Dollar Hegemony is a tough nut to crack.

China is taking another baby step in promoting the internationalization of the renminbi and nibble on the hegemony of the US dollar: It’s pushing a proposal to add a pile of yuan to the $240 billion currency swap agreement between ASEAN plus China, Japan, and South Korea, in order reduce the system’s reliance on the US dollar and to enhance its own economic clout in the region, according to the Nikkei.

On May 2, the finance ministers and central bankers of ASEAN – Singapore, Brunei, Malaysia, Thailand, Philippines, Indonesia, Vietnam, Laos, Cambodia, and Myanmar – along with those from China, Japan, and Korea will meet in Fiji to discuss modifications to the swap agreement, the Chiang Mai Initiative.

China, which co-chairs the meeting with Thailand, has added language to the draft joint statement concerning use of Asian-currency contributions to the pool – which for now is still entirely in dollars – as “one option” to enhance the swap arrangement.

“Allowing participants to access Asian currencies in an emergency could encourage their use in other contexts, including foreign exchange reserves, the thinking goes,” the Nikkei said. “The idea also anticipates a long-term rise in demand for these currencies in regional investment and trade.”

“China in particular sees it as another step on the path to internationalizing the yuan and expanding its economic influence in the region. But the proposal is likely to be complicated by U.S. alarm at the prospect of Beijing expanding its currency’s role at the dollar’s expense.”

The Chiang Mai Initiative was a response to the 1997 Asian currency crisis. It consists of a pool of US dollars, contributed by members, that members can draw on when their currencies come under attack. Since its establishment in 2000, the dollar pool has been increased to $240 billion. China is now lobbying the other members to add yuan and yen to that pool.

This is just one more effort by China to internationalize its currency, which has been a tough and thankless slog so far, despite the size of the Chinese economy and its giant weight in the global economic fabric.

In terms of global reserve currency, the renminbi (RMB) has a share of only 1.9%, in fifth place, and barely ahead of the Canadian dollar, but miles behind the US dollar (61.7%) and the euro (20.7%). Over the past two years, the RMB has made only microscopic headway as a reserve currency.

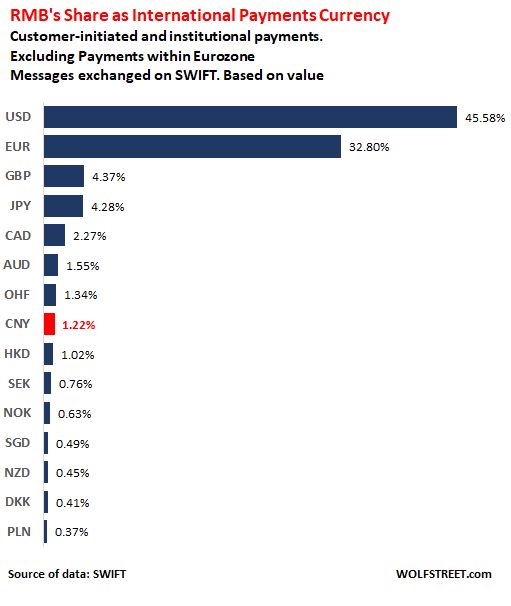

And as an international payments currency, the RMB has failed similarly to crack the co-hegemony of the dollar and the euro.

“With more than 1,900 financial institutions now using the RMB for payments with China and Hong Kong, the internationalization of RMB carries great strategic significance” for banks and financial institutions, gushes SWIFT (Society for Worldwide Interbank Financial Telecommunication), which tracks the progress of the RMB as payment currency.

But in March 2019, the RMB had a minuscule share of merely 1.22% for international cross-border payments by value (cross-border payments from one Eurozone country to another Eurozone country are excluded). This minuscule share put the RMB in 8th position, just behind the Swiss franc:

Two years ago, in March 2017, the RMB’s share had been 1.05%. In other words, in two years, the share of the RMB had ticked up by a whopping 17 basis points, from 1.05% to 1.22%. At this pace – about 8.5 basis points per year – the RMB will reach a share of 3% by 2040.

Meanwhile, the dollar’s share increased to 45.58%, from 45.44% two years ago; and the euro’s share increased to 32.80%, from 32.28% two years ago. So by this measure, and for this time span, the RMB made minuscule progress against smaller currencies but lost ground against the dollar and euro.

So chipping away at the dollar-euro co-hegemony as payments currencies will take some patience and lots of baby steps, such as China’s efforts to add yuan to the swap arrangement under the Chiang Mai Initiative.

The troubled internationalization of the RMB was topic of a 2018 report by SWIFT’s Chief Executive of APAC & EMEA, Alain Raes, looking back on 2017, when the RMB internationalization had actually backtracked.

On one hand, its internationalization was supported by major trends, such as:

- The growth of cashless payments, “mainly driven by the digital giants Alipay and WeChat Pay”

- “The far-reaching Belt & Road Initiative”

- “The globalization of Chinese banks and their adoption of SWIFT gpi”

- “The progress of China’s Cross-border Interbank Payment System (CIPS).”

On the other hand, there was this: “Despite these trends, there are a number of critical success factors necessary for widespread adoption of the RMB.”

And that’s where it gets tough. The headwinds the RMB faces “in the short term” include “capital controls imposed by the Chinese government” and “ongoing concerns over the Chinese currency’s depreciation.”

The report sees the Belt and Road Initiative as China’s key strategy to muscle in on the dollar as a payments and finance currency. The Belt and Road Initiative involves large infrastructure projects in Asia, Europe (particularly Eastern Europe), the Middle East, Latin America, and Africa.

“There is opportunity for China to use the RMB as a currency” for these projects, and Chinese companies could “potentially move to transactions denominated in RMB,” SWIFT’s report said. “Not unexpectedly, banks are stepping up to take advantage of the shift.”

“China is also pushing countries along the BRI to allow greater usage of the RMB, though countries are not always responding favorably,” SWIFT says, thus listing another headwind for the RMB: Resistance from other countries.

China is known to be patient and can measure progress in decades, rather than in quarters. But the progress of the RMB’s internationalization must be nerve-wracking slow, even for China.

There are now 486 electric-vehicle manufacturers in China, triple from two years ago. Most will disappear. Read... China EV Manufacturing Bubble Faces Getting Bludgeoned

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

China knows that they are screwed if the president wins a second term. Their whole game is IP theft and trade abuse and they need that game if they expect to replace USD. They will be supporting anyone other than the incumbent.

Nonsense they are bailing him out right now with massive credit stimulus while we are heading into a global recession, which is certain to be painful, but will get them a trade deal. A second term will almost certainly mean the US will devalue its own dollar and that’s fine with China as well. They need to bolster their currency to get reserve status, while the US trashes theirs. China can also claim market share in a global slowdown by pumping credit into their economy, inventory is no issue.

Let there be no mistake: the Chinese stimulus is intended to bail out China. If the US benefits, that’s a purely unintended consequence.

They would much rather deal with the weakest president in America’s history than anybody else.

What I have seen in Boise is that A LOT of home builders have put their spec builds for rent and large dogs are allowed.

2019

Hounds, houses and HELOCs

vs

1980

Gold, Guns and Grub

Let us assume for the sake of argument that you were right, Trump is a genius, and he has China pegged exactly right, etc, etc. it wouldn’t matter, because all Trump gets is eight years in any scenario. Comrade Xi is there for life, I would argue that his love of baozi will not significantly harm his longevity (Xi’s That is)

But beyond that, Trump will be too busy fighting Nancy and Chuck if he gets another terms. He won’t have much of a unified front against China. And look at his predecessors who had two terms, did any of them matter with their Asia pivot or focus on China, etc. US foreign policy will be forever dominated by the election cycles. So, in the end China with the longer view will likely prevail as long as they can manage the coming demographic crisis, loan crisis, etc. but China will have social credit to counter those things.

One cannot have a meaningful ‘long view’ in terms of industrial civilization, it burns on a short fuse of a mere few centuries.

We are now far into that: ecological devastation, resource degradation and pollution accumulation are accelerating, and the explosion is quite near in comparative terms.

What ever China or the US might plan, it is merely adding another story to the tower built on quicksand.

Dear old Xi will be Emperor of Nothing.

=>all Trump gets is eight years in any scenario.

Boy, that’s hopeful. ETTD.

Hmmm…… Wolf’s article on U.S. dollar hegemony turns into amateur Trump bashing. Good article Wolf.

1. the yuan is PEGGED to the U.S. dollar, not the other way around. NOBODY (outside of China) would hold the Yuan for anything longer than transactional time, without the peg. The Yuan holds no “store of value”.

2. I’ll take $10,000 USD in cash to virtually anywhere in the world and buy anything I want. Outside of China, take 67,000 yuan and you will buy nothing. You might get some dealer to exchange it for $5000 USD. But that is it.

3. The USD will be the cleanest dirty shirt for longer than most people here, will live. Not because of some absolute foundation, but because all other currencies are controlled by people in far worse, current and future, fiscal and monetary boxes than the U.S. is.

Cny to Cnh exchange in Hong Kong to US dollars. Dollar is so strong! Thanks guys.

Their whole game is IP theft and trade abuse? I’m not sure what this even means. But from my observations China (and Chinese companies) are aggressively buying and building in every corner of the world. And I’m not just talking about residential real estate. The prime example would be the Belt & Road initiative which is linking China with direct routes throughout Europe and the Middle East. I work for a Solar developer. We were brought by a Chinese company and we are aggressively bidding on renewable RFPs even if they appear to be break even. And we’re not the only one. China is actively taking the lead in building out solar farms – in America! Similar developments are occurring in other infrastructure building in every continent on the globe. Yes, the debt is heavy but at least they are backed by assets (roads, buildings, infrastructure projects of all sorts). All while US Treasury debt is consumed on wars, conflicts and military spending that benefits only the mighty few who actually run this country. As Jimmy Carter recently stated, the US has spent over $3,000,000,000,000 on wars this century, China $0. If currency valuation reflects the actual economic output & available resources a nation has then where does that leave the US? The saddest part is that this country could be the nation leading the way in creating a more modern, healthier world but no one wants to work for a living anymore. We just want to speculate and skim from the efforts of those who work for a living.

MarkinSF

China’s “belt and road” initiative is to lend yuan to other countries so that the other countries purchase Chinese-made stuff, mostly steel and electronics. And if the other country doesn’t have a work ethic, then China will supply Chinese labor, all paid with the Chinese yuan.

Endgame? Other countries owe China. China gets all the benefit. Copied directly from the U.S. playbook. And it will work so long as the Yuan/USD peg can hold.

Plus, it’s a whole lot cheaper to influence with infrastructure, agreements, and loans than it is to fight wars and maintain 800 military bases.

I’ve read that the Belt&Road is financed in USD. Chinese fiat is lucky to make it as far as HK. The US could shut Belt&Road down with a short squeeze, but I can’t believe the Federal Reserve would allow such a squeeze to happen. Central bank swap-lines are what have stopped USD short squeezes in the past. The US could stop most international trade for months if not years by creating FUD about getting paid. (I’m thinking that is the Kudlow strategy.) That is why Russia, China, Germany, and others are stock piling gold. US agencies are helping them out by suppressing the price of gold. Passive-aggressive or schizophrenic?

Why are the HKD and the CNY not combined? There really is no political reason for separation.

The Hong Kong banks are the only credible part of China’s banking system. While international companies may deposit their money in Hong Kong banks, they will never use mainland Chinese banks. The political reason for keeping the separation is the lack of credibility and trust in the Chinese govt.

When millions of wealthy Chinese are maneuvering like mad to get their assets out of the country, who would be nuts enough to use a currency subject to capital controls and politically-manipulated banks with murky accounting.

=> who would be nuts enough to use a currency subject to capital controls and politically-manipulated banks with murky accounting.

Which explains why gold bugs can be so militant.

Petunia,

It appears that you need some education on Xi Jinping’s Socialism with Chinese Characteristics :)

Word on the street is that we might see some small to medium banks start failing in China sooner then anticipated… The default wave is pretty rampant in domestic debt currently, and they are just about out of excess US dollars except there Treasuries. They are at the bare minimum to keep things flowing, they will start defaulting on US Issued debt this year, and by 2020 will be rampant.

The global recession is guaranteed at 100 % to happen in 2019… EM’s are gonna get smoked sadly, this one will be deep

Doesn’t China require in excess of 1.8 Trillion US Dollars in reserve to keep the economy balanced?

If the figure drops below 1.8T$ doesn’t nervousness creep in?

Under the Chinese Constitution, Hong Kong and Macau are mostly independent with a very long list of privileges, including striking their own currency. It’s a very fascinating arrangement, somehow reminiscent of those Qing China had with European trading companies and/or governments and in many ways represents well the deep contradictions of modern China.

Technically speaking both Hong Kong and Macau have “Monetary Authorities”, which function as de facto independent central bank.

The HK dollar is soft-pegged to the US dollar (US$1 = HKD7.57-7.85 range) while the pataca is hard-pegged to the HK dollar (HKD1 = MOP 1.03). This is made possible by very very large foreign reserve currencies: everybody is still laughing at how the Banque Nationale Suisse tried maintaining an irrealistic peg to the euro with completely inadequate currency reserves and then completely destroyed interest rates when they could not simply concede defeat. If you want to see how to destroy a central bank’s credibility in one stroke… here we go.

While Chinese authorities keep on pitching the RMB worldwide, very little has been done to substitute it to the US dollar when it comes to the HKD but some empty talk on official occasions. Plainly put too much money is at stake,so it’s just better to pitch the RMB charade abroad while keeping the good old HKD. ;-)

China has actually been doing a lot to shore up the RMB. The gold purchases are about strengthening their currency in the eyes of the world, and I’m sure even then, some would rather settle in gold then RMB. FX is always a confidence game.

The reason for those gold purchases which have gold bugs jumping up and down with excitement is much more mundane and it’s propping up the monstrously bloated gold mining and refining sector in China.

The largest player in the game is the State-owned China National Gold Group Corporation (CNGC), which over the last three years has been quietly vacuuming gold mines throughout China whose financial viability is dubious to say the very least: as it happens so often in China becoming number one in a given sector came at the price of incentivating unsustainable economic activity.

The CNGC is a publicly traded company (SEHK:2099) but it’s a classic case of a company which hasn’t been at the receiving end of the recent stock market bonanza in Hong Kong. Year on year their stocks have gone from HKD 15,700 to HKD 10,200. Remember: this is a State-owned Chinese company (meaning ready access to non-questions asked credit) in one of the most ebullient bull stock markets in history and backed by the shady funds collectively known as “National Team”. 2099 should be skyrocketing, not languishing. Something’s fishy here.

The same applies to all the other smaller but similarly State-owned Chinese gold companies such as Lingbao Gold.

CNGC needs much higher gold prices but at the same time it cannot prop up prices by cutting supplies because they cannot shut down gold mines and refineries. The Chinese government will attempt to prop up gold prices somehow but always has to thread carefully: the bulk of worldwide production is beyond their reach, in the US, Australia, Canada and South America. There’s no telling how foreigners will react to a massive gold spike whose epicenter is in Shanghai.

MC01,

During the worst part of the financial crisis we survived by selling all my gold jewelry. The better prices came from independently owned jewelry stores, the kind most middle class people never buy from, the kind who have the “we buy gold signs” out on the street corners in south FL. Out of curiosity, because I knew their normal customers were not spending, not even Palm Beachers were spending then, I asked who was buying the gold. The answer was Chinese guys. That answer coincided with all the news stories about China buying gold and accumulating large reserves.

Petunia

Right on point. If you were China and you knew the yuan was heading down, then you want to buy as many hard assets as you can, like gold, while you still have the USD peg.

But money is being called home. In subtle ways, and some not so subtle ways.

Petunia, I don’t know about the US, but generally speaking most of the gold coming from the retail market, be it from retail sales like yours (very sorry to hear about your misfortune; hope everything is fine now) or scrap metal ends up in Switzerland, where it’s smelted, refined and then… well, Swiss privacy laws do not allow us to know much more.

But a couple of years back the largest gold refinery in the world, Valcambi, headquartered in Balerna (don’t get me started because you would lose me very soon ;-)), was bought by Indian conglomerate Rajesh Exports.

The next top three gold refineries (Argor, Metalor and PAMP) are Swiss as well and all are either owned by Asian investors outright (Metalor is owned by Tanaka Kikinzoku) or rumored to be owned by Asian investors hiding behind a Swiss-registered SA. I won’t even get into the galaxy of smaller refineries.

All these companies are very jealous of their privacy, even more so than (usually foreign-owned) Swiss healthcare and defense companies, and as such do not like publicity of any kind.

To put gold in context Russia’s much touted gold store of about 2000 tonnes at 1200 per oz is worth about 50 billion or one month of the FED’s QE.

After 15 years of Putin the economy is about the size of Canada’s and the gold isn’t helping the ruble.

A staggering amount of gold over 8000 tons is held by PRIVATE citizens in Germany, more than double the govt 3000 plus tons.

The Global Overlords won’t like this. They want a utopia featuring a one world digital reserve currency run by the IMF and approved by Bank for International Settlements.

Not at all. The Global Banking Cartel will gladly take tribute in any convertible medium of exchange, but they could really care less about the money, they have so much of it they can’t use you may as well offer gold to a goblin, like Harry did. No, their currency is political control, the ability to pull the strings on any government on the planet, and has been since the 19th century.

The Iron Bank rules, not the Iron Throne. Cersei’s big mistake was paying off the crown’s humonguous debt, because now the Lannisters have no leverage on them. Now they’re free to invest in competitors like the Mother of Dragons. Tywin knew all this, as does Tyrion, and it’s a lesson to any and all with ambitions to rule the world. Which is way too much like work if you ask me.

The death of the U.S. dollar’s demise has been greatly exaggerated…for many years.

Why would anyone accept yuan ren(maybe) in payment? China would likely re-hypothecate dryer lint if they could get away with it.

HR01

Read the History of Currencies across the time span of the last two millennia and you’ll understand what “ ignorance “ your comment carries ( don’t take this personally) !

Just read up more, and observe with keen eye.

“Extraordinary risk. In a global financial crisis, however, the exorbitant privilege becomes an extraordinary risk. The risk-return differences between and within asset categories for U.S. inward and outward foreign investment mean that the United States effectively performs as a global insurer. The rest of the world effectively pays an insurance premium in the form an excess return on the outward foreign investment from the United States relative to inward foreign investment to the United States in normal times. The resulting primary income surpluses help the United States to record persistent trade deficits. In exchange, the United States accepts the risk of larger losses on its outward foreign investment during a global financial crisis than foreign countries accept on their inward foreign investment in the United States.”

https://www.caymanfinancialreview.com/2018/01/22/the-worlds-reserve-currency/

Search up the pdf “Global Debt Monitor Devil in the details” from iif to get something of a picture.

Export paper, import plastic

What’s the purpose of running two currencies used in international trade at the same time? I sort of imagined that the US might run two dollars, one being the physical money supply, and the other the digital pie in the sky currency, and floating the two against each other to see just how much fluff the bankers are creating. China isn’t long on opaque economic policies while the US will let you see just how opaque their system really is.

=>What’s the purpose of running two currencies used in international trade at the same time?

Diversification, for one. Playing one off the other, for another.

Playing Forex games, like high-frequency equity trading, requires having dedicated high-speed data links to the exchanges. Since almost nobody but the top players can afford such things there’s no point pursuing either.

If you want to get into high-risk/high return you could try trading options. If you’re really really smart you could hit a big one once in a while that might cover your months and years of losses. Complete amateurs in academia (SWIM) made huge fortunes this way off the Great Recession with a single well-conceived offering.

Not that I would ever give financial advice, and not just because you could never afford me. If I were, it might be to invest in one of the private space vehicle concerns like SpaceX. That way you could encourage them to hurry up so you can get to Elysium before somebody burns the planet so they can rule over the ashes, which was frankly expected to have happened already. Anybody investing in long-term securities really isn’t paying attention.

Long-term, the only return is the trip the Ferryman makes to pick up more souls.

Make sure you have the two coins for your eyes, as was traditional, and as Charon expects ….

Everybody believes in something. I believe I’ll have another beer.

They can’t seem to figure out how to burn it without turning themselves into ashes in the process. That is the purpose of concerns like SpaceX, whether they understand the purpose or not. Fig leaves were less expensive.

When they get to Elysium they will begin to have the same problems because they inadvertently brought along the source.

“What’s the purpose of running two currencies used in international trade at the same time? ”

US banks make a staggering amount of money in money changing fees, even a small slice of the pie would be very lucrative.

It will be interesting to see what ASEAN decides, and if they do decide to diversify, what effect that will have on the relevant currencies.

The key is of course in the oil currency.

Will oil exporting countries accept Yuan in a big way? I wouldn’t bet on it.

Probably some lip service promises.

Will China give them Yuan? I thought currency controls prevent that.

Does it matter? You could say oil reserves are a stronger currency than dollars, Saudi alone is said to hold very approximately 10 trillion dollars worth at a measly 50 dollars a barrel. The Chinese hold a billion workers and a lot of territory, or the west as a whole has a financial communication system that works to a similar theme etc. The role of reserve currency is overstated in my opinion, it is very useful and comes with certain advantages, but I don’t think it is correct to imagine that it is its own guarantee.

You know there are so many questions raised today to make your head spin. But, to keep your sanity, I think we best understand what are the most important questions (especially those that directly affect our lives)?

I like Howard Mark’s attitude where he says we are intelligent enough to know what is happening now, but we cannot tell what will happen in the future.

One cannot know the future: and informed projections are often grossly erroneous, even laughably so – but one can, sometimes, feel it coming……

The history of the senior currency and the financial centre has been interesting. It has always been at a natural trading point with free markets and integrity.

It has always been set by market forces and not by government fiat.

At one time it was at Rome, then the northern city-states, then Augsburg, Bruges, Antwerp, Amsterdam, London and now New York.

With Beijing still Communist and the US trying to get back to constitutional government, chances are NY will continue as the financial capital and the USD will remain the senior currency.

Wolf’s essay is on point.

Their belt and road program is financed with borrowed US dollars. Soon their need for dollars may be so great that in the short term the market may not be able to easily accommodate their needs.

Switching to their local currency negates that real problem and it also allows them to print and spend to stimulate growth in the future.

cad is number 5! i never woud have guessed. it makes when you think about canada’s trade relationship with the us.

Examples of nations ravaged by taking foreign currency loans which they cannot pay as their own currency depreciates abound (Venezuela and Argentina, for example.) So how are Asian nations protected simply by having a pool of dollars to borrow from? (“The Chiang Mai Initiative was a response to the 1997 Asian currency crisis. It consists of a pool of US dollars, contributed by members, that members can draw on when their currencies come under attack. Since its establishment in 2000, the dollar pool has been increased to $240 billion. China is now lobbying the other members to add yuan and yen to that pool.”)

Now we have also been told, for what it is worth, that China has been buying gold hand over fist. If they wanted to strengthen the appeal of their currency, having set the original bad example during Marco Polo’s time, of forcing fiat paper money on their people, why not try a virtuous turn: sell gold-backed bonds.

I’m always astonished that the nation that prides itself on FREEDOM AND CAPITALISM fears so greatly any form of competition. It seems that the US has devolved into a shadow of its former self where they fear competition, and have to resort to bullying and cheating.

“…resort to bullying and cheating.” You’re talking about China, it seems.

Delusional exceptionalism. I would remind you of 800+ military bases, IMF, World Bank, NSA, Regime Change, Sanctions, Endless War, Guantanemo. The list is long, and it isn’t China.

China is also doing the same.

China does not have bases all over the globe, nor does it participate with anywhere near the vigour of the US in regime change by any means necessary. Most of their interference is in building infrastructure, not destroying it.

Missing the point here is that when people in the West buy chinese stocks, they’re buying nothing, take BABA, you are buying is a fraction of claim to ‘cash flow’ from a cayman-island front. Thus in a way even more wealth is being transferred to china, so they can buy gold.

Like Perots giant vacuum years ago, now china is literally sucking the life out of the West.

The question begs to be asked, “How can I really invest in Chinese assets?”, and the answer is just buy Gold. Keep it local, keep it safe.

Why is the USD valuable to the world? Easy, for 50+ years the CIA made the USA the currency of death, the entire world is required to trade illicit good’s in USD. Take out the CIA, and the USD evaporates over-night.

Does China want to be a reserve-currency hegemon? No way, they would prefer to own hard-assets;

China is liquidating their USD paper-assets as quick as they can into real tangible assets.

03.04.2019 Belt and Road Initiative in Full Swing in Europe

The multipolar transformation that is occurring across the Eurasian continent confirms the industrial and diplomatic cooperation between China and the European continent in the spite of strong opposition from the United States.

https://www.strategic-culture.org/news/2019/04/03/belt-and-road-initiative-in-full-swing-in-europe.html