China’s corporations deleverage, forced or otherwise.

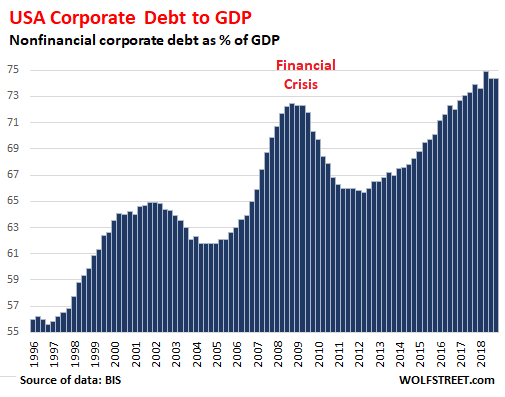

US “nonfinancial” corporate debt – this excludes debt by banks and by businesses that are not incorporated – rose to a record $15.2 trillion in the fourth quarter, according to data released by the Bank for International Settlements last week. To show how much of a burden this debt is, how it compares to other countries, and to eliminate the effects of inflation, the BIS also expresses this debt as a percent of nominal GDP. Given the growth of GDP in Q4, the ratio of corporate debt to GDP, at 74.4%, was unchanged from the upwardly revised Q3, and was down a tad from the record in Q2 of 74.9%.

The prior record of US corporate debt had been set in Q4 2008, at $10.7 trillion, as corporate debt had begun to unwind noisily, following the Lehman Brothers bankruptcy, and as GDP growth had turned sharply negative. In Q4 2018, corporate debt in dollar-terms was 42% higher than at the prior peak in Q4 2008. When measured as a percent of nominal GDP, the peak in Q4 2008 was 72.5% of GDP. And we’ve got that already beat by nearly two percentage points:

Corporate debt is high enough to be featured in the Fed’s Financial Stability Report at the top of the list of factors that might trigger the next financial crisis.

To compare the burden of debt levels from country to country, the BIS uses a country’s corporate debt as percent of nominal local-currency GDP. By this measure, and compared to all the debt sinners out there, the US is nevertheless only in a lowly 24th place.

All eyes are glued on China’d Corporate Debt

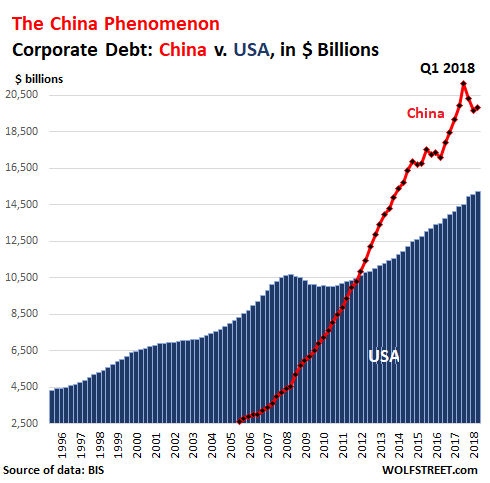

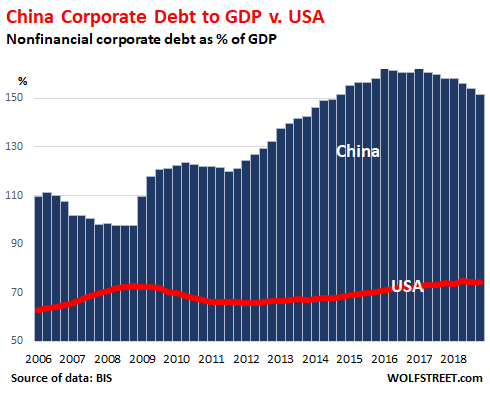

China, a smaller economy than the US economy, has by far more nonfinancial corporate debt: In US dollar terms, corporate debt in China hit a record of $21.1 trillion in Q1 2018, by far the most of any country. But since then, Chinese companies have been deleveraging under the orders from the central government. Deleveraging takes many forms in China, including defaults, state-mandated loan-to-equity swaps by Chinese state-owned banks, and bailouts by the central government, which includes the PBOC.

In Q4, 2018, China’s nonfinancial corporate debt (red line) was $19.8 trillion, with efforts to deleverage in Q4 having taken a backseat to efforts to boost the economy:

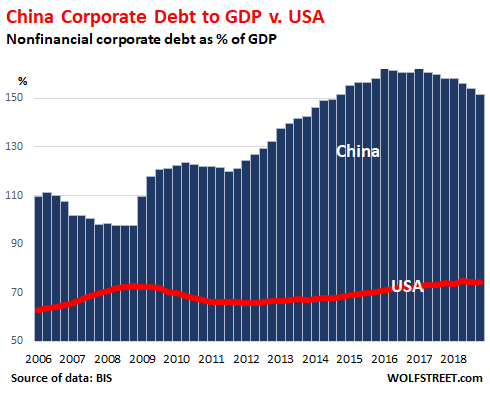

Among the major economies, China’s corporate-debt-to-GDP ratio is in a realm of its own. But there are some small economies with special tax laws and corporate tax-haven status that US, European, or Chinese corporations find attractive – and they have even higher corporate-debt-to-GDP ratios than China (we’ll get to those in a moment).

China’s efforts to deleverage its corporate sector, and the growth in its official GDP, have been reducing the corporate debt-to-GDP ratio from a peak of a blistering 162.6% in Q1 2016 to 151.6% in Q4 2018, still about twice the US ratio. In this chart and all charts below, the US debt-to-GDP ratio is added as a red line for comparative purposes:

Compared to all countries, including favorite tax havens and off-shore centers for corporations, China’s astronomical level of 151.6%, though twice as large as the US ratio, lands China in only 7th place! So here we go….

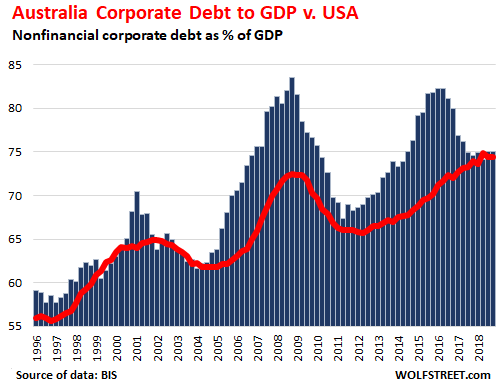

#23: Australia corporate debt-to-GDP ratio: 75.0%

Just barely ahead of the US, Australia’s corporate debt-to-GDP ratio has gone through bouts of leveraging. This is rather quaint compared to Australia’s household-debt-to GDP ratio, mostly caused by mortgages that financed one of the most magnificent housing bubbles in the world that is now unwinding. The red line for the US ratio adds some perspective. As we go up the scale, and as the corporate debt-to-GDP ratio rockets higher country by country, this red line gets pushed lower and lower until it is just a little decoration at the base of the chart of the winner.

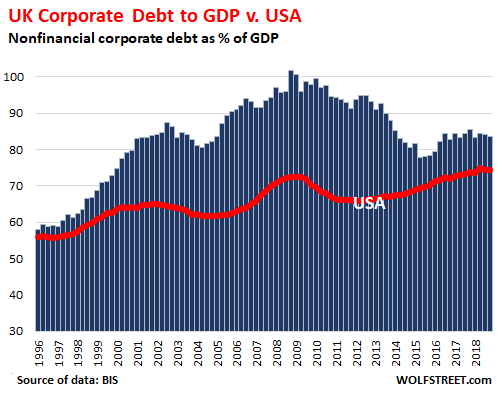

#22 United Kingdom corporate debt-to-GDP ratio: 83.6%

The UK debt-to-GDP ratio has been high for 20 years. It’s not that UK industrial companies borrow that much; it’s that the City of London is a tax haven for global corporations. But it has declined from 101% as the Global Financial Crisis broke loose:

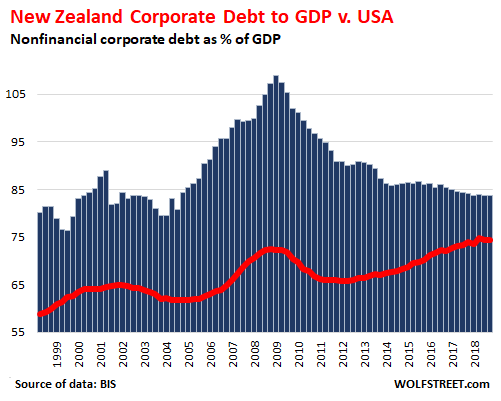

#21 New Zealand corporate debt-to-GDP ratio: 83.7%

New Zealand’s corporate world has deleveraged since the Financial Crisis, and never fully jumped back on the bandwagon, though debt levels remain much higher than in the US:

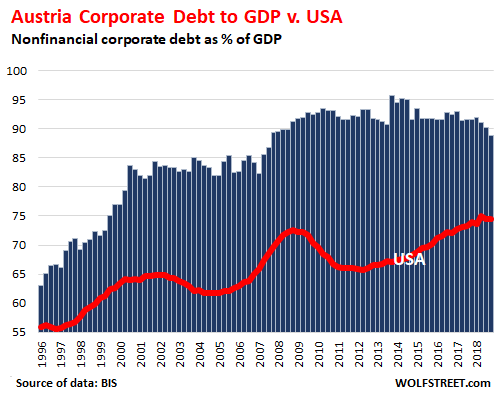

#20 Austria corporate debt-to-GDP ratio: 88.8%

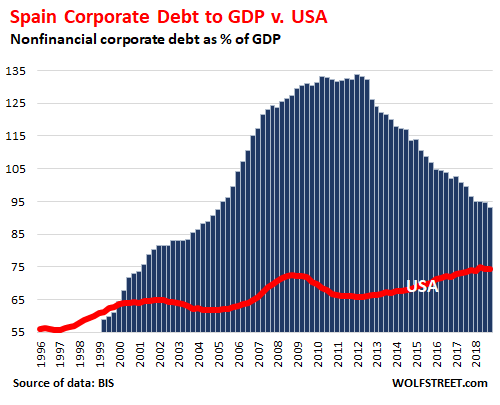

#19: Spain corporate debt-to-GDP ratio: 93.2%

Spain is what a chart of a real financial crisis looks like that followed a magnificent housing bubble and an over-indebted corporate sector that was concentrated on real estate and construction that ended in a brutal bust all around that took down the banks and triggered all kinds of bank bailouts and economic mayhem. And this deleveraging continued relentlessly through Q4 2018, with the ratio ticking down another half a percentage point from the prior quarter to 93.2%, though it remains very high:

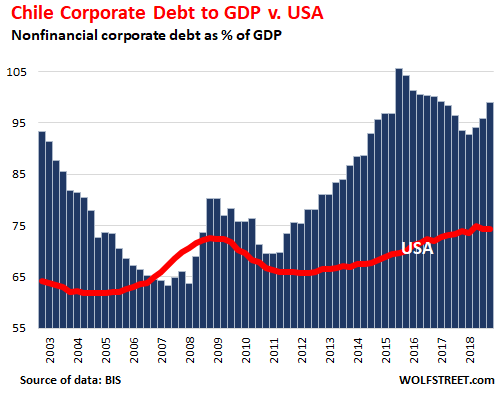

#18 Chile corporate debt-to-GDP ratio: 98.9%

Chile had begun to deleverage for a couple of years, after a phenomenal surge following the Financial Crisis. But in 2018, the debt-to-GDP ratio started jumping again and is now 34% higher than the US ratio (the BIS data for Chile only goes back to 2003):

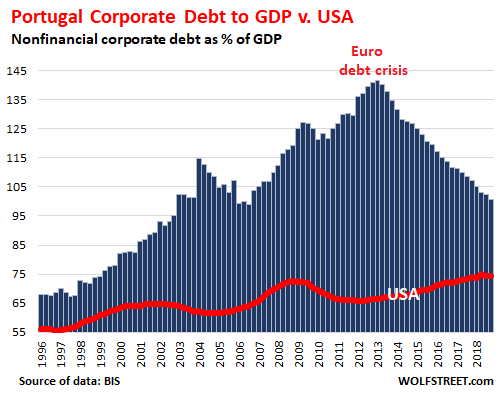

#17 Portugal corporate debt-to-GDP ratio: 100.6%

Portugal was one of the epicenters of the euro debt crisis after it had already had its own financial crisis, triggered in part by enormous amounts of cheap euro corporate debt: economic decline, pain, and forced deleveraging followed. But debt levels remain high, and there is still some deleveraging to do.

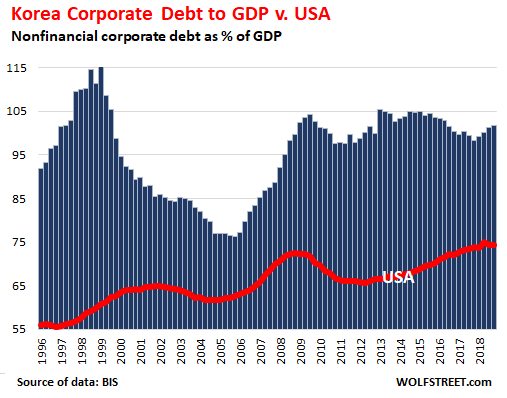

#16 South Korea corporate debt-to-GDP ratio: 101.7%

Note the effects of the buildup of debt in the 1990s that then ended in the Asian Financial Crisis that broke loose in 1997 and that was then followed by a painful bout of forced deleveraging:

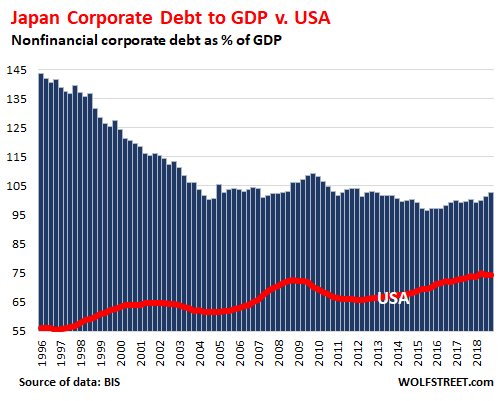

#15 Japan corporate debt-to-GDP ratio: 102.6%

Japan’s corporate sector spend over 15 years deleveraging. But debt levels remain high, and the debt-to-GDP ratio is growing again, and was 36% higher than the US ratio:

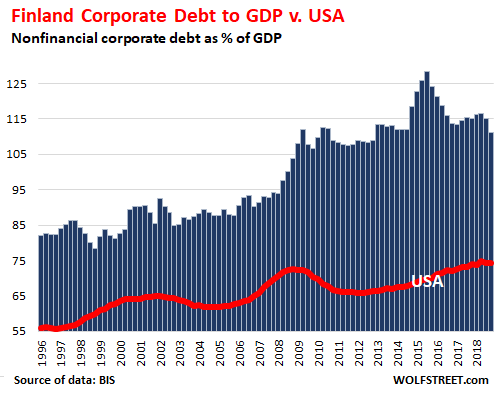

#14 Finland corporate debt-to-GDP ratio: 111.3%

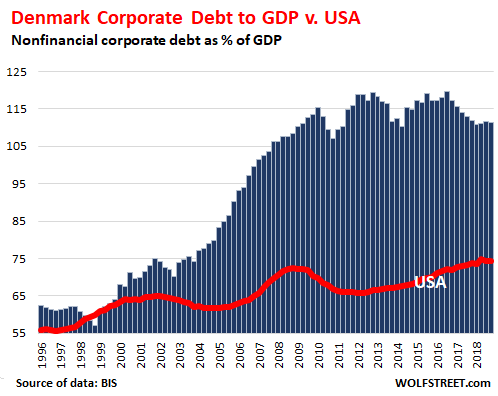

#13 Denmark corporate debt-to-GDP ratio: 111.3%

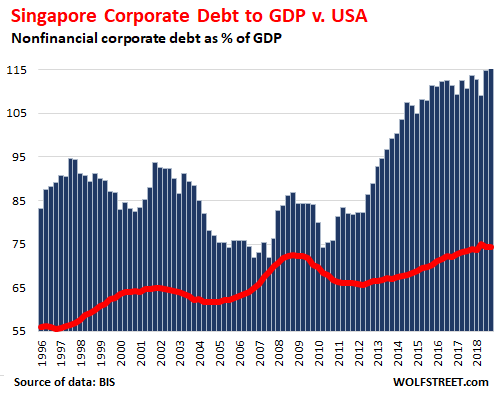

#12 Singapore corporate debt-to-GDP ratio 116.4%:

Singapore is one of the destinations for corporations and their debts from other countries, including China, and it shows in its corporate debt-to-GDP ratio:

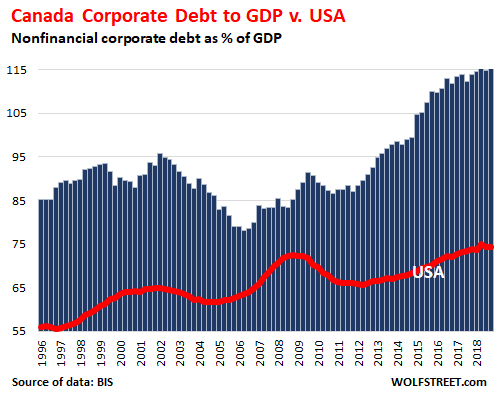

#11 Canada corporate debt-to-GDP ratio: 117.2%

The indebtedness of Canada’s household has become already legendary and ranks among the highest in the world. But so does Canada’s corporate sector.

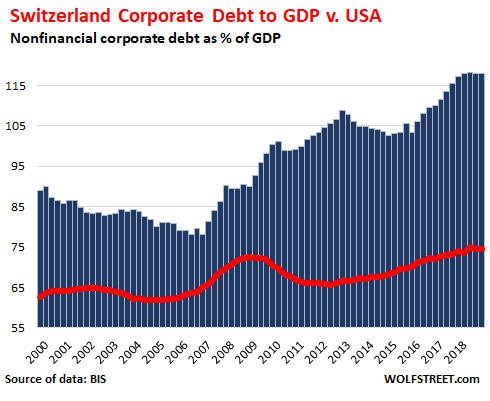

#10 Switzerland corporate debt-to-GDP ratio: 118.1%

OK, time to get dizzy. Switzerland is a corporate tax haven, and some Swiss companies are very large global M&A meisters, with some of their debts in Switzerland. In addition, Switzerland is steeped in NIRP where high-grade companies can borrow for just about free:

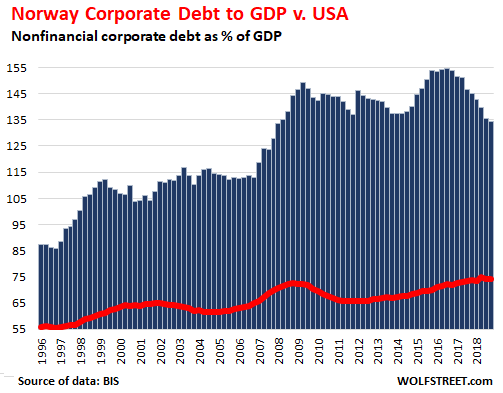

#9 Norway corporate debt-to-GDP ratio: 134.4

If Norway has a financial crisis, not a lot of people outside Scandinavia will notice. The economy of Norway is just too small. That’s the good part. But lordy, there sure is a lot of corporate debt:

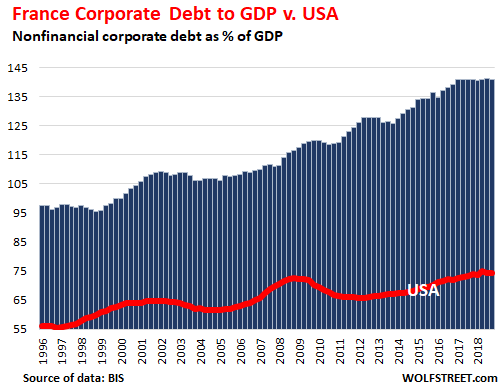

#8 France corporate debt-to-GDP ratio: 141.0%

The French corporate sector is dominated by enterprises that are either wholly or partially state-owned and that used to be wholly state-owned and have enormous amounts of debt that is assumed to be backed by the French state. Hence a debt-to-GDP ratio of Chinese proportions:

#7 China corporate debt-to-GDP ratio: 151.6%

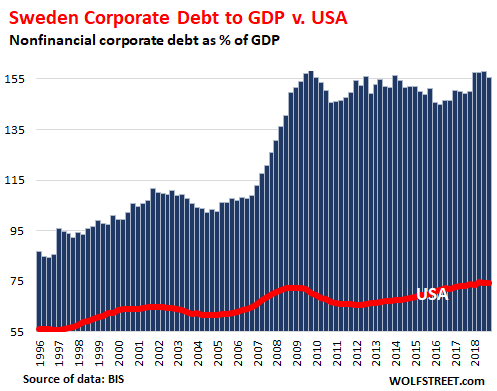

#6 Sweden corporate debt-to-GDP ratio: 155.5%

Another NIRP country — the wonders that are performed by NIRP, ZIRP, and very low interest rates. By comparison, the US ratio seems outright minuscule:

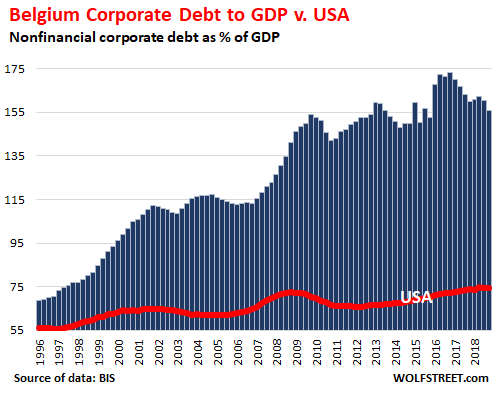

#5 Belgium corporate debt-to-GDP ratio: 155.9%

A role in this debt pileup can be ascribed to beer M&A, the debt that comes with it, along with the hangover.

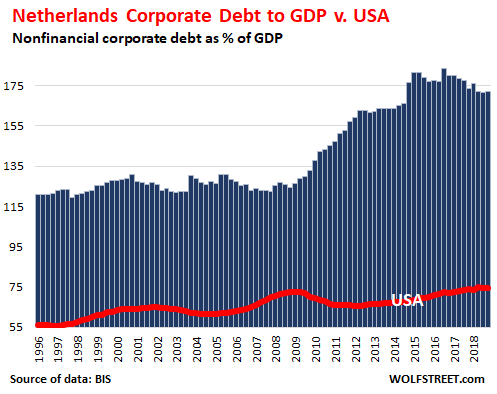

#4 Netherlands corporate debt-to-GDP ratio: 171.9%

A place for corporate tax avoidance specialists to shelter income and register their debts.

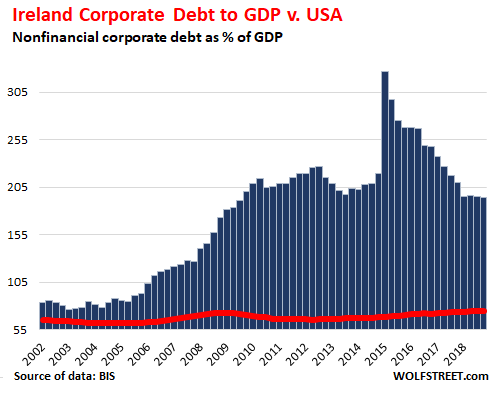

#3 Ireland corporate debt-to-GDP ratio: 194.6%

Ireland is where US corporations go to shelter their income via mailbox operations or even a corporate tax inversion where the US company ends up being headquartered in Ireland via a merger. This is a big thing for Big Pharma, such as Allergan, which generates most of its sales in the US, but was formed in 2015 when Irish–registered Actavis acquired the much larger US company, which caused the spike in Ireland’s corporate debt-to-GDP ratio that year. Actavis was itself a US company that did a tax inversion in 2013 to become, for tax purposes, Irish. These companies have some operations in Ireland but didn’t actually move to Ireland. But some of their corporate debt shows up in Irish data — instead of in the US data. Hence, the absurd chart:

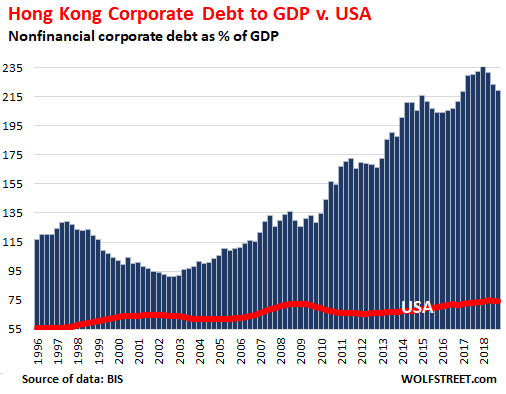

#2 Hong Kong corporate debt-to-GDP ratio: 219.4%

When it comes to corporate finances and international trade, Hong Kong and China should be added together.

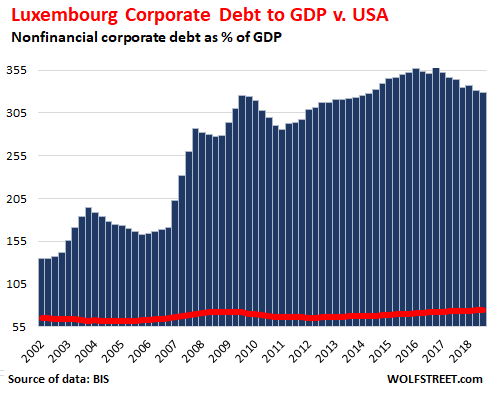

#1 Luxembourg corporate debt-to-GDP ratio: 318.7%

No country comes even close to Luxembourg. Its corporate debt-to-GDP-ratio is over four times that of the US. The country is a choice location to set up headquarters for tax-dodging global companies. This includes steel giant ArcelorMittal, satellite services companies SES and Intelsat, intercontinental airfreight company Cargolux, and “internet giants Amazon, Skype and Paypal,” brags the Luxembourg office of KPMG, which offers to set up and manage such mailbox headquarters:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

When the US printed about 4.5 trillion during QE, the other countries had to do the same to keep their currencies at par. What else could they do to keep exchange rates from blowing up?

It’s not like any of them needed encouragement ;-)

Does that come into line with matterial making industries?

Canada more seems to import and assemble products than actually manufacture anything.

Canada also has a very high percentage of financial services that may sway the numbers? Banks always have higher debt than the average company.

Bobby,

Bank debts are excluded from this data. This is “nonfinancial corporate debt.”

Oops, sorry about that. You stated that clear in your first sentence too!

The US numbers on GDP are totally bogus. The US manipulates the GDP number in a big way (up) to make all of our debt problems look favorable.

GDP is the big lie. Wolf, why don’t you do an article to parse that out?

Exactly.

This is based on “nominal” GDP, which is NOT adjusted for inflation. So if you have a beef with our inflation numbers, your beef doesn’t apply here.

Alternatively, I could just make up my own data, and it would be very entertaining, and a lot of folks are doing that.

Nominal GDP is not “a big lie.” It’s a huge pile of very complex data, all summarized and expressed in one number. It’s hard to count the flow money in an economy — that’s what GDP does — and GDP, with all its weaknesses, is the best measure we have at the moment.

I think the “lie” they are referring is that the US GDP number is pumped up by government spending programs, programs fueled with Trillions in debt and no true debt ceiling. Everytime the “ceiling” is reached the children have a tea party, ask each other if the number can be bigger, and then they all conveniently say yes. Then the debt keeps growing, the GDP keeps up with the debt and the rest of the world looks like fools.

Yes, GDP is “pumped up” by ALL forms of debt. In the US, government debt is smaller than the combined business and household debts.

Everyone who borrows to spend or invest pumps up GDP. That’s why economists — such as those at the Fed — love rising debt levels. But it’s not only “GDP” that gets pumped up by rising debt; it’s the real economy too. When you borrow to buy a car, that purchase pumps up the real economy.

the lies are buried in the ‘complex data’!!!

You need to turn that around, the corporate debt levels represent ‘global’ investment, the charts represent who is doing the heavy lifting in the global economy. The US is a consumer nation. US GDP is not the problem. Corporate debt will not be at cause in the next crisis, at least not ours. Neither will RE, when rates drop further, the problem is Treasuries. Foreign investment distorts prices, deficits matter, and the dollar is a convenient safety valve. In the moment between the end of cheap imports and the return of jobs, that will constitute a recession. Falling interest rates will accompany shrinking asset values (collateral) where Treasuries are currency (foreign exchange) and USG cannot afford to pay a higher rate of yield.

David Stockman is chronicling junk and low-rated U.S. corporate debt. It will become a problem when it doesn’t get repaid. Wolf’s fracking patch report is just one component.

I am from The Netherlands.

Like Germany we are an export driven economy and we have some big international companies ((Shell, Unilever)… to fund global growth you need investment… and maybe some stock buybacks.

If data would be available it would be interesting to look at data from SME’s and/or non-listed companies: those that make 80% of employment in a country…

Were does all the Investments in the startup scène show up?

Only the USA ups it’s GDP?

Where did you park your spacecraft?

In USA only?

All countries are uping their GDP, repeat ALL!

I live in EUssr, where everything is a lie!

That’s why I opened a brokerage account in USA.

At least in USA there are some Oasis of truth, like wolfstreet which make me see the greater picture!

In EUssr every econ/politic blog is paid by the apparatchik.

Thanks Wolf for your light in the dark.

Kind regards

USSR = union SOVIET socialist republics.

Is brussels trying to set itself up as the unaccountable to teh electorate dictator of a european socialist superstate.

Where crony profits are privatised, Losses are socalised, Much as it is in any socalist dictatorship , with the EU quirk that the bill for all losses, is funded by the German taxpayer.

YES.

However it is not Soviet.

In America much of the corporate debt is secured against fresh air like the vast majority of the corporate debt in ccp china, however we can see most of what Americas corporate debt is secured against.

how do the nations stack up when quality of security of the debt, not just % of GDP volume, is the rating factor ????

Love a great debt story, gluttony ++, so long as tomorrow comes. $1 down $ a day. This has been going on forever.Can a corporate be debt free without a bond/ loan or any other debt instrument??? Just good old money in the bank!!! I assume I’m being very naive due to taxation system

Corporations have become a larger part of the economy using economy of scale to fill niches once held by sole proprietors and small businesses. For example, small taxi cab and limo operators were driven out of business by Uber. Home Depot put out small hardware stores. Amazon booted small online stores in favor of larger online stores. Starbucks and Dunkin Donuts took the place of some local coffee shops.

Debt may be good, if the underlying investments are profitable. The subprime zombie company debt is the problem. As investors craved high yield junk bonds, their risk of default grew. A good investment advisor advised holding a diversified portfolio of securities to avoid being wiped out by a large stake in a few bad investments. Those whose retirement accounts contained all Enron stock suffered great loss as Enron filed for bankruptcy after massive fraud was discovered.

What a distorted world we live in. Pitchforks long since needed

Torches too, they go along with pitchforks. Remember the Frankenstein and werewolf movies of the 1930s and 1940s? The knock on the huge oak front door of the castle on a stormy night with bolts of lightening flashing? Igor pulling the creaking door open?

The ambience of torches was ruined when they were replaced with tiki torches and slacks. I certainly don’t fear a person in slacks and loafers.

I guess I’m pretty naive about high finance, but what percentage of corporations in the US paid no taxes in say, 2017? Taxes count as debts, don’t they? And if a company gets away with paying no taxes, that reduces its debt. Perhaps some other reader can explain to me why I’m all wet.

Interesting article. Meanwhile, “Government Debt to GDP in the United States is expected to be 108.00 percent by the end of this quarter, according to Trading Economics global macro models and analysts expectations.”

And: “Canada recorded a government debt equivalent to 90.60 percent of the country’s Gross Domestic Product in 2018.”…”With the total GDP somewhere around CAD$1.8 trillion, Canada’s overall debt/GDP ratio is around 77%.”

Now, what is going to happen when those darn “sochlists” get elected in 2020 and people expect affordable health care and a solvent pension plan? :-)

I went to Wiki and looked for total debts to GDP, or combination thereof, and found US to be in 12th place and about 50% of Japan’s, (between Mozambique and Singapore) and Canada in 31st, (better than UK but behind Ukraine)…another :-) That shows just how misleading these stats are. If you look at the quality of life experienced in many countries and where they sit on the debt scales, there is an obvious disconnect between numbers and reality.

From Bloomberg they explained it this way: “The central bank singled out companies in the commodities industry, which it says are carrying higher debt loads while suffering from falling income due to declines in global resource prices.

It’s a phenomenon affecting many developed countries, the central bank said, occurring as stricter regulation reduces the share of corporate debt funded by banks. That has allowed non- bank credit providers to step in.”

Bond buyers in the energy industry? I don’t know? Canada is largely a hewer of wood kind of place; “a biblical term (Joshua 9:21)1 that the Oxford Dictionary defines as “menial drudges; labourers”. For Canada, it has been pejorative shorthand for the country’s historic reliance on natural resources – versus “value-added” manufacturing – for economic growth.”

Being a woodchuck Canuck is a very prosperous lifestyle, highly unionized and well paid. The newish ow-end service industries, not so much.

I am more concerned about Canadian personal debt levels and the expectations that many younger individuals have about life and what a person is entitled to. Specifically, housing and job satisfaction. We largely missed the big Financial Crash of the oughts, just when these folks were coming of age.

It’s good to miss a few meals and suffer some fears, as far as I’m concerned. It’s tough out there and we are NOT prepared to suffer a downturn in Canada. Businesses have been there, and owners always know how precarious survival is, but imho Canadian individuals and investors, not so much.

The big looming and unknown factor? Climate, imho.

regards

You missed the expectations from younger generation of inheritance and entitlements while ignoring any debts behind it.

I find it amazing how politicians ignore debt to pass out decades of entitlements that is created.

my nephew and fiance just graduated from Mich biz school with MBAs and about 185k each in student debt. At least that what it says it cost to get that MBA. They think they work hard and in three years pay it off. Hope so for their sake

After tax they pay off $370,000 within three years of graduating?

Please report back in 3 years.

I wish most of the kids in law school and business school were studying engineering. The country needs engineers.

James Mitchell,

US ranks horribly in math and science. Now down to 24th or something, only above countries like Turkey and Chile. American parents put sports first and it shows. Sports are huge in middle and upper middle class suburbs. And these are the US workers who are all middle managing expendables easily laid off in recessions.

There will be no downturn in Canada. We’re different.

Go Raptors!

I would agree Paolo, much sense in that: being a little hungry, cold and insecure for a decent length of time is the best lesson in reality that anyone can have in our spuriously over-secure societies.

l’m more grateful for the failures in my life than for the flattering successes; and of the successes, only the really hard-earned ones.

Set everyone to memorise Kilping’s ‘If’, too. :)

Yes, capital-intensive commodity industries still dominate in Canada.

Also, every American multi-national company you can think of probably has a subsidiary company in Canada—Procter & Gamble, Kraft–Heinz, General Motors, General Electric, etc. It has been in their favor to load the Canadian subs with debt whose interest payments reduce Canadian taxes. (I think the term is “interest stripping”.) The incentive is greater now that the recent tax reform limited this deduction for American parent companies.

Canada has a general rule prohibiting such deductions for companies with “thin capitalization” (low equity), but I have never heard of any company being cited for that. Meanwhile, Boeing had a book value of NEGATIVE $2.13 per share (at Sept. 30, 2018)!

Germany, India, Italy and Brazil are all among the 10 biggest world economies by GDP, but no info about them. Yet we get the outlook of Denmark and Luxemburg, not exactly giant economies. Can we hope in a few additional charts?

That’s because their corporate debt-to-GDP ratios are lower than the US level. The cut-off here is the US — so the 24 countries with the most indebted corporations. Note, a country must have a stable currency for corporations to be able to borrow in that currency. So in countries like Argentina, with a currency that loses 40% of its value a year, it’s hard to borrow in pesos. They can borrow in dollars, but investors are leery of this too. So in these countries, credit is hard to come buy.

And German corporations — except for the largest ones — are notoriously conservative with debt.

Here is the whole list of the 44 countries the BIS tracks for this purpose. The number next to the country is the percent of corp debt to GDP:

AR:Argentina 15.8

ID:Indonesia 23.4

MX:Mexico 25.7

CO:Colombia 35.4

ZA:South Africa 38.6

BR:Brazil 42.2

SA:Saudi Arabia 42.8

IN:India 44.8

PL:Poland 45.5

RU:Russia 46.3

TH:Thailand 48.1

DE:Germany 56.7

CZ:Czech Republic 57.1

GR:Greece 58.2

HU:Hungary 67.0

MY:Malaysia 67.7

IL:Israel 69.3

TR:Turkey 69.7

IT:Italy 69.8

US:United States 74.4

AU:Australia 75.0

GB:United Kingdom 83.6

NZ:New Zealand 83.7

AT:Austria 88.8

ES:Spain 93.2

CL:Chile 98.9

PT:Portugal 100.6

KR:Korea 101.7

JP:Japan 102.6

XM:Euro area 105.0

DK:Denmark 111.3

FI:Finland 111.3

SG:Singapore 116.4

CA:Canada 117.2

CH:Switzerland 118.1

NO:Norway 134.4

FR:France 141.0

CN:China 151.6

SE:Sweden 155.5

BE:Belgium 155.9

NL:Netherlands 171.9

IE:Ireland 194.6

HK:Hong Kong SAR 219.4

LU:Luxembourg 318.7

Luxembourg 318.7 HK 219.4 and the other declining list members down to at least Beligum 155.9.

This has to be a distortion due to forigen entity registration for tax, sanction, import restriction purposes.

So the data set its self is already a distortion of reality.

`

“For Canada, it has been … the country’s historic reliance on natural resources – versus ‘value-added’ manufacturing – for economic growth.”

Sounds like West Virginia. That is changing in some ways, but slowly.

Unfortunately, under her present Governor she has taken a wrong turn, I think.

Her constitution had required a balanced budget but the voters approved a constitutional amendment allowing a bond issue to build new roads.

The Guv hijacked some of its proceeds to repair secondary roads, bridges and lanes, which caused the Commissioner of Roads to resign.

As you point out re Canada’s “woodchucks”: those parts of our micro economies that are financially and ethically sound are doing just fine.

Problem is far too many imposed safety laws and regulations as well as insurances, workmans compensation payments, health tax, etc, etc, etc…

Very discouraging that it is impossible now to start without massive capital backing…

No that’s not the problem at all I can assure you.

You’re just parroting what the neoliberal propaganda has done its job in making you believe.

I happen to have been a building contractor of over 40 years now…

Licenced trades, inspections on multiple levels, engineered drawings, retraining over and over to even step on a ladder, you need a certification. Insurances, now for the business end…

They are not the problem, the countries that are allowed to compete without them are.

I suppose it’s all about the location of real GDP to debt. If an American firm goes bust but is registered in Ireland, would it be a problem for Ireland, probably not. Would it be a problem for the USA if 10,000 workers lost their jobs….probably yes…

Wow ! I had not idea the northern European countries were so highly indebted; especially the Scandinavian countries – interesting as so many folks seem to point to Sweden as such a wonderful model.

Debt….it’s what’s for dinner !!!

The big question is what did non-financials do with all this new debt. Other than payback and renew old debt, how much of this debt was used to buy back stocks and pay dividends or takeover another company?

Canada you really goofed up. So does it explode this year or the next?

I expect China to totally pull out due to massive distances and US pressures to keep valuable trading partner close.

China is cracking down in Hong Kong….expect a surge into Lower Mainland BC. Winning Baby!

If China is in control of the banks, then the money is already locked up from leaving.

I would bet a steak dinner that Russia has excellent debt to GDP ratios.

A well run country that doesn’t like debt. Hated by fake legacy news media.

Hmmmm….

I’m not sure if you’re being sarcastic. Just in case….

You have to have a stable currency to borrow. The ruble is all but stable. And it’s hard and expensive to borrow in rubles — such as issuing a 10-year note. Companies can borrow in rubles at their local bank, but these are floating rate loans with hefty interest rates. The Russian Central Bank’s policy rate is 7.75%. So if a company borrows in rubles, it will pay somewhere around a double-digit interest rate.

So the big Russian companies borrow in dollars and euros and other hard currencies because it’s a lot cheaper. And they have a shitload of foreign-currency debt, such as euro debt registered at their entity in London.

Note that Russia had two big financial crises over the past two decades:

— Ruble Crisis of 2014–2015

— Russian Financial Crisis of 1998 – the Russian government and the Russian Central Bank devalued the ruble and defaulted on its debt.

Russia and China understand that they have to pay a price to to play long ball. I cannot confirm thru the main stream media , but apparently Russia just recently used its remaining us treasuries for collateral for gold in the euro fiat system. By the way has any one heard on the main stream media that Netanyahu has appointed himself Justice Minister and thus will not prosecute himself? The east understands a gold based instrument will replace the fiat dollar. This fact does not have to be a threat if the US can re-industrialize in some degree and not depend on Financials alone.. The Baltic Sea Nord Stream 2 will print money for Russia and make Germany the distribution hub , thus the energy King and manufacturing King.Euros will flow east but not dollars.The US wants Europe to buy its expensive LNG with no infrastructure to distribute it.Some type of nation to nation balance of payments system will have to be attached to gold when the dollar fiat system ends,trust will be in short supply. Furthermore targeting nations to prevent trade between them using the fiat dollar payment system such as SWIFT cannot be tolarated by these nations. I wish I could invest in Russian agri-business , Jim Rogers calls it a chance in a life time. I have lost trust in data or agencies connected to the fiat dollar such as GDP and Inflation and the BIS. Corporate debt or any debt does not matter if you close to spigot. It only matters if you are a late ,hapless schmuck with a title loan or a payday loan which is considered a moral hazzard. The Empire is terrified of ANY threat of de- dollarization.

Since then,

Russia has broken away from the SWIFT system and has amassed more gold reserves along with stronger ties with China.

The US sanctions no longer have much effects.

….and Russia’s economy and people continue to stagnate. Funny how that works.

The reason China and Russia do not have stable currencies is simply because they do not demand payment for their exports with their own currency (or gold).

If Russia demanded payment for their petroleum exports in rubles they would have the strongest currency in the world.

The reason Russia doesn’t have a huge debt is because they don’t have enough credit. China’s credit is dependent on the goodwill created by the Hong Kong banks, whether they know it or not. They may find out soon enough the strength of their banking system and credit, if the western banks pull out of HK.

The reason China and Russia stockpile gold is because they need it to trade with counter parties. While China and Russia pledge to trade with each other in their own currencies, I’ll bet there will be a limit, beyond which they will have to pay in gold.

This is the dumbest thing I have ever read. China’s credit based on its ability to produce. Soros would have eaten HK alive if CCP didn’t interfere during Asian financial crisis

Such an incisive insight earnestly expounded in good faith …

In socialist countries, corporate and government debt melt together. Like Fannie and Freddie in the US, companies like Huawei and Lockheed are quasi-government entities.

For all purposes, even in the US where many companies like Boeing, GM and Lockheed, come with implicit guarantees. Large corporate debt (SP500) and government are one large debt ranch.

Sensibly, the only valid number is the sum of all big debts.

In the next crisis RE will not be the cause, there is no more subprime crisis, mortgage rates will fall. Corporate debt is TBTF, at the global level. There may be some mini bubbles, in student and auto loans. The risk is that in the aggregate corporate debt to GDP is too big a slice of the global system and that it will implode globally (though US will not be hurt as badly since it’s debt to GDP is lower). The analysts continue to push the EM, (and EM debt) you wonder why? Foreign investment in US markets is waning, and money is flying into Treasuries. Best financial advice, wherever the money is going, don’t go there.

The GFC was blamed on subprime, but it was really an income crisis caused by credit contraction. While people are employed, they pay their bills. When credit lines are cut, people get fired and can’t pay their bills. The next time will probably be a variation of the same thing.

The GFC was blamed on subprime, and America.

Just as 1929 wall st crash was blamed for the Depression when the depression was in fact the result of a global CREDIT FREEZE caused by the collapse of Creditanstalt in Austria in 1931.

So Lehmans, bears, and sub prime are blamed for the GFC.

When in fact he GFC was set off by a European credit freeze caused by the revaluation of the true state of greek national, debt which also sparked the Euro crisis.

Russia, the Eu, ccp china, and the uninformed will keep on blaming wall street and America as it suits their malicious warped agendas to do so.

Those same uninformed will tell you the 2008 GFC is over, yet we still have QE infused CB Balance sheets all over the world, the EU is still in QE mode, Still Bloate with bank’s that have obscene NPL ratios,as it has been in since 2009 (App) and ccp china is still in Covert QE mode on a huge Scale. ccp china dosent have NPL mountains is has NPL OCEANS.

When all the CB Balance sheets are normalised and all the Notes that have been sold with QE Repressed interest rates are redeemed.

We may then be able to asses if we have finally cleared the 08 depression event.

The FED is one of the closest CB’s to this as it has reduced T notes to an acceptable level and simply needs to deal with the remaining 1.5 T of MBS as soon as is possible, without doing so at a loss.

I appreciate the article and the research you do. Some context seems in order, which in my opinion, is missing. The interest rate regime has changed significantly. Perhaps, some understanding of debt service requirements as a % of GDP is appropriate – since they are paying substantially less to borrow than they did historically.

Yes, we can say that is a result of QE, etc., but that is not my purpose. What matrix can be used to fairly evaluate the debt burden? Debt to GDP is misleading as it does not reflect the ability to pay.

Count the jobs and wages, interest rates are now irrelevant by design.

A meaningful portion of this $15 trillion in U.S. ‘nonfinancial’ corporate debt was used to pay for stock buybacks, leveraged buyouts, and on cash-flow negative companies which have rarely ever been profitable ( see tech unicorns and shale oil producers ).

Share repurchases or buybacks can spend a lot of money to temporarily push up a companies short term stock price, but this strategy contributes nothing to the companies revenues, profitability, future productivity, or new product development. Leveraged buyouts are known to overload a companies balance sheet with debts that can be difficult to sustain even for healthy firms. A cash-flow negative company doesn’t sell enough product to finance its daily operations, and therefore requires a constant inflow of outside capital to keep its business afloat.

Not sure where the other the countries spent their trillions when accumulating ‘nonfinancial’ corporate debt.

When CHINA can beat USA on NFCD we know they are the leaders!

\\\

How should I interpret this data? How much of this ratio is considered bad? Is there a “healthy balance” to this debt?

\\\

Very insightful composition which tells a couple of interesting stories. Looking at Europe, what stands out like a red blinking warning light is France. China and the little statelets aside, the most indebted country of all of them! Miles ahead of Italy, the much-touted trouble-maker. This could be a strong indicator for the epicentre of the next big Euro crisis. Or the explosives stockpile that must not be reached by the Euro crisis bushfires, or God help us Europeons.

Switzerland is the one wild card on your list Wolf. IF (big IF) they allowed their currency to float to its natural valuation, I fear they could obliterate the difference with a CHF closer to the 3+ valuation it deserves. Of course that would be a disaster for the Swiss economy and Northern Europe, but in reality a dollar devaluation against the real value of the Swiss Franc as a true shelter from global Central Bank stupidity would terrify everyone.

When you read the comments at WolfStreet , then another approach is needed here .

What will happen when commercial banks operate at quantum level in cooperation with the central bank at quantum level of the economy.

Everyone is terrified when a economic model is making a change to quantum level.

There goes most bankers wrong, ,and I can reasure the banks it is guaranteed upfront if you made a misinvestment.

It is a different perception only quantum shows you investors and bankers how it can be done and not the economic model what was developed before the computer era started.

Don;t blame the central bankers and commercial bankers if they are not familiar with quantum level of the economy

It falls for now under my IPR

The saddest part is that the marginal increase in GDP for every dollar of additional debt decreases as the cumulative debt load continues to mercilessly increase, Diminishing returns as applied via the production function. Dr Lacy Hunt speaks of this often. The central banks continue working their way to ZIRP and NIRP, one county after the other.

Debt build silk roads and skyscrapers .

Descending from heaven can get u presidential election.

It was worth every dime.

But debt can send u to hell.

Tech under attack, because they have no debt.

My biggest contribution to the GDP will be if I will get a heart attack.

What is next nobody know.

What is known is already painted on the chart in colors.

The chart always mimic itself in fractals, or inverse.

The double SPX humps on Jan 2018 and Oct 2018 look like the

2000/2009 DOW.

Currently the SPX is engaged in backups, push ups, to lift itself to the sky.

Dr. Chaos warned us that chart can send u to hell. Sometimes both :

first up in a decoy, like in 1961. From there to the 1962 Cuban crisis low.

China internal debts are very high is because China CCP have been printing more than one trillion Yuan every year since 2006.

Do you know why China able to print more than 3 trillion Yuan a year for the past 5 years, without much inflation ? China has been printing more than one trillion Yuan since 2005.

China able to print such huge trillions of Yuan yearly, with minimum inflation, is because China have US$300-400 billion trade surplus with USA every year.

In addition from 2000-2014, China have accumulated more than US$3.5 trillion in forex holdings overseas. This included US$1.3 trillion in US Treasury bonds making China the largest owner. (but Japan have recently overtaken China and become the largest owner of US treasury bonds.)

Therefore trillions Yuan China printed yearly are actually supported by China trillions in forex holdings and billions in yearly trade surplus.

This trillion Yuan printed every year, allow China to pay for all the expensive infrastructure, such as high speed railway network system, big dams, huge wind turbine farms, country wide telecom infrastructure, vast road network, south to north water transfer canal project,etc.

Also China was using the trillion Yuan printed to subsidise exporters such as Huawei, ZTE, etc.

China able to invest and build such giant infrastructure projects WITH NO NEED to depend on IMF, World Bank and foreigners investment. Don’t you think this is very amazing ?

I have discuss this with very brilliant and knowledgeable economists in the internet forum, and they all did not believe my analysis and observation.

But these so called brilliant academic also unable to explain why and where China get all the billions of Yuan or USD to build such advanced infrastructure for the past 10-15 years.

So there are no secrets of China economic success. It is all due to trade surplus earned from USA, and printed trillions Yuan to invest in their huge infrastructure projects, and subsidise exporters, to ensure can continue to earn trade surplus with US.

Americans consumers are the real suckers all along. None of them benefit from trade with China.

China is addicted to US dollars.

Without US dollars, China cannot print trillion Yuan without inflation, and China economy will collapse.

It is very easy to mess with China economy, just cut off the supply of USD to China.

( yewtaipan@yahoo.com )

So China printed trillions and spent it to build infrastructure, railways, power stations, telco networks, roads, water supply and what not.

Meanwhile the U.S. also printed trillions and mostly spent it to reduce those very same things, albeit in other places, to rubble and dust.

Upon reflection, there seems to be a harmonious (Keynesian?) balance to it and maybe we should stop complaining about our dear leaders.