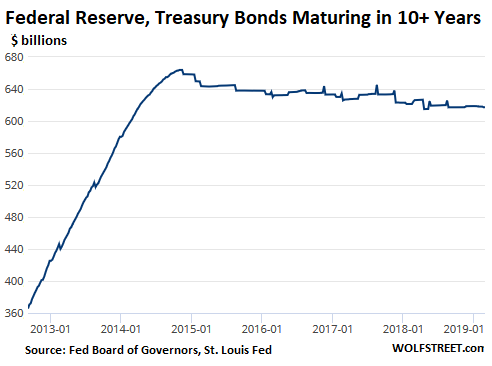

The albatross of $617 billion in bonds that mature in over 10 years.

Over the next few months, the Fed is expected to announce its new plan for its balance sheet. Meanwhile, as we’re riveted to the edge of our seat, the old plan continues on autopilot, and February was one of the few months when the Treasury “roll-off,” as Chairman Jerome Powell likes to call it, hit the “caps.”

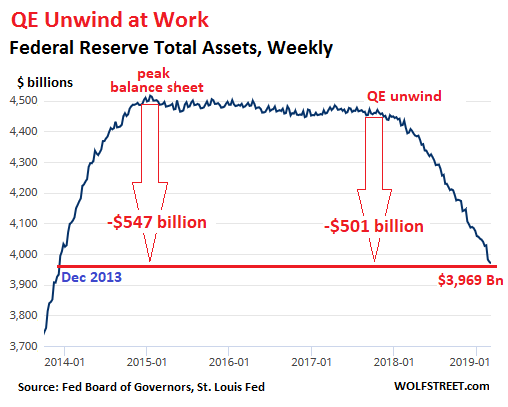

In February, the Fed shed $57 billion in assets, according to the Fed’s balance sheet for the week ended March 6, released this afternoon. This slashed the assets on its balance sheet to $3,969 billion, the lowest since December 2013. Via its “balance sheet normalization,” the Fed has now shed $501 billion. And since peak-balance-sheet at the end of 2014, the Fed has shed $547 billion:

During peak-balance-sheet at the end of 2014, total assets ($4.52 trillion) amounted to 26% of GDP. Today’s assets amount to 19.4% of GDP. In the years before QE started, the balance sheet ran around 6% of GDP.

By comparison, the ECB’s balance sheet assets now exceed 40% of GDP, and the Bank of Japan’s assets amount to 101% of GDP.

February’s drop of $57 billion is larger than the scheduled QE unwind that is capped at $50 billion. But the Fed has other activities that impact the balance sheet. QE revolved around Treasury securities and mortgage-backed securities (MBS). And so does the QE unwind.

According to the Fed’s plan revealed in 2017, the QE unwind is supposed to take place on automatic pilot, based on a formula by which the Fed is scheduled to shed “up to” $30 billion in Treasuries and “up to” $20 billion in MBS a month for a total of “up to” $50 billion a month, depending on the amounts of bonds that mature that month.

Treasury Securities

The Fed sheds Treasury securities by allowing them to “roll off” without replacement when they mature. It does not sell them outright. When Treasury securities mature, the Treasury Department transfers money in the amount of face value plus outstanding interest to all holders of those securities. Treasuries mature at mid-month or at the end of the month.

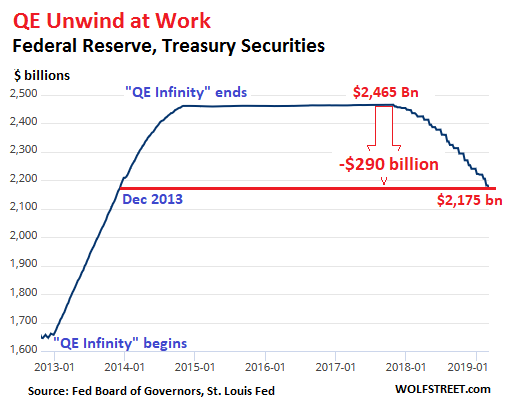

On February 15, three issues of Treasury securities on the Fed’s balance sheet totaling $43.5 billion matured. On February 28, three issues totaling $12.5 billion matured. This brought the total for the month to $56 billion – above the cap of $30 billion. So the Fed reinvested $26 billion in new Treasury securities and allowed $30 billion of Treasuries to “rolled off” the balance sheet without replacement.

This reduced the total balance of Treasury securities by $30 billion, to $2,175 billion, the lowest since December 2013 – and down by $290 billion since the QE unwind began. This has whittled down the Treasuries acquired during the infamous “QE Infinity” by about one-third:

Mortgage-Backed Securities (MBS)

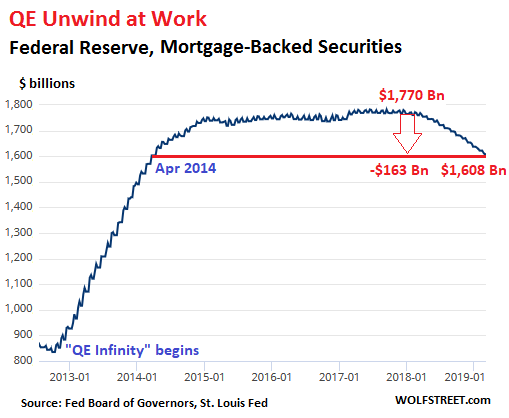

The Fed also holds residential MBS issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Holders of MBS receive pass-through principal payments as the underlying mortgages are paid down or are paid off, such as when mortgages are refinanced. The remaining principal is paid off at maturity.

These pass-through principal payments cause the principal amount of a portfolio of MBS to decline over time in an unpredictable manner. To keep the balance of MBS from declining after QE had ended, the New York Fed’s Open Market Operations continued purchasing MBS in the market.

But a rising interest-rate environment slows down refis, and the pass-through principal payments to MBS holders slow to a trickle. Even though mortgage rates have ticked down since the November peak, they’re still where they were about a year ago, and there has been no significant surge in refis. And pass-through principal payments remain slow.

In February, the balance of MBS fell by $14 billion to $1,608 billion, the lowest since April 2014. Since the beginning of the QE unwind, the Fed has shed $163 billion in MBS:

So the autopilot was still engaged in February, and the roll-off proceeded on schedule.

The slow roll-off of MBS securities – which is likely to slow further unless mortgage rates drop a lot – is now a topic at the Fed, which would like to get rid of them faster, but not too fast, as the most recent Fed meeting minutes indicated. In the new plan coming down the pike over the next few months, there will likely be a mention of this issue, and perhaps references to how it will be addressed.

Some of the suggestions have centered on selling the MBS outright and replacing those that have been sold with short-term Treasury bills, of which the Fed currently holds none. In addition, the Fed may switch more of the replacement Treasury securities it buys to Treasury bills, thereby bringing down the average portfolio maturity, which now exceeds 8 years.

Of the Fed’s $2,175 billion in Treasury securities, $617 billion are bonds with a remaining maturity of over 10 years! This has slowly declined since peak-balance-sheet in late 2014, as the maturity dates of some of these securities have moved into the 10-year window. But the QE unwind itself has no impact on it:

For the transmission of monetary policy purposes, these long-dated bonds are not particularly useful. So this fate of those long-dated bonds on its balance sheet is also likely to crop up somewhere in the Fed’s new plan.

The real worry is the economy in the Eurozone. Read… US Dollar Hits 52-Week High in Cleanest-Dirty-Shirt-Syndrome on New ECB Stimulus, as Old ECB Stimulus Fails to Stimulate

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have a naive question/statement – ” why can’t QE go on in perpetuity? its been done to the tune of trillion$ of dollars/euros/yen with no problems” thank you for insights – I recognize I am wrong but would like to respond intelligently to those who hold that view as “economic manifest destiny” thank you

Perpetuity is pretty long time. We’ll get back to QE soon after the crash, that’s about to start like now.

” why can’t QE go on in perpetuity? its been done to the tune of trillion$ of dollars/euros/yen with no problems” thank you for insights

Ditto. If the answer is inflation/hyperinflation, I get ti. But where is it? In assist, bonds, stocks, RE, yes. But on the street eats level? Yes I believe Shadow Stats is more accurate then CPI etc. But still, QE seems to be working, if exacerbating the wealth divide. An insightful answer would be appreciated.

There has been a LOT Of inflation, but it is asset price inflation, which includes housing inflation, where it takes twice as many dollars to buy the same house. QE caused a lot of asset price inflation — and that was its purpose — though it caused relatively little consumer price inflation.

That way, people will still be able to afford household appliances, but unable to afford a place to put them.

Wealthy bankers and corporate officers will be just fine, and that’s the important thing. Millions more serfs will have to struggle, of course, but everybody has to make sacrifices. Except the bankers and corporate officers. They’re special. Everybody else can try to live on false hope.

The plan is working.

And the answer to the other part of your question: “Why can’t it go on forever?”

I think theoretically, it can. But only if the global public continues to have faith in fiat paper currency. Once the tide turns on that, it should be all over.

As James Grant says, “the price of gold is equal to 1/Confidence in Central Banks.”

That is, high confidence in CBs, gold value is low. But as confidence in CB/fiat currency heads towards zero, gold price heads towards infinity.

Many people argue that the price of gold is being manipulated/held down, which is probably the case. But clearly, as history has shown, such manipulations can only go on for so long.

Yes, the inflation has been in items not picked up at all or weighted low in the CPI measurement: college education and some parts of medical care and insurance + the usual financial assets.

Hence QE favors the wealthy. The financial execs got bailed out and rewarded for 2008 with several Treasury Secretaries and Attorneys General saying they were truly too big to fail. Regulatory capture or the swamp or deep state, whatever term you like.

Don’t look for this to change.

Medical and education SERVICES have both experienced a Lot of inflation in the last ten years. So has food.

What do you think about the methods they use to calculate consumer inflation? It is often said out there in the world that the methods have changed such that inflation as gauged by 1970s methodology is more like 6-7% per year. I don’t know about that, but I do know that the comparison between things bought today to 30 years ago is not an apples to apples one, at least for anything not apples. If you buy a can opener in today’s world, you will be lucky if it is actually capable of opening a can. I spend a lot of my life in search of a capable can opener at a reasonable price.

I agree with you. Housing prices are reaching and exceeding the 2008 period once again. I feel like we are at an”Opps I did it again ” moment. I look at all these millennials committing to such over proportioned home debt…and as a parent/senior aged person I

know from hindsight they are stretched way too thin. I agree inflation otherwise has

not been as aggressive, but wages increases haven’t kept up either.

What are your opinions on overinflated housing prices in the bigger cities such as

Toronto, NYC ect. Do you foresee major corrections? What demographic group will be able to continue supporting the purchase of real estate at these all time high and disproportionate levels?

re out of control

Wolf, I think you misspoke when you say “which includes housing inflation”, there are many areas in the country that have not had housing or its cost increase substantially for the last decade, or lost much asset price during the housing recession.

Yeah, there is always a real estate market somewhere like that. This is more than counterbalanced by huge markets elsewhere where prices have boomed. All national averages have now transcended the prior bubble peak.

> why can’t QE go on in perpetuity?

That’s a pretty extreme situation.

So extreme that it would provoke an extreme reaction: people would stop using the dollar.

Here is a simplified explanation which demonstrates the key points :

With modern fiat, there is a base money supply, which is basically currency and central bank reserves. National debt taken onto the balance sheet of the central bank generally becomes base money supply by its monetisation

https://fred.stlouisfed.org/series/BASE

This is also termed power money. It is used as basis for further lending by banks into the wider economy, via frl, which increases the wider measure of money M2 – that is more than one claim on the original base money the bank has as deposit. In short a bank’s base money gets lent, spent, deposited, and over again, leading to various deposits of the same money with different claims. Banks adjust their lending according to economic circumstance of the people and businesses of the productive real economy, whose market has a way of showing how it values that money (if there were no intervention) by how much it asks from people to borrow it – if someone lends then they want to be repaid with extra to cover inflation. These are your rates.

Now, currently most government spending is taken from people’s pockets via tax and then spent on the wider public. The net change in money supply is close to zero normally from doing that, government is redistributing existing resources and shaping activity while leaving the currency more or less unchanged. So the market continues with its rates as a kind of reference, although obviously intervened by government in its choices to a greater or lesser extent.

Government spending in the west is between 25 and 45 % of GDP , that is to say it spends up to near half of what the whole country spends. So picture an extreme to understand the limit – all government spending done each year is done by QE. That would mean base money supply would increase by up to near half each year. As prices follow amount of money in circulation, and can be amplified greatly by changes in this, well the whole market set of valuations, and the currency itself, would become very unstable, in fact unworkable.

Historically this leads to hyperinflation, currency collapse, economic collapse. Attempts are sometimes made at government managing that, by directly controlling prices by law, by administering cash supply. That is total government economic management, it has been tried but tends to lead to very very unhappy results.

So, you decide how much QE is enough for yourself, but people who want easy access to money (that’s a lot of people) will often find it reasonable to continue down that path, out of convenience or because they become accustomed to that. Others though will say currency should not be manipulated by government at all, because that way any economy is more true to the reality of its needs and the demand of its people, and so will function more accurately, more fairly and more productively.

Incidentally, if you wonder why the recent QE events have not caused a major upheaval:

1. The economies are already saturated in debt, this new issuance was designed as a floor to work out the inconsistencies that had appeared (gfc) in those.

2. Government has methods of controlling the financial system and how that base money flows through into the economy, in other words we already have a heavy centralised management of the whole economy.

Where does it lead to, is it sustainable, is it fair or “right”, are the questions people are asking around the world.

The goal is just to keep people working, and making payments.

It is not sustainable, because it requires ever increasing purchasing, which long ago passed up income requiring debt purchases using future earnings. The real problem lies in the secondary costs associated with inflatiing assets values. Increasing RE values increases equity equal with increased payments, but the secondary costs such as interest, taxes, insurance, are the costs which eventually make the inflated asset costs unsustainable. At some point, market price discovery must happen, and at that point someone is going to lose a lot of money. That is why so much debt is being layed off on pension funds and other public owned entities. Even the FED does not want to be sitting on mass quantities of MBS when the next crisis hits.

“So, you decide how much QE is enough for yourself, but people who want easy access to money (that’s a lot of people) will often find it reasonable to continue down that path, out of convenience or because they become accustomed to that. ”

These are the libertarian socialists.

It’s very informative when you observe how different groups of people align with different ideas of monetary theory and government, how different kinds of cross association get created. I don’t pretend to understand it all to any great depth, but have noticed that there are often overlapping interests that govern differing ideologies, sometimes to a greater extent than the ideals themselves. The modern world is a very confusing place in that regard, maybe it is all meant to reduce to a simple “duh” while decisions get made elsewhere, who knows .

QE can go on for a very long time. The Japanese have mastered it. They are letting it run until all the people who are underwater are dead. I’m not kidding.

No!!! They drowning people now ? Before they jumping off of a cliffs now they drowning each other, no no no no no this is very sad :-( .

“They are letting it run until all the people who are underwater are dead. I’m not kidding.”

That has been obvious (and undeclared govt policy) since the late 1980’s. Notice that the screaming over Japanese Bank held, private NPL’S, is slowly dying, as is the volume of private NPL’S.

When the private NPL problems die, then only the zombie corporate issues remain. Much harder nuts to crack.

Why have the Japanese Banks been been nice to the “Private” NPL holders.

Simple. Much easier for a Bank to deal with a bankrupt estate due to death by natural causes, than deal with a Bankrupt estate, bad publicity and lawsuits, due to loan holders, taking traditional methods of dealing with personal failure, as Banks foreclosed on them.

This way also the insurance companies, that Banks are major shareholders in, take a much reduced hit.

The “Tokugawa Shogunate” (1600 – 1868) was bankrupt from its inception. The Japanese “finance system” (yes they had one even then) kept it alive, until the invasion and disruption, caused by an American “Black Swan”. An “Outside force” beyond their control.

Of all those using QE, at least the Japanese nave a vague idea what they are doing and documented historical experience, to refer to.

The question could be answered by a question: why couldn’t the Soviet economy work forever? It had a rather good start propelled by enthusiasm of the new, and went progressively downhill.

QE, even after it ended the balance sheet expansion, involves buying government bonds which decreases the interest government has to pay for debt. This sends wrong signals that the government can borrow with impunity, and also encourages useless gov. spending, sending other wrong signals down the path. It creates undeserved feeling of accomplishment where it’s not warranted.

This is aside from super low interest rates go hand-in-hand with QE, and creates yet more problems.

If you study the Green New Deal you might see where this is heading, a few years ago Fed funds were used for the Highway Fund, which caused those at Fed consternation. The Fed runs a surplus, and government taps into those funds. This Fed has had issues dovetailing with government policy, that doesn’t change their role in the process.

What can’t QE go on forever?

In reply I ask a simple question: why is counterfeiting illegal? It would solve lots of problems. Everyone would have all the money they need for food, shelter, transportation, and all their whims and desires.

To me the fallacy in this is pretty stark – who would be left to produce all the stuff there would be infinite demand for. A fundamental bedrock principle is that if it is not produced, it can’t be consumed. And, if I can print my own money, why work to produce anything.

QE is simply a legal form of counterfeiting. The fact that it is done by an “elite” group with supposedly good intentions does not make it any more right. There are numerous historical examples where it went totally out of control with devastating results.

Of course, “it is different this time”. However, the only real difference is that new groups of very high IQ fools are foisting it upon us. They use all kinds of sweet words to justify what they are doing. History moves slowly, but it will show the folly of what is being done. The vast majority of people will be worse off for it.

The difference is that people have no faith in actual counterfeit money but they continue to trust the USD. In fact it’s value is rising strongly and will continue to rise for at least the next five years while Trump’s policies cause it to strengthen. Yes he says he wants a weak dollar but nothing he actually does will produce a weak dollar – in fact quite the contrary!

I think Eferg is right. At this point the USD is “real” counterfeit money. It’s just that the people who are printing it are the only people who are “legally” allowed to do so.

That the US Govt is doing it couched in highfalutin language, doesn’t change the nature and fact of what is actually happening.

I think one other factor that’s overlooked is that if the “natural state” of the economy is, say, 3% DEFLATION in consumer prices but instead we’re seeing 2% INFLATION then the true “cost” of the QE is really 5% inflation.

Reasonable people can argue about whether this is a good or bad thing and how it truly effects the economy. But if consumer prices were dropping and wages were staying constant, then most people would be getting “richer” – that is standards of living would be going up. Nothing is that simple and this wouldn’t be sustainable long-term. But I believe this is another of the hidden costs of QE – one that I haven’t heard anyone talking about. The consensus seems that as long as CPI is around the magic 2% mark, QE isn’t causing any harm, but I would argue there’s nothing magic about it, and that periods of deflation would be beneficial to a lot of people.

I think everyone is forgetting what is stated in our constitution. Gold and silver are to be used as legal tender. It cannot be counterfeited or manipulated. Our forefather made the argument and were completely against central banks specifically for what has happened the past few decades. The rich get richer. Government becomes more powerful then the people

Anyone remember the great depression? Dot com bubble? Real estate bubble? History repeats itself. I guess nobody understands the term insanity. Doing the same thing over and over again and expecting different results.

I smell a rat, and the rat has been FED.

The question is, why would you want it to? QE does not create long term prosperity, it creates inflated asset values. The purpose of QE was to create false value in debt based assets to keep people paying the payments.

It benifits those in financial industries at the expense of working people trying to afford to live. At some point inflated asset values cause debt levels to exceed the ability of the average working person to service their debts. It is a confidence game, and it always ends the same way.

Looking forward to the day when MBS roll-off is replaced by outright MBS sales.

Don’t hold your breath. Letting MBS roll off is a whole lot less work than actually having to sell the damn things on the open market, which is susceptible to front-running and leaking.

I doubt they’d ever do open market MBS operations unless there was some crisis-grade urgent need to shrink the portfolio pronto.

Well, FRB bought the MBS on the open market in the first place, and as Iamafan posted further below, they announce their monthly purchases (reinvestment) every month ahead of time. So whoever might feel like frontrunning FRB already is. Selling would not be much different, I think. Just an auction in the other direction.

When .gov bot MBS, they represented the best price a seller could possibly get . . . i.e. no private buyer would be that stupid given the MBS quality. When .gov thinks about selling MBS, they may move the market (incr yields) considerably to reflect true price discovery on the stinking loan corpses they have buried on the taxpayer balance sheet. This COULD result in .gov reporting LOSSES, and more significantly for Muhummud Q Snackbar (or Joe 6-Pack), this could cause mortgage rates to increase. That is why, IMO, .gov is stuck holding MBS for a LOOOONG time.

I’m really surprised by this. I thought February would show the Fed surrendering and waving the white flag.

If the Fed is still on autopilot it would explain the market shifting into daily-drop mode. This looks like game over for the massively inflated stock market. I would expect the downward spiral to gain momentum from here. No more free money for the investor class means no more inflated assets and we now sit at dizzying heights.

I’ll be putting in a GTC order on SPY at 175. If SPY ever hits 175 it will, of course, go much lower but this time I’m buying with discipline. In March 2009 I had a GTC order on SPY at 650 (lowered from 750), regrettably Bernanke made a surprise announcement and that order never filled – not this time.

If this is going to happen markets may become unstable. Flash crash may enter our vocabulary again. There has been untold mal-investment over the last decade and if Powell sees this through there is no telling what will unfold.

Yes Van the Fed will by waving there white Flags pretty “ big time and pretty soon”.

and that will be accompanied or following immediately after the likes of Apple and FB

plus all the other cashed up corps go on a frenzied attempt to save their declining share prices by the ( tried and failed share buybacks)!

It will be ugly trust me!

and it will freak out the Fed to do a “ TRIPLE JAPAN “!!!

there will be No cover Van… No Solace for the Next Lehmans.

The Fed has already waved the white flag of surrender and has explicitly stated it will be using much larger QE in addition to zero interest rates. When exactly do you suppose they will use it…when the economy is good?

Bottom of this page:

https://economicequality.blog/2018/07/26/its-worse-than-you-thought/

“the Fed’s huge portfolio combines with ultra-low rates to realign asset-appreciation rates in ways that sharply make the rich still richer”

Asked a couple well known economists to describe the impact of the QE unwind relative to a rate hike of say 25bps. One said the impact of QE unwind was de minimis, perhaps keeping a bit of a lid on the long end. Other said the impact is significant and very comparable to the rake hikes. Glad I was able to get that sorted ;)

Setarcos,

The market agrees with both of them, but is flip-flopping between them: for a whole year, the QE unwind is no biggie and gets brushed off as stocks surge; then suddenly, the QE unwind gets blamed for a nearly 20% sell-off; then suddenly, it disappears as an issue and stocks surge; and then suddenly it reappears as an issue…

In terms of the real economy, not asset prices, I come down with your #1 scenario. I don’t think the QE unwind will impact the real economy much, just like QE didn’t do a lot for the real economy.

You are far wiser then I in all things financial so my assumption is I am probably wrong here, but needless to say I slightly disagree with the:

“I don’t think the QE unwind will impact the real economy much, just like QE didn’t do a lot for the real economy.”

I agree QE didn’t do a lot for the real economy, but when QT causes asset price deflation beyond a certain point I think we are going to see business and the wealthy “cut costs” which they only seem to know how to do by firing people these days. Yes I envision a sad irony: useless for the real economy on the way up, bad for the real economy on the way down.

Unless you consider the jobs in construction, finance, real estate and even building products. All that turn over of money that wouldn’t have happened with out it. This was reflected in vehicles sales and new fancy cell phones and even high end security systems.

As QE unwinds, all the above slows down and all those involved in those industries will take home less money.

If the FED kept this up long enough, it would have upward pressure on interest rates which would also put pressure on the real economy.

QE did affect the real economy. Even though there were unintended consequences that have created social issues and inequities that may end up being worse than having just let the system clear itself back in 2009. Time will tell.. Way to late to go back.. So no matter what, we deal with today and hope the future is so bright we all have to wear shades..

I can hope for a big stocks bear market and just a shallow recession, right?

Who cares about the Economy on the ground?

The QT effect on the prices of the assets on the stock Mkts?

The QEs pumped them up ( Correlated with S&P Chart!) and the QT will have the opposite effect.

That’s why so much Hue and CRY against it by Trump and Wall St!

“I don’t think the QE unwind will impact the real economy much, ”

Unless it inadvertently causes real pain amongst Employers.

“just like QE didn’t do a lot for the real economy.”

QE hurt the real economy, as it favoured of asset holders. When in fact the real economy is what really needed the assistance IT HAS NEVER RECEIVED and STILL NEEDS.

Several months ago John Hussman had a good explanation of its effects using a diagram of the liquidity preference curve combined with interest on excess reserves. The basic conclusion was that the economy was already behaving as if the balance sheet was much smaller at around $2T due to IOER and QT could continue for a lot longer before short term rates would rise much above IOER.

Reuters has an article saying the Fed isn’t buying any more MBS. Usually they try to keep the balance within their goals despite prepayment of mortgages.

Well it isn’t March 13 yet.

https://www.newyorkfed.org/markets/ambs/ambs_schedule.html

Whoa, that’s an interesting link. Had not seen that one before. MBS reinvestment going from 5.8B in Sep to 300M every month since then.

Total Assets : minus 10%.

UST30Y trading range :

Selling climax on 1/26/2015 @ 2.25% as support.

Resistance from : 6/22/2015 high @ 3.25%.

The 30Y is in the upper range, currently @ 3.03%.

When rates are high ==> price fall.

By the way, if you compare the COMPOSITION of the Treasuries maturing vs the ones they reinvest in, you will see that the Fed is actually exchanging older maturing notes with shorter new notes.

You can check this on the CUSIP level.

So surely enough the average holding is getting younger in that sense.

Iamafan,

Yes. You can also see that in the curve of the bonds maturing in 10+ years. The Fed is not replacing them. I haven’t checked years of data, but I doubt if it is taking on anything longer than a 10-year.

Also, during QE, the Fed bought Treasuries in the market. So it might have bought a 30-year bond maturing in 25 years. And that’s how it accumulated these long-dated bonds.

Since the end of QE, however, it has been exchanging maturing bonds with new bonds directly through its system with the Treasury Dept, thus bypassing the market. These are all newly issued securities. So it might replace a maturing 10-year note with a 7-year note. Or it might take on a five-year note to replace a maturing 30-year bond that it bought in 2011 with eight years left.

What’s striking is that many of those 30y maturing had yields near 8 1/4% !

To be replaced by paper at 2.5 – 3%.

On the other hand the 2Y to 7Y were much lower yields and they will be exchanged at higher rates.

Probably little effect as the Fed gives the Treasury (TGA account) what it makes (income).

Two observations: (a) Coupon of 8.25% is one thing, but FRB bought these 30Y at a much lower yield than that (higher price paid). (b) The return of interest to TGA is down by a lot because FRB since 2007 pays IOER (interest on excess reserves) to the tune of 308B in 2016 (wkipedia latest number). The IOER rate is now 2.4%, same as FFR. So it is the taxpayer paying the banks roughly 300B/year.

@Wolf, any reference on the “direct exchange” of maturing bonds between FRB and UST? Web search came up empty for me.

Well, those were just my own simple words, not google-able technical terms. Here is the more precise wording from the New York Fed:

“Consistent with current practice, rollovers will continue to be accomplished by placing non-competitive bids at Treasury auctions; the bids will be allocated across the securities being issued in proportion to their announced offering amounts.”

https://www.newyorkfed.org/markets/opolicy/operating_policy_170920

Thanks very much. That means that FRB will participate in the standard auction process alongside the primary dealers. Very handy for rolling over stuff, and/or if FRB suspects the primary dealers are not going to (be ble to) do their job of soaking up all treasury auction offerings.

All German rates up to 9Y underwater.

Central banks infantile playground on a swing :

The front end up, the middle and the long duration down.

They have fun.

Gravity between the German and the US yield curve is pulling

the US middle and 10Y down.

The 30Y is dragged down with them.

US middle is inverted.

It ‘s an infection spreading to the long duration.

Because of negative rates in Japan & Europe, the long duration

cannot warn the FED about inflation.

Prices might move higher in the future, but the yield curves will

not show it.

We are in a bear market rally, CAPEX will fall and one day there will

be no oil.

Thus spoke the oracle of Delphi – obscure, absolutely meaningless. indecipherable.

This is what Oracles do – no matter what is said, nobody knows what “it” means until…wait for it…after “it” has actually happened. Then people retrospectively translate the BS as reality.

However, at no point does anybody have the faintest idea what the hell the Oracle is ranting about BEFORE it actually happenes, which is the only time it actually counts.

Lot of that going here.

=>Thus spoke the oracle of Delphi – obscure, absolutely meaningless. indecipherable.

Subject to interpretation. That way the oracle’s pronouncements can be made to fit any outcome, and therefore can never be wrong. Infallability is mostly a matter of coming up with the right spin.

Remember, if it is contradicted by reality, it is reality that is mistaken. Plus you need more gaslighting.

I like Al Capp’s oracle, Ol’ Man Mose, best (in Capp’s comic strip “li’l Abner”):

Never explained, just said “Ah has spoken!”

QE was not going to be able to make the real economy grow over time, and since wages have still not grown enough to allow asset prices to be real in terms of saving actually supporting the returns.

So, asset prices will have to continue to adjust, LoL

GDP at start of QE in 2008: $14.9T; GDP in 2018: $21T. The $6T+ had to come from somewhere.

Asset pricing (especially real estate) is/has become globalized. That US wages haven’t “kept up” may be a simple statement of lots of US buyers can no longer afford all that beautiful real estate in San Francisco, New York, Seattle…

Javert Chip,

This is “nominal” GDP and doesn’t include the impact of inflation. So part of the increase is inflation. And the rest of the increase is “real” growth.

Deducting the Chapwood-index based inflation from GDP growth, there is NO growth left, on the contrary. And I think this is THE reality. No more growth over the last 10+ years. Only consolidated debt and unfunded liabilities grow – and fast.

hendrik,

I suspect that inflation as measured by CPI is understated systematically but by a small amount. These small amounts are additive, and over the years make quite a bit of difference. And real GDP growth would therefore be slightly lower. I’m with you so far.

But CPI is not understated by 7 or 8 percentage points. If you have 10% inflation, as the Chapwood index claims on the low end, cost of living would double in 7 years, not just for one person, but for all people in the US. This is TOTALLY NUTS. Just do the math. The Chapwood index is a BAD JOKE at best.

There is an alternate scenario by which the real Fed funds rate is closer to 5% according to the balance sheet runoff. If that is true then inflation could be higher by a factor of one, Shadow inflation in assets helps make the case. If the Fed is nominally running ZIRP or even NIRP, that makes sense as well. There is no global rate gap. You can start to connect the dots.

How much of that real growth was driven by cheap money.

Just want to add that a big chunk of the “real” growth is driven by population growth.

Javert’s data say GDP growth is about 40% over past 10 years, so 3-4% per year. It has to be under 4%/year because of compounding.

With ~2-3% real-world inflation and 1-2% population growth each year, all of that GDP growth is accounted for.

Per-person real growth is pretty small. And all that growth has gone to the few who were already well off.

All of this is a global thing, not just the US.

And it’s why the populace is restless.

Right on. GDP/capita is the only worthwhile measure. Using just GDP is skewed by population inflation.

Yes, forgot about that part of growth :-]

Japan had QE since the 90s, we since 2008, and EU around 2015 and going. It was global printing. Although the USD had to come from here, we offered swap lines. Many of the foreign banks are primary dealers and were the Fed’s open market participants. In fact most Fed repo are foreign. So yes it’s global and the Chinese have about 3T dollars. Money will go wherever it can go.

OK, I give up. I studied economics–macro and micro–in college decades ago, even tutoring students who were slightly more confused than me. Back then, you had ‘demand’ and ‘supply,’ and greater demand with lesser supply caused inflation because people were willing to pay more for desirable items that were in limited supply. Also, you had price ‘elasticity’ where, IIRC, demand remained the mostly the same even as the price went up (e.g. fuel and energy; which people needed for transportation and climate control regardless of their ability to pay).

In the last two decades I’ve learned that only too much money creates inflation and ‘debases’ the dollar according to the sage Rick Santelli, godfather of the totally organic and spontaneous ‘Tea Party.’ I can’t wrap my head around QE–my brain isn’t as elastic as it used to be–but, apparently, the Fed ‘buys’ paper that nobody wants and essentially flushes it down a money toilet. This somehow gooses the economy because now people can get more loans they don’t intend to repay and this is good. I do understand the Fed messing with interest rates, because theoretically this lets legitimate borrowers–i.e. young couples who want to start a family–buy a house in which to start said family, but also allows gamblers who take the cheap money and roll the dice on risky ‘investments’ because the Fed will buy the worthless paper so they can bet on the next risky endeavor (also, cutting tax rates on the gamblers does essentially the same).

Do I just not understand ‘Modern Monetary Policy?’ At least one thing hasn’t changed; no one really understood economics way back then, and they don’t seem to now.

Economics is the PR branch of the Financial Industrial Complex, posing as a pseudoscience, populated by flacks whose job is to persuade you that giving away the store to the hyperwealthy will somehow make everybody better off. It’s not supposed to make sense. You’re just supposed to nod your spinning head in agreement and promise yourself you’ll figure it out later.

Rick Santelli will tell you anything you want to hear, but first you have to believe everything he says. Muting the TV when he comes on never seems to work. His discredits include the creation of the Tea Party and despising the poor who are so lazy they only have three part-time jobs, and he should only be approached with a Geiger counter and an animal tranquilizer. I have some extra 8×10 glossies of him for your dartboard if you want.

Modern monetary policy isn’t that complicated.

1. Debt rises, and the economic measures of spending = earnings + additional debt.

2. Debt gets too high and additional debt can’t be added. That reduces spending.

3. Money is created by the Federal reserve and given to big banks to lend. It gets invested in things like housing, stock, and corporate debt. Asset prices rise so debt to asset ratios look lower and the asset rich can borrow even more to “invest” and the cycle continues.

4. Wages go nowhere as asset prices skyrocket. Jobs come back in things like construction to produce ever more investable assets.

5. Central banks slow monetary growth, curtailing the supply of money for these “investable assets”. Prices begin to fall making the debt to asset ratios look unsustainable again.

6. Central banks panic and give ever more money to big banks to invest in bubble assets again.

As this continues, inflation measures which typically measure the costs of discretionary purchases stay low. The costs of living continue to rise so people have less and less and get ticked off. Politics becomes unstable.

This keeps going until political forces change it, as ever more people are willing to roll the dice on political outsiders with crazy ideas. The system eventually rights itself with a major crash or a more orderly decline depending on the competence of whatever politicians we end up with.

We live in interesting times.

A fine summary, agreed word for word. Thank you.

A excellent summary: throw in the steadily rising energy cost of energy extraction and processing, and we see a very large cloud indeed on the horizon……

California Bob,

A lesson in handbag economics. Hermes makes the most expensive handbag in the world, starts at ~$15K, and there is a waiting list to get one. Due to the desirability of the bag, there is a huge market in used bags which increases the supply and holds down prices for the newer bags. While indicators would suggest huge price increases are in order, inflation is not possible because supply is plentiful. I’ll add that if you show up in a store with $15K burning a hole in your pocket, I doubt you will leave empty handed.

There is also a huge market in fakes at price points of $25 to $500 with the more expensive fakes being of higher quality. The fakes serve a different segment of the market but increase the overall supply, contain inflation, and help maintain the market for the bag.

Handbag economics teaches us that in any market with high demand and sometimes hidden supply, inflation is contained by large supplies of acceptable substitutes.

Reselling has also become a huge business in America under the nose of traditional retailers. This is containing inflation in those products. You can find used luxury goods sold in department stores, and new products discounted at Goodwill. I am always on the hunt for a good bargain and manage to look somewhat affluent on very little money.

Basically in an information society it is possible to arbitrage both supply and demand. That’s why economics doesn’t seem to make sense anymore.

That is a very good explanation. Personally I would add into that that we live in a time of super-abundance where the base values that used to guide people (everyday necessity) no longer receive the same focus, because expectations are placed higher, or differently. You could say this is partly a product of forward consumption, of gratification before effort, that is spurred by supply side monetary policy, and by easy credit.

I don’t think economics as a whole is a hard science, the mathematical side is, but there are social sides and behaviour, where all you can do is observe and say “Oh, this is how people have reacted to that, and this is how society is becoming”. So with all the above you have incalculable changes in attitude and action that all lead to wherever they do. Hindsight and history are good judges, but they are not outright determinant, just reasonable guides that are frequently subject to revision so as to better suit whatever narrative of the day is required.

Traditionally economics was a branch of political philosophy. They were describing economic activity under various political systems.

In the early 20th century a few physicists started trying to game markets by applying physics and math, some got luckier than others, as you would expect in a normal markets, and the rest is all of recent history.

BTW, I do agree with your view of a general over supply of everything. The point, that perhaps I made badly, is that people don’t always see the over supply due to structural issues.

You made the point well, but because at a certain level we are talking in a different language, say how sentiment and own organisation adjusts a market vs. how supply to that market and access to that market is affected by more external inputs (say price of money, or trade policy), the same picture will look slightly different due to where the accents appear using our own particular lense of understanding. All of these observations , where they are true, compliment each other and help build a fuller understanding, which I think is what is needed.

California Bob. You are a lot smarter than most about economics because you put the order right “demand” and “supply”. I see that most get it backwards, “supply” and “demand”. Demand in this relationship is key. Without demand supply is unimportant.

Monetary Policy can’t work with this much capital concentration, especially with secular stagnation.

The injections don’t really create any new wealth. They just finds ways to steal from existing pools of wealth.

Oh darn, now everybody’s going to know.

Super K cut the deal in the early 70’s ,tricky dick reset our currency off of gold and on the fed note.It was a stroke of genius to couple Saudi oil sales to treasury purchases And abra kadabra the petro dollar was born .The demand for dollars to buy oil is slipping away with the east wind and with it the reserve currency.QE,QT or whatever you want to call fiat ends on its own terms.The invisible hand of the market place is not just a quaint gurgle from an old dead guy from Edinburg

Wasn’t one of the complaints about QE that the stimulus didn’t stay domestic but flowed all around the world inflating bubbles everywhere?

For example, over-investment in China was blamed in part on the ability to borrow US dollars cheaply. ZIRP made the dollars cheap to borrow, but QE made them plentiful and available.

Then when the US QE unwind started there was some hand-wringing about causing crashes (or bubble pops) in other countries that had overindulged on cheap US debt.

All this seems a bit like observing that liquidity injections are liquid, but why else was there a global housing real estate bubble?

But now this year China has opened their own liquidity floodgates, with $1.1T (trillion US dollars) worth of liquidity injection in one particular week in January that I saw reported, plus I don’t know how much more in other weeks.

Given that, does US Fed QE unwind even matter any more? If the fed is soaking up drops while China is issuing a flood of new liquidity, why wouldn’t the argument about liquidity flowing across borders work in reverse to effectively erase the effect of what the fed is doing, and then some?

Even assuming that only a fraction of these programs migrates between countries, the Chinese injection is so massive that the spillover still must overbalance what the fed is doing.

I think what we need to be looking at is the aggregate world QE, which is still going up.

Lots of errors and misconceptions in here. Hardly any of it is correct. Start with this: China does not need to borrow USD . They have been flush with USD from trade for a long time, and have been lending USD to the US by buying UST bonds.

I wasn’t talking about China the country borrowing USD, but rather individual (large) Chinese businesses taking out dollar-denominated loans from US banks.

Wolf – Will the Fed’s MBS roll-off cause mortgage rates to tick up? Or do mortgage rates track the 10-year Treasury yield?

I’m trying to decide on where and when to purchase a home and all of the distortions in the market are causing me significant anxiety. Clearly, many major cities are overvalued and the full impact of higher interest rates, tax reform, and reduction of international investors have not been fully priced in to the market. I’m assuming that prices have to come down in many major cities.

However, when looking at 2nd tier cities in flyover country, housing still appear to be relatively affordable. Philadelphia in particular appears to have solid housing stock in great school districts that is priced around 2X-3X median incomes. As long as interest rates stay below 4.5%5%, purchasing a home in flyover country seems to be a solid investment assuming the Fed will reduce rates and start QE again as soon as the recession hits.

Or do you believe that even 2nd tier “affordable” cities will experience real estate declines over the next five years?

In my opinion, buying in the Midwest shouldn’t be a bad bet if you plan to stay in the house seven years or more. If there’s a recession and the Fed does QE again, you can refinance to a lower rate.

Of course, I wouldn’t buy in a state like Illinois that has huge financial and pension problems. This would be like tacking $150k onto your mortgage, in exchange for nothing. I would check out the debt and pension issues in Philly too.

This is good advice – to extend it, before you buy you need to carefully look at the obligations (bond and pension) of the state, county, and municipality of any place you are considering. Some states are ok but some large cities in those states are not because they have huge pension deficits. Texas, for example, is near the middle in terms of debt but Houston and Dallas have huge problems.

Come to Boise. Prices may decline, but at least you will have a decent standard of living and scenic surroundings here.

IdahoPotato – I don’t disagree with you. I love the NW. We may rent in Philly and buy a vacation home in the NW to retire to. We have small children that are pretty damn overwhelming at the moment and I feel we need help from family.

I’m a native NYer and I consider Philly to be a world class city, great shopping, great museums, great restaurants, great real estate, flyover country indeed!!! NYC and LA are the real s***holes.

Petunia – I agree with you. It didn’t attract the financial services, tech, or gov’t industries to save it from post-industrial decline, but it certainly has all of the amenities of a international city and discounted real estate as a result.

We were fortunate enough to ride the real estate wave over the past ten years in a big city and can buy a house all cash in our early thirties in a nationally ranked school district.

The house may depreciate due to a weak regional economy, but the numbers are relatively small and we won’t have a mortgage to worry about in a down turn.

Wolf,

The comments out of the Fed about reducing average maturity sounds like the real news.

If the Fed wants to reduce average maturity, then surely they would need to address the MBS issue first. 95% of its MBS portfolio matures greater than 10 years out vs just 28% of its Treasury portfolio. Time to switch from passive to active management? How else to whittle down that $1.6T in MBS other than by selling outright? As you say, no refi boom on the horizon.

The Fed now has quite the arsenal of ammo to “adjust” the Treasury yield curve. Just 16 basis points between 3-month T-Bills and 10-year Treasury bonds. Fed could steepen that pretty quickly with some portfolio restructuring.

QE will never end.

Pity The Nation: War Spending Is Bankrupting America

https://www.zerohedge.com/news/2019-03-15/pity-nation-war-spending-bankrupting-america

If less QE, how to pay for all the military overseas mission ?