Impact felt by the real economy and the most vulnerable consumers.

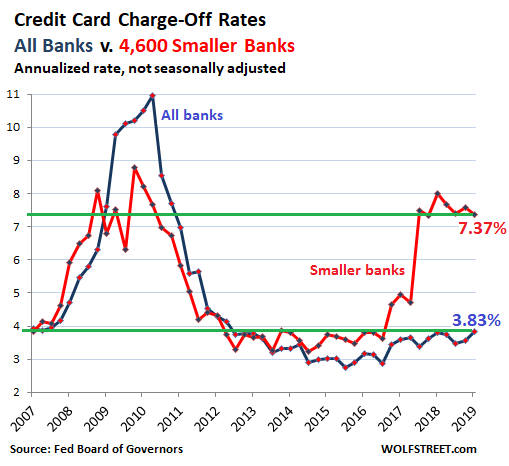

In the first quarter, the credit-card “charge-off” rate at the 4,650 or so smaller US commercial banks – all banks other than the largest 100 banks – ticked down to 7.37%, the sixth quarter in a row above 7%. During the peak of the Financial Crisis, the charge-off rate at these banks was above 7% only four quarters, but not in a row, topping out at 8.9%. These smaller banks have taken a lot of risk in their credit card strategies in recent years, going aggressively after subprime customers that had run out of luck at the largest banks.

The credit-card charge off rate at the largest 100 banks rose to 3.78%, the highest since the first quarter of 2013. For all commercial banks combined, the charge-off rate rose to 3.83%, the highest since the fourth quarter 2012. The largest banks have learned a costly lesson during the Financial Crisis, when they got hammered with double-digit charge-off rates and have since focused on customers with lower risk profiles. And yet, slowly but surely, credit card charge-offs are rising across the board:

These data points that the Federal Reserve Board of Governors reported Tuesday afternoon are another warning in consumer land where serious auto-loan delinquencies, driven by subprime loans, have reached Q3 2009 levels. Credit cards have not yet reached this stage, but problems are beginning to pile up.

A credit card loan is deemed “delinquent” when it is 30 days or more past due. Balances are removed from the delinquency basket when the customer cures the delinquency, or when the bank “charges off” the delinquent balance (net of whatever it was able to recover) against its loan loss reserves. The charge-off rate is figured as a percent of average credit-card balances, and is annualized.

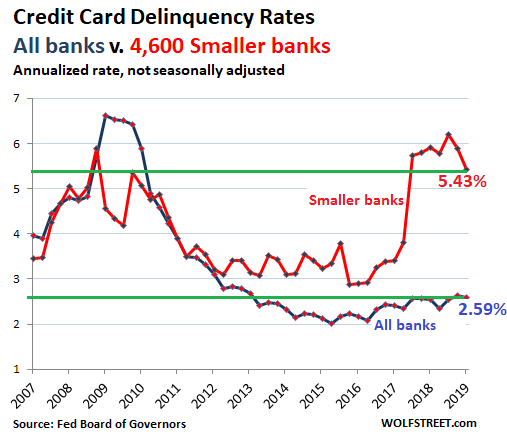

The delinquency rate on credit-card loan balances at commercial banks other than the largest 100 banks declined to 5.43%, after having spiked to 6.2% in the third quarter. During peak-Financial Crisis, the delinquency rate at these smaller banks topped out at 5.9%. So these smaller banks got walloped last year, and they’re now scrambling to clean up, and tighten the lending standards.

At the largest 100 banks, the credit-card delinquency rate, at 2.55% in Q1, was roughly flat with Q4, which had been the highest rate since Q1 2013. At all banks combined, the delinquency rate, ticked down to 2.59%, from Q4 at 2.63%, which had been the highest since Q1 2103.

This is on a “not seasonally adjusted” basis. On a “seasonally adjusted” basis, the credit-card delinquency rate reached a new high since Q1 2013.

There is about $1 trillion in revolving consumer credit outstanding, most of which are credit card balances. These rising charge-off rates and delinquency rates add another wrinkle to the State of the American Debt Slaves.

Banks take risks on credit cards because they’re immensely profitable for banks:

- The bank extracts a fee from the merchant for each transaction (the merchant figures this fee into the pricing strategy, and thus all customers pay, even those who pay cash)

- The bank also extracts fees directly from its credit card holders, such as annual fees, late fees, etc.

- The bank charges an extraordinarily high interest rate on credit card balances. In a world of interest-rate repression, interest rates for subprime-rated credit-card holders are in the double digits, and 20% or even 30% are not unheard off.

This rich profit obtained in the credit-card business induces banks to take some risks. And the calculus works out in good times. Banks make the most money off their riskiest customers, its subprime customers, that pay the highest interest rates and fees. But these are the people who can least afford them.

This too is part of the calculus, by definition: The highest risks have to reward investors with the highest yields to compensate them for the losses when they arrive. That’s why junk bonds pay higher yields than US Treasury securities. And that’s why a bank charges 25% or more in interest on a credit card offered to subprime customers because it sees a good chance it might eventually have to charge off some of the balances and take a loss on them.

These high interest rates increase the likelihood of a charge-off, but until it gets to this point, the bank books dizzying amounts of interest income – and income is a quarter-to-quarter affair.

So when a large part of the loans with 20%-plus interest rates default after a couple of years, while the bank collected 20% interest for those two years, it’s just part of the calculus. And the bank hopes that overall, the calculus works out. But that calculus can suddenly go haywire, as it does when the credit cycle turns, and as it did during the Financial Crisis.

Some smaller banks that have gone way out on the subprime limb are now getting bogged down in losses on their credit-card loan books. But at the overall delinquency rate of below 3% currently, credit cards are still highly profitable for banks overall.

Banks have also spread the risks by securitizing some of their credit-card balances and offloading them to investors.

As these delinquency rates grow, they will cause some losses and increase the focus during earnings calls. On their own, credit card losses won’t topple the overall banking system or the largest banks anytime soon – though when other factors start coming together at the same time, they could contribute to the pressure, but for that to happen, credit-card losses would have to be much higher to where they eat up all profits from credit cards.

But credit-card losses already have an impact on the economy, on retail sales, and on the most vulnerable consumers – and this is just the beginning. As banks tighten their lending standards in response to the rising losses, and as more credit-card accounts become delinquent and prevent their holders from buying on credit, the credit flow to the most vulnerable consumers gets throttled. And they have less money to spend. And so they will spend less.

This is already the case with subprime auto loans that are now blowing out and that have forced lenders to tighten their lending standards, which is causing a decline in new vehicle sales that is now in its third year. Read… Subprime Bites: Auto-Loan Delinquencies Spike to Q3 2009 Level, Despite Strongest Labor Market in Years

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

7%+ loans defaulted/written off on unsecured debt that will never be collected.

Hard to imagine a smaller bank credit card department staying solvent even with higher interest rates and annual fees.

And do these banks understand that they are not too big to fail? And QE has been tapering since DJT was elected?

2Banana, if you charge 25% interest and have a 10% charge off rate it’s still a very sweet 15% spread without taking into account merchant fees, late and overlimit charges….

Think more in terms of 39%. That’s what the CC’s charge

Anyone paying anything close to 25% has already demonstrated they are likely to not honor their contract. The average credit card APR in 2018 was 13.64%.

Having a net spread of 2% would be considered quite good.

Total CC charge-off rate at 3.83% at all commercial banks is almost the same as a year ago. Nothing to worry about. I will leave it to others to tell us how dire it looks.

\\\

Do not fear, because “The Others” are here!

\\\

1) Up to 2016 big and small banks have had roughly the same delinquency rate.

2) An event occured that induced a major increase in reported customer exposure to loans for small banks. Large banks stayed steady. The event can be a change in policy how delinquency is reported or calculated, or potentially the raw force of nature (a hurricane is the only that could affect so many people at once). …Newtons first law…

3) The graph skyrocketed by a 100% increase in a very short time frame.

4) After this sudden event another sudden event occurs, and a plateau is reached. The numbers are steady since.

\\\

Conclusion:

5) Very worrisome is the fact that the delinquency rate is not regressing from the plateau top back to it’s initial baseline.

6) If there was a policy change in delinquency definition, the spike and plateau are genuine. Then it was a simple adjustment. If not and the spike is real, the plateau is fake and the delinquencies by far exceed the reported numbers.

\\\

If you ask me

“Something is rotten in the state of Denmark.”

Hamlet (1.4), Marcellus to Horatio, Shakespeare

\\\

Something may be rotten, but it is too small to emit much of an odor. The top 10 banks have ~90% of the credit card market. Marketshare outside the top 100 banks is de minimus.

Proposition 1: the economy is doing great and the employment situation is great. Proposition 2: Auto loans and credit card loan defaults are rising, although not quickly. I don’t understand how both of these propositions can be simultaneously true unless a growing number of people who owe money and CAN pay it back have decided not to pay it back.

But the whole situation is what southerners call a “self eating watermelon” and what engineers call positive feedback. Along with the credit feedback loop mentioned, as people consume less, more stores close, and /or employment hours go down and so people have less money to spend. And repeat.

Coupled with the increased cost of gas and the increase in consumer product cost from the tariffs, the immediate future doesn’t look rosy.

Proposition 3. Eight years of QE1, QE2, QE3, QE4, Operation Twist, bailout after bailout, HARP, TARP, zero interest rates and adding more to the deficit than all other administrations combined have so distorted asset prices that even a good economy with expanding jobs can’t overcome the hurdles of such little money is left after paying for the basics.

I attribute the disparity of going broke on a good income to being mathematically challenged. The digital cash revolution is making the bad at math people, poor. Having cash or a checkbook tally imposes a boundary you cannot knowingly cross. The debit card and autopay lifts the discipline of counting your money. Most of these people really are not paying attention because they are placing the responsibility of knowing their limits on the banks.

Wonder what amount of overdraft penalties the “bad at math” group pays. Banks sure love those.

Petunia, I agree with you sthat many of the newer generations don’t really monitor their spending. I was surprised to learn how many people pay their credit card bills without checking the charges on it. They have the credit card bill paid automatically. And I don’t think many young people know what “balancing your checkbook” means. Which activity I would think would apply to debit card use as well.

People also have a lot more monthly maintenance bills as well. In addition to the conventional utilities they have cell phone service, internet and/or cable, movie streaming services, and things like Amazon prime and Costco annual fees, which can add a lot to the monthly cost of existence, especially when working 24 to 32 hours a week.

Costco plus amazon prime =$200 (per person) a year to be allowed to buy stuff from said retailers

Because many millennials rely on mommy and daddy to pay their bills including rent and credit card expenses. Self reliance ended with Gen X, millennials see living below means as living in poverty….

Gotta be a dismal life for Joe Snowflake to wake up every morning wondering if mom & dad died and left him the ranch.

Recent articles discussed millennial expectations of inheritance: the average dollar estimate is 3-5 times too high and will come 20 years later than expected.

Give it a rest. There are plenty of broke retirees. Mathematics is not the issue here. Age is not the issue here. People deciding to spend money they don’t have, with no plan to pay it back, is the issue here. That issue goes across demographics, ages and opportunities. Having opportunity and wasting it does not a victim make.

I’ve heard this before and I understand the logic, but my own experience is just the opposite. I find the digital era of banking to be far superior for tracking my own spending and knowing exactly how much money / liabilities I have at any moment. If someone is spending irresponsibility, I find it hard to believe that they would be somehow more responsible if they had a paper ledger.

None of this is new. Debt goes in cycles. Unemployment definitely goes in cycles. Some day millennials will post online about the irresponsible younger generations.

The human animal evolved to live in a much different world than one with money. We are bad at money (on a population level) because managing money is not instinctual. It is learned. And where there is learning, there are countless opportunities for mistakes.

except things like living below ones means, self reliance, not going into debt at double digit APR for depreciating items like clothing, electronics, a new flat screen TV every year where it costs $200 for cable + internet and apps.

The problem is that most millenials I have met have these extremely apologist parents who are on this extreme ‘guilt trip’ about how the boomers ruined everything so they feel that they have to give their kids everything because as they say “they can’t take it with them when they die”… what incentive is there is budget and watch your spending if someone else (mostly parents) are paying for everything like rent, car payment (even in the greater NYC or Boston area where a car is hardly a necessity), paying for a summer home on the cape or the jersey shore etc..

I don’t think either Petunia or I implied paper was the way to go. I think the main point was that with functions like automatic payment people don’t bother to review their charges each month and don’t get a feel for where there money is going. Not to mention not catching bogus charges. I don’t think it matters whether the review is done on paper or on screen. And additional point was that they simply over commit their resources to have all the stuff they “need” to be “in” in the digital age.

OE

Absolutely agree.

With a median US family income of $60,000/year ($5,000/month), spending $7 for a Starbucks seems trivial….if you do it 20 times a month, its $1,680/year, which is 3% of pre-tax income.

Petunia – right on point.

If these maths challenged people were forced to use only cash, they would be constantly seeking someone to lend them money.

However, as you say swipe it or tap-and-go makes it far to easy, since there is no upfront consequence, as in facing an empty wallet.

Having a job doesn’t mean having unlimited disposable income. Most people live beyond their means because of this obsession with buying the latest TV, iPhone, laptop, going on European vacation several times a year etc

Who are these people? Where I live (in a decent middle/upper middle class neighborhood) no one I know buys a new TV every year. Only retirees seem to go on vacations several times a year.

Do they really exist or are they just something others imagine to tell themselves how thrifty they are? Crapping on millennials is fun, but a how much of it is really justified?

As for spending $200 a year on Amazon and Costco membership, I get all of it back with rewards points on my cards.

In my opinion, both holds because there are two economies: One is actually doing great and the other one is doing worse and worse. The normal distributions plotted on top of each other would look like the humps on a camel.

When those distinct distributions are averaged together and rolled up into headline numbers, the resulting numbers look “great”, however, the distance between the two economies is clearly increasing.

The “confusing” or “discordant” numbers (things like auto loans and credit card defaults, infant mortality, life expectancy and whatnot) are primarily being generated from the “doing ever worse and worse” economic dataset, while the “doing ever greater” numbers are generated from the aggregated dataset.

In this case the “The Great Filter Wall” has a crack in it and some reality is shining through it. We don’t need to worry though. The crack will be fixed soon.

Loan delinquency and charge-offs are actually at the low end of the range of historical norms. Relative to the spike in card charge-offs at the small banks reported in this piece, keep in mind that a single large credit card bank’s size dwarfs the size of the all those outside of the top 100 COMBINED. It is sorta like comparing mom and pop retailer results to Wal Mart and Target.

Excellent article!

The scary thing is that with our current economic system growth must continue or the whole thing freezes up and collapses. Since we have not had real wage growth since 2000 and we are near a demographic standstill the growth of credit card debt, auto debt, mortgage debt and student loan debt is the only thing keeping the whole creaking system afloat. It is easy to be critical of those who live beyond their means, but if everyone followed sound financial advise and paid down all debt and purchased everything with money from savings the U.S. economy would collapse in a week.

No, the bubble would collapse in a week. Then asset prices would plummet and prudent financial players could pick them up at a discount. Real economic growth would begin at a lower sustainable level. Governments would be forced to make structural changes.

The delinquency vs charge-off rates don’t make sense to me – the charge-off rates for the top 100 banks is 3.83% and the delinquency rate is LOWER at 2.59%.

All charge-offs must pass through a period of delinquency first, so I would expect delinquency to necessarily be higher than charge-offs at any point in time, because some delinquencies will be cured. The only way charge-offs could be higher than delinquencies is if charge-offs are made in the same month/quarter (however the measurement works) that the balances become delinquent, which prevents them from being counted in the delinquent pool.

I am ignoring the lag involved, but I think that is okay because the rates don’t move very quickly.

Edit – rates mentioned above refer to the ‘all banks’ category, not ‘top 100’.

Charge-off rate here is an annual rate. Delinquency rate is a single observation at a certain point in time.

Should have added, many other factors as well. For example, a loan can default without being delinquent, e.g. in a bankruptcy filing.

Those darn kids – keep them off the lawn!

Is there a correlation between the uptick in defaults and the less intelligent/motivated believing Bernie will win and will then wipe out all their debt? Why pay on your student loan, CC, auto loan, etc…., when a carefree utopia awaits us?

The current average interest rate on all credit card balances is the highest it’s ever been. Yet the funding costs for banks (what they pay on deposits) is still very small compared with historical averages.

A couple of possible explanations:

– Banks might see higher default risks coming up in the not too distant future and are charging higher interest rates

– The consumer demand for credit card loans is very high which then allows banks to charge more (this might be the equilibrium price where supply meets the demand for credit). This correlates with the historic high of total US outstanding credit card debt.

Neither of these would lead one to believe that the economy is doing as great as the Trump administration might have you believe it.

I can think of another possible explanation regarding historically low funding costs with historically high lending rates, but I don’t want to be that guy.

Gershon, you out there? Think answer should include the word ‘oligargchs’.

;-]

Could it be that the big banks are hiding accounts that should be charged off and hiding delinquencies? Stretching the definition or playing with their calendars?

Hmmm.

I wonder how the flooding of the US bread basket is affecting those very same banks ? I suppose that losses on defaulted loans to farmers and agribusiness in the flooded regions will hurt, but how much ? I recon that local retail will take a considerable hit, too.

Picture/Point missed .

The smaller banks and auto credit companies, have a larger NPL/CC issue than the Larger institutions, on paper.

Many of those smaller institutions, get much of their liquidity, from the larger institutions, that previously pushed their bad credit customer to them. Or the Bond market.

So the “Default Exposure” is not limited, to only the smaller institutions, should it grow rapidly, and become problematic.

This is the same game the ccp chinese banks have played, except they have done it on a scale 10’s or even a 100 times, larger, than this US issue..

ccp Banker top ccp boss “Look boss my NPL’S are down by 0.3% this quarter”. Dosent tell boss about his huge and growing exposure, to the shadow banker next door, whose NPL ration, is now 4 times higher than his.

I recall 2016 saw gasoline demand plunge, and it appears credit card delinquencies went up a bit too. We lie about virtually everything else. I’d love to know the real number of jobs we were producing at that point.

What are likely endgame scenarios when the markets turn?

How about scores of smaller banks failing, staffs laid off, local economies hurt through ripple effects?

Will the Fed be able to issue enough to prop up failed institutions and to liquefy those new bad assets?

There are many uncomfortable questions to ask and answer.

(Somewhat confused with the term “liquify …bad assets”. but assume you mean “write-off non-performing loans”)

US bank laws and regulators are much more rigorous & aggressive than most of the rest of the banking world. Most classes of non-performing loans (bad assets?) are recognized quickly, and either resolved or written-off (aka: sold to a debt collector).

Most US banks (TBTF different story) hitting 8% NPL are pretty much toast and quickly “resolved” (branches & branch-staff sold to other banks, executives & back-office terminated).

The 1st line of defense is the bank’s own capital; 2nd line is bank-paid deposit insurance (FSLIC & FDIC); 3rd line is the Fed (aka taxpayers), which was liberally used in the Great Recession. Almost without doubt or exception, the sooner a bad bank is “resolved”, the less expensive it is.

Banks are legally required to charge off credit-card balances when 180 days delinquent.

Can’t afford not to use my CC, besides 5% on fuel and groceries they are offering special merchant discounts, most double digit. It beats the interest in a checking account and a debit card.

Senecas Cliff- saying if debt ceases to grow our economy would collapse. You must be reading too many articles written by bankers. That is how they get to own you. Suck you in with cheap money and wait for the economy to crash. Debt is tomorrow’s growth, so pulling it forward to today means future growth takes a big hit for years. As long as wage growth does not keep up with this expanding debt, the deflation will occur at some point.

If you believe in capitalism that is exactly why we need a deflation to to clean out all all the distorted economic factors and actors. This will bring prices down, as in deflation. But the Fed fights deflation by its stupid 2% inflation goal. Ye who controls interest rates controls all prices.

We live in a world where the Fed creates this booms and busts by ever expanding cheap money. Look at the history since 1999. They have been in overdrive ever since. Maestro Greenspan was a fraud. He was helping the Fed with his intellectual non-understandable double speak. He did everything he could to stay in power from 1986 to 2006. He got out because he knew what was coming and thought nobody would blame him for the mess of 2008. His first book was “Age of Turbulence”. Please, like I said he knew what was coming. He was working on it during the lead-up to the 2008 crisis as he released it Sept. 9, 2008.

One can also read what he said about gold and economic freedom in Ann Rand’s book “Capitalism”, page 101-107. This is why I say he was a fraud.