Soaring rents outran tenant wages, which can’t last.

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

Spain’s residential rental market has been on a bit of a roll of late. Over the last 45 months, median rents have risen year-on-year in all but one of them: August 2018. In the hottest markets, such as Barcelona, Madrid and the Balearic Islands, rents are now higher than they were even at the dizzying peak of Spain’s madcap real estate boom. But the boom may be coming to an end.

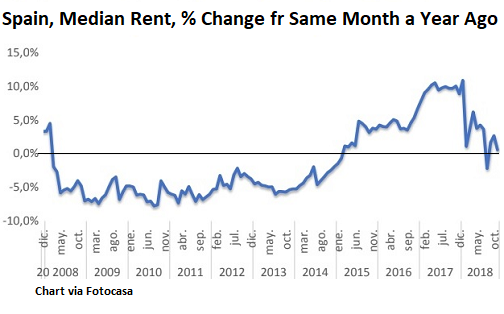

In November, median rents fell 0.5% from October, according to the real estate agency Fotocasa. On a year-by-year basis, rent increases eased to a meager 0.6%. Note the year-over-year gains of around 10% in 2017 (chart via Fotocasa):

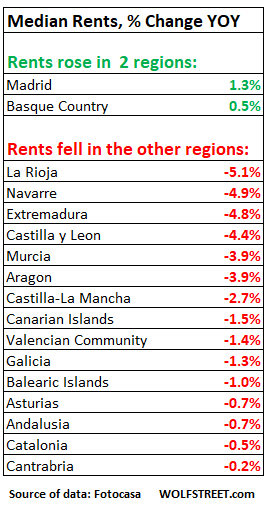

“The Fotocasa Price Index continues to show a clear tendency toward a stabilization of rents across large swathes of the country,” says Beatriz Toribio, Fotocasa’s director of research. “A year ago the median rent was rising on a year-on-year basis in all 13 autonomous regions. Now it only does so in two.”

Those two regions are Madrid, where rents rose 1.3% year-over-year in November, and the Basque Country (0.5%). In four regions, rents slumped between 4.4% and 5.1%: Castilla y Leon, Extremadura, Navarre, and La Rioja. Even in the prime markets of Catalonia and the Balearic Islands, rents fell:

In Madrid the rental market remains relatively buoyant, with year-on-year rises across 18 of the city’s 21 districts. Barcelona is still Spain’s most expensive city, with an average cost of 16€ per square meter (m2), but Madrid is snapping at its heels (15€/m2). For Spain as a whole, the median rent in November was €8.18/m2, its highest level since October 2010. But it’s still a full 19% off this century’s peak of €10.12/m2, registered way back in May 2007, just before the air began hissing out of Spain’s mind-boggling real estate bubble.

The last four years of soaring rents have been a bane for tenants, particularly in core markets like Barcelona, Madrid, Ibiza and Majorca where rents have surged 50% or more since 2012 while salaries have all but stagnated, squeezing tenants, and making for some lucrative deals for landlords.

Renting out real estate is by far the most profitable way to invest money in today’s Spain, according to data published by the Bank of Spain. In 2018, landlords earned an average gross accumulated profit of 4%. But that’s just one part of the gains available. Throw in the rising levels of rents plus the capital gains accumulated on the properties being rented and average annual returns shoot up to 10.9%.

To put that in perspective, it’s 7.5 times more than the amount an investor could have earned on a ten-year Spanish bond and 110 times more than the risible interest available on bank deposits. That’s not to mention, of course, Spanish equities, which are down 12.5% year to date.

In other words, investing in rental properties in Spain has been a virtual no-brainer for yield-starved investors both large and small, foreign and domestic, over the last few years. But that could be about to change. The first rental market to burn red hot, Barcelona, is already showing signs of fatigue, with prices dropping in the most expensive neighborhoods. “People can no longer pay the asking prices,” says Toni, a real estate agent with operations in the city center.

To try to tame soaring rents, the Spanish government this week unveiled a raft of reforms aimed at offering added security for tenants. The reform includes a measure that will extend the minimum duration of rental contracts from three to five years for private landlords and from three to seven years for institutional landlords. This will significantly hamper the ability of private-equity landlords like Blackstone to turf out the existing tenants of newly acquired properties as quickly as possible in order to jack up rents for new ones.

In addition, the proposed law will limit the amount landlords can ask as a deposit from tenants to two months’ rent. It will also make it harder for landlords to rent to tourists, which is often blamed for soaring rents in popular tourist cities like Ibiza, Malaga, Palma de Mallorca and Barcelona. If the law is passed, for vacation-rental sites like Airbnb to be able to operate in any given building, three quarters of that building’s residents will have to approve their entry.

The law has sparked a fierce backlash from institutional investors, many of whom accuse the government of discriminating against them by forcing them to sign longer rental leases. They also warn that the new reforms could have the opposite of the intended effect — i.e, rents could rise rather than fall if investors/landlords exit the market.

“Who will want to have a savings product that is completely illiquid for five years (let alone seven) and who can not take advantage of market increases during that time?” asked Javier Rodríguez Heredia, a partner of the Spanish real estate management fund Azora. Claudio Boada, senior advisor of Blackstone’s Spanish subsidiary — Spain accounts for roughly one-fifth of Blackstone’s global real estate investments since the financial crisis — warned that the reforms could “increase rents, decrease supply and reduce investment in this asset class.” But if rents continue to “stabilize” and the government’s new reforms get passed in some form, the juicy returns could begin to erode. By Don Quijones.

But will the big European banks play along? Read… ECB Just Launched “Better Than Blockchain” Instant Payments System

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What multifamily rentals are you talking about? Nearly all rentals in Spain are just apartments.

A building with several rental apartments is a “multi-family” building as opposed to a “single-family house.” It’s a commercial real estate category.

In the US, at least, income properties offer more than just rental income. You get cash flow from rents, tax shelter from the depreciation, principal pay down, and appreciation. You might not get all of them in the same year, but they beat most other investment classes in the long term.

I left out leverage. You pay 20% down. That is your investment. However, you get appreciation on the total price.

Very interesting… Thanks for the article. Will the 3- or 5- or 7-year “minimum” leases be mandatory or are they optional, for the renter, I imagine? It’s an interesting variation on rent control that isn’t as punishing on landlords. Maybe it sounds worse than it is if renters have the option to shorten that stay – say to only 1 year. I can’t imagine renters signing a 7-year lease agreement and be kept on the hook for that duration. Are there “buy out” options for renters, also?

There are various clauses, and the text is still open to modification:

Tenants only need provide one months notice before vacating.

After one year the owner may ask for the property to be vacated for own family use, as long as the owner then occupies within three months (seems like easy option for private owners, but not unstitutional investment).

Eviction, which is said increasing 5% yearly, will face a further month or two delay for those in vulnerable circumstance, and involve social services.

The left wing party Podemos wanted a cap on rental price, but this was excluded. It may be included next year.

Overall institutional investors will want long term steady rentals – they are not that easy to secure. However I am not sure this new raft of laws will guarantee that for them, but it will take away their ability to act aggressively in raising rents, something they have been known to do. The down side is probably that it all adds up to more bureaucratic involvement of one kind or another in the market. For holiday rentals different regions have already passed various forms of legislation making holiday rentals much more difficult for private owners to achieve legally.

Spain still has a thing called “rentas antiguas”: these are rent contracts that were originally signed under Generalissimo Franco or immediately after his death.

I was unaware of their existence until I was told by one of my acquaintances, who had inherited from her grandfather a building in Santa Cruz de Tenerife… complete with an “arrendatario antiguo”.

To cut a long story short a renta antigua can only be increased by what the government says, which is usually well below national averages. Not the end of the world, albeit it guts the very idea of being an “arrentador”, a landlord. But the big problem are the crazy rights the arrendatario antiguo gets by law, rights modern tenants can only dream about.

While most arrendatarios antiguos are elderly ladies and gentlemen who will stick to their contracts to the letter out of an old fashioned sense of honor, the rest aren’t. This belonged to the latter category.

Let’s just say that if you want to have PE firms experience the torments of Hell in this lifetime you should bring back rentas antiguas and fill their properties with scoundrels. Let’s see how long PE firms last before scurrying back to where they came from.

Same as NYC.

During the Ancient Regime They did that with grains, and the poor starved. They had already enclosed the common lands so the poor couldnt hunt nor gather fuel any longer. They had to pay Them for that privilege.

Today you can get a good deal off your neighbour if you have saved a bit. Make them sweat hard waiting tables, so they pay you a nice rent. It s called investment and It s just fine. If they cannot make ends meet but still owe you they could always sell their daughters as slave maids, if pretty.

What an amazing thing this grain and land and money scarcity, that one can live off other s brow (just like the Book says) And no one s to blame. Either you do it or they ll do you!

Always wondered how migrants would be received if they became enthralled the moment they landed in the free world.

Ask those who fear losing their goodies to the newcomers so they do show their true colours.

But just the poor would becomes slaves. The rich would get an EU visa if they brought their cash along…

Shit.

Don’t worry, with Deutsche Bank’s imminent demise/merger… rents will be falling in most of the tourist hot spots in Spain, which are really just proxies for the German economy at large.

Now at a measly 7 euros… this won’t take much longer. The the German taxpayer can spend the next 150 years bailing out a bank so big it won’t be allowed to fail, but will likely take the Euro to perdition with it.

Hello Wolf, I’m a long time reader, very thankful for your work and free sharing. Since you are an expert in Spain maybe you have some info to share about best areas for rentals, any info would be helpful. I am a EEuropean working in US for 20 years, and planning to take an early forced retirement and considering moving to Spain, as costs seem lower and cannot afford much, with hubby with no income. Thanks again for everything!

Hi Julia,

Author Don Quijones wrote the article, and is listed as author on the article. I’m just the bystander here. He’s a Brit who lives in Barcelona.

To respond to your question: we don’t give advice for free. There are plenty of people who charge an arm and a leg for this type of service, and they’re there to help you :-]

DB is a cluster meltdown waiting to coalesce , their derivative book attests pretty much that any run toward towards the exit would go explosive , no matter how much water you put on that fire.

Their Real Estate book in Spain is just the tip of the iceberg.

First on the lists of dangers for DB,

1) Messy derivative unwind/consolidation post merger with Commerzbank.

2) DB uses that RE business and issues funds / derivation of the product. MATI 2024 for example.

3) Spain’s new regulation will probably cause a derivative meltdown across key products of DB , locking them into a very constrained market.

4) BlackRock’s exposure to spain … 30B Euros … I can only imagine the massive rehypotecation that backs the deal and i would not be surprised to see that being repackaged.

Here we go again. We signed a load of leases in Barcelona in 2008 and got burned at the top of the market.Prices look similar today as it was then despite 10 years later and inflation etc. As wages have not risen much we are at the same level of financial pain for tenants as it was back then.

Everyone everywhere in Spain is bitching about how high rents are from the Balearics to the Canary islands. A common scapegoat is Airbnb but the real culprit is a decade of low interest rates almost everywhere in the world. I do not think they will bitching much in the coming years

London is sliding, the US is sliding, Australia is going down. To me this looks like we are heading down internationally now into a 2022-2023 low when the best bargains will be picked up again.

If you subscribe to Martin Armstrong’s idea central banks will be forced to raise rates as well out of necessity it is going to be even more brutal.