Central-Bank Stimulus Fail: The longer it drags on, the worse it gets?

Manufacturing in the powerhouses Germany, Japan, and China took a hit – all of them complaining about exports. But US manufacturing continues to expand, according to a slew purchasing managers indices (PMI) released by IHS Markit.

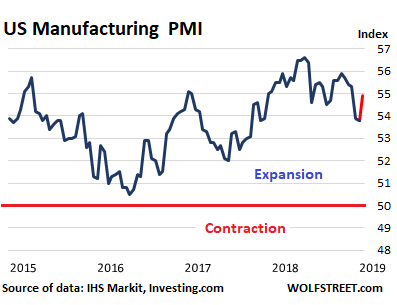

US Manufacturing Clings to Gains:

In the US, “manufacturing remained a bright spot as production volumes expanded at the fastest pace for eight months,” IHS Markit reported today. Domestic demand was strong, but export growth has been weakening. All factors combined, the Flash Manufacturing PMI rose to 54.9. In these indices, 50 is the dividing line, signifying “stagnation”; below 50 signals “contraction” and above 50 signals “expansion” (data via Investing.com):

In the chart, the current observation is in red to show as we go further down the line how much the US manufacturing sector is diverging from those in Germany, Japan, and China.

Companies saw “robust demand” in the US but a “slowdown in export sales growth,” the IHS Markit report said.

But their responses about hiring were “somewhat disappointing, with the overall rate of job creation slipping to a 20-month low,” it said. “However, even this weaker January survey employment index reading is consistent with private sector payroll growth of approximately 150,000.”

And “stretched supply chains remained a challenge for manufacturers, with vendor lead-times lengthening for the 55th month running in January,” it said.

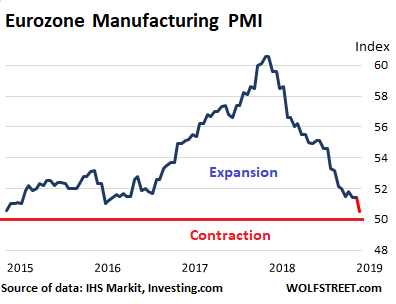

Eurozone manufacturing doesn’t look hot.

And that has been a problem for quite a while. The Flash Eurozone Manufacturing PMI dropped to 50.5, a 50-month low, an indication that the manufacturing sector is “close to stagnation” in a “broad-based slow-down” (data via Investing.com, current observation in red):

“The factory sector reported the weakest expansion since the current production upturn began in July 2013,” IHS Markit said in the report. And it added:

- Inflows of new work fell compared to December, registering the first such decline since November 2014 and signaling the largest drop in demand for goods and services since June 2013.

- New orders for goods fell for a fourth successive month, declining at a rate not seen since April 2013. Deteriorating exports contributed to the disappointing order book picture.

- Outstanding work decreased for the second consecutive month, worsening at the sharpest pace since December 2014.

- The Eurozone economy slipped closer to stall speed in January, with companies reporting the first drop in demand for over four years.

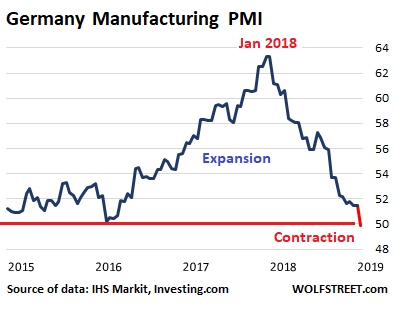

German manufacturing declines

For the first time since November 2014, the Flash Germany Manufacturing PMI dipped below 50, falling 1.6 points from the December reading, to 49.9, indicating contraction in the sector, continuing a steep deterioration from peak growth in January 2018 (data via Investing.com, current observation in red):

The report added these comments:

- Manufacturing fell into contraction in January as the sector’s order book situation continued to worsen, showing the steepest decline in incoming new work since 2012.

- Weakness in the auto industry was once again widely reported, as was a slowdown in demand from China.

- New export orders fell at an accelerated rate across both monitored sectors during the month.

- Notably, January’s survey data showed a decrease in overall inflows of new business – the first such decline since December 2014. This mainly reflected a deepening downturn in manufacturing order books, which contracted for the fourth successive month and at the quickest rate for over six years.

- Continued weakness across the auto industry, lower demand in overseas markets (particularly China) and heightened uncertainty were all highlighted as factors.

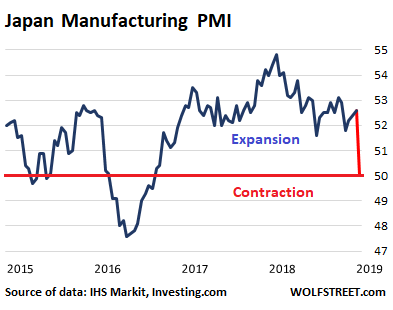

Japan’s manufacturing descends into stagnation.

The Nikkei Flash Japan Manufacturing Purchasing Managers’ Index fell a very steep 2.6 points to 50.0 in January, ending the “longest expansionary run for over a decade” (data via Investing.com, current observation in red):

Exports fell at the “strongest pace in two-and-a-half years,” the report said, production was cut for the first time since July 2016, and confidence was the “lowest in over six years,” all of which “bodes ill for Japan’s manufacturing sector.” And it added:

- The underlying picture will raise concern, given renewed reductions were seen in new orders and output.

- Further signs that the downturn in the global trade cycle could yet worsen were also signaled, with new export orders falling at the sharpest rate since July 2016.

- Domestic economic weakness compounded with slowing global growth coincided with the lowest level of business confidence for over six years.

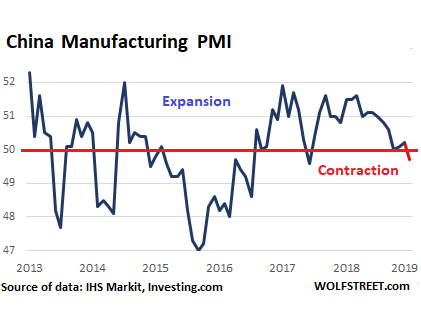

China’s manufacturing declines.

“Overall new business falls for first time in two-and-a-half years,” said the report of the Caixin Purchasing Managers’ Index, which covers December and was released in early January. It dipped below 50 (to 49.7) for the first time since May 2017. “It is looking increasingly likely that the Chinese economy may come under greater downward pressure,” the report said:

The subindex for new orders contracted “for the first time since June 2016, reflecting decreasing demand in the manufacturing sector,” the report said, as “external demand remained subdued due to the trade frictions between China and the US, while domestic demand weakened more notably.” And:

- New export business meanwhile fell for the ninth month in a row, albeit at a softer pace than in November.

- Efforts to reduce operating costs alongside decisions to not replace voluntary leavers meant that manufacturing employment in China continued to fall in December. The rate of job shedding was modest and similar to that seen in November.

- The output subindex rose slightly to above 50, but was still near its lowest level in three years. The drag of weak demand on production may gradually become more evident.

- Stocks of finished goods increased at a slower pace while stocks of purchased items declined, pointing to companies’ growing intention to destock, which may in future disrupt the stability of the manufacturing sector’s output.

This paints an interesting picture, not of a “global” slowdown in manufacturing, but of a slowdown in manufacturing in countries that have built up their export machinery in order to boost their economies. Germany (and the Eurozone overall), Japan, and China have vast merchandise trade surpluses with the US. They’re the most vulnerable to changes in the US – the auto sector in particular, with vehicles and components from Germany and Japan, and with components from China.

Also note that, ironically, the Fed is the only central bank in the bunch that has taken its foot off the gas, has been raising rates since late 2015, and has been unwinding its balance sheet since late 2017. And manufacturing in the US is hanging on.

But Japan and the Eurozone are still mired in negative-interest-rate policy. The ECB has stopped QE but has no plan to unwind it. The Bank of Japan continues its QE in fits and starts. And China is in a struggle all of its own, boosting its economy while also trying to keep its debt bubble from imploding all at once. Which should be proof that this central bank stimulus does little if anything for the real economy, though it’s very good at inflating asset bubbles and creating debt monsters.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Like USD ! USA is the least dirty shirt!

Or maybe just the last to catch the global flu?

Capt. Business Tripps …. ??

Or maybe just taking better care of business.

Or maybe it’s so dirty, it can only get cleaner.

You don’t know what you’re talking about, try living in EU, my case Portugal.

We have ocasio Lopez and the likes for 40 years.

Here there are 3,5 millions state pensions, we have 700,000 big government, we have 400,000 universal basic income.

For 3,5million private workers

Would you like to ask those poor taxes mules how they are doing?

Manuel, this is a commonplace occurence: in every single country I’ve been to there is a fair number of people honestly and genuinely convinced they live in the most corrupt system in space and time.

Sometimes it’s a form of chauvinism (“my country is number in everything including corruption”), sometimes it’s due to lack of experience (as I like saying most people only go abroad for the beaches and the cheap booze) and sometimes due to despondency brought about by lack of meaningful change.

More often than not however it’s just due to laziness. Most people read “US ranks only 30th in the Democracy Index, Freedonia rank number one again” and become easily convinced they live in some brutal dystopian dictatorship. Most people read “San Marcos ranked the happiest nation on Earth” and happily swallow the line.

And don’t get me started on the widespread belief in sinister secret societies or “elites” ruling the world. That Stonecutter song is pretty hardcore though.

Morale: there’s none so blind as those who will not see.

Responding to the comments, having been a lawyer for decades, I can certify that California has massive corruption in courts and politics. We need a ministry dedicated to prosecuting corrupt judges, billionaires, and politicians who are EFFECTIVELY above the law now. Notl counties have it and I hope not all states. Given the failure to prosecute any banksters, I suspect that they do.

As to the comment that we are better than other alternatives that has significant truth. However, our pensioners (as the reports here and in other sites confirm) will all suffer because the FED helped its patron, criminal banks and politicians to bail out financial institutions with ultra low interest rates. These politicians thereby concealed the weak economic position of the US government with 120 trillion plus in government LIABILITIES (which are different than treasuries, which are the debt that is commonly known. I doubt other countries have the same HUGE liabilities.

The low rates mean that pension funds do not see much growth in their holdings and pensioners will suffer low pension payouts as a result. Personally, I opne that we must at last take action.

In the US, we have one of or the wealthiest economy under a single set of controlling groups. Too many of these persons are what psychiatrists call high functioning sociopaths or maybe even psychopaths.

They are the people who fake concern but are happy to profit from death and misery: e.g., who pollute water going to cities or distribute knowingly harmful substances like opioids or tobacco. They can be identified and tagged with the right label on if they are subjected to a battery of tests for say one week. Businesses can then decide if they want to be liable for putting a sociopath, for example, in charge of lying to doctors to sell opioids.

They may be clever but faking concern and empathy over long periods of psychological examinations is not possible. We should take back control of our country from such people who have been responsible for such my sery for so long: e.g., the banksters.

The world-wide economy is slowing. Debt levels have reached “saturation” again. Trade wars, bogus fiscal accounting, US interest rate increases/Fed balance sheet reduction. China struggling with huge debt and no transparancy system.

Economic “growth” is stalled. Has been stalled. Several reasons: cost of energy, productivity “growth”…. NOT in developed countries, huge income and wealth disparities, NO savings of average “Joe”, etc, etc.

But debt is the big problem. As long as it overhangs, NO improvements.

Cost of energy is not the #1 OR EVEN MAJOR issue any more. Cost of RENT to get a building to use the energy in, is the new # 1 ISSUE. In many developed Nations/Economies.

Hmmm…

Another campaign promise with a check?

*****

“In the US, “manufacturing remained a bright spot as production volumes expanded at the fastest pace for eight months…:

Great story. Have we really decoupled and left the rest of the World crying? We, too, have a lot of debt but we are not that dependent on exports unlike China, Japan and Germany. The problem is that the first two are decreasing their purchase of Treasuries so (and with QT) we have to buy more of our own debt (the liquidity for stocks less).

How long is this gonna last? But as you said, truly ironic. We’re still doing fine (except for the furloughed gov’t workers) and our Treasury Yields are a lot better than theirs.

US Manufacturing Gains?

Up one index point in the PMI while exports fall and employment stagnates. This is hardly a circumstance to celebrate!

Taken together with what is economically occurring globally, while adding in geopolitical posturing by the worlds leading powers, points to a continuing slowing of growth as the global economy expires.

All global economic/political indicators are now aligned in unison, showing a general weakness and malaise, affecting global trade along with rising geopolitical tensions. This is not good.

All global economic/political indicators are now aligned in unison, showing a general weakness and malaise, affecting global trade along with rising geopolitical tensions. This is not good

Wrong! It is excellent news for bears =)

As the adage goes –

Be careful what you wish for!

I suspect a lot of bears are going to end up as rugs and fur hats.

In case nobody has noticed financial markets are not merely rallying: they are skyrocketing.

This is part of the “bad news is good news” mentality of the past five years or so: it means stimulus is just around the corner.

China has lighted the fireworks and just wait until the Fed raises a big white flag. Yes, I was wrong: these guys lack not merely a spine but any decency as well. They will fld, and fold in very spectacular fashion.

Bears are going to become an endangered species: they’ll be either slaughtered or will die of starvation while trying to hibernate for another decade or more.

Morale #1: hope is no substitute for cynicism.

Morale #2: the bad guys always win.

Morale #3: if you want something don’t behave like an adult but like a crybaby. You’ll get anything you want.

Employment numbers stagnate at lows not seen since 1969. ” Really ?” Yeah 1969 . Not a bad place to stagnate.

Did people stop buying cars and TV sets?

Don’t know about TVs. But I’ve been reporting about the situation with cars for a while, including most recently my podcast…

https://wolfstreet.com/2019/01/20/the-wolf-street-report-auto-sales-this-isnt-even-a-global-recession-yet/

People don’t need to buy TVs, Smartphones and cars every year. So once there is some trouble with the economy, they do not.

I remember that during the Smartphone craze, when Smartphones actually had significant changes every year, I had a friend that changed Smartphones every six months. Nowadays he does do every two years.

The last time I bought a TV set for myseft was ten years ago. I do not see much point in buying a new one when the one I have works fine.

Well, I guess my not getting around to researching international stocks (or bonds!) paid off :P

“But Japan and the Eurozone are still mired in negative-interest-rate policy. The ECB has stopped QE but has no plan to unwind it. The Bank of Japan continues its QE in fits and starts. ”

Debt is strangling long term global real economic growth and productivity. Monetary policy is an absolute failure.

“Total global debt is now at $244 trillion, or roughly 3.2 times the size of global GDP, according to the Institute of International Finance, as cited by Barron’s. In the year 2000, the global debt to GDP ratio was 1.7 times.”

Source

https://www.investopedia.com/the-high-yield-bond-market-is-flashing-danger-signals-4584615

Expanding credit along with the other side of the ledger-debt, is just shuffling asset prices, unless that credit goes into income creation.

Bringing jobs and investment back home to the USA is the spark that will keep the U.S. economy running.

Central Banks have burned out the “wealth creation” mirage.

Good Morning Wolf.

It’s confusing, because the last several big manufacturing facilities down here in South Carolina have all been Chinese owned (e.g. Volvo).

https://www.thestate.com/news/local/article218801820.html

Do we really have the latest numbers? I heard nobody knows because it’s not reported during the shutdown. Truly ironic.

These are not government numbers. They’re put together by Markit, which is owned by IHS, a publicly traded company. PMIs are based on surveys sent to manufacturing executives to get their input on how their business is doing. And they’re very immediate. The US data set was collected in about the second week in January.

I wonder how tempting it is for said “executives” to provide “rosy numbers” for PR & “investor relations” purposes.

There is no PR involved. No one outside even knows the companies or the executives involved.

I have followed those reports for many years. They give you a good insight into what these executives are seeing — and this can get doom-and-gloomish at times, as they did during the euro debt crisis. And when the service and manufacturing PMIs are combined, they give you a pretty good indication of where GDP is going.

This is the kind of boots-on-the ground data from a company perspective that speaks to me directly, having been in the same position myself. They make a lot more sense to me than some of the economic data we get elsewhere.

As I recall in the lead up to the GFC, Markit charts of CMO and CDS was superb. They nailed it and I wanted to short the junk but could find no vehicle to do it as a small time investor.

I have not followed them much since then, but I will attest to their coverage ahead of time.

It’s almost as if a push to build and buy in America is the right way to go? Who’d have thought

“Companies saw “robust demand” in the US but a “slowdown in export sales growth,”

It’s the right way to go only if the US consumers can digest everything they produce and don’t rely on export growth.

What this sentence means is that US exports are still growing (not declining), but that growth is slowing.

And energy is the number one export? Are we getting lower consumer prices while products (ex Pork) that were meant for China are dumped in the domestic market? If the trade war were suddenly resolved inflation could take a jump. These figures are what business uses to plan their inventory. On the outside chance that GDP will come in high, the Fed will be back with more rate hikes and hike right into the recession.

So; how is Europe going with the deal of raising rates?

There won’t be any interest rate hike in Europe (in fact there may be more rate cuts, always with the justification of “stimulating inflation” whatever that means) and the ECB is looking for a way to start expanding their corporate bond purchases once again without looking like complete fools.

Financial markets have spoken and they are betting on a huge round of stimulus from Frankfurt, and heavily so, and far from our pillars of integrity to disappoint them.

That is what I am hearing and seeing. No rate cuts till at least 2020 consensus, TLTRO, government yields sinking. Some say Japanese yield hunters are responsible for the last, others ECB, but you have to ask if there is some kind of synchronisation going between central banks. For example German/EU surplus much returns to US as fdi. Exactly what the ECB and EU think they are up to defies me, and it is NOT covered at all in mainstream except the occasional article on there being a “judicious” delay , but absolutely no talk of what the eventual gameplan of it all might be. This is maybe the economic equivalent of what a supra legal entity like EU stands for, Europe gets supra-nationalised but there is no super nation to be found to asign the label to. Doesn’t stop the labels being printed and distributed though, and it has all become the currency of the moment. Let’s all play at being Europeans I guess… “have you been yours today?”. Even the new “traditionalist nationalist patriotic” front in europe often seems no more than another proprietary EU cause sometimes.

That’s true: the fashionable Left phrase in Europe is ‘Europe of Nations’ as opposed to the ‘Europe of Capital’.

Same old EU totalitarianism however you cut it…..

Any bets on the new ECB chief. It must happen this year sometimes.

It’s irrelevant.

As François Mitterand said back in the days the European Central Bank must only concern itself with technicalities: monetary policies themselves are set by the European Council.

In spite of all claims to independence the ECB has always executed the decisions taken by the EC without fault, even when they flew against its mandate. So why things should change especially now that Santa Claus parties are ruling the continent?

Like the others, this one’s also a head-scratcher for me, Wolf. Is there a “non-GAAP” equivalent to the manufacturing index that can explain this? I’m sorry, I have a hard time believing the US figures.

These figures shouldn’t be a surprise. As my transportation reports have shown early and mid-2018, the US goods-based economy, which includes manufacturing, was booming last year. This was then confirmed by hot Q2 and Q3 GDP readings. This boom has slowed somewhat toward the end of 2018, as my transportation articles have shown, and as Q4 GDP will confirm (if the government opens up in time to release it). So for now, the US goods-based economy is growing at a good clip, but not at the pace seen in early and mid-2018. And this is exactly what the PMI shows you.

There will be a recession, and the goods-based economy will be what will lead it, but not now, not yet.

An index is one thing, the the absolute real trade balance is another. Over 2017 Germany had a positive trade balance of over 280 billion USD.

Unrelentless growth is unustainable. Prognosis for 2019 is that CO2 levels are about to increase at “near record” levels.

Ok, doom and gloom pretty much everywhere… where are the safehavens?

US manufacturing is still doing pretty good.

Sorry Wolf but it is hard to see the global slowdown and take the USA slowing down being slower as a positive. I look at your chart here and I look at your transportation boom fizzles chart and they are identical. That tells me the numbers are right and the exec’s are telling the truth. If the transportation numbers keep falling I would expect to see these reports do the same, not doom and gloom yet. But not very peachy either.

Note that the 10% to 25% China tariff on $200 billion of product was to be implemented on January 1st, 2019 (subsequently delayed Dec 1st, thus moved to March 2nd, 2019). A lot of manufacturing was front-loaded to escape the advertised increase. The latest U.S. PMI would include this front-loading.

2018 natural disasters in the U.S. should be around $400 billion. I have friends in Houston who are still re-building from hurricane $125 billion Harvey that occurred back in 2017. Fires and floods have damaged hundreds of thousands of homes and autos over the last two years. Replacement and restorations add to GDP and PMI…and like debt, natural disaster restorations simply pull future consumption forward that would have otherwise occurred at a later date.

Will the U.S. PMI soon decelerate as fast as the Japan PMI has recently? Will it follow the currently downward slope trajectory and take another 12 months to catch up the rest of the world? My guess is it depends on the China tariff resolution date somewhat. Yet I do believe much of the China tariff damage is already done and thus will take years, if ever, to recover. I also think the $50 billion QT will continue to slowly and methodically drain market liquidity silently and thus chip away at the financial markets. And then PMI can follow the markets down as market price “Twitter” sentiment seems to rule them all.

It seems that Just In Time logistics has been replaced by Make It Before Tariff Starts.

The USA has such a large SERVICE sector and the numbers weren’t so great. Then this –

However, as the survey does not include the government sector, the impact of the shutdown may not be fully captured.

Markit has never been my favorite, I prefer ISM. That is what GDPNow uses in their algorithm. If you look at the regional Fed surveys this month the only one doing much better is Philly. Next Friday ISM will be out, we’ll see.

The ISM and Markit indices track fairly closely, with the ISM now at 54.1 (strong expansion). But you cannot compare the ISM to indices for other countries. So if want to compare, you need to stick to apples and apples.

Imagine US were not in shutdown…The PMI numbers would sky rocket.

So…Where are the arguments for the Fed not to raise taxes?

Rich people already do enough for this nation

They really don’t – not in any way, manner or form.

Creating jobs is not a social service…altruism involved whatsoever.

The USA wouldn’t have third-world levels of income/wealth disparity if they did ‘enough’.

They’ve just spent lots of money to convince you they do.

It’s worked, too, it seems.

DB troubles mean that German businesses can’t buy out foreign competitors and continue financing projects below cost. Most Chinese products are not competitive without export subsidies. 200+ billion a year in US market share that could be captured by US businesses. Trump is right about the US stock market about to zoom upward. Tariffs, Wall, and enforcing $USD restrictions (eurodollars shrink).

Doomed to repeat? Before we do too much wishful thinking about the strength of US manufacturing compared with the rest of the world it would be prudent to remember that the great depression here was preceded by economic weakness elsewhere.

Bank failures, political upheaval, regional wars, and contracting economic demand all through the 1920’s. Sound familiar?

Ooh oh….

Article in ZH saying the Fed is considering halting it’s QT and might stop at a much higher balance sheet that previous Powell comments. Like, around it’s current balance.

ZH is not good, like WolfStreet is. Everything there should be read with a jaundice view IMO.

But should the Fed in fact do this, it would fit in with other actions that trend toward servicing Wall Street casino complex.

Why do you say that?

Domestic Securities Holdings as of January 23, 2019

Change From Prior Week -3,834,044.3

The Treasuries expire at the end of month still, so wait a week.

Just look at the numbers yourself and don’t trust the blogs.

Where is the QT hold?

No change now, article says changing/halting/slowing will be discussed at meeting soon.

One thing they’re already discussing — we know because Fed heads have publicly talked about it — is how to bring the MBS to zero and only keeping Treasuries on the balance sheet, as it was before QE. This would mean shedding MBS faster and slowing the runoff of Treasuries.

The balance will have to be much higher than it was before QE, as I pointed out many times, because it has always grown with GDP and the amount of currency in circulation (on the liability side of the balance sheet). But it will be smaller than it is now.

https://wolfstreet.com/2019/01/11/feds-powell-balance-sheet-to-be-substantially-smaller-how-small-he-gave-big-clues-my-dive-into-dynamics-w-charts/

How all this will shake out will be interesting, but I think it will play out slowly over a fairly long time — it has already been a decade.

Like USD ! USA is the least dirty shirt!

Is it any surprise that US manufacturing is rising relative to the rest of the world?

Trumps tax changes implemented over a year ago reduced corporation tax rates from 35% to 20%. That is a strong influence to move manufacturing to the US, or at least stem the rise of manufacturing outside the US. In addition, there is no longer any reason to leave foreign earnings outside the US due to tax concerns upon repatriation.

Plus, the threat of tariffs drives manufacturing to the US as well.

The downside of the tax plan, of course, is that government deficits and debt are rising, which is not sustainable. Also, the new tax policy increases wealth concentration in the US from already high levels.

Yup. That’s what I’m seeing in my neck of the woods, but ironically, most of the new or re-opened (i.e. textile mills) factories are Chinese/Taiwanese owned. Between tax breaks and automation, the labor costs differential isn’t as great as it once was.

Only small companies pay thirty some per cent in goomint taxes. When is the last time that GE paid any net taxes?

@Wolf,

>>Germany (and the Eurozone overall), Japan, and China have vast merchandise trade deficits with the US.

I think you mean surpluses, not deficits.

Well, yes, duh!

Thanks

:-]

US manufacturing benefiting from reversal of 40 years of US Chamber of Commerce’s “fair” trade agreements!

Fair trade replaced by reciprocal trade agreements!

The 1% no longer negotiating trade for the 99%!

Can you send a few of your latest extreme lay shrewd trade negotiators over here to help us in the UK ?

Mrs May needs ’em to help our government negotiate our numerous forthcoming bi-lateral world wide trade agreements after Brexit.