Debt out the wazoo, but someone is still buying it.

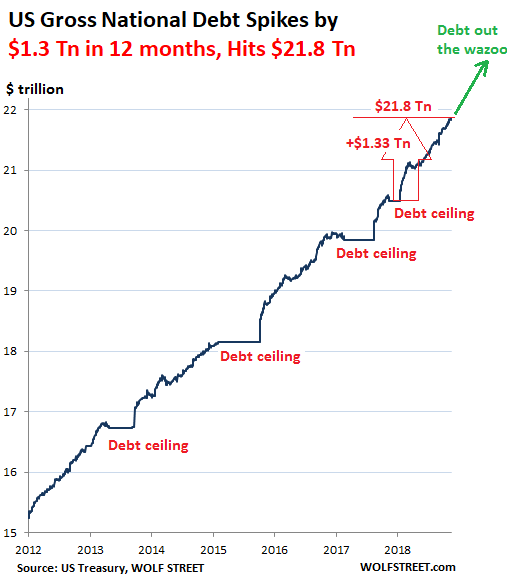

The US gross national debt has ballooned by $1.33 trillion over the past 12 months to $21.8 trillion as of December 14, according to Treasury Department data. Over the past six months alone, this debt has ballooned by $740 billion, despite a strong economy: Fueled by a stupendous spending binge and big-fat tax cuts, the government has been increasing its debt at a rate of $123 billion a month on average over the past six months.

But who’s buying all this debt?

US government debt is an income-producing asset for investors — the creditors of the US. And when the pile of US debt increases, by definition, someone has to buy it. But who? China, Japan, and other foreign investors? Nope. They’re shedding this debt. So here we go.

Foreign investors in total reduced their holdings of marketable Treasury securities in October by $25.6 billion from September, to $6.2 trillion, having shed $125 billion since the end of October 2017, according to the Treasury Department’s TIC data released Monday afternoon.

Foreign holders of marketable Treasury securities fall into two categories: “Foreign official” holders, such as central banks and government entities; they cut their holdings by $132 billion over the 12 months, to $3.95 trillion. And private-sector investors; they added about $7 billion to their holdings, totaling $2.25 trillion at the end of October.

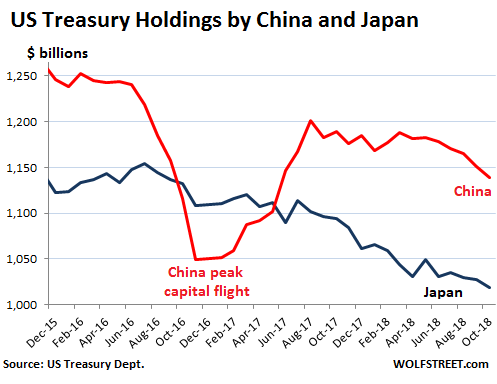

By country, the two biggest holders are China and Japan, but both have been shedding Treasury securities:

- China’s holdings of Treasury securities fell by $50 billion from a year earlier to $1.14 trillion.

- Japan’s holdings fell by $76 billion from a year ago to $1.02 trillion, continuing the trend since the peak of its holdings at the end of 2014 ($1.24 trillion).

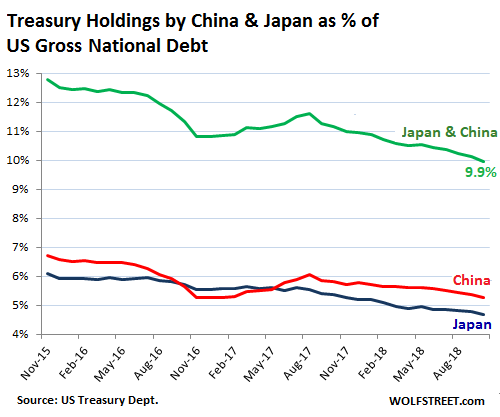

But over the same 12 months through October 31, 2018, as China and Japan reduced their holdings by $126 billion, the US gross national debt soared by $1.26 trillion, to $21.7 trillion, and both countries hold a smaller share of it. China’s holdings (red line in the chart below) accounted for 5.2% of US gross national debt, and Japan’s holdings (blue line) for 4.7%. For the first time since this cycle started many years ago, their combined holdings (green line), at 9.9%, fell below 10% of US gross national debt:

Other Big Foreign Creditors of the US government

Of the 12 largest holders of US Treasuries, after China and Japan, seven are tax havens for foreign corporate and/or individual entities (bold) and one (Belgium) is the location of Euroclear, a massive outfit that provides, as it says, Financial Market Infrastructure services, holds about $32 trillion in assets in fiduciary accounts, and settles about $830 trillion in trades per year for its clients. The value in parenthesis denotes the holdings in July 2017:

- Brazil: $314 billion ($270 billion)

- Ireland: $287 billion ($312 billion) as US corporations “repatriate” their US Treasury holdings — part of the famous “overseas cash.”

- UK (“City of London”): $264 billion ($226 billion)

- Luxembourg: $225 billion ($218 billion)

- Switzerland: $225 billion ($254 billion)

- Cayman Islands: $208 billion ($247 billion). More US corporate “overseas cash” being repatriated?

- Hong Kong: $185 billion ($192 billion)

- Saudi Arabia: $171 billion ($145 billion)

- Belgium: $170 billion ($99 billion)

- Taiwan: $164 billion ($116 billion)

- India: $138 billion ($141 billion)

- Singapore: $133 billion ($30 billion)

Russia has dumped most of its holdings, reducing them from $153 billion in May 2013 to $14.9 billion by May 2018, and has roughly kept them steady at this level. Russia’s Treasury holdings are now among the small fry.

On net, foreign investors reduced their holdings of Treasury securities in October by $125 billion from a year ago to $6.2 trillion.

So who is buying?

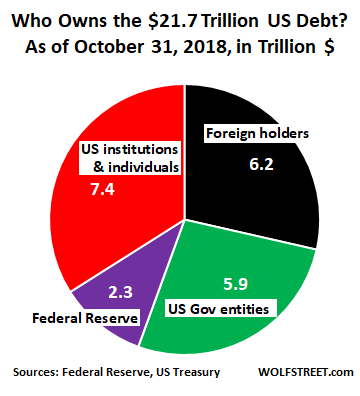

So let’s see. Over the 12-month period ended October 31, the US gross national debt rose by $1.26 trillion, to $21.7 trillion. Here’s who bought or shed this paper over those 12 months:

- Foreign holders (official and private-sector) shed $125 billion, whittling down their stake to $6.2 trillion, or to 28.6% of the total US national debt.

- US government entities (pension funds, Social Security, etc.) increased their holdings by $168 billion to 5.9 trillion. This “debt held internally” is owed the beneficiaries of those funds; it’s their money, invested in Treasury debt, and the US government owes every dime of it. They now hold 27.0% of the total US national debt.

- The Federal Reserve shed $190 billion over the 12 months through October as part of its QE Unwind, reducing its pile to $2.27 trillion by the end of October, or to 10.5% of the total US national debt.

- American institutions and individual investors increased their holdings by $1.41 trillion, directly and indirectly, through bond funds, pension funds, and other ways. Banks are very large holders of Treasury debt. Together, all these entities combined owned the remainder, $7.37 trillion, or 34% of the total US debt!

This is how the gargantuan US debt is carved up as of October, in trillion dollars:

The simple fact that long-term Treasury yields have been low relative to short-term yields (which are more responsive to Fed rate hikes), and that the yield curve has become nearly flat shows just how much desperate buying-pressure there is, especially when there is turbulence in the stock market and investors seek the safety of Treasury debt.

The 10-year yield, while up sharply from a year and two years ago, has been vacillating between 2.8% and 3.25% since early February. The massive buying-pressure in the Treasury market, in part triggered by stock-market sell-offs, has been easily mopping up the flood of new Treasury debt that the government has been issuing at an average rate of $123 billion a month over the past six months.

But foreign investors, as alluring as these Treasury yields may be in a negative-interest-rate world, would take on currency risk, and hedging against it has become prohibitively expensive at current Treasury yields.

Peak “Everything Bubble?” The data is piling up. A deep dive in my latest podcast, THE WOLF STREET REPORT

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Are the Government entities holding non-marketable bonds?

Yes, this $5.9 trillion of “debt held internally” by US government entities is not “marketable,” meaning it cannot be traded in the Treasury market and is immune to market forces.

Wolf, a few weeks ago Steve Mnuchin, US Treasury Secretary made an interesting comment to the Fed. To paraphrase it went like this, would it be more practical for the Fed to increase its treasury buyback program instead of raising the federal funds rate? This process would gradually increase interest rates, without the Fed “raising rates”, by letting market forces exert pressure via supply reduction. Obviously, it would take a substantial increase to “move interest rates up” via supply. Interesting to say the least.

You’ve got this exactly backwards. If the supply is reduced, prices go up. When prices go up for bonds, yields (interest rates) go down.

With a reduction of outstanding treasuries banks would potentially pay more for money loaned by depositors. Remove the excess treasuries/reserves from the system and banks would borrow from depositors to fund their investments/loans. Demand can have two effects. When you eliminate the excessive reserves, such as treasuries, you reduce the money supply. If you don’t think this can happen then revisit the Volcker era Fed 1977-1980. Paul Volcker reduced the money supply through the various tools of the Fed and interest rates went ballistic. Scarcity of money increases demand and treasuries are future discounted money. Since the dissolution of the Bretton Woods agreement the US has had an “elastic” currency/monetary supply. Stretching it increases the money supply (up to a point of being inflationary meaning a reduction in the value of the dollar) and compressing it reduces the money supply. This is accomplished by the various Fed tools. The current Powell Fed has raised the federal funds rate close to the point of inflation. The Powell Fed also wants to reduce the supply of money to increase the velocity of money. Less money, with all things being equal, would mean that money would have to circulate faster i.e. velocity. Jamie Dimon commented that the US has not had an increasing federal funds rate and a shrinking money supply simultaneously for quite some time.

Looking at speculative junk debt below investment grade the spread is currently compressed. You reduce the money supply and this debt will reflect its true risk because it will have to compete equally with scarce money. The speculative debt value will fall meaning a higher discounted rate and the borrowing of sound debt will increase meaning it will demand a higher rate of interest because there is less of it.

Could you kindly explain what the 500b off-budget deficit is and how it gets paid for.

Where does all this debt go? Thanks.

Foreign holders at $6.2 trillion.

The remaining three quarters of your pie chart hold $15.6 trillion.

Which according to ownership is all held internally. Is the US going the Japanese debt route, and in the process of holding all of it’s debt internally?

As for “safety of Treasury debt”, considering the near long term fiscal deficit policy of successive US governments, that phrase stands in danger of becoming an oxymoron.

The more debt that is piled upon debt, cheapens the US dollar that much more. Enough debt and the back of the donkey and it breaks. As does confidence in the currency. Safety? I don’t think so.

Shouldn’t the top chart title be debt hits “21.8 Tn”?

Sheesh. Yes. Fixed. Thanks.

The Federal Reserve reduction of its balance sheet over the next five years has been the subject of considerable media attention. An equally important if slightly longer term challenge will be the run-down of Treasuries held by US government entities — social security funds, civil service and military retirement funds. It would be interesting to see the speed at which these holdings will decline in the 2020s.

Good point. In this report, which is a more or less a regular feature here, we keep an eye on this via the “debt held internally” figure. So far there has been no year-over-year decline, and the line in the chart is still wobbling higher (there are a lot of smaller ups and downs in it). I will include a chart next time. This will start alerting us when the “debt held internally” is starting to draw down. So yes, 2020 may be about the time we can see that.

Was Social Security a net buyer or Seller of debt.

I was under the impression they have sending out more money than they were taking in for 5yrs or more and have been cashing in their chips so to speak..

Ditto medicare…

In October 2018 (this is the data we’re looking at here, though SS data for November is already available), the SS Trust Fund, at $2.79 trillion, was down by $22 billion from Oct 2017 ($2.81 trillion) but was up from Oct 2016. So yes, over the 12 months through October, SS was a net seller of $22 billion of US debt.

This does not include disability insurance (a separate fund).

We are in the end game for the US economy. Wolf’s article points to the shell game that has to go on to support all this deficit spending.

Treasury needs buyers of debt? No problem, communicate to the Feds’ banks and get them to buy. I would hazard an educated guess that more and more of these bond purchases are based on printed money.

If the US deficit is significantly reduced, we’ll be in a depression. That 1.3T is a lot of “stimulus”. And letting the huge deficits continue, which is what will happen, inflation will continue to nail the most vulnerable Americans and the rest of world will more seriously question the “value” of the dollar.

The politicians in power (any administration) always want to preserve the economy at all cost. The Fed generally wants to preserve the future value of the dollar but can’t ignore the real economy either.

The whole thing is a huge ‘Catch 22’ that can only end somewhere between terrible and catastrophic, imo.

The financial system seems to be the US economy, but it is not.

The real US economy consists of offices, factories, and farms full of workers producing goods and services. They produce whatever they can produce, and that is pretty much what we consume.

The financial system is all about who gets to consume what. Unless something extreme like hyperinflation comes along, it normally does not have to much impact on the real economy.

We consume a lot more than we produce. Our domestic production has been systematically looted and moved to china. It is so bad that there are more than 30 critical pharmaceutical drugs the DOD can only get from China. Indeed, we don’t even make the rivets for out Berry-compliant boots – had to get an exemption to use Chinese ones instead. The real US economy is, in my opinion, mostly worthless. Finance, healthcare, general services, tech to make services more efficient, government spending. To me this appears to be an economy designed to extract wealth from the US – without the USD to prop it up it is not very valuable.

And as there is a deliberate attack on the $ in finding alternatives to it’s dominance and control of world trade foreign,purchases of US debt will decline.In fact if there is a dependable alternative currency,in the not so distant future,domestic investors may be encouraged to look elsewhere,compounding the problem.

I am a born and raised US citizen and am constantly mulling over this dilemma.

US Asset Prices (Real Estate, stocks, etc.) are so inflated I don’t see the value in buying here. I live on the inflated West Coast, but this was also an issue on the East Coast when I lived there. The financial institutional investment into real estate combined with the flood of international money from Asia has assets at 2X the valuation in my opinion. I don’t see real estate falling by 50% here, but perhaps I am wrong. Unless the US has an interest in keeping institutional investment and foreign investment out of the residential market, this won’t change. And I don’t think wages for lower and middle class Americans are going to keep up with the cost, so essentially we are watching first-hand huge swaths of America being priced out for Americans.

I have toyed with buying my future retirement house abroad with my monies rather than invest domestically. And I am often looking at alternative investments in precious metals or other instruments that might hedge against a very volatile US system. Having lived through the 2008/9 crash, there is no way I’m buying real estate in this environment.

I remember traveling to Greek islands a couple years ago and seeing what my money would buy there – I could live in a few acres on Santorini with expansive water views for 1/2 the price it would cost me for a shack in Seattle. I know the valuations are comparatively higher in the US because of high paying jobs and wages here, but if I get to the point where I could work from anywhere I would seriously contemplate leaving.

There is such a misconception that life in the US is the best in the world, when I constantly find it the opposite. Healthcare is cheaper and equivalent in a lot of places around the world. The quality of life is better when you can buy real estate that doesn’t cost $1M+. You won’t be surrounded by asshole American’s who love their service based economy, create little production value themselves, and detract from the sense of community around them.

I don’t see things in the US getting better – the more debt burdened the economy becomes and more inflation that takes hold will increase crime and theft, and people’s attitudes will worsen.

We NEED a massive reset to the US financial system and asset values. Without that happening, I think we only have a very steady decline in the country’s future for a long time to come.

I wonder how history would have changed if these fiscal and monetary devices had been invented earlier. Napoleon could have sold Louisiana to the French Government instead, and have used the money to fight the United Kingdom. The Weimar Republic could have given wheelbarrows full of cash to the German government to pay off World War I reparations and prevent the rise of Nazism. The Soviet Union could have printed more rubles and use the money they created to make more bread!

The German reparations at the end of WWI were set at 132 gold marks ($33 billion US) under the Treaty of Versailles. Most Germans did not accept the treaty and were not willing to accept the taxation necessary to pay it off in a responsible manner. In the end, the politicians found it easier to print lots of money. The big losers in the early 1920’s were ordinary savers whose purchasing power was wiped out.

132 BILLION gold marks

(Just to be clear). sucks when you gotta pay with the real stuff

Yes, billion. My typing mistake. The exchange rate was based on the old pre-WWI gold standard rate.

“The massive buying-pressure in the Treasury market […] has been easily mopping up the flood of new Treasury debt that the government has been issuing at an average rate of $123 billion a month over the past six months.”

Massive buying-pressure is indeed the only logical explanation for the current yields.

Warren Buffett’s mantra is “be greedy when others are fearful”. Now would be a good time to buy the SP500. Except that the SP500 is heading towards a bear market. So we should buy bonds instead. But the bond market is so crowded…

Ah, what’s a little investor to do.

Excellent article, as always!

“Except that the SP500 is heading towards a bear market” is baking in a very uncertain outcome!

I am a small investor, and all I can say is I’m marginally more comfortable being invested in the S&P 500, than anywhere else. Compared to the alternatives, US stocks are cheap! Especially small caps.

I guess I’m a bit jealous of your conviction, because I fear I could be completely wrong, because cash might be the best choice…

If “US stock are cheap”, then things are getting better.

Ok then, what asset class is cheaper, relatively speaking?

It’s not bonds, it’s not real estate. You can argue that foreign stocks are much cheaper, what’s the risk profile on those? Would you put your money there?

Love to hear ideas.

PokerCat, we are in an everything bubble, so nothing is cheap. Foreign markets have been getting hammered all year. Perhaps they are due for a comeback, but if the US market goes down, I do not expect the foreign markets to fall out of line. That’s just me.

How are US stocks cheap? Shiller PE is still near 1929 levels. S&P 500 PE is at 20, peak valuation, and hasn’t dipped under 15 for 30 years! Prior to this, S&P 500 spent DECADES at or under 15 PE. But what do I know. Stock “value” is merely what people need it to be. It’s a shadow on a wall. And right now, stock prices need to be very high. Every Government budget, pension, 401k, IRA, 529, and college endowment depend on it.

Don’t forget. Baby Boomers owe Uncle Sam TRILLIONS in taxes that were deferred via their 401k’s. Uncle Sam doesn’t collect what he needs if those 401k’s crash. And it seems, 22 Trillion in debt, old Sam really needs that money.

PokerCat you are looking for some 2019 investment advice? If, like me, you think Wolf is pretty sharp then suggest you listen to last Sunday’s Wolf Street Report. A few times if necessary.

Some around here have hearing trouble, so will give you my interpretation…Get The F(heck) Out of commodities and into 1-2 year FDIC insured CD’s or Treasuries. ‘Only’ making 2-3% beats losing a lot!!

Goldman recommends cash as an asset.

If an investor had gone into cash a few months ago it would have appreciated well into double digits against the FAANGs.

Buffet is old but not THAT old. He has never seen anything like these market gyrations (worst December since 1931) or such completely irresponsible fiscal policy, i.e., a 1.2 trillion annual deficit and a bizarre tax cut. When he began investing in Coke etc. in the early 70’s, the accumulated debt of the US was one trillion.

If a buy- and- hold guy got into the market in September 1929, he didn’t get even until 1954.

What I meant was that “things are getting better” while “stocks are getting cheaper”

Is this sort of like using one almost maxed out credit card to make the minimum payment on another maxed out credit card?

Yes but imagine that you could just keep churning out credit cards to use one after another ad infinitum. Eventually Uncle Sam’s creditors are going to start refusing his cards and when that happens, it’s going to get ugly. Of course we’ve got another decade to run this thing up to 40 trillion.

It’s called a “Ponzi scheme” and you are right ! It is all a Ponzi scheme when it comes down to it !!

I’m weary of Charles Ponzi’s comparatively good name being soiled by association with goons and thugs.

Yes, govt has the ability to impose taxes to pay its “credit card”, which is different from the individual’s credit card metaphor.

Imagine if we gave individuals the ability to tax other individuals to pay off their credit cards. Oops, forgot that this mechanism already exists …it is called the ballot box.

Maybe banks are happy to hold the treasuries as, if I remember correctly, they don’t have to hold any capital against government bonds. I’m pretty sure that was the case.

Not sure if it still is.

So I guess government shutdowns will happen every year for the foreseable future since debt kepts breaking records?

And how come people got used to government shutdowns?

Please someone explain this to me, as someone not living in the US I got no clue how US citizens can be so chill about both the huge debt and the government shutdowns.

“Government shutdowns” are over disagreements between Congress and the White House, or between different sides in Congress. It’s a form of extortion. It goes roughly like this:

If you don’t agree to do x, we will not do y, and as a result, certain small but highly visible parts of the government (National Park Service, etc.) will not get funded and will have to curtail their services until an agreement is reached. The hope is that a public outcry (not being able to get into National Parks) will push one side or the other to do something they don’t want to do.

This “government shutdown” (the term is a HUGE exaggeration) is very different from another charade in Congress, the debt ceiling, which is a very big gun (threatening US Government default) that Congress can point at opponents in Congress or at the White House.

Meaning the more they do it, the less people will care?

“Extortion” captures the sentiment perfectly.

“If you don’t do what I want I will wreck the place”.

The Republicans essentially said, when Obama was the President, “if you don’t give me the Captians Hat I will sink the good ship America.”

A beautiful ship that took other people 12 score years to build.

The public voted the Republicans back in which didn’t turn them off that tactic.

(I’m not suggesting the Democrats are any better)

Wolf puts the problem in perspective, but as extortion goes 5B is not much, 43 wanted 1T for the wall. Illegal immigration has been on the decline. GOP reverts to obstructionist tactics now they are the minority party hence spending grinches. The US really needs some form of parliamentary system. It’s painful to watch the UK and Brexit but at the end of the day I think they will manage something everyone can accept.

To add to what Wolf said, “government shutdown” only actually shuts down non-essential government services.

If $1.3T of new bonds were issued and sold, then $1.3T came from somewhere. It couldn’t have come from stocks or RE because every time someone sells a position in those investments, someone else buys a position.

The new bond money must have come from the tax cuts. The money from tax cuts is going into government bonds rather than new private investments, and the tax cuts are not delivering on their promise.

Interestingly, deficit financed tax cuts will rarely spur an economy because the tax savings have to be reinvested in the new government debt that is created as a result of the tax cuts. The deficit financed tax cut is simply a handout to the wealthy that has little chance of generating any private investment or growth.

I think the above is largely correct. Whenever congress enacts a tax cut for the wealthy, the government has to borrow the shortfall, and we, the taxpaying people, end up paying interest on the amount of the tax cut. All hail the top 0.1% !!

After last crisis rules changed that required some Money Market Funds to switch to US Government Securities. I’m sure everyone here got a pamphlet from their broker explaining like I did. Anyone know how much $ treasuries that mops-up?

Hugs I’m an unsophisticated investor, but those govt funds make for some interesting reading. Vanguard or whomever takes your money and buys treasuries. They take a fee and give you less return because you’re in a 401k and have no choice.

You think you own treasuries? Sorry but you own SHARES of the XYZgovt fund which are subject to the overall performance of (ie) Vanguard and have none of the assumed guarantees of the underlying treasuries.

You’re getting shanghai’d (me too) into capitalizing your provider, paying for the privilege, and getting a ‘conservative’ return while being exposed the risk of the general condition of the provider. If the SHTF we’re at the bottom of the creditor list with all the riskier investors.

Like to put something light-hearted in my comments, but this crap keeps me up at night.

You are quite mistaken about Vanguard funds. Each fund is OWNED BY THE INVESTORS, not by Vanguard. The Vanguard settlement fund is VMFXX, which is almost 100% in T-bills or T-Bill repos. As of the last 7-days , the average yield was 2.24% after expenses, and you can move money in and out of this fund with no restrictions every day at no cost. Vanguard charges 0.11% in expenses. I very much doubt you can do better than that yield without accepting higher risks or lower liquidity.

I should also say that VMFXX is at the absolute bottom of my worry-list when it comes to investments, even half a notch below my FDIC-insured bank account. If VMFXX is not liquid, the world must be on fire.

Justme,

MB732 has a point, even if he is wrong on the specifics of Vanguard.

I have 401k’s I’ve placed into MM until stock prices come back down from Mars…or the closest thing to MM that my selections allow (I have several 401k’s managed by different advisors). Last I checked, they paid about 1.4%. Given you can open CD’s of almost any amount and get 2.7%, I make a point to using the work “theft” when talking to the phone reps of these 401k’s…as in “the organization you work is committing theft from my 401k and you should bring that up every chance you get.”

Timbers, great work pointing out the theft that occurs within these 401K “options”. Even at today’s yields, they’re skimming 1/2 the overall return. I never hear anyone complain about it.

Will add that some plans do not allow transfers between these options, which I guess is designed to prevent a run. So your money in a “stable value” bond fund which has longer duration corp bonds cannot be transferred to a fund with short duration Treasuries. So in that case they skim 50% and lock you in and expose you to risks most people aren’t aware of.

Your description is inaccurate, hugs. Rules changed so that MM funds were required to allow for NAV<1.00 ("breaking the buck") and to implement "gating fees" for customers who wanted to liquidate when NAV<1, so as to protect other customers that remained in the fund.

The choice by many/most brokers was to impose that customers had to use government-only MM accounts/fund for their settlement funds. But that was not a requirement from the rule changes. Brokers made a choice in response to the new rules. The aim was mainly to protect the brokers themselves against customer not having sufficient settlement funds, more so than to protect the customer.

So that pamphlet you and many others received from your broker was misleading about what really happened, to put it mildly.

Sincere Thanks Justme. Every time I go into my 401k rant am hoping someone with more knowledge will set me straight and ease my anxiety!

Searched regarding investors owning the funds. It is comforting to learn that Vanguard is somewhat unique in that its structure is something like a mutual insurance company that manages for fees and expenses and doesn’t generate profits for outside interests. Thanks for that.

But still, we give them US$, they buy USTs, and we get VMFXX SHARES–Vanguard bucks!! I get your point about the $1 NAV but the VMFXX page says NO value guarantees from FDIC, govt, or Vanguard. Please help me find information that states that no matter what happens to my 401k provider, the VMFXX fund is a separate legal entity owned SOLELY by VMFXX shareholders and the conservative govt fund money is safe so long as the govt does not default. If Vanguard doesn’t state that somewhere, then still believe we are capitalizing other riskier investments and paying for the privilege.

At what point does supply overwhelm the appetite for these bonds and rates rise? If bond supply continues without rates rising then what reflects the devaluation in bonds? My contention is steep discounts will apply. No government can afford to pay that higher rate of interest. They’ll choose to devalue their currency and their credit rating.

On another topic. Wolf, do you have any control over how ads accompanying your posts are arranged on a computer screen? Normally I see your columns running in about a four inch band down the screen center with ads appearing in a two inch space to the left or right. Suddenly today Google ads have additionally colonized a one by three inch oblong at the screen’s bottom that obscures your text. I don’t know how other readers feel, but for me this kind of distracting visual interference is off-putting.

Mary,

This is a new type of ad. It disappears as you scroll down the page. And you should not get it on every page.

So it appears and disappears in the most distracting way possible. Instead of concentrating on what you have to say, I have to monitor what my fingers are doing on the track pad. If I’m a robot, sure I can read at a steady pace top to bottom. But as a human being, I pause, maybe scroll back to a previous paragraph. Voila, an ad suddenly covers what I was just reading. I get the marketing theory. If something is jumping in and out of my field of vision, I’m more likely to notice it. I’m also likely to get a headache and double vision.

Once again I’m angrily thinking–wish Wolf would go to a subscription model so I wouldn’t have to court eyestrain to read his interesting views on the market.

Not sure you have noticed, but the Primary Dealers have not held as much Treasuries till the week of 12/5/18:

(in millions of US dollars)

Bills $47,470

1 to 2 to 3yrs to 6yrs to 7yrs to 11yrs $37,929

Total $212,524

They are holding 212.5 billion. Lots to wonder why.

“12/5/2018

Sorry that did not print right.

(in millions of US dollars)

Bills $47,470

1 to 2yrs $48,093

2 to 3yrs $9,284

3yrs to 6yrs $34,130

6yrs to 7yrs $27,833

7yrs to 11yrs $7,785

11yrs $37,929

Total $212,524

The stock market is fully and unequivocally rigged so that we are assured of an ever increasing growth of stocks that seem to grow like houses do forever.

Everyone knows that USD only goes up just like housing prices & crude does. There is no downside in a permabull rigged global economy, eh.

Mark my words, and not Greenspan’s of late. The markets will always go up and so will the stock markets ad infinitum without failure in a Too-BIG-to-Fail, Nail, or Jail rigged economy.

Nothing but blue sky all the day long just like it was in the good old days in the early 30s.

MOU

Barton Biggs’ book “War Wealth and Wisdom” has a number of informative charts on how various investment classes performed during the chaotic first half of the 20th century. As of this morning, you can buy a used copy on E-Bay for under $4 including shipping. I bought it new when it was published a decade ago and still find it useful as a reference book.

“Banks are very large holders of Treasury debt.”

And why wouldn’t they be? When you can lever super cheap funding 10X to buy risk-free assets, why bother making a loan?

Csmith, you have a point until you indicate that there is no need to lend all. Sweets can be a dietary delight, but eating 100% sweets kills. A bank that only has the Net Interest Margin of cheap deposits vs. Treasuries would not be viable.

I assume the US buyers of treasuries picked up the slack from fading foreign demand because of the relatively good yields treasuries are providing today.

Yet you seemed to completely ignore the elephant (and possibly a velociraptor) lurking just behind every word in your article.

The data you present strongly suggests that the Fed must stay in tightening mode in order to attract enough US investors to treasuries to counter slacking foreign demand.

You also cite ‘currency’ risk’ as a primary reason why foreigners are staying away from treasuries. Again, this would suggest the Fed must keep the dollar strong , to stem further outflows, by continuing to raise rates. I guess we’ll find out tomorrow.

The day will come when your US$100,000 repayment cheque will buy you a Big Mac, if you are lucky!

OC

During the early 1990’s, when the Soviet/Russian ruble had already lost much of its value, the major US TV networks would sometimes show scenes of old people in Moscow selling their meager possessions on the street just to make ends meet. There is no law that says the same thing could not happen on the streets of NYC.

U.S. government “debt” is more properly thought of as money. Treasury bonds are time deposits. Bank deposits are demand deposits. See The Socrates Show, with Guest Pete Peterson

If other countries are reducing their UST holdings, what are they buying? Lower yielding instruments with less currency risk?

I am in over my head here ….assets have to be held in some currency and if the US is in good enough shape to justify raising rates, where can less currency risk be found?

Chas. Dickens’ wisdom, “Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” , was a workable formula for human progress. *

That was 1850. Now, that formula is seen as quaint, or silly, or stupid or a sucker’s trap. The basis for it being wisdom and morphing into folly is the popular sense of fairness has collapsed. If so, that means our system of justice has collapsed.

*Chas. Dickens’ David Copperfield novel, the Micawber character speaking those lines.

Commercial Banks merged with Investment Banks when Dr. Greenspan & Bill Clinton signed off on the repeal of the Glass-Steagall Act with the full blessing of the SEC and Congress. Senator Gramm pushed the repeal through Congress and KPMG accountants & lawyers went to work on setting up their dummy company headquarters for the patsy if it all imploded as they knew it would. Iceland was their chosen fall sovereign because they were a backwater of International Banking that few understood at the time of their grand plan launch back when they blew Iceland into the stratosphere on leverage.

Charles Dickens was a great Macroeconomist well ahead of his time. He instinctively knew how bad these sociopathic speculators in Capitalism were towards the poor impoverished people that they victimize with their monetary leverage.

Dickens, aside from Professor Emeritus Karl Marx, has always been my favorite contemplative in the Finance game since I was a kid growing up watching Alistar Sim playing Scrooge every year in A Christmas Carol.

Fezziwig had the temerity to stick to professionalism & empirical rule whereas Ebinezer Scrooge & Jacob Marley were grifters. Scrooge ends up assuaging his leveraged guilt for the plight of the poor by supporting charity after his consciousness raising experience with the three ghosts.

He gave Bob Cratchit a raise and was nice to the poor after that but he was still an unscrupulous card dealer after that because he was a can kicking wizard of the accounts.

MOU

“despite a strong economy: Fueled by a stupendous spending binge and big-fat tax cuts”

In the past I have tried convincing you with data. Let me try a different approach this time. Let’s compare 2018 with 2016

2016:

Tax rates: “Fair”

Tax revenue increase YoY: ~$20B

Spending: “Justified”

Increase in deficit: ~$1.4T

2018:

Tax rates: “Big fat tax cuts”

Tax revenue increase YoY: ~$20B

Spending: “Stupendous”

Increase in deficit: ~$1.2T

You’re comparing apples and oranges. In 2016, GDP inched up 1.6%; in 2018, GDP is likely to grow at around 3.0% to 3.2% — nearly twice the rate of 2016. This growth generates a huge amount of new revenue growth. But it was a short-term spurt. It’s already slowing.

When GDP goes back to 1.6% growth, watch those revenues fizzle. And when GDP growth goes negative, watch those revenues fizzle even more. We’ll see some of this in the coming years.

It’s comparison of same metrics of 2 different years – why would that be apples to oranges?

Revenue fizzling out in 2019 is prediction, not evidence.

GDP growth of 3% isn’t an independent happenstance. Tax cuts spurred that spectacular GDP growth. I am trying to point out that smaller slice of bigger pie is better than bigger slice of smaller pie.

I guess I will never be able to convince you on this :)

Merry Christmas and happy holidays!

You convince me if during the next recession or even just downturn but no recession, revenues continue to rise. When that happens, I’ll become a true believer.

Merry Christmas and happy holidays to you too — and to everyone here.

Real market forces in auctions are sending a very strong message. With no CB open market operations, there’s been full and excess demand along with an interest rate dip.

The success in auction subscription in a going it alone process (no CB backstop) is an early and very important TELL and view through the windshield as we move forward.

It does affirm the safety of the dollar. There’s no entity on earth that can undermine the ability to continue to issue debt. We are 23% of the worlds GDP and have the singular unilateral and at will capacity to exact compliance from every other country (we will soon see this with China)

There is no greater country than America.

So, Social Security is the biggest holder, funded by paycheck deductions…..

So, just another tax to support the government, not support retirees…..

Social Security is a pension fund that US workers pay into, and from which they receive a pension at retirement age. It also offers survivor benefits, and the like. The accumulated surplus of the past years (the “Trust Fund”), including the Disability Insurance fund, currently is $2.8 trillion. This $2.8 trillion is invested in the most conservative income-producing assets, US Treasury securities. The effective interest rate earned by the Trust Fund in 2017 was 2.9%, or $81 billion, which was added to the Trust Fund.