Oh dude, glad no one saw it.

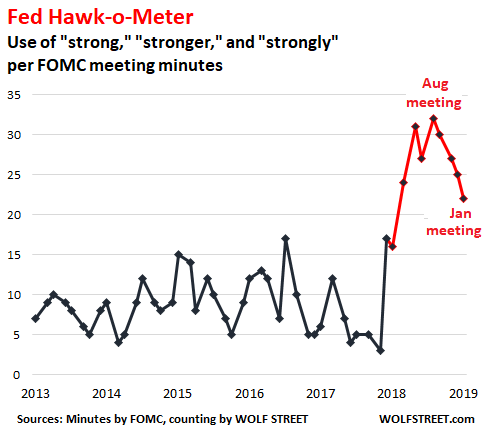

My fancy-schmancy Fed Hawk-o-Meter checks the minutes of the Fed meetings for signs that the Fed believes the economy is strong and that “accommodation” needs to be further removed by hiking rates, or that the economy is strong but not strong enough to raise rates further, or that the economy is spiraling down to where rates need to be cut. It quantifies and visualizes what the Fed wishes to communicate to the markets.

In the minutes of the January 29-30 meeting, released this afternoon, the mentions of “strong,” “strongly,” and “stronger” edged down for the fourth meeting in a row, this time by three points, to 22. The Hawk-o-Meter has now backed off quite a bit since the August 2018 high – when the Fed was rubbing it in that it would raise rates four times in the year – but it is still in outlier territory and redlining:

The average frequency of “strong,” “strongly,” and “stronger” between January 2013 and December 2017 was 8.7 times per meeting minutes. In the January meeting minutes, the 22 mentions were still 153% higher than that pre-redline average.

The average over the past 10 meetings minutes, starting with the December 2017 meeting, when the Hawk-o-Meter redlined inched down to 25.1 mentions.

Actually, “strong,” “strongly,” and “stronger” were mentioned 25 times in total, but as is not unusual, two were fake strongs, so to speak, and I removed them from the tally. But they’re interesting in their own right:

One referred the to strong-but-less-strong syndrome:

With regard to the postmeeting statement, members agreed to change the characterization of recent growth in economic activity from “strong” to “solid,” consistent with incoming information that suggested that the pace of expansion of the U.S. economy had moderated somewhat since late last year.

The other referred to the sudden hair-raising spike in repo rates at the end of 2018:

Repurchase agreement (repo) rates spiked at year-end, reportedly reflecting strong demands for financing from dealers associated with large Treasury auction net settlements on that day combined with a cutback in the supply of financing available from banks and others managing the size of their balance sheets over year-end for reporting purposes.

“Strong,” “strongly,” and “stronger” appeared in phrases like these:

- “Job gains have been strong, on average, in recent months….”

- “Household spending has continued to grow strongly….”

- “Total nonfarm payroll employment expanded strongly in December.”

- “Output gains were strong in the manufacturing and mining sectors….”

- “Real PCE growth was strong in October and November” [PCE = personal consumption expenditures or short, consumer spending].

- “Available indicators of transportation equipment spending in the fourth quarter were strong.”

- “Growth of C&I loans on banks’ balance sheets picked up in the fourth quarter, reflecting stronger originations….”

- “Issuance of both agency and non-agency CMBS [commercial mortgage backed securities] remained strong.”

But “moderated” also showed up:

- “Growth of business fixed investment had moderated from its rapid pace earlier last year.”

- “Global growth had moderated.”

- “The pace of expansion of the U.S. economy had moderated somewhat since late last year.”

And the brave new world of “patient.”

“Patient” was first and feebly introduced with one just mention in the minutes of the December meeting: “The Committee could afford to be patient about further policy firming.” This has now turned into a cacophony of “patient” with 13 mentions, including:

Early in the new year, market sentiment improved following communications by Federal Reserve officials emphasizing that the Committee could be “patient” in considering further adjustments to the stance of policy and that it would be flexible in managing the reduction of securities holdings in the SOMA.

Subsequent communications from FOMC participants were interpreted as suggesting that the FOMC would be patient in assessing the implications of recent economic and financial developments.

A patient approach would have the added benefit of giving policymakers an opportunity to judge the response of economic activity and inflation to the recent steps taken to normalize the stance of monetary policy.

A patient posture would allow time for a clearer picture of the international trade policy situation and the state of the global economy to emerge and, in particular, could allow policymakers to reach a firmer judgment about the extent and persistence of the economic slowdown in Europe and China.

But the minutes warned:

“Patient” might disappear without notice, if “uncertainty” abates, inflation rises, or economic growth gets hot again:

Many participants observed that if uncertainty abated, the Committee would need to reassess the characterization of monetary policy as “patient” and might then use different statement language.

And “patient” might then be replaced with something like the predecessor phrase, “some further gradual increases in the target range for the federal funds rate.”

Meanwhile, as we’re biting out fingernails, waiting for the drama to unfold,… The Fed’s QE Unwind Reaches $434 Billion, Remains on “Autopilot”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If the fed curtails QT will it stop letting treasuries roll off and still continue selling MBS ?

Stand by. We’re waiting for their plan. We’ll get some answers over the next few months.

The New Plan. :-]

So those who believed the Fed will stop tightening before long appear to be right.

Next up subsribers of QE forever.

QUOTE: Several participants, however, expressed concern that a slowing of redemptions could be misinterpreted as a signal about the stance of monetary policy.

This means that there is concern that slowing down QT (QTT = QT tapering?) will be interpreted too dovishly. And several pariticpants would like to squash that perception. Hawkish!!

The rate increase was nothing but a head-fake for negative interest rates in the near future. Whenever they say they’ll never lower rates below zero you can be assured negative interest rates is their plan.

Surely if one was to see negative interests coming; then the US$ would fall and physical gold would go up.

In Switzerland there are negative interest rates resulting in:

1) waiting list for safe deposit boxes because:

2) demand for Swiss Franc 1,000 notes (about US$1,000)

3) pysical gold

To be stored.

It makes sense because in Switzerland there is also capital tax which works out at about 0.2% per annum on personal assets.

Off Topic: I envisage that more and more western governments will be charging capital tax as more and more middle class people end up on minimum wage with AI, Robots and data bases reducing employment and more and more state benefits having to be paid out.

Wolf does it matter, the Fed is Wall Street’s puppet. Pushing on the string with more debt, IOUs, etc., is a GDP joke. We would of been better off if the Fed let another recession happen around 2015, everyone likes to talk about the wealth of the US, but not the total debt, like the gambler that tells you they won 10K, but spent 15K.

The debt tsunami is coming along with global slow- down = back to near 0 interest rates.

Wolf: Your Fed meter can not possibly be falling!

First of all your Fed meter scale only goes from zero to 30!

Haven’t you noticed that your Fed meter’s pointer is firmly wrapped several times around it’s maximum stop post at 30!

IMO, Wolf meter is not helpful this time around.

Powell in fact has:

1). Said the balance sheet will be much higher than recently thought.

2). Said QE will be used more frequently.

3). Endorsed nonsense the Fed will cut interest rates to help the economy in Vanuatu, Antarctica, North Pole, Mars, and other “global economies” which the Fed has no mandate for…as he ignores as he always has the American economy and crushes it with free money for his Ultra Rich friends who will give him a nice $$$ job when he leaves the Fed (bribery).

Note: More frequent use of QE on a balance sheet = much higher QE and balance sheet – there is no escaping this reality.

Powell’s slow and dovish interest rate increases these past few years has trapped him, he will forced to cut rates if the Martian economy does not improve.

Recently history tell us cutting interest rates reduces growth, and higher interest increases growth.

Exactly, the show must go on so the fed will make sure that rates don’t get much higher, or the treasury won’t be able to pay it’s bills. The rates going over 3% on the 10s scares the hell out of them.

Rates can’t travel north too far, regardless more QE is coming so the socialist leanings can expand. Money for nothing for the right people, and it is not the middle class.

In the beginning QE will be will be disquised as Reverse Operation Twist (ROT) to help control the yield curve from steepening too much. You could say QE becomes ROT, and then becomes the new less effective QE again.

It’s a balance point with interest rates…high enough to leave a little wiggle room downward… but not high enough to break the bank on paying interest on all that outstanding/growing debt.

IMLTHO, Powell’s knees buckled after Herr Trumpf’s onslaught/criticism in December. Paul Volcker he ain’t. Then again Trumpf isn’t Reagan either. Powell’s attempting a balancing act between doing what’s proper for the economy/body politic, and responding to Trumpf’s manipulation through pronouncements. In a tight spot he’ll need to placate Il Presidente, and relegate sound policy to second place to avoid conflict. And he’s conflict-averse. Good luck to all of us.

“…might then use different statement language.”

Which translates to :

“Early in the new year, market sentiment improved following communications by Federal Reserve officials emphasizing that the Committee could be “UNUSUAL” in considering further adjustments to the stance of policy and that it would be flexible in managing the reduction of securities holdings in the SOMA.

Subsequent communications from FOMC participants were interpreted as suggesting that the FOMC would be DEVIANT in assessing the implications of recent economic and financial developments.

An INHARMONIOUS approach would have the added benefit of giving policymakers an opportunity to judge the response of economic activity and inflation to the recent steps taken to normalize the stance of monetary policy.

A VARICOLOURED posture would allow time for a clearer picture of the international trade policy situation and the state of the global economy to emerge and, in particular, could allow policymakers to reach a firmer judgment about the extent and persistence of the economic slowdown in Europe and China.”

The FOMC goes full monty.

I placed around a word and it cut the word from my comment ? Must be a shortcut edit or something.

The first line should read

“…might then use – DIFFERENT – statement language.”

Warning, those two little pointed brackets erase everything in between, and themselves, when you push send. They just did that again.

Yes, these “little pointed brackets” indicate to the system that what is in between them is html code, and nearly all html gets stripped out with just a few exceptions. Security reasons. Don’t them. Use the ([{}]) instead.

I fixed it for you.

Thanks, I did not know that – you learn something

[different] every day.

« I also have double arrows :-) » which are twice as good.

August 2018, was a nice time to lock in some cd-ladders at 3%,

The USA can & never will allow the interest rates to go above say 2.5% again, as paying the debt is no longer possible.

Reality left the barn years ago, now its 100% alice-in-wonderland, stocks will continue to prosper, and those who ‘invest’ in the right stocks will continue to gain superior returns. ( Value +4* div, low-beta)

Don’t fight the fed, both yesterday and today still holds.

Even 30+ years ago Greenspan was talking ‘sh*t’, the script is well written, @xmas dTrump told the FED to return to Abnormality and so it was done.

All of us will be long dead before anything changes, the can be kicked much longer, as we all know the USA is still the best looking turd in the punch bowl to every ‘elite parasite owner’ on earth.

The PTB will continue to prosper the ‘poor’ will continue to grow, most likely we’ll see a ‘check’ going to every soul in the USA, because why not, the only inherent problem today is social stability, all else for the PTB(elite owners of Corp-USA ) is good.

I remember when young working for big-oil, the golden-boy (richest guy at the firm) said “The reason we have welfare is to keep them in the hood out of our yards”, Today the only thing missing is finding the sweet-spot to boil the frog (poor), with just enough sugar&opiates in the soup to keep them happy until death.

Today’s elite live in the best of times in human history, their only problem is the ‘final solution’ of solving the ‘poor problem’.

About once a week, one of my banks is trying to get me to buy a 9-month 2.6% CD.

CD unnecessary, there are savings accounts in the low to mid 2s

Yeah, I got two of those now… they’re all coming up.

Sounds awful and just about right.

Beautifully written chaos

=>Today’s elite live in the best of times in human history, their only problem is the ‘final solution’ of solving the ‘poor problem’.

There were viable solutions, but that was before their self-interested delays made the ‘problems’ unsolvable. In due course they will attempt ‘solutions’ which will make the ‘problems’ far worse.

You’re really not going to like them. I refuse to participate either way, but that’s just me.

Yup, Bilbobeer’s got it! The 1913 Federal Reserve has morphed into the post Glas-Steagall/overseas bank invasion of the USA Federal Reserve. This Fed has all those invader banks under its wing.

My prior post can best be summed by ‘Carlin’.

It’s a BIG CLUB, and most of you will never be allowed entry, the people that are hired to run the FED, know they’re just paying their dues so they can belong to this elite club, where they’re children, and children’s children will never have to compete or worry about a comfy, safe, pleasant life.

Most of what passes as ‘news’ is just cannon fodder to feed the frog’s, bread & circus to some, bile to the elite.

The goals of the FED we were originally told were INFLATION & UN-EMPLOYMENT, I think today the ‘goals’ should be safe-haven’s for elite wealth, and bile for the masses. Inflation has clearly been ‘cured’ and un-employment is now irrelevant in our post-industrial NWO.

Zero percent interest rates coming right after the recession that no one saw coming emerges on the scene with a bang.

The debt is there. The debt service will not be there. There is no other way out but to drop rates to zero otherwise it’s massive debt write offs which cause deflation, and deflation is anathema to a fiat-debt based financial system.

It’s not personal. It’s just math and debt slavery.

So you are saying the FED has reared so much debt that they are now the slave of the debt?

Several years ago, FED said “Market, go buy assets, or you get hurt! “.

Today, market says “ FED, go ease, or you will get hurt!”

The FED is a pathetic bitch of the market now. I wonder why people still pay attention to FED. FED will do what market tell it to do, or get hurt!

That’s what people mean when they refer to ‘financialization’.

The book ‘The Finance Curse’ spells out quite nicely why regulation is again necessary to prevent the financial sector becoming too large.

It’s now an out-of-control monster, feeding off free state-provided money (in the form of QE), and free to loan at 1000%+ IRs to desperate/gullible people if it so wishes.

What the world needs – amongst a plethora of measures to rein in the finance monster – is the trustbusting and breakup of banks/investment/hedge funds, and a limit placed on their size, so they can no longer subvert the democratic process.

Why stop rates at zero? Better to go negative, in which, the more debt there is, the more “profits” to the debtor. Governments can truly grow rich on their mountainous debts.

There is no CB Ponzi, Inc. “patient” – that flesh & blood GDP reality lay comatose on an immoderate fiat-bellows respirator after the Great Bush Recession mortally wounded it – and stayed that way until 2015; it died when China & global CB practitioners overdosed it with an unprecedented mega trillion$ speedball to try and stimulate it. It’s now been replaced with the monetary equivalent of a communal plutocrat sex doll…

I thought what mortally wounded it was a guy in France at Societe Generale in 2008 that went to try and mark to market the bank’s sliced and diced, AAA rated real estate notes. The guy said it was impossible to do. Oui??!!

Bush was just along for the ride.

So the next webpage I visit (at a European site) after reading the above article headlines

“The ECB is thinking of new liquidity injections that will be different”

I suspect an episode of plagiarism.

The ECB is unlikely to do anything bar small adjustments to their security purchase programs at least until the end of Q2. Expect however the media to turn these small adjustments into some sort of “Fed fold”.

The reasons are two.

First, next year the ECB will be under new management. It’s not merely Draghi that will finally ride into the sunset (hopefully never to be seen or heard of again) but a whole host of other decision-makers that will be given a gold watch, a handshake and sent into retirement.

Despite of what people here seem to think the ECB (very much like the Fed or even the Bank of Japan) is composed of many heads, and a surprisingly large percentage of those heads have not merely misgivings about present monetary policies but correctly predicted the present “credit exhaustion” scenario. While all bets are off the table I suspect the new ECB leadership will prove a surprise for pampered credit markets.

Second is that, plainly put, more of the same won’t help this time. Credit conditions in Europe are as loose as they were last year. Nothing changed bar the pace of balance sheet expansion. Yet it isn’t working. China has unleashed another gargantuan round of financial stimulus, as usual timed with the Lunar New Year. Will it work? Obviously. They’ll get their usual 6% GDP growth just like the Party intended. Joking aside China has become trapped in a vicious cycle of larger and larger rounds of stimulus and looser and looser credit standards which, for a variety of reasons, ended up eating their once formidable trade balance surplus. Don’t think this is lost upon the people at the ECB.

I agree, in that they want to hand the reigns over with the Eurozone economy more or less stabilised (and we’ll ignore at exactly what level it is stabilised at), but I do not see a good exit from the current low rate trap available. The only alternative is to use the resulting grind of higher rates as part of a political tool to reshape EU, but I seriously do not think Europe is in any shape to tolerate more upheaval and result more cohesive. I have stood back as one crisis after another has unfolded in different countries, without predicting the demise of Euro as many have, but I am very aware of some of the hard limitations that do exist, and I think we are quite close to them already.

The board of the ECB is made of an unelected representative from each country, hand picked by any government. The minutes of meetings are only recently available, the format is concensus, not vote. To my view it is more a group of shared influence. I can imagine a more regimented approach, matching the political overtones that are now appearing in Europe, that is to say a centralised management of the new tension. I find it hard to think that a credible EU representation of that will emerge though, it is as possible the resulting difficulties will be used to hammer nationalism back while searching for a wanted further synthesis of European rule. This might prove too much for some countries though, for the construct itself even maybe.

So I am not very sure at all at the moment exactly what lies ahead.

I was actually hoping that Brexit would happen. I have my doubts. I expect Brexit to be delayed indefinately resulting in the UK (second largest contributor to EU) continuming to pay the US$9 Bn per annum contribution the the EU club.

If the UK Brexited in real and doesn’t continue paying these monies to the EU, and with the inevitable recession coming (already there in my opinion) in the EU zone; could see the EU zone in big trouble.

If the UK did well after Brexiting (I believe would after 3 years), more countries in the EU zone would also leave and the Euro would be doomed.

That would actually suit the USA and give even more credibility to the US Dollar surely?

Grand dad said neither a lender nor a borrower be.I have seen nothing to upset that mantra.the fed will take care of the banks and ditch us.I am in hard assets And covered calls with a short leash.voltaire knew what he was saying about the fate of fiat paper but not when. Shoulders are in the smoke house.

Yes the Fed would/will do that because for 40+ years now we have been operating under the false premise that the ‘economy’ is more important than society – indeed, the latter was posited to not even exist under the monomaniacal, sociopathic doctrine of the Chicago boys, clutching their dog-eared copies of ‘Atlas Shrugged’ in their weak, clammy fingers.

This is the reason for one thing that there will NEVER be a debt jubilee – those holding the loan notes will see society go to hell in a hand cart before they let that happen (ref: Greece) – and unfortunately deregulation has allowed them to grow to the size where they have that power.

MD, a debt Jubilee means Social Security disappears. 100% not the SS surplus is invested in US T-bills. The government decided to forgive its own debt, and the pensioners starve. Not to mention all the other pension funds holding massive quantities of public and private debt. A debt Jubilee is no free lunch. It’s a scorched earth Hail Mary that incinerated savings and pensions. Careful what you wish for.

Sigh, my spellcheck really made a mess of things. Tenses are all wrong, an ‘If’ was dropped, ‘of’ became ‘not’, and ‘incinerates’ became ‘incinerated’. Blah…

And my grandma used to say ‘Many a mickle makes a muckle’. For a few decades now we’ve been steadily conditioned to believe that we don’t need mickles to make muckles, and we’re now into a stage where ‘Many a muckle makes a mickle’ seems a more appropriate term when it comes to the diminishing effects of the growing aggregate debt load.

Isn’t the Federal Reserve, ECB and Bank of Japan in effect buying all the assets?

Isn’t the solution for the USA to close the Federal Reserve?

Wouldn’t that solve the problem and wasn’t that the intentions of JFK and possibly President Trump whom actually surely has a personal hatred of banks and knows how to play them from his private business in the past?

Wolf has some very insightful content here but the hawk o meter got him carried away into thinking that interest rates will continue to rise and QT will go on for much more.

Those who look at the history of the FED since Volker times knew that the Fed will blink at the first whining of the stock market and boy it did, it didn’t even take a ten percent decline to make a complete U turn. Now we are talking about stopping QT altogether, how short our memory is when in December it was all in autopilot for the foreseeable future…what changed in such a short period of time?

Look into Japan for clues to our future, our debt has a very long way to go given their history. I except Dow 35000 within two years. When you have a fiat currency that can be printed in unlimited quantities, it’s only a matter of time before powers that be make use of the exorbitant privilege.

Although I could be wrong, I always get this sneaking feeling that too much retirement money is wrapped up in the stock market, so the Fed can’t let the market drop. My reasoning goes back to many years ago when it was a big scandal that the American government was moving everyone’s pensions into the market…it was the “big giveaway to Wall Street” and now the Fed is stuck propping up the market.

Right on, Stephan.

I remember those times, “many years ago”. I was born just soon enough that I was old enough to retire back then. I was a U.S. government employee and was given the option of staying in the old, defined benefit pension plan or getting into the marvelous world of a “private investment-based” pension.

Since I had long since determined that I preferred to base my financial future on my own use of my own capital (productive land, etc.) and not capital controlled by the other man (banks, brokers, corporations and paper representing their machinations, stocks, bonds, etc. sitting in a drawer). I stayed with the defined benefit plan for sustenance and used inflation and the saved surplus from the pension to enhance my capital, in fiat-dollar denomination.

But that denomination has never been important to me and my way of going.

My way will persist much better than strategies dependent on the Fed’s decisions, or anybody else’s.

I have never regretted how it’s gone for me, these last 45 years.

The pensions funds (CA) are backed by the states, so if the Fed lets pension funds go, (stock market) the states collapse and the dominoes go all the way back to DC. The new gov of CA cancelled most of the high speed rail plan, which led Prez to cancel 3.5B they had committed. It was like Huh? You don’t want our money, you can’t have it. It seems everyone is pulling back (Queens rejected Amzn HQ?) Everyone wants to just keep what they have.

What difference does this all make, if the natural world … you know .. the one that until recently sustained us all … is DEAD !

I mean, Really !! …. or perhaps I should say “Reality !!”

Externalities mean zilch in the world of Homo Econonicus … and it will mean our doom !

Econo(m)icus …

Lets just call contemporary humans what they really are: the Monkeys of All • About • MEEEEEEEEEEEE !!*

* and kill-off even moarrr insect life while we’re on a roll .. next up: krill and plankton …

You do understand that we have no choice. In order to service all the debts created requires exponential growth. Debt is bringing forward tomorrows income to spend today. When you borrow from the future enough, the future finally arrives. We are doing this also with the ecosystem. Trash and pollution and consumption and expansion. We have been building up to this for a few decades now. Anything less means a collapse of the economic system that supports all these billions of humans.

And we think we are so smart and cleaver…

So they will stop unwinding their asset purchases because they believe that continuing the unwind might damage U.S. asset prices?

The Fed really is in the business of coddling the market, if this is the main reason.

When I was a boy the markets were governed by economics….now politics….unfortunately for my children. The game appears to have a bad ending in 30 years or so when US debt will exceed US wealth. Its not about GDP its about total national wealth vs debt.

A lot of discussion about FED reversal juicing the market again. But if we go into a significant recession, and the negative economic indicators can’t be glossed over, could FED policy then fail to prop up the market?

Yes. The Fed doubled down on the financial distortions of 2008 instead of making Mr. Market take his medicine. Instead, by papering over unserviceable debt with even more debt all they bought was time, and at an enormous price, naturally to be paid in the future. They’re all doing it – Japan, the ECB, and China worst of all. A meltdown is inevitable, and it will be severe.

Well Trump wanted a more dovish FED & that’s what we got. The folly is that we’ve become so fixated with the count of certain words or phrases to substantiate or unsubstantiate FED Policy. It’s a bit of insanity that we need to “quantify & visualize” what the FED wants to communicate.

Isn’t that what transparency was supposed to provide? Powell said in the last FOMC Meeting that the FED isn’t concerned with fiscal policy only monetary policy. But that isn’t true. They’re concerned with keeping the stock markets propped which in turn keep us from flatlining into the next depression. The FED is the lifeblood of the global economy. They walk a tightrope that’s frayed at both ends. Tighten too much & crater the “strong” economy. Stay loose for too long reflects zero confidence in that “strong” economy & zero credibility. It’s a continual struggle between utilizing sound judgement or manifesting a horrible mistake. We’re at that juncture where FED Policy is more perilous than ever.

– It surprises me that the 3 month T-bill rate has remained flat since early december 2018. So, I am still betting on “No move”.

– There could be a GOOD reason why this rate hasn’t risien more. I have read (anecdotal) stories that the Treasury has issued A LOT OF short term debt. That could have pushed this one rate higher. Don’t know what to make of it (yet).

Unless the Dodo flies, I still think we will have two to three rate hikes this year. Then again who knows?

I do. It no longer matters what the Fed does.

It’s out of their control, not that they ever had much control. Their job has been to manage, as best they can, the distortions created by the Financial Industrial Complex in its mad pursuit of avarice. This merely enabled the FIC to up its madness until now the distortions are no longer manageable. The FIC has made such a proper mess of it that now they’re rather entirely focused on maintaining their privileged status after the debacle so they can at least rule over the ashes.

Apparently the FED has one policy when the US is locked in an existential war and another policy during peacetime. Right now, and maybe for a long time to come, the US is in an honest to god monetary war with China. The US asset markets are one measure of world dominance, and in reality must be supported by the FED under these circumstances. This is an era of Weaponized Monetary Theory and the evidence of this are the drastic measures being deployed. The political left have discovered MMT is now a possibility and maybe inevitable. I have no idea how to invest my meager savings in the midst of two monetary wars, one with China, and a civil war at home.

One note worth considering is that the notes being rolled over or reinvested (the ones maturing) have yields at around 0.50 to 1.625.

This is true for 2Y, 3Y, 5Y and 7Y issued during QE and previous SOMA reinvests. The 10Ys maturing have yields at around 2.75.

Therefore rollovers are going to cost the Treasury a lot more now since today’s Notes are at least 2.5%. Even if the Fed gives back these interests they earned, they are returned (recycled) MINUS the interest paid on bank reserves (which are increasing).

The real problem is a lack of understanding how QT works. There are 2 major accounting transformations.

1.) During a ROLL OFF at maturity, no additional purchase by the Fed is done. So the Treasury security (ASSET) at the Fed is reduced. So it the Treasury General Account (TGA) a LIABILITY is reduced. The Fed is essentially being paid by reducing the Treasury’s TGA account at maturity.

2.) But the Treasury needs NEW money (to replace the old) and the BANKS, or whoever they are acting as agents for, MUST PURCHASE NEW Treasuries and their reserves at the Fed decreased.

#2 is the main gripe of the banks. This is their so called LIQUIDITY complaint.

Now that the Fed has indicated they are more comfortable with a much larger BANK RESERVE (and of course a Balance Sheet) then all eyes should really be at the level of IOER. Surely too, the Fed has to improve the banks’ Net Interest Margin. Not sure how more Treasury Bills will to try to lower the front (shorter) end.

Well this Fed climbdown is one for the records, from full speed ahead to all engines stop. It is kind of sad that a state agency (presumably for the People), feels the need to engage in this tortuous language with the public, parsing words, literally, rather than just being straight. I guess if 3% interest rates going to bring disaster, then well, there is nothing “strong” or “solid” here, quite the opposite in fact.

“It is kind of sad that a state agency (presumably for the People), feels the need to engage in this tortuous language with the public, parsing words, literally, rather than just being straight.”

People are ALWAYS the sitting ducks at the ready waiting to be stiffed or lined up and shot when the economy or bankers need to be bailed out (else it will be worse).

The only solace is the end may be at hand because it has been going on since 1987 Greenspan put. It is unlikely people will wait for another 32 years before taking matters into their hands.

Reading through all the commentary here, I am struck by the nearly universal cynicism and disdain of the U.S.’s (and, indeed, the world’s) financial condition.

I agree with this view, but my personal situation is more independent of that that system than most.

Is enhanced independence perhaps a worthwhile goal for more people? Dump some of the paper and acquire locally productive hard assets?

A University of Michigan researcher analyzes U.S. Corporate function in our society and asserts its functions will devolve into more localized economic forms:

https://drive.google.com/file/d/0B16dMVHRjL5ddWVWQ1R5eURPWHM/view

There is some evidence of that trend in agriculture here in WV. Local farmer’s markets are now competing with regional grocery suppliers.

Local farmer’s markets have to raise prices because of increasing input costs – much more than regional grocery chains. There are fewer and fewer people who can afford a $4 head of lettuce when you can get an organic version for $2.50 at Kroger.

Many of my local farmer friends don’t know for how long they can sustain this unless they are selling niche products for restaurants like some exotic mushroom at $15 a pound.

Our best local farmer’s markets are pickup trucks parked in town, which quickly sell out their loads of sweet corn over the tailgate at considerably lower price than available at the local IGA. Same with eggs, etc. Local slaughterhouses do very well, also.

Bartering is going on all over the county.

Formal farmer’s markets and their costs affect them no more than the machinations of the Fed do.

RD Blakeslee – “Is enhanced independence perhaps a worthwhile goal for more people? Dump some of the paper and acquire locally productive hard assets?”

What productive hard assets have you in mind?

I actually believe that the future will be owning farm land and self sufficiency.

However, I cannot see the millenials having the energy (watching TV, playing games on smart phones) being capable of physical graft.

Isn’t that the sweetest part?

They just die off in the process. No more great hairstyles.

Natural selection, anyone?

The Fed has worked its way into a corner. Lowering rates or slowing the roll off will be inflationary which will increase pressure to raise rates to control it. Their choise at this point seems to be to fuel inflation, or crash the economy. If they choose to fuel inflation, that inflation wil in time crash the economy itself.

Was there anything in the minutes where Jerome Powell announced, “Yes, Donald Trump, I am your bitch.”? If not, then there really should have been.

The hesitation to push rates higher surprises

me . I felt confident Powell was going to follow through. My guess is human nature has taken

over and can kicking rules the day. The decision

makers in government and industry aren’t risk

takers. The horizon only extends until the next crisis.

“A patient posture would allow time for a clearer picture of the international trade policy situation and the state of the global economy to emerge and, in particular, could allow policymakers to reach a firmer judgment about the extent and persistence of the economic slowdown in Europe and China.”

The problem with this is, the Fed only became “patient” when Mr Market declined 10%. The “unclear picture of the international trade policy situation” had already existed for some time.

It was when Mr Market declined 10% – and only then – did the Fed act to freeze rates and talk up more QE.

At least they have not resorted to using the word, “bigly”…LOL! Or will it be: “We hate to report that the ‘patient’ (the economy) has died!'”

I’m getting it.

With asset values now pumped to stall-speed heights via low interest rates – now what? How risky would it be it for the Fed LOWER rates to goose sales? (And lift asset values higher.)

And how risky if the FED RAISED rates to SLOW rising asset values?

(And accelerate the slowing of home sales and bust the housing market.)

Seems our debts ARE the ‘monkey wrench’ which confounds the FED, (and makes fools out of investors).

The FED can do a few things but with regard to controlling inflation and maintaining high employment, the FED’s operating headquarters is left with 2 tools. Use the up and down interest rate button, or turn on the money copier. The money copier is just about busted. And too much button pressure in either direction is akin to over steering on an icy road. Meanwhile the ice thickens. As debts outpaces revenues, the comforts of a smooth ride will be deemed ‘what used to be normal’.

The FED has less chance to wiggle free of economic danger. Oh God how we’ll long for these good old days.

‘Many participants observed that if uncertainty abated, the Committee would need to reassess the characterization of monetary policy as “patient”

So what are the odds that Trump will NOT use the so-called “trade war” with China (and perhaps Europeans) to maiantain just enough uncertainty for The Fed to stay “patient?”