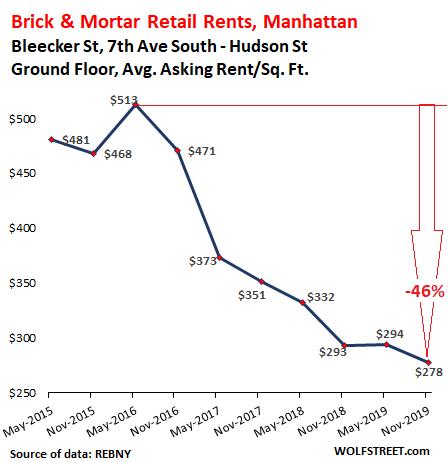

Concerning the 46% plunge in asking rents on Bleecker Street (chart below), REBNY explains:

Asking rents on Bleecker Street continue to decline from post-recession all-time highs, as lesser foot traffic and a more neighborhood-centric retail landscape has caused flagship brands to look for Downtown retail space elsewhere.

But dramatically lower asking rents make new things possible:

Bleecker Street has gained new traction with Brookfield Properties filling in its new portfolio of 7 storefronts with a mix of digitally native and e-commerce brands, which has encouraged similar retailers to search for space along the corridor. Examples of new digitally native and e-commerce tenants include LoveShackFancy, Hill House Home, Slightly Alabama, and Bonberi.

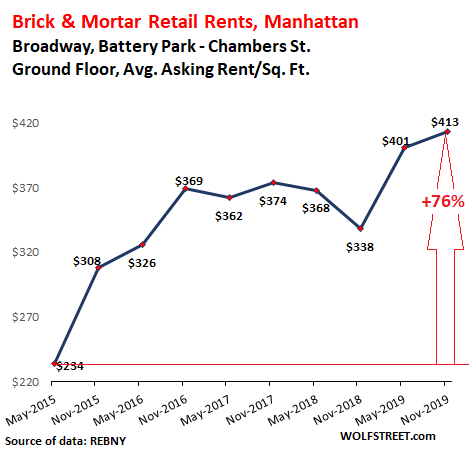

But in terms of asking rents, not every retail corridor in Downtown is going to heck. This is one of the two above mentioned exceptions of the 17 corridors tracked by REBNY where average asking rents for ground-floor retail space has skyrocketed since 2015 to an all-time high:

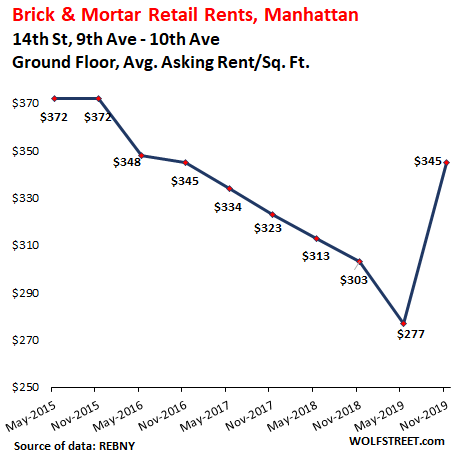

And still Downtown, a surprise jump that leaves some interesting question marks:

Upper West Side.

Upper Manhattan.

And here is the other exception, the shopping corridor along 125th Street in Harlem, from the Hudson River to the Harlem River (not a river but channel) where average asking rents for ground-floor retail space started to turn around in 2017 and have risen 23% since then:

And everyone is trying to figure out how to make this retail space work and fit into modern life where ecommerce is becoming an increasingly powerful force. REBNY outlines some of those initiatives, with a big emphasis on moving away from retail sales and into services, such as cafe’s and restaurants, financial services, health care, or personal care:

- “Manhattan retail leases in the second half of 2019 were driven by e-commerce proof of concept uses such as food/beverage, service, and medical offices.”

- “Omni-channel retail is effective for digitally native brands that require showrooms to showcase their products/services, which act in conjunction with their e-commerce and marketing efforts.”

- “An increased presence of pop-ups and promotional spaces indicate that brands are offering unique in-person experiences to attract both online and in-store shoppers.”

- “Other uses such as bookstore cafes and daytime co-working spaces reflect that consumer demand is shifting in favor of modern storefront uses.”

Eventually, rents drop far enough and lease terms are flexible enough to where potential tenants can figure out how to make this space work for them. That moment may have arrived in Harlem and in a few other corridors, but the rest are still struggling to find it.

Department stores and mall stores get crushed one by one. Read… Brick & Mortar Melts Down as Ecommerce Jumps by Most Ever

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I was in New York for the first time 2008ish and most recently a year or two ago, with a large gap in between. Both times I passed SoHo. First time, there were plenty of unique stores and it felt like an American cultural institution (albeit aimed at a different target audience than myself). Most recently, half the storefronts were empty and the other half were the chains that you find in any mall, the ones that have the scale to set money on fire just to say they have a storefront in SoHo.

Oh, and speaking of setting money on fire, it felt like you couldn’t walk two blocks without bumping into a TD Bank.

What deeply impressed me on my first visit was that the metropolitan scale of New York (and the amount of people that cram into Manhattan) allowed Manhattan to support a wider variety of the kinds of obscure stores and institutions that are unlikely to survive in a more typical American city (smaller, more spread out). What depressed me on my last visit was the extent to which that character had been eroded. It was like coral reef bleaching, applied to cities.

Thank you for that color :)

Seijio-For someone who has only visited twice you couldn’t be more accurate in your assessment. The reckless building flipping by investors has pushed the character out of many neighborhoods. The last person holding the bag can now choose 3 tenants that work, bank, Starbucks, pharmacy. Retail rents will plummet another 50/75% in the next ten yrs.

Coral bleaching of nyc is a great analogy.

Actually the best lesson for today is the lessons learned from the Japanese economy. Looks like America is about to make the same mistakes.

Storefront Churches tend to signal the end.

Halloween shops.

Christmas shops. Open one month a year but the (cheap) sign hangs the whole year.

LOL all of you

Dollar General, like in Pittsburgh.

Non-chain pound shops.

The end is nigh.

Not really a neigh. More like an erratic whinny.

Zactly. Churches, martial arts studies and to a lesser extent day care centers. The municipalities never want to deny a Cert of Occupancy for a church and the argument regarding parking is its “off hours.”

And the price of commercial real estate should be directly related to the leases/cash flow coming in.

In times before cheap and easy money.

“Eventually, rents drop far enough and lease terms are flexible enough to where potential tenants can figure out how to make this space work for them.”

The landlords (usually REIT and family funds) care to a point because the ground floor retail space is just a relatively small part of their building. With residential real estate going bananas all over the world with no sign of stopping empty storefronts are not a big problem in NYC, unlike other places where the same building is often parceled out among several owners.

The problem here is not so much that REIT aren’t able to make an extra killing, but that the brick and mortar meltdown is creeping among ultra high end retail which we were assured would be “immune” to e-commerce. That may well be, but it’s not immune to competition: exactly how many high end clothing retailers does the world need? These stores selling five grands handbags and ultra-expensive watches are a penny a dozen nowadays: they are everywhere, all competing for a tiny slice of customers, and all using exactly the same business model.

The luxury groups themselves care to a point: it’s their franchisees, the poor bloody infantry of retail, who bear the blunt of competition.

Dumb money has poured into franchising with a vengeance, from Burger King to Gucci, and now is left with a ton of competition and a market that, surprise surprise, doesn’t grow a yearly 10% plus inflation like promised.

“When you’re wounded and left on Afghanistan’s plains,

And the women come out to cut up what remains,

Jest roll to your rifle and blow out your brains”

Nice quote MC01. If only some of our politicians had read ” Arithmetic on the Frontier” we might not have been so keen to go to Afghanistan again – although

perhaps we would have.

Same story here in Netherlands: until about 10 years ago we had punishing rents for ground floor retail space (which is most of the retail in the smaller and medium size cities) with leases often running 5 or 10 years, and small retailers worrying how they were going to pay the final years of the rent/lease. The only way to make good money from retail was to own the shop building, e.g. because it was already family owned. Many of these shop buildings have several floors of (potential) apartments above that were unused in most cases, not worth the trouble. This trend of ever higher rents/leases lead to more and more small retailers closing shop, and more uniformity of all-the-same large retail chains who were still able to pay the high cost.

After the Financial Crisis, things have changed tremendously, very similar to what the article describes: more vacancies every year, more temporary pop-up stores paying almost zero rent (I think some of them might be paid for being there) while the big money is made by renting out the apartments above, sometimes for 2x more than the rent for the whole shop below. Most of the larger general retail stores catering to the middle class have disappeared and the smaller (more unique) ones that still exist move shop frequently because that always means even lower rents. Sadly, I see very few new shop activities that make sense; most of it cannot be profitable (or maybe just another way to whitewash the omnipresent Dutch drugs money).

I also see some shops that seem immune to the trend like more expensive shoe and clothing shops, but I don’t believe this can continue, there are way too many of them. A friend of mine got a 70% discount on the already much lowered rent for his shop and several offers for buying the property at a very low price -difficult to tell what these properties are worth because too many of them are empty and you are not (yet) allowed to convert them to private homes or apartments. But I guess people with the right connections are already gearing up for that ;(

Just the same in Britain: only a handful of true local small businesses left here.

As for drugs money, I’ve noticed that the Turkish community here always seems able to add to its portfolio of high street properties: barber shops, restaurants, 24/7 stores, cafes.

I wish I knew the secret of their commercial genius….

It was not so much the financial crises as that certain banks stopped lending to retail in 2013-14 and it felt like in that year every week a retail chain went tits up. Particular those owned by private equity. It was also the year the Blokker conglomerate started to die.

The chief reason those stores are disappearing is much simpler: people don’t see a point in shopping there.

Just look at music stores: those selling the same homogenized junk as everybody else are going down one by one, even the big chains that combine books and music with a meager selection and outrageous prices. Who wants to shop there when the local hypermarket carries the same selection at a lower price? Those going out a limb to offer something a little (or a lot) different are still there and often they added an online store to their lineup. These folks carry the ultra-obscure stuff I listen to not even Amazon bothers with. ;-)

And nice to see there are still many Kipling admirers out there.

Shops selling CD’s where killed by piracy, Amazon, ipod+music store and than the music streamers Others selling the top 100 only hurt a bit.

Sir Richard Branson is that you? ;-)

For those who don’t remember this fiasco, Virgin Music introduced a DRM system called Copy Control Technology (CCT) on their CD’s back in 2003 which caused a ton of issues with then last-generation CD players, especially high end car audio system (Becker, Alpine etc). The CD’s were effectively unplayable on normal stereos… but could be copied at will using a standard computer with no specific software.

Virgin swapped unplayable CD’s free of charge for years, as they apparently had some mix-up in their logistic chain that allowed for CCT-tainted stock to re-enter circulation after sales had been stopped.

If you lived through all the anti-piracy campaigns of the previous two decades it was just too funny. :-D

An apt quote for the times.

Another thought: free money won’t work forever.

“And that after this is accomplished, and the brave new world begins

When all men are paid for existing and no man must pay for his sins,

As surely as Water will wet us, as surely as Fire will burn,

The Gods of the Copybook Headings with terror and slaughter return!”

An interesting experiment.

Mice and rats were given every want and need.

They exterminated themselves.

http://www.returnofkings.com/36915/what-humans-can-learn-from-the-mice-utopia-experiment

I’m sure now the sentiment in retail is “If we can survive until the end of the lease!” Sorry building owners, the good old days are over. No one is creating a business model to make it work.

Stores are less valuable. I bought a Black Friday tablet computer online as they started Black Friday early this year. After a bad experience, I did not buy clothes online until recently I started again. I imagine parking in Soho is hard to find.

Yes it is but not impossible I just drive around and around until I get lucky and somebody leaves as I’m entering the block Always been that way in Manhattan some areas worse than others of course Midtown is impossible as nearly everywhere is no parking/ loading zone

One of my strategies for accessing a Manhattan on the cheap when I’m up on Long Island is to park on the street near a subway stop in Brooklyn / Queens.

No fast & cheap & easy way to access Manhattan.

What’s the Saying about being a good Mother, having a Career and being Happy? U can have 2 but not 3.

And what is the definition of “native digital” or “digital native”

Ragnar I’ve done that but back in my day you would be reluctant to leave a nice car anywhere near a subway stop to be honest Today might be better though those areas have gentrified a lot

@ Agreed.

I should add

Fast Easy Cheap Secure

But also, I think car break-ins in general are down a lot, because car Stereo equipment is not the “hot” fungible commodity it used to be.

The relationship between a landlord and tenant is symbiotic. But that comes in different flavours.

There is the parasitic version, where one benefits and the other is harmed, often mortally.

There is the commensal version, where one benefits but the other unharmed.

And there is the mutual version, where both benefit.

Most landlords are parasitic. Why? The short term bonuses of property management executives drive predictable behaviours. And the long-held belief that the line of new tenants is endless … until ecommerce killed that monopoly on distribution .

Most tenants dream of mutualism, but there is a reason that mostly occurs in dreams. Landlords do not provide palliative care.

That leaves commensalism. But that is a long term concept. And in today’s world I struggle to recognise where long term performance outbids short termism. Rather, its 6 quarters of bonuses – linkedin – new donkey to ride until death – wash & repeat.

Failing that, nature gives us extinction.

I follow fashion and the center of upscale shopping is no longer NY or LA. It is Miami, Paris, London, Milan, or Dubai.

Most of the middle class in NYC now lives in Brooklyn and shops locally or below 14 St. in Manhattan. Your charts reflect the new demographics and economic reality of the city.

Been that way for awhile I owned a three family in Queens near the Brooklyn border in the early eighties Manhattan was even expensive then but nothing like today of course Even my wife’s hairdresser who earned a small fortune commuted from Astoria to the West side because of the rents

Wolf, great reporting as usual. Any similar information for LA or the West Coast? As for Manhattan and the Great NY area, Occasional-Cortex will rue the day she prompted Amazon to abandon Long Island City and the promise of 25K jobs, regardless of their mix. She’s an extinct species after the 2020 General.

HB Guy – hoping the HB means Huntington Beach. I remember the place before it became some kind of Disney theme park. It was a nice funky little town. I knew a guy who lived in what had been an oil worker’s shack that rented for very little. It was a “regular guy” kind of town. Once upon a time…

Alex, you’re correct – Huntington Beach, aka Surf City. Agreed, not all of the changes have been to everyone’s liking, but it’s still a very nice place to live, especially from the perspective of the climate.

As we drop deeper into Grand Solar Minimum # 25, climate will be much more important to us than almost any other factor. Apart from Hawai’i (which is more humid), few places have the climate HB has.

it’s interesting that your charts show peak retail rent in about 2016. what they don’t reflect is what happened on the way up to those highs. by the time those 2016 highs were reached many of the independent businesses that made manhattan special had been priced out. it seemed like the only businesses that could afford the space were national chains and banks. manhattan under bloomberg turned into a suburban shopping mall.

the landlords are in big trouble now. they have leveraged these properties to the hilt to buy more real estate. i don’t have much sympathy for them. maybe after the rents are decimated, we can get our little shops and cheap restaurants back. you reap what you sow.

panatomic-x,

I can get the data for prior years, but it’s a lot of work because I have to do it manually. So for today, I stopped at 2015. Next time, I might add another year, and so on, until the history gets a little clearer. My impression is that the plunge in rents is undoing some of the huge gains seen since the Financial Crisis.

My assumption is that the landlords are still making money on the rest of the building. For example, when we were living in a new high-rise on 90th and 1st Ave back in the day, the retail level was empty for a long time, and finally they got a Starbucks to move in. But it was the same landlord that was trying to fill the apartments of the building too. So from the landlord’s point of view, having a vacant retail floor in a high-rise is likely not the end of the world. It’s just a small part of the total.

It’s been all downhill since Macy’s bought Marshall Field’s. Sad.

i’m not in real estate but i have had people who should know tell me that this is how it works. a landlord wants to get as big a lien as possible on a property in order to buy another property in a rising market. if the lease for the retail space is expiring, the appraiser looks around at recent leases in the neighborhood and computes the value of the space based on the new comparable lease. the landlord takes the loan and then raises the rent at the end of the lease. the current tenant moves out and nobody moves in. the building can usually carry the mortgage anyhow because the residential rents upstairs keep going up. if the landlord rents the ground floor for less than the appraised rate, they have their credit line lowered and they have to pay the bank the shortfall. if the space is vacant, they don’t have to make the payment. so they let them sit vacant. their are retail spaces in my neighborhood which have been empty for over five years. here’s an article from 2017. it’s worse now:

https://tribecacitizen.com/2017/08/28/the-desertification-of-street-level-tribeca/

What you describe is what I see in the Dutch cities although the top rents came probably a bit earlier here. Many of the more unique shops have disappeared for good and they are not going to come back. Here (too) commercial real estate is leveraged to the hilt and not marked down when empty, they use all kinds of tricks to keep the banks happy (and of course the banks don’t want to mark down until it is too late and the whole loan implodes).

Prices in restaurants have increased hugely here over the last few years (way above inflation). There is a strong increase in fast food outlets that cause a huge amount of trash in the city streets; not the type of retail that I like. I doubt there is anything to fill the void for now. Maybe in 5-10 years when the depression hits we can have some kinds of repair shops again, but with current wages and cost of new consumer goods it would not make any sense financially.

Check out Hell’s Kitchen and St Mark’s Place or Hudson Yards (a mall). New York City isn’t only Madison or 5th Avenue. Some die and some live.

hell’s kitchen and st. marks are full of empty storefronts. hudson yards is too new to judge.

Didn’t this just coincide with all the easy money being poured into the market? I know in London from 2014, huge amounts of funds poured into all the mid-tier chain restaurants. These opened up new sites all over the place, and caused many independent restaurants to close down due to unaffordable rents. Over the last year many (most) of these chains are now in severe trouble as the sales never materialised, and there are lots of sites sitting empty.

Same thing looks like it’s about to happen with commercial office space in the wake of the shared office fiasco (wework and its ilk).

IMHO this is just an example of the extreme damage to the real economy being done by QE and ZIRP. After a whole lot of spent effort, we now have less restaurants and higher prices. It would have been better if the money had stayed at home.

Better for the common working person.

Not better to the 1% and large corporations

As they are first in line for the cheap and easy money.

“It would have been better if the money had stayed at home.”

QE and ZIRP yes but also globalisation in general. The best example being the online sales that have been covered here to a great extent. Middle class folks that used to spend money, are now approaching extinction in most of western world. Having no money to spend and no time to go shopping (for having to have two or three jobs now to keep afloat), retail places are now being left with noone to sell to.

Thankfully, our “liberal” overlords that brought us this great state of affairs, are addressing the problem by bringing in major amounts of new people so the next business stream will be converting all these defunct commercial spaces into living accommodation.

I have got commercial tenants and hope they will stay to the end of their leases some 6 years hence, after which I am turning everything into little sleeping boxes.

Here’s the solution:

Convert all the absurdly redundant (but now empty) retail space into WeWork offices for Wag (SoftBank’s dog-walking & technology company).

At the craft beer bar, they could hand out cute plastic gloves for picking up Fido’s…ummm…errr…emissions (you would not need to do this in San Francisco).

Just what in the world does one have to sell to pay for a 3000.00 per SF store? 10 K Handbags? Kidneys? Stolen Babies? Was thinking about this on my last Mexico trip,despite all of that countries problems there was a abundance of bustling retail every place i went. made possible by dirt cheap store rents. different worlds. it gives the little guy a chance to participate in the market and feed his family. they do capitalism pretty well in a way we used to do it a long time ago.

Just what in the world does one have to sell to pay for a 3000.00 per SF store?

Your soul. There’s a market for souls, and it does get tracked, but not here. It collapsed in DC when sellers flooded the market, and futures are way down just about everywhere.

I had a breakfast date at Tiffany’s, but I got stood up.

They are not there to sell anything, they are there as a branding exercise. Which works until it doesn’t.

$3k per SF a month. $100 per SF per day. Only Apple makes that kind of money on iphone launch days

Maybe it’s money laundering? Keep in mind there’s tons of human trafficking and drugs in the US, plus tons of dirty money sloshing around all over the world.

Wolf, what’s the typical lease term in Manhatten? 2yr, 5yr? 20yr?

If they’re long term, maybe no one wants to take a longer term gamble that the boom years will return.

With the rise in sea levels over then next 20 years, maybe Manhatten’s days are numbered.

Leases are negotiable. I don’t know about Manhattan, but in San Francisco, the typical retail or restaurant lease is 10 years.

In terms of sea level, there are many places where the streets are below sea level, including in the San Francisco Bay Delta, New Orleans, the Netherlands, etc. So it can be done. It just costs some money.

Manhattan is consulting with some Dutch companies for protection from rising sea levels. Manhattan has the advantage that there is almost unlimited money available to protect a relatively small area, so they will probably do relatively well. But in most cases not much can be done when sea levels keep rising except prepare for disaster or move.

In the Netherlands too authorities have their heads in the sand when it comes to this topic “we will just build a very high dike 20 miles from the coast and pump all the water out (including all the water from the big rivers, and what about all those ships that visit harbours like Rotterdam?). I’m in the part of Netherlands that was flooded in 1953 which resulted in a couple thousand people drowning and destruction of countless properties and farmland (due to salt). After that they started to build huge installations to protect from the sea, finalized in the seventies/nineties and meant to be safe for over 100 years. But they never considered rising sea levels and in 20-30 years those flood protection barriers will no longer protect against the worst storms, and by 2100 no dike whatever the height will work because the water will simply seep through from underneath and half of the country might submerge.

But why worry, RE prices are at all time highs and still surging; as long as the epic Dutch mortgage bubble can be kept above water everything is fine, and who doesn’t want to live on the waterfront :)

Do you mean the actual Borough of Manhattan is consulting with the Dutch? Or is it the City of New York?

@HollywoodDog

sorry, don’t know the specifics but my impression was that this was about the financial district (which has Dutch origin …) so probably Manhattan and not City of New York.

There is no plan to pump out the river water. Just a river dyke until it reaches the sea dyke. And the deepest polder in the Netherlands is right next to a river (-10m) while most of the land is within -2m so worries about the sea level are a bit premature. Especially considering that most of the post war building stock will be demolished anyway because they will cost to much to heat.

@char:

why would they demolish the old building stock if it is about the best investment ever, with guaranteed fat price gains every year? Dutch homeowners buy anything that is said to be a “home” as long as they can get a mortgage for it ;(

Yes, upgrading those old homes for the new climate change plans doesn’t make any financial sense. But that doesn’t mean they won’t try, the plan seems to be that you can simply tack all the cost on top of the existing mortgage, don’t pay a thing out of pocket and let future taxpayers worry about paying it all back. Many companies are ready to profit from all the proposed climate “upgrade” measures (probably easier too from the legal side, compared to building completely new homes, with the current NOx discussions).

I’m convinced significant parts of the country will be inhabitable due to (temporary) flooding within 1-2 generations; just sad that I will not be around then to hear the explanations from “experts” and politicians about how nobody could ever have seen this coming.

To all:

In 1945 the Netherlands had a population of 7 million with very big families living in small homes. Now there are 17 million with small families living in bigger houses so obvious most homes have been build after the war. Especially between 1945 and 1995. Those homes can be divided in three types apartment buildings (NL:flat), terraced house (NL:rijtjeshuis) and other. Especial the two cheapest type of homes are owned by woningbouwverenigingen (kind of “state owned” foundations to keep rent controlled housing cheap). My guestimate for how the Dutch housing market is subdivide is 20^% older than 1945, 20% younger than 1995, 20% apartments (build 45-95), 20% terraces (45-95) and 20% other (45-95)

@nhz

It cost 100k to convert a rijtjeshuis if you do the whole terrace, It is more if you one except it is not really possible as converting means a new heating system, better ground isolation and new roof and a new outer wall around the old outer wall. Price before conversion 200k-250k, after conversion 220k-270k. You could also knock it down, build something for the same market for in total 150k and have something that is worth 300k-350k. But those old rijtjeshuizen are often close to the town center so for 200k you could get a house worth 400k-500k. As i said woningbouwverenigingen are there to keep rents cheap but it often feels more like they are big speculators (because they are) so first they try the conversion for the terrace houses they own, then they decide knock down and rebuild makes more economic sense and after that they will use imminent domain to redevelop the terraces owned by owner/occupier

it’s 10 years in nyc, too.

there is a lot of lobbying right now about protecting manhattan from storm surges. one real estate driven scheme is to fill in part of the east river. god save us. another interesting initiative is to recreate the oyster banks that protected the harbor before it was dredged for modern shipping.

https://ny.curbed.com/2019/8/1/20749875/east-side-coastal-resiliency-city-planning-commission-hearing

https://billionoysterproject.org/

I think that plans like the oysterbanks make sense, trying to let nature do most of the protection work. Problem is, this takes a lot of time and longterm effects are difficult to predict (we learned that form the much bigger waterworks in Netherlands …). The other problem is that nowadays there are many economic/financial interests that can clash with such protective measures (like shipping, aqua tourism, fishing).

In Netherlands too we have severe pressure from RE developers to build in areas that are very vulnerable to climate change (like on the coast of too close to large rivers) and politics is always happy to cooperate, offer the people who purchase a home there full flood insurance paid for by the other taxpayers (similar to what I read from much of the US), while they REALLY should use common sense and never build on those locations, or only temporary stuff like vacation homes without any insurance (for those who want to take the risk).

Hurricane Sandy showed us how truly vulnerable we are

Yes, nature has a way of pointing things out that we’ve forgotten.

A very old huge tree fell on our driveway and took the whole neighborhood’s power and phone lines down for more than a week. Thank goodness we had relatives who helped us with food and gas for the generator. Unforgettable. A whiff of the wind took about ten huge trees down.

When rents are rising, a landlord would want a shorter term lease. When they are falling, a landlord wants to lock a tenant into a longer term lease.

A longer term rent has likely an inflation term add

Hope and change just purchased a $16 million beach house within 200 miles of NYC.

He doesn’t seem to concerned about anything rising.

Yup Martha’s Vineyard to be exact and why would he Homeowners insurance and they stole enough during his “ career” to just walk away if need be so it’s all good right Politics as usual Nothing to see here

all the new and very expensive second homes in my part of the country are on or very close to the coast and probably the first to be gone when sea level rise becomes a bit more than currently expected. Apparently the elites who are buying these 1-1.5M EUR vacation properties don’t worry about the effects of climate change, although I noticed one of the recent parks has its own small dike which might be more to protection from public view than flood protection. Guess the elite has their priorities straight ;)

Very similar to the expensive mansions I see on the US coast near e.g. Miami, those will probably be gone even earlier.

$16m is changes for hope and change, also he can probably get the government to pay for sea defenses.

If you believe in rising sea levels you avoid the shoreline. In Manhattan we know the sea is not rising.

As a matter of facts, those who manage the carbon tax exchanges built an entire city on reclaimed land from the water: Battery Park.

Goldman Sachs knows there’s no rising sea levels.

We all know.

As always, The Simpsons predicted the future. The episode where Homer’s new town rips out all the retail stores and replaces them with coffee shops as far as the eye can see… Starbucks at no.1 High Street, Costa at no.2, Starbucks at no.3, Costa at no.4, Starbucks at no.5, and on and on and on… Urban city centres will eventually be retail-free zones, filled with hipster-like apartments and experience-led units.

Ah, the subtle irony. ;-)

Perhaps somebody in the writing staff remembered when Benetton franchisees were opening a store a few meters from each other. Literally.

Benetton made a killing (and thanks to that money owns the Italian government these days) and their franchisees were slaughtered.

I’d be really interested to learn how much Starbucks franchisees make after paying through the nose to inflate Starbucks stocks. Serving coffee is not exactly a sector with scant competition and with high entry barriers.

I’d be really interested to learn how much Starbucks franchisees make after paying through the nose to inflate Starbucks stocks.

They only stay in business because they can’t afford a bankruptcy lawyer.

Coffee shops as far as the eye can see, sounds like the future for Dutch retail although the word may have a slightly different meaning over here? For sure these shops always have enough money to pay the rent …

Coffee shops as far as the eye can see

Taco Bell. Pizza Hut in the European release. Sole survivors of the franchise wars. Everybody lost that one.

So I take the supply of tourists flowing into Amsterdam looking for baser entertainment than the Museumplein, the Artis and the Hortus Botanicus hasn’t diminished? Only them could pay the outrageous coffee shop prices. That’s unless there’s a two-tier pricing system of course: one for locals and the other for non-residents.

The tourist stream is still growing and Amsterdam residents are complaining loudly. From what I hear the Dutch prices are among the lowest in the world now thanks to the huge market and epic volume of local supply, but maybe non-residents are only allowed to purchase in the more expensive shops.

True in a time when pot was illegal in America and semi legal in Holland but will likely be legal in all Western states in the near future.

Heard on the radio (Radio 4, UK) the other day that small local businesses are being started in some of our run down high (main) streets. Landlords who have been abandoned by large chains stores are glad of some rent (it’s better than nothing) and willing to invest in converting their large properties in to smaller units to accommodate these local businesses, which are supported by the locals. People aren’t daft, they are waking up to the fact that supporting local business is good for the local economy and so good for them. It’s a form of selfishness but it’s healthy selfishness, unlike greed.

Also, local businesses can’t just up sticks and leave like large chains are wont to do when time are bad, thus local businesses make for a more robust economy. Yes, you may pay a little more for goods and services but that little more is, likely, spent locally.

That is not true. Local firms need to make a profit from a store. Large chains do not.

char: “That is not true.”

I take it you’re referring to my last paragraph? If so, good point.

Large chains can rely on stores elsewhere while making a loss in some stores, to make a profit overall. So large chains can carry on through dips in the economy and act as flywheels to keep employment up in harder hit areas thus lessening the blow the dip brings. But large chains are, well, large and so when they do go down (totally, like BHS etc) or exit a town then the hit is far bigger than a few local businesses going to the wall.

So locally run shop vs large chains is swing and roundabouts in this context. A mixture of both (proportions proportional to town’s size) is likely best, I thunk.

In HK the ground level got torched, the biz above ground level did fine.

I think the message got out and these riots are coming to every place where there haves & have-nots.

Almost all the mob biz in HK did fine, as they’re never on the ground level, always follow the dingy signs and stair cases up.

Who would want to be on street level Too rowdy Better off a few floors up to stay clear of the mobs when everything goes nuts

Absolutely. The last apartment I had in Sunnyvale/Slummyvale was a shit magnet. Ground floor and facing the street = double whammy.

Question) If the rents are falling, so would be the rateable value of the building. That also means that loan to value of the deal will go up.

Hence the owner of the property will have to put in more collateral.

Have we seen any bust up here, where the owner have not been able to pay up their covenants?

Tek,

In Manhattan this is less of a problem because most of the ground-floor retail spaces are in large buildings, and are only a small part of the building.

Also, the commercial mortgages I’m familiar with are not linked to potential changes in the value of the building. As long as the landlord keeps making the payments, there should not be any problem for the term of the mortgage. The problem arises when the final balloon payment – which is typical for commercial real estate loans — needs to be refinanced.

A property owner can for example get a real estate loan for 10 years with an amortization of 30 years. So after 10 years, the unpaid principal (balloon) needs to be refinanced. If the building’s value and its revenues from rents dropped a lot, this could be a problem.

Wolf, I have a story…

Timeshares.

In Collingwood, Ontario, these investors of timeshares are trying to get out of their contracts as the fees keep increasing.

They are so iron-clad that they are locked in for life and should they pass away, estate still owns it (meaning the children too) are locked in.

Some lawyers are trying to negotiate to get the owners out of the contract but that is failing.

The only way out now is for the Federal Government to pass some law but even that is quite a stretch.

Timeshares are one of the worst “investments” possible.

And done under enormous pressure with massive commissions and zero repercussions to these companies.

The entire industry should be banned.

Thanks for the heads up.

I just let mine go back to the sponsors during my divorce The fees were indeed out of control and I figured I’d just cut my losses Glad I did actually looking back They are unsaleable basically

As a lifelong NY’er, I’d say the place has become a colossal, homogenized bore. It was once a place with a vibrant counter-culture which made it an interesting contrast with the rest of America. Now it’s a mono-culture reflecting the mainstream liberal Establishment where one political and social view is so dominant that anyone holding an opposing view fled long ago. Add the high cost of housing and availability of online shopping and its a wonder why anyone would want to live there. Those who like the mainstream culture of Manhattan (woke and gay all day) can find that anywhere and those that don’t are hounded our of NY. It’s a dying city which has lost it’s raison d’etre. Another snooze fest? London.

And massive taxes.

Top rate to work in NYC is 13.5% with state and local income taxes. 10% sales taxes. Insane property taxes. Taxes upon taxes.

“Woked” = taxes to infinity….and beyond.

Now that carbon taxes have been imposed and riots are not occurring, a rain tax is now coming across the country. Of course blamed on global warming.

The only way to fix any problem.

Bigger and bigger government, more and more regulations and higher and higher taxes.

In the nineties income taxes alone in Netherlands – for incomes above 20K EUR or so – were 70%, and 10% sales tax sounds too good to be true. Since then income tax has been cut in half and life has become a lot more UNaffordable for the middle class ;(

Inflation is a tax TOO! The present regime in power has given carte blanche to corporations to start economy-wide PRICE RISES. We the people do notice it, though the Fed may not.

Just so I can follow your conspiracy thoery.

Corporations need permission from presidents to raise prices?

And have not had this permission until very recently?

And now it is off to the races?

@2banana….not a theory. COrporations always need “an excuse”. public cover.

San Jose California gave us the Grateful Dead, those black athletes who raised a fist at the medal ceremonies, and all kinds of quirky shit. Now, it’s becoming the most boring place ever, unless you’re a straight, white, 20-30-something male who’s politically conservative and worships tech as their religion. The official color of San Jose is beige.

And Winnipeg gave us Burton Cummings and it’s always been boring Go figure right?

The future sucks. Nobody goes there anymore.

Don’t need to go out anywhere now…

I’ll send my personal drone to watch a show…

The future of NYC will be that of the past.

1977 to be specific.

If they are lucky.

DeBlasio seeing to that. All of the safety gains the city made from early 90s will be reversed. Bad enough phonies like Bloomberg now apologize for the very policies that helped make the city safe again

Never apologize when you’re right.

Rents go down, then all the big balls real estate landlords will get together and sue the city on lower PROPERTY TAXES. Then the governator, will screw the sheeple more. Politrix.

A response to the Dollar General comment above. (Just to brighten your day)

I buy paint brushes from a dollar store, maybe 20 at a time, and use them for furniture stains, etc. Here, in BC, our local version is called Dollarama. Anyway, while standing in the checkout line, next to the gum and Werthers, I saw pregnancy test kits for a $1.25. Now, what could go wrong with a P kit from the dollar store? Seniors buying tuna, and young mothers buying Chinese-made gift wrap, bows, toys, and maybe a Preggers kit just in case. New retail operates in mysterious ways to serve our changing times. This Dollarama is located in a re-purposed mall that is 99% boat and rv storage. They probably get free rent. Busiest store in town. Starbucker coffee shops are the least of your worries. :-)

Do they $1 condoms too?

I sense a connection.

They sure might, but I didn’t look. Too stunned in too many ways, I guess. :-)

You know, when I was reading this article I was also in the middle of ordering a Christmas present online, and a bunch of electronic stores for my shop. I didn’t get the free shipping options as my orders were too small, but Canada Post will drop them off at the house for $11.96, per. I live 50 miles from town, but almost 200 miles from these specific stores. City shopping equals a drive and parking, or transit options if you live there. It takes time and will probably include a meal. No wonder these places are in melt down.

If Qualitex can make high quality balloons of the type street performers make balloon animals out of, for far less than a dollar per, I’m sure someone out there can make condoms that sell for a buck.

Also latex gloves are super cheap, and that’s 5 fingers not just one lol.

2banana,

OK, now you sent me checking to Walmart’s online site because that $1 condom seems expensive: The good folks at Walmart offer all kinds of condoms, obviously, including for example a fun-looking “sampler” pack of different condoms, different colors, etc., 48 condoms for $10.99. So that’s a cost of 23 cents per. Or a 96-pack for $12.04. That’s 13 cents per. There are probably cheaper ones out there too. So why buy at a brick & mortar Dollar store? Well, except when you’re running around and suddenly, unexpectedly, it looks like you’re going to get lucky, and you’re scrambling to find a condom somewhere.

And soon, Paulo will be buying his paint brushes online, by the dozens, for a multi-year supply :-]

I am 100% positive that people who by $1 condoms and $1.25 pregnancy test kits do not have the mentality to do bulk shopping of condoms or test kits with free delivery from any online store and wait for the postman. They are targeted to a different group of people.

Think about the shock of a husband because his wife placed an order for bulk pregnancy test kit with his credit card but he always placed order for the variety sampler and picked up from the store.

Condom Depot online has ‘screaming’ deals on prophylactics. I get all mine there.

Yeah but they are seconds so beware

As I read the comments, I have noticed increasing amounts of humor!

I trust everyone has stuffed themselves full of turkey!

So Happy Thanksgiving!

I am shocked, shocked to find that humor is going on in here.

Happy Thanksgiving too, to everyone.

Humor? Can’t have that This is a respectable site you know

All this proves indirectly, is there is a premium for online shopping. That premium may be expressed in many different ways, you are subsidizing nonliving wage labor, you are gambling on quality, or you are not seeing the good stuff. Either way you pay more to shop online. I don’t believe Bezos knows anything about retail, or marketing, or fashion. He just put together the company. Looking forward I retail entrepreneurs will be buying unique and trendy things (online!) which are not always available to the general public, and putting them “together” in retail shops. The internet may not be as democratic as you think. Shopping becomes a service, like it always was, and you get a discount of sorts buying in a storefront. And then you get a group of these shops together, out in the suburbs, and call it a MALL?!

Stop worrying.

NYC will catch up with Detroit, SFO, LA, and Chicago. Just give them a few more years.