But it’s even worse than it looks. And this time, there is no jobs crisis. This time, it’s the result of greed by subprime lenders.

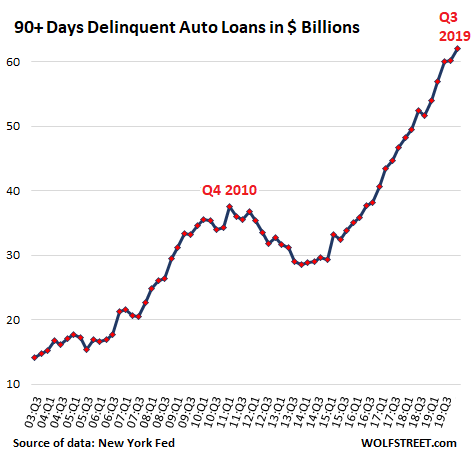

Serious auto-loan delinquencies – auto loans that are 90 days or more past due – in the third quarter of 2019, after an amazing trajectory, reached a historic high of $62 billion, according to data from the New York Fed today:

This $62 billion of seriously delinquent loan balances are what auto lenders, particularly those that specialize in subprime auto loans, such as Santander Consumer USA, Credit Acceptance Corporation, and many smaller specialized lenders are now trying to deal with. If they cannot cure the delinquency, they’re hiring specialized companies that repossess the vehicles to be sold at auction. The difference between the loan balance and the proceeds from the auction, plus the costs involved, are what a lender loses on the deal.

The repo business, however, is booming.

But delinquencies are a flow: As current delinquencies are hitting the lenders’ balance sheet and income statement, the flow continues and more loans are becoming delinquent. And lenders are still making new loans to risky customers and a portion of those loans will become delinquent too. And now the flow of delinquent loans is increasing – and this isn’t going to stop anytime soon: These loans are out there and new one are being added to them, and a portion of them will be defaulting.

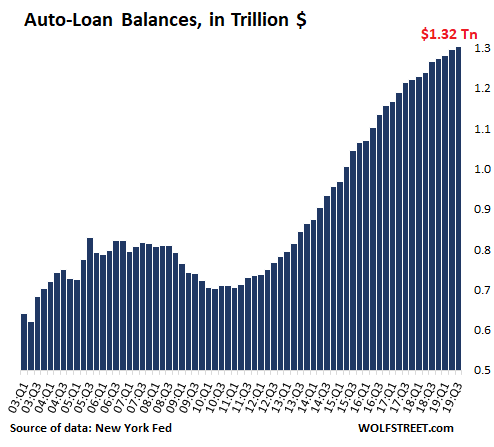

Total outstanding balances of auto loans and leases in Q3, according to the New York Fed’s measure (higher and more inclusive than the Federal Reserve Board of Governors’ consumer credit data) rose to $1.32 trillion:

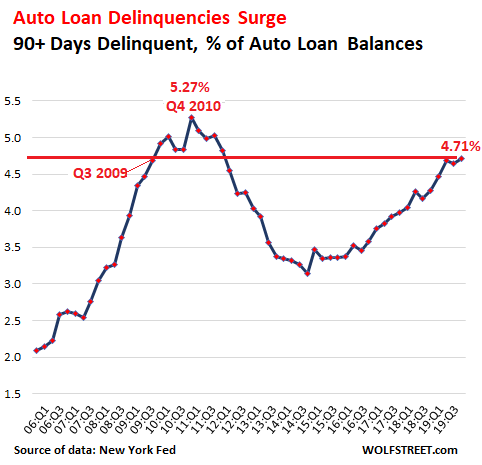

Serious delinquencies jumped to 4.71% of these $1.32 trillion in total loans and leases outstanding, the highest since Q4 2011, when the auto industry was emerging from collapse. And on the way up, this 4.71% is just above the level of Q3 2009, months after GM and Chrysler had filed for bankruptcy and a year after Lehman had filed for bankruptcy, when the US was confronting the worst unemployment crisis since the Great Depression, and when people were defaulting on their auto loans because they’d lost their jobs:

The current rate of 4.71% is just 56 basis points below the peak of Q4 2010. But these are the good times – and not an employment crisis, when millions of people who lost their jobs cannot make their loan payments.

So what is going to happen to auto loan delinquencies when employment experiences a pullback, even a fairly modest one, such as when one million people lose their jobs? That was a rhetorical question. We know what will happen: The serious delinquency rate will set a record for the annals of history.

But it’s even worse than it looks.

“Prime” auto loans have minuscule default rates. The total of $1.3 billion in auto loans and leases outstanding includes leases to consumers who could pay cash for the vehicles but lease them for various reasons. According to a different measure by Fitch, “prime” auto loans currently have a 60-day delinquency rate hovering at a historically low 0.28%.

Of the $1.32 trillion in auto loans outstanding, about 22% are subprime, so about $300 billion. Of them roughly, $62 billion are seriously delinquent – or around 20% of all subprime loans outstanding. One in five!

But this subprime delinquency fiasco is not a sign of an employment crisis and a brutal recession as these types of numbers indicated during the Financial Crisis. Employment is still growing, and unemployment claims are near historic lows. Nevertheless, subprime auto loans are defaulting at astounding rates.

What’s going on? Greed – not an economic crisis.

Subprime lending is risky but immensely profitable. The thing is: Customers who have a subprime credit rating are painfully aware of it. They have been turned down for low-interest rate loans. They have been turned away. And now they walk on a car lot where their credit rating suddenly is no problem. And they become sitting ducks. The industry knows this.

They don’t even negotiate. They just accept the price, the payment, the interest rate, and the trade-in value. They’re ecstatic to get a car. And they end up with a huge payment at a high interest rate, and given how strung out they already are to be subprime rated in the first place, that loan is doomed.

That’s the irony: a low-interest-rate loan on an affordable car, sold at an average profit, would give the customer a much higher chance of keeping the loan current than a loan with a 15% interest rate on a car the customer cannot afford, including a big-fat dealer profit of the type that can only be obtained from a sitting duck. Those loans, born out of greed, and are doomed.

This is what we’re seeing here. These loans were born out of greed over the past few years, as the industry was getting very aggressive in pursuing subprime rated customers because they’re sitting ducks and so immensely profitable. What we’re seeing now are the consequences of that greed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Why some poor will always be poor. More money can’t fix stupid.

“They don’t even negotiate. They just accept the price, the payment, the interest rate, and the trade-in value. They’re ecstatic to get a car. And they end up with a huge payment at a high interest rate, and given how strung out they already are to be subprime rated in the first place, that loan is doomed.”

“Stupid” seems a little harsh. Perhaps ignorant or unsophisticated. Some people just don’t know the rules of the game. I went to China a few years ago to a mall and started offering 1/10 of the listed price since that’s what a friend suggested. The first few vendors acted like I insulted their long lost mother and I was starting to think my friend was wrong when another vendor negotiated with me and we ended up pretty low. I had forgotten about this until now, but years ago I walked into a Tiffany’s and tried to negotiate a wedding ring. They don’t negotiate. Who knew. The point is if you don’t know the rules of the game you will lose every time.

“Stupid” seems a little harsh. Perhaps ignorant or unsophisticated.

Stupid? Maybe not.

Maybe it’s because they don’t have much choice, not if they need a car so they can keep that third part-time job – the one that keeps shorting their paycheck, not the one that owes them two months back pay.

Getting around without a car doesn’t leave much time to shop around for the best deal.

For the first 20 years of working, I drove well maintained beaters. Definitely won no style or cool guy points.

But they carried no debt and allowed me to save for other things.

And if/when they had a major repair needed (rare, but it happens) I just got another beater and sold the broken one for parts.

Not hard to do. Plenty of folks do it. Plenty of poor folks do it.

“Maybe it’s because they don’t have much choice” = Yes, I agree with you that some are pretty stupid or vain and will always be poor but I can’t say that because I have to virtual signal how much I care

People with choices don’t ever understand what it is to be without a choice. It’s called privilege.

I was a pretty poor college student. Came from a family with little money and tried paying as much of my way through college as possible. I honestly did not have enough to eat many days. My dinner would be a baked potato with a slice of American cheese on it. I shopped at a grocery outlet that sold expired food for pennies on the dollar and that helped alot.

But I’ll be 100% honest here. I was also really stupid. I made dumb choices that cost me money and I could have been better off had I been smarter about money. I don’t fault myself too much because I was pretty young, but the simple fact is that stupid choices contributed significantly to my situation.

Example: I drove an old beater that I bought for $900 with my summer job earnings. It was a 1979 Toyota Celica Supra (what I wouldn’t give to have that car back now!). Anyway in my Pittsburgh neighborhood they had these dumb ‘alternate side of street’ parking rules that were ostensibly due to street sweeping but I am pretty sure were just a way for the city to increase their parking ticket take. Anyway, rather than being organized and following the rules, I very often parked incorrectly or forgot to move my car. Ended up with tons of parking tickets, then my car was eventually ‘booted’ and I had to pay hundreds of dollars to get the boot off. That was hundreds of dollars I did *not* have, so I had to take an emergency loan from the university.

I am at a stage in life where money is just not a concern. I do remember what it was like to be up against it though, but I make no excuses – things could have been significantly better for me had I made better choices.

2banana – the last car I bought was a “well maintained beater” and it just f(_)cking *died* one day and to this day I don’t know what it died *of* and I’m pretty handy at fixing stuff.

I sold it as-is to a guy who said he was going to use it as a father-son fix up project with his kid, but I really hope he was lying to make me feel better about selling it so cheap, and his real plan was to part it out on Ebay.

Hopefully I will never own a car again.

But the problem is, you can’t be hired for any job, not even picking fruit, without a car in the US.

Gov make a law for people and they don’t protect us from the high rates if u had good rate u would full fill your obligation u can’t achieve this . They only offer good deal on a ride to try to break new people,to put them in a badloan too

Zantetsu:

“Baked potato with a slice of American cheese……”

At some pretty high class restaurants that would be considered:

“pomme de terre au four avec une tranche de fromage américain……” With good “presentation” and, pretty expensive!!! LOL!

Pretty classy!

Yeah, 2Banana, let them eat cake.

Because voluntarily buying a car you can’t afford somehow equals the French Revolution….

But please do continue.

You do realize that’s the same attitude..

Dave Calder, it’s false equivalency.

Zantetsu,

So being desperate from being ground into poverty is exactly the same thing as being stupid…ISN’T false equivalency ???

Straw man.

Anyone up for another logical fallacy?

Guys, keep in mind the Arab Spring started with a student not being allowed to sell vegetables off of a cart.

I agree that buying a car you can’t afford isn’t going to have you downloading plans for a guilllotine (hint: can probably make a pretty decent blade out of a car leaf spring with a plywood backing for weight) but we are heading in that general direction…

There are always choices. It is almost always cheaper to repair a beater than change vehicles. This is obvious as the one selling the car has OH and profit to cover not counting finance charges… There are also buses, trains, motorcycles and bicycles. Of course, a few become “wealthy” through inheritance, a terrific job, or some luck with fate, but the majority do so simply and slowly; Spending less than they make and saving and investing. Having children is also a choice…

>but the majority do so simply and slowly

They also made more than the cost of living.

This and the fact that salaries haven’t kept up with the cost of living is why remote work is so popular.

Move to a cheaper area on the same salary. More leftover money for you.

Not even to mention that they don’t even consider things like recurring property taxes some states charge on vehicles, the insurance rates that will be due, or the maintenance costs over time, especially for higher class vehicles.

2banana said:

Why some poor will always be poor. More money can’t fix stupid.

“They don’t even negotiate. They just accept the price, the payment, the interest rate, and the trade-in value. They’re ecstatic to get a car. And they end up with a huge payment at a high interest rate, and given how strung out they already are to be subprime rated in the first place, that loan is doomed.”

****************

I was going to use that quote for a different take:

Everything is going according to plan. We just need to continue with until the eager paupers are grateful no matter what we do to them.

Now we just need to instill the say desperation amongst the masses with regard to housing, medical care, jobs (oh wait…we are…everything’s going according to plan). Make them ecstatic to get minimum wage jobs at McDonalds or shipping containers or SUV’s as houses. Keep cutting taxes on corporations and the rich and declare “we have a spending problem” when the facts are clear historical spending has been holding steady (except maybe for 2019) so it’s a revenue problem of not taxing the rich and corporations. Bash people for wanting their paid for retirements funded like we funded the criminal Wall Street banks with bailouts and declare it’s socialism like it’s bad for working people but good for the rich. And tell students “it’s our tax dollars!” when we change loan rules in 2005 to screw them over making the debt slaves…possibly in violation of the Constitution which bans slavery. And my biggest laugh is when folks we we can’t afford Universal healthcare. In other workds we can’t afford to save fantastic amounts of money – For every $1 we spending providing MedicareForAll to every single person, we save $2.

Let that fact sink in:

For every $1 dollar we spend giving MedicareForAll to everyone, we save $2. Medicare costs about half of what we currently spend on health insurance.

Citizen savings are corporation profits.

Did you make that up? If not please show your calculations with references to back-up the numbers.

Google the cost of Medicare yourself. About half of all other private alternatives. The facts are not in dispute.

timbers – most of American health care is on the basis of … “Oh, I’ve had this mysterious cough for a long time now, but I can’t afford to see the doctor” then it gets really bad over time and when you figure you’re on the “final glide path” anyway, you go to the ER and get your several thousand dollars’ worth of medical care (check with a stethoscope, X-ray to be sure, then a few dollars’ worth of antibios because you’ve got pneumonia) and now you (to the tune of maybe $1000 out of pocket) plus “The Public”, the hospital, etc have to “eat” the rest of the bill.

In any other decent 2nd world country (because the US is certainly not a 1st world one, the way the terms are used now) you’d just go to the damn doctor, it’d cost you a day’s wage maybe, or it might cost you what a sandwich and a beer would cost, or it might cost you nothing, because pneumonia is an easy condition to cure, and decent 2nd world countries actually don’t want their citizens keeling over from pneumonia, TB, whooping cough, etc.

The stupid one is really you. If you don’t have a down payment, a good credit rating, and need a car to keep your job, your only source of income, a bad deal is better than no deal. Poor people are really quite smart about survival. They take the bad deal because if things get worse, they can only take back the car. Rinse repeat.

I do volunteer work that puts me in position to meet many lower income people who require transportation. There is no question that subprime lenders take advantage of some of these people.

But it is much more complicated than that. The wise low income people pay cash or borrow for very inexpensive 10-15 year old basic vehicles that cost around 2-5K. If family, usually minivan, if not, think Corolla.

Unfortunately, a great many of them also buy 2-3 year old vehicles that are not basic transportation (luxury SUV, large trucks). I know one such family that is driving a late model Rover with a 600$ a month loan instead of the 15 year old minivan that could be purchased outright with 1 year of those loan payments. People are extremely vain and there is a palpable sense of entitlement regarding smartphone and fancy vehicles among many people who really should be focused on building savings before status oriented purchases.

So the lenders are not the only place to lay blame. It is hard to overstate the vanity and foolishness of people in any social class.

Happy1,

There are a lot of subprime borrowers who are not “low income.” They got in over their head and fell behind on house payments and credit cards, and suddenly their FICO is below 620, and they’re “subprime” though they have a household income of $100,000+.

The credit rating has nothing to do with income but with debt levels, and how you service that debt (credit history).

Happy1,

What you don’t know is that the buyer has little choice in which car they can purchase under these deals. They are taking what they are offered based on the monthly payment they can make.

What “do gooders” don’t know about the poor is more than they think they know. If you really wanted to help the poor lobby for usury laws that protect them.

The poor in America are exploited at every level. Now the liberals want to give them a guaranteed income because they know it will be siphoned by the rich.

Side, somewhat related topic: The deluge of ads on TV from companies–mostly credit rating agencies, I presume–that promise they can raise your credit score ‘with a few clicks on your phone or browser.’ Out of curiosity, I pursued one of the links to see what the want/do, and by simply submitting a couple paid utility bills, for example, you could ‘raise’ your credit score by 10-15 points. I don’t recall for sure, but I believe you had to pay for this ‘help’ (I’m sure you’ll pay, one way or another). Presumably, the rating agencies already have access to all your credit purchases, though not utility bills in some areas, so you’d be paying them to arbitrarily raise your score, which you otherwise deserve anyway.

The implications are: 1) your credit score is possibly your most important asset in life and 2) you are, or should be, purchasing everything on credit and, of course, your ‘score’ means everything. This is, I believe, part of the ‘great normalization’ of being in debt. I’m old enough–66–to remember when debt was at best a necessary evil, except possibly for mortgages which, done right, can lead to a profit over time (and you have to have someplace to live anyway).

Responding to Happ1 and a few others. This also includes the homeless crisis.

I live in a rural area with a lot of sub-prime issues; spotty employment, lower education levels, and limited opportunities. It used to be a pretty high earnings blue collar job area for decades. Like most such places, it no longer is high earning. There are virtually no visible minorities. One thing I have noticed is that if you fall off the employment wagon, sobriety wagon, or have a few unproductive years, without family support you are pretty much hooped. All it takes is a poor auto purchase, combined with ‘barely making it’ and one unexpected maintenance issue.

I have quite a few neighbours who are also alcoholics. It’s brutal to watch all the assets disappear to pay for the booze and smokes, see the families drift apart, and then declining health leading to early death. These issues are so much connected.

Another thing is the poverty cycle. If you are frugal and live by a plan to go forward it looks like just self-indulgence, stupidity, or sloth. But there is a definite and recognised social cycle of spending any and all windfalls for immediate gratification. If you’ve always been downtrodden in your entire experience….. a sub-prime auto loan is opportunity, pure and simple. At least you have wheels for awhile.

I was pretty broke when I was in my 20s and just starting out with a family and mortgage. But we always had hope and a plan, and knew we could ask for help if we really needed to. (We never did, ever). We also never had a car loan preferring to drive beaters, by plan.

“The credit rating has nothing to do with income but with debt levels, and how you service that debt (credit history).”

Mr. Richter,

I have no debts other than monthly recurring ones (utilities, etc). Keep my one and only credit card at zero balance (And have since 2005), pay all monthly “recurrings” on time, and two years ago, I missed my property tax in full payment by one day…and yet my credit score is 795… I believe that there is more to the metric than debt levels and servicing. Maybe the more debt/payment churn? Perhaps I am not considered a “good consumer”?

elysianfield,

“Debt levels” go both ways. It means you have to have some debt (an established “credit history”), but not too much debt to get a top score. A mortgage, serviced perfectly, with no arrears in anything else for many years, is ideal to get a top score of 850.

But too much debt that you’re having trouble servicing, particularly credit card debt that you only make minimum payments on, will lower your score. A few missteps, and you’re below 620 (subprime).

Your score of 795 is high (congrats!). Top = 850. If you have not had any arrears at all over the past 7 years, it might tick up a little, but without actual debt, it might never get to 850. So take out a small mortgage on your home, and make payments like clockwork, and watch your score rise to perfection.

Oh come on. I have NEVER owned a new car and I was FI at 45. BTW, I drive alot and at one point, I drove 45k miles in a year. Never paid more than $4,000 for a car. When they die on me, I call the hook and get $100 for salvage and they tow it away. Ignorant and stoopid comes to mind and not just for the idjits that pay 10s of thousands of dollars on a depreciating asset. Grow-up and stop crying crocodile tears for idjits… and whoever holds that paper deserves to eat the loses. Peeps are rolling deficits on existing loans into new cars on the trade-in! They owe $40k on a $25k car vehicle. Touchy-feely sentiments will next lead to bail-out the poor auto consumer… but when the next recession hits I will get a nice used car super cheap…might go to $5,000 on a super deal! :)

That’s a personal choice buddy I bought a new BMW 525i in 1992 and it was a pleasure to own Junked it In 2015 but it served me very well for 23 years with only minor repairs/oil changes In my opinion buying new is the only way to go if you can afford it why NOT Paid cash for a Porsche Boxter in 2001 but my ex wife got that in our divorce Hope she enjoys the 500 dollar oil changes and new tires every year

Sorry, but I am just fine financailly buying a $15k lightly used Camry in cash every 4-7 years. No need to drive in $4k junk that’s been beaten to death by its previous owner.

I have to agree with you. I commuted on a motorcycle during my early years to save money and pay off my student loans. I still remember those cold nights on the bike. I also was renting a low end apartment not too far from the seedy side of town. Those savings allowed me to pay off my student loans in five years. I have no sympathy for people who demand luxury then get into financial trouble.

Petunia- yes, there are many who do this, and it does make sense for them in an unfortunate way.

On the other end, there are people who really are “stupid” and get a subprime loan because of all the usual: can’t manage their money, want a “better” car, etc. (Note the subprime real estate was like this. Contrary to what is often portrayed, a lot of the loans that went bad during the crisis were to mid-to-upper income people who either lost jobs or just wanted out of their big mortgage after their home’s price went down.)

I’m an educated woman and thought I was street smart but doing all the right things cost me everything. Since then I have learned there are different rules for people on every level of the income pyramid. If you have been fortunate enough not to fall of the cliff yet, you may not know or see, how things really work. Until then talk to your nanny, gardner, housekeeper and ask them how they survive on what you pay them. Let us all know how that goes.

Rule #1: Live beneath your means

“Until then talk to your nanny, gardner, housekeeper and ask them how they survive on what you pay them.”

BAHAHAHAHAHAHAHAHA!!!!!

OMG.

You really don’t get it.

Rule #2. You do all that sh!t yourself.

2Banana,

You don’t get it. It doesn’t matter what you save, when you get wiped out, it’s over. When your house value drops by more than half, and your “investments” too, you will only survive as before for a very short time. BTW, this can happen I lot faster than you ever dreamed possible. And it can be a lot worse than I just described. If you can’t accept that it could happen, you are on fantasy island.

Petunia you’re wafting quite a bit of fresh air around here.

I, too, have learned that the way the US economic system works, if you’re in the bottom 50% maybe more like 2/3rds, you’re going to get cleaned out periodically. Lose everything. So your best investments are things like skills that can’t be taken from you, social networks (which are a big taboo in mainstream America; you’re not supposed to care about anyone but yourself, not friends or family or anyone), and forms of wealth that are hard for “them” to take. These could be anything from caches of silver dimes buried here and there, to book royalties, memberships in things like the Navajo Nation or the Masons and so on, etc.

The new American Dream: Not Be Homeless.

I work with refugees who came to the U.S. and became citizens recently (less than five years ago). All of them work. Some of them get rides, many have vehicles.

A sub-prime is the only loan they will get. They manage to drive those cars and support their families.

Almost all the refugees I work with have been refugees twice over, fleeing war zones often as children to a camp in another country, living there for many years, then coming to the US and trying to work here after learning some English.

These are folks who are alive today because of their smarts and sheer grit.

But yeah, I am supposed to believe they are stupid.

@2banana Please consider reading: Hillbilly Elegy, a 2017 best seller.

1. I have read it

2. I highly recommend it

3. But…but…white privilege didn’t help

I don’t believe they are “sitting ducks” because they don’t try to negotiate. I think they just buy something more than they can afford because it is shiny and new. Add a 15% interest rate and now you are building a future disaster.

How can they get out of this

Stupid is exactly what you should call this, it can also be called, “keeping up with the Jones”.

And keeping up with the Jones is a thing across all income levels. It’s the the product of advertising that encourages envy and status seeking as a way to keep our “God-given, free enterprise system” TM working for what George Carlin called the “real owners”. These rich parasites love people who can be reliably propagandized to blame the poor instead of the people who profit off their labor. That’s why we bail out rich banks and not homeowners who believed in the American dream (a little too much). I have nothing but contempt for these apologists for a broken and failing economic system. Your time will come. In a winner take all system, ultimately there will be only one winner. Chances are it won’t be you. Wake the hell up people. Unless you are in Jamie Dimon’s class it ain’t you that will win.

“Stupid” is not necessarily the reason. A disabled friend was told by a dealership that he qualified for a loan for a used car. His income is $700 a month. The dealership said his loan payment would be $175 a month, which he could swing since he lived rent-free. When the bank paperwork came through, it called for a loan payment of $350 a month. My friend called the bank and told them to take back the car. He was told not to make any payments and the car then would be repossessed after three months. He filed a complaint about the dealership and never heard another word.

I, myself, got a car loan by lying on the application at a dealership, which never asked me for any proof of income. I lied because 1/3 of my income is from fracking and the amount varies from month to month, so my local banks wouldn’t count it as income. I have made the car payments for three years now and, because I am responsible and on time, I am getting offers from all sorts of companies that want to take over my loan so that I can buy another car at a higher rate for a longer period of time….

“They just accept the price”?

Hardly, it’s that car dealers cook a 15-20% profit into their “Hassle-free price” or cook the financing with a low monthly payment that’s stretched out at high interest rates.

Try negotiating the price of a cash sale, or the interest rate on a loan lower: Better off repeatedly pushing a rock up a hill.

I will make a statement regarding had been in that position….. so, I went to buy a truck a few months ago in Toledo Ohio. I didnt look for a car lot that did buy here pay here, as I had several thousand dollars cash and a good trade in. I told them what vehicle I wanted, and told them how much cash I had, and what I’d take for my trade in, which was less than I’ve seen private parties selling g the same truck for. So, they put together a deal playing the game…. but they came out with a contract and skimmed over it real quick and asked me to sign here…. I only needed to finance 4400 and really didnt care about the I treat trade because I was waiting g for a check to arrive from an insurance company for my car that was totaled…. so, for that 4400 I wanted to finance it was goi g to be 469 a month for 5 years….????? I’m assuming they used common core math to come up with that but I asked how 5hey came to that amount…. the sales man acted like I was a total mormon, and said it was the fees…. I said what fees? Well, interest, tag, title, taxes, an extended warnety and 5hen finance charges….wow…..11000 fees on borrowing g 4400….. talk about set up for failure…. well, I was the o ly one that left that day without a vehicle…. everyone else walked out with a huge smile and full of joy because they got financed….. but me…. I went to a real dealer, they got me financed with capital one auto finance and I got an awesome interest rate and I texted the sales man a picture of my new truck that could had been his sale….

Two questions:

How to you pronounce 5hey? 5hen? Language changes over time and I don’t want to fall behind.

“like a total mormon”? Don’t you mean the Church Of Jesus Christ And Latter-Day Saints? And what does being “treated like a total mormon” involve? Being offered a cup of decaf tea? Did they have the Tabernacle Choir on the TV instead of those irritating daytime TV shows?

“What we’re seeing now are the consequences of that greed.”

Hardly.

GMAC (spun off and now called Ally) cost taxpayers $17 billion.

https://www.businessinsider.com/how-the-gm-bailout-was-the-biggest-scam-of-them-all-2010-2

2banana,

What does GM’s bankruptcy that have to do with anything? Get over it. These loans that are now defaulting were originated 2017-2019.

GM and GMAC were two entirely different bankruptcies.

The names have changed, but the game never changed.

And the same results will happen.

According to the St. Louis Fed, US total vehicle sales are robust. Nowhere near as bad as during the recession.

Historical chart:

https://fred.stlouisfed.org/series/TOTALSA

I suppose the subprime delinquency rates show the poor are trapped in subprime agony.

Sales are “robust” because debt donkeys are buying cars (and other stuff) with money they don’t have. This is not going to end well.

Plus the increase in leasing that requires a 2 or 3 year re lease cycle.

David Hall,

Yes, vehicle sales are not nearly as bad as they were during the Financial Crisis, when they collapsed by 40% and automakers and their suppliers went bankrupt. Nothing in my lifetime compares to that period. According to the chart you linked, vehicle sales are:

— down 5.1% from last year

— at the lowest range since 2014

— below the 1999 and 2000 levels.

So I would NOT call vehicle sales “robust.” A better term might be “not catastrophic.”

I had two mortgages totaling a million three hundred thousand with GMAC back in 2008 Never missed a payment even through a brutal 4 year divorce while paying for my son at Georgetown Needless to say I’m now broke but happier to have those monkeys off my back Debt free now and looking at boats for after the reset

Now that’s a story I’d like to read about!

While your explanation makes a lot of sense couldn’t this also indicate that the job market isn’t as good as the numbers seem to indicate? How many of these subprime loans went to clueless Uber drivers that pretty quickly realized that they couldn’t make money as a driver or barely break even and are still counted as employed?

The amount of people “underemployed” is huge. On paper, the former middle management guy with a shitty retail job that works at McDonald’s nights and weekends looks great. Only on paper.

Very true I was one of them until I wised up and just got off the wheel for good Warren Pollocks advice is to get small or live simpler without a lot of debt for “stuff” you don’t really need

Seriously I am serving two masters right now …. working for my friend selling electronic surplus on Ebay, and working on my trumpet playing. The trumpet playing is looking promising when things go well. (And overall I’m just waiting out the time until I can college Social Security.)

Honestly, I think I’d be ahead if I just went fully homeless and thus I’d be able to, in fact have to, play trumpet for several hours a day, and it’d do wonders for my playing I think. I’m just not sure how I’d be able to do this without dying of some easily preventable/treatable disease, or being murdered in some especially painful way.

No. The job market was a lot worse four years ago than it is now, and the delinquency rates were a lot lower.

I’ve been watching this go to heck for years now — and have been writing about it. And I have tried to understand where this is coming from. And it’s not the job market. The job market has gotten better, not worse over those years. What has changed is how the business was done — greed and underwriting standards (such as income verification, etc.). Lenders offload of a lot of the risks via securitization, and investors have been clobbered by NIRP and they’re chasing yield, so subprime-backed securities have been hot.

Someday the job market will deteriorate, and then this whole thing will turn into fireworks.

Wolf I find it hard to believe that the job market is as good as all that Better than horrible perhaps ie 2009 thru 2015 The quality of the jobs created is much lower than in the past This will not end well IMO

Wolf I find it hard to believe that the job market is as good as all that

If you have a group of ten people, five of them with no job and five with two part-time jobs, you might think the unemployment rate is zero because there are ten people and ten jobs.

But that would not be so. It means the unemployment rate is less than zero because the five unemployed people aren’t in the job market and statistics are subject to interpretation.

I’m in Colorado, and have never in my life seen a job market this robust. Literally everyone I know is employed. And the jobs are not just part time or low level. It is obviously a bubble that cannot be sustained, and if delinquent loans are high now it will be terrible when the bubble pops, but claims that the job market is anything but all time, at least where I live, are false.

Wouldn’t payroll tax receipts be a better way of judging current/past employment.

ONLY FIREWORKS?

American optimism.

As an auto company, GM should not be around.

The only reason it is, is that a corrupt politician, needed the union votes.

Hopefully nobody will bail out, the sub auto lenders, who fail when this hits.

Sadly some people who think they are holding solid security will discover what standing in quicksand entails.

How much of that sub auto money originates in PRIME wall street lenders, and how hard will they get hit when it explodes, does this sub auto issue have any serious bearing on the REPO problems?

Very likely it does “d”

If GM was allowed to go bankrupt and 100 years of contract was not perverted in order to buy union votes, the following would have happened.

GM would still be a company.

GM’s worthless upper management would have been fired.

GM would be smaller, more nimble with much less debts.

GM would have shed much of thier insane union pensions and work rules.

GM would have been in the forefront of the EV revolution instead of playing catch up.

100 years of contract law would have been preserved.

If GM went bankrupt, GM would still be a robust, yet smaller company. They would have not kept a single factory in the US.

And, yet, Nissan, BMW, Toyota, Honda, Fiat, Mazda, Subaru, Kia, Hyundai, Volvo, Volkswagen, Mercedes, many more/etc. all managed to open auto plants in America.

But GM wouldn’t be able to do that with much less debt and with a much less insane union relationship.

So – I am going to call BS.

“They would have not kept a single factory in the US.”

None of the foreign owned plants are unionized.

GM would do almost anything to escape the UAW at this point. Hatred of unions runs deep at General Motors.

Spot on, “finacialization and securitization” and a dose of interest rate suppression and voila! Recipe for credit default disaster…

Eroc66

This was published just yesterday:

https://www.bloomberg.com/news/articles/2019-11-12/chrysler-pressured-dealers-to-absorb-a-glut-of-unordered-cars

Yes, that’s the oldest trick in the book. And dealers hate it. Back in the day when I was in the business, auto makers did it all the time to keep specific plants running.

One time we had to buy 100 Escorts, when we sold about 5 a month. This was in Pickup Country. We could sell all the pickups we could get, and we’d regularly sell well over 100 trucks a month, with the limit being our allocation of trucks. But how the heck were we supposed to sell 100 Escorts in Pickup Country? Well, we did, and it took us a long time, and cost us a lot of money, and I hated Ford for it.

I think what has changed and what is the cause is ultimately the unreported inflation.

Sure there are lots of jobs but many of them don’t pay enough to actually pay the costs of living. I would hate to be in the lower 80% of income earners today. As previously said, you have to have a car to maintain having a low paying job as the cost of rent in the inner cities where many of the jobs are is more than a person can make with the pay offered, so they have to drive in. Public transportation sucks in many cities and even where it doesn’t, it takes waaaay more time than driving yourself. Hard to maintain a bunch of low pay part time jobs under such conditions even with a car.

There are lots of Help Wanted signs as we have virtual full employment yet the imbalances are so great that the system is overly leveraged and very fragile IMHO.. And as you have pointed out, only able to function with ever increasing debt and Zombies.

For many, it is the Hunger Games where the elite party on and the masses struggle to survive.

I have worked around a lot of low income people. They can’t be lumped together. Some are industrious and smart. Some figure out how to have a great life and high standard of living.

Just met one guy who has blue collar job in a factory. Not paid too much. He had about 7 cars, two motorcycles, a home, a cheap place at the beach, a boat. The guy just knew how to use his skills to repair or build anything. He generally bought something nobody wanted and turned it in to something nice.

He had good hours two. Two days on three off. Then three on two off. So he got to go to the beach every time he got 3 days off.

Wolf,

“Lenders offload of a lot of the risks via securitization, and investors have been clobbered by NIRP and they’re chasing yield, so subprime-backed securities have been hot.”

Excellent as usual – but the quoted part is absolutely key.

Without government created yield starvation, no one would buy the insanely riskier tranches of securitized loans – and without those buyers, the insanely crappy retail loans would never be made – car dealers know they are making shitty doomed loans that they themselves would never hold.

But with post 2000 securitizations – and yield starvation – those middlemen car dealers can rip off both car buyers and Lenders – offloading almost all risks while goosing up sales volumes and related securitization proceeds.

The government looks the other way because they are responsible for a big part of the problem and these quasi-fraudulent practices give a sugar rush to employment and GDP – via shit sales that would never be made if the sellers had to hold more risk.

And in a perverse way, income inequality gets reduced – evil savers get defrauded/expropriated when the tranches implode and the poor get to have cars they can’t afford – for a while.

Wolf, there are definitely more than a few posts in the story of securitization/adverse selection/NIRP post 2000.

The real question is when Lenders will simply quit the fraud-rotted dollar rather than continually crawl back to securitization schemes more or less designed to implode.

@Josh “How many of these subprime loans went to clueless Uber driver…”

Excellent point. I thought it was odd there were so many new/newish cars with Uber/Lyft stickers on them!

as reported vy wolf, not all uberdricers are clueless about auto finance:

https://wolfstreet.com/2017/08/09/uber-gets-run-over-by-its-own-subprime-auto-leases/

Uberdricer – someone who drives for Uber, using their “ricemobile” (older term for Asian-made car esp. one that’s been hotrodded a bit) or “riced out” car (newer term, means the same) or if you’re really old school, their “rice burner”.

I, too, welcome our new Uber driving contingent and yearn to be picked up by a driver in a Honda with an engine that sounds like a bumblebee on sleeping pills and has an exhaust pipe opening bigger than my head.

@alex i’m half blind and all thumbs ;)

the unemployment numbers don’t reflect the job market. the labor participation rate gas improved a little in the last couple of years but it’s nowhere bear pre-2008 levels.

i don’t know why sone commenters think it’s ok to take advantage of desper and/or stupid people. bring back usury laws, and this whole problem goes away

As Gordon would say “Greed is Good”. Not….

Is it Greed or just that the interest rate suppression makes it so that a decent ROI is only achieved thru high risk. I mean what’s a pension fund or any entity to do other than take these high risks? Pension funds are caught in unrealistic expectations and have promised unrealistic returns. Those receiving the pensions in many cases have a legal right to those unrealistic returns and NO way the public entities can up the anti into them because of real income restraints and voter revolts. Catch 22.

You can blame both the FED and the Federal Government for this. The government couldn’t be running trillion$ deficits with higher interest rates and the FED is accommodating them.

EconomicMinor,

Everything you said is 100 pct correct – the practical question is how to make our criminal political class pay for the ruin they profited from.

One small step – all public pension shortfalls must first be offset by special confiscatory taxes on public pensioneers receiving above the median payout.

Those non-working high earners steered the ship to ruin during their “careers” – it is nothing more than justice to have them drown in the wreck.

“Greed is Good” is one of the very unfortunate sayings in recent times. I think even Prof Friedman repeated it.

Greed isn’t good because by definition it’s excessive-for example making a loan to somebody who can’t pay so their property can be foreclosed on.

Greed is ~ excessive (rapacious?) self interest. That’s not good.

Normal “Self Interest is Good”

I have a friend who works for Drive Time and it’s subsidiary Carvana. Two years ago he told me they repo about 50% of the cars the sell. Then, incredibly as this may sound, they turn around and let the poor sap pick out another car and put him into a new contract!

The owner has a checkered past as noted in a Forbes article

FEES are where the money is in this racket has been l so since before the subprime crisis.,

Talk about interest rate sensitivity…

the Fed raises their rates a bit, 2015-2018,

and we get a 20% default rate on subprime auto loans.

The same thing happened before, 2004-2007,

the last time the Fed (foolishly) tried that,

but with subprime mortgages.

In a tale as old as time, “wolves” devoure the weak;

Darwin won’t be cheated.

Ironically, wildly-expensive government “handouts”

( e.g. the 4.5 trillion $ in repos the Fed gave shadow banks )

are the most efficient killing machines ever devised.

Jeff Relf,

You nailed it – a tiny interest rate hike made the rotted out US economy nearly implode.

And subprime auto sales are the least of it – California home sales volume fell 15 pct with a rise in MTG rates from 3.7 to 4.7 (in the 90’s, a non fraud-based US economy could easily thrive with 7 or 8 pct MTG rates).

And the same tiny 1 pct hike caused the stock mkt to fall 20 pct.

After enduring the NIRP scam for two decades, investors know that the government has steered us into a dead zone that DC has zero idea how to get out of.

Would that the US ntl debt could be partially repaid with politicians’ flesh.

Which government are you thinking of, Cas127 ?

The global economy is diabetic;

“blood” (money) isn’t reaching the extremities.

China, India and Africa are allergic to foreigners.

The climate apocalypse cult is yet another religion;

— more divisive than uniting.

In the city, children are a liability — even in China,

where family values used to mean something.

Buyers, Sellers and Lenders. If the Buyer is risky, the Lender needs collateral = high interest rate. The Lender’s greed is equal to the Buyer’s inability to assess his/her desire for material indulgence as impractical. It’s a market / racket with willing participants. Though the article leans toward investor greed (chasing yield), I posit the last recession changed the attitude of borrowers in general….(loan) paybacks are optional. It’s just taking time and experience for Lenders to figure that out.

Loan paybacks should be optional. That forces lenders into making better business decisions. It also forces marginal buyers to set their sights lower, where they should be.

Loan paybacks should be optional.

Is that you, Bernie Sanders? We have enough moral hazard the way it is without encouraging more deadbeat behavior.

Paying back loans are only a moral issue if it is your Mama who lent you the money. You have no moral responsibilities to the mafia, bankers or loan sharks. I can assure you they feel no moral responsibility to you.

they are optional. you don’t have to pay but you will lose your collateral and your credit. ask me how i know… it was a business decision and i don’t lose any sleep over it.

now i’m screwed for a few more years and when my credit is restored, i will be more careful. the funny thing is, if the credit cards hadn’t tripled my interest rates (before i was late!), i probably wouldn’t have defaulted on them. i also had a rental property and that bank treated me well, they held the mortgage and i had the same loan manager for fifteen years. i paid them in full.

I think he means only for the elite.

Thanks for the great insight. My understanding is that some banks have a very big exposure to this, for example Wells Fargo in supposedly has big debts in this area? Can any one confirm who are most at risk from this toxic lending?

Michael Church,

Wells Fargo has other problems, not auto loan subprime — they’re doing some, but it’s not huge, compared to the size of the bank.

This is hitting smaller specialized non-bank lenders the hardest. Several have already collapsed, and when they collapsed, big banks were exposed to them in minor ways through the funding they provided. The two lenders I listed in the article are heavily exposed because they specialize in subprime and do a lot of it. Santander, one of them, is using super lousy underwriting and almost no income verification, so their loan losses are now substantial. But most of their loans are securitized, and investors in the lower-rated tranches are starting to eat the losses.

Santander is also a huge lender to high rise luxury apartments. While tracking notes to purchase their name comes up frequently.

Mr. Richter, do you have information on the Detroit manufacturer’s captured financial subsidiaries? It would be interesting to see what level of subprime they are holding.

As for your previous comment about having to buy Escorts it is worth remembering U.S. CAFE Requirements. The big three are into selling pickups and large SUVs. They have to balance that by selling offsetting high fuel economy vehicles and/or by credits from Tesla, Toyota or Honda which seem to be able to sell highly fuel efficient vehicle’s and make a profit.

Wes,

Fairly sure that what used to be Detroit’s captive lending subs – are now quasi-independent, stand alone entities.

IE, bookies don’t have to own the horses to make money – in fact, they would be getting high on their own supply if they did so.

Bookies simply charge a vig to the risk-addled addicts – the same relationship pdt sellers now have to pdt buyers and financing lenders via securitization.

Those middlemen offload almost all of the risk.

Subprime lending is about 22% of overall auto loan originations. All lenders are doing some of it. People with a FICO score of less than 620 can be good customers. Lenders just need to be prudent and not get too greedy.

Sometime in the past, the NY Fed had some data on subprime by lender category, and I covered it. I cannot find that article now. This is a summary off memory:

The captives are doing some subprime, but they’re using reasonable underwriting standards to mitigate the risks.

The small subprime-specialized lenders, many of them owned by private equity firms, are the most aggressive. Most of them do only subprime lending. I covered the collapse of three of them last year.

The big subprime-specialized lenders are those I mentioned in the article. Santander is reckless.

Big banks do some subprime, and use fairly solid underwriting, and they tend to cheery-pick the best subprime customers, so the portion of their overall auto-loan book that is subprime maybe less than average (below 22%).

Credit unions are very conservative.

Wolf,

It makes sense to me that in the cities where the cost of living far exceeds minimum wage, you need workers driving in from the outskirts or further.

Defaults then strand the workers and open up jobs that are difficult to fill now and shows huge job market openings.

There seems to be a rather large ‘informal’ car rental market among the ‘underclass’. This allows people with no license or credit card who need a car for a short period of time to ‘rent’ one from a private party on a cash basis on an hourly basis. If anything happens to the car it is simply reported as stolen.

I’m wondering if this is not part of what is going on in the subprime car market?

I’m wondering if this is not part of what is going on in the subprime car market?

I’m wondering when they’re going to do an IPO.

Good one!

I think most of us go through similar phases as we go through life and up the food chain. I think a lot of the people that are maxed out are younger immigrants who are not used to a society with easy credit. I know someone who was brought here illegally as a child and recently got legal. He is about 35. He works hard. In the last seven years he has:

1. Bought a nice home

2. Had 2 additional children

3.Wife has quit work

In the past two years he has:

1. Quit his job and started his own gutter business.

2. Bought a brand new Chevy 250 truck.

I know about what he makes on his business. He is maxed out and very likely to lose it all if we have a recession.

You sound a lot like my parents & in laws 30 years ago when we did the same.

Of course Wife and I have run the business together all these years.

If the housing depression had hit in 98 instead of 08, it would have been

a different story. No subsidies or bailouts here.

I dont know the %, to busy living & working, but I would assume

its under 50% survival rate for small business startups.

I wish him & his family great success!!

This country needs young entrepreneurs. We have a over abundance of

nay sayers.

I would assume its under 50% survival rate for small business startups.

Why not? Vacant commercial properties are plentiful in the US, and more are built all the time.

Depending on who you ask, the failure rate for small business startups in the US is around 90%. With the Small Business Reorganization Act, bankruptcy is easier than ever. Big Business loves it.

But let’s look at the positives. Of new small business startups, about two percent can support a family at some point, and less than one percent could support a middle-class family. The path to viability is heroic, meaning dark and fraught with dangers. Otherwise every miserable wage slave would do it.

What do you call an ongoing concern with hundreds of satisfied owners, no employees, no outside financing or support, no customer base, trivial revenues, trivial profits, trivial expenses, and a Bentley which requires no oil changes that comes with a chaffeuse who gave up modeling to take up heritage gunsmithing?

Wow…I’ll tell the wife we are 1 percenters.

I remember going to a garage sale in Morgan Hill, at a big house on one of the streets that run along the foothills – money territory and generally the best garage sales are found there.

It was indeed a huge house, and they even had an “AGA” stove/range and all that sort of things, I know, because it was all out on the driveway for sale. The sellers were a large Hispanic family, probably all working in things like construction, nannying, yard work, that sort of thing, and in the run-up of 03-04-05 and had done great and they could fog a mirror so they’d bought the kind of place they normally just worked on the grounds of, in the kitchen of, etc.

They all seemed pretty bewildered. I’m thinking the same look is to be found on the faces of those who go to a casino and either have beginner’s luck or more generally, are made to win by the management to hook ’em, and then experience their first big loss.

Just saw the numbers where home prices in Hong Kong exceed 20 times average income which means it would take all of your income to make a payment. I am sure people must be doubling and tripling up to afforded to buy or rent. Maybe Hong Kong riots and real estate collapse is going to be the trigger for the everything bubble.

Another thought I had is Fed is not going to tell us who is getting benefits of repo for two years. If you are a bank getting repo is that a material event that you would have to disclose to shareholders. I guess not. Sounds suspicious to me.

I also got a kick out of J. Powell’s now saying they have symmetric 2% policy. I figured the Fed is going to try to let inflation run hot. But symmetric must have a rolling average time frame. If the rolling average is since Nixon closed the gold window it’s probably between 3 and 4%. Oh we don’t count that I see how it works now.

Maybe Hong Kong riots and real estate collapse is going to be the trigger for the everything bubble.

Hong Kong young people realize they have no future under globalism or communism, which are the wings of the same bird of prey, and are making a stand. The collapse of the housing bubble in the most expensive housing market in the world probably doesn’t bother them one bit, since at present they don’t have a hope in hell of ever owning a decent home of their own.

I agree with you.

Sounds like it will happen in Canada too.

Just saw the numbers where home prices in Hong Kong exceed 20 times average income which means it would take all of your income to make a payment.

Obviously, HK residential real estate is not priced by free market forces.

Billionaires hate free-market capitalism even more than they hate taxes. They like monopolies, insider information, venal politicians, inherited wealth, big investors who can be manipulated and extorted, and mansions of Greater-Than-Oriental-Splendour that come with 25 bathrooms for reasons you can probably guess if you think about it.

The thing I keep trying to tell myself is I don’t have to buy any investment right now. It’s only been 11 years since you could have bought so for 666 now 3100 or brk.b for 45 or so now 220. Sometime in the next 10 years some things will be on sale again.

Heckova job, Ben, Janet, and Jerome. Shoveling created-out-of-thin-air liquidity to reckless and greedy lenders so they could finance autos for people who had already shown themselves to be manifestly unwilling or unable to pay back those loans, or be responsible borrowers. And now the banksters will once again be demanding bailouts from U.S. taxpayers, which their feckless bought-and-paid-for political hirelings on Capital Hill will scurry to make happen.

” … the banksters will once again be demanding bailouts from U.S. taxpayers …”

Not really. The bailout is “money” (new government debt) created by government. It cannot, and will not ever, be repaid by taxpayers or anybody else.

Many will be hurt by the denouement, but it won’t be from trying to pay a tax bill.

Yep. Heard Warren Buffet say it and he generally knows how the system works. The US debt will never be paid off. It will be rolled over and over and over. His take is the Fed’s are going to make sure a dollar tomorrow is worth less than today.

I think they teach in economics or business school the key is producing something people want to buy not holding fiat. Used to be Mercedes Benz. No matter how dirt poor the country the top wanted to be riding in a Benz. Now it’s an Apple phone. In the future there will be something else that there will be demand for.

“Yep. Heard Warren Buffet say it and he generally knows how the system works. The US debt will never be paid off. It will be rolled over and over and over.”

Hey, the bankers to the Tokugawa (Who were bankrupt from day 1) rolled their debts successfully for over 250 years. As the shogunate could always make the vig.

Until AMERICAN outside forces intervened and disrupted the system beyond repair.

So the problems with state debt that is internally held, are

the Major

outside forces intervention and

the medium

owing more than you can make the vig on.

With p 45 in office, America could easily run into the medium issue.

State debt is not a problem, as long as you can provide the services the state is required and expected to, and make the VIG, when you cant, you get USSR style implosion.

Chicago and the State of Illinois are not far from a USSR style implosion, p45 could put all of America in that situation, as he has this incorrect concept, that a sovereign default, and a bankruptcy, end teh same way, with fraudulent p 45 debtor walking away smiling.

Consumerism at its finest.

Smarter to buy a good used car for cash. Tons available for 1000 in the private market. Then save the 350 monthly payment and extra 100 for full coverage insurance. Save over 5000 a year!

Lack of knowledge perpetuates poverty.

Where can you buy a car that runs and passes inspection for $1k?

In the dark and dusty annals of long-forgotten history and the fevered imaginings of highly-opinionated Faux News viewers.

I think a lot of people get “imprinted” on how the world is in their 20s. When I was in my 20s, you could get motorcycles that ran, or could be gotten running, for a dollar a cc, all day. And a large “storage” space often used as an office, well that might cost you $300 or $400. A room to rent should not cost more than $200. And so on.

Dealer,

In the news we can all use dpt,

“Tons available for 1000 in the private market.”

Please specifically tell us where you are finding these 1000 dollar cars that are reliable.

I’m serious if you are – I know used is the way to go but how do you deal with the very real risk of a very unreliable low cost used car.

A non-functioning car is worth zero – how do reliably eliminate the risk of having a 1000 car dying on you in 2 months?

Come on Wolf, it’s all part of the Broad Based Recovery, of the Greatest Economy Ever, look at those charts going straight up, keep that “Expansion” going, party on, or as Trump says “Enjoy”. Thank you Mr. President. The sheep must be starting to get to skin level now, with little left to fleece….

Why do people even buy new cars? The prices are insane and the 1st year of depreciation is even more crazy. The value goes down 40% on most models.

Cars these days are so reliable and you can verify all maintenance online for free with just a VIN, why bother with new?

Get a used Toyota or Lexus for $10-15k that will last 10 years with only rubber and fluids needed to be replaced.

Subprime auto lending is big for used vehicles too.

I think there are a few exceptions. It used to be that Toyota Tacoma held their resale value so well you might as well buy a new one. Probably not the case anymore.

The key to buying a used car I think is to try to find a quality car, that has been garage kept and maintained and that was mass produced enough that parts are cheap. Got to know a low cost good mechanic or be able to do the work yourself. Can’t be OCD about keeping it like new. Some stuff that doesn’t matter stops working, learn to live with it instead of paying $500 to keep it perfect.

Right and if you need a more reliable vehicle for a long trip, rent it.

Old school,

Can’t help but think there is a market for a high tech startup to provide risk-reduction/risk-spreading tools to the private-sale used car market.

Those cars are the way to go price wise – but the reliability risk scares off a ton of buyers. A cheap car that doesn’t run after two months isn’t a bargain.

How can that risk be cheaply reduced?

After the repo has been put back in the market to another buyer and the costs are added up, what is the net profit/losses to the loan originator. What is the loss of those who have securitized the loans averaged across their portfolios?

My suspicion is that the mark-up and fees cover the losses in the spread and, at most, the lender is at breakeven. For those that securitize, I wonder whether the situation is the same across their portfolio?

What are the numbers?

Regarding the buyers, since the vehicle is the sole security, the vehicle becomes an expensive rental?

Tom,

Let’s use an example to see how the mechanics work: Someone buys a new car, and the dealer plows the negative equity from the trade-in into the loan — now common practice. The customer drives off the lot in a car with an MSRP of $32,000. The loan is $36,000. The customer never makes a payment. These “early payment defaults” are now a big problem with Santander.

So the vehicle gets repoed after a few months and is sold at auction as a used car at $22,000 (wholesale price of the used car). At this point, the loss for the lender is $14,000 plus the costs of the repo, transportation to the auction, auction fees, etc. So after it’s all said and done, the loss might amount to $15,000, on the $36,000 loan, which amounts to a loss of about 42%.

This assumes that the car is in good shape. If there is damage to the car that never got fixed because the customer failed to pay insurance premiums and let the coverage laps, or cashed the insurance settlement without making the repairs, it could look a lot worse.

But if I don’t care and can rent that car out for $20/hour or whatever the ‘street price’ is for a car and collect 50 hours of ‘rent’ per month for 3 or so months before it gets repoed I have made $3000 and had a car to use when it wasn’t rented.

I suppose sales tax and fees have to be lumped into most subprime auto loans, so state and local governments must be highly supportive of this cash cow. A 50k loan should bring in at least $4-5k taxes which pays for a lot of local waste on top and some trickle down.

This article ties closely with several others that Wolf a few days ago about debt slaves and Fed bailouts. I strongly recommend that you read them carefully.

We are being force fed consumption all the time at every turn. This is driving the addiction to consume at every economic level. Subprime debt is a consequence of this addiction.

Debt is driving economies worldwide, including our own. Many make lots of money from this.

In general, need or education are not the driving force to get that fancy new car, iPhone, etc that we cannot afford. Most know deep down what they are getting into, and are still compelled to do it.

This is driven by our culture and funded by those that benefit from the enslaving that debt brings.

There is a time tested solution: from whatever we make, save some and don’t spend more than what’s left.

This solution forces making tough choices and requires guts. It also leads to financial freedom.

I never was much of a consumer. When I had a family I got in debt and tried to provide everyone with a good middle class lifestyle.

Now that I am 63 and know somewhat how things work I generally have a good life on about $800 per month. I could spend a lot more and some day I might.

If I wanted to I think I could actually have a good life on about $400 per month but it would mean moving out of my current dwelling. It’s pretty easy if you are living where there is a lot of undeveloped land and you value ‘free’ time and you are around like minded people. We are very fortunate to live in a modern age where there are so many mass produced things around. There’s a lower end market for things not good enough for most people.

Amen.

You are lucky to be blessed with good health at age 63.

I might drop dead tomorrow. My mother’s father had the long lived genes. He lived to 99.9. Just missed 100. My mother is 93 and she has an older brother 95 that swims two or three times a week.

“Debt is driving economies worldwide, including our own.”

I think the BIS put out a rpt a few days ago putting worldwide debt at something like 175 trillion – which is some absurd multiple of world GDP.

Of course, risk premia on this scale of debt would have stopped the insanity long ago if corrupt gvts had not gutted interest rates by printing/lending money.

In this way, governments convert their corrupt spending/debt problems into their citizens inflation problems.

And before anyone points to low inflation – look at housing, medical, and education prices.

And just imagine how cheap Chinese goods would have been had the Fed not spent every waking second warning about the evils of deflation – otherwise known as production efficiency.

If you are in the fed club you can get all the cheap money you need. Subprime loan default portfolio, no problem, JPM or the MB will clear it as collateral for the repo loan.JPM can help you out with CDO ,CDS or invent another facility out of thin air to Get’er done. There is no down side for Club Members. Print baby print and employ miss- direction (lies) to keep the taxpayer herd oblivious until it is time to harvest them . Dow 30000+ is one the way . If you got staying power and are cold-blooded the biggest short play is coming.

>This is what we’re seeing here. These loans were born out of greed over the past few years

Nah it has been going on forever, I pitched iron back in the 80’s. Same scenario, if the customer did not have “gold” credit we would send them back to finance to be raked over the coals. Unfortunately we only got the front end of the deal so we would get as much profit margin there as well. But that is the life in sales.

Perhaps, it might be a good time to purchase a used car in cash over the next 6-12 months…. not that I need one, but if there is glut in the used car industry a reliable backup car could be nice.

I’ve been hearing people say this for years. The ultra cheap used car sale is always 6 months away. Much like the recession we’ve been promised for the past 3 years.

Used car prices have been high for years now because of demand. Some “trucks” cost almost as much used as they do new. I don’t see any sort of glut of cheap used cars coming in the near future. Unless new car prices suddenly plummet or everyone gets a free new car of their choosing…

I don’t understand why low income consumers haven’t figured out rapid transit, grocery delivery, shuttle services, Uber, and rentals? Do these people ever figure out what an auto costs per mile and what pay as you go costs? I bought a used PU last year because I load up at Home Depot a few times a year. What a waste, I can rent a PU from HD for $30. Do that once a month it’s cheaper than insurance alone. Compulsive car buying is like smoking, it’s going to take a public awareness campaign, and more DMV fees to get that monkey off their back. The cost of smokes is probably a good analogy. You are buying those on credit as well.

Rapid transit?

I’d have to drive 5 miles to the nearest bus stop.

A demographic breakdown of where subprime is prominent, might be useful. Makes you wonder if this is a red state issue, are people buying a car to drive to their new job which is just back from China/Mexico (paying $10hr/$7 hr more than Mexico, which has better healthcare?). Even urban SoCa residents might feel they need a car, but my god man, you put up a couple thou and pay $99 a month for a lease?? Why are people doing this?

Jaguar also stuffed their sales channels. In China a lot. Now looking to be rescued by BMW. IDK. Result is usually the government mops up the poor that enabled the car industry jobs. Gov don’t care about money. Wolf does. To gov money is like all bran cereal flakes where I obtained a 1000 pounds for 5¢. Healthy, filling, free. So I just pump it in until it chokes. It doesn’t carry this moral or social or psychological (greed) connotation. Only stuffing and fullness.

If your poor with little prospects of getting out of poordom, why not use the system and get the socialistic benefits available. The more poor the more you get. Get an expensive car if lenders are stupid enough to give you a loan. The he expensive transportation debit will only help you qualify for the negative balance sheet that offers the most benefits like housing food stamps education etc… It is just good business from a poor person to take advantage of the system and laws, just as well heeled bankers and the like take advantage of the system. The rich do the same thing, so there is no reason for anyone to get high on their moralistic horse.

In Louisiana a used car dealer with a small loan license can charge up to 36% interest. I think we also allow electronic devices to be placed in the vehicles such that if a payment is late the vehicle is disabled ( only if not turned on). Also the vehicles often have a locator device in them so they can always be found.

36% sound about right given the risk they incur.

On Deutsche Bank AG

Deutsche bank AG bought $34B of eurobonds in 2018 from the lebanese government traded in the luxembourg merket, most of the debt lost 50% of its value and the market froze. Lebanon foreign reserves went down $5B to $30B, Its waning quickly, the country is in 30% inflation at the moment.

Who will come to the rescue?

I see many presumptive comments directed at “poor” folks as it relates to the essay term “subprime auto loans”.

From my own personal experience I was a Realtor,GRI and property manager 1980-1995. In 1992 I had a friend living out of state who owned a 5000 sq ft house to rent in most exclusive area in Okla City. The tenant was a surgeon/wife, 2 kids in private school, 2 horses boarded, 12K per month income (1992 remember) and was always late with rent and had “subprime” loans on his vehicles (from credit check – back in the day I had to pay a private detective to pull credit checks for me at $100 a pop). Everything was financed – furniture, revolving charges at dept stores, CC cards, local grocery cut him off store credit (I knew the owner), etc. I eventually asked him to move, which he did, without eviction.

fwiw, many circumstances lead a person into the subprime market.

I hear the billionares cryin about Warren and my response is to tell them karma is a bitch. When half of the work force makes 33,000 a year or less and a lot of the factory jobs are gone you can’t blame them for wanting free stuff. Hell they need it just to survive. The average factory job in the U.S. paid 6400.00 in 1960 which is probably around 75,000 in todays money. Seems like greed has carried the day. Sad

Unions destroyed American manufacturing. Take it up with the union bosses.

The billionares ain’t cryin about Warren…

You do know that she and her husband have a net worth of about twelve million dollars, right?

And that a ton of Warren’s millions was paid out by universities whose multi-billion dollar endowments have compounded essentially tax free for many, many, many,….many, decades.

Great post as usual Wolf.My Question is at what point will

it all matter.At the first sound of trouble they just print.

This already matters — just not to the DOW. Nothing matters to the DOW.

After reading all of the above comments, I just had a sudden revelation!

You see years ago, while driving on the main highway between Casablanca and Marrakech, in the middle of the Sarhara desert, I saw a poor old man riding a donkey steadily plodding along with it’s head looking down. The old man was looking skyward, obviously praying to Allah, just as the donkey was about to cross the highway right in front of me!

It just hit me now that I witnessed the first autonomously programmed self driving vechicle!

And not only that, I just now realized the old man wasn’t as stupid as I thought he was, after all these years!

Obviously the old man must have had some doubts about how intelligent his central banker subprime financed self driving donkey really was inspite of the glowing pitch from the dealer’s salesman!

I mean why would the old man have tilted his head skyward?

He obviously must have had some doubts about how intelligent central banker subprimed financed programmed self driving donkeys really are, if the one he was currently riding on was about to cross a 100 km/hr highway with it’s head down!

In hindsight, he was probably praying to Allah for a miracle!

To make a long story short, his prayers were answered!

I didn’t hit the donkey!

After that close call, the poor old man stop making his monthly donkey payments and the donkey was sadly repro’d!

Now the subprime donkey is happily taking someone else for a ride!

…that is some funny stuff. My father use to tell about the donkey that would take him home in a house wagon after leaving the pub. He would just fall asleep in the wagon, the donkey took its time, and knew the direction; where he got fed.

“This is hitting smaller specialized non-bank lenders the hardest. Several have already collapsed, and when they collapsed, big banks were exposed to them in minor ways through the funding they provided.”

“That’s the irony: a low-interest-rate loan on an affordable car, sold at an average profit, would give the customer a much higher chance of keeping the loan current than a loan with a 15% interest rate on a car the customer cannot afford”

You get that the first quote means the interest rate in the second is too low right?

The affordable car part is where the issue and the greed come in. The dealer and the finance company both want to oversell the customer. The customer is always thrilled to get a car they don’t deserve.

If you think 15% is too high for subprime customers I would encourage you to lend to them and see how it goes for you.

Also this is not very accurate: “big banks were exposed to them in minor ways through the funding they provided”. The banks exposure on these deals is pretty high. The non-bank lenders have real capital at risk but the negative am loans you were talking about are way above the owner’s capital in these loan books. These non-bank lenders have taken a very recent, very savage turn for the worse. I’m seeing desperation plays from people who have been wealthy for generations.

I commend you for staying on this story. No one else really cares or has any knowledge at all.

Mike 1,

It seems you didn’t get the causal link between high interest rates and defaults. High interest rates CAUSE defaults. That’s the whole point. That’s where greed comes in. You charge 30%, then you’re GUARANTEED a default. If you charge 5%, and if the dealer makes no more than an average profit on the sale of an affordable car, the customer and lender have a chance of a good relationship.

In terms of the banks’ exposure to the collapsed subprime lenders: If I remember right, Bank of America was exposed to the tune of 10s of millions of dollars in warehouse funding. Peanuts for BofA. Subprime lenders securitize their auto loans, which provides them more funding. But they need temporary loans (warehouse funding) to cover them until they do the next securitization, after which they pay off the loan. So that is the exposure of the banks. It’s there, and it will cause some headaches, but it won’t take down the big banks, such as BofA, JPM, etc.