Instead of “bubble” or “collapse,” it uses “valuation pressures” and “broad adjustment in prices.” Business debt, not consumer debt, is the bogeyman this time.

Preventing another financial crisis – or “promoting financial stability,” as the Federal Reserve Board of Governors calls it – isn’t the new third mandate of the Fed, but a “key element” in meeting its dual mandate of full employment and price stability, according to the Fed’s first Financial Stability Report.

“As we saw in the 2007–09 financial crisis, in an unstable financial system, adverse events are more likely to result in severe financial stress and disrupt the flow of credit, leading to high unemployment and great financial hardship.”

Financial firms are OK-ish, except for hedge funds.

The largest banks are “strongly capitalized” and are better able to withstand “shocks” than they were before the Financial Crisis; and “credit quality of bank loans appears strong, although there are some signs of more aggressive risk-taking by banks,” the Financial Stability Report says.

Also, leverage at broker-dealers is “substantially below pre-crisis levels.” And “insurance companies have also strengthened their financial position since the crisis.”

A greater worry are hedge funds that are now being leveraged up to the hilt. “A comprehensive measure that incorporates margin loans, repurchase agreements (repos), and derivatives – but is only available with a significant time lag – suggests that average hedge fund leverage has risen by about one-third over the course of 2016 and 2017.”

“The increased use of leverage by hedge funds exposes their counterparties to risks [that would include banks and broker-dealers] and raises the possibility that adverse shocks would result in forced asset sales by hedge funds that could exacerbate price declines.”

But here is why they won’t get bailed out: “That said, hedge funds do not play the same central role in the financial system as banks or other institutions.”

Consumers are in pretty good shape, except…

In terms of their mortgage debt to GDP and income levels, consumers are in pretty good shape, the report said, but student loans – 90% of which are guaranteed by the government – and auto loans are out of whack, and there are some problems in the subprime segment.

But business debt, oh my!

The Fed finds that asset valuations are “generally elevated” as investors “exhibit a high tolerance for risk-taking, particularly with respect to assets linked to business debt.”

“Asset valuations appear high relative to their historical ranges in several major markets, suggesting that investor appetite for risk is elevated.” In this category of overvalued assets waiting for sharp price declines, it lists:

- Commercial real estate ($21.2 trillion in assets) – it has a lot to say about CRE valuations and risks – see below.

- Junk bonds and leveraged loans ($2.4 trillion combined) exhibit yield-spreads to Treasury securities that “are near the lower end of their historical range.”

- Investment-grade corporate bonds and commercial paper ($6.2 trillion) – see below.

- Stocks ($33.8 trillion in market capitalization) have seen rising P/E ratios since 2012 that are now “above their median values over the past 30 years despite recent price declines.”

- Farmland prices ($2.2 trillion total), though down from their 2016 peak, “remain very high by historical standards.”

Commercial real estate ($21.2 trillion in assets):

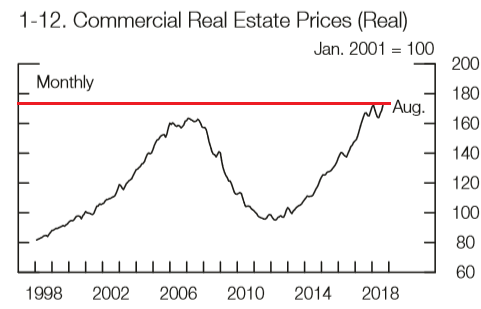

Though prices of commercial real estate (CRE) have been about flat compared to a year ago, they had been growing faster than rents for years. The chart below shows the index of CRE prices adjusted for inflation (via core CPI). These “real” CRE Prices are now higher than they were before it all blew up (I added the special effect in red):

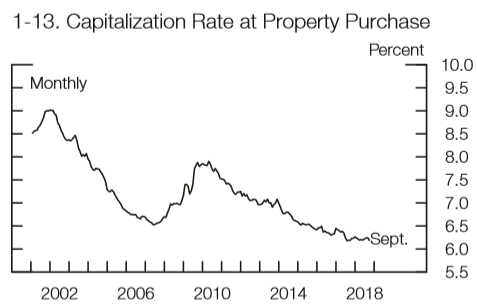

These high prices have led to capitalization rates at the time of purchase that are, compared to 10-year Treasury securities, very low. In other words, “returns to CRE property investors thus reflect a relatively low premium over very safe alternative investments.” And this cannot last.

The chart below shows the three-months moving average of cap rates across the US on a square-footage basis for industrial (warehouses and the like), retail, office, and multifamily sectors:

Given the CRE-bubble of historic proportions, banks should tighten lending to curtail their risks. Instead they “have eased a bit over the past year.”

Borrowing by nonfinancial businesses ($17.1 trillion, excluding banks)

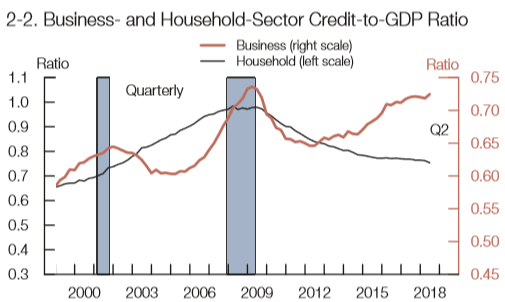

“Business-sector debt relative to GDP is historically high and there are signs of deteriorating credit standards,” the report warns – with debt “growing fastest at firms with weaker earnings and higher leverage.”

This $17.1 trillion in business debt includes:

- Corporate business credit: $9.4 trillion

- Noncorporate business debt: $5.4 trillion

- Commercial real estate debt: $2.4 trillion

The chart below (the original chart goes back to 1980) shows non-financial business debt and household debt in relationship to GDP. Due to the decline in mortgage debt in relationship to GDP, household debt overall is in pretty good shape, with a declining credit-to-GDP ratio. Before the Financial Crisis, it was household debt that was out of whack and that contributed to the Financial Crisis; now it is business debt:

Business debt has grown “faster than GDP through most of the current expansion.” This debt is “historically high,” and “total business-sector debt relative to GDP stands at a historically high level.” Even so, “risky debt issuance has picked up recently,” and “credit standards for some business loans appear to have deteriorated further.”

The Fed had a special word for leveraged loans:

“Credit standards for new leveraged loans appear to have deteriorated over the past six months.

“The share of newly issued large loans to corporations with high leverage – defined as those with ratios of debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) above 6 – has increased in recent quarters and now exceeds previous peak levels observed in 2007 and 2014 when underwriting quality was notably poor.

“Moreover, there has been a recent rise in ‘EBITDA add backs,’ which add back nonrecurring expenses and future cost savings to historical earnings and could inflate the projected capacity of the borrowers to repay their loans.”

The Fed has been warning about leveraged loans for years. Most recently it pointed at specific practices, such as EBITDA add-backs, collateral stripping, incremental facilities, and cov-lite [The Fed Broadsides $1.3-Trillion “Leveraged Loan” Market].

And it warns about investment-grade bonds.

“The distribution of ratings among investment-grade corporate bonds has deteriorated. The share of bonds rated at the lowest investment-grade level (for example, an S&P rating of triple-B) has reached near-record levels. As of the second quarter of 2018, around 35 percent of corporate bonds outstanding were at the lowest end of the investment-grade segment, amounting to about $2¼ trillion.

“In an economic downturn, widespread downgrades of these bonds to speculative-grade ratings [to junk] could induce some investors to sell them rapidly, because, for example, they face restrictions on holding bonds with ratings below investment grade. Such sales could increase the liquidity and price pressures in this segment of the corporate bond market.”

These investors that might be forced to sell a large amount of bonds as they get downgraded to junk include investment-grade bond mutual funds.

Alas, bond and loan mutual funds “have more than doubled in the past decade to over $2 trillion.” But “the mismatch between the ability of investors in open-end bond or loan mutual funds to redeem shares daily and the longer time often required to sell corporate bonds or loans creates, in principle, conditions that can lead to runs [on the bond funds]….”

“If corporate debt prices were to move sharply lower, a rush to redeem shares by investors in open-end mutual funds could lead to large sales of relatively illiquid corporate bond or loan holdings, further exacerbating price declines and run incentives.”

“Moreover, as noted in earlier sections, business borrowing is at historically high levels, and valuations of high-yield bonds and leveraged loans appear high. Such valuation pressures may make large price adjustments more likely, potentially motivating investors to quickly redeem their shares.”

And here is what this would do to conservative-sounding investment-grade bond funds, which pack special risks & surprises that can entail a catastrophic loss for investors when there is a run on the fund.

This is further exacerbated as “leverage of some firms is near its highest level seen over the past two decades,” the Fed mused:

“An analysis of detailed balance sheet information of these firms indicates that, over the past year, firms with high leverage, high interest expense ratios, and low earnings and cash holdings have been increasing their debt loads the most.”

“High leverage has historically been linked to elevated financial distress and retrenchment by businesses in economic downturns. Given the valuation pressures associated with business debt noted in the previous section, such an increase in financial distress, should it transpire, could trigger a broad adjustment in prices of business debt.”

For now, risky credit for the riskiest companies is still cheap and plentiful, allowing them to refinance their debts, and so “corporate credit performance remains generally favorable.”

But this is precisely what the Fed has set out to change by raising rates and unwinding QE to bring up interest costs for junk-rated companies after the decade long binge. So good luck, the report is essentially saying.

It is also significant that the Fed is now communicating these issues with its first Financial Stability Report. It could have done this years ago, but it didn’t. I see it as an effort to justify rate hikes publicly and in one document: asset prices are inflated, business leverage is at historical levels, and if the Fed doesn’t try to tamp down on it now, it might preside over another financial crisis – and this one would be totally the Fed’s own creation.

Shedding light on Fed Chairman Jerome Powell’s “just below neutral” and the hullabaloo about the Fed suddenly turning “dovish.” Read… My “Fed Hawk-O-Meter” Speaks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– LOL

Keynes wouldn’t have advocated an expansion to the money supply just for it to be dumped into the financial markets. That all pretty obviously doesn’t efficiently raise aggregate demand.

Distorting Keynes is a cottage industry on the internet. Market fundamentalists love blaming the excesses of the system that makes them rich on a straw man of superior economic thinking from a wiser age, which would annihilate them in an honest dialogue.

Nobody is more guilty of distorting Keynes than contemporary Keynesians. And please, let’s not elevate Keynes to God status. He was right about some things, wrong about others. He was a brilliant man, and I presume had he lived longer, his brilliance would have won out over his (equally legendary) vanity, and he’d have admitted to his earlier mistakes. Unlike his modern day followers, who have turned their version of the dismal science into the dismal religion.

Succinct and to the point. Well said (although open to interpretation).

I need to work on brevity.

+

The Fed has been wrong far more often than it has been right since its founding in 1913. Its track record since the Alan Greenspan’s tenure has been even more miserable. Thus, its policy pronouncements are an excellent contrary indicator to what’s really going on in the economy.

There is not much to disagree with in this latest monetary report.

HB Guy says……”the Fed has been wrong……..their pronouncements are an excellent contrary indicator….”

NOT THIS TIME.

>”…and auto loans are out of whack…”

No shortage of used pickup trucks with 120,000+ miles and $25k+ lien on the title. Any vehicle with 180,000+ miles is due for a complete replacement of the catalytic exhaust system along with some emissions management parts costing at least $2k+, or you can’t get it registered. And some states require this emissions work before you can sell it.

2012 3/4 T dodge 2500. 4X4. Crew cab diesel 24 valve. standard tranny. 228,000 miles. Runs like a shark. Books for maybe 13k but around here in nowhereville N-western CO 8500′ elevation it is worth 3X that price. A keeper.

I dunno, my ’06 Malibu has over 170k and the emissions system seems perfectly fine. It looks like new CA-compliant cats would cost around $600-$700 on RockAuto.

Try a Honda Pilot or Toyota Highlander. Add in some labor time with the vehicle plugged into the diagnostic computer, and don’t forget a couple of new O2 sensors along with those catalytic converters including shop labor done under a vehicle lift.

Just think how much debt there is on the shadow banking system side. The wealth of mom and pop, grandma and grandpa spent by the young because of the grants (“loans”) made to them. Consumer debt is much worse than this report. I believe the total US debt, let alone the world, to be much worse, because it just isn’t reported.

Have you ever heard of dark pools, pretty neat check it out:

https://www.investopedia.com/articles/markets/050614/introduction-dark-pools.asp

These graphs look a little different I like them.

If asset prices began to deflate to reasonable levels Millenials might be able to purchase homes for the first time. Where I live prices have octupled over the course of my life, granted inflation also plays a role in that.

There are some that would argue the power to print money should lie with the treasury, personally, I keep one of Kennedy’s treasury notes in my wallet what a great man he was I was just a little boy when he was killed my mother was watching the soap opera As the World Turns.

what a great man he was? look at Vietnam today and tell me why we had to sacrifice 58,000+ American lives for that place in the 60’s and 70’s…you obviously didn’t have to suffer because of those decisions but I and my era did…I don’t trust government any more than I trust your blind statements. We were not watching soap operas..we were watching horror movies…

“Communism had to be contained.”

Yes, that’s what the war profiteers were selling at the time. Now they just kill for profit, without excuses, no one says boo.

At the end of the day America keeps the world safe and the enemies at bay, so get off your high horse Lisa.

Don’t forget Robert McNamara.

It’s the weirdest thing. For a country that pounds its chest every time “democracy” is mentioned, so much power is given to two institutions (SCOTUS and the Fed) that aren’t democratically elected.

If you think monetary policy is bad now, just hand the reins over to elected officials and see how bad it gets. Don’t confuse the criticism of the Fed that you read in online comments with general public sentiment. The vast vast majority of people and politicians want lower interest rates and easier money policies all the time. “Democritize” central banks, and that’s exactly what you will get.

“If you think monetary policy is bad now, just hand the reins over to elected officials and see how bad it gets.”

Yep! Wolf had described it in the case of Argentina in one of his comments recently.

“The vast vast majority of people and politicians want lower interest rates and easier money policies all the time.”

Yep! Add businesses to people and politicians and you have them all covered! So you could say the Fed is obliging its constituents.

Since most people (may be because of the way they are wired) seem to like to exactly that which is harmful to their health, it is important for the regulators and politicians to ensure they are atleast hampered by good regulations at getting into trouble (but then who cares about the average citizen). Some examples here…

1. Warren Buffet: ‘Socks or stocks- I buy them when there is a mark down’. Exactly opposite of what the bag holders do.

2. Home prices may make you feel good if you own one – but your next generations can kiss their ability to own one goodbye (even price inflation lags asset inflation quite a bit, so let us not even drag wage inflation into the picture)

3. Low cost of capital leads to misuse and wastage (try free water, free power for the entire populace and see how soon these companies will end in bankruptcy) and therefore wasted economic opportunities

4. Pulling demand forward makes for increased demand and higher prices today but leads to a vacuum in demand in the future. Be careful what you wish for.

The point is as long as a resource is cheap it will be used injudiciously. It is human nature. As Javert Chip in his comment, on Australia housing post, put it succintly – “How about putting more capital & accountability into the “mortgage” game at the source of the problem”.

All the regulations (by all regulators and the Fed) and actions by politicians (getting re-elected and being able to kick the can being the main aganda and since it is not their money they exchange it for votes-prudent economics be damned! After all the tab is paid by savers, prudent people and tax-payers) are detrimental to the interests of an average citizen.

Hopefully there will come a point in future where we will have a reset in economic thinking.

Wolf, thanks for this dissection of the stability report.

Yes, that is the irony.

We’re so afraid of elected officials printing trillions of dollars to give to constituents in exchange for votes that we’ve created a system that allows a cadre of bankers to print trillions of dollars to give to their friends instead. Who then use those funds to buy the very politicians who are supposed to represent the public at large.

“If you think monetary policy is bad now, just hand the reins over to elected officials and see how bad it gets.”

“Yep! Wolf had described it in the case of Argentina in one of his comments recently.”

But that’s no defense for having a Fed. Neither the Fed nor the sleazy government should have any control over the monetary system. They are crooks. Always have been, always will be.

All of them!

I believe if we don’t destroy ourselves first, there will be a time when humankind will once again have very little government at all. I’m an optimist.

Easy money policies benefit the asset-holders over labor.

The wealthy always have the loudest voices and an outsized influence in politics.

The “constituents” of elected officials (as well as unelected like the Fed) is typically considered to be the wealthy interests rather than the working class voters. The working class is often looked down on by these elites who consider them stupid and easily swayed by their media control and propaganda.

It’s not that “the people” are clamoring for more easy money for Wall Street and the banks against their own interests, it is simply the mouthpieces of the elites that make it sound this way.

I do admit though that the majority of working people don’t understand the affects of QE, they just know if times are good or bad. When times are bad they vote to change the status quo looking to outsider candidates and fringe parties, which has been happening all over the world.

Rowen, I’ll add to your well taken point that fact that SCOTUS appointments are for life and Fed Governors are for very long terms, I think 14 years. I’m pushing 70 years of age and I don’t remember a removal from either position.

Huh, you’re actually I bit older than me Panamabob tell me were ever able to earn 12% on a CD under Carter it feels like that was a dream sometimes. Granted at the time an 16% mortgage rate felt like a steal although I’ll admit my memory is starting to get foggy.

Various reports from the Fed full of blather about liquidity concerns, elevated asset prices, inflated CRE prices and on and on have proven to be meaningless. What matters is guidance given by the Fed chairmen in post meeting statements.

On Wednesday Powell gave an extremely dovish speech indicating rates are very close to neutral (this despite saying rates were a long way from neutral just six weeks ago) and asset markets correctly interpreted this to mean the Fed is now embarking on easy money policy. If Powell did not realize he was providing the markets with tremendously dovish forward guidance then he is, by far, the worst Fed chairman in a long line of awful Fed Chairmen.

Powell sparked the strongest stock market rally in over two years (going back to the election of Trump) do you honestly believe this was unintentional? If you include todays futures (now up over 50 points on the S&P) the S&P has rallied almost 7% in just 6 days. Powell told the market, loud and clear, the Fed put is still in play and the heads wall street wins, tails main street loses bet is still in effect.

The easy money flood gates are once again to be opened. I went 100% to cash last September, hoping and praying that somehow Powell had a spine, obviously that move has now proven to be a financial catastrophe as the Fed, once again, caught me flat footed and left me holding dollars that they are full-on debasing. Some of us, it would seem, never learn. Some gotta win and some gotta lose and Fed has once again put me in the losing camp.

The Fed has already made simple shelter unaffordable to me, seems they will not be satisfied until I’m no longer able to feed myself with my earned income.

You’ve been saying the same stuff in your comments for two years: that the Fed will never raise rates and that it will never unwind QE, and that it will always try to inflate asset prices. You cherry-pick your impressions to suit your narrative, and you’ve been wrong about it every step along the way. What makes you think that Powell was “dovish?” Because you read it in the media, which wants to give a buy signal to the markets, always. And it worked. It has worked many times before, temporarily, and it’s just one more reason the Fed will continue to raise rates until this asset price inflation ends.

Nothing to see here, move along. The S&p futures are up 500 points which means the economy is great! So long as that Trump industrial average keeps going up then we have nothing to worry about.

Fair enough, although I have not been reading your articles for two years, point, none the less, taken. I will continue to enjoy your articles but will refrain from commenting in the future.

If I have commented too often and also sound like a broken record it is because Fed policy is a broken record. But, you are correct, no need to continue to comment further, the Fed is an inflation factory, commenting on it changes nothing.

No one would like my “narrative” to be wrong more then myself. If I’m wrong it would mean the Fed had adopted a position of responsible stewardship of the dollar.

As for Powell, he has changed his rhetoric from rates being “a long way” from neutral to “near” neutral. This change in rhetoric was clearly meant to signal a dovish tone.

The Fed, under Bernanke, encouraged everyone (corporations, governments, individuals…) to gorge on debt. Now that debt cannot be serviced at a normal rate of interest, is this Powell’s fault? Maybe not but he never once dissented along the way.

Up to now I have, in fact, been correct regarding Fed policy. Rates have been raised only as far as 40 year trend taking FFR to a lower high, the next lower low will require negative rates. I have seen this movie before (Brazil, Argentina, Zimbabwe…) and I know how it ends, the government will soon need the Fed to create endless sums to pay for our bloated and expanding deficits (deficits enabled by the Fed).

O.k. nuff sed. I will continue to enjoy your articles but comment no more. Time will soon enough reveal who was correct, unfortunately told-ya-so’s don’t the pay grocery bill.

hey Van

don’t get mad, get even.

i am sure wolf’s readers love your comments

don’t go please.

we are sitting here and hoping for a very hard brexit. any nuggets on that topic?

cheers

huis

You might wanna read Ray Dalio’s new book, “A Template for Understanding Big Debt Crisis”. This might help enlighten you as to what might be happening right now. You can get this book for free on the Bridgewater Associates Website. There is also a Research Library with a good explanation of how the economy works. This helped me a lot. Maybe, it will help you as well. The FED will never make it attractive to hold cash LONG TERM. It might be smart to hold cash for shorter periods of time, but usually you would want to diversify into a “Balanced Portfolio”, although most Folks have about ZERO idea of how to accomplish this.

van_down_by_river,

Like plenty of commenters, you’ll get your chance to tell me, “I told ya so.” You just have to be patient. Now doesn’t seem to be the moment.

I like your comments, Van. Keep ’em coming.

Hey, I am the brand new proud owner of a totally refurbished Westfalia. Not only do I have a new engine in it, I have another to rebuild as a project next winter. This is my second Westie as I gave my first one away to my daughter as a wedding present, 15 years ago.

I’m 63 and feel like I’m 33. Even my wife is looking at me differently. :-) Plus, the Westies not only hold their value, they increase as there is some kind of cult trend going on with these busses. The day I drove it home I could have sold it for a $4,000 profit. Weird.

In fact, I’m changing my post name to Van2.

(formerly known as paulo) And I’m down by the river. See what you’ve unleashed!!!!

Wolf,

Also missing from this “banks are safer” mantra are:

The CHOICE Act became law this summer, which essentially repealed Dodd Frank regulations for small to medium size banks.

Trump admin has also dismantled the Volcker Rule against banks making risky investments with their own money (ie your deposits)

Last “stress test” in August showed Goldman Sachs to have the lowest capitalization of major banks with 3.1%, barely above the Dodd Frank requirement of 3%

Lehman as I recall had a capitalization off a little over 1% in the last Crash, so theoretically Goldman is THREE times safer than Lehman, but who the heck knows what investment schemes they’ve cooked up with margin and debt, especially with rules against risky investments abolished? And how is 3% a “safe capitalization level?

Truth is banks are still up to their eyeballs with debt and margin

A fascinating paper from the Brookings Institute I found pointed out that these stress tests don’t take into account the behavior of depositers with these banks during an economic meltdown, ie, they tend to PULL OUT their deposits and that “safe capitalization” level suddenly drops

So, in summary, I don’t think it matters what the Fed does. Most likely it will keep increasing rates slowly a few more times while humming a tune that sounds like “Everything Is Awesome” while warning about a debt bomb explosion.

Exactly the sort of confused behavior that will both continue to build the Asset Bubble while setting the stage for causing it to explode

And then the debt bomb explosion goes off, slowly at first, but building up speed, corporate junk bonds default, Cov-Lite loans leave creditors with nothing, bond mutual funds and ETFs crash to zero as investors try to get out, pension funds default, other institutional investors like cities, counties, and states crash.

All that money pumped in by the Fed and the Trump Tax Cut just….. disappears

Everything is interlocked and connected, like a house of cards. People out of work need cash, bankrupt corporations and cities need cash, those bank deposits drop, safe capitalization drops.

Banks, having gotten the green light to make riskier investments, crash. First the small and medium size banks crash (remember Wolf, you had an article about the riskiest consumer debt and highest rates of defaults were with the smaller banks)

Another Financial Crisis comes into being, just like the olden days

You made up the Goldman Sachs capitalization rate of 3.2% to fit your narrative. It’s not even close. There are various capitalization rates. Here is the full report of Goldman’s stress test results, released in July.

https://www.goldmansachs.com/investor-relations/financials/current/other-information/2018-annual-dodd-frank-stress-test-disclosure.pdf

Goldman’s actual ratio are:

CET1 ratio: 12.1%

Tier 1 Capital ratio: 14.1%

Total capital ratio: 16.8%

In the nightmare scenario envisioned by the stress test, even after accounting for all losses Goldman would have to take under that scenario, capital ratios would still be higher than the number you threw about as your starting point.

Wolf,

Let me return to my operational amplifier model with delayed begative feedback.

The problem is that this negative Fed feedback to control the wildly rising asset inflation is delayed. It should have happened no later than 2015, before this Everything Bubble got out of control, but stocks tanked when the Fed hinted at reducing QE and fearing a recession, the Fed backed off.

And what the Fed is doing now is too little and too slow. The result are all these articles that you, Wolf, keep writing about how the junk bond markets and investors keep ignoring the Fed

It’s a huge bubble. The collapse could be severe. And the mantra that “banks are better capitalised”, does not mean that anybody has a clear idea of how much and how risky the bank loan portfolios are relative to this somewhat improved capitalization.

There are lots of indications from people much smarter than me that banks are every bit at risk this time around from bad loans as last time, as banks seem to have taken on MORE loans every bit as dodgy as last time to match their increased capitalization

Real Fed rates are still negative. The Fed is making their pitch to counter economic weakness and the stock market rallies [briefly]. When the Fed lets off the gas the mother of all deflationary crashes will occur, particularily if credit tightens and LIBOR-OIS blows out as seems likely. Their best hope is a systemic event, but should it mask a deeper bear market then all efforts to lower rates will only pound bonds into dust.

Yeah, that would seem logical, but what if they decide to pull the print lever.

There is simply no way to predict what will happen. The best Macro Guys on the planet screw these things up regularly.

These are the smartest guys in the room AND they have a plan.

What could go wrong?

Let’s not forget what happened to the last smartest guys in the room, hint they’re the reason bean counters like me will never be out of a job.

The smartest people make the biggest messes.

Anyway, this Financial Stability report sounds like a 5-alarm warning in Fed-speak, the biggest fear being that if rates rise too much companies won’t be able to afford to borrow enough money to do share buybacks to keep the market inflated, and if they don’t do that there’s going to be a major price adjustment because by every metric it’s seriously overpriced.

Maybe if things do go haywire they’ll implement the no-buyback rule that was rescinded in 1982. It’s usually been a horrible waste of shareholders’ money. Oh, and let banks be banks again. Glass-Steagall did get it right.

Amen

Hopefully Greenspan will be on the tallest tree with Bernanke tied to his feet!

Wolf, thanks for putting a spotlight on this Fed report and making the effort to translate it for non-financial people.

One comment: you wrote “Due to the decline in mortgage debt in relationship to GDP, household debt overall is in pretty good shape, with a declining credit-to-GDP ratio. Before the Financial Crisis, it was household debt that was out of whack”

While aggregate “household” debt is okay, the distribution of debt matters and I believe it’s badly skewed. While many of those who’ve been getting all the income gains in this recovery have kept their debt levels low, I don’t think the lower-income folks have done as well. It’s hard for folks to escape the debt traps when income doesn’t keep up with inflation.

Also, it would be very enlightening to unpack what the Fed calls “household sector” in this type of reporting. It’s a much broader category than just people living in houses.

“It’s hard for folks to escape the debt traps when income doesn’t keep up with inflation.”

Yes, and Income growth not at least matching inflation has actually impacted a large % of wage earners over a long period of time. Lack of any semblance of control over immigration and off-shoring have been full steam ahead.

Even with all the wage growth headwinds, debt is a choice. And that choice gets made by more than just low wage earners. Inflation incents that choice. The prudent elderly who worked and saved and are now relying on fixed income have been the folks absolutely crushed …what was their choice? This (silent) group was productive …and their savings has been slowly siphoned off.

And we are now much more concerned now about those who consume more than they produce. There are more voter in this group …and this group grows while the other group dies out. A self-reinforcing race to the bottom.

The French Yellow Jacket Protesters are born from a similar mixture of debt, income inequality and taxation.

“Asset valuations appear high relative to their historical ranges in several major markets, suggesting that investor appetite for risk is elevated.” Let me fix that: “Interest rates are low to their historical ranges, causing wage suppresion and asset bubbles and parasitical financialization of the economy.”

Wage suppression can be caused by many factors: for example in the aftermath of the Black Death, when sheer lack of labor was driving all wages upwards, including those of the humblest farm laborers, King Edward III (who also happened to be one of the largest landowners in Europe and by far the wealthiest) had passed progressively stricter legislation during the 1360’s and 1370’s to savagely cap wage growth. Combined with the three poll taxes levied between 1377 and 1381 and a “failing miserable war” with France it helped ignite the Peasants’ Revolt, which shocked contemporaries because English peasants were supposed to raise up in arms only when instructed to do by their own feudal masters, not because they had serious grievances.

Had Wat Tyler been a moderately competent leader instead of a boisterous fool history would have been very different.

A lesson we should all learn, regardless of how big our bank account, because history has a nasty tendency to rhyme with itself.

Doing someone else’s bidding is almost always oppressive, unless you are clan.

“Far right” Vox takes 12 in Andalucia and is given a key to hold in “electoral earthquake”.

Good morning Spain.

https://www.elespanol.com/espana/20181203/condiciones-abascal-vox-apoye-pp-andalucia/357964592_0.html

\\\

If the FED and other institutions did their work properly and informed us about the same, we would not need sites like Wolfstreet and others to inform us on economic matters.

\\\

On the other hand, it’s their deviant behaviour that triggered sites like this, leading to an increase of general economic literacy and a better understanding of the world we live in. I am not saying they are out of tricks, I am saying that we are getting better at figuring them out.

\\\

Amen to both points.

In the Bush I Real Estate Scam, certain insiders at certain Savings and Loans criminally pushed their appraisers to overvalue select and other commercial properties, which were then loaned way too much against their overvaluations. When interest rates rose at the Fed soon after, the Insiders then cherry picked the best portfolio properties that were in default at those certain Savings & Loans that the SEC had then declared ‘technically insolvent’ and the RTC took them over, and The Insiders picked up prime assets at ‘pennies on the dollar’ and the Taxpayers picked up the tab for the RTC cleanup.

In the Bush II Real Estate Scam, the Appraisers were under a microscope now so they had to do things different. This time the home Mortgage Lenders were criminally pushed to overvalue the Borrowers and qualify them for loans that they could never, ever repay. So when the Fed raised interest rates, and the Adjustable Rate Mortgages Teaser Rates reset a few years later, millions of residential properties went into foreclosure, and the robo-signing foreclosure executives rubber-stamped innumerable fraudulent foreclosure actions, and the Courts reacted by freezing the foreclosure process for a while, while the Mafia who had sliced-and-diced into the international selling of Mortgage Backed Portfolioed loans around the world, somewhere between $3 and $4 Trillion of ‘fake paper’. Thus the $5 Trillion ‘line of credit’ given to Fannie Mae and Freddie Mac to make international investors ‘whole’ (Germany, Russia, Iceland, England, etc etc who bought hundreds of millions of slices and dices) over time, thus the Fed’s purchases of ‘problem mortgage backed securities’ over a decade ! Not to mention the real estate insiders who picked up prime residential properties at ‘nickels on the dollar’ ! While the Taxpayers again picked up the tab in the form of $5 Trillion, $700 Billion, etc added to the Federal Government’s public debt.

Now it seems a 3rd Scam is coming to light ! That of Fed Zero-Rate ‘Free Money’ inflating corporate debt ! I didn’t see that either ! It took me several years after the fact to understand Bush I and Bush II. So I’m not ahead of the curve on any of this. Thanks Wolf for being spot on !! on this one ! before it becomes a major disaster, though I don’t know what we can do in sounding an alarm to mitigate the future.

So perhaps the 3rd Scam is to ‘bankrupt’ a huge number of corporations, leaving the ‘cash is king’ corporations (those who have been given an ‘unlimited line of credit’ so they can “be the last corporations standing”, and preordained to be so, so they can buy up large numbers of their competing businesses ! and ‘take over the world’ !

I think this person has read The Franklin Coverup…

interesting counter eulogy to the MSM requiem of 41 as a god. 43 referred to the housing bubble as the “home ownership society” a conservative, private enterprise answer to the New Deal inspired project to provide government backed loans for low income home buyers. Some have been around since the depression. My son bought his first home at the bottom in the 2008 crash using FHA. My cousin lost his home after doing a refi with Countrywide. My son still has his home. My cousin rents.

There are dozens, if not hundreds of moving parts in today’s world economy. It is impossible for any person or organization to know how to manage precisely.

They may want to give that impression to build confidence in “the system”, but in reality, they don’t know many or most of the answers.

We will have another crisis soon enough. The imbalances caused by debt and inflation are huge.

All of this in spite of what the Fed does or doesn’t do.

Glancing at the stock market, Fed Chairman Powell recent comments may have helped to wipe out his vaunted 3 years of “gradualism” and has

produced a strong market rally.

If nothing else, if Powell does succeed in reaching a point of reducing valuations, he just make his job harder and may also have set up a greater likely hood of a more severe crash should it ever come.

Kudos to the Oracles at the Fed.

What strikes me as odd is the disconnect between the Fed’s policy and the risks outlined in the risks report. It’s like they are providing two versions of the truth to keep everybody happy, so they can say “I told you so” no matter what happens.

Why didn’t they start raising rates year earlier than they did? Why did they let debts build up to catastrophic growth-devouring heights? Why did they let banks become “too big to fail”, and then “too big to counter”. Soon it will be “too big to not run everything”.

Overall, I find the Fed to be inconsistent, politically amenable, and slow to identify structural economic changes. It’s hard to identify anything they’ve done well. They’ve obviously accentuated market volatility through time, not dampened it.

The way they run to Goldman Sachs for every little piece of advice tells me there is a huge independence problem. Given the access Goldman has to the government, they should be put on government pay scales.

It’s good Powell started putting out the risk report though. It’s better to throw out some warnings, even if the Fed hasn’t fully addressed them. Bernanke and Yellen never had enough spine or common sense to do this.

Bobber,

“Why didn’t they start raising rates year earlier than they did? Why did they let debts build up to catastrophic growth-devouring heights?”

Yes, this remains inexplicable. imho they should have “gradually” started raising rates in 2010. They should have never undertaken QE. The bailout programs (low-cost loans to large companies and banks) were OK, as part of the Fed’s function as lender of last resort. But the rest was just a reckless drive to create rampant asset price inflation, and now they’re trying to figure out how to contain it.

To follow that thread Wolf, do you suppose that the Fed should KEEP raising rates now, and will history vilify this Fed for the same mistakes of Bernanke-Yellen? And do you suppose that new QE would be started with few problems. In 2008 we had a Democratically controlled congress under Nancy Pelosi. just for historical reference

Hi Wolf.

The Fed should have started raising rates much earlier, and 2010 would have been a good time to start. While the Fed acted as the lender of last resort, it violated Bagehot’s principles of such bailouts: they should only have been made to institutions that were fundamentally solvent, and the bailouts should have been made at a high rate of interest. The $16T in secret loans were made to all financial institutions (other than Lehman!) indiscriminately and at very low interest rates.

There was some justification for QE1, but not QE2 or QE3– except that the Fed was afraid. In the final analysis, the reason the Fed continued with ZIRP and QE was that they saw there was still enormous fragility in the markets and economy, and they didn’t think they had the tools to deal with another downturn. Plus there was enormous political / market support for QE. The ironic thing is that everything they did to avoid a re-crash increased the long-term fragility of the system.

> “But here is why they won’t get bailed out: That said, hedge funds do not play the same central role in the financial system as banks or other institutions.”

The probability of a bailout is correlated to the degree to which a fund failure would affect the larger economy. The Long Term Capital Management bailout of the late 90s is an example. Hedge Funds are a system of arbitrage that uses leverage to exploit differentials in how information is propagated through (often highly complex) system of markets. My view is that it’s likely the next crisis (if there is one) will be one involving the quant funds, and that a bailout will be required to stave off a general meltdown.

Note, bailout doesn’t mean that that the original fund investors will be protected. After factoring for debt, LTCM investors were left with basically nothing.

If there’s any risk to the economy, in my mind, it’s the continued growth (after a sharp downturn post 2008) of quant hedge funds. In fact, given the opaque and poor quality of Western analysis re: China’s involvement in the global economy, I’m actually surprised that there hasn’t been a crisis of LTCM proportions (or much greater) I’m rather surprised that there hasn’t already been a major crisis in the last decade.

When I ask myself why, I can think of the following possible reasons:

– Dumb luck

– Post LTCM reforms and particularly post 2008 reforms have had there intended effect of reducing the systematic risk posed by highly leveraged funds.

– Hedge funds themselves have matured and as have the numerical models and software used to manage them.

– The unusual period of market stability over the last decade (no US recession, very low interest rates, very low inflation, lack of emerging market flame-outs on the scale of Russia or East Asia) haven’t stressed funds by subjecting them to wide swings in the underlying parameters they track.

Of these my tendency is to suspect the last. You can never know the underlying strength of any financial instrument until you’ve gone through multiple business cycles, certainly at least one.

BTW, I see that as the major risk for the Feds, now long standing policy, of attenuating he business cycle through the manipulation of interest rates. Having a record 10 year run of low inflation and decreasing unemployment fulfills the Feds mandate perfectly, but at the cost of slowly building up systematic risks when the next recession does occur, which it must, no matter how good the Feds monetary policy is in defending against one.

Why are bond yield’s tightening if the economy is doing so well?

Has Wall St and muppet investors read the FRB financial stability report yet? They REALLY should. Never before have I seen that FRB has been so explicit about calling out bubbly market valuations and subprime corporate debt, to pick two highlights.

“Financial stability” has become the new code phrase that means “enough with the damn bubbles”.

My guess is that this type of report with this type of data gets generated every month or at least before every FRB/FOMC meeting. What is different this time is that FRB decided to publish it. It shows FRB is VERY serious about addressing asset and debt bubbles.

Powell’s bi-annual congressional testimony that was scheduled on Weds has been postponed, due to the Bush41 funeral. Markets are closed, too, for the same reason. I guess maybe it is going to be more dramatic to have Powell speak on a market day, anyway? No new date has been announced as of this writing.

So the Fed creates broad asset bubbles, and then warns about what THEY created? WTF?

Uh oh, 3 and 5 year yields just inverted and 2 vs 10 may be next!

Yup there’s only 1 basis point spread between the 2, 3 and 5 year with the latter inverted. The 2-10 was 15bps. I don’t know where this is going. Looks bad to me.

On the other hand, with all the QE around and in the past, the Yields are distorted and might not mean what they mean.

Conventional wisdom says that 2.83%/5 or 2.98%/10 will be golden because we’re permanently stuck in a ZIRP?

With the risk of sounding like a broken record, ZIRP can’t solve the debt/growth problem unless FedGov (not Fed) is willing to tackle the capital concentration issue.

Just an innocent observation, the 2/10 seems to flatten when rates are falling. The 10yr (DTYS) dipped briefly to 22 today. That could be a bottoming move, or it could be a probe of new lows. If the market likes the Pause and the Cease Fire in the Trade wars, then rates can come back up, as flight to safety buying lets up. Money reallocates at the speed of light. However if LIBOR ignores “the Pause” there are problems.

Louis Rouanet:

“By meddling with money, the Fed created an illusion of wealth and contributed to the creation of an all-pervasive world of illusion.

Under fiat money, reality is confused with illusion and inauthenticity becomes a prevalent trait among the people.”

Paul Cantor:

“In a paper money economy, one does not see gold anymore, but the currency gives the illusion of the presence of wealth. The increasingly mediated character of the modern economy, especially the development of sophisticated financial instruments, allows the government to deceive its people about the nature of its monetary policy. When a government tries to clip coins or debase a metal currency, the results are readily apparent to most people. By contrast, the financial inter-mediation involved in modern central banking systems helps to shroud monetary conditions in mystery.”

In the last H.4.1 Report

Maturity Distribution of Securities, November 28, 2018

(in millions)

With 15 days 24,916

16 to 90 days 78,011

91 days to 1 year 306,254

Over 1 year to 5 years 961,680

Over 5 years to 10 years 263,727

Over 10 years 618,528

Since the FED returns most maturing money to the Treasury anyway or re-invests the amount over 30 bil maturing per month, then the Treasury has all the money to reduce Long Term Issuance and thereby Yields.

It auctions mostly short term today anyways.

QE and its after effects will be with us for a very long time.

Imagine we will have inverted yield curves or a recession below 3%.

Isn’t that a first?

It’s an interesting question since given the purportedly booming economy, which trump reminds us of just about every 18 months , you’d expect rates to comfortably rise.

The 2 and 5 year bills just went through a yield inversion. Historically the 2 and 10 year inversion has preceeded recent recessions. So we’re not quite there but that 2 and 10 year spread is shrinking fast given the latter is now under 3%.

It seems the market expects interest rates beyond say years from now to be the same or possibly lower than today. Buyers of longer term debt aren’t demanding more interesthan which might be foreign buyers looking for yield or perhaps the expectation of a recession and likely fed cuts to rates.

[1] I would like to see a measurement of corporate debt used for share buybacks over the past decade. Such a number may well exist. THAT is the amount that was NOT invested in the USA. I wonder how that number compares with un-repatriated corporate profits due to the tax concerns. Nice little PhD thesis there on the unintended consequences of tax policy. [2] I like the way you monitor all comments and quickly jump in to throttle any “facts” which in fact are not “facts”, but are part of self-serving arguments. This is quite a menagerie reading your site.