Bubbles don’t end well for those who don’t get out in time.

US tariffs and threats of more tariffs have not been particularly well received in China, which is already being rattled by corporate credit problems, quakes in the shadow banking system, a peculiar Enron-type phenomenon at provincial and municipal governments called “hidden debt,” and the implosion of nearly 5,000 P2P lenders that have sprung up since 2015. And so today, the Shanghai Composite Index dropped 1.1% to 2,651.79.

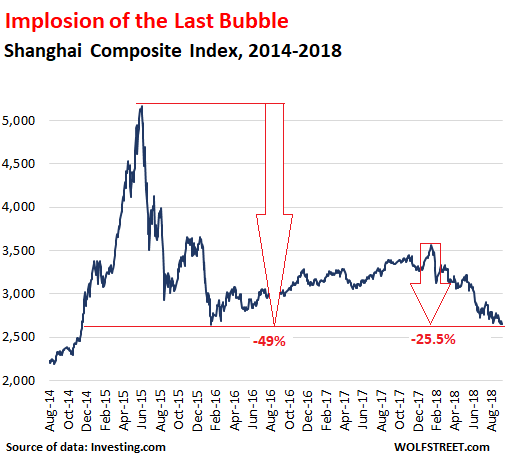

This is a big milestone:

- Below the low of its last collapse on January 28, 2016 (2,655.66)

- Down 25.5% from its recent peak on January 24, 2018, (3,559.47)

- Down 49% from its bubble peak on June 12, 2015 (5,166)

- Down 56% from its bubble peak on October 16, 2007 (6,092)

- Below where it had been for the first time on December 29, 2006 (2,675), nearly 12 years ago. That’s quite an accomplishment.

This chart of the Shanghai Stock Exchange Composite Index shows the last bubble in Chinese stocks. Note the rise from the last low in January 2016. This rise has been endlessly touted in the US as the next big opportunity to lure US investors into the Chinese market, only to get crushed again:

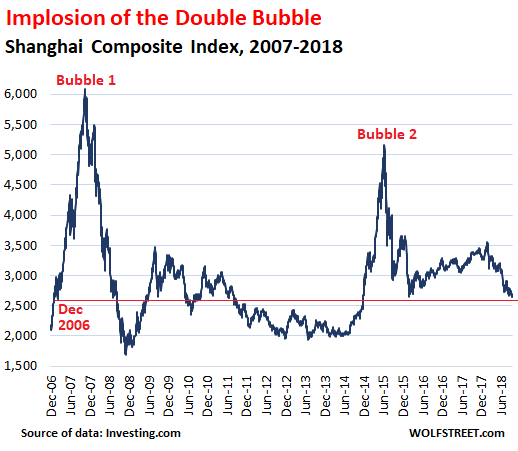

But what makes Chinese stocks interesting is not the collapse of one bubble and then the collapse of the subsequent recovery, but the longer view that is now taking on Japanese proportions.

The chart below shows the double-bubble and the double-collapse, interspersed with collapsed recoveries and failed excitement:

It is not often that a major stock market goes through two majestic bubbles and then revisits levels first seen 12 years earlier – despite inflation in the currency in which these stocks are denominated.

This whole procedure is somewhat reminiscent of the procedure Japanese stocks went through. The Nikkei 225 Index hit an all-time high on December 29, 1989, of 38,957 intraday, after having surged six-fold over the decade. This was part of a general asset-price bubble, including real estate, at a time when the idea was touted in the US that Japanese companies and banks, with their special and superior way of being run, would take over, or at least buy, the world.

The Nikkei eventually plunged to 7,054 by March 2009. Today, it closed at 23,094, down 40% from its peak nearly 30 years ago. Who knows where it would be if the Bank of Japan hadn’t stepped in to become the largest buyer of Japanese equities and the largest stock-market manipulator, as official part of its QQE program.

Bubbles are great fun on the way up. But when they implode, which they always do, they have a way of doing long-term damage.

By comparison, the US stock market is now in its third bubble since the 1990s – and this one is more magnificent than the prior ones, and it’s not just stocks but most other asset classes, and there is the hope that this Everything Bubble will go on forever, just like there was that kind of hope in China in 2015 and 2007, and in Japan in 1989.

In China, auto sales, which had been super-hot, suddenly plunged in July and August. What could be the reason? Read… Implosion of China’s P2P Lending Boom Hits Consumer Spending

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Chinese dont do stock buybacks I guess

At least the rest of the world lets their stock market indexes fall unlike America where a one day fall is a near national disaster.

I get a laugh reading comments like Tony’s.

Especially considering how much state manipulation has gone into propping up the Chinese market (government cash, forced buy-in of more stock, forced inability to sell…).

Yea, I know I’m going to get a comment about Fed manipulation (some truth there), but Chinese manipulation is light-years more intense.

See that tiny blip to the right of the first chart where July 2018 is?

That’s when a flurry of massive buybacks was announced by large mostly State-owned Chinese public companies, from China Chemical to China Mobile.

Apart from gullible Western analysts who went into the usual “Buy Now!” mode (a Pavlovian reflex?), it did very little good for the Shanghai Composite Index.

Note these buybacks are on par if not larger than Apple’s latest: China Mobile announced it will buy back 10% of their shares (about 2.05 billion), obviously pending approval from regulators. In the West this would have caused China Mobile to have double digit gains for several days in a row. In Shanghai it caused yawns.

China Mobile is a huge and very solid State-owned company. It has no need to boost share price through buybacks. It has no need to issue shares, to be honest.

But it’s a core component of pretty much any stock index tied to China, so the National Team (China Edition) has to get to work.

How these massive buybacks will affect the SSECI is hard to say, but given the National Team seems to have the ability to work wonders I am not holding my breath.

The Chinese govt does it. They also arrested short sellers.

Don’t worry, the Chinese Government will take care if it. People will get arrested, asssets seized and bribes will pass hands. Just business as usual inside the cage of fire.

During the last collapse didn’t they make it illegal for Chinese citizens to sell their own stocks and illegal for brokerages not to buy stock, whether they wanted to or not?

Ah, yes. The Chinese government uses outrageous rules and limitations to preserve it’s Potemkin economy, unlike the United States and European Union. Oh, wait…..

That’s the joke.

China is still part of the EM, and subject to the effect of tariffs and currency wars. The US stock market had a decade of obscene gains while the main economy was flat line, so China’s domestic economy may continue along, while its stock market collapses. Isn’t that the real lesson of Japan? In 2008 US market watchers were able to correlate mortgages and the stock market, but correlation is not causation. People ask what about the next US (global) recession? If it is like the recovery the recession will be a nonstarter. China has “normalized” its fx reserve balance sheet, and they will find that in the next wave of US debt issuance that they can acquire more of that debt while selling less of their own products.

Waiting for China’s Property bubble to burst…

And the US property bubble, not to mention the effect of rate increases on 21 trillion dollars of federal debt, all the debt fueled buybacks, the subprime auto debt and the even greater student debt. Someone has observed that these kinds of extreme economic stresses have traditionally been resolved via war, where governments are justifying in implementing whatever economic policies they wish. The US is not in a superior economic position to China and in fact may be in an inferior position because our decision making processes are longer.

lol, no. China can do nothing except steal and commit fraud. They have lots of bodies but little testosterone, despite eating all those weird exotic and protected creatures. Best they can do is continue to colonize (re: exploit/steal) Africa – maybe to the point of establishing a second china.

I just spent a month traveling across China by bus and train, and meeting many ordinary Chinese people… color me mostly impressed. As I traveled, I was reminded of the Aesop Fable about the Ant and the Grasshopper…one saving and storing food for the winter ahead, the other lazing in the summer sun. When it comes to the US and China, it’s no secret who plays the Grasshopper…and Winter is on the way.

Waiting for all the housing bubbles worldwide that the Chinese caused, to burst.

Don’t worry, it’s contained.

Suzanne researched it an that’s good enough for me!

This will never get old…….please make a special note of her facial expression after she says “what”

https://www.youtube.com/watch?v=20n-cD8ERgs

Good laughs. Anybody buying a house at today’s prices must be experiencing some of that irrational pressure.

The mirror image of the 2007-2018 chart, is what is waiting for Wall street.

General consensus among a broad group of global market observer’s, is that serious economic trouble will start at the periphery and move inexorably to the core.

This move began at the beginning of the year and has, as predicted, picked up momentum and scope. Now starting to have serious effect upon the larger global economies, as shown by Wolf’s article.

But don’t worry, its different this time. Permanently high markets and financial stability has been achieved. So don’t worry be happy now!

The coming ‘Great Devaluation’ will catch many totally unaware and flat footed. Indeed, even wrong footed!

There’s always a chance the bankers will short it on the way down as it looks like a bottomless pit already today. The PPT can only slow the decent in days, weeks or months but the top to bottom decline will be the same it will only take longer with the PPT.

The coming ‘Great bailout’ will catch many totally unaware and flat footed. Indeed, even wrong footed!

Wrong footed in that once again many will realize all one has to do is follow the heard and just take on as much debt as possible and either A: get in on the bailout or B: just walk away.

Reminder: last time people who should have got foreclosed on just stopped making payments and lived mortgage free long enough to save a big fat down payment and then bought the foreclose 3 doors down for half. I’ll never forget listening to “Handle on the law” and what sounded like a 15 year old called in talking about how it hadn’t made a payment in months and that he was forcing the lender to produce the “note” or some such paper trail bullshit and they couldn’t come up with it. Bill told him, looks like he’s got the home free and clear. I wish I knew how that ended up but the the excitement in that kids voice made me wanna smash my radio……lets face it, playing by the rules is for suckers.

Devaluation.

Bailout? Yes, you may throw all the paper you care to, at a financial crisis. It does not mean that crisis is solved. Far from it, when that currency carries little to no value.

Its true that the US dollar will most likely be the last currency standing. But by that time, outside of the US it will have no value.

That’s when its crunch time. Trump has just announced another big tariff squeeze against China.

http://www.gainspainscapital.com/2018/09/11/9466/

“lets face it, playing by the rules is for suckers.”

Yep! I curse myself daily for being the sucker I am. All my life I was taught to be law breakers go to jail but when I grew up I found that law breakers get the tax-payers money, they get bailed out, they get acronym money and it is the suckers who pay for it. This is done in the guise of helping the hapless suckers!

In short, the law maker, law implementer and law breaker make out like bandits and suckers pay for it. What a country we have become.

You mean requiring a claimant to produce some documentary evidence substantiating the claim is a foolish annoying formality?

All right then. You all me $10 million. I will assume my check is in the mail

No, you’re wrong. Wall Street fucked up their book keeping , the fact that everyone didn’t get a “free house” was perhaps the greatest failure of the system to follow the letter of the law that came of the whole debacle.

https://safehaven.com/article/18476/the-subprime-debacle-act-2

Not worried — China and Japan are RESILIENT countries and this short term roller coasters are anticipated as part of their Master Plan. China has solidly established it’s new Silk Road https://www.bloomberg.com/quicktake/china-s-silk-road…https://www.bloomberg.com/graphics/2017-china-belt-and-road-initiative/

Exciting news from Japan’s ABE who announced his AIM to REWRITE the Constitution https://abcnews.go.com/International/wireStory/japans-abe-aims-rewrite-constitution-3rd-term-57813906

Bernadette,

Er, Japan’s native population is in a fairly rapid and long term decline, a countdown clock at Tohoku Univ predicts the extinction of the Japanese people in about 1000 years because of the severely low birth rates of Japanese women (they don’t want to be tied down as traditional mothers, housewives, caretakers, etc)

http://mega.econ.tohoku.ac.jp/Children/index_en.jsp

And, the centerpiece of Abe’s attempt to revise the US written Japanese Constitution is to allow Japan to use its military more aggressively. There was a good reason MacArthur put “Defense” into the very definition of Japan’s military, and the memories and political dynamics of the Greater East Asia Co-Prosperity Sphere are still there. War in the region is not likely to favor Japan this time however

Gandalf,

Extinction in 1,000 years? Ha, I’m going to hold my breath. Population growth can turn around on a dime, and suddenly you have a baby boom, as seen after WWII, and all these silly and humorous (!) predictions for the next 1,000 years are just that: humorous.

BTW, the way we’re going, there may be far bigger problems on this planet, unless people do exactly what the Japanese, Chinese, Italians, Germans, Russians, and many others are already doing: bringing the idea of endless population growth to an end. When I was born, there were 2.5 billion of us. Now there are 7.5 billion of us. If this kept on going… Well, you can do the math of what this planet would look like in 1,000 years.

I also assume, from what you say in your comment, you have never actually been to Japan and have never seen how immensely crowded the two big urban plains are (Japan is very mountainous) and have never been on a commuter train during rush hour. There’s a reason why the Japanese don’t want to push this any further. BTW, I highly recommend a long visit to Japan: beautiful country (make sure you go see some of the temples), vibrant culture, some of the best food on earth, immaculate trains, etc. etc.

Wolf,

No need to worry, either human nature or Elon Musk will solve the population problem. Meaning, we’ll either get enough wars going to reduce the population, or Elon Musk will help ship people off planet. And if they don’t like the solutions, let them eat cake.

No need to go to Japan. In Argentina in Capital Federal a bus or train during rush hours is so full that even standing people are like sardines on a can.

Kudos for your comment regarding population decline doomsayers. Just about time for a frank talk about biggest threat of out time: the population boom.

It’s called the anthropogenically induced 6th major mass extinction on earth. Why? Too many humans on the planet. It is the only major mass extinction caused by an organism, the human. The other five major mass extinctions have been theoretically caused by volcanic activity (vulcanism), asteroid or comet impacts, or methane release from global warming.

Scientists estimate that the current 6th major mass extinction event is happening at a faster rate than the 3rd and largest extinction event from 251 million years ago called the Permian – Triassic (PT) event that eliminated an estimated 96% of the earths species.

The extinction event most familiar with the average human was the 5th and last extinction event known as the Cretaceous -Tertiary or KT event (the C being changed to K due to the German spelling of Cretaceous). Recently, scientists have renamed it the Cretaceous – Paleogene mass extinction event (I prefer the original name). It happened 65 million years ago when a 6 – 10 mile diameter bolide struck the ocean near the Yucatan Peninsula causing an estimated 1000 foot tsunami, nuclear winter, and extinction of all the dinosaurs except the birds. It is interesting to note that the resulting tidal wave was only 1000 feet high because the sea was relatively shallow at the point of impact, only about 900 feet deep. If the bolide had struck the deep Pacific Ocean at 6 mile depths, it is estimated that the impact would have parted the ocean floor creating a 15 mile deep crater, pushing the water back 17.5 miles in all directions from the center and creating a 15,000 foot tsunami (a surfers dream to catch the big one). Just don’t be caught standing in the middle when the 6 mile high walls of sea water come rushing back to fill the gap.

Without all 5 major mass extinction events happening along with many minor mass extinctions, we humans would in all probability never have evolved. We dance on top of the multiple leftover extinction event garbage piles, and when we have passed, new orders of life will evolve to live and dance on the top of our remains.

Yep clowns dont understand, very little of that Japanese land is usable, so the country is intensely overpopulated in any place there is flat usable land.

They have been engaging in land reclamation for over 1000 years, the issues with Kansai Airport. Can only be corruption, in a nation with that much land reclamation experience.

Global population HAS TO return to 1944, more realistically 1844 levels, or humans Will become extinct. AS we live on a finite resource planet. SIMPLE.

Wolf, your points are not pertinent to the two facts that I posted. Japan’s population increased only from about 72 million in 1945 to about 128 million in 2008-2010, when its population reached its peak, less than 1.8 – fold. Japan’s population has since dropped to 126.5 million in 2018. The main causes of Japan’s population decline have been a sharp drop in fertility rates of Japanese women, and Japan’s exclusive national identity culture which makes permanent immigration difficult, and gaining citizenship by foreigners nearly impossible.

Your point about Japan’s population congestion has everything to do with the fact that 75% of Japan is made up of mountains, and since 1945 (when its population was much more spread out around the country), the most efficient way for its industrial society to develop was in the coastal plains of the Taiheiyō Belt – some 70% of Japan’s population lives in this region, with the gigantic greater Tokyo area in the middle of this Belt alone holding a quarter of Japan’s population. As an island, Japan has quite a lot more nice coastal properties for its people to build and live in, and so it was really this drive for efficiency in its industrial output that created this concentration of its population into this small area. Living in such congested conditions is not the main reason for the decline in fertility rates – women in other congested and far poorer areas, the favelas of Brazil, the ghettos of Mumbai, continue to have children at prodigeous rates.

Population trends turn on a dime only in downward directions. Since ancient times, these downward forces have been from the usual causes of Disease, Famine, Pestilence, and War. However since the birth of farming some 5,000 years ago, and accelerating in the last 500 years, the population trends of the world have only been generally upward – increased agricultural yields was what first allowed European and Asian populations to explode several hundred years ago. Increased sanitation and healthcare subsequently improved birthrates and human lifespans worldwide even further.

Then, starting in 1960, when the birth control pill became available, followed by later advances to prevent pregnancies, a new trend started – women, for the first time, gained control of their own reproductive systems. And, in the 58 years since, the fertility rates of women in societies where education, self determination, and birth control for women are widely accepted has gone in one and only one direction – downward. In the overall timeline of hundreds and thousands of years of the growth of the human population, this is sort of a “turning on a dime”, and again in a downward direction.

Japan is not the only country where this has happened – European countries and virtually every modern industrialized First World country has had similar sharp declines in birthrates. South Korea’s birthrate levels are even lower than Japan. Birthrates of women even in less developed societies, as disparate as Mexico and the Palestinian Territories, have also declined as access to birth control have increased. Those countries continue to have birthrates above the replacement level of 2.1, however, and so their populations continue to grow. In the U.S., the birthrates of white women are well below 2.1, and so the white population of the U.S. is in decline. The overall U.S. population continues to grow only because of immigration and the higher birthrates of non-white and newly immigrant populations.

Religious indoctrination of women to have many children, in groups as disparate as Muslims to Orthodox Jews and American Mormons and Central/South American Catholics is the single major factor that continues to keep female fertility rates in those groups well above replacement levels. Worldwide, the Muslim populations of Africa and Asia are the single largest group contributing to the worldwide growth in world population.

None of these facts should be news to anybody who has been tracking the details underlying world population statistics.

Can these downward trends in the more advanced societies with liberated and educated women be reversed? I seriously doubt that women will change and give up their newfound freedoms to go back and focus on staying at home and having large numbers of children. But, considering that it is now possible to clone mammals like pet dogs and cats, it should just be a matter of time before humans are cloned or reproduced artificially. I fully expect at some point that this will happen. So, no, despite the doomsday clock of the Tohoku Univ. it is unlikely that Japanese people will become fully extinct. Somebody will start cloning Japanese people someday. There will not be a population explosion of clones, but Japanese are unlikely to become fully extinct.

Now, the other point I made about Abe wanting to get rid of its constitutional proscriptions against a more aggressive use of its military, and the legacy of Japan’s WWII era Greater East Asia Co-Prosperity Sphere, you did not address at all. It’s a hugely complicated topic, and since you did not say anything about that point at all, I can only assume you concede that point and so I leave that one for another day.

The US has been leaning on Japan to take on a more robust military role for decades to counter China. You won’t hear any complaints from the US about a less pacifist constitution.

Understandably, the US did this much faster with West Germany at the height of the Cold War when there was serious possibility of it going hot.

Then the USSR vanished and a united Germany got comfortable, too comfortable for the US who want it to increase military spending, especially after the seizure of the Crimea. This pressure has ratcheted up with Trump, but precedes him.

You can hide your jokes really well: the 1000 year timeline. :)

Are you implying that central planning is the better economic system?

A few trillion in cash on hand plus a few thousand tons of gold is a nice buffer for rainy days. Aside from that, China is not a centrally planned economy. That’s why it’s a powerhouse of production.

The nice thing about China is that if the government decides to let you down easy, the bubble might get deflated slowly. The problem is if comrade Xi decides that he just doesn’t care about the whiners and their money problems, he can always back things up with his moral authority. A lot of people (especially the older generations, or the ones who haven’t done as well) liked his anti corruption campaign. His moral authority, and his control of the Chinese military. Although with the introduction of social credits, it’s doubtful if guns are even necessary today. Just bar society in general from doing business with target, and start socially ostracizing the friends and family of the target, and we’ll see how fast that person breaks down.

I would be curious on what it would take for the Chinese economy to start collapsing, and what the rest of the world would do to keep that from happening, mainly because of all of the manufacturing that takes place there now, it would pretty much crush a whole lot of countries.

I used to call self-harming behavior a form of natural selection. Considering the type of human proliferation, as if it was taken out of the movie “Idiocracy,” it looks like humanity is close to eliminating itself either in the name of profit or due to the vast majority’s inability to think and act. Well, once you are dispossessed of the knowledge and the power to make a difference, the road looks like a one-way street. Such roads, as history suggests, hardly ever turn around or open up on the other end…

China’s stock market has even less relevance for its economy than our own: almost zero.

It’s debt-to-GDP is the same as ours but, because its GDP is growing three times faster than ours China’s debt burden in one third ours (and entirely domestic).

No one even knows how much debt there is in China at all levels because part of it — especially with corporate debt and provincial and municipal government debts — is what they all “hidden debt” that has been disguised in special purpose vehicles, some of them off-shore. Household debt has been ballooning in recent years too. The problems that China now has are centered around digesting this debt, some of which is now going bad.

So much debt even the stock market is hammered. Wow!

I’m a psychologist. We often tend to use human behavior metaphors to explain patterns in behavior – think anal-retentive children as a metaphor for stubbornness. I have become a student of economics the past 4 or 5 years (behavioral science without reference to human nature).

Wolf’s bubble observations bring to mind “Around the World in 80 Days” as a metaphor for government efforts to navigate their economies. I am not talking about Niven’s hijinx, but the sturm und drang of keeping the balloon airborne and directed while adapting to unpredictable atmospheric changes from storms, updrafts, downdrafts, jet streams (market volatility and natural catastrophes) and mountains (tariffs) – not mention weight (debt?) and fuel (monetary policies).

Historical patterns tend to be reliable predictors at the macro level even though humans ignore those patterns. China has millennia of historical patterns that all indicate amazing ascendance followed by economic implosions. Maybe their metaphorical balloon will deflate in the face of Trumpian tariffs. Who can say?

The US economy is not a free market economy as long as the Fed controls interest rates and the fiat currency. To think we are much different than China is a myth. All central banks moves are for THEIR economies. Boy, has the Fed brainwashed us with their rhetoric.