This is not exactly slow motion anymore.

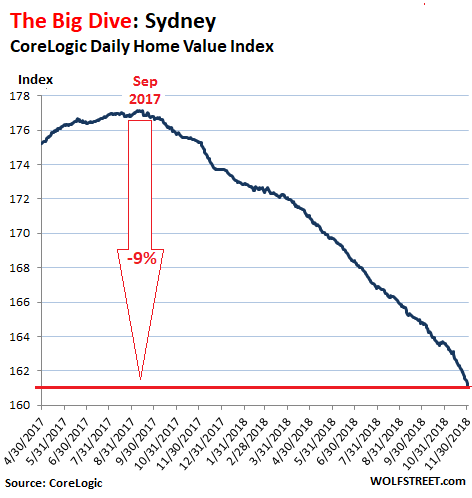

In Greater Sydney, Australia’s largest housing market, the housing bust, after a terrific housing bubble, is gaining momentum. In November, according to the CoreLogic Daily Home Value Index:

- Prices of single-family houses dropped 9.2% year-over-year.

- Prices of “units” (condos) fell 5.5%;

- Prices of all types of dwellings combined fell 8.1%;

The overall index for Sydney, after dropping 1.4% from the end of October to the end of November, is now down 9.0% from its peak in September last year:

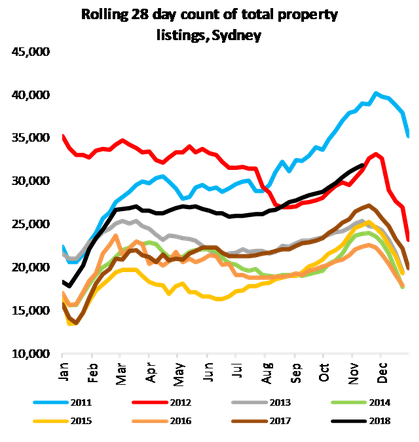

Over the past four weeks, potential sellers – seeing the condition the market is in and hoping for better times – have slowed putting their properties on the market, and the number of new listings over the four-week period has dropped 9.3% from a year ago to just 7,743 properties, the lowest for this time of the year since 2011, according to CoreLogic. However, total listings (new listings plus previously listed properties that haven’t sold yet) rose to 31,859 properties, the most for this time of the year since 2011. The pileup of total listings is happening due to plunging sales volume. CoreLogic:

This indicates that although fewer new listings are hitting the market, the stock that is currently listed is taking much longer to sell and overall listings are mounting as a result.

These potential sellers are going to try to outwait the downturn, which they assume is just a brief dip. This chart shows the total listings for 2018 (black line), compared to prior years (top blue line = 2011 via CoreLogic):

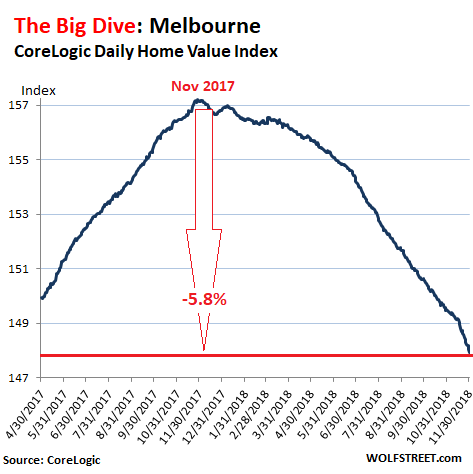

Greater Melbourne, the second largest housing market in Australia, has been lagging behind Sydney by a couple of months in the development of its housing bust. Its peak occurred in November 2017. But by now, the bust is well on its way. According to the CoreLogic Daily Home Value Index:

- Prices of single-family houses dropped 7.6% year-over-year;

- Prices of “units” fell 1.7%;

- Prices of all types of dwellings combined fell 5.8%.

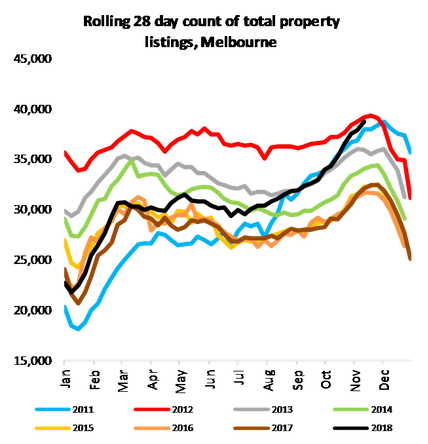

While new listings in Melbourne fell 5.6% from a year ago, to 9,714, as potential sellers are holding back putting their properties on the market in hopes for better times, total listings jumped 19.3% from a year ago to 38,730, the highest level since 2012, and higher than 2011 — highlighting “the difficulty in achieving sales currently,” CoreLogic pointed out (the black = 2018, chart via CoreLogic):

CoreLogic notes:

Overall as the housing market weakens and properties take longer to sell, the total volume of stock listed for sale is increasing. Encouragingly in terms of mortgage stress and potential arrears we are not seeing a significant dumping of new stock onto the market. If anything, in Sydney and Melbourne vendors are realizing that it is an inopportune time to sell and fewer vendors are now listing. Of course, this is not to say things can’t change and it is expected that total listings will continue to climb and selling homes will take longer.

In the other capital cities, property prices were mixed in November, compared to a year ago:

- Brisbane, Queensland: +0.3%

- Adelaide, South Australia: +1.4%

- Perth, Western Australia: -4.2% and are down 14% from their peak in 2014, following the mining bust.

- Darwin, Northern Territory: -0.8%; prices have been on the decline since the peak in 2014.

- Canberra, Australian Capital Territory: +4.0%

- Hobart, Tasmania: +9.3%

The sharp downturns in Sydney and Melbourne can be blamed on the confluence of several factors:

- An onslaught of supply from the construction boom;

- A crackdown on the banks’ mortgage shenanigans that were exposed in the media and eventually by the Royal Commission investigation;

- Tighter credit availability;

- Very stretched housing affordability following years of price gains that formed one of the most magnificent housing bubbles the world has seen;

- And the sudden reluctance of speculators to pile into the market – including non-resident Chinese investors. They’re getting hammered by the morale-crusher of sinking prices, higher mortgage rates for investors, and a crack-down on interest-only mortgages. Chinese buyers are having to jump over the additional hurdle of tighter capital controls in China.

And this is happening even as GDP has grown 3.4% compared to a year ago, and as the unemployment rate – at 5.0%, the way Australia measures it – is at the lowest level since 2012. So these are still the good times. This housing bust has not been caused by waves of people losing their jobs. Any future weakness in the economy will only add to the housing bust.

In the US, homebuilders are not amused. Read… New-Home Prices Drop Nearly 7%, Supply Spikes to Highest since Housing Bust 1

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The old wisdom (all real estate is local) needs an asterisk these days.

*Subject to normally functioning markets.

Curiosity killed the cat : Greed killed the pig.

All the little piggies go to the market at once. The big pigs sold before market day. Same old Same old.

coming to a theater near you…….

“The Big Short, Part II”?

So decade after decade in country after country, societies are subject to yet another iteration of the housing bubble with the usual cast of questionable practices: low/no down-payment, interest-only loans, highly ineffective underwriting.

This “Groundhog Day” scenario imposes huge financial & social costs to banks and the economy in general. Why the hell can’t regulators, who see this behavior year-in and year-out, tweak lending regulations/laws to disallow known bad practices?

How about putting more capital & accountability into the “mortgage” game at the source of the problem

1) No 0% down mortgage financing – 10% required (higher interest rate) & 20% preferred (lower rate) – HOMEOWNERS NEED SKIN IN THE GAME

2) No “interest only” mortgages (too risky; encourages speculation)

3) No 2nd mortgage to fund down-payment for a 1st mortgage financed by Federally insured institution (NOT ENOUGH HOMEOWNER SKIN IN GAME)

4) Mortgage issuer cannot sell loans without recourse. The more mortgages written & open, the more experience-rated capital required – ALL MORTGAGE ISSUERS NEED SKIN IN GAME

5) HELOC must be fixed rate (max 3-5 years?) & fully amortized (no tax deduction for interest) – reduce volatility

J Chip,

I agree with all your points. Plus, if folks were obligated to demonstrate financial prudence to get into the housing market, prices would drop along with sales numbers further reinforcing that option. People might actually get off the debt and consumption hamster wheel and become less materialistic. It sounds like a win win for all of society; less bling with debt and better more enduring values.

Fiat money foster bad behavior of excessive debt and punishes good behavior of saving andworking hard.

Fiat money enriches a select few at the expense of many others.

Fiat money lures states, banks, consumers and firms into the pitfall trap of excessive debt. Sooner or later borrowers find themselves in a deep hole with no way out.

Fiat money is easy to come by so the state can finance its adventures and misadventures. Easy money; easy come, easy go. And the government keeps growing as it keeps spending.

We can probably take a guess why this doesn’t happen. There are strong financial incentives for willing lenders to provide risky loans.

At some point the group of well qualified buyers runs low. The people who make money then find news groups groups of buyers.

You can make a lot of money and get up leave with your chips when the game is over.

RangerOne.

Those strong incentives is the reason that imposing Minsky Lending Rules would be an appropriate reform. Financial institutions would then be limited to lending based upon the return on the asset.

In a well functioning system, regulators, who are most responsible for these egregious situations , also must have skin in the game. Presently they have the least of all.

Worse than that: due to the revolving-door in which regulators go (back) to work for the lenders, the system gives the regulatory workforce a perverse incentive to do as little regulating as possible.

Regulatory agency staff should be barred from working anywhere near the industry they regulate for 10 years before-and-after leaving their regulatory roles. They should also be paid commensurately with the people they regulate, otherwise there won’t be any talented people applying for the jobs.

Of course, none of this is possible so long as the lenders are able to legally bribe Congress.

If you only dealt with the prudent and responsible, you would soon run out of customers. You really need deadbeats to supercharge economic growth – and profits.

So you say it is the poor who have no capacity to repay monies lent to them who are the problem ??

= Poor judgement on the banks in choosing potential mortgagee’s ??

How about this instead – rich & cashed up gringos take advantage of the poor judgement of the banks & borrow under pretence.

“Hey Rich Property Investor Multi-Millionaire who is about to take advantage of the “you don’t got to put none of your cash here & when the time is right sell & crash the market – no risk ??

Australian consecutive government have been stupid since day one.

So as to save on Welfare Payments to the population, they have employed all manner of tactics to vilify them = creating cause to snatch away welfare payments.

Mainstream Media was employed = MILLIONS $$$ – to go hammer & tong at the youth bludger who wilfully shunned work so as to live comfortably on the pittance that is the dole.

However – this talking up of unemployment is NOT A GOOD LOOK in the global world of borrowing monies.

Yes – they were continuously shooting themselves in the foot.

It is best to cook the books & present like a well oiled machine.

As it is the fault of the government body that unemployment exists.

Afterall they make up the rules of play –

We pointed the finger at them & shouted

“we want work”

“you destroyed our workplace”

“where are our jobs” ??

It was not a good look that it be know that the Australian government had decimated the Australian workplace and they became silent.

Today the Australian are insane about security & secrets & are about decrypting – even shopping lists – putting at risk to theft – intellectual property .

Why you ask – lest we talk behind their backs, many public servant have been sacked people who know to tell where the bodies are buried & whodunit.

Break wind & there is a distinct odor n’est pas.

Looks as though the intersection of the supply and demand curves is based largely on monthly payments. When the median salary isn’t enough to afford the payments on a median mortgage, demand drops.

I’d say what’s going on is that housing prices jumped due to very low interest rates. Purchase prices went up enough that folks were paying about the same amount per month as they were with a high rate mortgage on a less expensive house. Now that rates have risen, folks can’t afford to pay those prices any more.

Pretty much, Bingo. The price of housing is determined by the access to credit.

You have hit the nail on the head, it really is that simple!

Errr interest rates have not risen in a material sense…..

When they do, god help the bulk of homeowners.

Just last month I had to go to Melbourne to find a rental. My Dog the houses there are crapshacks. Not a penny has been spent in the 15 year interim that has expired flipping these 50’s toilet blocks for double, double and double again values. Except for the newly built dogboxes on awkward, minature, kite-shaped blocks next to noisy, busy roads with seriously sub-standard material. I’m talking wooden posts coated with sandpaper like material to mimick rendered concrete fragile enough that Jackie Chan’s grandmother could kick them down.

Then the joke is, people kid themselves saying they live in Melbourne. Not when they’re over 1 hour drive from the city, they’re not. They’re just there to make up the numbers. All the BS you read about Melbourne being the most livable city probably applies to roughly 10 suburbs where houses start at A$3Million and up. The other 311 are housing wastelands scarred by a massive network of highways making a quiet walk impracticable.

The plan was to move there for 3 years but the “charm” has alluded me. 6 months and I’m out.

There are nice Melbourne suburbs, but honestly there are far more crap ones than nice ones. And if you wanna live in a nice place and not pay millions for a house or live in a shoebox apartment made out of plastic and concrete you’ll have to make do without good public transport. Thats the only way you can live in a decent area that’s also affordable…

Glad to see the air is coming out, when the market bottoms out in 3-5 years I might even consider buying.

I did a drive around the Great Ocean Road and back to Melbourne earlier this year. Was impressed by the quaintness of Geelong. Nice solid brick federation homes. Nice new development of the retail/tourist/food spots. Train ride into Melbourne CBD.

Being named the most livable city is what has destroyed melbourne as flocks of migrants and immigrants bloating the city and inept state governments scared to spend the budget on infrastructure to accommodate.

There are two things about the Australian economy which I hope the good knowledgeable people here will help me understand.

First, my little experience of it would put it next to Switzerland as far as inflation is concerned: it’s an expensive place, and getting more expensive faster than many other countries. Only monetary policies will do that in a globalized economy, and both Australia and Switzerland have been opening the taps for over a decade now. While we await the Banque Nationale Suisse’s end of the year report to divine their intentions, we know they remain committed to a “toujours expansif” monetary policy. What is the Reserve Bank of Australia up to?

Second, Australia is one of the countries most committed to mass immigration, no doubt to provide a huge boost to both housing (immigrants tend to cluster where jobs are) and GDP figures. But mass immigration works until it doesn’t: just ask my countrymen (French and Italians, pity me).

Australia had the huge benefit of a relatively large percentage of immigrants being if not well-off at very least better-off than the average immigrant to Europe, but how is working out? When urban areas get as crowded as Greater Melbourne is now (according to Australian expatriates), a cascade of long-simmering events is invariably triggered.

Thanks.

I’m pretty convinced mass immigration is a scheme to buoy up the real estate wealth of the boomers and also raise more tax revenue from land without having to raise tax rates.

Who really profits from cheap 30 year mortgages?

The person buying the property with the debt or the person who can sell it because that debt is available?

It’s a sad story to tell you, MC01.

It would seem that the housing bubble was deliberately implemented by Reserve Bank and government policy. We had just “enjoyed” a mining boom. This boom was due the large amount of employment involved in getting a new batch of mines up and running. These mines were commenced in response to China’s truly amazing stimulus, which involved building ghost cities and much other resource intensive stuff, including more high speed railway than any other country has. As the mines were completed, a few minerals, such as iron ore, actually came into over-supply, prices fell and some mines got into financial trouble. The only other leg to Australia’s economic activity, housing, had to be ramped up to avoid the dreaded recession monster. This was achieved by cutting interest rates and running insane rates of immigration which sees the Australian population rising at 1.5% per annum or so.

The damaging effects of mass immigration are now grating on the populations of Sydney and Melbourne in particular, and it is getting a little harder politically to maintain the line that immigration is good for us.

The governments, (both major parties have followed the mass immigration line), enjoy the headline improvement in GDP achieved by the dumbest of growth – increasing sheer numbers of people. There is pride expressed in Australia’s long run of recession-free years, a record which would not have happened with jamming more people into apartments in the major cities. Politically, it is attributed to the excellent management of the economy provided by our leaders.

At the same time, there is general hand-wringing because salaries have stalled and struggle to match inflation. The competition for jobs caused by the influx of immigrants doesn’t seem to be mentioned in polite company as a contributing factor, but it must go mainstream fairly soon, one would think. The supply – demand balance which might otherwise drive up wages is affected by the continuous input of more labour supply.

That Australia relies on two centres of economic activity – mining and residential construction, is extremely concerning. It doesn’t seem like a robust arrangement. I recommend the Macroeconomics website. One of the principals there writes under the non de plume “Houses & Holes” in recognition of the two-legged economic stool we sit upon. (“Holes” being mines of course.)

Meanwhile, we continue to live beyond our means by (1) increasing debt, which is largely for mortgages and backed by now falling real estate prices, and (2), selling equity in the country itself – land, companies, utilities. More than half of the Australian Stock Exchange’s capitalisation is owned by foreigners. What could go wrong with this scheme?

Oops sorry: Macrobusiness website, not macroeconomics.

https://www.macrobusiness.com.au/

What could go wrong?

Sovereign Default Crisis, welfare state bankrupt and economic depression within 10 years.

The Australian economy is based mostly on mining and debt.

China’s use of resources is slowing hence recent drops in the price of oil, iron ore, coal, etc. In fact China has placed a temporary halt on buying coal from Australia.

Immigration has massaged the GDP figures but the wealth of a nation requires so much more than a high body count.

People the world over are tapped out by rising wealth inequality, cost of living and debt levels. Even in Australia there have been protest marches against such.

It is hard to see how economies can ‘stimulate’ their way out of a downturn after 10 years of very low interest rates and fake, money printing. Even China now is having trouble with non performing loans, bad debts, ghost cities, etc.

What measures will Govns and central banks have to resolve future downturns? None that I can see. It will be hard to bail out the banks in Australia especially after the recent Royal Commission. Bail ins won’t be popular.

I have little sympathy for what is coming because the bubbles have been blown by the worst aspects of human nature. There have been no checks or balances in Government either.

We have lived very well in the West not having any living memory of economic depression or war. The next 10 years are going to be very interesting.

hmm , an economy built on housing and natural resource development. kinda sounds like other countries also , take a guess

Mark, thanks for your reply.

My mostly technical knowledge of your mining industry tells automation has already started to take its toll: for example train crews are considered the highest personnel costs in the Pilbara regions, so how is Rio Tinto reacting? By teaming with EMD and Hitachi to make trains fully autonomous. The first of these autonomous trains is already in revenue-generating operations and more will follow.

I have also grown increasingly skeptical about China’s ability to continue her commodity consumption drive, for the simple reason the largest of their industries (construction) is literally running out of potential customers: home ownership among Chinese households has been at 90% for a few years now and the percentage of households owning “three or more” properties has now reached a frankly worrying 14%. More stimulus? You can bet a shiny groat on it. But how massive it needs to be and especially how effective it will be remains to be seen in light of what’s happening in Europe and especially Japan right now, where all a flood of stimulus is achieving is stagnation.

According to official data (which I’ve learned to take with more than a pinch of salt), Australia has an estimated population growth rate for 2018 of 1.01%, which may not sound like much until one notices it’s about the same as Bangladesh (1.02%), which however suffers from extremely high emigration (3.10 emigrants/1,000 units of population estimate).

You cannot keep the floodgates open so much and for so long and expect no political and social consequences, especially in a country like Australia where immigrants tend to concentrate in the most crowded parts of the country and given the chief and foremost reason Western governments (and their corporate pals) are so in love with open borders is to hit wages over the head with a club.

Hi MC01,

I really am surprised that Rio Tinto and BHP think it important to automate trains, given the enormous capital cost of a train a mile long with 4 locomotives. You’d think removing the driver would make only a marginal change to the cost of the operation. However that is what they are doing.

The percentage operational cost reduction may be modest, but it may still be attractive because train automation is relatively easy. You don’t have the navigation problem, because the train is constrained to follow the rails, and your signalling can tell you roughly where it is even if GPS disappears.

The rather more difficult task of automating haul trucks seems to have been solved. Automated trucks are now running at some mines. This would seem to threaten many more jobs than the train automation does.

Rio Tinto maintains a supervisory centre at Perth Airport, to which streams of telemetry make their way. It’s occurred to me, (and therefore must have occurred to many others), that the data sent to Perth Airport could just as easily go to India, where cheaper people could supervise operations. Ultimately we could have rather few Australians employed in the mining operation, and given the low local ownership of mining companies, (last figures I heard: BHP 40% Aust owned, Rio Tinto 15% Aust owned), Australia could just end up providing the venue, but not attending the party, a very disappointing outcome.

Rolling stock has the huge advantage of being so long-lived its cost can be spread over two/three decades and and often there’s some value left when it’s replaced: the GE Rail locomotives Rio Tinto bought in 1977-1978 were active until 2002-2005 and several have since found a new home in Chile, doing exactly what they did for over two decades.

Rio Tinto was one of the two companies chosen by Komatsu of Japan (the other being Codelco of Chile) to develop autonomous mine trucks, which were developed to work in hostile environments, just like Pilbara and the Atacama Desert are.

At last check Rio Tinto had 80 autonomous lorries (called AHS by Komatsu) in operation, all with over 200t nominal payload and all converted from manned trucks. A large order (at least 100) for the first ground-up trucks is being discussed, but the conversion of existing manned vehicles continues at a fast pace. These things not merely work, but allow considerable savings, for example by reducing tyre wear, extremely important when a single tyre can cost over US $20,000 and cannot be replaced in a shed by a bloke with improvised tools.

Revenues are a thorny issue when it comes to commodities.

Technically speaking as long as local laws are followed and royalties/taxes paid in full, all is well. The problems start when either locals are getting a rotten deal or politicians need an extra revenue stream to keep promises they cannot keep.

The re-nationalization of YPF by Argentina, after Repsol of Spain had bought it, is a classic case of “penny wise but pound foolish” nationalization because it allowed the Kirchner’s and their pals to keep on opening the taps for a while, but ended up not just starving YPF of capitals (as proven by their ever declining production while everybody else is pumping oil like there’s no tomorrow) but being forced to hand over to Repsol US $5 billion in damages at a time when US dollars were a scarce commodity in Buenos Aires.

The stats from the Australian Bureau of Statistics state:

“In the 10 years to 30 June 2017, Australia’s population increased by 1.7% per year on average, with around 60% of growth resulting from NOM and around 40% from natural increase (births minus deaths). In the year ending 30 June 2017, the contribution of NOM to population growth again increased to 64%, with natural increase decreasing to 36%. During this period there were 307,800 births and 160,200 deaths in Australia, resulting in natural increase of 147,600 people, and a population increase of 262,300 due to NOM.”

NOM = Net Overseas Migration

The lowest population of recent years was way back in 2000 when it was around 1.07%.

That population growth is generally concentrated in Sydney and Melbourne with Melbourne growing faster than Sydney.

Again from the ABS:

“Melbourne is projected to be the largest city in Australia by 2066 with a projected population between 12.2 million and 8.6 million, surpassing Sydney in 2031 (series A), 2037 (series B) and 2057 (series C).”

In 2017 the population growth of Melbourne was over 3% so the city is growing faster than the country and much faster than Sydney.

Estimates vary, but the population in Melbourne in now said to be over 5 million people.

As an aside, the only reason that the population in Sydney is as large as they say it is that they incorporate huge areas which are quite far from the city itself.

– Australia earns its money by exporting (predominantly) commodities to e.g. China. But when the number of australians increases (think: immigration) then it does NOT automatically mean that China buys more e.g. australian iron ore. Or put a different way: immigration doesn’t increase (australian) income.

– So, when the amount of australian immigrants increases then the same (australian) income has to be shared by an increasing amount of people. In other words, income per capita shrinks.

– This was papered over by a giant increase in debt. Look at Steve Keen’s formula:

Income + change in debt = aggregate demand.

– In spite of immigration, (australian) income remains flat. To boost demand (=growth) one has to make sure that debt keeps increasing.

– The bulk of immigrants stay in Melbourne and Sydney. And it’s there where people are getting more and more “frustrated”. And finally, the australian politicians are listening. The current premier, Scott Morrison, resisted a reduction in immigration for years. But suddenly, he has changed his mind. Immigration needs to be reduced.

Scott Morrison is the Prime Minister, not Premier.

He is NOT a Prime Minister, he is a gutless whoring scum bag, assisting the RBA and Big Four to STEAL the wealth from the Australian Middle Class. They are ALL Criminals, including Morrison!

I don’t believe morrison will change immigration, it’s too much of a strain on the economy, already reeling from lower credit creation, six months from the election. Instead he will fiddle the numbers to make it appear there is a reduction.

Just like Obama did.

Just like Trump is doing.

A strain on the economy? Are you serious buddy? The reason Refugees are even being allowed into this country, is to further suppress Australian wage growth, that has long ago fallen WAY BEHIND the CPI since the 1970’s! The other reason, pressure from the UN and their criminal friends, the Plutocrats, namely the Atlantic Council & Club Of Rome, these are the grubs ruining Australia along with the rest of the world, these scum are the filth behind all the wars, regardless of International Law that is enforced by the UN scum, a very biased criminal entity also!

– As far as I know the RBA was nowhere near as aggressive as the ECB and the FED in recent years.

– I look at the situation here in the US. In say mid 2008 the length of the FED’s balance sheet was at about $ 800 billion. But private debt then stood at about $ 56 trillion. People who know how debt/credit is being created will understand that the amount of debt created by the FED was smaller than 2% of total debt. In that regard, the creation of money by central banks was dismally small. We’re overstating the influence of central banks.

– Price inflation is a different beast than monetary inflation. Let’s take a copper mine. When this copper mine is opened then the high grade copper ore is mined first and then the mine can make a profit with a copper price of say $ 1 per pound. As time goes by and the copper ore grades get lower and lower, that mine needs higher and higher copper prices in order to continue to make a profit. This has NOTHING to do with MONETARY inflation.

Partially monetary, partly foreign buyers, partly that australia has not signed up to international money laundering requested by interpol, but mostly poor lending practices by banks.

The only anecdote I have is from an old friend who used to trade in the city (London) and emmigrated to Oz about twenty years ago, set up an auction house (antiquities) in Sydney. The last time I talked to him was around 2008 and we were on about a reset. He shrugged it off and would “just go and sit in the outback with some tinnies” if it came to it.

OK, I guess that won’t be everyone’s answer.

Not happy with the Swiss direction , have been watching since whenever. It isn’t just a question of keeping the franc reasonable, the country is going soft also in the process, it’s becoming less the Switzerland I know.

There’s immigration …and immigration.

While Australia/NZ benefit from a selective immigration France and Italy do not in any way choose their immigrants. Quite the opposite. France looses its elite people and imports poor unqualified immigrants who choose to not mix with society at large.

A recipe for economic decline and societal upheaval.

You think bankers and realtors are the same everywhere?

You bet

We’ve been in a bubble since the invention of the steam engine …

The public were under an illusion, an extrenal misleading sense, that housenorices always go up.

The banks were under a delusion, nothing is suggesting this is true but their own minds, that that ever increasing house price is independent of their lending.

Australian banks have avoided equiangular in to the income or expenses of thenbrowoer because that would be a waste of their precious time. As any future default would apoccur at a higher price. Removing any lose on default.

But that’s not thenmsontinterstingn part of thenaustrlian banking experiment.

The big four banks have been increasing their outstanding mortgages through “redraws and interest”. That is lending, against increased equity, for borrowers to pay interest.

I love the smell of burning speculators in the morning. It smells like…victory.

– There’s another time bomb. A VERY significant amount of australian mortgages are “reseting” from “Interest Only” to “Principal & Interest” in the next say 3 to 4 years. The bulk of these resets will occur in both 2019 and 2020.

– As a result of this reset the per mortgage payment will/can jump by some 50 to 70%.

– Even those who can afford it will have cut back on spending on other discretionary items, in order to be able to pay those higher mortgage payments.

We have friends from Queensland who relocated to where I live on northern Vancouver island. They bought some property here, built a new house + a guest cottage. They are living on riverfront as well. Regardless, they are not happy. After 10 years of building up a nice place, they are selling out this year and returning ‘home’. It’s all set up and come spring off they go.

When you live somewhere with roots in the countryside, climate, and culture, it is hard to pull up stakes and set up again even if the language is mostly the same, plus a similar foundation culture (Brit colony). I know some folks relish absolute change, but not everyone feels comfortable doing so.

It took them years to sell their house in Queensland, then the boom happened after they sold, and now they are returning to some real change and unknowns. We will miss them, but not their yearly cricket match party barbecue. We started showing up late to miss the cricket the past few years. Now, if it was a pickup baseball game, or better yet….. Road Hockey, now you’re talking!! :-) I don’t think they are planning to buy again when they return. It sounds like they are burnt out on the work involved in owning and maintaining a home/property.

I believe banks are helping in ways such as extending loans to cover the IO issue.

Having said that there is a slump in the economy at the moment as a number of industries, who are normally busy this time of year, are very quite.

A good proportion of those with current interest only loans will not qualify for interest and principle loans due to the fallout from the banking royal commission.

I would humbly suggest that the government of the day will panic and lending criteria will loosen again.

Housing and construction underlie the foundations of Australian government of either persuasion. Whoever kicks the stool from these foundations will be castigates for causing economic meltdown (not on my watch thank you).

The latest ploy is plying money into infrastructure projects. Australian pollies taken a leaf out of the China Model

Also bear in mind virtually all of Australia’s residential mortgages are “recourse” mortgages. So buyers have much more “skin in the game” in Oz, than they do in the US. I would think lending standards are more stringent as well, but its been a while since I’ve bought property in Australia.

So are there no true “short sales”? What happens after that, bankruptcy? (Obvs I have no knowledge of Australian law)

Wait until those are challenged in class-action lawsuits because the banks gave people mortgages they shouldn’t have because the broker fudged the numbers. And the LMI providers try to use the same as reason they shouldn’t pay out.

Foreign passport holders often have a “non-recourse” mortgage in practice.

I’ll know it’s serious when prices of property fronting Sydney harbor drop dramatically; especially east of the Opera House/bridge.

Grouping the western or southern suburbs in with the stratospheric Sydney harbor area (or even Bondi area …ocean front) is disingenuous.

Details count!

Grouping my house with the rest of the market is disingenuous :-]

When you look at a market overall, you don’t cherry-pick it.

Also, it should be noted that in Feb this year the Aus government snuck in bail-in legislation protecting all our major banks in the event of a default.

So the incentive for the banks is to maximise any and all speculative practices knowing the consumer ultimately picks up the tab.

Vast amounts of apartments, houses, and commercial spaces have been “bought” in Australia by Chinese, Indonesian, and Indian citizens. Most of it has been “bought” using interest only loans or where they used another loan to make a deposit to get a mortgage loan.

That strategy to get rich works as long as prices are rising. With prices falling, you can be sure nearly all those investors will disappear. How are Australian banks going to collect from a “Mr. Lee” in Hong Kong?

This is going to be like the Texas real estate crash of the mid 1980’s when the banks folded and real-estate lost 96 percent of its pre-crash values.

– Even the OECD is warning that the australian housing market could have “a hard landing”.

https://www.macrobusiness.com.au/2018/12/oecd-australia-must-prepare-house-price-hard-landing/

(comments also contain some interesting weblinks)

Thank you Wolf, for this editorial!

The RBA say’s the economy is gliding along very smoothly and have plenty room to move. It will be interesting during the mid collapse period in the next 12-18mths, as I believe there will be hundreds, possibly thousands, that will BANGING on the RBA doors demanding their HANGING, along with ALL the CEO’s of the Big Four! Best thing that could happen, I will be parked outside with the rope!