This will dog the stock market going forward.

Fixed-income investors – a financially conservative bunch buying Treasury securities, FDIC-insured CDs, and similar products that largely eliminate risk – have been getting crushed for a decade: Except for brief periods when inflation dipped to near zero or below zero, their minuscule returns have been eaten up by inflation, or worse, they lost money after inflation, as was the case with shorter-term Treasuries and just about all savings products. But it has ended.

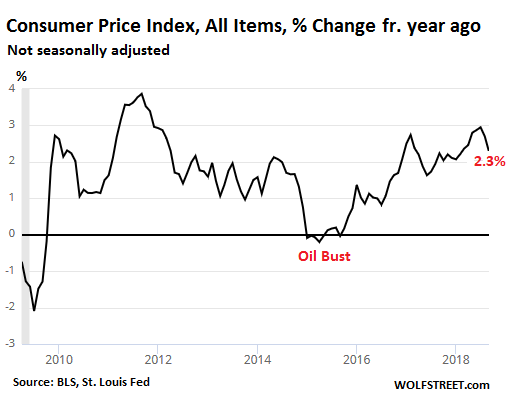

The Consumer Price Index (CPI) rose 2.3% in September (2.27%), compared to September a year ago, the Bureau of Labor Statistics reported this morning. This was down from the 2.9% increase in July. These numbers are volatile, but the trend is pretty clear: Outside of the Oil Bust and a few quarters during the Financial Crisis, inflation is a fixture in the US economy:

The CPI without food and energy – “core CPI” – rose 2.2% in September. Cost of shelter rose 3.3%. Cost of transportation services rose 4.0%. So prices are going up as measured by CPI.

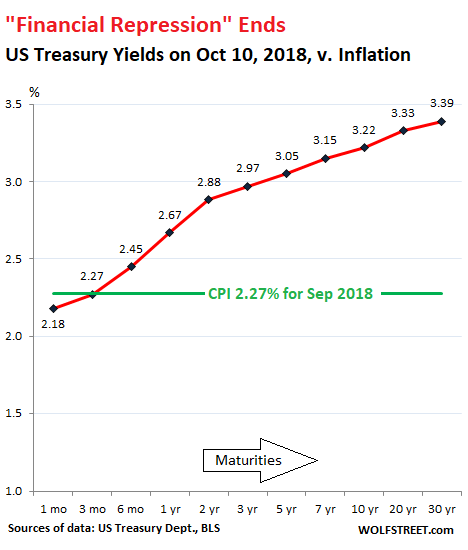

What has changed is that interest rates and yields are also going up, and they’re now higher than inflation as measured by CPI across nearly the entire spectrum of US Treasury securities – and if you shop around, across many CDs too.

This ends a decade of “financial repression” — a condition when the Fed repressed interest rates below the rate of inflation.

The chart below shows the US Treasury yield curve across the maturity spectrum, from 1-month to 30 years, at the close yesterday. The 1-month yield, at 2.18%, was the only yield still below the rate of inflation. The 3-month yield at 2.27% is right on top of CPI (green line). Every Treasury security with a maturity longer than three months is beating inflation.

Savings products are showing similar trends, but you may have to go shopping because your own bank may offer only stale peanuts to its loyal customers.

The average 12-month CD rate as of Monday, according to the FDIC, was just 0.47%, though it has more than doubled over the past 18 months; and the average savings account rate was an imperceptibly microscopic 0.09%. So on average, loyal bank customers are still getting screwed. But for those out shopping for better returns, there are now plenty of options. Here are some examples.

In terms of CDs, savers may have to check with their brokers for “brokered CDs.” These are FDIC-insured CDs offered by banks through brokers to attract new deposits. Banks may not offer their own customers the same deals.

For example, Charles Schwab’s brokerage offers FDIC-insured CDs with maturities of three months to 10 years, from a variety of banks. Here are some of the highest-yielding CDs by maturity (may vary by zip code):

- 15-month CD from Compass Bank: 2.7%

- 13-month CD from Wells Fargo: 2.65%.

- 12-month CDs by several other banks: 2.55%

- 2-year CD by Welles Fargo: 3.0%

- 2-year CDs by other Banks: 2.95 and 2.90%

- 5-year CD by Goldman Sachs Bank and Citibank: 3.50%

- 5-year CD by Wells Fargo: 3.45%

- 10-year CD by Discover Bank, Goldman Sachs Bank, and Citibank: 3.5%

Other brokers offer similar products with interest rates above the rate of inflation.

In terms of FDIC-insured savings accounts, among prominent candidates duking it out publicly to attract deposits are PNC Bank offering 2.20% for their online savings account; or American Express’s Personal Savings bank and Goldman Sachs’s Marcus, both offering 1.90%. These rates still lag inflation, but savings accounts are liquid, allowing customers to withdraw money without notice and without penalty. If you need to keep some funds liquid while waiting for a “buying opportunity” that might suddenly crop up, those are options.

[This always comes up, so here we go: Before you venture into brokered CDs and other savings products, make sure you know the FDIC rules, including those governing IRA accounts. If you bank at Citibank, and you want to buy a Citibank CD through your broker, read the rules first. However, you can own CDs from different banks, each CD being FDIC-insured up to the limit.]For now at least, this marks the end of an era. In the US, the Fed wielded “financial repression” as an instrument to screw many fixed-income investors and all savers for a decade, for the benefit of borrowers, leveraged speculators, and all those holding assets whose values inflated in the process. But this era of financial repression is now over.

What does that mean for those assets that have been inflated for a decade at the expense of savers?

The S&P 500 dividend yield, at 1.89%, is no longer attractive at current stock prices. In addition, companies are free to slash their dividends – which happens during rough times for the company or the market. So dividend investors are taking significant risks for so-so yields.

Suddenly, many investors are beginning to struggle with a question: Would I rather make 2.7% guaranteed risk-free for a year, such as with Treasury securities, or risk losing 10% or 20% as I might in the stock market? The market could surge another 15%, but it could also do the opposite. Year-to-date, the S&P 500, after all the gyrations and volatility, is up only 2.0% (last time I looked) and is potentially just a rough day or two away from turning negative for the year.

Some stocks have plunged, while others have surged this year, and as they say, results may vary.

But the relationship between risk and reward has changed. For a decade, so-called “risk-free” investments – nothing is totally “risk free,” but this is close – just about guaranteed a loss after inflation and were a terrible choice. But now they’re a reasonable choice, buy guaranteeing a gain after inflation in a world where nearly all assets are highly inflated and where volatility rules. They now effectively compete with high-risk assets on the risk-reward spectrum.

Some of these high-risk assets were touted last year as the best thing since sliced bread, and they experienced much higher returns last year and into January this year, such as Emerging Market equities and bonds, but have gotten crushed since. For example, the iShares JPMorgan USD Emerging Markets Bond ETF (EMB) has dropped 13% since January 26, and the MSCI EM equity index in US dollars has plunged 25% since January 26.

As investors realize that, indeed, they can lose money, and that capital preservation is a thing, risk-free assets that beat inflation are suddenly appealing, and will become even more appealing as the Fed continues to raise rates. And this is one of the factors that will dog the markets going forward. It’s all part of what the Fed is trying to accomplish by, as it says, “removing accommodation.”

Japan has monetized 50% of its national debt. Why has there not been a surge of inflation? And why can’t the Fed restart QE and do the same? Read… I Was Asked: Why Did All this Money-Printing Not Trigger Massive Inflation?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

When I left the equities market sometime ago, I started buying brokered 3 month CDs, friends ask why not longer, I tell them buy longer term when interest rates start to fall. I think the FED is really in the proverbial rock and hard place of their own doing, karma and all.

->karma and all.

Worse, their karma ran over their dogma.

Hehe, nice one! Amusing even if you are unamused.

Unfortunately, the Fed is fighting the last war. It assumes there will be no revolution at 28% unemployment because, during the Depression when unemployment was 28%, there was no revolution. But an urbanized population of 330 million people cannot tolerate 28% unemployment. Now what?

There was much greater social cohesiveness during the Great Depression. And the media outlets were all controlled by the oligarchy. Which they still are. But now we have the Internet, and people have much greater means to find real news and real truth via alternative media sites. And they’re going to be very, very pissed off at the political and financial elites who sold them down the river.

I’m always on the lookout for good books to read, and I’ve recently gotten a copy of “Hard Times” by Studs Terkel. It’s a great, highly recommended read. Indeed, the social cohesion was a magnitude greater and it’s extremely important, I think, that there was not the shame attached to having to take Relief, or being out of a job, etc that there is now. Many of Terkel’s interviewees are old, and they remember how it was, and compare it to how it “is” at the time of the interviews, in the 1970s. Over and over again they state how social cohesion is down, how anger and self-blame are so much higher, etc.

Several times through the book the interviewees, all different people, say that if Great Depression conditions come back we’ll have a revolution.

As it was we almost did, and avoided it because FDR came along. But would a modern-day FDR have a chance?

Maybe… the level of social friction some would posit has always been like it is today. The only real difference is that the range of disagreement is amplified and more apparent due to social media. We are actually being exposed to more opinions and viewpoints and the loadest voices from the far left and far right are drowning out the middle.

Most of us are still in the middle.

oh COME ON! It’s not like this stuff has been happening for the last 20 or even 30 years. The problem is the American mindset. We have huge INEQUALITY now but even in the 50’s the same corruption and government inefficiency and Wallstreet ponzi-schemes were in full force…..the only difference is back then EVERYONE was able to get in on it and there wasn’t such a wealth disparity. Hell if the American populace actually revolted during the 1920’s and realized how corrupt the Fed ponzi scheme was back then we’d be a different country. Americans don’t have anyone to be pissed off at except themselves. WE are the ones working for corporate America. We do this to ourselves. Ron Paul was probably the last great hope to turn this financial titanic ship of destruction around..but he was laughed off the stage as an “old kooky” guy. Everyone knew he was right but no one wants to take a hair cut. Certainly not the upper middle class middle managers/execs that are saddled down and loaded with debt but have all the fancy McMansions, cars, Hawaii vacations, and big inheritances from their baby boom wealthy parents who have been making a killing off the Fed and Wallstreet ponzi. I don’t feel one bit sorry for what’s coming down the pipeline. I feel sorry for my young kids and generations that will have to navigate through this nightmare that the selfish, limp wristed, older generations left them with. And YES that includes the so called “greatest generation” who’s kids’ were all spoiled baby boomer brats who have been running this country for the last 40 years. Jared Dimon, the Clintons, Bushes, Pelosi, McCain….it doesn’t matter if it’s government or private companies………these execs and politicians are ALL THE SAME! We haven’t had true capitalism and free markets in my lifetime and I’m 39 years old! If I had the means I’d move the hell out of American and go to Poland, Hungary or another eastern European country where people will be flocking to in the next century as America circles the drain and economically becomes a third world country.

@Nick truth

Before you think “they” will allow you to go revolution, they will send you to war. Cohesion solved.

The cold war of tribalism will become the hot war of tribalism !!

FWI for online CD’s (no broker) it’s easy to get 2.5% or a bit better for a 12m.

Citizensaccess (owned by Citizens Bank) is at 2.5% and at Goldman, Captialone are 2.55%. Have seen 2.65% pop up and disappear a few times.

For now I’m going with Citizensaccess as it’s related to my banking and local.

You can get 2.6% on a one year Treasury bill, and it’s free of state income tax which for me effectively boosts it x1.1.

I just use a TD Ameritrade account. It has a wide range of bonds and CDs.

A month ago I got a 13 month CD at 2.45%, you can probably do a bit better now.

For CDs you can generally put any amount you want, while for bonds, it’s typically around a $5,000 minimum depending on the price vs par.

And some well known leader is now blaming the Fed Chair for the current Market drop/rout because of this exact rise in rates.

Will the Chair be fired? I’ve read rumours. Isn’t the Fed supposed to be clear and free of overt political interference?

Meanwhile, bring it on and raise those rates. Double them. Too bad debt kings loaded up this past decade. Some of us didn’t. Some of us preserved our capital and sleep easy. When a person eschews debt, each and every day is a good experience and full of opportunity.

The Fed gaveth with ZIRP and QE and now the Fed taketh it away. Readers here have been warned and it is happening.

Paulo: Nah. Trump is just venting. He doesn’t like seeing the market decline during his presidency. CD’s make a whole lot more sense than bonds, which are going to decline as interest rates go up.

Ed,

Brokered CDs and bonds are very similar in that you can sell them at a discount or premium, depending on market conditions, but if you hold them to maturity you will get face value.

That well known president’s message is clear when he shout that to the crowd. “ I am the one propping it up, It is the FED! NOT me! Fed is independent, I can’t do anything” Translation —> Fed will keep doing what they are doing.

In reality, if Trump really want to influence FED, he would have called Powell into his office, closed the door, teach him a lesson of who is the boss and Powell will come out and do rate pause or cuts. The more Trump vents, the more it means he would do nothing under the name of FED independence.

Mr. Trump’s point was that the timing of the Fed announcement coincides with Congressional elections . Both Bernanke and Yellen kept rates low [to allow Obama to borrow trillions at low cost], and further they did not make any announcements which might affect elections. Trump further pointed out the robust growth in GDP and drop in unemployment. Both accomplishment should redound to the Republicans. Yet, Powell has decided to make his announcement now. Why? Why not wait until December. Looks as if The Swamp now includes the Fed.

Bruce,

In this rate-hike cycle, the Fed raised rates only at FOMC meetings that are followed by a press conference. There are only four them in 2018 and prior years. Those dates were announced in the prior year. For example, we already know the FOMC meeting dates for next year (but starting January, they all will be followed by a press conference… we already know that too).

So the rate hike followed a schedule that was published in 2017. This is done to keep timing away from politics. And this has nothing to do with the election. I’ve been writing about the September rate hike all year. This is not a secret.

BTW, many Americans like the rate hikes because now they earn more money. This includes retires and savers, who’ve been hounded. Trump should take full credit for making them more money, finally!!!

Trump thinks you can only make money through stocks or real estate. Even though he should know better.

But the brokered CD is a nice way to go, the real question is whether it makes sense to put money into the brokered CDs at longer periods. Yes, you can sell them, but it might not be worth it. Depending on the coupon on it, The rates aren’t adjusting. In this rising interest rate environment, it almost make sense to scale into different CDs.

Wolf, once again,my thanks for talking about brokered CDs

…that should solve the pensions crises, which is predicated on endless 8% p.a. returns

” Looks as if The Swamp now includes the Fed.”, what the heck and where have you been?

Bruce, the FED has been one of the most dangerous creatures in the Swamp from their beginning circa 1913.

The whole point is the GDP numbers and unemployment numbers are complete lies and distorted to keep this ponzi scheme running so the boomers don’t lose their pensions, both private and government. It’s ALL about propping up Fraud Street. Republicans have created this mess just as much as Democrats. Americans are too stupid and brainwashed to see they are 2 sides of the same coin. A coin of inefficiency, financial tyranny, corruption, etc.

Our defense industry is a pathetic joke. We spend BILLIONS more than any other country and we have to ground all our F35’s because they are overpriced junk? We have warfare machinery infiltrated by Chinese computer garbage or worse spyware? Americans for the last 50 years have been letting our government and private companies sell us down the river. That includes all of the so called American people that work for these big MIC companies. Who does the average Lockheed, Boeing, Northrup, employee vote for? Probably the CONgressman that will keep their bloated wasteful government contracts going! Russian and China could unite and pretty much take over the world as the next great superpowers. But hey I heard Apple is releasing new Emojis today!!!!!!!!! YAY!

Reply to Bruce Kowl

Your immediate take that this is about Trump and Obama is an indicator that you are missing the big picture. The Fed has been doing this for 105 years. The purpose of central banks is to fund wars. Then they have to clean up the books, which they are doing now. As the accounting gets corrected to reality, we will find out “who is swimming naked”.

Trying to analyze what politicians say to the cameras is generally a waste of time. At best it can give you an indication of what they think their base is excited about, though its typically credit-grabbing or blame-shifting that doesn’t reflect policy or action.

That’s not unique with Trump – what’s unique about him is just that he speaks publicly a lot more and the press can’t seem to get enough. In contrast I remember presidents like Bush giving speaches that were pretty much ignored by the press.

Paulo,

The only way Trump can fire the head of an independent agency, such as the SEC or the Federal Reserve Board of Governors, is “for cause” not “at will.” There may be some quibbling over what “for cause” means, but it is commonly understood to mean something like a criminal act. A difference in opinion over policy is precisely NOT “for cause.”

Everyone, especially Trump, would be a whole lot better off if Trump occasionally missed an opportunity to open his mouth or tweet.

Wolf, your last sentence is one hell of an understatement!

I reckon the same sentiment applies to Elon Musk.

There is a common refrain that if one keeps their mouth shut, people can only guess if one is an idiot. Opening one’s mouth usually provide confirmation that one is an idiot.

Somone already posted this youtube link on a prior post,of which I am eternally grateful, about our President and his constant tweets,and comments.

https://youtu.be/9RaDpHGMW1E

Thank you. Since the above post I looked it up and the term, “for cause” came up. As you mentioned in reply, the rate hikes have been implied with every scheduled meeting, plus if there is a downturn it would be nice to have some wriggle room.

With all the debt in every sector and an economy based on phony fundamentals (like QE) I think it’s all going to be too little too late. I guess we’ll see.

regards

However silence gets taken as complicity.

As president I don’t see why he should not signal when he disagrees with fed policy, he just has a very clear way of putting it.

When you understand what the stakes might be, e.g. from Hussman:

“Given current valuations, even a return to average run-of-the-mill historical norms would result in a loss of about two-thirds of U.S. stock market capitalization. Meanwhile, any significant recession will likely be accompanied by a wave of corporate bankruptcies in a system where corporate debt is easily at the highest percentage of corporate gross value-added in history, and the median corporate credit rating is already just one notch above junk.”

…and that is only the domestic market, then I think anyone should be watching how the fed levels, or deflates.

As far as I know, Trump may be saying the whole fed edifice is unstable that it has reached this point, the real economy plighted because of it, that he is enacting traditional policy incentives with a background of fed funded financial excess still present. It depends what point people focus on, how they interpret all the various moves from whoever, and so on, hence there is room to read it all in very different ways, and lay blame accordingly.

So to put it another way, is it worth raising rates continuously even if it resets the whole country into… into something else? Even if national government policy is not prepared to handle such an event? I am not American so it is in no way for me to say, and people will have their own views on whatever is better. This is not to be doomlike, but I think it really needs to be got across that pivotal moments like now are no small matter, and I think any manager, including a president, is going to be “quite upset” if a bunch of accountants mess up and completely trash the company.

So that is why I say it is fair play of Trump to voice his concern and frustration. Even if he has much influence over what the fed does, he is not in charge of their actions and is subject to their decisions, like everyone else.

To answer your question, yes it is worth it. Rates must rise. Period. The alternative is another decade of financial repression. Ask Japan what 25 years of rate repression looks like.

Unless we go back to a metals based currency, and despite the Jekyll Island conspiracy theorists, an independent central bank is the ONLY way to have any confidence in the monetary base. When Trump invents a better way, then he should open his mouth. Until then….

Trump was ushered into office due to Secular Stagnation and low volatility predicted. His mandate is to usher in extreme volatility in order to shake markets up enough to wrest some more volatility out of markets. His bombast is outrageous and ill conceived unlike seasoned professionals like yourself that are circumspect and well mannered. Frankly, I was raised by a Chartered Accountant that worked a lifetime in Senior Rulings National Revenue CANADA. I was raised to be circumspect whereas Trump was raised to be bombastic in business because he was encouraged to be dominant in terms of business. I was raised to be businesslike & professional in terms of business whereas Trump was raised to be ruthlessly competitive in a New York business climate of ‘kill or be killed’ Wall Street.

The way we do business is NOT the way people in New York City do business, Wolf. Business in NYC is about a confidence game and so-called ‘winners & losers’ or ‘elites & sad sacks’. Business in the real world as we understand ethical business conduct universally is not the same as business on the level of a real estate scion like Trump. Comey likened him to a ‘mafia don/boss’ with respect to his business dealings with him influence wise.

Trump is an influence peddler & confidence man. It is wholly unfortunate that he holds public office, I agree. He is not exactly an edifying individual business wise either. In brief, business ethics means something to you or I, but with the bombastic blustering crowd it is considered insignificant until things blow up politically.

Finance & business is much more level headed than politics is on average.

MOU

“His bombast is outrageous and ill conceived unlike seasoned professionals like yourself”.

It can certainly be bombastic but time has shown it is not ill conceived at all. Does the sun rise in the east? Not when you stand on the moon.

The economy was so weak that Yellen would not move beyond ZIRP and QE ad infinitum. That all changed and now the FED is putting the brakes on. So we have gone from ZIRP year after year to an environment of fear of the economy overheating in 2 years.

I’m no fan of Trump, but given that the Fed is planning to blow up the economy, it is only logical for him to distance himself and start laying the blame where it belongs early and often.

Some Guy,

At first reading, I thought you were being sarcastic. But on second reading, I think you’re serious. I’m still not 100% sure. In case you were serious: The Fed isn’t trying to “blow up the economy.” The Fed is just taking some ridiculously small and slow baby steps to ease interest rates back to some sort of normal to keep asset bubbles from getting so huge that they will take down the entire global financial system when they implode. And they’re years behind the curve.

They’ve been decades behind the curve.

Well this is an issue of intent. The Fed is probably not trying to crash the economy, but since most academic economists tend to believe in things like general equilibrium and efficient markets they tend to discount the idea that things can be overvalued. An economist sees a price as a result of supply and demand at work believing that it’s value really is the price. They don’t seem to think that the future change in price of a thing is in fact its value when people buy things to invest, and since no one knows the future for sure, value in the investment world is always a hazy and foggy thing. There is no clear or certain value at all so therefore how can a market possibly be efficient? It can’t be. As long as things are going up that is the value being generated and it self reinforces and lowering interest rates stimulates this effect. You reverse that and raise rates and you create massive headwinds, and it becomes easy for everything to reverse direction as assets are now devaluing and it feeds back on itself.

Now does stock trading really have much of an effect on the real economy (after the ipo)? Besides the wealth effect and maybe some extra money for retirees on the consumer end I’d say not really. That doesn’t portend any increase in real output necessarily anyway, as increased demand can also just mean inflation if it’s not also met with an increase in supply. When it comes to bonds though that’s a different story, because if the bond market sells off that could massively increase costs for many businesses and even bankrupt many others. That would definitely cause a retraction in the output of the economy for many reasons all feeding back on each other. Even if the Fed is taking baby steps, all we need to do is hit the tipping point wherever that is and it’ll cause a crash. These junk bond tightrope walking companies that have popped up everywhere cannot possibly deleverage even under a slow rate rise and therefore there will be no soft landing… The only thing the Fed is doing differently is being a little more cautious, however they are still being overly optimistic and naive same as they generally have been, otherwise they never would have left rates so low in the first place.

Do you think killing the money losing business like Tesla is “blowing up” the economy or “cleaning up” the rot? Do you think killing the speculators borrowing money and blowing bubbles is “blowing up” the economy or “discipline the bad actors?” It is time to Make America Great Again. The key thing is to remove the rot and cancer without killing the host. So baby steps and this is what Trump wants. But since there are more debtors than responsible savers in the population created by the previous globalists, Trump has to distance himself from “cleaning up the rot” while doing it. It is time. Suck the liquidity out of China and clean up domestic rots.

If you have five seconds to spare, let me tell you the story of my life:

Central bank raises rates – recession

Central bank raises rates – recession

Central bank raises rates – recession

Central bank raises rates – really big recession

Central bank raises rates – Gee, I wonder what will come next…

I agree with Minsky, the credit cycle is inevitable, but it is still smart for Trump to blame the people who are the direct cause.

Aside: If, as you say, and I agree, that there are huge bubbles everywhere, and ponzi finance, per Minsky, everywhere, then it won’t take many steps, baby sized or otherwise, to blow things up.

Some guy, Let me tell you the story of another version of your life that you have NOT lived. Imagine there were NO rate raise in the exact time that FED raised rate in the life that you lived, you will find all companies are losing money, and yet they will stay alive because they can borrow with 0 on tuesday and pay monday and borrow on wednesday yo pay tuesday…..

Unemployment rate is zero, wage inflation everywhere and CPI rise and then Zimbabwe. Then, as the Fed head, you will be prosecuted and jailed or executed. Do you want to live that or some recession cycles?

Spanish proverb: ‘Flies can’t get into a shut mouth’. :)

“There may be some quibbling over what “for cause” means…”

Yes, and they can “Quibble” in court for months after the bloodletting….”

There is little comfort here…cold or otherwise.

He would be extremely popular and probably get some nice historical notes if he wasnt a loud mouth jerk. For the time being he is pressing over a very good time by most measures. And his party is winning a lot of standard political victories…

Add in a more by the numbers foreign policy and demeanor and he would be better off than Bush…

Paulo : absolutely , people will be rewarded for working and saving again .

“risk-free assets”

No such animal exists! Even holding physical gold or silver carries the risk of having them stolen.

You may minimize your risk, but never eliminate it.

It’s a figure of speech; a benchmark against which all other investments of higher risk are measured. Let’s not quibble over definitions. The definition of “risk-free rate of return” is well known and well accepted by all, except by those who insist on the most literal interpretation of everything.

Such an animal does exist. Someone here recently set the CPI at 5.5% based on the price of dog food. There are no futures contracts in dog food. It is not a manipulated commodity. Dogs themselves have market prices, but these prices may be less representative of CPI than the food they eat.

->You may minimize your risk, but never eliminate it.

More or less. The traditional approach is to externalize it.

Nobody pays my bills for me. I feel so left out.

Could the increase in interest rates and a hawkish Fed a deep state ploy to crash the stock market and rob Trump from his major talking point of how well the economy is doing?

Yes, the Fed would have had to increase rates eventually and waiting until after November 7 would have made no political difference.

Now it might benefit Democrats ‘Trump couldn’t even handle the good economy that Obama gave him…’

Unfortunately, that ‘good economy’ seems to have missed most of the population. Those GDP increases do not seem to have accrued to the 99%.

What kind of GDP do you get if you subtract out the contribution of the financial sector, or if the country hadn’t dug itself another $2 tn in the hole? Inquiring minds want to know.

Or maybe there is no conspiracy, and the Fed is trying to ease us out of this asset-bubble fueled economy and back toward some relatively normal footing? In other words, precisely what this blog has been telling us? Nah, that’s no fun. Conspiracies are better.

I just googled the current rate of inflation. 1.9% CPI is just another feel good stat offered up by the people who never lie. Do they ever go out to eat?

1.9%? In what country? In the US it’s 2.3%.

https://www.bls.gov/news.release/cpi.nr0.htm

I bought a movie ticket yesterday. My senior discount price was $8. Last year it was $7.50. That’s a 6.7% increase. The inflation rate is always under-stated. That helps keep Social Security payment increases down.

“That helps keep Social Security payment increases down.”

Exactly. For that and other entitlement programs, holding down COLA increases by any means was the real reason behind the effort of the Boskin Commission. This effort to “more accurately” calculate CPI led to ridiculous hedonic and substitution fudging of the CPI figure. The original CPI calculation methodology had a 50/50 chance of being too high or too low, but you just knew it would be found to be too high, right?

Substitution is clearly ridiculous on its face – if you can no longer afford beef, you’ll switch to chicken. Thus, based upon that figure fudging alone, the CPI is not a measure of the ability to sustain a constant quality of life. In that example, it’s simply a measure of the ability to eat something. When you can no longer afford chicken, you’ll just eat kelp, right?

On hedonics, it’s even more insane:

The Illusions of Hedonics

https://mises.org/library/illusions-hedonics

And Welfare/Social Assistance too, eh.

MOU

Good article but it omits the alternative of buying Treasuries. Setting up a Treasury Direct Account online is quick and easy. It allows you to buy Treasuries at auction in amounts as low as US$1000.

You’re still buying Treasuries in your TreasuryDirect account. You’re just doing it in an account with the government, rather than your broker. But TreasuryDirect is a good thing.

Treasury direct sure is a good thing! Their “product” earned our family upwards of 10 % during the Volcker years and the interest paid from timber sales receipts paid for an automobile we needed at the time.

Over the last several years, online checking accounts paying over 2% when the account is used as directed have helped us peons some, as have cash-back credit cards used more or less like cash (outstanding balance paid in full each billing cycle).

Now, since we have preserved most of our capital, more rewarding options will be available.

It’s about time!

I got curious about your “timber sales receipts” reference. Could you provide a bit more detail – I am googling it as we speak.

Is that some other investment option by the federal govt and does it still exist?

Thanks!

Interesting1 I didn’t realize that was possible. Will have to check it out.

Wolf, could the higher US rates force the ECB to hike rates earlier and steeper than commonly anticipated? My thinking is that a lot of capital in the EU will flow into fixed income assets in the US. What’s your take on that?

“Force” is probably not the right word. But I see what you’re getting at. The Fed’s rate hikes are putting additional pressures on the ECB to hike rates. There are already other pressures to do so, including inflation. But I don’t think these rate hikes are going to be steep… maybe similar to the Fed, starting our very slowly, and then getting slightly less slow, so to speak. Much of it depends on who will run the ECB when Draghi leaves next year.

Started started buying CD’s in Feb, 250K and 225K at 2.05% and 2.10%. one year’s all based on what I was reading on this site. Thanks Wolf !

Nothing goes to heck in a straight line but when it does it always happens in October.. Of course we’ll see a bounce at some point but when stocks and bonds fall together and now housing is starting to take a hit that leaves no safe harbour for those with money. This is all happening because rising employment might impact wages because rising wages are something to quash which is the Fed’s real mandate. The next recession will cure that. Rising interest rates will be fatal to emerging nations that borrowed in dollars. Zombie corporations that borrowed cheap money to stay afloat will probably sink and corporations that borrowed cheap dollars to do stock buybacks as part of a CEO compensation package are now on the hook with expensive loans and a sinking stock market

Wolf; Do you disagree with John Williams on the real inflation? Can you recalculate using the “real” rate? It would make for interesting reading.

John Williams is just having fun. He uses government data and adds some big numbers to it. Why? Because it’s fun. There has no research or data of his own behind it. It’s just goofball stuff and people are taking it seriously. And when you take it seriously, it’s very misleading. I don’t allow people to promote this stuff on my site.

Wolf,

From casual reading of John Williams he claims to calculate the cpi the “old fashioned” way taking out new methodology like hedonic adjustment.

Myself I wonder what the real inflation is.Take a car for example:Audi 100 from 1989 was about 30 000 canadian dollars, a current A5 with technology packge is 66000 cad.

The new car has fancy electronics, stronger engine and takes less gas for double the money 28 years later. Low inflation here.

But a flight ober the atlantic has easily dounled in price in the last ten years with less luggage, less leg space and less service. That is inflation like shadowstats reports.

What is the true number here?

Our inflation has barely budged over the past 11 years. Our housing costs haven’t moved. Energy (including gasoline) is about the same. Food is higher, but it’s not a huge part of our budget. Healthcare is less because we switched to Kaiser and have huge deductibles, along with health-care savings accounts (HSA — contributions to which are deductible like to an IRA). We’re rarely sick, knock on wood, so we benefit from the tax savings of the HSA, which pays for part of the already low premiums. We haven’t bought a car in 11 years….

You see everyone’s inflation is different. Ours is very small.

Over 60% of US households own their home. If they don’t refinance, their housing costs don’t change much (except for taxes and insurance, depending on where they live).

But if you rent in a city where rents have surged 15% a year, and rent consumes half of your income, and your health insurance premium has gone up 30%, and you suddenly have major health issues…. Your inflation feels like 20%.

Buy a large notebook, a pencil (double color is optional) and an eraser and use them to keep track of the stuff you really have to pay month after month and year after year. You can make a spreadsheet in Excel or Open Office, but I find keeping paper records to be far more enjoyable and relaxing.

That’s your real rate of domestic inflation, the one you should be using to calculate what return on investment you need. Each situation is different: the retired widower living alone in rural Kansas has completely different needs and outlays than a couple with two small children living in SoCal, AKA New Bedlam. ;-)

You might also want to keep track of the downsizing of packaging, regardless of whether or not the price goes up. That’s an insidious form of inflation when you pay the same (or more) and get less.

I work for a big bank and most of my cash is sitting at Marcus earning 1.90%

I purchased TIPs when the market was discounting inflation, (it wasn’t much different, just the outlook) Looking at the chart of CPI I say the trend is down, but I am just a kid with a ruler. Circa 2009 CPI was negative, remember? Check S&P lately? I told my broker to buy the TIP etf when the price drops to 90. I own TIP bonds outright, (at low fixed rates) and hedged them with bond yield proxies for what the data here is saying, that rates are ahead of inflation. Commodities figure to take a hit. The market is telegraphing recession. Rates down, inflation down, and even gold will give it up. You want capital preservation put some cash in leveraged inverse bear ETFs. Any of them will do.

I disagree with Wolf’s assessment for two reasons:

First: If you believe the Fed’s plan to raise rates 1%/year, there’s no point in a 12-month CD at 2.5%, since you can get an identical return in a good money-market fund AND maintain liquidity. For instance, the Vanguard Federal Money Market fund currently yields 2.03%. This will rise to 3.0% if the Fed raises on schedule, so your average return over the next 12 months will be 2.5%. (At these rates the effect compounding is negligible.)

If the Fed is forced to accelerate its rate hikes (due to rising inflation), then the money market fund is the better bet.

If you don’t believe the Fed’s plan will continue, however, and rates will flatline or fall, you’re better off going for a CD or bond with more duration than 1 year, unless you know you’re going to need the money in a year.

So no matter what, I doubt a 1-year CD is your best option.

Second: Do you really want to be lending to a mega-bank by buying a CD? Banks don’t exactly distinguish themselves as paragons of virtue. Isn’t there a more worthy borrower for your hard-earned wealth? If you want to go with a CD, look to a local credit union. In my area one has a special offer on a 12-month at 3%, and there’s also one with a floating rate. (Or, if your tax bracket is high enough, consider muni bonds. You can come out ahead after taxes even if the nominal yield is lower.)

Finally, Wolf’s article should have mentioned TIPS, which are generally yielding CPI + 1.0% and are great for tax-deferred accounts.

I mostly agree with you and would add that some credit unions are paying up to 5% on checking with some strings attached. You must use the debit card about 10 times a month to get the rate. They are basically splitting the swipe fees with the customer. A good deal if you use a debit card anyway.

Amen

I wonder if Trump and Jim Cramer ( also screaming at the Fed) understand that rates have been at this centuries- low (real) level because they’ve been subsidized.

The Fed has taken from savers and given to borrowers.

This is not normal and has to end at some point.

I moved my checking and savings accounts from a community bank to Discover Bank in August. My savings account made more interest in September at Discover than the previous 12 months at the community bank.

I only wish I had moved the accounts over sooner.

Here’s another prop for Treasury Direct. Upon maturity of a bill, note or bond, money can be safely parked in the C of I account for zero interest but immediately available to deploy. TD allows the investor to be the “custodian” of the account some money isn’t co-mingled.

https://en.wikipedia.org/wiki/MF_Global

Wolf, if we have a CD in a Bank and it is the custodian of a CD we hold, is our investment at risk from the now adopted Bail-in rules and since Glass-Steagall is repealed aren’t we exposed as a commercial bank creditor to Investment Bank activity?

https://www.investopedia.com/terms/b/bailin.asp

Is the $50-100 Billion in the FDIC pool going to cover the hundreds of trillions of dollars or derivatives?!

These are not things on my worry list, and they won’t be on my worry list :-]

MCB your question is on my worry list. I’m in the Vanguard Federal Money Market Fund that Wisdom Seeker mentioned above. It’s ‘at least 99.5% invested in Gov’t securities’. So for return less than inflation and 0.11% expense ratio I get to bail-in Vanguard if they get cute with derivatives? From Vanguard:

You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

If your Bank CD’s value is over the FDIC insurance limit, you are a very fortunate person AND you should consider splitting into multiple CDs which are individually insured.

If you own a Government money market fund and it breaks the buck due to mismanagement, the entire investment company will probably go under due to the ensuing investor panic at their gross mismanagement. My assessment is that most of the larger investment companies, and especially Vanguard, are too enamored of staying in business to take such a risk. (Alternatively, if they break the buck because FedGov refuses to pay their debts, we’ll all have much bigger worries. The one scenario where this wouldn’t be the case is a short-term shenanigan by Congress over the debt ceiling, but they seem to have solved that problem by agreeing to spend ad infinitum…)

I recently moved all of my savings to Discover Bank. The APR is 1.85% but I have heard their customer service (all in Salt Lake City) and online portal are superior to the Marcus product. The account opening process was pretty straightforward and so far I have not been disappointed.

Wolf, how about US debt? If all government debt was added the result would be way highter that is it. I know that is not the number the FED uses for their calculations but is still interesting to know.

Hi Wolf

Could you please explain how an european investor can make use of the better interest rates in the US? I read working with TreasuryDirect is not allowed for europeans. Any easy way?

Thanks for helping a beginner – investor

You can buy US Treasury securities in Europe through your European broker. But note, they’re in dollars, and if you earn and spend euros, you engage in foreign exchange risk. For you this risk would be that the dollar would drop against the euro, and the meager proceeds from your Treasuries would be wiped out in euro terms. You can hedge against this, but hedging is so expensive on this trade now (because everyone in Europe is trying to do what you’re thinking about) that it will also wipe out your meager gains.

Instead, I think you should go and vociferously complain to Draghi and your government that the ECB’s monetary absurdity should be ended pronto.

Wolf, the policy won’t be changed until Super Mario term ends.

Why? Take a look at Spain and Italy, that’s why.

Europeans are scared of another Greek like effect.

In the Spanish press today is Draghi suggesting inflation will come back up enough to accept rate rises next summer…but it is all open ended, and even after they wind up QE this year they don’t plan to shrink their balance sheet any time soon afterwards.

Wolf, people would think your were nuts here if you asked for tightening. Only a few Germans hold that view and they are outnumbered, plus they realise as creditors they would not be repaid. It is not a pleasant reality, but not to be confused with the US powering out of its own state – you have a nation, ECB doesn’t ( and nor do nations have own CB) , and that is a big difference.

Everybody LOVES to borrow free money. Draghi gave it to them. Now they don’t want to give up free borrowed money. I totally get that. But ultimately, the cost of free borrowed money is VERY high, and no one wants to pay that cost. Just give us free money forever.

This shows just how addictive free borrowed money is.

you here that sucking sound? thats all the euros getting sucked up by us treasuries.

Oh, by the way, Italian government bonds are finally yielding more than US Treasuries. The Italian 10-year yield is at 3.5% (vs. 3.16% for the 10-year Treasury yield). Tempting?

Tempting? No, tulip bulb futures look better to me.

And that’s an outrage. Even if I had no choice but to buy bonds, I’d buy US treasuries over any Italian offering with that differential.

Italy is a cesspool compared to the US…

or risk losing 10% or 20% as I might in the stock market?

Should read as or risk losing 70% to 90% as I might in the stock market?

Once Trump is gone the market has to fall at least 70 percent but more likely in the 80 to 90 percent range.

Nine years of total bullshit where instead of the stock market falling every year for the last 9 years it went up instead. Reversion to the mean has to be at least 80 percent downward. In the case of the russell 2000 it would have to fall 90 percent to revert to the mean.

Plunge Protection Team at work today?

Even the PPT can’t beat a bunch of computers engaged in a food fight. It only stops when at least one of them runs out of money.

There are all sorts of biases and overrides built into computing platforms and they can be co-ordinated as well.

What is coordinated about the downward spirals at the close? The only thing stopping the carnage is a hard stop by the clock.

I came here for the truth…