New York condo prices flat year-over-year. San Francisco, SoCal, Seattle year-over-year gains shrink to near nothing. Las Vegas flat for sixth month. Miami & Phoenix at post-Housing Bust 1 highs.

Spring has come to the most splendid housing bubbles in America, but the seasonal upticks weren’t enough, compared to the seasonal jumps last year at this time. And year-over-year price gains narrowed further.

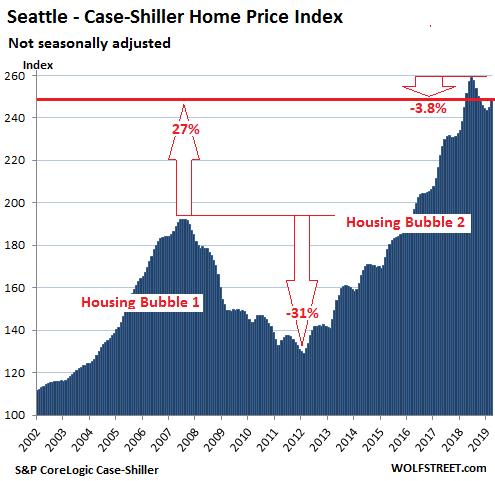

In the Seattle metro, prices of single-family houses rose 1.6% in March from February, according to the CoreLogic Case-Shiller Home Price Index released this morning. But in March last year, they’d soared 2.8% from February; so year-over-year, price gains narrowed further, with the index being merely 1.6% higher than in March last year, the smallest year-over-year gain since May 2012 when Seattle was emerging from the bottom of Housing Bust 1. The index is down 3.8% from the peak in June 2018 but is still up 27% from the peak of Seattle’s Housing Bubble 1 (July 2007):

The Core-Logic Case-Shiller Home Price Index is a rolling three-month average; today’s release represents closings that were entered into public records in January, February, and March.

The index was set at 100 for January 2000; a value of 200 now means prices have doubled since January 2000. Every market on this list of the most splendid housing bubbles in America has an index value of over 200, meaning that prices have more than doubled since January 2000. Having reached a value of at least 200 either during Housing Bubble 1 or during Housing Bubble 2 is the minimum requirement to be inducted into this list.

San Francisco Bay Area

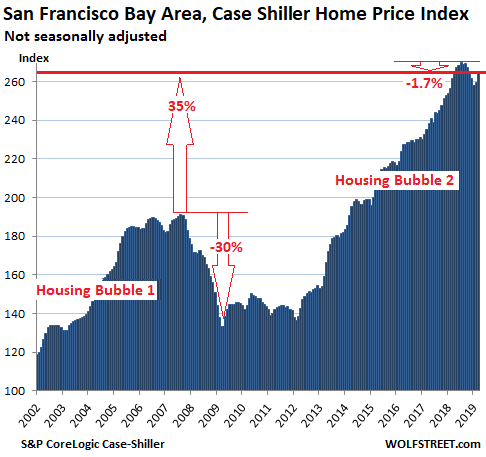

In the five-county San Francisco Bay Area – the counties of San Francisco, San Mateo (northern part of Silicon Valley), Alameda, Contra Costa (East Bay), and Marin (North Bay) – prices of single-family houses rose 2.1% in March from February, same increase as last year from in March from February.

This leaves the index down 1.7% from its peak last July. And the year-over-year gain was merely 1.3%. The index remains 35% above the peak of Housing Bubble 1:

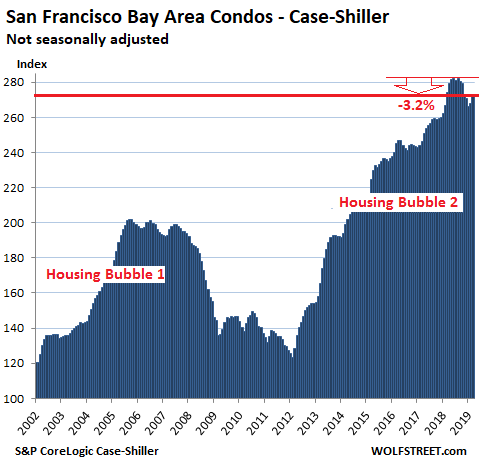

The Case-Shiller index for condos in the San Francisco Bay Area rose 2.0% in March from February. But last year in March, they’d risen 2.7% from February. This has whittled down the year-over-year gain to nearly nothing (+0.39%). The index is down 3.2% from the peak last June:

New York Condos:

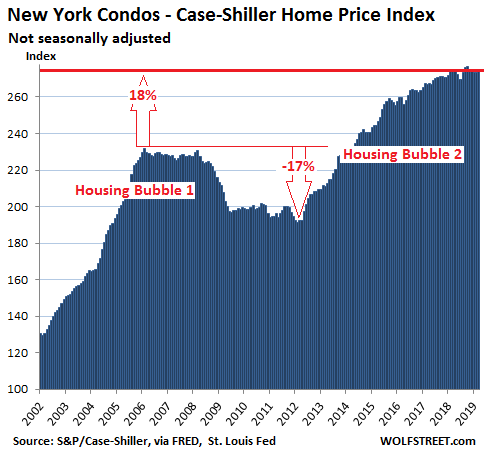

The Case-Shiller index for condo prices in the New York City metro rose 0.7% in March from February and are flat with March last year, with zero price gains over the 12-month period. The index is down a smidgen from the peak in October:

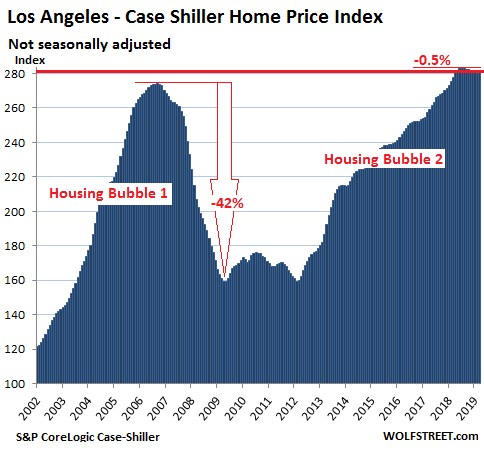

Los Angeles:

In the Los Angeles metro, house prices ticked up 0.5% in March from February. But the seasonal uptick in March last year had been 0.9%. And so the year-over-year gain shriveled further to just 1.3%. The index is now down 0.5% from the peak in August last year:

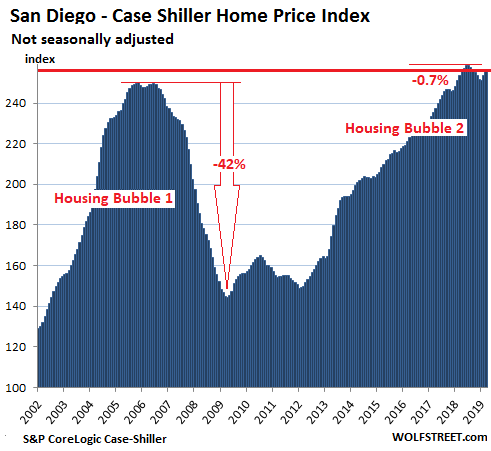

San Diego:

The Case-Shiller index for the San Diego metro rose 1.0% in March from February and is down 0.7% from the peak last July. Compared to March 2018, the index is up merely 1.3%.

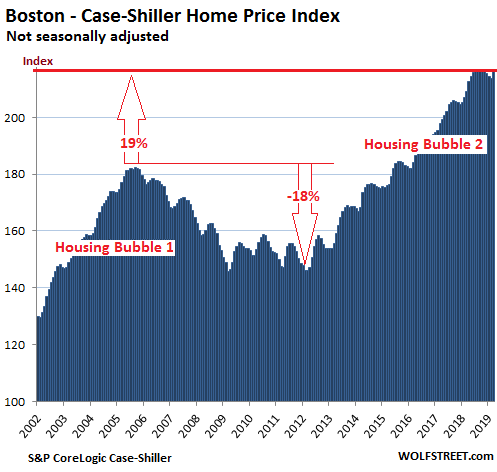

Boston:

The Case-Shiller index for the Boston metro jumped 1.6% in March from February, after having ticked down three months in a row, and eked out a new high by a tiny margin. This put the year-over-year gain at 3.8%. The index has been essentially flat since July 2016:

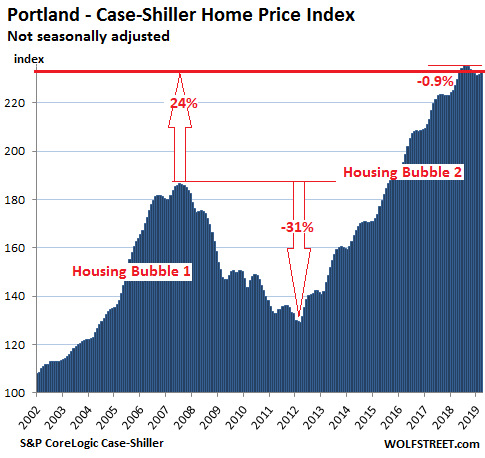

Portland:

House prices in the Portland metro ticked up 0.7% in March from February. But that seasonal gain was half the 1.4% gain in March last year. This whittled down further the year-over-year price gain to just 2.6%. The index is down 0.9% from the peak in July 2018:

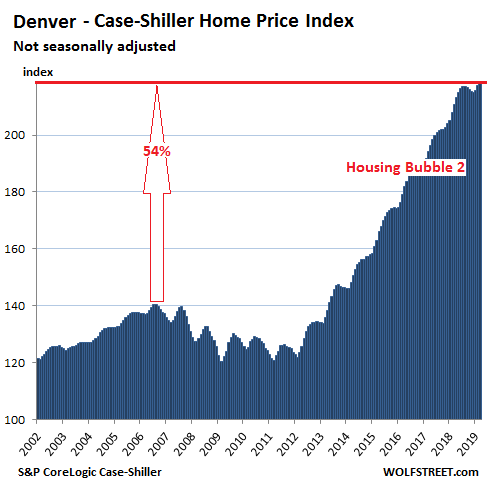

Denver:

House prices in the Denver metro rose 1.0% in March from February. But that seasonal gain was less than the seasonal gain in March last year (+1.4%), and the year-over-year gain in the index dwindled further to 4.3%, the smallest such gain since June 2012:

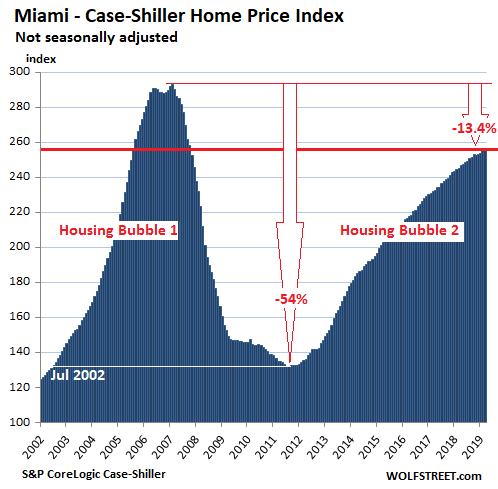

Miami:

In March, the Case-Shiller index for the Miami metro was flat with February. But in March last year, prices had ticked up 0.3%. So the year-over-year gain was whittled down to 4.5%. The index remains 13.4% below the crazy peak of Housing Bubble 1.

Miami was one of the epicenters of Housing Bubble 1 and Housing Bust 1. The index had peaked at 293 in February 2007, indicating that prices had nearly tripled in the seven years since January 2000. The collapse was equally epic. By August 2011, prices were back where they’d been in July 2002. Then it started all over again, but at a slightly slower pace:

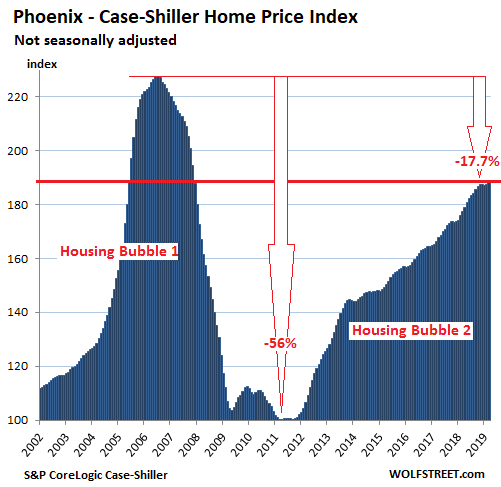

Phoenix:

House prices in the Phoenix metro – the unparalleled mind-bender of Housing Bubble 1 and Housing Bust 1 – rose 0.4% in March from February to a new post-Housing Bust 1 high. But in March last year, they’d risen at over twice that rate (1.0%), and so the big-fat year-over-year gain is slightly less big-fat, at 6.1% (down from 6.7% in the prior month). The index is now only 17.7% from its mind-bendingly crazy peak during Housing Bubble 1:

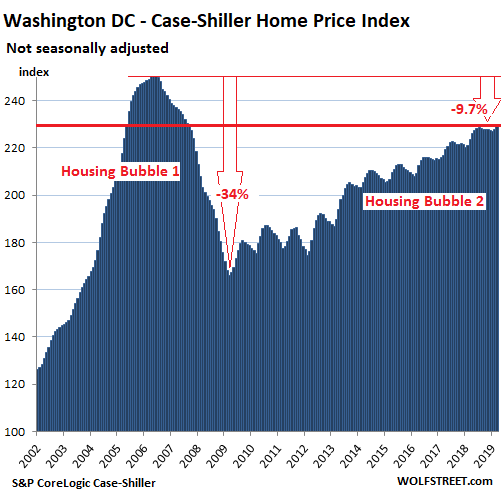

Washington DC:

House prices in the Washington D.C. metro ticked up 0.9% in March from February, to a new post-Housing Bust 1 high. But the gain was below the seasonal gain in March last year, which whittled down the year-over-year price gain to 2.8%. The index is now 9.6% below its ludicrous peak of Housing Bubble 1:

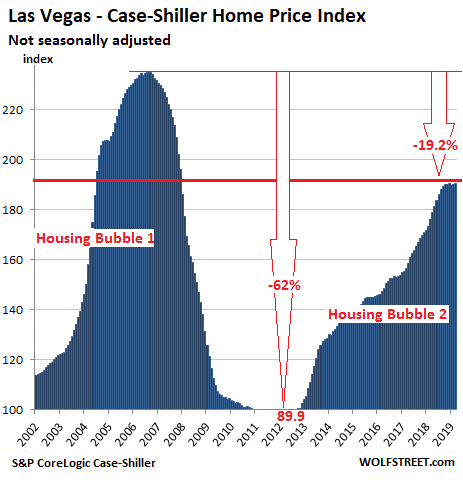

Las Vegas:

The Case-Shiller index for the Las Vegas metro was flat in March, compared to February. But in March last year, the seasonal gain had hit 1.5%. So the year-over-year gain (a fat 9.7% in February) was whittled down to a still fat 8.2%. The index has been essentially flat for six months, after a blistering rise in the first half last year:

A measure of house price inflation

The Case-Shiller methodology relies on “sales pairs,” comparing the sales price of a house in the current month to the last transaction of the same house, years earlier. This eliminates the issue of “mix” that skews median price indices and the issue of a few big outliers that skew average price indices. Since the Case-Shiller index tracks price changes of the same house (sales pairs) over time, it in effect tracks how many more dollars it takes to buy the same house, and thus it tracks the purchasing power of the dollar with regards to the same house — in other words, a measure of house-price inflation.

Where are the foreign investors in this phenomenon? Read… US Home Sales Drop, Drop, Drop Despite Lower Mortgage Rates. But Mortgage Applications Jump. What Gives?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Your a freak Wolf… A machine that never stops reading/writing, love it

Haha

Excellent article!

Dear readers,

Today I revamped this series in a major way for the first time since I started it a few years ago. I changed the definition of what it takes to qualify for this list. The new qualifications are a Case-Shiller value of at least 200 at any time since 2000. This moved four markets – Miami, Phoenix, Washington DC, and Las Vegas – from my “Less Splendid Housing Bubbles” series over to this one. And it moved two markets – Dallas and Atlanta – the other way.

I see you have a Boston data graph under Portland. The Boston data appears twice.

Splendid versus less splendid, you make a me laugh.

Gee, I wish that I could have sold my stuff in even a sub/less than splendid market last year. Alas this place is a dump. It rains every day and rarely goes above 52 degrees. Holy moley, the sun is unobscured for a few moments.

If it ever makes it to 90 degrees my wife will complain about the lack of central a/c in our 120 year old house.

Erle,

Yes, if I can make you laugh with how I present economic data, I’ve done at least part of my job :-]

But guys come on, this is not what timbers is seeing. His boss sold a house and got in a bidding war for a new one! That’s representative of the market as a whole.

Zillow says the split he bought at the trough of the last bubble is worth more. (No $h1t)

This is all the anecdotal evidence you need to know this is going TO THE MOON ALICE.

Yep. And Even Wolf states prices are up not down…did you even read it? No price declines in my area only higher prices in the Boston area. BTW Don’t think 3 yrs ago was a trough. Also, my Boss was on the both the receiving end of bidding and a participant.

So case Shiller isn’t a lie when it gives data you like? I bought in 2015 and it was a much, much slower market. Those prices won’t return ever again, but that buyers market will. I’m not deluded enough to think my equity will grow to infinity, knowing the plight of the American middle class.

Growth is slowing to a near halt, negative turns are next. Market is much slower in the same Boston for me. Price cuts, multiple open houses, all to chase one below asking price offer. Anyone can ask a price, doesn’t mean they’ll get it.

The REALTORS I know all tell me the market has slowed and bidding wars are the exception, not the rule here.

SC7,

In the Boston metro area, both single family home sales and prices are up. This is well reported. Your comment “the market has slowed” contradicts industry reports.

@socaljim

The sales spike is one month, I need more data to see that this has truly reversed the trend that was set in motion around September/October of last year.

Prices are growing, but the growth has slowed. All of this on the back of significantly lower mortgage rates this time last year, and after a year of 3.6% wage growth.

The possibility of a modest price correction seems all but likely if we head into a recession. Price growth overshot wage growth in this area a bit too far since the buble recovery (10-15%). Boston won’t suffer anywhere near what Denver is gonna see.

The insane housing prices in Seattle were an extreme spike upward due to almost no supply and an outrageous demand. The whole markets needs a downward price adjustment since only the very tippy top of home buyers can afford anything close-in. However, the sub-markets like Everett, Tacoma, Bremerton, Olympia, Marysville, etc. are seeing booming time since they are still somewhat affordable. The spike in the Seattle/Bellevue pricing was not caused by speculation, as was the case in the giant housing bubble of the mid to late 2000’s, but rather a bad case of supply and demand in favor of the property owners. This surely is not defined as a bubble by any means, but rather a case of run away spot inflation.

Things should be easing now that people are note immigrating to Seattle like they used to. People coming from other states simply won’t pay the home prices, unless they are coming from California.

In short, you are claiming that the seattle bubble was not a bubble, not in 2007 and nnot ow in 2019. That’s just nonsense and propaganda.

Read what I said to understand it. The 2007 bubble was caused by irresponsible lending practices in combination with massive speculation by so called investors. This particular housing problem in the Seattle/bellevue markets has nothing to do with the cause and effect of what happened in 2007. The current Seattle area housing issue is the result of restricting the availability of land, utilities, and zoning so that the supply of homes is extremely limited. This ineptitude has resulted with a higher than normal demand, due to big time job growth, being saddled with very high prices caused by the lack of supply. The housing market is out of balance favoring the sellers side of the equation, not a bubble with a huge housing supply being purchased by unqualified buyers, or speculators.

He is mostly right. The Seattle supply in early 2018 was nonexistent. However, the sensitivity of the market to a not outrageous mortgage rate increase makes me think this is bubble-like.

LessonIsNeverTry – The interest rate increase was outrageous. Rates jumped from 3.5% to 5.2% within two years. A 50% increase in mortgage rates dramatically increases the cost of financing a house. Add to that the increasing house prices and the change in tax deductions and the cost of buying a house on the coasts increased dramatically from November 2015 to November 2018.

I do not believe these markets are in a major bubble, but at the very least there should be a 15%-20% correction to reflect changes in interest rates and tax deductions.

Demographics are also another consideration here. Big cities had the best job prospects coming out of the the Great Recession in 2009-2012 so many millennials flocked to cities to find worked. Now that second tier cities have recovered I’m seeing people leave the big cities to move to more affordable parts of the country. Net migration has gone negative in most of the cities on the above list. Can’t be long before inventory skyrockets and price plummet in all of the major cities.

The rates at the peak in Seattle (mid summer 2018) were ~4.5%. They increased to ~5% for a brief period of time. You may call that an outrageous increase but I don’t. Yet it was the most reasonable explanation for the sharp pullback from the “blow off” top the Seattle market experienced.

I agree with you on the demographic trends and city dynamics. Seeing it all over. I was shocked the other day when pulling up home prices in 2nd and 3rd tier cities in nice areas!

I see the videos of the fairly large areas that the “homeless” congregate upon.

Has anyone done a study on burrowing below the surface of the open areas to provide nice skylight lit housing? If you ever get sun you have free heat and if it is too warm you can draw the blinds.

Interest rates dropped full percentage point in just 6 months. Soon they’ll be paying me to take on morgage.

In the Netherlands , 1 year mortgages are (-.23) %.

Please explain to me how that works as I can’t imagine it. Is the government the lender? Are the fees charged for origination high to make up for negative interest? What restrictions possibly go with this loan? This just seems crazy. Thanks.

That’s a good idea. If my interest rate goes negative, I won’t need to worry about petty things like price – I can purchase anything. In fact, the higher the price the better.

Too bad QE was set up to limit free money access to our overlords in big government, big banks, and big corporations.

Small error Wolf. See Portland graph.

Thanks!!

You omitted one of the strongest markets in the U.S. – Tampa. The migration from the Northeast and Upper Midwest due to 1) age demographics, 2) the tax bill’s affect on residential real estate ownership, 3) unfunded state liabilities in the aforementioned regions, and 4) the high prices of residences which can be sold in those regions, are all driving older, affluent citizens to Florida.

DCR,

The Tampa index moves in near lockstep with Miami, just on a slightly lower scale. So I didn’t think it was necessary (pile of charts already). Anyway, here it is:

Two thoughts:

1) Large bubbles don’t collapse overnight and everything is local. Last bubble, much of California peaked in fall 2005… national peak was years later. Stock market peaked in fall 2007 but we didn’t get into crisis mode until a year later. So you’ll still have some bidding wars and local crazy patches well after the peak has set in.

2) Speaking of peaks, it’s about time for a FANGMAN update, is it not?

This is a good point. For years many people have viewed houses as a license to print money, regardless if they are investors or mere owner-occupiers. It will take a while for a clear trend to emerge. But I have to say some of these cities may see a quite breathtaking abrupt reversal based on current prices. Denver, CO stands out as the most absurd bubble that will be ground zero for a dramatic collapse in housing prices. Denver is Las Vegas this time.

Eamonn Harter – Las Vegas is unique because it’s economy is completely dependent on tourism which took a major hit during the recession. Denver has a fairly well diversified economy, it’s a very desirable place to live, and the median priced houses weren’t impacted by the tax reform act.

The biggest losses in this recession are going to be major high price/tax coastal cities. NYC, SF, Boston, and LA are going to be the biggest losers in my opinion. Net migration losses and high impact from tax reform act.

What do you predict the price correction to be in Boston? I’m seeing 10-15, maybe 20%.

sc7 – I think Boston could go down 10%-20%. Anywhere that has a huge supply of mediocre $1M shacks and high tax rates is going to take a pretty good beating.

NYC and LA might be in the 30%-40% loss range.

Good idea, concerning the FANGMAN :-]

Sitting on the side lines in a desirable part of PHX for several years now just watching this balloon slowly inflate. I keep thinking it will stop, and yet the insanity continues. My wife and I do fairly well, and I can’t seem to figure out how so many others are purchasing homes at these prices. We could but things just don’t seem right. Maybe they’re CA transplants because there are quite a few of them here. But then when you read about corporate, public, and private debt levels it just makes me really cautious about diving in now. Feels like it did in 06 when coworkers were buying houses, and I was thinking they were nuts then.

I guess we’re committed to waiting at this point cuz something does smell right ..

A guy I know/knew has taken off for Arizona.

On NPR today they said the “housing slowdown” is “officially a year old now” so … whatever that means.

..Hard to figure out what anything means on NPR.

I was in central Wisconsin this past weekend. There are eight NPR stations within reach all with the same blather on womyn complaints and racial crap and how to cook with cannabis.

The rest of the radio spectrum is modern “country music” or 80’s rock crud. I do enjoy the show on word derivations but that is only carried by NPR but independently produced.

NPR is mostly insulting twatter and has almost nothing on even half serious econ.

Yep nothing but twaddle on NPR, useless stuff like the BBC World Service, lots of investigative journalism, some the hardest right-winger would be in favor of like the fake drugs from India scandal, the McNiell-Lehrer News Hour, important speeches by politicians, debates held by the Commonwealth Club and other groups … yep just lots of fluff.

Haven’t heard any cannabis recipes, maybe they only run ’em at 4:20 in the afternoon and I’m always in the bathroom or something.

It could be that you’re listening to a lot of college stations, or you may have a lot of KPFK/KPFA type stations, those guys get pretty fringe. But where I am, NPR is really solid.

Yet another reason to avoid flyover country.

Had to comment on NPR: for news forgettaboutit! (that pointedly since the “First Persian Gulf War” under GB the elder) But there is “Masterpiece Theatre” and some good nature shows.

Almost all of your friends and acquaintances who have bought houses recently have only put 5-10% down. Believe me. And probably closer to 5% in most cases. With loans up to 50% DTI. Things don’t seem right because they aren’t.

Completely agree. Things don’t seem right because they aren’t. And the most frustrating part of this true statement for me is: It may not matter to price! If MMT/QEInfinity take hold it is truly uncharted territory. Things may simply get worse for non-homeowners, not better, despite (or because of) the lunacy.

The low down payment is the norm from top to bottom, the 20% down is a myth. The exception is those cashing in stock options for down payments and who own there current home outright and sell along with those who have inherited from a SV relative. Most likely 95% of new mortgages in the are 5 to 10% down range with the bulk along the coasts.

Ron – 20% of sales in DC last year were ALL CASH. At the peak, 33% of sales were all cash. The booming stock and real estate market alone have minted so many millionaires that 1 in 5 people are buying shacks with no financing.

Most of the country is on the path to hyperinflation in housing.

Ed-

Source?

Eamonn – Please read the below article.

https://dc.urbanturf.com/articles/blog/20-of-homes-sold-in-dc-in-2018-were-all-cash-purchases/14845

The amount of liquid wealth sloshing around big cities is insane. We are not in a bubble. People are flush with cash right now. Jacking up interest rates 50% and changing the tax laws are certainly going to temporarily hurt the high end, but I see nothing stopping hyperinflation in the 2nd and 3rd tier cities.

Abomb – There are a lot of rich people and not many nice places to live. 95% of the country is a total dump and the 5% of the country that is nice is prohibitively expensive. It makes total sense.

Your neighborhood is probably fully built out/established and there is no room to add material supply to meet demand. In a city the size of Phoenix, there are thousands of families earning $400K+ per year competing over a limited supply of houses in desirable areas. Add to that equity locusts and rich people from cold weather cities buying vacation houses.

We had a similar experience in DC. We couldn’t believe that so many people could afford $1M+ houses until we had kids and started meeting a lot of other families in the neighborhood. Everyone we have met legitimately makes over $500K in the hood we live in. Add to that inherited wealth. Turns out people are just way wealthier than we assumed and they all cluster into the same desirable neighborhoods.

I don’t think there is a bubble anywhere. There is a legitimate scarcity of nice places to live and a excess of people that have a ton of money. I believe that prices should correct based on interest rate fluctuations and tax law changes. It makes total sense that California, Seattle, and NYC are slowing down while nicer hoods in PHX are still full steam ahead.

There is probably something too this, although I find it a bit difficult to believe so many people are willing share their 500k+ income numbers with others!

We tend to think in percentages and know that a 225k+ income is still a high percentile. Even in Seattle! And yet they seem to be everywhere. The absolute numbers are bigger now because of population and the built out neighborhoods are the same. Back to the “they aren’t building any more land” rule of thumb… and it is certainly true in desirable cities.

The only people that have told me how much money they made were trying to impress me or sell me something.

I never believe any of them.

Lesson – That is the beauty of google. Google somebodies name and linkedIn profile usually pops up which tells you the company they work for and title. Google the position they have + salary and you get a good range for what that person makes.

$225K is a pretty modest income for a family of four. i don’t think you would even be in the top 20% in family income age 35-50 in a major metro area. Median household income is heavily skewed by young and old people and immigrant families. In a desirable hood, $225K is probably under the median family income. There is a big difference between renters and home buyers. Home buyers earn signficantly more than renters on average.

Well, if you throw out enough of the lower income people, I bet the median income can be a million dollars!

Fun with statistics!

Harrold – Indeed! On my $15k a year, I’m not counted as unemployed, and I’m not counted as an employee. I’m actually considered a small business.

So some bored housewife makes $15k a year selling Lulu Lemon and I make $15k a year working for my friend and it’s all considered fine, except that $15k is my WHOLE living right now.

So you can make the economy look just peachy by simply not counting the legions of people like me.

Bingo. We thought it was bad in 2000 overpaying for an as-is needs work disaster. Now our son wants a house in the town he grew up in, any condition, but it’s one of ‘those’ areas. Established, good schools, on highway and commuter rail to Boston. He’s screwed, competing with house flipper cockroaches, bidding wars, escalation clauses in offers, every wealth extraction rip off game imaginable. The only thing not selling is overpriced crap, luckily a lot of it regurgitated with crap Home Depot renovations and being sold by the cockroach flippers. We need a vicious punitive short term capital gain tax on these scum bags yesterday, they get in and out in the sunshine market and stick the inter-generational long term debt on the buyers in an economy on the edge.

Wolf thank you so much for explaining how the index worked. I was unable to understand how these indexes worked. Being in Miami having experienced the Bubble 1 the Bust and now Bubble 2. Our prices of new single family homes are much higher than 2007. Land, materials, and labor all cost more than in 2006/07.

The sale new infill homes on waterfronts and in desirable in neighborhoods Miami have slowed. The higher price points IE higher $/sqft in those neighbor hoods are moving. There is still a lot of

new building taking place. The inventories are building. Most people are building without or with little bank financing. So there is much more cash in the deals than in bubble 1. Still at some point the rubber needs to meet the road for the market to clear the supply. It doesn’t look like we are going to get much flight capital from South America to help things clear. The strong $ is killing the market. The so called NE tax haven buyers I keep hearing about are here but have not struck us yet.

Will keep you posted on further developments.

Could you breakout a Miami Condo chart. I hear from my trade the condo work is slowing and not many new projects are coming out of the ground. Anecdotally, we have a lot fewer crane sightings Downtown and in the new urban Brickell area.

Thanks for your great site

Case-Shiller only offers condo data for five metros. Miami is not one of them. Sorry :-]

No, 95% of the U.S. is not a dump the housing may not have granite countertops and marble bathrooms but the housing is more then adequate. The race to look modern or updated is a veneer that quickly fades.

Ron – I wasn’t referring to housing stock specifically but rather criteria that make a geographic area or neighborhood “nice”. For example, my criteria are : great schools, great outdoor amenities, strong local economy, happy and healthy residents.

Every city/region has good and bad areas but the bad areas far outnumber the good ones. The ratio is somewhere around 20:1 based on my travels. If you factor in “bad” weather, entire regions are totally unlivable in my opinion.

America is a dump. There are tiny pockets of nice areas sprinkled across the country but the vast majority country is total crap. Take a long road trip and randomly stop at a gas stations and check out the people. Ride an Amtrak along the Northeast corridor. The people and boarded buildings are straight out of a Steven King novel.

How do you measure happy residents?

Ed – you must actually go out and explore once in a while. It’s refreshing.

I think your premise is faulty. 95% of the country is clearly not a dump, and the regions you think are attractive are shunned by many others for various reasons. Good jobs can be round all over the country, and every city has a nice part of town that wealthy people find attractive.

I’ve lived all over the country. Personally, I think the East and West Coasts have some big drawbacks, aside from housing prices. The traffic is nuts. There is no community feel. The coasts may be a “melting pot”, but the ingredients are sticking together and not mixing. Also, there is a focus on material wealth and showmanship that gives these communities a superficial desperate feel that will wear on you over time.

Every place has its attractions. A better way to express preferences is to simply say it would not be my first choice.

Although, about 15 years ago I drove through the 4 corners area, mostly to visit many sites mentioned in Tony Hillerman books. I remember seeing 50 year old mobiles with air conditioning units the size of shipping containers on their roofs. With not a drop of shade, maybe 120F in the afternoon, even that oft stated ‘dry heat’ didn’t tempt me to move. :-) But I understand the sunsets are to die for.

Bobber – So what do you believe is the ratio of nice to bad areas in any given metro area? How do you classify the dead areas between major cities? The majority of the country is dead space between major metro areas that are filled with small economically disadvantaged towns and little or no natural beauty or desirability.

I believe 20% of any given metro area is “nice” and most of the dead space in between in pretty awful. No way in hell more than 5% of all zip codes in the entire country are places you would consider living.

A $500K / year income places a household well within the top 1% of IRS returns (as of 2016, the latest data available). Of course, if a couple files separately (e.g., $250K each) then a lot more households could have $500K incomes.

But even if all filed jointly, that means at least 3,000,000 filers have that income. And they will tend to congregate in the same areas.

Ed, what do these people do to make 400k per year? That is far more than I get for owning a productive shop with two million in equipment , five hundred grand in depreciated buildings and no debt.

We can choose our customers and do not have direct competition for the most part because of our quality and price.

I find that much of the FIRE economy is unsupportable without artificially low rates. A very large proportion of these high earners are goomint grifters and “services” such as monopoly medical rackets.

Erle – Here are occupations that pay more than $400K if you are looking for a career change

Executives

Lawyers

Doctors

Management Consultants

Tech Sales

high end real estate agents

real estate developers

senior (director level) generic positions at mid-sized and large firms

professional athletes

Ed,

Sure, there are some lawyers that make over $400K a year. But the median pay for lawyers is $121K, according to the BLS, meaning that half the people who work as lawyers make LESS than $121K. And for the other half, from $121K to over $400k is a huge leap. You’re talking about a select few how get over $400K.

https://www.bls.gov/ooh/legal/lawyers.htm

I know a bunch of lawyers. Three of my best friends are lawyers. I don’t think any of them ever made anywhere near 400K. One of them is barely scraping by.

Don’t feed the trolls.

Ed – I do “tech sales” I photo, describe, determine price, deal with customer offers, bill, pack, ship, etc. I have to know a fair amount about tech and be good at researching as well as a decent photographer and being able to bang out ad copy.

I make $15k a year. So much for tech sales.

Seems to me everyone moving to the Phoenix metro is an Illinois refugee. Lots from the west coast too, but I swear everyone I meet is from a Chicago suburb. I’m noticing entire neighborhoods getting torn down near the older desirable areas (Arcadia, South Scottsdale, Encanto, etc.) to make way for new condos or the same white and gray housing developments with insane HOAs. I used to rent a condo south of Arcadia for years until the flippers came in to buy up all of the little 3/2 ranches for over 200k each, gut them, add a few hundred s/f, then list them for 400k+. My rent went up 50% over 4 years until I gave up and moved to Mesa.

This is also what I’ve observed in Denver. The number of people here from IL, and Chicago specifically, is absurd. First supervisor at my last job was from Chicago. His replacement? From Chicago. Illinois license plates are everywhere (how nice of all these Chicago people to pay lower Colorado taxes, but not pay their share of higher CO vehicle registration fees).

I think the mass exodus of people from IL is a serious factor in driving up RE prices in a lot of western cities.

Tampa Bay area has risen around 70%, since the 2012 bottom, and I am seeing multiple price reductions , especially on the high end. But even $175,000 homes aren’t moving, if they should be $150,000. My MLS has 1000 new homes listed in the last 24 hours, supply is definitely increasing rapidly, so prices have only one direction to go , DOWN!

A trade war with China resulting in strict capital controls, a stock market crash with those companies with the highest p/e hardest hit, a recession and super high housing valuations will all combine for blood in the streets of the real estate market.

What the data does not show, is that Concessions and Incentives increased, making the net after seller paid or contributed costs, lower.

Example a home that sold for $300,000 but the seller paid costs for the buyer were $9,000, the net price in terms of Market Value {as defined{ is $291,000.

National data retrieval systems do not include this level of information.

Which means that the actual declines are higher.

Thank you, I was just about to add the same comment. As an HOA president (I know, boo hiss, someone had to do it, long story), I am sent a copy of the settlement sheet. My neighbors have been very happy with the increasing home prices and fast sales. I don’t have the heart to break it to them that the seller credit is often well into five figures. For the most part, this means the home prices are flat.

Something else to consider regarding asset bubbles like real estate and stocks:

When the Fed responds to any economic weakness, don’t expect to hear about hawkish gradualism. And yet, wouldn’t be surprised to see a .50% cut right from the start on the way down. Not sure it will work as good as they used to with no options China wiping our arse in the trade war against us who supposedly hold all the cards added to the reasons we keep giving other parts of the world to move away from U.S. products (Boeing, LGN, ichPhone, 4G).

BTW, China absolutely should get rid of all herU.S. treasuries. Not because that will damage us, but to protect herself for American theft. The U.S. will seize and steal her Treasuries just as we have of other nations U.S. assets. They are not safe. All nations should divest form U.S. assets IMO given our recent illegal seizure of foreign owned assets.

The worse housing bubble in the world is probably Hong Kong. There is a rush to mark down prices:

https://www.scmp.com/property/hong-kong-china/article/3011952/hong-kongs-housing-market-sentiment-cools-us-china-trade

Investment advisor James Stack predicted a US real estate market downturn several month ago:

https://montrealgazette.com/real-estate/housing-bear-who-called-2018-slowdown-says-worst-yet-to-come/wcm/845e8498-477e-496b-aaec-98a4d96fce48

I am seeing a change in SoCal market conditions. The low interest rates has caused good areas priced under 1.2M to become quite heated. Properties are going fast. But, still above 3M, and especially above 4M, things are SLOW. 2M is the line between hot and cold. This is a Jeckyll and Hyde market, something that I have never ever seen. The surge of activity below 1.2M relative to the high end will definitely skew statistics reported next month. The surge of low priced sales combined with 3M+ slow market conditions will drag down the average price even though prices are grinding higher on most homes.

Same thing in Seattle, at least Eastside. Shift the numbers down to 950k and the same experience is true. Anything below is in a bidding war. Anything above tends to sit. Not forever. High end isn’t locked up, but dramatically different than low end.

I have to say…. the split market sure looks like a dead cat bounce!

SocalJim – The high end is obviously enormously impacted by the tax reform change. Smart money investors are exiting the market.

Unemployment is still low and houses priced under $1.2M are affordable to wage slaves. Any uptick in unemployment will start to crunch the low end. Recession indicators are pretty strong. Probably a bad time to buy any type of housing in California.

Grind higher until they hit 2 mil( the price ceiling you are seeing). Then they will buckle and repeat. The buyers aren’t pushing the market up anymore, just bullish realtors desperate for higher commissions trying to move the goal post.

praires, the price ceiling I am seeing is about 1.8M. 1.2M to 1.8M is a decent market. Below 1.2M is hot. 2.0M is OK. 2.5M is chilly. And, 3M+ is having a problem.

How much do you have to take home to afford a million dollar house? And then, who has this earning power?

The dopes that actually make the stuff that these high earners rely upon cannot afford anything near those prices.

Good luck when the hard recession rolls in.

I don’t particularly care if they default on their million dollar 1400 sq. ft. dwelling with no garden space.

Erle – A couple earning $180K will probably get approved for a $1M house with 20% down. The mortgage payment will be around $3,700, which is easily covered by the $10K+ in after tax income.

Ideally, you probably want to be making at least $400K to buy a $1M house. There are more than a million $400K+households in California. There are also probably thousands of nonresident millionaires and billionaires that own property in California.

Socal is special.

I own a home , I feel prices would never be lower here. This time is indeed different.

Home prices have nowhere to go but up in socal.

It raised more than 100 percent in last few years and now the rate of annual rise is still up.. it’s not going down YoY.

When it goes down YoY, then wake me up.

Just chant after me: SoCal is different. Home prices here have nowhere to go but up.

SocalJim you either speak with realtors often or are one. All your comments do not validate current market trends here in Southern California and after firing my last realtor I have a keen sense of how realtors operate. Truth of the matter is that California housing is under performing and forecasted to continue declining. I do not wish any bad to those in the real estate industry but why continue ignoring the market as it is? Spinning and ignoring the truth doesn’t help anyone.

Blanket, to be honest, I only know the coastal regions. SoCal is much larger than coastal, so my comments may not include your area.

So taking the Seattle graph we see in the index started at 110 in 2002, and went to about 250 by 2019, a period of 17 years. In that time we had a big upswing and downturn, but a compounded return of about 4.5% for 17 years.

17 years from now, we can also expect about a 4-5% return, or about 1% above inflation. There will be cycles, and best times to buy and sell, but I am sorry, I just can’t see why people get so excited about this stuff. Similar to a sailor or fisherman watching the tides, they have seen this before, but to the more excitable city dweller I guess it is possible to think that low tide will keep going out until the ocean is dry, or high tide will continue to the top of Everest, but it just ain’t so. The tide may be going out in real estate, but as Sam Zell once famously said, as long as people keep f*#&ing, there will be increasing demand for real estate in the future. That is a most splendid observation.

Lots of reasons people get excited by this Wendy:

1. If you buy at a top you don’t get a 5% return.

2. If you buy at a top you are exposed to significant risk on a highly leveraged investment.

3. If you buy an expensive market you better hope you aren’t forced to move/sell because of life changes, health, or recession in the short term.

How many people live in their homes for 17 years? I can’t think of many these days.

I have been in my uptown Toronto condo since early 2000.

Wendy, Sam Zell wasn’t shy when he did the F****** of the pension fund of the mopes at the Chicago Tribune.

Put in two cents on the dollar to leverage the buyout and then have the pension assets. Smooth move.

I don’t see a bubble in these charts. I see Eiffel Tower patterns in bubble one, where we have steep slopes, reaching peak value in 4 years. Housing Bubble 2 has more gradual slopes. 2011/2012 is the bottom and now, 7/8 years into it we’re seeing what looks to be stagnation (time will tell). Moreover, when we consider the fact that on an inflation-adjusted basis, housing bubble two is below where we were with housing bubble one, it’s difficult to declare, definitively, that a hard and fast decline in home values is on the horizon. As a young person who rents, I want nothing more than to be able to purchase at significantly lower prices in the immediate future, but I just don’t see that happening. I guess I will continue to rent like a chump until I am able to afford to buy.

Meanwhile the 10 year yield dropped 30 basis points in as many days. It would not want to do that too often in light of where the 3 month stands.

That is very interesting. The curve is inverting at a time when inflation is at the higher end of its range, and the Fed may be reluctant to reduce the short-term rate. In the not too distant future, we may be seeing an abrupt end to ponzi finance theory, not because the Fed came to its senses, but because it got cornered.

https://nahbclassic.org/generic.aspx?genericContentID=194717

Looks like about 13 years

Is it a bubble? or is it a path toward homelessness for the bottom 50 percent?

What a sad a scary thought with most likely and unfortunately a serious dose of truth. For the last few years I’ve often thought that with the next crisis folks will be lining up half a dozen deep at various street corners for panhandling spots. As Theoden, King of Rohan said: “how did it come to this???”

BenX – Homelessness will certainly rise but are houses actually unaffordable? I’m looking at 2nd and 3rd tier cities where houses and condos are insanely cheap.

The median houshold income is around $72K or about $4,000 after tax. The median house is around $300K or a $1,200 mortgage payment with 20% down. Isn’t a $1,200 mortgage easily covered by $4K in income? Why does anyone think we are in a national housing bubble right now?

100%, this is different than last time, as it’s a localized bubble in overheated coastal cities.

You’re assuming that a couple making roughly 35K each can afford a $60,000 down payment on a house. More likely they get under $15K, and will end up paying around $1800 a month with insurance and taxes. These days the average slave has a $500+ car payment. So there goes another $1000 a month. Add in your multitude of other insurance policies, and there goes another $1000+ a month. You still have food, those iPhone leases, those student loans, and all your other utilities eating up anything that might be left. The rest goes on the credit card to roll over month after month…and so the cycle perpetuates itself. So no, for the average sucker, I don’t think that mortgage is easily covered…

>$500/mo car payment

Anyone who does that to themselves on less than $120k a year deserves what they get

Ripp – People making $35K probably aren’t college graduates therefore do not have student loans. What kind of insurance policy adds up to $1000 per month? Are these people leasing BMW’s or Kia’s? My budget is very realistic. $1,500 total for housing, $700 for cars, $600 food, $300 phone and misc utilities. $900 left over to save or blow.

Houses are fairly valued in the majority of the country. As sc7 said, some of the expensive coastal markets should get hit by out migration driven by tax reform changes. The average Joe doesn’t even understand tax reform changes and itemized deductions so that segment of the country won’t be impacted at all. I

Ed,

I’m just giving you an example using your numbers. Median personal income is $35K regardless of education.

50% of young people have student loan debt. Something like 15% of parents have student loan debt for their kids. You don’t have to have a degree to have student loan debt.

Health insurance alone can cost over $1000 a month for a household.

I’m glad you’re smart enough to live within your means, but the average Joe isn’t. Personally, I would never go past a home price to income ratio of 4. That’s just me, and depending on where you live, you might have lots of options within that range.

I’m just saying that a household making $72K really shouldn’t be buying a $300K house unless they’ve got the money saved up and little to no other debt.

Where I live (Boise, ID), the median household income in 55k, the median home price is 300k. People with a couple of kids cannot easily scrape together 20% down.

Nor can they afford to get into bidding wars with people from other states. Renting is becoming out of reach as well. A couple of months ago a company from San Diego bought an apartment complex here and raised rents by 40%.

If your rent skyrockets, it hurts your ability to accumulate a down payment.

IdahoPotato – A 40% rate increase seems extreme, unless the apartments were significantly priced under-market prior to sale.

I’d be curious to hear what has happened to occupancy in the brief time that the price increase occurred. If this complex’s prices are now unjustifiably out-of-whack with market, the problem will take care of itself.

IdahoPotato – Median household income is irrelevant. The 85 year old granny down the street living off $25K per year isn’t in the market for a $300K house. Neither is the 25 year old pizza delivery driver working on his master degree. What is relevant is the median income of people in the market to purchase a $300K house. Which is obviously much higher than the overall median of $55K. Homebuyers earn more than renters and nearly 40% of households are renters.

Sitting on the sideline I wonder that myself….and if there’s a recession and loans lock up is big business going to swoop in and buy all the properties. Things are f#$&Ed up.

Ed,

Those percentages seem about right for people in the upper income or wealth bracket. Only 20% of the areas in a big city are acceptable for the upper income types.

I have to note, however, that even though nice areas may only 20% of the total, upper income earners are only about 20% of the total, so the demand is limited as much as the supply and things balance out. I don’t think there is any kind of nice housing shortages unless we are talking about San Fran or Seattle where land is limited.

Also, I see a ton of tear-downs these days. Once shabby neighborhoods within a reasonable commute to good employers are being torn down and re-vitalized into attractive communities. Assuming this continues, there is a lot of potential new housing supply within the city. Plus, we are seeing a trend towards condo living take hold, which mitigates the land supply issues. I hear there are tons of new condos going up in San Fran and Seattle – perhaps more than the market will bear.

“Once shabby neighborhoods within a reasonable commute to good employers are being torn down and re-vitalized into attractive communities. Assuming this continues, there is a lot of potential new housing supply within the city.”

Totally. But the process would be much more agreeable if there were an app we could use to instantly move all the differently-hued, differently-educated, differently-networked, and differently-wealthed people who do the unpleasant low-wage jobs beneath our station out to Manteca where they belong.

Bobber – Gentrification is certainly happening, but the schools in these areas are terrible. Once you factor in quality of public schools, there is a massive shortage of housing demanded by wealthy people. These types of neighborhoods are completely build out with large houses on large lots. All prime real estate has long been developed and the population continues to growth with the economy minting an increasing number of millionaires each year. Each year there is an increasing number of wealthy people competing over a fixed supply of housing in desirable areas.

This is my first post and I want to thank you Wolf for such an excellent website. I was compelled to post because I do not agree with your view on nominal vs. real housing prices, but I do agree that affordability is a good measure. I looked at mortgage vs rent affordability, which I believe is the biggest factor in determining whether housing prices are out of alignment (in a bubble). The only areas in the San Francisco Bay Area that I was able to find data on quickly were San Francisco, San Jose, and Vallejo, so I used those to create an average. The data for mortgage affordability assumes a median priced home, median income, a 20% down payment, and a 30 year fixed interest mortgage. Rent affordability takes into consideration median rent and median income. I found some very interesting results. To not bore you with all the details, bottom line is that the difference in the average mortgage and rent affordability for these three cities is currently around 2.5% (mortgage takes up 2.5% more in median income than rent). In the 2006 bubble the difference was almost 10x more at 24.9%! Clearly housing prices are not in a bubble, they are simply a reflection of high demand for housing in the San Francisco Bay Area, both in terms of buyers and renters. Worst case scenario and Silicon Valley collapses like it did in 2000, then the drop in demand for housing can definitely create a drop in housing and rental prices, although looking back to 2000 housing prices had a small correction in pricing while the rental market took a beating and rental affordability peaked. So bottom line, based on what people are currently getting paid, IPO’s, accessibility to 20% down payments, etc., I believe housing prices are currently not in a bubble, but there is a strong argument that rental prices are and will potentially take the biggest hit during the next recession.

This housing market will stagnate for a while until the sellers blink. Currently, sellers are thinking their 2500 sqft house from 1970 is still worth 1.5 million—basically the same price as a larger new house built by lennar or toll brothers, albeit minus a yard which no one really cares for nowadays.

We are actually ready to buy in San Ramon but will wait to see how much further these prices will drop. It seems like the builders are more willing.