Bank stocks crushed by negative interest rates, broader market goes nowhere in 4 years and is down 44% since 1989 despite BOJ’s equity purchases.

Despite the Bank of Japan’s repeated statements over the years that it would pursue its QE program – or “QQE” as it calls it to distinguish it from the Fed’s flimsy version – with full and relentless force by adding ¥85 trillion ($790 billion) a year to its balance sheet, it hasn’t done that since the beginning of 2017. Instead, it has sharply reduced its QE purchases.

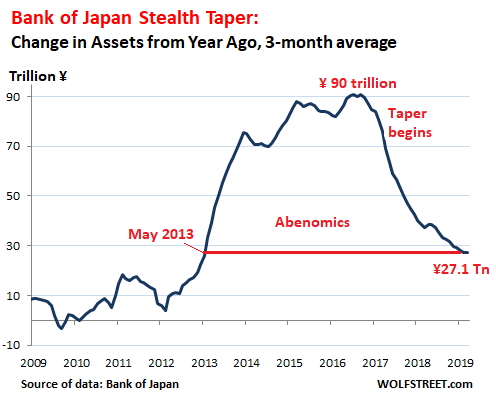

Today, the Bank of Japan disclosed that it had shed ¥2.3 trillion in assets in June, edging its holdings down to ¥565 trillion ($5.2 trillion). There is some volatility in its balance sheet when long-term securities mature. The three-month moving average of its assets, which irons out that volatility, has grown by merely ¥27.1 trillion from a year ago, the smallest 12-month increase since May 2013 – instead of the promised ¥85 trillion. This amounts to an unannounced stealth taper of QE:

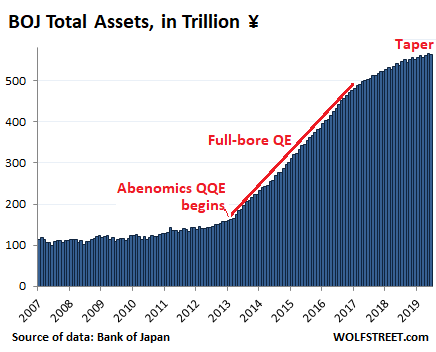

Over the years, the BOJ’s gigantic purchases of Japanese government securities, corporate bonds, equity ETFs, and Japan REITS, have produced an enormous balance sheet. But the rate of increase has now slowed, and the curve at the top is becoming less steep as a result of the stealth taper:

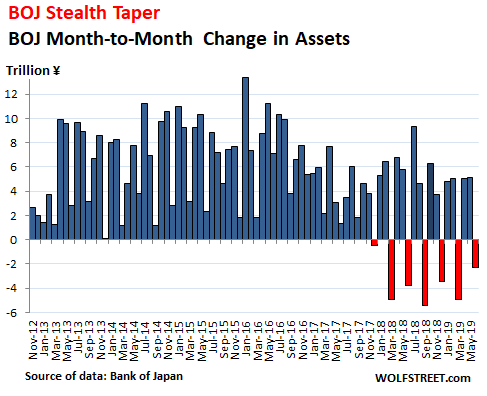

The BOJ’s asset purchases are now low enough to where they no longer cover the amounts of long-term securities that mature and roll off the balance sheet every third month. During these months – June was one of them – the balance sheet shrinks. Then the following two months, it makes up lost ground plus some:

The vast majority of what the BOJ has been buying is Japanese government debt, grabbing essentially every Japanese government bond (JGB) that came on the market. The government would sell new JGBs to its primary dealers that then turn around and sell them for a small profit to the BOJ. In addition, the BOJ bought whatever JGBs came on the market. The BOJ now holds ¥476.3 trillion in government securities — which is the equivalent of about 86% of Japan’s nominal GDP in yen.

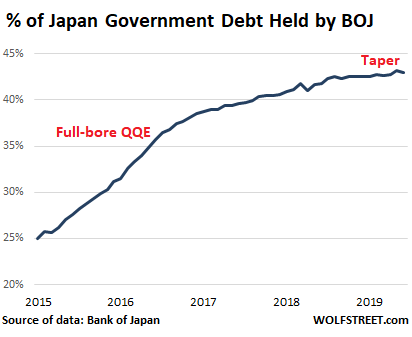

This whole game is of mind-boggling magnitude. But it’s not a game. The debt of the Japanese government has ballooned to ¥1.1 quadrillion, or about 200% of nominal GDP (in yen). And the BOJ now owns 43% of this debt, up from 25% in January 2015. But here too, you can see the impact of the taper, as the percentage has essentially been flat since August last year:

In addition, other official institutions, such as the Government Pension and Investment Fund, also own large piles of Japan’s government debt. This concentrated ownership gives officialdom in Japan total control over the government bond market, and yields do whatever the BOJ decides they should do – which currently means that the government issues bonds that have slightly negative yields all the way past 10-year maturities.

So government borrowing is more than free, and that those who still hold this debt pay an asset tax in form of a negative yield, instead of making a return, and that banks, pension funds, and other institutions that hold assets and need to make money off those assets to stay relevant and meet their obligations have to venture into risky affairs to make a tiny little bit of yield, such as US-originated highly-rated Collateralized Loan Obligations, backed by leveraged loans issued by junk-rated US corporations – and those are currently hot in Japan.

Japanese bank stocks have gotten crushed: the TOPIX Bank Index has dropped 41% from July 2015. The broader Japanese stock market – despite the BOJ’s purchases of equity ETFs – has gone nowhere over this period, with The Nikkei 225 Index up just 5% from July 2015, and still down 44% from its peak in 1989.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great article

Can I ask a direct question: what do you think the investment lesson is here? On the surface one would assume that the risk is that this sort of epic debt balloon in the US will pop, and lead to a far longer and more painful recovery than anybody imagined. What does this say about investing in other developed economies and stocks when the Japanese index has lost money over a 30 year period – would be great to get your views on this

“what do you think the investment lesson is here?”

Looks like the investment lesson is invest in stocks as it will not be allowed to falter let alone crash and not the bond market as slowly and steadily it will be eaten up like termites.

Also look at another lesson here is if bond market had allowed the capital to appreciate instead of depreciate it would have created capital for investment and might have created economic opportunities.

But then except the central bankers no one knows anything about economics or economy.

Do not invest in ponzi schemes (unless you’re one of the insiders!)… that’s the lesson!

Why are they backing off? I discount the possibility that they’ve come to believe this is insane. It is, but that’s not news. Is this the effect of central bank policy coordination, making room for the Fed and/or ECB?

The Bank of Japan (BOJ) chairman Haruchiko Kuroda, possibly the most important Abe ally, has a paper thin majority among BOJ governors after some his own key allies had to retire due to old age and ill health. For the first time in recent years he has to compromise as the new governors are proving far less amenable than their predecessors.

Should he lose his majority the situation could become very interesting: more and weirder compromises to keep Abenomics going a little while longer.

It’s the same thing as it’s happening in Europe: Christine Lagarde is being pushed to the Moon to replace Mario Draghi, but she is already running afoul of politics. 90% chances she’ll get the job in the end (are we to be spared nothing?) but she’ll face a largely hostile body of governors, including people who had been promised the job over the past couple of years before being passed over and who’ll have a personal axe to grind.

She’ll have to compromise, and not merely by not being the motormouth Draghi was.

Does anyone here discern the trajectory of all this? What’s the end game? I am confused beyond measure at what the elites who back Abe think this is all doing, other than acting as a bizarre exercise in national water-treading. My guess is that the old men who own and control Japan are simply playing out the string, and their children and hangers-on are preparing the way for national contraction (the population is falling and more and more work is being done by robots). But the concrete policies still don’t make a lot of sense, from any ideological position Right to Left.

I found a -25% Nikkei stock price return since 1990. I found an 8.6% total return with dividends reinvested since 1990.

Japan has an aging shrinking population. Had a Fukushima reactor meltdown. Shut down its nuke power plant fleet. Has 8 million vacant homes. They have an inflation rate lower than the US inflation rate. Central bank stealth moves baffle me.

Japan is the future of the US. We are going down exactly the same path expecting a different result. Enjoy the stock market highs – we will never see them again.

Escierto, I think you are right, at least in part. Lower interest rates have generated enormous amounts of borrowing. And the more the borrowing, the lower the interest rates will need to go. It is a vicious circle. When they fall below zero here what do you do? It is illegal to take it out of the bank in cash and the stockmarket is rigged. The future looks increasingly interesting.

Couldn’t be more wrong, through it all, the US has healthy demographics and robust immigration – the keys to success for any nation.

Very good article, Wolf.

What this tells me is that the BOJ and FIRE ? (finance, insurance, real estate), have run out of ammunition. IMHO the BOJ will never concede that QQE was an abject failure.

Purchasing riskier assets to make up the difference in lack of yield for bonds or ROI on equity appreciation is analogous to pushing on a string in a setting that is screaming defensive positioning.

The supposed good feeling after the G20 because the status quo remained, FED planned easing based upon data (poppycock on data dependent), and the easing of world tensions because 45 crossed over into N. Korea is just more delusional thinking based upon the stats and websites I read.

Yes, Japan is treading water and doing it well. They are playing a waiting game that takes discipline. In the end, they are waiting for the underwater generation to die, and repricing assets without having to force defaults.

It’s a game that cannot be played in America without political turmoil, because we don’t have the discipline.

Japan historically made their living off of the Yankee dollar and exporting unemployment to their trading partners that Japan ran a surplus.

https://tradingeconomics.com/japan/balance-of-trade

It isn’t looking promising that Japan can continue their exports in a setting that is lacking euro$ liquidity. In short, it isn’ trade spats but euro$ hoarding or scarcity that is the main contributor to world GDP deceleration.

Mrs Watanabe’s patience in this environment will wane.

Mrs. Watanabe is doing just fine. She lives in a civil and safe country.

It’s Mrs. Jones and her aspirational neighbors whose country is spiraling into chaos.

It is an accounting identity when trade imbalances occur the savings rate declines for the deficit country. Michael Pettis and Steve Keen that are economists that can also read a balance sheet for a country, which most central bankers cannot, have proven this time and time again.

Ergo, Mrs Watanabe is no longer a net saver, unless she is paying off credit, which miraculously through accounting gimmicks produces savings per Michael Hudson.

And finally is Mrs. Watanabe safer when Trump threatens to pull the 7th Fleet?

FDR,

Japan is doing fine and will probably be doing better in the future. The standard of living is high and their reputation in trade is excellent. I would buy Japanese over Chinese any day.

Also, the Japanese have a cultural distaste for debt which would automatically produce higher savings. Mrs. Watanabe doesn’t buy a lot of crap which lands up in the garbage. She buys less and better brands, which she can usually keep forever or resells.

Mr. Hudson and Mr. Keen are very competent economists, but they have a very deliberate leftists political agenda. Their positions must be evaluated in terms of their political views.

Petunia-

Right about Japan, they protect their country. If you look at the “numbers” (size, resources, location, etc.), it becomes clear that this is wise.

The US is different in many ways. It’s so big that it’s harder to generalize. The urban centers and poor rural areas are “chaotic” (poor financial position of citizens, drugs, crime, etc.- which come from the poor financial position…). There is a large group of people (maybe I’m one?) who live in “other places”, which will survive fairly well when the next recession comes- with more “chaos”…

Nobody will escape completely from the problems of the next downturn. I am hoping it’s one where the financial assets get repriced much lower, but the real economy muddles through. The wealth inequality, job market, etc., will then improve- being optimistic.

This is how big recessions used to play out.

√

+ forcing defaults would leave banks with the responsibility for a large number of suicides at their feet.

Easier to wait for them to die naturally and quietly wrap up the bankruptcy in the estate settlement.

Also, long term, a declining population, tends to become a wealthier one.

FDR Liberal.

“And finally is Mrs. Watanabe safer when Trump threatens to pull the 7th Fleet?”

if p 45 does that, remember article nine, and a non nuclear armed Japan leave with it.

FDR,

I forgot to address this in my previous reply. There are only three markets in the world that really matter and can break the global economy. They are New York, London, and Tokyo. America knows this better than anybody, and so does P45.

Japan’s population will shrink by a third over the next two decades. They are, without a doubt….screwed.

The mainstream economists play this game with GDP (macroeconomics is where all the flim flam resides due to the supposed mathematical prowess of the professors and other practitioners- they are very BAD microeconomists- bad at judging what incentives do).

Due to assumptions of investment returns (pensions, social security, etc.), the shrinking population will have some definite bad consequences.

However, the more important measure is “real GDP per capita”. The microeconomics of “good social and political” expectations (e.g. Japan society), can help get this measure to be positive.

One will have to work to find this information/data, as the mainstream media and economics profession will suppress it. They have axes to grind.

Petunia, it’s a game that cannot be played any way in the U.S. (absent confiscation of individual landholdings) against any individual who holds land that produces timber.

The timber grows every year, producing more footage on the stump, which cannot be affected by fiat money manipulation.

If the SPX is on the way to 3,500, why Japan yield curve

middle is caving, – their 7Y @ (-)0.239 –

and today the German 3Y is lurching down to (-)0.787, dragging down US middle and US 10Y to 1.976.

Options :

1) the stock market is right. The German 3Y on a spring board.

It will jump and popup > zero.

2) 3,500 SPX, not yet. Today SPX new all time high, closing @ 2,973.01 ==> giving a bearish signal.

Technicals work until fundamentals takeover.

To change the euro$ tightening, therefore deceleration in world trade the FED must inject US$ into their foreign primary dealers located in the US or create swaps currency swaps with the rest of world central banksters, otherwise King Python Dollar will strangle the ROW.

OMG, Wolf used the Q word. Sure, it was in Yen, but still, that’s gotta be some kind of milestone right?

It’s amazing that debt can be blown up into those types of astronomical numbers. The US debt is 22 trillion, so, I suppose if we convert that to yen, it’ll move into the Qunitillion range. But from that perspective, at least the Japanese overall debt isn’t that bad.

You know, the next milestone after Q is going to be quite significant. It’ll be an S. The only question is how long it’ll take to get there.

I guess that I must soon “Google” the term “quadrillion”, check how many decimal places it has and start getting used to using the term.

Let’s see, millions have 6, billions have 9, trillions have 12, so quadrillions must have 15?

If 100 whatever currency denomination bills were stacked, which planet would the pile reach to???????

At 64, I have only recently gotten comfortable with trillions.

Also need to brush-up on the old slide-rule skill of tracking decimal places while doing calculations using only a few significant figures.

Either that, or throw away most of the cheap calculators laying around the house (gifts from banks, securities firms, etc. mostly) and refresh my skills on the few engineering calculators with scientific notation that would be left.

There are only about 20 grams of gold above ground for every person in the world.

That is a number I can wrap my mind around.

Paul,

I feel your pain! Dealing with these Japanese debt numbers gives me a headache. I do it on a spreadsheet and divide these figures by trillions to get their size (number of zeros) down so I can gasp them mentally.

convert it into a dollar sheet the convert back only the totals needed.

“gasp” – fortuitous typo!

You have about a year to figure out the medice maze. Unfortunately, there’s no calculator for that. Congrats.

Is the 200% of GDP government debt gross or net of the assets in the BOJ?

If gross and the assets are netted out is it a more manageable 100% or so??

A quadrillion here, a quadrillion there, pretty soon you are talking about real money.

Wolf,

Many thanks for continuing to keep score with the BOJ balance sheet (and the Fed balance sheet).

The BOJ, with a balance sheet that is more than 100% of Japanese GDP, makes the Fed governors look like fiscally conservative investors.

Not sure how any Japanese bank manages to make money. Hunt for yield all across the globe and pay handsomely to hedge the currency risk.

The BOJ is totally out of ammo, no? Who saves the banks when the next credit crisis arrives?

So the Bank of Japan is lying about its asset purchases, then? I thought credibility was supposed to be of utmost importance to Central Banks?

No, it’s not lying about its asset purchases. This data is disclosed by the BOJ, and that’s where I get this data from. But they’re not following their stated policy goals.

Stated primary policy focus is managing the yield cure. No.

Normalization was erased from Japanese, European and American Economics. They don’t need piggy banks anymore.

Experts are focused on China’s liquidity problems, this country is truly leveraged up on a per capita basis. At the end of the day it is much easier for them to declare bankruptcy as a nation. Japan is like Switzerland in Zimbabwe, the disconnect between the people and the financial establishment is well, almost American.

So, this might sound dumb, but I have a question:

How does negative interest payments from a CB to a treasury work in practice? In the case of the US, the treasury pays interest to the fed which turns around and pays the treasury all of its income. Supposedly it retains no earnings. But in the case of negative rates, where does the money come from to pay the treasury for the privilege of borrowing from them?

Or they, in effect, just sell extra securities to pay the negative interest costs?

Japanese bonds aren’t that negative, it’s possible that those rolling off were mixes of issues that are not net negative?

Negative yield means that there may be a tiny coupon payment, but that the bond buyer has to buy the bond at a premium from face value. When the bond matures, the issuer (government) pays face value for the bond to redeem it, and the bondholder (BOJ) gets this face value, but loses the premium it had paid to buy the bond.

The amounts are not huge because the negative yields are very small in percentage terms.

If you pay a 5% premium for a bond which carries a 10% premium a year from now so much the better. There are a couple ways for that to happen, USG could set rates higher to attract investment, and bond buyers pay extra for the yield. (Not likely). More likely USG will set bonds at a ten cent discount with no benefit in yield. Then it’s a matter of how soon do I get my hands on the collateral. Soon they will be uncharted waters.

Looks like the Bank of Japan unlike the U.S. FED has figured it out finally. When you buy up everything at huge premiums and own everything then there’s no one to sell anything to and you end up in a recession/depression that never ends. Something the stupid U.S. FED is going to learn the hard way.

Madame Fatal : German 20Y @ zero.

European zone average CPI around 1%.

10Y x 20T debt x (-) 0.015 = (-) 3T tribute to the Madame,

Investors help the new Madam to manage Spain, Greece, Italy, keeping European tranquility.

It’s curious that all the warnings from the mistakes overseas have had little register with those pushing the buttons here. As if lemmings, they follow the trail of Japan…

Central Bankers have self expanded their powers and roles…

they have become planners…the planners Hayek warned us about…

and they think their duty is to iron out all cycles.

Cycles in a free market serve a purpose, to flush excesses. As the Central Bankers prevent cycles, they accumulate excesses in the markets..and thus set the stage for systemic threatening occurrences.

But they who set this stage are insulated from its effects via pensions and inflation protected retirements and other perks.

Central banks control their economies, meaning the free market is dead.

And all they do is push the crisis or crash out of their tenure onto the next person in that position. They all collude to devalue their currencies together so nobody can see how our currency us losing buying power.

Low interest rates are good for Wall Street, but not for the banks as their margins are squeezed. Loans should go to borrowers but since the Fed pays higher on bank reserves, they take the free money and do not loan to risky Main Street, that is why inflation does not rise like it should with all the QE’s programs.

Some think the Fed has no clue, but they are their for the banks first and others second. Most of their decisions look lost, but they could care little about the common citizen. Pay attention to what they do, its all for the banks, the stock market and to drive people to want to buy US Treasuries. These guys are Ivy League graduates and are not stupid.

The U.S. has to portray a solid economy and a strong growing stock market to give foreigners the illusion everything is grand in the USA. So they keep buying our financial paper. Otherwise the Ponzi crashes.

Modern Monetary Theory describes more than you’d think – the central banks are simply working with flawed models and limited authority.

Japan’s huge balance sheet expansion pumped yen into the Japanese stock markets, keeping them a bit higher for longer. The money easily flows to other asset classes, countries, etc but doesn’t do much in the real economy and doesn’t tick the government’s measure of inflation.

To create inflation the way the government measures it, you have to actually increase spending. This is done through expansionary fiscal policy- especially if the spending is targeted toward job creation and wage increases. Expansionary policy means that the government actually spends more than it takes in from taxes, not counting interest payments. This increases the money flowing through the economy and if pressed, say by having a “Great Society” program while ramping up war spending, will cause recurring bouts of wage and price inflation.

Contractionary government policy has the opposite effect. Say Greece cuts back government spending like crazy to focus on debt repayments, the public and private sector cut jobs to accommodate, unemployment soars and the GDP shrinks by 25%.

The key is to focus on the REAL economy not the financial summation. The real economy is labor and production. In this approach, wasting labor is inefficient and dangerous as unemployment causes serious problems. The balance here is to put a safeguard so that people interested in working can turn to the government and be assigned to do something useful even if it’s unprofitable overall, because that is a lower burden to society than having these people unemployed. If inflation is high you can pull money from the economy through higher taxes, selling bonds to soak it up, or cutting spending.

If you think about it, it’s no wonder the current central bank solutions have results ranging from ineffective to counterproductive. They focus on asset inflation, which distorts the real economy considerably without addressing the underlying problems of highly underutilized labor.