Bitter irony: As Draghi’s term is about to end, investor expectations plunge to where they’d been when he made his “whatever it takes” speech in 2012.

By Nick Corbishley, for WOLF STREET:

The Sentix economic index, a gauge of investor sentiment in the Euro Area, fell 7.9 points in August 2019 to minus 13.7, its lowest level since October 2014. The index has been on a downward spiral since January 2018 but in recent months the trend line has sharply steepened.

The index of investor confidence is meant to serve as a barometer of the general mood of people and institutions who are invested in bonds, shares, options and other financial instruments. It is run by the Frankfurt-based boutique investment firm Sentix and is based on a regular survey of investors from over 20 countries. It is less about the real economy than it is about the so-called “animal spirits” — the greed and euphoria, gloom and despondence, and fear and outright panic — of the investment community at any given moment.

And right now, those animal spirits, judging by the latest performance of the index, are subdued and dejected. The two basic measures of the index — investors’ opinion about the current state of the economy and how they expect things to be in six months’ time — both plunged to multiyear lows in August.

On the current state of the Euro Area economy, investor sentiment sank 9.2 points, to its lowest level since January 2015. The pace of deterioration “is increasing rapidly”, said Patrick Hussy, managing director at Sentix, adding that there’s no sign, as yet, of “the central banks being able to slow the trend”.

This is despite the fact that the ECB recently revamped its interest rate guidance and said it was preparing for yet more policy easing, including opening the door to a further rate cut and more bond purchases. It was the biggest gift Draghi has offered the markets since formally putting an end to the ECB’s quantitative easing program in December 2018. But since making the offer, on July 25, stock markets across Europe, rather than celebrating the news, have fallen sharply.

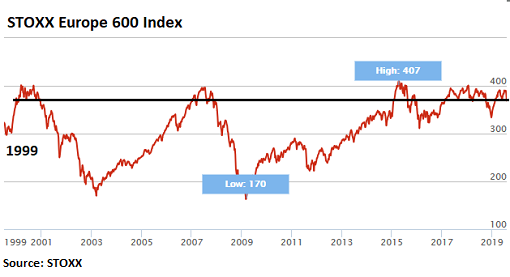

Germany’s DAX index is down 6.5%, France’s CAC index, 6.6%, Spain’s Ibex 35, 6%, and Italy’s FTSE MIB, 5%. The Stoxx 600 Banks index, which covers major European banks, has dropped 7.5% in the last six trading days, and is now at its lowest point since July 4, 2016, just a few days after the people of Britain voted to leave the EU. The broad STOXX Europe 600 index, which covers 600 stocks in the EU, is down 5.6%, and at 368, is back where it had first been in December 1999, which makes for a rather depressing 20-year history of European stocks:

“Measures announced by central banks have not turned economic expectations around,” Hussy says. In fact, the investors surveyed by Sentix are even more worried about what the near-term future holds than the present, as six-month expectations for the Euro Area fell by 7 points to -20 points, the lowest value since August 2012, when the region was in the deep, dark throes of the sovereign debt crisis.

It is perhaps the ultimate of ironies that just as Mario Draghi’s eight-year term of office is about to draw to a close, market expectations among investors have plunged to the exact point they were at when Draghi felt compelled to make his “whatever it takes” speech. Despite all the trillions of euros frittered away since then on the ECB’s quantitative easing program as well as the market distorting effects and financial repression of the ECB’s negative-interest rate policy, investor sentiment in the Eurozone is now back to where it was eight years ago.

In some places, it’s apparently even worse. The investment sentiment index for Germany, for instance, crashed to minus 13.7 points in August, its lowest level since August 2009, when Germany, and the rest of the global economy, was grappling with the Financial Crisis. Market expectations also slumped from minus 16 points in July to minus 21.5 points in August, a low not seen since July 2012.

Investors in Germany are clearly worried about the current state of affairs as well as what may lie in store for the German economy — with growth slowing, manufacturing output falling, global car sales declining — German enterprises are heavily focused on the global auto industry — a disorderly Brexit quite possibly approaching, the hunt for yield becoming an almost impossible quest, and stocks sliding.

But if Draghi’s suggestion of yet more monetary easing and even more negative interest rates with which to punish savers and pensioners and distort markets just a little bit more, at a time when the markets are already awash in liquidity, isn’t enough to placate them, what will? Directly buying stocks, as the chief investment officer for the world’s biggest money manager, BlackRock, recently suggested? Whatever.

Eight years of “whatever it takes” helped to blow bubbles in some asset classes and sharply lowered the cost of borrowing for European corporations and debt-sinner economies, to the point that Italy’s government now gets paid to issue debt with maturities of up to two years. But it has done precious little for the real economy. By Nick Corbishley, for WOLF STREET.

Negative interest rates are clobbering Eurozone banks and their shares have crashed to multi-decade lows. Even the ECB has admitted as much. Read… ECB’s NIRP-Forever Policy “Destroys Banks’ Profitability Equation”: Bankia CEO. Spanish Banks Reel. Problems Stack Up

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sales of Yellow Vests are up greatly…

“But it has done precious little for the real economy.”

Might be more of a referendum on Draghi’s replacement, La Garde comes over from IMF, which is central bank to the central bankers. In the next crisis their SDR should provide liquidity and solve crossborder monetary glitches. They also have the potential to expand the global monetary base by a whole lot. If Euro investors are not buoyed by more of “whatever it takes” it might be because they got rich off his policies and now they are looking for yield and NIRP no longer suits them. Boutique economic indicators, another Wolf classic. La Garde’s replacement is David Lipton, who is an Obama appointee, and you can read his take on tariffs. https://www.marketplace.org/2019/08/05/imfs-acting-director-on-u-s-and-china-it-takes-two-to-tango/

If there is low inflation that means there is a mismatch between supply (excess) and demand (low), so the policies should focus on demand side (consumers), through fiscal policies, and not in the supply side (corporate). The governments (starting by Germany) should transfer the low/negative yields to consumers’ pockets. What should ECB do in this circunstances? Absolutely nothing.

Yes, the current global slowdown is a result of neoliberal policies that shoveled all money to the side of capital, choking the demand of the other 99.9% of the population. Giving more money to capital merely exacerbates the problem. You would think that the 10 year head start that Japan had would have provided more clarity to the west.

You would think that the US would learn by these real life examples (Japan and now Europe) of the complete and utter failure of monetary policy tools when used in excess. The FED hasn’t apparently learned one thing, They would rather continue to live in the academic and theoretical world. I like the academics, but the laboratory is always what matters in the end. That’s where the lessons are learned…….

Japan started buying equities quite some time ago. I guess that’s the natural progression of this junk science. Doing “whatever it takes….” involved absolutely no heroics. He was using other people’s money…..

“But if Draghi’s suggestion of yet more monetary easing and even more negative interest rates with which to punish savers and pensioners and distort markets just a little bit more, at a time when the markets are already awash in liquidity, isn’t enough to placate them, what will? Directly buying stocks, as the chief investment officer for the world’s biggest money manager, BlackRock, recently suggested? Whatever.

Eight years of “whatever it takes” helped to blow bubbles in some asset classes and sharply lowered the cost of borrowing for European corporations and debt-sinner economies, to the point that Italy’s government now gets paid to issue debt with maturities of up to two years. But it has done precious little for the real economy. “

Ididsa, this is assuming that the FED wants something different for

us than Japan and Germany has; it’s began to dawn on me that maybe

a zombie economy is what the FED and central banks really want for the whole world but have managed to convince the general populace it exists only for their benefit.

There were two firings at the FED in the past week but it wasn’t revealed to us WHO. Members of the board?

Are we being manipulated, played for fools?

@John Vermeer

I agree insofar that they don’t seem to have any intention of stopping what they are doing. Perhaps this is their goal.

Draghi’s and Kuroda’s money printing was never about asset inflation (inflation of US assets was only a side effect). They are printing to fund government spending. Central banks have enabled governments to grow monstrously huge and bloated, now they must continue to print because 1) eliminating millions of useless, unproductive government jobs would crash economies and cause riots and 2) if workers were taxed to pay the government workers it would crash economies and cause riots.

Central banks have chosen the correct path. The cost is placed only on savers and since, in general, people don’t save the cost falls on a small minority. When central banks completely destroy the purchasing power of their currencies they can just start all over again with new currencies. It’s not as though this is a new idea, this is how governments have always run their economies and it is why you must own assets and treat currencies as the toxic waste that they are.

Free stuff! Why all the complaining? – the reformed skeptical bear (living in his van.)

No complaining here, @van_down_the_river

-I’m not in the savers group. That doesn’t make it good science.

-People do save, it’s just that we don’t hear about them.

-Just because something has resulted in a point of no return (“bloated governments”)doesn’t make it good science or legitimize it’s continued use.

-It never is about financial asset inflation…. initially.

-There’s never any free lunch. We just don’t hear about the those who pay the costs,

>> The cost is placed only on savers and since, in general, people don’t save the cost falls on a small minority.

> -People do save, it’s just that we don’t hear about them.

Everybody of working age saves for their pension. If they don’t in a private pension plan then they do through a government pension plan.

If neither they nor their government saves enough to cover their pension costs, then a very large can is being kicked which will end up viciously biting a lot of people on the ankle.

The prudent reaction to long term repression of interest rates is to save more not less!

There’s something about Europe we need to understand. Some or Most European nations have decided to put their money in US long term securities – government and mostly corporate. A large part of its assets (compared to size of GDP) is invested in America. This should behoove one to ask whether Europe really wants to invest their savings in Europe itself or in higher yield America. Maybe it’s an admission that they are doomed anyway. I can post the numbers but they are quite a lot. Another reason to avoid ZIRP NIRP QE.

There is something about europe you need to understand. You will never understand europeans. We are talking about effects of QE, but are ignoring the less than 2% inflation, stocks currently trading at 8-12 P/E, and DY of 10%. Europeans distrust stock markets. Especialy after 2008. Europeans like real estates. So much that a 1m2 of cheap flat goes for 3 average monthly salaries. And those who feel like investing in equity go to USA not because they feel like your economy is stronger, but because they expect higher returns. And they got higher returns. It will be interesting to see what happens when a recession hits.

As for the european stock markets, i think its the safest bet for my money on the short/medium run. Im not talking about profit, just safety.

European real estates can double in the nexy 5 years, but also fall 50% in the next 2.

Maybe we forgot the 2008 recession, but the generation that lost money in it is pretty much alive and kicking.

This is a clear buy signal, yes?

Dejected European investors can be expected to send their funds state-side.

We’ve put the little bit of nastiness behind us and now we would appear to be back on track to new highs yet again. Every dip (every dip!) in the last ten years has turned into yet another buying opportunity. Interest rates must be kept permanently low, to fund governments, and I believe that will be great for continued asset inflation. Buy tomorrow, buy today, buy forever. The central banks have your back, Powell is literally calling the last cut an insurance measure (ie a free market put)

To quote Monty Python’s black knight: “tis but a scratch”

And the bankers portray the killer rabbit that bites heads off…

I get it!

Maybe they should try another one of those ginormous Supply-Side stimulus programs. That way they can start up big new businesses and try to sell stuff to people who don’t have any money, go bankrupt, and get bailed out by the government. Darn impoverished minions, you throw a nice party for them and nobody shows up.

But they’re going have to do it. It’s not as if there’s any alternative, now is there?

But it has done precious little for the real economy.

Betcha nobody saw that coming. Certainly nobody at the ECB. Must be the blinkers. For sure it’s not their fault. They did everything they could they did, short of actually doing anything to help the real economy. That would be a dangerous extreme. The peons might get uppity.

Maybe when interest rates went to zero they should have taken the hint and stopped Chasing the Dragon, financially speaking. It’s not as if they’re ever going to catch it. They’re like a dog that chases cars: even if they did catch it, what then? Let it go and chase it some more?

You have to feel sorry for them, those poor, poor rich people. Maybe their minions should take up a collection and buy them something nice to cheer them up. No telling what that might be, since they already own everything worth having.

It’s a conundrum, I tell ya.

You can see where this is going. The hyperrich are going to rend their garments, give away all their worldly possessions, and throw themselves off the Eiger. Probably wouldn’t help anybody, though, at least nobody that matters. Either that, or have another hot tub party on top of Mt. Blanc and take selfies. Sure, it’s been done, but not lately.

Mario, then: “Whatever it takes.”

Mario, now: “Whatever.”

Investor sentiment will be getting much better since real estate will appreciate nicely from mortgage rates. As far as the sales slowdown, that is a false flag, since slower sales are largely the result of people keeping their homes twice as long as they did 15 years ago. At today’s prices, buying and selling is getting too expensive to trade up as often as in the past. Of course, retail sales will move higher when the low mortgage rates boost home values. The only risk we face that can hurt investor sentiment is the negative economic propaganda that is already being thrown around by 2020 Democrats and their buddies media. After the 2008 experience, the masses should be able to see through the propaganda smoke screen.

One other possible negative to investor sentiment is China may attempt to rock equity markets into 2020 hoping to scare 401K people into pulling support for the popular trade war.

“The only risk we face that can hurt investor sentiment is the negative economic propaganda”

SocalJim, I find myself concluding that we must be posting on here from different planets.

That’s not to say that markets can’t move higher still, but without further fiscal or montary ‘stimulus’ from our governments and central banks I can’t see them holding up well for very much longer in the face of slowing trends of gdp, inflation, employment, transportation etc., even in the supposedly healthy US.

Just look at how sharply the US yields have dropped. You might prefer to see that as a positive, but to me that is not a sign of any sort of perception of wonderful economic prospects reflecting self sustaining debt servicing income streams from capex resulting from the increasing debt…

Myself, I’d be suprised if most major central banks, including the Fed, aren’t back on QE sometime over the next few quarters.

And the really bad stuff is the horribly deteriorating state of our collective balance sheets (including not only exploding debt and declining equity, but the rapidly deteriorating state of natural resources and the ecologies we depend on).

I bet Mario’s announcement boosts the S&P back up a bit.

Financial repression in foreign currency regimes tends to make US assets seem a better investment – apparently even for US listed corporates that rely on growth elsewhere.

If the S&P shows some legs in the next few weeks only to plateau at a lower high, that would be a good sign to add some bets to the short side. Note that a more dovish fed will always add a temporary bump upwards, but it won’t always have the V effect it did last January.

I have read that there is no solid evidence that the Fed has the ability to improve economic growth in a meaningful way. If this is true it is darn sad because they obviously harm certain people and benefit others which should not be allowed for an unelected, opaque body.

I’ve always felt that the “whatever it takes” comment was not for the health of the Euro, but another Italian Banker bankrupting others to keep his country from being forced to modify its culture. They will never pay taxes, aggressively collect taxes, fail to bail out the other bankers, or live within their means. And because they’re “to big to fail” the guys in Brussels will continue to kick the can down the road to keep from having to fix the problem.

I’ll reveal to you one of Europe’s dirty little secrets: “fiscally conservative” Germany is not merely 100% onboard with the ECB policies but has benefited enormously from it, just like everybody else.

German companies have not merely been flooded with dirt cheap credit, but have received further blessings in form of much inflated export markets (especially in countries like Spain and Portugal) and a large network of vendors ready and willing to work at rice paper thin margins for them (especially in countries like Austria and Italy). ECB monetary policies made all of this possible.

However it has been very popular in German political circles to blast both the ECB and the governments of countries like Italy and Spain for those same policies successive German governments (mostly headed by the modern-day Gang of Four, starring Angela Merkel in the role of Jiang Qing) enthusiastically approved because it benefited their export-driven economy immensely. Always remember Trichet and Draghi weren’t all-powerful dictators: they were merely head bureaucrats tasked with implementing the monetary policies decided by the European Council, where the ultimate power resides.

Now German politics are starting to change, with the change driven by rot from the inside and a general “quiet riot” of the bagholders. The Gang of Four is quietly heading for the exits, albeit they’d deserve fully well a struggle session, if nothing else for their revolting hypocrisy. It will be interesting to see how things evolve, but I am not holding my breath.

Calling Merkel Jiang Qing is a bit harsh. The rest I more or less agree with. I wouldn’t be surprised if a lot of the current dissatisfaction with the EU is based on dissatisfaction with the Germans. For years, the Germans have benefitted from EU largess and exported their way to becoming the largest economy in Europe while most of the rest of the EU piled on debt to buy stuff. Then the Germans were nervy enough to tell Southern Europe to keep to their austerity program.

It is no wonder a lot of Europeans are looking at present day Germany like pre WWI Germany, busy throwing their weight around.

90 years ago we had a decade of Central Banker supremacy too. Whey they failed to get the global economy going the Generals took over. I fear we are going to see a similar shift in policy. Hong Kong or Taiwan the new flash point or Kashmir? Plenty of places will serve to get the show started and big wars have a way of cancelling a lot of debt.

It’s Traditional.

But not so big that A-birds fly, and rulers also lose. And also restricted by more limited fossil fuel. Need “right-sized” wars, and mostly using just troops and bullets, as practiced now in Africa, and parts of ME?

Visa Ceo Kelly said, everyone doing great except U.K. A no deal Brexit? A no deal Brexit!