But what happens if there’s actually a recession?

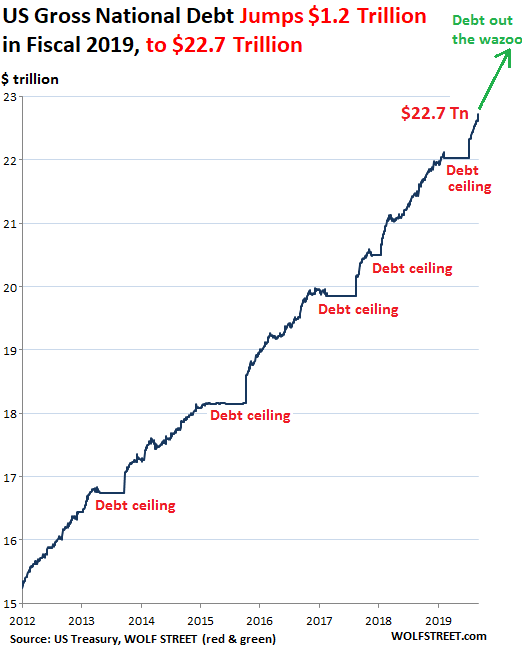

The US gross national debt jumped by $110 billion on the last two business days of Fiscal Year 2019, and by a breath-taking $1.2 trillion during the entire fiscal year, after having already jumped by $1.27 trillion in Fiscal 2018, the Treasury Department reported today. This ballooned the US gross national debt to a vertigo-inducing $22.72 trillion.

These beautiful trillions whipping by are a joy to behold: so much action in so little time. The flat spots in the chart below are the results of the debt-ceiling charade in Congress. When the debt ceiling is lifted, the debt spikes back to trend, and nothing changed:

During Fiscal 2019, the gross national debt increased by 5.6% and now amounts to 106.5% of current-dollar GDP, up from 105.4% at the end of Fiscal 2018.

The thing to remember here is that this isn’t the Great Recession or the Financial Crisis, when over 10 million people lost their jobs and credit froze up and companies went bankrupt and tax revenues plunged while outlays soared to pay for unemployment insurance and the like. This isn’t even the Collapse of Everything, but the longest expansion of the economy in US history.

Over the last four quarters, the US economy as measured by nominal GDP (not adjusted for inflation) grew by 4.0%. Over the same period, the US gross national debt grew by 5.6% (not adjusted for inflation).

In dollar terms, it looks even funnier: The economy as measured by nominal GDP over the past four quarters grew by $830 billion. The Gross National Debt grew by $1.2 trillion.

How can this be?

For the first 11 months of Fiscal 2019 through August, the latest data available from the Treasury Department:

- Tax receipts increased by 3.4%, less than the growth of the economy (4.0%), thanks to the tax cuts.

- Outlays soared by 7.0%, far outpacing economic growth (4.0%), as no one in Congress or in the White House even pays lip service anymore to the idea of budgetary discipline during good times.

With tax receipts growing more slowly than the economy, and outlays soaring 7.0%, it’s hard to have a recession, when you think about it. You’re buying the continued expansion, but you’re paying a very high price for that extra stretch, because some day, that expansion will end, and then what remains is the debt.

And that debt will then really blow out because, as they always do during a recession, receipts will plunge and outlays will spiral higher.

But no problem, it’s just some trillions.

The thing is, I get to write these articles once a year, every year, and have been for years, because it’s the same fiasco every year, all over again, only now it’s a little bigger.

From Fiscal 2012, after the Great Recession was declared over and done with, through Fiscal 2016, the gross national debt increased on average by $947 billion per year. In Fiscal 2018 and Fiscal 2019, the gross national debt increased on average by $1.23 trillion per year.

Fed Chair Jerome Powell keeps saying that the US is on an “unsustainable fiscal path,” which is fine and dandy, but every time he says this, he sounds like a fossil that is completely out of touch with reality in Congress where all this got passed. “Sustain” for these folks in Congress means sustaining their campaign funds and sustaining them through the next election.

Signs are now all over Silicon Valley and San Francisco. Read… THE WOLF STREET REPORT: IPOs Crash & Burn, Debris Hits Housing, Office Markets

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems like QE short term, helicopter money medium term, inflation long term.

R’s want to cut taxes and keep spending, D’s want to spend more without more taxes. No third way in sight.

The unforgivably naive aspect of MMT is the idea that any f’ing politician will have the discipline to tax as needed to regulate inflation.

“Dems want to spend more”…. INCORRECT. Did you just ignore Obama’s rabid austerity – endorsed by the so called Progressive Caucus – which helped cause the weakest recovery in 70 years? Or his constant attempts to cut Social Security & Medicare? True he turned GWB’s 3 wars to 7 but he viciously cut Social spending.

It sure would be nice for the jackasses and the elephants to leave the politics out of it he budget.

But the problem is that the jackasses don’t care about the debt at all, they just want free giveaways.

While the elephants have selective memory, the debt only matter when it suits them. Meaning when they aren’t in power.

What we need is some real people running the government, not these caricatures.

Not sure that’s possible. I think we just need a harder form of money. History shows govt / ppl will print & spend if they have the power / freedom to do so.

Gold and silver are on discount now. Get some.

Great piece Wolf.

Funny shit

Thanks

Reply to RagnarD VERY true they are surely on sale and I fully plan to take your very wise advice to the fullest

What ever happened to talk of a balanced budget amendment? We need it now more than ever.

Deficits don’t matter remember? Wasn’t it Dick Cheney who said that or was it the Bernank?

Trillions, at one point, billions meant something. But don’t you worry son, just wait until we get to quadrillions.

Sadly the babyboomer generation is burdening their children and grandchildren for their “excesses”.

USD has held up US constitution which stipulates that the debts will be paid but not so sure with no way out of ever-burgeoning debt other than print trillions to pay it off. Never mind the Weimar and modern-day Venezuela and Zimbabwe where the socialist fringes of DNC want to head to.

The “socialist fringes of DNC” are suggesting that not all of the money printing go to the corrupt, parasitic banksters, welfare-queen corporations owned by the wealthy (so many of which transferred US jobs to China for maximize profits and evade taxes with clever schemes), inefficient military industrial complex (with weapons that are like battleships in 1942, e.g., because now or very soon US carriers may have to try to unsuccessfully fend off dozens or hundreds of attacking, hypersonic missiles or stay away and be useless), and other parasitic persons that need government aid to survive.

The parasitic wealthy have evaded paying taxes for decades, received government aid directly (e.g., way below FMV loans to insolvent banks, whose risky derivatives bets and fractional reserve banking is guaranteed by the tax payers), even in China created slave-like working conditions in Chinese factories after unions prevented such misconduct in the US, and acted as parasites for the last hundred years. It is time that most of they paid a property tax on the vast wealth that bribes to politicians, profitable sale of dangerous products like opoids or cigarettes, whose resulting deaths and medical costs have been born by most Americans, financial frauds, monopolistic practices, etc., have enabled them to accumulate.

They are just like the Chinese communists who have used deception and control of the media to portray themselves as heros or at least hide their parasitic natures from their countrymen.

It’s weird, but the word “communism” in the US is often confused with social spending or progressive taxes, while economic power and decision making continues to concentrate more than ever.

The US beaurocratic and corporate model is so heavily micromanaged it’s insane. Communism in the form of centralized control is already here.

Just wait until Bernie and MMT advocates get to the power.

there will not be any debt, just inflation, all the way to the moon.

If you are lucky you will not expirience Yugoslav 1992 hyperinflation like me.

you can read it here on wikipedia:

https://en.wikipedia.org/wiki/Hyperinflation_in_Yugoslavia

Bern just blew a gasket at age 78. 2 stents installed, infection to follow. He be done. Welcome to Warren.

OKG. What a sense of humor. I laughed very hard…

Looking back, what would havw been the best way of doing things back then?

Gold?

Long term fixed debt on income producing assets? i.e. real estate?

What do you all think is the best way to hedge ? (Wolf- pls comment)

Andrew,

Its gold. Physical only. In a box in your house. And its not a hedge. Look at the chart. There’s no doubt where this is going. To not have some is reckless.

btw, if you arent a pro in real estate prepare to get wiped out. At least with gold you can buy ‘just a little bit’ whereas a property you’re stuck with debt, taxes, maintenance, lawsuits… real estate is real investing i.e. real difficult.

A stash of cash is rainy day money; you’re doing a good thing if you save some.

A stash of PM is blizzard day money and you’re commonly regarded as an idiot if you waste your money on some.

I gave my brother and his wife a 1oz gold bar for their fiftieth wedding anniversary and they didn’t even know what it was.

I agree that to not have some is reckless.

We could experience another economic meltdown like the one George W Bush/Republicans gave us in 2006.. thanks to Trump. Try to stick with reality and nor hysteria.

Keeping writing about it Wolf. Sooner then most people expect those trillions will not just be “some trillions” anymore. Simply amazing that there is no more political will to raise this issue to the forefront and deal with it.

Complete hypocrisy on the part of “fiscally conservatives” that just don’t see this as an issue anymore. And we cannot expect anything better in this regard from Democrats.

A Weimar style crisis might be the only medicine that can bring this back to public consciousness. There is probably a reason why Germans even today are still so concerned about and focused on having balanced budgets.

Yeah but everyone thought qe would cause inflation and yet it didn’t. I was convinced on economically sound principles that it would create heavy inflation. John Williams wrote these long expansive articles earlier in the decade detailing why he thought that it was an economic certainty that qe and gov’t deficit spending, at the latest by 2018, would cause hyperinflation in the U.S. There was plenty of confirmation bias out there if you wanted it. Yet here we are, 2020, and still no high broad based inflation.

Is it coincidence that most people are only getting wage gains around the official rate of inflation? Call it a gov’t conspiracy or else it’s just wages that are driving consumer inflation. My call on mmt after observing the economy for the last 10 years is that it won’t do anything but massively increase wealth and income inequality further because labor markets are broken.

“Put the blame where it belongs: on the people. Because if everything is really the fault of politicians, where are all the bright, honest, intelligent Americans who are ready to step in and replace them? Where are these people hiding? The truth is, we don’t have people like that. Everyone’s at the mall, scratching his balls and buying sneakers with lights in them. And complaining about the politicians.”

RIP George Carlin

In a democracy, the people get the government they deserve.

and they get it good and hard…

An honest man.

From the 2014 Princeton University study:

Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens

http://scholar.princeton.edu/sites/default/files/mgilens/files/gilens_and_page_2014_-testing_theories_of_american_politics.doc.pdf

Excerpts:

A great deal of empirical research speaks to the policy influence of one or another set of actors, but until recently it has not been possible to test these contrasting theoretical predictions against each other within a single statistical model. We report on an effort to do so, using a unique data set that includes measures of the key variables for 1,779 policy issues.

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes. When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system, even when fairly large majorities of Americans favor policy change, they generally do not get it.

…the preferences of economic elites (as measured by our proxy, the preferences of “affluent” citizens) have far more independent impact upon policy change than the preferences of average citizens do. To be sure, this does not mean that ordinary citizens always lose out; they fairly often get the policies they favor, but only because those policies happen also to be preferred by the economically-elite citizens who wield the actual influence.

BTW, the above is also obvious with Brexit.

“Sorry, you have voted INCORRECTLY!,” say those “who wield the actual influence.”

Funny, but true. The problem is the average person knows when they are getting screwed, but they don’t know who’s doing it, so they’ll vote for change in any form.

Thanks, Winston.

The Princeton Study (using many many years of data) laid it out for all to see. We DON’T live in anything like an informed democracy (or republic). For those interested, go to the paper and look at the graphs. If you don’t have money, you have no influence in the United States. Wake up, folks.

Economic mobility in the US is almost zilch, because the system is so rigged. The lessons taught 80-90 years ago have long been forgotten. The world that created the ‘expansion’ in the 1950’s has been withdrawn from the average (median) citizen. We live in a ‘house of cards’, one that rests upon increasingly shaky ground.

Pitchforks are being sharpened, and as Jared Diamond pointed out, when the collapse comes the wealthy are very likely to go from top to bottom very quickly.

Of course most voters don’t get equal voice BY DESIGN since the majority of the USA is represented by just 18 senators! And theoretically the president can be elected by a mere 22% of the population. There are structural changes needed to restore democratic control of our government that will probably never happen.

Another problem stems from elite and business funding of our elections. If you want to seriously attempt to reduce the money out of politics a good idea would be when then the FCC auctions broadcasts licensees, these license include a FREE block of advertising time to be divided and given equally to candidates/parties as towards the public good by some fair formula. While this may not be a perfect system it will help preventing the politicians beholden to those delivering us the best govt money can buy.

No one in their right mind would want to be in government today. This explains a lot.

George sure was great I miss that guy terribly Beam me up Jimmy Traficant as well Especially his hair Aaron Russo said decades ago that they would be eliminating cash and that their goal was to chip everybody for total financial control Funny with all the talk lately how right these people were

Government of the people, by (some highly duplicitous) people, for the people (in special interest groups / corporations who get favours for donations / cushy jobs post-Congress)

George Carlin again “It’s a big club and you ain’t in it”

The amount of debt is irrelevant as long as you have someone else to pay for it. In primitive societies, slaves in colonies bore the brunt of governments debt. In civilized societies, we have millions of debt slaves. In decadent societies, governments simply default betting that creditors won’t have the means to enslave them.

Some people see conspiracies. Some people claim to see aliens. Others see dead people. I see Blade Runner, which interestingly enough was set to happen in Los Angeles in 2019.

PS – In the US, the debt slaves are all of us.

None of the members of Congress who got us in this mess will be held responsible. So let’s keep reelecting them. What could possibly go wrong.

Don’t forget the workers in China and Mexico. They are the proxy debt slaves in the Vendor-Finance Scheme Congress runs.

By this argument, the Federal government should absorb all state and local debts and Cortez’s proposal to pay off all of the taxicab debt.

More like the Hunger Games with concentric circles.

None of us want to be on the real out side of the last fences yet we really have nothing to say about how the system is run.. And it is just luck we aren’t.

While those inside the first and second fences haven’t a clue what it takes to keep their fantasy world going either. While they run the whole show, they are very afraid of those outside.

The debt burden is upon those outside the first circles and the benefits go to those inside the center.

How long before the fences are pulled down? Can this go on forever? What will our world look like in the aftermath?

Excellent analogy. I used to just say “how many people can you put between you (and loved ones) and homelessness/starvation”, but the concentric circles with constant fence changes are much more easily visualized.

That’s why even the presently “well off” are on the menu, not just the previous “middle” and lower classes.

Nothing more dangerous than a human being whole feels there is nothing left to lose.

I got a good taste of “no fences” in Vietnam, but there was always that 13mo goal. The WW2 bunch were in for the duration.

I’ve always felt that was the main reason the wealth extractors allowed them a middle class, as they were NOT ready to play depression again, until they all were well into their 70’s or dead. Then it was time for 1980 and Coolidge #2. Like many, my dad kept (or bought very easily on the surplus market) his Garand.

Gerald Celente said “ When you lose everything you lose it” comes to mind

Well the slaves are currently paying, but clearly they are NOT going to pay it all off. Something is definitely going to pop before that ever happens, firstly (is that a word?) because paying it off is mathematically impossible.

Absolutely impossible Correct you are which brings us right back around to the pinnacle of the wealth pyramid doesn’t it?

If you look at the rest of that graph going back to the start of the 20th Century you will see that the debt has been growing more or less continuously for 100 years. Massive spikes during WW2 (didn’t seem to cause any inflation) and I don’t remember seeing any Yugoslavian style inflation in the USA – ever, or in GB where the national debt has been a major concern for all fiscal conservatives since about 1800 (also growing for ever also with no inflation whatsoever).

When are people going to look at the facts and realise that the national debt in and of itself has no meaning whatsoever.

Lets speak again next year when a few more trillions are on the pile and we still have no inflation.

Japan anyone?

Sure, we check after 1 year, or 2 or 10.. Buy “if” or “when”or “what” it will happen is NOT the point. We can argue all we can about “why spend more than we make matter or not”.

The point is, when shit do hit the fan, who goes to jail? who gets executed? whose life is destroyed?

If nobody goes to jail and everybody shoulder the consequences, I am 100% WE, then people, the mass, the politicians, the economists will all go down this path.

I do NOT believe any theory, I believe skin in the game. Do the people running the deficit has any skin in the game?

You mention Japan. I know one thing about Japan. When they “fail”, they take out a knife and stab themseleves in shame. That is skin in the game. What do US politicians do when they fail? They get paid.

JZ,

“I know one thing about Japan. When they “fail”, they take out a knife and stab themselves in shame. That is skin in the game.”

That’s like so old school. Now they bow deeply — upper body parallel to the ground. And that’s it. Watch the CEOs or government officials bow after they blow something up, and then they go on with their rich lives, often at the same job.

A big portion of the people who do commit suicide (a tragic issue in Japan as in other places too) are middle-aged men who never blew anything up, and who feel stuck, depressed, and alone.

Just like here in the US, Wolf, except ‘Muricans use Oxycontin/Fentanyl, and guns.

(60% of gun deaths in the US are suicides). For three years in a row average life expectancy in the US has dropped – the biggest factors were increases in drug overdoses and suicides.

Japanese go to the Aokigahara Forest or jump off bridges. They used to throw themselves in front of trains until the government started charging the suicide’s family for cleaning up the mess, as a way to dissuade that form of suicide

I know. When the Japanese lost that skin in the game, they create companies like softbank funding Uber and WeWork. That’s what skin in the game guard against. For science,entice theories. For social/political/economic, F theories and embrace skin in the game.

Yep. Only suicide I know of after the FC was a European noble feeding friends to Madoff.

My mom said during the ’29 crash suicides were in the news daily, even nobody small town bankers.

No Kennedys, Bushes, Rockefellers, etc, etc, though…….

In addition Wolf the elderly are willfully eating radiated rice due to Fukushima so the children don’t have to and all the homeless are rounded up willfully and are sent to Fukushima to do “decontamination” work.

Lol sure whatever you forget that the United States was exporting the inflation via their reserve currency

Too bad you will import that inflation your so missing after reserve status is diminished

The U.S. was on the gold standard back in the good old days and hence, constrained by the amount of gold held. Since the early 70’s (fiat currency) total credit market debt has been doubling every 9-10 years. Looking at graphs it’s a perfect exponential rise. If you truly believe this can go on forever, you’ve deluded yourself.

The national debt is only a problem when the underlying economy collapses and there isn’t enough tax income nor borrowing power to continue to service the existing debt plus run the government. Remember that all money in our system is a debt. New money comes from borrowing. So far that hasn’t been a big problem. At some point it will.

Underneath is the real problems. Not only consumer debt, much of which is guaranteed by the federal government, along with SS, Veteran services, student loans, much of the housing debt and Medicare/Medicaid but the biggie IMO which is corporate debt.

It is not only debt out the wazoo for the government, it is debt out the wazoo for the entire structure of society. Debts that have to be serviced or they collapse. Uber, WeWork, Forever 21, Sears, Penny’s, Chewy, GE, Boeing, Frontier Communications, E.T.A.L and all those insane business that borrowed and borrowed to buy up more revenue, to buy back stocks to fund corporate jets and fancy, smancy resorts and do dads..

No, the federal debt isn’t the big problem, it is all the other debts added to the federal debts that will bring us to our knees.

When Reagan took office the accumulated total debt of the US since 1776 was one trillion dollars. Now that’s less than the annual deficit.

It was double- digit US inflation in the 70’s that forced Volker to raise the Fed rate to double digits.

As for the UK not having problems with debt, around the same time the UK went broke and had to get an emergency loan from the IMF. And just like Greece, there were conditions it didn’t like. It had to sell off the govt stake in BP Oil and cancel some social spending. This was pre-Thatcher BTW. She inherited a basket case.

Why has there been no inflation, in your view?

Normansdog wrote:

If you look at the rest of that graph going back to the start of the 20th Century you will see that the debt has been growing more or less continuously for 100 years.

1)The very definition of a dollar has changed more than once during that time. So in a way its meaningless. They moved the goalposts to prevent total ruin.

2)There are plenty of families that passed on wealth during that time. They didn’t do it with cash. Money was a bad way to save value.

3)Wolf has pointed out in a comment that Japan is very expensive with lots of inflation

national debt in and of itself has no meaning whatsoever

Yup. There’s a million other factors too. None of which looks particularly good for the value of the dollar. Or any currency really. The real problem is not the debt per se. Its people who depend on that debt as their savings. The lender wants stability, the debtor wants inflation. that drama may very well reach a climax in our time.

Inflation?

Check out some of Wolf’s house bubble charts.

And when was the last time you looked at stock and bond valuations?

Assuming a person lives 78 years on average.

Use 2018 as an end date

Use 1940 as a start date

A 1940 US dollar is worth $17.94 and that is using

government statistics.

I laugh when I keep hearing people say there is no inflation

During WW2 we were still on a gold standard if I’m not mistaken The true inflation took off in earnest post Nixon’s work in 1971 I remember it well especially the cost of gasoline and of course precious metals

If USA set tax on income brackets comparable to the average rates in other nations (which are double or more), then the USA debt would be halved overnight.

So let’s assume our debt is halved. What exactly would that accomplish? The metric to look at is the ratio of debt to GDP and it is much easier and a lot less painful to inflate GDP than it is to pay down debt with austerity or taxes. Though a wealth tax would certainly help to justify higher fiscal spending.

The other metric is the total gov liabilities of about $125 trillion, and not just $22.7 trillion, plus all the corporate debt accumulated. Returning to normal means that we again can raise interest rates to a ‘normal’ level. That requires inflation, not austerity. I.e more fiscal spending not less.

Inflation (as opposed to hyperinflation) is not necessarily a bad thing. We are just not used to it anymore after 40 years of falling interest rates. Inflation taxes wealth and reduces financialization and debt burdens. Real assets, like real-estate and stocks, appreciate. So do wages, though often delayed.

Tony,

“Inflation (as opposed to hyperinflation) is not necessarily a bad thing.”

So if we have 5% inflation, are you and the housing market ready for 8% mortgage rates? If we have 10% inflation, are you and the housing market ready for 15% mortgage rates?

You know, we had those conditions in my lifetime. Houses were really cheap back then, and most of what you paid was interest. To bring home prices down to where they would be affordable with an 8% or 15% mortgage rate would be quite a mess for current homeowners, investors, and banks.

On the other hand, of the unfunded liabilities you’re talking about – future Medicare and other healthcare expenses, SS payments, pension payments, and the like – only a very small part can be deflated away. The rest adjusts to inflation and the liabilities rise with inflation.

So be careful what you wish for.

The COLA (Cost of Living Adjustment) for Social Security is not directly linked to the usual Consumer Price Index. They have a creature called CPI-W that is used instead.

For example, there were no COLA increases for SS in 2009, 2010, or 2015.

The government seems to be trying a slow boiling of the frog to reduce the future liabilities of the SS program by low-balling the inflation numbers as much as they can.

COLAs are calculated near the end of a year and go into effect in January of the next year.

From Table 2 of this document, https://fas.org/sgp/crs/misc/94-803.pdf, the COLAs starting from 2007 through 2018 have been:

2007 2.3%

2008 5.8%

2009 no COLA

2010 no COLA

2011 3.6%

2012 1.7%

2013 1.5%

2014 1.7%

2015 no COLA

2016 0.3%

2017 2.0%

2018 2.8%

From here, the COLAs indicate total increases in the SS level of 23.8%, if all of the increases are multiplied.

Let’s check against another source:

The CPI-U index that is more commonly used to define “inflation” had these numbers for January of the years starting in 2007, from https://inflationdata.com/Inflation/Consumer_Price_Index/HistoricalCPI.aspx?reloaded=true :

2007 202.416

2008 211.080

2009 211.143

2010 216.687

2011 220.223

2012 226.665

2013 230.280

2014 233.916

2015 233.707

2016 236.916

2017 242.839

2018 247.867

2019 251.712

From here, the ratio 251.712 / 202.416 indicates total inflation of 24.4% from 2007 to 2019. That’s virtually the same as the COLA increases which, when multiplied together, give a 23.8% increase. The difference is small enough to be a rounding error, as the percentage increases are less granular (four significant figures, i.e. a 0.3% increase is 1.003) than the CPI-U data (six significant figures).

Whether or not anybody other than Uncle Sam thinks that prices have increased by only 24% since 2007 is open to debate.

I am ready, yes. I owe my house. My much bigger concern is yield on savings, and that I am sure is the case for most people near or at retirement. Inflation is inevitable. So if you are not already, you better get ready.

I think you mean the deficit for a year would halve. The debt of 22 plus trillion would not go down at all and would actually keep rising.

Many nations in Europe have lower income tax rates than the USA. In Slovakia, the top rate is 25%.

Even in some higher tax countries, you have to be careful. The top tax rate in Germany is about 50%, but about equally divided between the federal government and the state governments. The top federal tax rate in the US is 37%, the top state tax rate is 13% (top rate in Cali), so in sum as well 50%. States in the US take a lot more via property taxes. In Europe indirect taxes like VAT and resource taxes on fuel etc. are bigger – this is actually the strongest difference and the place where most of the difference in tax income stems from.

Unless the politicians change, they would just spend all the new tax receipts.

Politicians = easy to spend other people’s money.

Reminds me of a bunch of Roman slaves sitting around discussing how they should only be whipped 2 times a day instead of 3.

We should stop thinking that this debt is here to be paid back one day. This is not your moms checking account. With a total US budget of about $5 trillion annually, paying back anything near the amount outstanding is never going to happen. We would first have to cut the $1.2 trillion to reach break-even…. And austerity has already failed.

What you should expect instead is accelerated fiscal spending. It is a paradigm shift where ‘normalization’ no longer means austerity, but increasing fiscal spending. We can argue whether inflation is good or bad, but it is inevitable as much as ZIRP and NIRP was after 40 years of falling interest rates. Inflation will inflate away the mountain of debt that accumulated in the world.

Fiscal spending will be used to equalize the wealth gap and it will be demanded by the retiring boomer generation with critically underfunded retirement accounts.

“Fiscal spending will be used to equalize the wealth gap… ”

Not sure what planet you are on, but here on earth federal spending is used to buy votes, funnel more money to the rich, and fund foreign wars.

That depends on who you vote for. Yes, it does.

We live in the Debt Age.

Every economy on the planet is trying to outgrow each other, and debt is the fastest way to do that. Eventually, the US will end up like the UK — a mature economy hobbled by war-and-peace debt. The UK today spends almost 10% of government taxes on servicing debt, and is still paying some debts from the 1700s.

R2D2, I was going to question whether it was a real economic expansion if it has to be fueled by so much debt, public and private when I read your comment. It seems to me that the UK has little to show for their centuries of debt. And the only growth industry in the UK today is the financial sector, which deals in debt.

To whom? Rothchild?

I wonder what the repercussions will be for the ordinary people? I’ve been thinking about the national debt for years. Knowing there is nothing I can do about it. Been watching the debt accumulate since Reagan was in office. Jesse Helms was one of the few politicians who actually sent unused money back to the govt. we are definitely in unchartered territory.

Let’s not forget private and corporate debt. This could wind up being at least as big a problem.

I am in my late 50’s and for decades people talk about the debt being a problem. So far it hasn’t been. Not being a financial person I just am not sure it matters. As much as I want it to matter i do not think it does. I don’t think it will ever be repaid or that there is any intent to. My question is in what scenario do people think the debt will be repaid and how?

Debt doesn’t matter until it does.

How did you go bankrupt?

Very slowly at first.

Then all at once.

If the federal debts don’t matter then let’s stop paying federal taxes and let the Feds stop paying interest on the federal debt.

We are all debt slaves, and that is how it matters. You do file an income tax form and pay about 25% of your income to the feds, don’t you?

OK, I woke up in a snarky mood this morning and am about to go over the 5% comment limit. I’m done.

I do pay taxes. But the question remains, what does payng off the debt look like? 60% taxes that would squash the economy, tax wealth? There is a point that it is unreasonable to expect it to be paid off. Does that have a downside? Sure it does but to Wolf’s point it doesn’t matter till it does. We can talk all day, what are the possible solutions? Cut military spending 50% that isn’t going to happen. Get rid of social spending? Cut education to nothing? Put large fees on stock buybacks?

This is an astute group of commentors surely somone has thought this through.

Eventually this will collapse the dollar and George Soros and family will make billions betting against us like he did UK…

A good question is what will the dollar collapse against? No other countries money is likely to appreciate against the U.S. dollar. They are more messed up than we are. So that pretty much leaves gold for it to collapse against.

It will collapse against physical tangible assets. Gold is at all time highs in most currencies already.

During the 1970’s Nixon was running large deficits and asking for interest rate cuts. His secretary of treasury had no formal economics training. The U.S. withdrew from the Vietnam War. Defense spending remained high as Russia and China planted Marxist-atheist revolutions threatening death to capitalism and religion. Inflation grew close to 14% in 1980. These years were called the “Great Inflation.”

Debt will never be a problem, at least not in our lifetime and probably much longer. We can just print money to service the interest.

Yes, Argentina has been on that program. Works like a charm.

Once you lose control over the currency — which is what you’re inviting — life gets very tough. And it’s hard to get the currency back under control.

The debt burden, in total or relative to GDP, doesn’t matter so long as the boom is on.

And once the post-bubble contraction becomes more evident then it will matter. As an obligation that needs servicing.

There has been five completed classic bubbles since the first in 1720. The current, which seems to be rolling over, is number six.

Four our of five were followed by lengthy contractions, when the senior currency became chronically strong.

The mechanism has been that on the boom the majority of the debt bubble was issued in senior currency units. Used to be sterling, now it is the dollar. The grinding problem has been the “due and payable” part.

Now in US dollars into New York.

This represents a massive short position.

The recurring pattern has been “inflation” in tangible assets. Crash. Inflation in financial assets the “Everything Bubble”. Crash. Long contraction.

Good one, the problem here is a slowing in the rate of new spending. New government spending results in growth and we outgrow the old debt. By the numbers the growth isn’t bad, except perhaps the inequities. Assets inflate, services contract relative to assets, (which causes a slight bump in consumer inflation or the median 2%). Should assets deflate (while rising nominally) then conversely services will expand, which they are, implying the top is already in. The real question where is the wage inflation that makes the system viable? Labor was offshored, a one off, which tells me the cycle stuff does not apply. Eventually wage pressure and workers rights returns and the global currency disparities are erased, perhaps by new technology (crypto currency) everyone, not just women, will get equal pay.

The world is an open-air debtor’s prison. You guys cover me while I go over the wall.

Great, so I see we are mostly agreed that sovereign national debt does not have to cause inflation and that the shit will not hit the fan, same as it has not done for the last 100 years in the USA and 200 in GB.

This debt funded stuff like roads and universities and electricity systems, it also funds now, in the USA, a massive military machine which is totally unproductive but does help in bullying the rest of the world.

Bond issues will never fail – the FED will always buy up as much paper as the treasury wants to sell i.e. endless new debt. The US Govt. can never go broke.

In any case you owe most of the debt to yourselves, social security, pension funds, infrastructure projects etc etc.

The problem is not monetary the problem is the depletion of real resources – that will cause inflation.

Normansdog,

“I see we are mostly agreed that sovereign national debt does not have to cause inflation…” you’re talking about Consumer Price Inflation.

But we have enormous Asset Price Inflation, across the board, from bonds and stocks to housing. This is a huge problem.

True – but that is more a problem with QE than the deficit as such. Pumping trillions into the banks was going to float some boats somewhere….

You’re talking a lot about the budget deficit but it’s the trade deficit to watch. When the exchange rate of the dollar slips (for whatever reason) and to keep the foreign goods coming in the government prints the money… thats where it gets real. Its a vicious circle because that printing will only hurt the exchange rate further, driving up prices of imports, meaning more printing, meaning higher prices etc. Anyways that’s how your s can htf.

Also, the trade deficit used to be larger than the budget deficit. So in a way, foreigners were picking up the tab. Not any more. The budget deficit is now the larger of the two (since 2016? I forget) meaning that we’re no longer being subsidized.

I honestly dont get how inflation doesnt concern some people. Im not saying life wont go on or there aren’t better things to think about, but the dollar is gonna be sacrificed so that we can continue on. It may be long in coming but the day will come and there’s no reason its not today.

I don’t agree. See reply above. You don’t think the UK needing to go to the IMF is their shit hitting the fan? Or Volcker needing to raise US rates over 15% because there is a world wide run on the US dollar?

Hi Nick,

The UK’s IMF loan is a very interesting subject – in fact inflation was high (but not Yugoslavian) and interest rates were high but real-rates were near zero. The government simply didn’t understand how to reduce inflation or didn’t want to, the IMF loan came with strict “austerity” conditions, as they always do, which in this case reduced inflation. There was though no need for the loan, the government could have done the job on its own.

The Volker 15% rates were a disaster that wiped out huge swathes of US industry and were not necessary. Volker was just another calvinist hair-shirt type. There were other ways to solve the problem, he just refused to use them.

Here is a good piece on the UK IMF loan:

https://mainlymacro.blogspot.com/2017/01/the-uks-1976-imf-crisis-in-light-of.html

I need a good economist, I’m certainly not one, to explain this to me. If we have trillions in deficit and a fairly low inflation rate, at least as it’s being measured, and as far as I know the way it’s measured hasn’t changed, and we are not in recession then how do we get to hyperinflation when a recession does come? Assuming a recession will balloon the deficit far beyond what we are now experiencing would that cause inflation to finally soar? I remember the bond vigilantes warning, and I believed them, that deficit spending, QE, unfunded entitlements, would lead to hyperinflation and if not that then certainly unsustainably high interest rates. Didn’t happen.. The only ones who are paying high interest rates are the poor with their 25% credit card rates coming from banks that got nearly free money and who just got their rates cut, once again.

Hussman had a good piece on inflation a month or two ago. Inflationary periods are correlated with rising fiscal deficits. Inflation pops up when enough people think the deficits are unsustainable and consistent money printing will result.

The Fed has been playing with fire for a while now.

correlation is not causation

Bobber, I think almost everyone thinks deficits are unsustainable (except the party in power says they (now) don’t matter) so haven’t we already been printing consistently?

I checked the Dept. of Labor whose figures for 12 months ending in June 2019 show an inflation rate (averaged) for the past 12 months at 1.6%…

Infaltiondata.com shows Aug. 2019 at 1.75% but what I found interesting is every single month this year is consistently less inflationary than last year and most months by 1% or more less inflationary.

Is it possible that in the next recession we get just the opposite of inflation? Trillions of dollars were wasted, they may as well evaporated, betting on junk bonds and unicorns.

I’ll have to check out Hussman. Thanks for heads-up..

Do you actually believe those government inflation figures because I sure don’t Same thing with unemployment It’s all smoke and mirrors to keep up the image that things are great IMO anyway

You get hyperinflation when the market corrects and there is no deleveraging, or the monetarists keep pumping the system with liquidity that has no where to go. In stocks you might get a melt-up. The good economist says that investors will reallocate back and toss traditional metrics of valuation, or phony the numbers. (like proforma earnings). If spending power in the currency declines and they keep making more currency, there is no reasonable choice, but to buy and hold securities which rise on the decline in the value of the currency .

But you are talking about an investor class who certainly could, actually have been, pumping up stocks with cheap money, (only to them,) since QE started? I think, I’m no economist, that money spent on goods and services, excess money chasing a shrinking supply, is the underlying cause of inflation. Running the Dow up to nearly 30,000 didn’t do it. Had QE been directed toward those who would have spent every dime trying to survive, on those goods and services, we would be in Weimar Republic territory but we are not.. It seems to me that literally trillions of dollars was pumped into anything that paid something beyond zero without regard to underlying fundamentals whether it was junk bonds or unicorns. Won’t that money disappear when those companies do?

David, you make two key points: QE went toward asset price expansion not household operations, so inflation was relatively contained. That’s a key point.

The other key point is that when the bubbles pop, a lot of debt evaporates when it’s written off as unpayable, and that default action can bring down a lot of dominoes. This is why the GR resulted in such colossal reaction by the Fed. They are terrified of collapse, and quite rightly so.

To me, the biggest problem with debt mountains is the velocity of the defaults, and the “reach” of the defaults – how many parts of the economy does it hit.

Wolf – this is the “deflation” I was speaking of. Not normal currency deflation, but massive, rapid reduction of money supply from default. That deflation.

[Assuming you have a source that shows the revenue to be 3.4% higher – I couldn’t find in CBO or UST sites.]

‘Tax cuts’ has a nice zing to it, but it doesn’t mean less tax revenue – it only means ‘cuts to the tax rates’. Tax revenues actually increase not decrease. This has been the first full fiscal year after the Tax cuts and Jobs act.

Thanks to the new law, we got that awesome GDP growth and the > 3% revenue increase. Without the law, we would have had a sluggish GDP growth and a flat revenue change.

Another effect of this ‘tax cut’ has been a big increase in SS contributions due to increased wages (payroll taxes).

‘Good times’ also enabled the Fed to finally dare reverse its QE and raise rates from near-zero levels.

Now for the spending part – how much is congressionally mandatory part and how much is the interest on accumulated debt and how much is discretionary.

btw Wolf, you seem to move the goalposts in every post on this topic. If I remember correctly, latest was ‘revenue should rise by at least 2-3%’. That’s not enough anymore?

Tax cuts do not pay for themselves, as you are suggesting.

Sure, the new law gave us a little positive blip in GDP growth, but the debt grew faster than GDP, as Wolf clearly shows. Thus, the tax cut did not buy enough growth to “pay for itself”. All it did was straddle future generations with more debt, in irresponsible fashion.

If the government wants to stimulate the economy for real, it should give out tax credits for actual investments in jobs and equipment. General tax cuts to the business class simply leads to more stock repurchases and wealth concentration.

I will be called broken record, but let me explain again.

Debt = Revenue – Spending.

Spending part has nothing to do with ‘tax cuts’. US Treasury lists all the programs where money is spent (you can start here: https://home.treasury.gov/data/receipts-outlays).

Those program costs will increase no matter what the GDP is or what the revenue is. Perhaps we should try to contain some of that?

Now, for the revenue part. New law cut tax rates, spur growth, bump up GDP and increase tax revenue. When the revenue increases (by a healthy 3% no less), yes, that’s called paying for itself.

Btw, when the spending has no correlation with GDP growth, expecting revenue to have that correlation is incorrect.

In 21st century has there been a single fiscal year when revenue was higher than spending?

During W years, debt increased from 5.7T to 9T. During O years debt doubled from 9T to 19.5T.

We are currently paying close to 0.5T each year servicing all that accumulated debt.

GP,

When tax receipts (revenues) increase by less than GDP, as in our case of 3.4% versus nominal GDP increase of 4%, it means that the more GDP grows the more the deficit will grow. This works only for countries that have a balanced budget or a surplus.

On the other hand, if you cut government spending, you will instantly cut GDP.

You could cut a lot out of the combined military and intelligence spending – and I’m all for that. But if you look at the Dept of Defense budget, you only see a portion of what the US spends on its defense and intelligence machinery.

The US defense and intelligence spending is spread all over the place, such as the budgets of the Dept of Defense, the VA, the nuclear weapons program tucked into the budget of the Dept of Energy, the Coast Guard tucked into Homeland Security, the budgets of the 16 agencies that make up the vast Intelligence Community (NSA, CIA, FBI, the National Geospatial Intelligence Agency, etc., etc.). And on and on.

These agencies spend some of their money overseas, and cutting that out would only be a partial hit to GDP. But cutting anything that is spent in the US is going to cut GDP. Which will cause economic activity to decline, and employment to decline, and tax revenues to decline. Think thousands of layoffs at Boeing, United Technologies, etc. And I’m still all for this.

But the issue is this: once tax revenues grow less than nominal GDP in a country with already a big deficit, you’ve got a structural problem in your revenue setup that will only make the deficit worse. An economy cannot outgrow this.

You said: “Now, for the revenue part. New law cut tax rates, spur growth, bump up GDP and increase tax revenue. When the revenue increases (by a healthy 3% no less), yes, that’s called paying for itself.”

That’s incorrect. The tax cuts added $2T to the national debt, which will harm growth in the future. The little economic bump you cited wasn’t real growth. We stole funds our kids bank accounts and spent it.

Bobber,

you say my statement is incorrect but don’t say how. Please care to explain how you arrived at “tax cuts added $2T to the deficit”?

Wolf,

Thanks for those insights and I happen to agree with most of those. No party, no admin seems serious enough to reduce or contain debt. Cans are firmly being kicked down the lane. There is a lot of money to be saved from the clutches of military-industrial complex. More money spent on defense and military operations doesn’t automatically translate to better defense anyway.

Revenue growth have lagged GDP growth for so many years. Why blame that on Tax cut act which has in fact increased revenue?

Regarding reduced government spending cutting GDP. That’s fallacious. Government is just a middleman; it doesn’t have own money; it is just spending people’s money. If government doesn’t take and spend people’s money, people can spend it themselves on things they choose and contribute to GDP growth.

Regarding the source, I assumed you somehow had the end of fiscal year (September) report. I usually check on the CBO website around 10th of the month when the report for previous month become available. CBO is usually ahead of UST in publishing these monthly reports.

Wolf & GP

“President Eisenhower’s warning about the military-industrial complex nearly 60 years ago noted that military demands on U.S. spending would become a “cross of iron” that would limit domestic spending”

This is an extraction from an article ( below) which tell you how convoluted the Pentagon’s Budget is!

If the money spent currently ( CAN’T) protect the US’s national security , then what amounts could?!!

My take is that HUGE portions of these monies is STOLEN from the US Citizens!

It is indeed a diabolical ball!

Enjoy the article:

https://www.counterpunch.org/2019/08/30/the-great-cost-and-myth-of-u-s-defense-spending/

“When the revenue increases (by a healthy 3% no less), yes, that’s called paying for itself.”

Is the revenue increase projected to be perpetual or just a 1-time bump from repatriation? I don’t know. If it is the latter, wouldn’t it be fallacious to say that the tax cut pays for itself since the tax cut is permanent (at least the corporate tax)?

GP, it’s very simple. When you fund a tax cut by increasing the deficit, all you’ve done is ACCELERATE economic activity. You haven’t created new growth, you’ve simply stolen growth from the future.

It’s no different than if you or I went crazy on a charge card.

In reality, nobody really got a decrease in their overall tax burden. If the tax cut isn’t matched with spending decreases, we wind up paying later for the tax cut we receive now. I don’t like it when someone, pretending to be nice, orders a drink for me, then sticks me with the tab. Do you?

Also regarding whether tax cuts pay for themselves, I tend to trust the Congressional Budget Office more than Rudy Giuliani.

From Wikipedia on the Tax Cuts and Jobs Act:

“The CBO estimates that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years, or about $1.891 trillion after taking into account macroeconomic feedback effects”

Bobber,

Funny thing about CBO projections… they are wildly inaccurate most of the times.

Here is the archive of CBO projections of upcoming fiscal years: https://www.cbo.gov/about/products/budget-economic-data

Let’s take example of 2016.

In 2008 CBO projected the revenue for 2016 would be $4.13T

In 2009 it was revised down to $3.93T

In 2010 revised down to $3.81T

In 2012: $3.78T

In 2013: $3.59T

In 2014: $3.48T

In 2015: $3.46T

Earlier in 2016 itself: $3.38T

Finally ended up being $3.27T

It’s a shame journalists run stories based on such CBO projections as if its the ultimate truth.

The estimate of $1.9T loss in revenue over a decade is well under margin of error. Might happen, but most likely won’t.

btw, LOL, what does Rudy Giuliani have anything to do with this?

According to your data, when the CBO errors, it’s too optimistic on revenue projections. If they say the tax cut will cost $2T, considering all macroeconomic feedback effects, then might it really cost us $4T of tax revenue?

Let’s not pretend the CBO is a hack organization. No projection of this nature is entirely accurate.

No Bobber it’s all upside down.

I don’t see anyone looking at past CBO projections and comparing them with actual revenue.

If people had done that, they would say ‘high taxes and high regulations of past admin brought in trillions of less Dollars’. Nobody does that.

But I hear all the time, based off a projection/hypothesis, that new law will cause trillions of dollars of debt.

GP,

You can get the report and download the data right here:

https://fiscal.treasury.gov/reports-statements/mts/current.html

When I was a kid PT flyers was the shoe to own. Now it’s Nike.

As long as the buck is the world’s reserve currency

“bob’s your uncle”. But things change and when they do

be ready.You’re gonna need to be in productive assets.

‘w/ the action wedge built in, run your fastest and jump your highest, pf flyers’ thanks for that!

The graph posted conveniently starts in 2012, not showing what happened between 2009 and 2012 when the debt increased 50% in those 3 years.

The debt has gone from 20 to 22.5 during Trump’s first 3 years. The debt went from 10 to 15 during Obama’s first 3 years. Granted I’m not a math genius or nothing, but it would appear on a percentage basis the debt increased more during Obama’s first 3 years.

Just Some Random Guy

Bush handed Obama the Financial Crisis, something you folks always sweep under the rug, and it was the worst economic crisis in my lifetime. Bear Stearns, Lehman, AIG, etc, happened under Bush. 12 million people lost their jobs and suddenly stopped paying payroll taxes. Many of them drew unemployment benefits…. And on and on. It was a true crisis. To compare this crisis to our economy today is nuts.

That said, Bush didn’t cause the Great Recession. Presidents generally don’t have that kind of power. Just like they cannot determine what gets spent where. They can only influence it (by proposing stuff). But Congress decides.

This chart compares what is happening during the longest recovery in history. It’s not looking back into the Great Depression or the Great Recession.

Bush allowed the Democrats, who controlled both chambers of Congress, to blow up the budget.

Additionally, Fannie and Freddie boards were loaded with Democrats…and Chris Dodd and Barney Frank were there, in control, assuring the public there was no problem.

In effect, no one was watching…under Bush or Obama

Wolf. Do you have any thoughts as to when it will be prudent to use logarithmic y-axis scaling for our time vs debt charts? Are we almost there yet?

Lisa_Hooker,

That’s why I don’t take the chart back to Adam and Eve. If you have to use log charts on a 7-year time frame for the national debt, something is terribly wrong, like 1,000% inflation or something. Under normal conditions, log charts over the medium term just hide reality.

I was just accused of the opposite here, of having “conveniently” taken the chart only to 2012, instead of back to Adam and Eve.

But what happens if there’s actually a recession?

then interest rates will go negative and the government will start making interest off of all that debt…

didn’t you ever wonder in all your years of repeatedly telling this tale about the debt why the elites don’t seem to be quite as excited about it as you are?

I need to get things down to a level where I can understand what’s going on…

I bought my first house in 1978 for $54,000, borrowing $48,000. I got a big printout of the loan, showing a total of about $130,000 in payments over 30 years. So, assuming a 10% reserve requirement, the bank tied up a paltry $4800 to get a return of $82,000 over the life of the loan, and I was really paying $136,000 for my $54,000 house.

This taught me all I needed to know about debt.

How much is your house worth now?

After only about 3 years in that house my neighbors in an identical one were paying more in rent than I was paying in PITI so, in spite of being raped by the loan, it was a good deal. I sold after 7 years and the place was subsequently expanded; unmodified, Zillow would now estimate it at about $705,000. I was on my third house and had been paying on mortgages for 28 years when I finally got one paid off. This is all nothing compared to the national debt – I don’t see any way out of that short of collapse.

Rationality has gone out of the government’s financial policies, given how the “Federal” Reserve bankster cartel has funneled billions of the tax payers’ money to their banksters. Helicopter money drops, i.e., some method of distribution of wealth to the average American would be great economically.

Most would use it to pay their bills and purchase goods, so that the multiplier effect would really goose the economy. However, helicopter money drops to the average Americans will not happen: the banksters want every penny.

Banksters are like the proverbial monkey that is captured by putting something shiny in a narrow necked bottle: the monkey’s fist holding the shiny bauble cannot be pulled out without letting go of the shiny bauble. The monkey is too greedy, so he is captured and eaten. Thus, they engage in riskier and riskier gambles with derivatives.

However, I guarantee that the banksters (or at least the leading banksters, who are the owners of the banks run by their lesser banksters (the crooked bank officers)) will manage to escape the consequences of their actions come the next collapse. Unfortunately, since so very many politicians are crooks (and I suspect pedophiles whose pictures may even now be getting searched for by “authorities” and then covertly destroyed in a certain Virgin Islands’ island and a ritzy New York townhouse), the banksters have captured the US government as Simon Johnson (former IMF economist) said about financiers. https://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/307364/

As to Timbers’ comment, Obama was judiciously attempting to put through an infrastructure bill, which even Republicans agreed in the past would be beneficial to the economy and supported when their fuhrer came to power. However, since that infrastructure bill would have made America prosper and ensure Obama’s reelection, the Republicans naturally blocked it. https://www.thefiscaltimes.com/2015/03/25/478B-Infrastructure-Bill-Blocked-Senate-GOP

With “friends” like Republicans, Americans do not need any enemies.

Mike:

Thx for the link to the (2007-dated) Atlantic article. It takes a “chapter 11 clean-up team” approach to failed national economies, as uses that as the lens to examine the U.S. financial sector.

It also talks about the Financial Sector – Government interactions so well that I may tatoo them onto my forehead. Very well-done.

People need to acknowledge that the selling of votes is why spending can’t be contained. The only resolution is to have fix rates of taxation (flat tax) at the personal and corporate level. Another words get rid of the 90,000 pages of tax code and stop the grifting. It’s sad that middle class and poor people don’t get it that THEY don’t have the resources to play the avoidance game with the current system, only the rich can afford it.

Central Bankers are complicit in this burgeoning debt creation.

They have temporarily suspended the law of supply and price.

More debt is now increasing the price of debt. This cant end well.