But first-time buyers cling to hope.

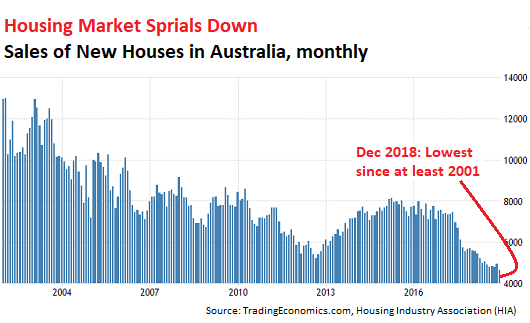

Sales of newly built detached houses in Australia plunged 6.7% in December 2018 from November, to just 4,622 houses, according to the Housing Industry Association (HIA), easily whizzing by the prior record low of 4,769 sales in August (chart via TradingEconomics.com):

In the fourth quarter of 2018, sales plunged 14.9% compared to the fourth quarter in 2017. On this year-over-year quarterly basis, sales fell in all states and territories. Here are the results for the most populous states:

- Queensland: -26.5%

- New South Wales: -18.8%

- Victoria: -10.9%

- Western Australia: -7.9%

- South Australia: -0.3%

The HIA report blamed “regulatory interventions” – in other words, the long overdue regulatory crackdown on mortgage fraud, the Royal Commission investigation into wrongdoing at the banks, and a crackdown on excessive housing speculation – for the decline:

Regulatory interventions in the lending market restricted access to credit for some home buyers and this was the catalyst for the broader housing market slipping into the contractionary phase, characterized by a softening in prices and a drop in the number of property transactions.

The tighter credit environment has been a factor in the reduction in new home sales, but the deterioration in the broader housing market has also dented household confidence.

Would-be new home buyers are far more cautious and this translates into weaker demand for new housing.

And this time it’s not rising interest rates that have caused the downturn: Mortgage rates in Australia are near record lows, and the policy rate of the Reserve Bank of Australia is stuck at a record low 1.5%.

Instead, the downturn was triggered by sky-high prices in one of the world’s most fabulous housing bubbles that smacked into a regulatory crackdown on some of the elements that had made those sky-high prices even possible: Mortgage fraud, bank wrongdoing, reckless lending, and excessive property speculation aided and abetted by the banks.

And so, as a consequence, the housing market in Australia, particularly in Sydney and Melbourne metros, has started spiraling down viciously.

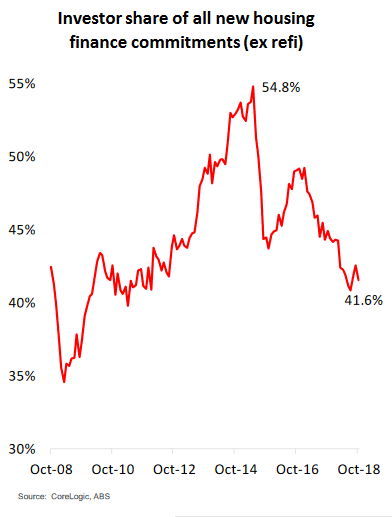

And given these price drops – in Sydney, prices have already fallen by the double digits – and the regulatory crackdown, investors no longer have the hots for speculating in this market, and banks no longer have the hots for lending to them.

Interest-only mortgage were a favorite with investors. Then regulators limited the big banks in terms of what portion of their originations could be interest-only mortgages, and banks looked at speculators with greater scrutiny. And now, according to CoreLogic, interest-only mortgages have plunged from 45.6% of purchase-mortgage originations in 2015 to just 16.1% at the end of 2018.

This is by far the lowest investor share in the data going back over a decade. Even in 2008, during the Financial Crisis, interest-only mortgages bottomed out at a share of 27%.

New mortgage commitments to investors in December plunged by 17.9% year-over-year, according to CoreLogic, and are down nearly 33% from the speculative peak in 2015, before the crackdowns started. But wait…. Investors are still very active – just somewhat less so. The share of purchase-mortgage commitments to investors dropped to a still high 41.6%, but that’s down from the speculative peak in 2015 of nearly 55% (chart via CoreLogic):

But first-time buyers are still trying to buy, and demand from them has increased in 2018, according to CoreLogic, “on the back of incentives, falling investor demand, and falling values in the largest cities.” But in the big cities, they’re mostly limited to buying lower-end condos, and not single-family detaches houses.

So for now, much of the impetus for the deflation of the housing bubble comes from a portion of investors and speculators that are trying to stay out of the way of the steamroller.

While prices at the low end — realm of the first-time buyers — are hanging on, prices of more expensive homes are falling at a rapid clip. But it wasn’t the central bank that pricked the bubble. Read.... The Housing Bust in Sydney & Melbourne, Oh My!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great article as usual, Wolf. And look at the last chart, showing the peak in the investor share of all new housing finance commitments, then add in the fact that many interest-only bank loans convert to principle + interest after 5 years, and things get interesting for speculators and other late entrants to our crazy housing market here in Oz. Static rental returns + falling real wages and house values + 40-60% increase in loan repayments = big ouch. Watch our weak federal government crap itself when this gets traction.

All interest only and investment loans brakes will be eased in the event of a protracted slowdown.

Many creative measures will be taken to awaken the animal spirits.

But if the judiciary decides lending was criminal, the only easing measure to look out for is one that effectively decriminalises mortgage fraud. All other easing measures stand after access to credit.

I think APRA removed the cap on IO loans so investors aka speculators can refinance to IO loan again. However, problem now is that banks tightened lending standards after being exposed by the banking commission of issuing liar loans (similar to NINJA loans in US). Anyone interested to watch what Royal Banking Commission uncovered can search on google and stream most hearings. Oz is in more trouble than US was in 2008.

Rough estimate is that people can now only borrow about 20% less than what they could before the banking commission. So, 20% price falls are baked but my view is things will be lot worse as Chinese hot money are gone (most of it anyway) and slowing economy over the next few quarters will do rest.

Liar loans, as I was taught back in the days (the definition may be different nowadays or may have a different meaning in Australia and other countries) have a substantial difference with NINJA loans: up until Dodd-Frank was passed in 2010 NINJA loans were legal, albeit in the ramp-up to the 2009 Financial Crisis they went from being a very specificl product to be issued only be lenders specializing in this kind of highly risky investments to being issued with abandon even by financial institution that had no idea what they were playing with.

Liar loans have never been legal, at least from a technical point of view. Australian authorities may have turned the other way but misstating income and/or assets to secure a loan has never been legal.

So if the RBA finds out that liar loans have been as widespread as it seems, the only sensible course of action would be at least to “hit one to educate a hundred”. There’s no need for special legislation to be passed: existing laws on credit matters are perfectly adequate all over the world. Big fines, jail sentences and crushing legal expenses are perfect deterrents.

Alas, my experience in real-estate-addicted countries such as Italy and Spain has shown me that no crime, no matter how heinous, must be allowed to “spook” the Holy Construction and Real Estate Industry.

People say because the Australian Govn can print its own money it can’t default on its debt.

Why then borrow in the first place?

I believe for a nation to be prosperous you need confidence in the money and trust in the Govn. If these are lost then no end of printing will deliver stability.

As the global recession turns into depression over the next 3 to 4 years I forecast the Australian Govn to default on its debt.

In the 3-4 years following that I expect the welfare state and pensions to become effectively bankrupt.

We are entering a depression which will be as severe as the 1920s and I don’t believe we have the social cohesion we had then. No baby boomer has living memory of the 1920s.

Laugh at me now if you wish. Remember me as we head into the end of 2020.

Totally impossible.

The Aussie dollar will get crushed.

The economy will shrink.

But the government is not going to default on its debt.

You are however right about no baby boomer remembering the Great Depression, which may be equaled in length, but not depth.

When millennials own enough votes, they may decide they don’t want to repay debts that were run up by prior free-loading generations. Why wouldn’t millennials repudiate the government debts when they have control? Who would blame them?

If enough governments repudiate the debt at the same time, the currencies would not collapse. “Safety in numbers” works for governments too.

“When millennials own enough votes, they may decide they don’t want to repay debts that were run up by prior free-loading generations.”

I assume this above piece of received wisdom came from a Millennial. Please note the following:

o Millennials started voting in 1998

o the people & policies millennials voted for have generated over half the current national debt

o There are more Millennials than there are boomers.

Note to Millennials: this is what it feels like to run out of other people’s money.

“Why then borrow in the first place?”

It gives the population the illusion that their government, and therefore they, have this debt. This is absolutely necessary to ensure the population does not vote itself the kinds of benefits that would make them less dependent on the job market for an income. Thus driving up wages and reducing profit.

Ironically though the government then gets voted to be borrower of last resort, when it has finished managing the flow of profits in the pseudo/capitalist setup ( or state capitalist or crony capitalist or anarcho capitalist or frankfurter or socio capitalist etc., take your pick).

So government is really a majority/capitalist/socialist/political/etc. fudge aimed at adding some kind of reasoned balance to a national cocktail of realities, it usually pretends to be more and is often legitimately corrupt also… just you try and build a concensus on anything beyond reason being all that is needed for the rational person (as per Jonathan Swift).

Anyway, Australia’s population has a steady historic increase over the last seventy years, so you are maybe looking at a scenario like

https://www.businessinsider.com.au/australia-population-growth-housing-affordability-supply-forecasts-hia-2018-4

maybe.

The question therefore being who pays what, how, and at what price. In other words who profits and manages, who the rentseekers are, who the sheep are, and do they bite unless fed.

Large swings in values cause discontent and chaos, but you cannot rule out that the policy that helps cause them is not purposeful, if not greed based or simply incompetence.

It’s also a way for governments to return money, with interest, to Capital that has been taxed.

Hehe, love when people think the end of the world is coming… You forgot, it’s all fiction, they will keep printing until next world war, then there will be a world debt forgiveness like previously done through out history

Money isn’t real or even backed by anything in FIAT, you can always keep on making it up, which is what you are seeing now

You can’t print forever if confidence is lost, history shows this time and time again.

The fiat bubble we are currently in has its roots going back to 1971 when Nixon came off the gold standard, that’s how big this bubble is. It affects all asset classes which is why some call it The Everything Bubble.

Most nations have drunk the cool aid of expanding Govn and Govn driven demand, printing to satisfy.

The last 10 years of Zero and Negative interest rate policies have decimated savings and pensions. There is no ammo left for the next downturn.

We have become very complacent, especially in the West, believing we can not enter another Great Depression, believing we can maintain the fiction by printing ad infinitum or by some other magical means.

But the piper must be paid!

The next World War may involve nuclear weapons – not good.

I’m not laughing. And remember that Morrison brought the ‘bail-in’ laws almost a year ago – hardly a word on the media and most people unaware.

I’ve always hoped I’d live to see the end of the welfare state and looks like I’ll make it. But the danger then will be survival as the many hundreds of thousands of Aussies used to a life time of freebies go feral when the cheques stop.

Hoping the RE overshoot will be closer to 60% and keeping powder dry. However interest rates likely to go to zero as the brave RBA stick their pudgies in the dam to save their ‘maaaaaates’. At that stage I suspect many will wake up to the fact that banks are not a safe place for hard-earned. Bank run, anyone?

The lesson of 2018 was don’t athropomorphise people.

Australians are people. They don’t think like you, if you are intelligent (same goes with most large groups of people).

They never learn. They just bump into different things.

Australians are learning, at the usual speed, that if everything is indicating that house prices will go up, if all the experts they subscribe to say house prices go up. And they take the action of borrowing money to buy a house to ensure the prophecy will occur. And the bank doesn’t lend to them or their equivalents.

Prices will fall.

The only thing you need to know is that at the moment a third of lending is under question legally. This will lately be cleared up in the Bank Royal Commission final findings released in a fortnight.

If the commission decides a third of the prior lending was criminal, prices will fall. Not because dots have been connected. But because of the mechanical certainty that buyers will not be able to access sufficient credit to balance sellers.

If they decide borrowing was legal and can return to boom time standards. Expect a sharp rally. Not because of some thinking having occurred. Rather, people going to do but press the only button they know.

Either way they will still have hope.

The commission already demonstrated that large percentage of the loans were issued using false expense calculations and in many cases falsified payslips.

Now everyone waits to see how bad it is going to be. There is no chance of report to clear the air. If not 30% I’d say at at least 20% of the loans were issued to people that should not..

You can watch all the hearings.. they are available online.

Australian voters installed the corrupt and captured politicians who enabled such systemic fraud by ensuring policymakers, regulators, and enforcers were in on the schemes and scams associated with these “superheated” housing bubbles. Now the sheeple are going to learn the hard way why wittingly voting for corrupt “leadership” never ends well. I have no sympathy.

Do you guys have banks that don’t care because they imidiately turn around and hot potato the mortgage to someone else?

What about ratings companies that blindly stamp them AAA?

Worked out great for us in states!

Gershon,

Have some sympathy. We didn’t vote them in we choose between the corrupt captured polticans on offer.

Shizz,

A vital question.

After the 2007/08 debacle the market for packaged mortgages understandably failed.

So, incredibly, the Australian banks adapted by keeping all those toxic mortgages on their balance sheet. Yes. It’s far worse for the banks than it was in 2007/08.

The only saving grace is that they don’t have to, due to the revoking of the FASB stipulation, correctly state the value of their holdings.

The biggest lie at the loan interview is saying NO when asked if they have a credit card.

OC

Nick, they were using the HEM on 70%+, all of them legally questionable. Just wait until the lawyers get a hold of this, $Billions and Billions just waiting to be taken. Not too long before you see and hear the billboards and tv/radio adds: “Did your banker/broker get you in over your head? Did they falsify (illegally) your income on your application? Do you want your house for FREE!! Call me, Bill Buttlicker of Dewey, Cheatum & Howe 1300 BITE ME.”

The banks know this, they are shatting in there pants right now. They were all basically running a systemic, massive, government enabled counterfeiting operations. And yes, make no mistake, mortgage fraud is counterfeiting, you are taking a known false/illegal/untrue document and “turning” it into “good money”. Those illegal mortgages are sitting on the books at the Big 4. How long to you think its going to take Mr. Institutional Investor who also owns some of these illegal mortgages to ring up the banks and say “We want our money, 100%, NOW”, “you sold us knowingly illegal mortgages, pay up”. First one gets paid, 2-xx, well maybe not so fast, hello institutional bank run. Think it can’t happen, think again.

Actually all the Hayne RC has to do is say all mortgages going forward have to be 2.5-3.5x stated income (BTW about OECD avg), verified by 3 years ATO tax returns and this whole thing goes Chernobyl.

The latest PR push from the housing industry is that this slump in the market will be saved by first home buyers (FHB’s) riding to the rescue but that’s extremely unlikely. Rejections for loans have risen from 6% to 40% in a year as regulations tighten and the smart money pulls out leaving small-timers and entry aspirants to try their hand.

Yes the ‘pent-up demand’ theory that will deliver a ‘soft landing’.

Never happened and never will – there’s only clamor for RE when its price is rising. For reasons that are quite obvious, as soon as the price rises end the clamor for vastly-overpriced assets vanishes in double-quick time.

Im Australian. I can tell you the HIA is nothing more than a middle man in some new homes that get built or renovated. If you think the HIA has morals and ethics, then your wrong. They have NONE!

As for the fall in Australian Home prices……its all FAKE, prices have NOT anywhere near as much as quoted in your article Wolf, they are trying to suck in new buyers….the real price discovery is NOT being allowed to surface, they are cheating once again….real estate and banks are the lowest of the low, after the Australian Government of SLIME and WHORES!

Prices are going WAY WAY LOWER, maybe another 2 or 3yrs yet, maybe more. Regulation on banks has been eased in Australian like the rest of the whoring West, only to drive more suckers into death row and bankrupt. What a great bunch of assholes run this country! I wouldn’t waste my piss on one of our politicians if they were on fire. I would let them burn!

Okay Stephen Sadd, tell us how your really feel :-)

Have faith Stephen Sadd,A Knight in shining armour awaits the man of the moment sitting astride his union steed, all is well he shouts Im here for YOU,mean while the the sheeple are concentrating on tennis ,cricket,horse racing reality TV etc the really important things .Have faith dear Stephen if not I can recommend a good singe malt.

Stephen, if it’s any consolation, I share your rage but with our political class in America. Ours are dumber and greedier than yours.

I’m in the typical first-home-buyer demographic. If prices drop 70% then we can start having a conversation. Higher than that and I’d rather not chain the rest of my life to some fixed location in a multicultural cesspit thank you mister banker.

Hope is not a tactic.

Sure it is.

Just not a good tactic.

The full magnitude of the fraudulent wealth effect created by the central bankers’ tsunami of printing-press “stimulus” is being exposed for all to see as true price discovery, long deferred by ultra-easy credit and limitless QE, is now stalking these Ponzi markets and asset bubbles. The coming (fake) wealth destruction is going to of Biblical proportions.

But first-time buyers cling to hope.

Hope was the last and most awful thing in Pandora’s Box.

Can’t you guys see it? It’s all that Chinese money rushing in and squeezing out the locals.

Yes, in Australia you’ll never hear a debate about the level of migration or restrictions on foreign buyers because…Both political parties are funded by the building lobby and therefore required to increase migration and encourage overseas property purchasers until their masters are happy.

Stupid analysts in the USA look at Australia’s median income and predict a slump – sorry it’s not happening. Compare house prices with median Chinese upper-class savings, not Australian incomes.

Much of the long term prospects of real estate has to do with

confidence that cash will hold its own value.If there are

signs that money is being devalued up she goes.

In Australia over the past few? years there has been a LOT of pain in saving for and buying an average family home, brick-veneer 3 bed, 2 bath, 2 car garage, maybe 1700 to 2200 sq feet.

In the newer, cheaper, ex-farmland suburbs up to about 4 months ago, the best you could do was about $550,000 to $600,000.

The same house today will cost you $450,000 to $500,000 and they will get cheaper still i am certain.

The average family man is struggling, wages are falling behind inflation and his job is not as secure as before even though the ‘official’ unemoployent says things are going well. Governments never lie do they?

In the malls, the lower and mid-range shops are selling the necessaties, and the upper range are almost deserted. No dead malls yet but most are ‘quiet’.

Rental homes very often have 3 and 4 cars parked outside indicating 2 families sharing to try and get ahead.

First to close in the malls are the mens wear shops, as always dad goes without first. Then Mum and the kids last.

As we say here, “things are crook”.

OC

single family detached houses are being snapped up by developers who build underground parking or street parking if your lucky or

single family detached houses in the outer areas = no public transport, no schools, no hospital, no job etc.

Indeed there is a short video on youtube telling that – they are committed to developing Melbourne & inner city surrounding – apartment of course – they expect Melb. to grow up to 5 million population.

Why the city ??

Because the get to save money utilizing the existing amenities / infrastructure.

Albeit St Vincent’s Hospital – The Royal Melb. Hospital – the Eye & Ear Hospital & other such shabby & dysfunctional healthcare facilities are already stretched to the limit & not coping with the current population.

& surrounding schools are limited – the Kennett government demolished several prominent public schools & built apartments.

There is no bed of roses in Victoria & will not be for a long time.

In the meantime Daniel Andrews & TRANSURBAN are digging rabbit warrens under melb. & surrounding suburbs for all they are worth.

Money flying all over the place here !!

“Money flying all over the place here !!”

All of it borrowed! Chairman Dan is just like Chairman Paul K, spends years building stuff and giving it to the “underprivaliged”, and leaving the mess for someone else to clean up. Now our idiot Federal Government says we are near a budget SURPLUS! Even though we are selling a BILLION dollars worth of OZ Treasury Bonds EVERY WEEK!

Recently visited Melbourne for the first time in over a decade and was amazed at the changes — lots more high rises in the city and suburbs, big population growth through immigration. But little improvement in the infrastructure – the trains are routinely overcrowded, many of the seats removed for more standing room. Big expansion in the universities, predominantly focused on overseas students. Big growth of suburban sprawl on the edges, but woeful roads and public transport not keeping up. The metro population is almost up to 5 million now.

1. Melbourne’s high rise nightmare taking a tall toll on residents & investors…………….

But many those closest to the booming industry say they would not buy….

….new apartments riddles with faults ……….some of the problems so costly to fix it would be cheaper to build anew.

2. Sydney tower block evacuated as residents hear the 36 story building ‘crack’.

Property in Sydney is in freefall. Where I live, In a block of 9 identical units, one sold 2015 for 1.53M, one in Sept 2018 for 1.44M and one in Jan 2019 1.28M. Just down the road, a unit that sold in Sept 2017 for 821k is for sale at 700k.

Aussie is a sexy warm exotic place, I am sure the Euros

who can not scam their way into the USA will flock to OZ.

Are worries about falling Aussie home prices overdone? It’s good news for first-home buyers, where market activity has risen strongly and now makes up nearly 20% of mortgage approvals. ANZ chief economist Richard Yetsenga adds there are plenty of homeowners who don’t watch every market ripple and aren’t worried. One-third of Aussie households have no mortgage, and another 1/3 are more than 2 years ahead on payments. Yetsenga says for them, jobs and wages are much-stronger drivers of their behavior. There’s also been little forced selling of homes, so Yetsenga calls the price drop textbook after years of strong gains.

And who the hell is Yetsenga and why are they such an authority?

Well my ancestors lived through two world wars and the Great Depression and survived. Took a lot of effort and sacrifice. Live within your means or get mean with your living. Freebies are about to end.

Wolf,

Indeed the future looks bleak for Australian real estate.

RBA is likely going to cut rates in an attempt to help the situation. Will likely do much more harm than good at this point. The Aussie dollar has been in decline and further rate cuts will hasten the decline. Latest forecasts pegging it at just 66 cents to the $USD.

Inflation headed higher down under while home prices get crushed?